- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 30-01-2024

Japanese monthly Industrial Production fell short of growth expectations in December, printing at 1.8% MoM compared to the market's median forecast of a rebound to 2.4% and failing to pull further away from November's -0.9% print.

Annualized Japan Industrial Production likewise showed further deceleration, with the YoY figure coming in at -0.7% for the year ended December, improving from the previous period's -1.4% but still etching in additional declines.

About Japanese Industrial Production

The Industrial Production released by the Ministry of Economy, Trade and Industry measures outputs of the Japanese factories and mines. Changes in industrial production are widely followed as a major indicator of strength in the manufacturing sector. A high reading is seen as bullish for the JPY, whereas a low reading is seen as bearish.

- GBP/USD trades on a flat note with a mild negative bias around 1.2695.

- The Federal Open Market Committee (FOMC) is likely to keep the rate unchanged in the range of 5.25–5.50% for the fourth straight time.

- The Bank of England (BoE) is expected to leave interest rates unchanged at its first meeting of the year.

- The FOMC and BoE interest rate decisions will be the highlights of this week.

The GBP/USD pair holds below the 1.2700 mark during the early Asian session on Wednesday. Later on Wednesday, UK Nationwide Housing Prices for January will be due ahead of the Federal Open Market Committee (FOMC) monetary policy meeting. The major currently trades around 1.2695, unchanged for the day.

The FOMC is widely anticipated to keep interest rates unchanged in the range of 5.25–5.50% for the fourth straight time. At the Fed's December meeting, Fed officials expected three rate cuts in 2024. However, the meeting minutes revealed that the future of monetary policy remains uncertain. According to CME Group’s FedWatch tool, traders have priced in 50% odds of rate cuts at the next meeting in March.

On the British Pound front, the Bank of England (BoE) is likely to maintain the status quo on the rate for the fourth time in a row. BoE governor Andrew Bailey said in December that there was “some way to go” as the central bank believed inflation would not return to its 2% target until 2025. Nonetheless, economists expect the BoE to open the door to a change of tack later this year.

Market players will closely monitor the FOMC interest rate decision and press conference on Wednesday. Also, the January US ADP Employment Change will be released. On Thursday, the BoE monetary policy meeting will be in the spotlight. Traders will also be looking to see whether the BoE changes its language, stating that monetary policy will most likely need to be restrictive for an extended period of time.

Japanese Retail Sales, or Retail Trade as it's referred to by the Japanese Ministry of Economy, Trade and Tourism came in well under expectations early Wednesday, with headline annualized Retail Sales for the year ended December growing by just 2.1% compared to the forecast 5.1%, falling even further back from the previous period's 5.3%.

Seasonally-adjusted December Japanese Retail Trade declined by 0.8% MoM, compared to November's print of 1.0%.

Market reaction

The USD/JPY is ticking down into 147.40 immediately after release after the pair caught a downside bounce from the 200-hour Simple Moving Average (SMA) mid-Tuesday just shy of the 148.00 handle.

About Japanese Retail Trade

The Retail Trade released by the Ministry of Economy, Trade and Industry captures the aggregate sales made through a business location (usually a store) in which the principal activity is the sale of merchandise and related services to the general public, for household or personal consumption. Consumer spending is a key important indicator for the Japanese economy. A high reading is positive for the JPY, while a low reading is negative.

- AUD/USD continues to cycle around the 0.6600 handle.

- Aussie CPI print for Q4 2023 expected to show further inflation easing.

- US Fed rate call, NFP labor figures to weigh down the rest of the trading week.

AUD/USD cycled in a familiar pattern around the 0.6600 price point on Tuesday as Antipodeans gear up for a fresh print of Australian Consumer Price Index (CPI) inflation figures with the next rate call from the US Federal Reserve (Fed0 in the barrel for Wednesday and US Nonfarm Payrolls (NFP) labor figures slated for Friday.

Australia’s QoQ CPI is expected to ease back to 0.8% from the previous quarter’s 1.2%, and the Reserve Bank of Australia’s (RBA) Trimmed Mean CPI for the annualized fourth quarter is likewise forecast to clip down from 5.2% to 4.3%.

Australia Monthly CPI Preview: Inflation expected to ease further

The heavy-hitters this week revolve around a one-two punch of another Fed rate call and Friday’s US NFP labor print. The Fed is broadly expected to keep rates on hold this week, but cut-hungry investors are having a hard time letting go of bets for a March rate cut, with 44% of the rate swap market still hoping for a rate cut by March according to the CME’s FedWatch Tool.

This week’s US NFP print is expected to show a slight cooling in US labor markets, with the NFP forecast to come in at 180K in January compared to December’s 216K. Markets have routinely undershot NFP forecasts recently, and a topside upset could see investors suffering a rate tantrum as a stubbornly-healthy US labor market reduces chances of rate cuts happening sooner rather than later.

AUD/USD technical outlook

AUD/USD continues to get hung up on the 0.6600 handle, with intraday price action cycling the major price level with near-term momentum getting propped up by a bullish tilt in the 200-hour Simple Moving Average (SMA) rising into 0.6590.

Daily candlesticks remain underpinned by the 200-day SMA at 0.6570, and the AUD/USD is caught in a dense congestion zone between the 50-day and 200-day SMAs as the pair consolidates into the midrange.

AUD/USD Hourly chart

AUD/USD Daily chart

- NZD/USD posts modest gains near 0.6135 in Wednesday’s early Asian session.

- The number of job openings in the US rose to 9.026 million in December; Consumer Confidence surged to a two-year high in January.

- RBNZ’s Conway maintained the hawkish stance and pushed back on rate cut expectations this year.

- The FOMC interest rate decision and press conference will be closely watched by traders.

The NZD/USD pair trims gains but is still comfortably above 0.6100 during the early Asian session on Wednesday. The stronger-than-expected labor market data might convince the Federal Reserve (Fed) to delay cutting rates this year, which caps the downside of the US Dollar (USD). Investors will closely watch the Federal Open Market Committee (FOMC) decision later on Wednesday, with no change in rate expected. At press time, the NZD/USD pair is trading at 0.6135, adding 0.02% for the day.

Data released from the Bureau of Labor Statistics on Tuesday showed that the number of job openings in the United States rose to 9.026 million in December, above the November figure which was revised up to 8.925 million. Meanwhile, Conference Board Consumer Confidence surged to a two-year high in January, coming in at 114.8 in January versus 108.0 prior. Both reports failed to boost the Greenback as traders prefer to wait on the sidelines ahead of the FOMC meeting.

The FOMC is anticipated to leave its monetary conditions unaltered. The markets will focus on any hint of the timing of a potential interest rate cut from the Chair Jerome Powell’s press conference. The dovish remarks from Powell might exert some selling pressure on the USD and act as a headwind for the NZD/USD pair.

On the Kiwi front, the Reserve Bank of New Zealand (RBNZ) Chief Economist Paul Conway maintained a hawkish stance and pushed back on rate cut expectations. Conway stated on Tuesday that recent economic data indicate that monetary policy is working as the economy slows and inflation eases. However, there is still some way to go before inflation reaches the target midpoint of 2%.

The US ADP Employment Change for January will be due on Wednesday, ahead of the FOMC interest rate decision and the press conference. On Friday, the attention will shift to US employment data, including Nonfarm Payrolls, and Unemployment Rate.

- US stocks spread heading into the midweek as investors brace for Fed rate call.

- Tech stocks that initially led the latest risk rally are hesitating ahead of earnings.

- Fed set to hold rates on Wednesday, traders looking for hints about March rate cut.

