- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 31-03-2022

- Oil prices are settling below $100.00 on additional oil release from US’s SPR.

- An additional oil release of 180 million barrels is equivalent to about two days of global demand.

- The DXY has been underpinned ahead of the US Nonfarm Payrolls on Friday.

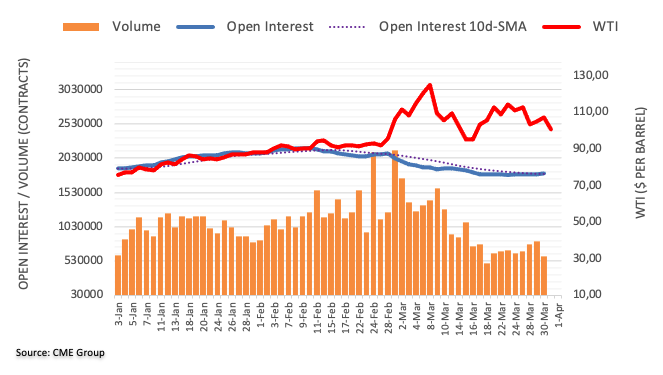

West Texas Intermediate (WTI), futures on NYMEX, has tumbled below $100.00 on Thursday after US President Joe Biden announced a release of one million barrels per day for six months out of their Strategic Petroleum Reserve (SPR) from May. Oil prices nosedive more than 6% on Thursday amid expectation of a less deviation in the demand-supply mechanism of the black gold.

To tame the galloping inflation, US President Joe Biden has urged oil drilling companies to exploit their unused capacities and pump more oil for bringing price stability to the oil market. This is the time to shift preference to the individuals and American families from prolonged investors. This is the third time in the last six months when the US administration has announced an oil release from the SPR. An additional oil release of 180 million barrels is equivalent to about two days of global demand, as per Reuters.

However, the additional oil release of one million barrels is unable to cover the three million barrels of oil from Russia and this kind of helicopter release of oil will not fix the structural deficit in global supply.

On the demand front, restrictions on men, materials, and machines in China amid lockdown measures due to the resurgence in Covid-19 has put a cumulative negative impact on the oil prices.

Meanwhile, the US dollar index (DXY) has climbed near 98.40 on negative market sentiment as investors are waiting for the US Nonfarm Payrolls, which are due on Friday.

- The US Dollar Index finished March with gains of 1.65%, boosted by a negative market mood.

- An extension of the Russia-Ukraine conflict could benefit safe-haven assets.

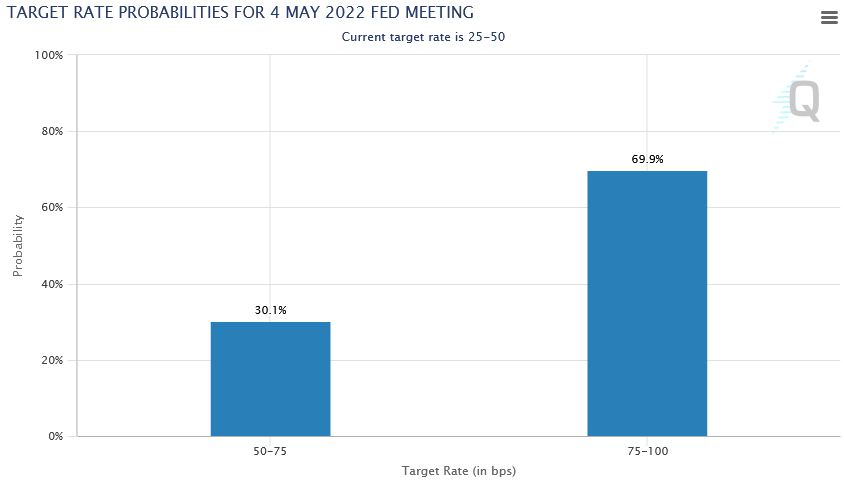

- Money market futures have priced in a 69.9% chance of a 50 bps rate hike by the Fed in the May meeting.

- DXY Price Forecast: The bias is upwards, but a break below 97.802 would open the door for further losses.

The US Dollar Index, a gauge of the greenback value against a basket of six currencies, also known as DXY, finished March positively, with a monthly gain of 1.65%, its highest since November of 2021. At press time, the US Dollar Index sits at 98.348.

The market mood on March’s last trading day was dismal. Failure to find a meaningful resolution to the Russia-Ukraine conflict keeps investors on their toes, boosting the buck’s prospects. Also, money market futures expectations that the Federal Reserve would hike 50-bps in May and June meetings loom, keeping the US dollar tilted upwards.

The CME FedWatch Tool has priced in a 69.9% chance of a 50 basis point rate hike in the May meeting, while June odds lie at 64%.

Source: CME FedWatch Tool

Thursday’s US economic docket featured the US Personal Consumption Expenditure (PCE), the favorite measurement of inflation of the Federal Reserve, for February, which rose by 6.4% y/y, higher than the previous 6% reading. Meanwhile, Core PCE, which excludes volatile items, rose by 5.4% y/y, better than the 5.5% foreseen by analysts.

At the same time, the US Department of Labor revealed Initial Jobless Claims for the week ending on March 26. The figure came at 202K, worse than the 197K estimated.

DXY Price Forecast: Technical outlook

The US Dollar Index remains upward biased but consolidates around the 97.800-99.418 range. The 50 and 200-day moving average (DMA) remain below the price with an upslope, meaning that the uptrend is still intact.

On the upside, the DXY first resistance is the 99.000 mark. Breach of the latter would expose the YTD high at 99.418, followed by the psychological 100.00 mark.

On the flip side, the DXY first support would be 98.000. A decisive break would expose 97.802, which in case of being broken, would pave the way towards 96.000, but it would find some hurdles on its way down. The following support would be the 50-DMA at 97.196, followed by 96.000.

Technical levels to watch

- Loonie bulls seek a death cross to attain a dominant position.

- The RSI (14) in a bearish range of 20.00-40.00 adds to the downside filters.

- Auctioning below the ascending triangle formation is making the loonie bulls hopeful.

The USD/CAD pair is balanced in a range of 1.2430-1.2593 from the last three trading sessions after remaining imbalance due to an intensified sell-off from March 15 high at 1.2871.

On the daily scale, the USD/CAD has settled below the ascending triangle formation whose upper end is capped around 1.2960 while the ascending trendline is placed from 18 May 2021 low at 1.2013. A breaking below an ascending triangle formation is followed by volume and volatility expansion in the asset. The death cross from the 50 and 200-period Exponential Moving Averages (EMAs) is in a queue and is likely to place around 1.2650.

The Relative Strength Index (RSI) (14) has settled in a 20.00-40.00 range, which signals an impulsive way and a dominant position for the loonie bulls going forward.

Should the asset drops below Thursday’s low at 1.2464, the major will be dragged towards the round level support at 1.2400, followed by the 29 October 2021 low at 1.2328.

On the flip side, greenback bulls can become worthy if the asset surpasses last week’s high at 1.2624, which will send the asset towards March 11 low at 1.2694. Breach of the latter will send the pair towards round level resistance at 1.2800.

USD/CAD daily chart

-637843655894134588.png)

- The AUD/JPY begins the Asian session in a positive mood, but Asian futures point to a lower open.

- US equities ended March in the red for the second consecutive day.

- AUD/JPY Price Forecast: The bias is upwards, but a series of three straight days recording subsequent lower highs/lower lows keeps the pair pressured.

The AUD/JPY begins the Asian Pacific session barely up after Thursday’s price action, which portrayed an extension of a three-day fall in the cross-currency pair, courtesy of a downbeat market mood as Russia-Ukraine failed to find common ground that could put an end to the conflict, as Vladimir Putin plans said that Russia will fulfill their gas contracts, but in exchange have to be paid in roubles. At 91.22, the AUD/JPY reflects a risk-off sentiment.

Wall Street’s last trading day ended on the wrong foot for US equities, which recorded losses. Meanwhile, Asian stock futures are pointing to a lower open, meaning that safe-haven peers might find a bid on April’s first trading day in the FX space.

AUD/JPY Price Forecast: Technical outlook

Overnight, the AUD/JPY opened near the 92.00 mark, the Thursday high. However, it was followed by a dip below the 200-hour simple moving average (SMA), extending its losses to 90.76 before resuming the uptrend and reclaiming 91.00.

Despite that, the AUD/JPY bias is upwards. However, it’s worth noting that the price action in the previous three days recorded subsequent lower highs and lower lows, meaning that a possible consolidation lies ahead.

Upwards, the AUD/JPY first resistance would be 92.00. Once cleared, the next resistance would be March 30 92.64 daily high, followed by March 29 daily high at 93.12, and then the YTD high at 94.32.

On the flip side, the AUD/JPY first support would be 91.00. A breach of the latter would expose Pitchrofk’s central-parallel line around the 90.20-30 area, followed by the 90.00 mark.

Technicals level to watch

- EUR/USD tumbles on negative market tone as optimism on the Russia-Ukraine peace talks faded.

- Soaring inflation in Eurozone is advocating an interest rate hike by the ECB.

- EU’s Unemployment Rate is slightly higher at 6.8% than the expectation at 6.7%.

The EUR/USD pair has plunged sharply on Thursday after the risk-off impulse gained traction amid falling global equities and a higher print of the European Union (EU) Unemployment Rate. The asset eroded half of its gains made in the last three trading sessions.

The shared currency has been hit hard after the Eurostat reported Unemployment Rate at 6.8%, which remains in the mid of market consensus at 6.7% and the prior figure of 6.9%. Meanwhile, bets on an interest rate hike by the European Central Bank (ECB) are rising higher. Soaring inflation in Eurozone is compelling the ECB’s policymakers to raise the interest rate for the first time after the Covid-19 pandemic. The German annual inflation has climbed to 7.3%, the highest print in more than four decades. While the Consumer Price Index (CPI) in France has landed at 5.1% and the inflation number in Italy has reached 6.7%.

On the dollar front, the US dollar index (DXY) has reclaimed 98.00 comfortably despite a minor slippage in Core Personal Consumption Expenditure (PCE) inflation. The yearly Core PCE inflation landed at 5.4%, slightly lower than the estimate of 5.5% but higher than the prior print of 5.2%. The improvement in the safe-haven appeal after the optimism in the Russia-Ukraine peace talks faded has underpinned the greenback against the shared currency.

Going forwards, investors will focus on US Nonfarm Payrolls (NFP), which is due on Friday.

