- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 30-12-2024

- Gold price edges lower to $2,600 in Tuesday’s early Asian session.

- The Fed's cautious stance might drag the precious metal lower.

- Uncertainty and geopolitical tensions could boost Gold price, a traditional safe-haven asset.

The Gold price (XAU/USD) attracts some sellers to near $2,600 during the early Asian section on Tuesday. Traders await fresh catalysts, including the US interest rate outlook and potential tariffs under President-elect Donald Trump. The markets are likely to be quiet before year-end.

The cautious stance of the US Federal Reserve (Fed) could weigh on the yellow metal as higher interest rates tend to reduce the appeal of holding the non-yielding asset. Fed Chair Jerome Powell hinted earlier this month that the US central bank might be cautious on further rate cuts after delivering a 25 basis points (bps) rate cut. The latest Summary of Economic Projections (SEP), or “dot plot”, indicated the Fed's intention to reduce the number of interest rate cuts next year from four to just two quarter-percent reductions.

On the other hand, geopolitical tensions and Donald Trump's potential return to the White House might intensify global trade tensions, fueling geopolitical crises and likely lifting the Gold price. "Geopolitical tensions have driven gold’s rise this year and will likely continue into 2025, especially with Trump’s return to office," noted Kelvin Wong, OANDA’s senior market analyst for Asia Pacific.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

- EUR/USD waffled on Monday, stuck near 1.0400 ahead of the midweek holiday.

- Global markets are set to go dark during the New Year’s holiday session.

- Mid-tier German labor figures, US ISM PMI data are the key releases this week.

On Monday, EUR/USD dipped below the 1.0400 mark as the market navigates the year-end holiday period. Trading volumes are low, and investors are hesitant to make significant moves, leading to a decline in risk appetite, affecting most asset classes and pushing them to the lower end of their recent ranges.

German stock markets will close on Tuesday and Wednesday for the New Year’s Eve and New Year’s Day holidays. The final HCOB Manufacturing Purchasing Managers Index (PMI) data for Germany is expected on Thursday; however, the final figures are not likely to generate significant momentum for the Euro. Additionally, labor statistics for Germany, including a projected increase in December's Unemployment Change to 15K from 7K, will be released on Friday.

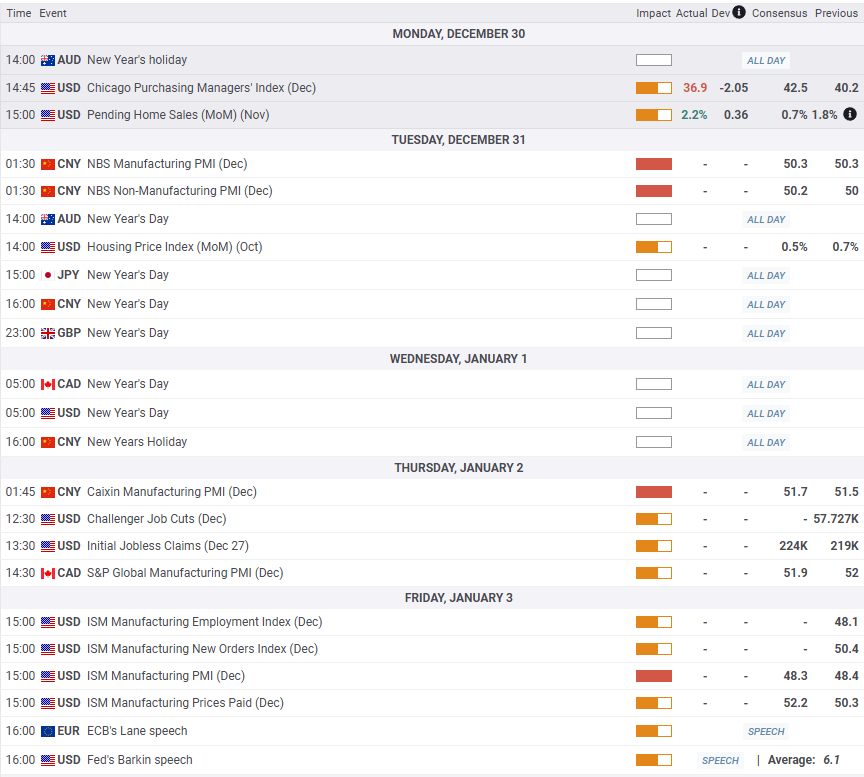

The primary data to watch this week will be the US ISM PMI figures for December, scheduled for release on Friday. The ISM Manufacturing PMI is forecasted to decrease slightly to 48.3 from 48.4. Throughout the latter half of the week, several Federal Reserve policymakers are expected to speak, aiming to clarify and reassure the market regarding the Fed’s recent adjustments to anticipated rate cuts in 2024.

EUR/USD price forecast

As EUR/USD rebounds to the lower end of 1.0400, the recent price floor around 1.0350 becomes crucial. The price has gradually decreased since the Fiber began its decline from the September highs just above 1.1200.

While it has not yet dropped below the mid-November low of 1.0332, EUR/USD is on track to finish in the negative for a fifth straight week. Observers focusing on longer timeframes will notice that the Fiber has closed lower in all but two of the last 13 weeks.

EUR/USD daily chart

Euro FAQs

The Euro is the currency for the 19 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

- USD/JPY shed 0.7% on holiday-thinned market volumes on Monday.

- It’s a thin data docket on both sides of the Pacific, but US PMI figures loom ahead.

