- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 28-01-2022

- The USD/JPY slides 0.15% as investors prepare for the weekend.

- The greenback finished the week above 97.00 for the first time since June 2020.

- USD/JPY is upward biased, but the pair could print a leg-down before resuming the uptrend.

As Wall Street closes, the USD/JPY slides ahead of the weekend, spurred by the US 10-year Treasury yield fall, which drops eight basis points, from 1.85% to 1.777%. At the time of writing, the USD/JPY is trading at 115.22.

The New York session witnessed a slight improvement in the market mood as US stocks rebounded near the close of Wall Street, finishing with gains.

The USD has been on the defensive in the FX market, undermined by falling US T-bond yields versus the Japanese yen, failing to break above an upslope trendline, drawn from October 2021 lows to December ones passing around the 115.40-60 range.

On Friday, during the overnight session for North American traders, the USD/JPY peaked at around 115.68, above the abovementioned trendline. However, as American traders got to their desks, the pair fell 40-pips to current levels.

USD/JPY Price Forecast: Technical outlook

The USD/JPY is upward biased, as depicted by the daily chart. Failure to break above 115.70 might open the door for a leg-down before resuming the uptrend. However, as long as the retracement remains above the 50-day moving average (DMA) at 114.34, it would keep the uptrend intact.

The USD/JPY to the upside, the first resistance would be January 4, YTD high at 116.35. A breach of the latter would expose a downslope trendline drawn since August 1998 swing highs, a 24-year old trendline around 117.00-20, followed by a test of January 3, 2017, swing high at 118.61.

- US equities surged in late trade after a broadly positive session as Fed bets eased after softer wage data.

- The S&P 500 lept to close above the 4400 level again to close 2.4% higher and end the week positive.

- Apple led the charge after positive Q4 earnings and record iPhone sales.

US equity markets posted solid gains on the final trading day of the week. The S&P 500 gained 2.4% to close at 4430, the Nasdaq 100 gained 3.2% to close just under 14.45K after bouncing again at 14K and the Dow gained 1.7% to rally above 34.7K from an earlier session dip under 34K. Much of the surge came in late trade, but equities also got a lift before the open after US Q4 Employment Cost Index data showed a more pronounced than expected slowdown in wage pressures, news analysts said would be met with relief at the Fed, thus reducing the likelihood of a larger 50bps hike in March. Bond yields have eased on the session as a result, helping tech/growth names outperform, after a tough week for these stocks as market participants upped tightening bets after Fed Chair Jerome Powell’s hawkish post-Fed meeting remarks.

The market was led by a more than 6% surge in Apple’s share price back towards $170, a more than 9% rebound from earlier weekly lows under $155, leaving shares only just over 7.0% above recent record highs at $183. The company posted better than expected top and bottom-line earnings results for Q4 after Thursday’s close, with iPhone sales in the quarter hitting a new record. Apple’s results come following a busy last few sessions for earnings, with 168 of the 505 S&P 500 companies having now reported for Q4. According to Refinitiv data cited by Reuters, 77% of those companies have beaten analyst expectations.

But the S&P 500 only closed the week 0.8% higher, the Dow 1.3% higher and the Nasdaq 100 0.1% higher. Analysts noted that investors have been more focused on earnings guidance, especially relating to how ongoing global supply chain snags are expected to impact earnings in the coming quarters. On this topic, the news has been mixed this week. Recall Tesla collapsed more than 10% on Thursday due to negative commentary regarding the impact of supply chains in the coming months. Elsewhere, Caterpillar’s share price, seen as a bellwether for the health of the global economy, fell more than 5.0% on Friday after the co. warned about higher production and labour costs.

- Silver losses almost 8% in the week, the biggest fall in the year.

- The greenback posts its best week since June 2021, with the DXY steady at 97.251.

- The XAG/USD stills downward pressured, and a break below $22.35 would expose $22.00 and beyond.

Silver (XAG/USD) looks forward to finishing its worst week in the year, slumping for six consecutive days, trading at $22.39 at the time of writing. That said, the white metal accumulates losses of 7.90% in the week, the largest since November 2021, when it shed 5.90% of its value.

King dollar is back, gaining 1.70% in the week, the largest since June 2021

The US dollar is the main gainer of the week. So far, the US Dollar Index, a gauge of the greenback’s value against a basket of its rivals, advances 1.70% in the week, sitting at 97.251. It is the biggest gain since June 2021 in the week when the US central bank favorite gauge of inflation, the Personal Consumption Expenditure (PCE), rose to 4.9%, the highest level reached since June 1982.

On Friday, the US Bureau of Economic Analysis reported that the Core Personal Consumption Expenditure (PCE) for December, the Fed’s favorite gauge of inflation, rose by 4.9%, 0.1% higher than expected, and left behind the 4.7% reported in November.

Meanwhile, investors appear to be rebalancing their portfolios after the FOMC monetary policy meeting. Even though the monetary policy statement was perceived as a “hawkish hold,” the market’s reaction was null. However, when Fed Chair Jerome Powell expressed at his press conference that “the committee is of a mind to raise the federal funds rate at the March meeting,” the stock sell-off began

Before Wall Street opened, Minnesota Fed President Neil Kashkari hit the wires. He said that the Fed needs to bring the US economy in balance by raising interest rates. Kashkari noted that the central bank does not know how many increases will take and emphasized that the Fed would be adjusting as more data comes in.

XAG/USD Price Forecast: Technical outlook

Silver is downward biased, though USD bulls are struggling to break an upslope trendline drawn from December 2021 lows up to January ones that pass around the $22.35-50 area. In the event of a test of the latter, that would send XAG/USD tumbling towards January 7 cycle low at $21.94, followed by December 2021 lows at $21.42.

- GBP/JPY dipped back from earlier highs near 155.00 to the low 154.00s but remains within recent ranges.

- The pair is still trading in the green after nursing a recovery from an earlier weekly dip.

- There is notable resistance in the 153.00 area and resistance in the 155.50 area.

GBP/JPY held within a 154.00-155.00ish range on Friday, as the pair continued to nurse a recovery from its earlier weekly dip to sub-153.00 levels. The pair, which was as much as 0.75% down at the start of the week, now trades with on the week gains of about 0.15% in the 154.20s. A late yen bid on Friday that has propelled the safe-haven currency to the top of the G10 performance table has seen the pair pull back from earlier session highs closer to 155.00, but the pair continues to trade broadly flat on the day and within recent ranges.

Looking ahead to next week, technicians will be keeping an eye on support in the 153.00 area where not only this week’s lows reside, but also the 200-day moving average. If another broad downturn in risk appetite (like what happened last week) sends the pair back lower again, a break below this area would open the door to a test of the key 152.40/50 balance area that has provided both support and resistance since last September. Conversely, to the upside, traders should keep an eye on notable resistance in the 155.50 area. The Bank of England policy announcement on Thursday will be the major economic event of the week.

- The Australian dollar fell off the cliff against the Japanese yen, down 0.77%.

- Market sentiment has improved in the session, but in the FX market, safe-haven peers rise.

- AUD/JPY bears look forward to a Weekly/Friday close below 80.70, which would increase the odds for a fall towards 78.78.

On Friday, as the North American session progresses, the AUD/JPY plunges close to 100-pips in the day. At the time of writing is trading at 80.47. Risk-sensitive currencies like the Australian and New Zealand dollar extended their slide vs. the Japanese yen for the second consecutive day, since Wednesday when the Federal Reserve officially signaled that they would hike rates “soon.”

The AUD/JPY seesawed at the announcement, though it remained within familiar levels. However, as Fed Chair Jerome Powell hit the stage, he noted that the US central bank might raise rates in March. The signal was clear for investors, as risk aversion appeared while market participants scrambled towards safer assets. In the FX complex, flows went to the USD and the JPY.

In the meantime, US equities trade in the green at press time, reflecting a slight improvement in appetite. Nevertheless, month-end flows will keep the greenback and the JPY in the front foot until the next month.

Fundamentally speaking, the AUD/JPY should be headed to the upside, based on central bank divergence. However, risk sentiment weighed on the Australian dollar. Also, the economic deceleration of China, and the People’s Bank of China (PBoC) cutting rates, signals nervousness of the communist party regarding the Asian giant economic outlook.

AUD/JPY Price Forecast: Technical outlook

The AUD/JPY depicts the pair as downward biased. Daily moving averages (DMAs) reside well above the spot price, around the 81.98-82.37 range. The break under January 24 daily low at 80.69, immediately exposed December 20, 2021, low at 80.27. A breach of the latter might send the pair tumbling close to 150-pips to the following support level located at 78.79, the December 3, 2021, daily low.

- After dipping to fresh 18-month lows under the 0.7000 level, AUD/USD has been consolidating.

- There are now not any major levels of support until the 0.6775 area, which coincides with a key 50% Fibonacci.

- Strong US data next week could further spur dollar gains if it further spurs Fed tightening bets.

- Already very hawkish RBA expectations reduce the scope of a hawkish surprise at next week’s meeting that could lift AUD.

After dipping to fresh 18-month lows underneath the 0.7000 level during morning European trade, AUD/USD has been consolidating just below the big figure. The pair was momentarily able to reclaim 0.70 status in wake of data showing an easing of US wage inflation pressures, which triggered some dollar profit-taking and paring back on Fed tightening bets. That dollar weakness didn’t last long, with Core PCE inflation data showing inflationary pressures remained highly elevated at the end of 2021.

