- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 28-02-2023

- The oil price has extended its correction to near $76.60 amid anxiety among investors ahead of Caixin Manufacturing PMI.

- Rising bets for a sheer economic recovery in China after the rollback of lockdown curbs are supporting an upside in PMI figures.

- A build-up of oil inventories by oil inventories at 6.20 million barrels, reported US API, is indicating weak demand.

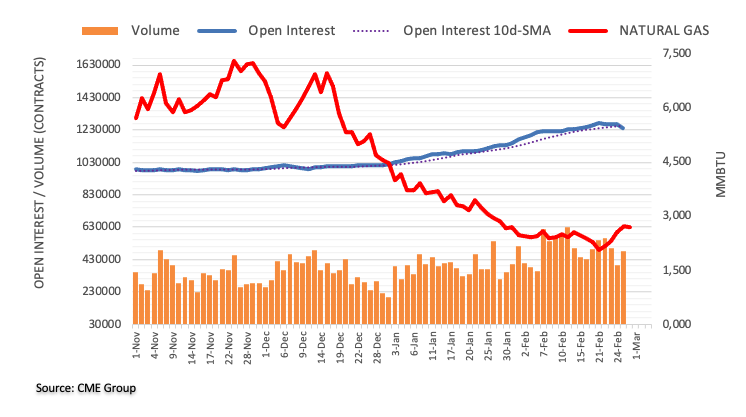

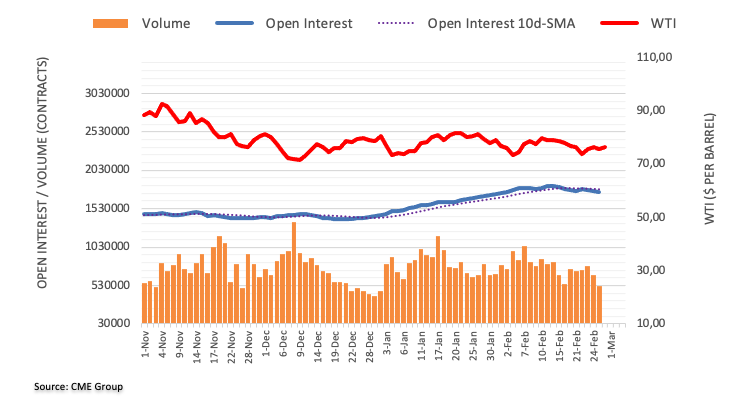

West Texas Intermediate (WTI), futures on NYMEX, have corrected firmly after facing firmer barricades above $77.50 in the late New York session. The oil price has dropped $76.60 and is expected to remain on the tenterhooks as investors are awaiting the release of the Caixin Manufacturing PMI data for fresh impetus.

There is no denying the fact that global institutions and investment banking firms are gung-ho for solid economic recovery in China after its administration dismantled pandemic controls post a three-year lockdown period. China’s post-pandemic era is expected to be resilient as the People’s Bank of China (PBoC) has promised a sheer revival in domestic demand through expansionary monetary policy.

Investors were surprised by weak January’s Caixin Manufacturing PMI data and are now anxious for February figures as a continuation of a downbeat spell will spoil the market mood. Broadly, the market sentiment is still risk averse as investors are anticipating a gloomy outlook due to hawkish Western central banks. And, now weak China’s Manufacturing PMI will worsen investors' risk appetite further.

According to the consensus, IHS Markit will report Caixin Manufacturing PMI at 50.2, higher than the prior release of 49.2.

Apart from the Caixin Manufacturing PMI, the oil inventory report by the United States Energy Information Administration (EIA) for the week ending February 24 will be keenly watched.

On Tuesday, the US American Petroleum reported a huge pile of oil inventories at 6.20 million barrels but lower than the prior release of nearly 10 million barrels. Oil stockpiles are continuously rising for the past three months, indicating a sheer decline in the overall demand.

- GBP/JPY formed an inverted hammer, meaning sellers are in charge.

- The GBP/JPY would face strong support at the confluence of the 100/200/20-day EMAs.

- GBP/JPY Price Analysis: In the near term, it’s neutral to upward biased.

The GBP/JPY registers a minimal upside as Wednesday’s Asian session begins. On Tuesday, the GBP/JPY printed losses of 0.35% and formed an inverted hammer, meaning that further downside is expected. At the time of typing, the GBP/JPY exchanges hands at 163.90 after hitting a YTD high on Tuesday of 166.00.

GBP/JPY Price Action

After hitting a new year-to-date high, the GBP/JPY retraced more than 200 pips and achieved a daily close below 163.60. Traders should be aware that the cross-currency pair pierced a four-month-old downslope trendline, but buyers unable to commit to its longs and sellers stepping in around 166.00 dragged the exchange rates lower.

The Relative Strength Index (RSI), albeit in bullish territory, is almost flat, while the Rate of Change (RoC) suggests that buying pressure is waning. Therefore, further downside is expected.

Hence, the GBP/JPY first support would be the February 28 daily low of 163.58, which, once cleared, would exacerbate a fall toward the weekly low of 162.59. A breach of the latter would send the GBP/JPY toward the confluence of the 100 and the 20-day Exponential Moving Averages (EMAs) at around 161.89/74, respectively.

As an alternate scenario, the GBP/JPY first resistance would be 164.00. Once the GBP/JPY hurdles that level, and the 165.00 figure would be the next to be challenged by Pound Sterling (GBP) buyers, ahead of the YTD high at 166.00.

GBP/JPY Daily chart

GBP/JPY Key technical levels

Australian GDP overview

Reserve Bank of Australia’s (RBA) readiness for further increase in interest rates and expectations of solid economic recovery highlights Australia’s fourth-quarter (Q4) Gross Domestic Product (GDP) figures, up for publishing at 00:30 GMT on Wednesday, for the AUD/USD pair traders.

The recent data from Australia portray a mixed picture as downbeat housing market data, inflation numbers and mixed employment report contrasts with upbeat Retail Sales. Even with these statistics in mind, the Aussie Q4 GDP is likely to print slightly better figures and could lure the AUD/USD bulls.

That said, forecasts suggest the annualized pace of economic growth to come in at 2.7%, softer than the previous period's 5.9%, while the quarter-on-quarter (QoQ) numbers could mark the improvement with 0.8% growth figures versus 0.6% prior.

Ahead of the outcome, Westpac said,

The economy was in transition heading into year-end as earlier policy and reopening supports worked against the adverse impacts of inflation and interest rates. Hence, we anticipate a soft read for domestic demand, with solid consumer spending being partially offset by flatness in building work and a modest decline in business investment. Westpac’s revised forecast is 0.8% QoQ, 2.8% YoY.

How could it affect the AUD/USD?

AUD/USD grinds higher past 0.6700 amid upbeat expectations from the key economic data from Australia during early Wednesday. Adding strength to the recovery could be the US Dollar’s latest retreat, as well as hopes of more investments from China and the easing tussles between the Washington and Beijing after US President Joe Biden’s scaling back of the previous plans to restrict American investments in China, per Politico.

That said, Australia’s Q4 GDP is likely to carry less importance for the pair traders, considering the present focus on the risk-aversion and hawkish Fed bets, as well as the key events lined up for publishing in March, including China PMI and Fed meetings. Also likely to dilute the importance of the data is the latest Reserve Bank of Australia (RBA) monetary policy meeting that failed to impress the hawks despite showing readiness to inflation the benchmark rate.

Hence, positive data from Australia might offer a knee-jerk rebound in the AUD/USD prices but not affect the overall bearish trend. On the contrary, downbeat figures won’t hesitate to please bears with a fresh multi-month low.

Technically, AUD/USD seesaws around the 100-DMA and an upward-sloping support line from late November 2022, highlighting the importance of the 0.6700 support. However, bears remain hopeful of meeting the last December’s low near 0.6630 unless the quote rises past the 200-DMA hurdle surrounding 0.6800.

Key notes

AUD/USD grinds above 0.6700 as Australia GDP, China/US PMI loom

AUD/USD Forecast: The 0.6700 area still critical, Australian data in focus

About the Aussie GDP release

The Gross Domestic Product released by the Australian Bureau of Statistics is a measure of the total value of all goods and services produced by Australia. The GDP is considered a broad measure of economic activity and health. A rising trend has a positive effect on the AUD, while a falling trend is seen as negative (or bearish) for the AUD.

- NZD/USD struggles inside one-month-old bullish chart formation after easing from weekly top.

- Bullish MACD signals add strength to the upside bias.

- Sellers need validation from mid-November 2022 low for further dominance.

NZD/USD picks up bids to reverse the previous day’s pullback from an important resistance surrounding 0.6200 during early Wednesday. In doing so, the Kiwi pair appears softer within the one-month-long falling wedge bullish chart formation.

In addition to the latest pick-up, the bullish MACD signals also add strength to the recovery hopes.

However, a two-week-old descending resistance line, close to the 0.6200 round figure, restricts the immediate upside of the quote.

Following that, a convergence of the 50-bar Simple Moving Average (SMA) and the stated falling wedge’s top line seems a tough nut to crack for the NZD/USD buyers around 0.6210.

In a case where the Kiwi pair remains firmer past 0.6210, the mid-February high near 0.6390 and the previous monthly top surrounding 0.6540 could act as intermediate halts during the theoretical run-up targeting the 0.6600 threshold.

On the flip side, pullback moves may witness multiple hurdles near 0.6170 and 0.6130 before poking the stated wedge’s lower line, close to 0.6120 by the press time.

Even if the NZD/USD bears defy the bullish chart pattern by breaking the 0.6120 support, lows marked during mid-November 2022, around 0.6060 could challenge the pair’s further downside.

NZD/USD: Daily chart

Trend: Further upside expected

- USD/CHF is marching towards 0.9430 as investors’ risk appetite has trimmed dramatically.

- The street is expecting that US recession fears cannot be ignored as the Fed has decided to announce more rates.

- Switzerland’s government admitted that it expects an economic slowdown but no recession this year.

The USD/CHF pair is facing fragile hurdles after a sheer run-up of around 0.9420 in the early Tokyo session. The Swiss Franc asset is expected to continue its vertical run as investors are gung-ho for safe-haven assets to dodge sheer volatility.

Federal Reserve (Fed) policymakers have kept on reiterating that the current monetary policy is not sufficiently restrictive enough to bring down the persistent inflation in the near period. Therefore, investors should brace for more rate hikes to cool down the Consumer Price Index (CPI) significantly.

Gains generated by S&P500 on Monday were surrendered in Tuesday’s session as the street is anticipating that recession fears cannot be ignored as the Fed has decided to announce more rates through summer to trim the stubbornness in the United States inflation. The US Dollar Index (DXY) has displayed a responsive buying action and has crossed the critical resistance of 104.60 amid a decline in investors’ risk appetite. Meanwhile, the alpha delivered on the 10-year US Treasury yields has scaled marginally higher to near 3.93%.

