- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 26-09-2014

Most stock indices closed higher on U.S. gross domestic product (GDP). The U.S. GDP rose at an annual rate of 4.6% in the second quarter, in line with expectations, after a 2.1% decline in the first quarter. A previous reading was a 4.2% gain.

That was the fastest pace since the fourth quarter of 2011.

Concerns are growing over the economy in the Eurozone. The Gfk consumer confidence index for Germany fell to 8.3 in October from 8.6 in September. Analysts had expected the index to decline to 8.5.

Allianz SE shares dropped 6.1% as Pacific Investment Management Co. (Pimco) co-founder and chief investment officer Bill Gross left the Pimco. Allianz owns Pacific Investment Management Co.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,649.39 +9.68 +0.15%

DAX 9,490.55 -19.46 -0.20%

CAC 40 4,394.75 +39.47 +0.91%

The U.S. dollar traded higher against the most major currencies after the U.S. final gross domestic product (GDP). The U.S. GDP rose at an annual rate of 4.6% in the second quarter, in line with expectations, after a 2.1% decline in the first quarter. A previous reading was a 4.2% gain.

The final Reuters/Michigan consumer sentiment index remained unchanged at 84.6 in September, missing expectations for a rise to 85.1.

The greenback remained supported on speculation the Fed will start to hike its interest rates sooner than expected. The Dallas Federal Reserve President Richard Fisher said yesterday that the Fed may start hiking its interest rates around the spring of 2015.

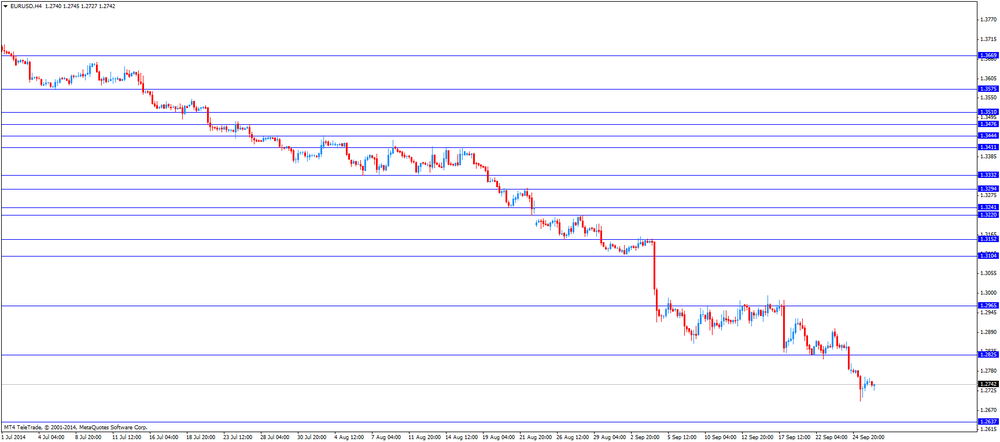

The euro traded lower against the U.S. dollar after the weaker-than-expected economic data from Germany. The Gfk consumer confidence index for Germany fell to 8.3 in October from 8.6 in September. Analysts had expected the index to decline to 8.5.

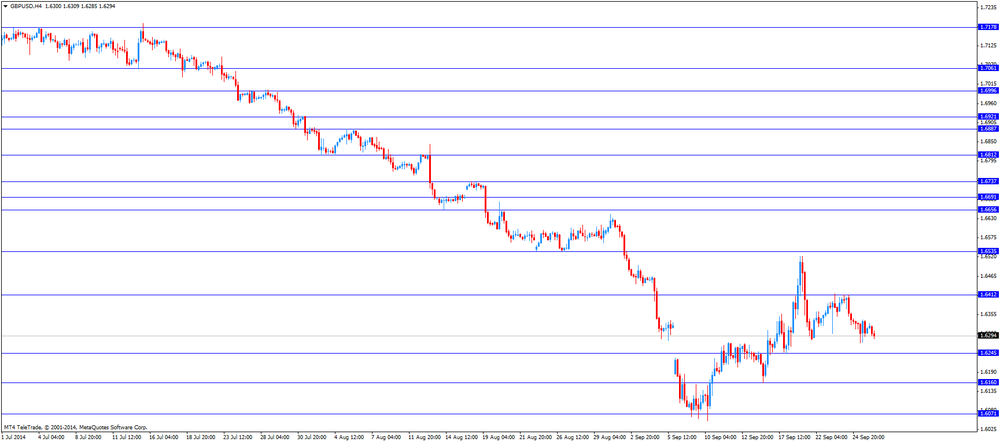

The British pound dropped against the U.S. dollar in the absence of any major economic reports from the U.K.

