- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 30-10-2018.

Major US stock indices rose significantly, helped by a rebound in the technology sector amid optimism about the US-China trade dispute and some positive corporate earnings reports.

Investors also focused on US data, which indicated that the Conference Board's consumer confidence index rose again in October. The index now stands at 137.9, compared with 135.3 in September (revised from 138.4). The current situation index rose from 169.4 to 172.8, and the expectations index increased from 112.5 to 114.6. "Consumer confidence increased in October, after a slight improvement in September, and remains at a level that was last observed in the fall of 2000. Consumer assessment of current conditions remains quite positive, primarily due to strong employment growth. The expectations index recorded another gain in October, suggesting that consumers do not foresee that the economy will lose momentum in the near future. Rather, they expect high growth rates to continue in early 2019, "said Lynn Franco, director of economic development in the Conference Board

Most of the components of DOW recorded an increase (26 of 30). The growth leader was Intel Corporation (INTC, + 4.87%). Outsiders were the shares of International Business Machines Corporation (IBM, -3.30%).

Almost all sectors of the S & P finished the sale in the black. The base materials increased the most (+ 1.8%). The decline showed only the conglomerates sector (-0.2%).

At the time of closing:

Dow 24,874.95 +432.03 +1.77%

S & P 500 2,682.63 +41.38 +1.57%

Nasdaq 100 7,161.65 +111.36 +1.58%

U.S. stock-index futures fell slightly on Tuesday, pointing to a small loss at the open.

Global Stocks:

| Index/commodity | Last | Today's Change, points | Today's Change, % |

| Nikkei | 21,457.29 | +307.49 | +1.45% |

| Hang Seng | 24,585.53 | -226.51 | -0.91% |

| Shanghai | 2,568.05 | +25.94 | +1.02% |

| S&P/ASX | 5,805.10 | +76.90 | +1.34% |

| FTSE | 7,017.90 | -8.42 | -0.12% |

| CAC | 4,966.31 | -23.04 | -0.46% |

| DAX | 11,292.94 | -42.54 | -0.38% |

| Crude | $65.87 | | -1.75% |

| Gold | $1,226.00 | | -0.13% |

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 34.63 | 0.81(2.40%) | 1030 |

| ALTRIA GROUP INC. | MO | 64.41 | -0.18(-0.28%) | 1219 |

| Amazon.com Inc., NASDAQ | AMZN | 1,519.60 | -19.28(-1.25%) | 90363 |

| Apple Inc. | AAPL | 212.2 | -0.04(-0.02%) | 355260 |

| AT&T Inc | T | 29.74 | 0.10(0.34%) | 55783 |

| Barrick Gold Corporation, NYSE | ABX | 12.6 | -0.08(-0.63%) | 30029 |

| Boeing Co | BA | 336.15 | 0.56(0.17%) | 9477 |

| Caterpillar Inc | CAT | 114.34 | 0.36(0.32%) | 15618 |

| Chevron Corp | CVX | 109.4 | 0.47(0.43%) | 2453 |

| Cisco Systems Inc | CSCO | 43.96 | 0.12(0.27%) | 19218 |

| Citigroup Inc., NYSE | C | 64.79 | 0.44(0.68%) | 14118 |

| Exxon Mobil Corp | XOM | 77.25 | 0.20(0.26%) | 4001 |

| Facebook, Inc. | FB | 142.44 | 0.35(0.25%) | 125713 |

| Ford Motor Co. | F | 9.32 | 0.04(0.43%) | 80338 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 11.06 | -0.03(-0.27%) | 11071 |

