- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 29-03-2022

The Bank of Japan has been intervening in the markets which has seen the yen depreciate significantly this month.

On Wednesday, they have announced that they offer to buy 600B yen in 3-5 yr JGBs and 725B yen in 5-10 yr JGBs.

This follows a number of days of heavier intervention in the central bank's quest to defend a key yield cap by offering to buy unlimited amounts of 10-year government bonds.

Its ultra-loose policy sent the yen skyrocketing to 125.10 on Tuesday, its highest level since 2015. Today, the price is a touch higher again by 0.24% and popping gin the last hour as the BoJ continues to show its hand.

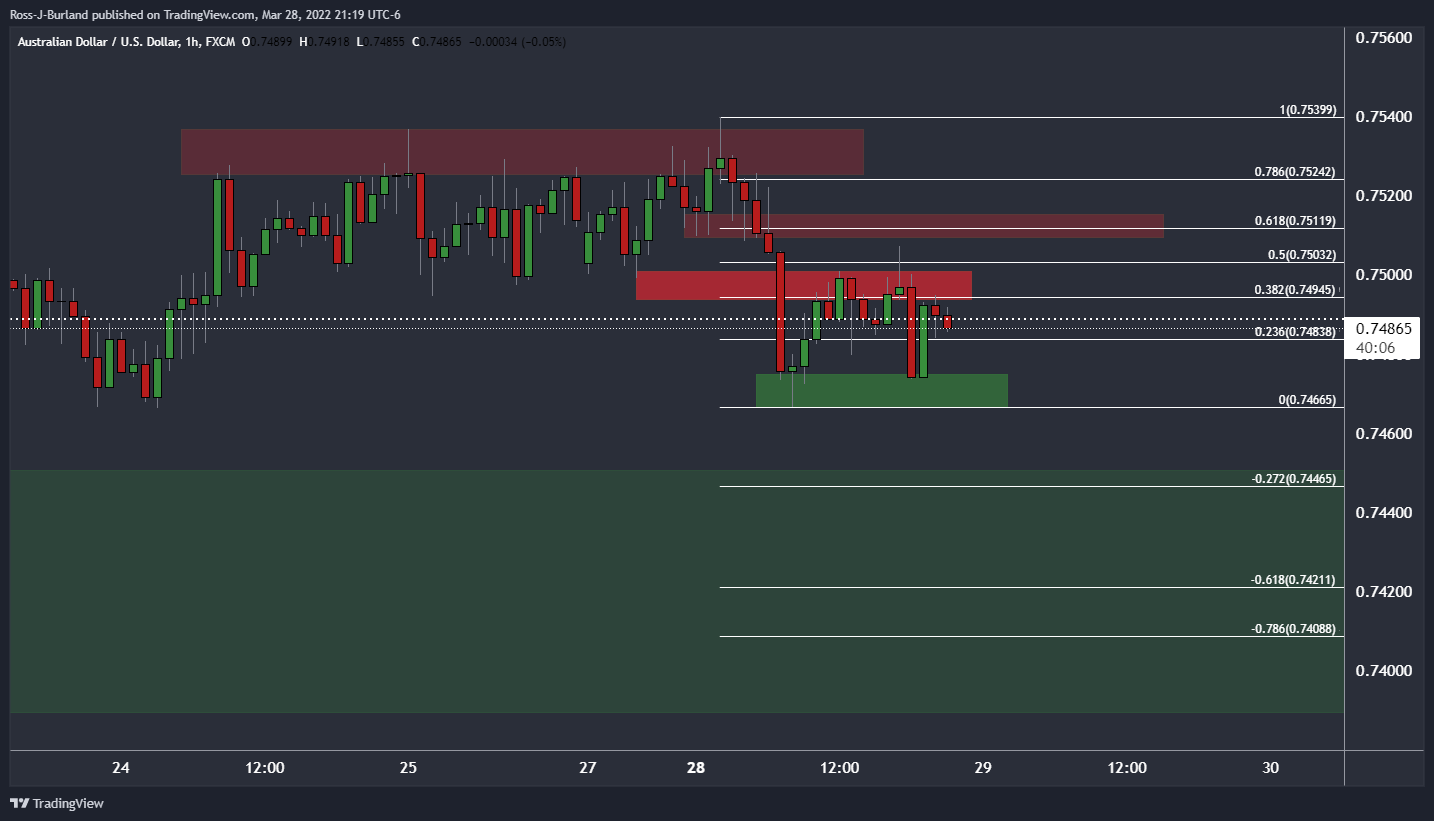

- AUD/USD has settled above 0.7500 as progress on the Moscow-Kyiv peace talks underpins risk-on impulse.

- The upbeat market sentiment has improved the demand for risk-sensitive assets.

- Strong Australian Retail Sales have underpinned the antipodean against the greenback.

The AUD/USD pair is breaching its previous balanced profile in which the auctioning was placed in a narrow range of 0.7466-0.7519 on the upside. The pair has displayed a firmer rally after hitting a low of 0.7165 on March 15.

The constructive step towards a ceasefire by the Kremlin and Kyiv has set a positive tone for the market. Risk-on impulse is gaining more traction and eventually, the risk-perceived assets are scaling higher. Russian leader Vladimir Putin has withdrawn some of its troops from the Ukrainian land against an adaptation of neutral status by Ukraine. The former has cut off its military activity in northern Ukraine and Kyiv while Ukraine has promised to abstain from alliances. The roadmap toward a truce between Russia and Ukraine has cheered the market sentiment.

Apart from that, the aussie has been underpinned against the mighty greenback on upbeat Australian Retail Sales, which were reported on Tuesday. The Australian Bureau of Statistics reported monthly Retail Sales at 1.8%, much higher than the preliminary estimate of 1% but in line with the previous figure of 1.8%.

Meanwhile, a dead cat bounce in the US dollar index (DXY) has pushed it towards 98.40 but is likely to lose grounds soon and will find initiative selling further. The odds of a 50 basis point (bps) interest rate hike by the Federal Reserve (Fed) are stabled amid the decent performance of US JOLTS Job Openings data. The JOLTS Job Opening was recorded at 11.266M, slightly higher than a month earlier figure of 11.263M but modestly higher than the estimate of 11M.

- Auction below the ascending triangle formation is making the loonie bulls hopeful.

- Loonie bulls await a death cross from 50 and 200-period EMAs for further validation.

- The RSI (14) has registered a fresh low around 38.00, which signals a fresh downside impulsive wave.

The USD/CAD pair has tumbled below 1.2500 after failing to turn the strong upside move of Monday into a bullish reversal. The asset is settling below 1.2500 and is likely to extend its losses amid broader weakness in the greenback.

On the daily scale, the USD/CAD has settled below the ascending triangle formation whose upper end is capped around 1.2960 while the trendline of the lower end is placed from 18 May 2021 low at 1.2013. Usually, a violation of an ascending triangle formation on the downside fetches volume expansion and displays wide range ticks.

Loonie bulls await a death cross from 50 and 200-period Exponential Moving Averages (EMAs), which are trading at 1.2662 and 1.2645 respectively. This will put loonie bulls in a dominant position.

Meanwhile, the Relative Strength Index (RSI) (14) has slipped below 40.00 from its previous oscillating range of 40.00-60.00, which signals a bearish move ahead. The RSI (14) has registered a fresh low of around 38.00.

Should the asset drops below Friday’s low at 1.2465, the major will be dragged towards the round level support at 1.2400, followed by the 29 October 2021 low at 1.2328.

On the flip side, greenback bulls can become worthy if the asset surpasses last week’s high at 1.2624, which will send the asset towards March 11 low at 1.2694. Breach of the latter will send the pair towards round level resistance at 1.2800.

USD/CAD daily chart

-637841909230707723.png)

- The S&P 500, the Dow Jones, and the Nasdaq Composite printed gains on upbeat market sentiment.

- Discussions between Russia and Ukraine improved as a meeting between Putin – Zelenskiy looms.

- Gold, the greenback, and US Treasury yields finished in the red.

US equities ended the Wall Street trading session in positive territory amid an optimistic market mood, as Russia-Ukraine jitters easied, thus boosting market participants’ sentiment. The S&P 500, the Dow Jones Industrial Average, and the heavy-tech Nasdaq recorded gains between 0.97% and 1.84%, finishing at 4,631.60, 35,294.19, and 14,787.13, respectively.

Positive developments in Eastern Europe underpins the market sentiment

The market mood improvement courtesy of developments in the Russia – Ukraine front boosted the prospects of a truce between both countries. Furthermore, Russia’s Medisnky noted that talks had been constructive, and Russia is taking two steps to de-escalate the conflict. Additionally, reports that a Putin – Zelenskiy meeting could be possible, according to the Ukrainian Presidential Advisor Podolyak, as reported by a CNN reporter on Twitter.

Meanwhile, the US Dollar Index, a gauge of the greenback’s value, ended at 98.410, down 0.69%, while the 10-year US Treasury yield extended its losses, down five basis points at 2.398%, and during the day sat below the 2-year, which now is at 2.372%, just two-basis point short of inverting the yield curve for the second time in the day.

Sector-wise, the leading gainers were Real Estate, Technology, and Consumer Discretionary, up 2.85%, 2.06%, and 1.54% each. The main loser was Energy which lost 0.44% despite rising crude oil prices.

In the commodities complex, the US crude oil benchmark, WTI, is up 1.58%, trading at $105.39 BPD, while gold (XAU/USD) is down 0.17%, exchanging hands at $1890.15 a troy ounce, pressured by risk appetite.

The US economic docket featured Philadelphia Fed President Patrick Harker crossing the wires. Harker stated that inflation in the US would be around 4% in 2022 and added that the US central bank “misjudged” the effect of fiscal expenditure on inflation.

He added his name to the list of policymakers that do not rule out a 50-bps increase in the Federal Funds Rate (FFR). Harker commented that the QT could add the equivalent of two quarter-point rate increases to Fed tightening.

Technical levels to watch

- USD/CHF slips to near 0.9300 on progress in the Russia-Ukraine peace talks.

- A constructive step by Moscow and Kyiv toward a truce has brought a fresh wave of risk-on impulse.

- The DXY failed to capitalize on upbeat Consumer Confidence and JOLTS Job Openings.

The USD/CHF pair has attracted some significant offers near 0.9375 and has been dropped near 0.9300 as the improved risk appetite of investors fades off the rally in the mighty greenback. The constructive outcome from the Russia-Ukraine peace talks has cheered the market sentiment and a risk-on impulse has underpinned the demand for risk-perceived assets.

The Kremlin is cutting its military activity in northern Ukraine and its capital Kyiv as an initial step to feature a truce. The withdrawal of Russian troops from various parts of Ukraine has indicated a ceasefire between the nations going forward. Meanwhile, Ukraine is adopting a neutral status and has proposed to abstain from joining alliances. It is worth noting that Russia was not dominating the position in those regions however a withdrawal of Russian military activity from Mariupol city will be considered a significant step towards a ceasefire further.

