- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 12-10-2018.

U.S. stock-index futures rose noticeably on Friday, as worries over rising rates mitigated and tech shares recovered from drastic losses earlier this week. In addition, a slew of strong bank financials also helped boost the market.

Global Stocks:

| Index/commodity | Last | Today's Change, points | Today's Change, % |

| Nikkei | 22,694.66 | +103.80 | +0.46% |

| Hang Seng | 25,801.49 | +535.12 | +2.12% |

| Shanghai | 2,606.91 | +23.45 | +0.91% |

| S&P/ASX | 5,895.70 | +11.90 | +0.20% |

| FTSE | 7,058.45 | +51.52 | +0.74% |

| CAC | 5,149.49 | +43.12 | +0.84% |

| DAX | 11,624.28 | +84.93 | +0.74% |

| Crude | $71.89 | | +1.30% |

| Gold | $1,224.20 | | -0.28% |

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 199 | 2.27(1.15%) | 2348 |

| ALCOA INC. | AA | 36.55 | 0.88(2.47%) | 1803 |

| ALTRIA GROUP INC. | MO | 60.56 | -0.56(-0.92%) | 2484 |

| Amazon.com Inc., NASDAQ | AMZN | 1,784.98 | 65.62(3.82%) | 200773 |

| American Express Co | AXP | 103.59 | 2.01(1.98%) | 3327 |

| AMERICAN INTERNATIONAL GROUP | AIG | 50.93 | 0.79(1.58%) | 1452 |

| Apple Inc. | AAPL | 219.08 | 4.63(2.16%) | 346471 |

| AT&T Inc | T | 32.18 | 0.43(1.35%) | 101599 |

| Barrick Gold Corporation, NYSE | ABX | 12.54 | -0.04(-0.32%) | 95987 |

| Boeing Co | BA | 365.48 | 7.37(2.06%) | 21676 |

| Caterpillar Inc | CAT | 144 | 3.03(2.15%) | 5445 |

| Chevron Corp | CVX | 120.4 | 1.97(1.66%) | 4811 |

| Cisco Systems Inc | CSCO | 45.23 | 1.11(2.52%) | 55675 |

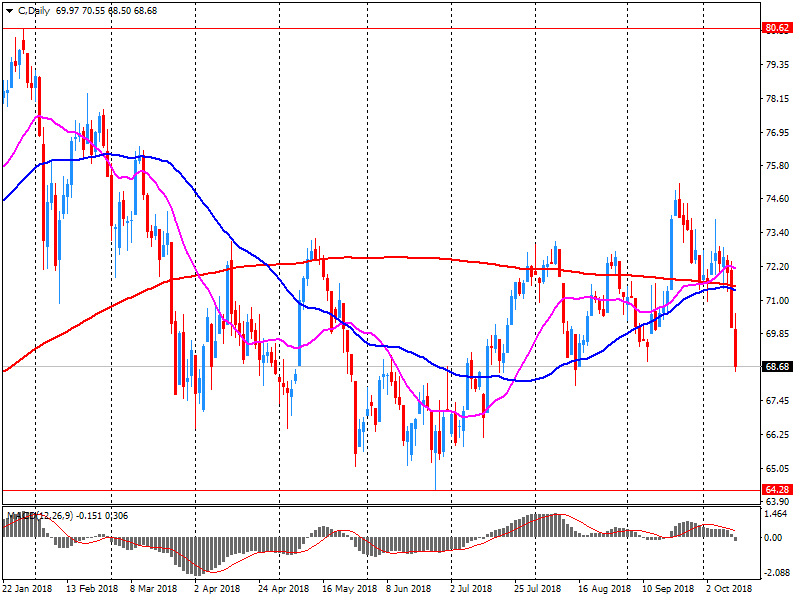

| Citigroup Inc., NYSE | C | 70.24 | 1.86(2.72%) | 221802 |

| Deere & Company, NYSE | DE | 148.22 | 1.75(1.19%) | 3958 |

| Exxon Mobil Corp | XOM | 82.9 | 1.30(1.59%) | 4637 |

| Facebook, Inc. | FB | 155.94 | 2.59(1.69%) | 242906 |

| Ford Motor Co. | F | 8.95 | 0.14(1.59%) | 55921 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 13.6 | 0.42(3.19%) | 51277 |

