- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 28-03-2022

A Kremlin spokesman Dmitry Peskov has stated that Russia would use nuclear weapons only when there is a 'threat to the existence of the state'.

''Peskov told PBS in an interview on Monday that Russia would resort to nuclear weapons only in the case of a 'threat to the existence' of his country - and not as a result of the current conflict with Ukraine,'' Reuters is reporting.

"But any outcome of the operation (in Ukraine), of course, is not a reason for the usage of a nuclear weapon," Peskov said.

"We have a security concept that very clearly states that only when there is a threat for the existence of the state, in our country, we can use and we will actually use nuclear weapons to eliminate the threat for the existence of our country."

Key notes

- Pskov tells PBS that Biden's remarks on Putin remaining in power were 'quite alarming' and a 'personal insult'

- Peskov says Russia would use nuclear weapons only when there is a 'threat to the existence of the state'

- Says Russia 'does not accept the jurisdiction of the international criminal court.

- Tells PBS in interview that Russia is not targeting civilian homes or apartments.

- Tells PBS that nato is a 'machine of confrontation'.

Market implications

The yen is higher which could be related to the comments.

- The GBP/JPY reached a new YTD high above 164.00 but trimmed 200-pips gains, but finished the session in the green.

- GBP/JPY Price Forecast: An inverted hammer in the daily chart paved the way for further losses.

The GBP/JPY reached a six-year-high at 164.65, retreating afterward 200-pips on profit-taking amid a slight shift in market mood to mixed in the mid-European session. At the time of writing, the GBP/JPY is trading at 162.12.

Overnight, the GBP/JPY began the week on a higher note, jumping more than 300-pips from 161.00 towards the YTD highs, retracing later, as the North American session kicked in and market sentiment turned sour, as reflected by US equities.

GBP/JPY Price Forecast: Technical outlook

Monday’s price action of the GBP/JPY formed an inverted hammer, a bearish candlestick, with a 230-pip large wick on top of the real body, suggesting that the cross-currency might correct further lower before resuming upwards.

That said, the GBP/JPY first support to test would be 162.00. A decisive break could pave the way for further losses. The following support would be March 28 daily low at 160.76, followed by March 25 daily low at 159.85.

Upwards, the GBP/JPY first resistance would be 163.00. Once cleared, there’s nothing in the way of another test of the YTD high around 164.65, only the 164.00 mark.

Technical levels to watch

- WTI has plunged 8.45% near $103.00 amid the resurgence of Covid-19 in China.

- Progress in the Russia-Ukraine peace talks has hammered oil prices.

- Moscow has allowed Ukraine to join the EU but drop NATO aspirations.

West Texas Intermediate (WTI), futures on NYMEX, has plunged around 8.45% from $113.25 on Monday amid the absence of Russia’s core initial demands in the draft documents, which are denazification, demilitarisation, and legal protection for the Russian language in Ukraine. Adding to that, Moscow has allowed Ukraine to join European Union (EU) but has to drop NATO aspirations. This has brought a sense of optimism about the progress of peace talks between the Kremlin and Kyiv and pessimism in oil prices.

Apart from that, lockdown measures in a large part of Shanghai city in Ukraine have diminished demand concerns. The Chinese administration went on a lockdown of nine days in Shanghai to undertake mass coronavirus testing. The renewed fears of Covid-19 in China have put restrictions on the movement of men, machines, and materials, which has raised questions over the demand for oil going forward.

Meanwhile, the energy minister of the UAE Suhail Mohamed Al-Mazrouei also underpins the oil bears, citing that OPEC+ might be tempted to fix the current shortage in oil stockpiles by raising production beyond its average monthly increments of 400,000 barrels per day (BPD).

The presence of a majority of the catalysts has brought an intensified sell-off in the oil prices. Going forward, the headlines from the Russia-Ukraine peace talks will remain a major driver. However, investors will also focus on fresh impetus from the Iran nuclear deal, which may bring more pressure on the oil prices.

- The AUD/JPY finished the day with gains, though retreated from highs around 94.31.

- AUD/JPY Price Forecast: Upward biased, but the inverted hammer exposed the pair for further losses.

The AUD/JPY reached a new YTD high on Monday but retreated some, as profit-taking sent the pair tumbling and formed an “inverted hammer,” a candlestick with bearish implications, which has a long wick on the top of the real body, meaning that lower prices loom. At the time of writing, the AUD/JPY is trading at 93.00.

Risk appetite improved towards the end of the New York session as positive news from the Russia – Ukraine front emerged. Sources linked to the Financial Times reported that Russia is prepared to let Kyiv join the EU if it remains military non-aligned as part of ongoing ceasefire negotiations. The headlines lifted US equities, while in the FX space, nothing changed.

Overnight, the AUD/JPY edged higher since Monday’s Asian session. However, it peaked near the mid-European session at 94.31, plummeting afterward towards 92.19, just above the 50-hourly simple moving average(SMA), but later stabilized around 92.82.

AUD/JPY Price Forecast: Technical outlook

The AUD/JPY stills in an uptrend, but the inverted hammer leaves the pair vulnerable to selling pressure. Furthermore, the AUD/JPY briefly pierced the 78.6% Fibonacci retracement at 93.39, retreating towards Monday’s daily low at 92.19, and then reclaimed the mid-line between Pitchfork’s top-central parallel lines around 92.90.

Downwards, the AUD/JPY first support would be 92.00. Once cleared, the next demand zone would be the 91.00 mark, followed by Pitchfork’s central parallel line around 90.00.

Upwards, the AUD/JPY’s first resistance would be the psychological 93.00 mark. Breach of the latter would expose the 78.6% Fibonacci level again at 93.39, followed by the 94.00 mark and the YTD high at 94.31.

Technical levels to watch

- USD/JPY is rallying higher as BOJ’s bond-buying program aims to keep interest rates from rising.

- Traders are dumping the JGSs on the expectation of a rise in the US Treasury yields.

- The asset has found a corrective pullback after recording a fresh six-year high at 125.10.

The USD/JPY pair has finally witnessed a barricade at 125.10 amid an ongoing unlimited bond-buying program from the Bank of Japan (BOJ) for the first four days this week, which will help them to defend their yield cap.

The BOJ bought the 10-year benchmark Japanese Government Bonds (JGB) on Monday and is intended to continue buying them till Thursday to keep interest rates from getting elevation bets. Usually, a bond-buying program by the central banks denotes their intention to keep the interest rates from rising while traders are dumping the JGBs on the expectation of higher US Treasury yields amid raising bets on aggressive tightening monetary policy in May.

It is worth noting that the major has been rallying sharply in March and has added 8.70% this month. Failing to elevate interest rates by the BOJ amid capped inflation numbers has brought a wide divergence in the interest rate cycle of the BOJ and other central banks. The defending approach of the ultra-loose monetary policy by the BOJ dictated the major’s price above 125.00. However, a corrective pullback has been observed but it might be capitalized as a buying opportunity by the responsive buyers going forward.

USD/JPY Technical Analysis

On a weekly scale, USD/JPY has witnessed some profit booking after printing a fresh six-year high at 125.10. The Relative Strength Index (RSI) (14) is oscillating in the 60.00-80.00 range, which indicates more upside ahead. The greenback bulls are holding above the 200-period Exponential Moving Average (EMA), which adds to the upside filters.

USD/JPY weekly chart

-637841038441535618.png)

- GBP/USD bears take control at the start of the week.

- Bulls in anticipation of demand from daily support, eye weekly bullish close and 1.34 the figure.

GBP/USD hs started off the week on the back foot which is starting to invalidate the M-formation's reversion prospects on the weekly chart.

GBP/USD weekly chart

The invalidation is not complete until the close of the weekly candle, so it is still early days, but it is not a positive start for the bulls in anticipation of a run to the 1.34 area.

GBP/USD daily chart

The price, however, is being held up at what could be a support zone on the daily chart. This is an old area of resistance and an M-formation could be marked so long as the forthcoming sessions are bullish.

Zooming in, the reversion pattern is clearer and a break of the neckline near 1.3150 could result in a bullish continuation, leaving prospects of a reversion into the weekly M-formation's neckline near 1.34 the figure. However, a break of the recent lows and 1.30 the figure will leave the focus on the downside.

- USD/CAD has found responsive sellers in an attempt to move inside the ascending triangle formation.

- The greenback bulls will find initiative selling below 1.2465.

- A settlement below 200 EMA adds to the downside filters.

The USD/CAD pair has attracted significant offers at 1.2593, which seems a failed attempt to come out of the woods as the asset has remained vulnerable in the past few trading sessions.

