- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 29-10-2018.

Major US stock indexes have fallen markedly against the backdrop of the collapse of technology sector stocks and concerns about the escalation of the tariff war between the United States and China.

The agency Bloomberg, referring to three sources, reported that the US is preparing to announce tariffs for all remaining Chinese imports by early December if negotiations between Trump and C fail. A new list of tariffs will be compiled for the remaining $ 257 billion of goods not yet covered by tariffs, and after the 60-day public comment period they will take effect in early February, when China celebrates the New Year according to the lunar calendar. "US officials are preparing for such a scenario if the Trump-C meeting planned for the end of November in Buenos Aires does not work," Bloomberg said.

Market participants also analyzed data on personal income and consumer spending. The Commerce Department reported that US consumer spending rose for the seventh consecutive month in September, but revenues recorded the smallest increase over the past year amid moderate wage growth, suggesting that the current spending rate is unlikely to be sustainable. According to the report, consumer spending rose by 0.4 percent, as households bought more cars and spent more on health care. Economists had expected consumer spending to rise 0.4 percent in September. Adjusted for inflation, consumer spending rose by 0.3 percent. Meanwhile, personal income rose by 0.2 percent in September, which is the smallest increase since June 2017, after they increased by 0.4 percent in August.

Most of the components of DOW finished trading in the red (18 out of 30). The outsider was The Boeing Company (BA, -7.36%). The growth leader was Verizon Communications Inc. (VZ, + 1.57%).

Almost all sectors of the S & P recorded a decline. The largest decline was shown by the industrial goods sector (-2.5%). The utility sector grew the most (+ 0.5%).

At the time of closing:

Dow 24,442.92 -245.39 -0.99%

S&P 500 2,641.25 -17.44 0.66%

Nasdaq 100 7,050.29 -116.92 -1.63%

U.S. stock-index futures rose on Monday, pointing to a solidly higher start after steep losses last week.

Global Stocks:

| Index/commodity | Last | Today's Change, points | Today's Change, % |

| Nikkei | 21,149.80 | -34.80 | -0.16% |

| Hang Seng | 24,812.04 | +94.41 | +0.38% |

| Shanghai | 2,542.10 | -56.74 | -2.18% |

| S&P/ASX | 5,728.20 | +63.00 | +1.11% |

| FTSE | 7,073.53 | +133.97 | +1.93% |

| CAC | 5,019.92 | +52.55 | +1.06% |

| DAX | 11,426.04 | +225.42 | +2.01% |

| Crude | $67.32 | | -0.40% |

| Gold | $1,233.30 | | -0.20% |

(company / ticker / price / change ($/%) / volume)

| ALTRIA GROUP INC. | MO | 63.24 | 0.15(0.24%) | 662 |

| Amazon.com Inc., NASDAQ | AMZN | 1,666.00 | 23.19(1.41%) | 68587 |

| Apple Inc. | AAPL | 219.51 | 3.21(1.48%) | 322987 |

| AT&T Inc | T | 29.48 | 0.39(1.34%) | 93118 |

| Barrick Gold Corporation, NYSE | ABX | 12.77 | -0.08(-0.62%) | 56719 |

| Boeing Co | BA | 361.6 | 2.33(0.65%) | 11940 |

| Caterpillar Inc | CAT | 116.7 | 1.65(1.43%) | 6253 |

| Chevron Corp | CVX | 112.8 | 1.27(1.14%) | 671 |

| Cisco Systems Inc | CSCO | 44.97 | 0.72(1.63%) | 26177 |

| Citigroup Inc., NYSE | C | 65.15 | 0.94(1.46%) | 16023 |

| Deere & Company, NYSE | DE | 135.06 | 2.06(1.55%) | 4271 |

| Exxon Mobil Corp | XOM | 78.4 | 0.87(1.12%) | 9386 |

| Facebook, Inc. | FB | 148.55 | 3.18(2.19%) | 166919 |

| FedEx Corporation, NYSE | FDX | 213.5 | 2.97(1.41%) | 194 |

| Ford Motor Co. | F | 9.3 | 0.32(3.56%) | 891415 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 11.73 | 0.23(2.00%) | 10761 |

