- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 30-07-2014

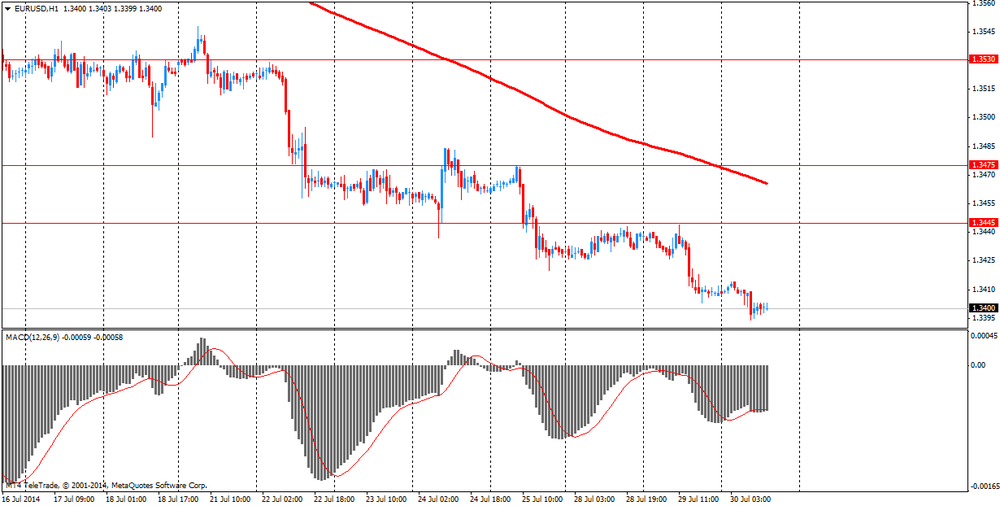

The dollar against the euro has increased markedly, which was associated with the release of better than expected U.S. GDP data. The U.S. economy rose sharply this spring after the reduction in the first quarter, which led to positive growth in the last six months and raised hopes for sustained growth in the second half of 2014. Gross domestic product, the broadest measure of goods and services produced in the economy, increased from a seasonally adjusted annual rate of 4.0% in the second quarter, the Commerce Department said Wednesday. Economists had forecast an increase of 3.1% for the quarter. The rise in stocks and acceleration in consumer spending led to widespread growth and leveled a lot of resistance from increased imports. Growth has replaced the first quarter, when the economy contracted by 2.1%. While this was the worst quarter in the current recovery, this figure reflects an upward revision from the previously estimated 2.9% reduction. The economy grew by about 1% during the first half of 2014. Annual changes published on Wednesday, showed that the economy also expanded by 4% in the second half of 2013, it is the best indicator for the six months to 10 years.

