- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 27-05-2014

Gold $1,265.40 -28.00 -2.16%

ICE Brent Crude Oil $110.02 -0.52 -0.47%

NYMEX Crude Oil $104.09 +0.07 +0.07%

Nikkei 14,636.52 +34.00 +0.23%

Hang Seng 22,944.3 -18.88 -0.08%

Shanghai Composite 2,034.57 -6.91 -0.34%

S&P 1,911.91 +11.38 +0.60%

NASDAQ 4,237.07 +51.26 +1.22%

Dow 16,675.5 +69.23 +0.42%

FTSE 1,378.82 +2.38 +0.17%

CAC 40 4,529.75 +2.82 +0.06%

DAX 9,940.82 +48.00 +0.49%

EUR/USD $1,3633 -0,08%

GBP/USD $1,6808 -0,19%

USD/CHF Chf0,8966 +0,21%

USD/JPY Y102,01 +0,09%

EUR/JPY Y139,08 +0,01%

GBP/JPY Y171,46 -0,09%

AUD/USD $0,9257 +0,21%

NZD/USD $0,8562 +0,15%

USD/CAD C$1,0857 0,00%

00:00 Japan BOJ Governor Haruhiko Kuroda Speaks

00:30 Australia Leading Index March 0.0%

01:00 New Zealand ANZ Business Confidence May 64.8

01:30 Australia Construction Work Done Quarter I -1.0% -0.3%

05:45 Switzerland Gross Domestic Product (QoQ) Quarter I +0.2% +0.5%

05:45 Switzerland Gross Domestic Product (YoY) Quarter I +1.7% +2.1%

06:00 Switzerland UBS Consumption Indicator April 1.84

06:45 France Consumer spending April +0.4% +0.5%

06:45 France Consumer spending, y/y April -1.2%

07:55 Germany Unemployment Change May -25 -14

07:55 Germany Unemployment Rate s.a. May 6.7% 6.7%

08:00 Eurozone M3 money supply, adjusted y/y April +1.1% +1.2%

08:00 Eurozone Private Loans, Y/Y April -2.2% -2.1%

10:00 United Kingdom CBI retail sales volume balance May 30 36

23:50 Japan Retail sales, y/y April +11.0% -3.2%

Stock

indices increased due to the better-than-expected U.S. durable goods orders. U.S.

durable goods orders rose 0.8% in April, after a 2.9% gain in March. March’s

figure was revised up to 2.9% from 2.6%. April’s increase of durable goods

orders was driven by demand for defence goods

The

consumer confidence index in the U.S. climbed to 83.0 in May, from 81.7 in

April. April’s figure was revised down from 82.3.

The

European Central Bank President Mario Draghi said at the conference in Sintra on

Tuesday the ECB is aware of risks from low inflation. He added that the ECB had

the tools to get inflation in the Eurozone back close to 2%. His comments have

fanned expectations for further stimulus measures by the ECB in June.

Aveva Group

Plc shares increased 9.1% after reporting the better-than-expected annual

profit.

InterContinental

Hotels Group Plc shares climbed 3.7% after the company rejected a takeover bid.

Indexes on

the close:

Name Price Change Change %

FTSE

100 6,844.94 +29.19 +0.43%

DAX 9,940.82 +48.00 +0.49%

CAC 40 4,529.75 +2.82 +0.06%

The U.S.

dollar traded higher against the most major currencies after the release of strong

U.S. economic data. U.S. durable goods orders rose 0.8% in April, after a 2.9%

gain in March. March’s figure was revised up to 2.9% from 2.6%. Analysts had

expected a 0.4% decrease. April’s increase of durable goods orders was driven

by demand for defence goods

U.S. core

durable goods orders excluding transportation climbed 0.1% in April, after a

2.4% gain in March. March’s figure was revised up to a 2.4% increase from a

2.0% rise. Analysts had forecasted a 0.2% gain.

U.S. core

durable goods orders excluding defence dropped 0.8% in April, after a 1.8% rise

in March.

The

Conference Board released its index of consumer confidence. The consumer

confidence index climbed to 83.0 in May, from 81.7 in April. April’s figure was

revised down from 82.3.

Standard

& Poor’s/Case-Shiller house price index increased at an annualized rate of

12.4% in March, after a 12.9% rise in February. Analysts had expected an 11.9% increase.