- Investors remain unsure of what signs the BoJ is waiting for to pull the rate hike trigger.

USD/JPY corkscrewed on Monday, backsliding seven-tenths of one percent and getting knocked back below the 157.00 handle as markets push back into the midrange ahead of the midweek New Year’s holiday closures. The year-end holiday session is in full swing, and broad-market volumes remain low.

The Bank of Japan (BoJ) has been fighting a hopeless battle trying to reverse a two-year decline in the Japanese Yen, pulling out all of the stops and attempting every policy tool at its disposal except raising interest rates. The BoJ reversed its negative-rate policy in March of 2024, followed by a tentative half-step in allowing interest rates to rise, reaching a blustery 0.25% before again freezing on policy rates. Nobody is particularly sure of what data will convince the BoJ to raise rates again, but the Japanese central bank has vowed to remain in a data-dependant approach on interest rates.

Both Japanese and US trade volumes are crimped as markets head into the New Year’s midweek holiday before the calendar rolls over into 2025. The US will kick things off next year with a fresh round of ISM Manufacturing Purchasing Managers Index (PMI) figures on Friday, with little else of note until then.

USD/JPY price forecast

Despite Monday’s bearish candle, USD/JPY is still holding deep into bull country, testing the waters near 157.00 after a brief push into the 158.00 handle. The pair rebounded off of the 200-day Exponential Moving Average (EMA) near 150.00, rising 6.35% bottom-to-top in the process.

The trick for buyers will be keeping the Greenback bid north of the 50-day EMA rising through 153.00. A break below this level could see price action return to the 200-day EMA currently grinding higher above 151.00.

USD/JPY daily chart

Japanese Yen FAQs

The Japanese Yen (JPY) is one of the world’s most traded currencies. Its value is broadly determined by the performance of the Japanese economy, but more specifically by the Bank of Japan’s policy, the differential between Japanese and US bond yields, or risk sentiment among traders, among other factors.

One of the Bank of Japan’s mandates is currency control, so its moves are key for the Yen. The BoJ has directly intervened in currency markets sometimes, generally to lower the value of the Yen, although it refrains from doing it often due to political concerns of its main trading partners. The BoJ ultra-loose monetary policy between 2013 and 2024 caused the Yen to depreciate against its main currency peers due to an increasing policy divergence between the Bank of Japan and other main central banks. More recently, the gradually unwinding of this ultra-loose policy has given some support to the Yen.

Over the last decade, the BoJ’s stance of sticking to ultra-loose monetary policy has led to a widening policy divergence with other central banks, particularly with the US Federal Reserve. This supported a widening of the differential between the 10-year US and Japanese bonds, which favored the US Dollar against the Japanese Yen. The BoJ decision in 2024 to gradually abandon the ultra-loose policy, coupled with interest-rate cuts in other major central banks, is narrowing this differential.

The Japanese Yen is often seen as a safe-haven investment. This means that in times of market stress, investors are more likely to put their money in the Japanese currency due to its supposed reliability and stability. Turbulent times are likely to strengthen the Yen’s value against other currencies seen as more risky to invest in.

- AUD/USD tried to stage a Monday rally, but fizzled.

- Aussie markets are set to be dark most of the week, but China data remains.

- Key US figures this week loom ahead with Friday’s ISM PMI.

AUD/USD churned on Monday, aiming for higher ground but waffling back into the day’s opening bids near 0.6220 as holiday market volumes remain too thin to produce anything except jerky intraday movements that go nowhere. Aussie flows are set to be particularly constrained this week as Australian markets take the entire front half of the trading week off, but some key Chinese economic activity data could spark some knock-on moves.

China will be hitting the ground running while most markets remain tepid through the rollover into the new trading year. China’s NBS Manufacturing and Non-Manufacturing Purchasing Managers Index (PMI) figures land early on Tuesday, with Caixin Manufacturing PMI component numbers due on Thursday after the New Year’s Day holiday on Wednesday. NBS China Manufacturing PMI for December is expected to hold flat at 50.3, while the Non-Manufacturing and Caixin Manufacturing components are both expected to register slight upticks.

Things remain equally tepid on the US side with market flows set to remain thin until after the New Year’s holiday on Wednesday. US ISM Manufacturing PMI figures will be the key figure for Greenback traders this week, slated for Friday and expected to tick down to 48.3 in December from the previous 48.4.

AUD/USD price forecast

AUD/USD continues to churn near a 26-month low set at 0.6199 in mid-December, and a bullish recovery attempt has made little progress, leaving bids to struggle at the low end of near-term consolidation. The pair is headed for a fresh retest of multi-year lows, with the 50-day Exponential Moving Average (EMA) declining through 0.6435 and adding additional downside pressure to price action.

AUD/USD daily chart

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

Markets are struggling to find a reason to move too much in either direction ahead of the New Year’s market closures, which will see most global exchanges shuttered during the middle of the trading week.

Here’s what you need to know heading into Tuesday, December 31

The US Dollar Index (DXY) churned in place on Monday, cycling near the 108.00 handle as investors take the year-end sessions off. Market momentum has evaporated with global markets taking the holiday season off. Except for some last-minute position adjustments and a smattering of over-eager market participants, market volumes are horrifically constrained as the calendar grinds toward the New Year’s Eve midweek market closure. Following the death of former President Jimmy Carter this week, US officials have flagged January 9 as an additional holiday in observance of Jimmy Carter’s contributions to the US and the world.