Contrary to the hawkish stance supported by the street, Vassili Serebriakov, FX strategist, at UBS said “The disinflation story continues. It took a bit of a pause in January, but it's not a reversal. We think some of the dollar strength is exaggerated. So we are cautiously fading dollar strength.”

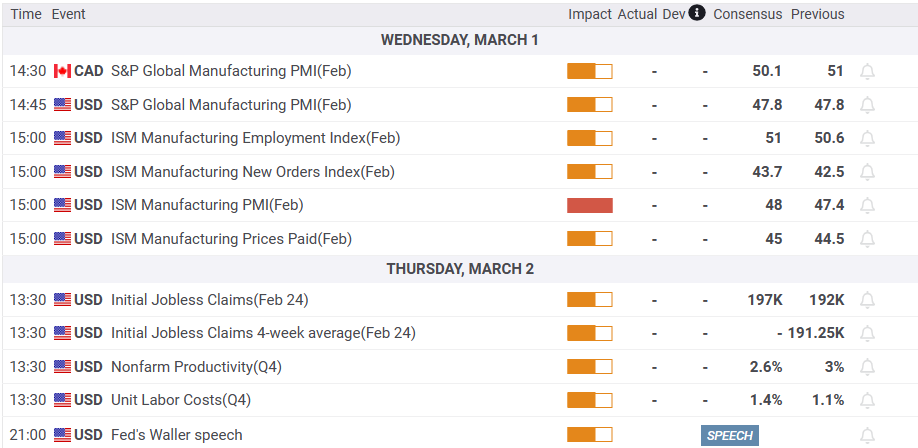

On Wednesday, USD/CHF will remain in action amid the release of the US ISM Manufacturing PMI data. The economic data has been reporting a figure below 50.0 for the past three months and a similar performance is expected today, however, the scale of contraction will be lower. The economic data is seen at 48.0 from the former release of 47.4, posing a gloomy outlook for the US economy ahead.

Meanwhile, the Swiss Franc witnessed pressure after a flat Gross Domestic Product (GDP) (Q4) release on Tuesday. The street was expecting a growth of 0.3%. Switzerland’s government said in a statement on Tuesday that it expects an economic slowdown but no recession this year.

- GBP/USD renews attempt to cross the 50-DMA hurdle amid bullish RSI divergence, sustained trading beyond the key technical support.

- Convergence of 200-DMA, ascending trend line from late November 2022 appears a tough nut to crack for bears.

- Doubts over Brexit deal’s acceptability, mixed US data probe cable bulls amid hawkish Fed concerns.

GBP/USD picks up bids to reverse the previous day’s pullback from the 50-DMA, around 1.2035 during the initial hours of Wednesday’s Asian session. The Cable pair rose to the highest levels in a week earlier on Tuesday before reversing from 1.2143 as optimism surrounding the Brexit deal and the pair’s strength from softer US data faded as the key March month begins.

Although UK PM Rishi Sunak has already signaled that he will move forward without the Democratic Unionist Party’s (DUP) support for Brexit deal, if they turn down his efforts, the fears of witnessing political drag on the key success weighed on the GBP/USD prices on Tuesday. “The framework is what we have agreed with the European Union”, said UK’s Sunak during the BBC interview when asked whether he would impose the new deal without the backing of Northern Ireland's DUP.

Apart from Sunak’s optimism, softer US data and month-end consolidation also initially helped the Cable pair. Among the key US statistics, the US Conference Board’s (CB) Consumer Confidence dropped for the second consecutive month to 102.9 versus 106.0 prior (revised) while US Housing Price Index drops 0.1% in December versus -0.6% market forecasts and -0.1% prior. On the same line, the S&P/Case-Shiller Home Price Indices grew 4.6% YoY during the said month compared to 6.1% market expectations and 6.8% previous readings. Furthermore, Chicago Purchasing Managers’ Index for February eased to 43.6 from 44.3 previous readings and 45.0 market consensus. Additionally, the Richmond Fed Manufacturing Index for the said month eased below 11.0 prior and -5.0 expected to -16 for the said month.

It should be noted that the softer data and month-end positioning failed to weigh on the hawkish Fed bets and recalled the GBP/USD bears late Tuesday as markets prepared for crucial March month events comprising Fed Chairman Jerome Powell’s testimony and Fed meeting.

Against this backdrop, Wall Street closed mixed and the US Treasury bond yields marked minor losses while the US Dollar Index (DXY) regained upside momentum in the last hour to end February on a firmer footing, by marking the first monthly gain in five.

Looking forward, final readings of the UK Manufacturing PMI for February will precede Bank of England (BoE) Governor Andrew Bailey’s speech to highlight today’s economic calendar for the GBP/USD pair traders.

GBP/USD technical analysis

GBP/USD eyes another attempt to cross the 50-DMA hurdle during early Wednesday in Asia, following multiple failures to overcome the same since mid-February.

The Cable pair’s recovery moves take clues from the hidden bullish divergence of the RSI (14), as well as the quote’s refrain from breaking the 1.1920-25 support confluence, including the 200-DMA and ascending support line from November 21, 2022. Adding strength to the upside bias is the impending bull cross on the MACD.

That said, the GBP/USD pair’s high low of the prices and lower high of the RSI (14) line is considered a hidden bullish divergence of the oscillator and suggests the quote’s gradual run-up.

A downward-sloping resistance line from February 02, close to 1.2080 at the latest, can be considered as an immediate hurdle during the anticipated rise of the Cable pair ahead of battling with the 50-DMA level, near 1.2145 by the press time.

Following that, the two-week high of around 1.2270 could probe the GBP/USD bulls before directing them to the multiple tops marked around 1.2445-50.

Meanwhile, a convergence of the 200-DMA and a multi-day-old ascending trend line, around 1.1925-20, appears the key support to watch for the Cable pair sellers to retake control.

GBP/USD: Daily chart

Trend: Further upside expected

- USD/CAD is struggling to surpass 1.3650, however, the upside looks favored amid strength in the USD Index.

- The Canadian Dollar witnessed immense heat on Tuesday after releasing weak GDP (Q4) figures.

- The RSI (14) has shifted into the bullish range of 60.00-80.00 after a long period of more than four months.

The USD/CAD pair has delivered a minor corrective move after failing to continue its upside momentum above 1.3650 in the early Asian session. The Loonie asset is expected to recover the corrective move as the US Dollar is extremely solid amid rising bets for more rates by the Federal Reserve (Fed) as inflation in the United States economy is getting more stubborn.

The Canadian Dollar witnessed immense heat on Tuesday after releasing weak Gross Domestic Product (GDP) (Q4) numbers. The annualized GDP remained flat lower than the expectations of 1.5% and the former release of 2.3%. While the monthly GDP (Dec) contracted by 0.1% vs. a flat consensus.

The US Dollar Index (DXY) is aiming to cross the immediate resistance of 104.60 as the risk-aversion theme has been strengthened amid hawkish Fed bets and geopolitical tensions. S&P500 was offered on Tuesday as investors see recession amid deepening rate hike discussions among Fed policymakers.

USD/CAD is meaningfully strengthened after delivering a breakout of the downward-sloping trendline plotted from October 13 high at 1.3978 on a daily scale. The 10-period Exponential Moving Average (EMA) at 1.3558 is providing cushion to the US Dollar bulls.

Meanwhile, the Relative Strength Index (RSI) (14) has shifted into the bullish range of 60.00-80.00 after a long period of more than four months. More upside looks favored as the momentum oscillator is not showing any sign of divergence and overbought levels.

The Loonie asset is expected to add more gains after surpassing February 24 high at 1.3665, which will drive the asset toward the horizontal resistance plotted from December 07 high around 1.3700 followed by November 03 high around 1.3800.

Alternatively, a break below February 6 high at 1.3474 will drag the asset to near January 26 high around 1.3408. A slippage below the same will expose the asset to February 16 low around 1.3357.

USD/CAD daily chart

-638132209251701907.png)

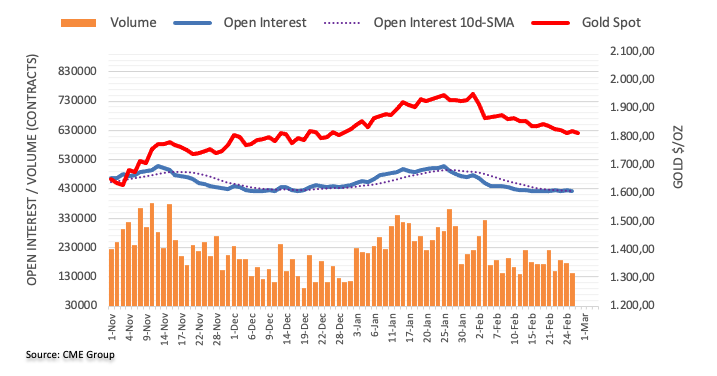

- Gold price bears are moving in to fade the Tuesday rally.

- US Dollar was momentarily knocked off its perch on softer data.

- Federal Reserve sentiment keeps the US Dollar afloat and Gold price weighed.

The Gold price stabilised at the end of the day and is up 0.5% near $1,826.67 after travelling from a low of $1,804 and $1,831 on the day. Weakness in the US economic data was widespread and weighed on the greenback that had otherwise been resurging on the back of prior inflationary readings.

Gold price rallies on poor United States of America data readings

Among the US data on Tuesday, Gold price rallied on the back of a survey of Consumer Confidence showed a decline to a three-month low of 102.9 in February. The Chicago Business Barometer, also known as the Chicago PMI, dropped to 43.6 in February from 44.3 in the prior month, according to a report from ISM-Chicago and MNI. The S&P CoreLogic Case-Shiller 20-city Home Price Index also dropped 0.5% in December.

Looking ahead, the Gold price could now be affected by the ISM manufacturing PMI which should continue reflecting the fragility of the sector in February (market f/c: 45.5); the final estimate to the S&P Global manufacturing PMI will likely confirm this too, analysts at Westpac said. ''Meanwhile, construction spending is expected to remain subdued in January given softening demand (market f/c: 0.2%). Minneapolis Federal Reserve president Neel Kashkari is also due to speak.''

Federal Reserve sentiment reigns

However, the US rate futures have priced in a peak fed funds rate of 5.4% hitting in September. The market has all but priced out Federal Reserve rate cuts this year. Consequently, the US Dollar index, DXY, which measures the currency against a basket of major currencies, managed to claw back by some 0.18% in late morning trade on Wall Street and was set for a February gain of over 2.5%, its first monthly increase since September. The Federal Reserve sentiment is keeping the greenback in the hands of the bulls as marked price in the notion that the central bank will have to raise interest rates more than initially expected.

