- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 27-04-2022

Reuters reports the Bank of Canada Governor Tiff Macklem saying on Wednesday that Canada needs higher interest rates, though how high those rates go will depend on how the economy responds and how the outlook for inflation evolves.

Key comments

"The economy needs higher rates and can handle them," Macklem told a Senate committee, reiterating recent comments. "How high rates go will depend on how the economy responds and how the outlook for inflation evolves."

The Bank of Canada governor Macklem reiterates higher interest rates are needed, how high they will go depends on how the economy responds, how inflation outlook evolves

Macklem reiterates it would be extremely unusual to increase interest rates by more than 50 bps in one move

Macklem says bank may have to raise rates above neutral, to "a bit above 2% or 3%"

USD/CAD has not reacted to the comments.

USD/CAD Price Analysis: The end of the rally is nigh according to market structure

- WTI hovers around 200-EMA after a solid rebound from $95.07.

- The 20- and 200-EMAs are overlapping each other, so a consolidation phase cannot be ruled out.

- The RSI (14) has affirmed the availability of responsive buyers.

West Texas Intermediate (WTI), futures on NYMEX, is holding itself above the psychological support of $100.00 after a firmer rebound from $95.07 on Monday. The asset has faced barricades at $102.51 multiple times since Friday and is consolidating beneath the resistance.

On a four-hour scale, oil prices have rebounded strongly after attracting significant bids at the trendline placed from March’s high at $126.51, adjoining March 24 high at $115.87. The black gold then moved sharply above the minor trendline placed from April 18 high at $109.13, adjoining April 21 high at $105.24.

The 20- and 200-period Exponential Moving Averages (EMAs) are overlapping to each other, which signals a rangebound move ahead.

Adding to that, the Relative Strength Index (RSI) (14) has rebounded sharply into a 40.00-60.00 range after testing the bearish range of 20.00-40.00, which signals the availability of responsive buyers. However, the black gold is likely to remain lackluster amid the lack of a potential trigger.

Should the asset violates April 21 high at $105.24, bulls will find momentum and will drive the asset to near April 18 high at $109.13, followed by March 24 high at $115.87.

On the flip side, bears can dictate the prices if the black gold drops below Tuesday’s low at $96.84, which will drag the asset towards the March low and February 25 low and at $92.37 and $89.59 respectively.

WTI four-hour chart

-637866990437428084.png)

- The euro remains on the back foot against the Japanese yen, down 2.25% in the week.

- An upbeat market mood is weighing on the JPY safe-haven status.

- EUR/JPY Price Forecast: Remains tilted to the upside as long as it remains above 134.30.

The EUR/JPY records modest losses, after on Wednesday, the euro regained composture and stopped the EUR/JPY fall of close to 500-pips, which began on April 21, when the cross reached a YTD high around 140.00. At 135.58, the EUR/JPY is down some 0.01% as the Asian Pacific session begins.

Asian equity futures point to a higher open, reflecting a positive market sentiment, carrying on Wall Street’s mood. China’s Covid-19 outbreak appears to be controlled. Last reports from China said that Shanghai is about to ease lockdowns restrictions despite the covid zero-tolerance. At the same time, Beijing, struck by the virus over the weekend, reacted fast and is already testing a substantial amount of people.

On Wednesday, the EUR/JPY opened near April’s 11 daily lows, around 135.20s. In the overlap of the Tokyo/Europan sessions, the cross-currency pair edged higher and peaked at around 136.15 (daily’s high). However, a sudden shift in mood sent the pair tumbling below 135.00 though in the mid-North American recovered and settled near current levels.

EUR/JPY Price Forecast: Technical outlook

The EUR/JPY remains upward biased from a technical perspective, as shown by the daily chart. As long as the EUR/JPY sits above 134.29, it would stay bullish and further confirmed by the location of the daily moving averages (DMAs) below the exchange rate. Also, the Relative Strenght Index (RSI) above 50 is almost flat and shows no signs of turning bearish.

Therefore, the EUR/JPY bias remains bullish. The EUR/JPY’s first resistance would be April’s 27 daily high at 136.15. A breach of the latter would expose April’s 11 daily high at 137.13, followed by the 138.00 figure.

Key Technical Levels

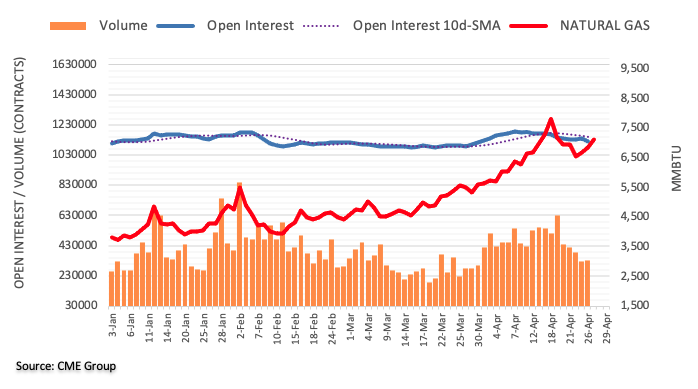

- Gold price is oscillating below $1,890 as the CME Fedwatch tool has bolstered hawkish guidance by the Fed.

- Investors are eyeing the release of the US Core PCE and GDP today.

- The precious metal is facing barricades at the supply zone placed in a range of $1,890.21-1,895.15.

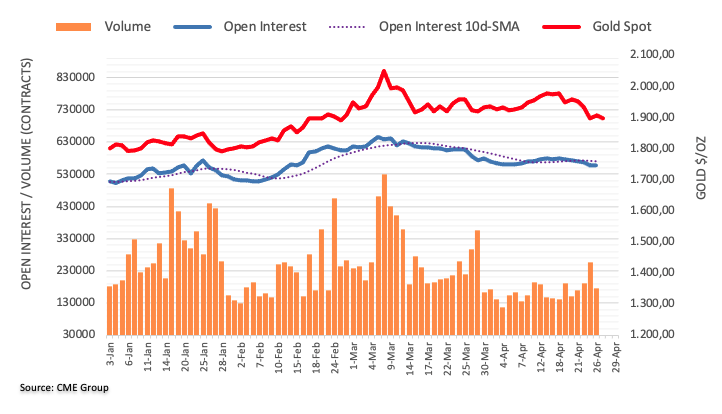

Gold price (XAU/USD) is balancing below $1,890.00 after remaining imbalance from the past few trading sessions. Market participants have strongly offered the precious metal on higher expectations of a jumbo interest rate hike by the Federal Reserve (Fed) in May in the last few trading sessions. The asset is heading south continuously since the last week after failing to sustain above the psychological resistance of $2,000.00.

Soaring inflation in the US economy along with the consistency in achieving full employment is fulfilling the stipulations of an interest rate elevation by the Fed. The US central bank policymakers have already warned that investors should brace for higher inflation going forward. Currently, the US Consumer Price Index (CPI) has been recorded at 8.5% for the month of March, the highest since December 1981 from 7.9% in February, which is hammering the precious metal.

Fed chair Jerome Powell has already spoiled the suspense by stating that an interest rate hike by 50 basis points (bps) is on the cards. Inflation is the major concern for Fed policymakers however, the tight labor market has eased the mess to some extent for the Fed. The agenda of balance sheet reduction was not discussed much but the Fed is expected to turn the wheel to squeeze liquidity from the market at a higher pace, which will bring an intense sell-off in the gold prices.

Also read: Gold Price Forecast: XAUUSD needs to hold $1,877 to maintain upward bias – Credit Suisse

Investors are also betting firmly on the hawkish guidance from the Fed. As per CME Fedwatch tool, Fed is expected to raise rates by half a percentage point at each of its next two meetings. Considering the outcome of the economic indicator and plummet in the gold prices, it would not be wrong to state that market participants are already discounting the whole liquidity constraint environment, which is likely to remain for the remaining year.

Meanwhile, the US dollar index (DXY) has fallen below the round level support of 103.00 but the upside remains favored on hawkish Fed bets. The asset registered a fresh five-year high at 103.28 on Wednesday but profit-booking dragged the DXY marginally below 103.00. Going forward, investors are focusing on some potential economic data, which will have a significant impact on the DXY. The US Bureau of Economic Analysis will report the quarterly Core Personal Consumption Expenditure (PCE) on Thursday, which is likely to print at 5.4%, higher than the prior print of 5%. A higher reading may strengthen the DXY further and investors will find the DXY kissing its 19-year high at 103.82.

Apart from the Core PCE, gold prices and the DXY will get impacted by the release of the Gross Domestic Product (GDP) numbers. The annual GDP is seen at 1.1% against the prior print of 6.9% while the quarterly GDP has room for an upside surprise. A preliminary reading for the quarterly GDP is 7.3% in comparison with the previous figure of 7.1%.

Gold technical analysis

On a four-hour scale, XAU/USD is facing barricades near the supply zone placed in a narrow range of $1,890.21-1,895.15. The 20- and 50-period Exponential Moving Averages (EMAs) at $1,905.31 and $1,925.57 respectively are heading south, which adds to the downside filters. Meanwhile, the Relative Strength Index (RSI) (14) is oscillating in a bearish range of 20.00-40.00, which signals more pain ahead.

Gold four-hour chart

-637866949020827975.png)

- GBP/USD bulls are about to step in as the bears take profits into month-end.

- Eyes on key upside technical levels and zones.

The price has moved in a parabolic move to the downside a correction is nigh. Scanning across the time frames, once the price breaks the prior day's highs with a daily close above it, the weekly VWAP that has a confluence of the 24 September 2020 lows around 1.2675 will be key and a 38.2% Fibo thereafter. The following illustrates the prospects of a bullish reversal in the coming days into month-end:

GBP/USD monthly chart

As illustrated, the price is now well below the Volume Point of Control, which is about the 50% mean of the monthly rotation channel's range, and while there is room to go to the downside, it is meeting a critical level. This level has been a support and resistance area repeatedly over the years. It would be expected to hold initial tests in a phase of accumulation on lower time frames. Therefore, traders can start to look for signs of accumulation in lower time frames and start to set sights on upside target areas.

GBP/USD weekly chart

The Weekly VWAP is located around the Sep 2020 lows which will be regarded as a key level for any reversal that could occur in the foreseeable future. With that said, there still appears to be some room to go to the downside until the imbalance of the July 2020 rally is fully mitigated.

