- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 29-02-2024

- Crude Oil capped after US stocks increase.

- US PCE print limits risk appetite.

- Geopolitical headline tension is easing slightly.

West Texas Intermediate (WTI) US Crude Oil traded closely with the $78.00 handle on Thursday as bullish Crude Oil momentum stopped in its tracks as rising US Crude Oil stocks begin to weigh on energy risk appetite. US Personal Consumption Expenditure (PCE) inflation came in at expectations but failed to spark renewed hopes for Federal Reserve (Fed) rate cuts.

US Crude Oil barrel counts from both the Energy Information Administration (EIA) and the American Petroleum Institute (API) this week saw additional Crude Oil reserves added to US supply lines. A steady buildup of barrel counts on the back of record Crude Oil production from the US is limiting upside potential in WTI, which has struggled to hold onto bullish territory after failing to capture the $79.00 handle

Geopolitical headline pressures from the Middle East have eased as markets await the outcome of renewed negotiations for a ceasefire in the ongoing Gaza conflict between Israel and Palestinian Hamas.

US PCE inflation printed at market expectations on Thursday, but the Fed’s preferred inflation metric still sees inflation too high for the FEd to be pushed into rate cuts sooner rather than later, and broad-market risk appetite eased back in the back half of the trading week.

WTI technical outlook

WTI has been trapped in heavy near-term consolidation, with intraday action cycling between $78.80 and $77.80 heading into the Friday market session.

Near-term technicals continue to find support at the $77.60 level, and the week’s high of $79.27 failed to kick off further gains.

Daily candles are caught in tight churn at the 200-day Simple Moving Average (SMA) as Crude Oil bids pull into the middle of long-term median prices.

WTI hourly chart

WTI daily chart

- AUD/USD hovers near week's low, with US inflation data briefly lifting the Aussie before a USD rebound.

- US Core PCE aligns with forecasts; unemployment claims rise, fueling speculation on June rate cut.

- Australian manufacturing PMI contraction raises concerns over post-pandemic economic recovery.

The AUD/USD registered back-to-back trading sessions with losses and remained within the lows of the week, just below the 0.6500 figure. US Inflation data initially boosted the Aussie, though the rally was short-lived, as the Greenback staged a comeback. The pair exchanges hands at 0.6490, virtually unchanged.

AUD/USD unchanged as US inflation data and Aussie PMI slowdown weighed on the AUD

Wall Street closed with gains, depicting an upbeat market sentiment. The Core Personal Consumption Expenditure (PCE) Price Index, the Federal Reserve’s preferred gauge for inflation, was aligned with estimates of 2.8% YoY, down from December 2.9%. The headline PCE continued its downward trend and rose by 2.4% YoY, down from 2.6% in the previous month.

Other data showed the Department of Labor announced unemployment claims for the week ending on February 17 jumped 215K above the consensus of 210K and the previous reading of 202K.

Following the data, Fed interest rates probabilities witnessed an increase in the odds of a 25 bps rate cut in the June meeting. A day ago, odds were at around 50%, and currently sit at 60.4%.

Recently, the Australia Judo Bank Manufacturing PMI for February came at 47.8, indicating that the business economy contracted, down from January’s 50.1 expansion. Warren Hogan, Chief Economist Advisor at Judo Bank, said “Australia's manufacturing sector is not growing, bringing into question the idea of a post-pandemic manufacturing revival. Over the past year, soft outcomes most likely reflect capacity constraints in Australia's construction sector (a major driver of domestic manufacturing) and the broader cyclical slowdown in the economy.”

What to watch?

Friday’s US economic docket will feature the release of the ISM Manufacturing PMI, the Consumer Sentiment of the University of Michigan, and Fed speakers.

- GBP/USD remains on the defensive around 1.2625 amid the firmer USD.

- The US Core PCE rose by 2.8% YoY in January versus 2.9% prior, in line with the market consensus.

- Investors will monitor the UK Nationwide Housing Prices and the final S&P Global Manufacturing PMI on Friday.

The GBP/USD pair extends its downside below the mid-1.2600s during the early Asian session on Friday. The renewed US Dollar (USD) demand above the 104.00 psychological mark drags the major pair lower. Investors will shift their focus to the final US S&P Global Manufacturing PMI for February. At press time, GBP/USD is trading at 1.2625, adding 0.01% on the day.

Data released from the US Bureau of Economic Analysis (BEA) on Thursday reported that the Personal Consumption Expenditure (PCE) Price Index eased from 2.6% to 2.4% YoY, in line with the market expectation. Additionally, the Core PCE, the Federal Reserve's (Fed) preferred inflation gauge, rose by 2.8% YoY in January compared to the December’s reading of. 2.9, matching with the consensus.

Atlanta Fed President Raphael Bostic said that the recent inflation data indicates the road back to the central bank’s 2% inflation target will be “bumpy.” Meanwhile, Chicago Fed President Austan Goolsbee, stated that he expects the first rate cuts later this year, but he cannot specify the timeline.

The market anticipate the Fed to begin cutting the interest rate by summer. Nonetheless, the timing of the easing policy is uncertain as inflation could be more stubborn than expected and it could convince the Fed to stay high on rate. This, in turn, might lift the Greenback and weighs on the GBP/USD pair.

On the other hand, the speculation that the Bank of England (BoE) will pivot to rate cuts later than the Fed might provide some support to the Pound Sterling (GBP). The BoE Deputy Governor Dave Ramsden said he wants to see how long inflation will remain elevated before considering a shift in monetary policy stance.

Looking ahead, the UK Nationwide Housing Prices is due on Friday. On the US docket, the final S&P Global Manufacturing PMI and the final Michigan Consumer Sentiment will be released. Furthermore, the Fed’s Williams, Logan, Waller, Bostic, Daly, and Kluger are set to speak.

The Reserve Bank of New Zealand (RBNZ) Deputy Governor Hawkesby said on Friday that interest rates in New Zealand need to stay restrictive for some time to ensure inflation expectations become fully anchored again while adding that the central bank was not in the position to consider cutting rates.

Key quotes

“Restrictive policy needed to ensure inflation expectations anchor at 2%.”

“Policy is going to stay restrictive for some time yet.”

“Policy will need to stay restrictive even when the output gap is negative.”

“We think the output gap now is around zero, if not a bit negative.”

“We don't have a lot of room to maneuver when it comes to future inflation shocks.”

“We are on the right path with inflation, have to hold our course.”

“Not in a mindset to cut rates now, will be cutting sometime down the track.”

Market reaction

The NZD/USD pair is trading lower by 0.05% on the day to trade at 0.6084, as of writing.

Bank of Japan (BoJ) Governor Kazuo Ueda hit newswires early in the Friday market session, noting that the BoJ remains skeptical that Japanese inflation will be able to sustain 2% price growth.

Key highlights

- Recent recession is a rebound from strong quarters.

- Inflation is easing at a faster pace.

- Wage negotiations will offer a tailwind.

- Japan's economy will continue to recover gradually.

- No change in view that Japan's economy is to recover moderately.

- Japan's economy not yet in a situation where sustained 2% inflation is foreseeable.

- Higher wage growth demand from labor unions YoY, big firms show interest in hiking wages.

- BoJ's Ueda wants to consider collective outcome of wage talks and firm hearings before assessing wage data.

- Japan GDP was negative in Q4, but economy likely flattening after strong growth due to post-COVID reopening.

- Expects recovery in Japan's consumption with solid results from spring wage talks.

- Soft landing in global economy, specifically the US, is becoming baseline view, which aligns with January projections.

- The NZD/USD traded at around 0.6085 with 0.25% losses in Thursday's session.

- US inflation rate, gauged by the Core PCE Price Index fell in January, matching expectations.

- Following RBNZ’s dovish hold, if the market keeps delaying rate cuts of the Fed, more downside may be incoming.

The NZD/USD pair is currently trading at 0.6085, reflecting a 0.25% decline in Thursday’s session. Data-wise, US Personal Consumption Expenditures (PCE) showed no surprises, but markets are aligning with the Federal Reserve’s (Fed) forecast of 75 bps of easing in 2024, which is benefiting the USD.

On Thursday, the US Bureau of Economic Analysis reported that the annual inflation rate in the US, measured by the change in the Personal Consumption Expenditures (PCE) Price Index, rose by 2.4% in January, decelerating from 2.6% in December, which was in line with what markets had anticipated. The index experienced a monthly uptick of 0.3%, exactly as expected. When excluding the fluctuating sectors of food and energy, the Core PCE Price Index rose by 2.8% year-over-year, aligning with the consensus.

