- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 28-07-2014

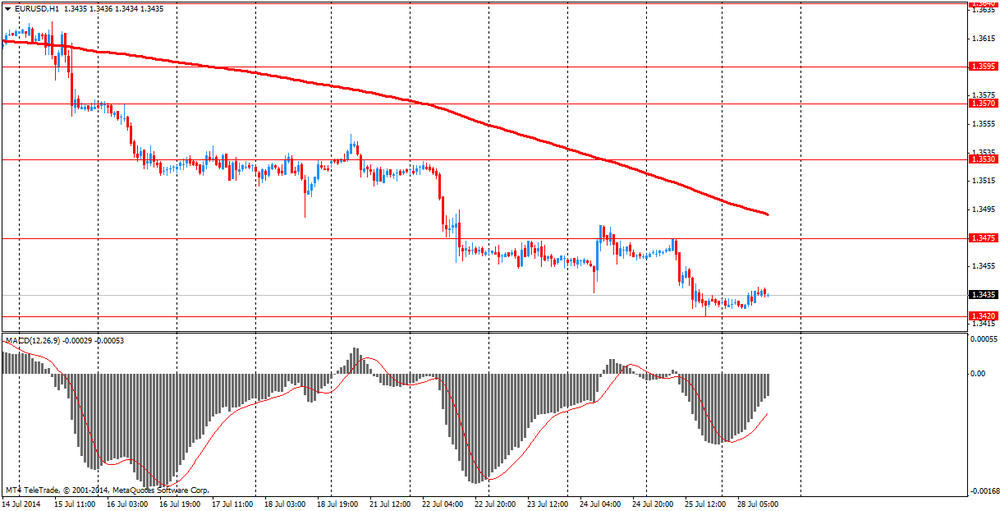

The euro exchange rate rose slightly against the dollar in terms of investor activity restrained. Market participants gradually shift focus to important statistical reports on the U.S. economy - preliminary data on GDP for the second quarter of 2014, the July report on unemployment and the index of business activity in the manufacturing sector. According to experts, the number of jobs in the U.S. economy in July increased by 228 thousand after increasing by 262 million in June, unemployment remained unchanged at 6.1%. U.S. GDP, according to the consensus of experts in April-June 2014 increased by 3%, after declining by 2.9%.

Focus will also have a Fed meeting. It is expected that at the upcoming meeting of the Monetary Policy FOMC, is likely to announce another round of quantitative easing to minimize the program (QE) for another $ 10 billion, bringing the total amount of monthly purchases of bonds of $ 25 billion With regard to the Committee, tone it is likely not practically change. Given that the document will be released before the release of the employment report, the economic statements are unlikely to be significantly different from previous ones. It is expected that Yellen will continue to argue that the rate of b / p at 6.1% is still pointing to weak growth in the labor market, as also evidenced by the slow growth of wages.

As for today's data, the report had little impact on the housing market, which showed: The index of pending home sales (PHSI), predictive indicator based on signed contracts, dropped 1.1 percent to 102.7 in June from 103.8 in May and was 7.3 percent lower than in June 2013 (110.8). Despite the decline, the index exceeds the level of 100, which is considered a middle-contract activity, the second consecutive month.

