- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 27-02-2022

- Ukraine risks are driving the price action at the start of the week.

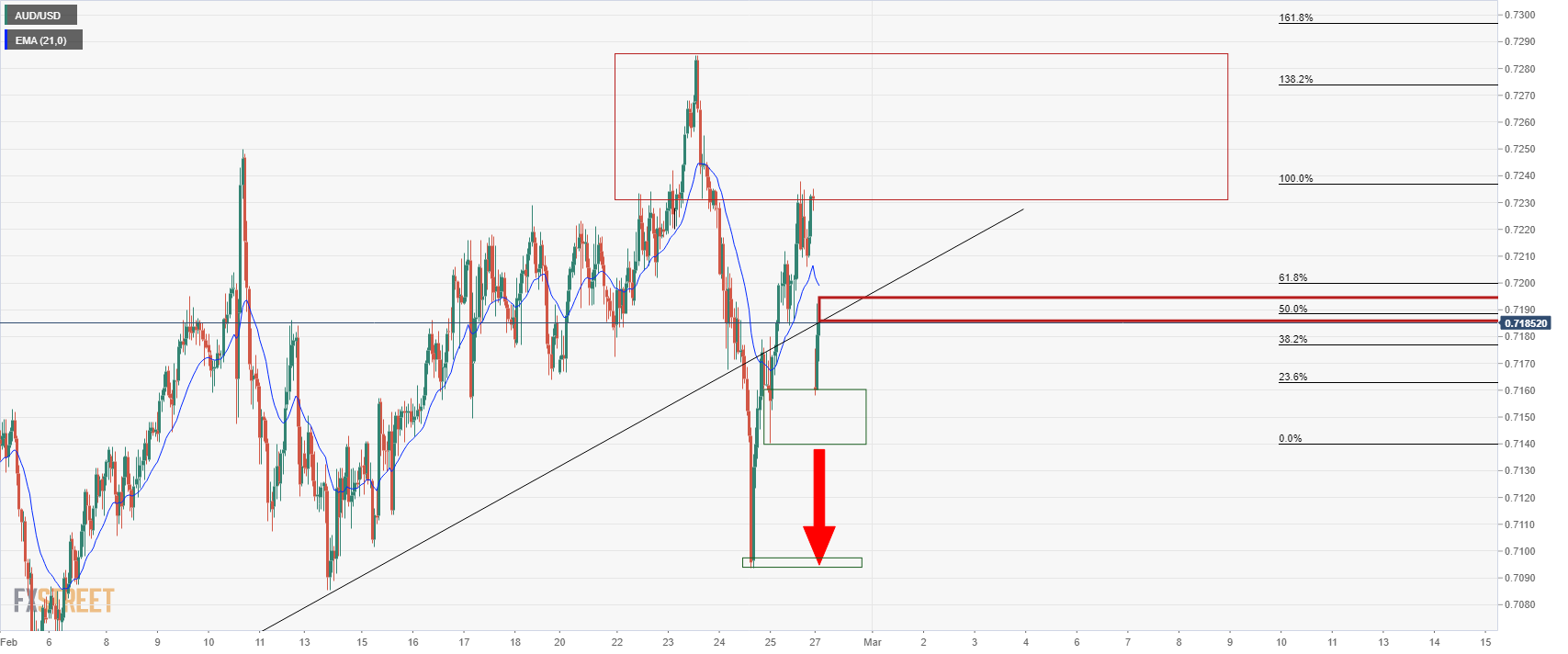

- AUD/USD bears eye between 0.7150 and the 0.7090s.

AUD/USD is under pressure in a risk-off environment at the start of the week as markets weigh the Ukraine crisis risks following the latest developments from over the weekend. This puts an emphasis on the downside with the price at a critical juncture as illustrated in the following analysis on the daily and hourly charts.

AUD/USD daily chart

The pair has been volatile over the course of the crisis and has managed, so far, to recover back to the counter-trendline of the rising wedge formation. However, there are prospects of a downside continuation should the resistance hold up.

AUD/USD hourly chart

The bears will note the imbalance of price to the downside below 0.7150 into the 0.7090s which could be targeted for the sessions ahead.

