- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 29-07-2020

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 01:00 | New Zealand | ANZ Business Confidence | July | -34.4 | |

| 01:30 | Australia | Export Price Index, q/q | Quarter II | 2.7% | |

| 01:30 | Australia | Import Price Index, q/q | Quarter II | -1% | |

| 01:30 | Australia | Building Permits, m/m | June | -16.4% | 1.5% |

| 06:00 | United Kingdom | Nationwide house price index, y/y | July | -0.1% | -0.3% |

| 06:00 | United Kingdom | Nationwide house price index | July | -1.4% | -0.1% |

| 07:00 | Switzerland | KOF Leading Indicator | July | 59.4 | 75 |

| 07:55 | Germany | Unemployment Change | July | 69 | 43 |

| 07:55 | Germany | Unemployment Rate s.a. | July | 6.4% | 6.5% |

| 08:00 | Eurozone | ECB Economic Bulletin | |||

| 08:00 | Germany | GDP (YoY) | Quarter II | -2.3% | -11.3% |

| 08:00 | Germany | GDP (QoQ) | Quarter II | -2.2% | -9% |

| 09:00 | Eurozone | Industrial confidence | July | -21.7 | -17 |

| 09:00 | Eurozone | Consumer Confidence | July | -14.7 | -15 |

| 09:00 | Eurozone | Economic sentiment index | July | 75.7 | 81 |

| 09:00 | Eurozone | Unemployment Rate | June | 7.4% | 7.7% |

| 12:00 | Germany | CPI, m/m | July | 0.6% | -0.2% |

| 12:00 | Germany | CPI, y/y | July | 0.9% | 0.2% |

| 12:30 | U.S. | Continuing Jobless Claims | July | 16197 | 16200 |

| 12:30 | U.S. | PCE price index, q/q | Quarter II | 1.3% | |

| 12:30 | U.S. | Initial Jobless Claims | July | 1416 | 1450 |

| 12:30 | U.S. | GDP, q/q | Quarter II | -5% | -34.1% |

| 23:30 | Japan | Unemployment Rate | June | 2.9% | 3.1% |

| 23:50 | Japan | Industrial Production (MoM) | June | -8.9% | 1.2% |

| 23:50 | Japan | Industrial Production (YoY) | June | -26.3% |

FXStreet notes that gold extended its record-breaking rally with futures touching $2,000/oz for the first time in history while silver hit $26/oz on Tuesday. Economists at TD Securities expect gold and silver to consolidate their gains at levels around $1,880/oz and $22/oz before resuming the uptrend.

“Before gold moves above $2,000/oz and silver into new highs, it is quite likely these metals consolidate their gains at levels around $1,880/oz and $22/oz first. After settling at lower price levels, however, a normalizing global economy, sub-potential growth for a prolonged period and the fraying of global supply chains in the aftermath of the coronavirus crisis likely means that policy rates could well continue to be set below the rate of inflation with yield suppression also being a feature of monetary policy, which should eventually see the resumption of the downward trend in real rates into even deeper negative territory.

“Gold prices could test well above TD Securities' Q4-2021 projected average price of $2,000/oz, with silver also surging to new cyclical records. Monetization pressures as fiscal deficits surge in the US and across the world, should increasingly see investors choose the yellow and white metal as safe-havens.”

The U.S. Energy

Information Administration (EIA) revealed on Wednesday that crude inventories tumbled

by 10.612 million barrels in the week ended July 24. Economists had forecast a gain

of 0.357 million barrels.

At the same

time, gasoline stocks increased by 0.654 million barrels, while analysts had

expected a decline of 0.733 million barrels. Distillate stocks rose by 0.503 million

barrels, while analysts had forecast a decrease of 0.267 million barrels.

Meanwhile, oil

production in the U.S. remained unchanged at 11.100 million barrels a day.

U.S. crude oil

imports averaged 5.1 million barrels per day last week, decreased by 0.8

million barrels per day from the previous week.

The National

Association of Realtors (NAR) announced on Wednesday its seasonally adjusted

pending home sales index (PHSI) climbed 16.6 percent m-o-m to 116.1 in June,

after an unrevised 44.3 percent m-o-m jump in May.

Economists had

expected pending home sales to jump 15.0 percent m-o-m in June.

On y-o-y basis,

the index rose 6.3 percent after a 5.1 percent decline in May.

According to

the report, all regional indices recorded m-o-m gains in May. The Northeast

PHSI climbed 54.4 percent m-o-m to 95.4 in June, but was still down 0.9 percent

from a year ago. In the Midwest, the index surged 12.2 percent m-o-m to 110.9

last month, up 5.1 percent from June 2019. Pending home sales in the South

jumped 11.9 percent m-o-m to an index of 140.3 in June, up 10.3 percent from

June 2019. The index in the West grew 11.6 percent m-o-m in June to 99.6, up

4.7 percent from a year ago.

“It is quite

surprising and remarkable that, in the midst of a global pandemic, contract

activity for home purchases is higher compared to one year ago,” noted Lawrence

Yun, NAR’s chief economist. “Consumers are taking advantage of record-low

mortgage rates resulting from the Federal Reserve’s maximum liquidity monetary

policy.”

