- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 28-08-2024

Federal Reserve Bank of Atlanta President Bostic said on Thursday that there is still a distance to go on inflation, adding that the central bank should wait for more data before cutting rates.

Key quotes

Inflation has more room to decline.

Sees solid employment despite the historical context.

Waits for more data before considering a rate cut.

Prefers waiting longer, even if it means being cautious.

It would not be good to cut rates only to have to raise them again.

Market reaction

The US Dollar Index (DXY) is trading 0.06% lower on the day at 101.00, as of writing.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

- USD/CAD trades with mild losses around 1.3480 in Thursday’s early Asian session.

- The Fed's dovish remarks continue to weigh on the US Dollar.

- The BoC is expected to cut more interest rates in its September meeting next week.

The USD/CAD pair trades on a weaker note near 1.3480 during the early Asian session on Thursday. The US Federal Reserve (Fed) Chair Jerome Powell signalled that the central bank is ready to ease its monetary policy this year, which weighed on the Greenback in the previous session. Investors await the preliminary US Q2 Gross Domestic Product (Q2) and the Fed's Raphael Bostic speech on Thursday for fresh drivers.

Fed Chair Jerome Powell hinted at Jackson Hole last week that cutting the interest rates is finally on the horizon, saying that “the time has come for policy to adjust.” Markets are now pricing in around 25-35% for a 50 basis points (bps) Fed rate cut, with 100 bps of easing still seen by year-end. Market players will closely watch the US employment report, as any signs of weakness in the labor market could trigger a deeper rate cut by the Fed and continue to undermine the US Dollar (USD).

The usual weekly Initial Jobless Claims for the week ending August 24 are estimated to remain unchanged at 232K compared to the previous reading. The attention will shift to the US Nonfarm Payrolls for August next week, which might offer some hints about the size of the Fed rate cut.

On the CAD’s front, economists expect the Bank of Canada (BoC) to cut additional interest rates for a third consecutive meeting next week due to persistent economic weakness, rising unemployment, and cooling down inflation. This, in turn, might drag the Canadian Dollar (CAD) lower against the Greenback.

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

- EUR/USD slipped back below 1.1150 as bidders struggle to maintain balance.

- A breakdown in bullish market sentiment is giving the Greenback room to breathe.

- EU and US inflation prints due at the end of the week to dominate investor attention.

EUR/USD trimmed recent gains on Wednesday, stepping lower after clipping fresh highs for the year as broad-market anticipation of Federal Reserve (Fed) rate cuts in September keeps broad-market risk appetite pinned to the ceiling.

There is little of note on the economic calendar for the middle range of the trading week, but Thursday will bring an update on US Gross Domestic Product (GDP) figures, which will be closely watched. However, little movement is expected as markets have broadly priced in Q2 annualized GDP growth to hold steady near 2.8%.

Friday’s data docket shows promise for markets slipping into a boredom trance, with a fresh print of pan-EU Harmonized Index of Consumer Prices (HICP) inflation due early in the European market session. Core EU HICP inflation is expected to continue trimming lower across the board, forecast to print at 2.8% YoY in August compared to the previous print of 2.9%.

US Personal Consumption Expenditure Price Index (PCE) inflation due on Friday remains the week’s key print, and investors are shuffling their feet while they wait for signs that inflation will continue to ease, or at least not rise, fast enough that the Federal Reserve (Fed) will be kept on rails to deliver a hotly-anticipated rate cut on September 18.

EUR/USD price forecast

EUR/USD slipped back below the 1.1150 level on Wednesday as bidders struggle to keep the Fiber moving north. The pair is still testing the waters well north of the 200-day Exponential Moving Average (EMA) at 1.0850, but a sustained slide will quickly see price action tumble back to the 50-day EMA near 1.0940.

EUR/USD daily chart

Euro FAQs

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

- GBP/USD slid back below 1.3200 on Wednesday.

- Recent bullish market flows are taking a breather.

- Rate-cut-hungry markets look ahead to Friday’s US PCE inflation.

GBP/USD fell back below 1.3200 on Wednesday after near-term bullish momentum eased. Markets have piled into a one-sided risk appetite stance as investors hunker down for the long wait to an anticipated kickoff of a rate-cutting cycle from the Federal Reserve (Fed) in September.

UK economic data remains limited this week, leaving the Pound Sterling exposed to broad-market sentiment flows. US Gross Domestic Product (GDP) figures are slated to release on Thursday, but little movement is expected as markets have broadly priced in Q2 annualized GDP growth to hold steady near 2.8%.

US Personal Consumption Expenditure Price Index (PCE) inflation due on Friday remains the week’s key print, and investors are shuffling their feet while they wait for signs that inflation will continue to ease, or at least not rise, fast enough that the Federal Reserve (Fed) will be kept on rails to deliver a hotly-anticipated rate cut on September 18.

GBP/USD price forecast

GBP/USD gave up ground on Wednesday, retreating from fresh 29-month highs hit this week. Downside momentum remains limited for the time being, but bids have slipped back below the 1.3200 handle and bearish momentum has plenty of room to run with price action trading well north of the 200-day Exponential Moving Average (EMA) at 1.2695.

GBP/USD daily chart

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, aka ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

- Silver's uptrend tested as it nears key support at 50 and 100-DMAs between $29.17 and $29.13.

- RSI neutral, indicating potential for more downside if direction doesn't solidify.

- Below $29.00, silver may target the August 12 high of $28.03, with support at the August 14 low of $27.18.

- Upside move reclaiming $30.00 could push towards June 21 high at $30.84 and July 11 peak at $31.75.

Silver prices tumbled toward a critical confluence technical level on Wednesday, after bulls failed to sustain the grey’s metal quote above the $30.00 a troy ounce level. Therefore, the XAG/USD finished yesterday’s session with losses of 2.84%, yet as Thursday’s Asian session begins, the XAG/USD trades at $29.10, virtually unchanged.

XAG/USD Price Forecast: Technical outlook

Silver’s uptrend remains in place, but since the XAG/USD rallied from around $26.45 to $30.18, the non-yielding metal has dropped toward the current spot prices, which is also the confluence of the 50 and 100-day moving averages (DMAs) at $29.17-$29.13, respectively.

Momentum indicates that neither buyers nor sellers are in charge, as the Relative Strength Index (RSI) is neutral.

That said, if XAG/USD drops below $29.00, this could exacerbate a test of the August 12 high turned support at $28.03. Silver could challenge the August 14 swing low of $27.18 on further weakness.

