- Analytics

- Market analysis

- Market Opinions

- Boeing's Shares Keep Afloat Despite All Disappointing News of the Business Horizon

Boeing's Shares Keep Afloat Despite All Disappointing News of the Business Horizon

Boeing Co scored no new orders at all for their airplanes in January, the first time it has come up empty-handed in the beginning of the year since 1962, while its European rival Airbus had its strongest showing in at least 15 years, Reuters reported.

The US planemaker's sales chief, Ihssane Mounir, told reporters last Wednesday at the Singapore Air show: "China has reduced capacity by 70%; that is money, that is revenue. It was a slow January but it doesn't mean it is going to be a slow February or slow March, so watch this space. Some 777 and 787 deliveries for China delayed due to coronavirus, too early to say if epidemic will delay further aircraft orders, further company coverage". He also mentioned they are in talks with several potential customers for wide-body aircraft.

However, the problem is deeper than it might seem in the first place. The January orders could not fully reflect the coronavirus impact on the expected decline in passenger and cargo air traffic. More important is that Boeing's once best-selling jet, the 737 MAX, remained grounded following two fatal crashes in five months and long-lasting investigations of the causes that maybe hidden in the airplane software, according to numerous experts and the preliminary conclusions of the company itself.

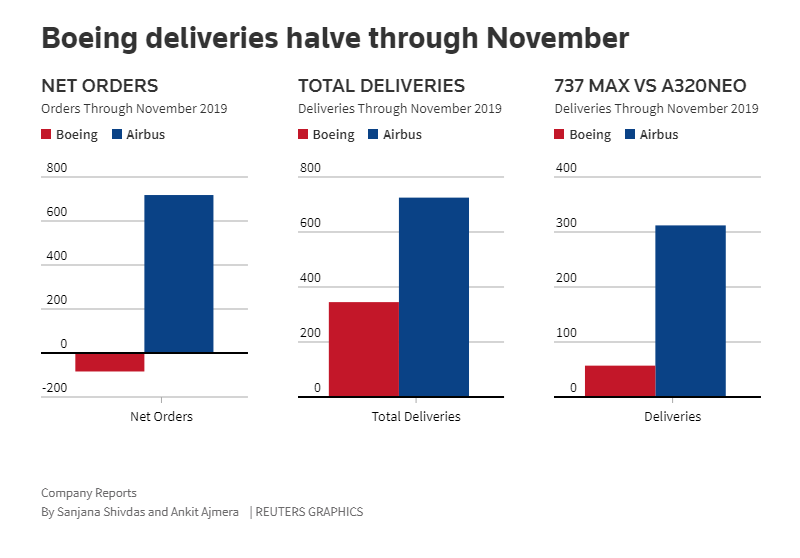

Too many airlines have doubts whether the safety problem could really be fixed so quickly. On the other hand, at least they could wait the moment until the 737 MAX is cleared by regulators to fly again, which leave Boeing trailing Airbus and swallowing huge monthly financial losses. The Paris-based Airbus last week reported of booked gross orders for 296 aircrafts or 274 net orders after cancellations. Boeing Co Chief Financial Officer Greg Smith said on Wednesday that it will take at least a couple of years before 737 MAX production rate can reach the 57 units per month that the company was targeting before the airplane was grounded.

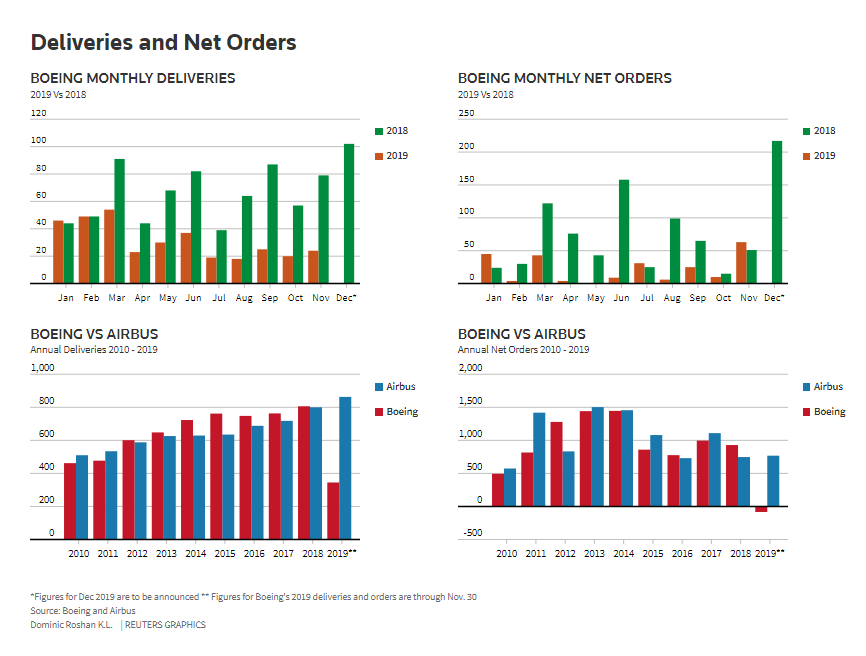

Pic 1. Boeing Deliveries and Net Orders vs Airbus in 2010-2019

Boeing Co delivered less than half planes in the first 11 months of 2019 as in the same period a year earlier, the specialists of the company reported in the year end: deliveries totalled 345 aircrafts in the 11 months ended November, compared to 704 last year and were also less than half the number delivered by European rival Airbus in the same period.