GBP/USD daily chart

The close on Wednesday was bearish, technically, but it was not a convincing continuation candle and more like a doji. Nevertheless, the bulls will need to see a bullish close or two, preferable bullish engulfing and above the Wednesday highs. A 38.2% Fibonacci retracement level, at this juncture, would roughly coincide with the rotation area around it, slightly through 1.27 the figure.

This can be seen better on a 4-hour time frame as follows:

GBP/USD H4 chart

- The Australian dollar is recording gains of 0.09% vs. the greenback.

- China’s Covid-19 outbreak appears to be capped as Shanghai prepares to ease restrictions.

- Russia would remain fighting with Ukraine until achieving its goals.

- Australia’s inflation hits a 20-year high, will the RBA act?

- AUD/USD Price Forecast: Further downside expected if AUD bulls fail to reclaim 0.7200.

On Wednesday, the Australian dollar prints modest gains after fluctuating in a 100-pip range as US equities finished with gains, reflecting an upbeat market sentiment throughout the North American session. The AUD/USD is trading at 0.7127.

Wall Street closed with gains between 0.19% and 0.73%, while the greenback remains buoyant, as the US Dollar Index illustrates, up by almost 0.70% back above the 103.000 mark. US Treasury yields, led by the 10-year benchmark note, gained ten basis points and finished at 2.826%.

Shanghai will ease lockdowns, and Russia to fulfill its military goals

During the day, the market mood fluctuated though it shifted positively in the overlap of the European/US sessions. China’s Covid-19 outbreak in the last two weeks has weighed negatively since the beginning of the week. Last reports from China said that Shanghai is about to ease lockdowns restrictions despite the covid zero-tolerance. At the same time, Beijing, struck by the virus over the weekend, reacted fast and is already testing a substantial amount of people.

Geopolitics-wise, the Russia-Ukraine conflict remains. On Wednesday, the Russian President Vladimir Putin expressed that Russia will fulfill its military goals and emphasized that any country interfering in Ukraine will be met with a “lightning-fast” response, using “tools no one else can boast of having.”

Australian inflation to “motivate” the RBA to hike rates

Earlier in the Asian session, the Australian Consumer Price Index (CPI) came hotter than foreseen and reached a 20-year high, lifting the AUD/USD cross towards 0.7190s. Across the pond, March’s Pending Home sales fell 1.2%, lower than a 1.6% contraction estimated. In the meantime, the Advance Goods Trade Balance fell to an all-time-high deficit of $125.3 billion from a prior $106.35 billion deficit in February as imports soared.

Therefore, with Australian inflation showing elevating signs, money market futures odds of a 0.25-bps rate increase by the RBA at its May 3 meeting are at 94%, which would boost the prospects of the AUD. However, as the Federal Reserve prepares to lift the Federal Funds Rates to 1% in May, further downside pressure on the AUD/USD is expected at its May meeting.

AUD/USD Price Forecast: Technical outlook

The AUD/USD shifted downward biased since the beginning of the week. Following the 200-day moving average (DMA) break at 0.7295 on last week’s Friday, downward pressured the Aussie, which extended its losses throughout the week. However, Wednesday’s price action gave a respite to AUD bulls, forming a “quasi gravestone doji” at the end of a downtrend? It is about to be seen.

A continuation of the AUD/USD downtrend will find the next support zone to overcome around April’s 27 daily low at 0.7101. A break below would expose February’s 4 daily low at 0.7052, followed by the figure at 0.7100.

If AUD/USD bulls would like to shift the bias to neutral, they need to reclaim 0.7200.

- NZD/USD bears are tiring although fundamental risks cap recoveries in the kiwi.

- Traders will look ahead to US GDP Thursday and the Fed next week.

At 0.6540, NZD/USD is down by some 0.33% from a high of 0.6590 but has consolidated into the close in the North American session above the tailspin lows of 0.6527. The bird has been pressured on Wednesday ahead of key data for the US on Thursday and the Federal Reserve next week as risk-off themes continued to underpin the US dollar.

''The Kiwi fell further versus the dollar overnight. This was amid broader stronger dollar moves, as the DXY reached its highest level since 2016,'' analysts at ANZ Bank said.

''The ongoing rally in the USD is being helped by concerns about the European outlook amid the ongoing war in Ukraine, and expectations that the Fed will hike quickly over the next few months to cap inflation. It will be difficult for markets to shift out of the current dynamic until next week’s FOMC meeting, as markets await to see how the Fed’s language evolves.''

The growth concerns in Europe are also underpinning the US dollar following yesterday's news that Russia cut off gas supplies to parts of the region. Russia's Gazprom (GAZP) halted gas supplies to Poland and Bulgaria on Wednesday over their failure to pay in roubles, cranking up an economic war with Europe in response to Western sanctions imposed for Moscow's invasion of Ukraine.

The global growth concerns are also due to China enacting lockdowns in a bid to stem the spread of COVID-19. Beijing has ramped up mass testing for COVID-19 while the financial hub of Shanghai has been under strict lockdown for around a month.

Analysts at Rabobank explain, that ''in contrast, against the backdrop of accelerated US inflationary pressures, the Fed is currently signalling that it will be tightening policy aggressively in the coming months. This should undermine the outlook for riskier EM currencies and keep the USD underpinned. '' The antipodeans are high beta currencies and much like EM-FX, they will struggle in such an environment.

US GDP eyed

For Thursday, traders will look to US growth data. ''US Real Gross Domestic Product likely slowed sharply in Q1 following a significant increase to 6.9% AR in Q4 from 2.3% in Q3,'' analysts at TD Securities said.

''As was the case last quarter, inventories will play a large role though they will be a drag instead. That said, domestic final sales likely continued to strengthen on the back of firming consumer spending. The inflation parts of the report will likely show acceleration.''

What you need to know on Thursday 28 April:

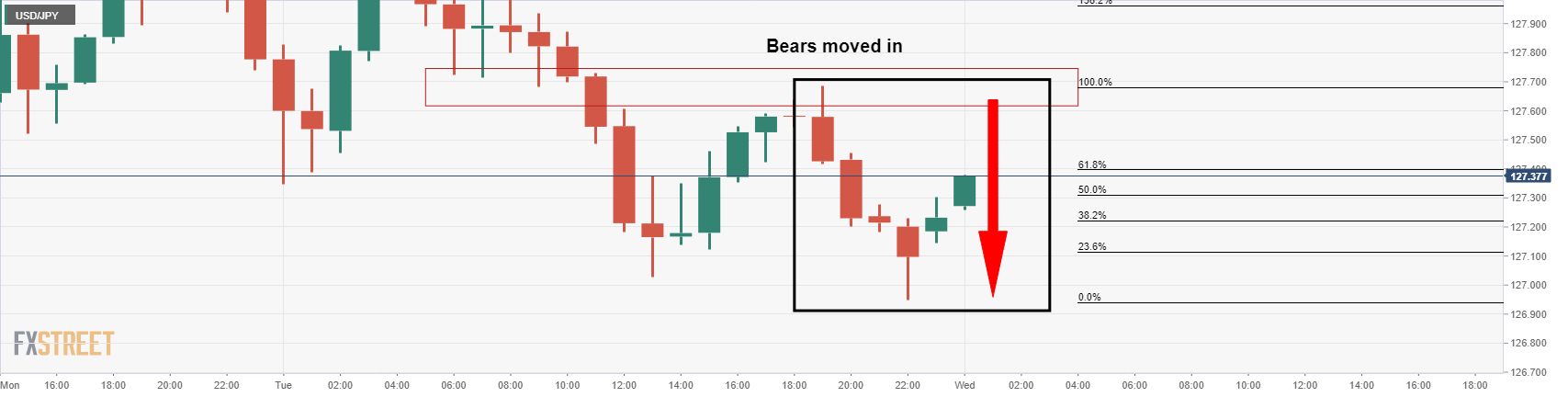

A sharp reversal of recent yen strength on Wednesday, which lacked a clear trigger, saw the US dollar reclaim the top spot in the daily G10 performance table, and saw the trade-weighted US Dollar Index (DXY) hit fresh more than five-year highs. The DXY rallied to the north of the 103.00 mark for the first time since January 2017, topping out near 103.30 before retracing lower to stabilise around the big figure as US trade drew to a close.

The buck bulls were unfazed by data that showed the US Goods & Services Trade Deficit hit a new record at more than $125B in March and resulted in some analysts downgrading their estimate for Q1 GDP growth, one day before the Bureau of Economic Analysis and Department of Commerce release the first estimate of Q1 growth. Rather, expectations for the Fed to implement the first of a series of 50bps rate hikes and quantitative tightening next week, negative geopolitical newsflow and ongoing China lockdown concerns were cited by analysts as benefitting the safe-haven buck.