Conversely, if XAG/USD climbs above $30.00, this could exacerbate a challenge of June 21 daily high at $30.84, before testing the latest swing high reached on July 11 at $31.75.

XAG/USD Price Action – Daily Chart

Silver FAQs

Silver is a precious metal highly traded among investors. It has been historically used as a store of value and a medium of exchange. Although less popular than Gold, traders may turn to Silver to diversify their investment portfolio, for its intrinsic value or as a potential hedge during high-inflation periods. Investors can buy physical Silver, in coins or in bars, or trade it through vehicles such as Exchange Traded Funds, which track its price on international markets.

Silver prices can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can make Silver price escalate due to its safe-haven status, although to a lesser extent than Gold's. As a yieldless asset, Silver tends to rise with lower interest rates. Its moves also depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAG/USD). A strong Dollar tends to keep the price of Silver at bay, whereas a weaker Dollar is likely to propel prices up. Other factors such as investment demand, mining supply – Silver is much more abundant than Gold – and recycling rates can also affect prices.

Silver is widely used in industry, particularly in sectors such as electronics or solar energy, as it has one of the highest electric conductivity of all metals – more than Copper and Gold. A surge in demand can increase prices, while a decline tends to lower them. Dynamics in the US, Chinese and Indian economies can also contribute to price swings: for the US and particularly China, their big industrial sectors use Silver in various processes; in India, consumers’ demand for the precious metal for jewellery also plays a key role in setting prices.

Silver prices tend to follow Gold's moves. When Gold prices rise, Silver typically follows suit, as their status as safe-haven assets is similar. The Gold/Silver ratio, which shows the number of ounces of Silver needed to equal the value of one ounce of Gold, may help to determine the relative valuation between both metals. Some investors may consider a high ratio as an indicator that Silver is undervalued, or Gold is overvalued. On the contrary, a low ratio might suggest that Gold is undervalued relative to Silver.

- NZD/JPY rose to 90.20 in Wednesday's session.

- The RSI is rising within neutral terrain, indicating increasing buying pressure.

- The MACD is flat green, suggesting that the buyer’s traction remains weak.

The NZD/JPY pair rebounded slightly in Wednesday's following session to settle around 90.20. Technical indicators are hinting that the pair might be approaching a bullish breakout in the short term as buyers seem to be waiting for a catalyst to test the 90.50 area.

The Relative Strength Index (RSI) is rising towards neutral terrain, currently at 49, indicating that buying pressure is increasing. This reading suggests that the pair is likely to continue its upward movement and challenge the resistance at 90.50. The Moving Average Convergence Divergence (MACD) is also showing a neutral bias, with flat green bars indicating that the bullish momentum is neither gaining nor losing strength.

NZD/JPY daily chart

As the pair seems to be gaining strength and with the RSI rising, the cross might continue trading within the 89.20-90.50 channel. A break above these levels might set the pace for the short term.

.

- The Canadian Dollar rose on Wednesday, supported by other markets.

- A lack of data from Canada leaves CAD at the mercy of sentiment.

- Canadian GDP figures set to be overshadowed by US PCE inflation.

The Canadian Dollar (CAD) drifted higher on Wednesday, bolstered more by overall market flows than any intrinsic bidding power behind the CAD itself. Markets have overspent on bullish risk appetite in the face of looming Federal Reserve (Fed) interest rate cuts expected in September, giving the Canadian Dollar room to breathe and pare back recent gains against the Greenback.

Canada remains broadly absent from this week’s economic calendar, with Friday’s Canadian Gross Domestic Product (GDP) figures slated to be entirely eclipsed by US Personal Consumption Expenditure Price Index (PCE) inflation data due to release at the same time.

Daily digest market movers

- An overall retreat in overextended market sentiment has sapped momentum from bidders, giving the Greenback a leg up and a chance to recover against a long side opposite the CAD.

- Canada is widely expected to report a slight downtick in annualized GDP on Friday, forecast to print at 1.6% in Q2 versus the previous 1.7%.

- Core US PCE inflation is expected to print at 2.7% YoY, a slight rise from the previous 2.6%.

- A below-expectations print in US PCE inflation will surely ignite a fresh broad-market splurge on rate cut expectations, while an above-forecast release will send rate cut hopes scurrying into the shadows.

- US GDP figures due on Thursday could also throw a spanner in the works, but the release is likely to be muted with US annualized QoQ expected to hold steady at 2.8%.

Canadian Dollar price forecast

The Canadian Dollar (CAD) shed weight on Wednesday, paring back recent gains against the Greenback, but only slightly. USD/CAD is still churning chart paper on the south side of the 1.3500 handle, and a near-term plunge from recent chart highs near 1.3950 has left long-term moving averages in the dust.

USD/CAD daily chart

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

- Australian Dollar slides lower on CPI release.

- RBA has stated last week that rate cuts are not on the table.

- Markets are confident of a single 25 bps cut by year's end.

The Australian Dollar retreated against its US counterpart following the release of Australia's latest inflation data. The soft inflation data has reinforced expectations that the Reserve Bank of Australia (RBA) will cut interest rates later this year. A slowdown in household spending further suggests that the economic cycle in Australia may be easing.

Amidst a complex economic landscape in Australia, the RBA is concerned over persistent inflation and have prompted a cautious approach. With the soft figures released on Wednesday, the markets now anticipate a modest 25 basis point rate reduction in 2024.

Daily digest market movers: Australian Dollar declines on CPI data

- Australia's July Consumer Price Index (CPI) came in at 3.5% YoY, slightly higher than expected but still within the RBA's target range.

- Trimmed mean inflation fell to 3.8% y/y, its lowest level since January.

- The RBA has indicated that it is unlikely to cut interest rates in the near term, but the market continues to expect a 25 bp cut by year-end.

- If the RBA signals a hawkish approach, the downside for the Aussie is limited.

AUD/USD Technical Outlook: Pair sees slight decline, key levels in play

The AUD/USD pair experienced a slight decline on Wednesday, as buyers continued to lock in profits from last week’s rally. The Relative Strength Index (RSI) fell to 60, indicating a lean towards a neutral market sentiment. The Moving Average Convergence Divergence (MACD) shows flat green bars, suggesting a lack of momentum.

After last week’s gains, the pair has been consolidating within a range of 0.6750-0.6820, and a break above these levels might set the pace of the pair in the next sessions.

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

- NZD/USD stood neutral around 0.6240, testing critical support.

- The RSI is declining, indicating potential selling pressure and a shift in momentum.

