- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 29-08-2024

The headline Tokyo Consumer Price Index (CPI) for August rose 2.6% YoY, compared to a 2.2% rise in the previous reading, the Statistics Bureau of Japan showed on Friday. Meanwhile, the Tokyo CPI ex Fresh Food, Energy increased 1.6% YoY, compared to the previous reading of 1.5% rise.

Additionally, Tokyo CPI ex Fresh Food rose 2.4% for the said month and came in above the market consensus of 2.2%.

Market reaction to the Tokyo Consumer Price Index

As of writing, the USD/JPY pair was down 0.01% on the day at 144.98.

Japanese Yen FAQs

The Japanese Yen (JPY) is one of the world’s most traded currencies. Its value is broadly determined by the performance of the Japanese economy, but more specifically by the Bank of Japan’s policy, the differential between Japanese and US bond yields, or risk sentiment among traders, among other factors.

One of the Bank of Japan’s mandates is currency control, so its moves are key for the Yen. The BoJ has directly intervened in currency markets sometimes, generally to lower the value of the Yen, although it refrains from doing it often due to political concerns of its main trading partners. The current BoJ ultra-loose monetary policy, based on massive stimulus to the economy, has caused the Yen to depreciate against its main currency peers. This process has exacerbated more recently due to an increasing policy divergence between the Bank of Japan and other main central banks, which have opted to increase interest rates sharply to fight decades-high levels of inflation.

The BoJ’s stance of sticking to ultra-loose monetary policy has led to a widening policy divergence with other central banks, particularly with the US Federal Reserve. This supports a widening of the differential between the 10-year US and Japanese bonds, which favors the US Dollar against the Japanese Yen.

The Japanese Yen is often seen as a safe-haven investment. This means that in times of market stress, investors are more likely to put their money in the Japanese currency due to its supposed reliability and stability. Turbulent times are likely to strengthen the Yen’s value against other currencies seen as more risky to invest in.

- USD/CAD trades on a stronger note around 1.3490 in Friday’s early Asian session.

- The second estimate of US GDP for Q2 2024 came in better than expected, growing by 3.0% vs. 2.8% prior.

- Higher crude oil prices might support the Loonie and cap the pair’s upside.

The USD/CAD pair trades with mild gains near 1.3490 during the early Asian session on Friday. The stronger-than-expected US economic growth provides some support to the US Dollar (USD). The markets might turn cautious ahead of the key US economic data, which is due later in the day.

Data released by the US Bureau of Economic Analysis (BEA) showed on Thursday that the US Gross Domestic Product Annualized for the second quarter (Q2) grew 3.0% in the second estimate from 2.8% in the initial estimate. This figure came in better than the expectation of 2.8%.

Meanwhile, the weekly Initial Jobless Claims for the week ending August 24 declined from 233K to 231K, below the market consensus of 232K. The US Dollar gains ground above the key 101.00 barrier in immediate reaction to the upbeat US economic data.

Federal Reserve Atlanta President Raphael Bostic, a leading FOMC hawk, said on Thursday that it might be "time to move" on rate cuts as inflation cools down further and the unemployment rate up more than he expected, but he wants to see confirmation from the monthly jobs report and two inflation reports due before the Fed September meeting.

Investors will closely monitor the release of the US Personal Consumption Expenditure (PCE) Price Index for July for some hints about the US interest rate path. A softer-than-expected PCE reading could trigger the Federal Open Market Committee (FOMC) to start a rate-cutting cycle, which acts as a headwind for the Greenback.

On the Loonie front, the rebound of crude oil prices might lift the commodity-linked Canadian Dollar (CAD) as Canada is the leading exporter of oil to the United States. However, economists anticipate the Bank of Canada (BoC) to cut additional interest rates for a third consecutive meeting next week due to persistent economic weakness, rising unemployment, and cooling down inflation. This, in turn, might drag the CAD lower against the USD.

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

- NZD/USD extended its winning streak in Thursday's session, rising to 0.6255.

- The RSI is near overbought territory and suggests selling pressure could emerge.

- Despite a looming correction, the overall outlook is bullish.

The NZD/USD pair extended its winning streak to three consecutive sessions on Thursday, rising to a high of 0.6300 and then stabilizing at 0.6250. As buyers got quickie rejected the buying steam seems to be running out of steam.

The technical indicators present a mixed picture. The Relative Strength Index (RSI) is rising and currently stands at 68 indicating that the pair is near overbought territory and selling pressure could emerge. In addition, the Moving Average Convergence Divergence (MACD) is almost flat, suggesting a weakening buying traction.

NZD/USD daily chart

The key resistance level for the NZD/USD pair lies at 0.6250. A consolidation above this level could lead to a move towards 0.6270 and potentially back towards 0.6300. On the downside, immediate support is seen at the 0.6230- 0.6200 area.

- Bearish technical outlook persists; pair remains below Ichimoku Cloud and 200-DMA, hinting at further declines.

- RSI suggests seller dominance, despite a temporary buyer-led recovery.

- Resistance levels to watch: 145.39 (Tenkan-Sen), 146.00, 146.92 (Senkou Span A), 148.45 (Kijun-Sen).

- Downside break below 144.00 targets 143.44 (August 26 low), with potential to test monthly low at 141.69.

The USD/JPY registered modest gains during the North American session on Thursday of over 0.27%. During the trading day, the pair retreated to a daily low of 144.22 but bounced off and ended the session near the 145.00 figure. At the time of writing, the major trades at 144.97 were virtually flat as Friday’s Asian session began.

USD/JPY Price Forecast: Technical outlook

From a technical perspective, the pair is downward biased despite registering a leg-up. Once the USD/JPY slid below the Ichimoku cloud and the 200-day moving average (DMA), it opened the door to posting a multi-month low of 141.69. Since then, the major enjoyed an uptick but failed to gain traction to clear the 150.00 figure.

The Relative Strength Index (RSI) shows sellers are in charge, although buyers enjoy a short-term leg-up.

If USD/JPY decisively clears 145.00, this could pave the way for further upside. Once it moves up, the first resistance would be the Tenkan-Sen at 145.39, followed by the 146.00 figure. Up next would be the Senkou Span A at 146.92, ahead of testing the Kijun-Sen at 148.45.

Conversely, if sellers push the exchange rate below 144.00, the next support would be the August 26 daily low of 143.44. A breach of the latter will expose the August monthly low of 141.69.

USD/JPY Price Action – Daily Chart

Japanese Yen FAQs

The Japanese Yen (JPY) is one of the world’s most traded currencies. Its value is broadly determined by the performance of the Japanese economy, but more specifically by the Bank of Japan’s policy, the differential between Japanese and US bond yields, or risk sentiment among traders, among other factors.