On the dollar front, the US dollar index (DXY) has lost its ground and is oscillating near 98.00 amid an upbeat market mood. The outperformance of US Consumer Confidence and JOLTS Job Openings has failed to provide any material optimism for the greenback. Although, their outperformance has firmed the odds of a 50 basis points (bps) interest rate hike by the Federal Reserve (Fed) in May’s monetary policy.

Apart from the Russia-Ukraine peace talks, investors will focus on US ADP Employment Change and Gross Domestic Product (GDP) Annualized, which are due on Wednesday while the Swizz docket will unfold Swiss National Bank (SNB) Quarterly Bulletin in the same period.

- The DXY sensed selling pressure and slipped near 98.00 on the upbeat market mood.

- Risk-sensitive assets are underpinned amid progress in the Russia-Ukraine peace talks.

- An uptick in US Consumer Confidence shows elevating confidence of individuals in US economic activities.

The US dollar index (DXY) has witnessed a serious plunge near 99.40 after its multiple failed attempts of kissing the psychological figure of 100.00. Souring market mood on obscurity over the progress of the Russia-Ukraine peace talks were providing a cushion to the mighty greenback but risk sentiment turned active after Moscow withdraw some of its troops from northern Ukraine and Kyiv. The initial step toward a ceasefire with Ukraine has cheered the market participants and risk-sensitive assets have witnessed stellar demand from investors. On the Ukraine front, the administration has announced to adopt a neutral status but with a stipulation of international guarantees that it would be protected from attack and proposed not joining alliances or hosting bases of foreign troops.

US Consumer Confidence and JOLTS Job Openings data

The US Conference Board reported Consumer Confidence at 107.2 in March from 105.7, reported a month earlier and a little above the expected 107.0 reading. This showed that the confidence of US individuals in the US economic activities is on elevation. Meanwhile, the JOLTS Jobs Opening landed at 11.266M, slightly higher than the previous print of 11.236M but modestly higher than the estimation of 11M.

Key events this week: ADP Employment Change, Gross Domestic Product (GDP) Annualized, Core Personal Consumption Expenditure, Initial Jobless Claims, Nonfarm Payrolls (NFP), Unemployment Rate, and ISM Manufacturing PMI

Eminent issues on the back boiler: Russia-Ukraine Peace Talks, OPEC Meeting, Fed President John C. Williams speech, European Central Bank (ECB) President Christian Lagarde speech.

- The NZD/JPY finished Tuesday’s session flat, as the Asian Pacific session is about to begin.

- Reports from Eastern Europe shed some light on a meeting between Putin and Zelensky.

- NZD/JPY Price Forecast: Price action over the last two days suggests consolidation lies ahead.

The NZD/JPY grinds lower on Tuesday, although an improved risk appetite as positive news from Eastern Europe suggests that Russia and Ukraine might be finding some agreements in their postures, which could trigger a cease-fire and find a diplomatic solution to the war. At 85.20. the NZD/JPY does not reflect the aforementioned, as the end of the Japanese fiscal year looms, meaning that the yen strengthened on month-end flows.

Market sentiment improved on Tuesday as reports from the Russia - Ukraine front increased the prospects of a cease-fire between both parties. As reported by a CNN reporter on Twitter, it is possible a reunion between Russian President Vladimir Putin and Ukraine’s President Volodymyr Zelenskyy, as stated by Ukrainian President Advisor Podolyak.

The optimistic tone lifted US equities, which ended in the green, gaining between 097% and 2.55%. The so-called “fear index,” the CBOE Volatility Index (VIX), dropped below 20, sits at 18.90, down 3.72%, reflecting confidence in investors.

In the FX space, the low yielder EUR and safe-haven peers benefitted, particularly the Japanese yen.

Aside from this, in the overnight session for North American traders, the NZD/JPY seesawed in the 85.30-80 range. However, late in the European session, it dropped below the 85.00 mark, reaching a daily low at 84.27, recovering later as the New York session ended, reclaiming the 85.00.

NZD/JPY Price Forecast: Technical outlook

The NZD/JPY printed an inverted hammer after a steeper upward move towards 87.00, followed by a regular hammer, but on a lower note, as the close is above the open. Those two candlesticks themselves signal that the upward bias could shift to consolidation, despite that the daily moving averages (DMAs) reside below the spot price.

With that said, the NZD/JPY first resistance would be 85.73. Breach of the latter would expose 86.00, followed by April 2013 high at 86.41, and then the multi-year-high reached on Monday at 86.95.

On the flip side, the NZD/JPY first support would be 85.00. A sustained break could lead towards March 29 low at 84.27, followed by the 84.00 mark, and then October 21, 2021, daily high at 82.50.

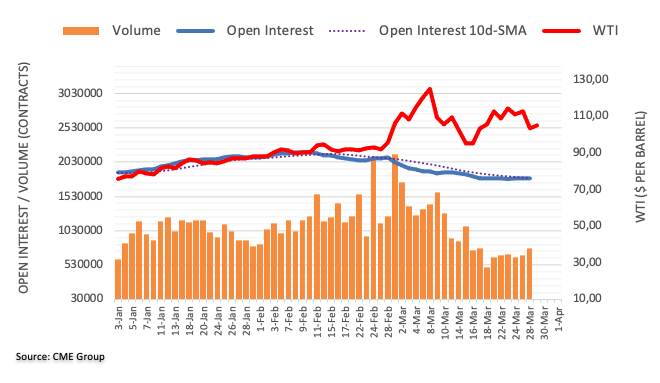

- Two-way price action in energy markets following peace talk headlines between Russia and Ukraine.

- WTI falls on the prospects of a cease-fire but rallies due to sceptism.

West Texas Intermediate (WTI) crude oil prices were starting out on the back foot again but managed to stage a recovery from below the US$100 level at the $98.54 spot following traction in Russian & Ukraine peace talks. Russia said it will reduce military activity around the Ukrainian cities of Kyiv and Chernihiv.

Spot WTI crude oil rallied to a high of $107.81 while for May delivery, the futures closed down US$1.72 to settle at US$104.24 per barrel after earlier touching US$98.44. May Brent crude, the global benchmark, was last seen down US$2.15 to US$110.33.

The moves in oil prices were counterintuitive to the prospect that a ceasefire could be around the corner. Russia indicated the talks could pave the way for a meeting between Russian President Vladimir Putin and his Ukrainian counterpart Volodymyr Zelensky. However, this initially saw Brent crude fall to USD106/bbl, down from USD120/bbl last week.

Coldwater, however, was poured over the good news by US Secretary of State Antony Blinken who expressed scepticism about Russia’s promise to de-escalate its military operations around Kyiv. ''The market is also grappling with the impact of lockdowns in China which are weighing on crude oil demand. A sharp slowdown in mobility in Shanghai, which accounts for 4% of China’s oil consumption, could lower overall consumption in China,'' analysts at ANZ Bank said.

''OPEC members continued to strike a cautious tone ahead of this week’s meeting. Saudi Arabia and UAE have suggested it doesn’t see the need to accelerate output increases, with several ministers highlighting how their production strategy has stabilised the oil market.''

Meanwhile, with regards to the peace talks, analysts at TD securities said, ''while these factors certainly tame some of the bullish factors present in the crude market, they are unlikely to completely undo the vast array of supply risks that come with self-sanctioning and extremely stretched spare capacity. ..

''Furthermore,'' the analysts added, ''China's zero-Covid strategy may once again translate into a short-lived but sharp hit to mobility, which could in turn boost prices as demand recovers in the aftermath. Despite the knee-jerk correction, the set-up is still ripe for higher energy prices.''

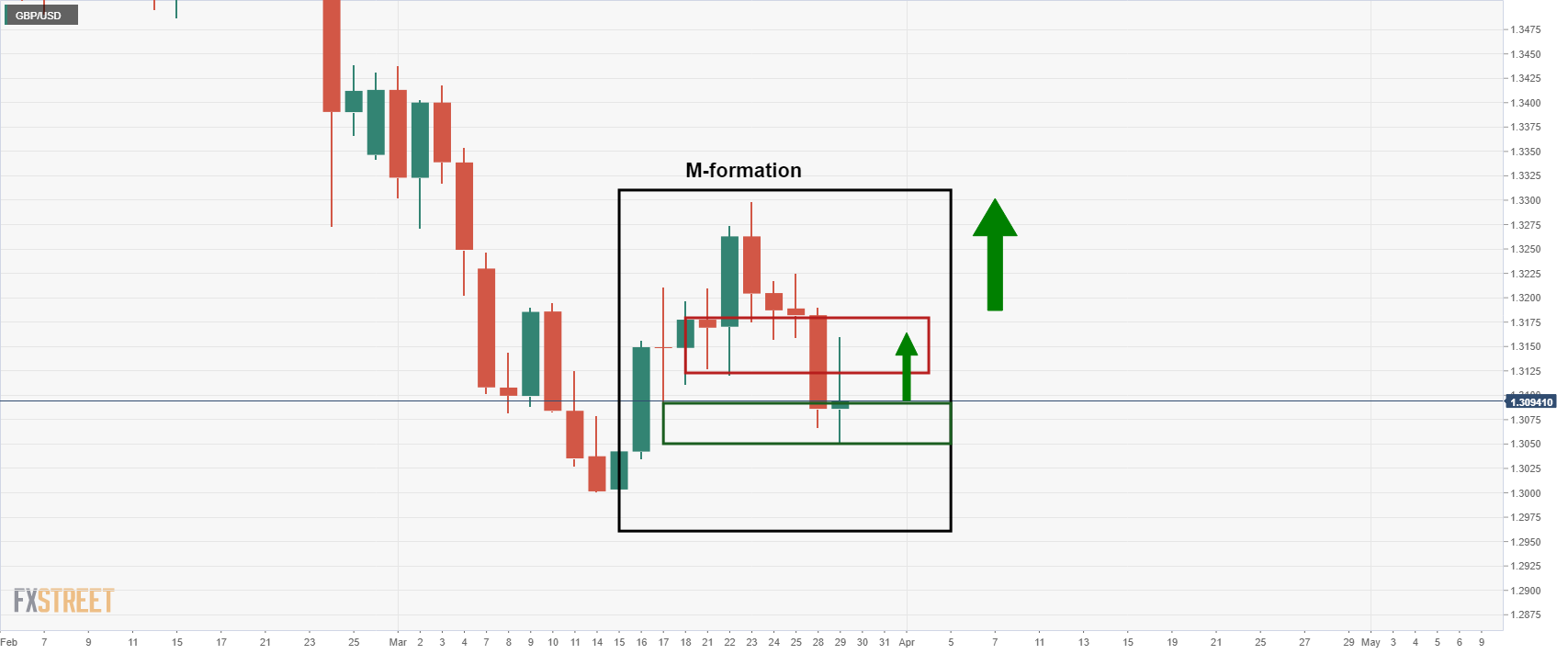

- GBP/USD in a chop as the bulls and bears battle it out within familiar ranges.

