- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 30-08-2019

MNI Indicators’

report revealed on Friday that business activity in Chicago contracted this

month.

The MNI Chicago

Business Barometer, also known as Chicago purchasing manager's index (PMI) came

in at 50.4 in August, up from an unrevised 44.4 in July. Economists had

forecast the index to increase to 47.5.

A reading above

50 indicates improving conditions, while a reading below this level shows

worsening of the situation.

According to

the report, only two components of the headline indicator saw a

monthly decline, as Supplier Deliveries posted a steep decline, dropping to

50.3 from July’s 55.6. In addition, Inventories tumbled by 11.2 percent to

47.9, indicating that firms started to run down inventories in August. Meanwhile,

New Orders, recorded the largest single component monthly gain and shifted back

into expansion, while Order Backlogs climbed to 51.3 in August from 43.5 in July.

Production recorded a pickup of 6.7 points but remains muted. Employment

indicator rose slightly to 43.7 but remained in contraction territory.

The final

reading for the August Reuters/Michigan index of consumer sentiment came in at 89.8

compared to a preliminary reading of 92.1 and the July final reading of 98.4. That

was the lowest reading since October 2016.

Economists had

forecast the index to be unrevised at 92.1.

According to

the report, the index of the current economic conditions fell to 105.3 from July’s

final reading of 110.7.

Meanwhile, the

index of consumer expectations decreased to 79.9 from July’s final reading of 90.5.

The report

notes that the consumer sentiment index posted its largest monthly decline in

August (-8.6 points) since December 2012 due to negative references to tariffs,

which were spontaneously mentioned by one-in-three consumers.

Nathan Janzen, the senior economist at Royal Bank of Canada (RBC), notes that Canada's GDP rose 3.7% (annualized) in Q2 but the stronger-than-expected increase was entirely due to a huge 5.4 percentage point add to growth from net trade.

- “That more-than-reversed a big drag from net trade in Q1 – and is clearly unsustainable going forward, even without considering growing external headwinds from slower global growth, an escalating US-China trade war, Brexit uncertainty, etc. ‘Final domestic demand’ declined in Q2 as consumer spending growth slowed and business investment declined.

- Still, the quarterly GDP numbers are often volatile, and surprisingly soft details from the Q2 report followed surprisingly strong details in Q1 (when final domestic demand jumped 3.2% and net exports were weak.)

- From the Bank of Canada’s perspective, though, the Q2 report will do nothing to alleviate concerns that an increasingly uncertain external growth backdrop will slow the Canadian economy going forward. We continue to expect the Canadian central bank will follow other global peers with a rate cut. Probably not at next week’s policy decision but with the risks tilted to an earlier cut than the Q1-2020 move we have in our current base case.”

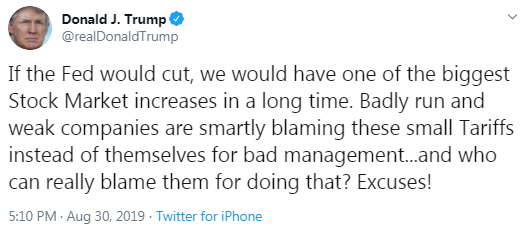

ABN AMRO's analysts note that the U.S.-China tensions escalated further a week ago as in response to fresh U.S. tariffs (10%) on $300bn of imports from China announced on 1 August, China retaliated on 23 August.

- “Beijing presented 5-10% tariffs on USD 75bn of US goods and reintroduced tariffs on US cars and car parts. The US responded immediately by raising existing tariffs over USD 250bn of Chinese goods from 25% to 30% (per 1 October) and by hiking the proposed tariff rates on the remaining USD 300bn from 10% to 15%. Strikingly, in a tweet president Trump ordered US companies to look for alternatives to China, a new element in the US-China conflict that would lead to a further decoupling of the world’s two largest economies.

- As a result of these escalating tensions, the Chinese yuan weakened further this week, as the Chinese authorities allow some (primarily market-driven) depreciation to offset the tariff impact on China’s external competitiveness. The yuan recovered a bit after comments from Beijing that it would not immediately retaliate the latest US tariff hikes, but rather preferred discussing the removal of tariffs.”