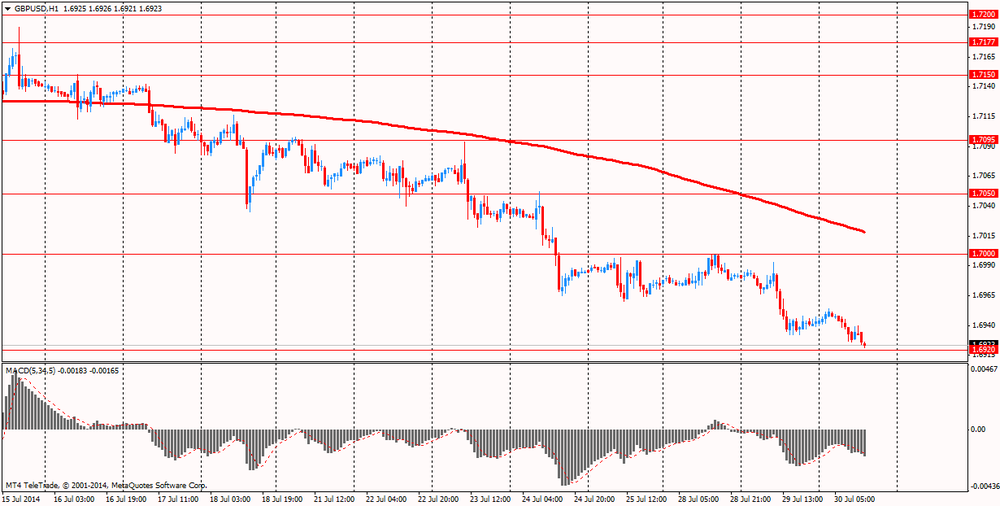

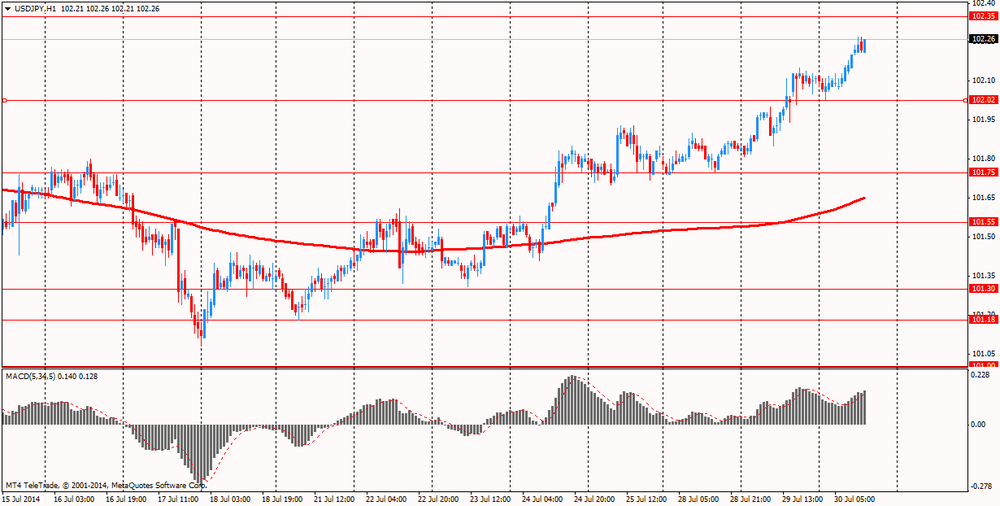

The dollar has appreciated significantly against the pound and the yen amid the U.S. economic recovery, as well as expectations for the outcome of the meeting of the monetary policy by the Federal Reserve later in the session. Official data showed that U.S. gross domestic product grew in the second quarter at an annual rate of 4%. The report also showed that the U.S. economy shrank by 2.9% in the first quarter, as harsh winter weather conditions suppressed economic activity. Report came after data that indicates that the level of employment in the private sector rose by 218 thousand this month, lower than expected increase of 234 thousand in June, the economy added 281 thousand jobs.

Now the focus of the Fed's decision on monetary policy, which will be announced tonight. The Committee is expected to announce more QE minimize the program to $ 10 billion to $ 25 billion. Earlier this month, the Federal Reserve Janet Yellen noted that U.S. interest rates may rise sooner if the recovery in the labor market will continue.

European stocks fell today as weaker-than-expected financial results of companies outweighed gains from upbeat U.S. data.

"We see a mixed bag of corporate earnings," - said Alessandro Fezzi, senior market analyst at LGT Bank Schweiz AG. - «European and Swiss companies have to deal with negative currency effects. Tougher sanctions against Russia also pressured mood. Russia has already warned the consequences. Rather, the conflict will not end very soon, so that the market sentiment for a while will be worse than usual. "

With regard to economic statistics, the U.S. Commerce Department announced that gross domestic product expanded at a seasonally adjusted annual rate of up to 4.0% in the second quarter. Economists had forecast an increase of 3.1% for the quarter. The rise in stocks and acceleration in consumer spending led to widespread growth and leveled a lot of resistance from increased imports. Growth has replaced the first quarter, when the economy contracted by 2.1%. While this was the worst quarter in the current recovery, this figure reflects an upward revision from the previously estimated 2.9% reduction. The economy grew by about 1% during the first half of 2014. Annual changes published on Wednesday, showed that the economy also expanded by 4% in the second half of 2013, it is the best indicator for the six months to 10 years.