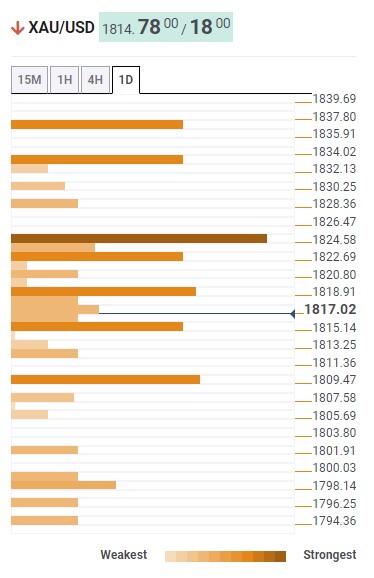

Gold technical analysis

As per the prior Gold price analysis, Gold price rallied as follows:

Gold prior analysis

The prior Gold price analysis said ''the double bottom near the $1,800 psychological Gold price level is offering a compelling case for a move towards the $1,830s, a touch above the January opening lows. However, a retest of the W-formation's neckline could be on the cards first.''

Gold price update

As illustrated, the Gold price burst higher after the correction and offered bulls an opportunity in late European and US markets to the target area. At this juncture, a correction is underway and bears can look to the lower time frame structure for a fading set-up:

Gold price H1 and M5 charts

The hourly topping pattern is in play and the price imbalances below it are compelling for a move back into old resistance down the Fibonacci scale towards $1,820.

The Gold price 5-min chart shows a structure near $1,826 that needs to give out in order for there to be prospects of a move to the target area.

- EUR/GBP recovered some ground and finished Tuesday’s sessions with gains but shy of 0.8800.

- Long-term, the EUR/GBP fall below the 20/50-day EMA would exert downward pressure on the pair.

- On an intraday time frame, the EUR/GBP is headed for a bearish continuation, with sellers targeting 0.8730s.

The EUR/GBP jumped after hitting a daily low at 0.8754 after piercing the 100-day Exponential Moving Average (EMA), which rests at 0.8759. Nevertheless, it finished Tuesday’s session with minuscule gains of 0.02%. At the time of writing, the EUR/GBP is trading at 0.8792.

After falling below the 20 and 50-day Exponential Moving Averages (EMAs) in the last week, the Euro (EUR) recovered some ground. Nevertheless, it clashed with the 20-day EMA at around the 0.8330s area and tumbled on news that the Eurozone (EU) and the United Kingdom (UK) reached an agreement on Northern Ireland. That exacerbated a fall below the 0.8800 figure, but EU’s inflation figures on Tuesday bolstered the EUR, which is staging a comeback.

Therefore, the EUR/GBP jumped and is hoovering underneath the 50-day EMA at 0.8808, waiting for a fresh catalyst.

EUR/GBP Price Action

Intraday speaking, the EUR/GBP 4-hour chart suggests the pair is downward biased, with all the EMAs sitting above the exchange rate and backed by the Relative Strength Index (RSI) in bearish territory, and it’s aiming down. In addition, the Rate of Change (RoC) it’s almost neutral.

As long as the EUR/GBP remains below the February 27 daily high of 0.8835, the path of least resistance is bearish. Hence, the EUR/GBP’s first support would be the daily pivot point at 0.8790, which, once breached, the pair’s next stop would be the S1 pivot at 0.8763. If sellers stepped in, that would open the door to test January’s 19 daily low of 0.8721, slightly below the S2 daily pivot point at 0.8730.

An alternative scenario would be that the EUR/GBP reclaims 0.8811, opening the door for further upside.

Trend: Downward biased.