One of the Bank of Japan’s mandates is currency control, so its moves are key for the Yen. The BoJ has directly intervened in currency markets sometimes, generally to lower the value of the Yen, although it refrains from doing it often due to political concerns of its main trading partners. The current BoJ ultra-loose monetary policy, based on massive stimulus to the economy, has caused the Yen to depreciate against its main currency peers. This process has exacerbated more recently due to an increasing policy divergence between the Bank of Japan and other main central banks, which have opted to increase interest rates sharply to fight decades-high levels of inflation.

The BoJ’s stance of sticking to ultra-loose monetary policy has led to a widening policy divergence with other central banks, particularly with the US Federal Reserve. This supports a widening of the differential between the 10-year US and Japanese bonds, which favors the US Dollar against the Japanese Yen.

The Japanese Yen is often seen as a safe-haven investment. This means that in times of market stress, investors are more likely to put their money in the Japanese currency due to its supposed reliability and stability. Turbulent times are likely to strengthen the Yen’s value against other currencies seen as more risky to invest in.

- Gold prices climb despite upbeat US Q2 GDP revision and drop in unemployment claims.

- Despite rising US Treasury yields (10-year at 3.86%) and DXY up 0.33% to 101.38, Gold's upward trend continues.

- Focus shifts to upcoming core PCE data, expected to slightly increase, potentially impacting Fed decisions.

- CME FedWatch Tool shows 65.5% likelihood of a 25 bps rate cut in September, bolstering Gold prices.

Gold prices rose late in the North American session even though the US economy remains resilient after Gross Domestic Product (GDP) figures propelled the Greenback higher. Despite this, Gold prices continue to grind higher amid expectations of the Fed's first rate cut. The XAU/USD posted gains of 0.78% and exchanged hands at $2,523.

Market sentiment is positive, as traders remain laser-focused on data that could confirm the size of the Federal Reserve’s (Fed) first rate cut. In the meantime, the US Bureau of Economic Analysis revealed the country grew in Q2 2024 above the preliminary release, lifting the Personal Consumption Expenditures Price Index (PCE) Deflator with it.

At the same time, the US Department of Labor revealed that fewer than expected Americans applied for unemployment benefits, which is a relief for the Fed, which acknowledged in Powell’s speech that employment risks are tilted to the upside.

Despite that, the golden metal extended its gains above $2,520 even though the US 10-year Treasury note yield rose two basis points to 3.86%. Meanwhile, the US Dollar Index (DXY), which tracks the buck’s value against a basket of six currencies, climbed 0.33% to 101.38.

Given the backdrop, traders should expect that the non-yielding metal would aim lower, but investors see a 65.5% chance of a 25-basis-point (bps) rate cut at the September meeting, according to the CME FedWatch Tool, which underpins the precious metal.

On Friday, the Fed’s preferred inflation gauge, the core Personal Consumption Expenditures Price Index (PCE) is expected to tick a tenth higher, according to the consensus.

The December 2024 Chicago Board of Trade (CBOT) fed funds future rates contract hints that investors are eyeing 98 basis points of Fed easing this year, up from Monday’s 97.

Daily digest market movers: Gold price advances as traders brace for US Core PCE data

- If US economic data continues to be weak, the Gold price uptrend is likely to persist, fueling speculation about a larger rate cut by the Fed.

- The second estimate of US GDP for Q2 2024 showed a significant increase from 1.4% in Q1 to 3%, surpassing estimates of 2.8%. The Personal Consumption Price Expenditures (PCE) Deflator indicated that inflation dipped from 3.1% to 2.5% QoQ, slightly higher than the anticipated 2.3%.

- Initial Jobless Claims for the week ending August 24 decreased from 233K to 231K, slightly below the estimate of 232K.

- Next week, the US economic docket will feature the August Nonfarm Payrolls report, which could be crucial to assess the size of the Fed’s first rate cut at the September meeting.

Technical outlook: Gold price uptrend extends, traders eye $2,550

Gold price uptrend remains in place on Thursday. As price action pushes above $2,520, buyers remain hopeful that XAU/USD could climb past the all-time high (ATH) at 2,531. Momentum suggests buyers are in charge as the Relative Strength Index (RSI) portrays. Given that backdrop, Bullion’s path of least resistance is tilted to the upside.

If XAU/USD clears the ATH, the next resistance would be the $2,550 mark. A breach of the latter will expose $2,600.

Conversely, if XAU/USD slumps beneath $2,500, the first support would be the July 17 peak at $2,483. O; once cleared, the next support would be the $2,450 psychological mark, followed by the 50-day Simple Moving Average (SMA) at $2,414.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

- Rising commodity prices are benefiting the Aussie.

- Weak Australia Q2 capex survey weighs on AUD and may limit its gains.

- Technicals suggest further AUD/USD upside is possible.

The AUD/USD rose by 0.30% to 0.6810 in Thursday's session. The Aussie has been supported by rising commodity prices, particularly iron ore, which is Australia's largest export. However, a weak Q2 capex survey and continued weakness in non-mining business investment might weigh on the currency. Despite these headwinds, technicals suggest that further AUD/USD upside is possible.

Amidst the ambiguous Australian economic outlook and the central bank's firm stance against high inflation, financial markets anticipate a modest easing of interest rates by only 0.25% in 2024.

Daily digest market movers: Australian Dollar gains despite weak investment data

- Business investment in Australia contracted for the second consecutive quarter in Q2, underscoring the challenges facing the domestic economy.

- Non-mining business spending recorded its first quarterly decline in three years, reflecting lower capex on building structures, plants and equipment.

- Weak capex survey adds to the view that the Reserve Bank of Australia (RBA) will likely cut interest rates by year-end as the central bank seeks to stimulate growth.

- On the positive side, monetary policy divergence might favor the AUD over its major counterparts.

AUD/USD technical outlook: Bullish momentum steady, buyers must secure 0.6800

Indicators are smiling on the pair. The Moving Average Convergence Divergence (MACD) is printing green bars, indicating that further gains are possible. The Relative Strength Index (RSI) also backs this up as it remains deep in positive terrain with some room before the overbought threshold.

The pair is facing resistance at 0.6800 and 0.6830, while support can be expected at 0.6790 and 0.6770.

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

- The Canadian Dollar halted a midweek pullback but still struggling to find gains.

- Canada is set to release its latest GDP figures on Friday.

- Canadian data prints are likely to be overshadowed by a fresh round of US PCE inflation.

The Canadian Dollar (CAD) tested higher ground against the Greenback on Thursday, looking to put a stop to the midweek’s pullback. However progress remains limited as jittery markets keep one foot in the US Dollar as key US inflation data due on Friday could set the tone for the Federal Reserve’s (Fed) upcoming rate decision in September.