On the weekly scale, USD/CAD has been slipped below the ascending triangle formation. Usually, breaking below the ascending triangle results in an expansion of volatility and volumes in the asset going forward. The upper end of the ascending triangle has remained capped at around 1.2960 while the trendline of the lower end of the ascending triangle formation is placed from 18 May 2021 low at 1.2013.

It is worth noting that after the breaking below the ascending triangle formation the attempt by the major to move back into the ascending triangle has been rejected by the responsive sellers at 1.2593.

The asset is holding below the 200-period Exponential Moving Average (EMA), which adds to the downside filters.

The Relative Strength Index (RSI) (14) is hovering near 40.00 and the asset is likely to attract initiative selling if the RSI (14) skids below 40.00.

Should the asset drops below Friday’s low at 1.2465, the major will be dragged towards the round level support at 1.2400, followed by the 29 October 2021 low at 1.2328.

On the flip side, bulls can become worthy if the asset surpasses last week’s high at 1.2624, which will send the asset towards March 11 low at 1.2694. Breach of the latter will send the pair towards round level resistance at 1.2800.

USD/CAD weekly chart

-637841009186594924.png)

- The Dow Jones Industrial Average ended up 0.3%.

- The S&P 500 gained 0.7% while the Nasdaq Composite added 1.3%.

- Gap between five- and 30-year yields briefly inverted for the first time since early 2006.

Stocks on Wall Street rallied in a late rally on Monday as big tech names supported the Nasdaq, the S&P 500 and the Dow. At the same time, investors cheered the prospects of positive progress in the development of peace talks between Russia and Ukraine.

The Dow Jones Industrial Average ended up 0.3%, the S&P 500 gained 0.7% while the Nasdaq Composite added 1.3%. In standout movers, Tesla Inc (TSLA) was the biggest support to the S&P 500. The carmaker said it will seek investor approval to increase its number of shares to enable a stock split. Meanwhile, the S&P energy index (SPN) was the worst-performing sector in the session. Oil prices were under pressure at the start of the week. News of a lockdown in China's financial hub, Shanghai, to curb a jump in COVID-19 infections lit-up demand worries and send oil giants, Exxon Mobil Corp (XOM) and Chevron Corp (CVX) lower on the day.

Additionally, a sell-off in the bond market resumed on Monday as short-dated yields hit their highest since 2019. The yield curve that is measured by the gap between five- and 30-year yields briefly inverted for the first time since early 2006. This has heightened the worries that the Federal Reserve's more aggressive monetary policy will damage economic performance and potentially cause a recession.

As for data, the Dallas Federal Reserve's monthly manufacturing survey for March, a narrower advance trade gap for February and a rise in inventories. The Dallas Fed's Manufacturing Activity Index dropped to 8.7 in March from 14 in February, in contrast to other regional data that indicated expansion in the sector.

Additionally, the trade gap narrowed 0.9% to $106.6 billion in February amid higher exports. The updated trade data for the month will be released on April 5. Lastly, Wholesale Inventories rose by 2.1% in February and retail inventories by 1.1%. Wholesale inventories will be updated on April 8, while retail inventories will be updated on April 14.

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 (GMT) | Australia | Retail Sales, M/M | February | 1.8% | |

| 06:00 (GMT) | Germany | Gfk Consumer Confidence Survey | April | -8.1 | -12 |

| 06:45 (GMT) | France | Consumer confidence | March | 98 | 94 |

| 08:30 (GMT) | United Kingdom | Consumer credit, mln | February | 0.608 | 0.885 |

| 08:30 (GMT) | United Kingdom | Mortgage Approvals | February | 74 | 74 |

| 08:30 (GMT) | United Kingdom | Net Lending to Individuals, bln | February | 6.5 | |

| 11:00 (GMT) | United Kingdom | BOE Quarterly Bulletin | |||

| 13:00 (GMT) | U.S. | Housing Price Index, y/y | January | 17.6% | |

| 13:00 (GMT) | U.S. | Housing Price Index, m/m | January | 1.2% | |

| 13:00 (GMT) | U.S. | S&P/Case-Shiller Home Price Indices, y/y | January | 18.6% | 18.3% |

| 14:00 (GMT) | U.S. | JOLTs Job Openings | February | 11.263 | |

| 14:00 (GMT) | U.S. | Consumer confidence | March | 110.5 | 107 |

| 21:45 (GMT) | New Zealand | Building Permits, m/m | February | -9.2% | |

| 23:50 (GMT) | Japan | Retail sales, y/y | February | 1.6% | -0.3% |

- The AUD/USD is down 0.28% in the last week of March, on a mixed market mood, and a buoyant greenback.

- The market mood improved late in the North American session, US equities gained.

- AUD/USD Price Forecast: Upward biased, though a daily close below 0.7500 would mean the pair is correcting lower before resuming the uptrend.

The Australian dollar slumps from YTD highs around 0.7540 as market sentiment fluctuates courtesy of Russia – Ukraine’s woes, China’s Covid-19 outbreak, and higher inflation prompted global central banks to tighten monetary policy conditions. At the time of writing, the AUD/USD is trading at 0.7492.

The market mood turned positive on Russia – Ukraine headlines, and Shanghai entered into lockdown on the Covid-19 outbreak

Risk appetite continues to be influenced by geopolitical jitters and the weekend Covid-19 outbreak in China, which affected Shanghai, one of the largest cities, weighed on market sentiment. Meanwhile, Russia – Ukraine woes keep grabbing the headlines.

Late in the North American session, sources linked to the Financial Times expressed that Russia is prepared to let Kyiv join the EU if it remains military non-aligned as part of ongoing ceasefire negotiations. That headline lifted US equities, which made a U-turn and ended Wall Street’s trading session in the green.

Meanwhile, the US Dollar Index, a gauge of the greenback’s value against its peers, stays resilient, up 0.38%, sitting at 99.160, while US Treasury yields fall.

AUD/USD Price Forecast: Technical outlook

The AUD/USD retreated below the 0.7500 mark in the mid-European session, but late is staging a recovery towards the figure. On the last three days, the Aussie consolidated in the 0.7450-0.7530 range until Monday’s price action, when the pair managed to record a YTD high around 0.7540, retreating afterward.

On the downside, the AUD/USD first support would be 0.7478. A breach of the latter would expose March 7 daily high at 0.7441, followed by 0.7400.

Upwards, the AUD/USD’s first resistance would be the 0.7500 mark. Once cleared, the next resistance would be Monday’s daily high at 0.7540, followed by October 28, 2021, a daily high at 0.7555, and then the 0.7600 mark.

- Gold is under pressure within a bullish month.

- Russian and Ukraine peace talks hopes keep spirits alive, stock positive.

- Can XAU/USD push higher as west blocks Russia's gold transactions?

The gold price is down on the day, losing around 1.9% at the time of writing as the US stock market rises later in the day for a positive close in hopes of a breakthrough in peace talks surrounding the Ukraine crisis.

Ukraine Peace talks hopes

The FT released an article that states that Russia is no longer demanding that Ukraine be ‘denazified’ in ceasefire talks and will allow Kyiv to join the EU if it abandons Nato aspirations. It went on to say that Moscow & Kyiv will discuss a pause in hostilities at talks in Turkey on Tuesday and draft documents do not contain three of Russia’s initial core demands — “denazification”, “demilitarisation”, and legal protection for the Russian language in Ukraine, sources told the FT.''

However, when it comes to the possibility of a Putin-Zelenskiy meeting, the Kremlin says there has been no progress. The Russian Foreign Minister Lavrov said recently that any meeting between Putin and Zelenskiy to exchange views currently would be counter-productive. Additionally, a senior US official said Russian President Vladimir Putin did not appear ready to make compromises. Ukrainian officials are also playing down the chances of a major breakthrough at the talks.

Mixed US data and solid stocks

The S&P 500 rose for a third day on Monday while Russia and Ukraine were poised to hold their first face-to-face peace talks in more than two weeks. According to the preliminary data, the S&P 500 gained 32.37 points, or 0.71%, to end at 4,575.43 points, while the Nasdaq Composite gained 184.43 points, or 1.30%, to 14,353.73. The Dow Jones Industrial Average rose 92.80 points, or 0.26%, to 34,954.04. The S&P was able to rebound from declines earlier in the session, with the benchmark index falling as much as 0.6% at one point.

Meanwhile, the US dollar was a touch shorter in the US session as well following mixed data and softer US yields that started to decline in the European session with the 2-year yields sliding from 2.414% to a low of 2.292% by very early North American trade.

The Dallas Federal Reserve's monthly manufacturing survey for March, a narrower advance trade gap for February and a rise in inventories. The Dallas Fed's manufacturing activity index fell to 8.7 in March from 14 in February, in contrast to other regional data that indicated expansion in the sector. The ISM's national index will be released on Friday. Additionally, the trade gap narrowed 0.9% to $106.6 billion in February amid higher exports. The updated trade data for the month will be released on April 5. Lastly, Wholesale Inventories rose by 2.1% in February and retail inventories by 1.1%. Wholesale inventories will be updated on April 8, while retail inventories will be updated on April 14.