U.S. stock-index futures rose on Friday, signalling about extension of the previous day’s rally on optimism around U.S.-China trade relations, despite impending new tariffs.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 20,704.37 | +243.44 | +1.19% |

Hang Seng | 25,724.73 | +21.23 | +0.08% |

Shanghai | 2,886.24 | -4.68 | -0.16% |

S&P/ASX | 6,604.20 | +96.80 | +1.49% |

FTSE | 7,236.34 | +52.02 | +0.72% |

CAC | 5,500.57 | +50.60 | +0.93% |

DAX | 11,981.42 | +142.54 | +1.20% |

Crude oil | $56.27 | -0.78% | |

Gold | $1,538.90 | +0.13% |

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 161.3 | 0.94(0.59%) | 446 |

ALCOA INC. | AA | 17.93 | 0.13(0.73%) | 1000 |

ALTRIA GROUP INC. | MO | 44.2 | -0.05(-0.11%) | 18477 |

Amazon.com Inc., NASDAQ | AMZN | 1,794.64 | 8.24(0.46%) | 33450 |

American Express Co | AXP | 121.5 | 0.76(0.63%) | 157 |

Apple Inc. | AAPL | 210.4 | 1.39(0.67%) | 142139 |

AT&T Inc | T | 35.24 | 0.09(0.26%) | 5895 |

Boeing Co | BA | 365.3 | 2.56(0.71%) | 16813 |

Caterpillar Inc | CAT | 118.67 | 0.90(0.76%) | 8685 |

Chevron Corp | CVX | 117.37 | -0.15(-0.13%) | 2386 |

Cisco Systems Inc | CSCO | 47.52 | 0.25(0.53%) | 23041 |

Citigroup Inc., NYSE | C | 64.25 | 0.35(0.55%) | 11645 |

E. I. du Pont de Nemours and Co | DD | 66.79 | 1.02(1.55%) | 1098 |

Exxon Mobil Corp | XOM | 68.36 | -0.07(-0.10%) | 2894 |

Facebook, Inc. | FB | 186.68 | 1.11(0.60%) | 39295 |

FedEx Corporation, NYSE | FDX | 158.25 | 0.80(0.51%) | 217 |

Ford Motor Co. | F | 9.15 | 0.03(0.33%) | 34648 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 9.18 | 0.06(0.66%) | 21256 |

General Electric Co | GE | 8.15 | 0.04(0.49%) | 196612 |

General Motors Company, NYSE | GM | 37.07 | 0.16(0.43%) | 2947 |

Goldman Sachs | GS | 205 | 1.56(0.77%) | 6430 |

Google Inc. | GOOG | 1,200.00 | 7.15(0.60%) | 2170 |

Home Depot Inc | HD | 229.17 | 1.85(0.81%) | 12892 |

Intel Corp | INTC | 47.12 | 0.25(0.53%) | 21537 |

International Business Machines Co... | IBM | 135.58 | 0.70(0.52%) | 3558 |

Johnson & Johnson | JNJ | 128.25 | 0.01(0.01%) | 2543 |

JPMorgan Chase and Co | JPM | 109.85 | 0.63(0.58%) | 11033 |

McDonald's Corp | MCD | 219.95 | 0.57(0.26%) | 4168 |

Merck & Co Inc | MRK | 87.07 | 0.35(0.40%) | 8885 |

Microsoft Corp | MSFT | 138.95 | 0.83(0.60%) | 87760 |

Nike | NKE | 85.64 | 0.48(0.56%) | 5536 |

Pfizer Inc | PFE | 35.6 | 0.27(0.76%) | 4174 |

Procter & Gamble Co | PG | 121.62 | 0.44(0.36%) | 855 |

Starbucks Corporation, NASDAQ | SBUX | 98.34 | 0.64(0.66%) | 2403 |

Tesla Motors, Inc., NASDAQ | TSLA | 228.5 | 6.79(3.06%) | 603011 |

The Coca-Cola Co | KO | 55.23 | 0.18(0.33%) | 1404 |

Twitter, Inc., NYSE | TWTR | 42.73 | 0.24(0.56%) | 38942 |

Verizon Communications Inc | VZ | 58.05 | 0.11(0.19%) | 1182 |

Visa | V | 182 | 0.83(0.46%) | 6174 |

Wal-Mart Stores Inc | WMT | 114.39 | 0.31(0.27%) | 5407 |

Walt Disney Co | DIS | 138.3 | 0.46(0.33%) | 17896 |

Yandex N.V., NASDAQ | YNDX | 37.03 | 0.17(0.46%) | 500 |

Statistics

Canada announced on Friday that the country’s gross domestic product (GDP) grew

0.2 percent m-o-m in June, the same growth rate as in May.

That was above economists’

forecast for a gain of 0.1 percent m-o-m.