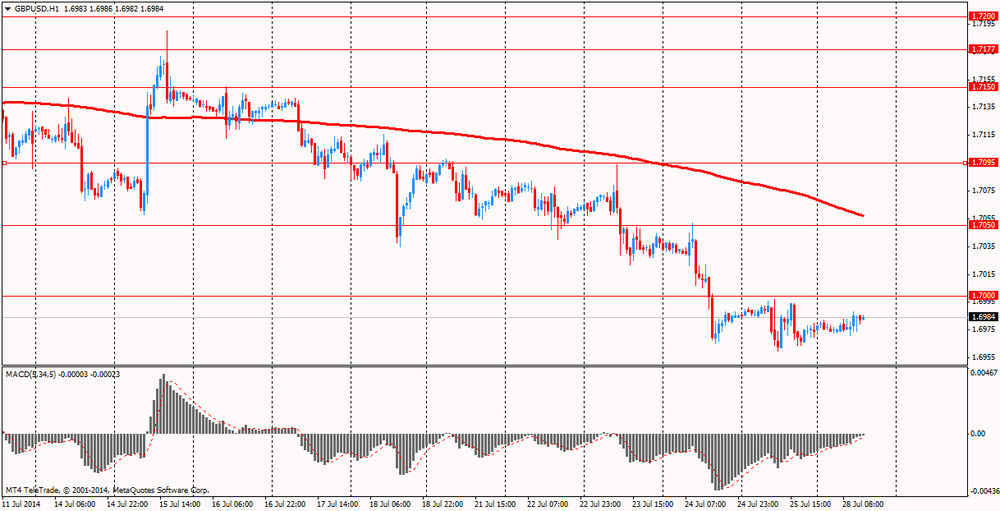

The British pound retreated from session high against the U.S. dollar, but continues to trade on the rise. Today we have published data on the secondary housing market, according to which the confidence of British homebuyers worsened in the second quarter. These results showed a survey by mortgage lender Halifax on Monday. The number of people who believe that today - "good time to buy," fell to 5% from 34% in the previous quarter, which is the most serious decline since April 2011. Approximately 57% of simplification believe that the time is now for sale real estate, and 32 believe the opposite; indicators, thus, form the balance 25. Craig McKinley, director of mortgages at Halifax, said: "It seems that we have reached a tipping point when the balance between buyers and sellers is not synchronized in the near future."

European stocks ended the day mixed after two weeks of growth, as investors monitor the situation in Ukraine and the Middle East, and evaluate the financial performance of companies.

It is worth noting that on Sunday the fighting in Gaza subsided a bit after the Islamic militants of Hamas said they support a 24-hour humanitarian truce in the light of the Muslim holiday.

Meanwhile, member states of the European Union agreed to impose economic sanctions against Russia because of its involvement in fomenting the crisis in Ukraine. Moscow has responded to the sanctions, warning that they will prevent cooperation on global security.

Investors are also watching corporate reporting. Of companies in the Stoxx 600, which presented the results of this season, 57 percent exceeded estimates for earnings and 51 percent better than expected sales, according to data compiled by Bloomberg.

As for today's economic reports that little influenced by the U.S. data, which showed that after three consecutive months of strong growth unfinished Home Sales slowed slightly in June. National Association of Realtors (NAR) reported that the index of pending home sales (PHSI), predictive indicator based on signed contracts, dropped 1.1 percent to 102.7 in June from 103.8 in May and was 7.3 percent lower than in June 2013 (110.8). Despite the decline, the index exceeds the level of 100, which is considered a middle-contract activity, the second consecutive month.

Lawrence Yun, chief economist of NAR, said that the housing market is stabilizing, but the current problems hinder the full potential sales. "The activity is significantly higher than at the beginning of this year, as prices have become more moderate, and inventory levels have improved," he said.

Meanwhile, adding that market participants gradually shift focus to other important statistical reports on the U.S. economy - preliminary data on GDP for the second quarter of 2014, the July report on unemployment and the index of business activity in the manufacturing sector. According to experts, the number of jobs in the U.S. economy in July increased by 228 thousand after increasing by 262 million in June, unemployment remained unchanged at 6.1%. U.S. GDP, according to the consensus of experts in April-June 2014 increased by 3%, after declining by 2.9% in the previous quarter.

National benchmark indexes fell in 15 of the 18 western European markets.