Now that AUD/USD has cleared key levels of support at 0.7000 in the form of the 2021 and Q4 2020 lows, technicians turn their attention to the next support zone. There is arguably some support in the 0.6920s and 0.6840s, but nothing major until the 0.6775 area. This level happens to roughly coincide with the 50% Fibonacci retracement back from the post-pandemic at roughly 0.8000 to the post-pandemic low at roughly 0.5500.

Despite having already lost 2.5% on the week, most would agree that AUD/USD’s recent break below 0.7000 leaves it very vulnerable from a technical perspective. Next week, AUD/USD traders will have plenty to focus on, with the RBA monetary policy announcement on Tuesday followed by a monetary policy statement on Friday, as well as key January US data releases (ISM survey and official jobs data). Friday’s sensitivity in the US dollar to the latest Q4 Employment Cost Index suggests things could get volatile if next week’s official jobs data surprises.

Meanwhile, some might argue that next week’s RBA meeting is one of the most highly anticipated in years. The bank is expected to axe its QE programme and faces immense market pressures to drastically shift its rate hike guidance. At the moment, the RBA board says it doesn’t see the conditions for rate hikes being met until 2023 at the earliest. That compares to money market pricing for a first rate hike as soon as May and a recent Reuters poll of economists where the median expectation was for the bank to hike rates in November.

Unfortunately for the AUD/USD bulls, the fact that market expectations have gotten so far ahead of the RBA’s stance means that even if they do complete a sizeable hawkish pivot on their current position (i.e. pointing to hikes by end-2022) the scope for a hawkish surprise that would lift the battered Aussie is low.

- The EUR/USD is under heavy downward pressure, as the pair eyes May 2020 swing lows.

- EUR/USD bulls failure to defend 1.1100, it would open the door towards 1.0775.

After holding above 1.1200 for too many days before USD bulls launched an attack to 2021 yearly low, however, the shared currency barely advances in the day. At the time of writing is trading at 1.1155, climbing 0.10% during the North American session.

EUR/USD Price Forecast: Technical outlook

During the overnight session for North American traders, the EUR/USD seesawed around 1.1140. However, in the European open, the pair dipped to 1.1122, jumping towards the daily high at 1.1173, attributed to USD month-end flows or technical moves, as the US Core PCE came at 4.9%, further emphasizing the need for higher rates on the Federal Funds Rate (FFR).

Weekly chart

The EUR/USD is downward biased, as depicted by the break of a bearish flag, which has 1.1100 as its target. Moreover, the weekly moving averages (WMAs) reside well above the spot price. So, a breach of the June 2020 swing lows at 1.1076 would accelerate a fall towards May 202 swing lows around 1.0775.

Daily chart

The EUR/USD daily chart depicts the pair as also downward biased, as the weekly chart. That said, the daily moving averages (DMAs) reside above the spot price. On January 26, the EUR/USD broke below the bottom trendline of a bearish flag, which gave way for a break of the 2021 yearly low at 1.1186 on Thursday.

That said, the first support would be the figure at 1.1100. A breach of the latter would expose May 14, 2020, daily low at 1.0775

- EUR/JPY was flat on Friday despite a heavy Eurozone data slate amid a calm end to the week.

- Focus now turns to next week’s ECB policy decision and flash Eurozone CPI data.

Despite a heavy slate of Eurozone data out during the European morning, it has been a rather tame trading day for EUR/JPY, with the pair swinging within 128.40-128.80ish ranges, well within this week's 100 pip, 128.20-129.20ish range. Right now, the pair is trading just to the north of the 128.50 mark and if roughly flat on the session. Where last week was a story of safe-haven demand driving FX market flows, thus pushing EUR/USD lower from the 130s, this week was a story of choppiness/indecisiveness, hence the mixed trading conditions for EUR/JPY.

Fed hawkishness in the middle of the week turned the focus in FX markets away from risk appetite back towards central banks and policy divergence. But in a win for the EUR/JPY bears, this did not seem translate into notable upside for the pair. Even if it had, short-term bears may well have used the opportunity to add to short positions in at resistance in the 129.50 area. They may be hoping that US data next week (ISM surveys and the official jobs report) contributes to a further surge in Fed tightening bets, thus knocking stocks lower again and triggering renewed safe-haven yen demand. That way the pair might fall back to test December lows in the 127.50 area.

But central bank policy will also be in the spotlight next week, with the ECB announcing a rate decision on Thursday. The meeting isn’t expected to yield any policy/guidance changes as ECB members have recently reiterated their belief in inflation being transitory and the bank’s current forecasts that it will drop back under 2.0% by the end of year. Wednesday’s Eurozone flash Consumer Price Inflation reading, if it comes in substantially hotter than forecast, may test this narrative. The theme of Eurozone inflation and how the ECB views it will also be an important driver next week.

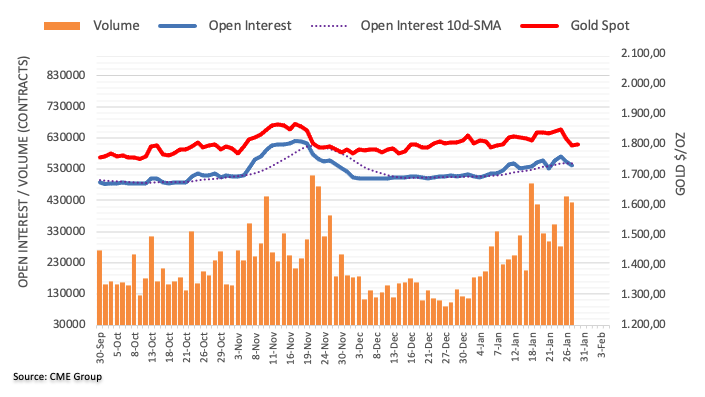

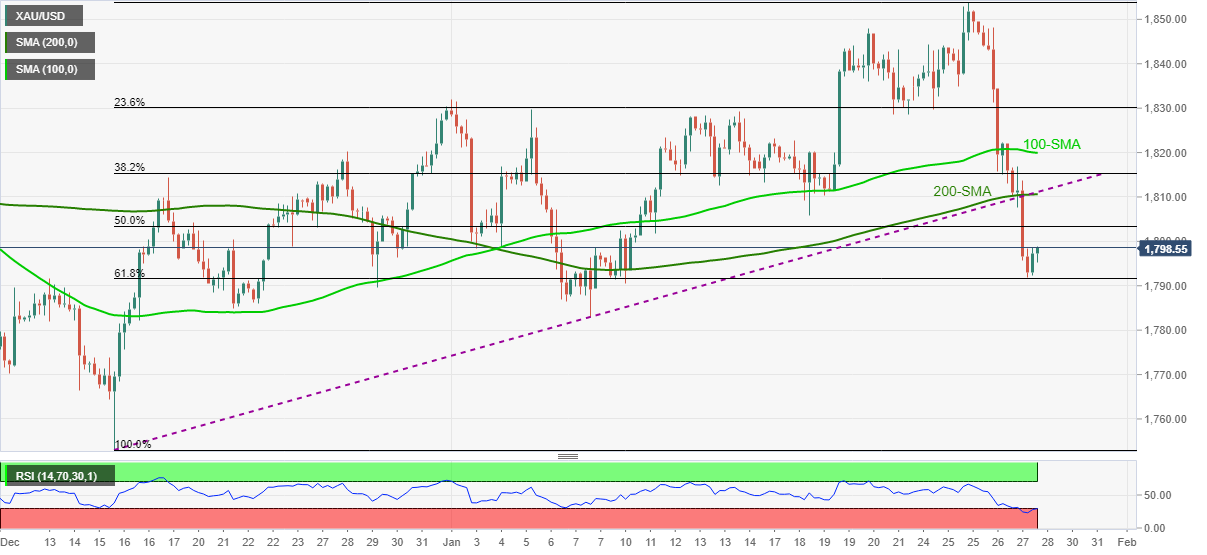

- The yellow metal has fallen close to 4% in the week, spurred by a hawkish US central bank.

- Fed’s Kashkari expects that the Fed would hike rates at the March meeting.

- XAU/USD is downward biased, though a daily close below $1752 would open the door for further losses.

Gold (XAU/USD spot vs. the US dollar extended its fall since Wednesday when the FOMC issued the first monetary policy statement of 2022. During the New York session at the time of writing, the XAU/USD is trading at $1,785.

US Core PCE increase higher than expected, Fed policymakers noted

The market sentiment has improved since the US cash equity markets opened. Nevertheless, European equity indices have been unable to get back in the green. Before Wall Street opened, the US Bureau of Economic Analysis unveiled the Federal Reserve favorite gauge of inflation, the Core Personal Consumption Expenditure (PCE) for December, increased by 4.9%, higher than the 4.8% foresee by analysts and 0.2% higher than the November reading.

Meanwhile, Minnesota Fed President Neil Kashkari said that the Fed needs to bring the US economy in balance by raising interest rates. Kashkari noted that the central bank does not know how many increases will take and emphasized that the Fed would be adjusting as more data comes in.

Later on, he said that “inflation is higher than expected” and expects the Fed to raise rates at the March meeting in an interview with Yahoo! Finance.

Concerns about the US central bank tightening dent the market sentiment

In the meantime, market participants keep digesting the Fed’s awaited change in monetary policy stance. Although the monetary policy statement was viewed as a “hawkish hold,” the initial reaction was no surprise. Nevertheless, Fed’s Chair Powell press conference rocked the boat, saying that “the committee is of a mind to raise the federal funds rate at the March meeting.”

Before Wall Street opened, Minnesota Fed President Neil Kashkari hit the wires. He said that the Fed needs to bring the US economy in balance by raising interest rates. Kashkari noted that the central bank does not know how many increases will take and emphasized that the Fed would be adjusting as more data comes in.