U.S. flash

services purchasing manager index surged to 58.4 in April, from 55.0 in March.

Analysts had expected an increase to 55.6.

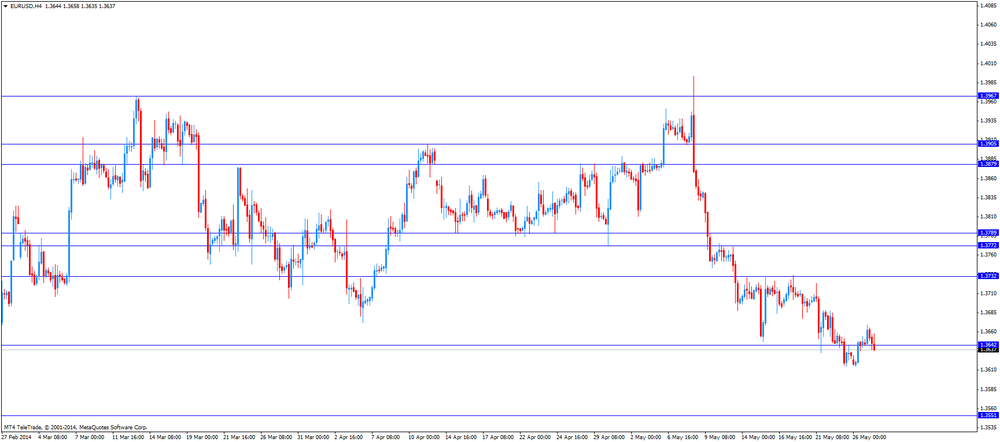

The euro

dropped against the U.S. dollar due to strong U.S. economic data. The European

Central Bank President Mario Draghi said on Tuesday the ECB is aware of risks

from low inflation. He added that the ECB had the tools to get inflation in the

Eurozone back close to 2%. His comments have fanned expectations for further stimulus

measures by the ECB in June.

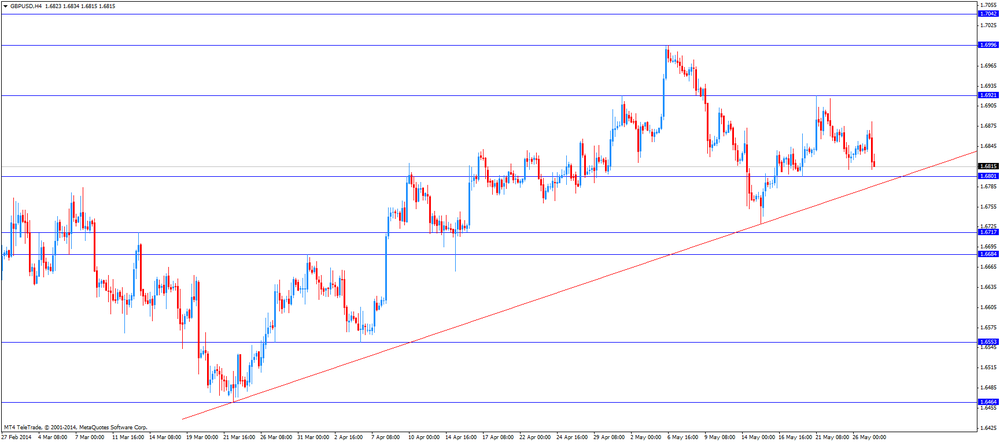

The British

pound declined against the U.S. dollar after the release of U.K. mortgage

approvals and strong U.S. economic data. U.K. mortgage approvals climbed by

42,200 in April, missing expectations for a 45,200 gain. March’s figure was

revised down to a 45,000 rise from a previously estimated 45,900 increase.

The Swiss

franc traded lower against the U.S. dollar. Switzerland's trade surplus rose to

2.425 billion Swiss francs in April, from 1.996 billion Swiss francs in March.

March’s figure was revised down from a previously estimated surplus of 2.050

billion Swiss francs. Analysts had expected the trade surplus to climb to 2.052

billion Swiss francs.

The number

of employed people in Switzerland remained unchanged at 4.190 million in the

first quarter. Analysts had forecasted an increase to 4.210 million.

The New

Zealand dollar declined against the U.S in the absence of any major economic

reports in New Zealand.

The

Australian dollar climbed to 1-week highs against the U.S. dollar in the

absence of any major economic reports in Australia, but later lost all its gains.

