- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 31-07-2014

(raw materials / closing price /% change)

Light Crude 97.65 -0.53%

Gold 1,281.70 +0.03%

(index / closing price / change items /% change)

Nikkei 225 15,620.77 -25.46 -0.16%

Hang Seng 24,756.85 +24.64 +0.10%

Shanghai Composite 2,201.56 +20.32 +0.93%

FTSE 100 6,730.11 -43.33 -0.64%

CAC 40 4,246.14 -66.16 -1.53%

Xetra DAX 9,407.48 -186.20 -1.94%

S&P 500 1,930.67 -39.40 -2.00%

NASDAQ 4,369.77 -93.13 -2.09%

Dow Jones 16,563.3 -317.06 -1.88%

(pare/closed(GMT +2)/change, %)

EUR/USD $1,3387 -0,05%

GBP/USD $1,6884 -0,16%

USD/CHF Chf0,9086 +0,01%

USD/JPY Y102,79 -0,01%

EUR/JPY Y137,62 -0,06%

GBP/JPY Y173,55 -0,17%

AUD/USD $0,9293 -0,34%

NZD/USD $0,8497 +0,15%

USD/CAD C$1,0903 +0,01%

(time / country / index / period / previous value / forecast)

01:00 China Manufacturing PMI July 51.0 51.4

01:30 Australia Producer price index, q / q Quarter II +0.9% +0.7%

01:30 Australia Producer price index, y/y Quarter II +2.5%

01:45 China HSBC Manufacturing PMI July 52.0 52.0

03:30 Japan BOJ Governor Haruhiko Kuroda Speaks

06:00 Switzerland Bank holiday

06:30 Australia Commodity Prices, Y/Y July -9.6%

07:48 France Manufacturing PMI July 47.6 47.6

07:53 Germany Manufacturing PMI July 52.9 52.9

07:58 Eurozone Manufacturing PMI July 51.9 51.9

08:30 United Kingdom Purchasing Manager Index Manufacturing July 57.5 57.2

12:30 U.S. Average workweek July 34.5

12:30 U.S. Average hourly earnings July +0.2% +0.2%

12:30 U.S. Personal Income, m/m June +0.4% +0.4%

12:30 U.S. Personal spending June +0.2% +0.5%

12:30 U.S. PCE price index ex food, energy, m/m June +0.2% +0.2%

12:30 U.S. PCE price index ex food, energy, Y/Y June +1.5%

12:30 U.S. Unemployment Rate July 6.1% 6.1%

12:30 U.S. Nonfarm Payrolls July 288 230

13:45 U.S. Manufacturing PMI July 56.3 56.3

13:55 U.S. Reuters/Michigan Consumer Sentiment Index July 81.3 81.5

14:00 U.S. Construction Spending, m/m June +0.1% +0.4%

14:00 U.S. ISM Manufacturing July 55.3 56.1

17:00 U.S. Total Vehicle Sales, mln July 17.0 16.8

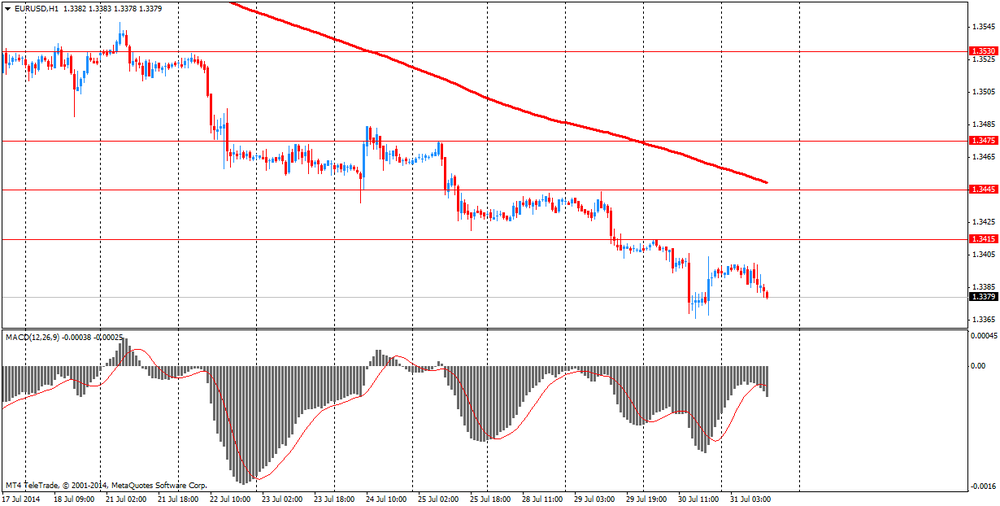

The euro exchange rate fell slightly against the dollar amid inflation data in the eurozone and the U.S. labor market. Eurozone inflation slowed in July to its lowest level in four and a half years, mainly due to falling energy prices, showed on Thursday, preliminary data from Eurostat. Inflation slowed to 0.4 percent in July from 0.5 percent in June. Inflation is expected to remain unchanged at 0.5 percent. This is the lowest figure since the beginning of price growth since November 2009. Core inflation, excluding energy, food, alcohol and tobacco remained unchanged at 0.8 percent in July. Energy prices fell by 1 percent, and prices for food, alcohol and tobacco fell by 0.3 percent. At the same time, the prices of non-energy industrial goods remained in the flat, and the cost of services increased by 1.3 percent.