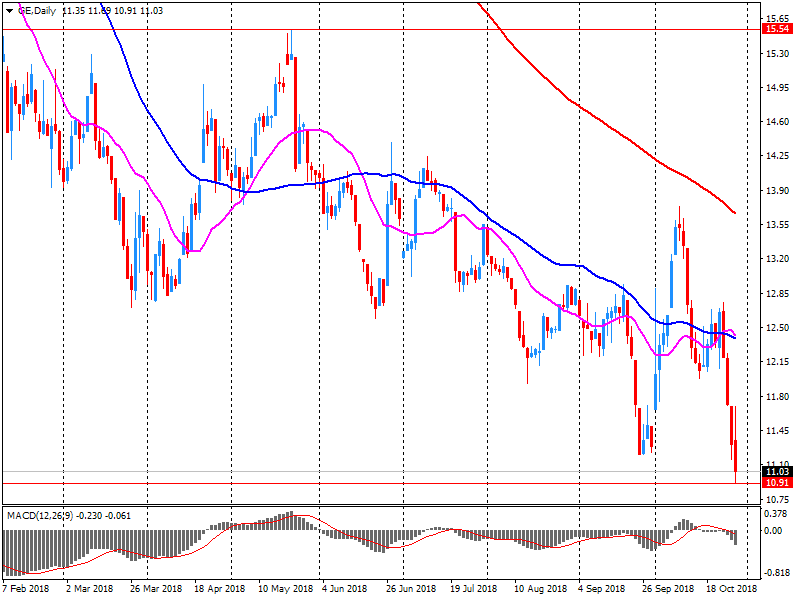

| General Electric Co | GE | 10.77 | -0.39(-3.49%) | 4451352 |

| General Motors Company, NYSE | GM | 33.27 | 0.14(0.42%) | 4689 |

| Goldman Sachs | GS | 215.78 | 1.29(0.60%) | 897 |

| Google Inc. | GOOG | 1,018.38 | -1.70(-0.17%) | 8438 |

| Home Depot Inc | HD | 173.99 | 0.79(0.46%) | 1187 |

| Intel Corp | INTC | 45.78 | 0.38(0.84%) | 90715 |

| International Business Machines Co... | IBM | 119.83 | 0.19(0.16%) | 11134 |

| Johnson & Johnson | JNJ | 137.52 | -0.03(-0.02%) | 989 |

| JPMorgan Chase and Co | JPM | 105.29 | 0.44(0.42%) | 8729 |

| Merck & Co Inc | MRK | 71.47 | 0.02(0.03%) | 1984 |

| Microsoft Corp | MSFT | 104.4 | 0.55(0.53%) | 211986 |

| Nike | NKE | 72.49 | 0.30(0.42%) | 5873 |

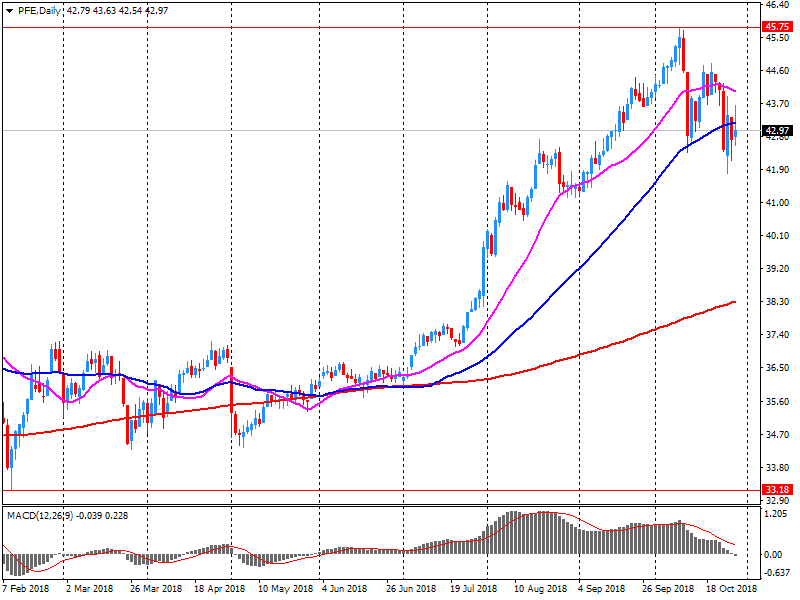

| Pfizer Inc | PFE | 41.81 | -1.42(-3.28%) | 90054 |

| Procter & Gamble Co | PG | 88.1 | -0.14(-0.16%) | 607 |

| Starbucks Corporation, NASDAQ | SBUX | 58.43 | 0.06(0.10%) | 3949 |

| Tesla Motors, Inc., NASDAQ | TSLA | 334.23 | -0.62(-0.19%) | 67708 |

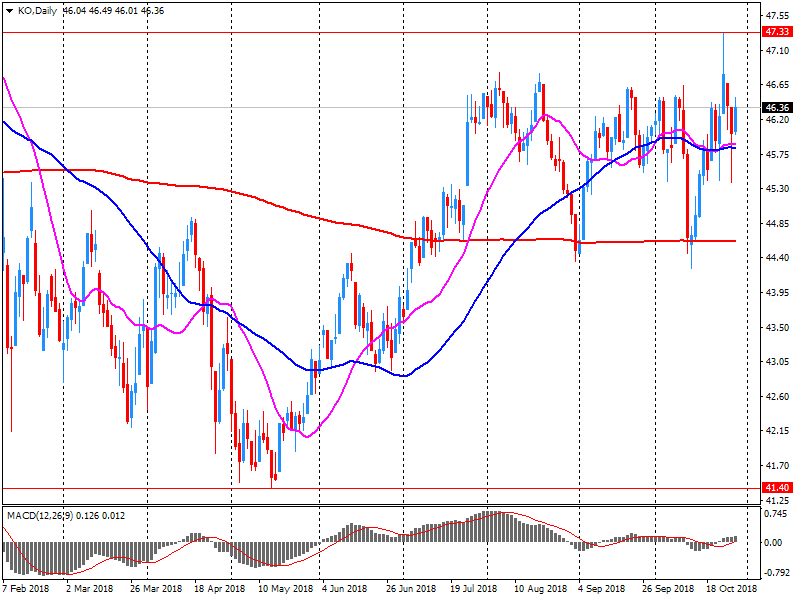

| The Coca-Cola Co | KO | 46.29 | -0.17(-0.37%) | 27612 |

| Twitter, Inc., NYSE | TWTR | 32.42 | 0.03(0.09%) | 68218 |

| United Technologies Corp | UTX | 121.13 | 0.04(0.03%) | 17320 |

| Verizon Communications Inc | VZ | 56.94 | 0.46(0.81%) | 2140 |

| Visa | V | 135.35 | 1.02(0.76%) | 16826 |

| Wal-Mart Stores Inc | WMT | 100.25 | 0.45(0.45%) | 7413 |

| Walt Disney Co | DIS | 113.33 | 0.29(0.26%) | 869 |

| Yandex N.V., NASDAQ | YNDX | 27.94 | 0.72(2.65%) | 33141 |

Arconic (ARNC) reported Q3 FY 2018 earnings of $0.32 per share (versus $0.25 in Q3 FY 2017), beating analysts' consensus estimate of $0.30.

The company's quarterly revenues amounted to $3.524 bln (+8.9% y/y), beating analysts' consensus estimate of $3.481 bln.

The company also raised FY 2018 EPS guidance to $1.28-1.34 from $1.17-1.27 (versus analysts' consensus estimate of $1.31) and reaffirmed FY 2018 revenues guidance at $13.70-14.00 bln (versus analysts' consensus estimate of $13.94 bln).

ARNC rose to $19.75 (+2.76%) in pre-market trading.

MasterCard (MA) reported Q3 FY 2018 earnings of $1.78 per share (versus $1.34 in Q3 FY 2017), beating analysts' consensus estimate of $1.68.

