- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 27-01-2023

- The US core PCE, the Fed’s preferred gauge for inflation, edges down, sparking speculations for a Fed pivot.

- Consumer Sentiment improved, while inflation expectations ticked lower.

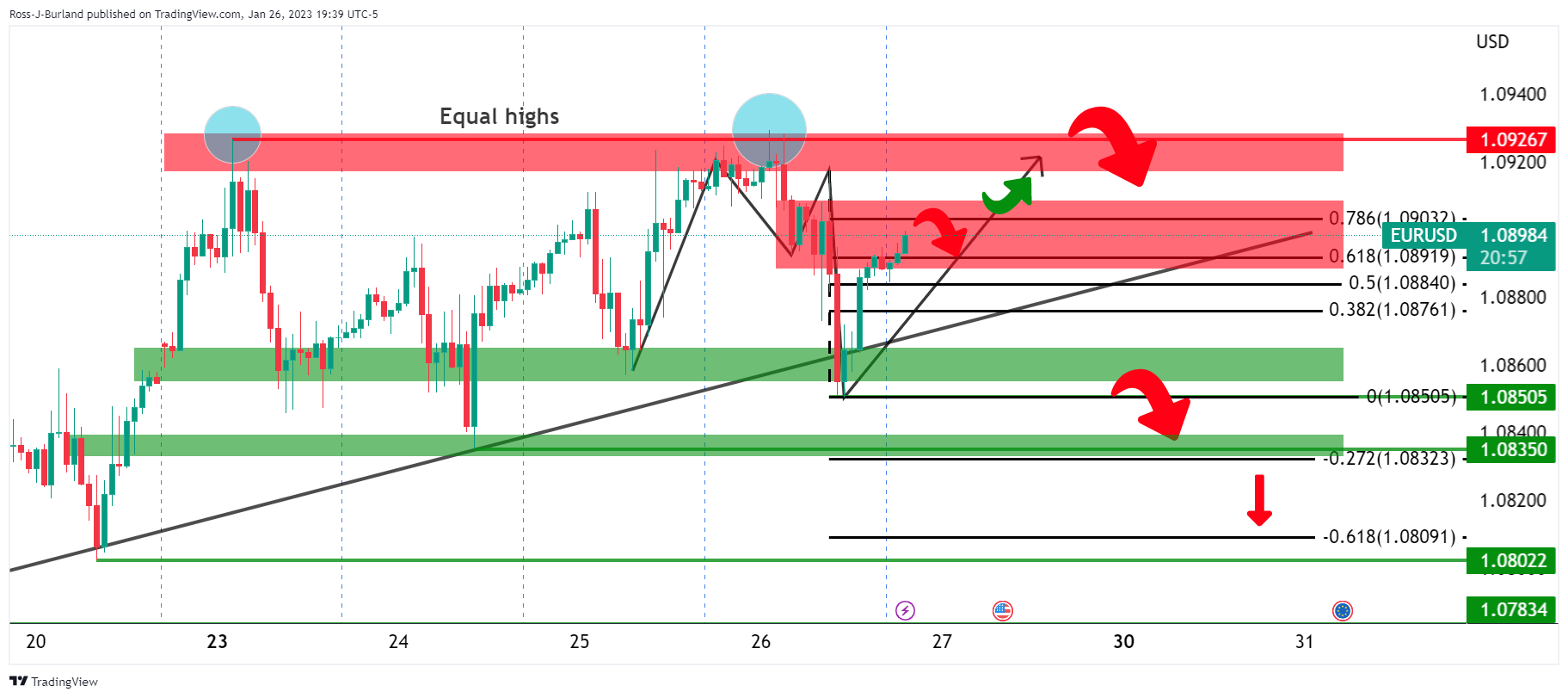

- EUR/USD Price Analysis: Upward biased, but short-term neutral, ahead of Fed and ECB’s decisions.

The EUR/USD got rejected from the 1.0900 psychological barrier for two consecutive days and on Friday slipped to the 1.0860 region after data from the United States (US) cemented the case for a 25 bps rate hike by the Fed. At the time of writing, the EUR/USD is trading at 1.0866.

Soft US core PCE increased the likelihood of the Fed lifting 25 bps

Wall Street finished the week with gains, shrugging off worries about an impending recession in the United States. Thursday’s data cemented the case for a robust economy, with Q4’s expanding by 2.9% QoQ above estimates of 2.6%, while Q3 remained at 3.2%. That sparked conversations of a possible “soft landing” by the US Federal Reserve.

In the meantime, Friday’s data revealed that inflation is cooling down, probably at a faster pace than estimated. The Fed’s favorite inflation gauge, the core Personal Consumption Expenditure (PCE) was aligned with estimates of 4.4% YoY, but below November’s 4.7%. That augmented speculations around the Fed would slash the size of rate hikes, as December marked the first lift in rates not being at 75 bps. Instead, Powell and Co. went for a 50 bps as it was appropriate, as mentioned by them while emphasizing that the pace was not as important as the peak of rates.

As Friday’s session ends, the CME FedWatchTool shows that odds for a Fed’s 25 bps rate hike stand at 99.2%, and traders are foreseeing the Federal Funds rate (FFR) to peak at around 5%, by March’s meeting.

In another tranche of data, a poll from the University of Michigan reported the US Consumer Sentiment, which improved vs. the preliminary reading of 64.6 to 64.9. Data revealed that inflation expectations for 1-year are estimated at 3.9%, lower than the previous poll, while for a 5-year, they stood at 2.9%.

Across the pond, European Central Bank (ECB) officials had reiterated they would raise rates at the upcoming meeting on February 2. ECB’s President Christine Lagarde said that the bank would “stay the course” with a 50 bps rate hike in January and the next meeting after that, albeit inflation in the Eurozone slid to 9.2%.

That said, the stage is set with the Fed lifting rates to 4.50-4.75% and the ECB to 2.50%, which would reduce the spread between the US and the Eurozone. Hence, the EUR/USD could resume its upward bias and test 1.1000 unless an unpleasant dovish surprise by Lagarde caps the rally and tumbles the EUR/USD.

EUR/USD Technical Analysis

Ahead into the next week, the EUR/USD remains upward biased. The pullback in the last couple of days could be attributed to the 1.0900 mark probing to be difficult resistance to hurdle. Also, the monetary policy decisions of the ECB and the Fed were an excuse for traders to close their positions.

Even though the EUR/USD is pressured, the price action from Thursday and Friday formed a series of successive candlesticks with a long bottom wick, suggesting that some buying pressure is resting. Nevertheless, the commitment o hold EUR/USD long positions throughout the weekend, and with uncertainty in the financial markets, kept the EUR/USD shy of reclaiming 1.0900.

A breach of the latter would expose the 1.1000 mark. As an alternate scenario, the EUR/USD diving below 1.0835, the weekly low, and the pair would dip toward the 20-day Exponential Moving Average (EMA) at 1.0788.

- USD/CHF is downward biased but subject to a mean reversion move towards 0.9300.

- Solid resistance lies at 0.9235/40, with the confluence of technical indicators rejecting the USD/CHF rally.

- USD/CHF Price Analysis: Bulls are hopeful if the pair remains above 0.9158.

After slumping on Wednesday, the USD/CHF stages a comeback recovering the 0.9200 psychological level, eyeing a break above a confluence of technical indicators. In addition, a falling wedge continued to develop ahead of the following week’s busy economic calendar in the United States (US). At the time of typing, the USD/CHF exchanges hands at 0.9218, above its opening price by 0.22%.

USD/CHF Price Analysis: Technical outlook

Short term, the USD/CHF is upward biased, though it was rejected at the confluence of a downward slope trendline and the 20-day Exponential Moving Average (EMA) around the 0.9235/40 area. Nevertheless, bulls remain hopeful for higher prices as long as the USD/CHF stays above the January 26 daily low at 0.9158.

Therefore, the USD/CHF first resistance would be the abovementioned confluence of the 20-day EMA and a downslope trendline around 0.9240. Once cleared, the USD/CHF pair might rally toward January 24 daily high at 0.9279, followed by the January 12 ad 0.9360.

As an alternate scenario, the USD/CHF first demand zone would be the January 26 daily low of 0.9158. Once broken, then the pair might dip to the YTD low at 0.9085.

USD/CHF Key Technical Levels

- USD/JPY remains downtrend but is about to form a bullish harami candle pattern, suggesting an upward correction on the cards.

- USD/JPY Price Analysis: Once it clears 129.50, it could rally towards 131.57 before turning neutral.

USD/JPY slumps in a choppy New York trading session and edges beneath 130.00 after a round of US economic data, suggesting the US Federal Reserve (Fed) could begin to hike rates in 25 bps sizes. Therefore, the Japanese Yen (JPY) strengthened, so the USD/JPY is down 0.24%. At the time of writing, the USD/JPY is trading at 129.92.

USD/JPY Price Analysis: Technical outlook

The USD/JPY remains downward biased as the pair has remained below the 20-day Exponential Moving Average (EMA) at 130.60. Friday’s price action remains contained within the boundaries of Thursday’s high and low, opening the door for a bullish harami candlestick formation, also known as an inside day, in the regular bar chart jargon. Therefore, the USD/JPY could print a leg-up before resuming its downtrend.

Hence, the USD/JPY next resistance would be 130.00, followed by the confluence of the 20-day EMA and a downslope trendline around 130.60, which, once cleared, might send the USD/JPY climbing towards the January 24 swing high at 131.11. Break above will expose the January 18 high of 131.57.