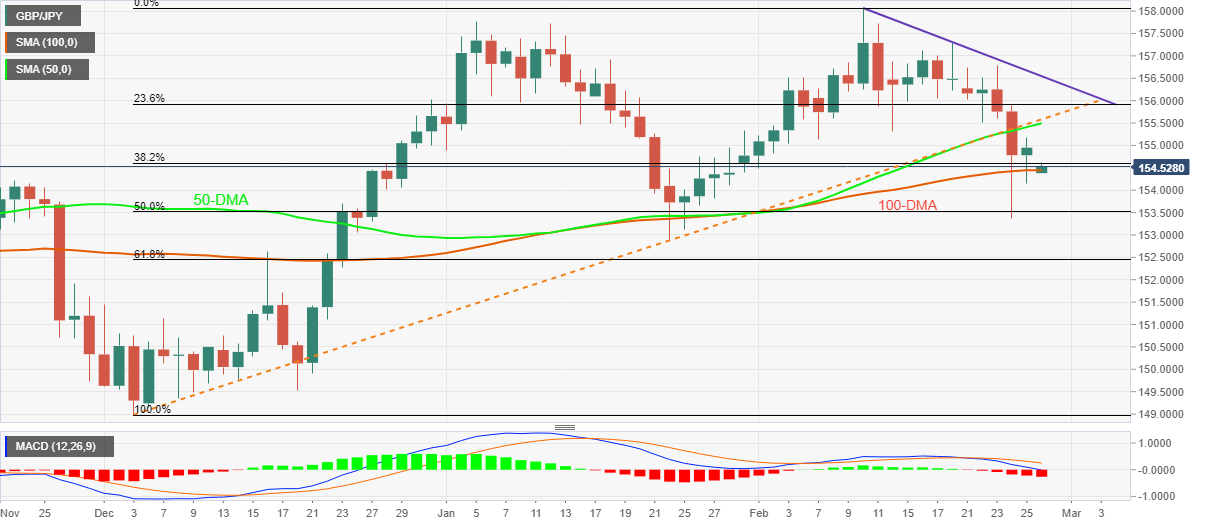

- GBP/JPY begins the week with a 60-pip gap-down, picks up bids of late.

- 100-DMA restricts immediate declines but bearish MACD signals, trend line breakdown favor sellers.

- 50-DMA, 12-day-old resistance line add to the upside filters, bears can aim for 50% Fibonacci retracement.

GBP/JPY fills the week-start gap to the south around 154.50, down 0.30% intraday during early Monday morning in Asia.

In doing so, the quote seesaws around the 100-DMA level while keeping the last week’s downside break of an upward sloping trend line from December 03 and the 50-DMA.

Given the bearish MACD signals joining the sustained downside break of the previous key supports, GBP/JPY prices are likely to decline further.

However, a daily closing below the 100-DMA level near 154.50 becomes necessary for the pair sellers to aim for the 50% Fibonacci retracement (Fibo.) of December-February upside, near 153.50.

Following that, January’s bottom of 152.90 and 61.8% Fibo. near 152.50 will test the GBP/JPY bears.

Alternatively, a convergence of the 50-DMA and previous support line, around 155.50, restricts the short-term upside of the quote.

It should be noted that the GBP/JPY buyers remain unconvinced til the quote stays below a 12-day-old resistance line, around 156.60 by the press time.

GBP/JPY: Daily chart

Trend: Further weakness expected

The UK government’s Spokesperson said early Monday that Ukraine President Volodymyr Zelenskyy hold British PM Boris Johnson that he believed the next 24 hours was a crucial period for Ukraine.

Meanwhile, President Zelenskyy tweeted out, “also, - had a phone conversation with @vonderleyen - Talked about concrete decisions on strengthening Ukraine's defense capabilities, macro-financial assistance and Ukraine's membership in the #EU.”

Related reads

- Ukraine and Russia are set to hold negotiations at the Belarusian-Ukrainian border

- S&P 500 Futures drop 2.50% as Russia-Ukraine crisis escalates

- USD/CHF is eyeing 0.9300 as fears amid the Russia-Ukraine war intensify post-nuclear deterrent.

- The risk-off impulse has underpinned the greenback against the Swiss franc.

- Investors have overlooked the expected Moscow-Ukraine negotiations without preconditions.