Meanwhile, analysts at TD Securities explained that an inverting yield curve is bringing back whispers of a recession on the horizon.

''This comes as rates markets are readying for the Federal Reserve to deliver a hawkish surprise to markets, sending a strong signal that markets are increasingly pricing in a Fed that is willing to overshoot the neutral rate in order to bring inflation under control. In this context, gold prices have remained incredibly resilient, reflecting that strong ETF inflows into gold are trumping outflows associated with a hawkish Fed, which is in turn creating a divergence between gold and rates markets.''

Key data events to watch for

As for the economic calendar for the week ahead, the US jobs market and eurozone inflation data will be keenly eyed. The US Nonfarm Payrolls at the start of the new month on Friday is likely to show that Employment continued to advance in March following two strong reports averaging +580k in Jan and Feb, analysts at TD Securities argued.

''That said, we expect some of that boost to fizzle, though to a still firm job growth pace of +350k. Indeed, job gains should lead to a new drop in the unemployment rate to a post-COVID low of 3.7%. We also expect wage growth to slow to a still firm 0.3% MoM pace.''

As for eurozone inflation, the analysts expect ''headline HICP inflation to soar across the euro area in March, mostly due to a substantial surge in energy prices.''

They are also looking for a rise in non-energy industrial goods prices to boost euro area core inflation to a 28-year high of 3.2% (mkt: 3.1%). ''However, newly passed energy subsidies and price caps add some downside risk to our headline forecasts.''

Gold technical analysis

Chart of the Week: Gold is moulding a bullish close for the month

As explained in the pre-market open note at the start of the week, the last week of the month and the start of a new quarter could print a bullish prospect on the monthly chart, as illustrated below:

The month is set to close with a bullish candle and long wick that represents a phase of accumulation on the lower time frames.

- The NZD/USD slumps 0.98% on broad US dollar strength on Monday.

- Risk appetite remains mixed as China’s Covid-19 outbreak and Russia – Ukraine woes dominate headlines.

- NZD/USD Price Forecast: Upward biased, but once 0.6900 gave way for NZD bears, opened the door for a correction.

After consolidating since the middle of the last week, the New Zealand dollar slides just broke below the 200-day moving average (DMA) amid broad US dollar strength and mixed market sentiment, as shown by US equities. The NZD/USD is trading at 0.6896.

US equities mixed, dollar solid as geopolitical issues and Covid-19 outbreak weighs on mood

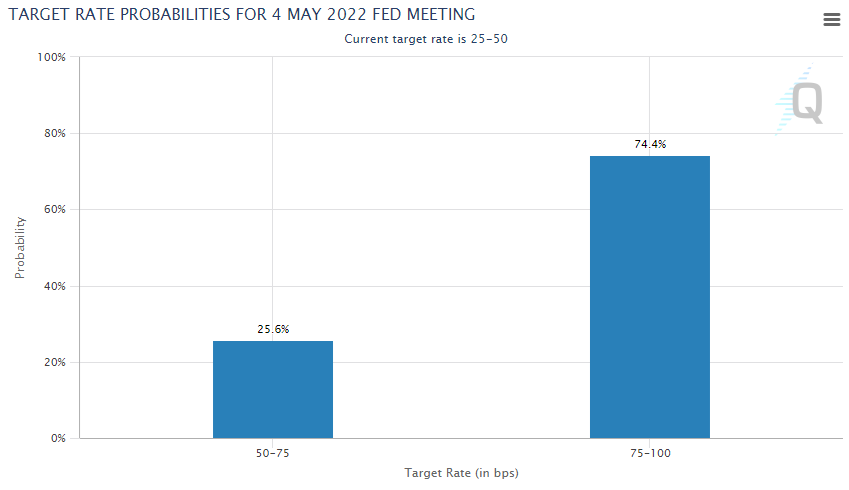

US equity indices fluctuate between gainers and losers, while the greenback remains buoyant. The US Dollar Index, a measure of the buck’s value vs. its peers, is up 0.33%, sitting at 99.138, despite that US Treasury yields are falling. Money market futures show that the Federal Reserve would hike 50 bps in its May meeting, underpinning the greenback as month-end flows boost the buck.

Meanwhile, a Covid-19 outbreak in China, particularly in Shanghai, weighed on Asian equities, thus slightly dampening the mood. Russia – Ukraine tussles continue grabbing the headlines, though not shifting the sentiment as initially when the war began.

An absent New Zealand economic docket left the NZD/USD pair adrift to market sentiment ahead of the US open. The US economic docket featured the US Goods Trade Balance for February, which came better than expected, showing a deficit of $106.59B, lower than the $107.57B in the previous reading. Later, the Dallas Fed Manufacturing Index for March rose by 8.7, lower than estimations and trailing February’s 14 number.

NZD/USD Price Forecast: Technical outlook

The NZD/USD broke below the 200-day moving average (DMA) at 0.6909 and slid below the 0.6900 mark. Nevertheless, despite being a “bearish” signal, the NZD/USD is in a correction, following a steeper advance from 0.6740s to just short of the 0.7000 mark.

That said, the NZD/USD’s first support before resuming upwards would be January 13 daily high at 0.6890. Breach of the latter would expose February 23 daily high at 0.6809, followed by the 50-DMA at 0.6746.

What you need to take care of on Tuesday, March 29:

The market mood was sour, helping the American dollar to end the day with gains against most major rivals.

The initial catalyst came from the Bank of Japan. The central bank announced it would be buying an unlimited amount of 10-year JGBs at 0.25% in an attempt to defend the yield cap. This is the second time the central bank has intervened in the FX market this year. The decision sent the JPY into a sell-off spiral that helped the greenback to advance further across the FX board. USD/JPY peaked at 125.05, to later stabilize around 123.60.

The yield on the 10-year Treasury note peaked at a fresh multi-year high of 2.557%, later retreating towards 2.46% and triggering a dollar’s bearish correction.

On the war front, Russian lawmaker Ivan Abramov on Monday said a refusal by the G7 to pay for Russian gas in roubles would lead to an unequivocal halt in supplies. German Finance Minister Christian Lindner responded that his country is ready if Moscow retaliates against the G-7 and that companies must resist Russia’s demands for gas payments in RUB.

Wall Street spent the day in the red, bouncing ahead of the close on news that Russia is ready to make some concessions, no longer demanding that Ukraine be “denazified” and letting the country join the EU if it remains neutral.

Also, China announced more coronavirus-related lockdowns, this time hitting Shanghai. The news further exacerbated concerns related to inflation and supply chain disruptions.

Bank of England Governor Andrew Bailey warned about swings in commodity markets posing a risk to financial stability. He also noted that there are risks on both sides to inflation. GBPUSD fell to 1.3065 and finished the day just below 1.3100. The EUR/USD pair reached a fresh 2-week low of 1.0944, meeting sellers on approaches to the 1.1000 figure.

Commodity-linked currencies ended the day with modest losses. AUD/USD trades just ahead of the 0.7500 level, while the USD/CAD pair is up at 1.2530. Gold came under pressure and finished the day at $1,926 a troy ounce, while crude oil prices also edged lower, with WTI now trading at around $104.60 a barrel.

The macroeconomic calendar, with the focus shifting to US employment data to be released by the end of the week.

Crypto.com price may blast through resistance to hit $0.60

Like this article? Help us with some feedback by answering this survey:

The FT has written an article that states that Russia is no longer demanding that Ukraine be ‘denazified’ in ceasefire talks and will allow Kyiv to join the EU if it abandons Nato aspirations.

Moscow & Kyiv will discuss a pause in hostilities at talks in Turkey tomorrow, and draft documents do not contain three of Russia’s initial core demands — “denazification”, “demilitarisation”, and legal protection for Russian language in Ukraine, sources told the FT.

There has been some relief in markets on the back of the headline as it could be the first signs of progress in peace talks, although when it comes to the possibility of a Putin-Zelenskiy meeting, the Kremlin says there has been no progress. The Russian Foreign Minister Lavrov said recently that any meeting between Putin and Zelenskiy to exchange views currently would be counter-productive.

Meanwhile, Ukraine and Russia said their delegations would arrive in Turkey for the peace talks that are expected to take place on Tuesday. Nevertheless, a senior US official said Russian President Vladimir Putin did not appear ready to make compromises. Ukrainian officials are also playing down the chances of a major breakthrough at the talks.

The S&P 500 has moved to session highs of 4,555.73 and is in the green by some 0.27% on the day.

US President Joe Biden announces his Budget for Fiscal Year 2023.

