- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 24-10-2018.

| Index | Change items | Closing price | % change |

| Nikkei | +80.40 | 22091.18 | +0.37% |

| TOPIX | +1.35 | 1652.07 | +0.08% |

| CSI 300 | +4.77 | 3188.20 | +0.15% |

| KOSPI | -8.52 | 2097.58 | -0.40% |

| FTSE 100 | +7.77 | 6962.98 | +0.11% |

| DAX | -82.65 | 11191.63 | -0.73% |

| CAC 40 | -14.60 | 4953.09 | -0.29% |

| DJIA | -608.01 | 24583.42 | -2.41% |

| S&P 500 | -84.59 | 2656.10 | -3.09% |

| NASDAQ | -329.14 | 7108.40 | -4.43% |

Major US stock indexes have declined significantly, as weak quarterly results from AT&T and poor forecasts from chip makers overshadowed optimism from Boeing results for the quarter.

In addition, investors were disappointed data on the US housing market. As it became known, sales of single-family homes fell to almost 2-year lows in September, and the data for the previous three months were revised down, which is the last sign that rising mortgage rates and higher prices are undermining the country's housing market . The Commerce Department reported that new home sales fell 5.5% to a seasonally adjusted annual figure of 553,000 units. It was the lowest level since December 2016. The pace of sales in August was revised to 585,000 units from 629,000 units.

The focus was also on the Fed Beige Book. The paper said that companies are still optimistic about the economic growth trajectory, but they pointed to concerns that prices will continue to rise due to import duties. Most of the 12 regions in the zone of responsibility of the Fed reported moderate or modest economic growth in early autumn. The beige book was based on information received before October 15 inclusive.

Most of the components of DOW finished trading in the red (24 of 30). Outsiders were United Technologies Corporation (UTX, -5.44%). The growth leader was the shares of The Procter & Gamble Company (PG, + 2.76%).

Almost all sectors of the S & P recorded a decline. The largest decline was shown by the technology sector (-3.8%). The utility sector grew the most (+ 1.8%).

At the time of closing:

Index

Dow 24,581.28 -610.15 -2.42%

S & P 500 2,656.18 -84.51 -3.08%

Nasdaq 100 7,108.40 -329.14 -4.43%

U.S. stock-index futures traded flat on Wednesday, as investors assessed a slew of corporate earnings reports.

Global Stocks:

| Index/commodity | Last | Today's Change, points | Today's Change, % |

| Nikkei | 22,091.18 | +80.40 | +0.37% |

| Hang Seng | 25,249.78 | -96.77 | -0.38% |

| Shanghai | 2,603.30 | +8.47 | +0.33% |

| S&P/ASX | 5,829.00 | -14.10 | -0.24% |

| FTSE | 7,036.04 | +80.83 | +1.16% |

| CAC | 5,035.52 | +67.83 | +1.37% |

| DAX | 11,358.94 | +84.66 | +0.75% |

| Crude | $66.96 | | +0.80% |

| Gold | $1,232.40 | | -0.36% |

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 37.28 | -0.04(-0.11%) | 2421 |

| ALTRIA GROUP INC. | MO | 62 | 0.15(0.24%) | 1679 |

| Amazon.com Inc., NASDAQ | AMZN | 1,777.25 | 8.55(0.48%) | 52314 |

| AMERICAN INTERNATIONAL GROUP | AIG | 44.2 | 0.02(0.05%) | 2580 |

| Apple Inc. | AAPL | 222.75 | 0.02(0.01%) | 271655 |

| AT&T Inc | T | 31.96 | -1.06(-3.21%) | 1687199 |

| Barrick Gold Corporation, NYSE | ABX | 13.3 | -0.04(-0.30%) | 18930 |

| Boeing Co | BA | 366.43 | 16.38(4.68%) | 161221 |

| Caterpillar Inc | CAT | 120.06 | 1.08(0.91%) | 45993 |

| Cisco Systems Inc | CSCO | 45.26 | -0.16(-0.35%) | 23379 |

| Exxon Mobil Corp | XOM | 80.02 | 0.18(0.23%) | 2500 |

| Facebook, Inc. | FB | 154.5 | 0.11(0.07%) | 75201 |

| FedEx Corporation, NYSE | FDX | 216.06 | -2.32(-1.06%) | 989 |

| Ford Motor Co. | F | 8.58 | -0.01(-0.12%) | 12733 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 12.15 | 0.54(4.65%) | 164599 |