The USD/CHF has opened on a cautious note on Monday but bounced back after sensing some significant bids around 0.9250 as investors underpin the greenback after the escalation in the Russia-Ukraine war. The former has threatened Ukraine with a nuclear attack. Although, this is an announcement yet by Russian leader Vladimir Putin the man is no joke and the Western leaders have nothing but to take his threats seriously.

Putin’s nuclear deterrent on Ukraine has set a risk-off impulse in the market. Meanwhile, the nations are ready for negotiations without preconditions but investors seem to overlook the negotiations' headlines and focus on a potential nuclear threat in isolation by the press time.

Post the sanctions imposed on Russia, the financial system has been disrupted as US President Joe Biden disconnected several Russian banks from the SWIFT international payments system. The Russian citizens are rushing for liquidity on ATMs as fears intensify amid the collapse of their international banking infrastructure.

Apart from the risk-off impulse, the greenback has been preferred against the Swiss franc on expectations of an aggressive tightening policy by the Federal Reserve (Fed). The monetary policy meet by the Fed is due in March and its members may vote for an aggressive policy to get a grip over soaring inflation.

On the data front, the Swiss docket will report the quarterly Gross Domestic Product (GDP) numbers on Monday, which are seen at 0.4% QoQ in Q4 2021, lower than the previous print of 1.7%.

- Gold holds steady above a demand area on the charts as the focus stays on Ukraine-Russia risk.

- In the background, the Fed is a driver for gold prices and US NFP will be eyed this week.

- Gold: Volatility to continue as investors stay on edge

Gold is holding near last week's lows in the open as markets weigh up the weekend headlines surrounding the Ukraine-Russia crisis. On the one hand, Russia's President, Vladimir Putin, put nuclear forces on high alert over the weekend, escalating tensions, but on the other hand, there are reports of a peace talk in the offing. Consequently, financial markets are mixed at the open with large gaps in forex being filled.

Western powers' moves to cut some Russian banks from the SWIFT global payments system and freeze the Bank of Russia's reserves have antagonised the Russian president. Putin said he was giving the nuclear readiness order because “top officials in NATO’s leading countries have been making aggressive statements against our country,” according to a report from Russian state news operator TASS.

Meanwhile, Ukrainian President Volodymyr Zelensky confirmed to Sky News that the two sides would hold the talks on the border of Ukraine and Belarus, where some of the Russian troops invading his country had been held.

Zelensky had refused to agree to an earlier request for talks in Belarus, arguing it was not neutral territory. Sky News, referring to a statement from Zelensky's office, said the two delegations will meet "without preconditions" near the Pripyat River.

The Russia risk premium has overwhelmingly contributed to the rise in gold prices from the start of February, analysts at TD Securities explained. ''The Russia risk premium has catalyzed a breakout from the wedge pattern, bringing in some chartist demand, and sparking a substantial CTA buying program which is supporting prices today. This rolling series of events have culminated in the strong price action.''

Looking forward, however, the analysts argued that the crushing weight of a hawkish Fed will ultimately sap appetite for precious metals, which should argue for lower prices as safe-haven flows reverse. ''Without sustained buying behaviour, gold prices are unlikely to remain in an uptrend, particularly as real rates rise sharply amid dual tightening via hikes and quantitative tightening.''

However, rising tensions in Ukraine have recently fueled expectations that the Fed may be less aggressive in tightening policy as it attempts to rein in inflation. Expectations for at least a 50-basis-point interest rate hike at its March meeting have fallen to 25% from around 34% a day ago, according to CME's Fedwatch.

In this regard, the data at the end of the week will be important. The US Nonfarm Payrolls report likely continued to recover in February following an unexpectedly strong Jan report—despite the Omicron-led surge in COVID cases, analysts at TD securities aid.

''We expect some of that boost to fizzle, though to still firm job growth pace. Seasonal adjustments were a factor last month and they will likely play a role again in Feb. We expect wage growth to slow to a still strong 0.5% m/m pace.''

Gold technical analysis

The price is testing a key daily support area that guards risk to below $1,844, However, should the bulls commit at this juncture, an upside continuation would be expected for the near future.

- Global markets began the week on a back foot on Russia-Ukraine headlines.