FTSE 100 6,788.07 -3.48 -0.05% CAC 40 4,344.77 +14.22 +0.33% DAX 9,598.17 -45.84 -0.48%

Value of the shares of Irish airline Ryanair Holdings Plc jumped 3.0%. Europe's largest airline discounter increased its net profit in the first fiscal quarter by 152% due to a significant increase in demand for its services during the Easter holidays, and raised its forecast for the entire fingoda and announced the payment of the special dividend.

Paper Reckitt Benckiser Group PLC rose 3.0%. British chemical company announced the separation of the pharmaceutical division.

The cost of the investment fund shares Aberdeen Asset Management Plc fell 5.3% after it became aware of reducing the amount of assets under management fund by 0.6 percent - up to 322.5 billion pounds.

Cost of TNT Express NV fell 5.6 percent. Dutch delivery company reported that second-quarter profit amounted to 1.66 billion euros, compared with a forecast of 1.69 billion euros.

Wincor Nixdorf shares fell 4.7 percent after reporting third-quarter revenue reached 573 million euros ($ 770 million), compared with estimates at 600 million euros.

The price of oil fell moderately, closer to $ 107 per barrel (mark Brent), as an ample supply in the Atlantic Basin and weak demand in Europe and Asia outweighed concerns about political tensions in Ukraine and the Middle East.

Traders say about oversupply in the physical markets of North and West African oil, forcing sellers to make significant discounts. The "low refining margins in all regions, including the U.S., says that the situation will not change in the near future" - said the oil market analyst Michael Wittner Societe Generale.

Market participants are also awaiting the release of statistics on the U.S. economy, as well as a meeting of the Federal Reserve System, which is scheduled for Wednesday. It is expected that at the upcoming meeting of the Monetary Policy FOMC, is likely to announce another round of quantitative easing to minimize the program (QE) for another $ 10 billion, bringing the total amount of monthly purchases of bonds of $ 25 billion With regard to the Committee, tone it is likely not practically change. Given that the document will be released before the release of the employment report, the economic statements are unlikely to be significantly different from previous ones. It is expected that Yellen will continue to argue that the rate of b / p at 6.1% is still pointing to weak growth in the labor market, as also evidenced by the slow growth of wages.

As for today's data, the report had little impact on the housing market, which showed: The index of pending home sales (PHSI), predictive indicator based on signed contracts, dropped 1.1 percent to 102.7 in June from 103.8 in May and was 7.3 percent lower than in June 2013 (110.8). Despite the decline, the index exceeds the level of 100, which is considered a middle-contract activity, the second consecutive month.

From a technical standpoint, the first resistance level WTI oil prices at around $ 101.40 and the second resistance level is $ 102.00. At the same levels of support may include the following $ 101.10 and $ 100.65.

The cost of the September futures on U.S. light crude oil WTI (Light Sweet Crude Oil) fell to $ 101.40 a barrel on the New York Mercantile Exchange (NYMEX).

September futures price for North Sea Brent crude oil mixture fell 67 cents to $ 107.37 a barrel on the London exchange ICE Futures Europe.

Gold prices have not changed today, continuing to trade near the level of $ 1,300 per ounce, which is associated with the tension between the West and Russia, and confrontations in the Middle East.

"The interest in gold as a reliable asset is retained, but the dollar is putting pressure. Main test will be later this week when we get the data for the U.S., and perhaps the Fed's comments on interest rates, "- said a trader in Sydney.

It is noteworthy that group Hamas in Gaza agreed to a 24-hour truce, but did not agree with Israel on a complete cessation of hostilities. At least 36 people were killed over the weekend during the fighting between the Libyan special forces and Islamists in the city of Benghazi in eastern Libya.

As regards the situation in Ukraine, the U.S. and the EU are preparing new sanctions against Russia on a background of continuing fighting in the east of the country.

On the dynamics of trade also affect expectations meeting of the Federal Reserve System and the publication of GDP data for the second quarter and non-farm payrolls, which will help to measure the strength of the economy and the prospects for the next cycle of changes in interest rates the U.S. central bank. According to analysts, the probability of these events to promote gold above current levels will be low.