In Wednesday's session, the NZD/USD traded around 0.6240 near crucial support levels. There are signals of a possible consolidation period as buyers pause after the rally which pushed the pair close to January's highs near 0.6250.

The technical indicators paint a neutral picture with the bullish momentum flattening. The Relative Strength Index (RSI) has retreated from overbought territory and currently points downwards, indicating a potential shift in momentum and a build-up of selling pressure. A fall below the 50 level would further underscore this bearish sentiment. In addition, the Moving Average Convergence Divergence (MACD) prints flat green bars.

NZD/USD daily chart

The key support levels for the NZD/USD pair lie at 0.6200 and 0.6150. A breach of 0.6150 could trigger a deeper decline towards 0.6100, a significant support zone. On the flip side, immediate resistance can be found at 0.6255. A consolidation above this level could open doors for a move towards the 0.6300 area.

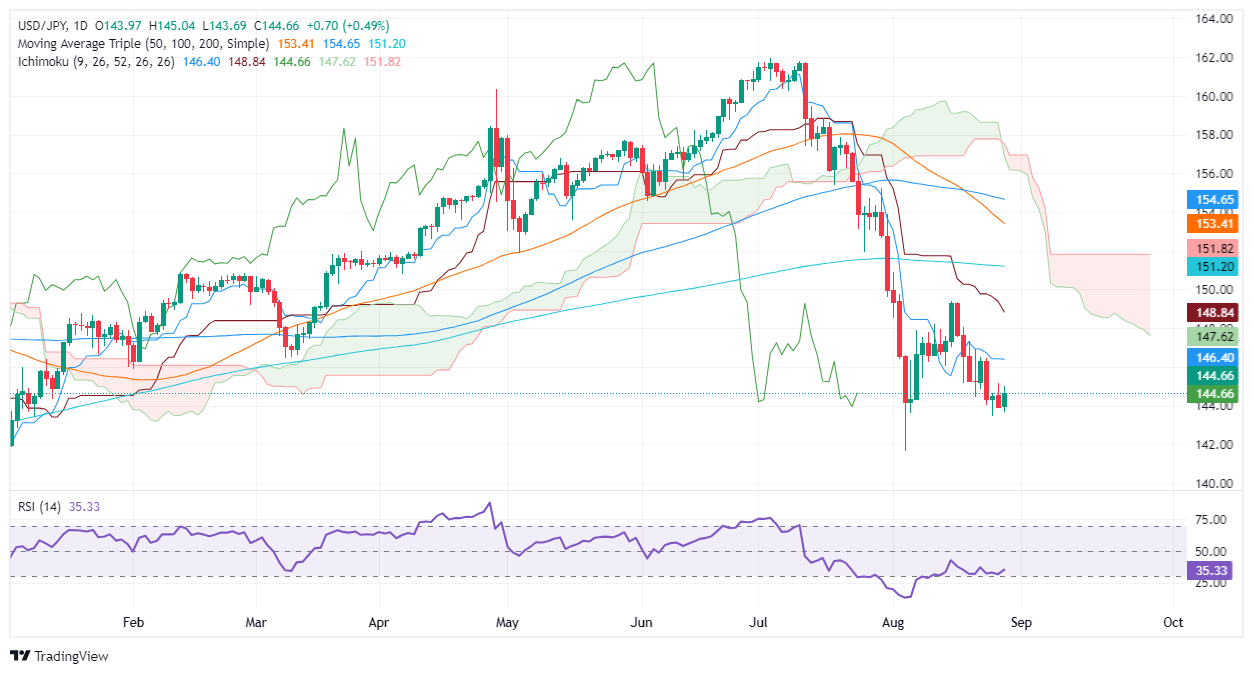

- USD/JPY rises 0.50%, crossing 144.00; downtrend persists with limited momentum for further gains.

- Key resistance at 145.00 crucial for bullish continuation; next targets at 146.39 (Tenkan-Sen), 146.48, and 148.84 (Kijun-Sen).

- If 145.00 isn't breached, may retest 144.00 with supports at 143.44 (August 26 low) and 141.69 (August 5 low).

The USD/JPY reverses its course and registers decent gains of over 0.50% on Wednesday as the Greenback gains some steam, yet it remains vulnerable to the release of crucial data over the remainder of the week. The pair trades at 144.73 after bouncing off daily lows of 143.68.

USD/JPY Price Forecast: Technical outlook

The USD/JPY downtrend remains intact, yet buyers stepped in and pushed the exchange rate above 144.00, with buyers unable to crack the 145.00 figure decisively. Momentum suggests that sellers had lost some steam as the Relative Strength Index (RSI) aims up, but they remain in charge.

For a bullish continuation, USD/JPY buyers must reclaim 145.00. Once surpassed, the Tenkan Sen at 146.39 would be next, followed by the March 11 daily low-turned resistance at 146.48 and the Kijun-Sen at 148.84.

Conversely, if USD/JPY remains below 145.00, this could pave the way for testing the 144.00 figure. Further downside lies at the August 26 low of 143.44, followed by the latest cycle low at 141.69, the August 5 low.

USD/JPY Price Action – Daily Chart

Japanese Yen FAQs

The Japanese Yen (JPY) is one of the world’s most traded currencies. Its value is broadly determined by the performance of the Japanese economy, but more specifically by the Bank of Japan’s policy, the differential between Japanese and US bond yields, or risk sentiment among traders, among other factors.

One of the Bank of Japan’s mandates is currency control, so its moves are key for the Yen. The BoJ has directly intervened in currency markets sometimes, generally to lower the value of the Yen, although it refrains from doing it often due to political concerns of its main trading partners. The current BoJ ultra-loose monetary policy, based on massive stimulus to the economy, has caused the Yen to depreciate against its main currency peers. This process has exacerbated more recently due to an increasing policy divergence between the Bank of Japan and other main central banks, which have opted to increase interest rates sharply to fight decades-high levels of inflation.

The BoJ’s stance of sticking to ultra-loose monetary policy has led to a widening policy divergence with other central banks, particularly with the US Federal Reserve. This supports a widening of the differential between the 10-year US and Japanese bonds, which favors the US Dollar against the Japanese Yen.

The Japanese Yen is often seen as a safe-haven investment. This means that in times of market stress, investors are more likely to put their money in the Japanese currency due to its supposed reliability and stability. Turbulent times are likely to strengthen the Yen’s value against other currencies seen as more risky to invest in.