The New Zealand dollar traded lower against the U.S. dollar in the absence of any major economic reports from New Zealand.

Yesterday's comments by the Reserve Bank of New Zealand Governor Graeme Wheeler still weighed on the kiwi. He said the strength of the New Zealand dollar was "unjustified and unsustainable".

The Australian dollar traded slightly lower against the U.S. dollar in the absence of any major economic reports from Australia.

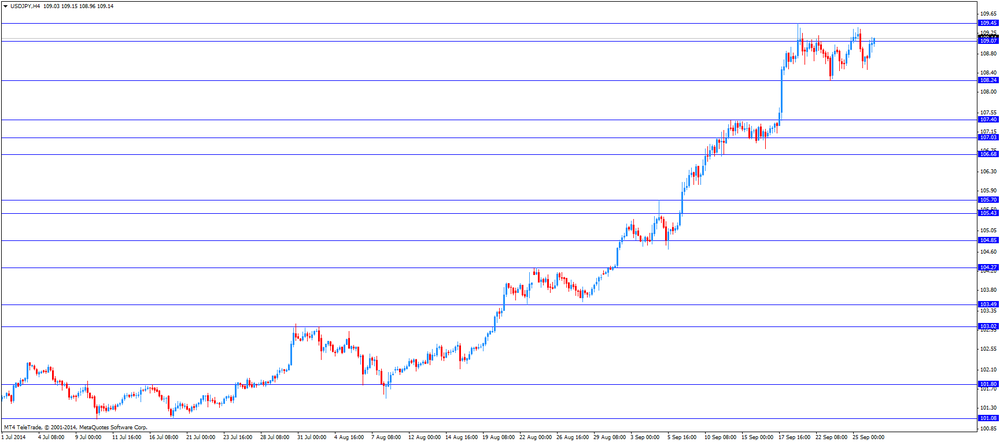

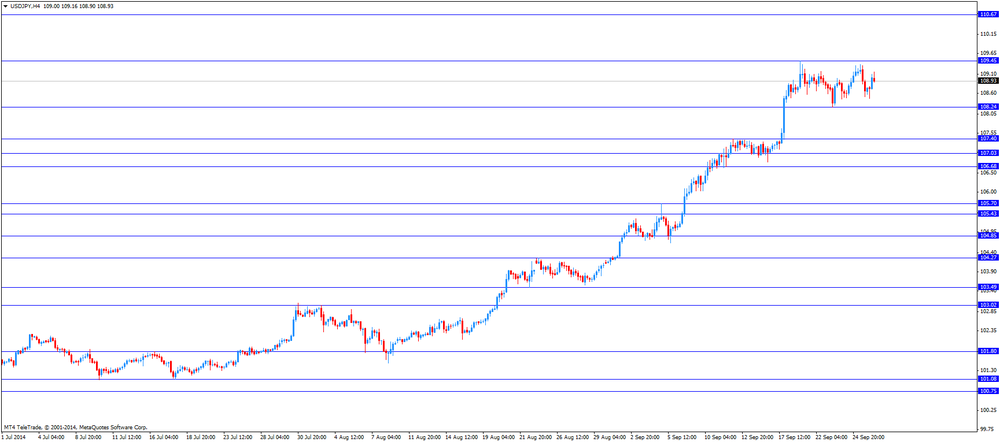

The Japanese yen traded lower against the U.S. dollar. Japan's nationwide core consumer price index increased 3.1% in August, missing expectations for a 3.2% rise, after a 3.3% gain in July.

Japan's nationwide consumer price index rose 3.3% in August, after a 3.4% increase in July.

Comments by Japan's Welfare Minister Yasuhisa Shiozaki also weighed on the yen. He said reforms for Government Pension Investment Fund (GPIF) would continue as planned.

The cost of WTI crude oil rose moderately today, heading for its second weekly increase, which helped to positive GDP data USA. Prices for Brent, the meanwhile, fell slightly.

