- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 19-10-2011.

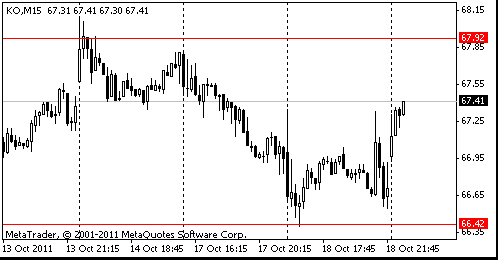

Gabelli tags shares of Coca-Cola (KO) with a Buy rating, pointing to an extra boost the company might see in Europe when the Olympics and Euro soccer championship are hosted in 2012. Shares of KO +1.08%

Currently FTSE 5,475 +64.78 +1.20%, CAC 3,177 +36.07 +1.15%, DAX 5,966 +88.23 +1.50%.

European stocks rose amid conflicting reports that France and Germany have reached a deal on expanding the region’s rescue fund.

Hang Seng 18,306 +229.04 +1.27%

S&P/ASX 4,214 +26.82 +0.64%

Shanghai Composite 2,378 -5.97 -0.25%

Asian stocks fell, driving the regional benchmark index toward its biggest drop in two weeks, as China said its economy grew at the slowest pace in two years, feeding global growth concerns after Germany damped expectations of a fast resolution to Europe’s debt crisis. The Asia-Pacific measure deepened declines today after a report showed China’s economy grew 9.1 percent in the third quarter from a year earlier, the slowest pace since 2009, as the central bank tightened monetary policy and export demand weakened. Policy makers have raised interest rates five times over the past year, curbed lending and imposed limits on home purchases to rein in property and consumer prices.

Financial stocks were the biggest drag on the Asia-Pacific gauge today after U.S. banks Citigroup Inc. and Wells Fargo & Co. said quarterly revenue dropped. Mitsubishi UFJ declined 1.8 percent to 335 yen in Tokyo, while, in Sydney, National Australia Bank Ltd. slid 2.1 percent to A$24.23. HSBC Holdings Plc, Europe’s biggest lender, lost 3.2 percent to HK$62.85 in Hong Kong.

Aluminum Corp. dropped 11 percent to HK$3.72, while China Coal Energy Co. slumped 6.2 percent to HK$8.05. China Merchants Holdings (International) Co., which operates container terminals, lost 7.5 percent to HK$21.70 and Industrial & Commercial Bank of China Ltd., the world’s largest lender by market value, dropped 6.1 percent to HK$4.04.

BHP Billiton Ltd., the world’s No. 1 mining company, slipped 3.3 percent to A$36.40 in Sydney. Rio Tinto, which makes more than 40 percent of revenue from China and Europe, slid 5.3 percent to A$66.25. Korea Zinc Co., which also produces gold and silver, fell 3.6 percent to 311,500 won. Mitsubishi Corp., a Japanese commodities trading company, retreated 2.5 percent to 1,574 yen in Tokyo.

Esprit Holdings Ltd., a Hong Kong-listed clothing retailer that gets 83 percent of its revenue from Europe, plunged 6.4 percent to HK$11.72 in Hong Kong. Sony Corp., which gets about 70 percent of its revenue overseas, dropped 1.2 percent to 1,588 yen in Tokyo. Nissan Motor Co., a carmaker that gets about 80 percent of its sales from overseas, fell 1.7 percent to 716 yen.

European stocks fell as concern that France may lose its top credit rating added pressure on the region’s leaders to find a solution to the debt crisis and as China’s economy grew at the slowest pace in two years. While Group of 20 finance ministers and central bankers are pressing European Union leaders to set out a strategy by the end of the week, divisions are flaring over an emerging plan to avoid a Greek default, bolster banks and curb contagion.

National benchmark indexes retreated in 7 of the 18 western European markets. The U.K.’s FTSE 100 dropped 0.4 percent and France’s CAC 40 fell 0.7 percent, while Germany’s DAX advanced 0.5 percent.

BHP Billiton, the world’s biggest mining company, lost 1 percent to 1,891.5 pence, while Rio Tinto, the second-largest, sank 4.2 percent to 3,162 pence. Copper slumped for a second day in London amid concern demand from China may slow as the economy cools. Lead, tin and zinc also fell.

Xstrata Plc retreated 1.3 percent to 936.3 pence even after the largest exporter of power-station coal said total third- quarter production of the fuel rose 8.1 percent. Copper output fell 4 percent, the company said.

BNP Paribas, France’s biggest bank, declined 4.4 percent to 29.69 euros. Societe Generale sank 5.2 percent to 19.19 euros.

France’s Aaa credit rating is under pressure from deterioration in debt metrics and the potential for additional liabilities from Europe’s debt crisis, according to Moody’s. The nation’s financial strength has weakened because of the global economic crisis, making the nation’s debt measures the weakest among its Aaa-rated peers, the New York-based company said in a statement late yesterday that it called a markets update.

Air France-KLM Group slid 2.6 percent to 5.46 euros after the airline ousted Pierre-Henri Gourgeon as chief executive officer amid slumping earnings and questions regarding the role of pilots in a fatal crash.

Aixtron SE, a supplier to the semiconductor industry, sank 5.3 percent to 9.99 euros. The company’s third-quarter results are likely to be “disastrous,” CA Cheuvreux analyst Klaus Ringel wrote in a report.

Danone, the owner of the Evian and Volvic bottled-water brands, rose 2.4 percent to 46.48 euros as three people familiar with the matter said the company is in talks to sell water assets to Japan’s Suntory Holdings Ltd. Danone also reported third-quarter revenue that beat estimates as it sold more baby food and medical nutrition products in China and Indonesia.

Continental AG added 4.4 percent to 53.08 euros, paring yesterday’s declines. The world’s fourth-largest tiremaker said Schaeffler Beteiligungsholding GmbH & Co.’s voting rights rose to 36.14 percent on Sept 30.

U.S. stocks gained, sending the Standard & Poor’s 500 Index to the highest level since August, as Bank of America Corp. paced a rally in financial shares and optimism grew over progress on expanding Europe’s rescue fund. France and Germany are engaged in “intensive talks” on bolstering the European Financial Stability Facility. In the U.S., data showed that homebuilders were less pessimistic than forecast in October, as near record-low borrowing costs and price decreases raised hopes the market will turn for the better over the next six months. In another report, wholesale prices rose more than forecast in September, boosted by gasoline, food and trucks.

Bank of America (ВАС) climbed 10 percent after it swung to a profit as credit quality improved. The provision for loan losses dropped to $3.4 billion from $5.4 billion a year earlier as credit improved in the card unit and commercial lending, the bank said. The card unit swung to a profit in the quarter, while income rose at the deposit unit, global wealth and investment management, and global commercial banking.

A gauge of homebuilders in S&P indexes jumped 9.6 percent, the most since March 2009, as data showed that industry sentiment increased more than forecast.

Alcoa (АА) gained 5.9 percent to $10.14. Caterpillar (САТ) climbed 3.9 percent to $84.72. PulteGroup Inc., the largest U.S. homebuilder by revenue, rallied 11 percent to $4.46.

International Business Machines Corp. (IBM) tumbled 4.1 percent to $178.90. The biggest computer-services company missed sales estimates for the first time in five quarters. Revenue showed slowing growth in IBM’s software, hardware and services businesses.

© 2000-2024. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.