Regarding expectations, markets seem to have given up the hopes of a cut from the Fed in March or May and instead pushed the start of the easing cycle in June, which seems to be pushing the pair down.

NZD/USD technical analysis

On the daily chart, the Relative Strength Index (RSI) on the NZD/USD shows an overall declining trend, transitioning from the positive territory to the negative territory. This indicates a shift from bullish to bearish momentum, demonstrating a power change from buyers to sellers. This is also supported by the decreasing green bars in the Moving Average Convergence Divergence (MACD) histogram, suggesting a deceleration in positive momentum.

In terms of the broader trend, despite the pair trading below the 20 and 100-day Simple Moving Averages (SMAs), it remains above the 200-day SMA. This indicates that while there is short-term bearish pressure, the long-term uptrend hasn't been completely overruled.

According to Cleveland Federal Reserve (Fed) President Loretta J. Mester, inflation remains a challenge that the Fed needs to overcome, but rate cuts should resume later this year as long as the data gives the Fed enough room to operate.

Key highlights

- We cannot rely on the pace of disinflation last year to continue this year.

- Demand will moderate, and growth this year will not be as strong as last year.

- Expects a slowdown in employment growth.

- A slowing of employment growth is what the Fed needs to see in order to ease rates.

- Three rate cuts this year feels about right.

- Fed is in a really good spot, both on policy and the US economy.

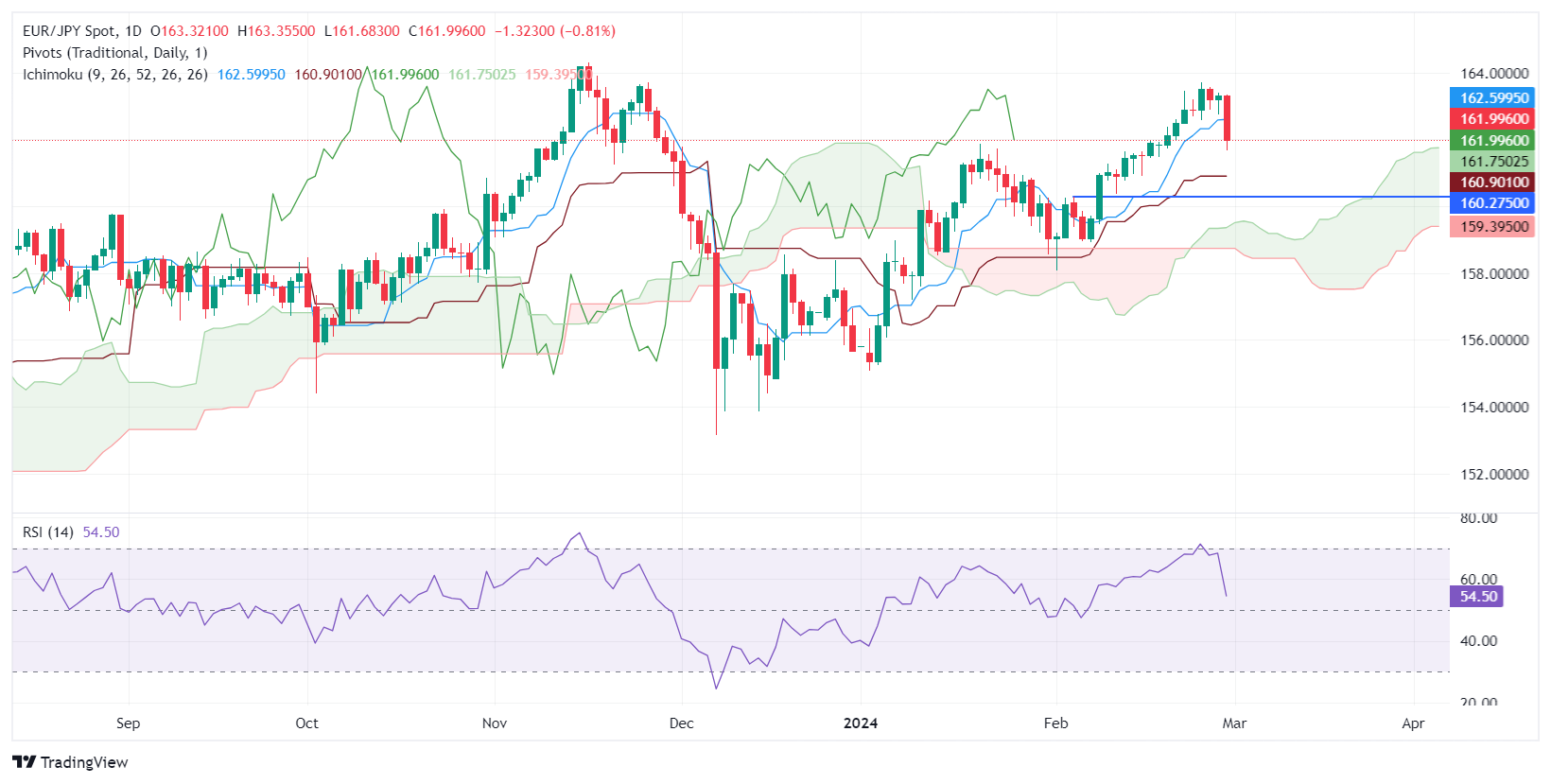

- EUR/JPY falls 0.80% to 162.00, reacting to BoJ's hawkish comments and soft EU inflation data.

- Technical analysis indicates crucial support and resistance levels, highlighting immediate market sensitivities.

- Further decline eyed with key supports at 161.75 and 161.00, unless buyers reclaim higher resistance points.

The EUR/JPY snaps two days of gains and drops on Thursday, following hawkish remarks by a Bank of Japan (BoJ) official. That and soft inflation data from countries in the Eurozone (EU) area are driving the cross-pair price action ahead of the Wall Street close. At the time of writing, the pair exchanged hands at 162.00, down 0.80%.

EUR/JPY Price Analysis: Technical outlook

The pair fell below 162.59, the Tenkan-Sen level, and slumped below the 162.00 figure, hitting a daily low of 161.68. However, the EUR/JPY recovered and reclaimed 162.00, though downside risks remain. If sellers achieve a daily close below 162.00, further weakness lies ahead. The next support would be the Senkou Span A at 161.75, followed by the 161.00 mark, and the Kijun Sen at 160.90.

Conversely, if buyers stepped in, stir resistance lies at 164.00, but firstly, they need to conquer the Tenkan-Sen at 162.59 before the 163.00 mark.

EUR/JPY Price Action – Daily Chart

- EUR/USD knocked back into 1.0800 again on Thursday.

- German Retail Sales, CPI showed economic weakness.

- US PCE inflation came in as expected, lower than the prior month

EUR/USD drifted back into the 1.0800 handle once again on Thursday after weak-kneed German Retail Sales and Consumer Price Index (CPI) inflation came in mixed but missed the mark overall. The US Personal Consumption Expenditure Price Index (PCE) printed at median market forecasts, but investor confidence still wavered as US inflation remains too high for the Federal Reserve (Fed) to rush into rate cuts.

Friday will bring pan-European Harmonized Index of Consumer Prices (HICP) inflation for February, and February’s US ISM Manufacturing will round out the trading week. European HICP inflation is forecast to tick lower for the year ended February, and the US ISM Manufacturing PMI is expected to recover slightly but remain in contraction territory.

Daily digest market movers: EUR/USD backslides on US PCE inflation non-starter

- German YoY Retail Sales in January came in at -1.4%, falling less than the forecast of -1.5% but still a slight recovery from the previous -1.7%.

- MoM German Retail Sales missed the mark, printing at -0.4% versus the forecast of 0.5%. The previous month saw a -1.6% print.

- Germany’s YoY CPI for February saw 2.5% versus the forecast of 2.6%, down from the previous 2.9%.

- US Core PCE for the year through January printed at market expectations, coming in at the forecast of 2.4% versus the previous 2.6%.

- The Fed’s favored inflation indicator eased back in-line with model forecasts, but the figure still remains above the US central bank’s inflation target, eating away at investor hopes for a near-term Fed rate cut.

- According to the CME FedWatch Tool, money markets see nearly 80% chance of no rate cut in May, and a 35% chance of another rate hold in June.