FXStreet notes that Mexican assets have continued to perform well over the last month despite concerns about growth and the spread of the COVID-19 pandemic throughout the country. USD/MXN has lost the 22.00 level and though a dip to 21.50 is not out of the cards, Luis Hurtado from CIBC Capital Markets expects short USD/MXN opportunities to dissipate into the fourth quarter and forecast the pair trading at 22 by year-end.

“The disconnect between the growth picture and the performance of the peso is evident, with two factors supporting it since the start of May. First, the high correlation of the MXN to global equities, and implicitly, global central bank liquidity, combined with vaccine hopes have provided a positive backdrop to the MXN. Second, Banxico’s cautious easing cycle, reinforced by recent upside surprises in inflation, has also provided relief as central banks in the region swiftly cut rates to historical lows due to the pandemic.”

“Although we do not discount USD/MXN revisiting 21.5, we expect short USD/MXN opportunities to dissipate as we move into Q4. First, we expect volatility to pick up as we approach the US election cycle, a scenario difficult to escape given the peso’s high correlation to US equities. Second, we expect the market to favour countries emerging from recession in better fiscal shape. Budget discussions and announcements during the second half of Q3 should also add to the increase in volatility as investors assess the possibility of further downgrades.”

U.S. stock-index futures rose on Wednesday, as investors hoped the Federal Reserve to signal it remains supportive of the economy as the country struggles in its fight against the COVID-19 pandemic.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 22,397.11 | -260.27 | -1.15% |

Hang Seng | 24,883.14 | +110.38 | +0.45% |

Shanghai | 3,294.55 | +66.59 | +2.06% |

S&P/ASX | 6,006.40 | -14.10 | -0.23% |

FTSE | 6,149.04 | +19.78 | +0.32% |

CAC | 4,967.25 | +38.31 | +0.78% |

DAX | 12,841.38 | +6.10 | +0.05% |

Crude oil | $41.28 | +0.58% | |

Gold | $1,953.30 | +0.45% |

(company / ticker / price / change ($/%) / volume)

ALCOA INC. | AA | 13.13 | 0.22(1.70%) | 5133 |

ALTRIA GROUP INC. | MO | 42.75 | 0.23(0.54%) | 6048 |

Amazon.com Inc., NASDAQ | AMZN | 3,035.50 | 35.17(1.17%) | 41918 |

American Express Co | AXP | 94.7 | 0.28(0.30%) | 832 |

AMERICAN INTERNATIONAL GROUP | AIG | 31 | 0.05(0.16%) | 543 |

Apple Inc. | AAPL | 375.5 | 2.49(0.67%) | 159330 |

AT&T Inc | T | 29.75 | 0.06(0.20%) | 31868 |

Boeing Co | BA | 171.36 | 0.52(0.30%) | 612232 |

Caterpillar Inc | CAT | 139.03 | 1.00(0.72%) | 694 |

Chevron Corp | CVX | 89.82 | 0.71(0.80%) | 2037 |

Cisco Systems Inc | CSCO | 46.55 | 0.27(0.58%) | 8244 |

Citigroup Inc., NYSE | C | 51.35 | 0.08(0.16%) | 19007 |

E. I. du Pont de Nemours and Co | DD | 54.32 | 0.30(0.56%) | 217 |

Exxon Mobil Corp | XOM | 43.77 | 0.22(0.51%) | 13794 |

Facebook, Inc. | FB | 231.12 | 1.00(0.43%) | 66774 |

FedEx Corporation, NYSE | FDX | 168.43 | 1.50(0.90%) | 137 |

Ford Motor Co. | F | 7.07 | 0.06(0.86%) | 242871 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 13.36 | 0.13(0.98%) | 22275 |

