- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 26-06-2014

Most stock indices declined after comments by St. Louis Fed President James Bullard. He told Fox Business Network that the Fed' interest hike by the end of the first quarter in 2015 will be appropriate, if the U.S. economy grows 3% in the next four quarters.

The Bank of England released its financial stability report. The BoE plans to cap mortgages beginning from October. Lenders must limit the proportion of mortgages at 4.5 times income to no more than 15% of their new home loans.

The Bank of England Governor Mark Carney said the recovery in the U.K. economy is strengthening. But he added the housing market is the main risk to financial stability.

London Stock Exchange Group Plc agreed to buy Frank Russell Co. for $2.7 billion.

London Stock Exchange Group Plc shares increased 6.2% after agreeing to acquire Frank Russell Co.

Fresenius Medical Care AG climbed 3.3% after Credit Suisse Group AG raised the company's rating on the stock.

Barclays Plc shares dropped 7.0% after the Attorney General filed a securities fraud lawsuit in New York. The bank is accused of falsifying marketing materials to hide how much high-frequency traders were buying and selling.

Standard Chartered Plc slipped 4.8% after reporting its first-half operating profit could drop 20%.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,735.12 +1.50 +0.02%

DAX 9,804.9 -62.85 -0.64%

CAC 40 4,439.63 -20.97 -0.47%

The U.S. dollar traded mixed against the most major currencies after the U.S. economic data. The Labor Department released initial U.S. jobless claims. Initial U.S. jobless claims dropped by 2,000 people to 312,000 last week. That is a sign of an improving labour market.

The previous week's figure was revised upward by 2,000 to 314,000. Analysts had expected an increase by 2,000 to 314,000.

Personal incomes in the U.S. increased by 0.4% in May, missing expectations for a 0.5% gain, after a 0.3% rise in April.

Personal spending in the U.S. rose 0.2% in June, missing forecasts of a 0.4% increase, after a 0.1% decline in May.

The core PCE (prices paid for consumer goods excluding food and energy), Fed's preferred measure of inflation, climbed at annual rate by 1.5% in May, missing expectations for a 1.7% gain, after a 1.4% rise in April.

On a monthly basis, core PCE increased 0.2% in May, in line with expectations.

