- Analytics

- Market analysis

- Market Opinions

- EURCHF – next exchange floor in sight?

EURCHF – next exchange floor in sight?

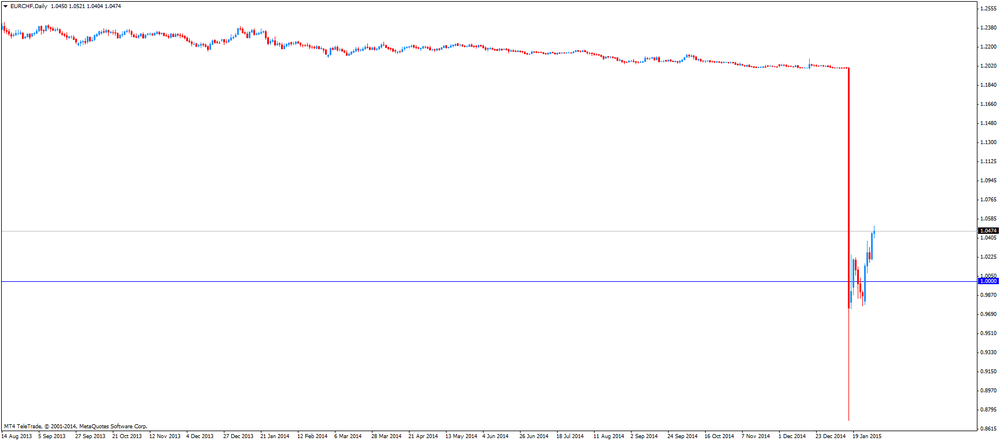

The Swiss National Bank (SNB) has discontinued the minimum exchange rate of 1.20 per euro on January 15, 2015. The Swiss has appreciated against the euro and the U.S. dollar.

The SNB President Thomas Jordan said that the CHF1.20 exchange rate floor has been discontinued because it was unsustainable. But he added that the SNB will intervene in the foreign exchange markets if required.

The Swiss National Bank (SNB) Vice President Jean-Pierre Danthine said in an interview with the Tages-Anzeiger newspaper published on January 27 that the central bank is prepared to intervene in markets. The Swiss franc has started to depreciate a day earlier.

The currency pair EURCHF increased this week from CHF0.9782 to CHF1.0521. That indicates that the SNB has intervened in the foreign exchange markets.

According to the SNB's monetary policy data for the week ending 23 January 2015, the amount of cash commercial banks hold with the SNB rose, and showed the biggest weekly increase since July 2013. That is another evidence that the SNB might intervene in markets.

It's possible that we might see the next EURCHF exchange floor: perhaps CHF1.0500 or CHF1.1000.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.