Euro price today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the weakest against the Japanese Yen.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.33% | 0.36% | 0.02% | 0.00% | -0.44% | 0.21% | 0.63% | |

| EUR | -0.35% | 0.02% | -0.32% | -0.33% | -0.78% | -0.11% | 0.30% | |

| GBP | -0.37% | -0.03% | -0.35% | -0.37% | -0.82% | -0.16% | 0.27% | |

| CAD | -0.02% | 0.33% | 0.34% | -0.02% | -0.47% | 0.20% | 0.62% | |

| AUD | -0.01% | 0.33% | 0.36% | 0.02% | -0.46% | 0.21% | 0.63% | |

| JPY | 0.44% | 0.79% | 0.81% | 0.45% | 0.44% | 0.68% | 1.09% | |

| NZD | -0.21% | 0.13% | 0.16% | -0.19% | -0.20% | -0.67% | 0.45% | |

| CHF | -0.63% | -0.29% | -0.27% | -0.61% | -0.64% | -1.10% | -0.41% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

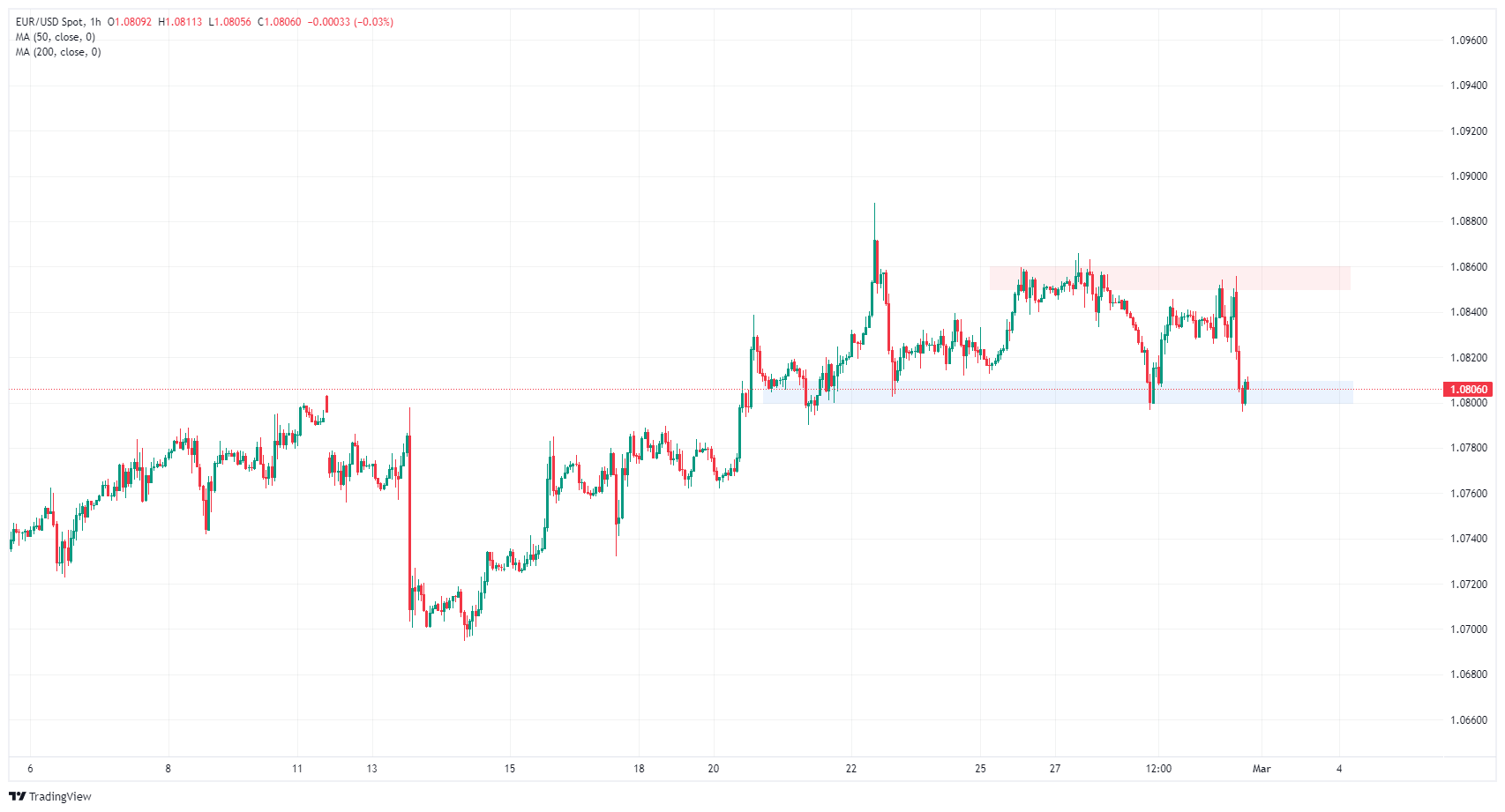

Technical analysis: EUR/USD drops back to familiar technical support at 1.0800 on Thursday

EUR/USD slid back into the 1.0800 handle on Thursday, declining a little over half a percent top-to-bottom from the day’s high at 1.0856. The pair has struggled to find topside momentum since climbing over 1.0800 on February 20.

EUR/USD remains trapped between a supply zone near 1.0860 and a heavy demand zone above 1.0800. Near-term technicals are leaning into a bullish recovery if selling pressure fails to crack 1.0800.

EUR/USD remains mired on the 200-day Simple Moving Average (SMA) at 1.0828, and Thursday’s decline sets the pair up for a steeper downside rejection. The pair has struggled at the key long-term moving average since rising from the last swing low into the 1.0700 handle.

EUR/USD hourly chart

EUR/USD daily chart

Euro FAQs

What is the Euro?

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day.

EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

What is the ECB and how does it impact the Euro?

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy.

The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa.

The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

How does inflation data impact the value of the Euro?

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control.

Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

How does economic data influence the value of the Euro?

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency.

A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall.

Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

How does the Trade Balance impact the Euro?

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

- The NZD/JPY is currently trading at around 91.20, recording a 0.73% decrease in Thursday's session.

- Based on the daily chart, RSI suggests a shift from a bullish to a bearish area.

- A closer look at the hourly chart underlines the intensified selling pressure with the RSI residing near oversold territory.

- Despite these short-term bearish signals, the NZD/JPY is still operating above main SMAs suggesting a continued influence from long-term bullish buyers.

In Thursday's session, the NZD/JPY pair is trading substantially lower at around the 91.20 level, implying a potent selling momentum marking a 0.73% decrease on the day. Despite the immediate downward inclination, the pair maintains its stance in a broader bullish territory as long-term buyers retain control and these movements could be considered as a consolidation phase after reaching multi-year highs.

Based on the daily Relative Strength Index (RSI), the pair has recently fallen from positive territories into negative. Yet, before this transposition, the pair spent considerable time in overbought territories, which could indicate profit-taking movements. Turning now to the Moving Average Convergence Divergence (MACD) histogram, an uninterrupted sequence of increasing red bars is seen. These highlight an expansion in negative momentum, suggesting that sellers are currently dictating the market dynamics.

NZD/JPY daily chart

Shifting focus to the hourly chart, the RSI is noticeably near the oversold territories revealing how the selling pressure has accelerated. This is further strengthened when topped by the continuous red bars on the MACD in the hourly chart cementing the argument for the increased selling pace.

NZD/JPY hourly chart

Despite the bearish signals from the daily and hourly charts, the pair is still in broader bullish territory as it lies above the 100 and 200-day Simple Moving Averages (SMAs), showing that long-term buyers are still in command. This discrepancy could imply a temporary bearish correction within an overall bullish trend ordained by the alignment of the SMAs.

- Gold price climbs over 0.50%, reaching $2,046, as Core PCE report supports continued disinflation trend.

- US Treasury yields fall, enhancing Gold's appeal, with market adjusting rate cut expectations for June.

- Economic indicators including Initial Jobless Claims and home sales data further shape monetary policy outlook.

Gold price rose more than 0.50% in Thursday’s North American session after the release of the Federal Reserve’s preferred gauge of inflation, the Core Personal Consumption Expenditure (PCE) Price Index, was aligned with estimates. The data confirmed the disinflationary process continues, triggering a drop in US Treasury bond yields, which correlate inversely to precious metals prices. Consequently, the price of the yellow metal surged, and the XAU/USD traded at $2,046.