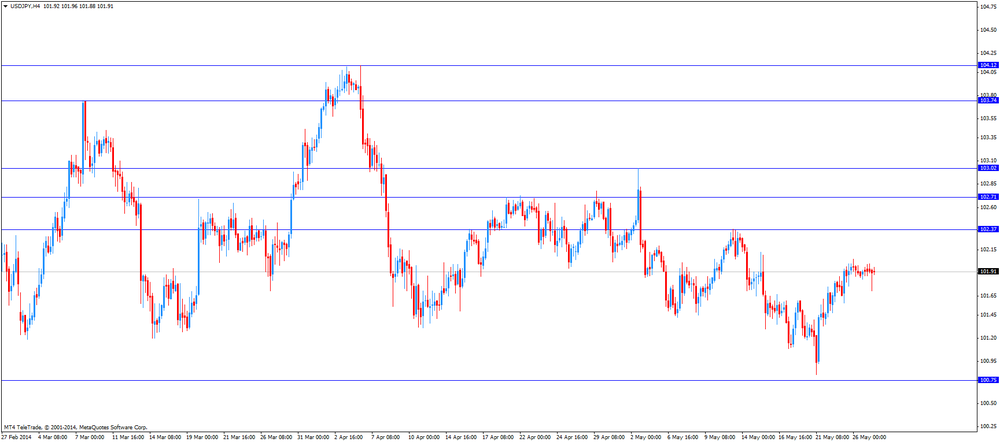

The

Japanese yen increased against the U.S. dollar after the release of

corporate services price index in Japan, but later lost all its gains. The

corporate services price index in Japan climbed 3.4% in April, from 0.7% in

March. Analysts had expected a 3.3% increase.

West

Texas Intermediate crude declined from a five-week high on speculation that

U.S. inventories are sufficient to meet increasing fuel demand. Brent slipped

below $110 after elections in Ukraine.

Futures

fell as much as 0.7 percent in New York. U.S. crude supplies, which rose in

April to the highest level since the government began publishing weekly data in

1982, are near a record for the time of year. Stockpiles at Cushing, Oklahoma,

the delivery point for WTI, dropped to a six-year low in the week ended May 16.

Ukraine’s President-elect Petro Poroshenko vowed to wipe out the separatists.

“There

are ample crude supplies here in the U.S.,” said Phil Flynn, senior market

analyst at Price Futures Group in Chicago. “The picture has been muddied

because of tightness at Cushing. WTI will be under pressure because there is so

much supply elsewhere.”

WTI for

July delivery fell 27 cents, or 0.3 percent, to $104.08 a barrel at 10:49 a.m.

on the New York Mercantile Exchange. Futures touched $104.50 for a second day,

the highest intraday level since April 21. The volume of all futures traded was

12 percent below the 100-day average.

There

was no floor trading in New York yesterday because of the U.S. Memorial Day

holiday and electronic transactions will be booked today for settlement

purposes.

Brent

for July settlement decreased 11 cents to $110.21 a barrel on the London-based

ICE Futures Europe exchange. Volume was 13 percent lower than the 100-day

average. The range was $109.75 to $110.80. The North Sea crude traded at a

$6.13 premium to WTI, compared with $6.19 at the close on May 23.

The price of gold has fallen sharply against the dollar strengthening after strong data on orders for durable goods .

Orders for durable goods rose markedly in the last month , helped by a surge in military spending and economic recovery after a harsh winter .

Ministry of Commerce announced that the seasonally adjusted volume of orders for April rose by 0.8 %, compared with an increase of 2.9 % in March. Economists had expected the value of this indicator decreased by 0.4%.

Experts note that orders for durable goods may signal about future production activities , as factories are ramping up production to meet demand , or reduce it , when orders are falling.

Most economists predict that the U.S. economy recovered during the spring of this year after a weak first quarter. Earlier this month, the Fed chief Janet Yellen said that the harsh winter behind us, and many recent indicators suggest that the recovery of costs and production is on the way , according to this , we can expect sustained growth in the current quarter .

Net import volume of China from Hong Kong gold in April 2014 amounted to 65.4 tons versus 80.6 tons in March and 75.9 tons in April last year, according to official information of Hong Kong authorities.

Gold imports to China last month fell by background cooling investment demand for the precious metal in the country, which is its largest consumer in the world.