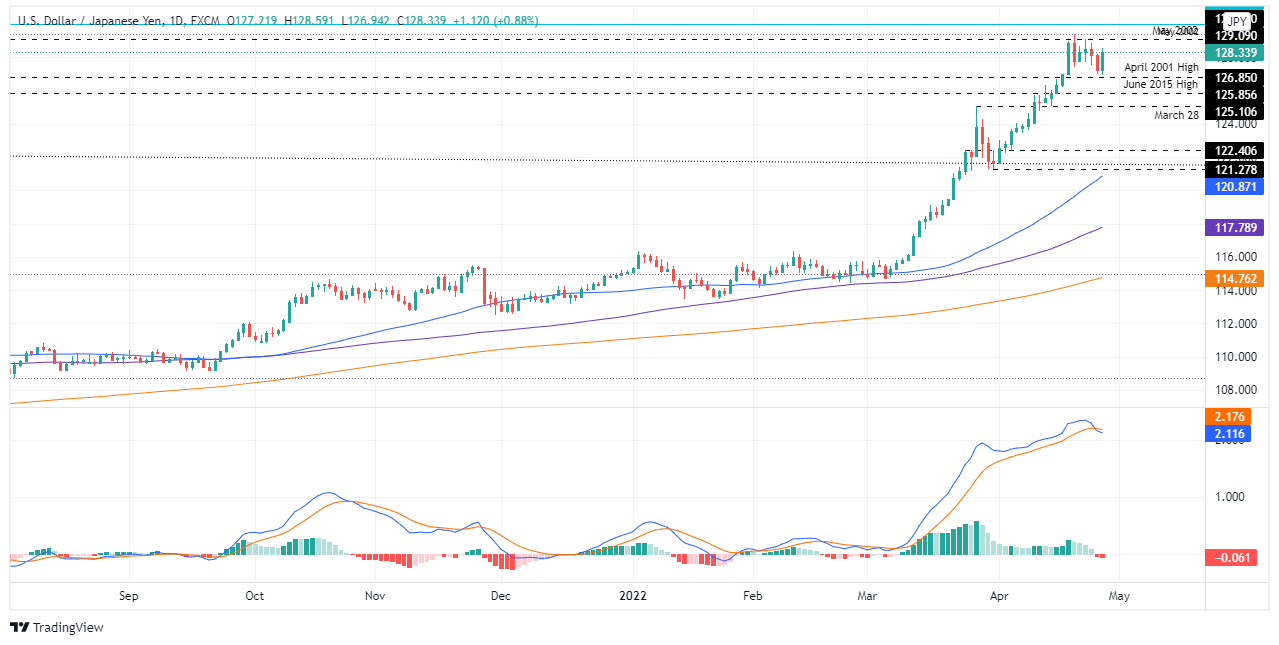

Regarding yen weakness, traders seemed to have taken the opportunity represented by the recent dip in many G10/JPY major pairs to reload on long positiongs, seemingly in a bet that recent risk-off flows won’t save the yen from further losses so long as the BoJ doubles down on its dovish policy stance. Speaking of, the BoJ will announce its latest monetary policy decision plus new economic forecasts during the upcoming Asia Pacific session, with any dovish vibes having the potential to exacerbate the yen’s latest drop. For reference, USD/JPY rallied more than 100 pips or 0.9% on Wednesday to the 128.30s from lows under 127.00.

Turning to the other major G10 underperforming currencies, the euro and Swiss franc were the next worst performers, depreciating 0.8% and 0.7% each on the day versus the US dollar. EUR/USD subsequently continued its run of recent losses to fall into the mid-1.0500s and with the bears eyeing a test of 2017 lows in the 1.0330s. Analysts cited the latest ramping up of EU/Russia tensions after Gazprom halted gas flows to Poland and Bulgaria (who have refused to pay for gas in roubles) as adding geopolitical risk premia to the single currency.

As the EU continues to jawbone about another round of energy sanctions that could target both oil and gas exports, fears about energy price shortage fuelled stagflation in the Eurozone remain elevated. According to some analysts, the unfavourable macroeconomic/geopolitical backdrop explains why EUR/USD has failed in recent weeks to take advantage of the ECB’s hawkish shift towards lift-off in Q3.

Elsewhere, a stabilisation in risk appetite that saw major US equity bourses close modestly in the green and stabilisation across commodity markets (aside from precious metals, which continue to be hit), helped cushion the downside in the more risk-sensitive G10 currencies. AUD/USD and USD/CAD both ended the US session flat around the 0.7120 and 1.2820 levels respectively, with the Aussie given notable assistance from hot domestic inflation figures which spurred bets that the RBA might hike rates as soon as next week.

Meanwhile, NZD/USD dropped another 0.3% to below 0.6550 but remained above its annual lows at 0.6530 and GBP/USD fell another 0.2% to below 1.2550, though support at 1.2500 held up (for now). Sterling’s better performance on Wednesday probably also owes much to the fact that over the past four sessions it has taken a historic beating as a recent string of UK economic and government borrowing data releases triggered fresh concerns about the country’s economic outlook and outlook for BoE tightening. Wednesday’s awful CBI Distributive Trades survey for April seemed to ensure that the beleagured currency did not enjoy a likely overdue technical rebound.

- The USD/JPY remains positive as the end of the month approaches, up by 5.50%.

- China’s news that Shanghai is about to ease lockdowns lifted investors’ spirits.

- USD/JPY Price Forecast: A bullish engulfing pattern in the daily chart opens the door toward a renewed YTD high.

The USD/JPY bounces from Tuesday’s lows and rallies above the 128.00 mark, attributed to an upbeat market mood as US Treasury yields grind higher in the North American session. At the time of writing, the USD/JPY is trading at 128.34.

Meanwhile, the buck stays resilient and records gains for the fifth consecutive day. The US Dollar Index, a basket of six currencies that measures the greenback’s value, is up 0.65%, sitting at 102.961, a tailwind for the USD/JPY as Wall Street’s close looms. Also, the US 10-year benchmark note prepares to close near the 2.80% threshold after Tuesday’s close at around 2.726%.

The market sentiment has improved throughout Wednesday. European equities pared losses while US stocks rose. China’s news that Shanghai might be about to “relax” Covid-19 zero-tolerance restrictions, alongside extensive testing in Beijing amid a coronavirus outbreak in the week, calmed market players. In the meantime, the conflict between Russia-Ukraine escalated a tick as Gazprom, a Russian company, halted natural gas shipments to Poland and Bulgaria.

USD/JPY Price Forecast: Technical outlook

In the meantime, the greenback’s bulls regained control in the pair, as shown by price action during the day. In the Asian session, the USD/JPY opened near Tuesday’s lows, around 127.20s, and slid towards 127.00 due to a dampened sentiment. Nevertheless, the pair recovered and rallied more than 150 pips, recording a daily high near 128.50.

The USD/JPY remains upward biased. The price action of the last two days formed a “bullish engulfing pattern,” suggesting the pair might resume upwards.

With that said, the USD/JPY’s first resistance would be Wednesday’s high at 128.59. Break above would expose the 129.00 mark, followed by the April 20 swing and YTD high, at 129.40, followed by the 130.00 mark.

Key Technical Levels

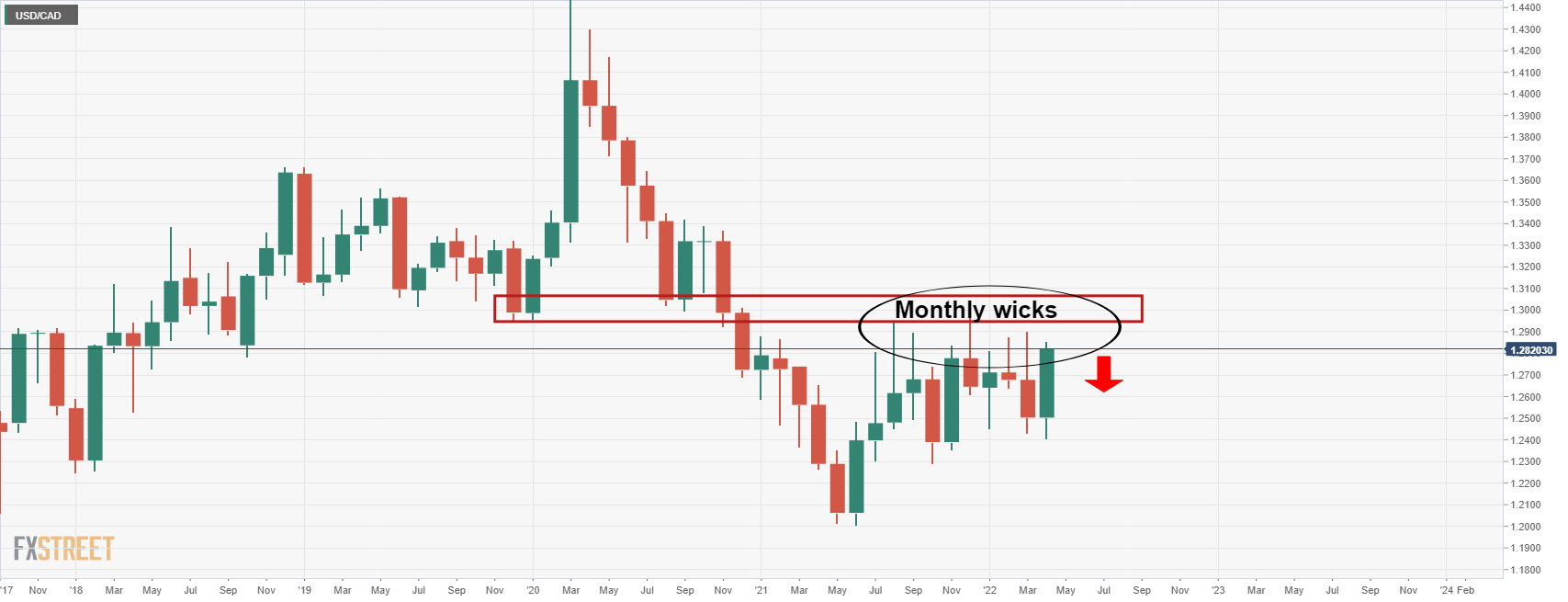

- USD/CAD could be about to turn and eyes are on the downside.

- Bearish engulfing close to confirm the prospects of a move towards the 38.2% and 50% ratios.

USD/CAD has continued to rally despite what some might perceive to be overextended conditions. The question traders are asking is whether this is now the top?

The US dollar is on fire due to fundamentals yet commodities could be on the verge of a move higher which would lend support to CAD.

Either way, from a technical standpoint, we can assess the price action and multi time frame market structures to determine the probabilities of whether this is, at least, a meanwhile top.

The following analysis will illustrate that USD/CAD's market structure and price action are turning bearish.

USD/CAD monthly chart

The monthly time frame shows multiple failures below resistance and while there is scope for a push to 1.30 the figure, given the strength of April's candle, it is probable that there will need to be a retracement in the coming days before the next push higher.

USD/CAD weekly chart

We could have some hidden bearish divergence on the weekly time frame if the price forms a lower high for the week and the daily chart could give us some clues.

USD/CAD daily chart

The price could be forming a daily doji and the bears will be looking for this to be followed by a bearish engulfing close on Thursday to confirm the prospects of a move towards the 38.2% and 50% ratios along the Fibonacci scale that have a confluence with the prior structures.

