- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 27-06-2014

Stock indices traded mixed after the better-than-expected economic data from Germany and France. The German preliminary consumer price index (CPI) climbed 0.3% in June, beating forecasts of a 0.2% gain, after a 0.1% decline in May. On a yearly basis, German preliminary CPI rose 1.0% in June, after a 0.9% rise in May.

The consumer spending in France increased 1.0% in May, exceeding expectations for a 0.3% gain, after a 0.3% decline in April.

On a yearly basis, the consumer spending in France declined 0.6% in May, after a 0.5% drop in April.

The gross domestic product in the U.K. rose 0.8% in the first quarter, in line with expectations, after a 0.8% gain the previous quarter. On a yearly basis, the U.K. GDP increased 3.0% in the first quarter, missing forecasts of a 3.1% rise, after a 3.1% gain the previous quarter.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,757.77 +22.65 +0.34%

DAX 9,815.17 +10.27 +0.10%

CAC 40 4,436.98 -2.65 -0.06%

Brent headed for the first weekly drop since violence erupted in Iraq amid speculation that oil output would remain safe in OPEC's second-biggest producer. West Texas Intermediate was steady in New York.

Futures were little changed in London and down 1.2 percent from June 20, the biggest weekly drop since April. Iraqi forces held the Baiji refinery in the north after repelling the latest attack by Islamist militants. Fighting hasn't spread to the south, home to more than three-quarters of the nation's oil production. U.S. crude stockpiles increased last week for the first time since May, according to the Energy Information Administration.

"Right now we are focusing hard on the situation in Iraq, although concern may have been a bit inflated," Jens Pedersen, an analyst at Danske Bank A/S in Copenhagen, said by e-mail. "The short-term risks to the oil market are limited."

Brent for August settlement was at $113.37 a barrel on the London-based ICE Futures Europe exchange, up 16 cents, at 1:12 p.m. London time. The volume of all futures traded was about 48 percent below the 100-day average for the time of day. Prices have climbed 2.3 percent this year.

WTI for August delivery was little changed after earlier sliding as much as 36 cents to $105.48 a barrel in electronic trading on the New York Mercantile Exchange. Prices are down 1.3 percent this week. The U.S. benchmark crude was at a discount of $7.48 to Brent on ICE, compared with $7.98 on June 20.

The U.S. dollar traded slightly lower against the most major currencies after the better-than-expected Reuters/Michigan consumer sentiment. Reuters/Michigan consumer sentiment index rose to 82.5 in June from 81.2 in May, exceeding expectations for an increase to 82.2.