- Russia-Ukraine agrees to talk peace but Moscow keeps nuclear facilities on high alert.

- Western sanctions cripple Russia's economy, oil in focus.

- Second-tier US data may entertain traders ahead of Friday’s US NFP, nothing more important than geopolitics.

Market sentiment remains sour as weekend headlines couldn’t placate fears of a full-fledged war between Ukraine and Russia, despite the latest agreement to talk for peace. While portraying the mood, S&P 500 Futures decline 2.5% to 4,275 whereas the US 10-year Treasury yields struggle around 1.96% by the press time.

The West agreed to cut some of the Russian banks from the SWIFT international payment system, also marked sanctions on the Russian central bank, to portray their dislike of Moscow’s invasion of Ukraine. In a reaction, Russian President Vladimir Putin puts nuclear deterrence forces on high alert and offered another blow to the market sentiment.

However, headlines conveying the Ukraine-Russia peace talks, at the Belarus-Ukrainian border, may offer a sigh of relief but global uncertainty keeps optimists at bay.

It’s worth noting that the US dollar cheers the market’s risk-off mood, which in turn drowns Antipodeans. However, firmer oil prices keep CAD buyers hopeful.

Despite fewer hopes of a settlement of geopolitical disputes between Kyiv and Moscow, any progress in talks will offer a good start to the week’s trading, especially to the riskier assets. However, any negatives won’t be taken lightly and can trigger a rush to risk-safety that propelled the US dollar and gold to the multi-month high in the last week.

Hence, markets are dicey amid growing anxiety over the Russia-Ukraine stand-off and hence traders should remain cautious.

Read: Ukraine and Russia are set to hold negotiations at the Belarusian-Ukrainian border

- WTI price explodes at the start of a fresh week, as Russia-Ukraine concerns dominate.

- The West banks Russian banks from SWIFT payments while Moscow threatens nuclear deterrence.

- Geopolitics will continue to drive the oil price action in the coming sessions.

WTI (NYMEX futures) has shot through the roof, in a massive bullish opening gap on Monday, as tensions between Russia and Ukraine heighten after the West banned Russian central banks from the SWIFT payment.

This comes after Russia invaded Ukraine last Thursday, triggering full-blown military warfare between both countries. Amidst escalating Russia-Ukraine tensions, the Russian President Vladimir Putin ordered “the minister of defense and the chief of the general staff [of the Russian armed forces] to transfer the deterrence forces of the Russian army to a special mode of combat duty,” per The Guardian.

Investors fear that the Russia-Ukraine war could disrupt the global oil supplies, leading to an oil market imbalance. Therefore, the black gold is on a run higher in anticipation of the tightening global supplies.

As of writing, WTI is adding 5.57% on the day, trading at $97.06, quickly retracing from daily highs of $98.68.

All eyes will remain on the incoming headlines on the Ukraine turmoil, which will significantly impact the market sentiment and oil prices as well. The weekly US crude oil stocks change data will offer little incentive to traders this week.

Read: Russian talk of nuclear weapons, West's SWIFT sanctions to trigger panic, then create opportunities

The Reserve Bank's Head of Economics and Chief Economist, Yuong Ha, has stated that trade links between new Zealand and Russia, Ukraine are minor, with some impact on commodities.

Ha said it is too early to say what effect the Russian situation might have on RBNZ policy

Key comments

Ha says still have more work to do on controlling inflation, need policy to be contractionary.

Ha says rates 100 basis points above neutral of 2.0% is reasonable from historical perspective.

Ha says content with market pricing of rate outlook, 50 bps moves are a possibility if needed.

Ha says wanted to give markets a strong message on our determination to control inflation.

Ha says heat coming out of housing market, prices were too high.

NZD/USD update

The Kiwi had opened below 0.67 in an unwind of earlier gains seen on Friday in a response to fresh sanctions against Russia which has diminished risk appetite in general.

''The RBNZ’s tone is secondary at the moment, but to the extent that it matters, our sense is that with them on the front foot, but with other central banks catching up, that potentially speaks to NZD strength fading as the year rolls on. Also in the region this week, watch the RBA (tomorrow); the NZD remains fairly closely correlated to the AUD,'' analysts at ANZ Bank argued.

- USD/CAD printed the biggest daily loss of 2022 on Friday as risk-off mood escalated.