The most awaited report for the week was finally released as the US Bureau of Economic Analysis revealed the Core PCE report. Annual figures came in as expected with inflation decelerating from December’s 2.9% to 2.8% YoY in January. Headline inflation cooled down sharply from 2.6% to 2.4% YoY in January, aligned with the consensus. The data sponsored a leg up in Gold prices after US Treasury bond yields plunged on expectations that rate cuts could arrive sooner than expected.

Following the data, interest rate probabilities measured by the CME FedWatch Tool suggest traders are expecting the first cut in June with odds increasing from 39% a day ago to 50.9% at the time of writing.

Further data revealed during the day witnessed the release of Initial Jobless Claims, Pending Home Sales and the Chicago Purchasing Managers Index (PMI) for February.

Daily digest market movers: Gold price climbs sharply as US yields drop on US data

- Data-wise, the US economic docket featured Initial Jobless Claims in the US for the week ending February 24 of 215K, exceeding estimates of 210K and the previous reading of 202K.

- Housing data from the US was revealed by the National Association of Realtors, Pending Home Sales dropped from 5.7% MoM in January to -4.9%.

- Chicago PMI in February came at 44.0, below the consensus of 48.0 and the previous reading of 46.

- A slew of Federal Reserve speakers have crossed the wires.

- San Francisco Fed President Mary Daly said the Fed’s policy is in a good place and the bank is ready to cut rates when the data demands it.

- Atlanta Fed President Raphael Bostic commented that economic data should guide the Fed on when to start rate cuts, which, according to him, could happen in the summer. Bostic acknowledged that inflation is slowing down, but they have to stay “vigilant and attentive.”

- Chicago Fed President Austan Goolsbee said that policy is restrictive, and the question is, “How long do we want to remain restrictive.”

- On Wednesday, New York Federal Reserve President John Williams said the rate-cut decision will depend on incoming data and stated the central bank has come a long way to bring down inflation to the 2% target, but there is more work to do.

- Boston Fed Bank President Susan Collins sees the Fed’s path returning to 2% as bumpy due to tight labor market conditions and higher inflation readings in January. Collins expects that the Fed will start reducing interest rates later this year.

- On Tuesday, Federal Reserve Governor Michelle Bowman said she’s in no rush to cut rates, given upside risks to inflation that could stall progress or cause a resurgence in price pressure. She added inflation would decline “slowly,” and she will remain “cautious in my approach to considering future changes in the stance of policy.”

- Previous data releases in the week:

- The Gross Domestic Product (GDP) for the final quarter of 2023 was reported at 3.2% YoY, slightly below the preliminary estimate of 3.3%.

- US Retail Sales Inventories rose 0.3% MoM in January, below 0.4% in the previous month's data, while Wholesale Inventories declined -0.1% MoM, missing estimates of 0.1%.

- US Durable Goods Orders dropped -6.1% MoM, more than the -4.5% contraction expected and the -0.3% dip observed in December.

- The S&P/Case Shiller Home Price Index for December rose 6.1% YoY, outpacing estimates of 6% and November’s 5.4% reading.

- US New Home Sales rose by 1.5% from 0.651M to 0.661M, less than the 0.68M expected.

- The US Dollar Index (DXY), which gauges the Greenback’s value against six major currencies, edges up by 0.19% at 104.11 as uncertainty over US economic data has improved the appeal for safe-haven assets.

- The US 10-year Treasury note yield stands at 4.236%, down three basis points (bps).

Technical analysis: Gold stays firm, fluctuating near the 50-day SMA

As I wrote on Wednesday, “Gold is trading sideways as XAU/USD has failed to break above the $2,035 psychological resistance level for the last 12 days.” Nevertheless, XAU/USD prices cleared that level and are testing a downslope resistance trendline drawn from the highs of the year near the $2,040-$2,050 region. A breach of the latter will expose the February 1 high at $2,065.60, ahead of the December 28 high at $2,088.48.

On the flip side, if Gold falls below the February 16 swing low of $2,016.15, XAU/USD would dive toward the October 27 daily high-turned-support at $2,009.42. Once cleared, that will expose key technical support levels like the 100-day SMA at $2,009.42, followed by the 200-day SMA at $1,968.00.

Gold FAQs

Why do people invest in Gold?

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Who buys the most Gold?

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

How is Gold correlated with other assets?

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

What does the price of Gold depend on?

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

The persistent buying pressure in the US Dollar weighed further on the risk-associated universe, against the backdrop of further signs of the loss of momentum in inflation on both sides of the Atlantic and steady bets of interest rate reductions by the Fed and the ECB at some point this summer.

Here is what you need to know on Friday, March 1:

Extra gains in the Greenback prompted the USD Index (DXY) to reclaim the 104.00 barrier and above, advancing for the third straight session. At the end of the week, the final S&P Global Manufacturing PMI is due in the first turn, seconded by Construction Spending, the final Michigan Consumer Sentiment, and the always-relevant ISM Manufacturing PMI. In addition, the Fed’s Williams, Logan, Waller, Bostic, Daly, and Kluger are all due to speak.

EUR/USD dropped further and challenged the key support at 1.0800 in response to further upside momentum in the US Dollar. In the euro area, preliminary inflation figures for the month of February will take centre stage on March 1, along with the Unemployment Rate and the final Manufacturing PMI in both Germany and the whole bloc.

GBP/USD deflated to multi-day lows and opened the door to a probable visit to the 1.2600 region sooner rather than later. Across the Channel, Nationwide Housing Prices and the final S&P Global Manufacturing PMI are scheduled for March 1.

USD/JPY resumed the downward bias and revisited the 149.20 region in response to investors’ repricing of a potential BoJ lift-off sooner than anticipated. The Unemployment Rate and February’s Consumer Confidence are due in “The Land of the Rising Sun” on March 1.

AUD/USD loses further momentum and breaches the 0.6500 support on the back of Chinese concerns and Dollar strength. In Oz, Commodity Prices will be the sole release on Friday.

Investors’ attention is expected to refocus on China with the release of Manufacturing PMIs tracked by the NBS and Caixin on March 1. USD/CNH reversed a multi-day positive streak and dropped marginally to the 7.2100 zone on Thursday.

WTI prices extended further their erratic performance in the upper end of the recent range around the $78.00 mark per barrel.

Gold prices climbed to four-week highs and retested the $2,050 region per troy ounce amidst lower yields and despite decent gains in the Greenback. Silver followed suit and left behind three daily pullbacks in a row, approaching the $22.80 level per ounce.

- GBP/JPY continues to deflate, falling sharply on Thursday.

- Japanese Retail Sales came in as expected, with revisions.

- Japan’s Unemployment Rate to wrap up the trading week.

GBP/JPY fell back towards the 189.00 handle on Thursday after Yen (JPY) markets stepped higher following a Japanese Retail Sales print that came in at expectations, and previous data saw mixed revisions. UK data remains thin on the economic calendar this week, and Yen traders will be looking ahead to next Tuesday’s Japanese Tokyo Consumer Price Index (CPI).

Japan’s Retail Sales came in at 2.3% for the year ended in January, meeting market forecasts while the previous period saw an upside revision from 2.1% to 2.4%. The MoM figure also recovered to 0.8% after the previous month saw a sharp downside revision to -2.6% from -0.8%.

Japanese Industrial Production in January also declined to -7.5%, missing the -7.3% forecast and falling back from the previous print of 1.4%.

Next up for economic calendar watchers will be Japan’s Unemployment Rate due early Friday, which is forecast to hold steady at 2.4%. Japanese preliminary inflation from the Tokyo CPI is slated for next Tuesday.

GBP/JPY technical outlook

GBP/JPY is down eight-tenths of one percent on Thursday as the pair grinds back towards the 189.00 handle. The pair has slid from the week’s early high near 191.30. GBP/JPY is trading back into a heavy supply zone built around 189.00.

Despite near-term weakness, the pair is buried deep in bull country, with daily candles trading well above the 200-day Simple Moving Average (SMA) at 183.43.

GBP/JPY hourly chart

GBP/JPY daily chart

San Francisco Federal Reserve (Fed) President Mary C. Daly noted on Thursday that while the Fed is ready to cut rates when the data says its okay to do so, the US central bank shouldn't be in a rush to do so as the US economy remains firm and sees little risk of faltering.