Meanwhile, a report by the United States has shown that the number of initial claims for unemployment benefits rose by 23,000 and amounted to a seasonally adjusted 302,000 in the week ended July 26. Data were slightly better than expected. Economists on average had forecast 306,000 initial claims. Treatment in the previous week were revised up to 279,000, the lowest level since May 2000. The four-week moving average of claims, which smooths out weekly volatility, fell by 3,500 to 297,250 - the lowest level since April 2006. The report also showed: number of workers continuing to receive unemployment benefits increased by 31,000 and reached a seasonally adjusted 2.54 million in the week ended July 19.

British pound retreated from a session low against the dollar, but continues to trade with a noticeable decrease since yesterday upbeat data on U.S. economic growth continue to support demand for the U.S. currency. We also add that yesterday the Fed in its decision on the rate stated that the labor market is still considerable slack, despite the recent acceleration of job growth, and pointed out that while the rates remain at current levels. The central bank also said that inflation is rising and approaching the long-term target level.

Also had little effect on Britain today's data, which showed that house price growth slowed in July, lagging behind the expectations of economists. Mortgage lender Nationwide said that house prices rose by 10.6 percent compared with the previous year in July, an increase of the seventeenth consecutive month, and followed growth of 11.8 percent in June. This was less than the growth of 11.3 percent expected by economists. On a monthly basis, prices rose at the slowest pace since April 2013, by 0.1 percent in July - much slower than the increase of 1 percent in June and 0.5 percent growth expected by economists. The average price of a house rose to 188,949 pounds from 188,903 pounds in June.

The Canadian dollar has appreciated strongly against its U.S. counterpart, received support from the Canadian GDP data. The Canadian economy grew at the fastest pace in four months in May, driven by growth in the manufacturing, wholesale and retail trade, energy and construction. Gross domestic product (the total amount of goods and services produced in the country) grew by 0.4% to 1.62 trillion Canadian dollars ($ 1,490 billion), accelerating compared with an increase in each of the previous two months by 0.1%. This Statistics Canada said Thursday. Rise exceeded market expectations (0.3%). In annualized growth rose to 2.3% from 2.1%. In the services sector grew by 0.4 release%, corresponding strengthening of the previous month. In the production of goods issue recovered from the recession in the previous month, an increase of 0.5% - this is the largest increase since February.

European stocks dropped significantly today, and recorded its first monthly decline in the last two years. Pressure on the company's stock indexes had Adidas, warned against the deterioration of indicators in Russia, as well as the situation with Argentina.