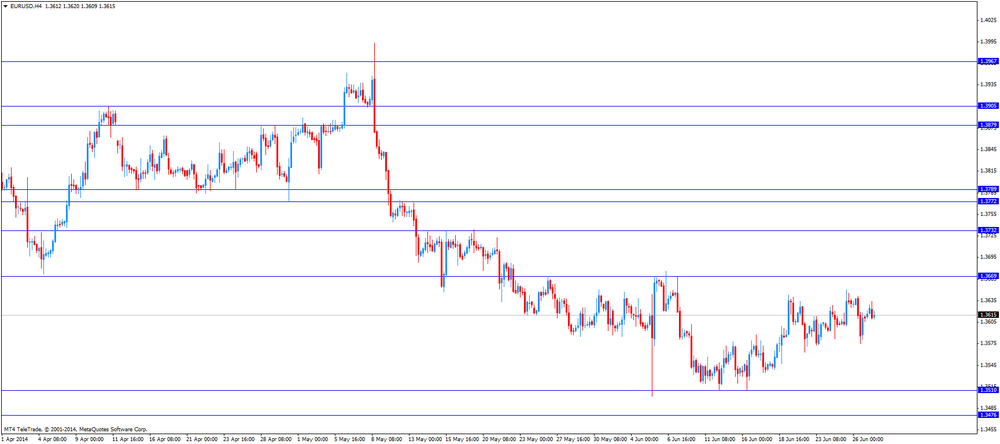

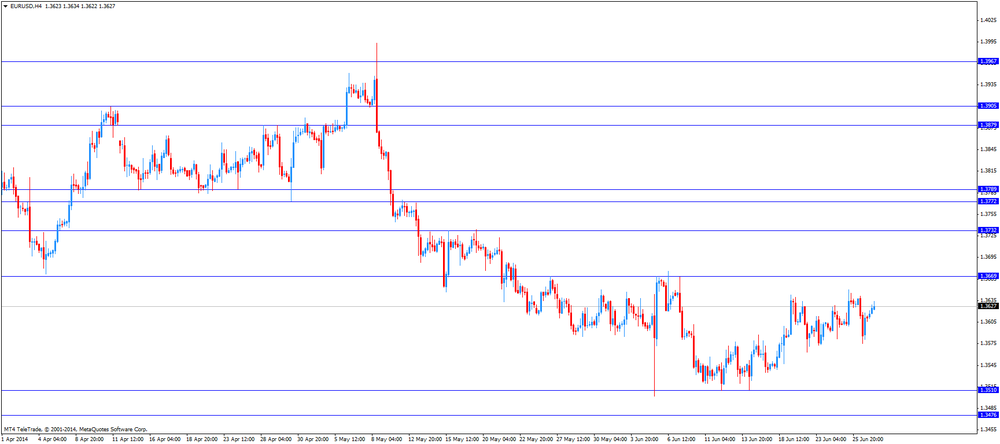

The euro traded higher against the U.S. dollar after the German and French economic data. The German preliminary consumer price index (CPI) climbed 0.3% in June, beating forecasts of a 0.2% gain, after a 0.1% decline in May. On a yearly basis, German preliminary CPI rose 1.0% in June, after a 0.9% rise in May.

The consumer spending in France increased 1.0% in May, exceeding expectations for a 0.3% gain, after a 0.3% decline in April.

On a yearly basis, the consumer spending in France declined 0.6% in May, after a 0.5% drop in April.