- Russia President Putin puts nuclear deterrence forces on high alert.

- Ukraine-Russia talks can trigger risk-on mood but nothing positive so far as West escalates pressure on Moscow with harsh sanctions.

- Canada Q4 Current Account, second-tier US data may decorate calendar but risk catalysts are crucial to follow.

USD/CAD portrayed the heaviest weekly loss in six by the end of Friday, poking 1.2700 at the latest. In doing so, the Loonie pair also marked the heaviest daily fall of 2022 as oil bulls remain hopeful over the Russia-Ukraine crisis.

With major currency pairs marking the week-start gaps to justify the risk-off mood in the market, due to weekend headlines from Russia and Ukraine, USD/CAD traders remain on the edge as the quote broke monthly support on Friday.

After the initial hesitance, the Western leaders finally agreed to cut some of the Russian banks from the SWIFT international payment system, also marked sanctions on the Russian central bank, to portray their dislike of Moscow’s invasion of Ukraine. In a reaction, Russian President Vladimir Putin puts nuclear deterrence forces on high alert and offered another blow to the market sentiment.

However, headlines conveying the Ukraine-Russia peace talks, at the Belarus-Ukrainian border, may offer a sigh of relief and could help the USD/CAD pare recent losses as the Asian markets gain momentum on Monday morning.

It’s worth noting that WTI crude oil prices, Canada’s key export item, printed ‘Gravestone Doji’ bearish candlestick on the weekly chart while closing around $91.80 on Friday.

That said, Canada’s Q4 Current Account will join the US trade numbers for January and Chicago Purchasing Managers’ Index for February to decorate the calendar for short-term directions to the USD/CAD traders. However, risk catalysts will be crucial, especially the Russia-Ukraine headlines.

Technical analysis

USD/CAD recently broke a monthly support line, around 1.2710 by the press time, which in turn directs the quote towards the 100-DMA level surrounding 1.2630. However, the 50-DMA level tests the downside momentum near the 1.2700 threshold.

- GBP/USD has opened on a gap down note below 1.3350 on Putin’s nuclear deterrent on Ukraine.

- The expectations of a recession in Europe have set a negative undertone in the market.

- The Russian-Ukraine negotiations may provide fresh impetus to investors.

The GBP/USD pair has opened on a negative note on Monday, heading towards 1.3350, as investors see a wave of risk-aversion on Russia’s threat of nuclear attack on Ukraine. The move has been called ‘totally unacceptable' by US President Joe Biden, being the largest assault in Europe since the Second World War.

Investors are also focusing on expected negotiations between the Kremlin and Ukraine. The nations have decided to call for negotiations at the Belarusian-Ukrainian border without any preconditions.

On that Ukrainian President Volodymyr Zelenskyy said "I do not really believe in the outcome of this meeting, but let them try, so that later not a single citizen of Ukraine has any doubt that I, as president, tried to stop the war,". This is because investors are hopeful for de-escalation but any negative outcome after the meeting may spurt uncertainty in an already volatile environment.

The market participants are also getting nervous about the Federal Reserve (Fed) monetary policy outcome as each day passes before March 16-17. An aggressive tightening policy from the Fed is on the cards amid rising oil prices. Also, the central bank seems to be in dilemma over choosing an aggressive policy to combat inflation or to prefer some leniency ahead of recession concerns in Europe amid the geopolitical tensions.

Other than the development over the geopolitical tensions and Fed’s monetary policy expectations, investors will keep an eye on the British Final Manufacturing PMI due on Tuesday.

- AUD/JPY is attempting a dead cat bounce after a big gap down open.

- Risk aversion remains at full steam on escalating Russia-Ukraine crisis.

- All eyes on the geopolitical developments, with Powell and NFP ahead.

AUD/JPY is warranting caution for the G10 currencies market this Monday, as the risk barometer gapped down nearly 70-pips in the weekly opening to reach as low as 82.39.

At the time of writing, the cross is trading at 83.50, down 0.47% on the day, staging a quick recovery.

Despite the rebound, the downside remains intact, as markets remain risk-averse amid escalating tensions between the West and Russia over the Ukraine turmoil.