EUR/USD saw some rough chop on Monday, testing 1.0450 before settling back into the 1.0400 handle. Market flows have cooled significantly during the holiday season, keeping Fiber constrained and on a tight leash near recent lows.

GBP/USD caught a similar downside move to kick off the new trading week, falling back into 1.2550 as Cable traders wait for a reason to bid the Pound Sterling. Some rough chop is expected in the near-term as market flows remain tight, and a lack of meaningful economic data from the UK side of things is doing little to provide directional bias for Cable traders.

AUD/USD is poised for a thunderously quiet week with Australian markets dark for the entire front half of the trading week, however some key Chinese activity figures due this week could have a knock-on effect on the Aussie. Chinese NBS Manufacturing and Non-Manufacturing Purchasing Managers Index (PMI) figures are due early Tuesday, followed by the Caixin Manufacturing PMI on Thursday.

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

- The Canadian Dollar rose nearly half of a percent against the Greenback.

- Canada is almost entirely absent from the economic calendar this week.

- Thin data and low holiday volumes bode poorly overall for CAD bulls.

The Canadian Dollar (CAD) caught a thin bid on Monday, rising a little over four-tenths of one percent against the Greenback as tepid markets round out the 2024 trading season. Investors are caught in a volatility trap ahead of the midweek market closure, with most of the global market space remaining off for the week.

Canadian economic data remains limited this week, and Loonie markets will be kicking off 2025 with a whimper with the only datapoint of note being Thursday’s Canadian Manufacturing Purchasing Managers Index (PMI) figures. US markets will follow up with ISM Manufacturing PMI numbers on Friday.

Daily digest market movers: Markets hunker down amid holiday trading doldrums

- The CAD rebounded 0.4% against the USD to start the new trading week, but meaningful momentum remains limited.

- The Loonie is still trading close to multi-year lows against the Greenback.

- Canadian and US markets will be shuttered for New Year’s Day on Wednesday.

- Canadian and US PMI figures are due after the midweek shutdown.

- Both survey result indexes are expected to tick lower as business expectations cool heading into the post-holiday slowdown.

Canadian Dollar price forecast

The Canadian Dollar is adrift near multi-year lows against the US Dollar, bolstering the USD/CAD pair into the 1.4400 chart region. Despite this, the key technical level appears to be holding, but a clear lack of bullish momentum underpinning the Loonie is keeping the pair well-bid.

A medium-term bull run in the US Dollar saw USD/CAD close higher for all but two of the last 12 straight trading weeks, lifting the Greenback 7.8% higher against the Loonie bottom-to-top. The immediate target for CAD bidders will be to force the pair back below the 1.4300 handle.

USD/CAD daily chart

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

- The Dow Jones shed 300 points on Monday as investors recoil at the year-end.

- The broad-market tech rally that bolstered indexes to record highs in 2024 looks set to evaporate.

- Most investors are sitting on the sidelines ahead of the midweek holiday closure.

The Dow Jones Industrial Average (DJIA) shed over 300 points on Monday, plunging to a near-term low just south of 42,300 before a half-hearted recovery back to 42,500 as equities swoon in one of the last trading days of the year. The broad-market tech rally, buoyed into lofty heights by even loftier investor expectations for the AI-fueled future, looks set to drain out of the markets for the time being.

Markets are hurtling toward the new trading year on decidedly softer footing. The Dow Jones is down 5.5% from record highs set in late November following a two-week period of straight daily declines, a feat the index hasn’t achieved since the 1970s. Markets hit the holiday season in a flat spin, keeping the Dow Jones from further declines but also preventing a meaningful bullish recovery.

After the midweek market closure for the New Year’s Day holiday, traders will be returning to the fold en masse in a much trickier environment than they expected through most of 2024. The Federal Reserve (Fed) has clamped down on the number of rate cuts it expects to deliver in 2025, forecasting a meager two 25 bps rate cuts through the calendar year before pausing. Despite the Fed’s insistence that their approach to interest rates remains ‘data dependent’, investors will have a hard time believing that incoming President Donald Trump’s strategy of sparking a trade war with everybody at the same time won’t have at least a marginal impact on the Fed’s policy stance.

Dow Jones news

The Dow Jones is broadly lower on Monday, with all but one of the index’s listed securities tilting into the red on the day. Nvidia (NVDA) is the only bright spot on the DJIA, rising a little over 2% and knocking on $140 per share. On the low side, Boeing (BA) and Nike (NKE) are in a dead heat race to the bottom, both shedding around 1.7% since the day’s opening bell. Boeing has fallen below $178 per share while Nike is testing $75 per share after falling to four-week lows.

Dow Jones price forecast

The Dow Jones’ recent plunge from all-time peaks has left near-term price action battling the charts below the 50-day Exponential Moving Average (EMA), a moving average that has provided technical support for bids through the last 13 straight months. Prices are still holding north of the 42,000 key handle, but bullish momentum remains limited as bids remain caught below the last swing low into 43,000.

Dow Jones daily chart

Dow Jones FAQs

The Dow Jones Industrial Average, one of the oldest stock market indices in the world, is compiled of the 30 most traded stocks in the US. The index is price-weighted rather than weighted by capitalization. It is calculated by summing the prices of the constituent stocks and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, who also founded the Wall Street Journal. In later years it has been criticized for not being broadly representative enough because it only tracks 30 conglomerates, unlike broader indices such as the S&P 500.