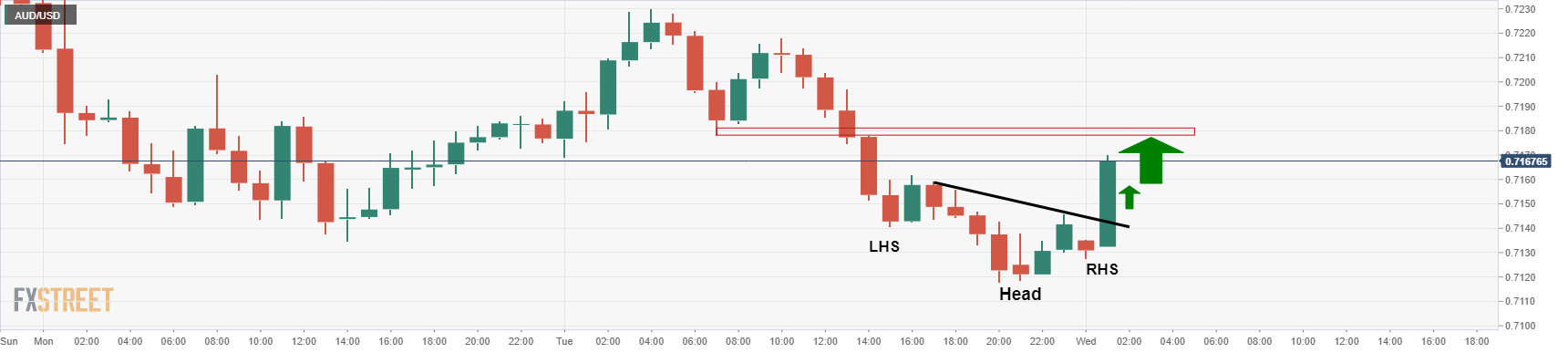

- AUD has been sold off despite the hot CPI data.

- The bulls are moving in following a significant spell of supply.

- The US dollar is picking up the flows in the forex space.

At 0.7142, AUD/USD is higher on the day by some 0.27% after recovering from a low of 0.7101 but still below the post inflation data highs posted in Tokyo at 0.7190. The Consumer Price Index outcome means that a rate hike from the Reserve Bank of Australia is coming sooner and faster than what markets had thought, yet a challenging external environment has continued to weigh on the Aussie nonetheless.

The RBA has been gradually making room for itself to tighten for the months ahead, but the CPI beat overnight for the first quarter of 2022 means has left the possibility of a rate hike as soon as May on the table. Additionally, there is a strong case for some front-loading for the rest of the meetings this year.

Trimmed mean inflation surged to 1.4% QoQ in Q1 (3.7% YoY), while headline inflation reached 5.1% YoY, the highest result since the mid-90s (excluding the introduction of GST in 2001). The momentum on wages, and not just disruptions in the global economy, means that high levels of inflation are likely to be persistent for the foreseeable future.

''We now expect the RBA to hike by 15bp next week. Inflation pressures have momentum and have broadened. A cash rate target of 0.1% is inappropriate against this backdrop,'' analysts at ANZ Bank argued.

Initially, the Aussie rallied to an important hourly resistance level as follows:

AUD/USD price analysis around CPI

''On the hourly chart, AUD/USD had been forming a bullish reverse head & shoulders ahead of the data as follows:

''This is a reversal pattern and the neckline of the prior M-formation near 0.7180 could be targetted for the day ahead. The outcome has triggered a bid, so this validates the chart pattern, as follows:

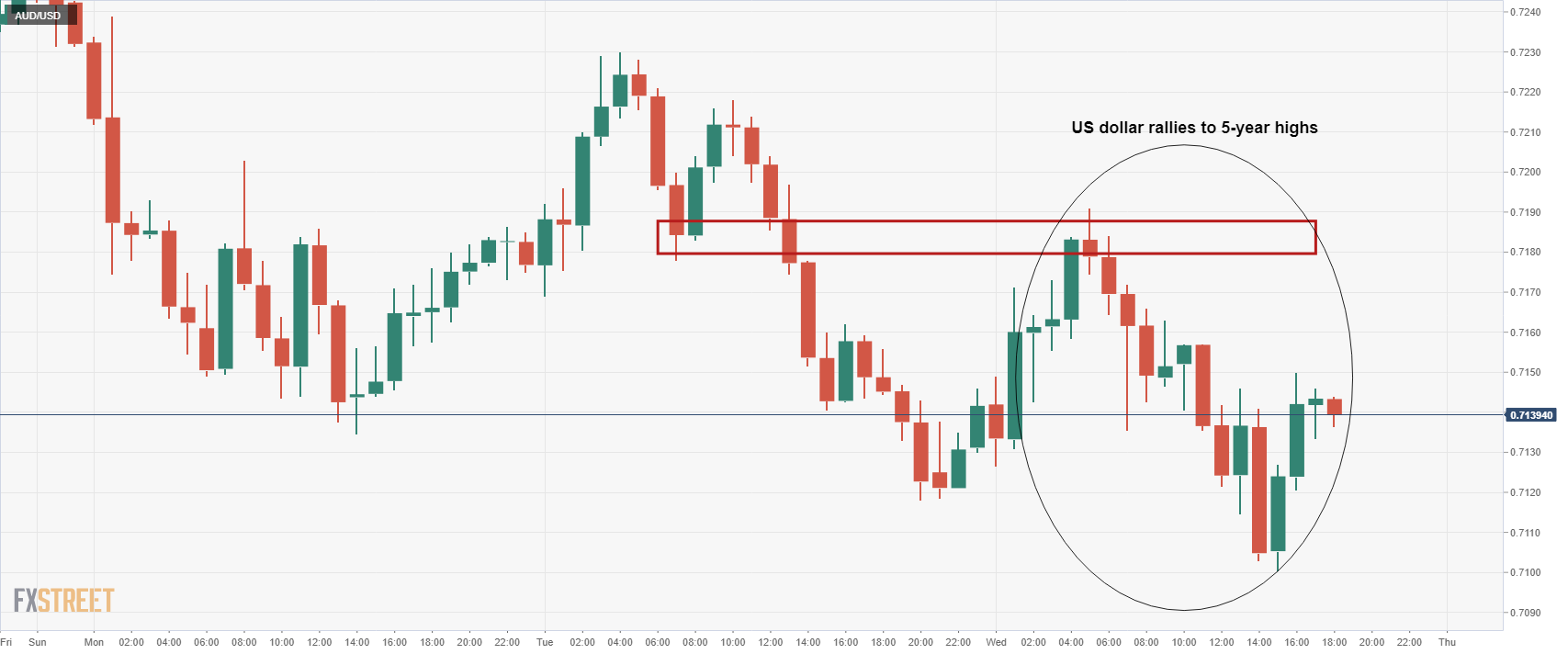

However, as illustrated here, the price has been rejected from this resistance as the US dollar hits a five-year high:

US dollar rallies to five-year highs

On Wednesday, the greenback rallied to a five-year high ahead of the Federal Reserve next week. The Fed is expected to increase rates by 50 basis points at its May 3-4 meeting, as well as in June and July. Some analysts, such as those from Nomura, are calling for a 75bp hike. The dollar index against a basket of currencies (DXY) reached 103.282, the highest since Jan. 2017.

Propelling the greenback further are the economic growth concerns in Europe after Russia cut off gas supplies to parts of the region. Russia's Gazprom (GAZP) halted gas supplies to Poland and Bulgaria on Wednesday over their failure to pay in roubles, cranking up an economic war with Europe in response to Western sanctions imposed for Moscow's invasion of Ukraine.

The greenback has also benefited from global growth concerns as China enacts lockdowns in a bid to stem the spread of COVID-19. Beijing has ramped up mass-testing for COVID-19 while the financial hub of Shanghai has been under strict lockdown for around a month.

''The step-up in risks to Chinese growth is set against the widespread acceptance that the war in Ukraine could continue for many months and an anticipated aggressive tightening in monetary policy by the Federal Reserve this year. This increased safe-haven demand stemming from growth fears could result in a stronger-for-longer USD,'' analysts at Rabobank explained.

''More restrictions in China imply a fresh test for global supply chains. At the start of this week, the unleashing of fresh growth concerns, spooked stock markets and triggered another round of demand for safe-haven assets,'' the analysts added. '

''In previous periods of heightened growth fears, the Fed has been in a position to loosen monetary policy as global growth stresses mount. At the start of the pandemic in 2020, the Fed swiftly batted away safe-haven demand by drastically increasing liquidity provision. The result was a surge in risky assets and persistent downward pressure on the then low yielding USD for the rest of that year.''

However, the analysts explain, that ''in contrast, against the backdrop of accelerated US inflationary pressures, the Fed is currently signalling that it will be tightening policy aggressively in the coming months. This should undermine the outlook for riskier EM currencies and keep the USD underpinned. '' AUD is a high beta currency and much like EM-FX, this environment should be to its detriment.

Eyes on US growth

meanwhile, for tomorrow, US Real Gross Domestic Product likely slowed sharply in Q1 following a significant increase to 6.9% AR in Q4 from 2.3% in Q3, analysts at TD Securities said.

''As was the case last quarter, inventories will play a large role though they will be a drag instead. That said, domestic final sales likely continued to strengthen on the back of firming consumer spending. The inflation parts of the report will likely show acceleration.''

AUD/USD technical analysis

We are seeing a gradual deceleration of the bearish impulse on the daily chart and a correction from the weekly support structure could be in order:

A bullish engulfing candle preceding what could turn out to be a bullish Doji close on Wednesday would signal prospects of a correction to test prior daily support structures and confluences along the Fibonacci retracement scale.

- The EUR/USD accumulates weekly losses close to 2.12%, the largest since June 2021.

- A risk-on market mood lifted the euro’s prospects after reaching a YTD low at 1.0514.

- EUR/USD Price Forecast: Poised to test January’s 2017 swing lows around 1.0340.

The EUR/USD continues its free fall in the month, which accelerated since April’s 22, when the EUR/USD closed around 1.0831, plunging more than 400 pips since the close, towards the fresh 5-year-low around 1.0514, recorded on Wednesday. At 1.0564, the EUR/USD recovered some ground, aiming to finish the day with losses for the fifth consecutive trading day.

Shanghai to ease lockdown restrictions, lifts the market mood

Investors’ mood improved since the mid-North American session. Probably on the news from China, as Shanghai is about to ease lockdowns following a Covid-19 outbreak that hit the second largest Chinese city a couple of weeks ago. That threatened to disrupt the supply side component of the second biggest worldwide economy. In the meantime, the conflict between Ukraine and Russia appears to be extending longer than expected. Additionally, Russia’s retaliation against “unfriendly” countries began on Tuesday, when the Russian gas producer Gazprom halted gas flows to Poland and Bulgaria, as both countries refused to pay for it in roubles.

The greenback remains buoyant, as shown by the US Dollar Index, rising above the 103.000 mark for the first time since January 4, 2017. As of writing, it sits at 102.846, up almost 0.53%. Meanwhile, the US 10-year Treasury yield is staging a comeback and is trimming Tuesday’s losses, gaining seven and a half basis points, sitting at 2.799%.