Agency reported today BBC, defaulted Argentine authorities - that is officially recognized that the country is able to pay its debts. This South American country to declare a default for the second time in the last 13 years, and the current debt of 1.3 billion dollars came just after the previous default in 2001 when hedge funds bought government bonds at a discounted price. Argentine officials have until recently tried to sign a contract with the funds of the installment, but last night the last round of talks also ended in nothing.

Investors also continue to evaluate corporate accountability. Of the 40 percent of the participating companies STOXX Europe 600 index, that reported for the second quarter, 55 percent short of analysts' expectations or exceeded them. Corporate profits have grown by an average of 7.1 per cent compared with last year, but sales have decreased by 1.5 percent.

"Despite some decent profit companies, the market is stuck in a range, and at the forefront of investors left many negative factors, including defaulted Argentine" - said Lionel Jardin of Assya Capital in Paris.

Meanwhile, add that pressure on mood have concerns about the impact of sanctions imposed by the West against Russia. Sanctions have already begun to undermine the position of the Western companies. In general, experts believe that it is too early to draw definitive conclusions about the effectiveness of sanctions, and note that the West should expect a response from Russia, which primarily take the form of trade sanctions.

Also had little impact today's data, which showed that inflation in the eurozone slowed in July to its lowest level in four and a half years, mainly due to falling energy prices. Inflation slowed to 0.4 percent in July from 0.5 percent in June. Inflation is expected to remain unchanged at 0.5 percent. This is the lowest figure since the beginning of price growth since November 2009. Core inflation, excluding energy, food, alcohol and tobacco remained at 0.8 percent.

Another report showed that the number of initial claims for unemployment benefits in the U.S. increased by 23,000 and amounted to a seasonally adjusted 302,000 in the week ended July 26. Data were slightly better than expected. Economists on average had forecast 306,000 initial claims. Treatment in the previous week were revised up to 279,000, the lowest level since May 2000.

National benchmark indexes fell in all of the 18 western European markets, except Iceland:

FTSE 100 6,730.11 -43.33 -0.64% CAC 40 4,246.14 -66.16 -1.53% DAX 9,407.48 -186.20 -1.94%

Adidas AG shares fell by the maximum value over the past 15 years, namely 15.6 percent, after the company on the reduction of development plans in Russia and revising manufacturing business of golf. These problems forced the company to reduce the forecast annual figures.

Quotes Banco Espirito Santo tumbled 39 percent after the reservation of 4.3 billion euros ($ 5.7 billion).

Paper Afren Plc fell 26% after the resignation of top executives from the investigation of unauthorized payments.

Shares of Royal Dutch Shell Plc added 2.5 percent. The largest oil company in Europe reported a profit, excluding one-time items and inventory changes, which rose 33 percent to $ 6.1 billion from $ 4.6 billion a year earlier. It surpassed the average analyst estimate of $ 5.6 billion

Paper Alcatel-Lucent SA fell 6.7 percent. French network equipment maker reported sales at 3.28 billion euros in the second quarter, which was less than the experts' forecasts of 3.3 billion euros.

Prices for Brent crude fell slightly today, dropping at the same time below $ 106 a barrel as higher OPEC production and weak demand in the U.S. outweighed fears of unrest in the Middle East, Africa and Ukraine. Add that in July the price of WTI crude oil fell by 5.7% - the maximum reduction for 9 months. Brent since the beginning of the month fell by 5.8%.

Today's data showed that crude oil production in OPEC was greater in July than in the previous month, despite fears that unrest in North Africa and the Middle East could hurt production. Meanwhile, we note that gasoline stocks in the United States rose last week by 365 thousand barrels - up to 218.2 million barrels, the highest level in 4 months. At the same time, the average volume of gasoline consumption in the past four weeks fell by 0.5% - to the lowest level since May, despite the peak driving season in the United States.

"It's incredible that gasoline inventories rose at all, given that the peak demand season now," - said the director of Energy Analytics Group LLC Tom Finlon. Over the past four weeks, gasoline demand in the U.S. fell by 0.5% to 8.948 million barrels. / day.