- Breakout of the descending triangle formation will be followed by volatility and volume expansion.

- The 200 EMA is offering a cushion to the greenback bulls.

- The RSI (14) in a 40.00-60.00 range has kept investors on the sidelines.

The USD/JPY pair is oscillating in a narrow range of 121.28-122.45 in the previous two trading sessions after recording a steep fall from March 25 high at 125.10. The asset is auctioning in a 10 pips range on Friday and is likely to witness a volatility expansion sooner.

On an hourly scale, USDJPY is sensing a cushion near the mighty 200-period Exponential Moving Average (EMA), which is trading at 121.60 at the press time. The major is auctioning in a descending triangle formation whose downward trending trendline is plotted from March 29 closing price at 123.21 while the horizontal line is placed from March 30 low at 121.31.

The 50 and 200-period EMAs have turned flat, which signals a consolidation going forward.

The Relative Strength Index (RSI) (14) is oscillating in a 40.00-60.00 range, which is likely to keep investors on the sidelines.

For further downside, yen bulls need to drag the asset below the establishment of the descending triangle formation at 121.28 decisively. This will expose the pair to more downside toward March 23 low and March 18 high at 120.59 and 119.40 respectively.

On the contrary, greenback bulls can obtain control if the asset advances above the 50 EMA at 122.00. This will drive the asset towards the March 29 closing price of 123.21, followed by the March 29 high at 124.31.

USD/JPY hourly chart

-637843618152867277.png)

Reuters has reported that the Ukrainian President Volodymyr Zelenskyy on Thursday said ''the situation in the south and the Donbas region remained extremely difficult and reiterated that Russia was building up forces near the besieged city of Mariupol.''

"There will be battles ahead. We still need to go down a very difficult path to get everything we want," he said in a late night video address.

In markets, US stocks suffered steep declines into month-end as a key US inflation gauge shot higher while the Ukraine conflict continued. President Joe Biden also reportedly said there is "no clear evidence" that Russian President Vladimir Putin is pulling his forces out of Kyiv.

- Asset shows indecisiveness on ‘Spinning Top’ candlestick formation.

- The RSI (14) looks to violate 40.00 on the downside for the first time this year.

- Swiff franc bulls have faced barricades at 200 EMA.

The USD/CHF pair has been bounced back sharply after tumbling below the round level support of 0.9200. The major has witnessed a minor responsive buying from the 200-period Exponential Moving Average (EMA) at 0.9217, after a two-day intensified sell-off.

On the daily scale, the trendline placed from January 13 low at 0.9092, adjoining the February 21 low at 0.9150 is providing a cushion to the asset. The formation of the ‘Spinning Top’ candlestick pattern near the trendline placed signals an indecisiveness in the sentiments of the market participants. The asset is established below 50 EMA at 0.9264, which adds to the downside filters.

The Relative Strength Index (RSI) (14) is oscillating in a 40.00-60.00 range but is likely to skid below 40.00 for the first time this year, which will result in intensified selling by investors.

Should the asset drops below the ‘Spinning Top’ candlestick formation at 0.9195, a bearish trigger will drag the asset towards monthly lows and January 24 low at 0.9150 and 0.9109 respectively.

On the contrary, greenback bulls can obtain control if the asset advances above the 50 EMA at 0.9264. This will drive the asset towards March 28 high at 0.9293, followed by March 30 high at 0.9319.

USD/CHF daily chart

-637843601859121833.png)

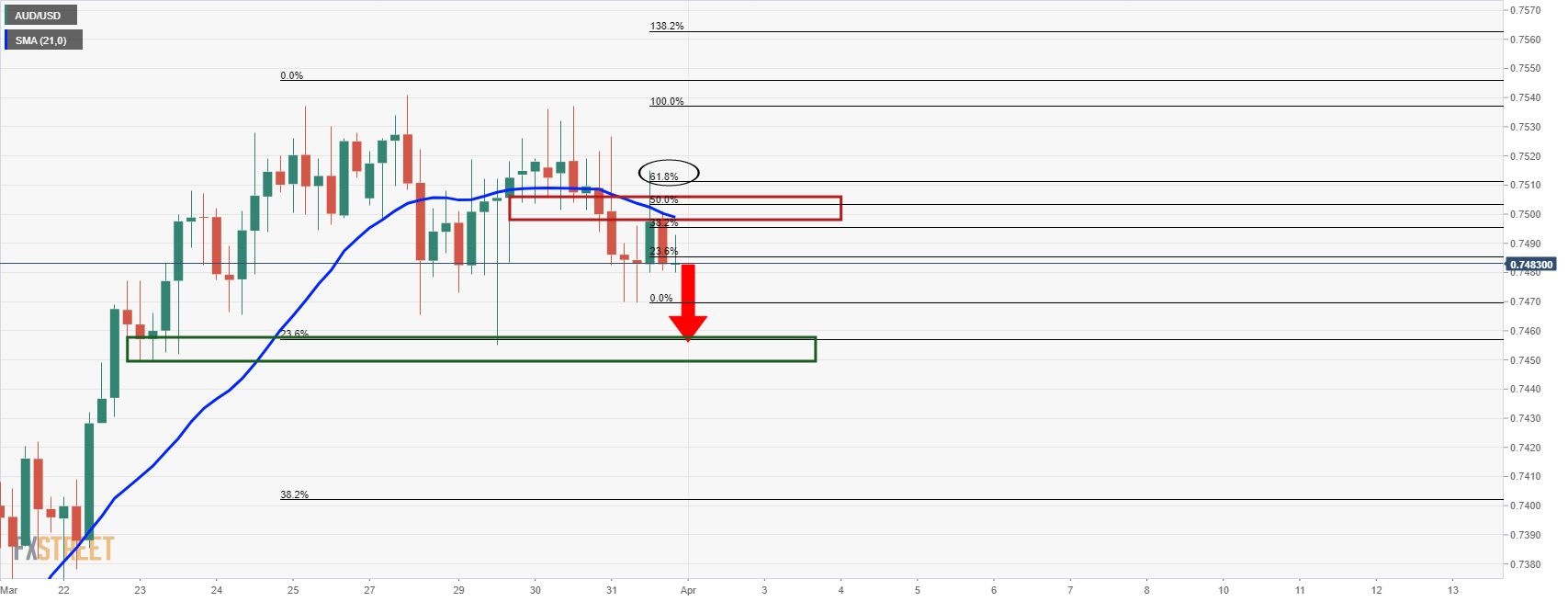

- AUD/USD bears take charge and are moving in for the kill.

- 0.7450 is the focus for the sessions ahead.

AUD/USD is under pressure below a wall of resistance on the daily chart and is in the hands of the bears leaving the focus on the downside. The prior resistance has a confluence with the 50% mean reversion target while the 21-day moving average is aligned in this area as well for additional confluence:

AUD/USD daily chart

AUD/USD H4 chart

From a 4-hour perspective, the pair is making tracks to the downside following a test of the 61.8% Fibonacci retracement of the prior bearish impulse and the 21 moving average. Bears will be seeking a break of the 0.7450s for a faster trip to 0.74 the figure.

- The NZD/USD fell on the last day of March amid a downbeat market mood.

- Russia will fulfill natural gas agreements but must be paid in Russian roubles.

- US Core PCE, the Fed’s inflation gauge, rose by 5.4% y/y.

- NZD/USD Price Forecast: Two bearish signals suggest more US dollar strength lies ahead.

After Wednesday’s attempt to reclaim 0.7000 as trader’s book profits, the New Zealand dollar retreats amidst quarter and month-end flows, a risk-off market mood, and broad US dollar strength. At 0.6933, the NZD/USD reflects the aforementioned.

Geopolitical affairs dominate headlines and market mood as March ends

Meanwhile, as Wall Street closes, the market sentiment is negative, spurred by no meaningful resolution between Russia and Ukraine and Russian President Vladimir Putin reiterating to Europe that payments for natural gas need to be in roubles; otherwise, if demands are not met, active contracts would be halted. Later, the French Finance Minister, Le Maire, said that France and Germany are preparing for a probable scenario of a halt in Russian gas flows.

That headline tumbled oil prices and dragged commodity currencies like the Canadian dollar and the antipodeans.

Meanwhile, the greenback finished March on the right foot, as portrayed by the US Dollar Index, rising 0.53%, up at 98.361. Contrarily, US Treasuries recorded gains at the short-end of the curve, while the 10-year T-note benchmark rate is almost flat at 2.349%.

Aside from those developments, the NZD/USD pair traded as a risk-sensitive currency, weakening on Eastern Europe issues. Furthermore, the lack of economic news from New Zealand keep traders glued to their screens, as US macroeconomic data crossed the wires.

The US docket featured the Federal Reserve’s favorite measure of inflation, the Core Personal Consumption Expenditure (PCE), which excludes volatile items for February, which rose by 5.4% y/y, lower than the 5.5% estimated.

At the same time, the US Department of Labor revealed that US Initial Jobless Claims for the week ending on March 26 increased by 202K, higher than the 197K expected.

NZD/USD Price Forecast: Technical outlook

The NZD/USD daily chart is forming a bearish-engulfing candle at press time, per the last two-days price action. Also, failure to reclaim 0.7000, for the second time in the previous seven days, formed a double-top, which added to a fundamental bias of US Dollar strength as the Fed hikes rates aggressively, could send the NZD/USD aiming lower.

The NZD/USD first support level would be the 200-day moving average (DMA) at 0.6907. Breach of the latter could send the pair towards an upslope trendline drawn from February lows around 0.6811 and then the 50-DMA as the last line of defense at 0.6757.

- The GBP/JPY falls on sour market sentiment, courtesy of Russian President Putin, while the conflict persists.

- GBP/JPY Price Forecast: The cross-currency pair is upwards and just formed a bullish harami in the daily chart.

GBP/JPY slides for the third consecutive trading session amid a risk-off market sentiment, courtesy of the extension of the Russia-Ukraine conflict, now hitting five weeks of hostilities. At the same time, Russian President Vladimir Putin is likely to force Eurozone countries to pay for natural gas in roubles. At 159.84, the GBP/JPY portrays the appetite of safe-haven peers, particularly the Japanese yen.

What appears to be a market sentiment move could also be influenced by fiscal, quarter, and month-end flows towards the Japanese yen. However, the GBP/JPY posted its biggest monthly gain since October 2021, with the pair up near 3.7%.