General Electric Co | GE | 6.99 | 0.10(1.45%) | 1760773 |

General Motors Company, NYSE | GM | 27.41 | 1.08(4.10%) | 382668 |

Goldman Sachs | GS | 202.1 | 0.48(0.24%) | 776 |

Google Inc. | GOOG | 1,511.31 | 10.97(0.73%) | 1121 |

Hewlett-Packard Co. | HPQ | 16.88 | 0.18(1.08%) | 4458 |

Home Depot Inc | HD | 265.8 | 0.52(0.20%) | 8936 |

HONEYWELL INTERNATIONAL INC. | HON | 153 | 0.99(0.65%) | 861 |

Intel Corp | INTC | 49.42 | 0.18(0.37%) | 305771 |

International Business Machines Co... | IBM | 124.95 | 0.48(0.39%) | 4754 |

Johnson & Johnson | JNJ | 147.25 | 0.42(0.29%) | 17343 |

JPMorgan Chase and Co | JPM | 97.5 | 0.18(0.19%) | 8150 |

McDonald's Corp | MCD | 196.5 | 0.26(0.13%) | 18367 |

Merck & Co Inc | MRK | 79.63 | -0.06(-0.08%) | 38048 |

Microsoft Corp | MSFT | 202.81 | 0.79(0.39%) | 112754 |

Nike | NKE | 96.5 | 0.23(0.24%) | 4164 |

Pfizer Inc | PFE | 39.4 | 0.38(0.97%) | 212691 |

Procter & Gamble Co | PG | 128.01 | 0.13(0.10%) | 4437 |

Starbucks Corporation, NASDAQ | SBUX | 78.48 | 3.84(5.14%) | 102945 |

Tesla Motors, Inc., NASDAQ | TSLA | 1,501.62 | 25.13(1.70%) | 98177 |

The Coca-Cola Co | KO | 48.28 | 0.10(0.21%) | 2901 |

Twitter, Inc., NYSE | TWTR | 36.99 | 0.38(1.04%) | 12645 |

UnitedHealth Group Inc | UNH | 300.42 | 0.49(0.16%) | 8770 |

Verizon Communications Inc | VZ | 57.47 | -0.01(-0.02%) | 1309 |

Visa | V | 193.7 | -3.04(-1.55%) | 27962 |

Wal-Mart Stores Inc | WMT | 132.36 | 0.60(0.46%) | 1927 |

Walt Disney Co | DIS | 116.2 | 0.02(0.02%) | 9592 |

Yandex N.V., NASDAQ | YNDX | 57.75 | 0.75(1.32%) | 22544 |

FXStreet notes that the loonie received a lift alongside other majors versus the greenback in the past month helped by firmer crude prices but the CAD has underperformed others like the euro and the rally is now running on empty. Katherine Judge and Avery Shenfeld from CIBC Capital Markets see USD/CAD ending the third quarter at 1.37.

“The strength in CAD appears set to reverse in short order as relatively weak fundamentals are revealed and the global economic recovery stalls, giving a safe haven bid to the USD. We see USD/CAD ending the third quarter at 1.37.”

“Upwards momentum in commodity prices seems poised to fade as the recovery in the US slows and second waves of the virus in other major regions challenge demand for Canada’s resource sector.”

“Canadian exporters outside of the energy sector were already struggling with an uncompetitive exchange rate heading into this crisis, something that worked to amplify the current account and trade deficits, and clearly requires a weaker loonie."

“Canadian households entered into this crisis in a weak position with elevated levels of debt, leaving population growth as the main driver behind consumption. Canada’s recovery is expected to be protracted relative to the US as a result, another ingredient for C$ weakness through the next year.”

Apple (AAPL) target raised to $340 from $295 at Credit Suisse

Raytheon Technologies (RTX) downgraded to Hold from Buy at Argus

FXStreet notes that the S&P 500 maintains a bearish “reversal day” and the index shows potential to form a small “head and shoulders” top if the market can close below 3198, which would reinforce the Credit Suisse analyst team bias for a short term phase of risk-off.

“A small bearish ‘outside day’ yesterday increases the risk to see the construction of a ‘right-hand shoulder’ to a small potential ‘head and shoulders’ top, with the market also still maintaining a bearish ‘reversal day’ from late last week and with the Nasdaq 100 also seen at risk of a ‘double top’ following its own bearish ‘reversal day’.”

“Key near-term support stay seen at its 13-day average at 3215, with a break below 3200/3198 still needed to confirm the aforementioned top. This would then open the door to a swing lower within the broader sideways range with support seen next at 3173, ahead of 3154 and then more importantly 3116.”

“Resistance is seen at 3233 initially, with a move above 3244/48 needed to ease the topping threat and see a move back to 3266. Above 3279/81 though is needed to reassert an upward bias again, with the top of the February gap seen at 3328/38.”

Boeing (BA) reported Q2 FY 2020 loss of $4.79 per share (versus -$5.82 per share in Q2 FY 2019), much worse than analysts’ consensus estimate of -$2.63 per share.

The company’s quarterly revenues amounted to $11.807 bln (-25.0% y/y), missing analysts’ consensus estimate of $12.946 bln.

BA rose to $173.30 (+1.44%) in pre-market trading.

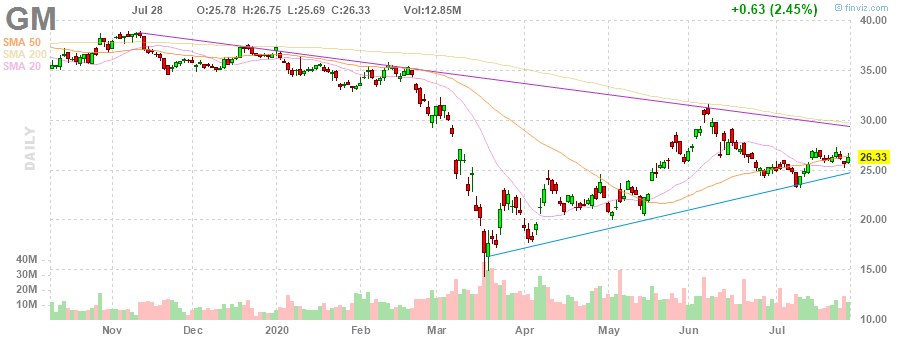

General Motors (GM) reported Q2 FY 2020 loss of $0.50 per share (versus earnings of $1.64 per share in Q2 FY 2019), better than analysts’ consensus estimate of -$1.76 per share.

The company’s quarterly revenues amounted to $16.800 bln (-53.4% y/y), generally in line with analysts’ consensus estimate of $16.927 bln.

GM rose to $27.35 (+3.87%) in pre-market trading.