As an alternate scenario, the USD/JPY could fall towards 129.49, January’s 27 low. Once broken, the next support would be the weekly low of 129.02, followed by the YTD low at 127.21.

USD/JPY Key Technical Levels

- GBP/USD is set to finish Friday with losses of at least 0.20%.

- United States inflation continues to wane but remains twice elevated of Fed’s target.

- GBP/USD Price Analysis: To remain sideways ahead of the Fed and BoE monetary policy decisions.

GBP/USD snaps two days of gains and tumbled below Thursday’s close of 1.2406, slumping toward 1.2370, amidst a choppy trading session. Inflation data revealed in the United States (US) augmented the likelihood of small-size rate hikes by the US Federal Reserve. Therefore, the GBP/USD is trading at 1.2372, below its opening price by 0.27%.

US core PCE presses lower and justifies Fed’s lower rate hikes

US equities turned mixed as of writing. The US Federal Reserve (Fed) preferred gauge for inflation, the Core Personal Consumption Expenditure (PCE) for December, climbed 4.4% YoY, lower than November’s 4.7%, cementing the Fed’s cause of lower the size of subsequent interest rate increases, throughout the remainder of the year. Headline inflation rose by 5% YoY, well above the Fed’s target of 2%.

Even though data showed that inflation is cooling down, the US GDP for Q4 released on Thursday could exacerbate officials from slowing the pace of rate increases.

In the meantime, the University of Michigan (UoM) Consumer Sentiment on its final reading for January rose by 64.9, above expectations of 64.6. The poll showed that The survey conducted by the University of Michigan updated inflation expectations, with a one-year horizon estimated at 3.9%, while for a 5-year rose to 2.9% compared to the preliminary 3.0%,

Across the pond, the UK docket showed that economic activity fell at its fastest pace in two years in January, as reported by a survey on Tuesday. Meanwhile, the Bank of England (BoE) is expected to raise rates by 50 bps on February 2, lifting the Bank Rate to 4%. Even though that would bolster the Pound Sterling (GBP), speculations grew that it could probably be the last hike in the BoE’s tightening cycle.

GBP/USD Technical Analysis

After the GBP/USD failed to break above/below the weekly range, price action would remain sideways, ahead of central bank decisions, next week. Therefore, the GBP/USD trading range for next Monday to Wednesday before the Fed meeting would likely be 1.2340/1.2430, Oscillators suggest that buying pressure is cooling, with the Relative Strength Index (RSI) aiming down, though at bearish territory. The Rate of Change (RoC) portrays volatility levels as almost unchanged.

If the GBP/USD breaks above 1.2430, that could pave the way towards 1.2500, but firstly bulls need to clear 1.2450. On the flip side, a fall of the GBP/USD beneath 1.2340 could put the 1.2300 figure into play. Break below, and the pair might test the 20-day Exponential Moving Average (EMA) at 1.2267.

Analysts at MUFG Bank see the USD/ZAR moving to the downside over the next days. They point out the South African Rand has failed to strengthen alongside other Emerging Market currencies on the back of building optimism over a dovish Federal Reserve policy pivot and China’s economy reopening more fully this year.

Key quotes:

“The ZAR has underperformed recently after USD/ZAR failed to break below support from the 200-day moving average in the middle of this month. It leaves the ZAR as one of the worst performing (-1.0% vs. USD) EM currencies so far this year.”

“Investor sentiment towards the ZAR has been hit recently by heightened concerns over the negative impact on growth in South Africa from worsening energy supply restrictions, and speculation that an amendment to the central bank’s mandate is imminent. While we acknowledge these domestic risks, we believe that the ZAR’s valuation now appears more attractive and offers room for catch up strength alongside the ongoing rebound in emerging market currencies.”

“The main downside risks in the week ahead would be if the Fed and other major central banks provide a hawkish policy shock that disrupts financial markets and lifts US yields and the USD.”

The Federal Reserve, the Bank of England and the European Central Bank (ECB) will have their policy meetings next week. Market participants expect a 50 basis points rate hikes and to signal it will continue raising rates. Analysts at Rabobank, point out that a 50bp rate hike is all but a given for next week. They still expect the ECB can scale back to 25bp hikes from March, but the stronger outlook and wage pressures could delay this and pose upside risks.

Hawks still have an upper hand, but are no longer getting carte blanche

“The ECB’s hawks are still in a strong position, but they no longer have carte blanche with initial signs of easing inflation. The 50bp hike at next week’s meeting has been well-communicated, so focus will be on the path thereafter. This message will be more difficult, with Lagarde’s latest verbal intervention at odds with the ECB’s discontinuation of forward guidance, in favour of a meeting-by-meeting approach. Finally, we don’t expect the parameters of quantitative tightening to be very brow-raising, but supranational debt could get a favourable treatment.”

“The ECB has already announced that quantitative tightening will start at a pace of €15 billion per month, and that this will not involve active sales. We don’t expect the ECB to favour any of the APP programmes or any of the sovereign issuers when it comes to redemptions.”

The EUR/CHF pair has climbed back above parity over the past week after bouncing off support for the 200-day moving average at around 0.9930, explained analysts at MUFG Bank. They see that price action supports their view that there is still room for the cross to rise back towards the levels that were in place during the second quarter of last year at closer to the 1.0500-level.

Key quotes:

“Euro-zone economies are proving more resilient over the winter period, and leading indicators such as the PMI surveys released over the past week have further dampened recession fears. The warmer winter weather has also meant that natural gas inventories are holding up better than expected in Europe putting additional downward pressure on prices. The favourable developments provide more support for the EUR at the start of this year. Given the CHF’s role as a regional safe haven currency, the CHF should weaken as downside risks in the euro-zone continue to ease.”

“We also believe there is room for EUR/CHF to play catch up with the move higher in EUR/USD since late last year. The SNB has been intervening to support the CHF recently. With inflation pressure globally and in Switzerland now easing, the SNB could become more tolerant of allowing the CHF to weaken somewhat.”

Next Wednesday, the FOMC will announce its decision on monetary policy. Analysts at Rabobank point out it has become increasingly likely that the Fed will slow down its hiking cycle to 25 bps.

Decline in inflation has increased the probability of smaller hikes

“The next meeting of the FOMC, on January 31 and February 1, takes place against the backdrop of falling inflation and signs of a weakening economy. What’s more, the annual rotation of regional bank presidents with voting rights is expected to lead to a more dovish set of voters. Therefore, it has become increasingly likely that the Fed will slow down its hiking cycle to 25 bps on February 1.”

“Today’s PCE deflator data for December were largely in line with market expectations and confirmed what we already knew from the CPI data, which is that the peak of inflation is behind us, unless we get new inflation impulses, such as new negative supply shocks or the wage-price spiral getting out of hand. Headline PCE inflation, which is the Fed’s preferred measured of inflation, slowed down to 5.0% year-on-year and core inflation fell to 4.4%.”

“We continue to think that based on the fading momentum of inflation, the FOMC is likely to stop at a 4.75-5.00 target range and pause for the remainder of the year.”

“We still see upside risks to inflation and the federal funds rate during the course of the year if new negative supply shocks take place and/or the wage-price spiral gets out of hand.”

- US Dollar climbs as the Federal Reserve preferred gauge for inflation, with core PCE creeping lower.

- According to the University of Michigan (UoM) poll, US consumers’ inflation expectations edged lower.

- Gold Price Analysis: The rally from $1,616.71 to $1,949.16 could end, as a doji emerged in the weekly chart.

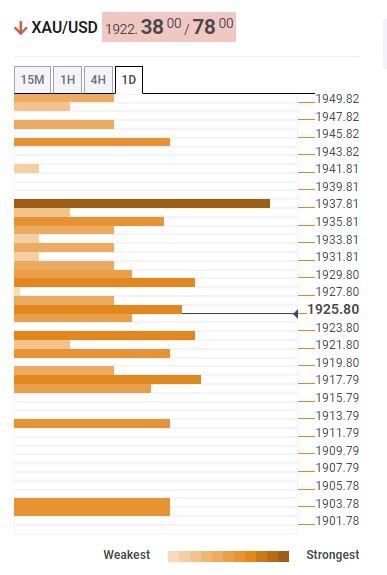

Gold price falls for the second consecutive day, but it remains above January’s 26 low of $1,918.74 and stays sideways, following the release of inflation data in the United States (US). The US Dollar (USD) shortened its drop during the week, while US Treasury bond yields are rising, two additional reasons behind Gold’s loss of its brightness. At the time of writing, the XAU/USD is trading at $1,924.39 after hitting a daily high of $1,935.06.

US Core PCE, the Fed’s gauge for inflation, cooled down

Wall Street turned green after the US Department of Commerce (DoC) revealed that the US Federal Reserve (Fed) preferred gauge for inflation, the Core Personal Consumption Expenditure (PCE) for December, rose 4.4% YoY, aligned with estimates, but lower than November’s 4.7%. The same report showed that headline inflation climbed 5% on a yearly basis, above the Fed’s 2% target. That said, data showed that inflation has begun to trend downwards finally, and traders brace for the Federal Reserve’s meeting next week. Speculations had been mounting that the Fed might raise rates by 25 bps, which would mark the end of 50-plus bps rate increases to the Federal Funds rate (FFR).