Upcoming in the economic docket, the Eurozone would reveal April’s Consumer Price figures. Across the pond, the Q1 Gross Domestic Product by Thursday and on Friday, the Fed’s favorite inflation indicator, the Core PCE, is expected to downtick to 5.3% from 5.4% y/y.

EUR/USD Price Forecast: Technical outlook

The EUR/USD remains defensive, and it seems that it could aim towards January’s 2017 lows around 1.0340. The EUR/USD is recording its worst week since June 2021 and is accumulating losses close to 2.10% as of writing. Also, momentum indicators like the Relative Strength Index (RSI), albeit at oversold conditions, seem poised to record lower readings. At the time of writing stands at 27.09.

With that said, the EUR/USD first support would be 1.0500. A breach of the latter would expose 1.0450, followed by 1.0400, and then a test of January’s 2017 cycle lows near 1.0340.

Key Technical Levels

On Thursday, the first estimate of US GDP growth will be released. Analysts at Wells Fargo, expect a 0.6% annualized growth rate. They point out that although the economy does not appear on the cusp of another downturn, the probability of a recession next year is not insignificant.

Key Quotes:

“We are not formally changing our projection of 0.6% annualized GDP growth rate in Q1-2022, but the risks to that estimate appear to be skewed to the downside. In short, we would not be surprised if the advance estimate of Q1 GDP growth, which the Bureau of Economic Analysis (BEA) is scheduled to release on Thursday morning April 28, turns out to be slightly negative.”

“A negative print in GDP growth in the first quarter, should it actually happen, would likely be due to two volatile components in the national income and product accounts: net exports and inventories. The underlying growth momentum in the economy appears to have remained reasonably solid in the first quarter. We estimate that real personal consumption expenditures (PCE), which account for roughly two-thirds of total spending in the economy, grew at an annualized pace of about 3% in Q1.”

“Furthermore, the jump in inflation has caused the Federal Reserve to turn hawkish. As we wrote in a recent report, we look for the Federal Open Market Committee to raise its target range for the fed funds rate by 50 bps at its meeting on May 4. We also expect that the FOMC will hike by another 50 bps at its meeting in June and by an additional 100 bps by the end of the year. We also expect the Fed to start shrinking its balance sheet, which will act as a form of additional monetary tightening. The combination of declining real disposable income and monetary tightening could potentially cause the economy to lose enough momentum that it slips into recession in 2023.”

- The USD/CHF advances In the week so far gain 1.25%.

- A risk-on market mood keeps the US dollar buoyant.

- USD/CHF Price Forecast: RSI at overbought conditions and a steeper uptrend might open the door for some USD/CHF consolidation.

On Wednesday, the USD/CHF rallies some 80-pips and gained 0.75%. At 0.9684, the USD/CHF retreated from 0.9701 and recorded an almost two-year fresh high during the day, amidst a positive market sentiment, which improved in the middle of the North American session.

The market sentiment has improved, in fact, for no fundamental reason. China’s covid woes grabbed some attention, but news wires that Shanghai’s lockdown measures might ease shifted investors’ mood. In the meantime, the Ukraine-Russia conflict escalated as Russian company Gazprom halted natural gas exports to Poland and Bulgaria.

In the meantime, the US Dollar Index, a gauge of the greenback’s measure of value against other currencies, edges up some 0.57% sitting at 102.887. The US 10-year Treasury yield is rising, trims some of Tuesday’s losses, and is gaining seven basis points, sitting at 2.791%.

USD/CHF Price Forecast: Technical outlook

The USD/CHF uptrend appears to be overextended, as shown by the Relative Strenght Index (RSI) with readings of 80, which could open the door for a USD/CHF consolidation in the near term.

With that said, the USD/CHF first support would be the April 26 daily high at 0.9626. Break below would expose the April 26 daily low at 0.9564, followed by the June 30, 2020 cycle high-turned-support at 0.9533.

Key Technical Levels

- GBP/JPY bounced at the key 160.00 level on Wednesday as risk appetite stabilised and is now back above 161.00.

- Analysts had warned of a technical correction following the recent unusually large 4.5% drop between last Thursday and Monday.

GBP/JPY is enjoying a much overdue bounce on Wednesday and was last trading higher by about 0.9% on the day in the 161.30s, having reversed an earlier session dip under the 160.00 level to fresh monthly lows. The pair is getting some tailwinds from broader a modest improvement in broader risk appetite after some stabilisation was seen in European equity markets and with US bourses trading higher. The yen is underperforming as a result.

Analysts had warned that the near 4.5% drop between last Thursday and Monday was an unusually large move in such a short period of time, and that some consolidation would likely be in order. But FX strategists think that risks remain tilted towards the downside for GBP, amid growing concerns about the UK economy and a market has been pulling back recently on BoE tightening bets.

Against the likes of the US dollar and euro, where the risks are tilted towards their respective central banks become more hawkish not less, GBP is likely to continue to struggle. But the performance of GBP/JPY may ultimately rest on the yen. Recall that prior to the last week or so, the yen had been getting absolutely battered across the board given BoJ insistence that it not deviate from its current ultra-dovish monetary policy stance.

The BoJ will be announcing monetary policy during the upcoming Thursday Asia Pacific session and is likely to reiterate this message, which risks reigniting yen weakness. Traders betting on this might have thus seen the retest of 160.00 as a golden opportunity to reload on longs to target a retest of recent multi-year highs above 168.00. After all, even if the BoE isn’t going to live up to market tightening expectations, at least it is going to do some tightening (unlike the BoJ).

- US dollar remains firm across the board amid risk aversion.

- Cable down for the fifth consecutive day, losing more than 500 pips.

- GBP/USD found support at 1.2500 and trimmed losses.

The GBP/USD dropped further and bottomed at 1.2502, a level last seen back in July 2020. The pair later trimmed losses, rising toward 1.2550. Despite moving off lows, it remains under pressure amid a strong US dollar.

A daily close far from the lows or in positive territory could be a positive sign for GBP/USD, suggesting not necessarily a recovery but increasing the odds of a consolidation.

The greenback continues to rally across the board amid concerns about the global economic outlook, inflation and monetary policy tightening. The DXY rose to 103.28, the highest level since January 2017 and then pulled back, amid some improvement in investor’s sentiment. US stocks bounced and turned positive again. The Dow Jones gains 0.83%.

Economic data from the US showed a record goods trade deficit in March, above expectations ($125.0B vs $106.0B); and a decline in Pending Home Sales of 1.2%, less than the 1.6% slide expected. On Thursday, Q1 GDP data will be released.

Regarding the pound, despite the slide versus the dollar and the volatility across markets, it is recovering against the euro. EUR/GBP dropped below 0.8400, reaching a five-day low.

“Bank of England tightening expectations have eased a bit. WIRP suggests another 25 bp hike to 1.0% is fully priced in for the next meeting on May 5, while swaps market is pricing in 175 bp of tightening over the next 12 months vs. 200 bp at the start of this week that would see the policy rate peak near 2.5%”, explained analysts at Brown Brothers Harriman. Under 1.2500, they see a target in GBP/USD at 1.2480, July 2020 low and then 1.2250 the June 2020 low.

Technical levels

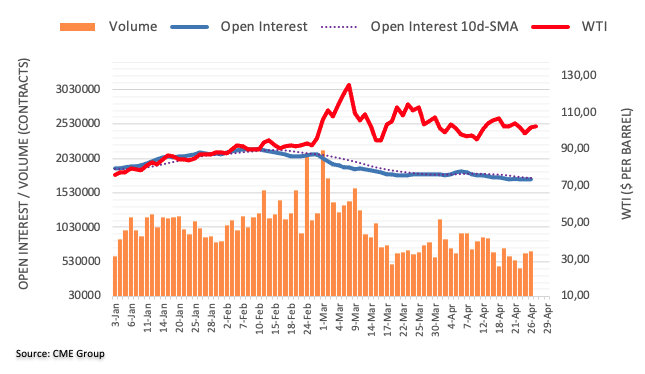

- WTI continues to trade near $100 as market participants weigh European energy security developments versus China demand/global growth fears.

- The latest US inventory figures gave WTI some short-lived upside with the US SPR falling to its lowest since 2002.

After posting a solid recovery on Tuesday following Monday’s brief dip back to the $95.00s per barrel, front-month WTI futures are back to pivoting on either side of the $100 per barrel mark on Wednesday. Oil prices continue to be buffeted by the conflicting forces of rising geopolitical and economic tensions between Russia/NATO and concerns about global growth weakness and demand in China.

The latest official weekly US inventory numbers gave WTI some short-lived upside after a smaller than expected build in headline inventories and a larger than expected decline in gasoline and distillate inventories saw the overall US Strategic Petroleum Reserve fall to its lowest levels since 2002. The data’s impact likely won’t have a massive impact in the grand scheme of things.

Regarding the Russia/NATO tensions, Russia’s Gazprom announced on Tuesday it would halt gas flows to Poland and Bulgaria after the countries refused to pay in roubles, which market commentators said at the time marked a major escalation in the ongoing EU/Russia stand-off over gas supplied. However, sources on Wednesday told newswires that major gas-importing companies in a number of other European nations have caved to Russian demands for rouble payments, even though EU Commission President Ursula von der Leyen talked a big game about how the EU wouldn’t be blackmailed by Russia over energy.

The EU has subsequently reiterated plans to toughen sanctions on Russia, including on oil imports, and market participants are interpreting developments as having raised the risk of energy shortages in the EU, which is supporting WTI. But this wasn’t enough to launch WTI back to the north of its 21 and 50-Day Moving Averages at the $101.58 and $102.81 levels. Though geopolitics has been supportive, oil prices have been weighed amid demand concerns in China and downside in global equities as a result of global growth and central bank tightening fears, as well as continued strengthening of the US dollar.

When the US dollar appreciates, USD-denominated crude oil becomes more expensive for the holders of international currency, reducing demand. Looking at WTI over a longer time horizon, the US benchmark of sweet light crude oil continues to consolidate within a pennant formation that has been forming since the beginning of March.

The recent consolidation shouldn’t come as too much of a surprise, with markets arguably in wait-and-see mode over whether the Chinese lockdowns get substantially worse (which could send WTI back below the $90 level), or whether there is an EU energy embargo/blockade on Russian imports (which could launch WTI back into the $110s). These will be the key themes to monitor looking ahead.