Key highlights

- Fed's Daly wants to avoid holding rates all the way to 2% inflation.

- Risks of persistent inflation and economic downturn are balanced.

- There is currently no imminent risk of the economy faltering.

- Fed policy is in a good place, but can cut if needed.

- Cutting too quickly could risk inflation becoming stuck.

- The AUD/JPY currently trades at 97.42, undergoing a 0.43% loss in Thursday's trading session.

- The daily chart shows a shift in RSI from positive to negative territory.

- If the AUD/JPY holds above the 100 and 200-day SMA the outlook will still be positive.

The AUD/JPY pair is currently trading at 97.42, marking a 0.43% loss. The pair is navigating moderate selling pressure, suggesting control from the sellers' side, albeit the bulls maintaining ground as the pair stands above key Simple Moving Averages (SMAs).

Considering the daily Relative Strength Index (RSI), a downward trend from positive territory into negative was seen. Combined with the rising red bars of the Moving Average Convergence Divergence (MACD) histogram, this indicates a shift in momentum toward sellers. Despite previously maintaining strength within positive territory, mild signs of price exhaustion emerged after hitting multi-year highs recently.

AUD/JPY daily chart

On an hourly chart, the RSI has remained within the negative territory, suggesting sustained selling pressure over the past hours. The MACD histogram, with flat green bars, confirms this bearish signal. A notable divergence between daily and hourly charts occurs, as the former has just entered a negative zone while the latter has been quite negative already. This underlines the speed and intensity of the bearish swing.

AUD/JPY hourly chart

Counterbalancing this pessimistic outlook, the AUD/JPY pair holds above its key 100 and 200-day Simple Moving Averages (SMAs), following the dip under the 20-day SMA. This suggests that despite the sudden bearish inclination, the bulls may not have entirely lost the game yet concerning the longer timeframe.

- USD/JPY down 0.47%, reacting to BoJ's Takata hinting at possible exit from stimulus, stirring market speculation.

- Technical analysis highlights crucial support at 149.21, with potential rebound or further decline in focus.

- Breach below 149.21 could lead to further losses, targeting 148.31 and possibly extending to the 146.00 region.

The USD/JPY trades with losses below the Tenkan-Sen level of 150.03, following “hawkish” comments by a Bank of Japan (BoJ) member, Takata. He said the BoJ needs to consider taking a flexible response, including exiting from monetary policy stimulus, which investors perceived as a normalization of monetary policy. At the time of writing, the pair exchanged hands at 149.98, down 0.47%.

USD/JPY Price Analysis: Technical outlook

The daily chart shows the pair printed a low at around 149.21, at the Senkou Span A level, before resuming to the upside and thus remaining shy of the 150.00 figure. A breach of the latter will expose the Tenkan-Sen and a resumption of the ongoing uptrend towards the 151.00 mark.

Conversely, if the USD/JPY stays below the 150.00 mark and achieves a daily close below 149.21, look for a fall to the Kijun-Sen at 148.31, ahead of the 148.00 mark. If surpassed, the pair could aim toward the top of the Ichimoku Cloud (Kumo) at around 146.00-146.15.

USD/JPY Price Action – Daily Chart

- EUR/USD falls 0.29% after US PCE inflation report shows expected slowdown, reversing early gains.

- Soft German inflation and lower Eurozone yields contribute to the pair's decline from daily highs.

- Fed officials' comments on future rate cuts influence market sentiment, with focus on economic data.

The EUR/USD reversed its course on Thursday after a report in the United States (US) witnessed a minimal jump in inflation, which initially triggered a rally to a daily high of 1.0855. However, the advance was short-lived as the pair exchanged hands at 1.0807, tumbling 0.29%.

EUR/USD drops as EU's yields fall and German inflation report weighs

The latest inflation report of the US Bureau of Economic Analysis (BEA) revealed the Personal Consumption Expenditure (PCE) Price Index slowed from 2.6% to 2.4% YoY as expected, reported on Thursday. Besides that, the Federal Reserve's preferred gauge for inflation, the Core PCE, which excludes volatile items, increased by 2.8% YoY, below December’s 2.9%, and aligned with the consensus.

The data sponsored a leg-up in the EUR/USD pair, breaking key resistance at the 200-day moving average (DMA) at 1.0828 towards the daily high. Nevertheless, yields dropping across the Eurozone (EU) and a soft inflation report from Germany during the European session dragged the exchange rate toward current levels.

Housing data from the US was revealed by the National Association of Realtors, with Pending Home Sales dropping from 5.7% MoM in January to -4.9%. at the same time, the Chicago PMI in February came at 44.0, below the consensus of 48.0 and the previous reading of 46.

Fed speakers grab the headlines

In the meantime, Atlanta’s Fed President Raphael Bostic commented that economic data should guide the Fed on when to begin to start rate cuts, which, according to him, could happen in the summer. Bostic acknowledged that inflation is slowing down, but they have to stay “vigilant and attentive.”

Chicago’s Fed President Austan Goolsbee said that policy is restrictive, and the question is, “How long do we want to remain restrictive.”

EUR/USD Price Analysis: Technical outlook

The swing of the EUR/USD on Thursday has opened the door for bears to push prices below the 200 and 100-DMAs, along with a break of a support trendline. A breach of the latter could sponsor a pullback all the way towards the October 3 low of 1.0448. On the other hand, if buyers cling to the 1.0800 area, the major could consolidate within the 1.0800-1.0850 range.

- DXY Index is trading near 104.00, up for Thursday’s session.

- Core PCE Price Index matched predictions.

- Markets continue delaying rate cuts from the Fed, which favors the Greenback.

The US Dollar Index (DXY) is trading near 104 and keeps gaining traction due to markets delaying rate cuts from the Federal Reserve (Fed). Datawise, Personal Consumption Expenditures (PCE) showed no surprises.

As long as the US does not show conclusive evidence of inflation coming down, the Fed won’t rush to cut rates. In addition, the markets are aligned with the bank’s forecasts and are now expecting 75 bps of easing in 2024, starting in June.

Daily digest market movers: US Dollar holds gains, PCE decelerated as expected in January

- The US Bureau of Economic Analysis announced on Thursday that the inflation rate in the US, gauged by the yearly change in the Personal Consumption Expenditures (PCE) Price Index, fell to 2.4% in January from 2.6% in December.

- The Core PCE Price Index climbed by 2.8% over the year, also meeting expectations.

- As the US economy doesn’t show conclusive evidence of inflation coming down, the markets are pushing the start of easing to June, while the odds of a cut in March and May remain low.

Technical analysis: DXY Bulls make a move to reclaim 100-day SMA

The indicators on the daily chart reflect a positive shift in buying momentum. Initially, the Relative Strength Index (RSI) exhibits a positive slope, and being in positive territory indicates a strengthening bullish trend. However, the Moving Average Convergence Divergence (MACD) shows flat red bars, hinting toward potential bearish pressure, where selling activity might prevail, though not necessarily resulting in a trend shift.

In the broader technical landscape, despite the underlying bearish pressure that has pushed the pair below the 20-day Simple Moving Average (SMA), the positioning above the 100 and 200-day SMAs suggests that buyers still have the upper hand in this play.

US Dollar FAQs

What is the US Dollar?

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022.

Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

How do the decisions of the Federal Reserve impact the US Dollar?

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

What is Quantitative Easing and how does it influence the US Dollar?

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

What is Quantitative Tightening and how does it influence the US Dollar?

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

President of the Chicago Federal Reserve (Fed) Austan D. Goolsbee noted on Thursday that a single month of inflation data is not enough to hinge an entire monetary policy decision on.

Key highlights

- Even with January PCE data showing a good rebound, we should be cautious about extrapolating.

- Fed has made substantial progress on long-term inflation.

- We need to be careful with arguments suggesting the supply chain is fixed, and we should not expect further benefit in 2024.

- Lags on labor supply shocks are probably long.

- Fed's Goolsbee continues to focus on why housing inflation hasn't come down more.

- If substantial productivity growth continues, that would have an impact on monetary policy.

- Impacts of supply shock in inflation takes time, suggests benefits of supply chain on disinflation are still to come.

- USD/CAD softer on Thursday, moves are limited.

- Canada saw a mixed GDP print, and US jobless claims ticked higher.

- Friday to bring Canadian, US PMIs.