US consumers estimate inflation would ease below 4%

Later, the University of Michigan (UoM) Consumer Sentiment on its Final reading exceeded estimates of 64.6 and rose by 64.9. The survey conducted by the University of Michigan updated inflation expectations, with a one-year horizon estimated at 3.9%, while for a 5-year rose to 2.9% compared to the preliminary 3.0%,

Gold pressured by high US Treasury bond yields

Meanwhile, US Treasury bond yields continue to be headwinds for Gold. The US 10-year Treasury bond yield continues to edge higher, almost four bps, and yields 3.540%, underpinning the greenback. The US Dollar Index (DXY), which tracks the buck’s performance against a basket of six peers, advanced 0.22%, and reclaimed the 102.000 mark at 102.051.

Gold Technical Analysis

Even though the XAU/USD remains slightly positive in the week, a doji emerging after a two-and-a-half-month rally from $1,616.71 to $1,949.16 suggests it could end. As XAU/USD drops below Thursday’s close, it has opened the door for further downside, but a daily close below the weekly low reached on Monday at $1,911.49 is needed to pave the way for a dip to $1,900. If that scenario plays out, the next support area would be the confluence of the January 18 low and the 20-day Exponential Moving Average (EMA) at around $1,896/97. Conversely, XAU/USD’s reclaiming $1,930 would keep Gold sideways.

- Mexican Peso among top performers on Friday.

- UUSD/MXN slide found support above 18.70 as DXY strengthens after the beginning of the American session.

- US data mostly in line with expectations on Friday.

The USD/MXN dropped on Friday to 18.71, reaching the lowest level since January 18 and then rebounded, erasing daily losses after the greenback gained momentum following Wall Street’s opening bell.

The dollar remains weak against emerging market currencies as equity and commodity markets rise. The Mexican Peso is outperforming its EM peers on Friday, although it pulled back during the last hour. US yields moved higher during the American session supporting the greenback.

Market participants focus now on next week’s FOMC meeting. The Federal Reserve is seen raising rates by 25 basis points. Data released on Thursday and Friday showed a slowdown in US economy and also in inflation indicators. At the same time, the labor market remains healthy. Next Friday, the Non-farm payroll report is due.

In Mexico, the unemployment rate dropped to a new record low but mostly due to a decline in the labor participation rate. Jobs actually fell by more than 900K, the worst month in years.

On Thursday, the Bank of Mexico will have its board meeting. A 25 basis point rate hike is expected as inflation remains well above the central bank’s target of 3%, plus or minus one percentage point. The half-month inflation in January showed an increase of 0.46%, with the annual rate at 7.94%. Worrying was the annual Core CPI rose from 8.35% to 8.45%.

USD/MXN outlook

The USD/MXN is back above the 18.75 area that is a relevant support area. A consolidation below should open the doors to more losses. On the contrary, if the pair moves above 18.90, the US Dollar would strengthen.

The daily chart shows the USD/MXN consolidating near 18.80. The main trend is bearish but if the Peso fails to print new highs in the near term, a recovery of the US Dollar seems likely.

Technical levels

-638104306358813317.png)

- USD/CAD picks up some pace and retests 1.3330.

- US headline, Core PCE drifted lower in December.

- US Consumer Sentiment comes next in the docket.

USD/CAD now gathers some upside traction and revisits the 1.3330 region on Friday, leaving behind at the same time earlier lows in the vicinity of 1.3300, an area last traded back in late November 2022.

USD/CAD looks supported by 1.3300

USD/CAD navigates a narrow range at the end of the week and still remains unable to gather some lasting upside traction following Thursday’s strong pullback to the vicinity of the 1.3300 region.

The pair, in the meantime, remained apathetic after US inflation figures showed the headline PCE rose 5.0% in the year to December (from 5.5%) and the Core PCE gained 4.4% over the last twelve months (from 4.7%).

Additional data releases from the US calendar saw Personal Income expand 0.2% MoM in the last month of 2022 and Personal Spending shrank 0.2% vs. the previous months. Later in the session, US Pending Home Sales are due along with the final print of the Michigan Consumer Sentiment for the current month.

Further out, another positive session in prices of the WTI lends extra legs to the Canadian dollar so far, keeping the pair’s upside potential contained somehow.

In addition, spot remains en route to close the sixth consecutive week with losses, although the 1.3300 region seems to have emerged as a tough support for the time being.

CAD, in the meantime, looks well propped up by crude oil prices and the recent rate hike by the BoC (January 25). It is worth recalling that the BoC matched consensus and raised the policy rate by 25 bps to 4.50%, although it signaled that extra rate hikes are now unlikely in a context of easing inflation and some loss of momentum in the economic activity. The bank, however, is expected to remain “data dependent”.

USD/CAD significant levels

As of writing the pair is gaining 0.09% at 1.3328 and faces the next up barrier at 1.3483 (55-day SMA) followed by 1.3520 (weekly high January 19) and finally 1.3685 (2023 high January 3). On the other hand, the breach of 1.3303 (2023 low January 26) would aim for 1.3225 (monthly low November 15 2022) and then 1.3205 (200-day SMA).

Next Thursday, the Bank of England will announce its decision on monetary policy. Analysts at Danske Bank expected the central bank to hike the Bank Rate by 50 basis points. They see the cycle ending in March with a 25 bps hike. They argue that next week the dovish communication from the BoE should send the EUR/GBP cross higher during the day.

EUR/GBP to move higher on BoE’s day

“We expect the Bank of England (BoE) to hike the Bank Rate (Policy Rate) by 50bp on 2 February bringing it to 4.00%. Markets are currently pricing 45bp for the meeting next week. Importantly, we consider it a closer call between 50bp and 25bp than what markets are pricing and the distribution of analyst expectations would suggest.”

“In our base case of a dovish 50bp hike, we expect EUR/GBP to move slightly lower upon announcement, but reverse higher on the back of a dovish statement and press conference. In its statement we expect the BoE to highlight the dire state of the UK economy lending support to our call that market pricing is too aggressive currently pricing a peak in the Bank Rate at 4.40% by June 2023.”

“Combined with the expectation of a hawkish 50bp hike by the ECB later in the afternoon, we expect EUR/GBP to move higher during the afternoon, ending the day at a figure higher than the opening levels.”

- USD/JPY maintains its offered tone and reacts little to the release of the US PC Price Index.

- Bets for smaller rate hikes by the Fed act as a headwind for the USD and exerts pressure.

- Traders, however, prefer to wait on the sidelines ahead of the FOMC meeting next week.

The USD/JPY pair remains depressed through the early North American session and drops to a fresh daily low, around mid-129.00s following the release of the US macro data.

The US Dollar trimmed a part of its modest intraday gains in reaction to the mixed Personal Consumption Expenditures (PCE) figures, which, in turn, exerts some pressure on the USD/JPY pair. The US Bureau of Economic Analysis reported this Friday that the Core PCE Price Index - Fed's preferred inflation gauge - declined to the 4.4% YoY rate in December from 4.7% previous. The monthly print, however, edged up to 0.3% against the 0.2% in November and estimated. Nevertheless, the data cements bets for a smaller 25 bps Fed rate hike in February and acts as a headwind for the greenback.

The Japanese Yen (JPY), on the other hand, draws support from fresh speculation that high inflation may invite a more hawkish stance from the BoJ later this year. This further contributes to the offered tone surrounding the USD/JPY pair. That said, signs of stability in the equity markets undermine the safe-haven JPY and might help limit losses for the major. Traders might also refrain from placing aggressive bets and prefer to move to the sidelines ahead of next week's key central bank event risk - the highly-anticipated FOMC decision on Wednesday.

Even from a technical perspective, the USD/JPY pair has been oscillating between two converging trend-line over the past two weeks or so. This constitutes the formation of a symmetrical triangle and points to a consolidation phase. Hence, it will be prudent to wait for a sustained break below the triangle support, currently around the 128.80-128.75 region, before positioning for an extension of the recent sharp pullback from over a three-decade high.

Technical levels to watch

Inflation in the US, as measured by the Personal Consumption Expenditures (PCE) Price Index, declined to 5% on a yearly basis in December from 5.5% in November, the US Bureau of Economic Analysis reported on Friday.

The annual Core PCE Price Index, the Federal Reserve's preferred gauge of inflation, declined to 4.4% from 4.7% in the same period, matching the market expectation. On a monthly basis, Core PCE inflation and PCE inflation rose 0.3% and 0.1%, respectively.

Further details of the publication revealed that Personal Income increased by 0.2% on a monthly basis in December but Personal Spending declined by 0.2%.

Market reaction

The US Dollar Index edged slightly lower with the initial reaction and was last seen posting small daily gains at 101.85.

- EUR/USD faces a corrective decline and drops to 1.0860.

- The short-term bullish bias remains unchanged above 1.0690.

EUR/USD retreats for the second session in a row and revisits the 1.0860 region on Friday.

While above the short-term support line around 1.0690, extra gains should remain in store for the pair.

Indeed, the continuation of the uptrend now needs to rapidly clear the 2023 high at 1.0929 (January 26) to allow for a test of the weekly top at 1.0936 (April 21 2022). A sustainable break above this level could pave the way for a challenge of the key barrier at 1.1000 the figure sooner rather than later.

In the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0309.

EUR/USD daily chart

- AUD/USD struggles to gain any meaningful traction and remains confined in a range.

- A combination of factors revives the USD demand and acts as a headwind for the pair.

- Bets for additional RBA rate hikes lend support ahead of the key US PCE Price Index.

The AUD/USD pair is seen oscillating in a narrow trading band on Friday and consolidating its recent strong gains to the highest level since June 2022 touched the previous day. The pair is currently placed around the 0.7100 mark, nearly unchanged for the day, as traders look to the key US macro data for a fresh impetus.