Overnight the GBP/JPY rallied towards the daily high around 160.88, but once the European session began, a shift in market sentiment propelled a fall towards the daily low at 159.79.

GBP/JPY Price Forecast: Technical outlook

The GBP/JPY is in an uptrend, and Thursday’s price action is forming a “quasi” gravestone doji, which means indecision amongst traders after Wednesday’s 200-pip average daily range (ADR). Also, the combination of both days’ candlestick’s formed a bullish harami, also known as an inside bar, meaning that the GBP/JPY would resume its uptrend.

Additionally, the Relative Strength Index (RSI) is at 61.12; although aiming lower, it just got out of overbought conditions, it remains in the bullish territory (above 50-midline).

That said, the GBP/JPY first resistance would be 160.00. A sustained break would expose March 30 daily high at 161.36, followed by 162.00, and then March 29 daily high at 162.71.

Here is what you need to know on Friday, April 1:

The euro tumbled on Thursday as investors fretted about rising EU/Russia economic tensions after Russian President Vladimir Putin doubled down on a demand that European nations pay for Russian gas in roubles, exacerbating fears that Russia might block energy exports to the continent. This, coupled with a generalized paring back on recent optimism about alleged progress in Russo-Ukraine peace talks, which recommence on Friday, contributed to risk-off flows and downside in global bond yields, with these moves most acute in Europe. Thus, the euro was the worst performing G10 currency, with EUR/USD dropping 0.8% from intra-day highs near 1.1200 to current levels in the mid-1.1000s.

The weakness in EUR/USD helped give the DXY a lift, with the trade-weighted index of major USD pairs rallying 0.5% to around 98.30 from weekly lows in the 97.70 area. The upside had little to do with another rise in US inflation in February as per the Core PCE Price Index, or the latest very solid weekly jobless claims figures, both of which support the economic rationale behind the Fed’s recent hawkish pivot. Indeed, against the rest of the G10 currencies, the US dollar was fairly mixed, with focus now shifting to the release of the official US labour market report for March on Friday.

The best performing G10 currency was again the Japanese yen, with the safe-haven currency benefitting from the downside bias to global equity market trade and in global bond yields, thus extending on a much overdue month/quarter-end recovery after weeks of underperformance. USD/JPY stabilized below the 122.00 level, with the bears eyeing a retest of 120.00. GBP/USD, meanwhile, was a tad higher on the day, but remained within recent intra-day ranges in the mid-1.3100s and capped by its 21-Day Moving Average.

Finally, it was a mixed picture for the commodity-sensitive Aussie, kiwi and loonie. USD/CAD was flat and managed to shrug off sharp losses in the crude oil complex as a result of the announcement of a historic Strategic Petroleum Reserve release out of the US (1M barrels per day for the next six months). The pair remained underneath the 1.2500 level and not far below recent multi-month lows printed in the 1.2430 area earlier in the week. AUD/USD, meanwhile, dropped 0.3% to back below 0.7500 but remains well within recent ranges and near to multi-month highs in the mid-0.7500s, while NZD/USD fell 0.6% to back under 0.6950, putting the pair back near the middle of this week’s approximate 0.6875-0.7000 ranges.

- Risk-off flows in European equities coupled with downside in Eurozone yields weighed heavily on EUR/JPY on Thursday.

- The pair was last trading down 1.0% in the 154.50 area, a sharp reversal from intra-day highs closer to 157.00.

A sharp drop in Eurozone yields coupled with downside in major European equity bourses amid rising EU/Russia energy-related tensions dampened the appeal of the euro on Thursday, with the single currency amongst the worst performing currencies in the G10. While the euro’s losses against its major currency peers were broad, they were most acute against the rate-differential sensitive/safe-haven Japanese yen. As a result, EUR/JPY slumped roughly 1.0% on Thursday, its worst one-day performance since 4 March. That saw the pair drop all the way back from intra-day highs in the upper 156.00s to the mid-154.00s.

At current levels near 154.50, the pair now trades just 0.3% above key support in the form of the 2021 highs at 154.12. Should EU/Russia economic/energy tensions continue to ramp up into the end of the week (could Russia start blocking gas flows into the EU?), then the pair might well extend on the recent bearish move that has already seen it pullback over 2.0% from earlier weekly highs around 137.50. A break below 154.12 support would open the door to a push lower towards support in the 153.50 and 153.00 areas.

Big upside surprises in the preliminary Spanish, French and German HICP inflation estimates for March over the past two days have done little to halt the euro’s downside reversal, with the pair instead taking its cue from the aforementioned movements in yields and risk appetite. As things stand, the current inflationary environment of the Eurozone suggests that the euro is set to maintain a sizeable monetary policy divergence advantage over the yen.

That was a key factor lifting the pair as of late, but as economic uncertainty in the Eurozone continues to grow as a result of the Russo-Ukraine war, it's difficult to be certain that the ECB will stick by its current policy guidance (of QE ending in Q3 and rate hikes in Q4). Unless geopolitical uncertainty clears a little, this is likely to keep a lid on any EUR/JPY rebound.

- The S&P 500, the Dow Jones, and the Nasdaq Composite recorded losses in a risk-off market mood, courtesy of Russo-Ukraine tussles.

- Russia insists on receiving natural gas payments in roubles, threatens to block proceedings in euros/dollars.

- Gold and the greenback are rising, while US Treasury yields and oil are trading in the red.

US equities are recording losses in the North American session as Wall Street is about to finish March on a lower note. The S&P 500, the Dow Jones Industrial, and the tech-heavy Nasdaq Composite are falling between 0.30% and 0.43%, each one sitting at 4,576.32, 35075.94, and 15,014.01 respectively

A negative market mood weighed on US equities

A risk-off market mood courtesy of Russian President Vladimir Putin, and continued fighting between Russia and Ukraine, keep grabbing the headlines. Russian President Putin signed a decree establishing natural gas trade rules, like payments in roubles, new proceedings in euros and US dollar could also be blocked. If demands are not met, current contracts will be halted.

Meanwhile, the greenback rose on the headline. In fact, it remains firm, as portrayed by the US Dollar Index, up 0.43%, sitting at 98.256. Contrarily, US Treasury yields continue falling for the second consecutive day, down four basis points, down at 2.316%.

Aside from this, Utilities, Consumer Staples, and Real Estate are the leaders of the trading session, up 0.69%, 0.34%, and 0.27%. The laggards are Communication Services, Financials, and Consumer Discretionary, down 1.14%, 1.02%, and 0.78%.

In the commodities complex, the US crude oil benchmark, WTI, is losing 5.27%, trading at $101.73 BPD, weighed by news that the Biden administration would tap 1 Million BPD from the SPR oil reserves for a period of six months. Precious metals like gold (XAU/USD) are rising 0.61%, exchanging hands at $1944.55 a troy ounce, boosted by a risk-off sentiment.

The US economic docket featured the Fed’s favorite gauge of inflation, the Core PCE for February, which rose by 5.4% y/y, lower than the 5.5% estimated, while US Initial Jobless Claims for the week ending on March 26 increased by 202K, higher than the 197K expected.

On Friday, April 1, the US Department of Labor will reveal the Nonfarm Payrolls report for March. Even though the NFP is one of the most important economic indicators, now that the Fed is focused on inflation, it has taken a backseat, except for Average Hourly Earnings, which could shed some light on rising inflation.