US equity indexes spread on Tuesday, with the Standard & Poor’s 500 (SP500) and the Dow Jones Industrial Average (DJIA) closing in opposite directions after the DJIA clipped into a new all-time high and the SP500 closed softly lower as the tech sector drags ahead of key earnings reports and traders bracing for another rate call from the Federal Reserve (Fed) on Wednesday as US Nonfarm Payrolls (NFP) labor figures loom over the horizon on Friday.

The tech sector led US equities by the nose into all-time highs across US indexes in the recent rally, fueled in part by earnings expectations on the back of developments in the AI spheres, as investors bet big on demand for products from chipmakers to fuel tech investment in the burgeoning space. Recent earnings have started to show cracks however, with major companies like Tesla, Alphabet, and Apple missing broad-market growth expectations and adding dark clouds to the market’s previously-rosy outlook on the prospect of forever growth in the tech sector.

Fed Preview: Forecasts from 10 major banks

The Fed will be presenting its latest rate call and monetary policy statement to markets on Wednesday at 19:00 GMT. Federal Reserve Chairman Jerome Powell is broadly expected to keep rates on hold at the end of the Fed’s two-day deliberations as investors continue to get pushed back on rate cut hopes. In December, money markets had priced in a nearly 90% chance of getting a first rate cut from the Fed as soon as March, but equity markets hungry for cheaper lending and borrowing costs have run up against the hard wall of a stubbornly-resilient US domestic economy with continuing tightness in the labor market and inflation that remains a threat despite continuing to ease toward policymaker targets.

According to the CME’s FedWatch Tool, rate swaps are pricing in a 56% chance of no rate cut from the Fed in March, and investors have pivoted to focus on May’s outlook, where money markets are pricing nearly a 70% chance of a cut.

The Dow Jones Industrial Average ended Tuesday at $38,467.31, ending in the green for a fourth straight trading session and gaining 0.35% on the day, gaining 133.86 points.

On the downside, the SP500 ended the day softly back, declining almost 3 points to end the day down 0.06% at $4,924.97. The NASDAQ Composite index also shed weight on Tuesday, declining 0.76% and shedding 118.15 points to close at $15,509.90.

NASDAQ 100 technical outlook

The NASDAQ 100 large-cap equity index lost nearly a full percent on Tuesday peak-to-trough, falling from the day’s early high of $17,612.50 to a near-term low of $17,442.31. The major index shed 0.97% before a slim recovery to end the day down 133.82 points or 0.76% at $17,487.68.

The NASDAQ 100 set a fresh all-time high last week at $17,668.73 but the major index has struggled to develop bullish legs over the key figure, closing at a record high of $17,596.12 on Monday but unable to etch in fresh highs above last week’s peak.

The NASDAQ large-cap index is on pace to close deep in the green for a third straight month and is currently trading up nearly 25% from last October’s bottom near the $14,000.00 major price handle.

NASDAQ 100 daily chart

- Gold continues upward trend, influenced by geopolitical risks and US economic data.

- Strong US labor market and consumer confidence contrast could affect Fed officials rate cut forecasts.

- Investor attention on upcoming Fed announcement and Jerome Powell's press conference for future policy insights.

Gold prices remain in an uptrend following data from the United States (US), which emphasized a possible “soft landing” is achievable for the US economy. Although that should be negative for Gold, rising tensions in the Middle East underpins the non-yielding metal. At the time of writing, XAU/USD exchanges hands at $2036.50, virtually unchanged as the Asian Wednesday session begins.

XAU/USD stays firm as market participants awaits Powell

On Tuesday, bullion rose a modest 0.17%, sponsored by a fall in US Treasury bond yields, amid expectations that the Federal Reserve will keep rates unchanged on Wednesday’s meeting. After that, XAU/USD traders would await Fed Chairman Jerome Powell's press conference, looking for some forward guidance.

Data-wise, December’s JOLTS report was hot, indicating the tight labor market. Vacancies rose by 9.02 million, exceeding November’s data and forecasts of 8.75 million. At the same time, the Conference Board (CB) revealed that Consumer Confidence jumped the most in the last three months, rising to 114.8 in January from 108 in December, slightly below the consensus of 115.0. Dana Peterson, Chief Economist at the Conference Board, said, “January's increase in consumer confidence likely reflected slower inflation, anticipation of lower interest rates ahead, and generally favorable employment conditions as companies continue to hoard labor.”

In addition, XAU/USD gathered traction as the US 10-year Treasury bond yield dropped four basis points (bps) to 4.036%, a headwind for the Greenback. (USD). Consequently, the US Dollar Index (DXY), which tracks the buck’s performance against a basket of peers, slid 0.04% at 103.41.

Tomorrow, the US economic docket will feature the ADP Employment Change report and the Chicago PMI. At 19:00 GMT, the Fed will announce its monetary policy decision, followed by the Fed Chair Jerome Powell press conference.

XAU/USD Price Analysis: Technical outlook

The XAU/USD is neutrally biased, but the clearing of the 50-day moving average (DMA) has opened the door to challenge the psychological $2050.00 mark. Once cleared, buyers could push prices toward the December 28 high of $2088.48, followed by the $2100 figure. In the outcome of sellers moving in and dragging prices below the 50-DMA at $2032.08, that would exacerbate a drop toward the January 25 swing low of $2009.66.

- EUR/JPY edges up after robust Euro area GDP figures and subdued Japanese inflation impact market sentiment.

- Technical analysis suggests a potential move towards the Tenkan-Sen at 160.54, with 161.00 and January 19 high at 161.87 as key resistance levels.

- Downward pressure remains a risk, with crucial support near the 159.50 - 159.70 range and further potential decline towards 159.00 and 158.47.

The EUR/JPY advances modestly on Tuesday, and buyers recover the psychological 160.00 figure. Solid GDP data from the Euro area, along with lower-than-expected inflation data in Japan, eases the pressure off the Bank of Japan (BoJ) to end its ultra-loose policy. At the time of writing, the pair exchanges hands at 160.08, after hitting a daily low of 159.21.

The pair is neutral biased as the daily chat portrays. But, the recent fundamental news, along with an improvement in risk appetite, could pave the way to test resistance at the Tenkan-Sen at 160.54. A decisive break could sponsor a leg-up to the 161.00 mark before buyers step in and lift the exchange rate toward January’s 19 high at 161.87. Further upside is seen at 162.00.

Conversely, if EUR/JPY sellers’ step in and prevent a daily close above 160.00, that would exacerbate a leg-down. The first support would be a seven-month-old support trendline at around 159.50 – 159.70, also a confluence with the Senkou Span A at 159.50. Once that area is cleared, expect a drop to 159.00, before diving to the Senkou Span B at 158.47.

EUR/JPY Price Action – Daily Chart

EUR/JPY Technical Levels

- The Australian Monthly Consumer Price Index rate is foreseen at 3.7% YoY in December.

- The Quarterly CPI inflation is expected to have eased further in the last quarter of 2023.

- The Australian Dollar is bearish ahead of inflation figures and the upcoming RBA monetary policy decision.

The Australian Bureau of Statistics (ABS) will release two different inflation reports on Wednesday. On the one hand, the organism will publish the quarterly Consumer Price Index (CPI) for the last quarter of 2023, and on the other hand, the Monthly CPI, estimated annually, for December. Additionally, the quarterly report includes the Trimmed Mean Consumer Price Index, the Reserve Bank of Australia's (RBA) favorite inflation gauge.

The figures are critical ahead of the RBA monetary policy meeting on February 6, as the central bank aims to keep the annual CPI rate between 2% and 3%. Price pressures in Australia are clearly moving in the right direction, although they are still above the desired levels.