The Fed's preferred inflation gauge - the Core PCE Price Index - is due for release in a short while from now. This might influence the US central bank's rate hike path, which, in turn, will drive the US Dollar demand and provide a fresh directional impetus to the AUD/USD pair. In the meantime, a goodish pickup in the US Treasury bond yields lends some support to the buck. Apart from this, the prevalent cautious market mood further benefits the greenback's relative safe-haven status and caps the upside for the risk-sensitive Aussie.

The modest intraday USD, however, lacks bullish conviction amid the prospects for a less aggressive policy tightening by the Fed. In fact, the markets are still pricing in a smaller 25 bps Fed rate hike move in February, which, in turn, keeps a lid on any meaningful upside for the greenback. Apart from this, rising odds for an additional rate hike by the Reserve Bank of Australia (RBA) in February, bolstered by the stronger domestic CPI report on Wednesday, underpin the domestic currency and acts as a tailwind for the AUD/USD pair.

Friday's US economic docket also features the release of Pending Home Sales data and the revised Michigan Consumer Sentiment Index. This, along with the US bond yields and the broader market risk sentiment, might influence the USD price dynamics and provide some impetus to the AUD/USD pair. The focus, however, will remain glued to the outcome of a two-day FOMC monetary policy meeting, scheduled to be announced next Wednesday. Heading into the key event risk, the major is more likely to prolong its consolidative price move.

Technical levels to watch

Alvin Liew, Economist at UOB Group, reviews the latest Industrial Prodcution results in Singapore.

Key Takeaways

“Singapore’s industrial production (IP) ended 2022 with a surprise +3.2% m/m SA increase in Dec. Nevertheless, this still translated into a contraction of -3.1% y/y in Dec. Excluding the volatile biomedical manufacturing, IP actually expanded by 6.8% m/m, +0.3% y/y in Dec (from a revised -7.0% m/m, -5.8% y/y in Nov).”

“The Dec IP was dragged by weaker biomedical, chemicals, precision engineering and general manufacturing, negating the continued gains in transport and a surprise rebound of electronics output. Indeed, electronics staged a surprise 4.6% y/y rebound, thanks to the key sub-segments of infocomms & consumer electronics and computer peripherals & data storage, while its most essential sub-segment, semiconductors, recorded a much smaller -0.3% y/y fall compared to -14.0% in Nov. However, the semiconductor rebound is likely temporary because of the continued declining trend of Asia-Pacific semiconductor sales.”

“IP Outlook – Taking into account of the Dec IP contraction, Singapore’s manufacturing sector declined by a smaller -2.6% y/y in 4Q 22 (versus the official estimates of -3.0% y/y from the advance estimates released in early Jan 2023), but for the full year, due to further downward revisions in earlier quarters that outweighed the improvements in 4Q, IP actually expanded by a slower pace of +2.5% in 2022, (versus the official estimate of 2.6% made based on advance estimates released on 3 Jan 2023). So even as we estimate a small upward revision to 4Q GDP to 2.3% y/y (from 2.2%), we expect full year GDP could be revised 0.1ppt lower to 3.7% (from 3.8%). We maintain our forecast for Singapore 2023 manufacturing to contract by 5.4% due to the faltering outlook for electronics and weaker external demand, a view that is supported by the declining trend in PMI and the increasing visible cracks in exports’ outlook. With the weaker 2023 manufacturing outlook and barring external events (such as escalating war in Europe and a deadlier variant of COVID-19), we keep our modest 2023 GDP growth forecast of 0.7% unchanged (versus the official forecast range of 0.5-2.5%).”

- The index extends the bounce in the second half of the week.

- The 3-month resistance line near 103.15 caps the upside.

DXY advances for the second consecutive session and challenges the key hurdle at the 102.00 mark on Friday.

Despite the rebound, the index remains well under pressure and a sustainable breach of the 101.50 level should accelerate losses to, initially, the May 2022 low around 101.30 (May 30) prior to the psychological 100.00 yardstick.

On the upside, the 3-month resistance line around 103.15 continues to limit occasional gains. Below this line, the dollar is expected to keep the short-term bearish bias unchanged.

In the longer run, while below the 200-day SMA at 106.47, the outlook for the index remains negative.

DXY daily chart

US PCE Price Index Overview

Friday's US economic docket highlights the release of the Core Personal Consumption Expenditure (PCE) Price Index, scheduled later during the early North American session at 13:30 GMT. The Fed's preferred inflation gauge is foreseen to rise by 0.2% in December, matching the previous month's reading. The year rate, however, is anticipated to have eased from 4.7% in November to 4.4%.

Analysts at Deutsche Bank, meanwhile, anticipate a rather stronger reading and write: “We don't expect the same declines as recently seen in CPI as some of the stronger components in PPI last week are better correlated to PCE components. We expect a +0.4% monthly gain.”

How Could it Affect EUR/USD?

Against the backdrop of the upbeat fourth-quarter US GDP report, a surprisingly stronger print will fuel speculations that the Fed will stick to its hawkish stance for a longer period. This, in turn, should prompt some near-term short-covering move around the US Dollar and drag the EUR/USD pair further away from a nine-month high touched earlier this week.

Conversely, weaker PCE data will cement expectations that the Fed will slow the pace of its policy-tightening cycle and lifts bets for a smaller 25 bps rate hike in February. This could exert downward pressure on the already weaker greenback. The market reaction, however, is likely to remain limited as the focus remains on the FOMC and ECB policy meetings next week.

Eren Sengezer, Editor at FXStreet, offers a brief technical outlook for the pair and writes: “EUR/USD broke below the ascending regression channel late Thursday. Although the pair returned within that channel during the Asian trading hours, it lost its recovery momentum and closed the last four-hour candle below the lower-limit. Furthermore, the pair now trades below the 20-period Simple Moving Average (SMA) and the Relative Strength Index (RSI) indicator stays slightly below 50, suggesting that buyers remain on the sidelines.”

Eren also outlines important technical levels to trade the EUR/USD pair: “On the downside, 1.0850 (static level, 50-period SMA) aligns as key support level. In case EUR/USD falls below that level and starts using it as resistance, it could continue to push lower toward the 1.0800/1.0790 area (psychological level, static level, 100-period SMA).”

“If EUR/USD rises above 1.0900 (20-period SMA, lower limit of the channel) and stabilizes there, it could extend its rebound toward 1.0930 (mid-point of the ascending channel, static level) and 1.0980 (former support, static level),” Eren adds further.

Key Notes

• US December PCE Inflation Preview: Is there room for further US Dollar weakness?

• US Core PCE Preview: Forecasts from seven major banks, decline continues

• EUR/USD Forecast: Euro faces key support at 1.0850

About the US PCE Price Index

The Personal Spending released by the Bureau of Economic Analysis, Department of Commerce is an indicator that measures the total expenditure by individuals. The level of spending can be used as an indicator of consumer optimism. It is also considered as a measure of economic growth: While Personal spending stimulates inflationary pressures, it could lead to raise interest rates. A high reading is positive (or Bullish) for the USD.

- Silver comes under some renewed selling pressure on the last day of the week.

- The technical setup supports prospects for a further intraday depreciating move.

- A sustained move beyond the $24.50-$24.55 area will negate the negative bias.

Silver extends the previous day's retracement slide from the $24.30 area, or over a one-week high, and remains under some selling pressure on Friday. The white metal maintains its offered tone through the mid-European session and is currently placed near the daily low, around the $23.70 region.

From a technical perspective, the XAG/USD, so far, has managed to defend the lower end of a four-day-old ascending trend channel. The said support coincides with the 100-hour SMA and should now act as a pivotal point for short-term traders. Given that oscillators on hourly charts have been gaining some negative traction, a convincing break below will set the stage for further losses.

The XAG/USD might then accelerate the fall towards intermediate support near the $23.50-$23.45 area before eventually dropping to test sub-$23.00 levels. This is followed by the weekly low, around the $22.75 region touched on Monday. Some follow-through selling has the potential to drag the commodity further towards testing the next relevant support near the $22.00 round figure.

On the flip side, the daily swing high, around the $24.00 mark, might now act as an immediate hurdle. Any further move up might confront resistance near the $24.25-$24.30 region ahead of the $24.50-$24.55 supply zone, or a multi-month high touched on January 16. A sustained strength beyond should allow the XAU/USD to reclaim the $25.00 psychological mark for the first time since April 2022.

Silver 1-hour chart

Key levels to watch

UOB Group’s Senior Economist Julia Goh and Economist Loke Siew Ting comment on the latest results from the GDP readings in the Philippines.

Key Takeaways

“The Philippines’ economy expanded at a stronger-than-expected pace of 7.2% y/y in 4Q22 (vs UOB est: +6.5%, Bloomberg est: +6.6%) but on trend wise, the growth rate decelerated from 7.6% in the preceding quarter and the previous peak of 8.2% in 1Q22. The full-year real GDP growth also came in higher than anticipated at 7.6% in 2022 (UOB est: 7.4%, Bloomberg est: 7.4%, 2021: +5.7%), marking the strongest annual growth since 1976.”

“Almost all economic sectors pencilled in positive growth in 4Q22, except for the agriculture, hunting, fishery & forestry industry. Resilient household consumption, higher government spending, sustained investments and stronger exports amid slower imports also helped to support the growth momentum last quarter and fully cushioned the drag from stock withdrawal activities.”