Pic 2. Boeing deliveries halved in first 11 months of 2019

Also, since 2018 summer, some engine problems at Britain's Rolls-Royce have rattled the production process of the new Boeing 787 Dreamliner model. In December 2019 Boeing Co's Starliner astronaut spacecraft landed in the New Mexico desert, according to the company information, after faulty software forced officials to cut short an unmanned mission aimed at taking it to the International Space Station. It capped a turbulent 48 hours for Boeing's botched milestone test of an astronaut capsule that is designed to help NASA regain its human spaceflight capabilities.

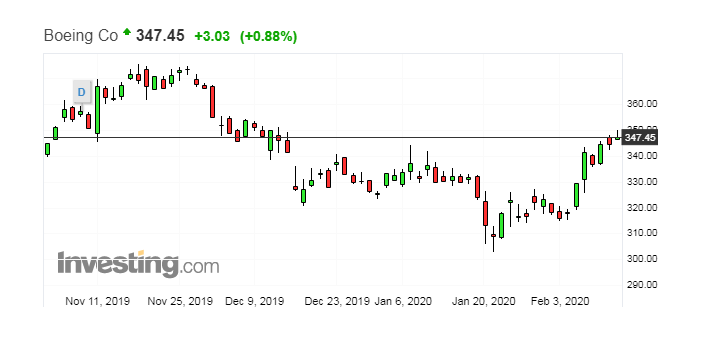

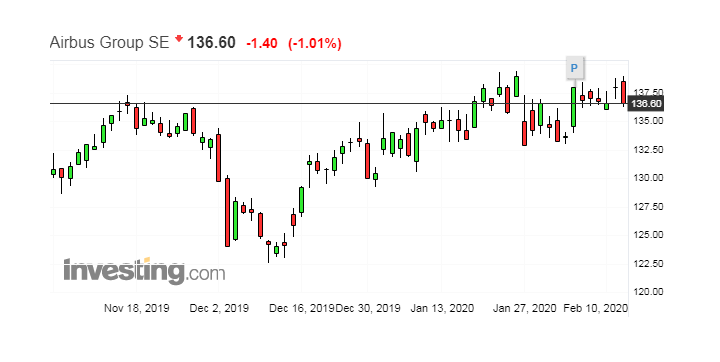

The Boeing Co, one of the top Dow Jones index drivers for many years, was the fourth-worst performer in the 30-member index in 2019. Many investors became cautious, but by the beginning of this year 13 out of 24 Reuters pole analysts rating the Boing's shares a "hold" while seven still saw it a "buy" and "strong buy". This may sound a little strange but at least for now Boeing's shares keep afloat despite all disappointing news. And they even recovered more than nine % in price for the last three weeks holding a longer run uptrend safe since 2016.

Pic 3. Boeing shares chart since November 2019

Source: Investing.com

Pic 4. Boeing shares in the longer run trend since 2016

Source: Investing.com

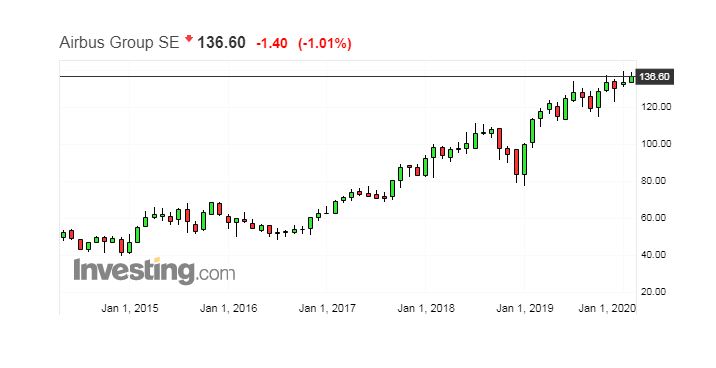

Pic 6. Airbus Group shares in the longer run since 2015

Source: Investing.com

One may wonder how it could happen?

Probably, the "secret weapon" of Boeing Co is a huge military order Boeing won or intercepted in 2011. Since then, the Boing Company has a $35 bln contract to build 179 strategic KC-46 Pegasus air-to-air tankers by 2027. The Boeing KC-46 Pegasus is a military aerial refuelling and strategic military transport aircraft developed by Boeing from its 767 jet airliner. In February 2011, the tanker was selected by the United States Air Force (USAF) to replace older KC-135 Stratotankers, also produced by Boeing.

Only the first phase of the contract costs $3.5 billion to cover the construction of the first 18 tankers by 2017. But first aircraft was delivered to the Air Force in January 2019 only, The Forbes and The Seattle Times reported. Although the deadlines were postponed several times this does not seem to have affected the cost of the order. And Boeing also has some export bids for KC-46 Pegasus from Canada, India, Indonesia and Japan, as some other NATO countries (Poland, Norway and Netherlands) gave their preferences to Airbus since 2014, according to Defence News.

According to the same Defence News sources, the Air Force restricted the KC-46 from carrying cargo and passengers due to an issue with the floor cargo locks coming unblocked in flight. A fix to this issue was approved by the Air Force on 12 November 2019 with plans to install the new cargo locks on delivered aircraft in the upcoming weeks. As of December 20, 2019, four KC-46A aircraft have received the new cargo locks and the Air Force has closed the Category 1 deficiency and cleared the retrofitted aircraft for cargo and passenger operations.

The company still faces certain technical issues with a military aircrafts too, but the huge size of the contracts and a very strong position of Boeing's USAF customers in the American establishment probably makes many investors to consider these longer-run military contracts, and not civil contracts, as the main source of the company welfare. This makes it much more difficult to predict the behaviour of Boeing's shares price.

Disclaimer:

Analysis and opinions provided herein are intended solely for informational and educational purposes and don't represent a recommendation or investment advice by TeleTrade.

Indiscriminate reliance on illustrative or informational materials may lead to losses.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.