The central bank is expected to leave the Cash Rate unchanged at 4.35%, as it did in the December meeting, following a 25 basis points (bps) hike in November. Previously, the RBA had held rates steady for four consecutive months. The November decision resulted from the Board assessing inflation was easing at a slower pace than earlier forecast.

What to expect from Australia’s inflation rate numbers?

The ABS is expected to report that inflation was 3.7% YoY in December, down from the 4.3% posted in November. The quarterly CPI is foreseen rising 0.8% QoQ and up 4.3% YoY in the three months to December, while the RBA Trimmed Mean CPI rate is foreseen at 4.3% YoY, declining from the previous 5.2%.

The anticipated gauges would support an on-hold RBA, but it is too early to discuss rate cuts in Australia. In its latest Statement on Monetary Policy, which is published quarterly in February, May, August and November, policymakers forecasted that it will take until late 2025 for inflation to moderate to under 3%, finally falling into the target range.

“Inflation is forecast to decline to 3½ per cent by the end of 2024 and to reach a little below 3 per cent at the end of 2025. The forecast decline in inflation is more gradual than anticipated three months ago because domestic inflationary pressures are dissipating more slowly than previously thought,” according to the official document. Furthermore, it added: “Growth in the Australian economy is expected to remain below trend over 2023 and 2024 as cost-of-living pressures and higher interest rates continue to weigh on demand.”

Finally, the International Monetary Fund (IMF) advised Australia to lift interest rates further to achieve its inflation target before 2026.

In such a scenario, trimming the Cash Rate seems out of the table at the time. If anything, inflation-related figures need to decline much more than anticipated throughout the next few months to allow policymakers a rate-cut discussion. At least, it seems safe to say that rates have peaked.

It is worth adding that the market is moving ahead of policymakers. In early January, speculative interest was pricing in six rate cuts for 2024, with the Cash Rate expected at 3.75% by the end of the year. That means softer-than-anticipated CPI figures could boost rate-cut odds regardless of RBA’s ability to deliver them.

How could the Consumer Price Index reports affect AUD/USD?

CPI readings will have a significant impact on the Australian Dollar (AUD) as the figures will guide the RBA's upcoming monetary policy decisions. As usual, the wider the deviation of the outcome from expectations, the larger the price movement. Generally speaking, higher-than-anticipated numbers fuel expectations of rate hikes and tend to boost the AUD. On the contrary, softer-than-expected figures should fuel hopes for soon-to-come rate cuts, and weigh on the local currency, at least in the near term. As the dust settles, easing price pressures should be understood as good news, and end up benefiting the Aussie in the longer run.

From a technical perspective, AUD/USD trades in the 0.6580 region ahead of the events, after posting a weekly peak of 0.6624 on Tuesday. According to Valeria Bednarik, FXStreet Chief Analyst, “the risk skews to the downside in the daily chart. The pair is currently developing just above a directionless 200 Simple Moving Average (SMA), stuck around the indicator for a second consecutive week. Furthermore, the 20 SMA maintains a firmly bearish slope above the current level, providing dynamic resistance at around 0.6630. Finally, technical indicators stalled their recoveries within negative levels and are slowly resuming their slides, reflecting persistent selling interest.”

Bednarik adds: “Buyers are defending the downside in the 0.6550/60 region, with a break below it exposing the 0.6500 threshold. Below the latter, AUD/USD has scope to test a strong static support level at 0.6470. On the flip side, the pair needs to recover beyond the aforementioned 0.6630 to gain upward traction and approach the 0.6700 figure.”

Inflation FAQs

What is inflation?

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

What is the Consumer Price Index (CPI)?

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

What is the impact of inflation on foreign exchange?

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attract more global capital inflows from investors looking for a lucrative place to park their money.

How does inflation influence the price of Gold?

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it.

Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.

Economic Indicator

Australia Consumer Price Index (QoQ)

The Consumer Price Index (CPI), released by the Australian Bureau of Statistics on a quarterly basis, measures the changes in the price of a fixed basket of goods and services acquired by household consumers. The CPI is a key indicator to measure inflation and changes in purchasing trends. The QoQ reading compares prices in the reference quarter to the previous quarter. A high reading is seen as bullish for the Australian Dollar (AUD), while a low reading is seen as bearish.

Read more.Next release: 01/31/2024 00:30:00 GMT

Frequency: Quarterly

Source: Australian Bureau of Statistics

Why it matters to traders

The quarterly Consumer Price Index (CPI) published by the Australian Bureau of Statistics (ABS) has a significant impact on the market and the AUD valuation. The gauge is closely watched by the Reserve Bank of Australia (RBA), in order to achieve its inflation mandate, which has major monetary policy implications. Rising consumer prices tend to be AUD bullish, as the RBA could hike interest rates to maintain its inflation target. The data is released nearly 25 days after the quarter ends.

- GBP/JPY rebounds from low, buoyed by changing market sentiments and central bank rate speculations.

- Break above Tenkan-Sen (187.72) may signal uptrend, eyeing recent high at 188.91, with 188.00 as pivotal.

- Downside risks if below 186.51; potential supports at 185.77, key 185.00 level, and 184.47 low.

The British Pound (GBP) pares earlier losses against the Japanese Yen (JPY) on Tuesday, even though data eased the pressure off the Bank of England (BoE) to keep interest rates higher. Therefore, the GBP/JPY cross-pair trades at 187.34 after hitting a daily low of 186.51.

From the daily chart perspective, the GBP/JPY is trading sideways just below the Tenkan-Sen level at 187.72 dot. If buyers lift the exchange rate above the Tenkan Sen, that will open the door to challenging the January 23 high at 188.91, but firstly they would need to reclaim 188.00. On the flip side, if sellers step in and drag prices below the January 30 low of 186.51, that will open the door to challenge the Senkou Span A level at 185.77, followed by the psychological 185.00 figure, ahead of the January 12 daily low of 184.47.

GBP/JPY Price Action – Daily Chart

GBP/JPY Technical Levels

- AUD/JPY currently facing minor losses, standing strong at 97.45 after hitting a low of 96.85.

- The cross faced losses following the release of weak Australian Retail Sales figures from December.

- Bulls display resilience but the bears are slowly building momentum.

In Tuesday's session, the AUD/JPY pair was observed at the 97.45 level, recording mild losses but recovering from a low of 96.85 as the Aussie weakened following the release of soft Retail Sales figures. The broader outlook on the daily chart showcased bullish dominance, with the bulls determinedly holding their ground. Meanwhile, the four-hour chart indicated a rapid recovery by the buyers, reaffirming the prevalent bullish sentiment.

Weak December Retail Sales underscore sluggish Australian economic momentum, but markets still only discount a 10% chance of a 25 bps rate cut from the Reserve Bank of Australia (RBA) in February. Meanwhile, mixed labor market figures in Japan including falling unemployment rate and job-to-applicant ratio, gives little impetus for Bank of Japan (BoJ) to rush in pivoting its monetary policy, with market expectations suggesting a June liftoff.

AUD/JPY levels to watch

The indicators on the daily chart are indicating a subtle power of the bulls over the bears. The Relative Strength Index (RSI) is displaying neutrality, situated comfortably in a positive zone. The Moving Average Convergence Divergence (MACD) mirrors this sentiment, with green bars that remain static, neither rising nor falling. That being said, the market sentiment leans slightly in favor of the bulls due to the crosses's position against the Simple Moving Averages (SMAs). Hovering above the 20, 100, and 200-day SMAs, the AUD/JPY displays signs of bullish dominance on a grander scale.

AUD/JPY daily chart

An inconclusive session in the Greenback left the USD Index (DXY) flat around the 103.40 region, while EUR/USD managed to edge further up and revisit the mid-1.0800s in the context of alternating risk-appetite trends prior to FOMC-day.