Technical levels to watch

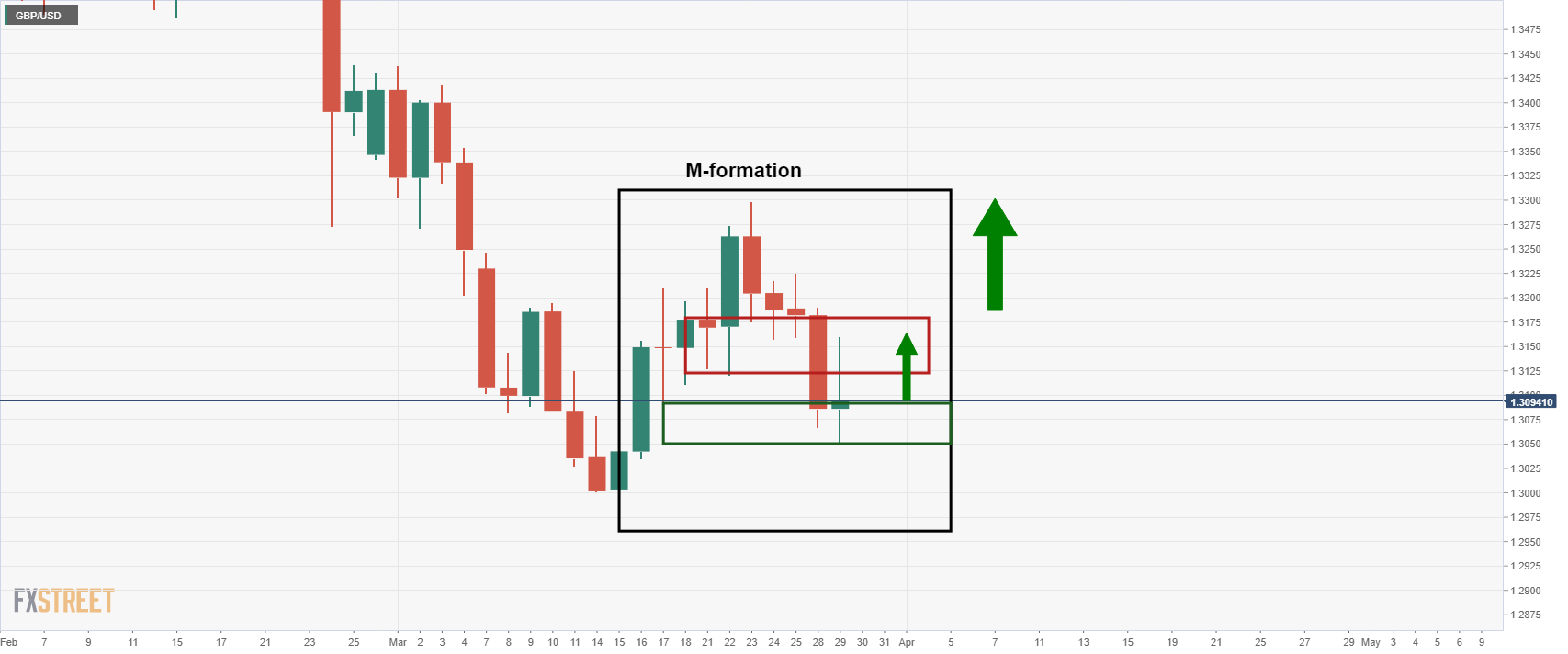

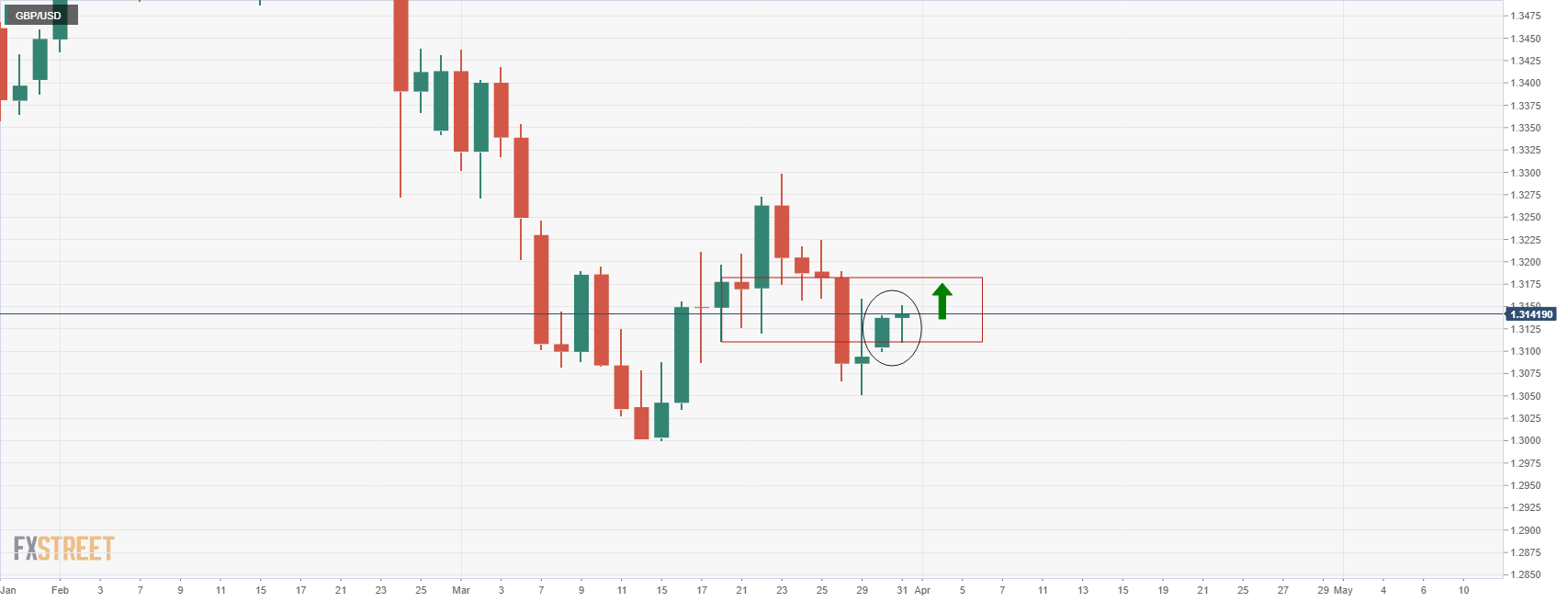

- GBP/USD on the verge of a bearish weekly close.

- Bears are seeking a fill of the weekly wick and a downside extension.

The following illustrates the pound's bullish trajectory on the daily chart in an M-formation as per prior analysis and live updates:

GBP/USD daily chart

The chart above was from the prior day's close. The price attempts to recover towards the neckline of the formation:

GBP/USD live market

The price is making slower progress on Thursday and given that it has now made a significant correction, the weekly chart's doji candle should be considered as bears seek a weekly bearish close:

GBP/USD weekly chart

The pair has formed a weekly doji and bears will now be on the lookout for this week's close to print bearish. So far so good in this respect and the wick would be expected to be filled in next week with a move that could result in a downside continuation.

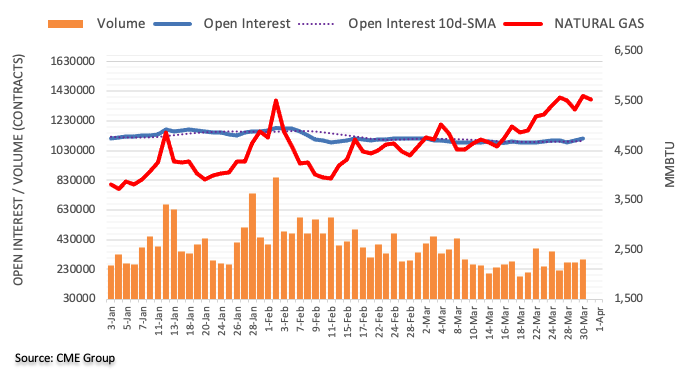

- Silver approaches $25.00 for the third time in the week.

- Russia-Ukraine woes, Putin’s demanding payments for gas in Russian roubles, and falling yields boost precious metals.

- XAG/USD Price Forecast: Remains upward biased, but downside risks remain unless XAG bulls push the prices above $25.40.

Silver (XAG/USD) is barely advancing for the second consecutive day amid a stronger US dollar courtesy of Russia-Ukraine jitters and Russian President Putin’s natural gas decree, triggering a downbeat market mood. During the North American session, XAG/USD is trading at $24.93 at the time of writing.

The market mood is downbeat, on Russo-Ukraine jitters, and Putin's decree of natural gas payments

Global equity markets reflect investors’ negative sentiment as March is about to end. The greenback remains in the driver’s seat, as portrayed by the US Dollar Index, up 0.38%, sitting at 98.204, opposite to falling US Treasury yields, led by the 10-year benchmark note rate at 2.323%, three basis points down.

The Russia-Ukraine fighting continues, putting aside peace talks, as Russian troops are redeployed towards the Donbas region. Also, Russian President Vladimir Putin signed a decree in which the Russian natural gas will need to be paid in Roubles while saying that proceedings in euros or US dollars could also be blocked. If demands are not met, current contracts will be halted.

Meanwhile, oil prices fell in the announcement, while the greenback and safe-haven precious metals like gold and silver rose.

The US economic docket featured the Fed’s favorite gauge of inflation, the Core PCE for February, which rose by 5.4% y/y, lower than the 5.5% estimated, while US Initial Jobless Claims for the week ending on March 26 increased by 202K, higher than the 197K expected.

XAG/USD Price Forecast: Technical outlook

After Tuesday’s price action, which formed a large hammer in a downtrend, that touched the 200-day moving average (DMA), silver settled around the $24.50-$25.00 area for the last couple of days. That means that XAG/USD might consolidate before resuming the uptrend, as long as it stays above January 20 daily high, resistance-turned-support at $24.07, just above the 200-DMA.

That said, the XAG/USD first resistance would be $25.00. A decisive break would expose a downslope trendline, drawn from March highs, which confluences with November 16, 2021, daily high at $25.40, followed by March 24 daily high at $25.85 and the $26.00 mark.

Analysts at Rabobank see the USD/MXN pair trading between 19.85 to 20.20 in the coming weeks before returning north of 20.50 near half of the year. They expect the Mexican peso to play catch up with the rest of Latin American currencies.

Key Quotes:

“The Mexican peso has been the main underperformer within the LatAm region since the beginning of this year. One reason for this is MXN’s role as a risk proxy for EM and LatAm in general. If you’re reading this you are likely aware that MXN stands out in EM as the only full deliverable, convertible, and 24-hour tradeable LatAm currency.”

Providing further support for LatAm currencies has been the process of EM portfolios rebalancing away from CEE into LatAm. The recovery in risk appetite also shone a light on rate differentials which have supported LatAm currencies

“We expect MXN to play catch up with the rest of LatAm, but we would exercise caution. We don’t expect much further downside for USD/MXN and MXN is unlikely to surpass gains seen in the rest of the region in the short term. USD/MXN has broken down through the 20 handle and is currently trading in the price congestion region of 19.85 to 19.95. Below that, it is largely thin air down to 19.50 but as always with USD/MXN its risk proxy status leaves it vulnerable to a surge higher on any bout of risk aversion. And of course, the Russia/Ukraine war leaves markets facing a significant risk of such safe haven flows.”

“We have long cited a primary trading range of 20.50 to 21.50 this year for USD/MXN and so far the pair has averaged 20.5 but recent developments suggest that we are more likely to see the pair trade 19.85 to 20.20 in the coming weeks before returning north of 20.50 as we move towards the middle of the year. As always, however, USD/MXN takes the stairs down and the elevator up. Broad-based risk appetite will remain the key variable to watch for USD/MXN direction in the coming weeks and months.”

February marked the seventh straight month in which inflation outpaced income, raising doubts about consumer spending stamina, explained analysts at Wells Fargo commenting personal income and spending data released on Thursday. They noted that “even with inflation at a 40-year high, the 0.4% drop in real spending in February might be overstating the burden and be more of a reflection of an upward revision that made January one of the best months on record for real spending.”

Key Quotes:

“The 0.4% drop in real spending in February comes on the heels of an already strong January gain that was revised much higher. In fact the 2.1% monthly jump in real PCE in January was the sixth largest increase in records going back more than 30 years. Of the five months that beat the January increase, four of them were pandemic-related surges tied either to major reopening months or to stimulus payments.”

“Diminished purchasing power will weigh on real spending. We do not wish to dismiss this risk, but we see some notable factors helping households today. Households are in decent financial shape and this should not be overlooked. Wage growth has been robust and shows few signs of slowing amid strong demand for labor. This is beneficial to households even if inflation is currently eating into much of the recent gain. More importantly, households can temporarily rely on their balance sheets. The personal saving rate rose to 6.3% last month, and since this was below the pre-pandemic rate of 7.8%, it implies a decline in 'excess' savings.”

“We expect households to save less in the near term to offset some of the hit to purchasing power from rising inflation. If they don't, spending could falter more than we presently forecast.”

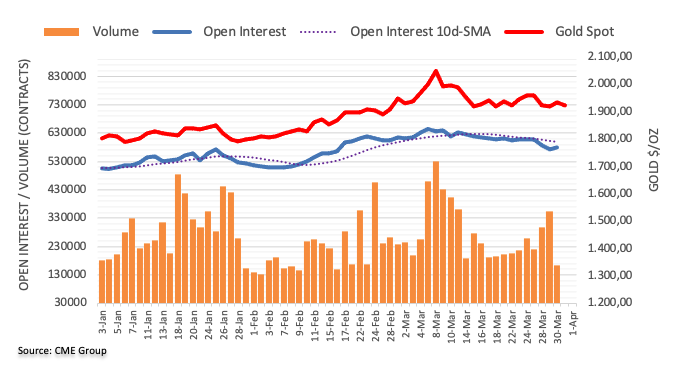

- Gold has been on the front foot since the European morning, bouncing from the $1920 level into the $1940s.