The US economic docket just featured the University of Michigan Consumer Sentiment for January on its final reading, which came at 67.2 lower than the 68.7 expected.

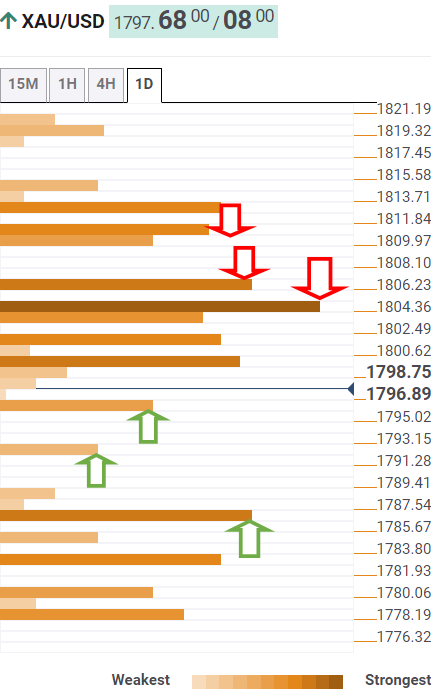

XAU/USD Price Forecast: Technical outlook

Gold is trading near the bottom of a Pitchfork’s channel, drawn from the beginning of December, as depicted by the daily chart. That trendline intersects with a downslope trendline, drawn from August 2020 swing highs, acting as resistance for the non-yielding metal around $1,790-$1,800. Furthermore, the daily moving averages (DMAs) reside above the spot price. Therefore, XAU/USD is downward biased.

The first support level would be December 15, 2021, swing low at $1,753. A breach of the latter would expose October 6, 2021, a daily low at $1746, followed by September 29, 2021, a low at $1,721.

Analysts at MUFG Bank, have a trade idea of a long position of the USD/ZAR, with an entry level at 15.500, a target at 16.300 and a stop loss around 15.000. They point out that broad dollar strength is already starting to weigh more heavily on the South African rand again.

Key Quotes:

“The ZAR has been one of the best performing currencies so far this year. It helped USD/ZAR to drop sharply from just above the 16.000-level at the end of last year and down closer to the 15.000 at the start of the New Year. The ZAR has been supported in part by strong foreign demand for South African bonds in January. It was the strongest month of foreign purchases since May of last year. It highlights the tentative pick-up in investor appetite for select emerging markets exposure.”

“We are not convinced that the turnaround in sentiment can be sustained in the current challenging external environment. The correlation between ZAR performance and US yields had broken down over the past month. The Fed’s decision to signal a faster pace of rate hikes should keep upward pressure on US yields and the USD in the near-term which we expect to begin to have more of a negative impact on the ZAR. Price action over the past week suggests that broad USD strength is already starting to weigh more heavily on the ZAR again.”

“We see room for a further reversal of the move lower in USD/ZAR from the start of this year.”

Analysts at Wells Fargo think the FOMC will announce the commencement of balance sheet reduction at the July 27 meeting. They look for the Federal Reserve to hike the Fed Funds rate by 125 bps in 2022.

Key Quotes:

“We now think it is likely that the Committee will hike rates by 25 bps at the March 16, May 4 and June 15 policy meetings. Previously, we had anticipated that the FOMC would pause in May.”

“Along with 25 bp rate hikes in September and December, we now forecast that the FOMC will raise its target range for the federal funds rate by 125 bps over the course of 2022. We continue to look for 75 bps more of additional rate hikes next year.”

“In light of Wednesday's developments, we now think that the Committee will bring forward its announcement of balance sheet reduction to the July 27 meeting with commencement in August.”

“We expect the FOMC will take a pass on a rate hike at that meeting, but the beginning of balance sheet reduction will also be another form of monetary policy tightening. If, as we currently anticipate, the Federal Reserve follows the same monthly schedule that was detailed above, then it will reach its monthly caps of $70 billion of Treasury securities and $30 billion of MBS in January 2023 rather than in March, as we previously forecasted.”

Analysts at MUFG Bank, point out that policy divergence and geopolitical risks will remain a weight on the euro in the near term, reinforcing the bearish trend in the EUR/USD pair. They see a widening policy divergence between the European Central Bank and the Federal Reserve, as the FOMC plays catch up with upside inflation risks.

Key Quotes:

“The EUR has fallen to fresh lows against the USD over the past week after breaking below the November low at 1.1186. It takes the pair closer to the lows during the initial phase of the pandemic when it briefly traded between 1.0500 and 1.1000 from February 2020 to May 2020. At the same time the EUR/GBP is trading close to recent lows at just above the 0.8300-level, and pre-pandemic lows from February 2020 and December 2019 at around 0.8280. The EUR has been now trending lower against the USD since June of last year, and for just over a year against the GBP.”

“The EUR’s downward momentum has been reinforced by the Fed’s hawkish policy update in which Fed Chair Powell opened the door to faster rate hikes than during the previous tightening cycle.”

“Recent developments support our forecast for EUR/USD to fall to 1.1000 in Q1. Downward pressure on the pair could be reinforced in the near-term if tensions between Russian and the Ukraine intensify. The bearish EUR trend would be challenged though in the week ahead if the ECB does not push back as strongly against rate hike expectations for this year.”

The Bank of Canada kept the interest rate unchanged this week but signalled imminent tightening at the next meeting in March. Next week, the key economic event will be the jobs report on Friday. Analysts at RBC Capital Markets see a drop of 70K in employment in January.

Key Quotes:

“Canadian labour market data for January is expected to weaken substantially. We’re eyeing a 75,000 drop in employment and an uptick in the unemployment rate to 6.4% after COVID-19 restrictions prompted business closures in large parts of the country.”

“Businesses in virtually all industries were reporting acute labour shortages just ahead of the Omicron surge, and are expected to be hesitant to let workers go as quickly as in past virus waves. For sectors unaffected by closures, high rates of absenteeism due to illness and self-isolation will weigh on total hours worked, if not official employment counts. Still, the number of available unemployed workers relative to the number of job postings is already very low—and that will likely still be the case once restrictions are lifted. Health experts are cautiously optimistic about the trajectory of infections in Canada.”

“Overall we do not expect Omicron disruptions to extend significantly beyond the first quarter of 2022.”

Data released on Friday showed the Employment Cost Index (ECI) rose 1% during the fourth quarter, and 4% during the year. Analysts at Wells Fargo point out the quarterly increase was more restrained than Q3's 1.3% gain, and they consider that may tamp down fears of a wage-price spiral amid signs businesses are not upping pay at such a frenzied pace.

Key Quotes:

“The ECI includes benefits in addition to wages and salary costs, and also controls for compositional changes in the workforce. That makes it a cleaner read on the degree of labor cost pressures facing businesses. The FOMC's emphasis on the ECI was on full display in Chair Powell's December post-meeting press conference, when he highlighted it as a reason he thought about announcing a faster pace for tapering asset purchases back in November.”

“The more temperate quarterly gain likely has Fed officials breathing a bit of relief that labor costs did not accelerate further on a sequential basis, but glad they have telegraphed a more hawkish path for policy given that the overall pace of employment costs continue to point to a very tight labor market.”

“While the cooler quarterly pace of ECI suggests employment costs are not running away, it is far too early to suggest the worst is over when it comes to labor cost growth. Amid an already tight labor market and the Omicron wave dealing a setback for the labor supply outlook, wage pressures are likely to remain firmly upward over the next few quarters.”

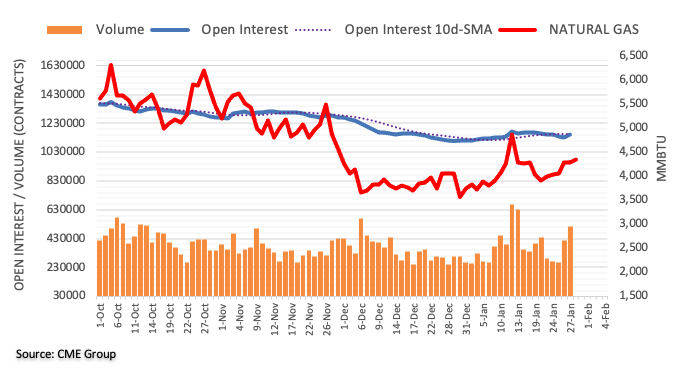

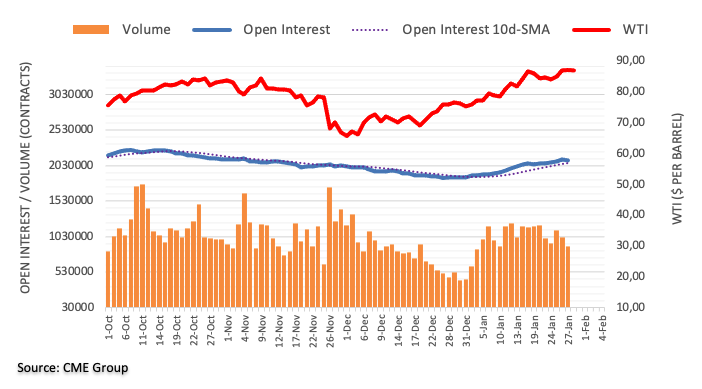

- WTI hit fresh seven-year highs at $88.82 on Friday, but has since pulled back under $88.00 again.

- WTI remains on course for healthy on the week gains of about $3.0, a sixth successive week in the green.

- Geopolitics and OPEC+ output capacity remain concerns that are supportive for prices as focus switches to next week’s OPEC+ meeting.