Here is what you need to know on Wednesday, January 31:

A positive surprise in JOLTs Job Openings coupled with an improvement in Consumer Confidence tracked by the Conference Board seem to have been insufficient to spark some reaction in the Greenback, which succumbed to the pre-FOMC lull. The Fed meets on Wednesday and is largely anticipated to leave its monetary conditions unaltered, while attention is expected to gyrate to Chair Powell’s press conference and to any hint of the timing of a potential interest rate cut. Previously, ADP was expected to report on job creation by the US private sector, seconded by the publication of the Employment Cost Index.

In the euro area, the focus of attention will be in Germany, with the publication of Retail Sales and the labour market report for the month of January, followed by the advanced Inflation Rate for the first month of the year. EUR/USD has been gathering some traction since last Friday, although its short-term price action is expected to largely depend on Fed dynamics.

GBP/USD traded on the defensive and returned to the sub-1.2700 zone despite the dollar’s irresolute price action. Looking at Wednesday’s docket, housing prices measured by Nationwide will be the only release of note.

Further side-lined trading saw USD/JPY reverse Monday’s decline and chart modest gains near the 148.00 barrier. On Wednesday, a busy Japanese calendar includes the BoJ Summary of Opinions, Retail Sales, Flash Industrial Production, Housing Starts, and January Consumer Confidence.

In Australia, traders will closely follow the release of the Q4 Inflation Rate and the December Monthly CPI Indicator ahead of the key RBA meeting next week. In addition, China’s NBS Manufacturing and Non-Manufacturing PMIs should also gather importance. AUD/USD, in the meantime, maintained its consolidative mood around the 0.6600 zone.

Prices of crude oil resumed the upside following Monday’s strong corrective decline, always supported by persevering geopolitical concerns in the Middle East and the Red Sea crisis.

Gold prices added to the positive start of the week and briefly probed the $2050 zone, or multi-day highs. Silver, on the other hand, partially faded Monday’s marked advance.

- AUD/USD fell into familiar lows after a rejection from 0.6625.

- The Aussie found a floor near 0.6575, but upside momentum remains thin.

- Australian CPI inflation in the pipe ahead of Wednesday’s Fed rate call.

AUD/USD is cycling the 0.6600 handle in a rough range as Aussie (AUD) traders gear up for Australian Consumer Price Index (CPI) inflation due during the early Wednesday session ahead of another rate cal from the US Federal Reserve (Fed).

Australia’s fourth-quarter CPI is expected to contract slightly on an annualized basis, with the headline YoY CPI forecast to print at 4.3% versus the previous 5.4% and the QoQ data expected to slip to 0.8% from 1.2%.

On the Fed side, markets are awaiting a pivot from Fed chairman Jerome Powell. Rate swap markets have seen their rate cut bets steadily pushed further out, and the CME’s FedWatch Tool now sees a less than 40% chance of a first rate cut from the Fed in March. Swaps originally priced in an over 80% chance of a March rate trim back in December, but easing inflation and stubbornly strong economic data from the US over the last quarter renders a rate cut from the Fed next to impossible for fear of re-stoking inflationary pressure.

The back half of the trading week will cap off with China’s Caixin Manufacturing Purchasing Managers’ Index (PMI) figure expected to tick down slightly from 50.8 to 50.6, and broader markets will be looking for a softer print in Friday’s US Nonfarm Payrolls. Friday’s NFP is forecast to tick down to 180K for January from December’s 216K.

AUD/USD technical outlook

The AUD/USD reclaimed the 0.6600 handle on Tuesday after a near-term dip into 0.6575, and the pair is catching intraday technical support from the 200-hour Simple Moving Average (SMA) near 0.6590.

The Aussie continues to catch technical support from the 200-day SMA just above 0.6550 on the daily candlesticks. The pair is still caught in a congestion pattern below the 50-day SMA just above 0.6650.

AUD/USD hourly chart

AUD/USD daily chart

- West Texas Intermediate (WTI) oil climbs 1.25%, driven by escalating tensions in the Middle East and positive global economic projections from the IMF.

- IMF's revised forecast boosts optimism for the US and Chinese economies, countering concerns from China’s real estate sector issues.

- Upcoming OPEC+ meeting and expectations of a US crude inventory drawdown boosted Oil prices.

West Texas Intermediate (WTI), the US Crude Oil benchmark, rises amid escalating tensions in the Middle East, along with updated forecasts of the International Monetary Fund (IMF), suggesting the global economy would grow more than expected. At the time of writing, WTI exchanges hands at $77.89, up 1.25%.

Oil price rebounds on Middle East developments, IMF forecasts

The IMF upward reviewed its forecast for the global economy, particularly the US and China, adding that a “soft landing” was in sight, though overall growth and global trade remain below the historical average.

On Monday, China’s property crisis concerns weighed on Oil prices as a Hong Kong court ordered the liquidation of property company China Evergrande Group.

In the meantime, the escalation of the Middle East conflict has boosted Oil prices. US President Joe Biden said the US “…will respond in an appropriate fashion, and it is very possible that what you'll see is a tiered approach here, not just a single action, but essentially multiple actions.”

Aside from this, the Organization of Petroleum Exporting Countries (OPEC+) will meet on February 1, and isn’t expected to provide a decision on the cartel’s Oil supply for April.

Meanwhile, a Reuters poll suggested the US crude inventories were foreseen to have drawn down in the last week some 900K barrels.

WTI Price Analysis: Technical outlook

WTI’s daily chart depicts Oil is neutrally biased, challenging the 200-day moving average (DMA) at $77.45 at the time of writing. If buyers keep prices above the latter, they could test the 100-day moving average (DMA) at $79.28. Once cleared, WTI would turn bullish, and resumes its uptrend toward $80.00. On the other hand, if sellers keep WTI price below the 200-DMA, that could pave the way to the 50-DMA at $73.58.

- EUR/USD extends rebound from 1.0800 on flat QoQ GDP print.

- Euro area bounce remains limited after German GDP constricts.

- German Retail Sales, CPI inflation due Wednesday ahead of Fed rate call.

EUR/USD climbed further on Tuesday after staging a near-term comeback from 1.0800 this week, extending a recovery after Euro area Gross Domestic Product (GDP) figures stayed flat instead of declining as markets forecast.

Europe next sees German Retail Sales and Consumer Price Index (CPI) inflation on Wednesday before the US Federal Reserve (Fed) drops their latest Monetary Policy Statement.

Daily digest market movers: EUR/USD climbs on GDP beat, but upside limited by Greenback bids

- EUR/USD is still up 0.4% from the week’s low of 1.0796 but remains capped by 1.0850.

- European GDP stayed flat at 0.0% for the fourth quarter compared to the forecasted -0.1% decline.

- YoY quarterly GDP also beat the street, printing at 0.1% versus the forecast flat print of 0.0%.

- Clouds still persist in Euro area outlook after German QoQ GDP declines -0.3%, in-line with forecasts.

- German YoY Retail Sales due on Wednesday, last came in at -2.4%.

- German CPI inflation for the year ending in January expected to decline to 3.2% from the previous period’s 3.8%.

- US ADP Employment Change due Wednesday before Fed rate call, ADJ jobs expected to shift lower to 145K in January versus the previous 164K.

- Fed is broadly expected to hold rates steady once more on Wednesday, but markets will be looking for a dovish pivot from Fed Chairman Jerome Powell to reignite rate cut hopes.

- Market sees less than 40% chance of a rate cut in March, May sees just 15% chance of rates staying where they are.