EUR/GBP 4-Hour chart

EUR/GBP Key technical levels

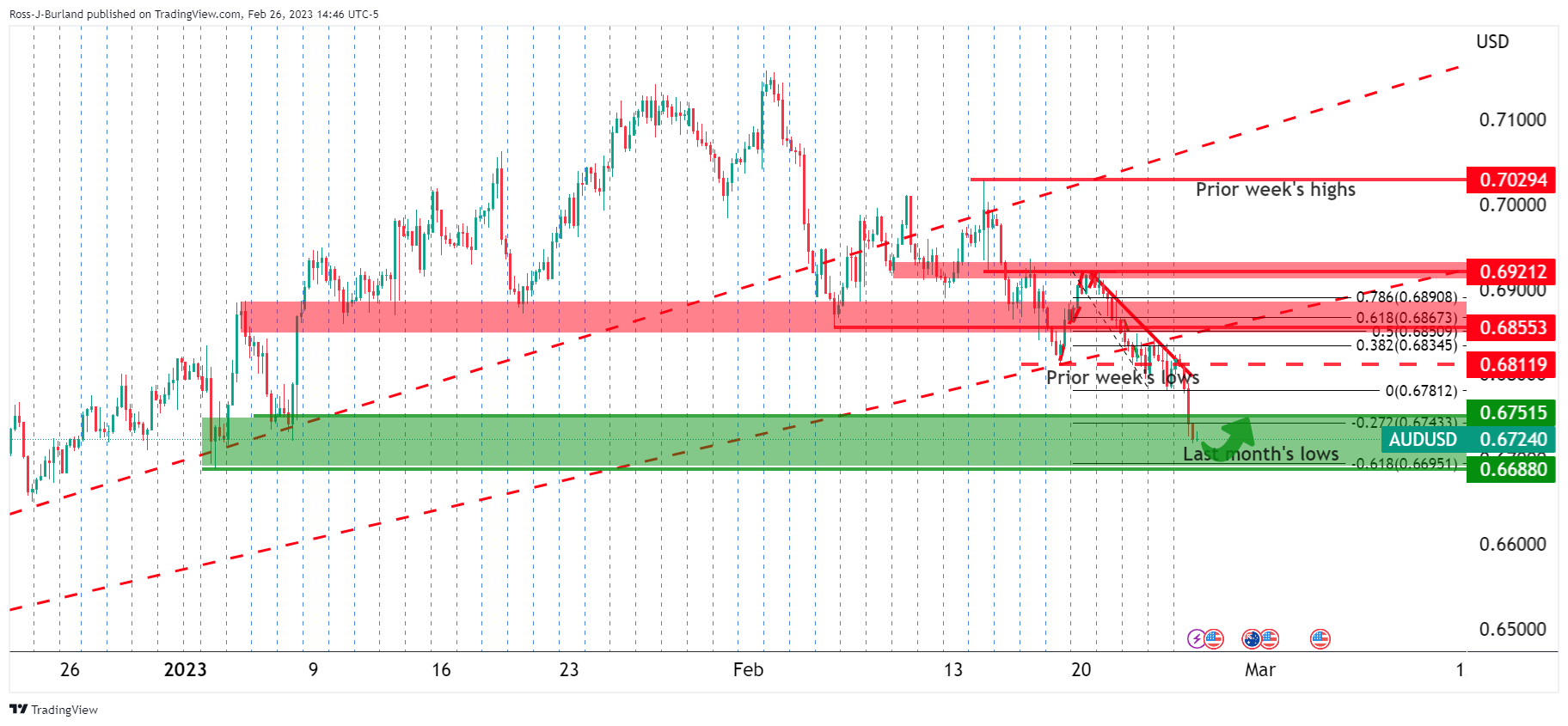

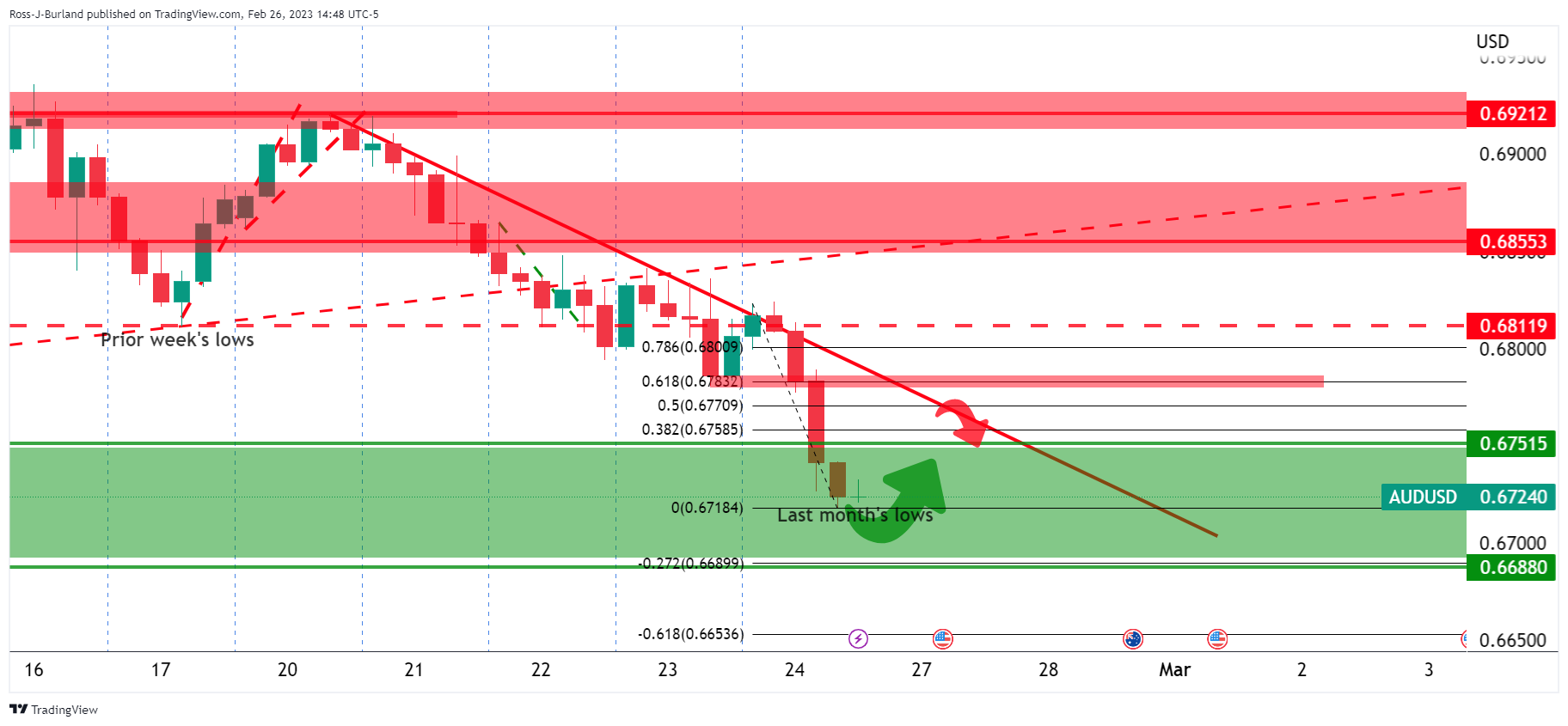

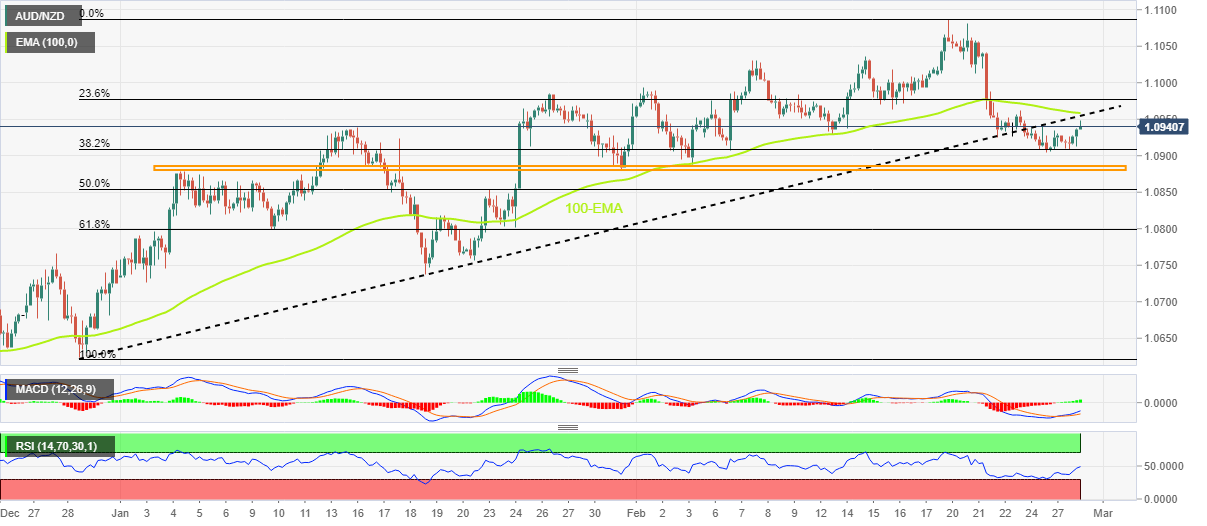

- AUD/USD stays defensive above 0.6700, having failed to recover much from two-month low.

- Mixed sentiment, month-end consolidation joined upbeat Aussie Retail Sales to probe bears at multi-day low.

- Sellers seek softer prints of Aussie GDP, China PMI to break 0.6700 support.

- Hawkish Fed bets, geopolitical concerns keep bears hopeful even as softer US data restrict immediate downside.

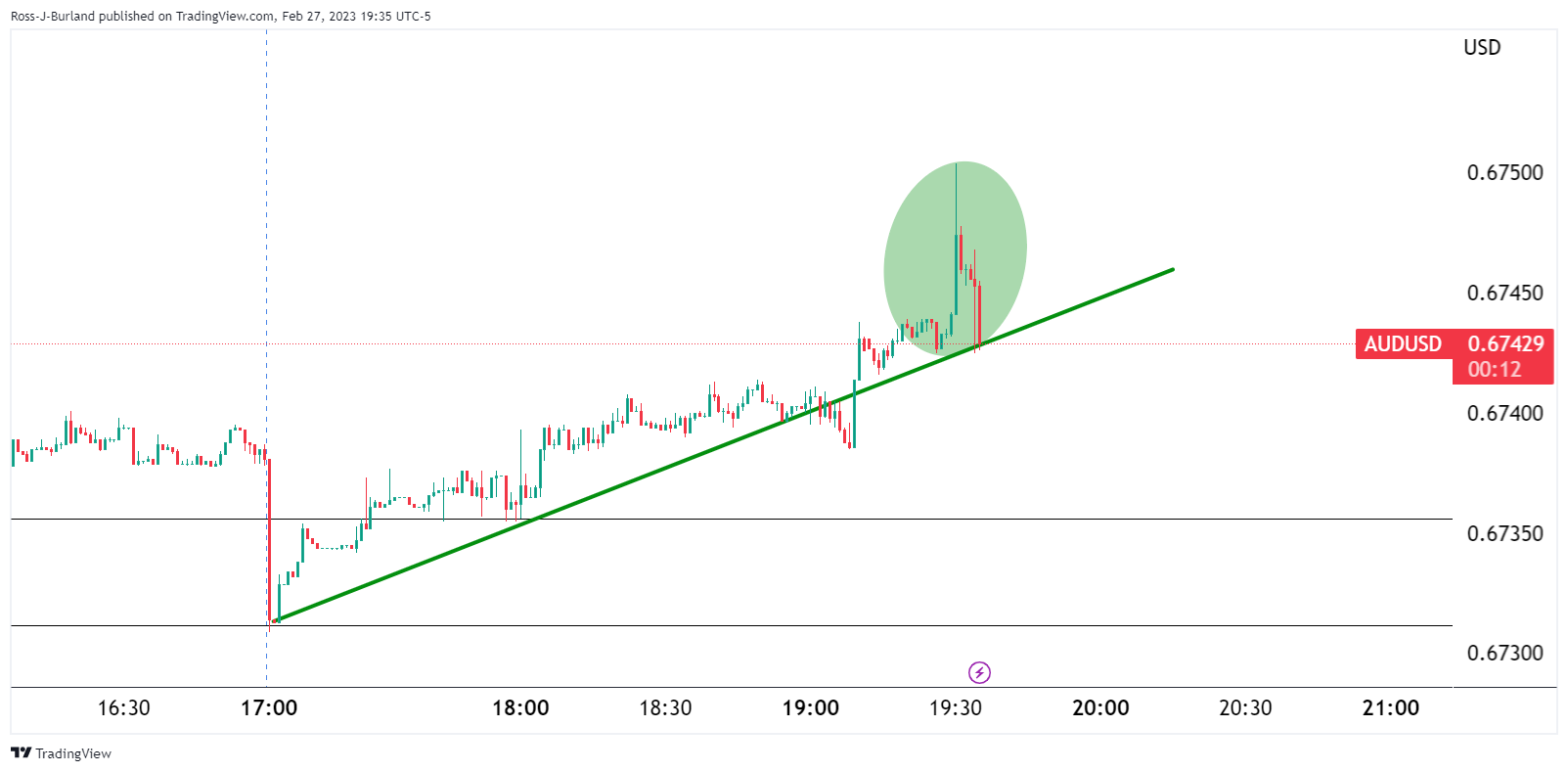

AUD/USD picks up bids to refresh intraday high around 0.6730, following a pullback from 0.6757 in the last hour, as traders await the key Australian fourth-quarter (Q4) Gross Domestic Product (GDP) details. Adding strength to early Wednesday’s cautious mood are the official activity numbers from China.

The Aussie pair managed to bounce off a two-month low the previous day after Australia Retail Sales marked a stellar 1.9% growth in January, versus 1.5% expected and -4.0% prior. Also keeping the AUD/USD buyers hopeful were headlines shared by Politico suggesting US President Joe Biden’s scaling back of the previous plans to restrict American investments in China. Further, mostly softer US data and month-end consolidation also strengthened the Aussie pair’s corrective bounce off the multi-day low on Tuesday.

That said, the US Conference Board’s (CB) Consumer Confidence dropped for the second consecutive month to 102.9 versus 106.0 prior (revised) while US Housing Price Index drops 0.1% in December versus -0.6% market forecasts and -0.1% prior. On the same line, the S&P/Case-Shiller Home Price Indices grew 4.6% YoY during the said month compared to 6.1% market expectations and 6.8% previous readings. Furthermore, Chicago Purchasing Managers’ Index for February eased to 43.6 from 44.3 previous readings and 45.0 market consensus. Additionally, the Richmond Fed Manufacturing Index for the said month eased below 11.0 prior and -5.0 expected to -16 for the said month.

It should, however, be noted that the hawkish Fed bets remain on the table despite the recently downbeat US data and keeps exerting downside pressure on the AUD/USD price ahead of the key Aussie data. As a result, the FEDWATCH tool highlights the market’s bets on Fed fund futures to be around 5.4% by late 2023 versus 5.1% signaled earlier by the US Federal Reserve (Fed).

Amid these plays, Wall Street closed mixed and the US Treasury bond yields marked minor losses while the US Dollar Index (DXY) regained upside momentum in the last hour to end February on a firmer footing, by marking the first monthly gain in five.

Looking ahead, Australia’s Q4 GDP, expected 0.8% QoQ versus 0.6%, will be crucial for the AUD/USD pair before China’s NBS Manufacturing PMI and Non-Manufacturing PMI for January, as well as Caixin Manufacturing PMI for the said month. “We expect Q4 GDP growth to come in at 1.0% q/q (3.0% y/y), suggesting the economy ended the year with quite a bit of momentum despite aggressive monetary tightening. While the partial data suggest a strong outcome for GDP, it will be the inflation and wages indicators in the GDP report that will be key for policy perspective. We expect the RBA’s preferred measure of wider labor costs – non-farm average earnings per hour – to have risen a modest 0.6% q/q,” said Analysts at the ANZ Bank ahead of the data release.

Technical analysis

AUD/USD seesaws around the 100-DMA and an upward-sloping support line from late November 2022, highlighting the importance of the 0.6700 support. However, bears remain hopeful of meeting the last December’s low near 0.6630 unless the quote rises past the 200-DMA hurdle surrounding 0.6800.

- EUR/USD has confidently slipped below 1.0580 as more rates by the Fed are in pipeline.

- S&P500 failed to hold gains added on Monday as higher rates by the Fed will push the US economy into a recession.

- German preliminary annualized HICP is expected to decline to 9.0% from the prior release of 9.2%.

The EUR/USD pair has slipped below the critical support of 1.0580 in the early Asian session as fears of more rates announcement by the Federal Reserve (Fed) are mounting among the market participants. The major currency pair is expected to re-test a seven-week low around 1.0530 as skyrocketing hawkish Fed bets have forced investors to hide behind the US Dollar to dodge volatility.

S&P500 failed to hold gains added on Monday as the street expects that higher rates by the Fed will push the United States economy into a recession. No doubt, the strong labor market is propelling consumer spending at the current juncture. However, a continuation of policy tightening will break optimism among firms, and demand for labor will be trimmed significantly.

The recovery move in the US Dollar Index (DXY) has pushed it above 104.60 and is expected to fuel it further to recapture a seven-week high around 105.00. Meanwhile, the return on 10-year US Treasury bonds is still inside the woods around 3.93%.

For further guidance, the US ISM Manufacturing PMI data will remain in limelight. As per the projections, the economic data is seen at 48.0 from the former release of 47.4. Apart from that, the New Orders Index that conveys forward demand is expected to rebound to 43.7 from the prior figure of 42.5.

On the Eurozone front, investors are keeping an eye on preliminary German Harmonized Index of Consumer Prices (HICP) (Feb) data. The annualized data is expected to decline to 9.0% from the prior release of 9.2%. It seems that rising interest rates by the European Central Bank (ECB) are doing the job effectively. However, ECB President Christine Lagarde has confirmed the continuation of the 50 basis points (bps) rate hike culture for the March monetary policy as the current monetary policy is not restrictive enough to squeeze inflationary pressures as expected.

