- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 15-11-2018.

Major US stock indexes have risen significantly, helped by the rally in the technology sector and the base materials sector, as well as favorable data on US retail sales.

The Commerce Department reported that retail sales rose 0.8% in October, after declining by 0.1% in September, as households bought electronics and household appliances. Economists had forecast a growth rate of 0.5%. On an annualized basis, retail sales grew by 4.6% after rising 4.2% earlier. With the exception of cars, gasoline, building materials and food, retail sales rose 0.3% last month. These so-called major retail sales most closely correspond to the consumer spending component of GDP. The retail sales report says that consumer spending retained most of its strong momentum at the beginning of the fourth quarter, probably keeping the economy on the path of strong growth, despite the trade deficit and the housing market, which is expected to worsen.

In addition, the focus was on statements by Fed Chairman Powell, who gave a positive assessment of the US economy, which can be regarded as the Fed's intention to continue raising interest rates next month. “The US economy is in good shape,” Powell said, adding that the last employment report for October was “very strong.”

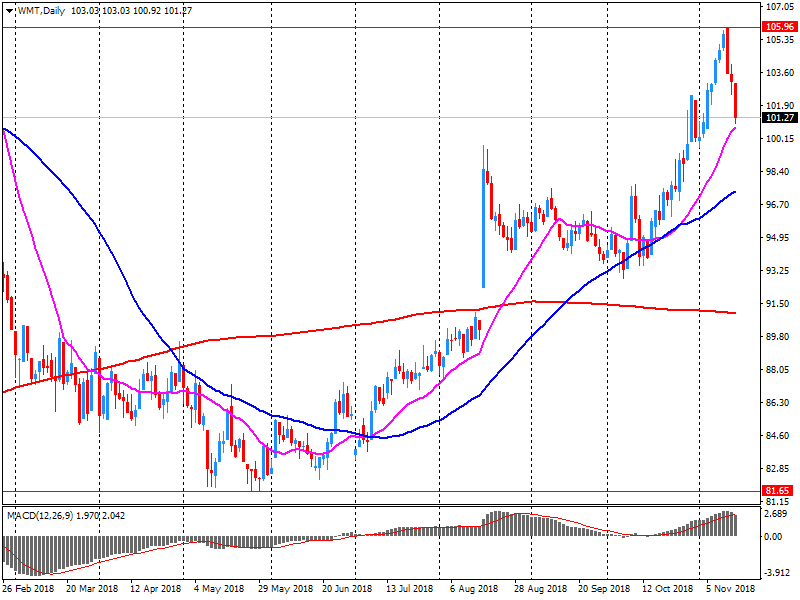

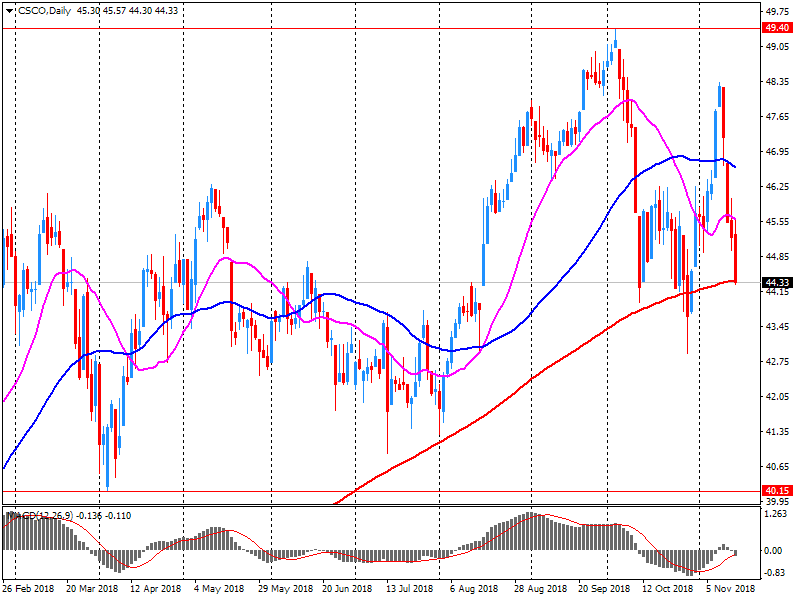

Most of the components of DOW finished trading in positive territory (20 of 30). The leader of growth were shares of Cisco Systems, Inc. (CSCO + 5.46%). Walmart Inc. shares turned out to be an outsider. (WMT, -2.20%).