- Gold drops 0.70% to $2,504 as US Dollar strengthens and Treasury yields rise following Powell's dovish policy comments.

- DXY up 0.60% to 101.15, propelled by rising 10-year Treasury yield at 3.841%, challenging non-yielding assets like Gold.

- Market anticipates key US data: GDP estimates, Initial Jobless Claims and core PCE inflation gauge this week.

- Gold sees inflows and demand from China yet contends with a stronger US Dollar and rising yields.

Gold prices dropped more than 0.70% on Wednesday as the Greenback staged a comeback after Federal Reserve (Fed) Chair Jerome Powell hinted that the US central bank is ready to ease policy, because policymakers are worried about a weak labor market. The XAU/USD trades at $2,504 after retreating from a daily peak of $2,529.

Wall Street trades with losses ahead of Nvidia’s fiscal Q2 2025 earnings report. The US Dollar hits a three-day high underpinned by heightened US Treasury bond yields, with the US Dollar Index (DXY) sitting at 101.15, gaining 0.60%.

Despite that, the golden metal hovers above $2,500 even though the US 10-year Treasury note yield rises two basis points to 3.841%, a headwind for the non-yielding metal.

Sources cited by Reuters noted, “We're seeing a little pressure coming from a bit firmer dollar. And at this point, we're waiting for further information to drive this market either one direction or the other based on that inflationary data.”

Meanwhile, bullion prices are expected to rise further in the aftermath of Powell’s speech at Jackson Hole, in which he said the time has come to begin lowering borrowing costs amid increased confidence that inflation is headed toward the Fed’s 2% goal.

He added that the risks of the dual mandate are skewed toward the downside of inflation and the upside of employment. The sudden shift suggests that upcoming jobs market data will be crucial to assess the pace and size of the upcoming interest rate cuts.

According to the World Gold Council, XAU/USD prices also benefitted from a modest increase in net inflows of 8 metric tons ($403 million) last week, led by North American funds. Moreover, China’s net Gold imports rose by 17% in July, marking the first month of increases since March, data showed on Tuesday.

The US economic docket is scarce on Wednesday, but Thursday and Friday will be busy. On Thursday, the second estimate of Gross Domestic Product (GDP) is expected to show the economy continues to grow above trend. At the same time, the US Department of Labor will release Initial Jobless Claims for the week ending August 24.

On Friday, the Fed’s preferred inflation gauge, the core Personal Consumption Expenditures Price Index (PCE) is expected to tick a tenth higher, according to the consensus.

The December 2024 Chicago Board of Trade (CBOT) fed funds future rates contract hints that investors are eyeing 100 basis points of Fed easing this year, up from Monday’s 97. This implies that traders estimate a 50 bps interest rate cut at September’s meeting, though odds for lowering rates of that size lie at 36.5%, according to the CME FedWatch Tool.

Daily digest market movers: Gold price retreats as traders brace for US data

- If US economic data continues to be weak, the Gold price uptrend is likely to persist, fueling speculation about a larger rate cut by the Fed.

- Gross Domestic Product (GDP) figures for Q2 in the second estimate are expected to improve from 1.4% to 2.8%.

- Initial Jobless Claims for the week ending August 24 are expected to remain unchanged at 232K compared to the previous reading. Weakness in the labor market could increase the chances of a bigger rate cut by the Fed.

- The core Personal Consumption Expenditures (PCE) Price Index is expected to rise from 2.6% to 2.7% YoY.

- Next week, the US economic docket will feature the August Nonfarm Payrolls report, which could be crucial to assess the size of the Fed’s first rate cut at the September meeting.

Technical outlook: Gold’s uptrend is intact despite posting losses, aiming toward $2,500

Gold’s uptrend remains intact, even though the yellow metal hit a daily low beneath the $2,500 figure at $2,493. The Relative Strength Index (RSI) shows bullish momentum has faded, yet buyers are looming amid the ongoing pullback.

If XAU/USD drops below $2,500, the first support would be the July 17 peak at $2,483. If surpassed, the $2,450 psychological mark would emerge as the next support, followed by the 50-day Simple Moving Average (SMA) at $2,414.

Conversely, if bullion prices stick above $2,500, the next resistance would be the all-time high at $2,531. On further strength, Gold could test $2,550 before challenging $2,600.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

- The Dow Jones shed three quarters of a percent amid cautious market flows.

- The midweek market session has investors looking ahead to US PCE inflation.

- China GDP downgrade has investors concerned about physical trade.

The Dow Jones Industrial Average (DJIA) trimmed near-term gains on Wednesday, backsliding 300 points in the midweek market session. A downgrade to China’s Gross Domestic Product (GDP) forecast has investors concerned about a possible overhang in global trade, but most of the market is buckling down for the wait to Friday’s US Personal Consumption Expenditure Price Index (PCE) inflation print.

Equities pared back across the board after UBS trimmed its forecasts of Chinese GDP growth in 2024 and 2025. The Fitch ratings agency also issued a warning about performance in several of China’s business sectors in the second half of 2024 in a double-punch to market expectations of Chinese growth forecasts.

According to UBS, Chinese GDP growth is expected to clock in at 4.6% for 2024 compared to the previous expectation of 4.9%, and its 2025 forecast has been shifted down to just 4.0% from 4.6%. From Fitch Ratings, China’s ongoing property development slump is expected to remain a drag on issuers across several sectors, crimping growth and activity prospects in a measurable way through the last half of the year.

This week, investors will be closely watching Friday’s US PCE Price Index inflation reading for July. It is anticipated that YoY PCE inflation will increase to 2.7% from the current 2.6%, while the MoM figure is expected to remain unchanged at 0.2%. Those who are anticipating a reduction in interest rates will be looking for the inflation data to be lower than anticipated. However, if the inflation data exceeds expectations, it could unsettle investor sentiment and throw a wrench in current rate cut forecasts.

Dow Jones news

Tepid risk appetite on Wednesday has most of the Dow Jones in the red for the midweek market session. Gains are being led by Merck & Co Inc. (MRK), which rose around 0.6% to $163.90 per share, while Nike (NKE) fell 3.5% to $82.30 per share.

The moment is almost here. Despite a number of showstopping earnings calls this season, everyone has been waiting for Nvidia (NVDA) to release fiscal 2025 Q2 results, which finally arrive after the closing bell on Wednesday.

Dow Jones price forecast

The Dow Jones’ midweek pullback is picking up speed, with the equity index backsliding nine-tenths of one percent and shedding over 350 points. The DJIA has once again fallen below the 41,000 handle as near-term bullish momentum takes a pause and overextended price action snaps lower.