This is expected to reduce deficits by more than $1 Trillion over the next decade, advance safety and security at home and around the world, and make the investments needed to build a better America.

Watch Live

The Biden administration on Monday unveiled the the budget proposal for 2023.This will be totaling more than $5.7 trillion in spending and including a new tax on billionaires. This comes just weeks after Congress passed the omnibus spending bill for the rest of 2022.

In a statement, Mr. Biden said his budget sends a "clear message that we value fiscal responsibility, safety and security at home and around the world, and the investments needed to continue our equitable growth and build a better America."

- EUR/USD bulls move in within bearish territory.

- Eyes on US and EZ data, Ukraine crisis updates and 4-hour technical support.

EUR/USD is back to being in the green in midday New York trade after being underwater at the start of the session when it was near to the lows of the day, 1.0944. The pair has perked up following a weakening in the US dollar and has climbed to a session high of 1.0999.

EUR/USD has caught a bid following mixed data and softer US yields that started to decline in the European session with the 2-year yields sliding from 2.414% to a low of 2.292% by very early North American trade. Meanwhile, markets will be on alert for developments in the main driver as being developments in the Russian invasion of Ukraine over the past month, this has taken centre stage with geopolitical uncertainty reaching new heights.

Consequently, higher commodity prices and rising global recession risk have been clear negatives for most G10 currencies namely the broad EUR. The currency has fallen around 6% since the middle of February and 2022 highs near to 1.15 the figure.

Ukraine / Russia peace talks

There has been some relief over the weeks on hopes of peace negotiations, although when it comes to the possibility of a Putin-Zelenskiy meeting, the Kremlin says there has been no progress. The Russian Foreign Minister Lavrov said recently that any meeting between Putin and Zelenskiy to exchange views currently would be counter-productive.

Meanwhile, Ukraine and Russia said their delegations would arrive in Turkey for peace talks that are expected to take place on Tuesday. Nevertheless, a senior US official said Russian President Vladimir Putin did not appear ready to make compromises. Ukrainian officials are also playing down the chances of a major breakthrough at the talks.

Currency positioning data

The crisis is driving the positioning of investment in the currency futures as well with the latest CFTC Commitment of Traders Report showing that Speculators’ net long USD index positions have crept higher. The ''safe-haven demand for USDs and expectations for progressive Federal Reserve rate hikes this year suggest the USD is set to remain well supported going forward,'' analysts at Rabobank said.

The analysts also explained that Net EUR Speculators’ net longs recovered some ground having dropped back significantly to their lowest level since January the previous week. ''ECB President Lagarde heavily caveated the central bank’s hawkish policy outlook in March. Also, the Russian invasion of Ukraine and questions about Europe’s energy security have undermined EUR in the spot market.''

Key data events to watch for

As for the economic calendar for the week ahead, the US jobs market and eurozone inflation data will be keenly eyed. The US Nonfarm Payrolls at the start of the new month on Friday is likely to show that Employment continued to advance in March following two strong reports averaging +580k in Jan and Feb, analysts at TD Securities argued.

''That said, we expect some of that boost to fizzle, though to a still firm job growth pace of +350k. Indeed, job gains should lead to a new drop in the unemployment rate to a post-COVID low of 3.7%. We also expect wage growth to slow to a still firm 0.3% MoM pace.''

As for eurozone inflation, the analysts expect ''headline HICP inflation to soar across the euro area in March, mostly due to a substantial surge in energy prices.''

They are also looking for a rise in non-energy industrial goods prices to boost euro area core inflation to a 28-year high of 3.2% (mkt: 3.1%). ''However, newly passed energy subsidies and price caps add some downside risk to our headline forecasts.''

EUR/USD levels

As per the 4-hour chart above, the price is stuck between support and resistance but trades with a bearish bias while below the counter trendline. If the price manages to close below support, this could signify the makings of a downside continuation and solidify the breakout below the counter trendline for the coming week ahead.

- The USD/CHF reached a daily high around 0.9381, retreated towards 0.9340s late in the European session.

- Despite falling US Treasury yields, the US Dollar Index remains above the 99.00 mark.

- USD/CHF Price Forecast: Upward biased, though a break above 0.9381 would further cement the bias.

The USD/CHF keeps buoyant after a positive Asian and European session, which witnessed the greenback’s strength, pushing the pair up to the daily high around 0.9381, but of late retreated just over January 31 daily high, which sits at 0.9342. At the time of writing, the USD/CHF is trading at 0.9353.

Reflection of the abovementioned about the buck, the US Dollar Index is advancing 0.27%, up at 99.068. The 10-year US Treasury yield is losing one basis point, at 2.462%, putting a lid on the USD/CHF gains, as bulls were aiming towards the 0.9400 mark, though as yields retreated, so did the buck.

Overnight, the USD/CHF surged from the first tick of the Asian session until the mid-European one, when some USD selling pressure entered around the daily highs, pushing the pair towards the 200-hour simple moving average (SMA) at 0.9339.

USD/CHF Price Forecast: Technical outlook

The daily chart depicts the USD/CHF as upward biased. Also, the 1-hour chart shows that USD/CHF traders leaned over the confluence of the March 24 daily high and the 200-hour SMA, a demand zone, that lifted the pair above the 0.9340s.

The USD/CHF first resistance would be an upslope trendline, drawn from the beginning of March 2022, which passes around 0.9360-65. Once cleared, the next resistance would be the daily high at 0.9381, followed by the 0.9400 mark.

- Silver lost some of its brightness as the last week of March began, down almost 2%.

- The market mood is mixed while a stronger US Dollar weighs on XAG/USD.

- XAG/USD Price Forecast: In the long term is upward biased, but once the $25.40 support was broken, it opened the door for further losses.

Silver spot (XAG/USD) slides after last Friday’s “gravestone-doji” in an uptrend, a candlestick pattern meaning “indecision” amongst traders. However, Monday’s price action showed that XAG bears prevailed of late. At the time of writing, XAG/USD is trading at $25.08.

Market sentiment is mixed, and the greenback remains firm

Factors like the Covid-19 outbreak in China, and the Russia – Ukraine conflict, weigh on the market mood. China is placing Shanghai, one of its major cities, in lockdown due to the zero-tolerance restrictions in the country. The Russia-Ukraine war continues as peace talks stagnated, while market players begin to price in a 50-bps increase of the Federal Reserve to its Federal Funds Rate (FFR) in its May meeting, as shown by the CME MarketWatch tool, with the odds at 74% as of March 28, 2022.

That said, the US Dollar Index, a gauge of the buck’s performance against a basket of majors, sits at 99.076, up 0.27%, underpinned by the aforementioned, while US Treasury yields fall. The US 10-year T-note is almost flat in the day at 2.471%, while the yield curve between 5s and 30s inverted during the day, a signal that triggered “recession concerns” in investors.

Aside from this, in the precious metals space, gold also lost some of its brightness, down close to 1%, sitting at $1938.94 a troy ounce.

The US economic docket featured the US Goods Trade Balance for February, which came at $-106.59B better than the $107.57B in January’s deficit. The Dallas Fed Manufacturing for March rose by 8.7, lower than the 11 foreseen, and trailed February’s 14 figure.

XAG/USD Price Forecast: Technical outlook

In the long-term, silver remains upward biased, but in the near term, silver is downward pressured once XAG/USD gave way to Friday’s low at $25.26. Also, once the November 16, 2021, daily high resistance-turned-support at $25.40 was broken, exposed XAG/ÛSD to be trading back in the $24.70-$25.40 area.

That said, XAG/USD’s first support would be $25.00. Breach of the latter would expose $24.88, followed by $24.70.

Analysts at CIBC looked at the past of Canadian monetary policy and considered what path will the Federal Reserve take over the next months. They see the Bank of Canada raising interest rates to the 2.25-2.5% range during the current cycle.

Key Quotes:

“We have one very easy guidepost for what the Bank of Canada is likely to settle on, because the US neutral rate, both in theory and practice, is a strong predictor for the Canadian neutral rate.”

“In practice, as they begin a tightening cycle, central bankers don’t know with certainty where the neutral rate lies, but they know it when they see it. A slowing in the economy that threatens to take the economy away from a starting point of full employment, or a drop in inflation to below target, can be signposts that rates are above neutral.”

“The finish line for this tightening cycle in Canada likely lies in the 2.25-2.5% range. The Bank of Canada won’t tell us that in April, let alone give out a forecast of the path from here to that target. There is a lot of scope for Governor Macklem’s team to adjust the timetable for rate hikes to incoming data on growth and inflation. But we’ll pay close attention to its discussion of neutral rates in the US and Canada as a signal of where we’re headed at the end of this run-up in overnight rates.”

- The S&P 500 and the Dow Jones began the week on the wrong foot, the Nasdaq Composite rose.