Many different factors drive the Dow Jones Industrial Average (DJIA). The aggregate performance of the component companies revealed in quarterly company earnings reports is the main one. US and global macroeconomic data also contributes as it impacts on investor sentiment. The level of interest rates, set by the Federal Reserve (Fed), also influences the DJIA as it affects the cost of credit, on which many corporations are heavily reliant. Therefore, inflation can be a major driver as well as other metrics which impact the Fed decisions.

Dow Theory is a method for identifying the primary trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA) and only follow trends where both are moving in the same direction. Volume is a confirmatory criteria. The theory uses elements of peak and trough analysis. Dow’s theory posits three trend phases: accumulation, when smart money starts buying or selling; public participation, when the wider public joins in; and distribution, when the smart money exits.

There are a number of ways to trade the DJIA. One is to use ETFs which allow investors to trade the DJIA as a single security, rather than having to buy shares in all 30 constituent companies. A leading example is the SPDR Dow Jones Industrial Average ETF (DIA). DJIA futures contracts enable traders to speculate on the future value of the index and Options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Mutual funds enable investors to buy a share of a diversified portfolio of DJIA stocks thus providing exposure to the overall index.

- GBP/USD coiled in familiar territory just above 1.2500 on Monday.

- A lack of notable data on the UK side will constrain already-thin Cable flows.

- Broader market volumes remain tepid as investors take the year-end off.

GBP/USD pulled back on Monday, kicking off the new trading week with a fresh down day. The pair fell around one-third of one percent, easing back below 1.2550 as bids remain mired in a near-term congestion pattern on the bottom end of recent price action. The UK’s data release schedule this week is devoid of any meaningful prints, leaving Cable at the mercy of broader market flows in a tepid year-end environment.

Outside of some general profit-taking and long-term position management, global market volumes are crimped tightly by the year-end holiday season. Markets will be further constrained in the midweek, when global markets will be shuttered for the New Year’s Day closure.

This week, the main data highlight will be the December US ISM PMI figures, set to be released on Friday. The December US ISM Manufacturing PMI is projected to decrease slightly to 48.3 from 48.4. Additionally, several Federal Reserve (Fed) officials are scheduled to speak during the latter part of the week, as they work to clarify the Fed’s recent shift towards lower-than-expected projections for the number of rate cuts anticipated in 2024.

GBP/USD price forecast

With Cable price action continuing to grind out chart paper just above 1.2500, GBP/USD is sliding into a sideways channel in the near-term. However, Cable traders should be on the lookout for a fast breakout to either side once the new year kicks off in earnest.

GBP/USD hasn’t made much progress to the low side after hitting multi-month lows in November, however a bullish recovery fizzled before bids could challenge the 200-day Exponential Moving Average (EMA) which is now falling through 1.2800.

GBP/USD daily chart

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, also known as ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

- EUR/USD tumbled back below 1.0400 amid tepid market flows.

- New Year’s midweek holidays set to constrain volumes even further.

- A thin data schedule this week leaves Fiber hopes on ice.

EUR/USD legged it lower on Monday, falling back below the 1.0400 handle as markets continue to churn through the year-end holiday season. Broad-market volumes are crunched and investors are finding little reason to push assets too far in either direction, but a fresh bout of cooling risk appetite has taken most asset baskets back into the low side of near-term congestion.

German equity markets will be shuttered on Tuesday and Wednesday for the New Year’s Eve and New Year’s Day holidays, respectively. German final HCOB Manufacturing Purchasing Managers Index (PMI) figures are due on Thursday, but the non-preliminary numbers are unlikely to spark much momentum in the Euro. German labor figures, including monthly Unemployment Change for December which is slated to tick up to 15K from 7K, are slated for Friday.

The key data print this week will be the December US ISM PMI figures, which are also expected on Friday. December’s US ISM Manufacturing PMI is expected to tick down to 48.3 from 48.4. Several Federal Reserve (Fed) policymakers are also slated to make appearances throughout the back half of the week as Fed speakers attempt to smooth over the Fed’s recent pivot into lower-than-expected forecasts for the number of rate cuts anticipated in 2024.

EUR/USD price forecast

With EUR/USD battling back into the low side of 1.0400, the immediate key figure becomes the recent price floor near 1.0350. Price action has steadily drifted into the low end after the Fiber kicked off a backslide from September’s highs just north of 1.1200.

Despite avoiding making any fresh lows below the mid-November bottom of 1.0332, EUR/USD is still on pace to close in the red for a fifth consecutive week, and traders watching the longer timeframes will note the Fiber has closed down for all but two of the last 13 consecutive weeks.

EUR/USD daily chart

Euro FAQs

The Euro is the currency for the 19 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

- Gold price falls to near $2,600 after the US Dollar recovers losses and turns positive.

- The US Dollar gains as the Fed signals fewer interest rate cuts for 2025.

- Market experts project the Fed to resume the policy-easing cycle in March.

Gold price (XAU/USD) falls to near the weekly low of $2,600 in Monday’s North American session. The precious metal faces selling pressure as the US Dollar (USD) recovers intraday losses and turns positive, with the US Dollar Index (DXY) returning above 108.00. The higher US Dollar makes the Gold price an expensive bet for market participants.

10-year US Treasury yields tumbled to 4.55% on Monday. Lower yields on interest-bearing assets generally weigh on non-yielding assets, such as Gold, by increasing their opportunity costs. However, the relationship appears positive on Monday.