With bullish pressure running out of gas near fresh all-time highs beyond 41,250, bids are poised for an extended backslide to the 50-day Exponential Moving Average (EMA) rising through 40,000. Despite a near-term crimp in bidding momentum, short positions in the Dow Jones are unlikely to find a clear path all the way back to the index’s last major swing low below 38,500.

Dow Jones daily chart

Dow Jones FAQs

The Dow Jones Industrial Average, one of the oldest stock market indices in the world, is compiled of the 30 most traded stocks in the US. The index is price-weighted rather than weighted by capitalization. It is calculated by summing the prices of the constituent stocks and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, who also founded the Wall Street Journal. In later years it has been criticized for not being broadly representative enough because it only tracks 30 conglomerates, unlike broader indices such as the S&P 500.

Many different factors drive the Dow Jones Industrial Average (DJIA). The aggregate performance of the component companies revealed in quarterly company earnings reports is the main one. US and global macroeconomic data also contributes as it impacts on investor sentiment. The level of interest rates, set by the Federal Reserve (Fed), also influences the DJIA as it affects the cost of credit, on which many corporations are heavily reliant. Therefore, inflation can be a major driver as well as other metrics which impact the Fed decisions.

Dow Theory is a method for identifying the primary trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA) and only follow trends where both are moving in the same direction. Volume is a confirmatory criteria. The theory uses elements of peak and trough analysis. Dow’s theory posits three trend phases: accumulation, when smart money starts buying or selling; public participation, when the wider public joins in; and distribution, when the smart money exits.

There are a number of ways to trade the DJIA. One is to use ETFs which allow investors to trade the DJIA as a single security, rather than having to buy shares in all 30 constituent companies. A leading example is the SPDR Dow Jones Industrial Average ETF (DIA). DJIA futures contracts enable traders to speculate on the future value of the index and Options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Mutual funds enable investors to buy a share of a diversified portfolio of DJIA stocks thus providing exposure to the overall index.

- Recovering US yields supported the USD on Wednesday.

- The August NFP release is the most important reading for the Fed's policy decision.

- Current market pricing still sees 100 bps of easing by year-end.

The US Dollar, measured by the US Dollar Index (DXY), recovered modestly on Wednesday, after closing lower on Tuesday. The 10-year US Treasury yield held slightly above 3.80%, supporting the Greenback.

With no high-tier economic data releases scheduled for Wednesday, the US Dollar might remain in a narrow range.

Daily digest market movers: DXY shrugs off weak sentiment data on the back of hawkish bets

- On a quiet Wednesday, US Treasury yields supported the US Dollar with the 10-year rate above 3.80%

- Market pricing still anticipates 100 bps of easing by year-end, and the odds of a 50 bps cut in September remain at 25-35%.

- Strong August Nonfarm Payrolls figures next week could result in a 25 bps cut, while a weak reading may trigger a 50 bps cut.

- The index might continue sideways trading in the next few sessions, while markets await labor market data — the policy driver at the moment, according to the Fed.

Technical analysis DXY: Bearish momentum eases, index finds support around 101.00

The DXY index is currently hovering around its support levels and near its December lows. Market participants are waiting for new catalysts, resulting in sideways movement in the index over the past few sessions.

The Relative Strength Index (RSI) has moved out of oversold territory, while the Moving Average Convergence Divergence (MACD) indicator’s red bars are signaling a decline in selling pressure. Support levels lie at 100.50, 100.30 and 100.00, while resistance levels are located at 101.00, 101.50 and 101.80.

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

The Greenback regained the smile on Wednesday and advanced to weekly tops vs. its main rivals as investors seek further clues regarding the potential Fed’s rate path ahead of key economic data releases.

Here is what you need to know on Thursday, August 29:

The US Dollar Index (DXY) regained the 101.00 barrier and above despite mixed US yields across the curve. Another estimate of US Q2 GDP Growth Rate is due on August 29, followed by usual weekly Initial Jobless Claims, Pending Home Sales, and the speech by the Fed’s Bostic.

EUR/USD came under marked downside pressure and disputed the 1.1100 region following the strong rebound in the US Dollar. On August 29, the preliminary Inflation Rate in Germany takes centre stage, ahead of EMU’s Consumer Confidence, Economic Sentiment, and Industrial Sentiment. In addition, the ECB’s Schnabel is due to speak.

GBP/USD receded from recent yearly peaks and broke below the 1.3200 support, challenging weekly lows. The annualized Car Production results are only expected on August 29.

USD/JPY tested waters above the 145.00 barrier in response to the strong bounce in the Greenback and mixed yields. The usual weekly Foreign Bond Investment figures are due on August 29.

AUD/USD could not extend its breakout of the 0.6800 hurdle, eventually succumbing to the Dollar’s uptick. The next data release on the Australian docket will be Housing Credit readings, as well as Retail Sales, both coming on August 30.

Demand concerns in China and the stronger Dollar offset supply worries and a mild bullish report from the EIA, all dragging WTI prices to weekly lows below the $74.00 mark per barrel.

Gold prices came under pressure and deflated to weekly lows in the sub-$2,500 region per ounce troy. Silver sold off and confronted the $29.00 mark per ounce, a region coincident with the interim 55-day and 100-day SMAs.

- Mexican Peso strengthens despite judiciary reform and AMLO's diplomatic "pause" with US and Canadian embassies.

- Focus on Banxico’s Q2 report and Fiscal Balance data this Friday amid a light economic calendar.

- USD/MXN spikes near 19.80 due to political worries despite a weakening US Dollar post-Powell dovish Jackson Hole remarks.

The Mexican Peso recovered some ground against the Greenback on Wednesday, yet it remains strongly influenced by political turmoil in Mexico linked to the judiciary reform and President Andres Manuel Lopez Obrador's decision to “pause” relations with the US and Canadian Embassies. At the time of writing, the USD/MXN trades at 19.64, falling some 0.44%.

Mexico’s economic docket remains absent, and traders are bracing for Bank of Mexico’s (Banxico) Q2 report ahead of Friday's reveal of July’s Fiscal Balance. In the meantime, Wall Street trades with losses as speculators await the release of Nvidia’s fiscal Q2 2025 earnings.

Political developments in Mexico weighed on the Peso after a commission of deputies approved the ruling on the judiciary reform. The reform is expected to be voted on once the new Mexican Congress takes office on September 1.