Exports from China to Hong Kong declined to 15.4 tons from 25.3 tons a month earlier.

As analysts , reducing demand for gold in China, in India last year outstripped consumption of this precious metal , may have an impact on world prices for him, since the beginning of the year increased by 6.8%.

" Consumer demand for bars and coins in China falls as prices rise and investment in it lose their appeal ," - said analyst Shanghai Leading Investment Management Duan Shihui .

Last year , when gold fell to a record in 30 years 28% , the demand for gold jewelry in China jumped 32%.

The cost of the June gold futures on the COMEX today dropped to $ 1266.00 per ounce.

EUR/USD $1.3600, $1.3620, $1.3625, $1.3650, $1.3700/05

USD/JPY Y101.00, Y102.00, Y102.30

GBP/USD $1.6900

EUR/GBP stg0.8050, stg0.8100

AUD/USD $0.9175, $0.9200, $0.9240, $0.9250-55, $0.9265-70

NZD/USD $0.8550

USD/CAD C$1.0905, C$1.0920

The

Commerce Department released the U.S. durable goods orders. U.S. durable goods

orders rose 0.8% in April, after a 2.9% gain in March. March’s figure was

revised up to 2.9% from 2.6%. Analysts had expected a 0.4% decrease. April’s

increase of durable goods orders was driven by demand for defence goods

U.S. core

durable goods orders excluding transportation climbed 0.1% in April, after a

2.4% gain in March. March’s figure was revised up to a 2.4% increase from a 2.0%

rise. Analysts had forecasted a 0.2% gain.

U.S. core

durable goods orders excluding defence dropped 0.8% in April, after a 1.8% rise

in March.

U.S. stock futures advanced as an unexpected rise in durable goods orders boosted optimism in the world’s largest economy.

Global markets:

FTSE 6,846.6 +30.85 +0.45%

CAC 4,525.1 -1.83 -0.04%

DAX 9,926.65 +33.83 +0.34%

Nikkei 14,636.52 +34.00 +0.23%

Hang Seng 22,944.3 -18.88 -0.08%

Shanghai Composite 2,034.57 -6.91 -0.34%

Crude oil $104.30 (-0.05%)

Gold $1276.60 (-1.19%)

Upgrades:

Cisco Systems (CSCO) upgraded to Buy from Hold at Deutsche Bank; tgt raised to $30 from $25

Downgrades:

Other:

(company / ticker / price / change, % / volume)

McDonald's Corp | MCD | 102.09 | +0.09% | 0.1K |

Microsoft Corp | MSFT | 40.18 | +0.15% | 1.7K |

The Coca-Cola Co | KO | 40.64 | +0.15% | 2.9K |

Intel Corp | INTC | 26.33 | +0.16% | 6.2K |

International Business Machines Co... | IBM | 186.29 | +0.19% | 1.4K |

Visa | V | 212.50 | +0.20% | 0.4K |

Procter & Gamble Co | PG | 80.69 | +0.21% | 1.4K |

Boeing Co | BA | 132.70 | +0.22% | 1.5K |

Exxon Mobil Corp | XOM | 101.60 | +0.28% | 2.3K |

Verizon Communications Inc | VZ | 49.91 | +0.34% | 7.9K |

Home Depot Inc | HD | 79.46 | +0.35% | 0.2K |

Travelers Companies Inc | TRV | 93.19 | +0.36% | 0.1K |

Wal-Mart Stores Inc | WMT | 75.89 | +0.37% | 0.2K |

Walt Disney Co | DIS | 83.63 | +0.37% | 8.4K |

General Electric Co | GE | 26.61 | +0.38% | 6.7K |

AT&T Inc | T | 35.46 | +0.40% | 0.7K |

Johnson & Johnson | JNJ | 101.42 | +0.44% | 1.2K |

Goldman Sachs | GS | 161.00 | +0.52% | 0.4K |

E. I. du Pont de Nemours and Co | DD | 68.47 | +0.54% | 0.1K |

Pfizer Inc | PFE | 29.66 | +0.58% | 35.4K |

JPMorgan Chase and Co | JPM | 54.85 | +0.59% | 0.9K |

Nike | NKE | 76.32 | +0.62% | 5.6K |

American Express Co | AXP | 89.35 | +0.64% | 0.2K |

Cisco Systems Inc | CSCO | 24.95 | +1.75% | 150.7K |

Economic

calendar (GMT0):

06:00 Switzerland Trade Balance April 1.99 2.05

2.42

07:15 Switzerland Employment Level Quarter I 4.19

4.21 4.19

08:30 United Kingdom BBA Mortgage Approvals April

45.9 45.2 42.2

The U.S.

dollar traded higher against the most major currencies ahead of U.S. economic

data. U.S. durable goods orders should decline 0.4% in April, from a 2.9% rise in

March. U.S. durable goods orders excluding transportation should climb 0.2% in

April, from a 2.4% gain in March.