“We expect real GDP to moderate further throughout 2023, taking the full-year economic growth rate down to 5.0% (official est: 6.0%-7.0%) from a 46-year high of 7.6% in 2022. Our view mainly takes into consideration statistical base effects and prevailing downside risks to the growth outlook. Although the nation’s economic growth is expected to extend its downtrend, inflation risks are still tilted to the upside, suggesting that interest rate will have to rise further to reach levels sufficiently restrictive for some time. Thus, we stick to our BSP call for two more 25bps hikes in 1Q23 before taking a pause at 6.00% thereafter.”

- EUR/JPY extends the erratic performance above 141.00 so far this week.

- The key 200-day SMA keeps holding the downside near 140.80.

EUR/JPY fades Thursday’s uptick and trades on the defensive within the so far multi-session consolidative theme at the end of the week.

Extra consolidation should not be ruled out in the very near term. In case the downside accelerates, the next support of note emerges at the 200-day SMA, today at 140.82. A sustainable drop below the latter exposes extra weakness to, initially, the 138.00 neighbourhood.

The constructive outlook for EUR/JPY is seen unchanged above the 200-day SMA for the time being.

EUR/JPY daily chart

UOB Group’s Economist Ho Woei Chen reviews the latest flash Q4 GDP figures in South Korea.

Key Takeaways

“South Korea’s advance GDP moderated to a growth of 1.4% y/y in 4Q22 from 3.1% y/y in 3Q22. The economy also recorded its first sequential decline since the technical recession in 1H20, contracting by -0.4% q/q SA in 4Q22. For the full-year, South Korea’s GDP grew 2.6% in 2022 compared to 4.1% in 2021.”

“Private consumption recovery turned out to be weaker-than-expected while external demand slowed.”

“We now expect a slower economic growth of 1.3% in 2023 compared to our earlier forecast of 1.7%.”

“We maintain our view that the BOK is done with its rate hikes and would stay on hold at 3.50% through 2023.”

USD/CNH could accelerate losses and revisit the 6.6985 level in the short-term horizon, comment Economist Lee Sue Ann and Markets Strategist Quek Ser Leang at UOB Group.

Key Quotes

24-hour view: “We noted yesterday that ‘the underlying tone has weakened somewhat’ and we expected USD to edge lower. However, we were of the view that the major support at 6.7400 is unlikely to come under threat. We did not anticipate the sudden surge in downward momentum as USD plunged to a low of 6.7250 before closing at 6.7373 (-0.45%). The boost in downward momentum is likely to lead to further USD weakness even though the month-to-date low near 6.6985 is unlikely to come under threat today (there is another support at 6.7100). On the upside, a breach of 6.7550 (minor resistance is at 6.7440) would indicate the current USD weakness has stabilized.”

Next 1-3 weeks: “Yesterday (27 Jan, spot at 6.7720), we held the view that USD is still consolidating, likely within a range of 6.7400/6.8000. We did not expect the sudden lurch lower as USD broke 6.7400 and plummeted to a low of 6.7250. Downward momentum is building quickly and we expect USD to weaken toward the month-to-date low near 6.6985. A break of 6.6985 is not ruled out but at this stage, the odds of USD weakening to the next support at 6.6500 are not high. Overall, only a breach of 6.7760 (‘strong resistance’ level) would indicate that the build-up in downward momentum has faded.”

- GBP/USD meets with some supply on Friday, though the downside remains cushioned.

- A softer risk tone, rebounding US bond yields benefit the USD and weigh on the major.

- Traders eye the US PCE for some impetus ahead of key central bank meetings next week.

The GBP/USD pair continues with its struggle to find acceptance above the 1.2400 mark and comes under some selling pressure on the last day of the week. The pair remains on the defensive through the first half of the European session and is currently placed around the 1.2380-1.3375 region, just a few pips above the daily low.

A combination of factors lends support to the US Dollar, which, in turn, is seen exerting some downward pressure on the GBP/USD pair. The better-than-expected US growth figures released on Thursday fueled speculations that the Fed will maintain its hawkish stance for longer. This, in turn, leads to a goodish intraday move up in the US Treasury bond yields, which, along with a softer risk tone, benefits the safe-haven Greenback.

The USD, meanwhile, fails to attract any meaningful buying as investors still seem convinced that the Fed will soften its hawkish stance and deliver a smaller 25 bps next week. Moreover, speculations that elevated consumer inflation will force the Bank of England (BoE) to continue lifting rates offer some support to the British Pound. This, in turn, should help limit any meaningful downside for the GBP/USD pair, at least for now.

Traders also seem reluctant and prefer to wait for the release of the Fed's preferred inflation gauge - the Core PCE Price Index. The data will play a key role in influencing the US central bank's rate-hike path, which will drive the USD demand and provide some impetus to the GBP/USD pair. The focus, however, will remain glued to next week's key central bank event risks - the FOMC policy decision on Wednesday and the BoE meeting on Thursday.

Technical levels to watch

- The daily upside in EUR/USD falters around 1.0900.

- The greenback looks side-lined ahead of key data releases.

- US PCE, Core PCE, Consumer Sentiment next of note in the docket.

After a brief test of the 1.0900 region earlier in the session, EUR/USD now comes under some mild downside pressure and revisits the 1.0880 zone at the end of the week.

EUR/USD: Near-term top at 1.0930?

EUR/USD seems to have met some resistance zone in the area of multi-month peaks near 1.0930 (January 26) amidst the broad-based consolidative mood in the global markets and some lacklustre recovery in the greenback.

On the latter, better-than-expected results from key US fundamentals on Thursday lent support to the buck and prevented the USD Index (DXY) from shedding further ground, which eventually morphed into the ongoing corrective decline in spot.

However, the ongoing debate between what markets believe the Fed should do – namely an impasse in its normalization process – and what the Fed’s rate setters think it is appropriate – again, raising rates above 5% and staying there longer than anticipated – remains poised to dominate the price action in the pair at least until the next week, where both the FOMC and the ECB meets to decide on rates.

In the domestic calendar, Consumer Confidence in France eased a tad to 80 in January (from 81) and the Spanish GDP Growth Rate surprised to the upside at 0.2% QoQ in Q4 and 2.7% over the last twelve months. In addition, Chairwoman Lagarde is also due to speak.

Across the pond, a busy calendar will show inflation figures gauged by the PCE followed by the final Michigan Consumer Sentiment, Pending Home Sales and Personal Income/Spending.

What to look for around EUR

The sharp yearly rally in EUR/USD appears to have met an initial and decent barrier around the 1.0930 for the time being.

In the meantime, price action around the European currency should continue to closely follow dollar dynamics, as well as the potential next steps from the ECB and the Federal Reserve at their upcoming gatherings in the next week.

Back to the euro area, recession concerns now appear to have dwindled, which at the same time remain an important driver sustaining the ongoing recovery in the single currency as well as the hawkish narrative from the ECB.

Key events in the euro area this week: France Consumer Confidence, ECB Lagarde (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle amidst dwindling bets for a recession in the region and still elevated inflation. Impact of the war in Ukraine and the protracted energy crisis on the bloc’s growth prospects and inflation outlook. Risks of inflation becoming entrenched.

EUR/USD levels to watch

So far, the pair is retreating 0.04% at 1.0883 and the breakdown of 1.0766 (weekly low January 17) would target 1.0598 (55-day SMA) en route to 1.0481 (monthly low January 6). On the other hand, the next up barrier is seen at 1.0929 (2023 high January 26) followed by 1.0936 (weekly high April 21 2022) and finally 1.1000 (round level).

- USD/JPY meets with a fresh supply on Friday and is pressured by a combination of factors.

- Strong Tokyo inflation fuels speculations about a hawkish shift by the BoJ and lifts the JPY.

- The emergence of fresh USD selling contributes to the intraday slide ahead of the US PCE.

The USD/JPY pair comes under some renewed selling pressure on Friday and reverses a major part of the overnight modest bounce from the 129.00 mark, or the weekly low. The pair remains depressed through the first half of the European session and is currently placed around the 129.80-129.75 region, down over 0.30% for the day.

A combination of factors provides a modest boost to the Japanese Yen (JPY), which, in turn, attracts fresh sellers around the USD/JPY pair. Data released earlier today showed that inflation in Japan's capital, Tokyo rose to a new 41-year high in December. This comes on the back of a similar rise in countrywide inflation and is expected to invite a more hawkish stance from the Bank of Japan (BoJ) later this year. Apart from this, a softer risk tone further underpins demand for the safe-haven JPY.

The US Dollar, on the other hand, struggles to preserve its modest intraday gains and contributes to the offered tone surrounding the USD/JPY pair. In fact, the USD Index, which tracks the greenback against a basket of currencies, languishes near an eight-month low amid the prospects for a less aggressive policy tightening by the Fed. Despite the stronger fourth-quarter growth figures from the US, the markets are still pricing in a smaller 25 bps lift-off at the upcoming FOMC meeting next week.

That said, a goodish pickup in the US Treasury bond yields might act as a tailwind for the greenback and should help limit deeper losses for the USD/JPY pair, at least for the time being. Traders also seem reluctant and move to the sidelines ahead of Friday's release of the Fed's preferred inflation gauge - the Core PCE Price Index. This, along with the US bond yields and the broader risk sentiment, should provide some impetus to the USD/JPY pair and allow traders to grab short-term opportunities.

Technical levels to watch

The UK Chancellor of the Exchequer Jeremy Hunt said on Friday that the “best tax cut right now is a cut in inflation.”

Additional comments

Understands importance of low taxes.

Best tax cut right now is a cut in inflation.

Bringing down inflation only way to fix industrial unrest.

Plan to halve inflaiton will require patience and discipline.

Weak recovery of public sector from pandemic strengthens case for reform.

UK is powerfully positioned to play leading role on innovation.

