- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 29-04-2022

- The EUR/USD recorded losses in April of 4.75%, the biggest since 2015.

- Though Wall Street finished with substantial losses, a sudden shift in sentiment failed to boost the greenback vs. the euro.

- US Core PCE down ticked, but headline inflation rose to 6.6%, as the FOMC will hold its May monetary policy meeting

The EUR/USD recovers some ground after being battered in the week, so far down 2.30%, but the hefty monthly losses amount to 4.68%, the most relevant since January 2015. At the time of writing, the EUR/USD is trading at 1.0541.

Sentiment turned sour late in the New York session

The week finished with dismal market sentiment. US equities recorded hefty losses, between 2.77% and 4.17%. China’s coronavirus outbreak which has lasted for the last couple of weeks threatens to disrupt supply chains. The US central bank’s increasing rate hikes to tackle inflation and the Ukraine-Russia conflict, further entering its third month, were the drivers of the last trading day of the month.

Data-wise, the US economic docket featured inflationary readings for March. The Fed’s favorite measure of inflation, the Core Personal Consumer Expenditures (PCE), rose by 5.2% y/y lower than expectations, indicating that inflation excluding volatile items is peaking. The data further strengthens the case for a Federal Reserve rate hike in the next week, as the US central bank chief Jerome Powell expressed during the month that a 50-bps increase is “on the table.”

Analysts at TD Securities expressed that “we now expect the Fed to deliver three consecutive 50bp hikes (in May, June, and July) and subsequently hike rates by 25bp per meeting until they reach a terminal funds rate of 3.25% by March 2023.”

The Eurozone docket featured inflationary figures. France’s inflation rose above expectations and the previous reading, to 4.8% y/y, while French HICP reached 5.4%. Regarding the whole Eurozone, general inflation climbed to 7.5%. Additionally, GDP for Q1 rose to 5%, aligned with estimations.

Next week’s economic docket

In the week ahead, the Eurozone and US dockets would be packed. The Eurozone docket would feature a raft of Retail Sales, PMIs, Industrial Production, and Unemployment rates from Germany, Italy, Spain, France, and the block.

On the US front, the docket would reveal S%P Global PMIs, ISM PMIs, the Federal Reserve monetary policy meeting, ADP Employment Change, and the Nonfarm Payrolls report.

Key Technical Levels

- The AUD/USD is aiming lower in the month and would record its most significant loss since March 2020., down 5.57%.

- A risk-off market mood dragged the AUD/USD lower as late position trading favors the greenback.

- US Treasury yields jumped late in the session, led by the 10-year up ten basis points, at 2.936%.

- AUD/USD Price Forecast: Bears prepare an assault of 0.7000.

The AUD/USD plummets from daily highs near 0.7200 and tanked below 0.7100 as market sentiment turned sour, ahead of a busy week for the Australian and US economic dockets, as both countries’ central banks would have monetary policy meetings. At the time of writing, the AUD/USD is trading at 0.7069.

Market sentiment weakens the risk-sensitive AUD

Risk-aversion rules April’s last trading day, as portrayed by US equities set to record losses between 2.32% and 4.09%. Factors like China’s covid outbreak, Federal Reserve tightening, and the Russia-Ukraine war developments weighed on market sentiment.

On Friday, the Fed’s favorite inflation gauge, the core Personal Consumption Expenditures (PCE), rose to 5.2% y/y, lower than the 5.3% estimations. However, headline inflation expanded by 6.6% y/y, from 6.3% in the previous month. The data further strengthens the case for a Federal Reserve rate hike in the next week, as the US central bank chief Jerome Powell expressed during the month that a 50-bps increase is “on the table.”

Hotter than expected inflationary readings reported during the week on the Australian front paint a problematic scenario for the Reserve Bank of Australia (RBA) as a federal election looms on May 16th. Money market futures odds of a 0.25 bps increase by the RBA sit at an 85% chance, though some analysts were expecting a 40-bps rate hike.

The consensus amongst economists is that the board would stay put and hold rates unchanged. However, according to Bloomberg, Goldman Sachs Group, Inc. sees the RBA delivering a 40-bps move in June.

Therefore, the AUD/USD scenario favors the greenback. But, a higher-than-expected RBA rate increase or a “dovish” Federal Reserve would boost the prospects of the AUD, though it’s unlikely to happen.

AUD/USD Price Forecast: Technical outlook

The AUD/USD remains downward biased, accelerating its downward trend as shown by the daily chart. The MACD remains bearish, as the MACD/signal lines aim lower while the histogram expands downwards. Additionally, the daily moving averages (DMAs) above the spot price confirm the aforementioned, though it’s worth noting that the 50-DMA remains on top of the 200 and the 100-DMA.

That said, the AUD/USD’s first support would be February’s 4 cycle low around 0.7051. A break below would expose February’s 1 daily low at 0.7033, followed by the S3 daily pivot at the triple-zero figure at 0.7000.

- Risk-off flows on Wall Street weighed heavily on AUD/JPY on Friday.

- Having failed to rally above its 21DMA near 93.00, the pair dropped over 1.0% to the mid-91.00s.

- Focus remains on broader risk appetite China lockdown risks next week, as well as on the RBA policy announcement.

A sharp deterioration in risk appetite on Wall Street on the final trading day of the month that saw the S&P 500 index drop around 3.0% to fresh multi-week lows weighed heavily on risk-sensitive currencies on Friday. As a result, the Australian dollar was one of the underperforming G10 currencies on the day, while the safe-haven yen was able to attract some safe-haven-related inflows.

AUD/JPY was subsequently last trading lower by more than 1.0% in the 91.75 region, having failed for a second successive session to rally above its 21-Day Moving Average near 93.00. Friday’s pullback puts the pair on course to have fallen about 1.5% this week, which is not too shabby considering the pair was at one point trading nearly 3.0% lows in the mid-90.00s. The dovish tone of the BoJ on Thursday, which triggered a broad drop in the yen at the time, combined with spicey Australian Consumer Price Inflation data on Wednesday, which triggered a build up of RBA tightening bets, was the main catalyst for the mid-week rebound.

Markets now expect that the RBA will hike interest rates by 15 bps next week to 0.25%, with the bank expected to fully depart from its prior stance emphasising “patience” to being more proactive in getting rates back to neutral. Against that backdrop, one might think that risks are tilted to the upside for AUD/JPY next week. But if the pair is to have any chance of rallying back towards recent multi-year highs in the upper 95.00s, risk appetite in equity markets is going to need to improve.

But with the Fed expected to hike interest rates by 50 bps, announce QT plans and signal its intent to get rates back to around 2.5% by the year’s end, betting on a risk appetite rebound against this hawkish backdrop is risky. Moreover, the Aussie also has to contend with risks related to lockdowns in China, which could yet further throttle demand in Australia’s most important export partner.

- The EUR/JPY prepares to finish April with decent gains of 1.64%.

- A dismal market sentiment, increased appetite for safe-haven peers.

- EUR/JPY Price Forecast: A head-and-shoulders pattern in the daily chart is forming and, once validated, could drag the EUR/JPY towards 130.00.

The EUR/JPY grinds lower during the North American session on Friday, though it looks forward to printing two consecutive monthly gains, up 1.64% as the month-weekly end looms. At the time of writing, the EUR/JPY is falling some 0.31%, trading at 136.80.

A risk-off market mood suddenly shifted appetite in the FX space. Except for the greenback, safe-haven peers are the leaders in the North American session. Risk appetite is weighed by concerns about China’s coronavirus outbreak which threatens to disrupt supply chains, Russia-Ukraine tussles continued, and a Federal Reserve aggressive tightening added a pinch of salt to a dismal sentiment.

During the overnight session, the EUR/JPY opened around 137.50 and meandered around the 200-hour simple moving average (SMA), almost horizontal, around 137.70. However, once European traders got off their desks, the US session’s sour sentiment weighed on the EUR/JPY, dragging the pair towards new daily lows around 136.50.

EUR/JPY Price Forecast: Technical outlook

The EUR/JPY daily chart depicts the pair as upward biased, though it in the last couple of days was unable to break resistance at 138.00, courtesy of EUR weakness. Also, a head-and-shoulders pattern is forming, which would add downward pressure on the pair, though a break below the neckline is needed to validate the pattern.

If that scenario plays out, the EUR/JPY first support would be 136.00. Break below would drag the pair towards the head-and-shoulders necklines, around 134.70-135.00. Once broken, the next stop would be last year’s high, around 134.12, followed by some DMAs before reaching the 130.00 head-and-shoulders targets.

- US equities slumped on Friday, led by a more than 15% decline in Amazon’s share price post-earnings.

- The S&P 500 dropped nearly 3.0% to test monthly lows in the 4,160s, where it trades over 8% lower on-the-month.