USD/CAD rose to an intraday high of 1.3597 before backsliding to 1.3541 after US Personal Consumption Expenditure Price Index (PCE) inflation figures printed exactly as markets were hoping. Annualized Canadian Gross Domestic Product (GDP) printed above expectations, but the MoM figure failed to meet expectations.

Canada still has the S&P Global Manufacturing Purchasing Manager Index (PMI) due on Friday, alongside the US S&P and ISM Manufacturing PMIs. Michigan State University’s Consumer Sentiment Index survey results are also slated for Friday. Several Federal Reserve (Fed) officials will be making appearances on Friday as well, and rate watchers will be keen to look for signs that Thursday’s PMI print drew rate cut interest from Fed policymakers.

Daily digest market movers: US PCE brings no surprises, mixed Canadian GDP limits moves

- US Core PCE printed at 2.8% YoY, exactly as expected, down slightly from previous 2.9%.

- The MoM Core PCE figure also printed at the expected 0.4%, but the previous print saw a slight downside revision to 0.1% from 0.2%.

- Canada’s Annualized Q4 GDP came in at 1.0%, above the 0.8% expected and posting a stronger recovery from the previous -0.5%, which also saw a healthy revision from -1.1%.

- US Initial Jobless Claims ticked higher for the week ended February 23, rising to 215K compared to the forecast for 210K, while the previous week saw a slight revision to 202K from 201K.

- US Pending Home Sales also declined to a five-month low, printing at -4.9% versus the forecast of 1.0%, a sharp pullback from the previous 5.7% (revised down from 8.3%).

- Friday brings the latest Canadian S&P Global Manufacturing PMI for February, which last printed at 48.3.

- Friday’s US ISM Manufacturing PMI is expected to tick slightly higher to 49.5 from 49.1 in February.

Canadian Dollar price today

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the weakest against the Japanese Yen.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.24% | 0.21% | -0.07% | -0.18% | -0.53% | 0.14% | 0.45% | |

| EUR | -0.28% | -0.06% | -0.32% | -0.40% | -0.80% | -0.12% | 0.18% | |

| GBP | -0.20% | 0.04% | -0.27% | -0.37% | -0.72% | -0.06% | 0.27% | |

| CAD | 0.06% | 0.32% | 0.27% | -0.11% | -0.47% | 0.21% | 0.52% | |

| AUD | 0.15% | 0.38% | 0.35% | 0.07% | -0.38% | 0.29% | 0.59% | |

| JPY | 0.54% | 0.78% | 0.72% | 0.46% | 0.37% | 0.71% | 1.01% | |

| NZD | -0.15% | 0.10% | 0.07% | -0.20% | -0.31% | -0.67% | 0.34% | |

| CHF | -0.45% | -0.21% | -0.25% | -0.53% | -0.64% | -0.99% | -0.31% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Technical analysis: USD/CAD still up on the week despite Thursday backstep

USD/CAD is trading into familiar near-term levels after falling toward 1.3540. The pair remains capped under the week’s high of 1.3606 set on Wednesday, and intraday price action is getting bolstered by the 200-hour Simple Moving Average (SMA) nearby at 1.3515.

Thursday’s daily candlestick is notably middling on the high side of recent consolidation. The pair is drifting away from the 200-day SMA at 1.3478 and is up over 3% from the last major swing low into the 1.3200 handle.

USD/CAD hourly chart

USD/CAD daily chart

Canadian Dollar FAQs

What key factors drive the Canadian Dollar?

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

How do the decisions of the Bank of Canada impact the Canadian Dollar?

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

How does the price of Oil impact the Canadian Dollar?

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

How does inflation data impact the value of the Canadian Dollar?

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

How does economic data influence the value of the Canadian Dollar?

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

Federal Reserve Bank of Atlanta President Raphael Bostic said on Thursday that it would probably be appropriate to reduce the policy rate in the summer time, per Reuters.

Bostic noted that the last few inflation readings had shown that it is going to be a bumpy path back toward the 2% target and reiterated that they have to stay vigilant and attentive.

"Economic data will ultimately be our guide on when rate cuts start," he added.

Market reaction

These comments failed to trigger a noticeable market reaction. At the time of press, the US Dollar Index was virtually unchanged on the day at 103.92.

Eurostat will release Eurozone Harmonised Index of Consumer Prices (HICP) data for February on Friday, March 1 at 10:00 GMT and as we get closer to the release time, here are the expectations forecast by the economists and researchers of five major banks regarding the upcoming EU inflation print.

Eurozone’s HICP is expected to fall to 2.5% after hitting 2.8% YoY in January. Meanwhile, Core HICP is expected to drop from 3.3% to 2.9%. The last time underlying inflation hovered below 3% was in February 2022 – just before Russia invaded Ukraine.

Commerzbank

At first glance, February's consumer price data should be grist to the mill for the doves on the ECB's Governing Council. After all, the inflation rate is expected to have fallen from 2.8% to 2.7%. In particular, the decline in the inflation rate excluding volatile energy and food prices from 3.3% to 3.0% should fuel speculation of an imminent rate cut.

TDS

We look for Euro Area inflation to continue to trek lower in February, with the headline rate likely falling to 2.6% YoY and core dropping to a 24-month low of 2.9% YoY. Developments in core dynamics should be constructive; we expect core goods inflation to fall to 1.5% YoY – its lowest rate since July 2021 – and a continued softening in services momentum will probably bring the YoY rate down to a 20-month low of 3.6%. Energy provides some upside pressure on the print, in part due to base effects in the natural gas component, but also due to the roughly 9% MoM increase in French electricity prices, as the government facilitates a gradual end to the tariff shield that protected households from the spike in prices in previous years. Petrol prices also increased roughly 2.5% MoM in February, on the back of the move higher in wholesale oil prices.

SocGen

We expect both the headline and core inflation prints to ease by 0.3pp in January to 2.5% and 3%, respectively, with some downside risk. However, our core forecast sits at the edge of 2.9%, so there is a risk of a weaker reading.

Citi

The Euro Area flash February HICP print on Friday is clearly a potentially pivotal data point. We expect headline HICP is likely to fall further towards target (to 2.5%), although we warn that core HICP may print with an above-average 0.3% MoM (SA).

Wells Fargo

February inflation figures could be influential as to whether the ECB lowers interest rates as early as April or takes a more patient approach by waiting until its June meeting. The February CPI is expected to deliver more good inflation news, with base effects likely to see headline inflation slow further to 2.5%YoY, while core inflation is also forecast to slow to 2.9%. There will also be interest surrounding whether services inflation slows from its current 4.0% pace. Should Eurozone CPI inflation decelerate as forecast, or even deliver a downside surprise, it would keep the possibility of an April rate cut alive. However, an upside surprise that sees an interruption to the disinflation trend would be supportive of some of the more hawkish ECB policymakers' views and would potentially take the chance of an April rate cut off the table.

- Mexican Peso strengthens after US inflation report and unexpected rise in Initial Jobless Claims.

- Banxico's latest report highlights ongoing disinflation, suggesting potential for future rate cuts.

- Market anticipates Banxico's March 21 policy meeting amid discussions on gradual rate adjustments.

The Mexican Peso appreciated against the US Dollar in early trading on Thursday after an inflation report in the United States was revealed, while Initial Jobless Claims rose above expectations for the first time in four consecutive weeks. The USD/MXN stands at 17.07, down 0.11% following the data release.

Mexico’s economic docket saw an uptick in the Unemployment Rate but not substantial enough to move the USD/MXN. On Wednesday, the Bank of Mexico (Banxico) announced its report for the last quarter of 2023, noting that the disinflation process continued while Governor Victoria Rodriguez Ceja said the real ex-ante rate hit 7.47%, exceeding the Bank’s neutral rate, thus opening the door for reducing interest rates.

Deputy Governors Jonathan Heath and Omar Mejia subscribed to the idea that rate adjustments must be gradual, with Heath opening the door for a 25-basis-point cut and then reassessing the restrictiveness of the policy. He added that declaring victory over inflation is too premature and that cutting the benchmark rate more than he suggested would be a “big mistake.”

In that regard, Deputy Governor Irene Espinosa said Banxico’s Governing Council should consider external and internal factors affecting inflation. Her colleague Galia Borja adopted cautious decision-making based on emerging inflation data. Given the backdrop, USD/MXN traders are eyeing Banxico’s next monetary policy meeting on March 21.