The outlook of the Gold price appears to be uncertain as the Federal Reserve (Fed) is expected to cut interest rates fewer times in 2025. Fed policymakers have guided smaller number of rate cuts for the next year as they are upbeat on the United States (US) economic growth. Additionally, a slowdown in the disinflation trend and better labor market conditions than what had been anticipated by Fed officials earlier are also responsible for the need for a gradual policy-easing cycle.

The Fed reduced its key borrowing rates by 100 basis points (bps) to the range of 4.25%-4.50% this year and is expected to leave them unchanged in January.

According to analysts at Goldman Sachs, the Fed is expected to deliver its next interest rate cut in March. The firm also expects two more in June and September.

Gold technical analysis

Gold price trades in a Symmetrical Triangle chart formation on a daily timeframe, which exhibits a sharp volatility contraction. The 20-day Exponential Moving Average (EMA) near $2,630 overlaps Gold’s price, suggesting a sideways trend.

The Relative Strength Index (RSI) oscillates in the 40.00-60.00 range, indicating indecisiveness among market participants.

Looking up, the Gold price would strengthen after a decisive break above the December high of $2,726.00. On the contrary, bears would strengthen if the asset breaks below the November low around $2,537.00.

Gold daily chart

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

- USD/CAD edges lower to near 1.4400 as the US Dollar trades subduedly in light volume conditions.

- The Fed has guided lower number of interest rate cuts for the next year.

- Investors see the BoC reducing interest rates further to avoid inflation overshooting risks.

The USD/CAD pair faces slight pressure near the key support of 1.4400 in Monday’s North American session. The Loonie pair ticks lower as the US Dollar (USD) trades subduedly in illiquid market ahead of New Year. The US Dollar Index (DXY), which gauges the Greenback’s value against six major currencies, struggles around 108.00.

Though the Greenback edges lower on Monday but it is almost set to wrap up the calendar year with 6.7% gains, largely came in last three months as investors priced in strong growth and higher inflation in the United States (US) economy in 2025 after victory of Republican Donald Trump in Presidential elections.

Trump is expected to tight immigration controls, raise import tariffs and lower taxes under his administration. The impact is already visible as the Federal Reserve (Fed) has signaled fewer interest rate cuts for the next year. However, Fed Chairman Jerome Powell has refrained from guiding any impact of Trump’s policies on economy, inflation and interest rates.

Jerome Powell said on December 18, "It is very premature to make any kind of conclusions”. “We don’t know what will be tariffed, from what countries, for how long, in what size."

Meanwhile, the broader outlook of the Canadian Dollar (CAD) remains weak as the Bank of Canada (BoC) is expected to continue reducing interest rates further to avoid risks of inflation undershooting the central bank’s target of 2%.

The BoC reduced its key borrowing rates by 175 basis points (bps) to 3.75% this year.

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

- NZD/USD jumps above 0.5650 after China vowed to boost private consumption.

- Investors await China’s official business activity data for December.

- The RBNZ is expected to cut interest rates by 50 bps in February.

The NZD/USD pair climbs to near 0.5660 in Monday’s European session. The Kiwi pair gains sharply after the Chinese government announced measures to boost private consumption. China’s central government stated that it would offer handouts to people struggling with the cost of living and vowed more benefits for some unemployed people, Xinhua News agency reported.

Going forward, investors will focus on China’s National Bureau of Statistics (NBS) Manufacturing and Non-Manufacturing Purchasing Managers’ Index (PMI) data for December, which will be released on Tuesday. The economic data is expected to show that the Manufacturing PMI expanded steadily to 50.3, while the non-manufacturing output grew slightly faster to 50.2.

Being a close trading partner of China, the New Zealand Dollar (NZD) is impacted by Chinese economic activity data.

However, the broader outlook for the Kiwi dollar remains weak. Investors are confident that the Reserve Bank of New Zealand (RBNZ) will cut its Official Cash Rate (OCR) again by 50 basis points (bps) to 3.75% in the February policy meeting.

Meanwhile, the US Dollar (USD) drops on a broadly quiet trading day ahead of New Year celebrations. The US Dollar Index (DXY), which tracks the Greenback’s value against ix major currencies, falls to near 107.85.

NZD/USD finds a temporary cushion near the two-year low of 0.5520 on a weekly timeframe. The outlook of the Kiwi pair remains bearish as the 20-week Exponential Moving Average (EMA), which trades around 0.5900.

The 14-week Relative Strength Index (RSI) slides to near 30.00, suggesting a strong bearish momentum.

If it breaks below the psychological support of 0.5500, the Kiwi pair could decline to near the 13-year low of 0.5470 and the round-level support of 0.5400.

On the other hand, a decisive break above the November 29 high of 0.5930 could drive the pair to the November 15 high of 0.5970 and the psychological resistance of 0.6000.

NZD/USD weekly chart

New Zealand Dollar FAQs

The New Zealand Dollar (NZD), also known as the Kiwi, is a well-known traded currency among investors. Its value is broadly determined by the health of the New Zealand economy and the country’s central bank policy. Still, there are some unique particularities that also can make NZD move. The performance of the Chinese economy tends to move the Kiwi because China is New Zealand’s biggest trading partner. Bad news for the Chinese economy likely means less New Zealand exports to the country, hitting the economy and thus its currency. Another factor moving NZD is dairy prices as the dairy industry is New Zealand’s main export. High dairy prices boost export income, contributing positively to the economy and thus to the NZD.