Euro price today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the weakest against the Canadian Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.02% | 0.27% | -0.05% | 0.27% | 0.19% | 0.13% | 0.14% | |

| EUR | 0.02% | 0.29% | -0.02% | 0.30% | 0.21% | 0.16% | 0.16% | |

| GBP | -0.28% | -0.29% | -0.33% | -0.01% | -0.09% | -0.15% | -0.14% | |

| CAD | 0.05% | 0.03% | 0.32% | 0.32% | 0.23% | 0.17% | 0.18% | |

| AUD | -0.28% | -0.30% | -0.01% | -0.32% | -0.09% | -0.14% | -0.14% | |

| JPY | -0.20% | -0.21% | 0.09% | -0.25% | 0.04% | -0.05% | -0.06% | |

| NZD | -0.13% | -0.15% | 0.14% | -0.17% | 0.17% | 0.06% | 0.00% | |

| CHF | -0.14% | -0.16% | 0.14% | -0.18% | 0.15% | 0.06% | 0.00% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Technical Analysis: EUR/USD stuck on the low side of 1.0850

Despite a rebound from near-term lows, EUR/USD remains constrained below the 200-hour Simple Moving Average (SMA) moving down into 1.0860. The pair is set to remain bearish as lower highs drag median prices further down the charts.

EUR/USD continues to drift into a technical congestion pattern on the daily candles, with price action hampered by the 200-day SMA near 1.0850 and the 50-day SMA preparing to roll over into a bearish crossover from 1.0900.

EUR/USD hourly chart

EUR/USD daily chart

Euro FAQs

What is the Euro?

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day.

EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

What is the ECB and how does it impact the Euro?

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy.

The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa.

The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

How does inflation data impact the value of the Euro?

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control.

Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

How does economic data influence the value of the Euro?

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency.

A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall.

Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

How does the Trade Balance impact the Euro?

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

- The DXY Index trades with a neutral bias near 103.50.

- Wednesday’s FOMC decision and labor market data will play a pivotal role.

- Low tier data including labor, housing and consumer confidence figures came in mixed.

The US Dollar (USD) Index holds steady near 103.50 on Tuesday, showing a neutral posture after the release of low-tier data. The two-day Federal Reserve (Fed) meeting kicked off on Tuesday and ends on Wednesday with a press conference from Fed Chair Jerome Powell. This makes the markets turn cautious, lending some support to the USD.

Market anticipation regarding the Fed's future decisions are shifting but remain restrained due to robust recent economic data, suggesting that earlier rate cuts are unlikely. The upcoming FOMC decision and jobs data are expected to further steer market sentiment and shape the easing cycle from the Fed.

Daily Digest Market Movers: US Dollar holds its ground as markets digest low tier data ahead of Fed’s decision

- According to the US Bureau of Labor Statistics, JOLTs Job Openings for December came in at 9.026M, slightly above the consensus of 8.75M but below November's 8.925M.

- The Conference Board reported a dip in its Consumer Confidence Index, with a January standing of 114.8 compared to 115 projected and the previous 108.

- The S&P Case-Shiller Home Price for November fell -0.2% MoM against a 0.1% gain in the prior period. On a yearly basis, it had an increase of 5.4%, lower than the expected 5.8% but up from previous 4.9%.

- Market's perspective on the Federal Reserve's next move, as gauged by the CME FedWatch Tool, suggest that investors are confident that the bank won’t change its policy on Wednesday. As for now, markets are seeing the easing cycle starting in May.

Technical Analysis: DXY bulls defend the 200-day SMA, further downside on the horizon if lost

On the daily chart, the Relative Strength Index (RSI) portrays a slight positive slope within positive territory, indicating steady buying momentum. This, in combination with the green bars represented by the Moving Average Convergence Divergence (MACD), furthers bullish sentiment and suggests an underlying upward price trajectory.

Meanwhile, the placement of the index with respect to the Simple Moving Averages (SMAs) provides additional insights. Remaining above the 20-day SMA confirms a short-term bullish bias. The DXY’s position below the 100-day SMA could introduce occasional pullbacks, yet sustaining above the 200-day SMA demonstrates that the buying pressure overweighs the selling momentum on larger time frames.

Support Levels: 103.45 (200-day SMA),103.30, 103.00.

Resistance Levels: 103.90,104.00,104.20.

US Dollar FAQs

What is the US Dollar?

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022.

Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

How do the decisions of the Federal Reserve impact the US Dollar?

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

What is Quantitative Easing and how does it influence the US Dollar?

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

What is Quantitative Tightening and how does it influence the US Dollar?

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

- USD/JPY up 0.20%, driven by higher US Treasury yields and strong US economic indicators.

- US JOLTs data indicates more job openings, reflecting a solid labor market; Consumer Confidence slightly underperforms.

- Anticipation of Fed's decision grows, with rate and balance sheet policies in spotlight, amidst Japan's easing labor market data.

The USD/JPY remains positive in the day, trimming some of its Monday’s losses, sponsored by an uptick in US Treasury yields, which underpinned the Greenback (USD). Data from the United States (US) was solid, though it isn’t expected to move the needle amongst US Federal Reserve’s officials on tomorrow’s decision. At the time of writing, the major exchanges hands at 147.80, up 0.20%.

Strong US JOLTS report and Consumer Confidence, boosts US Dollar

The US Department of Labor revealed the latest Job Opening and Labor Turnover Survey (JOLTs), which showed that job openings are rising, underscoring a strong labor market that powers economic growth. Openings rose 9.02 million, exceeding forecasts of 8.75 million and November’s 8.925 million. The data highlighted the largest increase came in education and health services.

At the same time, the Conference Board (CB) revealed its latest Consumer Confidence pollo, which came at 114.8 in January, from 108 in December, slightly below the consensus of 115.0. Dana Peterson, Chief Economist at the Conference Board, said, “January's increase in consumer confidence likely reflected slower inflation, anticipation of lower interest rates ahead, and generally favorable employment conditions as companies continue to hoard labor.”

Given the data released, the scenario for the US economy for a soft landing has increased, as the economy remains resilient while inflation continues to trend down.

That said, traders’ attention turns to Wednesday's Fed’s monetary policy decision. Most analysts estimate the US central bank would keep rates at 5.25%-5.50% and will eye if policymakers discuss halting the balance sheet reduction. Besides that, market players will be eyeing Chair Jerome Powell's press conference.

In Japan, the unemployment rate fell to 2.4% in December from 2.5%, showing the labor market is cooling, which could prevent the Bank of Japan (BoJ) from ending its negative interest rate cycle. That following last week, Japan’s inflation report dropped below the 2% goal set by the BoJ, and rose by 1.6% YoY, down from 1.9%.

USD/JPY Price Analysis: Technical outlook

the USD/JPY is trading sideways, as the daily chart depicts. Buyers are at the brisk of losing control if the major slips below the Tenkan-Sen level at 147.73. Further downside is seen at the 147.00 figure, ahead of the January 24 cycle low of 146.65. If the pair reclaims 148.00, that could pave the way to challenge the January 19 high at 148.80, ahead of 149.00.

- Canadian Dollar pares back recent gains, but price action remains nearby.

- Canada sees GDP figures on Wednesday, Manufacturing PMI on Thursday.

- US JOLTS beat trims rate cut bets ahead of Wednesday’s FOMC policy statement.

The Canadian Dollar (CAD) shed some points on Tuesday after a moderate data-beat for December’s US JOLTS Job Openings pushed investors back into the US Dollar (USD).

Canada brings November’s Gross Domestic Product (GDP) figures on Wednesday, which will be followed by the Canadian S&P Global Manufacturing Purchasing Managers Index (PMI) data on Thursday.

The broad market focus this week continues to be Wednesday’s US Federal Reserve (Fed) rate call. Friday brings another print for the US Nonfarm Payrolls (NFP).