- Bulls need to get above 1.3110 for the near term.

GBP/USD is stuck in ranges across the time frames without a clear bias one way or the other. The following illustrates this across the weekly, daily and hourly time frame.

GBP/USD daily chart

As illustrated above, the price has run into the neckline of the formation, a move that was telegraphed in the prior day's analysis as follows:

''The price, however, is being held up at what could be a support zone on the daily chart. This is an old area of resistance and an M-formation could be marked so long as the forthcoming sessions are bullish.''

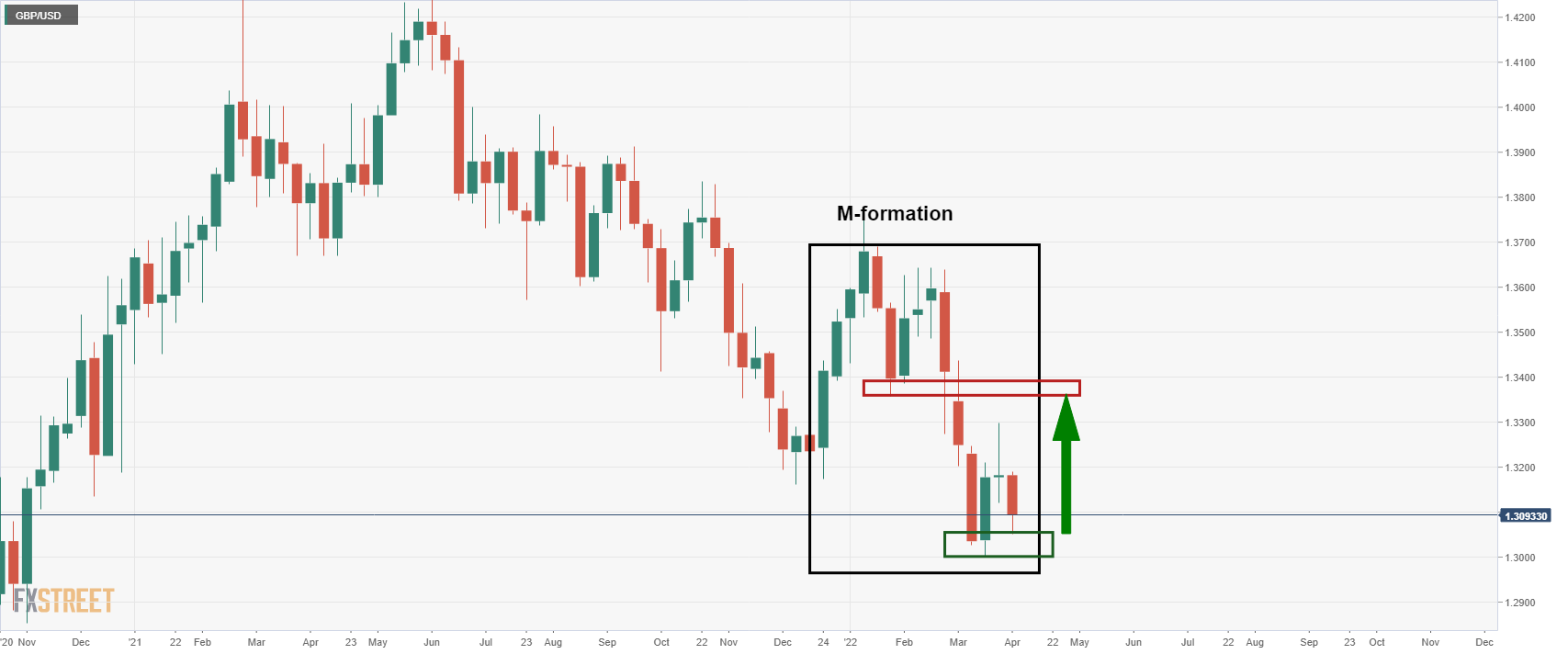

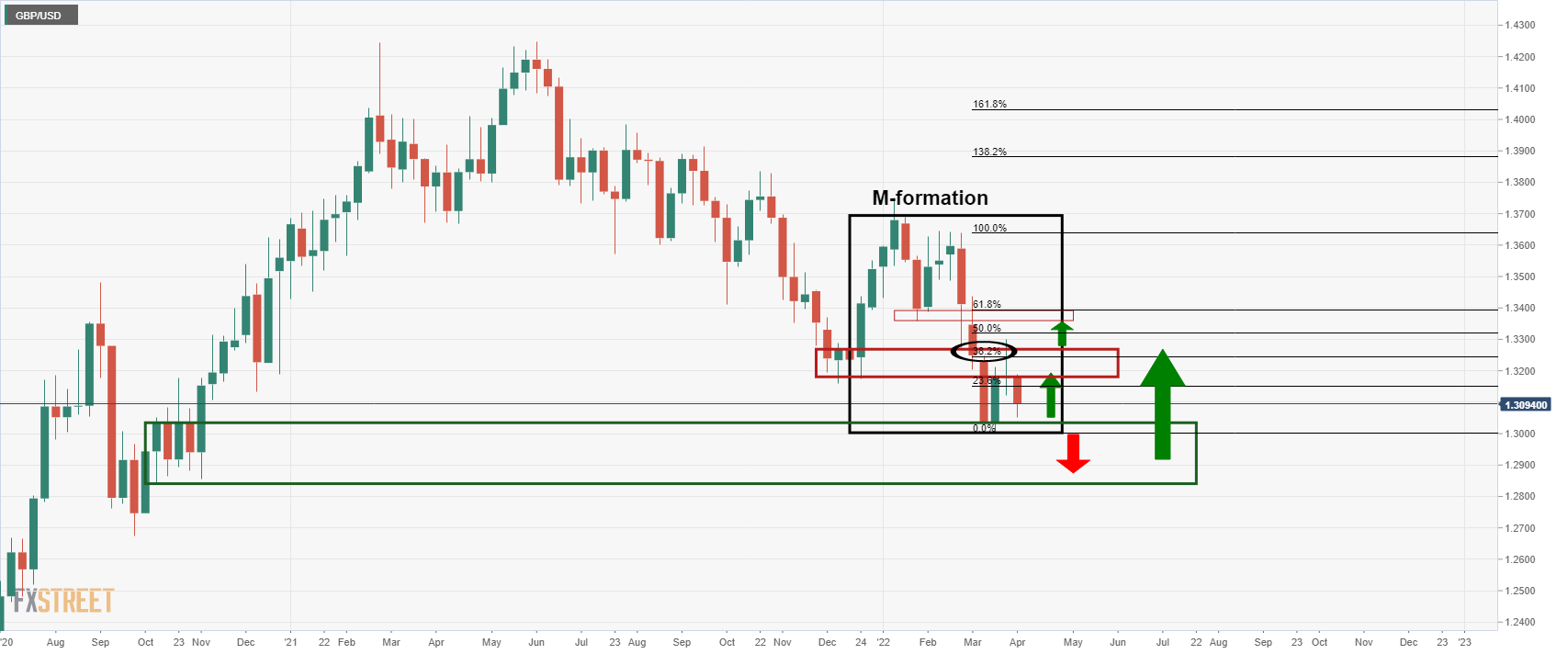

The analysis is fractal in nature and part of a long-term projection as per the weekly chart:

GBP/USD weekly chart

While the current week's candle is strongly bearish and arguably engulfing following the weekly dojo candle of last week, there is still time until the close for the price to move higher and even close bullish. However, this would be going against the grain in the futures market as short positions increased for the third week. Additionally, the price has already reached a 38.2% Fibonacci retracement level and prior support of December 2021. Therefore, there is a lot of work to come from the bulls:

Instead, we could see the price break the recent lows and mitigate the imbalance left behind from the summer of 2020 down in the 1.28 areas.

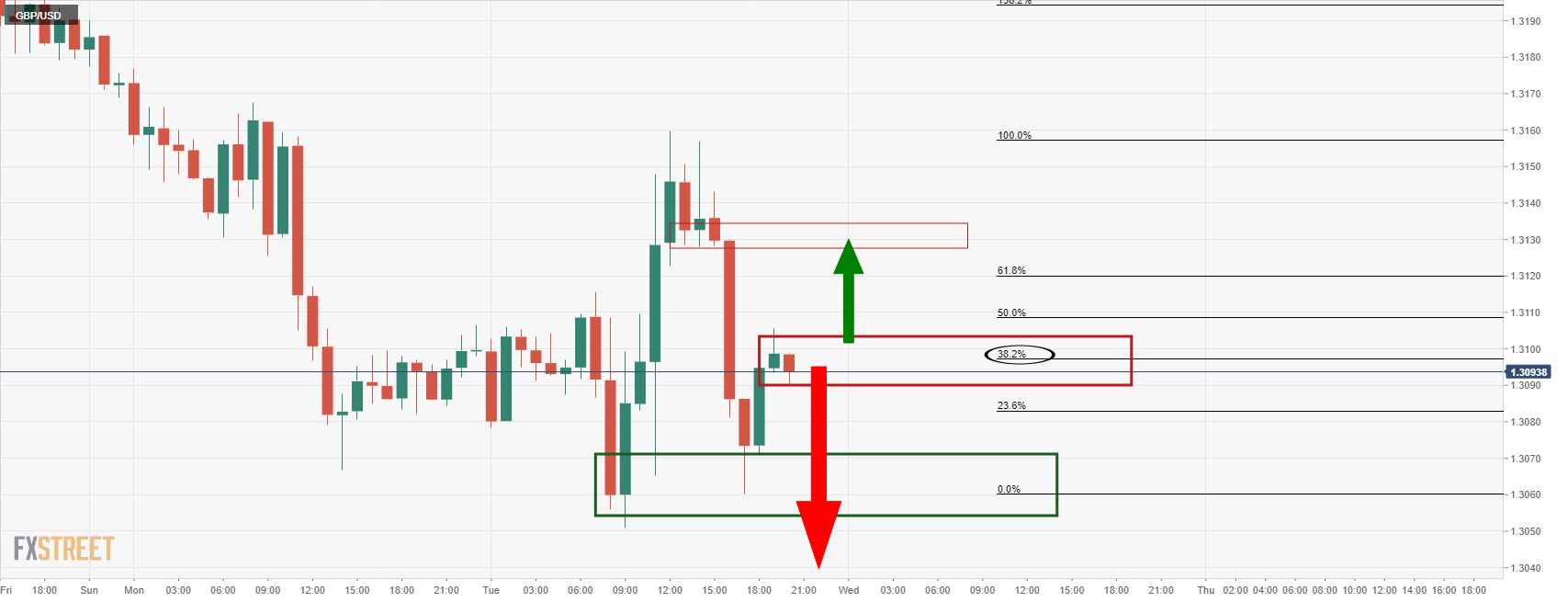

For the very near term, however, there is an M-formation on the hourly chart:

GBP/USD H1 chart

As seen, the price here has also made a 38.2% Fibo retracement from where the bears appear to be engaging from. However, should there be a move beyond the highs in the 1.3110 area, then the neckline of the formation would be expected to come under pressure near 1.3130.