Another report showed that employment in the U.S. private sector continued to show significant growth in the month of July, according to a report released Wednesday by ADP, although the pace of job growth were lower than estimates of economists. ADP reported that private sector employment increased by 218,000 jobs in July, after a gain of 281,000 jobs in June. Economists had expected employment to rise by about 234,000.

Also, add that investors are waiting for the end of the two-day meeting of the Federal Reserve System. Analysts predict that the leaders of the Central Bank once again reduce the amount of the third round of quantitative easing program by $ 10 billion - to $ 25 billion

National benchmark indexes fell in 12 of the 18 western European markets.

FTSE 100 6,773.44 -34.31 -0.50% CAC 40 4,312.3 -53.28 -1.22% DAX 9,593.68 -59.95 -0.62%

Schneider Electric shares fell during trading up 4.3%, as adjusted EBITDA in the second quarter did not live analysts' forecasts.

Airbus aircraft manufacturing concert capitalization increased by 3.6%. Net income in the first half jumped 50% on substantial growth in new orders.

Rates HeidelbergCement securities decreased by 3.1% after the company reported a reduction in operating profit in April-June by 1.5% - up to 699 million euros, as the cost of raw materials in Asia increased. Experts predicted a profit of 714 million euros.

Quotes of the second-capitalization Barclays Bank UK rose by 4.3%. In April-June FCCU returned to profitable levels, despite a drop in revenue from investment banking.

The market value of Holcim, cement maker, fell 5 percent after reporting that second-quarter net profit was in the amount of 406 million francs, compared with forecasts for the level of 459.5 million francs.

Paper Total SA fell 5.1 percent. French oil company said second-quarter profit, excluding changes in inventories fell to $ 3.2 billion, compared to estimates of experts at $ 3.26 billion

The price of oil fell slightly, closer to $ 107 per barrel (mark Brent), which was due to ample supplies in Europe and Asia. As for oil WTI, its price is also reduced, despite a report pointed to a decline in stocks.

Commercial U.S. crude inventories last week fell by 3,697 thousand barrels - up to 367,374 million barrels, according to the weekly report of the U.S. Department of Energy. Gasoline inventories rose by 365 thousand barrels and reached 218,236 million barrels. Commercial distillate stocks rose by 789 thousand barrels, reaching 126,721 million barrels. Experts expected a decrease of oil reserves by 1250 thousand barrels, gasoline inventories growth for 1000 thousand barrels and distillate stocks increase by 1,500 thousand barrels. We also add that the oil terminal in Cushing fell by 0.924 million barrels - up to 17.899 million barrels and refinery utilization in the United States decreased to 93.5% against 93.8% a week earlier

We also recall that yesterday's report from the American Petroleum Institute on changes in stocks in the U.S. showed that oil stocks fell by 4.4 million barrels, gasoline inventories rose by 0.06 million barrels, distillate stocks rose by 0.547 million barrels, while refining capacity utilization rate was 92.6% against 93.3% a week earlier;

On the dynamics of trade also affect expectations of the Fed meeting. Tonight, the Fed will issue a statement on the results of the monthly meetings, and on Friday in the United States will report on the employment market. Markets expect the Fed to reduce monthly program of buying bonds to $ 10 billion.

Meanwhile, adding that investors weakly reacted to news of strengthening sanctions against Russia and waiting for the reaction of President Vladimir Putin.

"The sanctions are directed against more investment in technology and their impact on the oil markets will manifest itself mainly in the long term," - said a senior economist at ABN Amro energy market in Amsterdam Hans van Kleef.

Regarding the situation in Libya, the production in the country is maintained at 500,000 barrels per day on a background of fighting in the capital Tripoli, a spokesman of the Ministry of Petroleum Industry.

The cost of the September futures on U.S. light crude oil WTI (Light Sweet Crude Oil) fell to $ 100.95 a barrel on the New York Mercantile Exchange (NYMEX).

September futures price for North Sea Brent crude oil mixture fell 16 cents to $ 107.30 a barrel on the London exchange ICE Futures Europe.

The price of gold fell today, while dropping below the psychological level of $ 1,300 per ounce, as strong economic data outweighed the purchase on the background of geopolitical problems.