This and AMLO’s pausing relations with the embassies of Mexico’s largest trading partners triggered a rally in the USD/MXN, which rose over 1.70% and was a whisker of hitting 19.80, even though the US Dollar sustained losses against most G7 FX currencies after Federal Reserve (Fed) Chair Jerome Powell hinted that rate cuts are looming at his Jackson Hole speech.

Across the border, the US economic docket is absent. Yet traders are awaiting the release of the second estimate of Q2’s 2024 Gross Domestic Product (GDP) and Initial Jobless Claims data for the week ending August 24.

Later, Atlanta Fed President Raphael Bostic will cross the newswires at around 22:00 GMT.

Daily digest market movers: Mexican Peso shrugs off risk-off mood and rises

- Comments from US Ambassador Ken Salazar, expressed on August 22, were the reason behind AMLO’s decision. Salazar said that the judiciary reform threatens the rule of law and added that “the direct election of judges represents a major risk to the functioning of Mexico’s democracy. Any judicial reform must have safeguards that guarantee that the judiciary is strengthened and not subject to the corruption of politics.”

- Market sentiment remains mixed, yet it would greatly influence the USD/MXN’s direction, given the US Dollar’s safe-haven status.

- Traders will eye Fed speakers, the release of US Q2’s 2024 GDP, and the Fed’s preferred inflation gauge, the core Personal Consumption Expenditures Price Index (PCE).

- Data from the Chicago Board of Trade (CBOT) suggests the Fed will cut at least 100 basis points (bps), according to the fed funds rate futures contract for December 2024.

Technical outlook: Mexican Peso strengthens as USD/MXN falls below 19.60

The USD/MXN daily chart hints that the uptrend remains intact despite the ongoing pullback. Momentum favors buyers as seen by the Relative Strength Index (RSI).

On further USD/MXN strength, the pair could challenge the current week-to-date (WTD) high of 19.79. A breach of the latter will expose 20.00, followed by the year-to-date (YTD) high at 20.22 and the psychological 20.50 supply area.

Conversely, if USD/MXN tumbles below 19.50, this could expose the 19.00 figure. Further losses lie beneath that level, opening the door to test the August 19 low of 18.59, followed by the 50-day Simple Moving Average (SMA) at 18.48.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

- EUR/GBP maintains its downtrend, falling near the 0.8400 mark and then recovering above.

- Indicators remain deep in negative area.

- Buyers must defend the 0.8400 range to avoid declines.

In Wednesday's session, the EUR/GBP pair extended its losses, down to 0.8425, reflecting a persistent bearish outlook by the sellers. The pair has been extending its losing streak to six consecutive sessions. The technical indicators continue to align with the bearish trend, but on the positive side, buyers stepped in to defend the 0.8400 area after falling to a low of 0.8410.

The Relative Strength Index (RSI) stands at 40 and the Moving Average Convergence Divergence (MACD) continues to print rising red bars, suggesting increasing bearish momentum This convergence of indicators points to a likely continuation of the downtrend.

After seven sessions of losses, the next sessions might see a rebound and sellers might eventually run out of steam. Regarding the overall outlook, it will depend on whether the pair holds the 0.8400 line or not.

EUR/GBP daily chart

- GBP/USD struggles to keep its uptrend above year-to-date (YTD) high of 1.3266.

- RSI shifting overbought opened the door for GBP/USD’s retracement.

- The uptrend will resume once the pair reclaims 1.3266.

- Downside risks emerge if GBP/USD tumbles below 1.3200.

The Pound Sterling retreats from the multi-year highs it reached on Tuesday and registers losses of over 0.40% against the Greenback as traders brace for the release of US inflation data on Friday. The GBP/USD enjoyed a ride and hit a two-year peak at 1.3266 following Fed Chair Jerome Powell’s speech, yet at the time of writing, the pair trades at 1.3220.

GBP/USD Price Forecast: Technical outlook

According to the GBP/USD daily chart, the uptrend will extend as long as the pair remains above the top trendline of an ascending channel that was broken on August 23. However, due to the 400-pip rally in August, the pair is set to consolidate as buying momentum begins to fade, as depicted by the Relative Strength Index (RSI).

The RSI turned overbought, meaning the pair could retreat before aiming for higher prices.

If GBP/USD clears the YTD high of 1.3266, that could pave the way for challenging the March 23, 2022 peak at 1.3298. Further gains are seen once that level is cleared, with the next key resistance being the 1.3400 figure before challenging the March 1, 2022, high at 1.3437.

Conversely, if GBP/USD tumbles below 1.3200, this could exacerbate a pullback toward the latest cycle high at 1.3044, hit on July 17. A breach of the latter will expose the 50-day moving average (DMA) at 1.2857.

GBP/USD Price Action – Daily Chart

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Euro.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.54% | 0.40% | 0.42% | 0.12% | 0.07% | -0.11% | 0.13% | |

| EUR | -0.54% | -0.13% | -0.13% | -0.41% | -0.45% | -0.37% | -0.41% | |

| GBP | -0.40% | 0.13% | 0.00% | -0.29% | -0.33% | -0.25% | -0.27% | |

| JPY | -0.42% | 0.13% | 0.00% | -0.27% | -0.34% | -0.27% | -0.28% | |

| CAD | -0.12% | 0.41% | 0.29% | 0.27% | -0.05% | 0.04% | 0.02% | |

| AUD | -0.07% | 0.45% | 0.33% | 0.34% | 0.05% | 0.08% | 0.06% | |

| NZD | 0.11% | 0.37% | 0.25% | 0.27% | -0.04% | -0.08% | -0.02% | |

| CHF | -0.13% | 0.41% | 0.27% | 0.28% | -0.02% | -0.06% | 0.02% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

- USD/JPY rises to near 145.00 as the US Dollar recovers strongly.

- Upbeat US Consumer Confidence eases US hard landing fears.

- Investors await the Tokyo CPI and the US core PCE inflation for July.

The USD/JPY pair climbs to near 145.00 in Wednesday’s North American session. The asset strengthens as the US Dollar (USD) delivers a strong recovery move after posting a fresh annual low. The USD rebounds as upbeat United States (US) Consumer Confidence data for August diminished fears of a hard landing.

Market experts started anticipating a hard landing for the US economy after the US Nonfarm Payrolls (NFP) report for July showed a slowdown in labor demand and a significant increase in the Unemployment Rate. The hard landing is a scenario in which the economy enters a recession in an attempt to bring inflation down to the bank’s target.

