- Analytics

- Market analysis

- Market Opinions

- Breakthrough of the euro?

Breakthrough of the euro?

The euro started to rise against the U.S. dollar yesterday morning. The euro appreciated more than 280 pips. The significant increase was driven by different factors. Investors hope that Greece and its creditors will sign a new agreement. Tsipras reshuffled his team negotiating with European and IMF creditors on Monday. Deputy Foreign Minister, Euclid Tsakalotos, was appointed co-coordinator of the team. This news was considered positive.

An agreement will be signed between Athens and its creditors sooner or later as worries about the possible consequences of the Grexit are very high among European officials.

Yesterday's weaker-than-expected U.S. GDP growth and the results of the Fed's monetary policy meeting are other factors. The U.S. preliminary gross domestic product increased at an annual rate of 0.2% in the first quarter, missing expectations for a 1.3% gain, after a 2.2% rise in the fourth quarter.

The Fed kept its monetary policy unchanged on Wednesday, but noted that the U.S. economy slowed down during the winter months. The slowdown was driven by "transitory factors", according to the Fed's statement.

The Fed did not rule out the interest rate hike in June. But it is unlikely that the Fed will raise its interest rate in June as the U.S. labour market slowed down in March. The U.S. economy added 126,000 jobs in March, missing expectations for a rise of 251,000 jobs, after a gain of 264,000 jobs in February.

The U.S. central bank will have to wait the release of the economic data in Mai and June to decide if it starts to hike its interest rate or not.

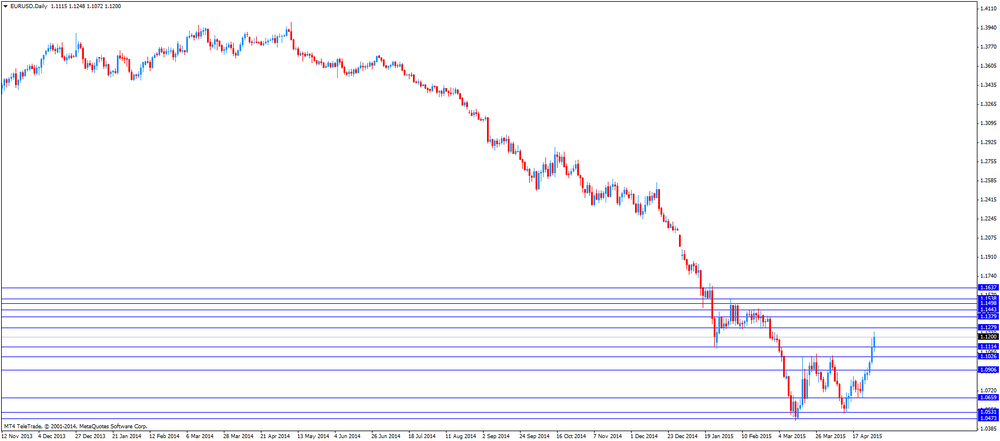

Due to the current factors, the euro is expected to trade in the range between $1.1000 and $1.1300. If the euro breaks through the resistance level at 1.1279, the euro may increase toward $1.1400.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.