A more than 15% drop in US tech giant Amazon’s share price to its lowest level in nearly two years under $2500 per share weighed heavily on the major US indices on Friday. Amazon posted its Q1 earnings results after Thursday’s market close, which revealed that higher costs were squeezing margins more than expected. Fellow tech giant Apple also reported earnings after Thursday’s close and failed to lighten the mood. The iPhone maker’s share price was last trading lower by about 1% despite posting record sales and profits in Q1, with traders citing a weak outlook.

Downbeat earnings meant the US equity markets were a sea of red on Friday, with no major sector able to escape the sell-off. The S&P 500 was last trading lower by nearly 3.0%, which saw it crash back below the 4,200 level and probe multi-week lows printed earlier in the week around 4,160. The tech-dense Nasdaq 100 index was down a little over 3.5% and eyeing a test of weekly lows at 13,000, while the Dow was last down a little over 2.0% and also eyeing a test of weekly lows just under 33,100.

Traders said Friday’s sell-off was partially worsened after US yields rallied in wake of data revealing a larger than expected jump in the Employment Cost Index in Q1 this year, which seemed to encourage markets to up their bets on Fed tightening. Indeed, fears about Fed tightening, with the bank expected to lift interest rates by 50 bps next week followed by a series of further rate hikes of similar magnitude, have been a key factor weighing on US equities this month.

The S&P 500 is currently on course to post a near 8.0% loss on the month, its worst performance since Q1 2020, with the index now back in correction territory versus record highs above 4,800 printed at the start of the year. The losses are more severe for the Nasdaq 100, which looks set to end the month around 12.5% lower, taking the index more than 20% below its peak last November, meaning the index is in an official “bear market”. The Dow, meanwhile, looks set to end the month a more modest 4.0% lower and is still less than 10% below its record highs from back in January.

Russian Foreign Minister Sergey Lavrov said on Friday that Russia does not consider itself to be at war with NATO, adding that such a development could raise the risk of a nuclear war, something which cannot be allowed, reported Reuters citing Russia's RIA news agency.

Moscow and Kyiv could already have achieved major results at peace talks, but Kyiv is changing its position under orders from the US and UK, Lavrov continued. Russia is not threatening anyone with nuclear war, he said seemingly in response to accusations from the West that Russia has been employing nuclear threats/blackmail recently.

Lavrov reiterated that any shipment of foreign weapons into Ukraine is a legitimate target for Russia.

Ukrainian President Volodymyr Zelenskyy said on Friday that peace talks with Russia at a high risk of ending given the action of Russian troops during the war, reported Russian state-run news agency Interfax reported according to Reuters.

Seperately, a Pentagon spokesperson said that it is hard to look at what Russian President Vladimir Putin is doing in Ukraine and think that any ethical, moral person could justify such actions. The Pentagon spokesperson added that Russian operations in Ukraine are brutality of the coldest and most depraved sort.

- The USD/CHF to record the biggest monthly gain since May 2012, up 5.17%.

- A dampened market mood increased the appetite for the safe-haven Swissy as US dollar traders booked profits.

- USD/CHF Price Forecast: A daily close below 0.9700 might open the door for a mean reversion move.

The USD/CHF retreats from YTD highs though clings to the 0.9700 mark despite broad US dollar weakness across the board, driven by traders booking profit as the month-weekly end looms. At 0.9706, the USD/CHF reflects the previously mentioned and is headed to record monthly gains of 5.17%, its largest since May 2012.

Sentiment turned sour once European markets closed. US equities remain on the backfoot, weighed by weak earnings from mega-cap companies like Apple and Amazon. Furthermore, China’s coronavirus outbreak, Federal Reserve aggressively tightening, and the Russia-Ukraine war concerns dented investors’ mood.

In the meantime, the US Dollar Index, a gauge of the buck’s value vs. a basket of its peers, drops below 103.000, down some 0.73%, sitting at 102.912.

During the overnight session, the USD/CHF seesawed around the daily pivot point at 0.9720. However, once European traders took over the market, the Swissy strengthened. The pair reached a daily low around the S1 daily pivot at 0.9670 on news that the US Core Personal Consumption Expenditure (PCE), the Fed’s favorite gauge of inflation, rose lower than estimated. Of late, the greenback recovered some ground, and USD/CHF bulls achieved to hold prices above 0.9700.

USD/CHF Price Forecast: Technical outlook

The USD/CHF is upward biased, as depicted by the daily chart, despite Friday’s fall. However, the steepness of the uptrend threatens to put into play a mean reversion move, further expected as the Relative Strength Index (RSI) within the overbought territory begins to aim lower.

If that scenario plays out, the USD/CHF first support would be June 5, 2020, swing high turned support at 0.9650. A breach of the latter will send the pair towards 0.9600, followed by June 30, 2020, a daily high at 0.9533.

Key Technical Levels

- It's been a quiet session for GBP/JPY, with the pair just above 163.00 but capped by its 21DMA.

- GBP/JPY still looks set to end the week lower by roughly 1.1%, as UK growth concerns outweighed the dovish BoJ.

It's been a quiet session for GBP/JPY, with the pair nudging slightly higher back above the 163.00 level, but with the upside remaining contained for a second session running by the 21-Day Moving Average, which currently sits at 163.40. Global yields have risen on Friday, wth recent upside in US yields as a result of evidence of stronger than expected wage growth in Q1 of this year, thus preventing the yen from mounting a comeback.

Nonetheless, after Thursday’s post-dovish BoJ meeting battering, the yen bears seem fatigued and content to see out the week in subdued fashion. Despite recent yen weakness that has seen GBP/JPY bounce over 2.0% from earlier sub-160.00 weekly lows, the pair still looks set to end the week lower by roughly 1.1%.

UK growth fears as evidence build of economic weakness amid the country’s worst cost-of-living squeeze in a decade were front and centre this week. While the BoE is expected to raise interest rates by a further 25 bps next week, the bank is expected to further moderate its tone on the need for further interest rate hikes amid growing concern about the economy.

This shift in expectations was attributed as a key driver behind this week’s broad GBP weakness. Aside from next week’s BoE meeting, bond yields and risk appetite will remain key drivers of the pair. While rising fears about global growth and recent weakness in risk appetite argue for GBP/JPY to continue pulling back next week, if hawkish central banks spark further upside in global bond yields (the Fed is going to lift interest rates by 50 bps next week), that could further weaken the yen’s appeal.

Analysts at MUFG Bank, point out the GBP/USD pair has weakened sharply after breaking below the 1.3000-level. They consider the pound became deeply oversold and weakness has overshot short-term fundamental drivers increasing the likelihood of a temporary relief rally.

Key Quotes:

“Unsurprisingly technical indicators are signalling that the GBP is now heavily oversold against the USD in the near -term which increases the likelihood of a temporary relief rally. The 14-day RSI has reached its low est level since March 2020. At the same time, our short-term regression model is signalling that cable has overshot fundamental drivers to the downside.”

“In light of the building risks for a sharper slow down for the UK economy as the cost of living crisis takes more of a toll on activity, we expect the BoE to maintain a more cautious outlook over the need for further tightening as it finely balances upside risks to inflation against downside risks to growth when setting policy. It should favour the BoE sticking to smaller 25bps hikes at upcoming policy meetings. The UK rate market is pricing in 25bps hikes at all six remaining MPC meetings this year. GBP weakness w ould be reinforced if the BoE signals that rate hikes could be paused sooner in response to weaker growth.”

“The fundamental outlook continues to favour further GBP weakness. A cautious message from the BoE should support a weaker GBP in the week ahead. The main risk is that the GBP is already heavily oversold.”

Canadian GDP rose at a 1.1% rate in February, above the 0.8% expected, according to a report released on Friday. Analysts at CIBC, point out that the Bank of Canada now has even more ammunition to justify a non-standard 50 bp interest rate hike at the next meeting, and likely the one thereafter.

Key Quotes:

“After hitting the fast lane in February, advance data suggests growth eased to a steadier pace in March. The 1.1% gain in February was even larger than the consensus and advance estimate (+0.8%), and was followed by a steadier, but still solid, 0.5% gain in March. This puts Q1 as a whole on track for a 5.6% annualized growth rate, well above the 3% forecast contained within the Bank of Canada's latest MPR.”

“The Canadian economy continues to surprise and the Q1 number now seems much stronger than expected. This would put our annual forecast at around 4%, all else equal, a few ticks higher than our last projection. However, we’ve seen on occasion big gaps between these monthly data on GDP by industry data and the subsequent quarterly GDP figures, which are measured by the sources of expenditures, most notably in Q2 2021. We continue to expect a deceleration in growth over the balance of the year as impact of high inflation and rate hikes put a squeeze on Canadians' spending power and slow the housing market.”