US Conference Board showed on Tuesday that Consumer Confidence rose to 103.30 in August, beating expectations of 100.7. The sentiment indicator exhibits the confidence of individuals in the economic prospects.

Meanwhile, the market sentiment appears to be risk-off as investors turn cautious ahead of the US core Personal Consumption Expenditure price index (PCE) data for July, which will be published on Friday. The S&P 500 has posted nominal losses in the North American session. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, recovered strongly above 101.00 from a fresh annual low of 100.50.

The underlying inflation data is expected to influence market speculation for the Federal Reserve (Fed) interest rate cut path. Financial markets currently expect that the Fed will begin reducing interest rates from the September meeting. Traders remain split over the likely rate-cut size.

On the Japanese Yen (JPY) front, investors await the Tokyo Consumer Price Index (CPI) data for August, which will be published on Friday. The data is expected to show that Tokyo CPI excluding Fresh foods rose steadily by 2.2% in August. The inflation data will influence market speculation for the Bank of Japan's (BoJ) interest rate hike path.

Japanese Yen FAQs

The Japanese Yen (JPY) is one of the world’s most traded currencies. Its value is broadly determined by the performance of the Japanese economy, but more specifically by the Bank of Japan’s policy, the differential between Japanese and US bond yields, or risk sentiment among traders, among other factors.

One of the Bank of Japan’s mandates is currency control, so its moves are key for the Yen. The BoJ has directly intervened in currency markets sometimes, generally to lower the value of the Yen, although it refrains from doing it often due to political concerns of its main trading partners. The current BoJ ultra-loose monetary policy, based on massive stimulus to the economy, has caused the Yen to depreciate against its main currency peers. This process has exacerbated more recently due to an increasing policy divergence between the Bank of Japan and other main central banks, which have opted to increase interest rates sharply to fight decades-high levels of inflation.

The BoJ’s stance of sticking to ultra-loose monetary policy has led to a widening policy divergence with other central banks, particularly with the US Federal Reserve. This supports a widening of the differential between the 10-year US and Japanese bonds, which favors the US Dollar against the Japanese Yen.

The Japanese Yen is often seen as a safe-haven investment. This means that in times of market stress, investors are more likely to put their money in the Japanese currency due to its supposed reliability and stability. Turbulent times are likely to strengthen the Yen’s value against other currencies seen as more risky to invest in.

This time last year, the FX futures market was reducing EUR longs. More recently, EUR positioning is very small, Société Generale FX strategists note

Risk reversals to return towards flattish levels

“EUR/USD’s acceleration above 1.10 over the past couple of weeks has pushed up both realised and implied volatility.”

“As the FX skew usually predicts more volatility on the USD upside, the switch to positive of short-dated EUR/USD risk reversals is an inversion.”

“This move is consistent with the positive vol/spot correlation, but as the spot stabilises, we’d expect risk reversals to return towards flattish levels.”

- AUD/USD continues rising in line with the dominant uptrend.

- The RSI is showing bearish divergence with price, however, warning of a possible pull back.

AUD/USD extends its rally and makes higher highs as it continues the uptrend it began at the start of August.

The pair reached a new monthly high of 0.6813 on Wednesday. Although it has pulled back since, it remains in an established uptrend which, given “the trend is your friend” is expected to extend.

AUD/USD 4-hour Chart

AUD/USD has broken above the key 0.6799 July 11 high, and now sets its sights on the next target at 0.6870, the December 2023 high. A break above 0.6813 would provide bullish confirmation.

The Relative Strength Index (RSI) momentum indicator is showing bearish divergence with price. The new monthly high price reached on Wednesday was not accompanied by a corresponding new high in the RSI, for example. This shows waning momentum which is a bearish sign and could infer a deeper correction is on the horizon.

The price levels at 0.6755 and 0.6639, however, would be expected to provide support to any pull backs and points of departure for fresh upswings as the dominant uptrend is likely to resume.

- NZD/USD declined to from 0.6250 after a strong recovery in the US Dollar.

- Annual US core PCE inflation is estimated to have accelerated to 2.7% in July.

- The RBNZ is expected to deliver more interest rate cuts this year.

The NZD/USD pair drops after facing selling pressure near 0.6250 in Wednesday’s North American session. The Kiwi asset falls as the US Dollar (USD) recovers strongly after posting a fresh annual low. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, extends its recovery above 101.00 from its year-to-date low (YTD) low of 100.50.

A decent recovery in the US Dollar appears to be bolstered by uncertainty among market participants as the United States (US) core Personal Consumption Expenditure inflation (PCE) for July comes under the spotlight. This has also weighed on risk-sensitive assets.

Investors await the US PCE inflation data to get fresh cues about the Federal Reserve (Fed) interest rate cut path. Currently, traders have fully priced in market expectations for the Fed to start reducing its key borrowing rates in September, while they are doubtful over whether the potential size of the rate cut would be 25 or 50 basis points (bps).

The data from the US PCE report is expected to show that annual core inflation rose at a faster pace of 2.7% from 2.6% in June, with monthly figures growing steadily by 0.2%.

Meanwhile, investors have underpinned the US Dollar against the New Zealand Dollar (NZD), but the Kiwi’s performance against other major peers has remained firm even though market participants expect that the Reserve Bank of New Zealand (RBNZ) will cut interest rates aggressively this year. The RBNZ unexpectedly pivoted to policy-normalization two weeks back.

New Zealand Dollar FAQs

The New Zealand Dollar (NZD), also known as the Kiwi, is a well-known traded currency among investors. Its value is broadly determined by the health of the New Zealand economy and the country’s central bank policy. Still, there are some unique particularities that also can make NZD move. The performance of the Chinese economy tends to move the Kiwi because China is New Zealand’s biggest trading partner. Bad news for the Chinese economy likely means less New Zealand exports to the country, hitting the economy and thus its currency. Another factor moving NZD is dairy prices as the dairy industry is New Zealand’s main export. High dairy prices boost export income, contributing positively to the economy and thus to the NZD.

The Reserve Bank of New Zealand (RBNZ) aims to achieve and maintain an inflation rate between 1% and 3% over the medium term, with a focus to keep it near the 2% mid-point. To this end, the bank sets an appropriate level of interest rates. When inflation is too high, the RBNZ will increase interest rates to cool the economy, but the move will also make bond yields higher, increasing investors’ appeal to invest in the country and thus boosting NZD. On the contrary, lower interest rates tend to weaken NZD. The so-called rate differential, or how rates in New Zealand are or are expected to be compared to the ones set by the US Federal Reserve, can also play a key role in moving the NZD/USD pair.