Canada is slated to print its latest round of Gross Domestic Product (GDP) figures on Friday, but a double-header of high impact US Personal Consumption Expenditure Price Index (PCE) inflation due at the same time will likely swamp out CAD flows as investors lean into bets that cooling inflation will keep the Fed on pace to deliver a first rate cut on September 18.

Daily digest market movers

- US GDP figures on Thursday showed the US economy grew slightly faster than expected, printing 3.0% in Q2 on an annualized basis.

- Markets broadly anticipated a steady print at 2.8%, in-line with the previous figure.

- Canadian Q2 GDP due on Friday is forecast to tick down to 1.6% from 1.7%, with the MoM figure in June easing to 0.1% from 0.2%.

- The big data print for the week is Friday’s US PCE inflation. Core US PCE for the year ended in July is expected to print at 2.7%, slightly higher than the previous period’s 2.6%.

- An upside swing in inflation data could crimp broad-market hopes for an extended rate cut from the Fed on September 18.

Canadian Dollar price forecast

With the Canadian Dollar (CAD) dumping out of an extended technical correction against the US Dollar, CAD bidders may be looking to chalk in some more gains against the Greenback as markets continue to tilt in a USD-negative stance. USD/CAD continues to churn just south of the 1.3500 handle in the near-term, and the pair has dropped well below the 200-day Exponential Moving Average (EMA) near 1.3625.

USD/CAD daily chart

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

- Atlanta Fed President Bostic is cautious about rate cuts and prefers to see more data before easing.

- Revised GDP growth of 3% in Q2 highlights the resilience of the US economy.

- Jobless claims came in better than expected.

The US Dollar, measured by the US Dollar Index (DXY), saw further gains above 101.00 on Thursday. The 10-year US yield holds above 3.8%, supporting the Greenback. US stock index futures trade mixed following Nvidia earnings, which could impact risk appetite and the US Dollar's demand as a safe-haven currency. On the data front, Gross Domestic Product (GDP) revisions highlight US economic resilience.

The US economy remains robust, exceeding expectations. However, market sentiment appears overly optimistic, with expectations of aggressive monetary easing.

Daily digest market movers: US Dollar extends gains after GDP revisions

- Atlanta Fed President Raphael Bostic, a leading FOMC hawk, expressed caution about imminent rate cuts, citing robust labor market conditions and elevated inflation.

- About 100 bps of easing is anticipated by year-end and 200 basis points over the following year.

- The odds of a 50-basis-point cut in September remain within the 30-35% range.

- Contrary to expectations, the Bureau of Economic Analysis revised Q2 annualized real GDP growth upwards to 3% from 2.8%.

- New unemployment insurance claims in the US declined slightly to 231K for the week ending August 23, marginally below market estimates.

DXY technical outlook: Index indicates potential recovery, resistance at 101.50

Indicators suggest a potential recovery for the DXY, with the Relative Strength Index (RSI) trending upward and the Moving Average Convergence Divergence (MACD) indicator printing lower red bars.

A consolidation above the 101.00 support level could trigger a rally. Key supports include 100.50, 100.30 and 100.00, while resistances are located at 101.50, 101.80 and 102.00.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

- The Dow Jones rose 450 points on Thursday as sentiment recovered.

- US GDP figures bolstered investor confidence after printing above expectations.

- US PCE inflation numbers still loom ahead on Friday.

The Dow Jones Industrial Average (DJIA) rose 1.1%, or 450 points, on Thursday, buoyed by a forecast beat in US Gross Domestic Product (GDP) growth numbers in Q2. US Personal Consumption Expenditure Price Index (PCE) inflation data, due on Friday, is still the key print of the week. Markets remain confident that the Federal Reserve (Fed) is on pace to kick off a rate-cutting cycle in September.

US Q2 GDP beat forecasts Thursday morning, propping up market sentiment and sending investors back into a bidding stance. Annualized Q2 GDP came in at 3.0% compared to the expected hold at 2.8%, and Initial Jobless Claims also ticked down to 231K for the week ended August 23. Investors had expected a print of 232K compared to the previous week’s revised 233K.

US core PCE inflation on Friday is expected to hold steady MoM and drift slightly higher on an annualized basis. July’s MoM core PCE inflation is forecast to hold at 0.2%, while the YoY figure for July is expected to tick up to 2.7% from the previous 2.6%. A below-expectations print will send markets piling back into hopes for an extended initial cut from the Fed on September 18, while an above-forecast release could send traders scurrying in the face of a potential resurgence in inflation, hobbling the Fed just before a widely-expected cut.

Dow Jones news

A risk-on Thursday has most of the Dow Jones index trading into the green in the back half of the trading week. Only one of the Dow’s listed securities are in the red for the day, with Home Depot (HD) shedding around one-fifth of one percent to trade below $370.00 per share.

Nvidia’s (NVDA) after-hours earnings call this week failed to jump-start tech-keen investors. Nvidia reported less-than-expected growth in earnings, with an overall uptick in profit failing to meet sky-high expectations set by runaway investors.

Dow Jones price forecast

The Dow Jones is back over 41,300 on Thursday after a brief midweek dip below the 41,000 handle. The index took a breather on Wednesday, but it has tilted back into the bullish side as daily candles continue to test chart paper near record highs set at the beginning of the trading week.

Traders hoping to capitalize on a bearish pullback run the risk of underestimating bullish market pressure, but risk-takers will be looking for signs of a technical breakdown to jump on the short train. Immediate technical targets are floating near the 50-day Exponential Moving Average (EMA) just above the 40,000 major price handle.

Dow Jones daily chart

Dow Jones FAQs

The Dow Jones Industrial Average, one of the oldest stock market indices in the world, is compiled of the 30 most traded stocks in the US. The index is price-weighted rather than weighted by capitalization. It is calculated by summing the prices of the constituent stocks and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, who also founded the Wall Street Journal. In later years it has been criticized for not being broadly representative enough because it only tracks 30 conglomerates, unlike broader indices such as the S&P 500.

Many different factors drive the Dow Jones Industrial Average (DJIA). The aggregate performance of the component companies revealed in quarterly company earnings reports is the main one. US and global macroeconomic data also contributes as it impacts on investor sentiment. The level of interest rates, set by the Federal Reserve (Fed), also influences the DJIA as it affects the cost of credit, on which many corporations are heavily reliant. Therefore, inflation can be a major driver as well as other metrics which impact the Fed decisions.