- A ramping up of energy-related tensions between EU nations and Russia plus risk-off flows have benefitted the precious metal.

Even though the White House’s announcement of a historic crude oil reserve release has triggered downside in global oil markets, contributing to a modest easing of inflation fears, geopolitical concerns and further month-end downside in US yields are keeping gold supported. Spot prices (XAU/USD) found good support in the $1920 area during the European session and have since advanced into the $1940s to now trade with on-the-day gains of about 0.6%. Russian President Vladimir Putin announced on Thursday that he had signed an order that European nations would need to pay for Russian gas by opening rouble accounts at Russian banks starting from 1 April (this Friday).

The announcement marks a ratcheting up of economic tensions between Russia and Europe and seemingly increases the risk that Russian gas flows to Europe are halted. If Russia did halt gas flows into Europe, this would have a catastrophic impact on the Eurozone economy (likely throwing it into immediate recession). The implications for ECB policymaking would not be immediately clear, but the uncertainty of the whole situation has triggered a flight to safety. Stocks are down globally, as are bond yields as investors pair risk heading into the quarter-end, creating positive trading conditions for gold.

Energy-related tensions between EU nations and Russia come against a backdrop of waning optimism relating to recent alleged progress in Russo-Ukraine peace talks. Talks recommence on Friday, but if the broader geopolitical picture continues to darken, XAU/USD might be in with a shot of testing recent highs in the $1960s. Of course, US economic data remains a focus with the official jobs report for March coming on Friday.

Labour market data out already this week has been robust, indicating it should be a strong release, which should further solidify expectations for a 50 bps rate hike from the Fed at its next meeting. Given there is a lot of Fed hawkishness already in the price, it's questionable as to how much downside risk Friday’s US jobs report poses to gold.

According to analysts from Rabobank, the euro has scope for some appreciation versus the pound taking into account what market participants currently expect from the Bank of England (BoE). Also, consideration of a potential rate hike from the European Central Bank (ECB) before year-end should support the euro.

Key Quotes:

“The MPC had already voiced its concerns over the economic outlook at the last BoE policy meeting. Although interest rate were hiked in March on account of current tight labour conditions and the high headline inflation rate, the rhetoric from policy-makers was cautious. They predicted that “further out, inflation is expected to fall back materially, as energy prices stop rising and as the squeeze on real incomes and demand puts significant downward pressure on domestically generated inflation.” Policy-makers also forecast that the impact of real aggregate demand is likely to be larger than it forecast in February which is consistent with a weaker outlook for growth and employment.”

“We expect the money market to retrace some of the BoE rate hikes forecast for this year. As long as the market retains the view that the ECB will be able to hike rates before the end of the year, the EUR is likely to hold its ground. On that basis, we see scope for upside pressure in EUR/GBP in the coming months.”

The Canadian economy expanded 0.2% in January. Analysts at CIBC point out first-quarter GDP is now tracking roughly 4% annualized growth, well above “what most people had expected at the start of the year and higher than the Bank of Canada's January MPR forecast of 2%.” According to them, the figures provide further ammunition for rate hikes.

Key Quotes:

“The Canadian economy certainly faired much better in Q1 than we had previously expected, and as a result we will be raising our forecast to around 4% annualized for the quarter. However, the impact of high inflation on household finances, potential supply chain issues in manufacturing stemming from Russia/Ukraine and China, and higher interest rates finally slowing the housing market, will mean that growth throughout the remainder of the year is slower than we had initially assumed. Because of that, our forecast for GDP growth in 2022 as a whole (roughly 3 1/2%) will be little changed.”

“The strong start to the year provides justification not just for further hikes, but potentially a 50bp move in April. That could mean a year-end rate that is 25bp above our current 1.5% forecast. However, with growth likely to slow in the second half of the year and inflation starting to decelerate, we still think that the path higher for interest rates won’t be as steep as financial markets are currently expecting, and we still see a peak of 2.25% in 2023.”

“While today's data, particularly the advance estimate for February, were better than expected and will lead to upward revisions in terms of Q1 growth, market reaction was very limited. That likely reflects the fact that the market is already pricing in a very quick tightening cycle from the Bank of Canada (to a 2.5% overnight rate by year-end) making it more susceptible to downside surprise rather than upside ones.”

Analysts at Rabobank see the AUD/USD pair not correlated to risk as it used to be. They forecast it will trade at 0.75 in three months.

Key Quotes:

“Measured since the start of the war in Ukraine, the AUD is the best performing G10 currency. In this time frame commodity currencies dominate the top of the performance table with the commodity importing currencies such as the JPY and European currencies trailing behind.”

“In addition to the boon coming from high commodity prices, there is pre-existing strength in Australia’s labour market. Concerns that this may result in higher wage inflation have increased the chances that the RBA will hike interest rates this year. The RBA has been one of the more dovish G10 central banks, but markets are anticipating that this will change in the coming months. Even in the best case scenario of a peace deal for Ukraine, it is likely that Europe will continue to strive for more energy independence from Russia. This suggests higher prices for alternative energy sources for some time, which is likely to maintain support for currencies such as the AUD.”

“We have brought forward our 6 month 0.75 AUD/USD forecast to a 3 month view and expect a move towards 0.76 in 6 months.”

- The Loonie losses traction for the first time in the week though it keeps trading with gains.

- Russia-Ukraine tussles and Putin’s natural gas decree weighs on market mood.

- The US would tap 1 M barrels per day of their SPR reserves.

- USD/CAD Price Forecast: Unless the pair trades above 1.2613, where the 200-DMA lies, the trend is downwards.

The USD/CAD snaps two days of losses and recovers some ground amidst a stronger US dollar, continuing hostilities between Russia and Ukraine, and lower oil prices. The Canadian dollar weakens vs. the greenback on the back of those factors but remains flat in the week. At the time of writing, the USD/CAD is trading at 1.2486.

Donwbeat market mood and falling oil prices weigh on the USD/CAD

Global equities keep trading in the red for the second straight day as Russia’s President Vladimir Putin signed a decree on natural gas, which has to be paid in Roubles and would begin on April 1. Furthermore, Putin’s added that proceedings in euros or US dollars could also be blocked while emphasizing that Russia will supply gas at agreed-upon volumes and prices. However, he reiterated that active contracts will be halted if demands are not met.

As a reaction to the headline, market sentiment turned sour, with the S&P heading lower, as market players turned towards the safe-haven US dollar.

The US Dollar Index, a gauge of the greenback’s value vs. a basket of its rivals, advances 0.19%, sitting at 98.021, weighs on the Loonie, also dragged down by falling oil prices.

Western Texas Intermediate (WTI), the US crude oil benchmark, fell from daily highs to the $102 mark on an announcement that the White House would tap its oil reserves and release 1 million BPD over six month period.

Macroeconomic-wise, the Canadian docket featured the GDP for January, which rose by 0.2%, in line with estimations, and higher than December’s 2021 reading. On the US front, the US central bank’s favorite gauge of inflation, the Core PCE for February, rose by 5.4% y/y, lower than the 5.5% estimated, while US Initial Jobless Claims for the week ending on March 26 increased by 202K, higher than the 197K expected.

USD/CAD Price Forecast: Technical outlook

The USD/CAD keeps trading downwards, as shown by the daily chart. Thursday’s price action reached a daily high at around 1.2533, but in the North American session, it gave back those gains and meandered around the 1.2480s highs. That said, the downtrend is intact unless the USD/CAD breaks above 1.2613, the 200-day moving average (DMA), and the top of the 1.2450-1.2600 range.

The USD/CAD first support would be March 25 daily low at 1.2465. A breach of the latter would expose January 12 low at 1.2447, followed by November 10, 2021, daily low at 1.2387.

- Euro among worst performers on Thursday.

- DXY rises after two days of declines, off highs.

- EUR/USD’s recovery finds resistance below 1.1135.

The EUR/USD bottomed at 1.1067 after the beginning of the American session and then rebounded to the 1.1135 area as stocks trimmed losses in Wall Street. The greenback lost momentum as US yields remain near daily lows.

The euro is the worst G10 performer on Thursday, hit by a decline in German yields and concerns about rising inflation in the Eurozone. The CPI is due on Friday, and it could reach 7%.

In the US, data showed the Core PCE rose to 5.4% (year-over-year), Initial Jobless Claims rose modestly to 202K from the lowest since 1969, and the Chicago PMI rose from 56.3 to 62.9. The figures were mostly ignored by market participants. On Friday, the US official employment report is due. Marker consensus points to an increase in payroll of 490K and a drop in the unemployment rate from 3.8% to 3.7%.

US yields look steady on Thursday, hovering near recent lows. The 10-year yield stands at 2.32% and the 30-year at 2.45%. The Dow Jones drops 0.36%, and the Nasdaq loses 0.27%.

Testing the 20-SMA in 4-hour chart

The correction of EUR/USD from the highest level in four weeks near 1.1200, alleviated the bullish pressure, but so far, it did not change the current positive outlook for the euro. The pair rebounded and managed to remain above the 20-Simple Moving Average in four hours chart (currently at 1.1080) and recovered 1.1100.

A firm break under 1.1080 would change the current bias to neutral. The immediate, relevant support might be seen at 1.1035/40. On the upside, the 1.1135 zone has become a critical resistance again. If the euro rises above a test of the weekly high at 1.1185 should not be ruled out.

Technical levels

- Oil markets continue to trade in choppy fashion and with large on-the-day losses after the US SPR release announcement.

- 1M BPD will be released for the next six months, keeping the pressure on WTI, which currently trades near $102.

- OPEC+ agreed on a 432K BPD output hike from May, helping keep WTI supported above $100 alongside waning Russo-Ukraine optimism.

Choppy conditions in global oil markets have continued during US trading hours, with prices continuing to trade with sharp on-the-day losses after the White House issued a statement confirming recent speculation regarding a historic crude oil reserve release. The White House said that it would be releasing 1M barrels of crude oil from the Strategic Petroleum Reserve (SPR) every day for the next six months and that it would then restock the SPR once prices are lower. Front-month WTI futures currently trade in the $102.00s, down slightly less than $5 on the day after earlier finding strong support in the $100 area.