As noted earlier, the United States Department of Commerce to improve the estimate of GDP growth in the second quarter of 2014 from 4.2% to 4.6%, based on an annual rate. Revision index coincided with the consensus forecast of analysts. Thus, the rise of the American economy in the April-June was the highest since the fourth quarter of 2012. Rise of the index PCE Core which closely tracks the Federal Reserve System in the assessment of the risks of inflation in the second quarter amounted to 2%. The rating index remained unchanged, as expected. In the first quarter, the indicator rose by 1.2%. Consumer spending, which accounts for 70% of America's GDP in April-June rose by 2.5% in terms of annual growth after an increase of 1%. Experts expect an increase in estimates from 2.5% to 2.9%.

"Improving the economic situation in the United States should have a positive impact on the fundamental prospects," - said Jean Makdzhillian, an analyst and broker Tradition Energy. - "The market is trying to stabilize.

Higher prices also contribute reports that air strikes on eastern Syria, where rebels are based Islamic state, occurred in the major oil fields in the country. But concerns about possible supply disruptions receded in the face of large-scale global production, as Libya has increased volumes despite the economic slowdown in Europe and China. In addition, on Thursday, Saudi Arabia, the world's largest oil exporter, said in August pumped 9.597 million barrels of oil per day. Although the volume decreased by 408,000 barrels per day from about 10 million barrels a day in July, the amount of crude oil supplied to the market, has reportedly increased to 9.688 million barrels per day in August.

Meanwhile, we add that Iran today urged OPEC jointly keep oil prices from falling further, but did not find understanding among the participants of the cartel, whose budgets are less dependent on oil prices. "Given the downward trend in prices, OPEC members should reduce production to avoid further price instability" - proposed Iranian Oil Minister Bijan Zanganeh. Iran's budget to the greatest extent among the 12 OPEC countries depend on world oil prices, so Iran, as a rule, in favor of measures to support prices. Others are members of the organization have not yet expressed concern decline in prices.

The cost of the November futures for the American light crude oil WTI (Light Sweet Crude Oil) rose to $ 92.83 a barrel on the New York Mercantile Exchange (NYMEX).

November futures price for North Sea Brent crude oil mixture fell $ 0.24 to $ 96.75 a barrel on the London exchange ICE Futures Europe.

Gold prices fell markedly today, heading for its fourth weekly drop in a row, due to the continued strengthening of the American currency.

"A strong dollar weakened the interest in gold. Demand for physical gold market can help to hold above $ 1,200, but demand is not high enough to support the market ", - said the chief dealer of Lee Cheong Gold Dealers Ronald Leung.

Many traders still do not rule out a drop in prices below $ 1,200 per ounce, which will result in further sales. Until now, falling prices are not driven by the recovery in demand for physical gold. Obviously, buyers in Asia are waiting, hoping for even lower prices. As a result, the dynamics of the price of gold is still dependent on Western investment demand. However, little support prices may have increased demand for gold in India in connection with the beginning of the holidays and the wedding season. Demand in China is also expected to increase at a holiday week from October 1.

The course of today's trading is also influenced American GDP data. It is learned that the United States economy grew at the fastest pace in the spring from the end of 2011: one more sign that the recovery is accelerating after five years of delay. Gross domestic product, the broadest measure of goods and services produced in the United States increased from a seasonally adjusted annual rate of 4.6% in the second quarter, the Commerce Department said. The Ministry had earlier said about the spring growth of 4.2%. Coincided with the revision of the forecast of economists. Economy last grew by 4.6% in the fourth quarter of 2011 and did not exceed this figure with the first three months of 2006. The last estimate (third) for the period from April to June, largely indicative of an increased level of investment in the business, in particular - for the construction of production facilities. Exports have also been revised upwards.

Experts say that after the GDP report the attention of the market gradually switched to the data on the labor market the United States, the publication of which is expected in the next Friday. This may limit the growth of quotations in the near future. Only if these data point to a slowdown in the economy, gold will be able to continue significant growth.

From a technical point of view, it is very likely that in the short term, gold will consolidate in a range 1200.00-1240.00. In this case, only way out of this range will contribute to the further development of medium-term trends.

The cost of the October gold futures on the COMEX today dropped to 1215.00 dollars per ounce.