Market reaction

GBP/USD remains unfazed by the above comments, trading at 1.2371, down 0.27% on the day.

- USD/CAD regains some positive traction on Friday amid a modest pickup in the USD demand.

- Thursday’s upbeat US macro data fuels hawkish Fed expectations and benefits the greenback.

- Bullish crude oil prices continue to underpin the Loonie and keep a lid on any further gains.

- Traders now eye the US PCE report for a fresh impetus ahead of the FOMC meeting next week.

The USD/CAD pair attracts some buyers on Friday and reverses a part of the previous day's slide to the 1.3300 mark, or its lowest level since November 17. The pair sticks to its intraday gains through the early European session and is currently placed near the daily top, just below mid-1.3300s.

The US Dollar draws support from the mostly upbeat US macro data released on Thursday and edges higher on the last day of the week, which, in turn, is acting as a tailwind for the USD/CAD pair. In fact, the US Commerce Department reported that the economy expanded at a 2.9% annualised pace during the fourth quarter against consensus estimates for a reading of 2.6%. The stronger-than-expected growth figures could allow the Fed to maintain its hawkish stance for longer. This pushes the US Treasury bond yields higher and continues to benefit the greenback.

The markets, however, still seem convinced that the Fed will slow the pace of its policy-tightening and deliver a smaller 25 bps rate hike in February. This holds back the USD bulls from placing aggressive bets. Apart from this, the underlying bullish sentiment surrounding crude oil prices is underpinning the commodity-linked Loonie. The aforementioned factors should contribute to capping any meaningful upside for the USD/CAD pair. Traders might also prefer to wait for the release of the US Core PCE Price Index, due later during the early North American session.

The key focus, however, will remain glued to the outcome of the highly-anticipated two-day FOMC policy meeting, scheduled to be announced next week. In the meantime, the US bond yields and the broader risk sentiment will drive the USD demand. Apart from this, oil price dynamics should provide some impetus to the USD/CAD pair and assist traders to grab short-term opportunities.

Technical levels to watch

FX option expiries for Jan 27 NY cut at 10:00 Eastern Time, via DTCC, can be found below.

- EUR/USD: EUR amounts

- 1.0700 882m

- 1.0825 695m

- USD/JPY: USD amounts

- 126.50 680m

- 128.80 330m

- USD/CHF: USD amounts

- 0.9130 498m

- AUD/USD: AUD amounts

- 0.6650 549m

- USD/CAD: USD amounts

- 1.3150 500m

- EUR/GBP: EUR amounts

- 0.8800 350m

According to Economist Lee Sue Ann and Markets Strategist Quek Ser Leang at UOB Group, USD/JPY is expected to keep navigating within the 128.00-130.80 range in the near term.

Key Quotes

24-hour view: “We highlighted yesterday that ‘the pullback in USD has room to extend but is unlikely to break 128.00’. Our view was incorrect as USD rebounded strongly from 129.01 to 130.61 before dropping quickly. USD appears to have moved into a consolidation phase and it is likely to trade between 129.10 and 130.55 today.”

Next 1-3 weeks: “The current movement in USD is likely part of a consolidation phase and we expect USD to trade within a range of 128.00/130.80 for now.”

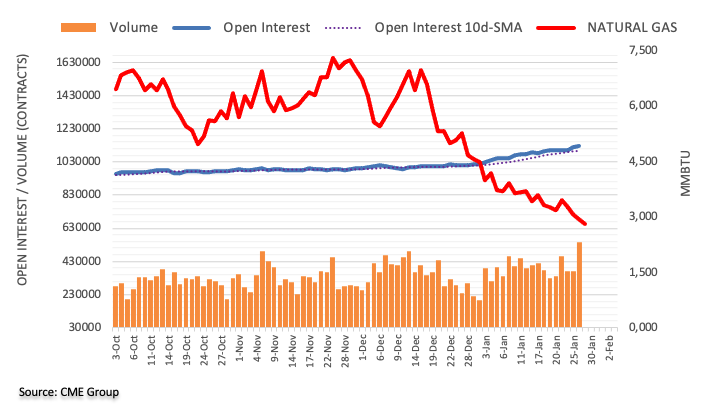

Open interest in natural gas futures markets went up for the third session in a row on Thursday, this time by nearly 9K contracts according to preliminary readings from CME Group. In the same line, volume rose for the second straight day, now by around 171.1K contracts, the largest single-day build since January 3.

Natural Gas now targets the $2.40 zone

Prices of the natural gas kept its downtrend well in place for yet another session on Thursday. The move was amidst rising open interest and volume and underpins the idea that extra weakness remains on the cards in the very near term. The next target of note appears at the 2021 lows around $2.40 per MMBtu.

Further upside could lift AUD/USD to the 0.7170 zone in the short-term horizon, according to Economist Lee Sue Ann and Markets Strategist Quek Ser Leang at UOB Group.

Key Quotes

24-hour view: “We highlighted yesterday that ‘further AUD strength appears likely even though the major resistance at 0.7170 is unlikely to come under threat today’. Our view was not wrong as AUD rose to 0.7143 before retreating. Upward pressure has eased and AUD is unlikely to advance much further. Today, the AUD is expected to trade in a range between 0.7085 and 0.7145.”

Next 1-3 weeks: “Our view from yesterday (26 Jan, spot at 0.7100) that ‘the improved upward momentum suggests AUD is likely to advance further’ is still valid. As highlighted, the level to watch is 0.7170. On the downside, a breach of the ‘strong support’ at 0.7040 (level was at 0.7025 yesterday) would indicate that AUD is not advancing further.”

- Gold price remains on the defensive for the second straight day amid modest US Dollar strength.

- Thursday’s upbeat US macro data fuels hawkish Fed expectations and underpins the Greenback.

- A positive risk tone further exerts pressure on safe-haven XAU/USD ahead of the US PCE data.

- The market focus will remain glued to the highly-anticipated FOMC policy meeting next week.

Gold price trades with a mild negative bias for the second successive day on Friday and hovers around the $1,925 region during the early European session. The intraday downtick, however, lacks follow-through, warranting some caution before positioning for a deeper corrective pullback from a nine-month peak touched the previous day.

Modest US Dollar strength weighs on Gold price

The US Dollar (USD) draws support from Thursday's mostly upbeat macro data from the United States (US) and turns out to be a key factor weighing on Gold price. In fact, the US Commerce Department reported that the world's largest economy expanded at a 2.9% annualised pace during the fourth quarter against consensus estimates for a reading of 2.6%. This points to an economy that continues to show resilience despite the rapid rise in borrowing costs and backs the case for the Federal Reserve (Fed) to maintain its hawkish stance for longer. This, in turn, pushes the US Treasury bond yields higher and underpins the Greenback.

Positive risk tone further undermines safe-haven XAU/USD

The robust economic indicators from the US ease recession fears and boost investors' confidence, which is evident from a generally positive tone around the equity markets. This is seen as another factor exerting some pressure on the safe-haven Gold price. The downside for the XAU/USD, meanwhile, seems cushioned as traders seem reluctant ahead of Friday's release of the Fed's preferred inflation gauge - the US Core Personal Consumption Expenditures (PCE) Price Index. This will influence the Fed's rate-hike path, which, in turn, will drive the USD demand and provide a fresh directional impetus to the non-yielding yellow metal.

Focus remains on Federal Reserve decision next week

The focus, however, remains on the outcome of a two-day Federal Open Market Committee (FOMC) meeting, scheduled to be announced next Wednesday. The markets still seem convinced that the US central bank will soften its stance and have been pricing in a greater chance of a 25 bps rate hike on February 1. Heading into the key central bank event risk, traders might refrain from placing aggressive bets. This further makes it prudent to wait for strong follow-through selling before confirming that Gold price has topped out in the near term.

Gold price technical outlook

From a technical perspective, any further slide below the $1,920 resistance breakpoint, now turned support, is likely to attract fresh buyers around the $1,911-$1,910 support zone. This, in turn, should help limit the downside for the XAU/USD near the $1,900 round-figure mark. The latter should act as a pivotal point, which if broken decisively might shift the near-term bias in favour of bearish traders and pave the way for a meaningful corrective decline.

On the flip side, the multi-month peak, around the $1,949 area touched on Thursday, now seems to have emerged as an immediate strong barrier. Some follow-through buying has the potential to lift the Gold price to the $1,969-$1,970 region. The momentum could get extended further, which should allow the XAU/USD bulls to surpass an intermediate hurdle near the $1,980 zone and reclaim the $2,000 psychological mark for the first time since March 2022.

Key levels to watch

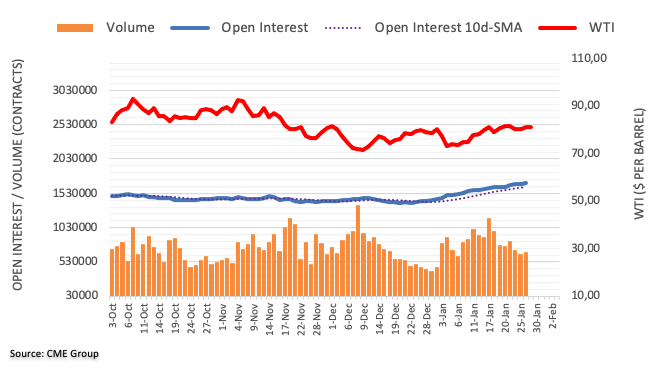

CME Group’s flash data for crude oil futures markets noted traders added nearly 16K contracts to their open interest positions on Thursday, extending further the ongoing uptrend. Volume followed suit and went up by around 22.1K contracts after two daily pullbacks in a row.