- Silver continues its recovery despite broad US Dollar strength and high UST yields.

- A bullish engulfing candle pattern in the XAG/USD daily chart emerged, warranting upside pressure.

- XAG/USD Price Analysis: In the medium term, the white metal is downward biased.

Silver price is staging a comeback after falling to fresh YTD lows at $20.43 a troy ounce and climbs toward the $20.80 area as Wall Street closes. The white metal is posting gains of 1.30% and is trading at $20.89 at the time of typing.

Silver’s rally was capped by fundamental reasons like a strong US Dollar (USD), up 0.32% per the US Dollar Index, and rising UST yields. Despite all that, Silver hit a daily high at $21.00 before retracing some of its gains.

XAG/USD Price Action

Technically speaking, XAG/USD is forming a bullish engulfing candle pattern, which would exacerbate a rally above $21.00, though it remains far from changing Silver’s bias.

The Relative Strength Index (RSI) exited from oversold conditions at 30, sponsored Tuesday’s gains, while the Rate of Change (RoC) portrays that previous selling pressure is waning.

The XAG/USD needs to crack the psychological $21.00 barrier for a bullish continuation. Once done, that would pave the way toward the 20 and 200-day Exponential Moving Averages (EMAs) at $21.82 and $21.89 a troy ounce, respectively, ahead of testing the 100-day EMA at $22.09.

On the flip side, the XAG/USD next support would be $20.43, which, once cleared, would keep sellers in charge, exposing the white metal to new YTD lows. The next floor would be the psychological $20.00, ahead of testing the November 3 daily low of $18.84.

XAG/USD Daily chart

XAG/USD Key technical levels

- NZD/USD is pulling up into the 0.6200 area and testing channel resistance.

- NZD/USD bears are lurking near a 61.8% Fibonacci.

NZD/USD rallied on Tuesday and reached up to test 0.62 the figure before meeting strong opposition from the bear in the later part of the day on Wall Street. At the time of writing, NZD/USD is trading at 0.6180, slightly off the 0.6207 highs but well up from the lows of the day down at 0.6132.

''The move was reasonably unique to the Kiwi; unlike on many other occasions, it wasn’t a USD move,'' analysts at ANZ Bank said. ''That’s seen the Kiwi outperform on crosses, notably against the AUD, as below. There wasn’t a clear catalyst, but as each day passes, the weight of evidence on the side of the Reserve Bank of New Zealand having to do more seems to grow,'' the analysts added.

''The jobs market doesn’t seem to be cooling. The 3-way tussle we spoke of yesterday (between those citing rebuild activity, those concerned about the disruption to exports and impact on Crown finances, and those expecting a USD rebound) is also at front of mind, and that’s suggestive of volatility.''

As for the US Dollar, despite some cooler data over the last couple of key releases, it remains bid with the US rate futures that have priced in a peak fed funds rate of 5.4% hitting in September supporting the bid. The market has all but priced out rate cuts this year. Consequently, the US Dollar index, DXY, which measures the currency against a basket of major currencies, was higher by 0.18% in late morning trade on Wall Street and set for a February gain of over 2.5%, its first monthly increase since September.

NZD/USD technical analysis

Meanwhile, NZD/USD is still eyeing up 0.6200 in the current bull correction:

The 61.8% Fibonacci is eyed as a key resistance near where horizontal meets channel resistance.

What you need to take care of on Wednesday, March 1:

USD reverse early losses and finished the day unevenly across the FX board. Correlations were off amid month-end flows, although the risk-averse sentiment remained the same. Most European indexes finished the day in the red, while Wall Street ended mixed.

The focus was on higher-than-anticipated inflation in Spain and France, boosting speculation the ECB will continue on the tightening path for longer than expected. Also, US Consumer Confidence fell for a second consecutive month in February, taking its toll on the Greenback. On a positive note, the report also showed inflation expectations decreased from the previous month.

EUR/USD peaked at 1.0644, but turned south during the American afternoon and now hovers around 1.0590.

The GBP/USD pair surged to 1.2143 on news the EU and the UK reached a deal over trade rules in Northern Ireland, the so-called “Windsor Framework,” meant to fix the issues resulting from the Northern Ireland Protocol. The pair later gave up to USD demand and now trades at around 1.2050.

AUD/USD is little changed on a daily basis, trading at around 0.6730. Australia will publish Q4 GDP figures early on Wednesday.

USD/CAD surged and stands near an intraday high of 1.3632 as Canada's GDP unexpectedly shrank 0.1% MoM in December. The country reported null annual growth in the last quarter of 2022, much worse than the 1.5% advance expected.

Weak stocks and easing US government bond yields weighed on USD/JPY, down on Tuesday and currently at around 136.10.

Gold jumped on demand for safety, and is currently hovering around $1,828 a troy ounce. Crude oil prices advance, with WTI now changing hands at $76.80 per barrel.

Shiba Inu Price Prediction: Is there a chance for traders to short the “Dogecoin killer”?

Like this article? Help us with some feedback by answering this survey:

- GBP/USD is back under pressure as the US Dollar resurges.

- Despite softer US data, the greenback is correcting the sell-off on Tuesday.

- GBP got only some temporary relief from the ''Windsor Framework'' deal.

GBP/USD was making good ground on Tuesday following on from the rally that started on Monday in an agreement that was made and hailing the end of a tense dispute between Britain and the EU over Northern Ireland. New trade rules were put together that could resolve import issues and border checks in Northern Ireland and that could help to ensure Northern Ireland was not somehow treated separately from the rest of the United Kingdom. The deal has been dubbed the "Windsor Framework" — a change to the original Northern Ireland Protocol — attempts to solve those issues.

The Pound Sterling climbed to a high of 1.2143 from 1.1925 at the start of this week after the UK's Prime Minister Rishi Sunak's announcement. Also, the cost of insuring British government debt against default dropped to its lowest in three weeks, close to January's five-month lows, reflecting greater investor confidence. But analysts said that any positives for the pound from the newly minted post-Brexit rules would likely not last, given the economic outlook.

''We remain unconvinced about the UK’s current fundamental backdrop,'' analysts at Rabobank said. ''In the absence of a deal on the Northern Ireland protocol, we expect upside flurries in GBP to be short-lived.''

Additionally, the analysts said, ''Comments around the risk of overtightening by BoE Chief economist Pill supported the notion that the Bank could be close to a pause in policy.'' Markets expect UK rates to peak around 4.8% by the end of the year, up from 4.0% now. At the beginning of the month, the expected peak was just 4.0%.

US Dollar bounces back to life

Meanwhile, the US Dollar has been dominating markets in the US and choppy trading on Wall Street. A round of mainly weak economic data knocked it off its perch but it soon turned over and was back on track for the best monthly gain since September. The Federal Reserve sentiment is keeping the greenback in the hands of the bulls as marked price in the notion that the central bank will have to raise interest rates more than initially expected.

Despite some cooler data over the last couple of key releases, due to the prior slew of inflationary outcomes, the US rate futures have priced in a peak fed funds rate of 5.4% hitting in September. The market has all but priced out rate cuts this year. Consequently, the US Dollar index, DXY, which measures the currency against a basket of major currencies, was higher by 0.18% in late morning trade on Wall Street and set for a February gain of over 2.5%, its first monthly increase since September.

As for the data that was released on Tuesday, showing signs of cracks in the economy, US single-family home prices increased at their slowest pace in December since the summer of 2020 while the US Chicago PMI fell to 43.6 in February, weaker than expected, after sliding to 44.3 in January. To round it off, Consumer Confidence also lost its footing this month to 102.9, down from a revised 106 reading last month.

- WTI erases Monday’s losses and jumps from around $75.60s on China’s reopening expectations.

- US inventories fell, a headwind for WTI price.

- WTI Price Analysis: To continue sideways unless bulls reclaim $78.00 bpd.

Western Texas Intermediate (WTI), the US crude oil benchmark, advance 1.90% on Tuesday courtesy of renewed expectations for oil demand due to China, despite growing speculations that the US Federal Reserve (Fed) would continue to tighten monetary conditions. Therefore, WTI is trading at $77.11, above its opening price, after hitting a low of $75.60.

Sentiment remains upbeat as Wall Street registers gains, except for the Dow Jones. The greenback has recently recovered some ground, capping WTI’s gains during the day, as the US Dollar Index edges up 0.14%.

WTI has reversed Monday’s losses spurred by expectations of increasing oil demand due to China’s reopening. That offset speculations that the Fed would raise rates at least to the 5.25%-5.50% threshold, as money market futures had shown. Furthermore, the US Energy Information and Administration (EIA) office said that production in the US fell to 12.10 million bpd, its lowest since April 2022.

In the meantime, Russia’s oil exports to China grew due to rising demand and lower freight costs.

Nevertheless, WTI’s rally was capped by the Organization of the Petroleum Exporting Countries (OPEC) announcement, which reported that OPEC+ countries pumped 28.97 million barrels per day (bpd) in February, up 150K from January. However, production remains 700K bpd below from September 2022.

According to a Reuters poll, oil prices are expected to rise above $90 a barrel toward the 2023 second half, as Chinese demand recovers and Russia’s output falls.

WTI Technical analysis

Technically speaking, WTI’s daily chart is neutral to downward biased. During Tuesday’s session, it was rejected at the 50-day Exponential Moving Average (EMA) around 77.99, though it’s clinging to gains above the 20-day EMA at 77.02. The Relative Strength Index (RSI) triggered a bullish signal as it crossed above the 50-midline, but buyers must reclaim the 50-day EMA for a bullish continuation that could send WTI rallying toward the YTD high at $82.44. On the flip side, a fall below the 20-day EMA will spur a drop to the February 22 daily low of $73.83.

- AUD/USD is correcting and the bulls might have only just got going.

- AUD/USD bulls eye the 78.6% Fibonacci near 0.6800.

AUD/USD is making a positive effort for the initial balance of the week, moving up into shorts that built from a breakout below 0.7000 in the middle of the month. The moves follow the pre-market open analysis from Monday Asia, here:

- AUD/USD Price Analysis: Bulls eye a correction to test dynamic resistance

AUD/USD prior analysis

It was explained that while potentially on course for a full test of last month's lows, AUD/USD was in a correction zone and the trendline resistance was compelling for a target of liquidity.

AUD/USD update

AUD/USD has reached toward a 50% mean reversion area and is starting to come under pressure. However, that is not to say that the correction is on the way out. Instead, it could be building up into a geometrical pattern:

A target of the 78.6% Fibonacci higher up near 0.6800 would align with the daily trendline resistance as follows:

- EUR/USD's rally has been met with strong opposition from the bears.

- EUR/USD bulls have not thrown in the towel yet and eye 1.0700.