EUR/USD: $1.2695(E512mn), $1.2730(E204mn), $1.2750(E3.04bn), $1.2800/05(E650mn)

USD/JPY: Y108.30($500mn), Y108.50-55($435mn), Y109.50($250mn)

GBP/USD: $1.6305-10(stg300mn), $1.6465-70(stg460mn), $1.6500(stg600mn)

EUR/GBP: Stg0.7750(E150mn), Stg0.7870(E240mn)

AUD/USD: $0.8750(A$301mn), $0.8900(A$136mn)

USD/CAD: C$1.1045/50($281mn), C$1.1100($100mn), C$1.1165-75($276mn)

U.S. stock futures fluctuated as investors assessed data showing the fastest economic growth since 2011 for clues on the timing of rate increases.

Global markets:

Nikkei 16,229.86 -144.28 -0.88%

Hang Seng 23,678.41 -89.72 -0.38%

Shanghai Composite 2,347.72 +2.61 +0.11%

FTSE 6,639.09 -0.62 -0.01%

CAC 4,375.72 +20.44 +0.47%

DAX 9,478.01 -32.00 -0.34%

Crude oil $92.89 (+0.41%)

Gold $1217.10 (-0.39%)

(company / ticker / price / change, % / volume)

| Procter & Gamble Co | PG | 84.35 | +0.02% | 0.4K |

| UnitedHealth Group Inc | UNH | 86.21 | +0.03% | 0.3K |

| Cisco Systems Inc | CSCO | 24.56 | +0.08% | 12.8K |

| The Coca-Cola Co | KO | 41.82 | +0.10% | 4.8K |

| McDonald's Corp | MCD | 94.27 | +0.12% | 1.4K |

| Chevron Corp | CVX | 120.85 | +0.14% | 8.6K |

| International Business Machines Co... | IBM | 189.31 | +0.16% | 0.1K |

| Verizon Communications Inc | VZ | 49.69 | +0.16% | 2.8K |

| Goldman Sachs | GS | 184.40 | +0.17% | 2.5K |

| Visa | V | 211.13 | +0.20% | 1.8K |

| Boeing Co | BA | 127.40 | +0.20% | 4.9K |

| Microsoft Corp | MSFT | 46.14 | +0.22% | 2.1K |

| Pfizer Inc | PFE | 30.май | +0.23% | 652.8K |

| 3M Co | MMM | 142.82 | +0.24% | 0.4K |

| United Technologies Corp | UTX | 104.75 | +0.25% | 0.3K |

| Walt Disney Co | DIS | 88.30 | +0.26% | 0.4K |

| E. I. du Pont de Nemours and Co | DD | 72.00 | +0.29% | 2.6K |

| Exxon Mobil Corp | XOM | 94.53 | +0.30% | 2.7K |

| Intel Corp | INTC | 34.25 | +0.32% | 2.9K |

| Merck & Co Inc | MRK | 59.83 | +0.32% | 300.3K |

| AT&T Inc | T | 35.20 | +0.34% | 5.2K |

| Caterpillar Inc | CAT | 99.85 | +0.34% | 0.1K |

| General Electric Co | GE | 25.64 | +0.35% | 6.6K |

| Johnson & Johnson | JNJ | 107.50 | +0.37% | 1.7K |

| JPMorgan Chase and Co | JPM | 60.40 | +0.42% | 1.2K |

| American Express Co | AXP | 87.18 | +0.48% | 0.5K |

| Nike | NKE | 87.00 | +9.09% | 309.9K |

Upgrades:

NIKE (NKE) upgraded to Buy from Neutral at Janney, tarhet raised to $93 from $80

Downgrades:

Other:

NIKE (NKE) target raised to $100 from $80 at JP Morgan

NIKE (NKE) target raised to $100 from $90 at Barclays

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

02:00 China Leading Index August +1.3% +0.7%

06:00 Germany Gfk Consumer Confidence Survey October 8.6 8.5 8.3

The U.S. dollar traded mixed to higher against the most major currencies ahead of the U.S. final gross domestic product (GDP). Analysts expect U.S. GDP to increase 4.6% in the second quarter, up from a previous reading of a 4.2% gain.

The final Reuters/Michigan consumer sentiment index is expected to climbs to 85.1 in September, up from a previous reading of 84.6.

The greenback remained supported on speculation the Fed will start to hike its interest rates sooner than expected. The Dallas Federal Reserve President Richard Fisher said yesterday that the Fed may start hiking its interest rates around the spring of 2015.