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 08:00 | Switzerland | Credit Suisse ZEW Survey (Expectations) | July | 48.7 | 42.4 | |

| 08:30 | United Kingdom | Consumer credit, mln | June | -4.542 | -2 | -0.086 |

| 08:30 | United Kingdom | Mortgage Approvals | June | 9.27 | 33.9 | 40 |

| 08:30 | United Kingdom | Net Lending to Individuals, bln | June | -3.3 | 1.8 |

USD fell against most other major currencies in the European session on Wednesday as a spike in COVID-19 cases in the U.S. dashed hopes for quick economic recovery, while congressional lawmakers remained apart on the next COVID-19 stimulus legislation.

Six U.S. states reported one-day records for coronavirus-related deaths on Tuesday and nationwide cases stayed high, adding to concerns that the resurgence of coronavirus infections could trigger the reimposition of restrictions in the weeks ahead. Overall, deaths in the country increased to 149,260, the most in the world, according to the Johns Hopkins Center for Systems Science and Engineering. The U.S. has 4,352,304 cases of COVID-19, also the most in the world.

In addition, market participants are awaiting the outcomes of the meeting of the Federal Reserve (due at 18:00 GMT). The central bank is not expected to make any major changes to its monetary policy stance and markets expect the Fed to signal it remains supportive of the economy as the country struggles in its fight against the COVID-19 pandemic. At its June meeting, the Fed left its interest rates unchanged and said it expects to hold the target range for the federal funds rate at the current level at least through 2022 or until the economy “had weathered recent events.”

USD/JPY seen lower at 102.00 in next two months - Scotiabank

FXStreet reports that in the view of the analysts at Scotiabank, the yen is likely to strengthen further, which could see USD/JPY falling as low as 102.00 in the coming months.

“The yen to show strength amid favorable real yield differentials, diverging growth outlook in the US compared to the rest of world, positive technical and seasonality, August has been the second-best month for the Japanese currency since 1994).”

"We think the charts point to a USD decline to 104 at least and suggest a potential for the decline to reach 102 in the next 1-2 months."

"This would approximate to the low point of the "dollar smile" framework (where the USD under-performs amid improving prospects ex-USA, risk assets are supported, and liquidity tensions are absent."

The Mortgage

Bankers Association (MBA) reported on Wednesday the mortgage application volume

in the U.S. fell 0.8 percent in the week ended July 24, following a 4.1 percent

climb in the previous week.

According to

the report, applications to purchase a home dropped 1.5 percent, while refinance

applications decreased 0.4 percent.

Meanwhile, the

average fixed 30-year mortgage rate remained unchanged at 3.20 percent.

“This trend,

along with the fact that average loan sizes are increasing, indicate that

prospective first-time buyers are being impacted more by the rising economic

stress caused by the resurgence in Covid-19 cases, as well as the uncertainty

on how the next round of government support will take shape,” noted Mike

Fratantoni, chief economist for the MBA.

FXStreet notes that the cable nears the highest levels since March 11 as trades around the 1.2930 level. Notwithstanding, Jeremy Stretch from CIBC Capital Markets expects the pound to be on the defensive amidst weak macro backdrop. The analyst just sees sterling recovering when a Brexit deal is reached near to the deadline.

“A near-14% advance in headline monthly retail sales volumes has helped drive the annual rate back into positive territory for the first time since February. We’ve also seen an aggressive rebound in flash July PMI, with services sentiment registering the highest outturn since July 2015. Of course, the data is distorted by coming from such a low base. But looking ahead, we see some headwinds against this trend continuing. A rising tide of job losses as government support is progressively withdrawn risks an economic disappointment and sterling remaining on the defensive.”

“While we do not expect the BoE to sanction negative rates, the fact that 3m Libor has traded below the base rate since early July shows that investors remain wary of rate cuts ahead.”

“The countdown to Brexit at year-end continues and an agreement remains far from certain. Although one of the red lines, regarding the role of the European Court of Justice, seems to have been clarified, fishing rights and level playing field criteria remain unresolved. Expect the discussions to stretch into Q4. Only when right up against the deadline can we expect a deal and the sterling relief it will provide.”

General Electric (GE) reported Q2 FY 2020 loss of $0.15 per share (versus earnings of $0.17 per share in Q2 FY 2019), worse than analysts’ consensus estimate of -$0.09 per share.

The company’s quarterly revenues amounted to $17.750 bln (-38.4% y/y), beating analysts’ consensus estimate of $17.269 bln.

GE rose to $7.02 (+1.89%) in pre-market trading.

Visa (V) reported Q2 FY 2020 earnings of $1.07 per share (versus $1.37 per share in Q2 FY 2019), beating analysts’ consensus estimate of $1.04 per share.

The company’s quarterly revenues amounted to $4.837 bln (-18.6% y/y), generally in line with analysts’ consensus estimate of $4.847 bln.

V fell to $194.00 (-1.39%) in pre-market trading.

NFXStreet notes that Kiwi was trading flat this morning after drifting off yesterday high above 0.67, with gold and other assets also taking a breather. Nonetheless, despite daily volatility, the NZD/USD pair is set to continue rising due to US issues such as the spread of coronavirus in the American country or the dovish Fed stance expectations, economists at ANZ Bank reports.

“Daily volatility aside, the USD remains unloved and with a very dovish tone likely to emerge from the FOMC meeting, it’s difficult to see that changing.”

“The Fed’s monetary policy framework review isn’t due till later, but most expect the Fed to target higher inflation, which means easier policy for longer, and further USD debasement.”