Dow Theory is a method for identifying the primary trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA) and only follow trends where both are moving in the same direction. Volume is a confirmatory criteria. The theory uses elements of peak and trough analysis. Dow’s theory posits three trend phases: accumulation, when smart money starts buying or selling; public participation, when the wider public joins in; and distribution, when the smart money exits.

There are a number of ways to trade the DJIA. One is to use ETFs which allow investors to trade the DJIA as a single security, rather than having to buy shares in all 30 constituent companies. A leading example is the SPDR Dow Jones Industrial Average ETF (DIA). DJIA futures contracts enable traders to speculate on the future value of the index and Options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Mutual funds enable investors to buy a share of a diversified portfolio of DJIA stocks thus providing exposure to the overall index.

The Greenback extended its march north, helped by higher yields and firmer-than-expected results from GDP figures and weekly data of the labour market, all ahead of the publication of key PCE readings on Friday.

Here is what you need to know on Friday, August 30:

The US Dollar Index (DXY) remained firm and extended its breakout of the key 101.00 barrier amidst rising US yields across the board. The release of inflation figures tracked by the PCE takes centre stage on August 30, seconded by Personal Income, Personal Spending, the Chicago PMI, and the final Michigan Consumer Sentiment print.

EUR/USD suffered the Dollar’s rebound and broke below the 1.1100 support to reach multi-day lows. On August 30, Retail Sales are due in Germany, along with the labour market report. In the broader Euroland, the advanced Inflation Rate is expected, followed by the Unemployment Rate and the speech by the ECB’s af Jochnick.

GBP/USD bounced off weekly lows and managed to trim some losses and retreat just marginally on Thursday. Mortgage Approvals and Mortgage Lending will be published on August 30.

USD/JPY rose for the second day in a row, reaching multi-day highs near 145.50 on the back of the strong dollar and higher yields. Busy calendar in Japan on August 30 will release the Unemployment Rate, along with the Jobs/Applications Ratio and Tokyo inflation data. In addition, preliminary Industrial Production is also due, seconded by Retail Sales and Housing Starts.

AUD/USD resumed its robust rally and surpassed once again the key 0.6800 barrier, hitting new tops in levels not traded since early in the year. Housing Credit figures, and Retail Sales are coming on August 30.

Supply concerns stemming from Libya, as well as positive US data releases, lent legs to crude oil prices and lifted WTI to the vicinity of the $77.00 mark per barrel.

Prices of Gold traded in a cautious albeit positive tone near their recent all-time highs beyond the $2,500 mark per ounce troy despite the firm greenback and rising yields. Silver prices partially recouped ground lost in the previous day and approached the $29.70 zone.

Following the Bank of Mexico (Banxico) release of its Q2 2024 Quarterly Report, analysts of local and foreign banks estimated the central bank would not pause lowering rates for the remainder of the year.

Economists at Banorte expect a 25-basis-point (bps) rate cut in September and estimate that interest rates will end at 10.25%.

Citibanamex expects a quarter of percentage rate cuts in September, November, and December, with Banxico’s reference rate hitting 10.00%. It cites that the beginning of the Federal Reserve's easing cycle would ease pressures on the Mexican Peso, giving the Mexican central bank a green light to lower borrowing costs.

In Monex, they expect the bank’s reference rate to end the year at 10.25%, expecting cuts in September. The November and December meetings are live.

Goldman Sachs anticipates rate cuts of 25 bps each in the three remaining meetings of the year, bringing the interest rate down to 10.00% by year’s end.

Banxico FAQs

The Bank of Mexico, also known as Banxico, is the country’s central bank. Its mission is to preserve the value of Mexico’s currency, the Mexican Peso (MXN), and to set the monetary policy. To this end, its main objective is to maintain low and stable inflation within target levels – at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%.

The main tool of the Banxico to guide monetary policy is by setting interest rates. When inflation is above target, the bank will attempt to tame it by raising rates, making it more expensive for households and businesses to borrow money and thus cooling the economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN. The rate differential with the USD, or how the Banxico is expected to set interest rates compared with the US Federal Reserve (Fed), is a key factor.

Banxico meets eight times a year, and its monetary policy is greatly influenced by decisions of the US Federal Reserve (Fed). Therefore, the central bank’s decision-making committee usually gathers a week after the Fed. In doing so, Banxico reacts and sometimes anticipates monetary policy measures set by the Federal Reserve. For example, after the Covid-19 pandemic, before the Fed raised rates, Banxico did it first in an attempt to diminish the chances of a substantial depreciation of the Mexican Peso (MXN) and to prevent capital outflows that could destabilize the country.

- Mexican Peso declines as Banxico cuts 2024, 2025 GDP forecast.

- Political unrest over judiciary reform and dismantling of autonomous bodies further pressures the Peso.

- Banxico sees inflation reaching 3% target by late 2025, with growth risks skewed downward due to slowing US economy.

The Mexican Peso depreciated against the Greenback on Thursday, with the latter extending its gains for the second straight day on robust US data. Meanwhile, the emerging market currency dropped after the Bank of Mexico (Banxico) revised Mexico’s growth expectations to the downside for the rest of 2024, according to its quarterly report. The USD/MXN trades at 19.77 and gains over 0.70%.

Mexico’s political turmoil continues to dampen the prospects of the Mexican currency. President-elect Claudia Sheinbaum reassured foreign investors that their investments are secure, even though she approves the judiciary reform and the bill for the dissolution of autonomous bodies pushed by President Andres Manuel Lopez Obrador.

In addition, Banxico downwardly revised the Gross Domestic Product (GDP) for 2024 from 2.4% to 1.5% and from 1.5% to 1.2% for 2025 after revealing its Q2 2024 quarterly revision.

In the report, policymakers mentioned that “national economic activity is going through a period of market weakness and uncertainty.” They revisited inflation expectations higher and expect it to hit the bank’s 3% goal toward the end of 2025.

Furthermore, they added that risks to growth are tilted to the downside, adding that an economic deceleration in the US economy weighs on Mexico’s economic outlook.

Banxico Governor Victoria Rodriguez Ceja warned that adjustments to the main reference rates would be gradual only when macroeconomic conditions allowed them.

Across the border, the US Bureau of Economic Analysis (BEA) upwardly revised the second estimate for Gross Domestic Product (GDP). At the same time, the US Department of Labor revealed that the number of Americans filing for unemployment benefits dipped.

Daily digest market movers: Mexican Peso collapses as AMLO pauses relations with US-Canada ambassadors

- Mexican President Andres Manuel Lopez Obrador's decision to pause relations with the US and Canadian ambassadors this wee will continue to weigh on the Mexican Peso.