- The Covid-19 outbreak in China, Russia – Ukraine jitters, and Fed tightening weighs on US stocks.

- WTI and gold are down amid a firm US dollar in the commodities complex.

US equities are trading mixed after Wall Street’s opened two hours ago. The losers are the S&P 500 and the Dow Jones Industrial Average, each losing between 0.15% and 0.49%, sitting at 4537.05 and 34,691.34, respectively. The gainer is the heavy-tech Nasdaq Composite gaining 0.25% at 14,787.13 around 15:33 GMT.

China’s Covid-19 outbreak, Russia - Ukraine woes dampened the market mood

The market risk appetite was affected by “fear” of a deceleration of the Chinese economy once China was hit by an outbreak of the Covid-19 Omicron variant. Also, the Russia – Ukraine conflict peace talks languished as Russia continued its offensive. At the same time, the greenback gains, underpinned by the Federal Reserve, as market participants expect a 50 bps increase in the May meeting by the US central bank, as US Treasuries yields keep advancing.

Aside from this, US equities sector-wise are led by Consumer Discretionary, Real Estate, and Utilities, up 1.25%, 0.73%, and 0.01% each. The main losers are Energy, Materials, and Financials, down 2.65%, 1.41%, and 1.31%, respectively.

The US Dollar Index, a gauge of the greenback’s value, sits at 99.224, up 0.42%, while the 10-year US Treasury yield eased off the highs, down three basis points at 2.462%.

Worth noting that parts of the yield curve inverted, with 5s at 2.636%, while the 30s at 2.600%, at some time during the day, a signal that triggers “recession concerns” in the market participants.

In the commodities complex, the US crude oil benchmark, WTI, is down 4.69%, trading at $107.39 BPD, while gold (XAU/USD) is down 1.05%, exchanging hands at $1936.85 a troy ounce, pressured by buck’s gains.

The US economic docket featured the US Goods Trade Balance for February, which came at $-106.59B better than the $107.57B January’s deficit, while the Dallas Fed Manufacturing for March rose by 8.7, lower than the 11 foreseen, and trailed February’s 14 figure.

Technical levels to watch

- US dollar strengthens versus Mexican peso as stocks slide.

- Signs of exhaustion in the USD/MXN decline.

- Recovery above 20.30 to boost the US dollar further.

The USD/MXN is rising on Monday for the first in almost a week, after making a rebound from six-month lows. On Friday, the pair bottomed at 19.90 and then trimmed losses, ending the week away from the bottom, creating a sign of exhaustion to the downside.

On Monday, USD/MXN is rising further from the multi-month low, adding more credibility to the bearish exhaustion. The dollar peaked at 20.17 and then pulled back modestly. The greenback needs to rise back and hold above 20.30, in order to gain support.

The next key level stands at 20.41, the 200-day Simple Moving Average; above, the scenario could change from bearish to neutral. The following level to consider is 20.60.

A decline back under 20.10 should be a positive development for the MXN that could drop further to test 19.90, reinforcing the downside bias. The next support is the 19.80/85 area, a strong barrier that if hit over the next sessions, could prompt profit-taking, favoring a rebound back to 20.00.

USD/MXN daily chart

-637840799899640627.png)

- The GBP/USD slides in the day by 0.75% amid a mixed market mood and firm US dollar.

- China’s Covid-19 Omicron outbreak and Russia-Ukraine discussions unchanged, keep hurting the appetite for riskier assets, weighing on the GBP.

- GBP/USD Price Forecast: Downward biased, aiming towards 1.3000.

The British pound begins the week plummeting 100-pips amid broad US dollar strength in the financial markets, courtesy of higher yields as market players expect a 50 bps increase to the Federal Funds Rate (FFR) by the US central bank. Alongside that, the market mood is mixed as European bourses rise, while across the pond, equities fluctuate. At the time of writing, the GBP/USD is trading at 1.3078.

The buck remains firm, while China's and Eastern Europe's conflict weighs on sentiment

The US Dollar Index, a gauge of the greenback’s value vs. a basket of rivals, advances 0.42%, reclaims the 99 mark at 99.220, while the US 10-year T-note yield declines six basis points down to 2.429%.

Factors like China’s Covid-19 Omicron outbreak and the continuation of the conflict between Russia and Ukraine keep investors uneasy. The Russian Foreign Minister Lavrov said that a meeting between Zelenskiy and Putin would be counter-productive, while the Kremlin emphasized that there has been no progress.

In the mid-European session, Bank of England’s Governor Andrew Bailey crossed the wires in an event held in Brussels. Bailey said that “swings in commodity markets after Russia’s invasion of Ukraine posed a risk to financial stability, and the challenges facing the world economy are bigger than after the global financial crisis,” per Reuters.

Furthermore, he added that the rise in energy prices would be the most significant since the 1970s. When asked about hiking rates in the May meeting, the BoE Governor said that the situation is “very volatile” after Russia’s invasion of Ukraine, lifting energy prices higher.

Aside from this, the US economic docket featured Goods Trade Balance for February, which came at $-106.59B lower than January’s $-107.57B.

GBP/USD Price Forecast: Technical outlook

The GBP/USD is still downward biased, and Monday’s fall extended beyond December 8, 2021 lows at 1.3160 and November 13, 2020, daily low at 1.3105, as selling pressure mounts in the pair, as GBP bears eye the 1.3000 figure. Furthermore, crossing the 50-day moving average (DMA) under the 100-DMA, each at 1.3381 and 1.3392, adds fuel to the downward move.

With that said, the GBP/USD first support would be March 15, 1.2999. Breach of the latter would expose November 2, 2020, daily low at 1.2853, followed by September 2020 lows at 1.2675.

- Pound hit by risk aversion and Bailey’s comments.

- Euro shows resistance versus strong dollar, up against Swiss franc.

- EUR/GBP heads for highest close since March 17.

The EUR/GBP rose further after the beginning of the American session and hit a fresh weekly high at 0.8396. The euro remains near the top with the positive tone intact.

Pound under pressure as GBP/USD tumbles

The pound was trading lower and it extended losses following comments from Bank of England governor Andrew Bailey. He talk about signs of growth deceleration and warned about the impact of commodity price swings.

More recently, European markets trimmed gains and US stocks opened mixed after being in positive during most of the pre-market session. Investors’ sentiment deterioration weighed on GBP which dropped further.

Also, the decline of GBP/USD below 1.3100 added to the negative tone of the pound across markets, pushing EUR/GBP closer to 0.8400. The next key level could be seen at 0.8415, a daily close clearly above would expose the March high at 0.8465.

The area around the 20-day Simple Moving Average at 0.8350 has become relevant support. A slide below would negate the current positive bias in EUR/GBP. The next support stands at 0.8320 followed by last week’s low at 0.8293.

Technical levels

Citing sources familiar with the matter, Reuters reported on Monday that the OPEC+ group was expected to stick to the May oil output plan increase plan at the March 31 meeting.

"The Saudis are careful," one of the sources told Reuters. "They don't want to hike oil output above plan in order not to show they are against Russia."

Market reaction

Oil prices continue to push lower after this headline. As of writing, the barrel of West Texas Intermediate (WTI) was trading at $105.00, losing 6.8% on a daily basis.

Russian President Vladimir Putin does not appear to be ready to make compromises to end the war with Ukraine for now, a senior US State Department official told Reuters on Monday.

Market reaction

Markets don't seem to be reacting to this headline. As of writing, the US Dollar Index was up 0.47% on a daily basis at 99.28. Meanwhile, Wall Street's main indexes trade mixed at the start of the week. As of writing, the S&P 500 was flat on the day, the Dow Jones Industrial Average was down 0.35% and the Nasdaq Composite was rising 0.3%.

- USD/TRY remains side-lined in the 14.80 region.

- The solid note in the greenback pushes spot higher.

- The lira remains focused on the geopolitical scenario.

The Turkish lira gives away part of the recent gains and motivates USD/TRY to resume the upside to the 14.80/85 band at the beginning of the week.

USD/TRY looks to Ukraine

USD/TRY regains upside bias and trades with decent gains near 14.85 following two consecutive daily pullbacks.

The move higher in spot tracks the intense upside in the greenback and the poor performance of the risk-associated universe, while attention remains on the Russia-Ukraine talks despite lacklustre hopes of a diplomatic solution of the conflict for the time being.

In the Turkish cash market, yields of the 10y note recede to the 26.70% region following last week’s tops past the 28% yardstick.

What to look for around TRY

The lira keeps the range bound theme unchanged vs. the greenback, always in the area below the 15.00 neighbourhood for the time being. So far, price action in the Turkish currency is expected to gyrate around the performance of energy prices, the broad risk appetite trends, the Fed’s rate path and the developments from the war in Ukraine. Extra risks facing TRY also come from the domestic backyard, as inflation gives no signs of abating, real interest rates remain negative and the political pressure to keep the CBRT biased towards low interest rates remain omnipresent.