| General Electric Co | GE | 12.82 | 0.10(0.79%) | 491350 |

| General Motors Company, NYSE | GM | 32.76 | 0.45(1.39%) | 4495 |

| Goldman Sachs | GS | 217.3 | 4.33(2.03%) | 27689 |

| Google Inc. | GOOG | 1,101.87 | 22.55(2.09%) | 11661 |

| Hewlett-Packard Co. | HPQ | 23.6 | 0.59(2.56%) | 7616 |

| Home Depot Inc | HD | 193 | 3.26(1.72%) | 8613 |

| HONEYWELL INTERNATIONAL INC. | HON | 155.8 | 2.18(1.42%) | 2524 |

| Intel Corp | INTC | 45.14 | 0.91(2.06%) | 82064 |

| International Business Machines Co... | IBM | 141.28 | 2.26(1.63%) | 6459 |

| International Paper Company | IP | 43.94 | 1.12(2.62%) | 1764 |

| Johnson & Johnson | JNJ | 134.75 | 0.91(0.68%) | 7840 |

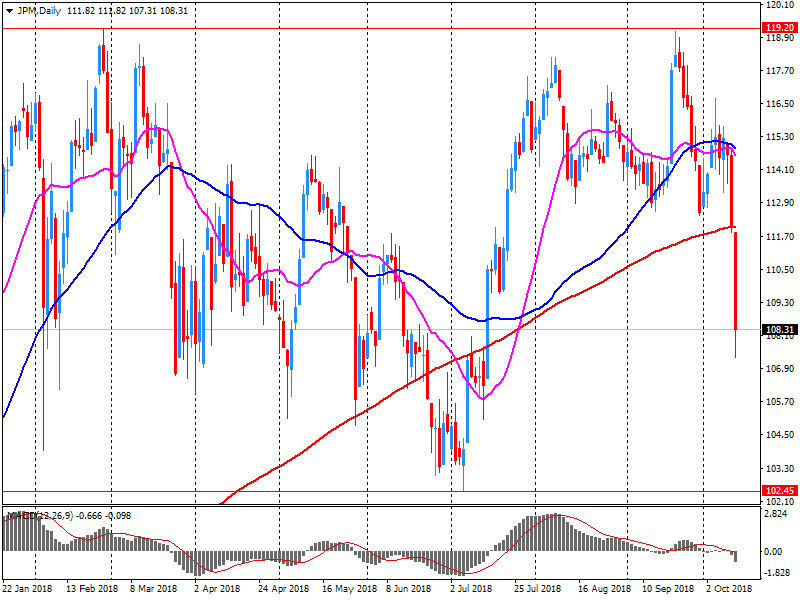

| JPMorgan Chase and Co | JPM | 110 | 1.87(1.73%) | 273095 |

| McDonald's Corp | MCD | 165.4 | 2.43(1.49%) | 2830 |

| Merck & Co Inc | MRK | 69.45 | 1.08(1.58%) | 2568 |

| Microsoft Corp | MSFT | 108.86 | 2.95(2.79%) | 286779 |

| Nike | NKE | 75.55 | 1.04(1.40%) | 16791 |

| Pfizer Inc | PFE | 43.25 | 0.44(1.03%) | 7297 |

| Procter & Gamble Co | PG | 79.44 | 0.57(0.72%) | 7123 |

| Starbucks Corporation, NASDAQ | SBUX | 55.97 | 1.11(2.02%) | 35881 |

| Tesla Motors, Inc., NASDAQ | TSLA | 258.98 | 6.75(2.68%) | 110789 |

| The Coca-Cola Co | KO | 44.86 | 0.22(0.49%) | 4285 |

| Twitter, Inc., NYSE | TWTR | 27.73 | 0.73(2.70%) | 76546 |

| UnitedHealth Group Inc | UNH | 261.09 | 3.97(1.54%) | 3906 |

| Verizon Communications Inc | VZ | 54 | 0.67(1.26%) | 15726 |

| Visa | V | 137.46 | 3.73(2.79%) | 35195 |

| Wal-Mart Stores Inc | WMT | 95.25 | 1.33(1.42%) | 11553 |

| Walt Disney Co | DIS | 111.4 | 0.25(0.22%) | 68741 |

Twitter (TWTR) upgraded to Hold from Sell at Pivotal Research Group; target lowered to $24 from $26

Microsoft (MSFT) upgraded to Outperform from Neutral at Macquarie

Wells Fargo (WFC) reported Q3 FY 2018 earnings of $1.13 per share (versus $0.84 in Q3 FY 2017), missing analysts' consensus estimate of $1.17.

The company's quarterly revenues amounted to $21.941 bln (+0.4% y/y), generally in-line with analysts' consensus estimate of $21.850 bln.

WFC rose to $52.28 (+1.63%) in pre-market trading.

Citigroup (C) reported Q3 FY 2018 earnings of $1.73 per share (versus $1.42 in Q3 FY 2017), beating analysts' consensus estimate of $1.66.

The company's quarterly revenues amounted to $18.389 bln (-0.2% y/y), generally in-line with analysts' consensus estimate of $18.469 bln.

С rose to $69.80 (+2.08%) in pre-market trading.

JPMorgan Chase (JPM) reported Q3 FY 2018 earnings of $2.34 per share (versus $1.76 in Q3 FY 2017), beating analysts' consensus estimate of $2.26.

The company's quarterly revenues amounted to $27.3 bln (+7.8% y/y), generally in-line with analysts' consensus estimate of $27.318 bln.

JPM rose to $109.38 (+1.16%) in pre-market trading.

© 2000-2024. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.