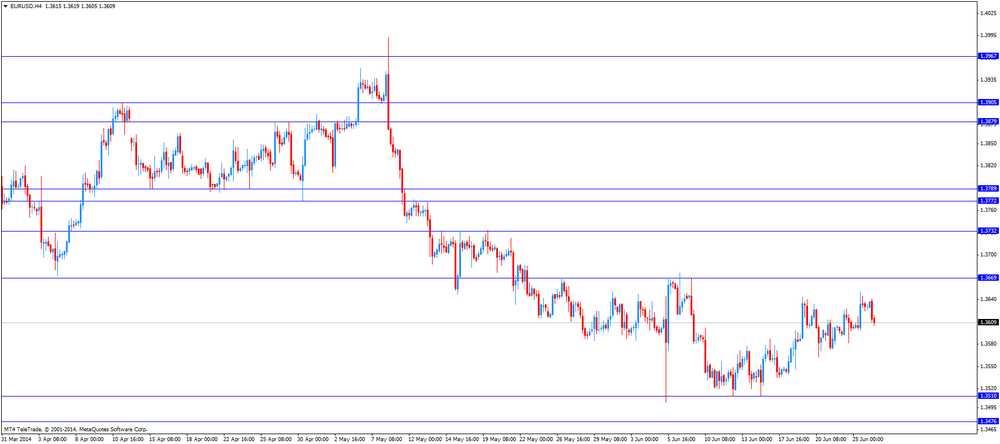

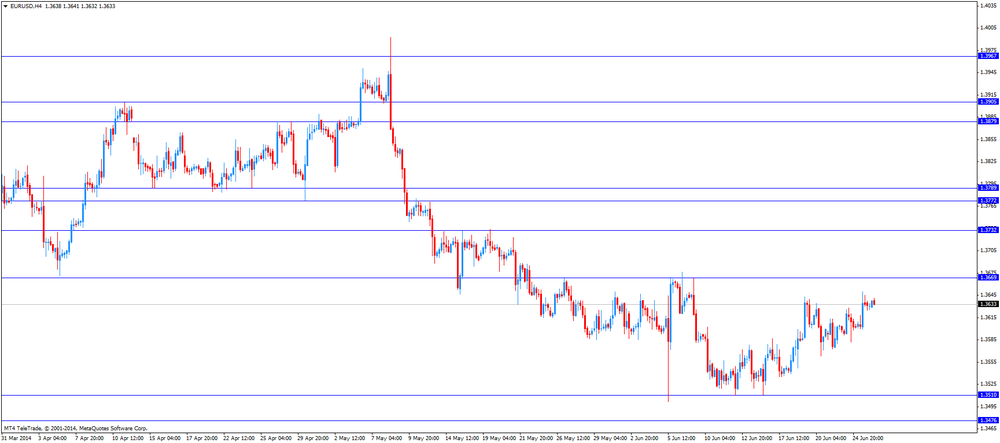

The euro declined against the U.S. dollar in the absence of any major economic reports.

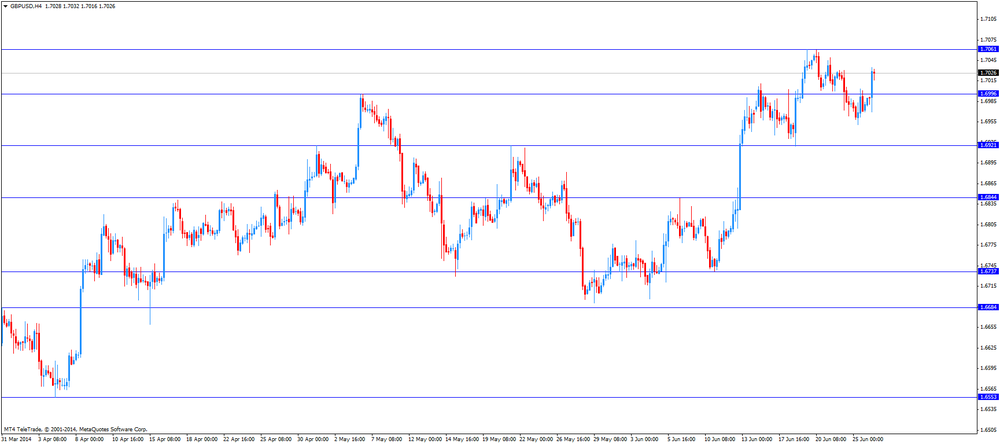

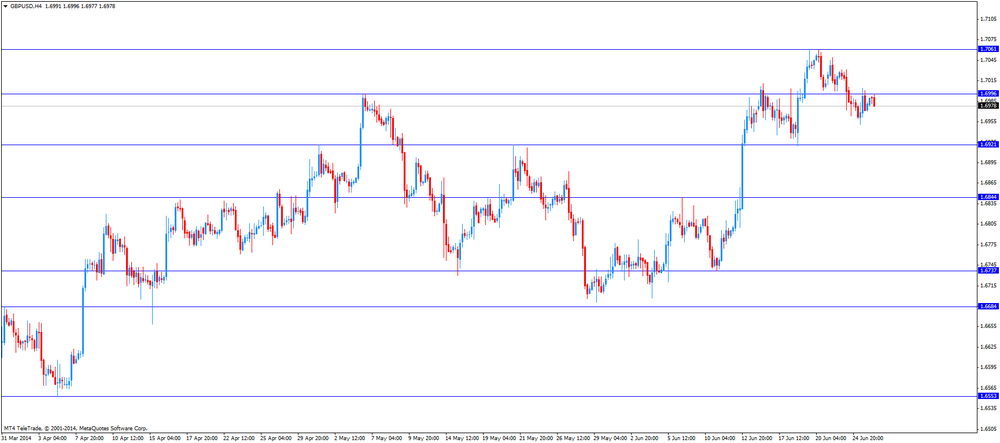

The British pound traded lower against the U.S. dollar. The BoE plans to cap mortgages beginning from October. Lenders must limit the proportion of mortgages at 4.5 times income to no more than 15% of their new home loans.