It should also add that today, analysts Reuters raised its forecast for Brent oil prices in 2014 and 2015 taking into account the geopolitical risks. Average price forecast for 2014 rose to $ 108.60 a barrel from $ 108.00 in June, while the forecast for 2015 - to $ 105.20 from $ 104.80.

"The oil market is roughly balanced, however, oil prices should remain steady range. Do not expect any serious supply problems, as Saudi Arabia will be able to compensate for all the missing supplies, "- said Commerzbank analyst Carsten Fritsch.

Meanwhile, we note that the United States for the first time in 40 years sent crude oil for export. On the night of July 31, 2014, the tanker BW Zambesi under the flag of Singapore, left the port of Texas City towards South Korea. The tanker is 400 thousand barrels of oil, the cost of which is estimated at 40 million U.S. dollars. Officially, the U.S. export policy has not changed, especially on the eve of elections, but preliminary shipping oil to South Korea can contribute in the future removal of the ban on exports.

The cost of the September futures on U.S. light crude oil WTI (Light Sweet Crude Oil) fell to $ 99.51 a barrel on the New York Mercantile Exchange (NYMEX).

September futures price for North Sea Brent crude oil mixture fell 5 cents to $ 105.96 a barrel on the London exchange ICE Futures Europe.

Gold prices fell markedly today, reaching at this six-week low, which was associated with the strengthening of the dollar and the Fed's statement yesterday.

FOMC decision to leave interest rates unchanged and reduce the amount of the third round of quantitative easing was expected. However, the accompanying statement was somewhat different from the previous one, which reinforced expectations earlier Fed interest rate increase. Without a doubt, this is a negative factor for gold. Analysts believe that before tomorrow's publication of data on employment in the U.S. non-farm payrolls, which will indicate the degree of recovery in the labor market, speculators refrain from taking action. It should be noted that if the employment report in the U.S. will be good market expectations for a more rapid closure or stimulate a quicker rate hikes grow.

The course of trade also influenced today's data, which showed that the number of initial claims for unemployment benefits rose by 23,000 and amounted to a seasonally adjusted 302,000 in the week ended July 26. Data were slightly better than expected. Economists on average had forecast 306,000 initial claims. Treatment in the previous week were revised up to 279,000, the lowest level since May 2000. The four-week moving average of claims, which smooths out weekly volatility, fell by 3,500 to 297,250 - the lowest level since April 2006. The report also showed: number of workers continuing to receive unemployment benefits increased by 31,000 and reached a seasonally adjusted 2.54 million in the week ended July 19.

Meanwhile, we add that, despite the decline in prices, the demand for gold is still supported as the tensions between Russia and the West because of the situation in Ukraine remains high, while the fighting between Israel and Hamas militants in Gaza also remain in the spotlight. The precious metal is often seen as a safe haven for investment in times of geopolitical instability.

The cost of the August gold futures on the COMEX today fell by $ 8.8 - to $ 1286.10 per ounce.

EUR/USD $1.3382, $1.3400, $1.3405, $1.3450

USD/JPY Y101.00, Y101.40-45, Y101.50, Y101.75, Y101.80, Y101.85, Y101.95, Y102.00, Y102.20, Y102.25, Y102.40, Y102.50, Y102.60, Y102.75, Y103.00

GBP/USD $1.6850

EUR/GBP stg0.7850, stg0.7900, stg0.7920, stg0.7980

AUD/USD $0.9320, $0.9360, $0.9365, $0.9375

USD/CAD C$107.65, C$1.0800

U.S. stock futures declined as earnings at companies Whole Foods Market Inc. (WFM), Kraft Foods Group Inc. (KRFT) and ExxonMobil (XOM) disappointed investors and Argentina missed a debt payment.