“With another strong release in hand, the Bank has even more ammunition to justify a non-standard 50 bp interest rate hike at the next meeting, and likely the one thereafter. However, with growth likely to slow in the second half of the year and inflation poised to decelerate, we still think that the path higher for interest rates won’t be as steep as financial markets are currently expecting, and we still see a peak of 2.5% reached in early 2023.”

Data released on Friday showed persanal income rose 0.5% in March and a 1% increase in personal spending. Consumers had to dip into savings to pull it off, but not only did real personal expenditures rise in March, revisions lifted real February spending into positive territory as well, noted analysts at Wells Fargo.

Key Quotes:

“In the wake of yesterday's negative GDP print, the additional detail from today's March personal income and spending report point to consumer spending growth that is outpacing the fastest inflation in decades.”

“Overall personal income rose 0.5% in March with broad-based gains across major components of income. But once adjusting for higher prices during the month—the PCE deflator rose 0.9% in April—real disposable income told a slightly different story, sliding 0.4% from a month earlier. Upward revisions to prior months' data lifted the level of real disposable income by about $70 billion and turned income growth positive in February. Still, the trend is clear with real disposable income down in ten out of the past twelve months, leaving income about 4% below the level implied by its pre-pandemic trend.”

“As persistently high inflation has weighed on overall income growth, households have had to make tough decisions around purchasing patterns and increasingly rely on their balance sheets to fund spending. The personal saving rate slid to 6.2% in March, which not only marks a fresh cycle low but marks the lowest monthly rate at which households have saved at in almost nine years.”

“For now at least, consumers have been able to absorb the worst price hikes in decades by dialing back saving, a trend that likely will continue in the months ahead amid persistently high prices and slowing income growth but isn't sustainable over the medium-to-longer term.”

- USD/CAD resumes upside despite upbeat Canadian GDP data.

- US dollar recovers from correction as US yields move higher.

- Consumer income and spending data from the US surpass expectations.

The USD/CAD printed fresh daily highs on Friday during the American session above 1.2800. It rebounded from three-day lows it hit earlier after Canadian data at 1.2718.

Dollar surges again

On Friday, the greenback was correcting lower across the board, but it turned to the upside, particularly against commodity currencies. The DXY is still down for the day, but now by 0.45%, off lows.

The US dollar started to recover after the personal consumption and personal spending report that showed larger-than-expected increases. The same report showed no surprises in the Core PCE. The Chicago PMI dropped from 62.9 to 58.5 and the Consumer Sentiment Index from the University of Michigan declined to 65.2.

The USD/CAD bottomed after Canadian GDP data showed an increase of 1.1% in February, above the 0.8% of market consensus. “With February's upside surprise and solid flash estimate for March, Q1 GDP is now tracking well above BoC projections at 5.6%. This will add more pressure for the Bank to return policy to neutral, and while we continue to see a high bar for 75bps, we look for a 50bp hike in June and July”, said analysts at TD Securities.

Later in the day, USD/CAD bounced to the upside on the dollar’s strength and printed a fresh daily high at 1.2820. The pair is hovering around 1.2800, headed toward the fifth weekly gain in a row.

Technical levels

- The USD/JPY is set to record its biggest monthly gain since November 2016 so far, up 6.70%.

- The market mood is mixed, as European stock indices rose while US equities fell.

- USD/JPY Price Forecast: Though it remains upward biased, it is in a correction.

The USD/JPY pullbacks from two-decade highs during April’s last trading day and edges lower some 0.52%, amid broad US dollar weakness, courtesy of traders booking profits ahead of next week’s Federal Reserve monetary policy meeting. At around 129.80, the USD/JPY is set to finish the month with hefty gains close to 7%, the greenback’s most significant gains since November 2016.

Mixed sentiment and US dollar weakness, a headwind for the USD/JPY

Sentiment shifted to a mixed one, as European equities rise while US ones fall. The Fed’s favorite gauge for inflation, the Core Personal Consumption Expenditure (PCE) for March, rose by 5.2% y/y, lower than the 5.3% foreseen, a sign that inflation might be peaking. However, analysts of ING in a note wrote that “even if supply chains improve and we see geopolitical tensions ease a little, we doubt this inflation measure will be below 4% before early next year.”

Also, the Bank of Japan’s (BoJ) commitment to its ultra-loose monetary policy weighed on the JPY throughout the week. The BoJ kept rates unchanged on Thursday and reiterated that it would buy an unlimited amount of 10-year JGBs at a fixed 0.25% rate. The BoJ’s expressed that they will ease policy without hesitations as needed with an eye on pandemic impact.

Meanwhile, China’s Covid-19 worries wane as its health agency emphasized its commitment to COVID zero, but instead would optimize its response. Also, further economic stimulus from Beijing on COVID affected industries and small firms improved the market mood.

Also read: USD/JPY Weekly Forecast: The fallacy of devaluation or the BoJ is out of ideas

Elsewhere, the recent Ukraine-Russia developments have taken a backseat so far. However, Ukraine’s President Zelenskyy said that Kyiv is ready for immediate negotiations for evacuation from the Azonstal plant.

In the meantime, the US Dollar Index, a measurement of the greenback’s value against a basket of its peers, retraces 0.44%, sitting at 103.215, a reflection of profit-taking and month-end flows. Contrarily to the previously mentioned, the 10-year benchmark note rate sits at 2.904%, up almost eight basis points from yesterday’s close.

Therefore, the USD/JPY is ongoing through a correction on Friday. However, financial analysts speculate that the FOMC’s May meeting could be a “buy the rumor, sell the fact” event due to the steeper rally posted by the greenback. USD/JPY traders might need to be aware of it because a deeper correction might be on the cards.

USD/JPY Price Forecast: Technical outlook

The USD/JPY remains upward biased, despite Friday’s fall. For the USD/JPY pair to shift to a neutral bias, a daily close below 129.40 is needed, which could threaten to drag prices towards April’s 27 swing low at 126.94. Nevertheless, that scenario is unlikely to happen unless a fundamental shift from Japanese authorities could boost the JPY.

Upwards, the USD/JPY first resistance would be 130.00. A break above would expose 131.00, followed by the multi-decade-high around 131.25. On the other hand, the USD/JPY’s first support would be 129.00. A breach of the latter would expose April’s 129.40 daily high, followed by April’s 28 daily low at 128.33.

A senior US defense official said on Friday that the US does not believe that there is a threat of Russia using nuclear weapons, despite the recent escalation in rhetoric/jawboning from Russian officials, reported Reuters. "We continue to monitor their nuclear capabilities every day the best we can and we do not assess that there is a threat of the use of nuclear weapons and no threat to NATO territory," said the official.

The comments come after another US defense official said earlier in the day that recent Russian airstrikes in Kyiv were meant to target military production capabilities and that Russia appears to be behind schedule regarding its assault in Ukraine's Donbass region.

- NZD/USD has pulled back from earlier session highs in the 0.6540s as the buck pares intra-day losses.

- The pair is back under 0.6500 and on course for its worst one-month performance since mid-2015.

- The US dollar has been strong this month amid a combination of hawkish Fed bets plus safe-haven demand.

A pickup in the strength of the US dollar, which has been on the back foot on Friday amid month-end profit-taking, in tandem with a rally in US yields following data that showed wage pressures building in Q1 has seen NZD/USD reverse back from intra-day peaks in the 0.6540s to trade back below 0.6500 and close to multi-month lows once again. The latest batch of US data showed core inflationary pressures (according to the Core PCE Price Index) easing in March, but a larger than expected jump in the Employment Cost Index during Q1.

That appears to have resulted in markets upping their Fed tightening bets, hence a rally in US yields (which has been most acute at the short-end) that has seen the US dollar reverse some of its earlier intra-day losses. At current levels in the 0.6480s, NZD/USD is trading flat on the day, but looks set to close out the week 2.2% lower, which would mark a fifth successive week in the red. As a result, the pair looks on course to have dropped nearly 6.5% this month, its worst one-month performance since mid-2015.

NZD/USD, as have many of its other major G10 /USD peers this month, appears to have fallen prey to a combination of USD bullish factors, including heightened Fed tightening bets and safe-haven demand amid concerns about global growth amid growing geopolitical risks as Russia/NATO economic/military tensions rise and China lockdowns bite. Next week will be a big one for the pair, with the Fed expected to hike interest rates by 50 bps and signal intent to get rates near 2.5% by the year’s end and also announce quantitative tightening plans, plus a barrage of tier one US data releases (official jobs report plus ISM business surveys).

But New Zealand data will also be in focus with the release of Q1 labour market figures in focus on Wednesday. This data, if it continues to show a super tight New Zealand labour market, may give the kiwi some much-needed support, if it results in a build-up of RBNZ tightening bets. One advantage the kiwi has over other G10 currencies that could help it hold firm in the face of hawkish Fed fuelled buck strength is the fact that the RBNZ is arguably the most hawkish central bank in the G10 at the moment.

