- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 01-08-2018.

| Index | Change items | Closing price | % change |

| Nikkei | +192.98 | 22746.70 | +0.86% |

| TOPIX | +16.47 | 1769.76 | +0.94% |

| CSI 300 | -70.27 | 3447.39 | -2.00% |

| KOSPI | +11.81 | 2307.07 | +0.51% |

| FTSE 100 | -95.85 | 7652.91 | -1.24% |

| DAX | -68.45 | 12737.05 | -0.53% |

| CAC 40 | -12.93 | 5498.37 | -0.23% |

| DJIA | -81.37 | 25333.82 | -0.32% |

| S&P 500 | -2.93 | 2813.36 | -0.10% |

| NASDAQ | +35.50 | 7707.29 | +0.46% |

Major US stock indexes finished trading mostly in the red, losing almost all the positions earned after a strong report from Apple caused the growth of the high-tech sector. Pressure on the market raised concerns about additional US duties on Chinese goods, as well as growth in yields on US government bonds.

The focus of investors' attention was also the outcome of the Fed meeting. As expected, the Fed left the range for interest rates unchanged, sounding at the same time a positive assessment of the economy, which signaled a probable increase in rates at the next meeting. "Economic activity is growing at a strong pace," the Fed said in a statement. She also called job growth "strong" and noted "strong" growth in household investment and expenditure. In general, the Fed has used the word "strong" or its synonyms six times in its statement to describe the state of the economy and the situation in the labor market.

In addition, according to a report published by the Institute for Supply Management (ISM), activity in the US manufacturing sector deteriorated sharply in July. The PMI index for the manufacturing sector fell to 58.1 points against 60.2 points in June. Analysts had expected that the figure would drop only to 59.5 points.

However, construction costs in the US recorded the largest drop in more than a year in June, as investments in both private and public projects declined, but expenses for the previous months were revised upward. The Ministry of Trade reported that in June construction costs fell by 1.1%, which is the biggest decline since April 2017. Meanwhile, the growth rates of expenditures for May were revised to + 1.3% from + 0.4%. Expenses for April were also revised towards improvement - to + 1.7% from + 0.9%. Economists predicted that in June construction costs would grow by only 0.3%. Meanwhile, in annual terms, construction costs increased in June by 6.1%.

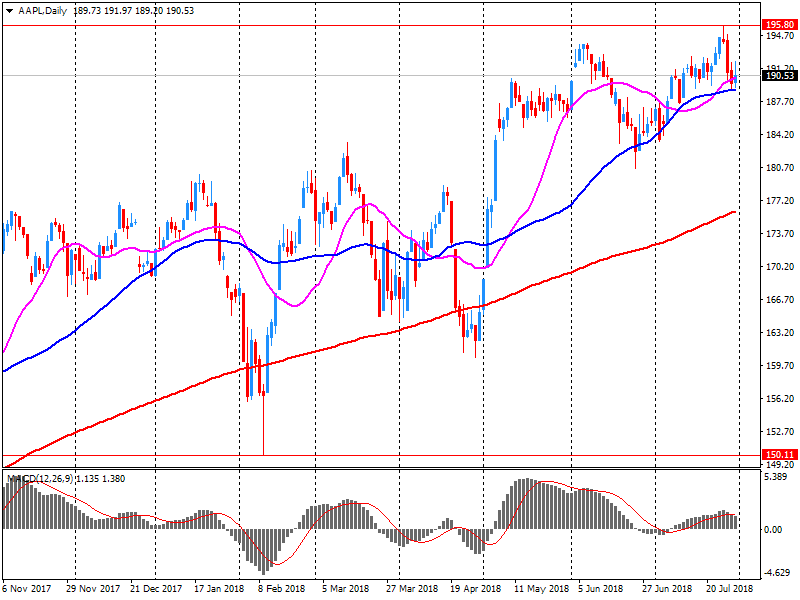

Most of the components of DOW finished trading in the red (19 of 30). Outsider were shares of Caterpillar Inc. (CAT, -3.73%). The leader of growth was the shares of Apple Inc. (AAPL, + 5.96%).

Most S & P sectors recorded a decline. The largest drop was shown by the sector of industrial goods (-1.2%). The consumer goods sector grew most (+ 0.6%).