- XAG/USD continues to trade with a downside bias and hit more than two-month lows in the $23.20s on Wednesday.

- The buck continues to advance, weighing on the pair, amid risk-off flows, geopolitical jitters and Fed tightening bets.

Continued buck buoyancy against the backdrop of still very jittery global market risk appetite (US stocks have pared earlier gains to trade flat again and remain near weekly lows) has kept spot silver (XAG/USD) prices trading with a negative bias. XAG/USD continues to struggle on rebounds back towards its 200-Day Moving Average at $23.83 per troy ounce, with the precious metal printing a fresh more than two-month lows on Wednesday in the $23.20s.

Upcoming US GDP and Core PCE inflation data on Thursday and Friday will likely underpin expectations for the Fed to hike interest rates by 50 bps next week and at its coming meetings, which should, alongside concerning geopolitical developments in Europe, keep USD well supported in the coming days. If stocks resume their recent drop, which seems more likely than not at this stage, falling US (and global) yields on safe-haven bond demand might slow the pace of any XAG/USD decline, but bears will nonetheless be eyeing a test of $23.00.

In the slightly longer-term, bears will target test of annual lows in the $22.00 area, with recent failures to get back above the 200DMA and resistance at $24.00 a bearish sign for XAG/USD, so technicians say. But technicians have also warned that the recent build-up of USD long positions is becoming overstretched. A period of likely means a break below $23.00 isn’t on the cards before the end of this month.

US Pending Home Sales fell by 1.2% MoM in March, less than the expected 1.6% drop, after sales fell 4.0% in February, the latest figures from the National Association of Realtors showed on Wednesday. That meant the US Pending Home Sales index fell to 103.7 in March, from 105.0 a month earlier.

Market Reaction

FX markets did not react to the latest US housing figures, with the DXY continuing to trade close to five-year highs in the 103.00 area, as the buck continues to benefit from risk aversion amid heightened geopolitical tensions.

- DXY clinches multiyear peaks above the 103.00 mark.

- Further gains now target the 2017 high at 103.82.

Tracked by the DXY, the greenback trades in fresh multi-year peaks north of the 103.00 mark midweek.

The intense upside pushed the index into the overbought territory – as per the daily RSI near 80 - and this could be the prologue to a potential technical correction in the short-term horizon. The underlying bullish bias, however, remains intact and now targets the 2017 high at 103.82 (January 3).

The current bullish stance in the index remains supported by the 7-month line near 96.70, while the longer-term outlook for the dollar is seen constructive while above the 200-day SMA at 95.60.

DXY daily chart

- USD/CAD attracted some dip-buying on Wednesday and climbed to a fresh multi-week high.

- A combination of factors favour bullish traders and supports prospects for additional gains.

- Any meaningful pullback is likely to be bought into and remain limited near the 1.2700 mark.

The USD/CAD pair shot to its highest level since mid-March on Wednesday, though struggled to capitalize on the move and retreated a few pips from the mid-1.2800s. The pair was last seen trading in neutral territory, around the 1.2830-1.2825 region during the early North American session.

A fresh leg down in crude oil prices undermined the commodity-linked loonie and acted as a tailwind for the USD/CAD pair. Apart from this, the recent US dollar rally remains uninterrupted amid expectations for a more aggressive policy tightening by the Fed. This, in turn, supports prospects for a further near-term appreciating move for the major

From a technical perspective, the overnight strong rally beyond the 61.8% Fibonacci retracement level of the 1.2901-1.2403 downfall was seen as a fresh trigger for bullish traders. The emergence of some dip-buying on Wednesday adds credence to the positive outlook, suggesting that the path of least resistance for the USD/CAD pair is to the upside.

Hence, a subsequent move towards retesting the YTD high, around the 1.2900 mark, remains a distinct possibility. The upward trajectory could further get extended towards the 2021 swing high, around the 1.2960-1.2965 zone, above which bulls might aim to reclaim the key 1.3000 psychological mark for the first time since December 2020.

On the flip side, the daily low, around the 1.2780-1.2775 region, now seems to protect the immediate downside. Any further slide could be seen as a buying opportunity around the 1.2765-1.2755 area. This should limit losses near the 1.2710-1.2700 zone, which if broken decisively could drag spot prices back towards the 50% Fibo. level, around mid-1.2600s.

USD/CAD daily chart

-637866648680309463.png)

Key levels to watch

- NZD/USD has stabilised just above 0.6550, reflecting a better tone to risk appetite and commodity markets.

- But the pair remains at risk of a break towards 0.6500, as geopolitical, global growth and Fed tightening concerns mount.

NZD/USD traded with a slightly negative bias on Wednesday just above the 0.6550 mark, with bears eyeing a test of 2022’s late January lows at 0.6530. Stabilisation in commodity prices (excluding precious metals) and risk appetite (major US bourses are a tad higher on the day) seems to have facilitated some stabilisation in the likes of the risk and commodity-sensitive Aussie, loonie and kiwi currencies.

This has helped shield NZD/USD somewhat against the latest gains made by the US dollar. The US Dollar Index (DXY) recently broke out to its highest since early 2017 above 103.00, primarily as a result of weakness in the euro and yen. As tensions between the EU and Russia over sanctions and energy supplies grow, investor concerns about geopolitics and global growth weakness are unlikely to abate any time soon, suggesting the safe-haven US dollar will continue to do well.

Throw into the mix upcoming US Q1 2022 GDP growth and March Core PCE inflation data, scheduled for release on Thursday and Friday, that are expected to reinforce expectations for multiple 50 bps rate hikes from the Fed at upcoming meeting, and its no wonder the US dollar has been so strong as of late. NZD/USD remains very much at risk of breaking out to fresh year-to-date lows and towards a test of key support at the 0.6500 level.

- DXY gathers extra steam and surpasses 103.00.

- Flash results saw a $125.32B trade deficit in March.

- US yields remain on the positive territory so far on Wednesday.

The greenback, when gauged by the US Dollar Index (DXY), navigates in levels last seen more than five years ago past the 103.00 mark on Wednesday.

US Dollar Index in multi-year highs

The rally in the index stays unabated and now surpasses 103.00 the figure for the first time since January 2017, as the sentiment around the buck remains solid and propped up by investors’ conviction of a Fed’s tighter monetary policy stance.

The latter also appears underpinned by the daily improvement in US yields, while the CME Group’s FedWatch Tools continues to signal the probability of a 50 bps rate hike at almost 95% at the May 4 event.

In the US calendar, MBA Mortgage Applications contracted 8.3% in the week to April 22 and preliminary trade data showed a $125.32B deficit for the month of March. Later in the session, Pending Home Sales are also due.

What to look for around USD

The dollar picks up extra pace and surpasses the key 103.00 barrier in quite a convincing fashion so far on Wednesday. Persevering risk aversion, geopolitics and the bounce in US yields all collaborate with the upside momentum in the buck. In the meantime, the likelihood of a tighter adjustment to the Fed’s monetary conditions continues to be the main driver behind the sharp move higher in the index in past sessions, which also appears reinforced by current elevated inflation narrative and the solid health of the labour market.

Key events in the US this week: MBA Mortgage Applications, Flash Goods Trade Balance, Pending Home Sales (Wednesday) – Advanced Q1 GDP Growth Rate, Initial Claims (Thursday) – Core PCE, PCE, Final Consumer Sentiment, Personal Income/Spending (Friday).

Eminent issues on the back boiler: Escalating geopolitical effervescence vs. Russia and China. Fed’s rate path this year. US-China trade conflict. Future of Biden’s Build Back Better plan.

US Dollar Index relevant levels

Now, the index is advancing 0.67% at 102.98 and the breakout of 103.10 (2022 high April 27) would open the door to 103.82 (2017 high January 3) and finally 104.00 (round level). On the other hand, initial contention emerges at 99.81 (weekly low April 21) seconded by 99.57 (weekly low April 14) and then 97.68 (weekly low March 30).

Russian President Vladimir Putin on Wednesday said that Western plans to suffocate Russia's economy with sanctions have failed, reported Reuters. Putin accused the West of wanting to cut Russia up into different pieces and accused the West of pushing Ukraine into a conflict with Russia.

Putin reiterated that Russia will reach all of its objectives in Ukraine and reiterated his threat that if anyone meddles in Ukraine, Russia's response will be "quick", with all necessary decisions on this already having been taken.

Platinum may be close to a significant break lower. Under $905/897, the precious metal could dive as low as $730, strategists at Credit Suisse report.

Break above $1,026 needed to alleviate immediate downside bias

“A weekly close below $905/897 would be seen to mark a significant break lower with just initial support then seen at the 61.8% retracement of the 2020/2021 bull trend at $860, then the lows from late 2020 at $840828. Big picture though, we would see scope for a fall to $730.”

“Above $1,026 is needed to ease the immediate downside bias and reassert the broader sideways range again.”

- AUD/USD struggled to preserve stronger Australian CPI-inspired gains to the 0.7200 neighbourhood.

- The prospects for rapid interest rate hikes in the US underpinned the USD and capped the upside.

- The risk-on impulse extended some support to the perceived riskier aussie and might help limit losses.

The AUD/USD pair surrendered its intraday gains and dropped to a fresh two-month low, around the 0.7120 region during the early North American session.

The initial market reaction to Wednesday's hotter-than-expected Australian consumer inflation figures faded rather quickly amid the prevalent strong bullish sentiment surrounding the US dollar. It is worth recalling that the headline Australian CPI recorded the fastest annual rise in two decades and fueled speculations that the Reserve Bank of Australia could hike interest rates from record lows as soon as next week. This, in turn, provided a goodish lift to the AUD/USD pair, though the momentum faltered just ahead of the 0.7200 round-figure mark.

On the other hand, the USD prolonged its recent runup and shot to the highest level since March 2020 amid expectations that the Fed will tighten its monetary policy at a faster pace to curb soaring inflation. In fact, the markets now expect the US central bank to raise interest rates by 50 bps when it meets on May 3-4, and again in June, July and September. Apart from this, the deteriorating global economic outlook - amid rising geopolitical tensions and strict COVID-19 lockdowns in China - further benefitted the greenback's status as the reserve currency.