The Reserve Bank of New Zealand (RBNZ) aims to achieve and maintain an inflation rate between 1% and 3% over the medium term, with a focus to keep it near the 2% mid-point. To this end, the bank sets an appropriate level of interest rates. When inflation is too high, the RBNZ will increase interest rates to cool the economy, but the move will also make bond yields higher, increasing investors’ appeal to invest in the country and thus boosting NZD. On the contrary, lower interest rates tend to weaken NZD. The so-called rate differential, or how rates in New Zealand are or are expected to be compared to the ones set by the US Federal Reserve, can also play a key role in moving the NZD/USD pair.

Macroeconomic data releases in New Zealand are key to assess the state of the economy and can impact the New Zealand Dollar’s (NZD) valuation. A strong economy, based on high economic growth, low unemployment and high confidence is good for NZD. High economic growth attracts foreign investment and may encourage the Reserve Bank of New Zealand to increase interest rates, if this economic strength comes together with elevated inflation. Conversely, if economic data is weak, NZD is likely to depreciate.

The New Zealand Dollar (NZD) tends to strengthen during risk-on periods, or when investors perceive that broader market risks are low and are optimistic about growth. This tends to lead to a more favorable outlook for commodities and so-called ‘commodity currencies’ such as the Kiwi. Conversely, NZD tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

- Silver price hovers near $29.50 in an illiquid market with the US Dollar and bond yields closing the calendar year on a strong note.

- The Fed sees the federal fund rate heading to 3.9% by the end of 2025.

- Strong US economic growth prospects allowed the Fed to guide fewer interest rate cuts for the next year.

Silver price (XAG/USD) trades cautiously near Friday’s low around $29.50 in thin volume conditions before New Year on Monday. The white metal is broadly under pressure as the outlook of the US Dollar (USD) remains firm on expectations that a moderate policy-easing cycle by the Federal Reserve (Fed) in 2025 will keep US Treasury yields elevated.

10-year US Treasury yields are down 0.5% in Monday’s European session but are still almost 15% higher this calendar year near 4.60%.

The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, ticks lower but remains broadly sideways around 108.00.

Market speculation for the Fed to follow a slower rate-cut path next year stemmed from the central bank’s latest dot plot, which showed that policymakers collectively see the Federal fund rate heading to 3.9% by the end of 2025.

Fed policymakers shifted their stance on interest rates from ‘dovish’ to ‘cautious’ as they were upbeat about the United States' (US) economic growth. Additionally, a slowdown in the disinflation process in the last few months forced them to guide fewer rate cuts for the next year.

This week, investors will focus on the US ISM Manufacturing PMI data for December, which will be released on Friday. The Manufacturing PMI is estimated to have come in at 48.3, slightly lower than 48.4, which suggests that manufacturing output contracted at a slightly faster pace.

Silver technical analysis

Silver price stays below the upward-sloping trendline after a breakdown near $30.00, which is plotted from the February 29 low of $22.30 on a daily timeframe,. The white metal wobbles around the 200-day Exponential Moving Average (EMA), suggesting that the longer-term outlook is uncertain.

The 14-day Relative Strength Index (RSI) falls inside the 20.00-40.00. A fresh bearish momentum would trigger if it sustains in that range.

Looking down, the September low of $27.75 would act as key support for the Silver price. On the upside, the 50-day EMA around $30.90 would be the barrier.

Silver daily chart

Silver FAQs

Silver is a precious metal highly traded among investors. It has been historically used as a store of value and a medium of exchange. Although less popular than Gold, traders may turn to Silver to diversify their investment portfolio, for its intrinsic value or as a potential hedge during high-inflation periods. Investors can buy physical Silver, in coins or in bars, or trade it through vehicles such as Exchange Traded Funds, which track its price on international markets.

Silver prices can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can make Silver price escalate due to its safe-haven status, although to a lesser extent than Gold's. As a yieldless asset, Silver tends to rise with lower interest rates. Its moves also depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAG/USD). A strong Dollar tends to keep the price of Silver at bay, whereas a weaker Dollar is likely to propel prices up. Other factors such as investment demand, mining supply – Silver is much more abundant than Gold – and recycling rates can also affect prices.

Silver is widely used in industry, particularly in sectors such as electronics or solar energy, as it has one of the highest electric conductivity of all metals – more than Copper and Gold. A surge in demand can increase prices, while a decline tends to lower them. Dynamics in the US, Chinese and Indian economies can also contribute to price swings: for the US and particularly China, their big industrial sectors use Silver in various processes; in India, consumers’ demand for the precious metal for jewellery also plays a key role in setting prices.

Silver prices tend to follow Gold's moves. When Gold prices rise, Silver typically follows suit, as their status as safe-haven assets is similar. The Gold/Silver ratio, which shows the number of ounces of Silver needed to equal the value of one ounce of Gold, may help to determine the relative valuation between both metals. Some investors may consider a high ratio as an indicator that Silver is undervalued, or Gold is overvalued. On the contrary, a low ratio might suggest that Gold is undervalued relative to Silver.

Silver prices (XAG/USD) broadly unchanged on Monday, according to FXStreet data. Silver trades at $29.37 per troy ounce, broadly unchanged 0.03% from the $29.38 it cost on Friday.

Silver prices have increased by 23.43% since the beginning of the year.

| Unit measure | Silver Price Today in USD |

|---|---|

| Troy Ounce | 29.37 |

| 1 Gram | 0.94 |

The Gold/Silver ratio, which shows the number of ounces of Silver needed to equal the value of one ounce of Gold, stood at 89.02 on Monday, broadly unchanged from 89.03 on Friday.