Meanwhile, the IMF report presented today showed that the central banks of several countries around the world are actively increasing gold reserves. Fill up their gold reserves decided, in particular, central banks in Turkey, Kazakhstan, Mexico, Russia, Tajikistan, Serbia, Greece and Ecuador. However, the total amount of gold reserves in the world fell in June, the second consecutive month and reached 1,022 troy ounces. In June, the price of gold rose highest growth rate over the past 4 months, aided by the unstable situation in Ukraine, Israel and Iraq. At such a geopolitical backdrop, investors are choosing the precious metal as a hedge.

The cost of the August gold futures on the COMEX today rose $ 1 - up to $ 1304.30 per ounce.

U.S. stock futures rose on merger activity, before a Federal Reserve policy decision this week and reports that will provide more clues to the strength of the world's largest economy.

Global markets:

Nikkei 15,529.4 +71.53 +0.46%

Hang Seng 24,428.63 +212.62 +0.88%

Shanghai Composite 2,177.95 +51.33 +2.41%

FTSE 6,796.15 +4.60 +0.07%

CAC 4,343.54 +12.99 +0.30%

DAX 9,630.08 -13.93 -0.14%

Crude oil $101.34 (-0.72%)

Gold $1304.80 (+0.11%)

EUR/USD $1.3475

USD/JPY Y102.00/10, Y102.45

AUD/USD $0.9350

GBP/USD $1.6975, $1.7035

EUR/GBP Stg0.7910/15, stg0.8000

(company / ticker / price / change, % / volume)

| United Technologies Corp | UTX | 108.96 | +0.07% | 2.0K |

| American Express Co | AXP | 92.10 | +0.18% | 4.4K |

| Exxon Mobil Corp | XOM | 103.41 | +0.22% | 0.1K |

| Boeing Co | BA | 123.50 | +0.24% | 0.1K |

| International Business Machines Co... | IBM | 194.40 | 0.00% | 0.2K |

| Procter & Gamble Co | PG | 79.55 | -0.01% | 6.0K |

| E. I. du Pont de Nemours and Co | DD | 64.90 | -0.05% | 0.8K |

| 3M Co | MMM | 145.03 | -0.06% | 0.1K |

| Verizon Communications Inc | VZ | 51.25 | -0.06% | 5.5K |

| Johnson & Johnson | JNJ | 102.04 | -0.07% | 0.2K |

| AT&T Inc | T | 35.50 | -0.11% | 0.6K |

| Nike | NKE | 77.63 | -0.12% | 0.1K |

| McDonald's Corp | MCD | 95.60 | -0.13% | 13.1K |

| Microsoft Corp | MSFT | 44.43 | -0.16% | 3.5K |

| Goldman Sachs | GS | 175.09 | -0.18% | 7.2K |

| General Electric Co | GE | 25.74 | -0.19% | 3.9K |

| Wal-Mart Stores Inc | WMT | 75.73 | -0.32% | 3.6K |

| Visa | V | 214.07 | -0.33% | 0.1K |

| Intel Corp | INTC | 34.11 | -0.41% | 5.9K |

| Chevron Corp | CVX | 133.00 | -0.43% | 0.4K |

| The Coca-Cola Co | KO | 40.82 | -0.44% | 1.3K |

| JPMorgan Chase and Co | JPM | 58.71 | -0.51% | 0.9K |

| Pfizer Inc | PFE | 30.02 | -0.56% | 8.6K |

| Travelers Companies Inc | TRV | 91.54 | -0.61% | 0.7K |

| Cisco Systems Inc | CSCO | 25.80 | -0.65% | 14.2K |

Upgrades:

Downgrades:

Cisco Systems (CSCO) downgraded to Sector Perform from Outperform at Pacific Crest

Pfizer (PFE) downgraded to Mkt Perform from Outperform at BMO Capital Mkts

Other:

During the European session, the Forex market the euro rose slightly against the dollar in the conditions of low-key activity of investors. Danske Bank analysts say that today we are calm before the storm, because on the eve of the eventful week calendar Monday is almost empty.