Key events in Turkey this week: Economic Confidence Index (Wednesday) – Trade Balance (Thursday) – Manufacturing PMI (Friday).

Eminent issues on the back boiler: FX intervention by the CBRT. Progress (or lack of it) of the government’s new scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Structural reforms. Earlier Presidential/Parliamentary elections?

USD/TRY key levels

So far, the pair is gaining 0.41% at 14.8317 and a drop below 14.5217 (weekly low March 15) would expose 13.9161 (55-day SMA) and finally 13.7063 (low February 28). On the other hand, the next up barrier lines up at 14.9889 (2022 high March 11) seconded by 18.2582 (all-time high December 20) and then 19.00 (round level).

European Central Bank (ECB) hike bets may get another push this week with the release of Eurozone CPI. Economists at Scotiabank believe that a strong beat could prompt markets to double down on a likely incorrect call, leaving the euro at risk of falling to 1.08.

Lot of room for ECB disappointment

“The surge in inflation will prompt the hawks in the council to push for rate hikes this year, but the bank is unlikely to dramatically change its tune at its mid-April meeting given continued downside risks to the eurozone economy from high commodity prices.”

“We remain skeptical that the EUR can maintain gains ahead of (or following) the ECB as market expectations of two hikes this year are already the maximum by which the bank would hike – and there remains a lot of room for disappointment. Hawkish Fed expectations seem less likely to be disappointed.”

“We see the EUR/USD weakening toward 1.08 in the coming months, with the move probably waiting until after the ECB’s decision.”

Economists at TD Securities see rising risks that the Federal Reserve will deliver a hawkish surprise to markets, which could further sap interest from a cohort of participants who view the Fed's hiking path as being behind the curve on inflation.

Gold remains vulnerable to a deescalation in the war in Ukraine

“An inverting yield curve is bringing back whispers of a recession on the horizon. This comes as rates markets are readying for the Fed to deliver a hawkish surprise to markets, sending a strong signal that markets are increasingly pricing in a Fed that is willing to overshoot the neutral rate in order to bring inflation under control.”

“While the yield curve may be bringing back whispers of a looming recession that could re-ignite investor interest in gold, ETF flows have not historically been strongly associated with the yield curve during a hiking cycle. This suggests that the strong ETF inflows have rather been associated with safe-haven appetite, which leads to downside risks as the negotiators continue to work towards a ceasefire.”

EUR/USD is capped near 1.10. While below this level, the pair is set to suffer further losses to 1.09 once support at 1.0950 gives way, economists at Scotiabank report.

Resistance past the 1.10 area and 1.1025 is the mid-figure zone

“A failure to regain the 1.10 handle leaves the EUR at risk of losses continuing to a re-test of 1.09 once support at ~1.0950 gives way.”

“Resistance past the 1.10 area and 1.1025 is the mid-figure zone where trendline resistance from its mid-Feb high stands.”

- USD/JPY surged to a fresh multi-year peak in reaction to the BoJ’s intervention on Monday.

- Extremely overbought conditions prompted profit-taking amid retreating US bond yields.

- The Fed-BoJ policy divergence acted as a tailwind for the major and favours bullish traders.

The USD/JPY pair trimmed a part of its strong intraday gains to the multi-year peak and was last seen trading around the 123.80 region, still up nearly 1.5% for the day.

The pair caught aggressive bids on the first day of a new week after the Bank of Japan (BoJ) steeped in to arrest the continuous rise in yields. In fact, the BoJ made two offers in a single day to buy unlimited amounts of 10-year Japanese government bonds (JGBs) to protect the 0.25% tolerance ceiling under its yield curve control policy. This, in turn, weighed heavily on the Japanese yen and pushed the USD/JPY pair to the 125.00 psychological mark for the first time since August 2015.

The momentum was further fueled by a broad-based US dollar strength, bolstered by rising bets for a 50 bps Fed rate hike move in the May meeting. That said, a combination of factors prompted traders to take some profits off the table. The lack of progress in the Russia-Ukraine peace negotiations, along with the imposition of fresh COVID-19 restrictions in China, weighed on investors' sentiment. This, along with an intraday pullback in the US Treasury bond yields, capped the USD/JPY pair.

This comes on the back of the recent blowout rally of over 1000 pips from the monthly low, around the 114.65 area, and forced investors to lighten their bullish bets. The downside, however, remains cushioned amid the divergence monetary policy stance adopted by the Fed and the BoJ. The fundamental backdrop favours bullish traders, suggesting that the intraday fall of around 100-150 pips could still be categorized as a corrective pullback amid extremely overbought conditions.

In the absence of any major market-moving economic releases, the incoming geopolitical headlines might provide some impetus to the USD/JPY pair. Traders will further take cues from the US bond yields, which will influence the USD price dynamics. This, in turn, should produce some meaningful opportunities ahead of the release of the Japanese Unemployment Rate and BoJ Summary of Opinions, due during the Asian session on Tuesday.

Technical levels to watch

"Russia has broken rules of international order, we'll all suffer, but Russia will suffer most," German Chancellor Olaf Scholz said on Monday, as reported by Reuters.

"A delay in the European Union's accession talks will make western Balkans vulnerable to outside influence," Scholz added. "It is clear for both Germany and Sweden that the EU must push ahead with institutional reforms to make itself capable of enlargement."

Market reaction

These comments don't seem to be having a noticeable impact on risk sentiment. As of writing, Germany's DAX 30 was up 1.41% on the day.

The S&P 500 Index managed to close last week above its key 63 and 200-day moving averages (DMA) seen at 4482 and 4477 respectively. Next resistance is seen at the 61.8% retracement of the 2022 fall at 4550, then the February highs at 4590/95, strategists at Credit Suisse report.

Although volume remains worrying light, the immediate risk is still seen higher

“Whilst volume remains light to suggest this is still a rally within a broader range, we continue to see scope for a move above here to test the February highs at 4590/95, but we would expect a fresh cap here. Should strength directly extend though, we would look for a move to next resistance at the 78.6% retracement and price resistance at 4663/68.”

“Near-term support moves to 4501, then 4485/77, with the immediate risk seen staying higher whilst above the 4456 recent reaction low. Below here can mark a minor top to ease the immediate upside bias for a fall back to the 13-DMA and low of last week at 4424/21.”

AUD/USD is close to challenging the October high at 0.7557. A break above here would reinforce the case for further medium-term upside, in the view of analysts at Credit Suisse.

Below under 0.7450 to open the door to the last week’s low at 0.7372/58

“We stick with our bullish outlook and expect the currently strong rise to test the 0.7557 level imminently, with a bias to eventually move above it. If broken, this would open the door for a medium-term uptrend to arise, with resistance at the late June and July highs at 0.7599/7616 then serving as an important indicator to confirm the medium-term trend higher. If confirmed, we would target a move to the 0.7777/85 high and retracement resistance.”

“Support is seen at 0.7493/97 initially, next at 0.7466/64 and eventually at the recent price low at 0.7450/41. Below here would open the door to the last week’s low at 0.7372/58, below which would shift the risk back lower again.”

“Below 0.7300/7287 would then open up a move to the mid-March low at 0.7173/63.”

The Norwegian krone has seen support over the past month on notably rising energy prices. Strategists at Danske Bank expect EUR/NOK to move slightly higher towards 10.00 on rising global recession risks but emphasise that 2022 ultimately could prove the turning point for NOK.

Spring risks are skewed to the topside

“Our models indicate that EUR/NOK is now overvalued and we cannot rule out a regime shift in terms of a year-long NOK rally eventually starting in 2022. Meanwhile, we think global recession risks will dominate in the coming months and we think spring risks are skewed to the topside – albeit uncertainty is high.”

“In light of the substantial rise in energy price we lower our profile but have the same trajectory. We forecast EUR/NOK at 9.80 in one month (from 10.10), 10.00 in three months (from 10.30), 10.00 in six months (10.40) and 10.00 in 12 motnhs (10.40).”

UOB Group’s Senior Economist Julia Goh and Economist Loke Siew Ting review the latest inflation figures in the Malaysian economy.

Key Takeaways

“Headline inflation moderated for the third straight month to 2.2% y/y in Feb (from 2.3% in Jan), defying our estimate (2.5%) and Bloomberg consensus (2.4%) for an uptick. It marked the lowest reading in five months and bucked the regional trend of rising inflationary pressures.”

“The smaller inflation rate in Feb was chiefly credited to the government’s fuel subsidies that helped to contain the effects of elevated global oil prices on transport costs. The COVID-19 Omicron wave which started in early Feb further weighed on passenger transport services by air during the month. This fully offset a broad-based gain across other consumer price index (CPI) components last month.”