- US dollar corrects lower across the board, trend remains positive.

- Mexican peso’s recovery limited so far.

- USD/MXN to gain momentum if it rises above 20.40.

The USD/MXN is about to erase all losses and is back near a critical technical level, showing that the strength is still in the dollar. The correction from the one-month hit it reached on Thursday at 20.63, extended to 20.28. Later the pair rose back to the 20.40 area.

Despite the correction and the failure of the USD/MXN to hold clearly above 20.40, risks remain to the upside. At 20.45, the 200-day Simple Moving Average (SMA) stands, a daily close above should clear the way to more gains. The next strong resistance is seen at around 20.70.

On the downside, the USD/MXN could drop even further to 20.20 without changing the bullish bias. The 20.15/20.20 zone could be seen as an opportunity to buy the pair again. A break lower would expose the 20-day SMA at 20.07. A slide back under 20.00 would negate the short-term bullish outlook, leaving the dollar vulnerable.

The weekly chart shows USD/MXN far from the peak (a positive for the MXN) and the 20-week SMA (a relevant technical level) is at 20.44.

USD/MXN daily chart

-637868421513691481.png)

- EUR/USD rebounds to the proximity of 1.0600 on Friday.

- Another visit to the YTD low at 1.0470 stays on the cards.

EUR/USD attempts a technical bounce following oversold levels, although the move ran out of steam near 1.0600 at the end of the week.

The offered stance in the pair remains well and sound despite Friday’s bounce and the door stays open to another probable visit to the YTD low around 1.0470 (April 28).

While below the 2-month line around 1.0990, extra losses in the pair are likely.

EUR/USD daily chart

- WTI hit fresh weekly highs in the $107.00s on Friday and is eyeing last week’s highs above $109.00.

- EU/Russia gas tensions and the growing risk of an EU embargo on Russian oil imports has supported prices this week.

- But China demand concerns as the country continues to fight its Covid-19 outbreak remains a downside risk.

Oil prices remain on the front foot as the weekend approaches, with front-month WTI futures currently trading at weekly highs in the mid-$107.00s per barrel area, up nearly $2.50 on the day and on course for a fourth successive daily gain. At current levels just above $107.50, Wti looks on course to post a weekly gain of about $6.0, having reversed more than $12 higher versus earlier weekly lows in the $95.00s. WTI bulls have last week’s highs just above $109.00 in their sights, a break above which could open the door for a push into the $110s.

The main catalyst behind this week’s rally in crude oil markets has been an increased focus on Russia/Europe tensions regarding energy trade. Earlier in the week, Russia halted gas exports to two European countries (Poland and Bulgaria) that have refused to pay in roubles, triggering a surge in gas prices on fears of a larger blockade on Russian gas. Later, reports began doing the rounds suggesting Germany has dropped its opposition to a blanket ban on all Russian oil imports.

While an EU ban on Russian oil imports would exert further downwards pressure on Russia’s benchmark Ural grade of crude oil, it exerts upward pressure on other global crude oil grades, like WTI, as European buyers look for new markets. An official announcement of a ban on Russian oil imports next week could be a key catalyst to launch WTI back above $110.

Amid the heightened focus on geopolitical and energy trade tensions with Russia, Chinese lockdown concerns and the potential impact on Chinese oil demand have taken a back seat. However, analysts note that if the lockdowns in Beijing were to widen in the coming days, or Covid-19 was to spread to more major urban centres, WTI’s recent upwards progress would once again be at risk.

Looking ahead to next week, major central banks like the Fed will be meeting and likely lifting interest rates, which could keep broader risk appetite ropey. Further weakness in, say, US equity markets could weigh on crude oil prices. OPEC+ will also be in focus with the group expected to stick to their current output policy of incremental 400K barrel per day output hikes each month once again in June. China risks aside, it seems likely that Russia supply concerns and OPEC+’s slow approach to increasing output should be able to keep WTI underpinned above $100 for the time being.

- DXY retreats from Thursday’s 19-year highs near 104.00.

- A deeper correction could extend to the 101.00 region.

Following nearly 2-decade highs around 104.00, DXY is finally facing some corrective downside at the end of the week.

There is still scope for further downside, as the index keeps navigating the overbought territory, as per the daily RSI around 75. That said, the retracement carries the potential to extend to the 101.00 area prior to the weekly low in the 99.80 zone (April 21).

The current bullish stance in the index remains supported by the 7-month line near 96.70, while the longer-term outlook for the dollar is seen constructive while above the 200-day SMA at 95.70.

DXY daily chart

- EUR/JPY’s daily advance falters around 138.00 on Friday.

- Some range bound trading could emerge in the short term.

EUR/JPY trades on the defensive around 137.00 following two daily gains in a row on Friday.

The cross could move into a consolidative phase in the very near term ahead of the potential continuation of the uptrend. Against that, the immediate hurdle still emerges at the 2022 high around 140.00 (April 21). If cleared, the cross should then focus on the June 2015 high at 141.05. Beyond this level, there are no hurdles of note until the 2014 top at 149.78 (December 2014).

In the meantime, while above the 200-day SMA at 130.69, the outlook for the cross is expected to remain constructive.

EUR/JPY daily chart

- UoM's headlines Consumer Sentiment Index came in a tad lower than the flash estimate, but still much higher than last month.

- FX markets did not react to the latest UoM data, which was close to expectations.

According to the final version of the University of Michigan's (UoM) Consumer Sentiment survey, the headline Consumer Sentiment Index for April came in at 65.2, a tad below the flash estimate released earlier in the month of 65.7. That meant the headline index remained well above March's reading of 59.4, the worst level in over a decade.

The UoM's Consumer Expectations Index came in at to 62.5, a little below the flash estimate of 64.1, but, again, well above last month's reading of 54.3. The Current Conditions Index came in at 69.4, which was better than the flash estimate of 67.8 and better than last month's 68.1 reading.

UoM's gauge of one-year inflation expectations remained unchanged versus the flash estimate at 5.4%, while the gauge for five-year inflation expectations was also unchanged versus the flash estimate at 3.0%.

Market Reaction

FX markets did not react to the latest UoM data, which was close to expectations.

Markets await next week’s Bank of England (BoE) decision. Economists at Scotiabank expect GBP losses to resume to below 1.24.

A firm and longer-lasting drop under 1.25 seems likely

“The bank is likely to hike by 25bps but it looks set to accompany this with a cautious economic outlook and implicit guidance that market pricing seeing 150bps in hikes by year-end is significantly out of line – as this would result in a notable undershoot in inflation.

“There’s very little possible upside for the GBP from this meeting and considerable downside as the bank strikes a much more neutral to even dovish tone than markets are reflecting in rate bets.”

“A firm and longer-lasting drop under 1.25 seems likely and with it a test of 1.24 with continued weakness below this mark also a possibility.”

EUR/USD ends its six-day losing streak. However, economists at Scotiabank note that the pair is in a bearish trend and expect more dowside ahead.

Clear risk of a re-test of the 1.05 zone and Thursday’s 1.0472 low

“Weak growth, continued risks surrounding energy supply, and exhausted ECB hike bets point to more downside than upside risks for the EUR over the coming months.”

“After closing just under 1.05 yesterday, the EUR strengthened to as high as the 1.0590/00 resistance zone that should continue to act as a strong ceiling during today’s session.”

“Downward pressure could face support at the mid-1.05s but the EUR’s steep bearish trend suggests it is at clear risk of a re-test of the figure zone and yesterday’s 1.0472 low; no obvious support markers come in until the early 2017 low of 1.0341.”

Canadian GDP bounced back in February. The reaction in CAD was fairly muted but it reinforces that the status quo of outperformance on the crosses should prevail, economists at TD Securities report.

More pressure for the Bank of Canada to bring policy back to neutral

“Industry-level GDP surprised to the upside with a robust 1.1% print in February, easily beating the market consensus for 0.8%. Growth was broad-based with a strong performance across goods (+1.5%) and services (+0.9%), while a strong flash estimate for March (+0.5%) added to the upbeat tone.”

“With February's upside surprise and solid flash estimate for March, Q1 GDP is now tracking well above BoC projections at 5.6%. This will add more pressure for the Bank to return policy to neutral and while we continue to see a high bar for 75bps, we look for a 50bp hike in June and July.”

“Without significant changes elsewhere and the prospect of doing more, not less, on BoC hikes, we look for CAD to trade on its front foot against EUR and JPY.”

“We think USD/CAD is a much trickier proposition given that the Fed has scope for a much higher terminal rate relative to the BoC. We prefer to fade a 1.24/28 range in USD/CAD until proven otherwise.”

This week, gold hit its lowest levels since late February near $1,880. As economists at TD Securities note, Chinese lockdowns fuel demand concerns across the yellow metal market.