Silver FAQs

Silver is a precious metal highly traded among investors. It has been historically used as a store of value and a medium of exchange. Although less popular than Gold, traders may turn to Silver to diversify their investment portfolio, for its intrinsic value or as a potential hedge during high-inflation periods. Investors can buy physical Silver, in coins or in bars, or trade it through vehicles such as Exchange Traded Funds, which track its price on international markets.

Silver prices can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can make Silver price escalate due to its safe-haven status, although to a lesser extent than Gold's. As a yieldless asset, Silver tends to rise with lower interest rates. Its moves also depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAG/USD). A strong Dollar tends to keep the price of Silver at bay, whereas a weaker Dollar is likely to propel prices up. Other factors such as investment demand, mining supply – Silver is much more abundant than Gold – and recycling rates can also affect prices.

Silver is widely used in industry, particularly in sectors such as electronics or solar energy, as it has one of the highest electric conductivity of all metals – more than Copper and Gold. A surge in demand can increase prices, while a decline tends to lower them. Dynamics in the US, Chinese and Indian economies can also contribute to price swings: for the US and particularly China, their big industrial sectors use Silver in various processes; in India, consumers’ demand for the precious metal for jewellery also plays a key role in setting prices.

Silver prices tend to follow Gold's moves. When Gold prices rise, Silver typically follows suit, as their status as safe-haven assets is similar. The Gold/Silver ratio, which shows the number of ounces of Silver needed to equal the value of one ounce of Gold, may help to determine the relative valuation between both metals. Some investors may consider a high ratio as an indicator that Silver is undervalued, or Gold is overvalued. On the contrary, a low ratio might suggest that Gold is undervalued relative to Silver.

(An automation tool was used in creating this post.)

- The Pound Sterling falls slightly against its major peers as market experts see more interest rate cuts by the BoE in 2025 compared to market pricing.

- Goldman Sachs sees the BoE reducing interest rates in each quarter of the next year.

- The US Dollar flattens in illiquid trading conditions before New Year celebrations.

The Pound Sterling (GBP) edges lower against its major peers in Monday’s London session. The British currency ticks lower, partly due to a mild increase in the Bank of England's (BoE) dovish bets for 2025.

Traders price in a 53-basis points (bps) interest rate reduction for the next year, up from the 46 bps estimated after the policy announcement on December 19, when the Bank of England (BoE) left borrowing rates unchanged at 4.75% with a 6-3 vote split. Before the policy announcement, market participants were anticipating that only one Monetary Policy Committee (MPC) would vote for a rate cut.

The BoE has been the slowest among European and North American nations to reduce interest rates this year. The BoE has reduced its key borrowing rates by 50 bps, while other peers such as the Federal Reserve (Fed) and the European Central Bank (ECB) pushed their borrowing rates lower by 100 bps. The Bank of Canada (BoC) and the Swiss National Bank (SNB) lowered interest rates by even more due to higher risks of inflation undershooting their respective targets.

"UK wage growth and services inflation have remained notably stickier than elsewhere, despite signs of material labor market rebalancing,” analysts at Goldman Sachs said in a note. “As a result, the BoE has been more cautious than other major central banks," they added. However, the investment banking firm expects continued quarterly cuts through 2025, more than what markets expect, as a “weaker labor market cools underlying inflation.”

Daily digest market movers: Pound Sterling edges lower against US Dollar

- The Pound Sterling struggles to hold Friday’s gains near 1.2580 against the US Dollar (USD) at the start of the week. However, low volatility is expected from the GBP/USD pair due to thin trading volume conditions before New Year celebrations. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, trades in a tight range of around 108.00, set to end the year with almost 6.7% gains.

- The USD performed strongly this year even though the Federal Reserve (Fed) reduced its key borrowing rates by 100 basis points (bps) to 4.25%-4.50%. The Greenback has gained significantly in the last three months after Republican Donald Trump’s victory in the United States (US) Presidential election as policies such as immigration control, higher import tariffs and lower taxes are expected to be inflationary and pro-growth.

- The Fed has also signaled fewer interest rate cuts in 2025 amid strong economic growth prospects, a slowdown in the disinflation trend, and better labor market conditions than previously forecasted. However, Fed Chair Jerome Powell refrained from guiding the likely impact of Trump’s policies on the economy.

- "It is very premature to make any kind of conclusions,” Powell said on December 18. “We don’t know what will be tariffed, from what countries, for how long, in what size," he added.

- This week, the major trigger for the Pound Sterling and the US Dollar will be final estimates for S&P Global and the US ISM Manufacturing Purchasing Managers’ Index (PMI) data for December.

Technical Analysis: Pound Sterling consolidates below 1.2600

The Pound Sterling trades broadly sideways against the US Dollar below 1.2600 on Monday. The outlook of the GBP/USD pair remains vulnerable as it trades below the upward-sloping trendline around 1.2600, which is plotted from the October 2023 low of 1.2035.

All short-to-long-term Exponential Moving Averages (EMAs) are sloping down, suggesting a strong bearish trend in the long run.

The 14-day Relative Strength Index (RSI) hovers around 40.00. A fresh downside momentum could trigger if the oscillator sustains below this level.

Looking down, the pair is expected to find a cushion near the April 22 low at around 1.2300 if it breaks below the immediate support of 1.2485. On the upside, the December 17 high at 1.2730 will act as key resistance.

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, also known as ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

- AUD/USD appreciates due to thin trading volumes ahead of the New Year holiday.

- The US Dollar remains subdued as the 10-year bond yield depreciates to 4.59%.