Front-month WTI futures hit fresh seven-year peaks on Friday, reaching $88.82 for the first time since October 2014, before pulling back somewhat to just below $88.00 again. Still, that leaves WTI trading more than 50 cents higher on the session and about $3.0 higher on the week. Indeed, WTI is on course to post a sixth successive weekly rally, a run that has seen the American benchmark for sweet light crude oil rally more than $20.00 from the low-$66.00s. The next area of major upside resistance is the psychologically important $90.00 level and then the late-2013 lows in the mid-$91.00s just above it.

Oil market analysts continue to cite a combination of bullish factors on both the demand and supply side as supporting the recent rally. Firstly, on the demand side, as the Omicron variant fades in major developed economies facilitating “reopening”, demand has held up and is expected to post strong growth for the year. Meanwhile, on the supply side, market commentators continue to cite OPEC+ capacity constraints and geopolitical tensions between NATO/Ukraine/Russia as supportive. Traders have also cited an increase in the threat to UAE output presented by an uptick in Iran-back Houthi militias based in Yemen.

“The risk premium on the oil price is now likely to be almost $10/bbl,” said analysts at Commerzbank. These factors helped to support oil this week in the face of large surprise crude oil inventory builds in the US. Attention now turns to next week’s OPEC+ meeting where sources have already said the cartel is set to stick to its existing policy of hiking output quotas by 400K barrels per day each month. Market participants remain highly skeptical about the group’s ability (particularly the smaller producers) to keep up with output quota hikes.

- US dollar remains firm across the board, holds onto weekly gains.

- USD/CAD heads for the highest daily close in a month.

The USD/CAD rose earlier on Friday to 1.2796, the highest intraday level since January 6. It then pulled back to the 20-hour SMA at 1.2745, and it is moving again toward the recent top. The key driver continues to the dollar’s rally.

The greenback remains supported by risk aversion and Fed’s tightening expectations. Higher crude oil prices supported the loonie only modestly.

From the level it had a week ago, USD/CAD is up more than 200 pips, having the best performance since August of last year.

After central banks, Jobs data

Despite falling against the US dollar, the loonie is about to post the highest weekly close in more than a year versus AUD and NZD on a risk aversion environment. The Bank of Canada did not hike rates this week, but offered signs that a tightening cycle will begin in March.

The focus across financial markets will likely continue around Wall Street and the US dollar. Regarding data, the key report in the US will be the Non-farm payroll report. After Wednesday’s FOMC meeting, prices are still adapting to the changes in monetary policy expectations.

“Next week, the focus will be on January jobs data in Canada, a chance to measure the impact of Omicron restrictions in the country. Signs of resilience and more wage growth pressure could fuel speculation around a 50bp March hike and support CAD. We expect USD/CAD to stabilise around current levels with more USD strength that should mostly be channelled through weaker low-yielders”, explained analysts at ING.

Technical levels

- USD/CHF has remained well supported above 0.9300, shrugging off strong Swiss data and unreactive to the latest US data dump.

- The pair is trading higher on the week by about 2.2% and trades close to weekly highs in the 0.9330s.

- USD/CHF is now eyeing a test of H2 2021 highs in the 0.9370 area.

USD/CHF has remained well supported to the north of the 0.9300 level on Friday, as has been the case now since prior to Thursday’s US open, as the December highs at 0.9294 offer support. To the upside, technicians will note resistance in the form of weekly highs in the 0.9330s which are likely to cap the price action for the remainder of the week. The pair didn’t react to stronger than expected Swiss KOF Leading Indicator data, which edged higher for the first time since early 2021, nor has it seen much of a reaction to the recent heavy slate of US data.

Admittedly, the buck saw some minor initial weakness following evidence of easing wage pressures after the QoQ inflation rate of the Q4 Employment Cost Index fell more than expected. That may have triggered some momentary dollar profit-taking, but with a larger than expected rise in Core PCE inflation in December and heavy slate of US data next week, it is far to early to say the recent dollar rally is over.

That dollar rally, which was initially triggered on Wednesday after more hawkish than expected remarks from Fed chair Jerome Powell in the post-Fed meeting press conference, has seen USD/CHF surge from under 0.9200 to current levels above 0.9300 since Wednesday. That surge since Wednesday has taken the pair’s on-the-week gains to around 2.2% and has taken the pair to the north of the 0.9100-0.9300 range that had prevailed since the start of December.

USD/CHF is now eyeing a test of H2 2021 highs in the 0.9370 area. If next week’s US data (ISM surveys and the official labour market report) comes in hot and further boosts hawkish Fed bets, bulls will be betting that USD/CHF has a run at the 0.9400 level.

The jump in US short-dated rates on a hawkish Fed has sent EUR/USD to new cycle lows. Economists at ING expect the pair to challenge the 1.10 level as the European Central Bank (ECB) stance does not seem to support the shared currency.

ECB offers little support

“It looks just a matter of time before 1.10 is tested.”

“Ahead of Thursday’s ECB meeting, we’ll get to see 4Q Eurozone GDP data and the January CPI reading. Consensus expects +0.4% QoQ for the Eurozone figure. Eurozone CPI is expected to turn the corner in January at 4.3% YoY as some base effects drop out. Clearer indications that inflation peaked at 5% in December will hardly push the ECB into a more aggressive stance.”

“With the ECB providing no support for short-dated Eurozone interest rates, EUR/USD will remain at the mercy of the re-priced Fed tightening cycle.”

- The NZD is losing 0.53% during the New York session.

- US Core PCE closes to 5%, while Fed tightening conditions spurred market sentiment.

- Tensions in Eastern Europe ease as Russia engages in negotiations with the US.

As the North American session begins, the NZD/USD slides for the seventh straight day, unable to recover from its losses since January 20. At the time of writing is trading at 0.6552. Risk-aversion in the markets keeps safe-haven peers in the bid, while risk-sensitive currencies like the NZD, the AUD, and the GBP, fall.

US Core PCE inflation rises

The US Bureau of Economic Analysis reported on Friday that the Core Personal Consumption Expenditure (PCE) for December, the Fed’s favorite gauge of inflation, rose by 4.9%, 0.1% higher than expected, and left behind the 4.7% reported in November.

Concerns about the US central bank tightening dent the market sentiment

In the meantime, market participants keep digesting the Fed’s awaited change in monetary policy stance. Although the monetary policy statement was viewed as a “hawkish hold,” the initial reaction was no surprise. Nevertheless, Fed’s Chair Powell press conference rocked the boat, saying that “the committee is of a mind to raise the federal funds rate at the March meeting.”

Before Wall Street opened, Minnesota Fed President Neil Kashkari hit the wires. He said that the Fed needs to bring the US economy in balance by raising interest rates. Kashkari noted that the central bank does not know how many increases will take and emphasized that the Fed would be adjusting as more data comes in.

Eastern Europe tensions ease

During the European session, it crossed the wires that Russia is willing to engage with US security proposals and emphasized that it does not want the war over Ukraine, giving a slight relief for investors.

Gold climbed to its highest level since November at $1,853 on Wednesday but ended up losing more than 3% from that level to end the week deep in the negative territory below $1,800. In the view of FXStreet’s Eren Sengezer, XAU/USD is poised for further losses.

Focus shifts to the US January jobs report

“Nonfarm Payrolls are forecast to rise by 238K in January. The low bar suggests that there is room for a positive surprise and a stronger-than-forecast NFP print should favour the dollar in the near-term. On the flip side, a third disappointing reading in a row could weigh on the dollar and open the door for a rebound in XAU/USD.”

“Average Hourly Earnings will be the key data point to watch. On a yearly basis, wage inflation is expected to rise to 5.1% from 4.7%. Fed policymakers are concerned that a steady rise in wages could cause consumer inflation to remain high for a prolonged period. Hence, high wage inflation should be seen as a dollar-positive and vice versa.”

“First support is located at $1,770 (static level). In case this level turns into resistance, the next bearish target could be seen at $1,755 (static level).”

“On the upside, the 100-day SMA forms the first resistance at $1,795. Even if XAU/USD reclaims that level, the 200-day SMA aligns as the next hurdle at $1,805. Only a daily close above the latter could attract buyers and help gold shake off the bearish pressure.”

- DXY comes under pressure near 97.50 on Friday.

- US Core PCE rose more than expected in December.

- Final Consumer Sentiment deflates to 67.2 in January.

The upside momentum in the greenback seems to have run out of some steam after hitting new cycle tops past 97.40 when gauged by the US Dollar Index (DXY).

US Dollar Index capped near 97.50

The index now gives away part of the recent advance along with the loss of upside bias in US yields, particularly in the short end and the belly of the curve.

It seems investors decided to cash out some gains in light of the recent acute move higher in the buck, while market participants continue to recalibrate expectations around the potential moves by the Fed in the next months.

In the US docket, inflation tracked by the Core PCE rose 4.9% YoY in December and 5.8% when it comes to the headline PCE. Further results showed Personal Income and Personal Spending expanding 0.3% MoM and contracting 0.6% MoM in December, respectively. Lastly, the Consumer Sentiment eased a tad to 67.2 in January as per the final U-Mich Index.

US Dollar Index relevant levels

Now, the index is losing 0.01% at 97.19 and a break above 97.44 (2022 high Jan.28) would open the door to 97.80 (high Jun.30 2020) and finally 98.00 (round level). On the flip side, the next down barrier emerges at 96.05 (55-day SMA) seconded by 95.41 (low Jan.20) and then 94.62 (2022 low Jan.14).