- Comments from US Ambassador Ken Salazar, expressed on August 22, were the reason behind AMLO’s decision. Salazar said that the judiciary reform threatens the rule of law and added that “the direct election of judges represents a major risk to the functioning of Mexico’s democracy. Any judicial reform must have safeguards that guarantee that the judiciary is strengthened and not subject to the corruption of politics.”

- US GDP for Q2 2024 saw a second estimate that jumped from 1.4% in Q1 to 3%, exceeding estimates of 2.8%. The Personal Consumption Price Expenditures (PCE) Deflator hinted that inflation dipped from 3.1% to 2.5% QoQ, slightly higher than the 2.3% foreseen.

- Initial Jobless Claims for the week ending August 24 dipped from 233K to 231K, below estimates of 232K.

- Traders will eye Fed speakers and the Fed’s preferred inflation gauge, the core Personal Consumption Expenditures Price Index (PCE), which arrives on Friday.

- Data from the Chicago Board of Trade (CBOT) suggests the Fed will cut at least 98 basis points (bps), according to the fed funds rate futures contract for December 2024.

Technical outlook: Mexican Peso slumps as USD/MXN hits two-week high at 19.95

The USD/MXN is at the risk of decisively clearing the 20.00 hurdle. From a technical standpoint, the uptrend remains intact as the Peso, although it has achieved some positive days, continues to register more significant losses.

The Relative Strength Index (RSI) suggests that buyers are in charge. The RSI is still bullish but not in overbought territory.

Therefore, the path of least resistance is to the upside. The USD/MXN first resistance would be 20.00. A breach of that level will expose the year-to-date (YTD) high at 20.22, followed by the September 28, 2022, daily high at 20.57. If those two levels are surrendered, the next stop would be the August 2, 2022, swing high at 20.82, ahead of 21.00.

Conversely, if USD/MXN tumbles below 19.50, this would expose the 19.00 figure. Further losses lie beneath that level, opening the door to test the August 19 low of 18.59, followed by the 50-day Simple Moving Average (SMA) at 18.48.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

- EUR/GBP bears pushed the cross near 0.8410 on Thursday.

- Indicators remain aligned with the bearish trend.

- Daily RSI is marching towards oversold terrain.

The EUR/GBP pair extended its losses on Thursday, declining by 0.20% to 0.84010. However, the pair remains above the 0.8400 mark, which is a key support level but selling pressure is increasing.

The Relative Strength Index (RSI) is currently at 35 and it is decreasing. This indicates that there is growing selling pressure. The Moving Average Convergence Divergence (MACD) is printing red bars, which also suggests that the bearish momentum is increasing.

Overall, the technical outlook for the EUR/GBP pair remains negative. The pair is likely to continue to decline in the near term, and if the bears breach the 0.8400 area the next support is seen at 0.8380. However, if the pair can hold above the 0.8400 level, the bearish traction might lose steam and with the RSI near 30, there are chances of an upward correction.

EUR/GBP daily chart

Aluminum prices are struggling to rally further following last week's signs of CTA buying exhaustion, Senior Commodity Strategist Daniel Ghali note.

Demand sentiment starts to decline again

“Under the hood, demand sentiment embedded within the cross-section of commodities prices has started to decline once again, following a brief recovery off the lows marked by the recent turmoil in August.”

“Supply risk premia has been an insulating force for Aluminum and certainly supported the recovery in prices, reflecting risks to European smelter output associated with higher energy prices. But our gauge of supply risk premia also points to the first signs of notable pressure since Ukraine's incursion in Russia.”

“While CTA flows are likely to remain muted over the next week barring a large downtape in prices, continued pressure from demand sentiment or easing supply risk premia could eventually catalyze renewed selling activity in a big downtape. Barring this catalyst, however, the balance of risks suggests LME3m prices may remain pinned to $2500/t in the near-term.”

Algo buying activity in palladium is now likely to hit the tapes, Senior Commodity Strategist Daniel Ghali notes.

Discretionary shorts are vulnerable

“Prices still need to break north of $1000/oz to catalyze the next large-scale buying program, but considering the massive net short position held by discretionary traders, we estimate substantial scope for subsequent buying in the current set-up. In fact, there are already signs that discretionary shorts are under pressure, in stark contrast to previous set-ups where this cohort held a large margin of safety in the form of paper profits to withstand an attempted squeeze.”

“This time around, recent swings in their positions have completely eroded their margin of safety. We estimate the aggregate entry price for discretionary shorts since May 2023 at only $1010/oz, but more recent shorts are worse-off. For those entering since May 2024, we calculate a weighted-average entry price of $940/oz. For those engaging in the latest round of short-acquisitions since July — only $915/oz.”

“Discretionary shorts are not only vulnerable, but are now underwater. This set-up could lead to explosive price action, given the critically low stockpile in CME vaults relative to the open interest in paper markets.”

- GBP/USD momentum favors sellers, possibly targeting the July 17 high of 1.3043.

- Further declines could test 1.3043; next major support at March 8 high of 1.2893.

- For an upside reversal, buyers need to breach 1.3200, aiming for two-year high at 1.3266, then 1.3293 and 1.3437.

The GBP/USD extended its losses to two straight days and cleared the 1.3200 figure on the downside, as bears woke up after August’s 400-pip rally, crushed their expectations for lower prices. Despite the lack of UK economic data, the docket remains busy across the pond, with goodish data bolstering the Greenback. Therefore, the pair trades at 1.3151, down 0.30%.

GBP/USD Price Forecast: Technical outlook

The GBP/USD daily chart hints that in the short-term, the pair could aim and test the latest cycle high witnessed on July 17, at 1.3043. Momentum has shifted in sellers' favor as the Relative Strength Index (RSI) peaked at overbought territory. However, it has finally retraced below the 70 level, spurring the major’s two-day pullback to current exchange rates.

Although sellers are in charge, they must clear the 1.3100 figure and the psychological 1.3050 support before testing lower waters. If those two levels are taken out, the GBP/USD could aim for 1.3043, and on further weakness, the March 8 daily high emerges as the next demand zone at 1.2893.

On the other hand, if buyers want to counterattack, they must breach the 1.3200 figure. This will immediately expose the two-year high at 1.3266. A breach of the latter, and buyers could challenge the March 23, 2022, daily high at 1.3293 ahead of the March 1, 2022, swing high at 1.3437.