S&P/Case-Shiller

home price indices in the U.S. should rise 11.9% in March, from a 12.9%

increase in February.

U.S.

consumer confidence should climb to 83.2 in May, from 82.3 in April.

The euro dropped

against the U.S. dollar amid the speech of the European Central Bank President

Mario Draghi.

The British

pound declined against the U.S. dollar after the release of U.K. mortgage

approvals. U.K. mortgage approvals climbed by 42,200 in April, missing

expectations for a 45,200 gain. March’s figure was revised down to a 45,000

rise from a previously estimated 45,900 increase.

The Swiss

franc traded lower against the U.S. dollar. Switzerland's trade surplus rose to

2.425 billion Swiss francs in April, from 1.996 billion Swiss francs in March.

March’s figure was revised down from a previously estimated surplus of 2.050

billion Swiss francs. Analysts had expected the trade surplus to climb to 2.052

billion Swiss francs.

The number

of employed people in Switzerland remained unchanged at 4.190 million in the

first quarter. Analysts had forecasted an increase to 4.210 million.

EUR/USD:

the currency pair declined to $1.3635

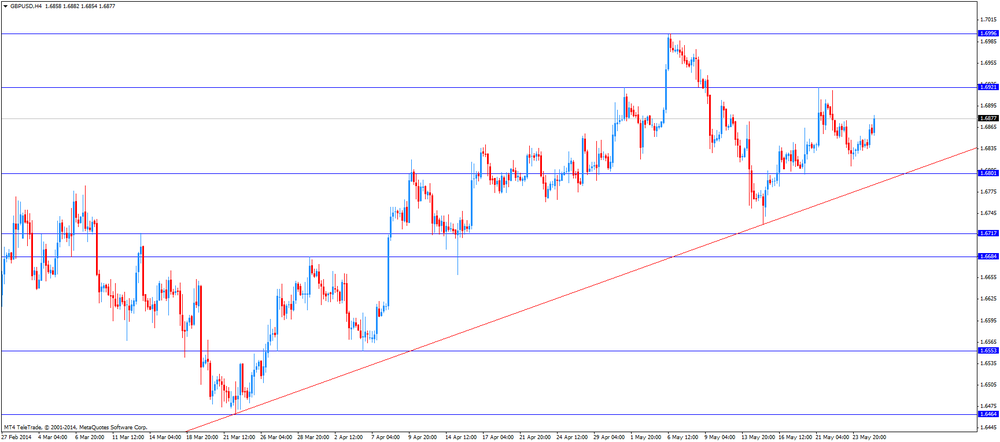

GBP/USD:

the currency pair dropped to $1.681

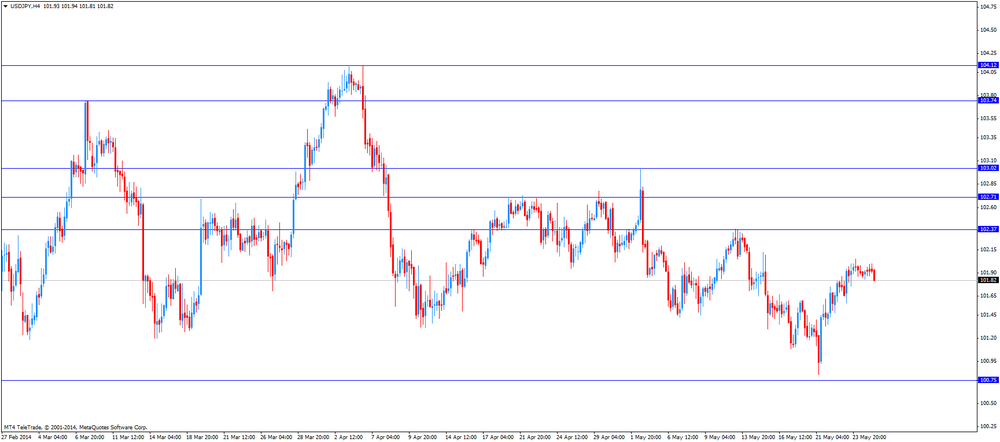

USD/JPY:

the currency pair traded mixed

The most

important news that are expected (GMT0):