At closing:

Dow 25,333.82 -81.37 -0.32%

S&P 500 2,813.36 -2.93 -0.10%

Nasdaq 100 7,707.29 +35.50 +0.46%

U.S. stock-index futures were flat on Wednesday, as Apple's (AAPL) upbeat report was outweighed by increased concerns of escalation trade tensions between the U.S. and China, following news the U.S. president is considering raising its planned tariffs on $200 billion in Chinese imports to 25 percent from initially proposed 10 percent. Investors also remained cautious ahead of the announcement of the Fed's decision on monetary policy later today.

Global Stocks:

| Index/commodity | Last | Today's Change, points | Today's Change, % |

| Nikkei | 22,746.70 | +192.98 | +0.86% |

| Hang Seng | 28,340.74 | -242.27 | -0.85% |

| Shanghai | 2,824.21 | -52.19 | -1.81% |

| S&P/ASX | 6,275.70 | -4.50 | -0.07% |

| FTSE | 7,656.07 | -92.69 | -1.20% |

| CAC | 5,507.96 | -3.34 | -0.06% |

| DAX | 12,740.88 | -64.62 | -0.50% |

| Crude | $67.68 | | -1.57% |

| Gold | $1,230.10 | | -0.28% |

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 211.99 | -0.33(-0.16%) | 660 |

| ALCOA INC. | AA | 42.93 | -0.34(-0.79%) | 500 |

| Amazon.com Inc., NASDAQ | AMZN | 1,784.85 | 7.41(0.42%) | 28825 |

| AMERICAN INTERNATIONAL GROUP | AIG | 56.17 | 0.96(1.74%) | 981 |

| Apple Inc. | AAPL | 198.02 | 7.73(4.06%) | 1188450 |

| Boeing Co | BA | 354.1 | -2.20(-0.62%) | 1748 |

| Caterpillar Inc | CAT | 142.94 | -0.86(-0.60%) | 12775 |

| Chevron Corp | CVX | 125.5 | -0.77(-0.61%) | 2044 |

| Cisco Systems Inc | CSCO | 42.18 | -0.11(-0.26%) | 16226 |

| Citigroup Inc., NYSE | C | 72.28 | 0.39(0.54%) | 8656 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 16.03 | -0.47(-2.85%) | 69829 |

| General Motors Company, NYSE | GM | 38 | 0.09(0.24%) | 826 |

| Goldman Sachs | GS | 238.18 | 0.75(0.32%) | 3204 |

| Google Inc. | GOOG | 1,228.50 | 11.24(0.92%) | 17811 |

| Google Inc. | GOOG | 1,228.50 | 11.24(0.92%) | 17811 |

| Home Depot Inc | HD | 197.42 | -0.10(-0.05%) | 1506 |

| Intel Corp | INTC | 47.99 | -0.11(-0.23%) | 43528 |

| International Business Machines Co... | IBM | 144.68 | -0.25(-0.17%) | 553 |

| Merck & Co Inc | MRK | 65.36 | -0.51(-0.77%) | 618 |

| Microsoft Corp | MSFT | 105.85 | -0.23(-0.22%) | 70019 |

| Pfizer Inc | PFE | 39.7 | -0.23(-0.58%) | 7162 |

| Starbucks Corporation, NASDAQ | SBUX | 52.25 | -0.14(-0.27%) | 3228 |

| Tesla Motors, Inc., NASDAQ | TSLA | 298 | -0.14(-0.05%) | 19638 |

| The Coca-Cola Co | KO | 46.45 | -0.18(-0.39%) | 875 |

| The Coca-Cola Co | KO | 46.45 | -0.18(-0.39%) | 875 |

| Verizon Communications Inc | VZ | 51.75 | 0.11(0.21%) | 2527 |

Apple (AAPL) target raised to $220 from $210 at Needham

Apple (AAPL) reported Q3 FY 2018 earnings of $2.34 per share (versus $1.67 in Q3 FY 2017), beating analysts' consensus estimate of $2.18.

The company's quarterly revenues amounted to $53.265 bln (+17.3% y/y), beating analysts' consensus estimate of $52.430 bln.

The company also issued upside guidance for Q4, projecting revenues of $60-62 bln versus analysts' consensus estimate of $59.4 bln.

AAPL rose to $198.44 (+4.28%) in pre-market trading.

© 2000-2024. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.