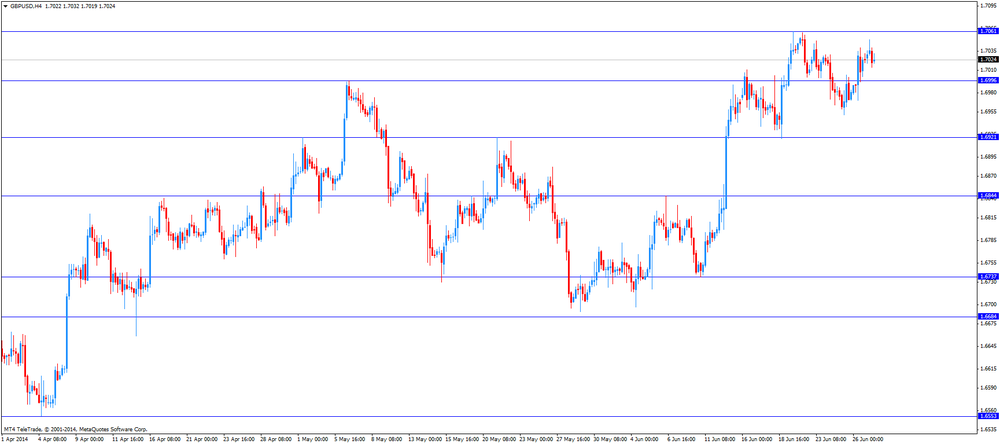

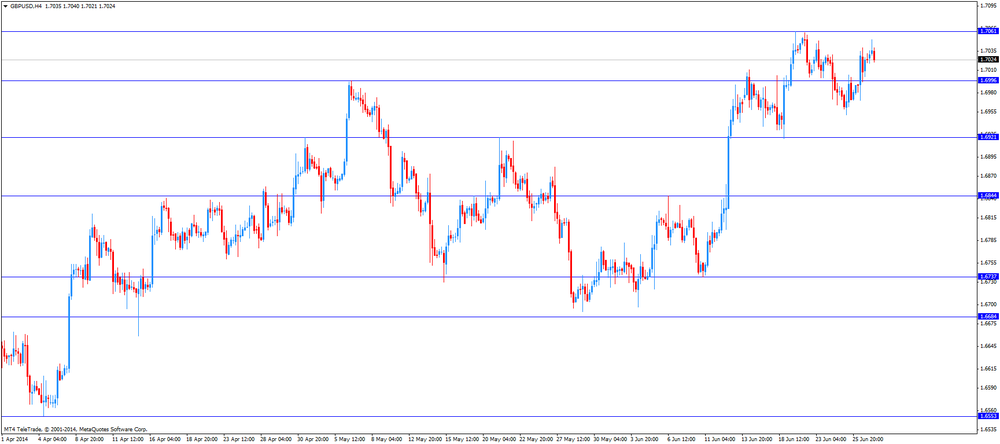

The British pound traded slightly higher against the U.S. dollar after the U.K. economic data. The gross domestic product in the U.K. rose 0.8% in the first quarter, in line with expectations, after a 0.8% gain the previous quarter. On a yearly basis, the U.K. GDP increased 3.0% in the first quarter, missing forecasts of a 3.1% rise, after a 3.1% gain the previous quarter.

The U.K. current account deficit declined to £18.5 billion in the first quarter, from £23.5 billion in the fourth quarter of 2013. The fourth quarter's figure was revised down from a deficit of £22.4 billion. Analysts had expected the current account deficit to decrease to £17.1 billion.

Business Investment in the U.K. rose 5.0% in first quarter, exceeding expectations for a 2.7% gain, after a 2.7% rise the previous quarter. On a yearly basis, business Investment in the U.K. surged 10.6% in first quarter, beating expectations for a 8.7% rise, after a 2.7% increase the previous quarter.

The Swiss franc increased against the U.S. dollar after the release of KOF leading indicator. The KOF leading indicator for Switzerland increased to 100.4 in June from 99.8 in May, beating expectations for a decline to 99.1.

The Canadian dollar climbed against the U.S. dollar. The raw material price index in Canada declined 0.4% in May, missing expectations for a 1.3% increase, after a 0.1% gain in April.

The industrial product prices in Canada decreased 0.5% in May, missing expectations for a 0.4% rise, after a 0.2% decline in April.

The New Zealand dollar traded slightly higher against the U.S dollar. New Zealand's trade balance declined to NZ$285 million in May from NZ$498 million in April, beating expectations for a drop to NZ$250 million. April's figure was revised down from NZ$534 million.

The Australian dollar traded mixed against the U.S. dollar in the absence of any major economic data in Australia.