Global markets:

Nikkei 15,620.77 -25.46 -0.16%

Hang Seng 24,756.85 +24.64 +0.10%

Shanghai Composite 2,201.56 +20.32 +0.93%

FTSE 6,753.04 -20.40 -0.30%

CAC 4,262.52 -49.78 -1.15%

DAX 9,464.56 -129.12 -1.35%

Crude oil $99.66 (-0.61%)

Gold $1289.40 (-0.42%)

06:00 United Kingdom Nationwide house price index July +1.0% +0.6% +0.1%

06:00 United Kingdom Nationwide house price index, y/y July +6.0% Revised From +11.8% +10.6%

06:00 Germany Retail sales, real adjusted June -0.2% Revised From -0.6% +1.1% +1.3%

06:00 Germany Retail sales, real unadjusted, y/y June +2.4% Revised From +1.9% +0.4%

06:45 France Consumer spending June +1.0% +0.3% +0.9%

06:45 France Consumer spending, y/y June -0.6% +1.8%

07:55 Germany Unemployment Change July +7 Revised From +9 -5 -12

07:55 Germany Unemployment Rate s.a. July 6.7% 6.7%

09:00 Eurozone Harmonized CPI, Y/Y (Preliminary) July +0.5% +0.5% +0.4%

09:00 Eurozone Unemployment Rate June 11.6% 11.6% 11.5%

During the European session on Forex euro fell against the dollar on background data on inflation and unemployment in the eurozone. Eurozone inflation slowed in July to its lowest level in four and a half years, mainly due to falling energy prices, showed on Thursday, preliminary data from Eurostat.

Inflation slowed to 0.4 percent in July from 0.5 percent in June. Inflation is expected to remain unchanged at 0.5 percent. This is the lowest figure since the beginning of price growth since November 2009.

Core inflation, excluding energy, food, alcohol and tobacco remained unchanged at 0.8 percent in July.

Energy prices fell by 1 percent, and prices for food, alcohol and tobacco fell by 0.3 percent. At the same time, the prices of non-energy industrial goods remained in the flat, and the cost of services increased by 1.3 percent.

Eurozone unemployment rate unexpectedly fell in June, showed data released Thursday by Eurostat.

The unemployment rate fell slightly to 11.5 percent from 11.6 percent in May. Rate forecast was to remain unchanged at 11.6 percent.

In addition, the youth unemployment rate fell to 23.1 percent in June from 23.2 percent a month earlier.

The total number of unemployed persons decreased by 152,000 from May to 18.41 million in June.

The British pound fell against the dollar after data on house prices. In the UK house price growth slowed in July, lagging behind the expectations of economists, data showed on Thursday surveys mortgage lender Nationwide.

House prices rose by 10.6 percent compared with the previous year in July, an increase of the seventeenth consecutive month, and followed growth of 11.8 percent in June. This was less than the growth of 11.3 percent expected by economists.

On a monthly basis, prices rose at the slowest pace since April 2013, by 0.1 percent in July. It was slower than the increase of 1 percent in June and 0.5 percent growth expected by economists.

The average price of a house rose to 188,949 pounds from 188,903 pounds in June.

Robert Gardner, chief economist at Nationwide, said: "The slowdown should not be considered surprising, given the evidence of moderate activity in recent months."

"Approved Mortgage Applications fell by almost 20 percent in the period from January to May, and there has also been some easing in promising indicators - such as new customer demands."