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:00 (GMT) | New Zealand | ANZ Business Confidence | March | -51.8 | |

| 07:00 (GMT) | Switzerland | KOF Leading Indicator | March | 105.0 | 100.8 |

| 08:00 (GMT) | Switzerland | Credit Suisse ZEW Survey (Expectations) | March | 9 | |

| 09:00 (GMT) | Eurozone | Economic sentiment index | March | 114 | 109 |

| 09:00 (GMT) | Eurozone | Industrial confidence | March | 14 | 9 |

| 09:00 (GMT) | Eurozone | Consumer Confidence | March | -8.8 | -18.7 |

| 09:00 (GMT) | Eurozone | ECB President Lagarde Speaks | |||

| 12:00 (GMT) | Germany | CPI, m/m | March | 0.9% | 1.6% |

| 12:00 (GMT) | Germany | CPI, y/y | March | 5.1% | 6.3% |

| 12:15 (GMT) | U.S. | ADP Employment Report | March | 475 | 400 |

| 12:30 (GMT) | U.S. | PCE price index, q/q | Quarter IV | 5.3% | 6.3% |

| 12:30 (GMT) | U.S. | PCE price index ex food, energy, q/q | Quarter IV | 4.6% | 5% |

| 12:30 (GMT) | U.S. | GDP, q/q | Quarter IV | 2.3% | 7% |

| 14:30 (GMT) | U.S. | Crude Oil Inventories | March | -2.508 | -1.558 |

| 23:50 (GMT) | Japan | Industrial Production (YoY) | February | -0.5% | |

| 23:50 (GMT) | Japan | Industrial Production (MoM) | February | -1.3% | 0.5% |

- AUD/JPY’s rally eased on Tuesday, with the pair on course to post only its second daily loss since 14 March.

- But after dipping as low as the 91.40s, the pair managed to recover back above above the key 92.00.

- Any pullback towards support in the form of 2017 highs around 90.00 likely to be viewed as a buying opportunity.

The AUD/JPY rally eased on Tuesday, with the pair on course to post only its second daily loss since 14 March after hitting its highest level since mid-July on Monday. Crucially though, after dipping as low as the 91.40s, the pair managed to recover back above the key 92.00 level that had been acting as resistance last week, a sign that the rally isn't dead just yet. At current levels in the 92.30s, the pair still trades with losses on the day of about 0.4%, but the day’s price action will instill some confidence that the sharp rally of recent weeks isn't over yet.

Indeed, as the end of the month and quarter approaches, AUD/JPY looks on course to confirm a historic rally. The pair is up over 10.5% on the month and on course for its best monthly gain since 1995. While signs from the RBA haven't exactly been hawkish, a hawkish repricing of central banks globally (apart from in Japan) and a subsequent sharp rise in global yields (again, apart from in Japan) has sent the pair lurching higher.

The Aussie also continues to benefit from the idea that the Australian economy is disproportionately geared to benefit from the global surge in commodity prices as a result of the Russo-Ukraine war. At the same time, amid recent positive updates regarding Russo-Ukraine peace talks, the risk-sensitive Aussie alsos stands to benefit from the ongoing recovery in global equity markets.

Perhaps the main bearish factor for AUD/JPY at this point is the fact its already come so far in such a short time and is thus looking overbought. A lack of meaningful economic events in Australia and Japan this week mean focus will very much remain on geopolitics, risk appetite and global yields, with any pullback towards support in the form of 2017 highs around 90.00 likely to be viewed as a buying opportunity, with a target (perhaps) of 100.00.

- NZD/USD has surged towards 0.6950 on Tuesday in a risk-on setting.

- The bulls are lapping up the positives from the Ukraine & Russian peace talks.

NZD/USD is trading near 0.8% higher on the day in a risk-on setting as the US dollar bleeds out following positive progress in Ukraine and Russian peace talks. The pair has rallied on Tuesday from a low of 0.6875 to a high of 0.6945 so far.

''While overall FX market volatility has been elevated (with EUR/USD surging 1½ cents before coming back a touch and USD/JPY now about 2½ cents off Monday night’s peak), AUD and NZD have been much calmer against the USD (but more volatile on crosses),'' analysts at ANZ Bank explained.

Meanwhile, Russia promised on Tuesday to scale down military operations around Ukraine's capital and north, while Kyiv proposed Ukraine join the EU while adopting neutral status by not joining NATO.

This sparked off a risk-on wave during the peace talks that are taking place in an Istanbul palace more than a month into the largest attack on a European nation since World War II. There was a heads up on Monday, however, and was something telegraphed by Financial Times Monday which had already led to an improved risk-on environment for the week.

''Talks successful enough for a possible meeting between Putin and Zelensky, says Ukrainian presidential advisor Mykhailo Podolyak. “We have documents prepared now which allow the presidents to meet on a bilateral basis," he said.

However, Russia's top negotiator has warned that there is still a long way to go until a mutually acceptable agreement with Ukraine is reached and de-escalation around Kyiv and Chernihiv does not mean a cease-fire. British Prime Minister Boris Johnson said a ceasefire agreement in Ukraine will not be enough to lift British sanctions against Russia. US president, in the same vein, says that the US will keep sanctions.

In more recent trade, Ukraine's Volodymyr Zelenskyy has said that signals from talks with Russia could be called positive, but these signals don't drown out explosions of Russian shells.

Overall, ''the NZD story is a good one, but having “gone early” with the recovery and hikes, it may not be as good as the AUD story; so, could we be in for a period of slight gains against the USD but losses against the AUD as the latter re-awakens,'' analysts at ANZ Bank said.

What you need to take care of on Wednesday, March 30:

The dollar plunged alongside other safe-haven assets amid renewed hopes for a diplomatic solution to the Russia-Ukraine conflict. Risk appetite surged following headlines indicating a de-escalation of Russian attacks around Kyiv and Chernihiv, as announced by Russia's mediator Vladimir Medinsky.

Ukraine has suggested a new security guarantee system, with Turkey as one of the main potential security guarantors. If the security guarantee system works out, then Ukraine will agree to neutral status, including not to host foreign military bases in its territory. Kyiv wants to hold a referendum on Ukraine's neutrality.

Meanwhile, the US yield curve temporarily reverted, as the 2-year and the 10-year Treasury noted were hovering around 2.40%, although that on the shorter note retreated to 2.35%. An inverted yield curve is usually seen as a sign of recession.

Wall Street rallied following its overseas counterparts on easing concerns related to the Eastern European crisis.

Central banks and potential rate hikes returned to the spotlight. Financial markets are pricing in a 60 bps hike in Europe, while US Philadelphia Federal Reserve President Patrick Harker noted that rate hikes should be methodical. He said he would not rule out a 50 bps hike in May but would not commit either. Finally, he added that the balance sheet reduction could be equivalent to two quarter-point rate increase.

The EUR/USD pair trades just below the 1.1100 threshold, maintaining its bullish potential. GBPUSD struggled to post gains, now trading at around 1.3100. Commodity-linked currencies find room to advance at the end of the American session, with AUD/USD trading above 0.7500 and USD/CAD in the 1.2480 price zone. The USD/JPY pair settled around 122.90.

Commodity prices were firmly down, with WTI currently trading at $104.30 a barrel. Spot gold fell to $1,890.05 a troy ounce, to later bounce to settle around $1,917.00.

Top 3 Price Prediction Bitcoin, Ethereum, XRP: Crypto markets hold off sellers as bulls keep charging

Like this article? Help us with some feedback by answering this survey:

- The British pound gave back Monday’s gains amid a risk-on market sentiment.

- A positive market mood failed to underpin the GBP/JPY cross currency.

- GBP/JPY Price Forecast: Upwards, but a bearish engulfing candlestick pattern looms.

GBP/JPY erases Monday’s 300 plus pip rally gains and is set to form a bearish engulfing candlestick pattern, which means that the pair is about to be under downward pressure. However, a daily close below 160.87 is needed to confirm its validity. At the time of writing, the GBP/JPY is trading at 161.01.

The market mood has improved since the mid-European session, as European and US equity indices reflect. Discussions between Russia and Ukraine seem to progress. Latest developments in Eastern Europe suggest that a Putin – Zelenskiy meeting would likely happen, as Ukrainian presidential advisor Podolyak said, according to a CNN reporter via Twitter.

Overnight, the GBP/JPY clung to the 50-hour simple moving average (SMA), followed by a slump during the European session, which carried on to the North American one, witnessing a daily low at 160.25.

GBP/JPY Price Forecast: Technical outlook

The GBP/JPY retreated below 161.00, but the bias remains upward. Nevertheless, if the GBP/JPY records a daily close below 160.87, it would form a bearish engulfing candlestick pattern, suggesting that downward pressure is mounting on the GBP/JPY.

If that scenario plays out, the GBP/JPY first support would be 160.00. Once cleared, the next demand zone would be March 23 daily low at 159.03, followed by 158.00.

Otherwise, the GBP/JPY first resistance would be 162.00. Breach of the latter would expose March 29 daily high at 162.71, followed by 163.00 and then 164.00.

Technical levels to watch

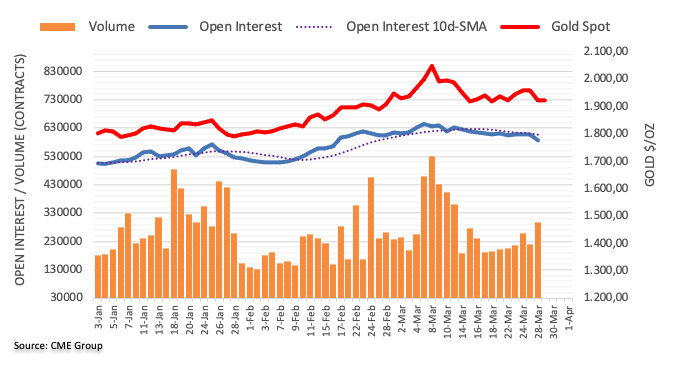

- Gold has rebounded well from earlier session lows in the $1890 area and is back to the mid-$1910s.

- But a sustained rebound is unlikely against the backdrop of positive Russo-Ukraine updates and yields that may remain buoyant.

Spot gold (XAU/USD) prices have enjoyed a healthy rebound from earlier session lows in the $1890 area during US trade and are now back to trading near $1915, with on-the-day losses brought back to just 0.3% versus 1.6% at earlier lows. The rebound was in part facilitated by the presence of strong support in the $1890 area in the form of the 50-Day Moving Average (at $1892) and earlier monthly lows at $1895. This encouraged buyers to pile back, with a sharp pullback from recent highs across the US yield curve also helping.