Opposition politicians/commentators accused the White House of timing the release specifically to attempt to lower gas prices right before the November mid-term elections and, in doing so, jeopardizing long-term US energy security. Analysts at Goldman Sachs said the move would help the oil market rebalance in 2022, but was cautioned that it wasn’t a permanent fix and “would therefore not resolve the structural supply deficit, years in the making”.

The US SPR release aside, crude oil traders have also had plenty of other themes to monitor on Thursday. As expected, OPEC+ agreed on a 432K barrel per day (BPD) output quota hike from May, resisting continued calls from major oil-importing/consuming nations for the likes of Saudi Arabia and the UAE to lift output at a faster pace. Meanwhile, optimism regarding progress in Russo-Ukraine peace talks has waned a little as Russian attacks have continued and officials expressed skepticism. For now, these two factors seem to be underpinning WTI above the $100 mark.

The Biden Administration will release 1M barrels per day in oil from the US Strategic Petroleum Reserve (SPR) over the next six months, according to a statement released by the White House on Thursday. The White House statement continued that the President will call on Congress to pass his plan to speed the transition to clean energy that is made in America and that President Joe Biden will issue a directive authorising the use of the defense production act to secure American production of critical materials to bolster the domestic clean energy economy.

The EUR has clawed back some of its recent losses vs. the NOK in recent weeks. However, economists at Rabobank expect the EUR/NOK pair to grind lower towards 9.50 the next quarter.

Eurozone economy is faced with more risks than the Norwegian

“Due to energy security, the eurozone economy is faced with more risks than the Norwegian. Additionally, wage inflation and over-heating risks are larger for Norway.”

“We expect EUR/NOK to continue to trend lower in 2022. We see scope for a move back to the 9.50 area on a three-month view.”

- NZD/USD drifted lower on Thursday and reversed the overnight gains to the YTD peak.

- Fed rate hike bets, a softer risk tone benefitted the safe-haven USD and exerted pressure.

- Retreating US bond yields did little to dent the USD bullish sentiment or lend any support.

The NZD/USD pair maintained its offered tone through the early North American session and was last seen trading near the daily low, around the 0.6940 region.

Having faced rejection near the 0.7000 psychological mark, the NZD/USD pair witnessed some selling on Thursday and snapped two days of the winning streak to the highest level since November 2021. The US dollar made a solid comeback and has now reversed the previous day's losses to a nearly two-week low. This, in turn, was seen as a key factor that exerted downward pressure on spot prices.

The incoming geopolitical headlines dashed hopes for a breakthrough in the Russia-Ukraine peace talks. . This, along with the growing prospect of new Western sanctions against Russia, tempered investors' appetite for riskier assets. This was evident from a fresh leg down in the equity markets, which drove some haven flows towards the greenback and weighed on the perceived riskier kiwi.

Apart from this, expectations that the Fed would adopt a more aggressive policy stance to combat high inflation acted as a tailwind for the buck. In fact, the markets have been pricing in a 50 bps Fed rate hike move at the next two meetings. The bets were reaffirmed by Thursday's release of the US Core PCE Price Index, which rose to 5.4% YoY in February from the 5.2% in the previous month.

The combination of supporting factors helped offset the ongoing decline in the US Treasury bond yields, which, so far, did little to hinder the intraday USD positive move or lend support to the NZD/USD pair. It, however, would be prudent to wait for strong follow-through selling before confirming that the pair has topped out in the near term and positioning for a deeper correction.

Technical levels to watch

A Western official said on Thursday that they don't think "we" are seeing any signs there is a really serious attempt at finding a compromise in Russo-Ukrainian peace negotiations, reported Reuters. It is incredibly difficult for Russia to stop selling oil and gas to Western Europe, the official continued, noting his skepticism that these threats will be seen through.

Peace talks between Russia and Ukraine recommence on Friday and come after Tuesday's allegedly "constructive" round of talks that was seen at the time as raising the likelihood of a Presidential level meeting and of a ceasefire agreement being reached. However, optimism that a deal might be near has waned in recent days, with Russian President Vladimir Putin reportedly not in the mood for compromise and Ukraine still not offering to fulfill all of Russia's demands.

German Economy Minister Robert Habeck said in a speech in Berlin on Thursday that, regarding gas payments, Germany will not be blackmailed by Russian President Vladimir Putin and reiterated that gas payments will be made in euros. Putin had earlier announced that payments for gas must be made in roubles as of 1 April.

French Finance Minister Bruno Le Maire, speaking alongside Habeck, said that France and Germany are preparing for a possible scenario that Russian gas flows are halted and that both countries are prepared for anything Putin might decide on gas. We are totally determined to protect households from the fallout of the current energy crisis, Le Maire noted.

- AUD/USD dipped back under 0.7500 but remains well within this week’s ranges as focus shifts to Friday’s US jobs data.

- The Aussie remains resilient against the backdrop of “structurally” higher commodity prices and expectations for a hawkish RBA policy shift.

AUD/USD dipped back to the south of the 0.7500 level on Thursday, though remains robustly supported near the big figure and well within this week’s approximate 0.7460-0.7540ish ranges. The pair was little moved by the latest batch of US data which saw inflation (according to the Core PCE Price Index) rise again in February and further evidence of a robust labour market one day ahead of the release of the official US jobs report. Despite the data and Fed rhetoric this week supporting the Fed’s recent hawkish shift in stance this week, month/quarter-end selling means the buck has had a tough time.

As a result, AUD/USD has been able to hold near the 0.7500 level this week, with the short-term bulls eyeing a test of Q4 2021 highs in the 0.7560 area. The Australian economy's geographical removal from the war in Ukraine and positive exposure to the resultant sharp recent rise in commodity prices has been a key tailwind for the Aussie as of late, analysts argued. “If we are right the war leads to a structural increase in energy prices, there is more upside to AUD this year,” said currency strategists at CBA. “We expect AUD/USD will soon break above its resistance near $0.7516 and lift higher to $0.7673,” they continued.

Such a move may have to wait until after Friday’s official US jobs report, with trading conditions ahead of this key data release normally non-committal. In the meantime, recent strong Australian data should keep the pair support above this week’s mid-0.7400 lows. For reference, new homes building approvals surging a massive 43.5% MoM in February, more than recovering January's 27.1% MoM drop, while data showed job vacancies rose 6.9% in the quarter to February to hit a record 423,500. Recent data underpins expectations that RBA will soon catch up with many of its other G10 central bank peers by announcing a hawkish policy shift.

- EUR/GBP retreated sharply from the fresh YTD peak touched earlier this Wednesday.

- The inverted head and shoulders breakout supports prospects for some dip-buying.

- Sustained break below 0.8400 is needed to negate the near-term positive outlook.

The EUR/GBP cross witnessed an intraday turnaround on Thursday and retreated around 60-65 pips from the fresh YTD peak - levels just above the 0.8500 psychological mark. The cross, for now, seems to have snapped three successive days of the winning streak and was seen trading around mid-0.8400s during the second half of the European session.

The British pound's relative outperformance followed the release of a better-than-expected UK GDP print, which showed that the economy expanded by 1.3% in A4 2021 as against the 1% estimated. On the other hand, the shared currency stalled its recent bullish run amid fading hopes of diplomacy in Ukraine, which revived fears about the economic fallout from the crisis.

From a technical perspective, the strong move up witnessed since the beginning of this week confirmed a bullish breakout through a resistance marked by the neckline of an inverted head and shoulders pattern. A subsequent move beyond the very important 200-day SMA further added credence to the constructive set-up and supports prospects for the emergence of some dip-buying.

Hence, any further decline could be seen as an opportunity for bullish traders and is more likely to find decent support near the 0.8400 mark. The said handle should act as strong base for the EUR/GBP cross, which if broken decisively might negate the bullish outlook. The corrective slide could further get extended towards the next relevant support near the 0.8335 region.

On the flip side, the 0.8500-0.8510 region now seems to act as an immediate hurdle. This is followed by a downward sloping trend-line extending from April 2021, around the 0.8535-0.8540 zone, which if cleared would set the stage for additional gains. The momentum could then allow the EUR/GBP cross to aim back to reclaim the 0.8600 round-figure mark.

EUR/GBP daily chart

-637843298239125688.png)

Technical levels to watch

The ongoing geopolitical and macroeconomic instability is driving safe-haven fund flows into gold. Economists at TD Securities expect the yellow metal enjoy further upside amid this backdrop.

Hawkish Fed backdrop still poses downside risks

“So long as material progress on ceasefire talks and de-escalation remains elusive, haven flows are likely to keep the yellow metal propped up against an increasingly hawkish Fed backdrop.”

“The 2y-10y curve flirting with inversion has further fueled talk of recession on the horizon, offering another positive dynamic for the gold market.”

“Rates markets are readying for the Fed to deliver a hawkish surprise to markets. On this front, with markets only pricing in roughly a 73% chance of a 50bp move in May, there is still room for the market to price in the full move that we are expecting, which could increase macro outflow pressures for precious metals markets.”

Russian President Vladimir Putin announced on Thursday that Russia is to halt gas contracts if buyers don't pay in roubles, reported Bloomberg. Active contracts will be immediately halted if these demands are not met, Putin continued, noting that buyers of gas should open accounts in Russian banks. Putin said that he had signed an order on these new gas trading rules, which come into force as of 1 April. Putin pledged that Russia would continue providing gas at the already set volumes and prices and will move to increase settlements in national currencies.

Putin explained that by continuing to sell gas in euros and dollars, assets that could easily be frozen by the West, Russia deems the risk of providing gas for free as unacceptable. The switch to rouble payments is meant to strengthen Russia's sovereignty, he continued, before lambasting Europe for being ready to ignore the interests of its own citizens.

- EUR/USD drifts lower following new tops around 1.1180.

- The 8-month resistance line emerges as the next hurdle of note.

EUR/USD corrects lower after reaching new 4-week tops in the 1.1180/85 band on Thursday.

That said, immediately to the upside comes the temporary resistance at the 55-day SMA, today at 1.1198 ahead of the 1.1250 region, where the 100-day SMA and the 8-month line coincide. Beyond this area, the selling bias is expected to subside and allow for extra gains in the short-term horizon.

The medium-term negative outlook for EUR/USD is expected to remain unchanged while below the key 200-day SMA, today at 1.1488.