Over the weekend, the US and its NATO allies excluded a number of Russian banks from SWIFT while Russia's President Vladimir Putin had been reported to order his military to put Russia’s nuclear deterrence forces on high alert.

Amid escalating crisis, traders continue to move away from risk-sensitive currencies while boding well for safe-havens such as gold, the US dollar etc.

Markets remain cautious, with Ukraine and Russia set to hold negotiations at the Belarusian-Ukrainian border later on Monday.

AUD/JPY technical levels to watch

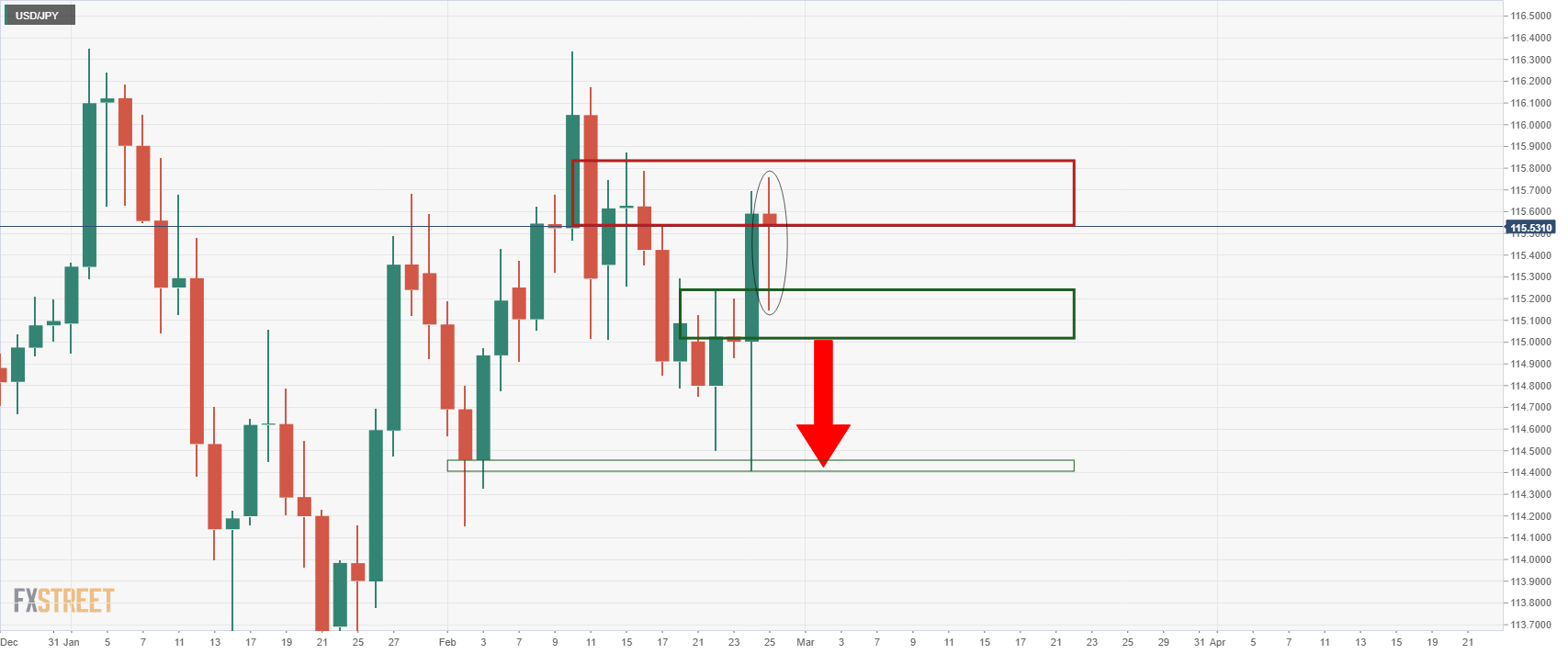

- USD/JPY recovers from the opening bearish gap as markets are mixed on the Ukraine crisis.

- Headlines from the weekend offer something both the bears and bulls.

USD/JPY opened at 115.14 and moments later, the pair has recovered to print a high of 115.78 on news that Ukrainian President Volodymyr Zelensky said Ukraine and Russia would conduct the first diplomatic talks since the Kremlin-launched invasion.