On the other hand, the US Bureau of Economic Analysis (BEA) revealed that the Personal Consumption Expenditure (PCE) Price Index climbed as expected. Regarding the Federal Reserve’s preferred gauge for inflation, the Core PCE rose as expected, though it justified Fed officials' rhetoric against premature interest rate cuts.

Daily digest market movers: Mexican Peso boosted by US inflation report

- Mexico’s economy is expected to slow down due to higher interest rates set by Banxico at 11.25%. That’s the main reason that sparked a shift in three of the five governors of the Mexican Central Bank, who are eyeing the first rate cut at the March 21 meeting.

- Banxico updated its economic growth projections for 2024 from 3.0% to 2.8% YoY and maintained 1.5% for 2025.

- Expectations for the Mexican central bank to ease monetary policy in March remain high, with investors projecting 75 basis points of easing over the next six months. This means the Mexican interest rates, currently standing at 11.25%, would be lowered to 10.50% in the first half of 2024.

- The latest inflation report in Mexico showed that headline and underlying inflation continued to dip toward Banxico’s goal of 3%, plus or minus 1%, while economic growth exceeded estimates but finished below Q3’s 3.3%.

- Mexico’s economic data released during the week thus far:

- The Unemployment Rate rose from 2.6% to 2.9% YoY in January, exceeding estimates of 2.8%.

- The Balance of Trade for January revealed the country posted a trade deficit of $302 million.

- Mexico’s Consumer Price Index (CPI) in the first half of February was 4.45%, down from 4.9% YoY.

- Mexico’s Core CPI slowed from 4.78% to 4.63% on an annual basis.

- Mexico’s GDP for Q4 2023 exceeded estimates of 2.4% YoY and hit 2.5%, less than Q3 2023 print of 3.3%.

- Economic trade issues between Mexico and the US could depreciate the Mexican currency if the Mexican government fails to resolve its steel and aluminum dispute with the United States. US Trade Representative Katherine Tai warned the US could reimpose tariffs on the commodities.

- January’s US PCE Index rose 2.4% YoY from 2.6%, as expected. The so-called Core PCE, which excludes volatile items, increased by 2.8% YoY, below December’s 2.9%, and aligned with the consensus.

- Initial Jobless Claims in the US for the week ending February 24 grew 215K, exceeding estimates of 210K and the previous reading of 202K.

- The USD/MXN fell following the US data release as market players increased the odds for the first 25-basis-point (bps) rate cut in June, from 49% to 54.1% a day ago. Meanwhile, 33% of investors expected the Fed to keep rates unchanged at the current level of 5.25%-5.50%.

Technical analysis: Mexican Peso climbs as USD/MXN hovers around 50-day SMA

The USD/MXN trades near the 50-day Simple Moving Average (SMA), which stands at 17.06, after the pair snapped three days of losses but resumed its downtrend on Thursday. The bearish bias is confirmed by the Relative Strength Index (RSI) staying below the 50-midline, keeping sellers hopeful of retesting the 17.00 psychological level. If traders clear that level, the exotic pair could dive to the year-to-date (YTD) lows of 16.78, followed by last year’s low of 16.62.

Conversely, if buyers reclaim the 17.20 area, further gains are seen. The next supply zone would be the 200-day SMA at 17.26 and the 100-day SMA at 17.31.

USD/MXN Price Action – Daily Chart

Mexican Peso FAQs

What key factors drive the Mexican Peso?

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

How do decisions of the Banxico impact the Mexican Peso?

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

How does economic data influence the value of the Mexican Peso?

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

How does broader risk sentiment impact the Mexican Peso?

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

The Euro (EUR) is the third best performer in the year to date after the US Dollar (USD) and the Pound Sterling (GBP). Economists at Rabobank analyze EUR/USD outlook.

Strong case for remaining bullish on the USD

While we acknowledge that the EUR has been more resilient than we expected so far this year, we still see fundamentals as favouring the USD.

We maintain our three-month forecast of 1.0500 and remain of the view that there is a higher chance of EUR/USD remaining in a 1.0400 to 1.1200 range over the next 18-24 months or so, than of the currency pair holding levels above 1.1500.

Our three-month forecast of 1.0500 is followed by an expectation of a moderate move higher to 1.0900 early next year as Fed rate cuts are extended.

Economists at Commerzbank do not expect a weaker Dollar in the medium to long term. Thus, positive surprises for the Euro are only probable in the near term.

A strong Dollar is justified in the long run

We see some upside potential for EUR/USD in the short term.

Upwardly surprising Eurozone inflation and a more or less synchronised entry of the Fed and ECB into the rate cut cycle should have a slight net positive effect on the EUR.

In the medium term, however, no USD weakness should be justified. The current USD strength should be justified if (as we expect) the US will have a growth advantage over the Eurozone (and most Western industrialised countries) over our entire forecast period.

Source: Commerzbank Research

- The EUR/GBP is trading at 0.8550, after peaking at a high of 0.8570.

- The Core HICP in Germany grew at a slower pace than expected in February.

- Soft inflation figures fuel the hopes of sooner cuts by the ECB.

the EUR/GBP pair recorded a slight gain in Thursday's session but gave up gains which took the pair to a high of 0.8570. This comes on the heels of softer inflation data from Germany's Harmonized Index of Consumer Prices (HICP), which fueled bets of sooner policy shifts by the European Central Bank (ECB).

February’s preliminary HICP from Germany, showed a continued but slower inflation rate at 2.7% year-on-year, aligning with forecasts yet decreasing from January's 3.1%. The monthly inflation rate was as anticipated at 0.6%, a rebound from January's 0.2% decline. Core inflation, a key focus for the ECB, rose by 2.5%, slightly below the expected 2.6% and down from the previous 2.9%. This slowdown in core inflation growth suggests potential early policy adjustments by the ECB, as President Christine Lagarde hinted at possible rate cuts in the upcoming summer with over 100 bps of easing expected by the European bank in 2024.

EUR/GBP technical analysis

Considering the Relative Strength Index (RSI) for the EUR/GBP pair, the index holds in positive territory, confirming the market is primarily influenced by buyers at the current moment but its flat nature, suggests a market equilibrium, with neither buyers nor sellers gaining additional ground.

Regarding the Moving Average Convergence Divergence (MACD) histogram, it exhibits a falling trend with a sequence of decreasing green bars, which portrays a picture of negative momentum building up. This combination of signals suggests that the buyers are struggling to hold their momentum, but in case they hold above the 20-day Simple Moving Average (SMA) the outlook for the short term, may remain somewhat positive.

EUR/GBP daily chart

Could Trump’s universal tariff revive inflation? Economists at Rabobank analyze how a raise in import tariffs could affect the trajectory of inflation and consequently the Fed’s rate path.

Universal tariffs would complicate the Fed’s mission to get the inflation genie back into the bottle

Based on current opinion polls and our expectation of a deterioration of economic data in 2024, we have decided to assume a Trump victory in our current forecasting round for the global economy.

Given Trump’s first term in office and his recent remarks on trade policy, we should expect a broad rise in import tariffs under a Trump presidency. This could lead to a rebound in inflation, especially in 2025, complicating the Fed’s mission to get inflation back to its 2% target in a sustainable manner. Ceteris paribus, this could reduce the amount of rate cuts that the Fed has in mind for 2025.

The Pound Sterling (GBP) has been consolidating at higher levels this month after strengthening in January. Economists at MUFG Bank analyze GBP outlook.

UK budget next key event for GBP

The next key event for the Pound in the week ahead will be the government’s upcoming budget announcement on March 6.

The pre-election budget is expected to provide fiscal giveaways that could provide fresh impetus for a stronger Pound.

While the size of the potential fiscal giveaway is unlikely to be sufficient to significantly alter the performance of the UK economy, it could discourage the BoE from delivering an earlier rate cut in May or June.

There is scope for divergence further down the road between the BoE and other major central banks in how they continue to implement QT.

The Japanese Yen (JPY) is the best performing major after the Bank of Japan (BoJ) board member Hajime Takata sent a strong signal for ending the negative interest rate policy. Economists at Scotiabank analyze USD/JPY outlook.

Spring start to monetary tightening from the BoJ to bolster prospects of a Q2 rally in the JPY

JPY outperforms following comments from BoJ Governor Takata. He commented that the central bank’s price target was ‘finally coming into sight’, suggesting the BoJ may be closer to a rate hike.