12:30 U.S. Durable Goods

Orders April +2.9%

-0.4%

12:30 U.S. Durable Goods Orders ex

Transportation April +2.4%

+0.2%

12:30 U.S. Durable goods orders ex

defense April +1.8%

13:00 U.S. S&P/Case-Shiller

Home Price Indices, y/y March +12.9% +11.9%

13:30 Eurozone ECB President Mario Draghi

Speaks

13:43 U.S. Services PMI (Preliminary) April 55.0

55.6

14:00 U.S. Richmond Fed

Manufacturing Index May 7 5

14:00 U.S. Consumer confidence May 82.3

83.2

EUR/USD

Offers $1.3800, $1.3775, $1.3735, $1.3685/90

Bids $1.3600, $1.3550, $1.3525/20, $1.3500

GBP/USD

Offers $1.6975, $1.6950, $1.6930/35, $1.6900

Bids $1.6810/00, $1.6780, $1.6730

AUD/USD

Offers $0.9370, $0.9335, $0.9300, $0.9280

Bids $0.9230, $0.9200, $0.9150, $0.9100

EUR/JPY

Offers Y140.00, Y139.75/80, Y139.50

Bids Y138.50, Y138.20, Y138.00, Y137.50

USD/JPY

Offers Y103.00, Y102.40, Y102.10

Bids Y101.58, Y101.05/00, Y100.80

EUR/GBP

Offers stg0.8170, stg0.8140, stg0.8120,

Bids stg0.8050, stg0.8035/30, stg0.8005/000

Most stock

indices traded higher ahead of U.S. economic data and the speech of the

European Central Bank President Mario Draghi.

U.K.

mortgage approvals climbed by 42,200 in April, missing expectations for a

45,200 gain. March’s figure was revised down to a 45,000 rise from a previously

estimated 45,900 increase.

Aveva Group

Plc shares increased 12.0% after reporting the better-than-expected annual profit.

InterContinental

Hotels Group Plc shares climbed 5.2% after the company rejected a takeover bid.

Current

figures:

Name Price Change Change %

FTSE 100 6,849.09 +37.01 +0.37%

DAX 9,929.83 +91.38 +0.94%

CAC 40 4,525.93 -1.00 -0.02%

Monetary policies

of central banks have an impact on the dynamics of exchange rates. Therefore,

information about these regulatory bodies is required for a successful trade on

the financial markets.

Our new website

section provides information on the eight major central banks, their monetary policies

and their outlooks.

We hope this

website section will help you to make a better decision.

TeleTrade continues

to enhance and expand the website section “Market Overview” to make it as

convenient as possible for our clients. Stay tuned for updates!

EUR/USD $1.3600, $1.3620, $1.3625, $1.3650, $1.3700/05

USD/JPY Y101.00, Y102.00, Y102.30

GBP/USD $1.6900

EUR/GBP stg0.8050, stg0.8100

AUD/USD $0.9175, $0.9200, $0.9240, $0.9250-55, $0.9265-70

NZD/USD $0.8550

USD/CAD C$1.0905, C$1.0920

Asian stock

indices were exhibiting a mixed trend due to growing geopolitical

tensions between China and Vietnam. Vietnam's coastguard accused China of sinking

one of its fishing vessels in the disputed waters of the South China Sea.

The

corporate services price index in Japan climbed 3.4% in April, from 0.7% in

March. Analysts had expected a 3.3% increase.

Indexes on

the close:

Nikkei

225 14,636.52 +34.35 +0.23%

Hang

Seng 22,944.3 -18.88

-0.08%

Shanghai

Composite 2,034.57 -6.91 -0.34%

Economic

calendar (GMT0):

06:00 Switzerland Trade Balance April 1.99 2.05 2.42

07:15 Switzerland Employment Level Quarter I 4.19 4.21 4.19

08:30 United Kingdom BBA Mortgage Approvals April 45.9 45.2 42.2

The U.S.

dollar traded lower against the most major currencies. Markets in the U.S. were

closed for the Memorial Day holiday.