“Notwithstanding Feb’s softer inflation, we expect CPI growth to ratchet up over the next few months with signs of domestic inflation pressures building up from surging costs and improved demand as the economy reopens. Uncertainties surrounding the Russia-Ukraine conflict and sanctions remain key upside risks to inflation. Domestically, the ongoing post-pandemic labour shortages, increase in national minimum wage, and review of the government’s fuel subsidy mechanism infer potential second-round effects. We maintain our 2022 full-year inflation forecast at 3.0% for now (2021: 2.5%).”

USD/CAD fell sharply at the end of last week after closing below the key 2021 uptrend. Analysts at Credit Suisse stay biased to the downside, targeting a move to 1.2450/48.

Resistance at 1.2614 set to cap any bounce

“We stay biased lower and look for a deeper decline within the broader range, with a clear break below support seen at 1.2486/64 expected imminently, which would open up the YTD low at 1.2450/48. Below here would reinforce our bearish bias for a move to the 1.2287 low of October 2021.”

“Resistance stays at the recent breakdown point at 1.2589 /2614, which we would expect to cap any rebounds from here. The next level above here is seen at 1.2645/59, above which would signal a false break lower. Next resistances are seen at 1.2693/98, ahead of the 16th March price high at 1.2775/78.”

Analysts at Danske Bank revise their forecast for EUR/SEK lower on the outlook for Riksbank rate hikes and now expect a move to 10.10 in six months.

Krona supported by hawkish shift from Riksbank

“We expect the Riksbank to deliver two rate hikes this year (Sep, Nov) and a third (final one) in Feb 2023 – moving before ECB. Market pricing is fairly in line with our call for 2022, but further upside in the short end is still possible.”

“We revise our EUR/SEK forecasts now expecting the cross to move down to 10.10 in six months.”

“We expect the cross to move back towards 10.20 in 12 months, as the Riksbank ends its hiking cycle and slower global growth start weighing on SEK.”

- EUR/USD extends further the recent weakness to 1.0940.

- A deeper retracement exposes a drop to the 1,0900 area.

EUR/USD keeps the bearish note unchanged and drops to 2-week lows in the 1.0940 zone on Monday.

Considering the ongoing price action, further decline remains in the pipeline with the immediate target at the weekly low in the 1.0900 neighbourhood (March 14). The breach of this level paves the way for a move to the 2022 low at 1.0807 (March 7).

The medium-term negative outlook for EUR/USD is expected to remain unchanged while below the key 200-day SMA, today at 1.1500.

EUR/USD daily chart

EUR/USD is coming under downside pressure again. A break below 1.09 is expected to clear the way for a retest and eventual break of the recent low at 1.0825/06, analysts at Credit Suisse report.

Resistance is seen at 1.1039/52

“We remain of the view that the current consolidation is temporary ahead of the broader trend turning lower again. We thus look for a test of 1.0900, below which should clear the way for a retest of uptrend support from early 2017 low and the recent low at 1.0825/06.

“Whilst a fresh hold at 1.0825/06 should be allowed for, we continue to look for a sustained break lower in due course. Below 1.0806 and we see support next at 1.0775/66, ahead of 1.0727 and eventually the 2020 low itself at 1.0635.”

“Near-term resistance moves to 1.0997. Above the recent highs and downtrend from February at 1.1039/52 is needed to ease the immediate downside bias for strength back to 1.1120 and then the recent high and Fibonacci retracement at 1.1138/45, potentially as far as 1.1275, but with fresh sellers expected here.”

Economists at Danske Bank revise their EUR/USD forecast down to 1.05 (from 1.08) in 12 months. They see policymakers remaining increasingly committed to curtailing global inflation by tightening financial conditions despite global manufacturing already slowing.

Dollar can keep going higher

“We revise down our EUR/USD forecast in 12M from 1.08 to 1.05.”

“Global manufacturing is slowing, valuations shows risks are to the downside for spot and the near-term consequences of the war in Ukraine will likely be a further strengthening of the USD. We thus continue to expect EUR/USD can drop further in this environment.”

“The risks to see EUR/USD above 1.20 include global inflation pressures fading and industrial production increasing. The upside risk also include a renewed focus on easing Chinese credit policy and a global capex uptick and the latter two have increased in probability over recent weeks.”

USD/JPY has seen yet another further dramatic surge higher. Analysts at Credit Suisse see scope for strength to extend a touch further to the 2015 highs at 125.29/86.

Resistance from the 2015 high at 125.86 ideally caps at first

“We see scope for strength to extend a touch further yet to test the 2015 highs at 125.29/86 but with daily, weekly and monthly RSI momentum now well above 80, we suspect we are now in the final exhaustive stages of this phase of the uptrend. We thus look for 125.86 to try and cap, and for a consolidation phase to emerge. A direct break though can see resistance next at 127.21/34.”

“Support moves higher to 124.34 initially, then 124.02, with 123.87 needing to hold to keep the immediate risk higher. Below can see a setback to 123.58, then 122.03/121.97.”

There is no change to the current range bound theme in USD/IDR, commented Quek Ser Leang at UOB Group’s Global Economics & Markets Research.

Key Quotes

“We expected USD/IDR to trade sideways between 14,260 and 14,400 last week. While our view for sideway-trading was not wrong, USD/IDR traded within a narrower range than expected (14,324/14,375).”

“The quiet price actions offer no fresh clues and further sideway trading would not be surprising. Expected range for this week, 14,300/14,390.”

- USD/CAD gained some positive traction on Monday and snapped ten days of the losing streak.

- A slump in oil prices undermined the loonie and extended support amid sustained USD buying.

- The lack of follow-through buying warrants cautions before positioning for any further recovery.

The USD/CAD pair traded with a positive bias heading into the North American session, though seemed to struggle to capitalize on the move beyond the 1.2500 psychological mark.

A combination of supporting factors assisted the USD/CAD pair to attract some buying on the first day of a new week and recover a part of Friday's slide to over a two-month low. Crude oil prices plunged over 5% amid fears over weaker fuel demand led by fresh COVID-19 restrictions in China. This, in turn, undermined the commodity-linked loonie and acted as a tailwind for the major amid sustained US dollar buying.

The greenback drew support from expectations for a more aggressive policy response by the Fed to combat high inflation. In fact, the markets have priced in a 50 bps rate hike at the May meeting. This, along with worries that rising commodity prices would put pressure on already elevated high inflation, pushed the yield on the benchmark 10-year US government bond to a nearly three-year high and underpinned the buck.

The USD/CAD pair, however, lacked bullish conviction, warranting some caution before confirming that the two-week-old downward trajectory has run its course. Nevertheless, the pair, for now, seems to have snapped ten successive days of the losing streak. In the absence of any major market-moving economic releases, the USD/oil price dynamics will influence spot prices and allow traders to grab some short-term opportunities.

Technical levels to watch

- US international trade deficit narrowed modestly in February.

- US Dollar Index stays in positive territory above 99.00 after the data.

The international trade deficit of the US declined by $1 billion in February to $106.6 billion from $107.6 billion in January, the US Census Bureau reported on Monday.

"Exports of goods for February were $157.2 billion, $1.9 billion more than January exports," the press release further read. "Imports of goods for February were $263.7 billion, $0.9 billion more than January imports."

Additionally, Wholesale Inventories n February rose by 2.1% on a monthly basis, surpassing the market expectation for an increase of 1.7%.

Market reaction

These figures don't seem to be having a noticeable impact on the greenback's performance against its rivals. The US Dollar Index was last seen rising 0.4% on the day at 99.20.

- GBP/USD witnessed selling for the fourth straight day and dropped to over a one-week low on Monday.

- Hawkish Fed expectations continued underpinning the USD and acted as a headwind for the major.

- Dovish remarks by BoE’s Bailey weighed on the British pound and contributed to the ongoing slide.

The GBP/USD pair extended last week's retracement slide from the 1.3300 mark, or the 200-period EMA on the 4-hour chart and witnessed some follow-through selling on Monday. This marked the fourth successive day of a negative move and dragged spot prices to over a one-week low, around the 1.3110 region during the mid-European session.

The US dollar continued drawing support from rising bets for a 50 bps Fed rate hike move at the May meeting. Conversely, the sterling was weighed down by dovish remarks from the Bank of England Governor Andrew Bailey, saying that we are starting to see evidence of a growth slowdown. This, in turn, exerted downward pressure on the GBP/USD pair.

Looking at the broader picture, the pair on Friday confirmed a break through an ascending trend channel, which constituted the formation of a bearish flag pattern. Sustained weakness below the 1.3100 round-figure mark will further validate the bearish bias and set the stage for a further near-term depreciating move for the GBP/USD pair.