However, this comes on the back of Russian President Vladimir Putin stating on Sunday that he had put his nuclear deterrence forces on high alert, attributing the move to "aggressive statements" from the West against Russia. The White House called the order an example of "manufacturing threats that don't exist."

The Pentagon has criticized Putin's decision to put his nuclear forces on high alert as "unnecessary" and "escalatory," but remains confident that the United States and NATO will be able to defend themselves, according to a senior defence official.

In other news from the weekend, the Kremlin's access to its sizable foreign currency reserves in the West will be cut off some as the West decides to block Russian banks from the SWIFT financial messaging system.

Meanwhile, the week ahead will be important for financial markets considering the economic data slated. In particular, US Nonfarm Payrolls will be of interest. ''Employment likely continued to recover in February following an unexpectedly strong Jan report—despite the Omicron-led surge in COVID cases,'' analysts at TD Securities explained.

''We expect some of that boost to fizzle, though to still firm job growth pace. Seasonal adjustments were a factor last month and they will likely play a role again in Feb. We expect wage growth to slow to a still strong 0.5% MoM pace.''

- NZD/USD begins the week with a downside gap, picks up bids of late.

- Russian central bank sanctions, West united to cut some banks from Moscow from SWIFT.

- Talks between Ukraine and Russia trigger cautious optimism as well.

- Second-tier NZ, US data may decorate today’s calendar, Moscow-Kyiv headlines are the key.

NZD/USD began the week’s trading with a downside gap to 0.6664 as markets reacted to the weekend news with a stark risk-off mood. However, the kiwi pair regains upside momentum afterward and is currently taking the bids around 0.6700 amid hopes of easing tensions between Russia and Ukraine. That said, the quote rose for the consecutive four weeks in the last.

The Western leaders finally agreed to cut some of the Russian banks from the SWIFT international payment system, also marked sanctions on the Russian central bank, to portray their dislike of Moscow’s invasion of Ukraine. In a reaction, Russian President Vladimir Putin puts nuclear deterrence forces on high alert and offered another blow to the market sentiment.

However, headlines conveying the Ukraine-Russia peace talks, at the Belarus-Ukrainian border, seemed to have offered a sigh of relief as the Asian markets gain momentum on Monday morning.

Hence, risk appetite witnessed a heavy blow at the start but the mood is improving as traders gain news headlines on the key geopolitical issues, which in turn helps NZD/USD to pare the week-start losses.

That said, markets printed heavy risk-off during the last week but the Reserve Bank of New Zealand’s (RBNZ) hawkish tone and a 0.25% rate-hike seems to have helped the kiwi pair a fourth weekly upside by the end of Friday’s trading.

Moving on, risk catalysts keep the driver’s seat and will direct immediate NZD/USD moves. However, ANZ Business Confidence and Activity Outlook data for February may offer immediate directions to the pair traders. Following that, the US trade numbers for January and Chicago Purchasing Managers’ Index for February will decorate the daily calendar. That said, major attention will be given to Tuesday’s China PMIs for February and Friday’s US jobs report, not to forget the Russia-Ukraine headlines.

Technical analysis

NZD/USD bears need to remain cautious until witnessing a clear downside break of the monthly support line, around 0.6650 by the press time.

- AUD/USD sees a bearish opening gap amid the escalation of war between Russia and Ukraine.

- The risk-off impulse may keep the aussie under tremendous pressure.

- Investors will focus on negotiations between Russia and Ukraine without preconditions.

The AUD/USD pair sees a bearish start upon the negative developments in the Russia-Ukraine war over the weekend and investors witness a risk-off impulse, which keep the aussie on its toes.

For the first time, the 27-countries basket European Union (EU) decided to supply weaponry aid to a nation for a war. The EU would send 450 million euros of weaponry to its eastern neighbor, as per Reuters. The promise of weaponry aid to a country by the EU itself had raised the expectations of a war outrage extension beyond two countries. This has underpinned the risk-off impulse starting out Monday’s session.

The US President Joe Biden mentioned that the Moscow has escalated the war in a ‘total unacceptable’ way as the ongoing Russian invasion on Ukraine is the biggest military action in Europe since 1945.