The New

Zealand dollar rose against the U.S in the absence of any major economic reports

in New Zealand.

The

Australian dollar climbed to 1-week highs against the U.S. dollar in the

absence of any major economic reports in Australia.

The

Japanese yen increased against the U.S. dollar after the release of corporate

services price index in Japan. The corporate services price index in Japan

climbed 3.4% in April, from 0.7% in March. Analysts had expected a 3.3%

increase.

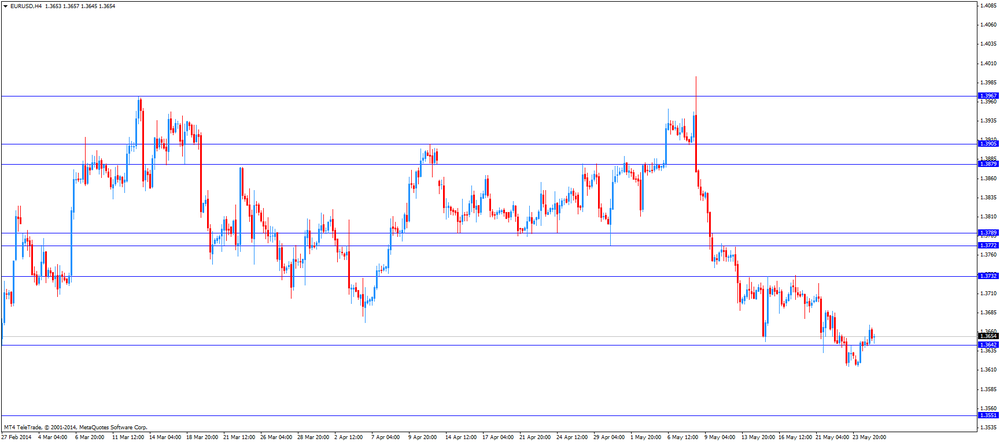

EUR/USD:

the currency pair increased to $1.3665

GBP/USD:

the currency pair climbed to$1.6870

USD/JPY:

the currency pair declined to Y101.92

The most

important news that are expected (GMT0):

12:30 U.S. Durable Goods Orders April +2.9% -0.4%

12:30 U.S. Durable Goods Orders ex Transportation April +2.4% +0.2%

12:30 U.S. Durable goods orders ex defense April +1.8%

13:00 U.S. S&P/Case-Shiller Home Price Indices, y/y March +12.9% +11.9%

13:30 Eurozone ECB President Mario Draghi Speaks

13:43 U.S. Services PMI (Preliminary) April 55.0 55.6

14:00 U.S. Richmond Fed Manufacturing Index May 7 5

14:00 U.S. Consumer confidence May 82.3 83.2

EUR / USD

Resistance levels (open interest**, contracts)

$1.3777 (3260)

$1.3742 (4266)

$1.3690 (552)

Price at time of writing this review: $ 1.3650

Support levels (open interest**, contracts):

$1.3599 (2833)

$1.3584 (6379)

$1.3563 (3500)

Comments:

- Overall open interest on the CALL options with the expiration date June, 6 is 56873 contracts, with the maximum number of contracts with strike price $1,3850 (6343);

- Overall open interest on the PUT optionswith the expiration date June, 6 is 73732 contracts, with the maximum number of contractswith strike price $1,3500 (6679);

- The ratio of PUT/CALL was 1.30 versus 1.26 from the previous trading day according to data from May, 23

GBP/USD

Resistance levels (open interest**, contracts)

$1.7100 (1855)

$1.7001 (2727)

$1.6903 (2070)

Price at time of writing this review: $1.6856

Support levels (open interest**, contracts):

$1.6796 (1669)

$1.6698 (2394)

$1.6599 (1605)

Comments:

- Overall open interest on the CALL options with the expiration date June, 6 is 23555 contracts, with the maximum number of contracts with strike price $1,7000 (2727);

- Overall open interest on the PUT optionswith the expiration date June, 6 is 25155 contracts, with the maximum number of contracts with strike price $1,6700 (2542);

- The ratio of PUT/CALL was 1.07 versus 1.05 from the previous trading day according to data from May, 23

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.