EUR / USD: during the European session, the pair fell to $ 1.3379

GBP / USD: during the European session, the pair fell to $ 1.6869

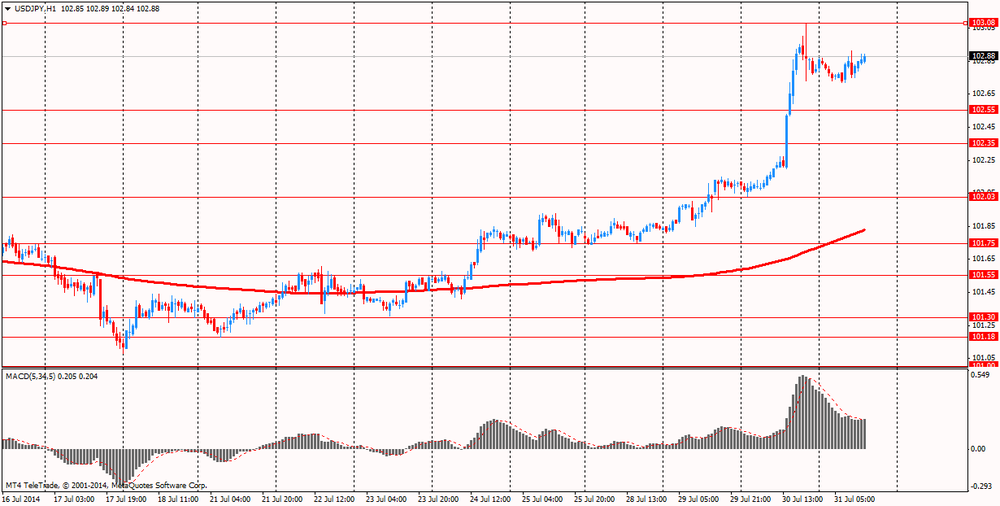

USD / JPY: during the European session, the pair rose to Y102.91

At 12:30 GMT, Canada will release the change in GDP in May. In the U.S. at 12:30 GMT will number of initial claims for unemployment insurance, the number of repeated applications for unemployment benefits, labor cost index for the 2nd quarter in 13:45 GMT - Chicago PMI index for July.

EUR/USD

Offers $1.3485, $1.3460, $1.3440-50, $1.3440, $1.3415-25

Bids $1.3360/50, $1.3320

GBP/USD

Offers $1.7065, $1.7020-25

Bids $1.6870/65, $1.6850/40, $1.6800

AUD/USD

Offers $0.9400, $0.9350, $0.9310/15

Bids $0.9280, $0.9250, $0.9200

EUR/JPY

Offers Y138.50, Y138.00

Bids Y137.50, Y137.20, Y137.05/00, Y136.80, Y136.50

USD/JPY

Offers Y104.00, Y103.50, Y103.15, Y103.00

Bids Y102.50, Y102.25/20, Y102.00, Y101.85/80

EUR/GBP

Offers stg0.8000, stg0.7980/85, stg0.7940-50

Bids

European stocks declined the most in two weeks as Adidas AG lowered its profit forecast and Banco Espirito Santo SA led a plunge in Portuguese equities. U.S. stock-index futures and Asian shares also dropped.

Adidas sank 12 percent to 61.66 euros after forecasting net income of 650 million euros in 2014. The owner of the Adidas and Reebok brands had estimated profit of 830 million euros to 930 million euros. The German sportswear company said the conflict between separatists and the Ukrainian government poses increasing risks to spending on its products in Russia and neighboring countries.

The European Union froze the assets of two Russian oligarchs last night as part of a broader range of measures to make President Vladimir Putin withdraw his support from rebels in eastern Ukraine. The 28-nation club has toughened its measures against the Kremlin after Malaysian Air Flight 17 was shot down on July 17. The U.S. says the missile was fired from an area controlled by pro-Russian separatists.

Banco Espirito Santo SA tumbled 42 percent to 20 euro cents.

Afren slumped 32 percent to 101 pence. The U.K. explorer of oil in Africa and northern Iraq suspended Chief Executive Officer Osman Shahenshah and Chief Operating Officer Shahid Ullah after an independent review found evidence of unauthorized payments to both managers. The investigation didn't find evidence that other board members were involved, the company said in a statement.

Shell advanced 3 percent to 2,454.5 pence. Europe's biggest oil company reported profit, excluding one-off items and inventory changes, that climbed 33 percent to $6.1 billion from $4.6 billion a year earlier. That beat the $5.6 billion average estimate of analysts surveyed by Bloomberg.

In Germany, a Federal Labor Agency report showed that unemployment stayed at 6.7 percent in July, matching the median estimate of economists surveyed by Bloomberg News.