The U.S. Commerce Department announced that gross domestic product expanded at a seasonally adjusted annual rate of up to 4.0% in the second quarter. Economists had forecast an increase of 3.1% for the quarter. The rise in stocks and acceleration in consumer spending led to widespread growth and leveled a lot of resistance from increased imports. Growth has replaced the first quarter, when the economy contracted by 2.1%. While this was the worst quarter in the current recovery, this figure reflects an upward revision from the previously estimated 2.9% reduction. The economy grew by about 1% during the first half of 2014. Annual changes published on Wednesday, showed that the economy also expanded by 4% in the second half of 2013, it is the best indicator for the six months to 10 years.

Experts note that the latest data reinforce the arguments in favor of accelerated clotting program to stimulate the economy and the earlier-than-expected rise in U.S. interest rates. Now the focus of the Fed's decision on monetary policy, which will be announced tonight. The Committee is expected to announce more QE minimize the program to $ 10 billion to $ 25 billion. Earlier this month, the Federal Reserve Janet Yellen noted that U.S. interest rates may rise sooner if the recovery in the labor market will continue.

"Nobody wants to hold long positions in gold now, when the Fed, according to most people inclined to tighten policy sooner rather than later," - said Frank Lesh, broker FuturePath Trading.

Demand for gold is still supported, as tensions between Russia and the West in relation to the situation in Ukraine remains high, while the fighting between Israel and Hamas militants in Gaza also remain in the spotlight.

The cost of the August gold futures on the COMEX today fell by $ 4.6 - to $ 1293.40 per ounce.

EUR/USD $1.3400, $1.3415, $1.3470, $1.3500

USD/JPY Y101.70-75, Y102.50

GBP/USD $1.6800

EUR/GBP stg0.7800, stg0.7900, stg0.7950, stg0.8000

AUD/USD $0.9400, $0.9425, $0.9450, $0.9475

USD/CAD C$1.0800

U.S. stock futures rose as data showed the U.S. economy rebounded more than forecast in the second quarter and Twitter Inc. (TWTR) rallied before a Federal Reserve policy decision.

Global markets:

Nikkei 15,646.23 +28.16 +0.18%

Hang Seng 24,732.21 +91.68 +0.37%

Shanghai Composite 2,181.24 -1.95 -0.09%

FTSE 6,803.61 -4.14 -0.06%

CAC 4,365.52 -0.06 0.00%

DAX 9,670.73 +17.10 +0.18%

Crude oil $101.46 (+0.50%)

Gold $1294.40 (-0.35%)

(company / ticker / price / change, % / volume)

| International Business Machines Co... | IBM | 194.57 | 0.00% | 1.5K |

| General Electric Co | GE | 25.62 | +0.67% | 0.9K |

| Pfizer Inc | PFE | 29.65 | +0.61% | 5.7K |

| JPMorgan Chase and Co | JPM | 58.99 | +0.60% | 0.5K |

| Boeing Co | BA | 123 | +0.56% | 1.9K |

| Walt Disney Co | DIS | 86.65 | +0.52% | 4.5K |

| Johnson & Johnson | JNJ | 102.47 | +0.50% | 3.1K |

| Visa | V | 214.5 | +0.47% | 0.3K |

| Intel Corp | INTC | 34.35 | +0.47% | 0.6K |

| Caterpillar Inc | CAT | 105.17 | +0.46% | 23.0K |

| E. I. du Pont de Nemours and Co | DD | 66.44 | +0.36% | 0.3K |

| American Express Co | AXP | 92 | +0.32% | 0.2K |

| Microsoft Corp | MSFT | 44.01 | +0.28% | 0.7K |

| McDonald's Corp | MCD | 95.98 | +0.17% | 1.7K |

| The Coca-Cola Co | KO | 40.41 | +0.15% | 1K |

| Travelers Companies Inc | TRV | 91.26 | +0.15% | 0.7K |

| AT&T Inc | T | 36.64 | +0.14% | 7.2K |

| Procter & Gamble Co | PG | 78.7 | +0.06% | 0.1K |

| Cisco Systems Inc | CSCO | 25.72 | +0.04% | 0.1K |

| Verizon Communications Inc | VZ | 51.98 | +0.02% | 9.8K |

| Wal-Mart Stores Inc | WMT | 75.45 | +0.01% | 0.2K |

Upgrades:

Twitter (TWTR) upgraded to Neutral from Sell at UBS

Downgrades:

Other:

Twitter (TWTR) target raised from $60 to $65 at RBC Capital Mkts

Twitter (TWTR) target raised from $35 to $45 at Wunderlich

06:00 Switzerland UBS Consumption Indicator June 1.77 2.06

07:00 Switzerland KOF Leading Indicator July 100.5 Revised From 100.4 101.1 98.1

09:00 Eurozone Business climate indicator July 0.22 0.17

09:00 Eurozone Industrial confidence July -4.3 -4.5 -3.8

09:00 Eurozone Economic sentiment index July 102.1 Revised From 102.0 102.2

12:00 Germany CPI, m/m (Preliminary) July +0.3% +0.2% +0.3%

12:00 Germany CPI, y/y (Preliminary) July +1.0% +0.9% +0.8%

During the European session, the Forex market the euro fell slightly against the dollar on the data by the mood in the economy.

In the eurozone, the level of economic confidence rose unexpectedly in July, which was due to the improvement of industrial sentiment data showed on Wednesday the European Commission survey.

Economic sentiment index rose to 102.2 in July from a revised 102.1 in June. Economists predicted that the figure will fall to 101.9 from June initial appraised value 102.

Industrial Confidence rose to -3.8 from -4.3 a month ago. Increased confidence in the industry was the result of more optimistic managers on expected production and the current level of total portfolio, and their assessment of stocks of finished products in general remained unchanged.

Meanwhile, confidence in the services sector fell to 3.6 from 4.4 months ago. Reduced confidence in the services sector was due to significantly lower expectations and managers demand more muted assessment of past business situation, which outweighed a more positive stance on past demand.

According to preliminary estimates consumer sentiment fell to -8.4 from -7.5 in June. The consumer confidence index fell due to the markedly more pessimistic estimates of future unemployment and future general economic situation, which were only partially offset by a moderate improvement in consumers' assessment of their readiness for future savings.

Sentiment in the construction sector improved to -28.2 from -31.7 in the previous month. Increased confidence in the building was part of the revision of the expressed expectations of employment and, to a lesser extent, improved assessment of the level of portfolio managers orders.

More data showed that business confidence dropped slightly to 0.17 in July from 0.21 in June.

The U.S. dollar rose against the yen in anticipation of strong employment data in the U.S. that may prompt the Fed to further reduce the incentive programs. Remember, today completed a 2-day meeting of the Committee on the open market operations of the Federal Reserve System and the decision will be announced on the possible timing of rate increases the rate of the Central Bank and the further reduction of bond purchases.

In addition, will be held today publication of data on U.S. growth in the preceding quarter. According to the median forecast of economists, GDP world's largest economy will grow by 3.1%, after falling 2.9% previously. If this forecast is confirmed, then this figure will rise to the highest since September 2013.

EUR / USD: during the European session, the pair fell to $ 1.3394

GBP / USD: during the European session, the pair fell to $ 1.6921

USD / JPY: during the European session, the pair rose to Y102.27

At 12:15 GMT the United States will change ADP Employment for July. At 12:30 GMT, Canada will present the raw material price index for June. U.S. at 12:30 GMT to publish preliminary data on changes in GDP, the GDP price index, the index of personal consumption expenditures, the main index of personal consumption expenditures for the 2nd quarter to 14:30 GMT - data on crude oil inventories from the Energy Department. At 18:00 GMT we will know the FOMC decision on the basic interest rate and the accompanying statement will be made FOMC. At 23:05 GMT UK release indicator of consumer confidence from the GfK July.