Daily digest market movers: Canadian Dollar pulls back from near-term highs

- Canadian Dollar is largely mixed on Tuesday but moderately down against Tuesday’s top performers in the US Dollar and the Euro (EUR).

- US JOLTS Job Openings in December came in at 9.026 million versus the expected decline to 8.75 million from November’s 8.925 million (revised from 8.79 million).

- Initial prints in US labor figures continue to see revisions on an ongoing basis, JOLTS has been revised every month since at least October 2013.

- JOLTS data to see further adjustments from March 6 when the Bureau of Labor Statistics (BLS) incorporates annual updates to current employment statistics as seasonal adjustment factors.

- JOLTS print pushes rate cut expectations further down, rate swaps now see 62% chance of no rate cut from the Fed in March, 17% chance of no rate move in April, according to CME’s FedWatch Tool.

- Investors will be looking for a firmer pivot from Fed Chairman Jerome Powell on Wednesday.

- Fed Monetary Policy Statement slated for 19:00 GMT Wednesday, Federal Open Market Committee (FOMC) Press Conference scheduled for 30 minutes later.

- Canadian GDP forecast to tick up slightly from 0.0% to 0.1% in November.

- Friday’s US NFP forecast to slip to 180K in January from December’s 216K.

Canadian Dollar price today

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the weakest against the Euro.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.06% | 0.40% | 0.11% | 0.44% | 0.26% | 0.31% | 0.24% | |

| EUR | 0.06% | 0.46% | 0.18% | 0.51% | 0.32% | 0.37% | 0.30% | |

| GBP | -0.40% | -0.45% | -0.28% | 0.05% | -0.13% | -0.09% | -0.15% | |

| CAD | -0.10% | -0.15% | 0.30% | 0.33% | 0.16% | 0.21% | 0.14% | |

| AUD | -0.43% | -0.49% | -0.03% | -0.32% | -0.18% | -0.12% | -0.18% | |

| JPY | -0.25% | -0.30% | 0.15% | -0.14% | 0.16% | 0.06% | -0.02% | |

| NZD | -0.29% | -0.35% | 0.10% | -0.18% | 0.15% | -0.03% | 0.01% | |

| CHF | -0.24% | -0.30% | 0.15% | -0.12% | 0.21% | 0.03% | 0.06% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

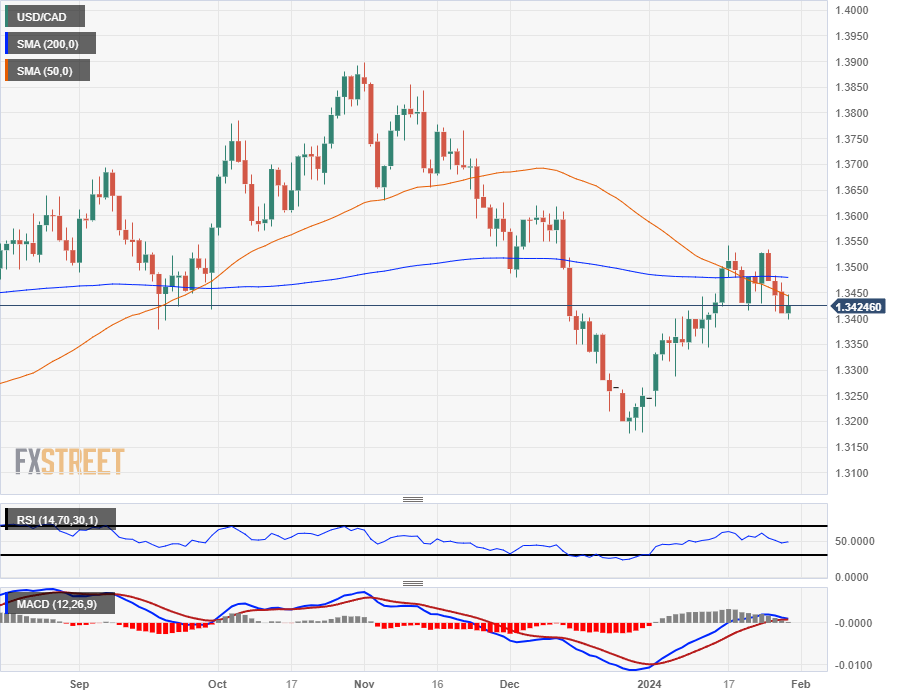

Technical Analysis: Canadian Dollar pulls back from recent highs against US Dollar

The Canadian Dollar (CAD) is moderating on Tuesday, gaining a quarter to a third of a percent against the Pound Sterling (GBP) and the Australian Dollar (AUD), while declining around a sixth of a percent against the US Dollar and the Euro.

The USD/CAD tested into the low side at the 1.3400 handle early Tuesday before a Greenback rally made up for near-term losses as USD/CAD splashes around the familiar 1.3430 level.

USD/CAD continues to drift into the low side as the pair grapples with a bearish crossover of the 50-day and 200-day Simple Moving Averages (SMA), pricing in a near-term technical ceiling near the 1.3500 handle.

A continued drag down will see the USD/CAD crack through 1.3400 to make a fresh run at the last swing low near December’s bottom bid of 1.3177.

USD/CAD hourly chart

USD/CAD daily chart

Canadian Dollar FAQs

What key factors drive the Canadian Dollar?

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

How do the decisions of the Bank of Canada impact the Canadian Dollar?

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

How does the price of Oil impact the Canadian Dollar?

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

How does inflation data impact the value of the Canadian Dollar?

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

How does economic data influence the value of the Canadian Dollar?

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

- The EUR/GBP secured a 0.50% rally to rest at 0.8565.

- The Eurozone’s Q4 GDP data came in better than expected.

- Signs of bearish exhaustion are seen on the daily chart.

On Tuesday's session, the EUR/GBP was witnessed at 0.8565, exhibiting a 0.50% rally. The daily chart reflects a neutral to bullish outlook with bears taking a breather after driving prices to multi-month lows. All eyes are on the Bank of England (BoE) decision on Thursday as monetary policy divergences with the European Central Bank (ECB) are the one who pushed the cross lower in the last sessions.

In Q4 2023, the Eurozone economy measured by the Gross Domestic Product (GDP) stagnated but slightly outperformed market expectations which seemed to have given the EUR a lift. As stated by Eurostat, investment spending slowed, largely due to surged interest rates leading to reduced loan demand. On Wednesday, inflation figures from January are due and may generate further volatility on the pair as it might affect the expectations on the next ECB decisions.

EUR/GBP levels to watch

The daily chart, suggests that the bears ran out of steam. The Relative Strength Index (RSI) shows a positive incline, albeit still within the negative territory, hinting at a decrease in downward momentum. This, coupled with the Moving Average Convergence Divergence (MACD) displaying a reduction of red bars, further strengthens the view that the selling pressure may be lessening. However, the pair's positioning below the 20, 100, and 200-day Simple Moving Averages (SMAs), relays the message that in the grand scheme, bearish momentum remains the dominant force. The recent push to multi-month lows by the bears signifies they are still commanding the market, and that they are currently taking a respite.

Inspecting the shorter four-hour chart, there's a noticeable uptick in buying force. This is evident by the RSI nearing the overbought zone, signifying an increased bullish momentum. The MACD also dovetails with this sentiment as the number of red bars is tapering, suggesting a subsiding in selling forces.

EUR/GBP daily chart

-638422291825942711.png)

Economists at TD Securities like the Mexican Peso (MXN) and expect the USD/MXN pair to move lower.