Federal Reserve Bank of Minneapolis President Neel Kashkari said on Friday that he expects the Fed to raise rates at the March meeting, in an interview with Yahoo Finance.

Additional Remarks:

"Inflation is higher than I expected, has lasted longer."

"Inflation should start to normalize this year."

"The Fed will do its part."

"I would expect by mid-year inflation will show evidence of trending down."

"We have to see how data plays out."

"Other factors should start to bring inflation down even before the Fed acts."

"The Fed's messaging on rates has already had an effect on the economy."

"The Fed needs to follow through and walk the walk."

"A pause in spring on rate hikes is conceivable."

"Would not be appropriate to signal rate hikes would be gradual or deliberate... too much is outside our control."

"We need more information before we can decide what we'll do a few months from now."

"If inflation comes down faster than we expect, that would be good news, and the Fed would need to do less."

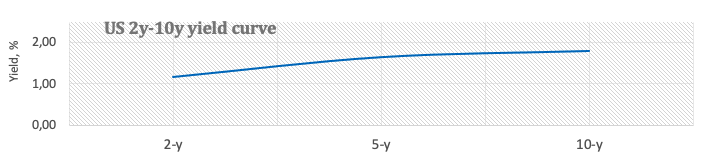

"The Fed has much less influence on long-end of the yield curve."

"Long end of the yield curve is signaling we are probably heading into a period of more modest inflation, growth."

"The yield curve gives us feedback on where we are relative to neutral."

"The yield curve suggests we are not that far away from neutral, not as far as we thought."

"We don't want to slam on brakes."

"Investors have confidence that we are serious about keeping inflation in check."

"The fear of the virus is still keeping people on the sidelines of the workforce."

"China's zero covid policy could affect US supply chains and the global economy."

"It's a very muddy economic picture right now."

"It's unacceptable what took place with Fed policymakers trading during 2020."

"We are committed to re-earning the public's trust, there was damage."

- UoM Consumer Sentiment fell to 67.2 from the flash estimate of 68.7, its lowest reading since 2011.

- There was no market reaction to the latest UoM data.

The University of Michigan's (UoM) final estimate of the Consumer Sentiment Index came in at 67.2 in December, below the flash estimate of 68.7 released earlier in the month, and well below November's reading of 70.6. That marked a fresh low since 2011. The Current Conditions index fell to 72.0 versus expectations for 73.2 and down from November's 74.2 reading, while the Consumer Expectations index fell to 64.1 from 68.3 in November, below the expected 65.8.

Market Reaction

There was no market reaction to the latest UoM data.

S&P 500 remains capped at its 200-day average and the 38.2% retracement of its January collapse at 4434/53. Economists at Credit Suisse continue to view this as a temporary relief bounce only ahead of a retest of the recent low, the 23.6% retracement of the entire 2020/2021 uptrend and the 38.2% retracement of the rally from October 2020 at 4223/4199.

A short-term pause only prior to the risk turning firmly lower again

“Whilst further near-term consolidation should be allowed for, we remain of the view this is a short-term pause only prior to the risk turning firmly lower again.”

“Below 4276 should clear the way for a retest of support at 4223/4199 – the recent low, the 23.6% retracement of the entire 2020/2021 uptrend and the 38.2% retracement of the rally from October 2020. Whilst we will look for evidence of a floor here again, should weakness directly extend we would see scope for further weakness to 4173/64 next, ahead of 4057 and eventually we think more important support at 3855/15.”

“Near-term resistance moves to 4355, then 4374.”

“A close above 4450 remains needed to mark a stabilization and a more prolonged consolidation, with resistance then seen next at 4495.”

In the view of economists at Scotiabank, the EUR/USD pair will remain on a path toward 1.10 as price action points to continued losses to a test of 1.11.

Resistance is located at 1.1150/55

“Support at the intraday low of 1.1120/25 will stand ahead of the figure zone, after which point there are no obvious markers to prevent a decline to 1.10.”

“The week’s losses have left the EUR just shy of oversold on the RSI which may help to ease the currency’s slide and see it settle into a 1.1150/200 consolidation band.”

“Resistance is 1.1150/55 followed by the 1.12 area.”

USD/CAD is poised to close out the week on a firm note nearing 1.28. A break above the 1.2815 would clear the way towards the 1.2950 region, economists at Scotiabank report.

Minor support for the loonie from crude

“Firm commodity prices – with crude heading for a sixth weekly gain – are providing a modest prop for the CAD but near term risks are tilting a bit lower for the currency amid soft risk appetite and a long wait for the March BoC decision.”

“The short-term uptrend has gathered a little more bullish momentum over the past session or two and the USD is within reach of minor resistance at 1.2815 (minor high from January). There is little resistance above there until the 1.2900/50 zone, however – the range highs for spot over the past year.”

“Intraday support is 1.2710/15.”

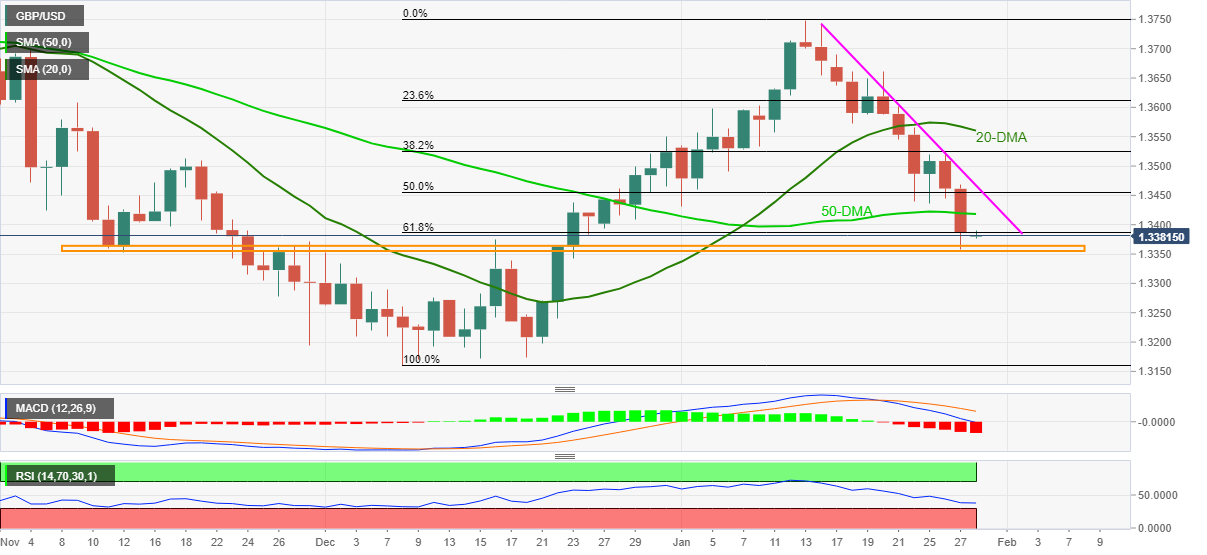

- GBP/USD has jumped back above 1.3400 in wake of the latest US data dump.

- The dollar has weakened amid profit-taking after data revealed an easing of US wage pressures in Q4.

In wake of the latest US data dump that contained promising signs of easing US wage pressures last quarter, the dollar has seen broad weakness which has helped to propel GBP/USD back above the 1.3400 level. Indeed, the pair recently high session highs in the 1.3420s, where it now trades with modest gains of about 0.3% on the session. Technicians may now look for cable to test resistance in the form of the earlier weekly lows in the 1.3430-50 area, where some swing traders may be tempted to reload short positions.

Despite some profit-taking in wake of the latest US data dump that saw Core PCE and Personal Income/Spending figures print roughly in line with expectations but surprising weakness in Q4 Employment Cost inflation, many buck bulls will remain confident. Indeed, the broader Dollar Index (DXY) is still up about 1.6% on the week (and GBP/USD is down about 1.0% on the week), spurred by Fed tightening bets after Fed Chair Jerome Powell’s hawkish post-policy announcement remarks. As the Fed leaves itself plenty of optionality to tighten at a faster, or slower pace, dependent upon the data, there is plenty of space for further data surprises next week to power further Usd upside.

That suggests downside risks for G10/USD majors, including GBP/USD in the week ahead, with the most important data releases to scrutinise the January ISM surveys and official labour market report. As some strategists talk about a return to GBP/USD to December’s sub-1.3200 lows, note that next week’s BoE meeting may offer some upside risk, given the bank is likely to implement another rate hike and layout quantitative tightening plans.

At the very least, even if the broad dollar rally does power on and drives GBP/USD lower, there is a distinct chance that sterling’s losses against the buck are limited compared to other G10 currencies. That has been the case this week, with GBP down around 1.0% versus the buck, while CAD, JPY and EUR are 1.4-1.6% lower and CHF, NZD and AUD all more than 2.0% lower.

USD/JPY maintains its strong recovery for a break above the recent reaction high at 115.06 to mark a fresh base. As the Credit Suisse analyst team notes, the risk has turned back higher with key resistance seen at 116.35/75.

Support at 114.48 now ideally holds

“USD/JPY above 115.06 sees a base established to clear the way for strength back to 116.35/75, then the long-term downtrend from April 1990 at 116.75.”

“Whilst a fresh cap at 116.75 should be allowed for, with a major base established last year we continue to look for an eventual clear break above 116.75 in due course. This should then clear the way for a move to the 118.61 highs of late 2016/early 2017.”

“Support moves to 115.16/06 initially, then 114.49, with 114.48 now ideally holding to keep the immediate risk higher. Below would warn of further ranging and a fall back to 113.78.”