FTSE 100 6,751.47 -21.97 -0.32%

CAC 40 4,282.5 -29.80 -0.69%

DAX 9,496.82 -96.86 -1.01%

EUR/USD $1.3382, $1.3400, $1.3405, $1.3450

USD/JPY Y101.00, Y101.40-45, Y101.50, Y101.75, Y101.80, Y101.85, Y101.95, Y102.00, Y102.20, Y102.25, Y102.40, Y102.50, Y102.60, Y102.75, Y103.00

GBP/USD $1.6850

EUR/GBP stg0.7850, stg0.7900, stg0.7920, stg0.7980

AUD/USD $0.9320, $0.9360, $0.9365, $0.9375

USD/CAD C$107.65, C$1.0800

Asian stocks fell, with the regional benchmark index paring its third straight monthly gain, as Samsung Electronics Co. and Nintendo Co. led information technology shares lower.

S&P/ASX 200 5,632.9 +10.01 +0.18%

TOPIX 1,289.42 -2.82 -0.22%

SHANGHAI COMP 2,201.56 +20.32 +0.93%

Samsung sank 3.7 percent in Seoul as the world's biggest manufacturer of smartphones posted net income that fell short of expectations amid increased competition from Apple Inc. and Chinese producers.

Nintendo slumped 6.5 percent in Tokyo after the maker of Wii game consoles reported its third loss in the past four quarters.

Singapore Airlines Ltd. slipped 2.6 percent after Asia's second-largest carrier by market value reported weaker earnings.

EUR / USD

Resistance levels (open interest**, contracts)

$1.3511 (2347)

$1.3473 (1518)

$1.3444 (516)

Price at time of writing this review: $ 1.3397

Support levels (open interest**, contracts):

$1.3370 (3500)

$1.3349 (2624)

$1.3320 (2539)

Comments:

- Overall open interest on the CALL options with the expiration date August, 8 is 30827 contracts, with the maximum number of contracts with strike price $1,3600 (4125);

- Overall open interest on the PUT options with the expiration date August, 8 is 34294 contracts, with the maximum number of contracts with strike price $1,3500 (6567);

- The ratio of PUT/CALL was 1.11 versus 1.17 from the previous trading day according to data from July, 30

GBP/USD

Resistance levels (open interest**, contracts)

$1.7200 (1648)

$1.7101 (2005)

$1.7002 (1063)

Price at time of writing this review: $1.6922

Support levels (open interest**, contracts):

$1.6895 (2107)

$1.6798 (1993)

$1.6699 (1035)

Comments:

- Overall open interest on the CALL options with the expiration date August, 8 is 17502 contracts, with the maximum number of contracts with strike price $1,7250 (2423);

- Overall open interest on the PUT options with the expiration date August, 8 is 24988 contracts, with the maximum number of contracts with strike price $1,7000 (2692);

- The ratio of PUT/CALL was 1.43 versus 1.47 from the previous trading day according to data from Jule, 30

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

01:30 Australia Building Permits, m/m June +10.3% Revised From +9.9% +0.2% -5.0%

01:30 Australia Building Permits, y/y June +15.2% Revised From +14.3% +16.0%

01:30 Australia Import Price Index, q/q Quarter II +3.2% -1.4% -3.0%

01:30 Australia Export Price Index, q/q Quarter II +3.6% -7.9%

01:30 Australia Private Sector Credit, m/m June +0.4% +0.4% +0.7%

01:30 Australia Private Sector Credit, y/y June +4.7% +5.1%

01:30 Japan Labor Cash Earnings, YoY June +0.6% Revised From +0.8% +0.7% +0.4%

05:00 Japan Housing Starts, y/y June -15.0% -11.2% -9.5%

The U.S. currency has risen versus all except one of its 16 major counterparts in July as reports have shown gross domestic product rebounded, consumer confidence improved and durable goods orders increased. The world's biggest economy expanded at a 4 percent annualized pace last quarter, rebounding from a contraction of 2.1 percent in the previous three months and beating the median forecast for 3 percent in another Bloomberg survey.