“A lack of success in containing the virus and fiscal disagreement isn’t helping the USD; meanwhile New Zealand is open for business, albeit with deep scars. The easier road is the high road, even if it’s mostly a USD story.”

“Support 0.6450 Resistance 0.6755.”

Starbucks (SBUX) reported Q3 FY 2020 loss of $0.46 per share (versus earnings of $0.78 per share in Q3 FY 2019), better than analysts’ consensus estimate of -$0.57 per share.

The company’s quarterly revenues amounted to $4.222 bln (-38.1% y/y), beating analysts’ consensus estimate of $4.138 bln.

The company issued in-line guidance for Q4 FY 2020, projecting EPS of $0.18-0.33 versus analysts’ consensus estimate of $0.27 and its prior guidance of $0.15-0.40.

It also issued upside guidance for FY 2020, projecting EPS of $0.83-0.98 versus analysts’ consensus estimate of $0.77 and its prior guidance of $0.55-0.95.

SBUX rose to $78.80 (+5.57%) in pre-market trading.

FXStreet reports that FX Strategists at UOB Group see the possibility that USD/JPY could slip back to the 104.80 area in the next weeks.

24-hour view: “USD traded between 104.94 and 105.68 yesterday. The price action was not unexpected as we highlighted that ‘after two straight days of back-to-back sharp decline, the weakness in USD appears to be overstretched’ and that USD ‘is more likely to consolidate and trade between 105.00 and 105.80’. Conditions remain oversold but USD appears to have enough momentum to grind lower towards 104.80. The next support at 104.40 is unlikely to come into the picture. Resistance is at 105.30 followed by 105.50.”

Next 1-3 weeks: “USD dropped by -0.71% yesterday (closed at 105.37) and downward momentum has improved further. We continue to hold a negative view and as highlighted yesterday (27 Jul, spot at 105.90), ‘the next level to focus on is at 105.00’. In view of the strong downward momentum, a break of 105.00 would not be surprising. That said, shorter-term conditions are oversold and the next support at 104.40 is unlikely to come into the picture so soon. All in, USD has to move above 106.30 (‘strong resistance’ level was at 106.80 yesterday) in order to indicate the current weakness has stabilized.”

Advanced Micro (AMD) reported Q2 FY 2020 earnings of $0.18 per share (versus $0.08 per share in Q2 FY 2019), beating analysts’ consensus estimate of $0.17 per share.

The company’s quarterly revenues amounted to $1.930 bln (+26.1% y/y), beating analysts’ consensus estimate of $1.856 bln.

The company also issued upside guidance for Q3 and FY 2020. It sees Q3 revenues of $2.55 bln, +/- $100 mln, equating to revenues of $2.45-$2.65 bln versus analysts’ consensus estimate of $2.3 bln. For FY 2020, it predicts revenues growth of 32%, equating to revenues of ~$8.88 bln versus analysts’ consensus estimate of $8.39 bln.

AMD rose to $75.57 (+11.77%) in pre-market trading.

FXStreet reports that economists at CIBC Capital Markets continue to expect the Swiss National Bank (SNB) to maintain a vigilant stance regarding the franc, as the central bank believes the currency is highly valued. With a floor settled around the 1.06 mark, the EUR/CHF is forecast to end the year trading at 1.09.

“We continue to expect the SNB to maintain a vigilant stance regarding the currency, through rapid expansion in the central bank’s balance sheet, despite the scale of the balance sheet remaining a potential concern.”

“The SNB continues to view the currency as ‘highly valued’. Indeed, according to OECD estimates, the CHF is the most overvalued major vs the EUR, suggesting that SNB intervention will persist as their primary option, rather than conventional or unconventional policy.”

“We continue to view the SNB as intent upon putting a floor under EUR/CHF, at around 1.06, in order to limit disinflationary tendencies and sustain exporter competitiveness.”

“With the Swiss economy closely aligned with Germany and the eurozone as a whole, and the German economy expected to get a boost from the aggressive fiscal expansion, combined with the boost to EUR sentiment following the agreement of the EU 27 on the rescue fund, EUR/CHF remains biased towards a return to 1.09 into year-end.”

CNBC reports that China’s President Xi Jinping affirmed his country’s commitment to working with others, as he pushed for the cementing of the role of the Asian Infrastructure Investment Bank in the global economic governance system.

“Let us stay open and inclusive and make the AIIB a new paradigm of multilateral cooperation,” Xi said Tuesday at the opening ceremony of the the Chinese development bank’s annual meeting, which was held virtually this year due to the coronavirus pandemic.

Xi called on the bank to “grow into a new platform that promotes development for all its members and facilitates the building of a community with a shared future for mankind.”

The AIIB has provided nearly $20 billion in infrastructure investment to its members since its launch in 2016, said Xi. Seen as a rival to the U.S.-led World Bank and Japan-led Asian Development Bank, the AIIB currently has 102 members from Asia, Europe, Africa and the Americas.

“Under the principle of extensive consultation, joint contribution and shared benefits, the AIIB needs to respond to adjustments and changes in the global economic landscape and engage more development partners in cooperation,” Xi said in Beijing at the start of the two-day event.

“It needs to provide public goods for our region and beyond, push for regional economic integration, and help make economic globalization more open, inclusive, balanced and beneficial for all,” Xi said, according to an official translation from the bank.