The USD is overbought and expensive

After the recent correction higher in the USD, it does not look as cheap or oversold. It now looks more balanced versus not just macro drivers but also our positioning indicators. This means that the USD's move higher should run out of steam soon, and risk-reward tilts towards fading the USD strength.

Tactically, we like USD/MXN lower, reflecting a powerful mix of disinflation and good US data, which is a sweet spot for MXN until we have to worry about elections and cuts by Banxico.

- Mexican Peso notches minor gains with USD/MXN trading at 17.23, up 0.03%, as investors assess economic indicators from Mexico.

- Mexican GDP growth falls short of expectations, influenced by Banxico's aggressive interest rate policy now at 11.25%.

- In the US, Consumer Confidence improves and the robust labor market is highlighted by the latest JOLTs report, which could affect Federal Reserve policy.

The Mexican Peso holds minuscule gains versus the US Dollar in early trading during the North American session, sponsored by economic data from Mexico. In the US, the release of the JOLTs reports and Conference Board (CB) Consumer Confidence data could underpin the Greenback (USD), ahead of the US Federal Reserve (Fed) monetary policy decision on Wednesday. The USD/MXN exchanges hands at 17.19, down 0.13%.

Mexico’s economy grew below estimates, revealed the National Statistics Agency (INEGI). Higher interest rates set by the Bank of Mexico (Banxico) at 11.25% is having the desired effect on the economy as the latest GDP data trends lower alongside business activity. Across the border, CB Consumer Confidence improved in January, while the labor market remains hot, according to the JOLTs data.

Daily Digest Market Movers: Mexican Peso barely blinks after GDP figures, awaiting Fed decision

- INEGI revealed that Mexican GDP for Q4 2023 expanded 0.1% QoQ, below forecasts of 0.4% and trailing the 1.1% expansion achieved in the third quarter. For annually based figures, GDP saw its preliminary reading rise by 2.4%, missing forecasts of 3.1% and down from 3.3% in Q3.

- US Job Openings rebounded above the 9 million threshold, the highest level in three months and exceeding estimates of 8.75 million. The data emphasizes the strength of the labor market and might deter Fed officials from cutting rates sooner than expected.

- Further, US data revealed that Consumer Confidence exceeded estimates of 114, coming at 114.8, up from December’s 108. “January's increase in consumer confidence likely reflected slower inflation, anticipation of lower interest rates ahead, and generally favorable employment conditions as companies continue to hoard labor,” said Dana Peterson, Chief Economist at The Conference Board.

- Today’s data shows the Mexican economy remains strong. Coupled with inflation remaining above Banxico’s target, this could delay the first rate cut by Banxico, even though some officials commented that rate trimming could happen in the first quarter of 2024.

- If Banxico’s officials remain determined to begin its easing cycle in Q1 of 2024, that could depreciate the emerging market currency due to the reduction of interest rate differentials. That could also underpin the USD/MXN pair toward the psychological 18.00 figure.

- Additional factors that might depreciate the Mexican currency are geopolitical risks and risk aversion

- Across the border, the US economy remains resilient, as GDP in Q4 of last year crushed forecasts despite easing from Q3’s 4.9%. That could force Fed officials to refrain from easing policy, but the latest inflation data suggests they’re close to getting inflation to its 2% target.

- Nevertheless, mixed readings in other data suggest that risks have become more balanced. That is reflected by investors speculating that the Fed will cut rates by 139 basis points during 2024, according to the Chicago Board of Trade (CBOT) data.

Technical Analysis: Mexican Peso status firm as USD/MXN hovers near 17.20

The USD/MXN trades sideways and is about to form an ascending triangle. The 200-day Simple Moving Average (SMA) at 17.34 is the first resistance level. If buyers conquer that level, the next stop would be the 100-day SMA at 17.41, followed by the December 9 high at 17.56. Last of all sits the May 23 high from last year at 17.99.

On the flipside, although a less likely scenario, the USD/MXN exchange rate could drop below the 50-day SMA at 17.13. A breach of the latter will expose the January 22 low at 17.05, followed by the 17.00 psychological level.

USD/MXN Price Action – Daily Chart

Mexican Peso FAQs

What key factors drive the Mexican Peso?

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

How do decisions of the Banxico impact the Mexican Peso?

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

How does economic data influence the value of the Mexican Peso?

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

How does broader risk sentiment impact the Mexican Peso?

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

The US Federal Reserve (Fed) will announce its Interest Rate Decision on Wednesday, January 31 at 19:00 GMT and as we get closer to the release time, here are the expectations as forecast by analysts and researchers of 10 major banks.

No change in policy is expected as the Fed is set to hold interest rates in the range of 5.25%-5.50% for the fourth consecutive meeting. Chair Jerome Powell’s press conference will be key. Investors will focus on any potential push back on market speculation regarding rate cuts.

Danske Bank

We expect the Fed to maintain its monetary policy unchanged. We expect the first rate cut in March and a total of four cuts in 2024. The Fed is in a comfortable position with regard to both sides of its dual mandate. Cooling inflation warrants cutting rates towards neutral, but solid growth and labour markets allow the Fed to move gradually. The Fed is also starting to look towards fine-tuning the endgame for QT, which we expect to last at least until the end of the year. Overall, we see risks tilted towards slightly higher yields and lower EUR/USD around the meeting.

Commerzbank

The Fed will not change its interest rates, leaving the target corridor for Fed Funds at 5.25%-5.50%. However, the Fed may gradually enter into a discussion about how long and at what pace it wants to continue reducing its balance sheet.

ING

The Fed is widely expected to keep the Fed funds target range unchanged at 5.25%-5.50% while continuing the process of shrinking its balance sheet via quantitative tightening. We think it is only a matter of time before they do indeed cut interest rates, but we think the starting point will be in May. We continue to see some downside risks for growth in the coming quarters relative to the consensus as the legacy of tight monetary policy and credit conditions weigh on activity and Covid-era accrued household savings provide less support. Our forecast is for the Fed funds target range to be cut to 3.75%-4.00% by the end of this year.

TDS

The FOMC is widely expected to keep the Fed funds target range unchanged at 5.25%-5.50%. Contrary to December, we expect Chair Powell to convey a more balanced approach regarding the Fed's next policy steps, with the Committee likely preferring to be patient as it ensures that the move lower in PCE inflation can be sustained at the 2% objective. The Fed is unlikely to signal a timeline for cuts. Given the recent strength in data, the question we get is whether the US is exceptional again like last summer. We think not as a combination of good data and low inflation is still one where the Fed cuts rates to prevent further real tightening. Historic Fed cutting cycles are accompanied by bull steepening and USD weakness.

RBC Economics

The Fed is widely expected to hold the fed funds target range unchanged for a fourth consecutive meeting on Wednesday. Attention will be focused on any hints on the potential timing of a pivot to cuts. Another round of strong GDP data in Q4 showed that the economy is still weathering higher interest rates better than expected. But slowing price growth is leaving the Fed with flexibility to hold the line on interest rates for now – and to respond with lower rates later this year (we expect before mid-year) once the economy starts to soften more significantly.

ABN Amro

We expect the Fed to keep policy on hold. There is no update to the projections at this meeting, leaving markets to focus on Chair Powell’s press conference remarks. We expect the recent tone of commentary to be maintained, with acknowledgement of the continued progress on inflation, but continued vigilance given the recent resilience in activity. There may also be hints at a potentially earlier winddown of QT, as signalled by the December FOMC minutes.

Rabobank

We expect the FOMC to remain on hold, repeat its data dependence and intention to proceed carefully. The focus will be on Powell’s press conference and how much or how little (again) he is going to push back against market expectations of an early rate cut. We continue to pencil in the first rate cut in June. Once started, we expect the Fed to continue with one cut of 25 bps per quarter.