Shanghai traders are liquidating their gold length at a fast clip

“Our tracking of the top SHFE traders' net length highlights continued and substantial liquidations from Shanghai traders cohort since last Friday. After all, concerns are emerging surrounding the broadening lockdown's impact on domestic demand for the yellow metal. With economic activity also plunging, jewelry sales are likely to collapse as well, which erodes a major pillar of support for the yellow metal.”

“The outlook for investment demand also remains muted, with gold bugs staring down the barrel of a hawkish Fed, while safe-haven flows associated with the war in Ukraine begin to fizzle out.”

“A contingent of participants also expects the Fed's ability to constrain supply-side inflation is limited, which argues for a stagflationary regime in which gold will be in high demand as a store-of-value. However, the decline in prices is rather nodding to a growing cohort which expects that the last month's inflation print may have marked the peak.”

- Modest USD pullback from the multi-year peak prompted some short-covering around AUD/USD.

- Stronger US PCE and a softer risk tone helped the USD to pare intraday losses and capped the pair.

- The prospects for rapid US rate hikes warrant caution before placing bullish bets around the major.

The AUD/USD pair held on to its strong intraday recovery gains, just above mid-0.7100s through the early North American session and moved little following the release of the US macro data.

The pair witnessed a short-covering bounce on Friday and moved away from its lowest level since early February, around the 0.7055 area touched the previous day amid broad-based US dollar weakness. Month-end flows prompted the USD bulls to take some profits off the table after the recent strong bullish run to the five-year peak. Apart from this, the USD downtick lacked any obvious fundamental catalyst and remained limited amid the prospects for a more aggressive policy tightening by the US central bank.

The Fed is expected to hike interest rates by 50 bps when it meets on May 3-4, and again in June and July, and ultimately lift rates to around 3.0% by the end of the year to curb soaring inflation. The bets were reaffirmed by the release of the March Personal Consumption Expenditure (PCE) Price Index. In fact, the Fed's favourite inflation gauge - the PCE Deflator - accelerated to the highest level since January 1982 and rose by 6.6% YoY in March. This helped offset a slight disappointment from the core PCE.

Additional details revealed that both Personal Income and Spending rose by 0.5% and 1.11% in March, respectively. This marked the sixth straight month of increase in income and the third successive month of rise in spending. Apart from this, a softer risk tone, assisted the safe-haven USD to trim a part of its intraday losses and acted as a headwind for the perceived riskier aussie. Hence, it will be prudent to wait for some follow-through buying before confirming that the AUD/USD pair has bottomed out in the near term.

Technical levels to watch

The new geopolitical situation following the war in Ukraine raises many questions relating to the future of global trade and globalisation more broadly. Economists at Danske Bank envision three possible longer-term geopolitical scenarios and how these could affect the global economy.

A new cold war

“This is an extreme scenario where world powers form two competing blocs: an eastern group led by China (with Russia) and a Western alliance rallying behind the US. Winners: Defence, commodities, green transitioning, sectors providing near-sourcing technologies. Losers: Globally orientated manufacturing and services companies, shipping companies, housing market (lower growth, higher interest rates).”

Limited deglobalisation and spheres of interest

“We consider a limited de-globalisation with strengthening spheres of interest as the most likely outcome, and hence, our base case scenario. Winners: Tech and digital (robotics), domestic-focused service companies. Losers: Global manufacturing companies (need to set up regional hubs), housing market (higher interest rates).”

A return to globalisation

“This scenario would involve the trade tensions in recent years between China and US being resolved and also a re-integration of Russia into the global economy on the back of a peace deal between Ukraine and Russia. Winners: Global service sector and manufacturing, shipping companies, housing markets (lower rates). Losers: Defence.”

- EUR/USD trims gains and refocuses on the 1.0500 level.

- EMU flash CPI seen at 7.5% in April, GDP to expand 5% in Q1.

- US headline PCE rose 6.6% YoY, Core CPI gained 5.2% YoY in March.

The bullish attempt in EUR/USD appears to have bumped into a wall around the 1.0600 yardstick at the end of the week.

EUR/USD clings to gains on USD-selling

EUR/USD retreats from earlier highs near 1.0600 amidst some tepid rebound in the greenback, although the mood around the dollar remains tilted towards the bearish side on Friday.

Indeed, the pair manages well to capitalize on some profit taking around the buck, while the upbeat tone in German 10y bund yields also collaborates with the improvement in spot following Thursday’s drop to fresh 5-year lows around 1.0470.

Data wise in Euroland, the German economy is expected to expand at an annualized 3.7% in Q1, while preliminary figures for the euro area see the bloc growing 5% YoY in Q1 and headline CPI rising 7.5% in the year to April.

In the US data space, inflation tracked by the headline PCE rose 6.6% YoY in March and 5.2% when it comes to Core prices. In addition, Personal Income expanded 0.5% MoM and Personal Spending rose 1.1% MoM, both prints for the month of March. Later in the session comes the Chicago PMI and the final U-Mich Index for the month of April.

What to look for around EUR

EUR/USD leaves behind part of the recent multi-session sharp selloff and rebounds from 5-year lows around 1.0470 (April 28). The outlook for the pair still remains tilted towards the bearish side, always in response to dollar dynamics, geopolitical concerns and the Fed-ECB divergence. Occasional pockets of strength in the single currency, in the meantime, should appear reinforced by speculation the ECB could raise rates at some point around June/July, while higher German yields, elevated inflation and a decent pace of the economic recovery in the region are also supportive of an improvement in the mood around the euro.

Key events in the euro area this week: Germany, EMU Flash Q1 GDP Growth Rate, EMU Flash Inflation Rate (Friday).

Eminent issues on the back boiler: Asymmetric economic recovery post-pandemic in the euro area. Speculation of ECB tightening/tapering later in the year. Second round of the presidential elections in France (April 24). Impact on the region’s economic growth prospects of the war in Ukraine.

EUR/USD levels to watch

So far, spot is up 0.34% at 1.0533 and faces the next hurdle at 1.0593 (high April 29) followed by 1.0936 (weekly high April 21) and finally 1.1000 (round level). On the other hand, a break below 1.0470 (2022 low April 28) would target 1.0453 (low January 11 2017) en route to 1.0340 (2017 low January 3 2017).

- USD/CAD witnessed heavy selling on Friday and was pressured by a combination of factors.

- Rising oil prices underpinned the loonie and exerted pressure amid a sharp USD pullback.

- Stronger US PCE Price Index/Canadian GDP report failed to provide any meaningful impetus.

The USD/CAD pair maintained its offered tone below mid-1.2700s through the early North American session and had a rather muted reaction to the US/Canadian macro releases.

A combination of factors exerted heavy pressure on the USD/CAD pair and dragged spot prices away from the highest level since March 9, around the 1.2875-1.2880 area touched the previous day. Crude oil prices climbed to a near two-week high amid concerns that falling output in sanctions-hit Russia will tighten supply. This, in turn, underpinned the commodity-linked loonie and attracted some follow-through selling around the major amid broad-based US dollar weakness.

The USD downfall could be attributed to month-end profit-taking following the recent strong bullish run to the five-year high. That said, expectations that the Fed would tighten its monetary policy at a faster pace to curb soaring inflation should act as a tailwind for the buck. The bets were reaffirmed by the Personal Consumption Expenditure (PCE) Price Index, which accelerated to a 6.6% YoY rate in March from the 6.3% reported in the previous month.

Additional details revealed that the Core PCE Price Index - the Fed preferred inflation gauge, which excludes seasonally volatile products - eased to 5.2% YoY in March from 5.3% previous. The disappointment, to a larger extent, was offset by a sharp jump in the Employment Cost and a stronger-than-expected rise in the Personal Income/Spending data. The data all but confirms that the Fed would hike interest rates by 50 bps at its meeting next week.

From Canada, the monthly GDP report showed that the economy expanded by 1.1% in February, surpassing consensus estimates pointing to the 0.8% growth. The backward-looking data, however, did little to impress traders or provide any meaningful impetus, leaving the USD/CAD pair at the mercy of the USD/oil price dynamics.

Technical levels to watch

- Core PCE inflation fell a little more than expected in March, but the Employment Cost Index jumped in Q1.

- The latest Personal Income and Spending figures for March will instill confidence about the underlying strength of the US economy.

- The DXY has not seen a notable reaction to the latest batch of mixed US economic data.

Annual inflation in the US fell to 5.2% in March according to the latest Core PCE Price Index reading released by the US Bureau of Economic Analysis on Friday. That was slightly below median economist forecasts for a reading of 5.3%, while February's reading was downgraded from 5.4% to 5.3%. MoM, Core PCE Price Index rose at a pace of 0.3% in March, in line with expectations and unchanged from February's 0.3% rate, which was revised lower from 0.4%.