As per the prior analysis, EUR/USD Price Analysis: Bulls on the sidelines in anticipation of a discount, the more composed bulls, tolerant of the initial runaway train who waited for a discount were paid off nicely with the pair rallying from lows of 1.0580 to a high of 1.0645 between London and ahead of the cash open on Wall Street.

EUR/USD prior analysis

It was stated that EUR/USD could be an attractive play for the bulls if enough of a discount was awarded from what would have been regarded as counter-trendline support as illustrated above. It was explained that Asian shorts could set up the day for London traders as a buy-low opportunity.

EUR/USD update

As shown, the bulls did indeed get a discount from the Asian sell-off into London's buyers.

It was explained in the prior analysis that while the bias is to the downside, as per the longer-term outlook, there were prospects of a correction into the bearish trend:

I was explained that ''this might only be premature in the correction and this could offer a buy-low opportunity for bulls in the coming sessions in anticipation of a test of the trendline resistance.''

That is what we got as shown in the daily chart above. However, there are still prospects of a firmer test and a move higher for the day ahead given how short the market is and the following illustrates such a scenario across the daily and hourly time frames:

The strong bull candle has a lot of commitment in there and despite the sell-off in the US session, bulls may remain committed still which offers prospects of another test higher as per the following hourly chart:

Bulls could be seen to emerge from a number of sweet spots on the chart as illustrated.

However, 1.0620/50 could be a tough nut to crack and this might take a number of sessions to break down. 1.0580 will be key in this regard should the bears continue to push back.

1.07 is eyed as a key target for the days ahead.

- USD/JPY hovers at around 136.00, an essential level for bulls to extend their gains.

- A bullish resumption would happen once the USD/JPY reclaims 137.00, with bulls eyeing 140.00.

- Otherwise, USD/JPY bears would have the upper hand if the major falls beneath 136.00.

After hitting a new YTD high at 136.91, the USD/JPY fell short of piercing the 137.00 figure and is staging a recovery as the New York session progresses. At the time of writing, the USD/JPY is trading at 135.85, below its opening price by 0.24%.

The USD/JPY bias is upward once the pair emerged above the 100-day Exponential Moving Average (EMA) last Friday. That exacerbated a rally above 136.00, an important price level for USD/JPY bulls as they prepare to launch an assault to 137.00. Though, the pair remains vulnerable at around 136.00, with sellers eyeing to drag prices below the latter, which would exacerbate a fall toward the 100-day EMA at 134.81.

For a bullish continuation, the USD/JPY needs to rise above 137.00, opening the door toward the 140.00 mark. But on its way north, the USD/JPY would face some hurdles. The first supply area would be the December 20 daily high at 137.47, followed by the December 16 high at 137.80, ahead of testing the November 30 daily high at 139.89.

USD/JPY Daily chart

USD/JPY Key technical levels

- Last Friday’s report of a high Core PCE, the Fed’s gauge for inflation, augmented speculations of rates “higher for longer.”

- US housing data in the United States was mixed, though the markets mainly ignored it.

- XAU/USD Price Forecast: Albeit jumping at the 200-DMA, downside risks remain below $1850.

Gold price is recovering after hitting a new YTD low of $1804.78, rising above the 100-day Exponential Moving Average (EMA). Factors like a mixed sentiment and a soft US Dollar (USD) are tailwinds for the yellow metal, even though there are growing speculations for higher rates in the United States (US). Hence, the XAU/USD is trading at $1827.03, above its opening price by 0.56%.

The jump in Gold prices is courtesy of an offered US Dollar

The financial markets narrative has not changed. Last Friday’s US Core Personal Consumption Expenditure (PCE), the Fed’s preferred gauge for inflation edging higher above expectations and closing to the 5% mark, caused a repricing for the Federal Funds Rate (FFR) terminal rate. Money market futures estimates 25 bps rate increases in March, May, and June, which would drag the FFR to the 5.25% - 5.50% range. Nevertheless, some investors are betting the Fed will ease in Q4 2023.

In the meantime, the US economic docket features housing data. According to the US Federal Housing Finance Agency’s data released on Tuesday, house prices in the US decreased by 0.1% from November to December. The S&P/Case-Shiller Home Price Index for December was also released and showed a year-over-year increase of 4.6%, lower than the previous month’s 6.8% and lower than the 6.1% estimated by analysts.

The US Dollar Index (DXY), a measure of the buck’s value against a basket of peers, has been volatile during Tuesday’s session, at around 104.630. Meanwhile, UST yields, mainly the 10-year benchmark note rate, sit at 3.936% and gains two bps, capping XAU/USD rally towards the $1830 area.

XAU/USD Price Analysis: Technical outlook

Technically speaking, the XAU/USD’s recovery above the 100-day EMA keeps Gold bulls hopeful of reclaiming the $1850 area and cemented the case for a bottom around $1800. Nevertheless, the 20-day EMA is about to cross below the 50-day EMA in the $1847 area, which would be of greater importance for sellers, leaning to the $1850 region as they try to re-test the $1800 figure.

XAU/USD needs to get above the intersection of the 20/50-day EMAs for a bullish continuation. Once done, that could pave the way towards the February 9 high at $1890.21, ahead of $1900. For a bearish scenario, the XAU/USD needs to drop below the 100-day EMA at 1820.31, exacerbating a re-test of the 200-day EMA at $1803.57.

What to watch?

Economists at Société Générale discuss EUR outlook. In their view, risks for the shared currency are tilted to the downside.

Key support below 1.0500 at 1.0450

“EUR/USD support at 1.0450 if 1.05 gives way.”

“March seasonals are bearish.”

“European stocks and spreads have outperformed the US since the start of the year and a reconvergence would undermine the bullish EUR/USD view.”

“Euro flash CPI for February is due this week and could cause more pain for bonds but also for EUR/USD if the data surprises to the upside.”

Economists at Wells Fargo expect the GBP/USD pair to move gradually higher toward 1.22 by the end of the year.

BoE will be comfortable shifting to a slower pace of rate hikes

“Should inflation continue to show a pronounced declaration, and activity and survey data show renewed softening, we expect the BoE to deliver a final 25 bps rate to 4.25% in March and to begin cutting interest rates as early as Q4 of this year. Our forecast policy rate peak is well below the level implied by current market pricing.”

“The less aggressive approach we envisage from the BoE is an important reason we expect that, over the medium-term, the Pound will be an underperformer against a broadly soft USD, targeting a GBP/USD exchange rate of just 1.2200 by the end of this year and 1.2400 by mid-2024.”

- Canada’s economy grew at a 0% pace in Q4, annualized, justifying the BoC pause in rate increases.

- US house prices tumbled while the US Dollar continued to trade in the backfoot.

- USD/CAD Price Analysis: Further upside is warranted on a daily close above 1.3600.

After dismal economic data reported from Canada, the USD/CAD advances toward the 1.3600 figure, while the US Dollar (USD) registers some losses. In addition, market sentiment shifted sour as US equities opened in the red. At the time of writing, the USD/CAD exchanges hands at around 1.3610.

Canada’s GDP was flat, a tailwind for USD/CAD

Statistics Canada revealed the Gross Domestic Product (GDP) for Q4, which was expected at 2.9% QoQ, though missed estimates and came flat at 0%. According to the agency, inventory accumulations and declines in business investment, mainly machinery, and equipment were the reasons for weaker growth in Q4.

Even though the reading is negative, it takes the pressure off the Bank of Canada (BoC). The BoC announced at its last monetary policy meeting that it would pause rate hikes. Consequently, further USD/CAD strength is warranted, as the US Federal Reserve (Fed) is expected to continue its tightening cycle with speculation around the financial markets that the Fed could go as high as 6%, according to Bank of America (BofA) Global Research.

The USD/CAD jumped after the data release and printed a daily high of 1.3609. Nevertheless, the dust had settled, and the major retraced toward the 1.3590s area.

On the US front, monthly house prices dropped in December by 0.1% MoM, in data published by the US Federal Housing Finance Agency showed on Tuesday. At the same time, the S&P/Case-Shiller Home Price Index arrived at 4.6% YoY in December, down from 6.8% in November and lower than analysts’ estimate of 6.1%.

Also read:

- Canada: Annualized real GDP declines to 0% in Q4 vs. 1.5% expected

- US: Housing Price Index declines 0.1% in December vs -0.6% expected

USD/CAD Technical analysis

The USD/CAD daily chart portrays the pair as upward biased after bottoming around 1.3200. After falling to YTD lows at 1.3262, the USD/CAD has prolonged its gains and has broken above crucial resistance areas, like the 20, 50, and 100-day Exponential Moving Averages (EMAs). Therefore, interest rate differentials and technical momentum could pave the way for further upside.

The USD/CAD next resistance would be the daily high at 1.3609. A breach of the latter will expose the YTD high at 1.3685, ahead of 1.3700, followed by the November 3 swing high at 1.3808.

What to Watch

There is scope for near-term softness on the policy divergence that's underway between the Fed and BoC, but a broad weakening trend in the USD by mid-year will give CAD a lift, economists at CIBC Capital Markets report.

Loonie could stay under a bit of pressure in the near term

“The Loonie could stay under a bit of pressure in the near term with risks of a move towards 1.37, as markets focus on the divergence in policy that is underway between the Fed, which is still expected to take rates a quarter point higher at least two more times, and the BoC that is currently on hold.”

“By June, we still expect to see enough evidence of a cooling in US growth and inflation to have markets looking past the end of a US tightening cycle, a development that should put the US Dollar on the defensive.”

“We see USD/CAD ending the year at 1.31.”

“With global growth likely to receive a lift as central banks outside of North America also start to cut policy rates towards neutral, and higher commodity prices benefitting Canada’s export sector, look for USD/CAD to reach 1.28 in 2024.”

- Consumer confidence in the US weakened in February.

- US Dollar Index stays in the red below 104.50 after the data.

Consumer sentiment in the US deteriorated modestly in February with the Conference Board's Consumer Confidence Index declining to 102.9 from 106 in January (revised from 107.1). This reading came in below the Reuters estimate of 108.5.

Further details of the publication revealed that the Jobs Hard-to-Get Index edged lower to 10.5 from 11.1 and the one-year consumer inflation rate expectations declined to 6.3% from 6.7% in December.

Market reaction

The US Dollar Index stays on the back foot after this data and was last seen losing 0.17% on the day at 104.46.

Hopes of a swift further decline in the inflation rate have received a noticeable damper at the beginning of 2023. Accordingly, the Fed will probably raise interest rates several more times, economists at Commerzbank report.

No further disinflation

“Our review of various core measures suggests that the inflation trend is probably still above 4%, way above the Fed's 2% target.”

“The Fed will hope that the effects of rate hikes have not yet shown up because of the usual lags in their impact. This will change and price pressures will then ease noticeably as the year progresses. If this does not happen, the Fed has obviously not cooled demand sufficiently. Significantly more rate hikes than previously expected (our forecast: three further hikes by June of 25 basis points each to 5.50% for the upper end of the target range) would then be likely.”