NBF

The FOMC is widely expected to leave the target range for fed funds unchanged at 5.25-5.50% while continuing to run down its balance sheet. Though the topline decision is but a formality, markets will be keenly focused on the Fed’s guidance for the near-term monetary policy path. Those anticipating a March rate cut (fed funds futures are discounting a roughly 50% probability of this) will hope to see the statement scrap the line, ‘in determining the extent of any additional policy firming…’ and opt for something that could tee up a March cut. The former may materialize, but we’re unconvinced that policymakers will be willing to usher in easing at the subsequent meeting. Instead, we’d expect the Fed’s stance to become decidedly neutral. We still expect the first cut to come in June. In addition to the rate path, we’ll be looking for discussions on the future of QT which is growing increasingly topical with investors.

Citi

The Fed is likely to keep policy rates unchanged at this week's FOMC meeting and will likely remove its ‘hiking bias’ from the post-meeting statement. Chair Powell will likely send a similar message to that communicated by Governor Waller a couple of weeks ago in that the Fed is not in a rush to cut and will proceed carefully. This would further reinforce the lower, but still positive, probability for a March cut priced by the market. Fed officials are also likely to discuss the process for slowing and ending balance sheet reduction at this meeting, but not release a final plan. In the OCIS base case, the Fed will likely commence its rate cut cycle in June with a 25 bps cut and may also slow its balance sheet reduction in June and end it by year-end.

ANZ

The January meeting of the FOMC is an important opportunity for it to outline its framework for policy decision making this year. The FOMC is data driven and will review policy meeting-by-meeting. The market will be keenly watching if a March rate cut is discussed. We think Chair Powell will flag if a rate cut is imminent. When the Fed does start to ease, we expect cuts will be gradual. Based on the broad suite of data, the soft core Personal Consumption Expenditure (PCE) deflator readings in Q4 may not prove sustainable. We have the northern summer pencilled in for the start of rate cuts. Ultimately, the pace of the incoming data will determine the timing of the pivot, and it is prudent to be on alert for cuts from spring.

The Australian Bureau of Statistics (ABS) will release the Consumer Price Index (CPI) for December and the fourth quarter (Q4) of 2023 on Wednesday, January 31 at 00:30 GMT and as we get closer to the release time, here are forecasts from economists and researchers of six major banks regarding the upcoming inflation data.

Headline is expected at 3.7% year-on-year in December vs. 4.3% in November. If so, this would be the lowest since December 2021 but still above the Reserve Bank of Australia's (RBA) 2-3% target range. For the fourth quarter, both headline and trimmed mean inflation are expected at 4.3% YoY.

ANZ

We expect headline CPI to print at 0.8% QoQ in Q4, which would see annual inflation slow sharply to a two-year low of 4.3% YoY. Trimmed mean inflation forecast is expected to be a little stronger than the headline measure at 0.9% QoQ and 4.4% YoY. But this would still be the lowest quarterly result since Q3 2021. A result in line with our forecasts would be lower than the RBA’s latest forecasts of 4.5% YoY for both headline and trimmed mean inflation in Q4. This should be enough to stay the RBA’s hand at its February 5-6 meeting. However, we expect non-tradables and services inflation will still be very strong in Q4, with six-month annualised rates of around 6% and 4½% respectively. This suggests that further rate hikes aren’t fully off the table yet, although our base case remains that the cash rate has peaked at 4.35% and that the next move is down (in late 2024). The monthly CPI indicator is forecast to slide to 3.7% YoY in December, which would be a two-year low.

ING

We expect the CPI increase to come in at about 0.8% MoM, which would take the inflation rate all the way down from 4.3% to only 3.5% YoY, within spitting distance of the RBA’s 2-3% target. That’s all very well, but the run rate for Australian monthly CPI is still way too high to take inflation meaningfully lower in the medium term. We will need to see this slow markedly over the first half of the year if rate cut expectations are not to turn sour.

Westpac

Our December quarter CPI forecast is 0.8% QoQ / 4.3% YoY. The Trimmed Mean forecast is 0.9% QoQ / 4.4% YoY. At 4.3% YoY, headline inflation is forecast to come in a bit softer than the RBA forecast of 4.5% YoY. At 4.4% YoY for the Trimmed Mean, our forecast is marginally softer than the RBA’s forecast of 4.5%. Our forecast for inflation is consistent with our current view that the RBA will remain on hold at the February meeting and that the RBA will be reducing the cash rate at the September meeting later this year. For the December Monthly CPI Indicator, we forecast a 3.0% YoY increase which would be a 0.3% increase in the month.

TDS

We expect Dec monthly CPI to continue to decelerate to 3.5% YoY in part aided by base effects and some pullback in recreational prices from lower airfares. Factoring in our Dec f/cs and the Oct/Nov prints, we project Q4 headline CPI at 0.7% QoQ, more dovish than the RBA forecast at 1.0% QoQ, and pins annual inflation at 4.2% YoY. A cap in utilities fees from subsidies and lower transport inflation are likely the main drags to Q4 headline inflation while for trimmed mean, we suspect price pressures may be a tad stickier. We project trimmed mean at 0.8% QoQ, 4.2% YoY, lower than the RBA's f/c of 1.1% QoQ. While the deceleration in inflation is making good progress, we doubt the RBA will be convinced that annual trimmed mean inflation will return to the 2-3% target this year. Upside risks to inflation remain, especially after scheduled tax cuts to commence in Jul'24, possible cost of living relief before the May'24 Budget and no evident improvements in productivity. We have the first RBA cut penciled in for Aug.

SocGen

We forecast a further decrease in monthly headline inflation to 4.0% YoY in December, with the housing and recreation/culture sectors likely to have been the two main drivers of the decline given high base effects. We also expect the 4Q23 data to show a decrease in both year-on-year and quarter-on-quarter inflation. The decline in inflation we anticipate would support our base scenario of no further hikes in the RBA policy rate.

Citi

We reduce our headline Q4 CPI inflation forecast by 0.3pp to 0.7% QoQ with the trimmed mean forecast also reduced marginally by 0.1pp to 0.9% QoQ, while the weighted mean forecast is now 0.8%. Over the year, headline inflation is expected to be 4.2%, while underlying inflation is forecast at 4.3%. Crucially, both these projections are below the RBA’s SMP forecast from November, which had both headline and underlying inflation at 4.5%. If our forecast is correct, and both headline and underlying inflation undershoot the Bank’s SMP projections, then it’s unlikely the RBA will hike in February. However, we keep our call unchanged of one more hike and will readjust the cash rate view following the CPI data.

European Central Bank (ECB) policymaker Gabriel Makhlouf said on Tuesday that the essence of data-dependency suggests that they should remain open-minded about the interest rate path, per Reuters.

"With disinflation well underway, we are confident in sustainably reaching our target of 2%," Makhlouf added.

Market reaction

These comments don't seem to be having a noticeable impact on the Euro's performance against its major rivals. As of writing, the EUR/USD pair was virtually unchanged on the day at 1.0835.

- US CB Consumer Confidence Index continued to rise in January.

- US Dollar Index clings to small daily gains above 103.50.

Consumer sentiment in the US continued to improve in January, with the Conference Board's Consumer Confidence Index rising to its highest level since December 2021 at 114.8 from 108.0 (revised from 110.7) in December.

Further details of the publication showed that the Present Situation Index rose sharply to 161.3 from 147.2 and the Expectations Index advanced to 83.8 from 81.9.

Finally, the one-year consumer inflation rate expectation edged lower to 5.2%, marking the lowest reading since March 2020.

Market reaction

The US Dollar Index edged higher after the data and was last seen gaining 0.1% on the day at 103.60.