Most sectors of the S & P showed an increase. The technological sector grew the most (+ 1.8%). The largest decline recorded sector conglomerates (-1.0%)

At the time of closing:

Dow 25,289.27 +208.77 +0.83%

S & P 500 2,730.20 +28.62 +.06%

Nasdaq 100 7,259.03 +122.64 +1.72%

U.S. stock-index futures traded flat on Wednesday, as declines in technology sector, led by Amazon (AMZN) and Facebook (FB), offset upbeat earnings reports from Walmart Inc (WMT) and Cisco Systems Inc (CSCO), as well as better-than-expected retail sales data.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 21,803.62 | -42.86 | -0.20% |

Hang Seng | 26,103.34 | +448.91 | +1.75% |

Shanghai | 2,668.17 | +35.93 | +1.36% |

S&P/ASX | 5,736.00 | +3.20 | +0.06% |

FTSE | 7,038.41 | +4.62 | +0.07% |

CAC | 5,041.90 | -26.95 | -0.53% |

DAX | 1,405.79 | -6.74 | -0.06% |

Crude | $56.46 | +0.37% | |

Gold | $1,212.00 | +0.16% |

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 201.2 | 3.14(1.59%) | 1499 |

ALTRIA GROUP INC. | MO | 59.11 | 0.01(0.02%) | 2133 |

Amazon.com Inc., NASDAQ | AMZN | 1,590.14 | -8.87(-0.55%) | 89659 |

Apple Inc. | AAPL | 187.94 | 1.14(0.61%) | 404467 |

AT&T Inc | T | 30.54 | 0.03(0.10%) | 18800 |

Barrick Gold Corporation, NYSE | ABX | 12.83 | 0.12(0.94%) | 24040 |

Boeing Co | BA | 342 | -2.72(-0.79%) | 6816 |

Caterpillar Inc | CAT | 125.36 | 0.26(0.21%) | 3921 |

Chevron Corp | CVX | 114.44 | -0.16(-0.14%) | 1616 |

Cisco Systems Inc | CSCO | 46.12 | 1.79(4.04%) | 235586 |

Citigroup Inc., NYSE | C | 63.16 | -0.34(-0.54%) | 72155 |

Deere & Company, NYSE | DE | 145.42 | -1.80(-1.22%) | 3401 |

Exxon Mobil Corp | XOM | 77.3 | -0.09(-0.12%) | 4147 |

Facebook, Inc. | FB | 141.5 | -2.72(-1.89%) | 167881 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 11.6 | 0.06(0.52%) | 31114 |

General Electric Co | GE | 8.28 | -0.04(-0.48%) | 209339 |

General Motors Company, NYSE | GM | 35.08 | -0.15(-0.43%) | 4020 |

Goldman Sachs | GS | 202.5 | 0.01(0.00%) | 8767 |

Hewlett-Packard Co. | HPQ | 23.75 | 0.02(0.08%) | 560 |

Home Depot Inc | HD | 180 | 0.10(0.06%) | 13028 |

Intel Corp | INTC | 47.11 | 0.02(0.04%) | 21750 |

International Business Machines Co... | IBM | 120.39 | 0.19(0.16%) | 2015 |

Johnson & Johnson | JNJ | 144.16 | -0.09(-0.06%) | 556 |

JPMorgan Chase and Co | JPM | 108.25 | 0.92(0.86%) | 73457 |

McDonald's Corp | MCD | 183.55 | -0.30(-0.16%) | 294 |

Microsoft Corp | MSFT | 104.88 | -0.09(-0.09%) | 35506 |

Pfizer Inc | PFE | 42.78 | -0.13(-0.30%) | 1808 |

Procter & Gamble Co | PG | 93.1 | -0.39(-0.42%) | 2320 |

Starbucks Corporation, NASDAQ | SBUX | 66.83 | -0.21(-0.31%) | 590 |

Tesla Motors, Inc., NASDAQ | TSLA | 344.25 | 0.25(0.07%) | 34844 |

The Coca-Cola Co | KO | 49.73 | -0.03(-0.06%) | 534 |

Travelers Companies Inc | TRV | 123.41 | 0.37(0.30%) | 1281 |

Twitter, Inc., NYSE | TWTR | 32.9 | -0.01(-0.03%) | 41850 |

UnitedHealth Group Inc | UNH | 264.48 | -0.48(-0.18%) | 1140 |

Verizon Communications Inc | VZ | 58.91 | -0.03(-0.05%) | 6121 |

Visa | V | 139.4 | 0.16(0.11%) | 3962 |

Wal-Mart Stores Inc | WMT | 102.4 | 0.87(0.86%) | 586369 |

Walt Disney Co | DIS | 116.95 | -0.17(-0.15%) | 1826 |

Yandex N.V., NASDAQ | YNDX | 29.18 | 0.27(0.93%) | 2194 |

Walmart Inc (WMT) reported Q3 FY 2019 earnings of $1.08 per share (versus $1.00 in Q3 FY 2018), beating analysts’ consensus estimate of $1.02.

The company’s quarterly revenues amounted to $123.897 bln (+1.4% y/y), generally in-line with analysts’ consensus estimate of $124.421 bln.

WMT rose to $102.07 (+0.53%) in pre-market trading.

Cisco Systems Inc (CSCO) reported Q1 FY 2019 earnings of $0.75 per share (versus $0.61 in Q1 FY 2018), beating analysts’ consensus estimate of $0.72.

The company’s quarterly revenues amounted to $13.072 bln (+7.7% y/y), beating analysts’ consensus estimate of $12.861 bln.

CSCO rose to $46.10 (+3.99%) in pre-market trading.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.