The company's quarterly revenues amounted to $3.898 bln (+14.7% y/y), beating analysts' consensus estimate of $3.861 bln.

MA rose to $195.50 (+2.33%) in pre-market trading.

Pfizer (PFE) reported Q3 FY 2018 earnings of $0.78 per share (versus $0.67 in Q3 FY 2017), beating analysts' consensus estimate of $0.75.

The company's quarterly revenues amounted to $13.298 bln (+1.0% y/y), missing analysts' consensus estimate of $13.533 bln.

The company also narrowed FY 2018 EPS guidance to $2.98-3.02 from $2.95-3.05 (versus analysts' consensus estimate of $2.99) and lowered revenues guidance to $53-53.7 bln from $53.5-55.5 bln (versus analysts' consensus estimate of $54.16 bln.

PFE fell to $41.70 (-3.54%) in pre-market trading.

General Electric (GE) reported Q3 FY 2018 earnings of $0.14 per share (versus $0.29 in Q3 FY 2017), missing analysts' consensus estimate of $0.20.

The company's quarterly revenues amounted to $29.573 bln (-3.6% y/y), missing analysts' consensus estimate of $30.077 bln.

The company also announced about plans to reduce its quarterly dividend by 92% from $0.12 to $0.01 per share beginning with the Board's next dividend declaration, which is expected to occur in December 2018.

GE rose to $11.36 (+1.79%) in pre-market trading.

Coca-Cola (KO) reported Q3 FY 2018 earnings of $0.58 per share (versus $0.50 in Q3 FY 2017), beating analysts' consensus estimate of $0.55.

The company's quarterly revenues amounted to $8.245 bln (-9.2% y/y), generally in line with analysts' consensus estimate of $8.196 bln.

KO rose to $46.90 (+0.95%) in pre-market trading.

A mixed start to trading on the stock markets of Europe is expected. Quotes in the US fell, and most Asian stock indices rose after a negative start. The caution in the markets is maintained against the background of growing trade tensions between the US and China, as well as political instability in Europe.

| Index | Change items | Closing price | % change |

| Nikkei | -34.80 | 21149.80 | -0.16% |

| SHANGHAI | -56.74 | 2542.10 | -2.18% |

| ASX 200 | +63.00 | 5728.20 | +1.11% |

| FTSE 100 | +86.76 | 7026.32 | +1.25% |

| DAX | +134.86 | 11335.48 | +1.20% |

| CAC 40 | +21.98 | 4989.35 | +0.44% |

| DJIA | -245.39 | 24442.92 | -0.99% |

| NASDAQ | -116.92 | 7050.29 | -1.63% |

| S&P 500 | -17.44 | 2641.25 | -0.66% |

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.