EUR/USD daily chart

AUD/CAD rally rums out of momentum around 0.9450. The pair needs to extend its race higher above this region to enjoy further gains, economists at Scotiabank report.

AUD/CAD rally is starting to flag

“Choppier price action and waning bullish momentum suggest the AUD rally is starting to flag. A narrow range (so far) this week rather supports that impression.”

“AUD/CAD is still finding demand on short-term dips but will have to extend gains above 0.9450/60 sooner rather than later (by next week, we estimate) in order to extend gains or downside risks will increase for a test of support in the mid-0.92s (40-day MA).”

CAD/MXN tests major weekly support at 15.89. A weekly close below here would open up additional losses to the 15.60 area, economists at Scotiabank report.

CAD/MXN to recover some ground on a weekly close above 15.89

“A weekly close below 15.89 should be enough to maintain pressure on the CAD in the near-term and drive the cross back to the 15.60 area – lows from the middle of last year.”

“If 15.89 holds through the close of the week, the CAD/MXN may be able to recover some ground but a move back above 16.20/25 is needed to confer any sort of near-term technical strength on this market.”

EUR/CAD has reached the 1.37 level. The pair may consolidate but downside risks remain, economists at Scotiabank report.

Minor EUR/CAD rallies are liable to attract better selling interest

“We could certainly see some consolidation in the EUR in the short run but absent a more significant rebound – back through 1.4250 – medium-term risks will remain geared towards low, or lower, levels prevailing.”

“A high close on the week may signal more short-term gains/consolidation but trend momentum oscillators are bearishly aligned across medium, long and very long-term timeframes, meaning minor EUR rallies are liable to attract better selling interest.”

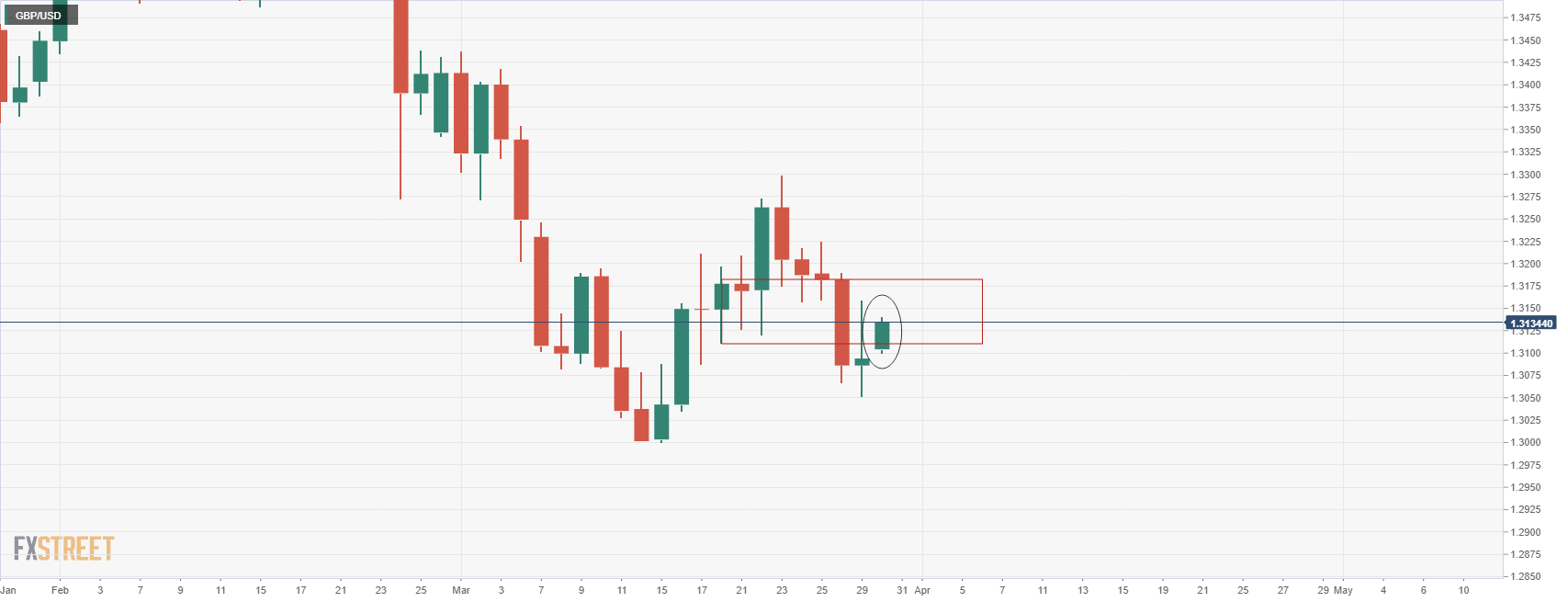

GBP/USD holds unchanged in narrow trading. Economists at Scotiabank expect cable to move downward as there is little room to rebuild the Bank of England’s (BoE) expectations.

Break under 1.31 faces limited support until 1.3050/60

“With a quiet data and events calendar ahead meaning that there is little to rebuild BoE expectations on next week, we may see further GBP weakness in the coming day.”

“A resumption of bearish pressure that sees the GBP break under the 1.31 zone faces limited support until 1.3050/60, the Tuesday lows.”

“Resistance past yesterday’s peak of ~1.3180 is the 1.32 figure area.”

EUR/USD has endured a correction, slipping from resistance at 1.1180 to below 1.11. Economists at Socitbank highlight that the world’s most popular currency pair needs to close above the 1.11 level to resume its gains.

EUR’s picture still looks positive

“Price action over Tue/Wed still leaves the EUR picture looking relatively positive, but a close above 1.11 may be needed to maintain the recently bullish tone.”

“The 50-day MA at 1.1180 will act as resistance alongside 1.1190/00.”

“Support is 1.1090/00 followed by 1.1070/75 and the mid-1.10s.”

- DXY’s downside failed to break below the 97.70 region.

- Further recovery looks to regain 99.00 and above.

The index reclaims ground lost in the last couple of sessions and regains the area beyond 98.00 the figure on Thursday.

DXY manages well to rebound from the decent contention area in the 97.70 zone and the ongoing rebound is expected to target the 99.00 neighbourhood and above in the near term.

The current bullish stance in the index remains supported by the 6-month line near 96.20, while the longer-term outlook for the dollar is seen constructive while above the 200-day SMA at 94.83.

- A combination of diverging forces failed to provide any impetus to USD/JPY on Thursday.

- Fading hopes for diplomacy in Ukraine underpinned the safe-haven JPY and capped gains.

- The emergence of aggressive USD buying extended support and helped limit the downside.

The USD/JPY pair seesawed between tepid gains/minor losses through the early North American session and held steady around the 121.80-121.85 region post-US macro data.

Speculations that authorities would intervene and respond to the recent sharp decline in the Japanese yen, along with fading hopes for diplomacy in Ukraine, acted as a headwind for the USD/JPY pair. Bearish traders further took cues from the ongoing decline in the US Treasury bond yields, though resurgent US dollar demand helped limit the downside for spot prices, at least for the time being.

Following the recent fall to a nearly two-week low, the USD made a solid comeback amid acceptance that the Fed would hike interest rates by 50 bps at the next two meetings to combat high inflation. The market bets were reaffirmed by Thursday's release of the US Core PCE Price Index, which accelerated to a 5.4% YoY rate in February from the 5.2% reported in the previous month.

This, however, was slightly below consensus estimates pointing to a reading of 5.5%. Additional details revealed that Personal Spending decelerated sharply and rose 0.2% in February, though was offset by an upward revision of the previous month's increase from 2.1% to 2.7%. Separately, the US Weekly Initial Jobless Claims also missed expectations and edged higher to 202K from 188K.

The mixed economic data did little to impress the USD bulls or provide any meaningful impetus to the USD/JPY pair. That said, it will still be prudent to wait for strong follow-through selling below the weekly low, around the 121.20-121.15 region, before positioning for an extension of this week's sharp pullback from the highest level since August 2015, around the 125.10 region.

Thursday's US economic docket also features the release of Chicago PMI, though is likely to pass unnoticed as the focus remains glued to developments surrounding the Russia-Ukraine saga. Apart from this, trades will take cues from the US bond yields, which will influence the USD price dynamics and produce some short-term opportunities around the USD/JPY pair.

Technical levels to watch

Personal Income in the US rose by 0.5% MoM in February whist Personal Spending rose by 0.2%, the latest data release by the Bureau of Economic Analysis and Department of Commerce showed on Thursday. The latter thus came in in line with the expected gain of 0.5% MoM, while the former came in lower versus the expected MoM gain of 0.5%.

Market Reaction

The latest batch of US data has not provoked a reaction in FX markets, given that market participants are viewing February data as "out of date" given geopolitical developments that took place late last month.

- Annual US inflation according to the Core PCE Price Index was a little weaker than expected in February at 5.4%.

- But with the data viewed as out of date given geopolitical developments late last month, FX markets have not reacted.

Annual inflation in the US rose to 5.4% in February according to the latest Core PCE Price Index reading released by the US Bureau of Economic Analysis on Thursday. That was a tad below the expected reading of 5.5% YoY, but above January's 5.2% reading. The MoM gain in prices according to the Core PCE Price Index was 0.4%, in line with expectations and a tad lower versus January's 0.5% MoM gain. The Core PCE Price Index is the Fed's favoured measure of underlying US inflationary pressures.

The headline PCE Price Index rose at a pace of 6.4% YoY and 0.6% MoM in February. The slightly lower than forecast YoY reading in February for the Core PCE Price Index will do little to ease inflation fears. Indeed, given the onset of the Russo-Ukraine war at the end of last month and its subsequent impact on global commodity prices and supply chains, inflation is expected to have surged in March. This is exactly what has been seen in the timelier Eurozone HICP inflation data released this week for March. Given the US' lower economic exposure to the Russo-Ukraine conflict, the surge in prices in the US shouldn't be quite so acute.

Market Reaction

The idea that the latest PCE Price Index figures are out of date means that markets have not seen any notable reaction to the data. The DXY is broadly unmoved versus pre-data levels just above 98.00.

Initial Jobless Claims in the week ending on 26 March came in at 202,000, a tad above the expected reading of 197,000 and up versus the previous week's 188,000 print. Continued Jobless Claims fell to 1.307M in the week ending on March 19, below the expected rise to 1.35M from 1.342M the week prior. The Insured Unemployment Rate fell to 0.9% in the week ending on March 19 from 1.0% a week earlier.