The sanctions imposed on Russia, which had disconnected the Moscow from international payments environment, dampened the overall financial system of the country. Moscow’ people were rushing to ATMs for cash on intensifying fears of liquidity situation in Russia.

One thing which will keep investors hopeful is the negotiations between the Kremlin and Ukraine at the Belarusian-Ukrainian border and ‘without preconditions’, the Ukrainian president's office said.

Apart from the Russia-Ukraine headlines, investors will look for fresh impetus from the Federal Reserve (Fed)’ members on monetary policy announcement, which is due in March. But, for the activity in the session ahead, the Retail Sales from Australian Bureau of Statistics will remain in focus, which is due on Monday.

- EUR/USD falls to fresh lows for 2022 following weekend headlines surrounding the Ukraine crisis.

- Traders will look for updates surrounding the prospects of peace talks.

- Risk-off start to week: Russia's Putin puts nuclear deterrence forces on high alert

EUR/USD dropped to 1.1118, a fresh low for 2022 as markets open risk-off due to the heightened tensions surrounding the Ukraine crisis.

However, there are also prospects of negotiations between Ukraine and Russia but there is no full picture on this as of yet. However, there are hopes of peace talks that balances out the nuclear noise in the markets.

Putin said he was giving the nuclear readiness order because “top officials in NATO’s leading countries have been making aggressive statements against our country,” according to a report from Russian state news operator TASS.

-

Ukraine and Russia are set to hold negotiations at the Belarusian-Ukrainian border

Besides the Ukraine crisis, Euroland inflation data will be key and markets look for upside risks in Germany & the euro area in general. ''We expect core and headline inflation to reach new all-time highs, as food and energy prices continue to surge (we expect EZ headline at 5.7% YoY). Price pressures are broadening out, and the Ukraine conflict adds a substantial amount of upside risk to the inflation outlook,'' analysts at TD Securities explained.

At the end of the week, Nonfarm Payrolls from the US will be watched following an unexpectedly strong January report—despite the Omicron-led surge in COVID cases.

''We expect some of that boost to fizzle, though to still firm job growth pace. Seasonal adjustments were a factor last month and they will likely play a role again in Feb. We expect wage growth to slow to a still-strong 0.5% m/m pace,'' the analysts at TD Securities said.

EUR/USD weekly chart

Below these fresh 2022 lows, bears will look left to the weekly target near 1.1020.

The Ukrainian government plans to dispatch a delegation to meet with its Russian counterparts “without preconditions” on the Ukrainian-Belarusian border, near the Pripyat River, according to a statement issued by Zelensky’s official channel on the Telegram messaging app.

Earlier in the day, an aide to Russian President Vladimir Putin and the head of the Russian delegation, Vladimir Medinsky, had set a 3 p.m. local time deadline for Ukraine to join negotiations, saying that rejecting the proposal would put “all responsibility for the bloodshed” on the Ukrainian side, according to a report from Russian state news outlet RIA.

This follows news of Russia's blackmail over nuclear war threats as the nation puts its nuclear capability at a higher rate of readiness.

In the latest escalation to the Ukraine crisis, Russia's Vladimir Putin has been reported to order his military to put Russia’s nuclear deterrence forces on high alert.

“Senior officials of the leading Nato countries also allow aggressive statements against our country, therefore I order the minister of defence and the chief of the general staff [of the Russian armed forces] to transfer the deterrence forces of the Russian army to a special mode of combat duty,” Putin said in televised comments.

The Guardian reports:

''The Russian leader is prepared to resort to the most extreme level of brinkmanship in his effort to achieve victory in Ukraine.''

''The US accused Putin of “totally unacceptable” escalation and made clear that it would keep up its support of Ukraine and punitive measures on Russia. With the EU also announcing unprecedented new measures against Moscow, it was clear that Putin’s assault on Ukraine had failed to yield the quick victories he had anticipated but had instead rallied a concerted western response that was potentially devastating for Russia’s economy.''

The Ukrainian president, Volodymyr Zelenskiy, announced that a delegation from Kyiv would meet Russian officials without preconditions on his country’s border with Belarus, but it was far from clear Putin was ready to entertain talks that did not involve compliance with his demands that Ukraine accept partition and disarm.''

Market implications

A risk-off start to the week would be expected and the yen's Doji is worth noting:

© 2000-2024. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.