There was a lot of focus on the first inversion of the US 2-year/10-year yield spread since 2019, a classic recession indicator. Indeed, anxiety regarding US economic weakness in wake of the Fed’s recent hawkish shift in policy guidance and amid ongoing global economic uncertainty as a result of the ongoing Russo-Ukraine conflict has likely helped to support precious metals during US trade.

But in wake of Tuesday’s positive Russo-Ukraine developments that included “constructive” talks which appeared to make progress towards a peace deal and a Russian announcement of scaling down military activities in Ukraine’s north, it remains far to soon to bet on a sustained XAU/USD rebound back to earlier weekly highs in the $1960 area. Further positive Russo-Ukraine headlines later this week could well inject bearishness into gold markets, as was the case momentarily on Tuesday.

There is also a barrage of US data to consider (official March jobs report and ISM surveys, plus Core PCE), all of which should continue to indicate a hot economy, thus supporting the Fed’s recent policy shift. This is likely to keep the trajectory of US bond yields pointed upwards, with higher borrowing acting as a headwind to non-yielding precious metals via a higher “opportunity cost”. Rallies back towards the mid-$1900s may well be sold.

- AUD/USD is moving in on the key hourly resistance.

- Risk sentiment remains positive and unhinged by yield curve inversions.

- Ukraine & Russian peace talks take precedence and lift market spirits.

At 0.7510, AUD/USD is attempting to move higher as it takes on a wall of resistance near 0.7520. The price has travelled from a low of 0.7456 to a high of 0.7518 so far.

The risk sentiment is making for a better environment for the high beta currency as US stocks climb on Tuesday, lifted by signs of progress in peace talks between Russia and Ukraine. However, the US Treasury yield curve has flashed warning signs for the economy as curves invert, keeping a lid on the risk-on mood.

Moscow has decided to drastically cut military activity around Kyiv and northern Ukraine, while Ukraine proposed adopting a neutral status but with international guarantees that it would be protected from attack. This was something telegraphed by Financial Times Monday which had already led to an improved risk-on environment before Aussie Retail Sales beat expectations and started to lift the currency also.

Retail Sales increased by 1.8% MoM in February, resulting in annual growth of 9.1% YoY. The strong monthly result was driven by social spending, which recovered as Omicron caution dissipated in most states, analysts at ANZ Bank said. ''Strong discretionary spending in February is a good sign of household financial wellbeing ahead of intensifying inflation.''

Meanwhile, the Reserve Bank of Australia's tightening expectations continues to rise. ''WIRP suggests liftoff is fully priced in for the June 7 meeting now. At the beginning of March, liftoff was priced in for the August 2 meeting,'' analysts at Brown Brothers Harriman argued.

''Swaps market sees 225 bp of tightening over the next 12 months and another 125 bp over the following 12 months that would see the policy rate peak near 3.75%, up from 3.5% at the start of the week. ''

The analysts noted that AUD is nearing a test of the October high near 0.7555. ''A break above that would set up a test of the May 2021 high near 0.7890. it is the best performing major YTD, followed by NOK, CAD, and NZD.''

US recession on the cards?

In the US, there are worries that a recession is on the way as the US 5s30s curve has inverted for the first time since 2006 and the 2s10s curve has inverted for the first time since 2019 as the market prices in faster rate hikes.

''Historically, a US recession tends to follow a year after the curve inverts, though the variance is large and there are occasional false positives,'' analysts at TD Securities said, adding:

''The 10y-2y curve, which is another common metric, implies a 37% probability of recession within a year and a 43% probability one- to two-years ahead at current levels. The 30y-5y curve has actually moved in the opposite direction of late, with current levels suggesting a 19% recession chance in one- to two- years.''

Ukraine & Russian peace talks

Meanwhile, during the highly anticipated start of fresh peace talks, Russia promised on Tuesday to scale down military operations around Ukraine's capital and north, while Kyiv proposed Ukraine join the EU while adopting neutral status by not joining NATO.

The peace talks are taking place in an Istanbul palace more than a month into the largest attack on a European nation since World War II.

''Talks successful enough for a possible meeting between Putin and Zelensky, says Ukrainian presidential advisor Mykhailo Podolyak. “We have documents prepared now which allow the presidents to meet on a bilateral basis," he said.

Nevertheless, Russia's top negotiator said that there is still a long way to go until a mutually acceptable agreement with Ukraine is reached and de-escalation around Kyiv and Chernihiv does not mean a cease-fire. British Prime Minister Boris Johnson said a ceasefire agreement in Ukraine will not be enough to lift British sanctions against Russia. US president, in the same vein, says that the US will keep sanctions.

Looking ahead for the week, US Nonfarm Payrolls data will take centre stage as a meanwhile distraction t the Ukraine crisis on Friday. ''Employment likely continued to advance in March following two strong reports averaging +580k in Jan and Feb,'' analysts at TD Securities said.

''That said, we expect some of that boost to fizzle, though to a still firm job growth pace of +350k. Indeed, job gains should lead to a new drop in the unemployment rate to a post-COVID low of 3.7%. We also expect wage growth to slow to a still firm 0.3% MoM pace.''

- Gains in the EUR/USD lift the EUR/GBP, gaining 1.01%.

- The market sentiment improvement benefits the EUR, as it gains against most G8 currencies.

- EUR/GBP Price Forecast: Neutral biased but a daily close above the 200-DMA would shift the bias to neutral upwards.

The EUR/GBP is rallying sharply from Monday’s highs and is probing the 200-day moving average (DMA), which in the case of being broken and then a daily close achieved, would suggest a shift in the EUR/GBP bias. At the time of writing, the EUR/GBP is trading at 0.8470.

An upbeat market sentiment keeps safe-haven peers pressured. In the case of the EUR/GBP, the GBP/USD has remained downward pressured, losing 0.04% in the day. Contrarily, the EUR/USD advances almost 1%, a tailwind for the EUR/GBP.

Overnight, the EUR/GBP was subdued in the Asian Pacific session, within the 0.8383-90 range. However, as European traders got to their desks, the shared currency began its 100-rally of the day, breaking the 0.8400 mark on its way to the daily high at 0.8482.

EUR/GBP Price Forecast: Technical outlook

The EUR/GBP daily chart depicts a neutral bias. However, as mentioned in the first paragraph, a daily close above the 200-DMA which sits at 0.8467, would open the door for further gains and shift the bias to neutral-upwards.

If that scenario plays out, the EUR/GBP first resistance would be 0.8500. Breach of the latter would expose the confluence of a descending channel top-trendline and December 20, 2021, 0.8550, a daily high, followed by December 8, 2021, a daily high at 0.8599.

On the flip side, the EUR/GBP first support would be 0.8400. Once cleared, the next demand zone would be March 11 daily low at 0.8360, followed by February 21 daily low at 0.8309.

Technical levels to watch

- EUR/USD peace talk rally is faded as the US dollar recovers.

- Ukraine and Russian peace talks are making positive progress but risk of global recession looms.

Trading at 1.1078 currently, EUR/USD is back under pressure in the mid-US session trading in the green by some 0.87% after correcting from the peace talk rally highs of 1.1137, its highest level since March 17.

During the highly anticipated start of fresh peace talks, Russia promised on Tuesday to scale down military operations around Ukraine's capital and north, while Kyiv proposed Ukraine to join the EU while adopting neutral status and not join NATO. The Financial Times had previewed such a proposal on Monday which led to a bout of risk-on during the latter part of the New York session.

This was the first taste of any real progress towards negotiating peace between the two nations and the markets have reacted in kind. Their talks took place in an Istanbul palace more than a month into the largest attack on a European nation since World War II.

''Talks successful enough for a possible meeting between Putin and Zelensky, says Ukrainian presidential advisor Mykhailo Podolyak. “We have documents prepared now which allow the presidents to meet on a bilateral basis," he said.

In response, the safe-haven US dollar fell against a basket of peer currencies on Tuesday as measured by the DXY index which is trading off the lows of 98.037 and back to 98.485 currently. Meanwhile, steps toward a ceasefire or potential peace deal in Ukraine would be expected to significantly support the euro as Europe is seen suffering a hefty economic hit from the conflict and rises in energy prices.

Nevertheless, the markets are very much driven by headlines and the volatility is starting to wipe out some of the risk-on gains made at the start of the day. Some of the subsequent announcements have not been so positive, with Russia's top negotiator saying that there is still a long way to go until a mutually acceptable agreement with Ukraine is reached and de-escalation around Kyiv and Chernihiv does not mean a cease-fire.

British Prime Minister Boris Johnson said a ceasefire agreement in Ukraine will not be enough to lift British sanctions against Russia. US president, in the same vein, says that the US will keep sanctions strong and help aid Ukraine in its military forces.

Yield curve inversion implications

Additionally, there are concerns out there in markets that a recession is on the way as the US 5s30s curve has inverted for the first time since 2006 and the 2s10s curve has inverted for the first time since 2019 as the market prices in faster rate hikes.

''Historically, a US recession tends to follow a year after the curve inverts, though the variance is large and there are occasional false positives,'' analysts at TD Securities said.

Additionally, the analysts explained, ''the 5s30s inversion signals the market concern that the Fed might choose inflation credibility over achieving a soft landing, though it is too early to draw this conclusion. The Fed is sounding hawkish right now, but if growth begins to slow, some of the Fed's urgency to tighten will fade. "Nimble" could become consistent with a pause once the Fed reaches neutral. Note that QT will also be tightening financial conditions in the background.''

For now, however, the interest rate differentials between the US, EU and other nations, such as Japan, is underpinning a strong safe-haven greenback and the meanwhile peace talk relief rally in the euro may struggle to maintain traction.

''In comparison, the steepening in the US has moved way ahead of that in the EU, Japan, and the UK, and is only comparable to Australia,'' analysts at Brown Brothers Harriman said. ''This supports our view that growth differentials (and inflation expectations) are starting to play an increasingly larger role in asset prices as investors become more confident that the vaccine-led normalization is within sight.''

''While we are getting increasingly confident that the US dollar can carve out a bottom in the first quarter, the recovery won’t be a straight line as the US data can continue to disappoint. That said, the vaccine rollout here continues and should allow the US economy (and the dollar) to outperform in the coming months.''

- USD/JPY’s pullback from Monday’s 125.00 highs continued on Tuesday after Japanese policymaker jawboning triggered profit-taking.

- But the pair bounced at 122.00 and many strategists don’t expect a lasting pullback given the Fed’s recent hawkish shift.

USD/JPY’s sharp pullback from multi-year highs as traders mull recent jawboning from Japanese policymakers and assess whether the recent rally has gone too far continued on Tuesday, with the pair at one point testing the 122.00 level during US trade. The pair has since bounced back into the upper 122.00s, but at current levels in the 122.70s still trades lower by about 0.8% on the day and about 1.9% lower versus Monday’s highs around 125.00.