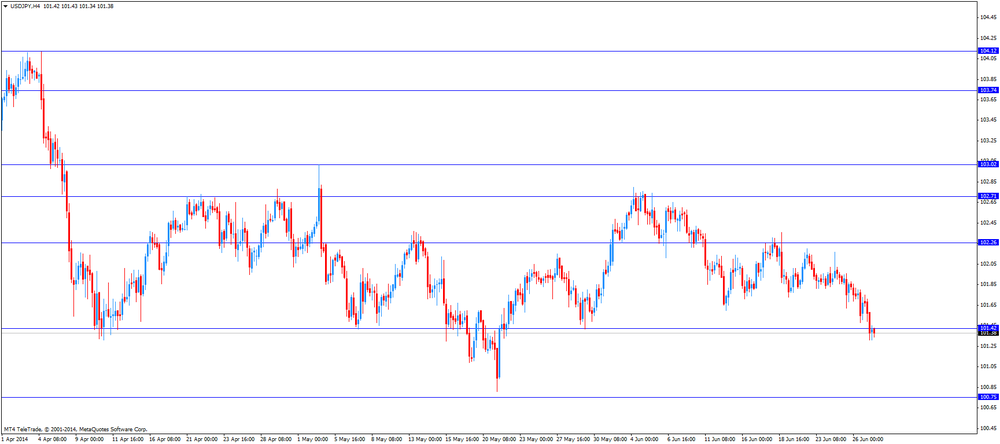

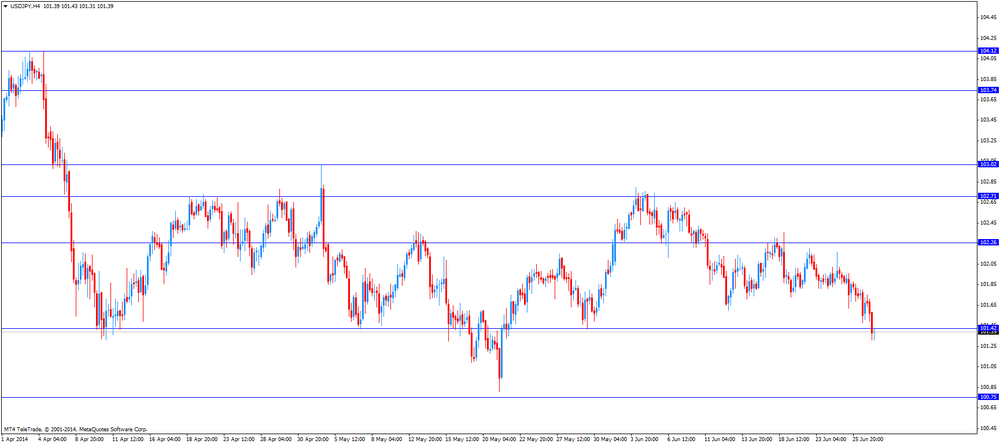

The Japanese yen traded mixed against the U.S. dollar. Japan's national CPI excluding fresh food increased 3.4% in May, in line with expectations, after a 3.2% gain.

Japan's national CPI rose 3.4% in May, after a 3.4% gain.

The Japanese unemployment rate declined to 3.4% in May, exceeding expectations for 3.6%, after 3.6% in April.

Household spending in Japan dropped 8%, missing expectations for a 1.9% decline in May, after a 4.6% decrease in April.

Retail sales in Japan decreased 0.4% in May, after a 4.3% decline in April. Analysts had expected a 1.9% decline.

Gold prices show a moderately positive trend after declining the previous day, as investors weighed news about illegal transactions with the metal to obtain loans in the PRC and signs that U.S. inflation is accelerating.

During the investigation conducted by the Chinese authorities became aware of the loans totaling 94.4 billion yuan (15.2 billion dollars), which are associated with the possible misuse of gold as collateral for loans since 2012. According to the report of the National Audit Office of China, check zolotoobrabatyvayuschih 25 companies revealed a large amount of illegally obtained loans secured by gold. Recipients of loans used the funds to profit from the spreads on interest rates and foreign exchange market. However, management did not specify what was the structure of these loans or making them illegal.

For some traders investigation in respect of loans with gold as collateral raises doubts about the future of such loans in China, said Edward Meir, a senior strategist at INTL FCStone.

Market participants fear that "the authorities are tightening the terms of this type of lending, which in turn could weaken import demand," - he added.

However, it is too early to assess the impact of the results of this investigation on the world gold market, as the details are still unclear, warned Jim Wyckoff, senior analyst at Kitco.

"We do not know much about this situation - he said. - The situation is evolving, but $ 15 billion - this is not a small amount, "- said Woolfolk.

However, gold prices have recovered somewhat from the sharp decline after data showed that the price index for personal consumption expenditures, a key indicator of inflation, rose by 1.8% compared with the same period last year. This is the strongest growth in 19 months.

Gold is considered by some investors, holds its value better rates or Treasury bonds, and they tend to buy the metal as a hedge against inflation.

The cost of the August gold futures on the COMEX today rose to $ 1323.1 per ounce.

EUR/USD $1.3550, $1.3570-75, $1.3600, $1.3650

USD/JPY Y101.45, Y102.15, Y102.25, Y102.50

GBP/USD $1.6900, $1.7000, $1.7050-60

EUR/GBP stg0.7965

AUD/USD $0.9350, $0.9450

USD/CAD C$1.0700, C$1.0750

U.S. stock-index futures fell as investors awaited data on U.S. consumer confidence to gauge the health of the world's largest economy.