The Bank of England Governor Mark Carney said the recovery in the U.K. economy is strengthening. But he added the housing market is the main risk to financial stability.

The New Zealand dollar traded slightly lower against the U.S dollar in the absence of any major economic reports in New Zealand.

The Australian dollar traded lower against the U.S. dollar. The number of job vacancies in Australia increased 2.5% in March-May, after a 2.8% gain in December-February.

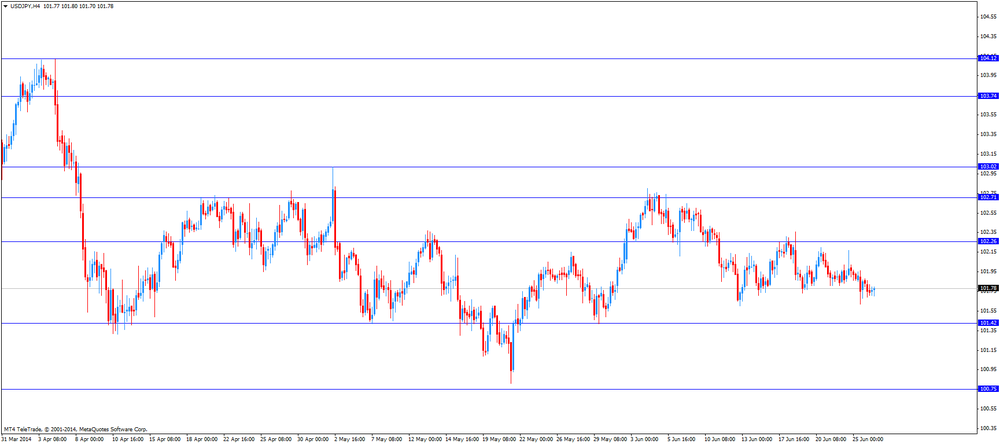

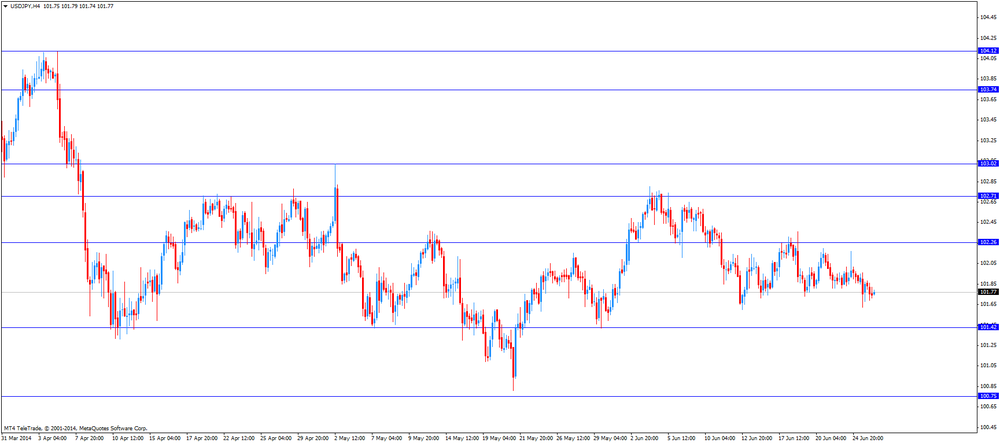

The Japanese yen rose against the U.S. dollar in the absence of any major economic reports in Japan.

West Texas Intermediate and Brent crudes fell on signs that the insurgency in Iraq won't curb output and as U.S. stockpiles climbed.

Iraq's crude exports will rise next month, Oil Minister Abdul Kareem al-Luaibi said yesterday. Government forces repelled an attack by the Sunni Islamic State in Iraq and the Levant on the Baiji refinery north of Baghdad. U.S. crude stockpiles rose by 1.74 million barrels to 388.1 million last week, the Energy Information Administration said yesterday.