The euro declined against the U.S. dollar after the weaker-than-expected economic data from Germany. The Gfk consumer confidence index for Germany fell to 8.3 in October from 8.6 in September. Analysts had expected the index to decline to 8.5.

The British pound traded mixed against the U.S. dollar in the absence of any major economic reports from the U.K.

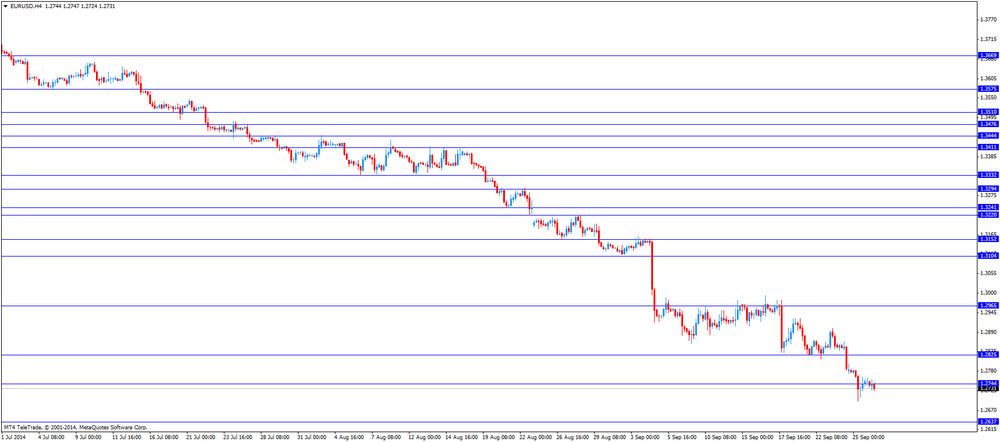

EUR/USD: the currency pair fell to $1.2724

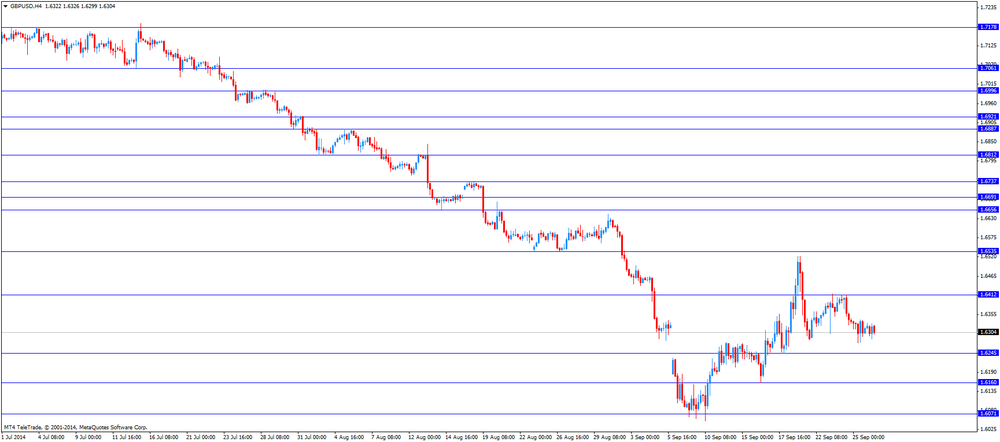

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair rose to Y109.16

The most important news that are expected (GMT0):

12:30 U.S. PCE price index, q/q Quarter II +2.5%

12:30 U.S. PCE price index ex food, energy, q/q Quarter II +2.0%

12:30 U.S. GDP, q/q (Finally) Quarter II +4.2% +4.6%

13:55 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) September 84.6 85.1

EUR/USD

Offers $1.2820-30, $1.2800, $1.2780/85, $1.2765

Bids $1.2660/50

GBP/USD

Offers $1.6430/35, $1.6400

Bids $1.6210/00, $1.6180

AUD/USD

Offers $0.8900, $0.8850, $0.8795/00

Bids $0.8700, $0.8650

EUR/JPY

Offers Y140.00, Y139.50, Y139.15/20

Bids Y138.55/50, Y138.20, Y138.00, Y137.50

USD/JPY

Offers Y110.00, Y109.50, Y109.40, Y109.20

Bids Y108.40

EUR/GBP

Offers stg0.7829-31

Bids stg0.7755/45

Stock indices traded little changed. Investors are awaiting the release of the U.S. final gross domestic product (GDP). Analysts expect U.S. GDP to increase 4.6% in the second quarter.