The Core PCE Price Index is the Fed's favoured gauge of underlying inflationary pressures in the US economy. The headline PCE Price rose at a pace of 6.6% YoY in March, up from 6.3% a month earlier amid a MoM rise of 0.9%, which comes after February's 0.6% reading.

Separately, US Personal Income and Spending data for March was also released, with the latter rising 0.5% MoM and the former rising 1.1% MoM. Both of these figures were stronger than the median economist forecast for 0.4% and 0.7% MoM gains respectively. Taken in tandem with the MoM growth in the headline PCE Price Index, real consumption growth was 0.2% MoM in March, up from 0.1% in February.

Elsewhere, Employment compensation data for Q1 was also released. The Employment Cost Index rose at a QoQ pace of 1.4% in the first quarter of 2022, above the forecasted gain of 1.1% and above Q4's 1.0% gain. Employment Benefits rose at a QoQ pace of 1.8% after rising 0.9% in Q4, while Employment Wages rose at a pace of 1.2% after rising at a pace of 1.0% in Q4.

Market Reaction

The DXY has not seen a notable reaction to the latest batch of mixed US economic data. Evidence of easing US inflationary pressures as per the latest Core PCE Price Index numbers was negated by a larger than expected rise in the Q1 Employment Cost Index, while the latest Personal Income and Spending figures for March will instill confidence about the underlying strength of the US economy.

- Silver prices have risen on Friday, boosted by month-end profit-taking in the US dollar.

- But XAG/USD has pulled back sharply from intra-day highs in the $23.50s, and remains vulnerable.

- Markets are focused on upcoming US Core PCE inflation data and next week’s Fed meeting.

Pre-month-end profit-taking in the US dollar, which has seen significant strength in recent weeks that has weighed heavily on precious metals, is giving spot silver (XAG/USD) prices a modest lift on Friday. XAG/USD was last trading higher by about 0.5% in the $23.25 area per troy ounce, more than 1.5% higher versus Thursday’s sub-$23.00 lows, though the precious metal has seen a sharp more than 1.4% pullback from earlier session highs in the $23.50s.

Silver traders are bracing for the release of US Core PCE inflation data for March at 1330BST, which will probably just reaffirm the scale of the inflation problem currently plaguing the US economy, before focus then turns to next week’s Fed meeting. With policymakers at the bank now seemingly in unanimous agreement that getting interest rates to around 2.5% by the year’s end is appropriate (meaning a series of 50 bps rate hikes, starting next week, are likely) and increasingly leaning toward’s the need to take interest rates into outright restrictive territory (i.e. above 2.5%) to tackle inflation, risks to the US dollar likely remain tilted to the upside for the foreseeable future.

In that regard, it probably isn't to surprising that XAG/USD bears jumped on the opportunity to sell the precious metal when it rallied back into the $23.50s and may be looking for a retest of Thursday’s weekly lows under $23.00. Even if the positioning-related pullback in the US dollar does continue next week and XAG/USD rebounds into the mid-$23.00s once again, any recovery back above the 200-Day Moving Average near $23.80 will be difficult.

US PCE Price Index Overview

Friday's US economic docket highlights the release of the March Personal Consumption Expenditure (PCE) Price Index, scheduled later during the early North American session at 12:30 GMT. The headline gauge is expected to edge higher from 6.4% YoY in February to 6.5% during the reported month. The core reading, however, is anticipated to have eased to 5.3% YoY in March from 5.4% previous and rose 0.3% on a monthly basis, down from 0.4% in February.

How Could it Affect EUR/USD?

Ahead of the key release, a sharp US dollar corrective pullback assisted the EUR/USD pair to snap a six-day losing streak to its lowest level since January 2017 touched the previous day. That said, expectations that the Fed would adopt a more aggressive policy response to curb soaring inflation should act as a tailwind for the buck. Stronger PCE figures will reinforce market bets and provide a fresh lift to the greenback.

Conversely, softer-than-expected readings might prompt traders to continue unwinding their USD bullish bets and offer additional support to the major, though any meaningful recovery still seems elusive. Concerns about the economic fallout from the ongoing Ukraine crisis might hold back traders from placing aggressive bullish bets around the shared currency. This, in turn, suggests that any further move up is more likely to attract fresh sellers and runs the risk of fizzling out rather quickly.

Eren Sengezer, Editor at FXStreet, outlined important technical levels to trade the EUR/USD pair: “The Fibonacci 23.6% retracement of the latest trend seems to have formed a key resistance level at 1.0600. In case the pair rises above that level and makes a four-hour close there, the next recovery target could be seen at 1.0660 (Fibonacci 38.2% retracement) ahead of 1.0700 (Fibonacci 50% retracement, 50-period SMA on the four-hour chart).”

“Ideally, the Relative Strength Index (RSI) indicator, which is currently located at around 40, would rise above 50 in such a move, possibly attracting additional buyers. On the downside, interim support aligns at 1.0520 (static level) before 1.0500 (psychological level) and 1.0470 (multi-year low set on April 28),” Eren added further.

Key Notes

• EUR/USD Forecast: Euro eyes 1.0660 as next recovery target

• US Dollar Index comes under pressure near 103.00 ahead of PCE

• EUR/USD: Limited correction to 1.0560/70, with outside risk to 1.0650 – ING

About the US PCE Price Index

The Personal Spending released by the Bureau of Economic Analysis, Department of Commerce is an indicator that measures the total expenditure by individuals. The level of spending can be used as an indicator of consumer optimism. It is also considered as a measure of economic growth: While Personal spending stimulates inflationary pressures, it could lead to raise interest rates. A high reading is positive (or Bullish) for the USD.

- GBP/USD has rebounded about 1.0% into the upper 1.2500s amid pre-month-end selling pressure in the US dollar.

- Focus now turns to next week’s Fed and BoE meetings, which could pose downside risks to the pair.

- GBP/USD rallies, for now, may remain vulnerable to being sold.

Pre-month-end profit-taking in the US dollar, which has up until this point been on a rampage higher in recent weeks against most of its major counterparts, is being attributed as the main factor giving GBP/USD a lift on Friday. The pair was last trading in the 1.2575 region, up about 1.0% on the day and over 1.3% higher versus Thursday’s intra-day lows at 1.2410.

But the pair’s latest rebound comes as little consolation for the deflated GBP/USD bulls, with cable still set to end the week with losses of about 2.0% and the month with losses of about 4.25%. That would mark GBP/USD’s joint-worst one-month performance since July 2019.

Upcoming US Core PCE inflation data for March at 1330BST will be of interest and is likely to reaffirm the scale of the inflation problem currently plaguing the US economy. Focus then turns to next week’s Fed and BoE meetings which, a cursory examination of which would seem to imply downside risks for GBP/USD.

After all, the Fed seems increasingly tilting towards the need to take rates above so-called neutral to control inflation, which the BoE has been coming across as more concerns about weak UK growth as of late, seemingly weakening their resolve to tighten. As a result, any further GBP/USD rebound might well be viewed as a good opportunity to sell. Resistance in the 1.2675 area looks may attract particular attention from the bears.

- The Canadian economy expanded at a MoM pace of 1.1% in February, faster than expected.

- The loonie did not react to the latest data, even though it will underpin BoC tightening expectations.

Canadian real GDP expanded at a pace of 1.1% MoM in February, according to the latest data release by Statistics Canada on Friday, a faster pace of growth than the 0.8% forecasted by economists. That marked an acceleration in the pace of economic growth in Canada after January's 0.2% rise in real GDP.

Market Reaction

Though the robust growth data will increase confidence at the BoC that it can get away with rapid rate hikes given underlying economic strength, the loonie has not seen any reaction. USD/CAD continues to trade close to session lows just under the 1.2750 mark, with traders more focused on the latest batch of mixed US economic data.

European Central Bank Chief Economist Philip Lane on Friday said in an interview on Bloomberg TV that the entire Euro area must adapt to high energy prices and warned that "we" are facing new bottlenecks due to lockdowns in China. The Eurozone is not returning to the low inflation path, he noted, adding that the ECB has already done a lot in pulling back stimulus.

The larger issue, he continued, is not about raising the deposit rate away from -0.5%, but about normalisation, before adding that euro depreciation will be an important element when creating the ECB's next set of projections.

- USD/JPY corrected from the two-decade high amid aggressive USD long-unwinding trade.

- The Fed-BoJ policy divergence extended some support and helped limit any further losses.

- Mixed oscillators on hourly charts warrant caution before placing aggressive bearish bets.

The USD/JPY pair came under some selling pressure on the last day of the week and eroded a part of the overnight strong gains to a fresh two-decade high. The pair remained on the defensive through the first half of the European session, albeit managed to rebound a few pips from the daily low and was last seen trading just below mid-130.00s.

The US dollar witnessed aggressive long-unwinding trade and snapped a six-day winning streak to the five-year high. This, in turn, was seen as a key factor that exerted downward pressure on the USD/JPY pair. That said, a big divergence in the monetary policy stance adopted by the Bank of Japan and the Fed helped limit the downside.