| General Electric Co | GE | 11.43 | 0.13(1.15%) | 130636 |

| General Motors Company, NYSE | GM | 34.16 | 1.51(4.62%) | 176681 |

| Google Inc. | GOOG | 1,085.39 | 13.92(1.30%) | 15346 |

| Hewlett-Packard Co. | HPQ | 23.4 | 0.27(1.17%) | 1000 |

| Home Depot Inc | HD | 173.5 | 1.27(0.74%) | 4280 |

| HONEYWELL INTERNATIONAL INC. | HON | 145 | 3.60(2.55%) | 1134 |

| Intel Corp | INTC | 46.47 | 0.78(1.71%) | 95366 |

| International Business Machines Co... | IBM | 120.09 | -4.71(-3.77%) | 544848 |

| International Paper Company | IP | 45.65 | 0.80(1.78%) | 1400 |

| Johnson & Johnson | JNJ | 137.58 | 0.61(0.45%) | 1044 |

| JPMorgan Chase and Co | JPM | 104.66 | 1.24(1.20%) | 9758 |

| McDonald's Corp | MCD | 174.25 | 0.91(0.53%) | 359 |

| Merck & Co Inc | MRK | 71 | 0.60(0.85%) | 865 |

| Microsoft Corp | MSFT | 108.54 | 1.58(1.48%) | 93573 |

| Nike | NKE | 72.96 | 0.89(1.23%) | 3903 |

| Pfizer Inc | PFE | 42.95 | 0.35(0.82%) | 1727 |

| Procter & Gamble Co | PG | 88.14 | 0.28(0.32%) | 1225 |

| Starbucks Corporation, NASDAQ | SBUX | 58.71 | 0.64(1.10%) | 1823 |

| Tesla Motors, Inc., NASDAQ | TSLA | 342 | 11.10(3.35%) | 285383 |

| The Coca-Cola Co | KO | 46.1 | 0.18(0.39%) | 879 |

| Twitter, Inc., NYSE | TWTR | 32.9 | 0.54(1.67%) | 166376 |

| UnitedHealth Group Inc | UNH | 260.81 | 2.63(1.02%) | 1376 |

| Verizon Communications Inc | VZ | 55.99 | 0.48(0.86%) | 1841 |

| Visa | V | 140.25 | 2.51(1.82%) | 9397 |

| Wal-Mart Stores Inc | WMT | 99.45 | 0.51(0.52%) | 1313 |

| Yandex N.V., NASDAQ | YNDX | 29.15 | 1.90(6.97%) | 232680 |

Apple (AAPL) initiated with a Buy at Jefferies; target $265

Starbucks (SBUX) target raised to $62 from $58 at Telsey Advisory Group

Verizon (VZ) target raised to $58 from $56 at Morgan Stanley

Amazon (AMZN) target lowered to $2050 from $2075 at JMP Securities

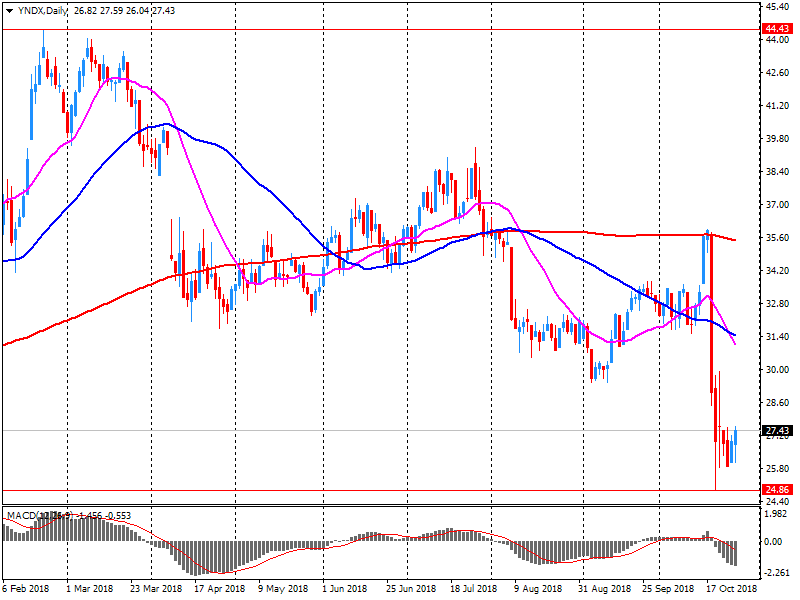

Yandex N.V. (YNDX) reported Q3 FY 2018 earnings of RUB18.80 per share (versus RUB7.16 in Q3 FY 2017), beating analysts' consensus estimate of RUB17.66.

The company's quarterly revenues amounted to RUB32.570 bln (+39.0% y/y), beating analysts' consensus estimate of RUB30.884 bln.

YNDX rose to $28.97 (+6.31%) in pre-market trading.