The combination of factors attracted fresh sellers around the AUD/USD pair and dragged spot prices to the lowest level since February 24. That said, the risk-on impulse - as depicted by a solid rebound in the equity markets - could extend some support to the perceived riskier aussie and help limit deeper losses. Nevertheless, the fundamental backdrop favours bearish traders and the price action supports prospects for an extension of the recent sharp pullback from the YTD peak, around the 0.7660 region, touched earlier this April.

Technical levels to watch

The Norwegian krone has weakened markedly over the past week. The NOK could face additional headwinds in the short-term if equity markets continue down when the Federal Reserve most probably hikes by 50bp next week, economists at Nordea report.

Risk aversion is back

“The NOK could weaken further, especially if the sour sentiment continues going into next week’s Fed meeting when they are expected to hike by 50bp and likely signals faster rate hikes going forward. Rate markets have taken this into account, but equity markets could face a reality check and fall further going forward.”

“From a technical perspective, the NOK is now oversold against the USD but not yet oversold against the EUR.”

USD/CAD has climbed to the 1.2845-1.2850 area – a fresh six-week high. Economists at Scotiabank expect the pair to test the 1.29 zone.

USD/CAD trend higher intact and well-supported

“The USD’s advance from the upper 1.27 area leaves the short-term USD/CAD trend higher intact and well-supported on the short and medium-term charts.”

“Extended gains through the 1.27 zone this week leaves the CAD looking soft technically and prone to a renewed test of the 1.29+ zone, where the USD has tended to peak out over the past year.”

“Intraday, we see resistance at 1.2900/05. Support is 1.2770/80.”

How low for EUR/USD? After tumbling to its lowest level in more than five years, analysts at Credit Suisse expect the world’s most popular currency pair to extend its slide towards the 1.0485/1.0341 zone.

Direct break below 1.0341 to open up parity

“Below the 1.0635 low of 2020, we see potential channel support from the 2016 high at 1.0485 next, then the 1.0341 low of 2017. Our bias, for now, would be to look for a low in this 1.0485/1.0341 zone.”

“A direct break below 1.0341 would warn of a further acceleration in the downtrend, with support seen next at the 78.6% retracement of the entire 2000/2008 bull trend and psychological floor at 1.00/0.99. Big picture, we suspect this is where EUR/USD weakness eventually extends to.”

The Bank of Japan (BoJ) will hold its policy meeting on Thursday, April 28 at 03:00 GMT and as we get closer to the release time, here are the expectations forecast by the economists and researchers of six major banks.

The BoJ is unlikely to announce any changes to its monetary policy settings, maintaining rates at -0.10% while holding onto its pledge to buy J-REITS at an annual pace of up to JPY180 bln. The central bank, however, is expected to upgrade its inflation forecasts amid a fragile economic recovery.

Standard Chartered

“While we expect the BoJ to keep policy rates on hold, it may signal policy changes in response to sharp JPY weakness. Rising US and global bond yields have turned yield differentials further against the JPY, pushing the currency to multi-year lows. Sharp JPY weakness (down c.11% versus the USD and c.8% on a NEER basis since March) has raised concerns among Japan’s policymakers. We believe the BoJ may have to increase YCC flexibility, by widening the band or shifting the YCC target to a shorter tenor, amid a persistent global bond sell-off and rising JPY weakness concerns.”

TDS

“BoJ's commitment to YCC has been severely tested. While we do not expect the Bank to follow verbal intervention with actual FX intervention there is potential for a widening in the YCC band. An alternative is to shift the target bond from the 10y to a shorter maturity bond. The BoJ is likely to raise its inflation target to somewhere between 1.5% to 1.9% for FY 23.”

SocGen

“We expect the BoJ to maintain its monetary policy, but the forward guidance is likely to be changed slightly, relaxing its stance to keep the 10-year rate below +0.25%. Also, the BoJ will probably raise the core CPI forecast but lower the growth forecast for FY22.”

BBH

“Another dovish hold is expected after the bank defended its Yield Curve Control again last week. Reports suggest the Bank of Japan will probably raise its FY22 projection for core inflation to 1.5-1.9% vs. 1.1% in January and will probably cut its FY22 growth forecast from 3.8% in January. However, officials stressed that there is no need to tighten policy as the inflationary impact from high oil prices is seen as temporary. This supports our view that Governor Kuroda is likely to maintain current policy through the end of his term in 2023, leaving it to his successor to tighten if conditions warrant.”

MUFG

“We expect at the very least the BoJ to alter its guidance which currently is biased to further easing. Governor Kuroda in addition could launch another ‘policy assessment’ like in March 2021 which coincided with a widening of the 10yr JGB yield band to +/-25bps. It is clear that global yields and inflation in Japan would be consistent with a potential change. If some change in stance is confirmed, it would provide some narrowing of the divergence between BoJ policy and MoF concerns over JPY weakness.”

Citibank

“We expect policy to be kept on hold as there appears to be no change in Governor Kuroda’s basic view that a weak yen remains an overall plus even as he readily acknowledges that the excessively fast forex movements provide a tailwind to rising import prices which increases the burden on households and erodes earnings of SMEs that cannot pass on higher costs. We also point to current forward guidance on BoJ interest rate policy that is linked to COVID-19, which has yet to be contained sufficiently. What about forex intervention? – while the US might accept smoothing operations designed to slow yen’s depreciation, the USD pushback would probably be no more than limited and temporary if unaccompanied by monetary policy change.”

EUR/USD has reached a new low since April 2017. Economists at Scotiabank note that the pair remains at risk of continued losses to 1.05.

Decline into oversold on the RSI may see a slow grind lower to 1.05

“EUR/USD shows limited signs that it will avoid a test of 1.05 soon.”

“~1.0620 stands as an intermediate resistance marker ahead of firmer at the mid-1.06s.”

“There are no major support markers until the 1.05 zone for the EUR but the decline into oversold on the RSI may see a slow grind lower to the figure.”

USD/CAD is testing the top of the high-level range at 1.2844/72. A break above here would open up 1.2900/02 next and potentially 1.2951/64, analysts at Credit Suisse report.

Important near-term support zone seen at 1.2684/53

“In light of the magnitude of the recent advance and the climbing daily MACD momentum, we stay biased for 1.2844/72 – the downtrend from the 2021 high and the 78.6% retracement of the December 2021 fall – to be broken for a test of the March high at 1.2900/02 next.”

“Should 1.2900/02 also break, we would see scope for a move back to the very top of a long-term range from Q1 of 2021 at 1.2947/63, which we would look to serve as a crucial barometer for the market’s medium-term direction.”

“Support moves to 1.2775 and then to 1.2729/28, with a more important near-term support zone seen at 1.2684/53, which ideally holds to maintain the upside pressure. Below here though would support further short-term sideways movement.”

- EUR/JPY remains under pressure and challenges 135.00.

- Further downside could see the 134.30 zone retested.

EUR/JPY accelerates losses and revisits new 3-week lows in the 135.00 neighbourhood on Wednesday.

Further weakness remains the name of the game for the cross in the very near term at least. That said, the leg lower could extend further and retest the monthly lows around 134.30.

In the meantime, while above the 200-day SMA at 130.61, the outlook for the cross is expected to remain constructive.

EUR/JPY daily chart

EUR/USD has extended its slide toward 1.0550 amid unabated dollar strength on Wednesday and touched its lowest level since March 2017.

At the time of press, the pair was down 0.77% on a daily basis at 1.0555 and the US Dollar Index, which tracks the dollar's performance against a basket of six major currencies, was rising 0.65% at 102.96.

The data from the US showed that the international trade deficit in March widened to $125.3 billion from $106.3 billion in February.

Investors continue to flee to safer assets as they grow increasingly concerned about the coronavirus-related lockdowns in China and the protracted Russia-Ukraine conflict weighing heavily on the global economic activity. In the meantime, the dollar also capitalizes on the US Federal Reserve's willingness to tighten its policy at an aggressive pace to tame inflation.

On the other hand, the European economy faces a tough road ahead with the European Union preparing to sanction Russian gas imports. German economy minister said on Wednesday that they are forecasting the economy to grow by 2.2% in 2022 but added that they would go into a recession if they were to ban Russian energy imports.

The US Bureau of Economic Analysis will release its first estimate of the first-quarter Gross Domestic Product (GDP) growth on Thursday.

EUR/USD technical levels to watch for

- A combination of factors assisted USD/JPY to regain positive traction on Wednesday.

- The risk-off impulse undermined the safe-haven JPY and extended support to the pair.

- The Fed-BoJ policy divergence favours bullish traders amid broad-based USD strength.

The USD/JPY pair maintained its bid tone through the mid-European session and was last seen hovering near the daily high, just above the 128.00 round figure.

Having shown some resilience below the 127.00 mark, the USD/JPY pair staged a goodish rebound from the one-week low touched earlier this Wednesday and was supported by a combination of factors. A goodish recovery in the global risk sentiment - as depicted by a solid bounce in the equity markets - undermined the safe-haven Japanese yen. This, along with sustained US dollar buying and the Fed-BoJ monetary policy divergence, offered additional support to spot prices.

The USD rallied to its highest level since March 2020 amid expectations that the Fed will tighten its monetary policy at a faster pace to curb soaring inflation. In fact, the markets now expect the US central bank to raise interest rates by 50 bps when it meets on May 3-4, and again in June, July and September. Apart from this, rising geopolitical tensions and the deteriorating global economic outlook further boosted the greenback's status as the reserve currency.

Russia announced plans to halt gas flows to Poland and Bulgaria from Wednesday amid a standoff over fuel payments from “unfriendly” buyers in rubles. The development raised concerns that Russia would cut off supplies to Europe and impact the region's economic growth. Moreover, strict COVID-19 lockdowns in China is expected to take its toll on the world's second-largest economy, which provided an additional incentive for traders to hold the greenback.

In contrast to the Fed, the BoJ again offered to buy unlimited amounts of Japanese government bonds on Tuesday to defend the 0.25% yield cap. Moreover, Japanese Prime Minister Fumio Kishida urged BoJ to maintain its ultra-loose monetary policy, dismissing the idea of using interest rate hikes to prevent further declines in the domestic currency. The fundamental backdrop favours bulls, though traders seemed reluctant ahead of key event/data risks on Thursday.

The BoJ will announce its monetary policy decision on Thursday and investors will be waiting to see if the central bank makes any changes to its yield curve control policy. Apart from this, the focus will be on the Advance US Q1 GDP report, which might influence Fed rate hike expectations. The combination of factors should provide a fresh impetus to the USD/JPY pair and assist investors to determine the next leg of a directional move.