| General Electric Co | GE | 12.65 | -0.04(-0.32%) | 30569 |

| General Motors Company, NYSE | GM | 32 | -0.12(-0.37%) | 4557 |

| Google Inc. | GOOG | 1,107.00 | 3.31(0.30%) | 2519 |

| Home Depot Inc | HD | 178 | -0.53(-0.30%) | 748 |

| HONEYWELL INTERNATIONAL INC. | HON | 151 | 0.40(0.27%) | 1520 |

| Intel Corp | INTC | 44.3 | -0.20(-0.45%) | 25826 |

| International Business Machines Co... | IBM | 131.35 | 0.14(0.11%) | 1830 |

| International Paper Company | IP | 41.55 | 0.17(0.41%) | 1001 |

| Johnson & Johnson | JNJ | 139.03 | 0.10(0.07%) | 1403 |

| JPMorgan Chase and Co | JPM | 105.26 | 0.01(0.01%) | 7711 |

| McDonald's Corp | MCD | 176.35 | -0.80(-0.45%) | 21773 |

| Microsoft Corp | MSFT | 108.5 | 0.40(0.37%) | 155698 |

| Nike | NKE | 73.34 | -0.01(-0.01%) | 2571 |

| Pfizer Inc | PFE | 43.86 | -0.24(-0.54%) | 2978 |

| Procter & Gamble Co | PG | 87.03 | -0.13(-0.15%) | 6645 |

| Tesla Motors, Inc., NASDAQ | TSLA | 300.8 | 6.66(2.26%) | 411943 |

| Twitter, Inc., NYSE | TWTR | 28.8 | 0.03(0.10%) | 49702 |

| United Technologies Corp | UTX | 130.63 | 0.61(0.47%) | 2211 |

| UnitedHealth Group Inc | UNH | 265.68 | 0.82(0.31%) | 1321 |

| Verizon Communications Inc | VZ | 57.09 | -0.12(-0.21%) | 10859 |

| Visa | V | 139.47 | 0.35(0.25%) | 12153 |

| Walt Disney Co | DIS | 117.4 | -0.45(-0.38%) | 3449 |

| Yandex N.V., NASDAQ | YNDX | 27.6 | 0.82(3.06%) | 54519 |

Tesla (TSLA) initiated with a Mkt Outperform at JMP Securities; target $350

Verizon (VZ) coverage resumed with Buy at Guggenheim

McDonald's (MCD) target raised to $195 at Telsey Advisory Group

Morgan Stanley (MS) upgraded to Outperform from Market Perform at Wells Fargo

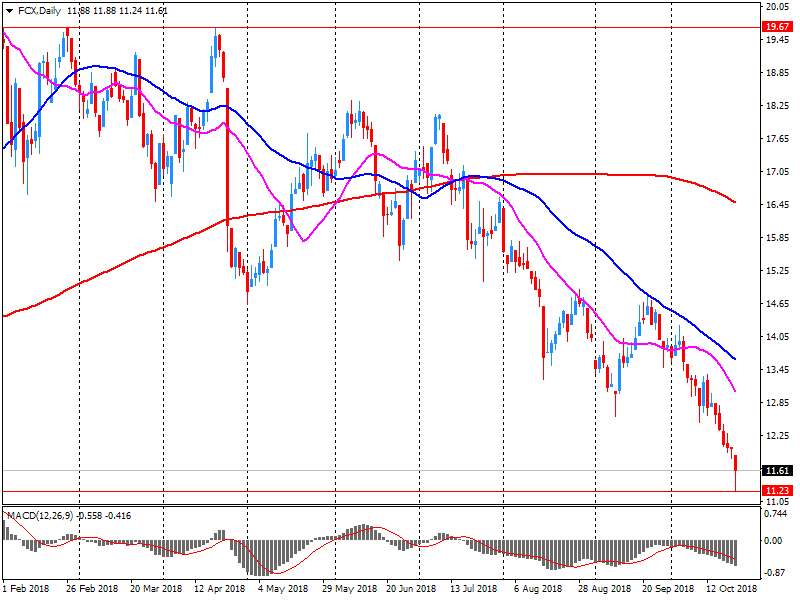

Freeport-McMoRan (FCX) reported Q3 FY 2018 earnings of $0.35 per share (versus $0.34 in Q3 FY 2017), beating analysts' consensus estimate of $0.32.

The company's quarterly revenues amounted to $4.908 bln (+13.9% y/y), beating analysts' consensus estimate of $4.499 bln.