"Prices are retreating because the insurgency hasn't had a material impact on the Iraqi production and we might be looking at a gain in exports," said Gene McGillian, an analyst and broker at Tradition Energy in Stamford, Connecticut. "Prices are consolidating here just below the nine-month highs."

WTI for August delivery slipped $1.23, or 1.2 percent, to $105.27 a barrel at 10:51 a.m. on the New York Mercantile Exchange. The volume of all futures traded was 7.5 percent below the 100-day average for the time of day. Futures are up 7 percent this year.

Brent for August settlement fell 74 cents, or 0.6 percent, to $113.26 a barrel on the London-based ICE Futures Europe exchange. Futures slipped to $113.11, the lowest level since June 18. Trading volume was 4.5 percent than the 100-day average. Prices have increased 2.2 percent this year.

The European benchmark crude traded at a $7.99 discount to WTI, up from $7.50 yesterday.

The price of gold is reduced by a stronger dollar after data on the U.S. labor market.

Number of new applications for unemployment benefits fell slightly last week, indicating that the improvement in the labor market.

The Labour Department said the seasonally adjusted number of initial claims for unemployment benefits fell for the week ending June 21, 2000 - to the level of 312 000. Economists forecast the value of this index level of 314 thousand

Meanwhile, the figure for the previous week was revised upward for 2000 - to a level of 314,000.

Another report showed that U.S. consumers have moderated their consumption by the end of May, despite higher revenue growth. This was stated in the report of the Ministry of Commerce.

According to data seasonally adjusted volume of personal spending rose in May by 0.2% (on a monthly basis). Last upgrade was entirely due to higher prices and followed zero change in April. Adjusted for inflation, spending decreased.

Meanwhile, the amount of personal income rose in May by 0.4%. Add that earnings growth for the past five months in a row, but Americans use a greater share for savings. Economists had expected personal spending will grow by 0.4%, while personal income - 0.5%.

The price index for personal consumption expenditures, which is the preferred sensor inflation for the Fed, rose 0.2% in May from April. In annual terms, index grew by 1.8%. Basic index rose by 0.2% on a monthly basis and by 1.5% per annum.

The cost of the August gold futures on the COMEX today dropped to $ 1306.8 per ounce.

EUR/USD $1.3570-75, $1.3585-89, $1.3600, $1.3610-20, $1.3640-50

USD/JPY Y101.00, Y101.50, Y101.65, Y101.95, Y102.00, Y102.20-25, Y102.30

EUR/JPY Y138.00, Y138.20

GBP/USD $1.6900, $1.7000

EUR/GBP stg0.7970, stg0.8030

AUD/USD $0.9400

The Bank of England released its financial stability report:

- BoE plans to cap mortgages beginning from October;

- 85% of mortgage approvals would need to be below 4.5 times of the borrowers' income;

- BoE plans to test banks, whereby borrowers could repay the mortgage even if interest rates rise to 3%;

- No new mortgages around the limit of 4.5 would be allowed.

The Bank of England Governor Mark Carney said at the press conference today:

- The recovery in the U.K. economy is strengthening;

- The housing market is the main risk to the U.K. economy's stability.

U.S. stock-index futures were little changed as Alcoa Inc. rallied amid merger activity while data showed consumer spending grew less than forecast in May.

Global markets:

Nikkei 15,308.49 +41.88 +0.27%

Hang Seng 23,197.83 +331.13 +1.45%

Shanghai Composite 2,038.68 +13.18 +0.65%

FTSE 6,735.05 +1.43 +0.02%

CAC 4,462.87 +2.27 +0.05%

DAX 9,861.86 -5.89 -0.06%

Crude oil $106.25 (-0.23%)

Gold $1316.80 (-0.44%)