The BoJ this week stepped up its Yield Curve Control efforts to defend the upper limit of its 10-year target range (at 0.25%). The increased purchases mark an increase in monetary stimulus at a time when other major global central banks like the Fed, BoE and ECB are removing such stimulus and helped power the recent melt-up in USD/JPY. But as the pair hit its highest levels since 2015 on Monday at 125.00, and as its 14-day Relative Strength Index (RSI) hit its highest levels since 2014 above 87.00, traders warned that profit-taking and a technical correction was likely.

That profit-taking on USD/JPY long appeared triggered by comments from Japanese Finance Minister Shunichi Suzuki, who said the government would closely watch currency moves to prevent a "bad" weak yen that hurts the economy. “While the comments from Japanese officials overnight are unlikely to reverse the yen weakening trend on their own, they should at least help to slow the recent fast pace of yen selling” said analysts at MUFG.

Strategists at UniCredit said that “the divergence between the US and Japan’s monetary policy will continue to weigh on the yen, which we expect to stabilize at around 125 versus the dollar and probably even beyond that level”. “Our view on the greenback remains positive due to the Federal Reserve’s hawkish stance,” they added. Perhaps it shouldn’t have come as too much of a surprise then to see USD/JPY find support at 122.00. As a barrage of US data (including the latest NFP number) looms and as Fed policymakers throw their weight behind the Fed’s new hawkish rate guidance, a retest of this week’s highs at 125.00 looks very much on the cards.

The difference between the US 2-year (just under 2.40%) and 10-year (just under 2.40%) yields just fell below 0.0% (or "inverted") for the first time since 2019. Over the past 70 years, this has been a reliable indicator that a recession in the US economy is coming within the next 18-24 months.

The 2s/10s inversion comes after multiple inversions on other key parts of the US curve. Other key spreads like the 5s/10s and 5s/30s have been inverted for a while now. Market participants often interpret an inverted yield curve as a sign that monetary policy in the short-term is overly tight, or more broadly, as a reflection of expectations for weaker longer-term growth versus short/medium-term growth.

- The USD/CAD erases Monday’s gains and trades near its close.

- A risk-on market mood weighed on the USD, thus slightly boosting the CAD.

- The Fed and BoC to hike rates aggressively in 2022, as shown by money market futures.

- USD/CAD Price Forecast: The pair is downward biased.

The USD/CAD is barely flat during the North American session after a volatile Monday’s session, which pushed the pair towards a weekly high at 1.2592, retreating afterward towards the 1.2510 area. At the time of writing, the USD/CAD is trading at 1.2514.

The geopolitical situation in Ukraine progressed, lifting the market mood

On Tuesday, the market sentiment improved as talks between Russia and Ukraine have been constructive, said the Russian negotiator Medisnky. Additionally, reports emerged that a Putin – Zelenskiy meeting could be possible. At the same time, the Ukraine negotiator noted that Ukraine’s neutral status would mean that there would not be any foreign military bases in the country.

Meanwhile, Philadelphia Fed President Patrick Harker crossed the wires. Harker noted that inflation in the US would be around 4% in 2022 and added that the US central bank “misjudged” the effect of fiscal expenditure on inflation. He added to the list of policymakers that do not rule out a 50-bps increase to the Federal Funds Rate. Harker commented that the QT could add the equivalent of two quarter-point rate increases to Fed tightening.

Money market futures expect six more rate hikes by the Federal Reserve in 2022. In fact, some market players expect two 50 bps increases in the May and June meetings. Meanwhile, regarding the Bank of Canada, money markets are pricing in “between 200 and 225 basis points in the six remaining interest rate announcements in 2022, up from about 140 basis points before a blockbuster employment report this month,” according to Reuters.

USD/CAD Price Forecast: Technical outlook

The USD/CAD downfall appears to have bottomed, though the Relative Strength Index (RSI), at 38.05, almost horizontal, never reached oversold conditions, meaning that the USD/CAD might consolidate before resuming downwards.

That said, and once the daily moving averages (DMAs) reside above the spot price, the USD/CAD path of least resistance is downwards. The USD/CAD first support would be 1.2500. Once cleared, the next demand zone to test would be March 25, 1.2465 daily low, followed by November 10, 2021, daily low at 1.2386, and then October 2021 lows at 1.2288.

- Pound among the worst G10 performers during the American session.

- DXY trims losses as optimism starts to fade.

- GBP/USD unable to sustain a recovery, 1.3050 exposed.

The GBP/USD gave up all gains and dropped back under 1.3100 after reaching earlier a daily high at 1.3159. The dollar gained strength as Wall Street trimmed gains, while the pound weakened.

Data offset by market sentiment

The rally in stocks at the beginning of the US sessions pushed the dollar to fresh lows across the board. During the last hours, the optimism faded and the greenback recovered momentum. Still, lower US yields could limit the dollar’s upside. The 10-year yield is under 2.40%, down 2.60% so far on the day.

US data came in above expectation on Tuesday. The Jobs Opening and Labor Turnover Survey (JOLTS) showed job positions at 11.26 million (consensus 11.0 million); The S&P/Case-Shiller Home Price Index rose 19.1% in January from a year ago, above the 18.4% of market consensus. On the negative front, Conference Board’s consumer confidence index declined to 107.2, the lowest level in thirteen months. The ADP employment report is due on Wednesday and the Non-farm Payroll report on Friday.

Analysts at ING point out that “strong and vibrant housing and jobs markets reinforce the message that the Fed has a lot of work to do to regain control of inflation pressures. Consumer confidence is softening, presumably on the back of higher prices, but at least for now, households are happy to keep spending. The case for a series of 50bp Fed rate hikes is growing.” Fed’s Harker mentioned on Tuesday the central bank “collectively underestimated” the impact of fiscal spending on inflation.

The pound continues to show weakness after Bank of England Governor Bailey on Monday offered a cautious tone, warning about economic uncertainty. Also, the currency is being affected by the rally of EUR/GBP that trades above 0.8465, at the highest level since early March.

Technical levels

- The USD/CHF erases Monday losses courtesy of market sentiment improvement and a softer USD.

- Falling US Treasury yields undermine the greenback, as the DXY falls below the 99.00 mark.

- USD/CHF Price Forecast: Upward biased in the daily chart, but a double top in the hourly chart, suggest a correction towards 0.9280.

The USD/CHF erases Monday’s gains amid an improved market mood courtesy of advancement in peace talks in Eastern Europe and a softer US dollar, underpinned by falling US Treasury yields. At the time of writing, the USD/CHF is trading at 0.9304.

Reflection of the greenback’s weakness is portrayed by the US Dollar Index, falling almost 1%, sitting at 98.246. US Treasury yields eased from highs, a headwind for the USD/CHF.

The USD/CHF remained buoyant overnight in the Asian and early European session and reached a daily high at 0.9373. But headlines that Russia-Ukraine negotiations progressed, and the possibility of a Putin – Zelenskiy reunion, improved the market mood; thus, traders rushed out from US dollars which lifted the prospects of the Swiss franc, dragging the pair towards lows of 0.9310s.

USD/CHF Price Forecast: Technical outlook

The daily chart depicts the USD/CHF as upward biased, but Tuesday’s price action threatens to engulf the previous bullish candle, which could lead to further losses.

Meanwhile, the USD/CHF 1-hour chart depicts the formation of a double top near the 0.9373 area, double-tested on Monday and Tuesday, which pushed the USD/CHF below the double-top neckline, which is located at 0.9326, exposing the 0.9300

That said, the USD/CHF first support would be 0.9300. Breach of the latter would expose the double-top measured target at 0.9280.

Hourly chart

- Gold tumbles to 1890$ and then rebounds more than 20$.

- Volatility is set to remain high amid news from Ukraine and sharp moves in the Treasury market.

- Bearish bias prevails in XUA/USD, more losses seen on a consolidation under 1900$.

Gold is having another volatile session on Tuesday. Price dropped sharply to 1890$ following positive reports about the conversation between Ukraine and Russian authorities. It then rebounded sharply, rising back above 1910$.

XAU/USD is hovering around 1912$ as stocks in Wall Street hold onto daily gains. The yellow metal received support from a weaker US dollar and lower US yields. The DXY is having the worst day since March 10, falling 0.90%; it trades at 98.25, after finding support above 98.00.

The Treasury market is also making sharp moves. The US 10-year yield peaked earlier at 2.53% and then tumbled to as low as 2.38%. As of writing, it is hovering around 2.43%. The decline in yields took place amid an improvement in market sentiment.

XAU/USD holding above 1910$

While US yields continue to correct lower, gold could find buyers after dips. If yields start rising again, gold will likely came under pressure. A consolidation under 1900$ (or a daily close below 1910$) would likely trigger more losses. The next strong support stands at 1885$ (55-day SMA) followed by 1875$ and 1850$.

On the upside, the daily high at 1930$ is the first relevant resistance, followed by the 20-day simple moving average that stands 1955$. A daily close above 1960$ would negate the current negative bias.

Technical levels

- Silver has been volatile on Tuesday, dipping briefly under $24.00 but then recovering back above $24.50.

- Positive Russo-Ukraine updates triggered the initial dip to sub-$24.00 levels, whilst falling yields then helped the recovery.

- But that still leaves prices lower by more than 1.0% on the session.

It’s been a volatile session for spot silver (XAG/USD), with prices now back to just above $24.50 having at one point been below the key $24.00 level to test key support in the form of the 200-Day Moving Average. A combination of different factors have been exerting themselves on precious metal prices, with the initial drop under $24.00 as a result of the knee-jerk reaction to positive Russo-Ukraine updates, but the more recent rally likely as a result of a pullback in yields.

Indeed, commodity prices such as oil saw sharp downside in wake of the most recent positive Russo-Ukraine commentary and this saw bond market participants paring back on the inflation compensation they demand on bonds (i.e. via higher yields). Lower yields reduce the “opportunity cost” of holding non-yielding precious metals and, so, arguably, the reversal lower helped support spot silver recovery from more than one-month lows.

With silver thus having found robust support at the $24.00 area and at its 200DMA, the bears might not be confident of continued downside going forward. Lockdowns in China, whilst they might ease energy prices, risk exacerbating global supply chain snags which might worsen the inflation problem, thus presenting an upside risk for silver. That will be key a theme to watch.

Aside from this and geopolitics, there is plenty of data this week for investors to sink their teeth into, culminating in the official jobs report on Friday. All this data should feed into the narrative of a hawkish Fed that wants to get rates back to neutral as quickly as possible and Fed rhetoric, like Patrick Harker’s most recent remarks, are also likely to reinforce this narrative. This is a downside risk for silver, but high inflation may continue to negate it for now.