Market Reaction

Further robust US labour market data underpins the notion that the jobs market in the US right now is hot and that Friday's official jobs report should be a good one. FX markets have not reacted to the latest data, as the current strength of the US labour market right now is widely understood and known to be strong, and is well priced in by markets. Indeed, assumptions of continue labour market strength underpin the Fed's recent shift towards signalling faster and larger interest rate hikes in the coming years.

Gold’s status as a safe-haven asset has shone brightly over the past month. It is likely the market will have a long period of uncertainty. With such a backdrop, gold is likely to find plenty of support from investors, economists at ANZ Bank report.

Gold remains an effective hedge against geopolitical uncertainty

“While geopolitical crises do not last forever, we expect the secondary impacts of the Russia-Ukraine crisis to provide a strong level of support for gold prices this year.”

“The broader isolation of Russia will see a structural shift in the energy sector, which will be inflationary. There is also a higher risk of weaker economic growth (particularly in Europe). This should create a positive backdrop for investor demand. As such, we see the gold price staying above $1,900/oz, despite the prospects of an aggressive rate hike cycle by the Fed.”

OPEC+ agreed as expected to increase oil output quotas by 432,000 barrels per day (BPD) from May, as had broadly been expected by analysts, and as had been recommended by the group's Joint Ministerial Monitoring Committee, whose meeting concluded just minutes ago, reported Bloomberg on Thursday. The next OPEC+ meeting will be held on May 5.

Thursday's OPEC+ meeting came against the backdrop of a large intra-day decline in oil prices as a result of sources reporting that the White House is considering a record oil reserve release of up to 180M barrels over the next several months (allegedly amounting to about 1M BPD). OPEC+ nations have up until now ignored calls from the US and other major oil-consuming nations (like India) to increase output at a faster pace.

Market Reaction

Oil prices remain choppy and continue to trade close to session lows just above the $100 per barrel mark as traders weigh up evolving geopolitical risk, potential near-term supply increases as a result of large oil reserve releases and OPEC+ output policy.

US PCE Price Index Overview

Thursday's US economic docket highlights the release of the February Personal Consumption Expenditure (PCE) Price Index, scheduled later during the early North American session at 12:30 GMT. The headline gauge is expected to have accelerated from 6.1% YoY in January to 6.7% during the reported month. The core reading is also anticipated to rise from 5.2% to 5.5% YoY in February and come in at 0.4% on a monthly basis, down from 0.5% in January.

How Could it Affect EUR/USD?

A strong than expected reading will reaffirm market bets that the Fed would hike interest rates by 50 bps at the next two meetings. This should be enough to push the US Treasury bond yields higher and assist the US dollar to capitalize on its intraday gains. Conversely, a softer print is more likely to be overshadowed by concerns about the Ukraine crisis and do little to dent the intraday USD bullish sentiment. This, in turn, suggests that the path of least resistance for the EUR/USD pair is to the downside.

Eren Sengezer, Editor at FXStreet, outlined important technical levels to trade the EUR/USD pair: “On the downside, 1.1100 (200-period SMA) aligns as key support and buyers could take action in case the pair retreats toward that level. If that support fails, however, the near-term technical outlook could turn bearish and the pair could face interim support at 1.1080 (Fibonacci 61.8% retracement of the latest downtrend, 20-period SMA) before targeting 1.1040 (Fibonacci 50% retracement, 50-period SMA, 100-period SMA).”

“The first resistance is located at 1.1200 (psychological level) ahead of 1.1230 (Static level). If the pair starts using the latter as support, it could stretch higher toward 1.1270 (static level),” Eren added further.

Key Notes

• US February PCE Inflation Preview: Will inflation data confirm 50 bps May hike?

• EUR/USD Forecast: US inflation data could derail euro's rally

• EUR/USD fades the spike to weekly highs around 1.1180

About the US PCE Price Index

The Personal Spending released by the Bureau of Economic Analysis, Department of Commerce is an indicator that measures the total expenditure by individuals. The level of spending can be used as an indicator of consumer optimism. It is also considered as a measure of economic growth: While Personal spending stimulates inflationary pressures, it could lead to raise interest rates. A high reading is positive (or Bullish) for the USD.

The OPEC+ Joint Ministerial Monitoring Committee, which typically meets ahead of the main OPEC+ meeting of oil ministers, agreed to recommend that the group raise its output quotas by 432,000 barrels per day (BPD) from May, as expected. Focus now shifts to the OPEC+ meeting of oil ministers, which allegedly just begun. Likely, as has been the case in meetings over the last few months, a deal will be struck quickly.

The OPEC+ meeting comes against the backdrop of a large intra-day decline in oil prices as a result of sources reporting that the White House is considering a record oil reserve release of up to 180M barrels over the next several months (allegedly amounting to about 1M BPD). OPEC+ nations have up until now ignored calls from the US and other major oil consuming nations (like India) to increase output at a faster pace.

- GBP/USD is consolidating in the 1.3100s ahead of key US data releases as traders monitor geopolitical developments.

- BoE dovishness in contrast to the Fed is keeping the pair capped under its 21DMA for now.

Amid a lack of fresh UK fundamental developments to drive any independent movements in sterling, and as US dollar markets consolidate ahead of key US data releases as market participants monitor geopolitical developments, GBP/USD is trading subdued in the low-1.3100s. At current levels in the 1.3120s, the pair trades flat and well within this week’s approximate 1.3050-1.3200 ranges. Notably, the 21-Day Moving Average continues to act as a barrier to further progress for the pair, suggesting the near-term technical bias remains tilted to the downside.

Many strategists have noted the stark divergence between the BoE, which has been sounding ever more dovish on the need for further tightening as worries switch more to economic weakness as a result of the growing cost-of-living squeeze in the UK as opposed to rampant inflation, and Fed. Indeed, further strong data releases this week plus more hawkish rhetoric from monetary policymakers has solidified expectations for a 50 bps rate hike in May. Though this hasn’t prevented some month-end weakness in the US dollar and yields, the combination of which helped lift GBP/USD from earlier weekly lows in the mid-1.3000s, it is likely a key factor preventing the pair from advancing above its 21DMA.

US February Core PCE inflation data, February Personal Income and Spending figures and the latest Weekly Jobless Claims report will all be released at 1330BST. The data is likely to underpin the narratives of high inflation/a tight labour market in the US, meaning further USD weakness is unlikely. In the absence of further pricing out of geopolitical risk related to the Russo-Ukraine war, GBP/USD’s near-term upside prospects look somewhat limited.

NATO Secretary General Jens Stoltenberg said on Thursday that though NATO has heard that Russia will scale down its attacks in Ukraine, Russian units have not been withdrawing, but have been repositioning instead, reporter Reuters. Thus, we can expect more Russian attacks in Ukraine, which will bring more suffering, Stoltenberg added.

Russia announced earlier in the week that it would be scaling down its military operations around the northern cities of Kyiv and Chernihiv, which it said was to foster better negotiating conditions, but the US and its allies have said is a redeployment/regrouping strategy. Russia has said it wants to focus its military efforts on key fronts and the "liberation" of Donbass. Peace talks between the two sides recommence on Friday after the last "constructive" round of constructive talks ended on Tuesday.

- EUR/JPY adds to Wednesday’s losses and approaches 135.00.

- Further down comes a Fibo level around 134.40.

EUR/JPY keeps correcting lower following Monday’s fresh cycle highs and trades at shouting distance from the 135.00 neighbourhood.

The underlying upside momentum in the cross remains unchanged, although further retracement should not be ruled out in the very near term. Against that, there is an interim support at a Fibo level (of the March rally) at 134.44 prior to the former 2022 high at 133.15 (February 10).

In the meantime, while above the 200-day SMA at 130.08, the outlook for the cross is expected to remain constructive.

Economist at UOB Group Barnabas Gan reviews the latest interest rate decision by the Bank of Thailand (BoT).

Key Takeaways

“The Bank of Thailand (BOT) held its policy rate steady at 0.50% for its 15th consecutive meeting on 30 Mar 2022. The last time it made a move was in May 2020, when the benchmark rate was cut by 25 bps.”

“Given the immediate growth headwinds and higher domestic prices, policymakers downgraded its 2022 GDP growth outlook to 3.2% (from a previous 3.4%), while expecting inflation to surge to 4.9% (up from 1.7%) this year.”

“We expect BOT to inject a token 25 basis point rate hike in 2022, possibly as early as 3Q22, in response to higher inflation risk and the faster-than-anticipated FOMC rate hike for the year ahead. Notwithstanding the projected 25bps hike later this year, we continue to view the monetary policy stance of BOT to be accommodative, especially against the backdrop of potentially higher global interest rates.”

- USD/CAD caught aggressive bids on Thursday and was supported by a combination of factors.

- A slump in oil prices undermined the loonie and extended support amid resurgent USD demand.

- Traders now eye the OPEC+ meeting, US/Canadian macro data, geopolitics for a fresh impetus.

The USD/CAD pair built on its steady intraday ascent through the first half of the European session and climbed to a three-day peak, around the 1.2530-1.2535 region in the last hour.

A combination of supporting factors assisted the USD/CAD pair to regain positive traction on Thursday and recover further from its lowest level since November 2021 touched in the previous day. A sharp fall in crude oil prices undermined the commodity-linked loonie and acted as a tailwind amid strong pickup in the US dollar demand.

Reports that the US is considering a massive release of up to 180 million barrels from its strategic petroleum reserve (SPR) over several months triggered a steep decline in crude oil prices. Apart from this, fears that fresh COVID-19 restrictions in China could impact fuel further exerted downward pressure on the black liquid.

On the other hand, expectations for aggressive policy tightening by the Fed, along with fading hopes for diplomacy in Ukraine assisted the USD to reverse the overnight slide to a nearly two-week low. In fact, the markets seem convinced that the Fed would deliver a 50 bps rate hike at the next two meetings to combat high inflation.

The fundamental backdrop favours bulls and supports prospects for a further intraday appreciating move, though traders preferred to wait for important macro releases from the US and Canada. Thursday's economic docket highlights the US Core PCE Price Index and the monthly Canadian GDP print, due later during the early North American session.

Traders will take cues from the OPEC+ meeting, which, along with fresh developments surrounding the Russia-Ukraine saga will influence oil price dynamics. Apart from this, the US bond yields and the broader market risk sentiment, will drive the USD demand and produce short-term trading opportunities around the USD/CAD pair.