Global markets:

Nikkei 15,095 -213.49 -1.39%

Hang Seng 23,221.52 +23.69 +0.10%

Shanghai Composite 2,036.51 -2.17 -0.11%

FTSE 6,748.81 +13.69 +0.20%

CAC 4,441.2 +1.57 +0.04%

DAX 9,819.47 +14.57 +0.15%

Crude oil $106.10 (+0.24%)

Gold $1318.00 (+0.08%)

(company / ticker / price / change, % / volume)

| Procter & Gamble Co | PG | 78.63 | +0.01% | 2.3K |

| Walt Disney Co | DIS | 84.47 | +0.02% | 0.4K |

| United Technologies Corp | UTX | 115.80 | +0.04% | 0.1K |

| Visa | V | 209.07 | +0.05% | 0.3K |

| Pfizer Inc | PFE | 29.61 | +0.07% | 1.4K |

| Intel Corp | INTC | 30.82 | +0.13% | 8.5K |

| Nike | NKE | 79.04 | +2.84% | 19.7K |

| AT&T Inc | T | 35.23 | -0.09% | 2.4K |

| General Electric Co | GE | 26.26 | -0.11% | 5.6K |

| Cisco Systems Inc | CSCO | 24.62 | -0.12% | 2.6K |

| McDonald's Corp | MCD | 101.38 | -0.13% | 0.5K |

| JPMorgan Chase and Co | JPM | 57.30 | -0.16% | 0.1K |

| Boeing Co | BA | 127.75 | -0.21% | 2.3K |

| Verizon Communications Inc | VZ | 49.09 | -0.24% | 10.6K |

| Exxon Mobil Corp | XOM | 101.67 | -0.35% | 1.4K |

| The Coca-Cola Co | KO | 41.85 | -0.43% | 5.2K |

| E. I. du Pont de Nemours and Co | DD | 65.86 | -2.72% | 52.8K |

Upgrades:

Intel (INTC) upgraded to Mkt Perform from Underperform at Bernstein

Downgrades:

Other:

Google (GOOG) target raised to $686 from $675 at Citigroup

Nike (NKE) target raised to $76 from $71 at Canaccord Genuity

UnitedHealth (UNH) initiated with an Underperform at Sterne Agee

Nike (NKE) target raised to $80 from $77 at Janney

RBC Capital Mkts raises their Alcoa (AA) target to $16 from $15

Economic calendar (GMT0):

06:45 France Consumer spending May -0.3% +0.3% +1.0%

06:45 France Consumer spending, y/y May -0.5% -0.6%

07:00 Switzerland KOF Leading Indicator June 99.8 99.1 100.4

08:30 United Kingdom Current account, bln Quarter I -22.4 -17.1 -18.5

08:30 United Kingdom Business Investment, q/q Quarter I +2.7% +2.7% +5.0%

08:30 United Kingdom Business Investment, y/y Quarter I +8.7% +8.7% +10.6%

08:30 United Kingdom GDP, q/q (Finally) Quarter I +0.8% +0.8% +0.8%

08:30 United Kingdom GDP, y/y (Finally) Quarter I +3.1% +3.1% +3.0%

09:00 Eurozone EU Economic Summit

The U.S. dollar traded mixed against the most major currencies due to yesterday's weak U.S. economic data. Personal incomes in the U.S. increased by 0.4% in May, missing expectations for a 0.5% gain, after a 0.3% rise in April.

Personal spending in the U.S. rose 0.2% in June, missing forecasts of a 0.4% increase, after a 0.1% decline in May.

The euro traded mixed against the U.S. dollar. The consumer spending in France increased 1.0% in May, exceeding expectations for a 0.3% gain, after a 0.3% decline in April.

On a yearly basis, the consumer spending in France declined 0.6% in May, after a 0.5% drop in April.

The British pound traded lower against the U.S. dollar after the U.K. economic data. The gross domestic product in the U.K. rose 0.8% in the first quarter, in line with expectations, after a 0.8% gain the previous quarter. On a yearly basis, the U.K. GDP increased 3.0% in the first quarter, missing forecasts of a 3.1% rise, after a 3.1% gain the previous quarter.