European Central Bank Governing Council member Bostjan Vasle on Tuesday said that an interest rate hike this year is feasible, reported newswires. It would be prudent for the ECB not to increase current uncertainties, he added, noting the important of monetary policy predictability.

Market Reaction

Markets did not react to Vasle's latest remarks, but it has nonetheless been a volatile day for Eurozone bond/short-term interest rate markets. German 2-year yields came within a whisker of positive territory and interest rate future markets were at one point showing that 67bps of tightening by the end of the year is priced for the ECB.

These moves have now backed of a little, but markets are clearly saying they expect more than one rate hike from the ECB in 2022. Flash March Eurozone HICP inflation readings later in the week will be important in this context.

- The EUR/JPY holds to the 136.00 mark on positive news from Russia-Ukraine.

- ECB’s Chief Economist Lane said it would be appropriate to normalize rates later this year.

- EUR/JPY Price Forecast: The path of least resistance is upwards, but it would depend on market sentiment.

The EUR/JPY climbs in the North American session but is off from seven-year-highs, lifted by news from Russia’s – Ukraine front, emerged of a possible cease-fire between both parties, an advance in negotiations after two weeks of being stuck. At the time of writing, the EUR/JPY is trading at 136.24.

Russia and Ukraine negotiations improve, the market sentiment shifts positively

Risk appetite increased after Russia’s Medisnky said that talks had been constructive and Russia is taking two steps to de-escalate the conflict. Furthermore added that a Putin – Zelenskiy meeting could be possible. On the Ukraine front, the negotiator said that neutral status would entail not having foreign military bases.

Headlines lifted the market sentiment alongside the shared currency against most crosses, including the Japanese yen, which has been under much stress, courtesy of the Bank of Japan (BoJ).

On Monday, the BoJ decided to buy Japanese Government Bonds (JGBs) to achieve its Yield Curve Control (YCC) fixed at 25 bps, as the BoJ maintains its loose monetary policy.

In the European session, the Chief Economist of the European Central Bank (ECB), Philip Lane, said that “there are scenarios where it would be appropriate to start to normalize interest rates later this year. And then, of course, there are scenarios where it could be appropriate to move at a later point.” However, he added that “inflation will decline later this year and will be a lot lower next year and the year after compared to this year.”

The Eurozone economic docket featured the German Gfk Consumer Sentiment for April, which tumbled to -15.5, more than the -14.5 estimated. Also, German Import Prices for February fell in both annual and monthly readings.

With that said, fundamentally, the central bank policy divergence between the ECB and the BoJ would favor the shared currency. Nevertheless, it’s essential to notice that unless Russia and Ukraine achieve a truce and the conflict de-escalates, the Euro area will feel the pain of elevated energy prices, meaning higher rates of the ECB but at the cost of slower growth.

EUR/JPY Price Forecast: Technical outlook

Monday’s price action in the EUR/JPY witnessed a seven-year-high at 137.54 but retreated 150-pips towards the 136.00 mark, on a downward move that seems to be profit-taking due to the steepness of the rally. However, the EUR/JPY buying pressure remains due to the size of Monday’s real-body of the candlestick, which is more extensive than the wick, suggesting that the JPY would continue losing vs. the EUR if the market sentiment improves.

That said, the EUR/JPY path of least resistance is upwards and would face its first resistance at 136.50. Breach of the latter would expose 137.00, followed by the YTD high at 137.54.

On the flip side, the EUR/JPY first support would be 136.00. Once cleared, the next demand zone would be March 29 low at 135.30, followed by March 25 134.74 daily high.

Philadelphia Fed President and FOMC member Patrick Harker said on Tuesday that Fed policymakers "collectively underestimated" the impact that fiscal spending in 2020 would have on inflation, reported Reuters. Harker said that there is "definitely correlation" between the yield curve and later recessions, but there is a need to look at a host of market signals, including inflation expectations and market sentiment.

Referring to his dots in the Fed's latest dot-plot, Harker said that he was a "median dot" and predicts seven rates hikes this year, though that is not a commitment to seven. Developments in China are "another wrench" in global supply chain and could make a 50 bps hike more appropriate, Harker noted, adding that balance sheet reduction could add the equivalent of two quarter point rate increases to Fed tightening.

Apparent progress in ceasefire talks has put a dent in safe-haven flows. Subsequently, gold tumbled beneath the $1,900 level. The path of least resistance appears to the downside amid positive Russo-Ukraine updates, economists at TD Securities report.

Strong ETF inflows associated with safe-haven appetite

“The latest easing of tensions comes at a time when rates markets are readying for the Fed to deliver a hawkish surprise to markets while easing price momentum has brought CTA liquidation triggers within range near $1880/oz.”

“While the yield curve may be bringing back whispers of a looming recession that could re-ignite investor interest in gold, ETF flows have not historically been strongly associated with the yield curve during a hiking cycle. This suggests that the strong ETF inflows have rather been associated with safe-haven appetite, which leads to downside risks as the negotiators continue to work towards a ceasefire.”

Philadelphia Fed President and FOMC member Patrick Harker said on Tuesday that interest rate hikes are to be "deliberate" and "methodical", reported Reuters. Inflation is "far higher than ... we are comfortable with" Harker said, caveating that "there are some signs in the data, and in what we hear from our contacts, that supply chain constraints are finally easing". Harker said that there is the potential for a "significant uptick" in the service sectors of large, Democrat-leaning cities that had the toughest pandemic rules. Harker did not speak on whether he would prefer 25 or 50 bps rate hikes in the coming months.

- WTI has been volatile on Tuesday and currently trades in the $102.00s, near the middle of the day’s $98.50-$107.80ish range.

- Weighing on prices has been positive Russo-Ukraine headlines and ongoing China lockdown worries.

Oil prices have seen rollercoaster price action on Tuesday. Front-month WTI futures currently trade in the $102.00s, slightly below the mid-point of the day’s near-$10 per barrel $98.50-$107.80ish ranges. On the week, WTI’s losses currently stand at more than $10, with the major bearish news having come out of China, where the Covid-19 outbreak continues to spread and authorities continue to try and stamp it out as per their so-called “dynamic zero Covid strategy”. Shanghai was the latest place to go into strict lockdown as infections in the city surge and this is a major theme playing on the mind of global oil market participants, given China’s status as both a major consumer and massive importer of the black gold.

But the major catalyst behind more recent volatility on Tuesday, i.e. the reason WTI slumped nearly $10 from session highs in within the space of about one hour, has been recent positive Russo-Ukraine updates. Peace talks have wrapped up and were framed as constructive by both sides, with the Ukrainians making a new security proposal to the Russians and hinting towards a possible Presidential meeting between the two sides. Meanwhile, the Russian Defense Ministry said it was scaling down military activities around northern Ukrainian cities in order to foster more conducive conditions for negotiations.

Moving forward, while WTI clearly remains vulnerable to both China lockdown and Russo-Ukraine peace talk progress-related headlines, a few factors may help underpin things. Firstly, Western leaders have said that a Russo-Ukraine peace deal does not mean an immediate end to sanctions, meaning that severe disruptions to Russian oil exports likely won’t ease any time soon, regardless of developments in Ukraine. Secondly, recent commentary from OPEC members suggests a more significant boost to output will not be forthcoming. The oil rollercoaster is likely to continue, but it remains far too early to bet on a return back to pre-Russo-Ukraine war levels under $90.00.

There were 11.266M job opening in the US at the end of February, the latest JOLTs Job-Opening data release on Tuesday by the US Labour Department showed. That was slightly less than the 11.283M openings at the end of January, but well above the 11.0M expected.

Market Reaction

Robust JOLTs data which points to a backdrop of continued very strong demand for labour throughout the US economy has not been enough to lift the buck from session lows, with the DXY still trading in the low 98.00s. The safe-haven USD has been weighed on Tuesday amid positive Russo-Ukraine updates that have spurred hope for a ceasefire.

The US Conference Board's measure of US Consumer Confidence rose slightly to 107.2 in March from 105.7 one month earlier, a little above the expected 107.0 reading, data released on Tuesday showed. The Consumer Present Situation Index rose to 153.0 in March versus 143.0 one month earlier and the Consumer Expectations Index fell to 76.6 versus 80.8 a month earlier. The Jobs Hard-to-get index fell to 9.8 from 12.0 the month prior and the 1-year Consumer Inflation Expectation Rate rose sharply to 7.9% from 7.1%.

Market Reaction

Currency markets did not react to the latest US data release.

- USD/JPY witnessed heavy selling on Tuesday amid a broad-based USD weakness.

- Hopes for diplomacy in Ukraine lifted the euro and weighed on the greenback.

- A combination of factors should lend support to the pair and limit deeper losses.

The heavily offered tone surrounding the greenback dragged the USD/JPY pair to a fresh daily low, around mid-122.00s during the early European session.

Following an early uptick to the 124.30 area, the USD/JPY pair witnessed some selling on Tuesday and extended the overnight sharp pullback from the 125.10 area or the highest level since August 2015. The latest optimism over the possibility of a diplomatic solution to end the war in Ukraine triggered aggressive short-covering around the shared currency. This, in turn, weighed on the US dollar and was seen as a key factor exerting downward pressure on the major.

Apart from this, the US dollar downtick lacked any obvious fundamental catalyst and is more likely to remain limited amid rising bets for a 50 bps Fed rate hike move at the next two meetings. Moreover, the divergence in the monetary policy stance adopted by the Fed and the Bank of Japan supports prospects for the emergence of dip-buying around the USD/JPY pair. The constructive outlook is reinforced by the risk-on impulse, which tends to undermine the safe-haven Japanese yen.

Russian Defense Ministry said that it would scale down military activity in Kyiv and Chernihiv in order to create conditions for dialogue. Adding to this, a Ukrainian negotiator noted that there have been enough developments to hold a meeting between Ukrainian President Volodymyr Zelenskyy and Russian President Vladimir Putin. The incoming geopolitical headlines boosted investors' confidence, which was evident from the bullish trading sentiment around the equity markets.

This makes it prudent to wait for strong follow-through selling before confirming that the USD/JPY pair has topped out in the near term. Next on tap is the US economic docket, featuring the release of JOLTS Job Openings and the Conference Board's Consumer Confidence Index. The focus, however, will remain on fresh geopolitical developments, which will influence the risk sentiment and drive demand for the safe-haven JPY, providing some impetus to the USD/JPY pair.

Technical levels to watch

- DXY tanked to the 98.00 area on Tuesday.

- Auspicious headlines open the door to a ceasefire in Ukraine.

- CB’s Consumer Confidence next of note in the calendar.

The greenback accelerates losses to 2-week lows near the 98.00 mark when tracked by the US Dollar Index (DXY) on turnaround Tuesday.

US Dollar Index offered on upbeat news from Ukraine

The index shed more than a big figure on Tuesday following encouraging news from the geopolitical scenario, which at the same time has opened the door to a potential ceasefire and eventually the end of the military conflict between Russia and Ukraine.