The next relevant support is pegged near the 1.3070 region, below which the downward trajectory could further get extended towards the 1.3035 intermediate support. The GBP/USD pair could eventually drop back to challenge the key 1.3000 psychological mark, or the lowest level since November 2020 touched earlier this month.

On the flip side, attempted recovery moves might now confront stiff resistance near the 1.3150-1.3160 region. Any subsequent move up is more likely to attract fresh selling and remain capped near the 1.3180-1.3185 zone. This is closely followed by the 1.3200 mark, which if cleared decisively might prompt some short-covering around the GBP/USD pair.

GBP/USD 4-hour chart

-637840658275859952.png)

Technical levels to watch

"We have been very cautious on forward guidance language because things are so uncertain," Bank of England Governor Andrew Bailey said on Monday, as reported by Reuters. When asked about May rate decision, Bailey noted that the situation was very volatile.

Additional takeaways

"Will take time before we really come to a proper assessment of how the joint experience of COVID and Ukraine invasion causes world economy to emerge into new steady state."

"We are at an even more challenging point for global economy than after the global financial crisis."

"We must as policymakers say we do not want to see the breakdown of the open world economy."

"Trade-off situations are much harder to deal with for monetary policymakers."

"We are not facing market conditions similar to March 2020."

"Clearly commodities are the area of greatest volatility and has a connection to monetary policy."

"We have to be very alert to the risk of interaction between the real economy and financial market impact from commodities."

"Impact of real income shock is yet to materialise."

Market reaction

GBP/USD continues to edge lower during the European session and was last seen losing 0.4% on the day at 1.3135.

- DXY accelerates the upside and reclaims 99.00 on a convincing note.

- Next on the upside now comes the YTD high at 99.41.

The dollar adds to the ongoing uptrend and pushes the index back above the key 99.00 yardstick at the beginning of the week.

Monday’s advance manages to retest the 99.30 region and another visit to the 2022 peak at 99.41 (March 7) now looks imminent. Once cleared, DXY will be looking to test the psychological 100.00 barrier in the relatively near term ahead of the May 2020 top at 100.55.

The current bullish stance in the index remains supported by the 6-month line just above the 96.00 level, while the longer-term outlook for the dollar is seen constructive while above the 200-day SMA at 94.74.

DXY daily chart

Bank of England (BOE) Governor Andrew Bailey explained on Monday that the change in their language on the outlook for rates last week was caused by the level of uncertainty and heightened risks, as reported by Reuters.

Additional takeaways

"Core of financial system is standing up well to shock of Ukraine invasion."

"Core commodity markets are functional at the moment."

"Liquidity conditions have deteriorated in many markets."

"Margin costs have risen in commodity markets due to higher volatility."

"We must watch that step change in risk does not cause a market failure."

"We cannot take resilience in the market for granted."

"We are working closely on this at the financial stability board."

Market reaction

The GBP/USD pair stays on the back foot on these comments and was last seen trading at 1.3135, where it was down 0.4% on a daily basis.

- EUR/JPY moves to multi-year highs near 137.50 on Monday.

- Next of relevance on the upside comes the 2018 tops near 137.50.

EUR/JPY quickly reversed Friday’s modest pullback and resumed the strong upside bias at the beginning of the week.

The upside momentum in the cross appears unabated for the time being. However, the cross has entered into the overbought territory, indicative that a potential corrective move could be in the pipeline in the short-term horizon. Next on the upside, in the meantime, emerges the August 2015 peak at 138.99 followed by the round level at 140.00.

In the meantime, while above the 200-day SMA at 130.03, the outlook for the cross is expected to remain constructive.

EUR/JPY daily chart

Bank of England (BOE) Governor Andrew Bailey noted on Monday that they are beginning to see evidence of a slowdown in the UK's economic growth, as reported by Reuters.

Additional takeaways

"In the UK and elsewhere, we are facing a very large shock to aggregate income and spending."

"Unfortunately, there is more to come on inflation shock."

"Shock from energy prices this year will be larger than in any single year in the 1970s."

"There are risks in both directions for outlook."

"Very important to bear in mind that inflation hurts the least well off the hardest."

"Very large trade-off between inflation and output."

"The task we have is clear but hard, we will stick to it."

"Appropriate to tighten in these circumstances, but there are risks to inflation on both sides."

Market reaction

The GBP/USD pair showed no immediate reaction to these remarks and was last seen losing 0.3% on a daily basis at 1.3148.

Further upside could encourage USD/MYR to retest the 4.2360 level, noted Quek Ser Leang at UOB Group’s Global Economics & Markets Research.

Key Quotes

“We highlighted last Monday that USD/MYR ‘is likely to trade sideways for this week, expected to between 4.1800 and 4.2100’. We added, ‘looking ahead, if USD/MYR closes above 4.2100, it would increase the odds for a sustained rise above 4.2150’.”

“We did not expect the subsequent spike in volatility as USD/MYR cracked 4.2100, surged to 4.2360 before pulling back sharply. Despite the sharp pullback, there is scope for USD/MYR to retest the 4.2360 level. For this week, a sustained rise above this level is unlikely. Support is at 4.2010 followed by 4.1940.”

- GBP/JPY rallied to a fresh multi-year peak in reaction to the BoJ’s intervention to curb rising yields.

- Hopes for diplomacy in Ukraine further undermined the safe-haven JPY and remained supportive.

- Extremely overbought conditions prompted profit-taking ahead of BoE Governor Bailey’s speech.

The GBP/JPY cross quickly retreated nearly 150 pips from the multi-year peak touched during the early European session, albeit has managed to hold its neck above the 163.00 mark. The cross was last seen trading around the 163.25-163.30 region, still up over 1.5% for the day.

The cross caught aggressive bids on the first day of a new week and rallied nearly 400 pips from the daily low after the Bank of Japan (BoJ) steeped in to arrest the continuous rise in yields. In fact, the BoJ made two offers in a single day to buy unlimited amounts of 10-year Japanese government bonds (JGBs) to protect the 0.25% tolerance ceiling under its yield curve control policy.

Apart from this, a generally positive risk tone weighed heavily on the safe-haven Japanese yen and provided a strong lift to the GBP/JPY cross. Ukrainian President Volodymyr Zelensky said on Sunday that they are prepared to adopt a neutral status as part of a peace deal with Russia. This raised hopes for a diplomatic solution to end the war in Ukraine and boosted investors' confidence.

The sharp intraday momentum took along some trading stops placed around the 162.00 round-figure mark and pushed spot prices to the highest level since May 2016. That said, extremely overbought conditions

held back bulls from placing fresh bets, instead prompted some profit-taking around the 164.60-164.65 region. This, in turn, led to the GBP/JPY pair's sharp intraday pullback from the daily swing high.

In the absence of any major market-moving economic releases, investors now look forward to the Bank of England Governor Anders Bailey's speech for some impetus. Traders will further take cues from fresh developments surrounding the Russia-Ukraine saga. This, along with the market risk sentiment, will influence the safe-haven JPY and produce some trading opportunities around the GBP/JPY cross.

Technical levels to watch

- USD/CHF gained strong positive taction on Monday and was supported by a combination of factors.

- A generally positive risk tone undermined the safe-haven CHF and acted as a tailwind for the major.

- Hawkish Fed expectations continued lending some support to the USD and remained supportive.

The USD/CHF pair maintained its bid tone through the first half of the European session and was seen trading around the 0.9355-0.9360 region - just a few pips below the one-week high touched in the last hour.

A combination of supporting factors assisted the USD/CHF pair to build on Friday's goodish rebound from over a two-week low and gain strong positive traction on the first day of a new week. A generally positive tone around the equity markets undermined the safe-haven Swiss franc. This, along with sustained US dollar buying, acted as a tailwind for the major.

Ukrainian President Volodymyr Zelensky said on Sunday that they are prepared to discuss adopting a neutral status as part of a peace deal with Russia. This raised hopes for a diplomatic solution to end the war ahead of the Russia-Ukraine ceasefire talks in Turkey later this week and boosted investors' confidence and undermined demand for traditional safe-haven assets.

On the other hand, the USD continued drawing support from growing acceptance that the Fed would adopt a more aggressive policy response to combat stubbornly high inflation. In fact, the markets have been pricing in a 50 bps rate hike move at the May meeting. This, in turn, pushed the yield on the benchmark 10-year US government bond beyond 2.5%, or a nearly three-year high.

The fundamental backdrop favours bullish traders, though the lack of follow-through buying beyond the 0.9380 region warrants some caution. Hence, it will be prudent to wait for sustained strength above the said area before traders start positioning for a further near-term appreciating move, towards retesting the YTD peak, around the 0.9460 area touched earlier this month.