Argentine President Alberto Fernandez announced on Friday that they have reached an agreement with the International Monetary Fund to revamp the debt of over $40 billion that the country has been struggling to pay, as reported by Reuters.

"The agreement does not condition Argentina's economic policies nor impose reaching 'zero deficit'," Fernandez added and said that they will send the agreement to Congress for approval.

Commenting on this development, Argentina's Economy Minister Martín Guzmán explained the agreement with the IMF involves an economic framework and measures that promote the country's growth. "There will be no sudden exchange rate shock," Guzmán further noted. "International reserves expected to grow by $5 billion in 2022."

- EUR/USD manages to rebound from 2022 lows.

- US Core PCE rose 4.9% YoY in December, more than estimated.

- US final Consumer Sentiment is due next in the docket.

After bottoming out inf the 1.1120 region, or new YTD lows, EUR/USD regains some composure and returns to the positive territory near 1.1160 at the end of the week.

EUR/USD looks contained near 1.1100

EUR/USD now reverses part of the recent intense selloff and regains the 1.1150/60 band on the back of the knee-jerk in the greenback.

Indeed, the US Dollar Index (DXY) trims earlier gains along with the loss of upside momentum in yields in the short end of the curve, which came under pressure after hitting 2-year peaks near 1.23%.

The pullback in the dollar came after US inflation figures measured by the Core PCE rose 4.9% YoY in December, more than initially estimated, while the headline PCE gained 5.8% from a year earlier. Additionally, Personal Income expanded 0.3% MoM in the same period and Personal Spending contracted 0.6% MoM.

Later in the session, the final Consumer Sentiment print for the month of January will close the weekly calendar.

EUR/USD levels to watch

So far, spot is up 0.10% at 1.1156 and faces the next up barrier at 1.1308 (55-day SMA) seconded by 1.1369 (high Jan.20) and finally 1.1450 (100-day SMA). On the other hand, a break below 1.1121 (2022 low Jan.28) would target 1.1100 (round level) en route to 1.1000 (psychological level).

- USD/JPY witnessed some profit-taking from a near three-week high touched earlier this Friday.

- The USD retreated from the highest level since July 2020 after the release of the PCE Price Index.

- The risk-off mood benefitted the safe-haven JPY and further contributed to the intraday decline.

The USD/JPY pair surrendered its intraday gains to a near three-week high and retreated back below mid-115.00s, or the lower end of its daily trading range during the early North American session.

The pair build on its solid rebound from a two-month low, around the 113.45 region touched earlier this week and gained some follow-through traction on Friday. The momentum was sponsored by the sustained US dollar buying, bolstered by expectations that the Fed will tighten its monetary policy at a faster pace than anticipated to contain stubbornly high inflation.

In fact, the markets have started pricing in the possibility of five quarter-point rate hikes by the end of 2022 and also expect that the first hike in March could be 50 basis points. The bets were reinforced by Friday's data, showing that the Fed's preferred inflation gauge – Core PCE Price Index – rose 0.5% MoM in December and the yearly rate climbed to 4.9% from 4.7%.

The USD, however, witnessed some profit-taking from the highest level since July 2020 touched earlier this Friday. On the other hand, the prevalent risk-off mood drove some haven flows towards the Japanese yen. The combination of factors prompted some long-unwinding around the USD/JPY pair led to an intraday pullback of over 50 pips from the 115.65-115-70 area.

That said, the Fed's more hawkish stance, along with elevated US Treasury bond yields should continue to act as a tailwind for the greenback. This, along with the recent widening of the US-Japanese bond yield spread, should help limit any meaningful corrective slide for the USD/JPY pair, rather attract some dip-buying at lower levels.

Hence, it will be prudent to wait for a strong follow-through selling before confirming that the post-FOMC rally has run out of steam and placing any bearish bets around the USD/JPY pair. Nevertheless, the pair remains on track to post strong weekly gains, snapping two successive weeks of the losing streak.

Technical levels to watch

Federal Reserve Bank of Minneapolis President Neel Kashkari said that the Fed needs to bring the US economy back into balance by raising interest rates a little bit. We don't know how many interest rates hikes it will take, he added, saying that we (the Fed) are adjusting as the data comes in.

Market Reaction

There was no reaction to Kashkari's remarks.

- Personal Income rose 0.3% MoM in December, below expected, while Personal Spending fell 0.6% MoM as expected.

- The DXY has seen some weakness, which analysts said reflected weaker Q4 US wage data released at the same time.

US Personal Income rose by 0.3% MoM in December, below expectations for a 0.5% MoM rise, according to a report released on Friday by the Bureau of Economic Analysis and Department of Commerce. That marked a slight deceleration from November's 0.5% MoM growth rate. Meanwhile, Personal Spending fell by 0.6% in December, in line with expectations for a 0.6% MoM drop, confirming a deceleration from November's 0.4% MoM positive growth rate.

Market Reaction

Broadly in line with expected Personal Income and Spending figures don't seem to have impacted FX markets. The dollar has eased in wake of the latest data dump, where the focus has been on a larger than expected deceleration in the US Q4 Employment Cost Index inflation rate. The data has been interpreted as easing the pressure on the Fed to aggressively hike interest rates this year to tame labour market inflationary pressures and short-end US yields have seen a sharp pullback, weighing on the buck.

- Core PCE inflation came in a little above expected at 4.9% in December.

- The DXY has seen some weakness, which analysts said reflected weaker Q4 US wage data released at the same time.

Inflation in the US, as measured by the Core Personal Consumption Expenditures (PCE) Price Index, rose to 4.9% YoY in December, the US Bureau of Economic Analysis reported on Friday. That was slightly above the consensus forecast for an inflation rate of 4.8% and marked a slight acceleration from November's Core PCE inflation rate of 4.7%. The MoM rate of Core PCE inflation was 0.5% in December, in line with expectations and unchanged from November's inflation rate. Core PCE is the Fed's favoured measure of underlying inflation.

Market Reaction

Despite the headline YoY rate of Core PCE coming in a little hotter than expected for December, the DXY has seen a slight pullback in recent trade, dipping back into the 97.10s from close to 97.40 prior to the data. Some analysts have said this could be a reflection of weaker than expected US Q4 Employment Cost Index data, which was released at the same time as the Core PCE data at 1330GMT. The Index rose 1.0% QoQ last quarter, below expectations for an inflation rate of 1.2% and below Q3's 1.3% rate.

- Silver witnessed some follow-through selling for the sixth successive day on Friday.

- The technical set-up favours bearish traders and supports prospects for further losses.

- Any attempted recovery could now be seen as a selling opportunity and remain capped.

Silver extended its recent rejection slide from the very important 200-day SMA and continued losing ground for the sixth successive day on Friday. The white metal remained depressed heading into the North American session and was last seen trading around mid-$22.00s or a near three-week low.

The overnight breakthrough the 50% Fibonacci retracement level of the $21.43-$24.70 strong move up and a subsequent slide below last week's swing low, around the $22.80 area, favours bearish traders. The negative outlook is reinforced by the fact that oscillators on the daily chart have been gaining negative traction and are still far from being in the oversold territory.

Hence, some follow-through weakness towards testing the next relevant support, around the $22.20 region, remains a distinct possibility. This is followed by the monthly low, around the $22.00-$21.95 area. Failure to defend the mentioned support levels will be seen as a fresh trigger for bearish traders and set the stage for a further near-term depreciating move for the XAG/USD.

On the flip side, attempted recovery might now confront immediate resistance near the $22.80 region ahead of the $23.00 mark, or the 61.8% Fibo. level. Any further move up might still be seen as a selling opportunity and runs the risk of fizzling out rather quickly. This, in turn, should cap the upside for the XAG/USD near the 50% Fibo. level resistance, around the $23.30 region.

Silver daily chart

-637789726909460505.png)

Technical levels to watch

- Spot gold is a little lower ahead of a US data dump, trading about 0.3% lower around $1790.

- That leaves the precious metal a few bucks above annual lows.

- Analysts warn that strong US data could feed the Fed tightening narrative and push gold towards support around $1750.

Spot gold (XAU/USD) prices are currently holding up above support in the form of the annual lows at $1782 as attention turns to an imminent US data dump at 1330GMT. December Core PCE inflation, December Personal Income and Spending and Q4 Employment Cost data will all be released. On the day, gold prices are nonetheless trading in heavy fashion, and currently trade about 0.3% lower around the $1790 mark, leaving them on course to post a third successive negative session.

The dollar remains perky on Friday with the DXY at fresh multi-month highs near 97.50 and on course for its largest one-week rise in seven months, which, combined with higher US yields across the curve, has been weighing on gold. Spot prices are now down about 2.5% on the week and more than 3.5% lower versus their pre-hawkish Fed levels. Analysts note that if the upcoming data releases (most importantly, the inflation data) feed into the narrative of more aggressive/front-loaded Fed tightening, thus further boosting the buck and yields, gold remains vulnerable to further losses.

That logic applies not only to the upcoming data on Friday, but also to next week’s data. Looking at XAU/USD from a technical perspective, its recent break below a medium-term upwards trend channel on Thursday that also saw the precious metal break below its 200-day moving average just above $1800 suggests further selling in on the cards. Bears will be looking for a test of recent November/December lows in the $1750 area.

Will central banks have to react to the inflation that will result from the energy transition? Economists at Natixis believe the answer is clearly no. A hike in central bank interest rates in response to this inflation would be absurd.

The energy transition will require massive additional investment

“Raising interest rates in response to inflation would reduce energy demand somewhat but would not change the fact that the cost of producing energy is higher. It is not excess energy demand that causes inflation, but the change in energy production technology.”