From a technical perspective, the intraday downtick stalled near the 129.75 region, or the 50-hour SMA. The said area coincides with the 38.2% Fibonacci retracement level of the strong gains recorded over the past two trading sessions. This, in turn, should act as a pivotal point and help determine the USD/JPY pair's intraday move.

Technical indicators on intraday charts - though have been losing positive traction - are yet to confirm a bearish bias. This makes it prudent to wait for sustained break below the aforementioned confluence support before confirming that the USD/JPY pair has topped out and positioning for any meaningful corrective pullback.

Spot prices could then accelerate the decline towards testing the 50% Fibo. level support, around the 129.00 round-figure mark. The downward trajectory could further get extended towards the 61.8% Fibo. level, around the 128.60-128.55 region, which coincides with the 200-hour SMA and should act as strong base for the USD/JPY pair.

On the flip side, immediate resistance is pegged near the 130.75 area ahead of the 131.00 round-figure mark and the post-BoJ swing high, around the 131.25 region. Sustained move beyond the said barriers will be seen as a fresh trigger for bullish traders and set the stage for an extension of a near two-month-old bullish trend.

USD/JPY 1-hour chart

-637868238684704181.png)

Key levels to watch

FX option expiries for April 29 NY cut at 10:00 Eastern Time, via DTCC, can be found below.

- EUR/USD: EUR amounts

- 1.0565 1.4b

- 1.0600 542m

- 1.0650 436m

- 1.0700 2.3b

- 1.0750 423m

- GBP/USD: GBP amounts

- 1.2900 585m

- USD/JPY: USD amounts

- 126.75 500m

- 127.00 460m

- USD/CAD: USD amounts

- 1.2395 650m

- 1.2695 649m

- EUR/GBP: EUR amounts

- 0.8215 560m

- 0.8285 486m

- 0.8475 652m

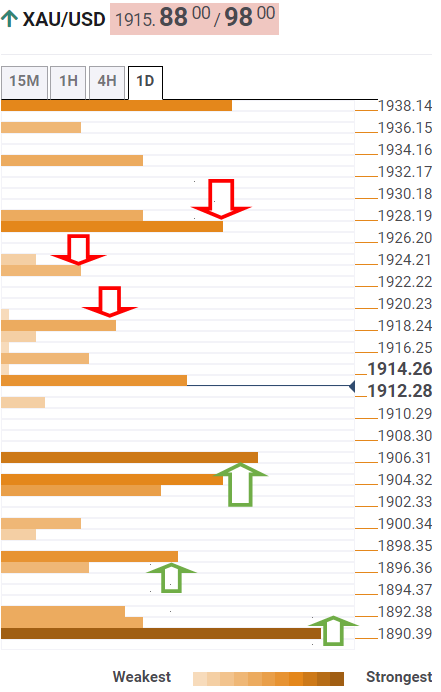

- Gold Price extends the rebound amid a sharp correction in the US dollar.

- Profit-taking engulfs the dollar heading into the Fed and NFP next week.

- $1,890 appears as strong support for XAUUSD while $1,927 guards the upside.

Month-end flows combined with profit-taking have triggered a sharp correction in the US dollar against its major rivals, aiding Gold Price to recover sizeable ground above the $1,900 mark. Investors unwind their USD longs ahead of next Wednesday's critical Fed rate hike decision, with a 50-bps lift-off well priced in. The rebound in Gold Price, however, appears shallow, as the dollar will continue capitalizing on the aggressive Fed rate hike expectations, despite the dismal US Q1 GDP print.

Also read: Gold Price Forecast: XAUUSD rebound - a good selling opportunity?

Gold Price: Key levels to watch

The Technical Confluences Detector shows that Gold Price is running into stiff resistance near $1,918 on the road to recovery.

A sustained break above the latter will put the SMA50 four-hour at $1,923 to test, above which the confluence of the previous week’s low and pivot point one-day R3 at $1,927 will challenge the additional upside.

Alternatively, if the recovery momentum fizzles out, then sellers could target the pivot point one-day R2 at $1,913 once again.

The next relevant support awaits around $1,905, where a dense cluster of support levels comprising the pivot point one-week S1, SMA5 one-day and pivot point one-day R1 converge.

The previous day’s high at $1,898 will be tested on the move lower. The last line of defense for XAU bulls is seen at $1,890, the intersection of the Fibonacci 23.6% one-day, the previous month’s low and SMA10 four-hour.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

- A combination of supporting factors assisted GBP/JPY to gain traction for the third straight day.

- A sharp USD corrective pullback from the multi-year peak extended support to the British pound.

- The risk-on impulse undermined the JPY’s relative safe-haven status and remained supportive.

The GBP/JPY cross maintained its bid tone through the first half of the European session and was last seen trading near the daily high, around the 163.70-163.85 region.

Following the overnight sharp pullback of nearly 150 pips from the three-day high, the GBP/JPY cross regained positive traction for the third successive day on Friday, though lacked bullish conviction. The US dollar witnessed aggressive long-unwinding trade and benefitted the British pound. On the other hand, the risk-on impulse undermined the Japanese yen's relative safe-haven status and acted as a tailwind for the GBP/JPY cross.

The Japanese yen was further pressured by the dovish Bank of Japan statement on Thursday. It is worth recalling that the Japanese central bank stuck to its ultra-loose policy setting and vowed to conduct daily operations to defend its “near-zero” target for 10-year bond yields. Moreover, the BoJ Governor Haruhiko Kuroda said that risks to the economy are skewed to the downside and showed readiness to ease policy further if necessary.

Despite the supporting factor, the GBP/JPY cross, so far, has struggled to attract strong follow-through buying amid diminishing odds for aggressive Bank of England rate hikes. Weak UK Retail Sales figures released last week highlighted that high inflation might have already started taking its toll on consumer spending. Adding to this, the flash PMI prints showed that the UK economy is under stress from the soaring cost of living.

The mixed fundamental backdrop makes it prudent to wait for sustained strength above the 164.00 mark before positioning for an extension of this week's solid bounce from the monthly low. In the absence of any major market-moving economic releases, the USD price dynamics will play a key role in influencing sterling. Traders will also take cues from the broader market risk sentiment for some short-term opportunities around the GBP/JPY cross.

Technical levels to watch

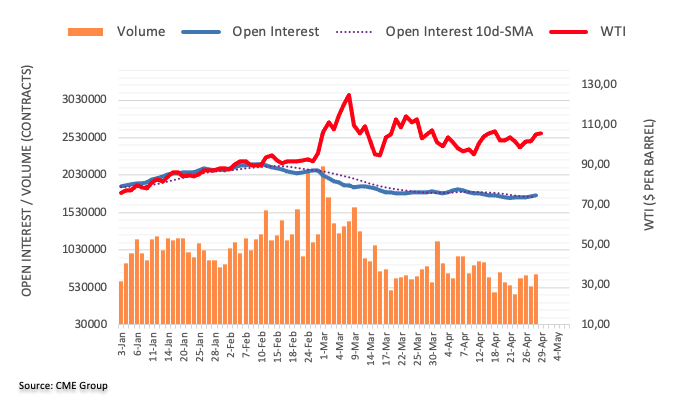

Open interest in crude oil futures markets went up for the third consecutive session on Thursday, now by nearly 19K contracts according to advance prints from CME Group. Volume followed suit and rose by 157.3K contracts, fading the previous day’s retracement.

WTI now targets April tops around $109.00

Prices of the WTI extended the weekly recovery on Thursday. The move was accompanied by rising open interest and volume, paving the way for the continuation of this bounce to, initially, the April high just above the $109.00 mark per barrel in the very near term.

The Eurozone economy expanded by 0.2% on the quarter in the three months to March of 2022, missing 0.3% expected and 0.3% prior, the preliminary estimate showed on Friday.

On an annualized basis, the bloc’s GDP rate rose by 5.0% in Q1 vs. 4.7% booked in the fourth quarter of 2021 while matching 5.0% expectations.

Also read: Eurozone Preliminary Inflation rises 7.5% YoY in April vs. 7.5% expected

FX implications

EUR/USD was last seen trading at 1.0575, up 0.78% on the day. The euro failed to react to the Eurozone GDP and inflation data, as the correction in the US dollar leads the way.

About Eurozone Preliminary GDP

The Gross Domestic Product released by Eurostat is a measure of the total value of all goods and services produced by the Eurozone. The GDP is considered as a broad measure of the Eurozone's economic activity and health. Usually, a rising trend has a positive effect on the EUR, while a falling trend is seen as negative (or bearish).

The annualized Eurozone Harmonised Index of Consumer Prices (HICP) rose by 7.5% in April, coming in higher than the previous reading of 7.4%, the latest data published by Eurostat showed on Friday. The consensus forecast was for a reading of 7.5%.