FCX rose to $12.00 (+3.36%) in pre-market trading.

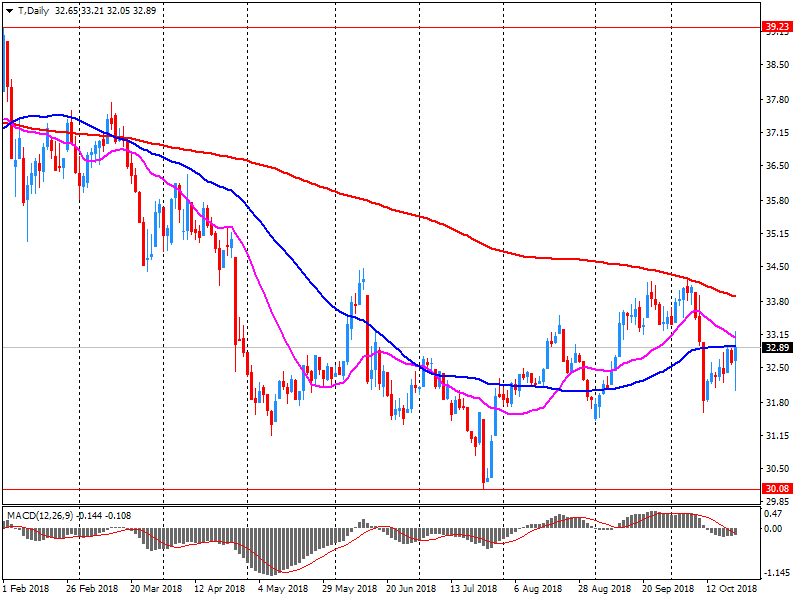

AT&T (T) reported Q3 FY 2018 earnings of $0.90 per share (versus $0.74 in Q3 FY 2017), missing analysts' consensus estimate of $0.95.

The company's quarterly revenues amounted to $45.739 bln (+15.3% y/y), generally in line with analysts' consensus estimate of $45.733 bln.

The company also reaffirmed guidance for FY 2018, projecting EPS of $3.50 versus analysts' consensus estimate of $3.53.

T fell to $32.00 (-3.09%) in pre-market trading.

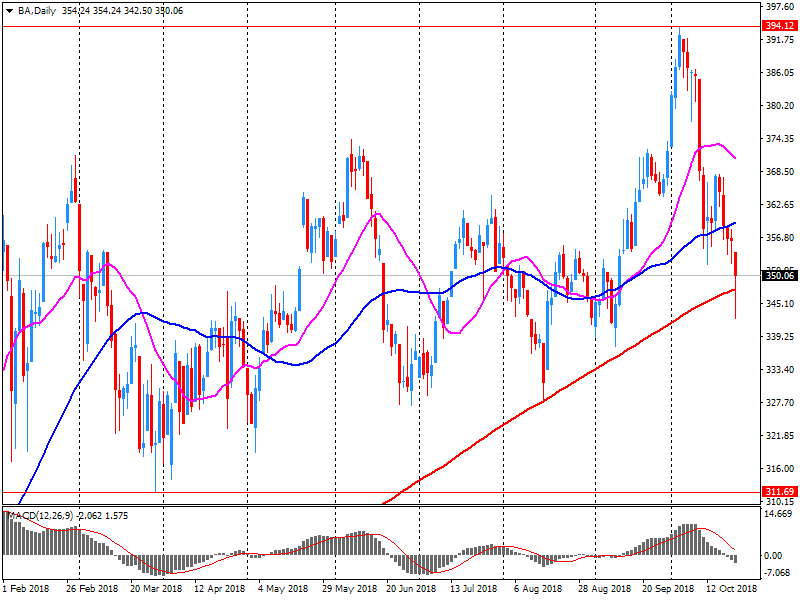

Boeing (BA) reported Q3 FY 2018 earnings of $3.58 per share (versus $2.72 in Q3 FY 2017), beating analysts' consensus estimate of $3.47.

The company's quarterly revenues amounted to $25.146 bln (+3.8% y/y), beating analysts' consensus estimate of $23.839 bln.

The company also issued upside guidance for FY 2018, projecting EPS of $14.90-15.10 (versus analysts' consensus estimate of $14.64 and its prior guidance of $14.30-14.50) and revenues of $98-100 bln (versus analysts' consensus estimate of $98.48 bln and its prior guidance of $97-99 bln).

BA rose to $365.50 (+4.41%) in pre-market trading.

© 2000-2024. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.