Reuters reports that France will continue to take a tough line on defending the rights of French fishermen in Brexit talks but a deal with the United Kingdom is still possible, France’s new European affairs minister Clement Beaune said on Wednesday.

“We will not accept a deal at any price,” he told France Inter radio in his first public comments on Brexit since his appointment on Sunday. “Better no deal at all than a bad deal,” he said while adding that a deal was nevertheless the best outcome for all concerned.

Britain and the European Union clashed last week over the chances of securing a free trade agreement, with Brussels deeming it “unlikely” but London holding out hope one could be reached in September.

France is one of the coastal states that has pushed hardest for EU fishermen to keep the right to fish in British waters after a transition period ends at the end of this year.

Before becoming Europe minister, Beaune served as President Emmanuel Macron’s Europe adviser. A self-described anglophile, he has advised Macron on Brexit negotiations since the 2016 referendum.

He said France would be “intransigent” on fishing, and will not be “intimidated” by Britain in the negotiation “game”.

“Let’s not kid ourselves, if there is no deal, it will be a difficult issue,” he added. “We’ll have to organise a response for sectors like fisheries. Support our fishermen financially. We’re not there yet.”

FXStreet reports that in opinion of FX Strategists at UOB Group, USD/CNH could attempt a move to the 6.9645 level in the next weeks.

24-hour view: “Our expectation for USD to ‘weaken towards 6.9750’ yesterday was incorrect as it rebounded after touching 6.9865. Momentum indicators are mostly neutral now and for today, USD is likely to trade sideways between 6.9930 and 7.0140.”

Next 1-3 weeks: “Our latest narrative was from last Thursday (23 Jul, spot at 7.0155) wherein USD ‘is in a corrective rebound but any advance is expected to face solid resistance at 7.0400’. USD subsequently popped to a high of 7.0301 but has since eased off. For now, there is no change in our view but the underlying tone has softened and from here, a break of 6.9750 would indicate that the correction phase has ended. To look at it another way, a breach of 6.9750 would increase the risk of USD moving below the month-to-date low at 6.9645. For now, the prospect for such a move is not high but it would continue to increase as long as USD does not move above 7.0300 within these few days.”

The signs are clearly pointing to a recovery.

Despite the strong growth, it will probably take two years before the historic slump in spring is made up for.

According to the report from Bank of England, UK households and businesses continued strongly increasing their sterling money holdings in June. The £16.0 billion increase was, however, less than the £53 billion monthly average increase seen since March. Interest rates on deposits fell further in June - new time deposit rates fell 14 basis points to 0.73%.

Household’s net borrowing was £1.8 billion in June following large repayments in previous months. The increase can all be accounted for by mortgage borrowing. Mortgage interest rates were broadly unchanged.

Approvals for mortgages for house purchase increased to 40,000 in June, up from the record low of 9,300 in May, but still below February’s pre-Covid level of 73,700.

Households repaid £86 million of consumer credit, on net, in June, following average monthly repayments of around £5 billion since March. The interest rate on new consumer credit borrowing fell 68 basis points to 4.42% in June, while credit card interest rates fell 42 basis points to 17.94%.

Corporates raised an extra £10.7 billion of finance in June, almost all from financial markets. SMEs continued borrowing from banks, drawing £10.2 billion of extra loans, while large businesses repaid loans.

CNBC reports that the gold market is “very strong” and could hit $3,500 in two years, one analyst told.

Prices have surged and reached record highs on Monday amid worries over the coronavirus pandemic and tensions between the U.S. and China.

“What is really significant is how quickly it went through that $1,923 which was the previous high. The other thing which was … very, very important was the fact that it went through $1,800 and with similar ease,” said Barry Dawes, executive chairman at Martin Place Securities. “That’s basically saying to me that this is a very, very strong market.”

“I’m looking for $3,500 within two years,” Dawes told CNBC. He said some consolidation is “probable,” but the underlying strength of the rally is “very significant.”

Garth Bregman of BNP Paribas Wealth Management predicted that prices could consolidate around $2,000, before increasing again.

“We don’t see any catalyst in the short term for gold to stop its rise. In fact, the factors that have driven gold to these new highs are still very much in place,” said Bregman who is the Asia Pacific head of investment services.

Juerg Kiener, managing director of Swiss Asia Capital, is also bullish on the precious metal.

“If you look at the technical picture, you could actually take this gap from the bottom up and going to the top, that gives you about $2,834 and that would be (an) initial target probably that you could achieve quite fast,” he said.

“I think my longer term targets are significantly higher,” he told.

Historically, he pointed out that gold prices have moved seven or eight times higher from their bottoms.

“If your bottom structure was $1,050, times seven, that will give you about $8,000,” he said.

FXStreet reports that EUR/USD have now seen five straight weeks of appreciation, the longest such stretch since February 2018. Jeremy Stretch from CIBC Capital Markets expects the world’s most popular currency pair to erase some gains amid a risk-off environment after the EU deal, however, he still targets the pair at 1.19 in the long-term.

“While the €750 billion rescue package, and the new 7-year Multiannual Financial Framework was not quite a ‘Hamiltonian moment’, it is path breaking given that grants were given to those most affected by Covid. That’s true even though the grant component was watered down from the original Franco-German proposal, still, full debt mutualisation remains something of a pipedream.”