GBP/USD Price Action – Daily Chart

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Swiss Franc.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.44% | 0.25% | 0.54% | -0.02% | -0.13% | -0.21% | 0.75% | |

| EUR | -0.44% | -0.19% | 0.11% | -0.48% | -0.58% | -0.65% | 0.31% | |

| GBP | -0.25% | 0.19% | 0.31% | -0.28% | -0.39% | -0.46% | 0.53% | |

| JPY | -0.54% | -0.11% | -0.31% | -0.56% | -0.68% | -0.78% | 0.23% | |

| CAD | 0.02% | 0.48% | 0.28% | 0.56% | -0.10% | -0.18% | 0.82% | |

| AUD | 0.13% | 0.58% | 0.39% | 0.68% | 0.10% | -0.05% | 0.95% | |

| NZD | 0.21% | 0.65% | 0.46% | 0.78% | 0.18% | 0.05% | 0.99% | |

| CHF | -0.75% | -0.31% | -0.53% | -0.23% | -0.82% | -0.95% | -0.99% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Quiet markets have resulted in substantial price impacts from the recent whipsaws in Commodity Trading Advisor (CTA) positioning, Senior Commodity Strategist Daniel Ghali notes.

Prices are staging a recovery

“Massive algo buying activity at the turn of the week morphed into large-scale selling activity. Prices are staging a recovery this morning, but under the hood, the combination of likely CTA selling, a renewed slump in energy supply risk premia and deteriorating commodity demand sentiment still point to lower prices.”

“CTAs could sell up to -12% of their max size as they completely liquidate recent longs and build a net short.”

Commodity Trading Advisors (CTAs) are now set to buy Platinum in most scenarios for prices over the coming week, marking yet another whipsaw in trend follower positioning, Senior Commodity Strategist Daniel Ghali notes.

Little scope for additional outflows from speculators

“While we expect some algo selling activity this session, there is little scope for additional outflows from speculators with signs of a short covering trend from discretionary traders, who have built a modest net short position over the last few weeks.”

“Selling exhaustion from CTA trend followers may well be setting the stage for local lows to form.”

- USD/CAD licks its wounds as the US Dollar extends its upside.

- The upbeat second estimate of the US Q2 GDP boosted the US Dollar’s recovery.

- Investors await the US PCE inflation for July and Canada’s Q2 GDP data.

The USD/CAD pair recovers its entire intraday losses and attempts to reclaim the psychological resistance of 1.3500 in Thursday’s North American session. The Loonie asset bounces back strongly as the US Dollar (USD) extends its upside after the United States (US) Bureau of Economic Analysis (BEA) reported that the pace at which the economy grew in the second quarter was higher than it initially appeared.

The agency reported that the economy grew at a robust pace of 3% on an annualized basis against the preliminary estimates of 2.3%. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, climbs to near 101.50.

Meanwhile, major action in the US Dollar will be driven by the US Personal Consumption Expenditure Price Index (PCE) data for July, which will be published on Friday. The PCE report is expected to show that year-on-year core inflation rose at a faster pace of 2.7% from 2.6% in June, with monthly figures growing steadily by 0.2%. The inflation data would significantly influence market speculation for the Federal Reserve’s (Fed) September monetary policy.

Currently, financial markets seem to be confident that the Fed will start reducing interest rates in September. However, traders remain split over the potential size by which the Fed will pivot to policy-normalization.

In the neighboring nation, upbeat Oil prices continue to keep the Canadian Dollar’s (CAD) broader appeal upbeat. The Oil price bounces back strongly amid escalation in Middle East tensions. It is worth noting that Canada is the largest exporter of Oil to the US, and higher oil prices increase Greenback flows into Canada, strengthening the Canadian Dollar.

On the economic front, investors await the monthly and Q2 GDP data, which will be published on Friday. The Canadian economy is estimated to have barely grown in June. Annualized Q2 GDP is projected to have risen at a slower pace of 1.6% from the prior release of 1.7%.

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

The Pound Sterling (GBP) is little changed on the session, Scotiabank’s Chief FX Strategist Shaun Osborne notes.

Break below 1.3160 to signal a further drop

“Overnight price trends suggest the slide in the EUR dragged the GBP down in sympathy to some degree although EUR/GBP retains a better offered tone as the cross nears 0.84 and a potential retest of the July low at 0.8380 (lowest since August 2022).”

“Short-term trends in the GBP have turned flat after yesterday’s drop in Cable. Spot trends are holding a neutral pattern at the moment but loss of support at 1.3160 will signal potential for losses to extend a little more (towards 1.3050/60) in the coming days.”

Mexico's planned judicial reform continues to cause considerable volatility for the Peso. Earlier in the week the reform completed its first step through the parliamentary process, with a parliamentary committee approving the reform. At the same time, the US and Canadian ambassadors expressed their concerns about the reform. The response was quite harsh: relations with the ambassadors were 'suspended' for the time being. Neither of these developments did the Peso much good, Commerzbank’s FX analyst Michael Pfister notes.

Peso to benefit from reassuring statements in the short term

“Attempts were made yesterday to put the situation back on track. The outgoing Mexican president, Andrés Manuel López Obrador (AMLO), insisted that the suspension only concerned relations with the respective embassies and did not affect relations with the respective governments. At the same time, there were rumors that the president-elect, Claudia Sheinbaum, had asked that the judicial reform not be pushed through the parliamentary process in this way.”

“This would be a positive development, as it would indicate that policymakers are at least aware of the concerns of many market participants. The Peso could benefit somewhat as a result.We do not want to repeat here why we think the planned reform is problematic for the Peso. But we would still be cautious about taking such rumors at face value. Last week, Sheinbaum sought to allay market concerns about the reform.”

“And even before that, her statements tended to indicate that she too would like to see the reform through the parliamentary process as soon as possible. With this in mind, we could well see the Peso benefiting from reassuring statements in the short term, but we continue to see little upside potential for Mexico's currency in the medium term.”

- EUR/AUD is falling steeply after inflation data from Germany and Spain came in lower than expected.

- The cooler inflation data increases the chances of the ECB cutting interest rates in September.

- The RBA continues to hold back from cutting interest rates because of stubbornly high inflation in Australia.

EUR/AUD is down by almost three quarters of a percent on Thursday, trading in the 1.6270s, after the release of German and Spanish inflation data revised the outlook for interest rates in the Eurozone as a whole, weakening the Euro (EUR) in the process.

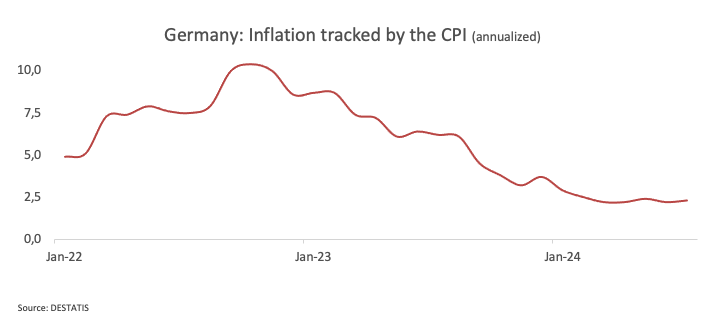

German preliminary Consumer Price Index (CPI) data fell to 1.9% YoY in August from 2.3% in July, and came in below economists expectations of 2.1%, according to data from Destatis.