Macroeconomic data releases in New Zealand are key to assess the state of the economy and can impact the New Zealand Dollar’s (NZD) valuation. A strong economy, based on high economic growth, low unemployment and high confidence is good for NZD. High economic growth attracts foreign investment and may encourage the Reserve Bank of New Zealand to increase interest rates, if this economic strength comes together with elevated inflation. Conversely, if economic data is weak, NZD is likely to depreciate.

The New Zealand Dollar (NZD) tends to strengthen during risk-on periods, or when investors perceive that broader market risks are low and are optimistic about growth. This tends to lead to a more favorable outlook for commodities and so-called ‘commodity currencies’ such as the Kiwi. Conversely, NZD tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

The main FX positioning story was the unwind of a massive carry trade and the associated yen shorts, Société Generale FX strategists note.

CAD short covering looks far from over

“As we suspected on 7 August, these shorts were almost cleaned out, while CFTC reports released since then show that yen positions have totally normalised. Now, the biggest FX position is in CAD, as a very significant short accumulated between March and July.”

“The reversal of this position started this month and has already pressured USD/CAD below 1.35 from 1.40. But given the size of the remaining short, the CAD short covering looks far from over.”

- WTI falls to the $74.00 level as lower demand from China, the world’s largest Oil consumer weighs.

- The weakness comes despite a Libyan political faction shutting down all the country’s Oil production.

- OPEC+ is expected to increase production which could bring down the equilibrium rate of WTI.

West Texas Intermediate (WTI), the US Crude Oil benchmark, is trading down by almost one and a half percent to just above $74.00 on Wednesday. WTI is falling as concerns about Chinese demand and risks of a broader economic slowdown offset supply losses from Libya and wider geopolitical risks from the region.

A slowdown in the Chinese economy, the largest importer of Crude Oil in the world, is reducing demand whilst structural changes and the replacement of gasoline-fueled cars with electric vehicles, as well as a general shift towards a greater reliance on green energy, is further taking its toll.

“The big surprise this year on the demand side has been the softness of Chinese demand growth. The slowdown in China demand, which is mostly structural, is an important factor in Oil markets over the next few years. Some of it is a macro story – GDP is rising at a slower pace – the other reasons are more Oil-specific and micro, and include fuel-switching to EVs and from Oil to LNG,” says Daan Struyven, Head of Research at Goldman Sachs.

WTI price declines on Wednesday despite the news from Libya that the Sarir Oil field has almost completely halted output, according to Reuters. The move was orchestrated by the Libyan National Army (LNA) who are protesting about the Libyan government’s sacking of the Governor of the Central Bank of Libya (CBL), Sadiq al-Kabir. The LNA controls the country's east and south where most of the oil fields lie. The LNA declared on Monday that all production and exports would be halted.

Speculation that OPEC+ will begin raising production in order to bring down the price of Oil so as it make it less profitable for competitors in the form of US shale producers, is further weighing on WTI.

“OPEC has been quite effective in balancing the market and keeping Oil prices in a range,” said Struyven, in an interview with Bloomberg News, however “this is set to change, if OPEC+ increases production.”

The result of such changes in OPEC+’s strategy will be that Oil prices could fall to a lower equilibrium rate where the new floor for prices becomes the equilibrium rate for shale producers. However, the decline is likely to be gradual given countervailing bullish factors, says the Goldman Sachs researcher.

US monetary policy could be a further factor for Oil price. If the US Federal Reserve (Fed) decides to go ahead with cutting interest rates in 20204-5, as now seems highly likely, WTI could gain a back wind because it would lower the opportunity cost of holding Oil vis-a-vis interest-paying assets.

The US Crude inventories declined last week, according to data from the American Petroleum Institute (API). Crude Oil stockpiles in the United States for the week ending August 23 fell by 3.4 million barrels. This compared to an increase in stockpiles of 0.347 million barrels in the previous week. The market consensus estimate had been for stocks to decline by 3.0 million barrels.

On Wednesday, the Energy Information Administration (EIA) will release its figures on US crude inventories. They are expected to show a similar fall, in line with the downtrend witnessed during the summer. Out of the last nine US inventory releases, eight showed declines. This reflects increased demand which is a supportive background factor for Oil.

A period of high deficits, slowing growth, sticky inflation, currency devaluation and an imminent cutting cycle has already attracted capital towards Gold's warm embrace, TDS Senior Commodity Strategist Daniel Ghali notes.

Visible short positions remain near decade-lows

“Macro fund positioning in Gold is at its highest levels since the depths of the pandemic. It is more statistically consistent with deep recession cuts than it is with normalization cuts, or alternatively may be bloated due to geopolitics, deficits, or any number of the bullish narratives touted above.”

“What is clear is that macro funds have scarcely held more Gold than they do today, with our estimates now at levels that marked local highs in 2019 and 2016. CTAs are also effectively 'max long'. Chinese ETF outflows have resumed. Shanghai trader positioning near record-highs already reflects Gold’s allure in the face of a weaker domestic currency, stock and property market.”

“Asia is on a buyer's strike in physical. Visible short positions remain near decade-lows. Narratives in Gold markets are unanimously bullish. We see significant risks to the near-term outlook tied to positioning, despite the strong fundamental backdrop.”

The Pound Sterling (GBP) has drifted lower in line with the broader trend in the USD so far today, Scotiabank's Chief FX Strategist Shaun Osborne notes.

GBP consolidates

“PM Starmer is in Germany to try and rebuild UK/EU ties—a potential GBP-positive. BoE MPC member Mann, who dissented in favour of a hold at the last MPC policy decision, speaks at 8.15ET. A generally firm run of UK data reports in the recent past will not have allayed her concerns about an ‘upward ratchet’ to wage trends.”

“GBP is consolidating but has put minor bull trend support at 1.3235 behind it on the session, suggesting that a little more drift may develop in the short run. A low close on the session could form a bearish “harami” candle. GBP support is 1.3180.”

The Euro (EUR) has lost 0.5% over the course of the session so far as EUR consolidation from earlier in the week develops into a little more softness, Scotiabank's Chief FX Strategist Shaun Osborne notes.

EUR slips despite some narrowing in short-term EZ/US spreads

“Absent any data or fundamental developments, short-term flows appear to be driving movement on the session. Note that EZ/US 2Y spreads have narrowed further today (-147bps, the narrowest since mid-2023) which suggests EUR losses may snap higher again after month -end flows run off.”