WTI: Next on the upside comes $82.60

Prices of the barrel of the WTI added to the previous daily upside on Thursday amidst increasing open interest and volume. Against that, there seems to be scope for the continuation of the move with the immediate target at the so far 2023 peak at $82.60 per barrel (January 23).

In the opinion of Economist Lee Sue Ann and Markets Strategist Quek Ser Leang at UOB Group, GBP/USD could still advance to the 1.2450 zone in the next few weeks.

Key Quotes

24-hour view: “We highlighted yesterday that ‘the bias for GBP is still on the upside but a sustained advance above 1.2445 is unlikely’. However, after rising briefly to 1.2431, GBP pulled back to 1.2345 before rebounding quickly to close little changed at 1.2412 (+0.09%). While upward momentum has waned, there is room for GBP to test 1.2450 first before the risk of a more sustained pullback increases. The major resistance at 1.2500 is not expected to come into view. Support is at 1.2385, followed by 1.2350.”

Next 1-3 weeks: “There is no change in our view from yesterday (26 Jan, spot at 1.2400) that GBP is likely to edge above 1.2450 but as upward momentum is not strong, it remains to be seen if GBP can break 1.2500. Overall, only a breach of 1.2300 (no change in ‘strong support’ level) would indicate that the current mild upward pressure has eased.”

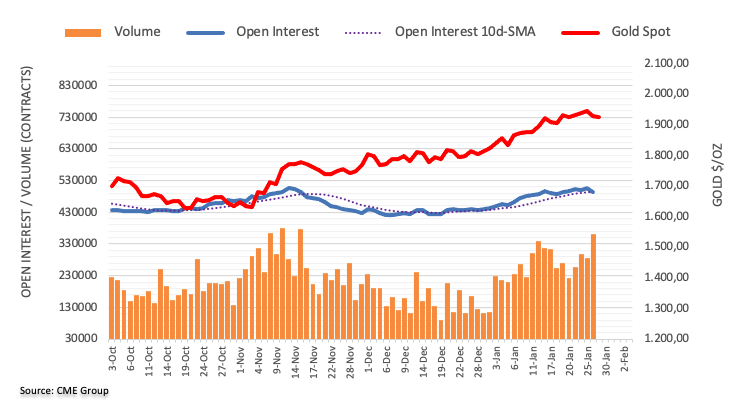

Considering advanced prints from CME Group for gold futures markets, open interest remained choppy and shrank by around 14.3K contracts on Thursday, reversing at the same time the previous daily build. Volume, instead, resumed the uptrend and rose by around 75.5K contracts.

Gold: Decent support emerges around $1900

Thursday’s decline in gold prices was on the back of diminishing open interest and removed strength from an occasional deeper pullback in the very near term. That said, the precious metal is likely to remain supported around the $1900 region per ounce troy for the time being.

Economist Lee Sue Ann and Markets Strategist Quek Ser Leang at UOB Group suggest EUR/USD remains poised to challenge the key 1.1000 zone in the next few weeks.

Key Quotes

24-hour view: “We highlighted yesterday that ‘upward momentum has improved a tad’ and we held the view that EUR ‘could edge above 1.0950’. However, EUR pulled back from 1.0929 to 1.0848 before rebounding to close at 1.0889 (-0.24%). The price actions appear to be part of a consolidation phase and EUR is likely to trade between 1.0855 and 1.0925 today.”

Next 1-3 weeks: “There is not much to add to our update from yesterday (26 Jan, spot at 1.0920). As highlighted, while upward momentum has not improved much, EUR appears poised to head higher toward 1.1000. In view of the current lackluster momentum, any advance is likely to be slow and grinding. The current mild upward pressure is intact as long as EUR stays above 1.0840. Looking ahead, a breach 1.0840 would suggest that EUR could consolidate first before heading higher at a later stage.”

- The index extends the optimism and retargets 102.00.

- US yields pick up extra pace along the curve on Friday.

- Final Consumer Sentiment, PCE, housing data next on tap.

The greenback, in terms of the USD index (DXY), maintains the bullish outlook and refocuses on the 102.00 barrier and beyond at the end of the week.

USD Index remains supported near 101.50

The index advances for the second session in a row and keeps the positive performance unchanged in the second half of the week, although a convincing breakout of the 102.00 barrier still remains elusive.

In the meantime, the dollar appears propped up by recent positive results from the US calendar, particularly after the US economy expanded more than initially estimated during the last quarter of 2022 (+2.9%), as per Thursday’s GDP figures.

The improvement in the buck also comes in tandem with extra recovery in US yields across the curve.

In the US data space, inflation figures tracked by the PCE will take centre stage seconded by the final Michigan Consumer Sentiment, Pending Home Sales and Personal Income/Spending.

What to look for around USD

The dollar wakes up and rebounds from recent lows in the 101.50 region, although a sustainable breakout of the 102.00 hurdle still remains to be seen.

The idea of a probable pivot in the Fed’s policy continues to weigh on the greenback and keeps the price action around the DXY subdued. This view, however, also comes in contrast to the hawkish message from the latest FOMC Minutes and recent comments from rate setters, all pointing to the need to advance to a more restrictive stance and stay there for longer, at the time when rates are seen climbing above the 5.0% mark.

On the latter, the tight labour market and the resilience of the economy are also seen supportive of the firm message from the Federal Reserve and the continuation of its hiking cycle.

Key events in the US this week: PCE, Core PCE, Personal Income, Personal Spending, Pending Home Sales, Final Michigan Consumer Sentiment (Friday).

Eminent issues on the back boiler: Rising conviction of a soft landing of the US economy. Prospects for extra rate hikes by the Federal Reserve vs. speculation of a recession in the next months. Fed’s pivot. Geopolitical effervescence vs. Russia and China. US-China trade conflict.

USD Index relevant levels

Now, the index is up 0.12% at 101.93 and the immediate hurdle comes at the weekly high at 102.89 (January 18) followed by 105.63 (monthly high January 6) and then 106.47 (200-day SMA). On the flip side, the breach of 101.50 (2023 low January 26) would open the door to 101.29 (monthly low May 30 2022) and finally 100.00 (psychological level).

- NZD/USD surrenders modest intraday gains amid the emergence of some buying around the USD.

- Thursday’s upbeat US macro data fuels hawkish Fed expectations and underpins the greenback.

- A positive risk tone acts as a headwind for the buck and offers support to the risk-sensitive Kiwi.

The NZD/USD pair continues with its struggle to find acceptance above the 0.6500 psychological mark and seesaws between tepid gains/minor losses on Friday. The pair trades around the 0.6485-0.6480 region during the early European session and remains well within a familiar trading range.

A modest US Dollar strength is seen as a key factor acting as a headwind for the NZD/USD pair, though a generally positive tone around the equity markets limits the downside for the risk-sensitive Kiwi. The greenback draws some support from the mostly upbeat US macro data released on Thursday, which backs the case for the Fed to maintain its hawkish stance for longer. This leads to a further recovery in the US Treasury bond yields and underpins the buck.

The robust economic indicators, meanwhile, boost investors' confidence and acts as a headwind for the safe-haven greenback. Furthermore, the markets still seem convinced that the US central bank will slow the pace of its policy tightening. The CME's FedWatch Tool points to a nearly 90% probability for a smaller 25 bps rate hike at the upcoming FOMC meeting next week. This further contributes to capping the greenback and lends support to the NZD/USD pair.

Traders might also be reluctant to place aggressive bets and prefer to wait for the release of the US Core PCE Price Index - the Fed's preferred inflation gauge. This, along with the US bond yields and the broader risk sentiment, might influence the USD and provide some impetus to the NZD/USD pair. The fundamental backdrop, meanwhile, warrants some caution before confirming that the pair has topped out and positioning for any meaningful corrective pullback.

Technical levels to watch

Here is what you need to know on Friday, January 27:

The US Dollar Index managed to post small daily gains on Thursday following the robust macroeconomic data releases from the US but seems to be struggling to gather further bullish momentum early Friday. The benchmark 10-year US Treasury bond yield holds steady above 3.5% and US stock index futures trade modestly lower on the day after having rallied on Thursday. Ahead of the weekend, the Personal Consumption Expenditures (PCE) Price Index data from the US will be watched closely by market participants. Personal Spending and Personal Income figures for December will also be featured in the US economic docket alongside Pending Home Sales and the University of Michigan's Consumer Sentiment Index (final) for January.

US December PCE Inflation Preview: Is there room for further US Dollar weakness?

The US Bureau of Economic Analysis reported on Thursday that the US economy grew at an annual rate of 2.9% in the fourth quarter. Although this reading came in weaker than the 3.2% expansion recorded in the previous quarter, it surpassed the market expectation of 2.6%. Other data from the US revealed that the weekly Initial Jobless Claims declined to 186K from 192K and Durable Goods Orders increased by 5.6% in December, compared to analysts' estimate of 2.5%. These upbeat numbers, however, had little to no impact on the market pricing of the Fed's rate outlook. According to the CME Group FedWatch Tool, there is still a nearly 70% chance that the Fed will stay on hold after hiking the policy rate by 25 basis points in February and March.

EUR/USD snapped a fix-day winning streak on Thursday and edged slightly lower early Friday. The pair was last seen trading at around 1.0870. European Central Bank (ECB) President Christine Lagarde is scheduled to deliver a speech at 1030 GMT but she is unlikely to comment on the policy since the 'quiet period' has already started.