EUR/USD

Offers $1.3485, $1.3460/65, $1.3440-50, $1.3430/35

Bids $1.3390, $1.3380-70, $1.3355/50

GBP/USD

Offers

Bids $1.6925-20, $1.6900, $1.6885/80

AUD/USD

Offers $0.9480, $0.9450, $0.9420/25, $0.9400

Bids $0.9350, $0.9320, $0.9300

EUR/JPY

Offers Y137.75/80, Y137.50, Y137.20/25

Bids Y136.80, Y136.50, Y136.00

USD/JPY

Offers Y102.80, Y102.50

Bids Y102.00, Y101.85/80, Y101.50

EUR/GBP

Offers stg0.7980/85, stg0.7950

Bids

European stocks were little changed as investors weighed earnings from companies including Schneider Electric Plc and Airbus Group NV, and the U.S. joined Europe in imposing new sanctions on Russia for its role in the insurgency in Ukraine. U.S. stock futures were also little changed, while Asian shares rose.

The U.S. Treasury Department announced late yesterday penalties for American citizens dealing with equity or bonds of VTB Bank OAO, Bank of Moscow and Russian Agricultural Bank. United Shipbuilding Corp., which has contracts with the Russian military, was also sanctioned.

The Federal Reserve will reduce its monthly purchases for the sixth time to $25 billion from $35 billion as it ends a two-day meeting after European markets close today, according to economists surveyed by Bloomberg.

An ADP Research Institute report at 8:15 a.m. New York time may show U.S. companies added 230,000 workers to their payrolls in July, following a 281,000 increase last month, according to the median economist projection in a Bloomberg survey. A government report 15 minutes later may show the U.S. economy expanded 3 percent in the second-quarter, following a 2.9 percent contraction in the first three months of the year.

Schneider declined 3.2 percent after first-half adjusted earnings missed analysts' estimates.

Airbus climbed 5.2 percent after posting a 10 percent increase in first-half earnings.

FTSE 100 6,805.04 -2.71 -0.04%

CAC 40 4,353.8 -11.78 -0.27%

DAX 9,641.04 -12.59 -0.13%

EUR/USD $1.3400, $1.3415, $1.3470, $1.3500

USD/JPY Y101.70-75, Y102.50

GBP/USD $1.6800

EUR/GBP stg0.7800, stg0.7900, stg0.7950, stg0.8000

AUD/USD $0.9400, $0.9425, $0.9450, $0.9475

USD/CAD C$1.0800

Asian stocks rose for a fourth day, with the regional benchmark index extending a six-year high, before the Federal Reserve updates markets on monetary policy today and as the U.S. and European Union strengthened sanctions against Russia.

S&P/ASX 200 5,622.9 +34.46 +0.62%

TOPIX 1,292.24 +1.83 +0.14%

SHANGHAI COMP 2,181.24 -1.95 -0.09%

Honda Motor Co. climbed 3.1 percent in Tokyo after the carmaker raised its profit forecast to the highest in seven years.

Oversea-Chinese Banking Corp. gained 1.7 percent as it prepares to take Hong Kong's Wing Hang Bank Ltd. private after shareholders accepted its $5 billion takeover offer.

Hyundai Heavy Industries Co. tumbled 9.5 percent after South Korea's biggest shipbuilder reported a wider-than-expected second-quarter loss.

EUR / USD

Resistance levels (open interest**, contracts)

$1.3515 (2360)

$1.3481 (1309)

$1.3455 (264)

Price at time of writing this review: $ 1.3408

Support levels (open interest**, contracts):

$1.3380 (3638)

$1.3356 (2973)

$1.3324 (2365)

Comments:

- Overall open interest on the CALL options with the expiration date August, 8 is 29713 contracts, with the maximum number of contracts with strike price $1,3600 (3991);

- Overall open interest on the PUT options with the expiration date August, 8 is 34638 contracts, with the maximum number of contracts with strike price $1,3500 (6975);

- The ratio of PUT/CALL was 1.17 versus 1.20 from the previous trading day according to data from July, 29

GBP/USD

Resistance levels (open interest**, contracts)

$1.7200 (1636)

$1.7101 (2005)

$1.7003 (1005)

Price at time of writing this review: $1.6943

Support levels (open interest**, contracts):

$1.6896 (2162)

$1.6799 (2113)

$1.6700 (1058)

Comments:

- Overall open interest on the CALL options with the expiration date August, 8 is 17067 contracts, with the maximum number of contracts with strike price $1,7250 (2423);

- Overall open interest on the PUT options with the expiration date August, 8 is 25014 contracts, with the maximum number of contracts with strike price $1,7000 (2692);

- The ratio of PUT/CALL was 1.47 versus 1.51 from the previous trading day according to data from Jule, 29

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

The dollar was near the highest in almost eight weeks against major peers amid prospects jobs numbers will add to indicators of stronger economic growth, prompting the Federal Reserve to further taper stimulus at a meeting that concludes today.