The U.K. current account deficit declined to £18.5 billion in the first quarter, from £23.5 billion in the fourth quarter of 2013. The fourth quarter's figure was revised down from a deficit of £22.4 billion. Analysts had expected the current account deficit to decrease to £17.1 billion.

Business Investment in the U.K. rose 5.0% in first quarter, exceeding expectations for a 2.7% gain, after a 2.7% rise the previous quarter. On a yearly basis, business Investment in the U.K. surged 10.6% in first quarter, beating expectations for a 8.7% rise, after a 2.7% increase the previous quarter.

The Swiss franc traded mixed against the U.S. dollar after the release of KOF leading indicator. The KOF leading indicator for Switzerland increased to 100.4 in June from 99.8 in May, beating expectations for a decline to 99.1.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair declined to $1.7014

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:00 Germany CPI, m/m (Preliminary) June -0.1% +0.2%

12:00 Germany CPI, y/y (Preliminary) June +0.9%

12:30 Canada Raw Material Price Index May +0.1% +1.3%

13:55 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) June 81.2 82.2

EUR/USD

Offers $1.3695/00, $1.3688, $1.3670/80, $1.3650

Bids $1.3595, $1.3580, $1.3550, $1.3535, $1.3515/10

GBP/USD

Offers $1.7110/20, $1.7090, $1.7080/85, $1.7062

Bids $1.6950, $1.6920, $1.6910/00, $1.6845

AUD/USD

Offers $0.9545, $0.9500, $0.9460, $0.9450

Bids $0.9400, $0.9350, $0.9320, $0.9300, $0.9255, $0.9230

EUR/JPY

Offers Y140.00, Y139.50, Y139.20, Y139.00, Y138.55

Bids Y137.90, Y137.70, Y137.00

USD/JPY

Offers Y102.80, Y102.65, Y102.40, Y102.20, Y101.90

Bids Y101.00, Y100.80, Y100.45, Y100.00

EUR/GBP

Offers stg0.8100, stg0.8080, stg0.8050, stg0.8040

Bids stg0.7980, stg0.7950, stg0.7900

Stock indices traded little changed after the better-than-expected consumer spending in France. The consumer spending in France increased 1.0% in May, exceeding expectations for a 0.3% gain, after a 0.3% decline in April.

On a yearly basis, the consumer spending in France declined 0.6% in May, after a 0.5% drop in April.

The gross domestic product in the U.K. rose 0.8% in the first quarter, in line with expectations, after a 0.8% gain the previous quarter. On a yearly basis, the U.K. GDP increased 3.0% in the first quarter, missing forecasts of a 3.1% rise, after a 3.1% gain the previous quarter.

Current figures:

Name Price Change Change %

FTSE 100 6,742.54 +7.42 +0.11%

DAX 9,803.76 -1.14 -0.01%

CAC 40 4,443.54 +3.91 +0.09%

Most Asian stock traded lower due to comments by St. Louis Fed President James Bullard. He told Fox Business Network on Thursday that the Fed' interest rate hike by the end of the first quarter in 2015 will be appropriate, if the U.S. economy grows 3% in the next four quarters.

Japan's national CPI excluding fresh food increased 3.4% in May, in line with expectations, after a 3.2% gain in April.

The Japanese unemployment rate declined to 3.4% in May, exceeding expectations for 3.6%, after 3.6% in April.

Household spending in Japan dropped 8%, missing expectations for a 1.9% decline in May, after a 4.6% decrease in April.

Retail sales in Japan decreased 0.4% in May, after a 4.3% decline in April. Analysts had expected a 1.9% decline.

Indexes on the close:

Nikkei 225 15,095 -213.49 -1.39%

Hang Seng 23,221.52 +23.69 +0.10%

Shanghai Composite 2,036.51 -2.17 -0.11%

Oracle Corp. Japan declined 5.1% after missing its operating-profit forecast estimates.