The U.S. Labor Department will say tomorrow employers added 231,000 jobs in July, versus 288,000 the prior month, according to a Bloomberg survey.

Treasury 10-year yields climbed to a two-week high yesterday, while economists predict data tomorrow will show U.S. employers added more than 200,000 jobs for a sixth month. Treasury 10-year yields increased to 2.56 percent yesterday, the highest since July 16. The unemployment rate held at 6.1 percent, the lowest in almost six years, economists predicted.

Australia's dollar approached an eight-week low after building approvals unexpectedly declined. The Bureau of Statistics said building approvals fell 5 percent in June, compared with economist forecasts for an unchanged reading.

EUR / USD: during the Asian session, the pair traded in the range of $ 1.3390-00

GBP / USD: during the Asian session, the pair rose to $ 1.6925

USD / JPY: on Asian session the pair fell to Y102.75

Focus this morning will initially be turned to the release of Nationwide house price data at 0600GMT (median 0.5%mm, 11.3%yy), though more focus will be on outside influences with US weekly jobless claims and the Chicago Report the main focus as main drive seen coming via dollar moves.

(raw materials / closing price /% change)

Light Crude 99.33 -0.94%

Gold 1,295.10 +0.02%

(index / closing price / change items /% change)

Nikkei 225 15,646.23 +28.16 +0.18%

Hang Seng 24,732.21 +91.68 +0.37%

Shanghai Composite 2,181.24 -1.95 -0.09%

FTSE 100 6,773.44 -34.31 -0.50%

CAC 40 4,312.3 -53.28 -1.22%

Xetra DAX 9,593.68 -59.95 -0.62%

S&P 500 1,970.07 +0.12 +0.01%

NASDAQ 4,462.9 +20.20 +0.45%

Dow Jones 16,880.36 -31.75 -0.19%

(pare/closed(GMT +2)/change, %)

EUR/USD $ 1,3394 -0,10%

GBP/USD $1,6911 -0,19%

USD/CHF Chf0,9085 +0,20%

USD/JPY Y102,80 +0,67%

EUR/JPY Y137,70 +0,57%

GBP/JPY Y173,84 +0,49%

AUD/USD $0,9325 -0,60%

NZD/USD $0,8484 -0,25%

USD/CAD C$1,0902 +0,49%

(time / country / index / period / previous value / forecast)

01:30 Australia Building Permits, m/m June +9.9% +0.2%

01:30 Australia Building Permits, y/y June +14.3%

01:30 Australia Import Price Index, q/q Quarter II +3.2% -1.4%

01:30 Australia Export Price Index, q/q Quarter II +3.6%

01:30 Australia Private Sector Credit, m/m June +0.4% +0.4%

01:30 Australia Private Sector Credit, y/y June +4.7%

01:30 Japan Labor Cash Earnings, YoY June +0.6% Revised From +0.8% +0.7%

05:00 Japan Housing Starts, y/y June -15.0% -11.2%

06:00 United Kingdom Nationwide house price index July +1.0% +0.6%

06:00 United Kingdom Nationwide house price index, y/y July +11.8%

06:00 Germany Retail sales, real adjusted June -0.6% +1.1%

06:00 Germany Retail sales, real unadjusted, y/y June +1.9%

06:45 France Consumer spending June +1.0% +0.3%

06:45 France Consumer spending, y/y June -0.6%

07:55 Germany Unemployment Change July +9 -5

07:55 Germany Unemployment Rate s.a. July 6.7%

09:00 Eurozone Harmonized CPI, Y/Y (Preliminary) July +0.5% +0.5%

09:00 Eurozone Unemployment Rate June 11.6% 11.6%

12:30 Canada GDP (m/m) May +0.1% +0.3%

12:30 U.S. Initial Jobless Claims July 284 306

12:30 U.S. Employment Cost Index Quarter II +0.3% +0.5%

13:45 U.S. Chicago Purchasing Managers' Index July 62.6 63.2

23:30 Australia AIG Manufacturing Index July 48.9

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.