In the second

quarter of 2019, the Canadian GDP rose 0.9 percent q-o-q, following a 0.1

percent q-o-q advance in the first quarter. That was the strongest growth rate

since the second quarter of 2017.

According to

the report, growth in GDP was led by a 3.2 percent jump in export volumes,

while final domestic demand decreased 0.2 percent.

Expressed at an

annualized rate, Canada’s GDP surged 3.7 percent in the second quarter, while

economists had predicted it would grow 3.0 percent.

The Commerce

Department reported on Friday that consumer spending in the U.S. rose 0.6

percent m-o-m in July, following an unrevised 0.5 percent m-o-m gain in June.

Economists had forecast the reading to show a 0.5 percent m-o-m growth.

Meanwhile,

consumer income edged up 0.1 percent m-o-m in July, following a revised 0.5

percent m-o-m increase in the previous month (originally a 0.4 percent m-o-m

rise). Economists had forecast a 0.3 percent m-o-m advance.

The July

increase in personal income primarily reflected increases in compensation of

employees and government social benefits to persons, which were partially

offset by a decline in personal interest income.

The personal

consumption expenditures (PCE) price index, excluding the volatile categories

of food and energy, which is the Fed's preferred inflation measure, rose 0.2

percent m-o-m in July, the same pace as in the prior month. Economists had

projected the index would increase 0.2 percent m-o-m.

In the 12 months

through July, the core PCE increased 1.6 percent, the same pace as in the 12

months through June. Economists had forecast a gain of 1.6 percent y-o-y.

TD Securities analysts are expecting the U.S. spending to have advanced at a strong 0.5% m/m pace in July, up from 0.3% in June.

- “In the details, a 0.5% m/m increase in services spending should have been the main driver of the July gain, with a rise in spending on nondurables also helping on the headline.

- Separately, we project headline PCE and core inflation to advance 0.2% m/m each for July. This should keep their annual rates unchanged at 1.4% and 1.6% y/y, respectively. We note, however, that the recent revision to PCE inflation for Q2 raises the odds for softer prints on the annual measures.”

- I want to try and get an agreementParliament will have a lot of time for further Brexit consideration

- Parliament will have a lot of time for further Brexit consideration

- We are in the last stages of negotiating with our EU "friends"

- If the EU thinks that Brexit can be stopped, the less likely they are to gives us a deal

- The worst thing for democracy would be to cancel the referendum

- If we stop the UK from leaving on 31 October, it will do lasting damage to people's trust in politics

Bert Colijn, a senior Eurozone economist at ING, notes that Eurozone's headline inflation is at 1%, with core inflation at 0.9% in August and unemployment falling by just 16,000 in July.

- "Headline inflation had been elevated for some time thanks to energy price growth, but recent developments in the oil price and a downward base effect have brought headline inflation more or less in line with core. The fact that this is happening at around 1% is indicative of rather anemic economic growth and is cause for the activist ECB speeches that seem to be the prelude to significant action in September.

- While core inflation has not moved out of the 1% range for quite some time now, drivers of inflation have not provided much reason for optimism about a quick core inflation recovery in the months ahead. Producer price growth has fallen significantly in recent months and wage growth, while justifying a much higher core inflation rate than 1%, has dropped back from 2.25% to 2% YoY. Businesses also indicate a stagnation of selling price expectations at the moment as downside economic risks remain top of mind.

- The job market has remained an important reason for growth to remain positive and has provided some much needed upward pressure on inflation, even though they have so far not materialized. One of the crucial questions surrounding the economy at the moment is whether the labour market can continue to provide enough job growth to maintain wage pressure and boost household consumption.

- The July unemployment numbers saw just a minor decline, with 16,000 fewer people unemployed. While these numbers are volatile, a slowing labour market would raise red flags about economic growth and inflationary pressures. Taking all of this into account, there’s good reason not to expect the ECB to hold back next month."

Analysts at TD Securities notes that Canada is to release GDP data for both the second quarter and the month of June, and they are looking for better-than-expected prints, with Q2 growth of 3.3% q/q (mkt: 3.0%; BoC 2.3%) and June growth of 0.2% m/m (mkt: 0.1%).

“Q2 growth was likely boosted by a strong contribution from net exports, while residential investment likely surged into double-digit territory. We expect relatively modest growth from other components. For June GDP, energy production and non-residential construction will be key sources of strength.”