- EUR/USD adds to the weekly recovery beyond the 1.0600 mark.

- The 55-day SMA at 1.0715 emerges as the next up barrier near term.

EUR/USD extends the optimism seen at the beginning of the week and looks to extend the breakout of 1.0600 the figure on Tuesday.

There is a provisional up barrier at the 55-day SMA at 1.0715 prior to the weekly high at 1.0804 (February 14). A convincing move above this level could open the door to extra gains in the short-term horizon.

Looking at the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0328.

EUR/USD daily chart

- France and Spain's inflation numbers surpass expectations, according to preliminary data in February.

- Agreement between the UK and EU boosts the Pound.

- EUR/GBP moving with a bearish bias.

The EUR/GBP is falling on Tuesday, trading at the lowest level in a month. The cross broke under 0.8780 and fell to 0.8759, the lowest level since late January.

EUR and GBP outperforming

Despite falling versus the Pound, the Euro is among the top performers on Tuesday boosted by rising Eurozone government bond yields. The German 2-year yield rose to the highest since 2008 and the 10-year stands at 2.70%, up 4.65% for the day, at the highest since July 2011.

France and Spain reported preliminary inflation numbers showing an unexpected acceleration. French CPI rose 7.2% from a year ago, against expectations of 7%. Spain's CPI rose 6.1% from 5.9%, above the market consensus of 5.7%.

Inflation figures boosted a decline in European bonds and an increase in European Central Bank tightening expectations. Despite those effects, EUR/GBP drifted lower.

The Pound benefited from the deal between the European Union and the United Kingdom on the Northern Ireland Protocol. "This had been widely reported for weeks but markets reacted positively to the news. Now comes the hard part, as Prime Minister Sunak must get Parliament to approve the agreement", explained analysts at Brown Brothers Harriman. They suspect the deal will eventually be passed "but there is absolutely nothing to get bullish about. The agreement simply avoids a potential trade war as the UK had threatened to unilaterally change the Brexit deal, which would trigger sanctions from the EU".

The Brexit deal and an improvement in market sentiment are favoring the Pound on Tuesday. Also, some technical factors contribute to the negative momentum. EUR/GBP broke below 0.8780 and fell to 0.8759. It is hovering near the lows, under pressure.

Technical levels

Economists at Société Générale discuss USD/INR technicals. The pair could enjoy further gains on a break past the 82.95/83.30 resistance zone.

82.30 is crucial support

“USD/INR has evolved within a large sideways consolidation resembling an ascending triangle; a clear direction has been lacking.”

“Overcoming the resistance zone at 82.95/83.30 would be essential for affirming an extended uptrend.”

“Recent bullish gap at 82.30 is the first layer of support. In case this gets violated, a short-term pullback is likely.”

See: USD/INR to move slightly lower toward 81.50 by year-end – Commerzbank

GBP/USD surged higher and closed the day above 1.2000. Economists at Scotiabank believe that the pair could extend its rally as high as the mid-1.24s.

Last week’s peak is a potential double bottom trigger

“Sterling had a very positive session overall yesterday (bullish outside range to reject the 200-Day Moving Average support). Follow-through demand puts near-term focus on the mid-1.21 zone where last week’s high and the 55-DMA converge.”

“Last week’s peak is a potential double bottom trigger following the GBP’s two recent tests of the 1.1925/30 area. Gains through here would target a retest of the GBP’s recent peaks in the mid-1.24s at least.”

USD/CNY rose for the fifth consecutive week from 6.70 in mid-January to 6.96 last week. Economists at Commerzbank believe that the pair could move back lower in the coming quarters.

Heightened US-China tensions are likely to keep the volatility high

“Heightened geopolitical tensions between the US and China could continue to support USD/CNY in the near term. However, CNY could stabilize somewhat if the upcoming economic data shows a continued improvement in the economy.”

“Further, the tailwinds from Covid reopening and an expected weaker Dollar later this year could support a modest appreciation of the CNY in the coming quarters. But an expected narrowing in China’s trade surplus will limit the pace of any possible yuan appreciation.”

“Heightened US-China tensions are likely to keep the volatility high.”

- House prices in the US declined at a softer pace than expected in December.

- US Dollar Index stays in negative territory at around 104.50.

House prices in the US declined by 0.1% on a monthly basis in December, the monthly data published by the US Federal Housing Finance Agency showed on Tuesday. This reading came in better than the market expectation for a decrease of 0.6%.

Meanwhile, the S&P/Case-Shiller Home Price Index arrived at 4.6% on a yearly basis in December, down from 6.8% in November and lower than analysts' estimate of 6.1%.

Market reaction

The US Dollar stays under modest selling pressure after this report and the US Dollar Index was last seen losing 0.15% on the day at 104.47.

Analysts at Société Générale discuss GBP outlook. The GBP/USD pair is not out of the woods yet.

Resistance running at 1.2450

“Much stronger than forecast UK services PMI and optimism that inflation will fall sharply by the end of the year have caused the narrative on the pound to improve. GBP/USD is not in the clear however and must hold the 200-DMA at 1.1926 to avoid deeper losses which could still materialise in March.”

“The outlook for wider Fed/BoE policy spread should limit upside for GBP/USD in the medium-term with resistance running at 1.2450.”

“The new deal between the UK and the EU on changes to the NI protocol will be signed but will not immediately translate into windfalls for the economy and the currency. It has no impact on the BoE and at what level interest rates peak.”

- GBP/USD turns positive for the second successive day and climbs back above the 1.2100 mark.

- A positive risk tone undermines the USD and lends some support amid the latest Brexit optimism.

- Bulls might still wait for a sustained strength beyond the 50-day SMA before placing fresh bets.

The GBP/USD pair catches fresh bids following an early slide to the 1.2025 area on Tuesday and builds on the previous day's solid bounce from the very important 200-day Simple Moving Average (SMA). The momentum pushes spot prices to a four-day high, beyond the 1.2100 mark, during the early North American session and is sponsored by a combination of factors.

The latest optimism over a new deal on the Northern Ireland protocol between the UK and EU, along with rising bets for additional rate hikes by the Bank of England (BoE), underpin the British Pound. Adding to this, a generally positive tone around the equity markets weighs on the safe-haven US Dollar and lends some support to the GBP/USD pair. That said, the prospects for further policy tightening by the Fed should act as a tailwind for the Greenback and cap the major amid looming recession risks.

Moreover, neutral oscillators on the daily chart warrant some caution for aggressive bullish traders and before positioning for a further appreciating move for the GBP/USD pair. Hence, any subsequent move up is more likely to confront stiff resistance and remain capped near the 50-day SMA, currently around the 1.2145 region. Some follow-through buying, however, could trigger a short-covering rally and lift spot prices beyond the 1.2200 mark, towards the recent swing high, around the 1.2265-1.2270 zone.

On the flip side, the 1.2065-1.2060 area now seems to act as immediate support ahead of the 1.2025 zone (the daily low) and the 1.2000 psychological mark. Any further decline might continue to attract some buyers and remain limited near the 200-day SMA, currently pegged near the 1.1925-1.1920 region. A convincing break below the latter will complete a bearish double-top pattern formed near the 1.2445 area and drag the GBP/USD pair to the YTD low, around the 1.1840 zone touched in January.

GBP/USD daily chart

Key levels to watch

- DXY recedes to the lower end of the weekly range near 104.60.

- Next on the upside emerges the 2023 peak around 105.60.

DXY alternates gains with losses near 104.60 following Monday’s marked retracement.

The ongoing price action favours the continuation of the uptrend despite the ongoing corrective move. Further bouts of strength should then clear the February high at 105.35 (February 27) to allow for a probable challenge of the 2023 top at 105.63 (January 6).

In the longer run, while below the 200-day SMA at 106.49, the outlook for the index remains negative.

DXY daily chart

- Canadian economy performed much worse than expected in Q4.

- USD/CAD rises toward 1.3600 following the disappointing GDP data.

The Canadian economy stagnated in the fourth-quarter with the annualized real Gross Domestic product (GDP) growth arriving at 0%. This reading followed the 2.3% expansion recorded in the third quarter and missed the market expectation for a growth of 1.5% by a wide margin.

On a monthly basis, real GDP in Canada contracted by 0.1%.

Statistics Canada explained slower inventory accumulations and declines in business investment in machinery and equipment were behind the poor economic performance in Q4.

Market reaction

USD/CAD edged higher with the initial reaction and was last seen posting small daily gains at 1.3585.

- AUD/USD is seen consolidating its recent fall to the lowest level since January.

- A positive risk tone undermines the USD and benefits the risk-sensitive Aussie.

- The setup still favours bearish traders and supports prospects for further losses.

The AUD/USD pair seesaws between tepid gains/minor losses, though manages to hold its neck above the 0.6700 mark heading into the North American session on Tuesday. The setup, meanwhile, remains tilted in favour of bearish traders and supports prospects for a further near-term depreciating move.

A modest recovery in the risk sentiment undermines the safe-haven US Dollar and turns out to be a key factor lending some support to the risk-sensitive Aussie. That said, rising bets for more interest rate hikes by the Fed remain supportive of elevated US Treasury bond yields and act as a tailwind for the Greenback. This, along with looming recession risks and geopolitical tensions, suggests that the path of least resistance for the AUD/USD pair is to the downside.

From a technical perspective, Friday's breakdown through confluence support near the 0.6800-0.6780 region was seen as a fresh trigger for bearish traders. The said area comprises the 200-day SMA and the 38.2% Fibonacci retracement level of the rally from the October 2022 low. Moreover, oscillators on the daily chart are holding deep in the negative territory and are still far from being in the oversold zone, validating the bearish outlook for the AUD/USD pair.

That said, bearish traders are likely to wait for sustained weakness below the 0.6700 round figure before placing fresh bets. The AUD/USD pair might then accelerate the fall to the 0.6660 zone, or the 50% Fibo. level, en route to the 0.6600 mark. The downward trajectory could get extended further towards the 61.8% Fibo. level, around the 0.6550 region. The latter should act as a strong base for spot prices and help limit further losses, for the time being.

On the flip side, any meaningful recovery attempt beyond the 0.6750 level, or the daily top, could meet with a fresh supply near the 0.6780-0.6800 confluence support breakpoint, now turned resistance. A sustained strength beyond, however, might trigger a short-covering rally and lift the AUD/USD pair to the next relevant hurdle near the 0.6875-0.6880 region. This is followed by the 0.6900 mark and the 23.6% Fibo. level, around the 0.6925 area, which should cap gains.

AUD/USD daily chart

Key levels to watch

USD/CAD gains through 1.35 points to a test of 1.37, Shaun Osborne, Chief FX Strategist at Scotiabank, reports.