The sharper-than-expected decline in German CPI followed similar data from Spain which showed Spanish CPI in the month of August falling to 2.2% from 2.8% in July, and also coming in well below estimates of 2.4%, according to INE. Data for the region as a whole is scheduled for release on Friday.

The disinflationary number has increased expectations that the European Central Bank (ECB) will lower interest rates by 0.25% at their September meeting. Such a move would weaken the Euro as lower interest rates attract less inflows of foreign capital.

At the last ECB meeting, the President of the ECB Christine Lagarde adopted a “wait and see approach” and said future interest rate decisions would be dependent on incoming data. Given the incoming data has been more disinflationary than expected, the market is pricing in a greater chance of the ECB moving to lower rates.

“With the growth outlook quite soggy, the ECB is widely expected to resume easing in September. 75 bp of total easing by year-end is nearly priced in,” says Dr. Win Thin, Global Head of Markets Strategy at Brown Brothers Harriman (BBH).

Commentary from ECB officials has fallen short of endorsing a rate cut so far.

ECB Executive Board Member Philip Lane, said on Thursday, that although wages in the Eurozone were expected to rise in the second half of 2024 they were “peaking now” and likely to lose momentum in 2024-5.

Earlier in the day, the Governor of the Central Bank of Cyprus, Christodoulos Patsalides said that if the ECB’s projections “continue to materialize, there’s nothing to prevent the Governing Council from reducing interest rates”, adding that “Policymaking is still data-dependent.”

EUR/AUD is falling because inflation in Australia is higher than in Europe. Australia’s monthly CPI rose 3.5% YoY in July, and although down from the 3.8% in June it came in above estimates 3.4%, and remains well above the levels for the Eurozone as a whole (2.6% in July).

Policymakers in Australia are less certain the time is right to reduce interest rates with the Minutes of the Reserve Bank of Australia’s last meeting revealing that members considered raising interest rates to tame inflation before ultimately deciding to hold steady.

RBA Governor Michelle Bullock also said recently that it was still “premature” to consider cutting rates. She warned that inflation remains “too high” and is not expected to return to the central bank’s 2%-3% target until the end of next year.

- US GDP growth for the second quarter got revised higher to 3%.

- US Dollar Index stays in positive territory above 101.00.

The US Bureau of Economic Analysis (BEA) announced on Thursday that it revised the annualized real Gross Domestic Product (GDP) growth for the second quarter to 3% from 2.8% in the initial estimate. Markets were expecting the BEA to confirm the GDP growth at 2.8%.

"Compared to the first quarter, the acceleration in real GDP in the second quarter primarily reflected an upturn in private inventory investment and an acceleration in consumer spending," the BEA noted its press release and explained that the update in the second estimate primarily reflected an upward revision to consumer spending.

Market reaction

The US Dollar preserves its strength after this report. At the time of press, the US Dollar Index was up 0.3% on the day at 101.35.

- Initial Jobless Claims rose by 231K vs. the previous week.

- Continuing Jobless Claims increased by 1.868M in the week ending August 17.

US citizens that applied for unemployment insurance benefits increased by 231K in the week ending August 24, according to the US Department of Labor (DoL) on Thursday. The prints came in a tad below initial consensus (232K) and were slightly lower than the previous weekly gain of 233K (revised from 232K).

Further details of the publication revealed that the advance seasonally adjusted insured unemployment rate was 1.2% and the 4-week moving average was 231.5K, a decrease of 4.750K from the previous week's revised average.

In addition, Continuing Claims increased by 13K to 1.868M in the week ended August 17.

Market reaction

The US Dollar Index (DXY) extends its daily recovery and surpasses the key 101.00 barrier, in the context of the mixed note in US yields across the curve.

The CAD has picked up a little ground in overnight trade, supported by a firmer risk backdrop and the USD’s overall drift, Scotiabank’s Chief FX Strategist Shaun Osborne notes.

Narrower spreads support gains.

“The compression in US/Canada yield spreads remains a key driver of broader CAD gains. The 2Y spread has eased to just under 60bps as US yield edge lower, the narrowest yield gap since May. Spread compression plus the general weakness in the USD is very likely driving CAD shortcovering demand. Spot continues to trade a little below our estimated fair value (1.3537 today).”

“The divergence is not significant but may constrain the CAD’s ability to extend gains significantly for now. Decent gains in the USD yesterday failed to deliver a definitive signal that USDCAD’s August slide was steadying. The shortterm downtrend remains intact and trend oscillators remain bearishly aligned for the USD across the intraday, daily and weekly DMIs.”

“It will take a lot more than Wednesday’s rally to lift the USD technically. Minor resistance is 1.3475 and 1.3490/00, with firmer resistance (potential bull trigger) distant at 1.3620. Intraday losses below 1.3440 may see USD losses resume towards 1.3350.”

Weak August regional CPI readings from Germany alerted markets to the risk that the national data (8.00ET) will undershoot expectations (unchanged M/M and 2.1% Y/Y, down from 2.3% in July), Scotiabank’s Chief FX Strategist Shaun Osborne notes.

Weak German regional CPI data disapoints

“Soft data weighed on Eurozone short rates (compressing EZ/US 2Y spreads somewhat) and drove the EUR back through the 1.11 area before spot steadied.”

“The softer EUR tone evident this week this week has edged spot below short-term support (August rally bull trend) at 1.1100 today.”

“EUR losses are not showing signs of picking up below the figure at this point but the soft undertone could extend back to the mid-1.10s unless the EUR can regain 1.11+ in fairly quick order.”

- Silver corrects back more deeply than was expected.

- The market is balanced, the correction is questioning the dominant uptrend.

- RSI is diverging bearishly suggesting potential underlying weakness.

Silver (XAG/USD) has corrected back after posting higher highs of $30.19 on August 26. During the pull back, the pair broke below key support at $29.23 (August 2 high) and this brought the short-term uptrend into doubt.

That said, given the price overall continues posting higher highs and higher lows the trend is probably still, on balance, probably still bullish – if weaker than it was.

Silver 4-hour Chart

A break above the August high at $30.19 would confirm more upside and the continuation of the bull trend, with the next target coming into view at $30.61 the July 18 swing high.

A break below the August 22 swing low at $28.79, however, would indicate a break in the sequence of rising peaks and troughs. This could indicate a reversal in the short-term uptrend and more downside on the horizon.