- “I would completely exclude it [buying equities]” as a tool because “for Europe it is inappropriate”

- "We can tweak the instruments we have to a certain extent, but I wouldn’t expect us to have new measures"

- Important for ECB to maintain strong monetary stimulus

- The situation calls for an effective policy package in September

Analysts at TD Securities note that Eurozone’s inflation was on the soft side for August.

- “Headline inflation was in line with consensus at 1.0% y/y, but core CPI surprised to the downside at 0.9% y/y (mkt 1.0%). The trend there is still looking quite soft into the ECB meeting coming up in two weeks, supporting the need for further easing.”

According to preliminary estimates from Istat, in August 2019 the Italian consumer price index for the whole nation (NIC) increased by 0.5% on monthly basis and by 0.5% with respect to August 2018 (slightly up from +0.4%).

The dynamics of all items index was the result of a situation with very small differences with respect to July. It is just worth to report the slight speed-up of prices of food including alcohol (from +0.7% in July to +1.0%), mainly due to those of Processed food (from +0.1% to 0.6%), and of prices of Non-durable goods (from +0.2% to +0.7%).

The core inflation excluding energy and unprocessed food was +0.6% (up from +0.5%) and inflation excluding energy was +0.7% (up from +0.6%).

In August 2019, according to preliminary estimates, the rate of change of Italian harmonized index of consumer prices (HICP) was null compared with the previous month and equal to +0.5% with respect to August 2018 (up from +0.3% in July).

TD Securities analysis team is expecting a decline in China’s official manufacturing PMI to 49.5 in August from 49.7 in July, which would mark the fourth consecutive month of contraction.

“The intensification of tariffs from both US and China will have served to hit manufacturing sentiment further. Indeed Chinese companies will be reeling from the US announcement that it will move forward with tariffs on almost all remaining imports. The subsequent delay of additional tariffs to December 15 as well as CNY weakness will have done little to mitigate the intensifying pressure on manufacturers as the economy continues to slow.”

According to the report from Eurostat, the euro area (EA19) seasonally-adjusted unemployment rate was 7.5% in July 2019, stable compared with June 2019 and down from 8.1% in July 2018. This remains the lowest rate recorded in the euro area since July 2008.

The EU28 unemployment rate was 6.3% in July 2019, stable compared with June 2019 and down from 6.8% in July 2018. This remains the lowest rate recorded in the EU28 since the start of the EU monthly unemployment series in January 2000.

Eurostat estimates that 15.613 million men and women in the EU28, of whom 12.322 million in the euro area, were unemployed in July 2019. Compared with June 2019, the number of persons unemployed increased by 27 000 in the EU28 and decreased by 16 000 in the euro area. Compared with July 2018, unemployment fell by 1.093 million in the EU28 and by 898 000 in the euro area.

In July 2019, 3.195 million young persons (under 25) were unemployed in the EU28, of whom 2.245 million were in the euro area. Compared with July 2018, youth unemployment decreased by 167 000 in the EU28 and by 149 000 in the euro area. In July 2019, the youth unemployment rate was 14.3% in the EU28 and 15.6% in the euro area, compared with 15.0% and 16.7% respectively in July 2018.

According to a flash estimate from Eurostat, the statistical office of the European Union, euro area annual inflation is expected to be 1.0% in August 2019, stable compared to July. Meanwhile, the core figures also remained unchanged at 0.9% in the reported month when compared to 1.0% expectations and 0.9% previous.

Looking at the main components of euro area inflation, food, alcohol & tobacco is expected to have the highest annual rate in August (2.1%, compared with 1.9% in July), followed by services (1.3%, compared with 1.2% in July), non-energy industrial goods (0.4%, stable compared with July) and energy (-0.6%, compared with 0.5% in July).

Bank of England said, the extra amount borrowed by consumers in order to buy goods and services was £0.9 billion in July vs £1.0 billion expected. This was broadly in line with the £1.0 billion average over the past 12 months, but below the £1.5 billion average from January 2016 to June 2018.

Within the July figure, the extra amount borrowed for other loans and advances fell on the month to £0.6 billion, while net credit card borrowing remained stable.

The annual growth rate of consumer credit remained at 5.5% in July, markedly lower than its peak of 10.9% in November 2016. This slowing reflects the weaker monthly lending flows over most of the past year.

Mortgage market activity has remained stable, notwithstanding some strengthening in key indicators. Net mortgage borrowing by households picked up in July, rising to £4.6 billion. While this was the strongest since March 2016, it reflected a fall in repayments rather than an increase in new lending. The annual growth rate remained at 3.2%, close to the level seen since 2016. Mortgage approvals for house purchase (an indicator for future lending) increased in July to 67,300. This was the strongest since July 2017, but remains within the very narrow range seen over the past two years.