Gains through 1.37 cannot be excluded

“USD/CAD strength may persist a little longer now; not only has the pair traded through key resistance but trend strength (DMI) oscillators have aligned bullishly for the USD across intraday, daily and weekly studies. This should mean firm support for the USD on modest dips from here and ongoing pressure higher towards a retest of the 1.37 area, where USD gains stalled late last year.”

“Initial support is likely to emerge in the mid-1.35 zone but the support zone likely runs fairly deep (back to the 1.35 area).”

“Gains through 1.37 – which cannot be excluded, given the bullish alignment of trend strength oscillators – would suggest USD gains can extend a little more to retest the 1.38 zone.”

Economists at Commerzbank analyze the figures for Gold imports in China.

China’s low Gold imports from Hong Kong not a sign of weak consumer demand

“According to data from the Census and Statistics Department of the Hong Kong government, China imported a good 22 tons of Gold from Hong Kong on a net basis in January. This was only roughly half as much as in December.

“Refinitiv data show that physical premiums for Gold in China, that is to say, the surcharge payable on the global reference price level, amounted to as much as $30 per troy ounce in January. The decrease in gold imports cannot, therefore, be seen as a sign of weaker consumer demand. It is more likely the case that there was insufficient supply in China.”

“A week ago, the Swiss Federal Customs Administration had already published figures for Gold exports to China in January. They paint a mixed picture: whereas shipments to China likewise fell sharply to 26 tons, those to Hong Kong increased to 27 tons, their highest level since April 2019. This also points to robust Gold demand in China following the end of the coronavirus restrictions.”

USD is mixed versus majors. As economists at Scotiabank note, the supportive yield story is fading.

Spreads turn mildly less supportive

“The USD is trading mixed versus the majors but retains a soft undertone overall, suggesting more weakness ahead for the USD in the short run at least.”

“The Dollar’s essential problem is that the supportive yield story that powered gains for much of the past month is a bit less compelling now as markets price other central banks (essentially, the BoE and ECB) a little more aggressively.”

“Month-end flows may provide the USD with some support over the session.”

Canadian GDP overview

Tuesday's economic docket highlights the release of monthly Canadian GDP growth figures for December, due to be published at 13:30 GMT. Statistics Canada will also release the quarterly growth figures, making this more significant than the ones including only monthly data. Consensus estimates suggest that the economy remained flat during the reported month and expanded by a 1.9% annualized pace during the October-December period. This, however, will mark a slowdown from the 2.9% growth recorded in the previous quarter.

Analysts at CIBC offer a brief preview and explain: “Growth in the Canadian economy continued to cool during the final quarter of 2022 (1.3%), likely clocking in at a pace below the economy’s long-run potential and therefore helping ease inflationary pressures. Continued weakness in commodity prices likely brought a further drop in the overall price deflator and a second successive quarterly decline in GDP in nominal terms. The monthly GDP print for December is expected to show little change in economic activity for that month, although the advance estimate for January should point to at least modest growth for the first month of 2023 if the surge in employment is a reliable guide.”

How could it affect USD/CAD?

Ahead of the key macro release, a goodish pickup in Crude Oil prices underpins the commodity-linked Loonie and drags the USD/CAD pair lower for the second straight day. A stronger-than-expected report will point to an economy that remains resilient. This should be enough to provide an additional boost to the domestic currency and pave the way for deeper losses for the major.

Conversely, a softer reading should reaffirm speculations that the Bank of Canada (BoC) will pause the rate-hiking cycle. This, along with bets for further policy tightening by the Fed, should assist the USD/CAD pair to capitalize on the recent breakout momentum through the 100-day Simple Moving Average (SMA). Nevertheless, the data should infuse some volatility around the CAD pairs and allow traders to grab short-term opportunities.

Key Notes

• Canadian GDP Preview: Forecasts from six major banks, economy cooling, but not stalling

• USD/CAD Forecast: Bulls have the upper hand above 100-day SMA amid Fed rate hike bets

• USD/CAD Price Analysis: Bears lurking at key H4 resistance

About the Canadian GDP

The Gross Domestic Product released by Statistics Canada is a measure of the total value of all goods and services produced by Canada. The GDP is considered a broad measure of Canadian economic activity and health. Generally speaking, a rising trend has a positive effect on the CAD, while a falling trend is seen as negative (or bearish) for the CAD.

AUD/USD continues its decline toward 0.6700. Further losses toward 0.6660 are on the cards, potentially to 0.6550, economists at Société Générale report.

Support 0.6660, resistance 0.6800

“AUD/USD evolved within a Head and Shoulders. Confirmation of this formation has resulted in a short-term down move. The decline is expected to persist towards 0.6660 and target of the pattern near 0.6550.”

“Confluence of the MA and the neckline at 0.6800/0.6870 is the first layer of resistance near term.”

See – AUD/USD: Near-term outlook remains weak – UOB

- EUR/JPY climbs to fresh yearly highs past the 145.00 mark on Tuesday.

- Further up comes the December 2022 high near 146.70.

EUR/JPY adds to the ongoing strong rebound and surpasses the key hurdle at 145.00 the figure on Tuesday.

The continuation of the current upside momentum should challenge the December 2022 top at 146.72 (December 15) ahead of the 2022 high at 148.40 (October 21 2022).

In the meantime, while above the 200-day SMA, today at 141.50, the outlook for the cross is expected to remain positive.

EUR/JPY daily chart

The Dollar is restrengthening on Tuesday after a soft start to the week. Risk sentiment is too fragile for a big USD correction, in the opinion of economists at ING.

Further improvements in risk sentiment may become harder to sustain

“US data may not move the market dramatically today, so the Dollar may be primarily driven by global risk sentiment.”

“We struggle to see a material and sustained recovery in global equities in such a worsening valuation environment, and with data still supporting the Fed’s hawks for now, the Dollar’s short-term bias still appears neutral/modestly bullish.”

“A return above 105.00 in DXY seems possible in the ISM services release on Friday.”

EUR/USD is hanging in around 1.06. Economists at Société Générale expect the pair to move back higher toward 1.10 by the end of March.

Yield differentials are wind in the Euro’s sails

“We argued that a bit of risk aversion and wider credit spreads could take EUR/USD to 1.06 (and GBP/USD below 1.2). Both went marginally further, and we could still see some wobbles in the days ahead but yield differentials should start to matter again and I expect we’ll be climbing back towards EUR/USD 1.10 by the end of March.”

“As for Sterling, everything now depends on DUP support for the Windsor Framework. Some negotiation may be required, but if support is forthcoming, we might see EUR/GBP get back below 0.86.”

Economists at Nordea see a weak NOK until the summer.

NOK will remain weak for now

“We expect the NOK to remain weak until the summer – with our view for EUR/NOK around 11.10 in 3M and 10.00 by mid-2023.”

“We expect a somewhat lower EUR/NOK toward year-end, but the pair will likely remain high in a historical context.”

“Norges Bank reducing their NOK sales after the summer should help the NOK. Other bright spots for the NOK should be higher petroleum investments, the reopening of China which means higher oil prices, and central banks pausing their rate hikes.”

“We see EUR/NOK around 10.60 at end-2023”

Economists at Société Générale discuss JPY outlook. The USD/JPY pair is forecast at 125 by the end of the year.

Yen to continue to appreciate gradually in the next few years

“We expect the Japanese Yen to resume appreciating and the USD/JPY pair to move toward 125 at the end of 2023.”

“We are also expecting the Yen to continue to appreciate gradually in the next few years, along with the US treasury yield decline and the rising possibility of Japan overcoming deflation.”

- NZD/USD languishes near the YTD low and seems vulnerable to decline further.

- Hawkish Fed expectations, elevated US bond yields act as a tailwind for the USD.

- Looming recession risks, acceptance below the 200-day SMA favour bearish traders.

The NZD/USD pair comes under fresh selling pressure on Tuesday and drops closer to a nearly three-month low touched the previous day. Spot prices manage to bounce back to mid-0.6100s during the first half of the European session, though the near-term bias remains tilted in favour of bearish traders.

The US Dollar stalls the overnight pullback from a seven-week high amid rising US Treasury bond yields, bolstered by hawkish Fed expectations. In fact, the markets seem convinced that the US central bank will stick to its hawkish stance in the wake of stubbornly high inflation. This, in turn, favours the USD bulls and supports prospects for an extension of the near-term depreciating move for the NZD/USD pair.

Apart from this, a generally weaker risk tone should act as a tailwind for the safe-haven Greenback and contribute to driving flows away from the risk-sensitive Kiwi. The market sentiment remains fragile amid worries about economic headwinds stemming from rapidly rising borrowing costs. This, along with geopolitical tensions, keeps a lid on the overnight optimistic move in the global equity markets.

The NZD/USD pair, meanwhile, now seems to have found acceptance below a technically significant 200-day Simple Moving Average (SMA). This adds credence to the near-term negative outlook and suggests that the path of least resistance for spot prices is to the downside. Traders now look to the US macro data - regional Manufacturing PMIs and the Conference Board's Consumer Confidence Index - for a fresh impetus.

Technical levels to watch

The Swiss Franc eased a little against EUR over the past few days. Economists at Commerzbank believe that the EUR/CHF pair could extend its advance, but the Swiss National Bank is set to avoid a substantial depreciation of the CHF.

SNB likely to keep a close eye on Franc exchange rate

“As we assume that the price data, and in particular core inflation, from the Eurozone due to be published this week is unlikely to signal the all-clear regarding price pressure, further upside pressure in EUR/CHF might arise.”

“The SNB is likely to keep a close eye on Franc depreciation and – if necessary – intervene if the CHF were to depreciate too much, just as was the case last year.”

“The threat of interventions and hawkish SNB communication is likely to limit depreciation pressure on the Franc for now, at least while inflation pressure in Switzerland remains elevated.”

The continuation of the uptrend could see USD/CNH challenge the 7.0000 level and beyond in the short-term horizon, comment UOB Group’s Economist Lee Sue Ann and Markets Strategist Quek Ser Leang.

Key Quotes

24-hour view: “While we expected USD to strengthen further yesterday, we were of the view that ‘the major resistance at 7.0000 is unlikely to come into view’. We noted, ‘Support is at 6.9650, followed by 6.9550’. Our view was not wrong as USD rose to 6.9898 before pulling back to a low of 6.9551. The pullback amid overbought conditions suggests USD is likely to consolidate today, expected to be within a range of 6.9500/6.9800.”

Next 1-3 weeks: “There is no change in our view from yesterday (27 Feb, spot at 6.9750). As highlighted, the strong boost in momentum from last Friday is likely to lead to further USD strength. The resistance levels to watch are at 7.0000 and 7.0200. On the downside, a break of 6.9220 (no change in ‘strong support’ level) would indicate that the USD strength that started early this month has ended.”

- EUR/USD advances further north of the 1.0600 barrier.

- The dollar gives away part of the initial bullish attempt.

- Flash inflation figures in France and Spain surprised to the upside.