GBP/USD came under modest bearish pressure and during the Asian trading hours and dropped below 1.2400 after having closed virtually unchanged on Thursday. Reuters reported that British Treasury Secretary Jeremy Hunt will say on Friday that he will tackle the country's weak productivity growth, including by using post-Brexit finance reforms to drive more investment into the economy.

USD/JPY managed to stage a rebound and was last seen trading little changed on the day slightly above 130.00. Japanese Prime Minister (PM) Fumio Kishida said in an appearance on Friday that he acknowledged the Bank of Japan’s (BoJ) December policy decision was an operational tweak to enhance and sustain monetary easing effects smoothly. This comment, however, doesn't seem to be having a significant impact on the Japanese Yen's valuation. Earlier in the day, the data from Japan showed that the Tokyo Consumer Price Index rose to 4.4% on a yearly basis in January from 4% in December as expected.

Gold price turned south amid rising US Treasury bond yields and erased a large portion of its weekly gains on Thursday. At the time of press, XAU/USD was seen trading modestly lower on a daily basis slightly above $1,920.

Bitcoin seems to have gone into a consolidation phase at around $23,000 following Wednesday's decisive upsurge. Ethereum lost nearly 1% on Thursday and continued to stretch lower early Friday. ETH/USD was last seen losing more than 1% on the day at $1,580.

- EUR/GBP takes the bids to refresh intraday low after snapping two-day downtrend.

- Convergence of 200-EMA, immediate descending trend line guards recovery moves.

- 50% Fibonacci retracement appears the key support for bears to watch.

EUR/GBP bulls struggle to retake control as the cross-currency pair renews intraday high near 0.8785 heading into Friday’s European session.

In doing so, the quote jostles with the 200-bar Exponential Moving Average (EMA) and a downward-sloping resistance line from Wednesday, close to the 0.8785-90 hurdle.

It’s worth noting that the receding bearish bias of the MACD and the RSI (14) attempt to regain the 50 level keeps the EUR/GBP buyers hopeful.

Also luring the EUR/GBP bulls could be the cross-currency pair’s bounce off the 50% Fibonacci retracement level of December 01, 2022, to January 13, 2023 upside, close to 0.8720.

Hence, the quote’s one more attempt to break the two-week-old resistance line, around 0.8840 by the press time, can’t be ruled out. Following that, a run-up to the monthly peak of 0.8897 becomes imminent.

Meanwhile, the EUR/GBP pair’s fresh weakness remains unimportant till it stays beyond the 50% Fibonacci retracement level of 0.8722.

In a case where EUR/GBP remains bearish past 0.8720, the 61.8% Fibonacci retracement level, also known as the golden ratio, could act as the last defense of the buyers around 0.8680.

Overall, EUR/GBP is likely to witness further recovery but the bulls are far from retaking control.

EUR/GBP: Four-hour chart

Trend: Corrective bounce expected

GBP/USD takes offers to refresh intraday low near 1.2380 amid the first loss-making day heading into Friday’s London open. In doing so, the Cable pair not only justifies the broadly firmer US Dollar but also traces the options market signals as it braces for the first negative week in five.

That said, one-month Risk Reversal (RR) of the GBP/USD, a gauge of the difference between the call options and put options, prints the biggest weekly fall since November 18, 2022, while marking -0.160 figures at the latest.

It’s worth noting, however, that the daily RR prints the strongest figure in over a week, to +0.025, as traders remain cautious ahead of the Federal Reserve's (Fed) favorite inflation number, namely the US Core Personal Consumption Expenditures (PCE) – Price Index for December, expected to remain unchanged at 0.2% MoM.

In addition to the options market signal and pre-data anxiety, downbeat catalysts from the UK also weigh on the GBP/USD prices of late.

Also read: GBP/USD retreats to 1.2400 as Fed vs. BoE drama looms, US PCE inflation in the spotlight

- EUR/USD holds lower ground near intraday bottom, down for the second consecutive day.

- Bearish MACD signals, failure to cross 1.0930 hurdle keeps sellers hopeful.

- Fortnight-old ascending trend line defends bulls beyond 1.0820.

- Recovery needs validation from weekly hurdle to refresh multi-month high.

EUR/USD licks its wounds near the intraday low surrounding 1.0870 as traders await the key US inflation number during early Friday in Europe. In doing so, the major currency pair drops for the second consecutive day while staying inside a two-week-old rising trend channel formation.

It’s worth noting that the quote’s multiple failures to cross the weekly horizontal resistance near 1.0930 joins bearish MACD signals and downbeat RSI (14) to keep EUR/USD bears hopeful.

However, a clear downside break of the stated bullish channel’s support, close to 1.0840 by the press time, becomes necessary to convince EUR/USD bears.

Following that, a downward trajectory towards the 1.0700-715 region comprising the multiple levels marked in the last six weeks, as well as the 200-SMA level, will be crucial to confirm the EUR/USD bear-run.

Alternatively, a successful break of the 1.0930 horizontal resistance could propel the EUR/USD prices towards the stated channel’s upper line, close to 1.0965 by the press time.

In a case where the EUR/USD buyers keep the reins past 1.0965, the 1.1000 psychological magnet should return to the chart while any further advances may aim for the mid-March 2022 peak surrounding 1.1140.

EUR/USD: Four-hour chart

Trend: Further downside expected

-

Investors have turned risk-averse ahead of the US PCE Price Index data.

-

The formation of an Ascending Triangle indicates sheer volatility contraction.

-

The RSI (14) has shifted into the 40.00-60.. range, which indicates an exhaustion in the upside momentum.

The AUD/USD pair has corrected sharply to near 0.7100 in the early European session. The Aussie asset has sensed selling pressure as investors have turned risk averse ahead of the release of the United States Personal Consumption Expenditure (PCE) Price Index data. Meanwhile, an improvement in the safe-haven’s appeal has strengthened the US Dollar Index (DXY).

S&P500 futures has demonstrated a sell-off as further interest rate hikes by the Federal Reserve (Fed) might accelerate recession fears. The 10-year US Treasury yields has added gains further to near 3.53%.

On an hourly scale, AUD/USD is oscillating in an Ascending Triangle chart pattern that indicates a sheer contraction in volatility. The upward-sloping trendline of the chart pattern is plotted from January 25 average price at 0.7061 while the horizontal resistance is placed from January 26 high around 0.7140.

The 20-period Exponential Moving Average (EMA) at 0.7110 has overlapped the asset, which indicates a rangebound acution profile.

It is observed that the Relative Strength Index (RSI) (14) has shifted into the 40.00-60.00 range from the bullish range of 60.00-80.00, which conveys that the bullish momentum has faded now.

Should the asset breaks above January 26 high at 0.7142, Aussie asset will deliver a breakout the Ascending Triangle, which will drive the major towards the round-level resistance of 0.7200. A breach of the latter will expose the asset for more upside toward June 3 high at 0.7283.

On the contrary, a downside move below December 29 low at 0.6710 will drag the major further toward December 22 low at 0.6650 followed by November 21 low at 0.6585.

AUD/USD hourly chart

- USD/JPY retreats towards intraday low, reverses the previous day’s corrective bounce.

- BoJ extends five-year loans against collateral to financial institutions to defend YCC as JGB rallied after Tokyo inflation.

- US Dollar traces firmer yields ahead of US Core PCE Price Index for December.

USD/JPY prints mild losses around 130.00, after a failed attempt to recover, as the Bank of Japan (BoJ) marks a show of Yield Curve Control (YCC) during early Friday morning in Europe. In doing so, the Japanese central bank extends five-year loans against collateral to financial institutions, from February 01, 2023, to 2028.

The BoJ activity could be linked to a jump in the 10-year Japanese government bond (JGB) yield to 0.50% after Tokyo Consumer Price Index (CPI) refreshed a 42-year high of 4.3% for January.

It’s worth noting that this is the BoJ’s second attempt in January to defend the YCC policy, which in turn suggests further challenges for the ultra-loose monetary policy of the Japanese central bank.

Contrary to the BoJ action, a run-up in the US 10-year Treasury bond yields and the market’s rush towards risk-safety, mainly after Thursday’s upbeat US growth numbers, challenges the USD/JPY bears. On the same line could be the cautious mood ahead of the Federal Reserve's (Fed) favorite inflation number, namely the US Core Personal Consumption Expenditures (PCE) – Price Index for December, expected to remain unchanged at 0.2% MoM.

Against this backdrop, the US 10-year Treasury yields extend the previous day’s recovery to 3.52% while the S&P 500 Futures print mild losses. That said, Japan’s Nikkei 225 drops 0.12% on a day as it snaps a five-day uptrend.

Looking forward, the US Core PCE data will be crucial for the USD/JPY pair as the Fed is ready to announce another 0.25% rate hike in the next week. It should be noted that the downbeat US inflation precursor could confirm the market’s dovish expectations from the US central bank and may exert more downside pressure on the Yen pair.

Also read: US December PCE Inflation Preview: Is there room for further US Dollar weakness?

Technical analysis

Multiple failures to cross the 21-DMA surrounding 130.00 keeps pushing USD/JPY down even as a fortnight-old support line, close to 128.80 at the latest.

Bank of Japan (BoJ) marked another show of the Yield Curve Control (YCC) on early Friday as it extends five-year loans against collateral to financial institutions, from February 01, 2023, to 2028, after the 10-year Japanese government bond (JGB) yield crept up near the BOJ's 0.5% cap, per Reuters.

The news also states that this is the second time BoJ has made such an offer after ramping up the funds-supply operation this month as a tool to defend its yield control policy.