“Since the deal will benefit hard-hit Italy and Spain, expect yield differentials between the periphery and Germany to continue to compress. The currency has been supported by material increases in euro holdings by real money investors in the last four months.” “Leveraged investors betting against the euro have also been squeezed. But given our expectation for a risk-off environment in the next few months, we look for the euro to give back some of its recent gains in the upcoming quarter while retaining a longer-term target of 1.19.”

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 01:30 | Australia | CPI, y/y | Quarter II | 2.2% | -0.4% | -0.3% |

| 01:30 | Australia | Trimmed Mean CPI y/y | Quarter II | 1.8% | 1.4% | 1.2% |

| 01:30 | Australia | Trimmed Mean CPI q/q | Quarter II | 0.5% | 0.1% | -0.1% |

| 01:30 | Australia | CPI, q/q | Quarter II | 0.3% | -2% | -1.9% |

| 06:45 | France | Consumer confidence | July | 96 | 99 | 94 |

During today's Asian trading, the US dollar fell against the euro and the yen on expectations of the outcome of the two-day meeting of the Federal reserve system (Fed).

"The extremely rapid growth of the Euro and gold stopped on the eve of the decision of the US Central Bank," said Western Union analyst Joe Manimbo.

The ICE index, which tracks the dynamics of the US dollar against six currencies (euro, swiss franc, yen, canadian dollar, pound sterling and swedish krona), fell by 0.12%.

The Fed ends its regular two-day meeting on Wednesday. Given that the US is still losing the battle with coronavirus, the Fed is likely to confirm at the meeting on July 28-29 plans to keep the interest rate at close to zero for a long time.

The Ged has kept the rate in the range of 0% to 0.25% since March, and is also implementing a quantitative easing (QE) program and a number of credit programs designed to support various sectors of the economy.

Yesterday, the Fed extended seven emergency lending programs for three months, until December 31, 2020, to support economic activity during the coronavirus pandemic.

In addition, investors continue to monitor the discussion of a new package of measures to support the US economy. On Monday, Republicans introduced a package of measures totaling about $1 trillion, which, in particular, provides for reducing the amount of the allowance for unemployment benefits from $600 a week to $200 a week.

According to the report from Insee, in July 2020, households’ confidence in the economic situation has decreased: the synthetic index has lost 2 points, after gaining 4 points last month. At 94, it remains below its long-term average (100).

Households' opinion balance on their past financial situation has lost 3 points. It nevertheless remains above its long-term average. The balance related to their future financial situation has remained stable, standing slightly below its long-term average.

In July, the share of households considering it is a suitable time to make major purchases has decreased slightly: the corresponding balance has lost one point and falls just below its long-term average.

In July, the share of households considering it is a suitable time to save has increased for the third consecutive month: the corresponding balance has gained 9 points and thus exceeds its long-term average.

Households’ opinion balance related to their expected saving capacity has increased by 2 points and remains well above its long-term average. Households’ opinion balance on their current saving capacity has lost 2 points but stands well above its long-term average.

Households' fears about the unemployment trend have decreased slightly in July. The corresponding balance has lost 2 points but it remains well above its long-term average.

In July, households considering that prices will be on the rise during the next twelve months have been markedly less numerous than the previous month: the corresponding balance has lost 9 points. Nevertheless, it stands above its long-term average.

Households considering that prices were on the rise during the past twelve months have been a little bit more numerous than the previous month: the corresponding balance has gained 3 points but remains clearly below its long-term average.

FXStreet reports that cable’s recent performance hints at a potential move to the key 1.30 mark in the next weeks, suggested FX Strategists at UOB Group.

24-hour view: “We highlighted yesterday that ‘upward momentum is still strong, overbought conditions suggest a slower pace of advance and the next major resistance at 1.3000 is out of reach for today’. We added, ‘1.2940 is already quite a strong level’. Our view was not wrong as GBP rose to an overnight high of 1.2952. The combination of overbought conditions and waning momentum suggest further sustained gain in GBP is unlikely for today. While GBP could edge above 1.2952 from here, any advance is viewed as part of a 1.2860/1.2965 range. In other words, a sustained rise beyond 1.2965 is unlikely.”

Next 1-3 weeks: “While we noted yesterday (27 Jul, spot at 1.2805) ‘the next level focus on is at 1.2860 followed by 1.2900’, we did not quite expect the latter level to come into the picture so quickly as GBP surged to an overnight high of 1.2904. The positive phase in GBP that started one week ago (21 Jul, spot at 1.2670) is still clearly intact. From here, all eyes are on the round-number resistance level of 1.3000. Overall, the current positive phase in GBP is deemed as intact as long 1.2740 (‘strong support’ level was at 1.2700 yesterday) is not taken out. On a shorter-term note, 1.2800 is already quite a solid level.”

RTTNews reports that Fitch Ratings downgraded Japan's sovereign rating outlook citing the sharp economic contraction caused by the coronavirus pandemic.

The outlook on 'A' rating was lowered to 'negative' from 'stable'.

The agency observed that a downturn in consumer spending and business investment has been exacerbated by a steep decline in exports associated with weak external demand.