USD/JPY is still some way from technical support at 149.55 that could unlock a drop back to the 148.00 area but the prospect of a spring start to a mild round of monetary tightening from the BoJ would bolster prospects of a Q2 rally in the JPY, in line with seasonal patterns.

- Initial Jobless Claims rose by 215K from a week earlier.

- Continuing Jobless Claims also surprised to the upside.

US citizens that applied for unemployment insurance benefits increased by 215K in the week ending February 24 according to the US Department of Labor (DoL) on Thursday. The prints came in short of initial estimates and followed a 202K gain in the previous week.

Further details of the publication revealed that the advance seasonally adjusted insured unemployment rate was 1.3% (from 1.2%) and the 4-week moving average stood at 212.50K, a decrease of 3.000K from the previous week's revised average.

In addition, Continuing Claims increased by 45K to 1.905M in the week ended February 17.

Market reaction

The US Dollar Index (DXY) gyrates around the 103.80 zone following the weaker-than-expected report from the US labour market, trading almost unchanged from Wednesday’s closing level.

According to Statistics Canada, the GDP Growth Rate expanded more than expected by 1.0% on a yearly basis during the October-December period, reversing the 1.1% annual contract.

In addition, the GDP Growth Rate increased by 0.2% vs. the previous quarter, while preliminary readings expect the Canadian economy to have expanded by 0.4% in January.

Market reaction to Canadian GDP Growth Rate data

USD/CAD reverses its initial gains and hovers around the 1.3570 in the wake of the release, all following the earlier uptick to the 1.3600 barrier on Thursday.

- EUR/USD drops sharply on the slower-than-projected rise in German core inflation.

- Easing price pressure in the Eurozone would allow ECB policymakers to consider rate cuts sooner.

- The US core PCE Price Index data will guide the US Dollar.

The EUR/USD pair falls sharply to 1.0820 as the preliminary German Harmonized Index of Consumer Prices (HICP) remains soft in February. The annual headline inflation grew by 2.7% as expected, slower than January’s reading of 3.1%. Also, the monthly headline HICP matches expectations at 0.6%. In January, the German economy deflated by 0.2%.

The annual core inflation that excludes volatile food and oil prices, closely tracked by European Central Bank (ECB) policymakers, rose at a moderate pace of 2.5%, against an expectation of 2.6% and the prior reading of 2.9%.

Significant progress in inflation returning to the 2% target would allow ECB policymakers to consider a change in the monetary policy stance early. Earlier, ECB President Christine Lagarde said rate cuts are expected in summer.

Besides a slower growth in Germany’s inflation data, caution among market participants ahead of the United States core Personal Consumption Expenditure Price Index (PCE) for January has also weighed on the Euro.

The US core PCE Price Index data is expected to have risen by 0.4% on a month-on-month basis against a 0.2% increase in December. Investors anticipate that the underlying inflation data have decelerated to 2.8% annually against the former reading of 2.9%. Sticky price pressures would force traders to dial back expectations of rate cuts in the June monetary policy meeting.

Meanwhile, the US Dollar Index (DXY), which gauges the value of Greenback against six major currencies, rebounds sharply to 104.00.

GBP/USD holds neutral 1.2600/1.2700 range. Economists at Scotiabank analyze the pair’s outlook.

Cable will have to move significantly from current levels to boost directional momentum

Cable’s sideways range trade over the past few months leaves short, medium and long-term DMI studies all sitting at weak and neutral levels. That suggests spot will have to move significantly from current levels to boost directional momentum.

More choppy range trade is likely in the short run as the market seeks a stronger sense of direction.

Support is 1.2600/1.2615. Resistance is 1.2700/1.2715.

- Inflation in Germany rose at a slightly softer pace than expected in February.

- EUR/USD stays in negative territory below 1.0850 after the data.

Inflation in Germany, as measured by the change in the Consumer price Index (CPI), declined to 2.5% on a yearly basis in early February from 2.9% in January, Germany's Destatis reported on Thursday. This reading came in below the market expectation of 2.6%. On a monthly basis, the CPI rose 0.4%.

The Harmonized Index of Consumer Prices (HICP), the European Central Bank's (ECB) preferred gauge of inflation, rose 0.6% on a monthly basis. The annual HICP increased 2.7% in the same period, at a softer pace than the 3.1% growth recorded in December.

Market reaction

The EUR/USD pair edged lower with the immediate reaction and was last seen losing 0.12% on the day at 1.0823.

USD/CAD edges marginally higher in rather quiet, month-end trade so far. Economists at Scotiabank analyze the pair’s outlook.

USD retains a clear advantage over the CAD

Passive hedge rebalancing flows may be mildly CAD-supportive if anything, but the sharp widening in US/Canada spreads over the second half of the month remains a drag on the CAD’s broader outlook.

The USD retains a clear advantage over the CAD from a broader perspective, with Wednesday’s gains extending the new year run higher in spot marginally.

A small, inside range (within Wednesday’s range) today does suggest some reluctance to push higher still, however, and a lack of momentum behind the move.

Resistance is 1.3610/1.3620. Support is 1.3540/1.3550.

EUR/USD remains in the mid 1.0800-1.0900 range. Shaun Osborne, Chief FX Strategist at Scotiabank, analyzes the pair’s outlook.

Flat trading in the short run

Intraday price moves leave the EUR/USD pair trading more or less mid-way between support at 1.0800 and resistance at 1.0890.

Trend momentum is weak and suggests flat trading in the short run.

Longer-term price action looks a little more supportive to my eye but spot needs to regain – and hold – the upper 1.0800 area if spot gains are to develop further.

- The US Dollar trades in the red, with the Japanese Yen as the biggest winner against the Greenback.

- Risk-on market sentiment returns, with Crypto assets and Chinese stocks soaring.

- The US Dollar Index slides below 104.00, breaking below several technical pivotal levels.

The US Dollar (USD) extends losses on Thursday’s European session ahead of the US Personal Consumption Expenditures (PCE) Price Index data release. The Greenback lost the most against the Japanese Yen, retreating more than 0.50%, as the Japanese currency was supported by surprise comments from Bank of Japan (BoJ) board member Hajime Takata, who said that multiple interest-rate hikes are being considered.

On the economic front, the big focal point on Thursday will be the Personal Consumption Expenditures (PCE) Price Index numbers for January. Markets are anticipating a strong print after the Consumer Price Index (CPI) and the PCE print on Wednesday under the Gross Domestic Product report both came in hotter than expected. Still, this could set up the US Dollar in a perfect “buy the rumour, sell the fact” scenario, where markets already have gotten way ahead of themselves. In this case, the actual PCE print could have already been factored in and thus a weakening of the US Dollar could be the end result.

Daily digest market movers: A lot of moving parts

- At 13:30 GMT, both the Jobless Claims and Personal Consumption Expenditures Price Index will be released:

- Jobless Claims for this week:

- Weekly Initial Jobless Claims are expected to jump from 201,000 to 210,000.

- Continuing Jobless Claims are seen decreasing from 1.862 million to 1.847 million.

- Personal Consumption Expenditures (PCE) Price Index for January:

- The monthly Headline PCE is expected to accelerate from 0.2% to 0.3%, while the yearly reading is seen softening from 2.6% to 2.4%.

- Fore the core reading, which excludes the more volatile categories of food and energy, the monthly PCE is expected to accelerate from 0.2% to 0.4%. The yearly core PCE is expected to fall slightly from 2.9% to 2.8%.

- Personal Income is expected to increase slightly, from 0.3% to 0.4%, while Personal Spending should decelerate substantially, from 0.7% to 0.2%.

- Jobless Claims for this week:

- At14:45 GMT, the Chicago Purchasing Managers Index for February will be released. Expectations are for a jump from 46 to 48, which means the index will likely remain in contraction.

- At 15:00 GMT, though probably less relevant for this trading day, Pending Home Sales data for January will be released. Sales are expected to decelerate sharply, from a 8.3% increase in December to 1% in January.

- the last economic number for this Thursday will be the Kansas City Fed Manufacturing Activity Index for February. The previous number was at -17, with no forecast pencilled in.

- A slew of US Federal Reserve speakers will make its way to the stage as well:

- Expect around 15:50 GMT comments from the head of the Atlanta Fed, Raphael Bostic.

- Briefly after Bostic, around 16:00 GMT, the head of the Chicago Fed Austan Goolsbee will speaking..

- Around 18:15 GMT, Loretta Mester, head of the Cleveland Fed, will also take the stage..