The Bloomberg Dollar Spot Index gained the most in six weeks yesterday, rising above its 200-day moving average, before data today forecast to show the U.S. economy rebounded last quarter. The Commerce Department will say today that U.S. gross domestic product climbed an annualized 3 percent last quarter, rebounding from a 2.9 percent contraction in the prior three months. That would indicate the fastest pace of growth for the world's biggest economy since the quarter ended September 2013.

The euro was near an eight-month low after German benchmark yields dropped to a record as the European Union and U.S. increased sanctions against Russia. Germany is forecast to report today that inflation slowed this month. German consumer price inflation moderated to 0.8 percent in July compared with a year earlier, from 1 percent in June, economists predicted before a report today.

EUR / USD: during the Asian session, the pair traded in the range of $ 1.3410-15

GBP / USD: during the Asian session, the pair traded in the range of $ 1.6945-55

USD / JPY: on Asian session the pair traded in the range of Y102.05-15

A light UK calendar today with most attention on US ADP (ahead of Friday's NFP), US Q2 GDP and tonight's FOMC announcement. Ahead of this the market will turn focus on Germany CPI state/national releases.

(raw materials / closing price /% change)

Light Crude 101.16 +0.19%

Gold 1,299.00 +0.05%

(index / closing price / change items /% change)

HANG SENG 24,633.64 +205.01 +0.84%

S&P/ASX 200 5,588.4 +11.01 +0.20%

SHANGHAI COMP 2,183.04 +5.09 +0.23%

FTSE 100 6,807.75 +19.68 +0.29%

CAC 40 4,365.58 +20.81 +0.48%

Xetra DAX 9,653.63 +55.46 +0.58%

S&P 500 1,969.95 -8.96 -0.45%

NASDAQ 4,442.7 -2.21 -0.05%

Dow Jones 16,912.11 -70.48 -0.42%

(pare/closed(GMT +2)/change, %)

EUR/USD $1,3408 -0,23%

GBP/USD $1,6943 -0,22%

USD/CHF Chf0,9067 +0,32%

USD/JPY Y102,11 +0,26%

EUR/JPY Y136,92 +0,04%

GBP/JPY Y172,99 +0,03%

AUD/USD $0,9381 -0,23%

NZD/USD $0,8505 -0,49%

USD/CAD C$1,0849 +0,48%

(time / country / index / period / previous value / forecast)

06:00 Switzerland UBS Consumption Indicator June 1.77

07:00 Switzerland KOF Leading Indicator July +0.3% +0.2%

09:00 Eurozone Business climate indicator July 0.22

09:00 Eurozone Industrial confidence July -4.3 -4.5

09:00 Eurozone Economic sentiment index July 102.0

12:00 Germany CPI, m/m July +0.3% +0.2%

12:00 Germany CPI, y/y July +1.0% +0.9%

12:15 U.S. ADP Employment Report July 281 234

12:30 Canada Industrial Product Prices, m/m June -0.5% +0.3%

12:30 Canada Raw Material Price Index June -0.4% +0.6%

12:30 U.S. PCE price index, q/q Quarter II +1.0%

12:30 U.S. PCE price index ex food, energy, q/q Quarter II +1.2%

12:30 U.S. GDP, q/q Quarter II -2.9% +3.1%

14:30 U.S. Crude Oil Inventories July -4.0

18:00 U.S. Fed Interest Rate Decision 0.25% 0.25%

18:00 U.S. FOMC QE Decision 35

18:00 U.S. FOMC Statement

23:05 United Kingdom Gfk Consumer Confidence July 1 2

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.