The economy is forecast to contract 5 percent in 2020, before rebounding to 3.2 percent growth in 2021 due partly to the low base effect. However, the economy would not recover to its pre-pandemic level until the fourth quarter of 2021, Fitch said.

"The Negative Outlook indicates that the higher debt ratio and downside risks to the macroeconomic outlook will nevertheless exacerbate the challenge of placing the debt ratio on a downward path over the medium term," the agency added.

According to Fitch, Japan's gross general government debt ratio will rise to around 259 percent of GDP this year, and stabilize just above 260 percent in 2021-22, before turning to a gradual downward path.

The rating agency projected the deficit to narrow to 10.9 percent of GDP in 2021 and 5.3 percent in 2022, as the recovery gradually solidifies and the authorities seek to return to their path of debt reduction.

eFXdata reports that Societe Generale Research discusses EUR/USD outlook and flags a scope for EUR/USD hitting 1.20 if not seen a correction in the near-term.

"Gold has stalled but it usually enjoys August. But so does the dollar and if we get end-July dollar buying, that could increase the short-covering pressure. As noted before, if EUR/USD doesn't correct in August, not sure if it will before getting to 1.20," SocGen notes.

"The long-term bullish case is enhanced by the sense that Europe is weathering the pandemic better, but new European lockdowns would change that and in any case, it has simply risen too fast. The 14-Day EUR/USD RSI has spiked above 70 for the third time in 5 months, after not doing so since early 2018. If nothing else, that represents a speed-bump, particularly if we get positive noises from Washington and a further Treasury sell-off," SocGen adds.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1845 (2812)

$1.1814 (1090)

$1.1790 (947)

Price at time of writing this review: $1.1729

Support levels (open interest**, contracts):

$1.1646 (98)

$1.1615 (112)

$1.1578 (340)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date August, 7 is 53695 contracts (according to data from July, 28) with the maximum number of contracts with strike price $1,1400 (4029);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3005 (671)

$1.2988 (1142)

$1.2975 (1839)

Price at time of writing this review: $1.2920

Support levels (open interest**, contracts):

$1.2872 (171)

$1.2812 (67)

$1.2775 (84)

Comments:

- Overall open interest on the CALL options with the expiration date August, 7 is 21012 contracts, with the maximum number of contracts with strike price $1,3000 (2485);

- Overall open interest on the PUT options with the expiration date August, 7 is 19786 contracts, with the maximum number of contracts with strike price $1,2400 (1526);

- The ratio of PUT/CALL was 0.94 versus 0.99 from the previous trading day according to data from July, 28

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 43.1 | -0.83 |

| Silver | 24.31 | -0.98 |

| Gold | 1957.71 | 0.85 |

| Palladium | 2279.24 | -1.3 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | -58.47 | 22657.38 | -0.26 |

| Hang Seng | 169.5 | 24772.76 | 0.69 |

| KOSPI | 39.13 | 2256.99 | 1.76 |

| ASX 200 | -23.7 | 6020.5 | -0.39 |

| FTSE 100 | 24.38 | 6129.26 | 0.4 |

| DAX | -3.38 | 12835.28 | -0.03 |

| CAC 40 | -10.68 | 4928.94 | -0.22 |

| Dow Jones | -205.49 | 26379.28 | -0.77 |

| S&P 500 | -20.97 | 3218.44 | -0.65 |

| NASDAQ Composite | -134.18 | 10402.09 | -1.27 |

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 01:30 | Australia | CPI, y/y | Quarter II | 2.2% | -0.4% |

| 01:30 | Australia | Trimmed Mean CPI y/y | Quarter II | 1.8% | 1.4% |

| 01:30 | Australia | Trimmed Mean CPI q/q | Quarter II | 0.5% | 0.1% |

| 01:30 | Australia | CPI, q/q | Quarter II | 0.3% | -2% |

| 06:45 | France | Consumer confidence | July | 97 | 99 |

| 08:00 | Switzerland | Credit Suisse ZEW Survey (Expectations) | July | 48.7 | |

| 08:30 | United Kingdom | Consumer credit, mln | June | -4.597 | -2 |

| 08:30 | United Kingdom | Mortgage Approvals | June | 9.3 | 33.9 |

| 08:30 | United Kingdom | Net Lending to Individuals, bln | June | -3.4 | |

| 12:30 | U.S. | Goods Trade Balance, $ bln. | June | -74.34 | |

| 14:00 | U.S. | Pending Home Sales (MoM) | June | 44.3% | |

| 14:30 | U.S. | Crude Oil Inventories | July | 4.892 | |

| 18:00 | U.S. | Fed Interest Rate Decision | 0.25% | 0.25% | |

| 18:30 | U.S. | Federal Reserve Press Conference | |||

| 22:45 | New Zealand | Building Permits, m/m | June | 35.6% | |

| 23:50 | Japan | Retail sales, y/y | June | -12.3% | -6.5% |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.71558 | 0.17 |

| EURJPY | 123.122 | -0.56 |

| EURUSD | 1.17191 | -0.24 |

| GBPJPY | 135.807 | 0.06 |

| GBPUSD | 1.29287 | 0.37 |

| NZDUSD | 0.66549 | -0.22 |

| USDCAD | 1.33775 | 0.14 |

| USDCHF | 0.91701 | -0.31 |

| USDJPY | 105.044 | -0.31 |

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.