Interest is the only U.S. report on pending real estate transactions, which is a good leading indicator of existing home sales.

Recently, the report featured a good performance, demonstrating that the last two months, this sector is recovering, confirmed that the housing market index and NAHB.

Meanwhile, other indicators were not as optimistic, in particular - building permits and new home sales.

J. Yellen noted priority market dynamics properties for CB, stressing that the sector remains weak, and although he showed little progress, the overall results of this year so far has been disappointing.

The British pound is trading sideways against the U.S. dollar. Published secondary data on the housing market, according to which the confidence of British homebuyers worsened in the second quarter. These results showed a survey by mortgage lender Halifax on Monday.

Balance of people who believe that now the "good time to buy" fell from 34 to 5 in the previous quarter. It was the biggest drop since April 2011.

Meanwhile, about 57 percent believe that now is a good time to sell, and 32 percent think it's a bad time to form the balance of 25.

Craig McKinley, director of mortgages at Halifax, said: "It seems that we have reached a tipping point when the balance between buyers and sellers is much far from the synchronization."

EUR / USD: during the European session, the pair rose to $ 1.3441

GBP / USD: during the European session, the pair traded in the range of $ 1.6971 - $ 1.6988

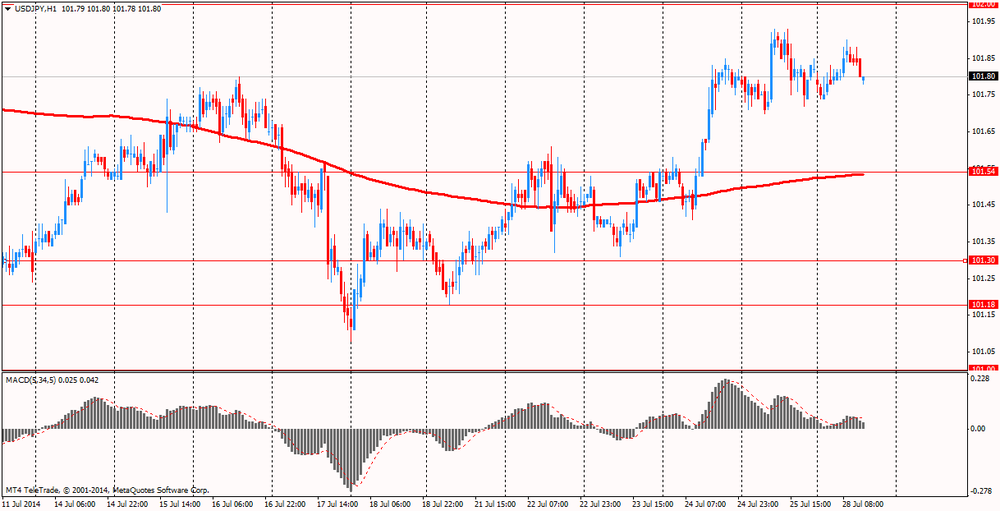

USD / JPY: during the European session, the pair rose to Y101.90 and stepped

At 14:00 GMT the United States will change in the volume of pending home sales for June. 23:30 GMT Japan will present the change in volume level of household expenditure in June in 23:50 GMT - the change in retail sales for June.

EUR/USD

Offers $1.3500-10, $1.3440-50

Bids $1.3420

GBP/USD

Offers $1.7080, $1.7065

Bids $1.6920, $1.6900, $1.6885/80

AUD/USD

Offers $0.9480, $0.9450, $0.9420/25

Bids $0.9385/80, $0.9370, $0.9350, $0.9320

EUR/JPY

Offers Y137.75/80, Y137.50, Y137.20/25, Y137.00

Bids Y136.50, Y136.00, Y135.75

USD/JPY

Offers Y102.20, Y102.00

Bids Y101.50, Y101.20, Y101.00

EUR/GBP

Offers stg0.7980/85, stg0.7950

Bids stg0.7850

European stocks were little changed, following a two-week advance, as investors weighed company earnings and awaited data on American services and home sales. U.S. index futures were little changed, while Asian shares rose.