- The Australian Dollar gained support as the 10-year government bond yield rose to 4.50%, near its monthly highest.

The AUD/USD pair halts its five-day losing streak, trading around 0.6200 during the European hours on Monday. The pair appreciates as the US Dollar (USD) remains softer amid thin trading ahead of New Year’s holiday, while US Treasury bond yields depreciate.

The US Dollar Index (DXY), which measures the value of the US Dollar (USD) against its six major peers, trades around 108.00, with 2-year and 10-year yields on US Treasury coupons standing at 4.30% and 4.59%, respectively, at the time of writing.

The US Dollar may receive upward support from growing expectations of fewer rate cuts next year by the US Federal Reserve (Fed). Traders continue to digest the Fed’s hawkish pivot. The Fed cut its benchmark interest rate by a quarter point at the December meeting, and the latest Dot Plots indicated two rate cuts next year.

Additionally, the Australian Dollar (AUD) finds support from an improved 10-year government bond yield, which is trading around 4.50%, its highest level in over a month. Meanwhile, the Reserve Bank of Australia (RBA) has reiterated its commitment to maintaining a "sufficiently restrictive" policy stance until inflation uncertainty diminishes and the 2–3% target range is achieved.

The RBA emphasized that its primary focus is bringing inflation back to target, relying on a data-driven approach for future rate decisions. The December meeting minutes highlighted growing confidence among central bank’s policymakers in their ability to control inflation, although they acknowledged ongoing risks. Market expectations suggest a divided outlook, with some anticipating a 25 bps rate cut as early as February, while a full easing is more widely priced in by April.

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

- USD/CAD edges lower amid thin trading volumes ahead of the New Year holiday.

- The US Dollar may appreciate due to the rising hawkish outlook for the Fed’s interest rates next year.

- The commodity-linked CAD gains ground amid improved crude Oil prices.

USD/CAD breaks its three-day winning streak, trading around 1.4400 during the European hours on Monday. The USD/CAD pair loses ground as US Dollar (USD) holds losses amid thin trading volumes ahead of the New Year holiday.

Markets continue to process the US Federal Reserve’s (Fed) hawkish stance, which could provide support for the US Dollar and the USD/CAD pair. The Fed reduced its benchmark interest rate by 25 basis points at the December meeting, the latest Dot Plot projections signal only two rate cuts in 2025, reinforcing cautious sentiment.

Fed Chair Jerome Powell said earlier this month that Fed officials "are going to be cautious about further cuts" after an as-expected quarter-point rate reduction. The Fed’s hawkish message is likely to support the US Dollar (USD) and act as a tailwind for the USD/CAD pair in the near term.

Traders broadly anticipate that the incoming administration of President-elect Donald Trump will implement tax cuts, tariffs, and deregulation, measures expected to fuel inflation. This could prompt the US central bank to adjust its outlook for the upcoming year.

Additionally, the commodity-linked Canadian Dollar (CAD) receives support from improved crude Oil prices, given Canada is the largest Oil exporter to the United States (US). West Texas Intermediate (WTI) Oil price continues to gain ground for the second successive day, trading around $70.20 per barrel at the time of writing.

However, the potential rise in crude Oil prices might be limited as the market shifts its attention to the 2025 demand outlook. Projections of an oversupplied market next year could hinder the Organization of the Petroleum Exporting Countries and its allies' (OPEC+) efforts to resume idled production. Furthermore, uncertainties surrounding future demand from China, the world’s largest Oil importer, could add additional downward pressure on crude Oil prices.

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

- EUR/USD trades in a limited range above 1.0400 as volumes are low with investors enjoying holidays as the end of 2024 approaches.

- The Euro is poised to end the year with an almost 5.5% loss against the US Dollar due to the ECB’s dovish guidance and the potential trade war with the US.

- This week, US investors will focus on the US ISM Manufacturing PMI data for December.

EUR/USD trades lackluster slightly above 1.0400 due to illiquid trading activity in the European session on Monday. The Euro (EUR) is set to wrap up the calendar year with an almost 5.5% decline against the US Dollar (USD), hit particularly hard during the last three months of 2024 as the European Central Bank (ECB) maintained dovish guidance on interest rates. Additionally, market participants are worried about the Eurozone’s economic growth as incoming tariff hikes from United States (US) President-elect Donald Trump will likely jolt its export sector.

The ECB reduced its Deposit Facility rate by 100 basis points (bps) to 3% this year and is expected to lower it to 2%, which policymakers see as a neutral rate, by the end of June 2025. This suggests that the ECB will cut its key borrowing rates by 25 bps at every meeting in the first half of next year.

A slew of ECB policymakers have expressed concerns about the risks of inflation undershooting the central bank’s target of 2%, given the political uncertainty in Germany and the potential trade war with the US. ECB officials have expressed opposing views on how the continent should address the US trade situation.

Last week, ECB President Christine Lagarde said in an interview with the Financial Times (FT) that retaliation was “a bad approach” because she thinks that trade restrictions and a tit-for-tat response “is just bad for the global economy at large.”.

Contrarily, ECB policymaker and Finnish central bank Governor Olli Rehn said: "Negotiation is preferable, and the EU’s negotiating position can be strengthened by demonstrating in advance that it is ready to take countermeasures if the United States threatens Europe with higher tariffs.”

On the economic front, investors await preliminary Spain's Harmonized Index of Consumer Prices (HICP) data for December, which will be published at 08:00 GMT.

Daily digest market movers: EUR/USD follows sideways US Dollar