Confidence drained away from British businesses and consumers in August as the Brexit crisis deepened, according to surveys that suggested the political ructions are increasingly taking a toll on the economy.

The Lloyds Bank Business Barometer slid to 1% from 13% in July, its lowest level since December 2011, when Britain was struggling to recover from the global financial crisis.

Separately, a survey of consumer confidence from market research company GfK was its joint weakest since mid-2013, driven lower by deepening pessimism about the economy.

Overall, the reports added to signs that Britain's economy is likely to struggle to bounce back from its contraction in the second quarter, the first time it shrank since 2012. Britain would be in recession if growth contracts in the third quarter.

"We have seen a dip in overall business confidence this month, with firms appearing less positive about their own trading prospects and the broader economy," Hann-Ju Ho, senior economist at Lloyds Bank Commercial Banking, said.

An indicator reflecting the current economic situation in the euro area fell in August after rising in the previous month, survey data from the Bank of Italy and the Centre for Economic Policy Research showed.

The Eurocoin indicator dropped to 0.18 from 0.21 in July. In June, the reading was 0.14.

The indicator continues to be adversely affected by the slowdown in international trade, The weak industrial cycle and the consequent worsening in business confidence, especially in the manufacturing sector, the report said.

Danske Bank analysts note that the Brexit situation remains fluid after UK PM Boris Johnson's suspension of the UK parliament will get an early test on Friday when two courts could rule on challenges from Brexit opponents.

“In light of the recent events, we have changed our call and our base case now is that a small majority in the House of Commons will eventually bring the Johnson government down, form a temporary government, ask the EU 27 for an extension and call for election when the extension is granted (40%). However, we stress that uncertainty is high and the risk of a no-deal Brexit has increased in the past days in our view (30%).”

Survey from U.S. bank Citi and pollsters YouGov showed on Friday that british households' expectations for inflation in the year ahead rose in August to their highest level since 2013, possibly reflecting the rising chance of a no-deal Brexit.

The public expects inflation over the next 12 months to rise to 3.2%, up from 2.9% in July.

"Such high levels have previously usually been associated with high energy prices," economists at Citi said in a research note.

"However, in the absence of those at the moment, the increase could be driven by rising chances of a rupture with the EU on Oct. 31, which could lead to higher consumer prices via tariffs, supply disruptions and weaker sterling."

According to the report from KOF Economic Research Agency, the leading indicator shows the same reading in August as in the previous month. The Barometer thus continues to indicate below-average momentum. Accordingly, during the next few months the Swiss economy can be expected to perform moderately.

In August, the KOF Economic Barometer remained at the previous month’s level of 97.0 (revised from 97.1). This, however, conceals slight shifts amongst the components underlying the Barometer. Somewhat more favourable signals than before are coming from indicators of foreign demand and domestically from consumer prospects and manufacturing. The remaining indicator bundles (accommodation and food service activities, financial, insurance and other services as well as construction), however, tend to point to stagnation or slight deterioration in economic sentiment.

In the goods producing sectors (manufacturing and construction), the barometer is strengthened mostly by indicators on order backlog and inventories. The remaining indicators are emitting only negligible signals.

Within manufacturing, the outlook has become more favourable especially for machinery, the metal industry, the chemical industry as well as for food and beverages. On the other hand, the outlook has mainly worsened for the paper and the electrical industries.

According to the provisional estimate from Insee, over a year, the Consumer Price Index (CPI) should increase by 1.1% in August 2019, as in the previous month. Economists had expected a 1.0% increase.

This stability in inflation should be due to a more marked fall in manufactured good prices and a slight slowdown in those of energy and tobacco, offset by an acceleration in food prices. The services prices should increase at the same rate as in the previous month.

Over one month, consumer prices should recover significantly (+0.5% in August, after –0.2% in July). Prices should be driven mainly by the seasonal rebound in manufactured goods prices after the end of summer sales in metropolitan France and by the equally seasonal rise in the prices of certain tourism-related services. In addition, food prices should continue to rise mainly due to fresh foods. Tobacco and energy prices should be stable this month. The increase in electricity prices should be offset by lower prices for petroleum products and domestic gas.

Year on year, the Harmonised Index of Consumer Prices should slow down (+1.2% after +1.3% in July). Over one month, it should rebound to +0.5%, after –0.2% the previous month.