October 29

Before the Open:

Yandex N.V. (YNDX). Consensus EPS RUB17.66, Consensus Revenues RUB30883.53 mln.

October 30

Before the Open:

Arconic (ARNC). Consensus EPS $0.30, Consensus Revenues $3484.09 mln.

Coca-Cola (KO). Consensus EPS $0.55, Consensus Revenues $8196.01 mln.

General Electric (GE). Consensus EPS $0.20, Consensus Revenues $29936.13 mln.

MasterCard (MA). Consensus EPS $1.68, Consensus Revenues $3862.59 mln.

Pfizer (PFE). Consensus EPS $0.75, Consensus Revenues $13532.96 mln.

After the Close:

Baidu.com (BIDU). Consensus EPS $2.56, Consensus Revenues $4051.94 mln.

eBay (EBAY). Consensus EPS $0.54, Consensus Revenues $2651.83 mln.

Facebook (FB). Consensus EPS $1.44, Consensus Revenues $13819.55 mln.

October 31

Before the Open:

General Motors (GM). Consensus EPS $1.25, Consensus Revenues $34848.26 mln.

After the Close:

American Inl (AIG). Consensus EPS $0.17, Consensus Revenues $12443.53 mln.

November 1

Before the Open:

DowDuPont (DWDP). Consensus EPS $0.72, Consensus Revenues $20222.24 mln.

After the Close:

Apple (AAPL). Consensus EPS $2.78, Consensus Revenues $61603.68 mln.

Starbucks (SBUX). Consensus EPS $0.60, Consensus Revenues $6274.76 mln.

November 2

Before the Open:

Alibaba (BABA). Consensus EPS $1.12, Consensus Revenues $12565.72 mln.

Chevron (CVX). Consensus EPS $2.09, Consensus Revenues $47171.48 mln.

Exxon Mobil (XOM). Consensus EPS $1.21, Consensus Revenues $72908.61 mln.

A positive start of tradin expected, after most Asian stock indices again suffered losses, although less significant than last week. Futures on U.S stock indexes are in the fla area, and their rebound from Friday's lows can be expected to continue.

| Index | Change items | Closing price | % change |

| Nikkei | -84.13 | 21184.60 | -0.40% |

| SHANGHAI | -4.95 | 2598.85 | -0.19% |

| ASX 200 | +1.10 | 5665.20 | +0.02% |

| KOSPI | -36.15 | 2027.15 | -1.75% |

| FTSE 100 | -64.54 | 6939.56 | -0.92% |

| DAX | -106.50 | 11200.62 | -0.94% |

| CAC 40 | -64.93 | 4967.37 | -1.29% |

| DJIA | -296.24 | 24688.31 | -1.19% |

| S&P 500 | -151.12 | 7167.21 | -2.07% |

| NASDAQ | -46.88 | 2658.69 | -1.73% |

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.