“The energy transition will require very significant investments, some of which have low financial returns (thermal renovation of housing, decarbonisation of industry). This will be all the easier as long-term interest rates remain low: raising interest rates in response to inflation would prevent these investments from being made.”

- EUR/USD sheds further ground and drops to new lows near 1.1120.

- A deeper pullback could expose a test of the 1.10 mark.

EUR/USD remains well under pressure and tumbles to the low-1.1100s, an area last visited in June 2020, on Friday.

Further downside appears likely in light of the ongoing price action. Against this, the next support could turn up at the round levels at 1.1100 and 1.1000, all ahead of May 2020 low at 1.0766 (May 7).

Extra losses in the pair remains well on the cards as long as it remains capped by the 4-month resistance line, today near 1.1340.

In the longer run, the negative outlook is seen unchanged below the key 200-day SMA at 1.1700.

EUR/USD daily chart

US PCE Price Index Overview

Friday's US economic docket highlights the release of the November Personal Consumption Expenditure (PCE) Price Index, scheduled later during the early North American session at 13:30 GMT. The headline gauge is expected to have edged lower to 0.5% in December from 0.6% previous, while the yearly rate is seen rising to 6.1% from 5.7% in November. The core reading is forecast to come in at 0.5% for the reported month and rise from a 4.8% YoY rate from 4.7%.

How Could it Affect EUR/USD?

A strong than expected reading will boost bets for a 50 bps Fed rate hike in March and push the US Treasury bond yields/US dollar higher. Conversely, a softer print might do little to derail the Fed's plan for an eventual liftoff in March or dent the prevalent strong bullish sentiment surrounding the buck. This, in turn, suggests that the path of least resistance for the EUR/USD pair is to the downside.

Meanwhile, Eren Sengezer, Editor at FXStreet, offered a brief technical outlook for the major: “the pair continues to show extremely oversold conditions with the Relative Strength Index (RSI) staying way below 40. Furthermore, EUR/USD is trading below the descending regression channel coming from mid-January. Even if the pair were rise above 1.1150 and return within the descending channel, sellers are likely to remain in control as long as the 1.1220 (upper limit of the descending channel) resistance holds..”

“On the downside, 1.1100 (psychological level) aligns as the next support. Back in January 2020, EUR/USD extended its decline to 1.1000 after it broke below 1.1100 and a similar action could be expected in the short term,” Eren added further.

Key Notes

• US PCE Inflation Preview: Dollar rally has more legs to run

• EUR/USD Forecast: No convincing recovery in sight for euro

• Further weakness lies ahead for EUR/USD – UOB

About the US PCE Price Index

The Personal Spending released by the Bureau of Economic Analysis, Department of Commerce is an indicator that measures the total expenditure by individuals. The level of spending can be used as an indicator of consumer optimism. It is also considered as a measure of economic growth: While Personal spending stimulates inflationary pressures, it could lead to raise interest rates. A high reading is positive (or Bullish) for the USD.

- EUR/GBP is flat in the 0.8320s as FX markets head into the weekend in a calmer mood.

- Looking ahead to next week, ECB and BoE policy meetings will dominate the headlines and the price action.

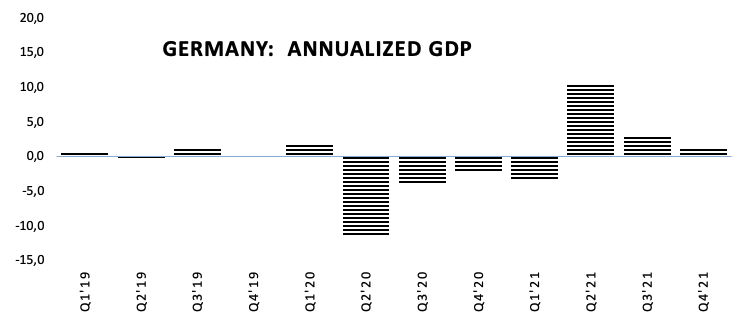

EUR/GBP trades flat on the day in the 0.8320s, just above multi-year lows just above the key 0.8300 level and late-2019/early-2020 lows around 0.8280. The pair has ignored the latest mixed Eurozone GDP numbers, which saw France and Spain both post better than expected QoQ Q4 growth rates of 0.7% and 2.0% respectively, whilst Germany saw a larger than expected QoQ contraction of 0.7%. GDP data aside, the Eurozone data slate has been heavy, with the latest European Commission Business and Consumer sentiment survey coming in a little weaker than expected in January and at its lowest since last April.

Elsewhere, the YoY rate of M3 money supply growth was a tad stronger than expected, whilst Import price growth in Germany slowed significantly more than expected in December. As with the GDP data, other releases were also ignored (hence why EUR/GBP is flat), as FX markets see some pre-weekend calm after a volatile week. On which note, EUR/GBP currently trades roughly 0.5% lower on the week and is currently about 1.2% below Monday’s highs in the 0.8420s, the pair reversing lower as FX market focus switched from risk-off to central bank divergence.

On which note, central banks will be a key theme for EUR/GBP traders next week with the BoE and ECB both announcing policy decisions next Thursday. No policy or guidance changes are expected from the latter, but the BoE is now near-unanimously expected to hike rates by 25bps to 0.5% and kick off a discussion on (or even kickstart) outright quantitative tightening (QT) that is likely to begin with ending reinvestments. Recall that the BoE said last year that when rates reached 0.5%, QT could begin. Many FX strategists expect this divergence to continue to drive EUR/GBP lower in the short-term and are targetting the multi-year lows in the 0.8280 area.

Risk appetite has been choppy and shakey this week and another sharp downturn, perhaps if strong US data triggers further hawkish Fed bets, presents some upside risk to the pair. Other things for investors to watch will be flash Eurozone January Consumer Price Inflation data in the early part of the week and German Factory Orders data on Friday.

- DXY records new cycle tops near 97.40 on Friday.

- Next on the upside is seen the June 2020 high at 97.80.

DXY pushes higher and clinches fresh highs in levels last seen in June 2020 in the 97.40/45 band on Friday.

The intense upside in the dollar quickly left behind the 97.00 barrier and remains well poised to extend the leg higher in the short-term horizon. That said, the door now remains open to a potential move to the June 2020 peak at 97.80 (June 30) ahead of the round level at 98.00.

In the short-term horizon, the upside pressure remains intact while above the 4-month line near 95.50. Looking at the broader picture, the longer-term positive stance in the dollar remains unchanged above the 200-day SMA at 93.35.

DXY daily chart

Senior Economist at UOB Group Alvin Liew comments on the last FOMC event (January 26).

Key Takeaways

“The Jan 2022 FOMC was seen as visibly hawkish as the Fed signaled clearly that the first policy rate hike will take place in the upcoming 15/16 March FOMC. Adding to the hawkish bias was the Fed’s opaqueness about the policy rate trajectory.”

“The FOMC statement also confirmed that the asset purchase program (QE) tapering will be further reduced in Feb 2022 (increase its holdings of Treasury securities by at least $20 billion per month and of agency mortgage-backed securities by at least $10 billion per month) and be completed by early Mar 2022, before the 15/16 March FOMC.”

“The FOMC also released a document titled the “Principles for Reducing the Size of the Federal Reserve's Balance Sheet” of which the FOMC members affirmed that the Federal funds rate remains the primary tool for the Fed’s monetary policy… Powell during the press conference said no decision was taken at the Jan FOMC meeting on the pace of the balance sheet runoff or when it would start, adding that the Fed will discuss balance sheet at next two meetings.”

“FOMC Outlook: We now expect the first Fed funds target rate (FFTR) hike will be in Mar 2022 FOMC by 25bps to 0.25-0.50%, followed by 3 more 25bps hikes in Jun 2022, Sep 2022 and Dec 2022, bringing the FFTR to the range of 1.0-1.25% by end of 2022. Risks are evidently skewed toward more aggressive and frequent Fed hikes in 2022, and will largely depend on the inflation path, especially if price increase accelerates significantly in 1Q due to Omicron-related factors, wage increases and inflation expectations. That said, Powell did note that Omicron will surely weigh on 1Q 2022 GDP growth and that makes us hesitate to call for a more aggressive opening hike.”

- AUD/USD extended its recent downfall and dived to the lowest level since July 2020 on Friday.

- The Fed's hawkish stance, elevated US bond yields underpinned the USD and exerted pressure.

- The risk-off mood further contributed to driving flows away from the perceived riskier aussie.

The AUD/USD pair continued losing ground through the mid-European session and dropped to its lowest level since July 2020, around the 0.6970-0.6965 region in the last hour.

Following an early uptick to the 0.7045 area, the AUD/USD pair met with a fresh supply on the last day of the week and prolonged its recent rejection slide from the 100-day SMA. This marked the third successive day of a negative move – also the fifth in the previous six – and was sponsored by a combination of factors.

The US dollar remained well supported by expectations for a more aggressive policy response by the Fed to contain stubbornly high inflation. In fact, the markets have started pricing in the possibility of five quarter-point rate hikes by the end of 2022 and also expect that the first hike in March could be 50 basis points.

This was reinforced by a fresh leg up in the US Treasury bond yields, which continued acting as a tailwind for the buck. Apart from this, the risk-off mood – as depicted by a weaker tone around the equity markets – further benefitted the safe-haven greenback and drove flows away from the perceived riskier aussie.

The combination of negative forces contributed to the AUD/USD pair's ongoing decline, taking along some short-term trading stops placed near the key 0.7000 psychological mark. Hence, the latest leg down witnessed over the past hour or so could further be attributed to some technical selling below the mentioned handle.