Nationwide Building Society said, UK annual house price growth remained subdued in August, at 0.6%. In July, prices rose 0.3%. Prices unchanged month-on-month, after taking account of seasonal factors. Economists had expected a 0.1% increase.

Commenting on the figures, Robert Gardner, Nationwide's Chief Economist, said: “Annual house price growth remained below 1% for the ninth month in a row in August, at 0.6%. While house price growth has remained fairly stable, there have been mixed signals from the property market in recent months. Surveyors report that new buyer enquiries have increased a little, though key consumer confidence indicators remain subdued. Data on the number of property transactions points to a slowdown in activity, though the number of mortgages approved for house purchase has remained broadly stable. Housing market trends will remain heavily dependent on developments in the broader economy. In the near term, healthy labour market conditions and low borrowing costs will provide underlying support, though uncertainty is likely to continue to exert a drag on sentiment and activity.

According to provisional data from Federal Statistical Office (Destatis), turnover in retail trade in July 2019 was in real terms 4.4% and in nominal terms 5.4% larger than in July 2018. The number of days open for sale was 27 in July 2019 and 26 in July 2018.

Retail trade in food, beverages and tobacco grew by 4.0% in real terms and 5.1% in nominal terms in July 2019 compared with July 2018. Sales in supermarkets, and hypermarkets were up 4.3% in real terms and 5.4% in nominal terms on the same month of the previous year. The specialist retail trade in food was up 1.0% in real terms and 3.0% in nominal terms compared with July 2018.

In the retail trade of non-food products, sales rose by 4.6% in real terms and 5.8% in nominal terms in July 2019 compared with the same month of the previous year. Internet and mail order trading recorded the largest increase in sales, with 8.4% in real terms and 9.2% in nominal terms.

Compared with the previous year, turnover in retail trade was in the first seven months of 2019 in real terms 2.8% and in nominal terms 3.5% higher than in the corresponding period of the previous year.

When adjusted for calendar and seasonal variations, the July turnover was in real terms 2.2% and in nominal terms 2.1% lower than in June 2019.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1203 (2158)

$1.1156 (2073)

$1.1116 (1561)

Price at time of writing this review: $1.1046

Support levels (open interest**, contracts):

$1.1026 (3669)

$1.1009 (1531)

$1.0989 (7018)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date September, 6 is 111197 contracts (according to data from August, 29) with the maximum number of contracts with strike price $1,1400 (8819);

GBP/USD

Resistance levels (open interest**, contracts)

$1.2330 (2301)

$1.2265 (1420)

$1.2224 (843)

Price at time of writing this review: $1.2183

Support levels (open interest**, contracts):

$1.2141 (1537)

$1.2120 (1169)

$1.2094 (699)

Comments:

- Overall open interest on the CALL options with the expiration date September, 6 is 31014 contracts, with the maximum number of contracts with strike price $1,2750 (4128);

- Overall open interest on the PUT options with the expiration date September, 6 is 26756 contracts, with the maximum number of contracts with strike price $1,2100 (2129);

- The ratio of PUT/CALL was 0.86 versus 0.87 from the previous trading day according to data from August, 29

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 60.24 | 0.79 |

| WTI | 56.4 | 1.13 |

| Silver | 18.23 | -0.6 |

| Gold | 1526.801 | -0.87 |

| Palladium | 1471.8 | -0 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | -18.49 | 20460.93 | -0.09 |

| Hang Seng | 88.02 | 25703.5 | 0.34 |

| KOSPI | -7.68 | 1933.41 | -0.4 |

| ASX 200 | 6.8 | 6507.4 | 0.1 |

| FTSE 100 | 69.61 | 7184.32 | 0.98 |

| DAX | 137.86 | 11838.88 | 1.18 |

| Dow Jones | 326.15 | 26362.25 | 1.25 |

| S&P 500 | 36.64 | 2924.58 | 1.27 |

| NASDAQ Composite | 116.51 | 7973.39 | 1.48 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.67246 | -0.17 |

| EURJPY | 117.763 | 0.27 |

| EURUSD | 1.10572 | -0.2 |

| GBPJPY | 129.734 | 0.24 |

| GBPUSD | 1.2181 | -0.24 |

| NZDUSD | 0.63092 | -0.43 |

| USDCAD | 1.32869 | -0.16 |

| USDCHF | 0.98619 | 0.53 |

| USDJPY | 106.494 | 0.48 |

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.