The dollar rapidly lost ground and approached the 98.00 region alon with a U-turn in yields in the belly and the long end of the curve, while the short end still cling to daily gains just below the 2.50% area.

In the docket, the House Price Index gauged by the FHFA rose 1.6% MoM in January, while house prices measured by the S&P/Case-Shiller Index gained 19.1% in the year to January.

Later in the session, the Conference Board’s Consumer Confidence is due along with JOLTs Job Openings.

What to look for around USD

Positive developments from the geopolitical landscape put the buck under strong downside pressure and forced the index to drop further into the negative territory. In the meantime, very near-term price action in the greenback continues to be dictated by geopolitics, while the case for a stronger dollar in the medium/long term remains well propped up by the current elevated inflation narrative, a potential more aggressive tightening stance from the Fed, higher US yields and the solid performance of the US economy.

Key events in the US this week: FHFA House Price Index, CB Consumer Confidence (Tuesday) – Mortgage Applications, ADP Employment Change, Final Q4 GDP (Wednesday) – PCE Price Index, Initial Jobless Claims, Personal Income, Personal Spending (Thursday) – Nonfarm Payrolls, Unemployment Rate, Final Manufacturing PMI, ISM Manufacturing PMI (Friday) .

Eminent issues on the back boiler: Escalating geopolitical effervescence vs. Russia and China. Fed’s rate path this year. US-China trade conflict. Futures of Biden’s Build Back Better plan.

US Dollar Index relevant levels

Now, the index is down 1.03% 98 09 and a break above 99.41 (2022 high March 7) would open the door to 100.00 (psychological level) and finally 100.55 (monthly high May 14 2020). On the flip side, the next down barrier emerges at 97.72 (weekly low March 17) seconded by 97.71 (weekly low March10) and then the 55-day SMA at 96.92.

USD/CAD trimmed nine consecutive days of losses. However, economists at Scotiabank still expect the pair to move downward.

Rallies towards the high 1.25/low 1.26 zone remain an attractive selling opportunity

“Given that the TSX has been one of the best performing major equity markets so far this year, month and quarter-end rebalancing flows may weigh on the CAD in the short run, delaying a run down through 1.2450. As yesterday’s CAD sell-off and today’s rebound reflect, however, USD rallies towards the high 1.25/low 1.26 zone remain an attractive selling opportunity.”

“A heavy tone persists on the short-term chart and trend momentum, while choppy, suggests the USD bear trend remains quite strong.”

“We see support at 1.2465, ahead of the Jan low at 1.2450, then 1.23.”

“Resistance remains 1.2585/1.2615 on the charts.”

- AUD/USD turned lower for the second straight day, though the downside remains limited.

- Hopes for diplomacy in Ukraine weighed on commodities and the resources-linked aussie.

- The risk-on impulse undermined the safe-haven USD and extended support to the major.

The AUD/USD pair witnessed aggressive selling during the mid-European session and dropped to a four-day low, around mid-0.7400s in the last hour.

The pair struggled to preserve its intraday gains, instead met with a fresh supply near the 0.7250 region and drifted into the negative territory for the second successive day on Tuesday. The incoming geopolitical headlines surrounding the Russia-Ukraine saga lifted hopes for a diplomatic solution to end the war. This, in turn, triggers a sharp pullback in commodity prices and was seen as a key factor that undermined the resources-linked Australian dollar.

In fact, the Russian Defense Ministry said that it would scale down military activity in Kyiv and Chernihiv in order to create conditions for dialogue. Moreover, a Ukrainian negotiator noted that there have been enough developments to hold a meeting between Ukrainian President Volodymyr Zelenskyy and Russian President Vladimir Putin. The AUD/USD pair retreated around 70 pips from the daily high, though a broad-based US dollar weakness helped limit losses.

The risk-on impulse - as depicted by a strong rally in the equity markets - dented demand for traditional safe-haven assets, including the buck, and extended some support to the perceived riskier aussie. This warrants caution before confirming that the AUD/USD pair has topped out and before positioning for any meaningful corrective pullback. Hence, any subsequent slide might still be seen as a buying opportunity and remain limited near the 0.7420 horizontal support.

Market participants now look to the US economic docket, featuring the release of JOLTS Job Openings and the Conference Board's Consumer Confidence Index. The focus, however, will remain on geopolitics, which will influence the risk sentiment and commodities. This, along with the US bond yields, will drive the USD demand and provide some impetus to the AUD/USD pair.

Technical levels to watch

- EUR/USD rebounds markedly and surpasses the 1.1100 mark.

- Further up comes the weekly high at 1.1137 (March 17).

EUR/USD jumped above the 1.1100 mark on the back of the sudden change of heart around the risk complex.

That said, the recovery now targets the weekly high at 1.1137 (March 17). The surpass of this level could open the door to a test of the temporary barrier at the 55-day SMA, today at 1.1207.

The medium-term negative outlook for EUR/USD is expected to remain unchanged while below the key 200-day SMA, today at 1.1496.

EUR/USD daily chart

Russia has begun withdrawing forces from around Ukraine's capital Kyiv in what the US assesses to be a "major strategic shift", a senior US official told CNN on Tuesday. The comments from the US official follow an announcement by the Russian Defense Ministry earlier in the day where it said it would "scale down" operations around northern Ukrainian cities Kyiv and Chernihiv in order to foster more constructive conditions for negotiations. Russia has in recent days hinted towards a strategic shift by a change in their language regarding the war and a placing of more emphasis on the "liberation" of Ukraine's Eastern Donbass region.

The S&P 500 Index has cleared with ease the 61.8% retracement of the 2022 fall at 4550. Although volume remains worrying light, analysts at Credit Suisse stay biased higher for a test of the February highs at 4590/95.

Only a close below 4456 would be seen to mark a minor top

“We continue to look for a move to test the February highs at 4590/95, but we would expect a fresh cap here at first and a retracement lower. Should strength directly extend though, we would look for a move to next resistance at 4612, then the 78.6% retracement and price resistance at 4663/68.”

“Near-term support moves to 4538, then 4418/14, with the immediate risk seen staying higher whilst above the 63- and 200-day averages at 4485/78.”

“Only a close below the 4456 recent reaction low though would be seen to mark a minor top.”

- DXY plummets to multi-day lows and challenges 98.00.

- Decent contention is seen around the 97.70 region.

The index accelerates losses and trades close to the 98.00 mark following encouraging news from the geopolitical landscape.

The continuation of the decline carries the potential to break below the key support at 98.00 and drag DXY lower to visit the weekly lows around 97.70 (March 10, 17).

The current bullish stance in the index remains supported by the 6-month line just near 96.10, while the longer-term outlook for the dollar is seen constructive while above the 200-day SMA at 94.77.

DXY daily chart

Spot gold (XAU/USD) prices tumbled beneath the $1900 level on Tuesday in wake of constructive Russo-Ukraine developments, with the precious metal now trading in the $1890 area, its lowest in roughly one month and down over 1.5% on the day. Russo-Ukraine peace talks seemingly made decent progress, while the Russian Defense Ministry announced that it would be scaling down its military operations near key Ukrainian cities in order to foster more constructive negotiating conditions.

XAU/USD is now probing its 50-Day Moving Average in the $1890 area, having already broken below earlier mid-month lows around $1895. A break below could open the door to a push lower towards the next key support area which would be around $1880 - this level has acted as key support and resistance in recent months.

Positive geopolitical updates arent the only factor weighing on gold. Bond yields globally continue to melt higher, with focus on Eurozone yields on Tuesday as the German 2-year approaches 0.0% for the first time since 2015, but US yields also hitting/nearing multi-year highs. Bond market participants are upping their central bank tightening bets and higher interest rates tend to erode demand for gold by increasing the "opportunity cost" of holding non-yielding assets. The push higher in yields is one key reason why gold prices have reversed lower so sharply this week - XAU/USD is already down more than 3.0% or over $60 on the week.

- GBP/USD staged a goodish rebound from a near two-week low touched earlier this Tuesday.

- The risk-on impulse weighed heavily on the safe-haven USD and extended support to the pair.

- Hawkish Fed expectations, elevated US bond yields could limit USD losses and cap spot prices.

The intraday USD selling picked up pace during the mid-European session and pushed the GBP/USD pair to a fresh daily top, around mid-1.3100s in the last hour.

The pair witnessed an intraday short-covering move and rallied around 100 pips from the 1.3050 area, or a near two-week low touched earlier this Tuesday amid a broad-based US dollar weakness. The incoming geopolitical headlines lifted hopes for a diplomatic solution to end the war in Ukraine and boosted investors' confidence.

In fact, the Russian Defense Ministry said that it would scale down military activity in Kyiv and Chernihiv in order to create conditions for dialogue. Adding to this, a Ukrainian negotiator noted that there have been enough developments to hold a meeting between Ukrainian President Volodymyr Zelenskyy and Russian President Vladimir Putin.

The latest developments triggered a risk-on rally in the global equity markets, which, in turn, weighed heavily on the safe-haven buck and was seen as a key factor behind the GBP/USD pair's strong rebound. That said, the fact that the Bank of England had softened its language on the need for further rate hikes acted as a headwind for sterling.

Conversely, the markets have been pricing in a more aggressive policy response by the Fed and a 50 bps rate hike move at the next two meetings. This was reinforced by elevated US Treasury bond yields, with the benchmark 10-year note holding above 2.5%, or a nearly three-year high, which should limit the USD losses and further contribute to capping the GBP/USD pair.

Even from a technical perspective, the recent weakness below an ascending trend channel marked a bearish flag breakdown and favours bearish traders. Hence, it will be prudent to wait for some follow-through buying before confirming that the GBP/USD pair has bottomed out and positioning for any further near-term appreciating move.

Market participants now look to the US economic docket, featuring the release of JOLTS Job Openings and the Conference Board's Consumer Confidence Index. The focus, however, will remain on fresh developments surrounding the Russia-Ukraine saga. This, along with the US bond yields, will influence the USD and provide some impetus to the GBP/USD pair.

Technical levels to watch

- Positive Russo-Ukraine updates and Eurozone bond yield upside has propelled EUR/USD towards 1.1100 and to more than one-week highs.

- The pair’s technical momentum has shifted after earlier breaching the 21DMA for the first time in weeks.

A barrage of positive newsflow/developments regarding the Russo-Ukraine war and peace talks has seen EUR/USD in recent trade extend on what was already healthy gains on the session, with the pair making further progress towards 1.1100. At current levels in the 1.1090s, where the pair is trading at more than one-week highs and with gains of about 1.0% on the session, the bulls are eyeing a test of mid-month highs in the 1.1120s-30s area. Even prior to recent positive headlines, EUR/USD’s rally on Tuesday was already significant from a technical standpoint, with the pair successfully breaking to the north of its 21-Day Moving Average, which currently resides at around 1.1005, for the first time since February.