Concerns are growing over the economy in the Eurozone. The Gfk consumer confidence index for Germany fell to 8.3 in October from 8.6 in September. Analysts had expected the index to decline to 8.5.

Current figures:

Name Price Change Change %

FTSE 6,699.62 -6.65 -0.10%

DAX 9,706.64 +44.67 +0.46%

CAC 40 4,427.74 +14.02 +0.32%

Most Asian stock indices closed lower, following U.S. markets.

Japan's nationwide core consumer price index increased 3.1% in August, missing expectations for a 3.2% rise, after a 3.3% gain in July.

Japan's nationwide consumer price index rose 3.3% in August, after a 3.4% increase in July.

Comments by Japan's Welfare Minister Yasuhisa Shiozaki said reforms for Government Pension Investment Fund (GPIF) would continue as planned.

The Conference Board released its leading index for China. The index rose 0.7% in August, after a 1.3% gain in July.

Indexes on the close:

Nikkei 225 16,229.86 -144.28 -0.88%

Hang Seng 23,678.41 -89.72 -0.38%

Shanghai Composite 2,347.72 +2.61 +0.11%

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

02:00 China Leading Index August +1.3% +0.7%

06:00 Germany Gfk Consumer Confidence Survey October 8.6 8.5 8.3

The U.S. dollar traded higher against the most major currencies on speculation the Fed will start to hike its interest rates sooner than expected. The Dallas Federal Reserve President Richard Fisher said yesterday that the Fed may start hiking its interest rates around the spring of 2015.

The New Zealand dollar fell against the U.S. dollar in the absence of any major economic reports from New Zealand.

Yesterday's comments by the Reserve Bank of New Zealand Governor Graeme Wheeler still weighed on the kiwi. He said the strength of the New Zealand dollar was "unjustified and unsustainable".

The Australian dollar declined against the U.S. dollar in the absence of any major economic reports from Australia.

The Japanese yen traded lower against the U.S. dollar after the consumer inflation data from Japan. Japan's nationwide core consumer price index increased 3.1% in August, missing expectations for a 3.2% rise, after a 3.3% gain in July.

Japan's nationwide consumer price index rose 3.3% in August, after a 3.4% increase in July.

Comments by Japan's Welfare Minister Yasuhisa Shiozaki also weighed on the yen. He said reforms for Government Pension Investment Fund (GPIF) would continue as planned.

EUR/USD: the currency pair fell to $1.2737

GBP/USD: the currency pair decreased to $1.6294

USD/JPY: the currency pair rose to Y109.10

The most important news that are expected (GMT0):

12:30 U.S. PCE price index, q/q Quarter II +2.5%

12:30 U.S. PCE price index ex food, energy, q/q Quarter II +2.0%

12:30 U.S. GDP, q/q (Finally) Quarter II +4.2% +4.6%

13:55 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) September 84.6 85.1

EUR / USD

Resistance levels (open interest**, contracts)

$1.2877 (1657)

$1.2844 (2315)

$1.2797 (259)

Price at time of writing this review: $ 1.2743

Support levels (open interest**, contracts):

$1.2687 (3291)

$1.2658 (3895)

$1.2622 (2380)

Comments:

- Overall open interest on the CALL options with the expiration date October, 3 is 59604 contracts, with the maximum number of contracts with strike price $1,3000 (5054);

- Overall open interest on the PUT options with the expiration date October, 3 is 61664 contracts, with the maximum number of contracts with strike price $1,2800 (6025);

- The ratio of PUT/CALL was 1.03 versus 1.07 from the previous trading day according to data from September, 25

GBP/USD

Resistance levels (open interest**, contracts)

$1.6600 (1337)

$1.6501 (2523)

$1.6403 (1603)

Price at time of writing this review: $1.6299

Support levels (open interest**, contracts):

$1.6197 (2136)

$1.6099 (3351)

$1.6000 (2017)

Comments:

- Overall open interest on the CALL options with the expiration date October, 3 is 31587 contracts, with the maximum number of contracts with strike price $1,6700 (3699);

- Overall open interest on the PUT options with the expiration date October, 3 is 41401 contracts, with the maximum number of contracts with strike price $1,6300 (4690);

- The ratio of PUT/CALL was 1.31 versus 1.31 from the previous trading day according to data from September, 25

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.