- Analytics

- News and Tools

- Market News

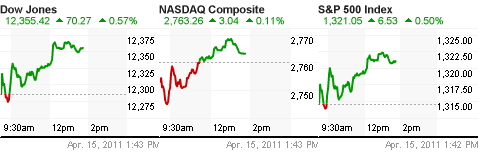

Analytics, News, and Forecasts for CFD Markets: stock news — 15-04-2011.

Stocks have been hit by a recent bout of selling pressure, which has taken the stock market to its lowest level in about 90 minutes. The action has left shares of Google (GOOG 536.06, -42.45) to drop through their session low so that they now trade at their worst level in six months.

Stocks have stretched to fresh session highs. The move comes amid some relatively broad buying interest. However, financials have failed to return to the levels that they set in the early going. Instead, financials are up a moderate 0.4%.

Bank of America (BAC 13.00, -0.13) has become a burden to the financial sector after it had actually traded with strength in the early going. Volatility in shares of BAC come in the wake of news of an earnings miss for the most recent quarter and an announcement that the bank has reached an agreement on mortgage repurchases with Assured Guaranty (AGO 17.90, +3.73). The expiration of monthly options is likely adding to volatility.

Stocks had made a strong upward push on the back of a stronger-than-expected consumer sentiment survey reading, but they have since drifted down from morning highs. The action has left the major equity averages to continue trading with mixed results.

Amid the sloppy trade seen this morning, Treasuries have rallied. The move has the yield on the benchmark 10-year Note down to 3.42%, which is only a couple of basis points above its 10-day low. Renewed strength among Treasuries comes after analysts at Moody's downgraded the debt of Ireland -- a move that has rekindled concerns about conditions among the less fiscally sound countries in the eurozone and its periphery.

The preliminary Consumer Sentiment Survey for April from the University of Michigan came in at 69.6, which is greater than the 66.5 that had been expected. The preliminary reading for April is also greater than the 67.5 that was posted for the prior month.

Stocks have reacted positively to the news.

Advancing Sectors: Utilities (+1.2%), Health Care (+0.8%), Industrials (+0.6%), Financials (+0.5%), Materials (+0.4%), Telecom (+0.4), Energy (+0.1%)

Declining Sectors: Tech (-0.4%)

U.S. stocks were poised for losses Friday, as Google and Bank of America earnings disappointed investors.

"Obviously right now, investors are a little concerned," said Ethan Anderson at Rehmann in Grand Rapids, Mich. "You're seeing data out of China showing higher inflation and that puts more upward pressure on interest rates. Meanwhile, earnings reports haven't been horrible, but they have certainly not been incredibly impressive either."

Dow component Bank of America (BAC, Fortune 500) fell 1% in premarket trading after the bank fell short of analyst estimates when it reported first-quarter earnings of $2 billion, or 17 cents a share. Analysts were forecasting a 27-cent profit.

Like JPMorgan Chase (JPM, Fortune 500) earlier this week, Bank of America said losses from mortgage-related assets would continue to hurt its bottom line.

Google (GOOG, Fortune 500) shares also dragged on premarket trading, falling 5.7% early Friday. Late Thursday, Google reported a quarterly profit that rose from year-ago results but missed Wall Street forecasts.

Economy: The Consumer Price Index during March rose mostly in line with expectations. The CPI rose 0.5% on a monthly basis and the annual rate reached 2.7%.

Core inflation rose at a slowest rate than in February at 0.1% in March, below expectations of a 0.2% rise. In the last 12 months the Core CPI rose 1.2%.

Investors will get the University of Michigan's consumer sentiment survey for April.

Companies: Other companies reporting results on Friday included broker Charles Schwab (SCHW, Fortune 500) and toy maker Mattel (MAT, Fortune 500).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.