Preliminary data at 9:45 a.m. Washington time may show the Markit Economics purchasing managers' index for the services industry fell to 59.8 in July from 61 in the prior month, according to economists surveyed by Bloomberg. A separate report at 10 a.m. from the National Association of Realtors may show a pending home-sales index climbed 0.5 percent in June following a 6.1 percent gain in May.

Goldman Sachs Group Inc. cut its rating on stocks to neutral, the equivalent of hold, for the next three months, saying they are at risk of a brief selloff, according to a quarterly strategy report July 25. The bank also lowered corporate credit to underweight and predicted that U.S. government bond yields will increase.

Aberdeen lost 3.1 percent to 445.1 pence. Europe's biggest publicly traded money manager said assets under management fell 0.6 percent to 322.5 billion pounds ($547.4 billion) in the quarter ended June 30 from the prior three months.

Ryanair rose 4 percent to 7.12 euros. Europe's biggest discount carrier said profit after tax will probably be 620 million euros to 650 million euros for the year through March 2015, up from a previous forecast of 580 million euros to 620 million euros. The Dublin-based airline also said profit after tax for the three months ended June 30 more than doubled to 197 million euros.

Reckitt Benckiser climbed 2.8 percent to 5,210 pence. The spinoff will occur in the next year and will be a U.K.-listed company. Slough, England-based Reckitt Benckiser also reported that sales in the second quarter climbed 4 percent, excluding the pharmaceutical business. That matched analysts' estimates.

FTSE 100 6,801.42 +9.87 +0.15%

CAC 40 4,346.1 +15.55 +0.36%

DAX 9,633.36 -10.65 -0.11%

EUR/USD $1.3475

USD/JPY Y102.00/10, Y102.45

AUD/USD $0.9350

GBP/USD $1.6975, $1.7035

EUR/GBP Stg0.7910/15, stg0.8000

Asian stocks rose, with the regional benchmark index extending a six-year high, as Chinese shares traded in Hong Kong headed for a bull market amid optimism government stimulus is boosting economic growth.

HANG SENG 24,441.61 +225.60 +0.93%

S&P/ASX 200 5,577.4 -6.10 -0.11%

TOPIX 1,286.07 +4.72 +0.37%

SHANGHAI COMP 2,177.95 +51.33 +2.41%

Bank of Communications Co. soared 4.9 percent in Hong Kong on a report the lender wants to sell more stakes to private investors.

Hitachi Chemical Co. soared 9.5 percent in Tokyo after announcing job cuts and reporting a quarterly profit.

Resona Holdings Inc. jumped 5.4 percent after the Japanese bank said it would buy back preferred shares to repay public funds.

The dollar traded near the strongest in eight months against the euro as investors raised bets it would climb versus the single currency to the most since November 2012.

The U.S. currency maintained its biggest weekly advance since March against major peers before reports forecast to show growth in services held near the fastest pace in at least three years, employers added more than 200,000 jobs for a sixth month, and economic growth rebounded last quarter. The preliminary reading of a Purchasing Managers' Index of U.S. services from Markit Economics was at 59.8 in July, according to the median estimate of economists in a Bloomberg survey. That would be the ninth-straight month above the 50 level that divides expansion from contraction.

Economists in a separate Bloomberg poll predict the U.S. Commerce Department will say on July 30 that gross domestic product rose at a 3 percent annualized rate in the second quarter. The 2.9 percent decline in the first quarter was the worst reading since the same three months in 2009. A Labor Department report on Aug. 1 will show nonfarm payrolls increased 231,000 in July, economists' forecasts show.