Technical levels to watch

- GBP/USD has stabilised somewhat in the mid-1.2500s after losing over 3.5% in the last four sessions alone.

- Traders have attributed a weakening UK economic outlook, subsequent paring of BoE tightening bets and broader risk-off flows as weighing.

- Against this backdrop, the prospect for a meaningful rebound looks slim in the near term.

Tuesday’s major underperformer pound sterling has seen some much-needed stabilisation on Wednesday, with GBP/USD currently trading a little lower on the day near 1.2550, having dropped a staggering more than 3.5% over the last four sessions alone. Traders attributed recent weakness to a combination of factoring, including last week’s ugly UK March Retail Sales figures which underscore the impact of the UK’s most severe cost-of-living squeeze in decades, evidence on Tuesday of higher-than-expected government borrowing and a backdrop of risk-off flows amid fears about geopolitics, global growth weakness and central bank tightening.

Some analysts have said that bearish sentiment in the pair might now be getting a little stretched in the run-up to next week’s BoE meeting. That could explain how GBP was able to shrug off Wednesday’s ugly UK CBI Distributive Trades survey data, which indicates a massive further downturn in retail spending this month after March’s already large decline. Some analysts argued that buying ahead of support at the key 1.2500 level could offer the pair some short-term respite.

But most would agree that the prospect of a more meaningful rebound in GBP/USD remains remote. Sentiment towards the health of the UK economy seems only likely to worsen, meaning markets may continue to pare BoE tightening bets. Meanwhile, the prospect for a broader upturn in risk appetite (i.e. a rebound in global stocks) against the backdrop of still very elevated inflation and geopolitical tensions and a Fed keen to press ahead with policy tightening also looks limited.

European Commission President Ursula von der Leyen said on Wednesday that it would be a breach of sanctions imposed against Russia if they were to pay in rubles, as reported by Reuters.

Von der Leyen further added that they will continue to work to ensure that they have sufficient gas supply and storage in the medium term and noted that the "era of Russia fossil fuels" in Europe was coming to an end.

Market reaction

Although the Euro Stoxx 600 clings to strong daily gains after these comments, the shared currency is having a difficult time finding demand. As of writing, EUR/USD was trading at its lowest level in five years at 1.0575, losing 0.6% on a daily basis.

German Economy Minister Robert Habeck said on Wednesday that German GDP growth in 2022 is now seen at 2.2% and 2.5% in 2023, assuming there is no embargo or blockade on Russian energy imports, reported Reuters. If that was to transpire, he added, there would be a recession this year.

Habeck added that German dependency on Russian gas is now 35% and said that Germany must be willing to pay the price of higher inflation and slower growth for supporting Ukraine. Ukraine is fighting for its freedom, he noted, before adding that Ukraine is also fighting for "us".

Gold has fallen sharply over the past couple of days, with the market now testing key support at $1,877. XAUUSD needs to hold above here to maintain a slight upward bias, economists at Credit Suisse report.

Gold to complete a top on a break below $1,877

“The $1,877 level needs to hold to avoid an in-range top and to maintain an upward bias in the broader sideways range, with first key resistance at the recent $1,998/2,000 high.”

Only above the $2,070/75 highs though would be seen to resolve the broader-medium-term range higher for a fresh bull trend, with resistance then seen at $2,280/2,300.”

“A break below $1,877 would complete a top to turn the risks lower within the broad sideways range, with next support then seen at $1,845/33.”

- EUR/USD has seen further downside since the start of European trade and is now under 1.0600.

- That marks its weakest level since April 2017, with the pair on course for its worst month since early 2015.

- The latest leg lower reflects concerns about Eurozone energy supply as tensions with Russia over gas supply rise.

After falling marginally below the 2020 low at 1.06359 but then proceeding to meander sideways during Asia Pacific trade, EUR/USD’s downside momentum gathered pace at the start of the European trading session. Ahead of the start of the US session, the pair is now trading to the south of the 1.0600 level for the first time since April 2017, some five years ago. Traders attributed the most recent leg lower to concerns about Eurozone energy supply, with Russia’s Gazprom on Tuesday announcing that it would halt gas shipments to countries that refuse to pay in roubles.

Signs this morning suggest that numerous European gas companies are caving to the threat of an abrupt halt in supplies and have either already agreed to pay in roubles, or are in the process of opening new accounts at Russian banks to do so. Regardless, currency traders are upping the geopolitical risk premia priced into the euro and, at current levels in the 1.0580s, EUR/USD is trading lower by about 0.5% on the session.

That takes the pair’s losses on the month to nearly 4.5%, which would mark the pair’s worst one-month performance since the start of 2015. Russo-Ukraine/NATO tensions since the start of the war in February have, of course, been one crucial driver of the recent acceleration in EUR/USD downside. But Fed/ECB divergence and a hit to global risk appetite on central bank tightening fears has also been a key driver.

Upcoming Eurozone April Consumer Price Inflation and US March Core PCE data out on Thursday and Friday will serve as a timely reminder of the rampant inflation faced by both economies and should underscore the need for both the Fed and ECB to tighten policy in the coming quarters. But Q1 2022 GDP growth out of the US and Eurozone, also on Thursday and Friday, will underscore the divergence in economic health of the two regions. This could further weigh on EUR/USD. Bears will be eyeing a test of 2017 lows in the mid-1.0300s.

- USD/CHF jumped to a fresh YTD peak on Wednesday amid the prevalent USD buying interest.

- Bets for aggressive Fed rate hikes, a bleak global economic outlook continued boosting the USD.

- The risk-on impulse could undermine the safe-haven CHF and supports prospects for further gains.

The USD/CHF pair retreated a few pips from its highest level since May 2020 touched during the first half of the European session and was last seen trading just below the mid-0.9600s.

The pair prolonged its recent strong bullish run witnessed since the beginning of this month and gained follow-through traction for the fifth successive day on Wednesday. The momentum was sponsored by sustained buying around the US dollar, which climbed to a more than two-year peak amid the prospects for a more aggressive policy tightening by the Fed.

Investors now expect the Fed to raise interest rates by 50 bps at each of its next four meetings in May, June, July and September. The bets were reaffirmed by the recent hawkish comments by influential FOMC members, including Fed Chair Jerome Powell. This, along with the deteriorating global economic outlook, boosted the greenback's reserve currency status.

Expectations for rapid interest rate hikes in the US, prolonged Russia-Ukraine conflict and the latest COVID-19 outbreak in China have raised fears of stalling global growth. Investors now seem worried that Russia could follow through on its threat to halt gas flows to countries that refuse to pay for fuel in roubles and cut off supplies to Europe.

That said, extremely overbought conditions held back traders from placing fresh bullish bets and kept a lid on any further gains for the USD/CHF pair, at least for now. The intraday bias, however, remains tilted in favour of bulls amid the prevalent strong bullish sentiment surrounding the USD and the risk-on impulse, which tends to undermine the safe-haven Swiss franc.

Market participants now look forward to second-tier US economic releases for some impetus later during the early North American session. The data, along with Fed rate hike expectations, would influence the USD price dynamics. Traders will further take cues from the broader market risk sentiment to grab some short-term opportunities around the USD/CHF pair.

Technical levels to watch

- USD/CAD attracted some dip-buying on Wednesday and shot to a fresh multi-week high.

- Aggressive Fed rate hike bets pushed the USD to a two-year top and remained supportive.

- An uptick in oil prices did little to benefit the loonie or hinder the intraday positive move.

The USD/CAD pair rallied around 80 pips from the daily low and climbed to the 1.2845-1.2850 region, or a fresh six-week high during the first half of the European session.

Following an early dip to the 1.2780-1.2775 region, the USD/CAD pair regained traction on Wednesday and turned positive for the fifth successive day amid the prevalent US dollar buying interest. Rising bets for a more aggressive policy tightening by the Fed continued acting as a tailwind for the buck, which was further underpinned by the deteriorating global economic outlook.

Investors now expect the Fed to raise interest rates by 50 bps at each of its next four meetings in May, June, July and September. The expectations were reaffirmed by the recent hawkish comments by influential FOMC members, including Fed Chair Jerome Powell. prolonged Russia-Ukraine conflict and the latest COVID-19 outbreak in China have raised fears of stalling global growth.

The supporting factor, to a larger extent, helped offset an uptick in crude oil prices, which tend to benefit the commodity-linked loonie. Poland and Bulgaria said that Russia will stop supplying gas on Wednesday. This, in turn, fueled worries that Russia could follow through on its threat to halt gas flows to countries that refuse to pay for fuel in roubles and cut off supplies to Europe. This, along with hopes for more Chinese economic stimulus, underpinned crude oil prices.

Nevertheless, the emergence of dip-buying and acceptance above the 1.2800 mark favours bullish traders. Hence, some follow-through strength back towards testing the YTD peak, around the 1.2900 round figure, remains a distinct possibility. Market participants now look forward to second-tier US economic data, which, along with the broader market risk sentiment, will influence the USD. Traders will also take cues from oil price dynamics to grab short-term opportunities around the USD/CAD pair.

Technical levels to watch

The Reserve Bank of Australia (RBA) is set to hike rates next week. However, any positive impact on the aussie may be offset by a challenging external environment, economists at ING report.

Positive impact on AUD may not last long

“If our expectation for a 40bp hike proves correct, AUD is looking at some decent upside potential next week. The market’s pricing further down the road is, however, more aggressive (around 240bp worth of hikes), and while the notion of front-loaded tightening can offer support to the currency in the near term, it can limit the room for appreciation in the longer run.”

“Looking at the coming weeks, there is a risk that the impact from an RBA hike may prove a one-off positive event for the aussie, as the external environment remains highly challenging for the currency, due to its high beta to: 1) China’s covid crisis and the negative implications for the demand outlook in the region; 2) Global risk sentiment as markets grow increasingly concerned of a global slowdown; 3) Fresh weakness in iron ore prices.”

“Adding some limited USD downside risks as the Fed starts a more aggressive phase of monetary tightening, we think any RBA-induced rally in AUD/USD may stall around the 0.7300 area if it even reaches such levels.”

“Contrasting factors suggest a flattish profile in AUD/USD into the summer.”

Economists at Barclays Research see the USD/JPY pair trapped in a 126.50-130.00 this week. They highlight the key technical levels to watch.

Resistance comes initially at 129.40

"We see USD/JPY trading in a technical range of 126.5-130.0 this week.”