Economic calendar (GMT0):

06:45 France Consumer spending May -0.3% +0.3% +1.0%

06:45 France Consumer spending, y/y May -0.5% -0.6%

07:00 Switzerland KOF Leading Indicator June 99.8 99.1 100.4

08:30 United Kingdom Current account, bln Quarter I -22.4 -17.1 -18.5

08:30 United Kingdom Business Investment, q/q Quarter I +2.7% +2.7% +5.0%

08:30 United Kingdom Business Investment, y/y Quarter I +8.7% +8.7% +10.6%

08:30 United Kingdom GDP, q/q (Finally) Quarter I +0.8% +0.8% +0.8%

08:30 United Kingdom GDP, y/y (Finally) Quarter I +3.1% +3.1% +3.0%

09:00 Eurozone EU Economic Summit

The U.S. dollar traded lower against the most major currencies after comments by St. Louis Fed President James Bullard. He told Fox Business Network that the Fed' interest rate hike by the end of the first quarter in 2015 will be appropriate, if the U.S. economy grows 3% in the next four quarters.

The New Zealand dollar traded higher against the U.S dollar after New Zealand's better-than-expected trade balance surplus. New Zealand's trade balance declined to NZ$285 million in May from NZ$498 million in April, beating expectations for a drop to NZ$250 million. April's figure was revised down from NZ$534 million.

The Australian dollar traded higher against the U.S. dollar in the absence of any major economic data in Australia. The Aussie was supported by the weak U.S. economic data.

The Japanese yen rose against the U.S. dollar after the economic data from Japan. Japan's national CPI excluding fresh food increased 3.4% in May, in line with expectations, after a 3.2% gain in April.

Japan's national CPI rose 3.4% in May, after a 3.4% gain.

The Japanese unemployment rate declined to 3.4% in May, exceeding expectations for 3.6%, after 3.6% in April.

Household spending in Japan dropped 8%, missing expectations for a 1.9% decline in May, after a 4.6% decrease in April.

Retail sales in Japan decreased 0.4% in May, after a 4.3% decline in April. Analysts had expected a 1.9% decline.

EUR/USD: the currency pair increased to $1.3630

GBP/USD: the currency pair rose to $1.7050

USD/JPY: the currency pair declined Y101.30

The most important news that are expected (GMT0):

12:00 Germany CPI, m/m (Preliminary) June -0.1% +0.2%

12:00 Germany CPI, y/y (Preliminary) June +0.9%

12:30 Canada Raw Material Price Index May +0.1% +1.3%

13:55 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) June 81.2 82.2

EUR/USD $1.3550, $1.3570-75, $1.3600, $1.3650

USD/JPY Y101.45, Y102.15, Y102.25, Y102.50

GBP/USD $1.6900, $1.7000, $1.7050-60

EUR/GBP stg0.7965

AUD/USD $0.9350, $0.9450

USD/CAD C$1.0700, C$1.0750

EUR / USD

Resistance levels (open interest**, contracts)

$1.3712 (2737)

$1.3677 (2238)

$1.3650 (3721)

Price at time of writing this review: $ 1.3626

Support levels (open interest**, contracts):

$1.3599 (1569)

$1.3584 (1076)

$1.3561 (3836)

Comments:

- Overall open interest on the CALL options with the expiration date July, 3 is 31908 contracts, with the maximum number of contracts with strike price $1,3700 (5154);

- Overall open interest on the PUT options with the expiration date July, 3 is 41676 contracts, with the maximum number of contracts with strike price $1,3500 (5678);

- The ratio of PUT/CALL was 1.31 versus 1.28 from the previous trading day according to data from June, 26

GBP/USD

Resistance levels (open interest**, contracts)

$1.7300 (383)

$1.7201 (2018)

$1.7102 (2329)

Price at time of writing this review: $1.7039

Support levels (open interest**, contracts):

$1.6994 (1652)

$1.6899 (2214)

$1.6800 (1776)

Comments:

- Overall open interest on the CALL options with the expiration date July, 3 is 23148 contracts, with the maximum number of contracts with strike price $1,7005 (4173);

- Overall open interest on the PUT options with the expiration date July, 3 is 26827 contracts, with the maximum number of contracts with strike price $1,6700 (2412);

- The ratio of PUT/CALL was 1.16 versus 1.24 from the previous trading day according to data from June, 26

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.