The Federal Reserve meets from tomorrow to debate the pace of interest-rate increases and whether to further reduce bond purchases.

The New Zealand dollar fell to a one-month low. Reserve Bank of New Zealand Governor Graeme Wheeler said on July 24 that the currency's level is "unjustified and unsustainable," after signaling a pause following four interest rate increases this year.

EUR / USD: during the Asian session, the pair traded in the range of $ 1.3425-35

GBP / USD: during the Asian session, the pair traded in the range of $ 1.6975-85

USD / JPY: on Asian session the pair traded in the range of Y101.75-85

A generally light data calendar for Monday (US Svcs PMI at 1345GMT then pending home sales at 1400GMT the stand out interest) with moves to come from end month flows and any geopolitical developments.

EUR / USD

Resistance levels (open interest**, contracts)

$1.3522 (821)

$1.3491 (756)

$1.3469 (134)

Price at time of writing this review: $ 1.3426

Support levels (open interest**, contracts):

$1.3411 (7006)

$1.3392 (3652)

$1.3364 (3408)

Comments:

- Overall open interest on the CALL options with the expiration date August, 8 is 28738 contracts, with the maximum number of contracts with strike price $1,3650 (4142);

- Overall open interest on the PUT options with the expiration date August, 8 is 34720 contracts, with the maximum number of contracts with strike price $1,3500 (7006);

- The ratio of PUT/CALL was 1.21 versus 1.24 from the previous trading day according to data from July, 25

GBP/USD

Resistance levels (open interest**, contracts)

$1.7200 (1661)

$1.7101 (2053)

$1.7004 (919)

Price at time of writing this review: $1.6975

Support levels (open interest**, contracts):

$1.6897 (2091)

$1.6799 (2402)

$1.6700 (1157)

Comments:

- Overall open interest on the CALL options with the expiration date August, 8 is 16851 contracts, with the maximum number of contracts with strike price $1,7250 (2424);

- Overall open interest on the PUT options with the expiration date August, 8 is 25486 contracts, with the maximum number of contracts with strike price $1,7000 (2679);

- The ratio of PUT/CALL was 1.51 versus 1.53 from the previous trading day according to data from Jule, 25

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

(raw materials / closing price /% change)

Light Crude 101.77 -0.31%

Gold 1,306.40 +0.24%

(pare/closed(GMT +2)/change, %)

EUR/USD $1,3429 -0,25%

GBP/USD $1,6974 -0,06%

USD/CHF Chf0,9046 +0,24%

USD/JPY Y101,82 +0,02%

EUR/JPY Y136,75 -0,22%

GBP/JPY Y172,84 -0,04%

AUD/USD $0,9394 -0,21%

NZD/USD $0,8552 -0,14%

USD/CAD C$1,0812 +0,65%

(index / closing price / change items /% change)

Nikkei 225 15,457.87 +173.45 +1.13%

Hang Seng 24,216.01 +74.51 +0.31%

Shanghai Composite 2,126.61 +21.55 +1.02%

FTSE 100 6,791.55 -29.91 -0.44%

CAC 40 4,330.55 -80.10 -1.82%

Xetra DAX 9,644.01 -150.05 -1.53%

S&P 500 1,978.34 -9.64 -0.48%

NASDAQ 4,449.56 -22.54 -0.50%

Dow Jones 16,960.57 -123.23 -0.72%

(time / country / index / period / previous value / forecast)

13:45 U.S. Services PMI (Preliminary) July 61.0 62.3

14:00 U.S. Pending Home Sales (MoM) June +6.1% -0.2%

23:30 Japan Unemployment Rate June 3.5% 3.5%

23:30 Japan Household spending Y/Y June -8.0% -3.7%

23:50 Japan Retail sales, y/y June -0.4% -0.4%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.