The core figures arrived at 3.5% YoY in April when compared to 3.2% expectations and 2.9% booked in March.

The Euro area figures are reported a day after Germany’s annual inflation for April arrived at 7.8%, beating expectations of 7.6% following a 7.6% increase reported in March.

The bloc’s HICP figures hold significance, as it helps investor assess the chances that the European Central Bank (ECB) might signal a faster than an expected path for policy tightening.

Key details (via Eurostat)

“Looking at the main components of euro area inflation, energy is expected to have the highest annual rate in April (38.0%, compared with 44.4% in March), followed by food, alcohol & tobacco (6.4%, compared with 5.0% in March), non-energy industrial goods (3.8%, compared with 3.4% in March) and services (3.3%, compared with 2.7% in March).”

EUR/USD reaction

EUR/USD paid little heed to the mixed Eurozone inflation figures. The spot is adding 0.77% on the day, currently trading near-daily highs of 1.0578.

The index hit another record high, as the Russian invasion of Ukraine pushed fuel and natural gas prices to all-time highs.

- AUD/USD witnessed a short-covering bounce amid a sharp USD slide from the multi-year high.

- The risk-on impulse undermined the safe-haven USD and benefitted the perceived riskier aussie.

- Any further upside seems limited ahead of the RBA/FOMC monetary policy decisions next week.

The AUD/USD pair built on its steady intraday recovery move through the first half of the European session and climbed to a fresh daily high, around the 0.7160 area in the last hour.

The pair gained strong positive traction on the last day of the week and moved further away from its lowest level since early February, around mid-0.7000s touched the previous day. The US dollar witnessed aggressive long-unwinding trade and for now, seems to have snapped a six-day winning streak to the five-year peak. This, along with the risk-on mood, extended support to the perceived riskier aussie and triggered some short-covering around the AUD/USD pair.

Apart from this, a goodish pickup in commodity prices offered additional support to the resources-linked Australian dollar amid expectations for an early rate hike by the Reserve Bank of Australia. The Australian Bureau of Statistics reported on Wednesday that consumer prices surged at the fastest annual pace in two decades during the first quarter. The data fueled speculations that the RBA could start the policy tightening cycle as soon as next week.

It, however, remains to be seen if bulls are able to capitalize on the move or the AUD/USD pair meets with a fresh supply at higher levels amid the prospects for rapid interest rate hikes in the US. The markets have been pricing in a 50 bps rate hike at the upcoming FOMC meeting on May 3-4. The US central bank is also expected to continue tightening its monetary policy when it meets again in June and July, and ultimately lift rates to around 3.0% by the end of the year.

Hence, the market focus will remain glued to the upcoming central bank event risks - the RBA policy update on Tuesday and the highly anticipated FOMC decision on Wednesday. In the meantime, traders might refrain from placing aggressive bets, making it prudent to wait for some follow-through buying before positioning for any further gains. Nevertheless, the AUD/USD pair seems all set to end in the red for the fifth successive week and remains at the mercy of the USD price dynamics.

Technical levels to watch

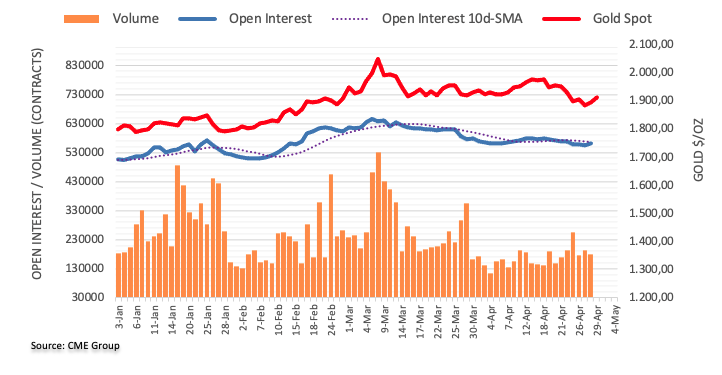

Considering preliminary readings from CME Group for gold futures, open interest increased by more than 7K contracts on Thursday, reversing the previous pullback. Volume, instead, left behind Thursday’s build and shrank by nearly 11K contracts.

Gold: Next hurdle comes around $1930

Thursday’s decent gains in gold prices were amidst rising open interest, allowing for the continuation of the upside momentum in the very near term and with the immediate target at the 55-day SMA around $1930 per ounce troy.

Here is what you need to know on Friday, April 29:

The US Dollar Index (DXY) turned south following a six-day rally, during which it gained more than 3%, early Friday with investors finally looking to book their profits on the last trading day of April. First-quarter Gross Domestic Product (GDP) and April HICP inflation data from the euro area will be watched closely by market participants ahead of the Personal Consumption Expenditures (PCE) Price Index, Personal Income and Personal Spending figures from the US.

Although the dollar continued to outperform its rivals despite the disappointing growth data on Thursday, it is having a difficult time finding demand ahead of the weekend. The improving market mood, as reflected by strong gains seen in major European equity indexes, seems to be playing a role in recent dollar weakness.

US GDP Quick Analysis: Houston, we have contraction, but three reasons support dollar strength.

EUR/USD is trading at a fresh daily high above 1.0570 early Friday. In addition to the selling pressure surrounding the dollar, the euro's strength is helping the pair extend its rebound. The data from Germany revealed earlier in the day that the economy grew at an annualized rate of 3.7% on a yearly basis in the first quarter (calendar-adjusted) of 2022. This reading came in better than analysts' estimate of 3.6%.

After touching its lowest level since July 2020 near 1.2400 on Thursday, GBP/USD gained traction and was last seen rising nearly 0.8% on the day above 1.2550.

USD/JPY is pulling away from the fresh multi-decade high it set above 131.00 on Thursday and is trading below 130.00 in the early European session.

Gold registered modest gains on Thursday and gathered bullish momentum after breaking above $1,900 early Friday. The benchmark 10-year US Treasury bond yield is trading flat on the day near 2.84%, allowing XAU/USD to capitalize on the dollar weakness.

Bitcoin rose above $40,000 but failed to close there on Thursday. BTC/USD trades with modest losses near $39,500 on Friday. Ethereum lost its bullish momentum before reaching $3,000 and was last seen fluctuating in a relatively tight range around $2,900.

- EUR/USD regains the smile and targets 1.0600.

- EMU flash April CPI next of note on Friday.

- US inflation tracked by the PCE comes next in the dockewt.

Finally, some light at the end of the tunnel for the European currency, as EUR/USD regains some upside traction and manages to break above the 1.0500 mark on Friday.

EUR/USD focuses on EMU, US inflation data

After six consecutive day pullbacks, EUR/USD rebounds with some conviction and now approaches the key barrier at 1.0600 the figure amidst the corrective decline in the greenback and the mixed performance in yields.

On the latter, US yields advance modestly and remain close to weekly highs, while German 10y bund yields fade part of Thursday’s decent advance.

In the domestic calendar, flash GDP Growth Rate in Germany showed the economy is expected to expand 3.7% YoY and 0.2% inter-quarter. Later in the European morning, advanced inflation and GDP figures in the broader Euroland will be in the limelight.

Across the pond, all the attention is predicted to be on the inflation figures gauged by the PCE and Core PCE along with Personal Income/Spending and the final U-Mich Index.

What to look for around EUR

EUR/USD leaves behind part of the recent multi-session sharp selloff and rebounds from 5-year lows around 1.0470 (April 28). The outlook for the pair still remains tilted towards the bearish side, always in response to dollar dynamics, geopolitical concerns and the Fed-ECB divergence. Occasional pockets of strength in the single currency, in the meantime, should appear reinforced by speculation the ECB could raise rates at some point around June/July, while higher German yields, elevated inflation and a decent pace of the economic recovery in the region are also supportive of an improvement in the mood around the euro.

Key events in the euro area this week: Germany, EMU Flash Q1 GDP Growth Rate, EMU Flash Inflation Rate (Friday).

Eminent issues on the back boiler: Asymmetric economic recovery post-pandemic in the euro area. Speculation of ECB tightening/tapering later in the year. Second round of the presidential elections in France (April 24). Impact on the region’s economic growth prospects of the war in Ukraine.

EUR/USD levels to watch

So far, spot is up 0.72% at 1.0574 and faces the next hurdle at 1.0936 (weekly high April 21) seconded by 1.1000 (round level) and finally 1.1142 (100-day SMA). On the other hand, a break below 1.0470 (2022 low April 28) would target 1.0453 (low January 11 2017) en route to 1.0340 (2017 low January 3 2017).

- A combination of factors prompted aggressive selling around USD/CAD on Friday.

- Rising oil prices underpinned the loonie and exerted pressure amid a weaker USD.

- Traders now eye Canadian GDP/US PCE inflation data for a meaningful impetus.