It will now be interesting to see if the AUD/USD pair is able to find any support at lower levels amid slightly oversold conditions on short-term charts. Market participants now look forward to the US macro data – the Core Personal Consumption Expenditure Price index and revised Michigan Consumer Sentiment Index – for a fresh impetus.

Technical levels to watch

- EUR/JPY extends the erratic performance so far this week.

- The cross appears supported around 128.20.

EUR/JPY regains upside traction and leaves behind Thursday’s pullback.

In light of the recent price action, the cross seems to have moved into a consolidative phase, with support emerging around 128.20 for the time being. On the upside, there is a temporary and initial hurdle at the 55-day SMA at 129.29. The surpass of the latter could alleviate the downside pressure and allow for a probable move to the more relevant 200-day SMA.

While below the 200-day SMA AT 130.48, the outlook for the cross is expected to remain negative.

EUR/JPY daily chart

UOB Group’s Senior Economist Julia Goh and Economist Loke Siew Ting review the latest GDP figures in the Philippines.

Key Takeaways

“The Philippines’ economy recovered at a faster-than-expected pace of 7.7% y/y in 4Q21 (UOB est: +7.0%; Bloomberg est: +6.3%; 3Q21: +6.9%), bolstered by all sectors and resilient household consumption. For the full year of 2021, GDP expanded by 5.6%, in line with our projection of 5.5% (official est: 5.0%-5.5%; 2020: -9.6%).”

“Notwithstanding a stronger growth rebound in 4Q21, we maintain our 2022 full-year GDP growth forecast at 6.5%, lower than the government’s 7.0%-9.0% target, as the growth outlook remains subject to downside risks. Downside risks could arise from the pandemic, prolonged global supply chain bottlenecks, softening global growth momentum, tighter global financial conditions, and domestic policy uncertainty post the presidential elections on 9 May.”

“Although BSP has inclined to err on the side of sustaining growth rather than fighting transitory inflation, the Fed’s abrupt shift in policy since Dec 2021 has piled pressure on other central banks including BSP to embark on a wider normalization path this year. Following our revised Fed outlook this morning (27 Jan, see details in report), we are now expecting BSP to raise policy rate twice this year (+25bps each in 3Q22 and 4Q22), versus our previous forecast of just one 25bps hike in 3Q22. This will bring the overnight reverse repurchase rate to 2.50% by end-2022 (from 2.00% currently).”

UOB Group’s FX Strategists now see the upside momentum lifting USD/CNH to the 6.3975 level in the next weeks.

Key Quotes

24-hour view: “While we detected the ‘build-up in momentum’ yesterday and expected USD to advance, we were of the view that ‘the resistance at 6.3555 may not be easy to break’. However, USD has no problem cracking 6.3555 as it rocketed to 6.3755 before easing. The advance is deeply overbought but there is room for USD to test 6.3800 before easing. The next resistance at 6.3975 is unlikely to come into the picture for now. Support is at 6.3600 followed by 6.3530.”

Next 1-3 weeks: “Yesterday (27 Jan, spot at 6.3425), we indicated that the recent weak phase in USD has ended. We noted shorter-term upward momentum is beginning to build but USD has to clear 6.3555 before a sustained advance is likely. We did not anticipate the rapid upward acceleration as USD lifted off and closed sharply higher (+0.47%). Strong boost in momentum is likely to lead to further USD strength. Next resistance level of note is at 6.3975. The upside risk is intact as long as USD does not move below 6.3490 (‘strong support’ level was at 6.3270 yesterday).”

- Gold continued losing ground for the third straight day and dropped to a three-week low.

- The Fed's hawkish stance, elevated US bond yields, stronger USD contributed to the slide.

- The prevalent risk-off mood could help limit any further losses for the safe-haven metal.

Gold extended the post-FOMC decline and witnessed some follow-through selling for the third successive day on Friday. The bearish pressure remained unabated through the first half of the European session and dragged spot prices to a fresh three-week low, around the $1,790 region.

The Fed took a more hawkish stance on Wednesday and indicated that it could raise interest rates at a faster pace than anticipated to contain surging inflation. The money market was quick to react and started pricing in the possibility of five quarter-point rate hikes by the end of 2022. Short-term interest rate futures also imply a 20% risk that the first hike in March could be 50 basis points. This, in turn, pushed the 2-year US government bond yields, which is more sensitive to rate hike expectations, to a 23-month high and continued driving flows away from the non-yielding gold.

Expectations for a more aggressive policy response by the Fed, along with elevated US Treasury bond yields pushed the US dollar to the highest level since July 2020. The greenback was further underpinned by Thursday's release of the Advance US GDP report, which showed that the world's largest economy grew at a 6.9% annualize pace during the fourth quarter. For 2021 as a whole, the economy expanded by 5.8% and notched its strongest growth in nearly four decades. A stronger buck was seen as another factor that exerted pressure on the dollar-denominated gold and contributed to the decline.

Apart from this, Friday's downfall could further be attributed to some technical selling on a sustained break below the $1,800 round-figure mark. That said, the prevalent risk-off mood – amid concerns about a potential armed conflict in Ukraine – could hold back bearish traders and limit losses for the safe-haven gold. Traders now eye US macro releases – the Core Personal Consumption Expenditure Price index and revised Michigan Consumer Sentiment Index – for a fresh impetus. Nevertheless, the XAU/USD remains on track to record its worst weekly slide since late November.

Technical outlook

From a technical perspective, gold has now confirmed a near-term bearish break below an upward sloping trend-line extending from the August 2021 swing low. This, in turn, supports prospects for a further depreciating move. The negative outlook is reinforced by bearish technical indicators on the daily chart, which are still far from being in the oversold territory. Hence, a subsequent fall towards the $1,785 intermediate support, en-route the $1,770-$1.768 region, remains a distinct possibility.

On the flip side, attempted recovery moves might now confront stiff resistance near the mentioned ascending trend-line support breakpoint, around the $1,798 region. Any further move up could be seen as a selling opportunity and remain capped near the very important 200-day SMA, currently around the $1,805 area. The latter should act as a pivotal point for traders, which if cleared decisively might trigger a short-covering move towards the $1,830-$1,832 static resistance.

Gold daily chart

-637789631161781321.png)

Levels to watch

- Euro area consumer and business sentiment deteriorated slightly in January.

- EUR/USD continues to trade in the negative territory below 1.1150.

The monthly data published by the European Commission showed on Friday that the Economic Sentiment Indicator (ESI) eased further in January in both the EU (-1.4 points to 111.6) and the euro area (-1.1 points to 112.7). The market expectation was for the ESI to improve to 114.5 in the euro area.

Further details of the publication revealed that Industrial Confidence declined to 13.9 in the euro area from 14.6 and Services Sentiment edged lower to 91. from 10.9. Both of these prints came in worse than analysts' estimates.

Finally, Consumer Confidence fell by 0.4 points to -8.5, slightly weaker than the flash estimate of -8.4.

Market reaction

The shared currency showed no immediate reaction to these figures. As of writing, the EUR/USD pair was down 0.1% on a daily basis at 1.1132.

USD/INR has enjoyed a four-day winning streak though is retreating from five-week highs of 75.31 on Friday. Still, economists at Société Générale expect the pair to test the 75.50/70 region.

Revisit of 75.50/75.70 on the cards

“A quick rebound is under way and it could retest graphical levels of 75.50/75.70.”

“Only a break below 200-DMA at 74.30 would denote a deeper pullback.”

- EUR/USD extends the downside to 1.1120 on Friday.

- German Q4 GDP expanded 1.4% YoY, contracted 0.7% QoQ.

- US PCE, Consumer Sentiment next of relevance in the NA session.

The single currency extends the weakness for yet another session and drags EUR/USD to fresh lows in the 1.1120 region at the end of the week.

EUR/USD remains weak post-FOMC

EUR/USD sheds ground for the fifth consecutive session on Friday, dropping to levels last traded in June 2020 in the 1.1130/20 band and always on the back of the intense rally in the greenback.

Indeed, the strong upside in the greenback remains bolstered by the firm sentiment sparked following the FOMC gathering on Wednesday, which lent extra wings to the buck and propelled the US Dollar Index to new cycle highs.

In the domestic calendar, the German economy expanded at an annualized 1.4% in the October-December period and contracted 0.7% inter-quarter, as per the release of the GDP figures. In addition, ECB’s M3 Money Supply expanded 6.9% in the year to December.

In the NA session, the inflation figures gauged by the PCE will take centre stage seconded by the final U-Mich Index and Personal Income/Spending.

What to look for around EUR

The selloff in EUR/USD remains unabated and the pair now approaches the 1.1100 level amidst the relentless march north in the dollar. Moving forward, dark clouds seem to be piling up when it comes to the outlook for the pair, particularly in light of the Fed’s imminent start of the tightening cycle vs. the accommodative-for-longer stance in the ECB, despite the high inflation in the euro area is not giving any things of cooling down for the time being. On another front, the unabated advance of the coronavirus pandemic remains as the exclusive factor to look at when it comes to economic growth prospects and investors’ morale in the region.

Key events in the euro area this week: Germany Advanced Q4 GDP, EMU Final Consumer Confidence (Friday).

Eminent issues on the back boiler: Asymmetric economic recovery post-pandemic in the euro area. ECB stance/potential reaction to the persistent elevated inflation in the region. ECB tapering speculation/rate path. Italy elects President of the Republic in late January. Presidential elections in France in April.

EUR/USD levels to watch