The Relative Strength Index (RSI) momentum indicator is diverging bearishly with price when comparing the August 22 and August 28 lows. Although the price did not make a lower low on the 28th, the RSI did, suggesting underlying weakness in the price.

The trend on the medium and longer-term charts is unclear – possibly sideways – indicating little directional bias from higher time frames.

The JPY held on to earlier gains, with USD/JPY consolidating around mid-144, DBS FX & Credit Strategist Chang Wei Liang notes.

BOJ to continue normalizing monetary policy

“Markets will watch Tokyo CPI tomorrow closely, as BOJ Governor Ueda had expressed that further rate hikes could come if the Japanese economy moves in line with forecasts. Meanwhile, equity risks and tensions around the Middle East could keep the JPY supported on safe haven bids.”

“On the political front, former Foreign and Defense Minister Kono Taro announced his plans to run in the Sep 27 LDP leadership election, and stated that it is appropriate for the BOJ to continue normalizing monetary policy as long as inflation remains in line with the Bank’s expectations. He also said it is time to discuss how to balance the budget as interest rates rise.”

The USD is trading lower against the majority of its major currency peers so far today but the DXY is registering a small gain on the session, reflecting the underperforming EUR, which has slipped 0.2% to give the index a modest boost, Scotiabank’s Chief FX Strategist Shaun Osborne notes.

DXY gains on EUR weakness

“Weaker stocks and perhaps month-end flows helped the USD bid tone yesterday but the overall USD tone remains soft and minor gains so far this week in the DXY are barely challenging the downtrend that has developed over the past few weeks. Stocks look in better shape today, however, and there is not much talk or evidence of month-end USD demand. The USD is likely to retain a soft undertone while markets continue to price in the risk of aggressive Fed rate cuts over the balance of the year.”

“Next Friday’s Non-Farm Payrolls data will go a long way in shaping rate cut expectations. The second update of US Q2 GDP is released at 8.30ET (expected unchanged at 2.8%). Weekly claims data and July Wholesale Inventories are out at the same time. July Pending Home Sales are out at 10ET while Bostic (FOMC voter) speaks on the Fed’s economic outlook at 15.30ET. Bostic commented yesterday that he wanted to see more data confirming the need to cut rates in September.”

- The US Dollar trades on the back foot, weakening against most major peers, as traders focus on key US data.

- Markets cramped on Wednesday on the back of a miss in estimates for Nvidia earnings, benefiting the Dollar.

- The US Dollar Index popped above 101.00, but is unable to hold this level.

The US Dollar (USD) trades broadly unchanged on Thursday, easing somewhat against most of its peers, failing to extend Wednesday’s gains. The USD faces two days of a busy US economic calendar, with some data having the potential to be market-moving. Expect to see volatile moves unfolding as markets constantly flip-flop between bets of a 25-basis-point or a 50-basis-point interest-rate cut in September, depending on how incoming economic data plays out. Federal Reserve (Fed) Jerome Powell didn’t commit to any rate-cut size or forward guidance in his speech at Jackson Hole, so markets will have plenty of variables to speculate with.

On the US economic calendar front, a rough patch in terms of volatility will be offered this Thursday. Besides the weekly Jobless Claims, the second reading of the US Gross Domestic Product (GDP) will be released for the second quarter. The Personal Consumption Expenditure (PCE) number under that GDP umbrella will get a lot of attention ahead of the monthly PCE numbers on Friday.

Daily digest market movers: Hold on tight

- Inflation data from both Germany and Spain showed an intensifying disinflation trend, with even some German provinces posting price declines on a monthly basis. This triggered a sharp move lower for the Euro (EUR) against the US Dollar (USD), erasing nearly all gains booked last week.

- At 12:30 GMT, a chunky batch of data will be released:

- Weekly Jobless Claims for the week ending August 23:

- Initial Claims are expected to hold steady at 232,000.

- Continuing Claims were previously at 1.863 million.

- US Gross Domestic Product for the second quarter will see its second estimate, with economists not expecting any significant revisions:

- Headline GDP is expected to have grown at an annualised rate of 2.8% as previously estimated.

- The headline Personal Consumption Expenditure (PCE) Prices component is expected to come in at 2.6%, unchanged from the first reading. The Core PCE isn’t expected to be revised either from the 2.9% previously reported.

- The GDP Price Index component was at 2.3% in the first reading, with no forecast available for the second reading.

- Wholesale Inventories for July should grow by 0.2%, the same increase as in June. The Goods Trade Balance, meanwhile, is expected to widen slightly to $97.5 billion from $97.4 billion.

- Weekly Jobless Claims for the week ending August 23:

- At 14:00 GMT, Pending Home Sales for July will come in. Expectations are for sales to increase by 0.4%, down from the 4.8% rise seen a month earlier.

- Around 19:30, comments are expected from Federal Reserve Bank of Atlanta President Raphael Bostic, who delivers a presentation and participates in a Q&A about the Federal Reserve and the US economic outlook to Georgia Tech's Scheller College of Business Management of Financial Institutions class.

- Equities are trading flat in Asia, looking for directions after markets branded the Nvidia earnings report as a miss. European and US equities are trading flat to minor losses.

- The CME Fedwatch Tool shows a 65.5% chance of a 25 basis points (bps) interest rate cut by the Fed in September against a 34.5% chance for a 50 bps cut. Another 25 bps cut (if September is a 25 bps cut) is expected in November by 44.2%, while there is a 44.6% chance that rates will be 75 bps (25 bps + 50 bps) below the current levels and an 11.2% probability of rates being 100 (25 bps + 75 bps) basis points lower.

- The US 10-year benchmark rate trades at 3.84%, not that far off its peak for this week near 3.87%.

US Dollar Index Technical Analysis: You get what you give

The US Dollar Index (DXY) could enter a rough volatile patch in the coming 48 hours with a bulk load of data making its way to markets. That the DXY is set to make some whipsaw moves is due to the Fed not committing to the size of its initial rate cut and also not clarifying if this is the start of a rate cutting cycle or could still end in a one-and-done cut. Markets were euphoric last week, and clearly have tuned down that cheerful mood with the DXY becoming the barometer on how markets foresee the next steps of the Fed.

For a recovery, the DXY faces a long road ahead. First, 101.90 is the level to reclaim. A steep 2% uprising would be needed to get the index to 103.18. A very heavy resistance level near 104.00 not only holds a pivotal technical value, but it also bears the 200-day Simple Moving Average (SMA) as the second heavyweight to cap price action.

On the downside, 100.62 (the low from December 28) tries to hold support, although it looks rather feeble. Should it break, the low from July 14, 2023, at 99.58 will be the ultimate level to look out for. Once that level gives way, early levels from 2023 are coming in near 97.73.

US Dollar Index: Daily Chart

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.