(company / ticker / price / change, % / volume)

| McDonald's Corp | MCD | 101.62 | +0.01% | 200.00 |

| Verizon Communications Inc | VZ | 49.43 | +0.04% | 3.8K |

| Walt Disney Co | DIS | 83.95 | +0.06% | 785.00 |

| General Electric Co | GE | 26.45 | +0.11% | 22.8K |

| Travelers Companies Inc | TRV | 95.00 | +0.15% | 200.00 |

| Procter & Gamble Co | PG | 79.45 | +0.16% | 6.0K |

| Nike | NKE | 76.60 | +0.17% | 9.3K |

| Boeing Co | BA | 127.55 | +0.39% | 128.00 |

| UnitedHealth Group Inc | UNH | 83.43 | +1.32% | 100.00 |

| Cisco Systems Inc | CSCO | 24.72 | 0.00% | 2.0K |

| Pfizer Inc | PFE | 29.79 | -0.03% | 500.00 |

| International Business Machines Co... | IBM | 180.61 | -0.06% | 599.00 |

| Intel Corp | INTC | 30.83 | -0.16% | 8.8K |

| Wal-Mart Stores Inc | WMT | 75.50 | -0.16% | 600.00 |

| The Coca-Cola Co | KO | 41.87 | -0.21% | 24.1K |

| Goldman Sachs | GS | 167.80 | -0.34% | 5.5K |

| Microsoft Corp | MSFT | 41.85 | -0.43% | 1.5K |

Upgrades:

Downgrades:

Other:

Fecebook (FB) initiated with an Overweight at Barclays

Twitter (TWTR) initiated with an Overweight at Barclays

Walt Disney (DIS) initiated with Buy at Jefferies

Economic calendar (GMT0):

07:30 Switzerland SNB Quarterly Bulletin Quarter II

09:00 Eurozone EU Economic Summit

09:30 United Kingdom BOE Financial Stability Report

09:30 United Kingdom BOE Gov Mark Carney Speaks

The U.S. dollar traded mixed against the most major currencies ahead of the U.S. economic data. Initial jobless claims in the U.S. should increase by 2,000 to 314,000.

The personal income should climb 0.5% in May, after a 0.3% gain. The personal spending in the U.S. should rise 0.5% in June, after a 0.1% decline.

Yesterday's weak U.S. GDP weighed on the U.S. currency. U.S. GDP dropped 2.9% in the first quarter, missing expectations for a 1.7% decline, after a 1.0% decline the previous quarter.

The euro declined against the U.S. dollar in the absence of any major economic reports.

The British pound increased against the U.S. dollar after the Bank of England report and the Bank of England Governor Mark Carney's speech. The BoE plans to cap mortgages beginning from October. Borrowers limited to 4.5 times income.

The Bank of England Governor Mark Carney said the recovery in the U.K. economy is strengthening. But he added the housing market is the main risk to financial stability.

EUR/USD: the currency pair declined to $1.3605

GBP/USD: the currency pair increased to $1.7035

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 U.S. Initial Jobless Claims June 312 314

12:30 U.S. Personal Income, m/m May +0.3% +0.5%

12:30 U.S. Personal spending June -0.1% +0.4%

12:30 U.S. PCE price index ex food, energy, m/m May +0.2% +0.2%

12:30 U.S. PCE price index ex food, energy, Y/Y May +1.4% +1.7%

22:45 New Zealand Trade Balance, mln May 534 250

23:05 United Kingdom Gfk Consumer Confidence June 0 2

23:30 Japan Unemployment Rate May 3.6% 3.6%

23:30 Japan Household spending Y/Y May -4.6% -1.9%

23:30 Japan Tokyo Consumer Price Index, y/y June +3.1%

23:30 Japan Tokyo CPI ex Fresh Food, y/y June +2.8% +2.8%

23:30 Japan National Consumer Price Index, y/y May +3.4%

23:30 Japan National CPI Ex-Fresh Food, y/y May +3.2% +3.4%

23:50 Japan Retail sales, y/y May -4.3% -1.9%

EUR/USD

Offers $1.3695/00, $1.3688, $1.3670/80, $1.3650

Bids $1.3605, $1.3580, $1.3550, $1.3535, $1.3515/10

GBP/USD

Offers $1.7110/20, $1.7090, $1.7080/85, $1.7062

Bids $1.6920, $1.6910/00, $1.6845

AUD/USD

Offers $0.9545, $0.9500, $0.9460, $0.9450, $0.9430

Bids $0.9350, $0.9320, $0.9300, $0.9255, $0.9230

EUR/JPY

Offers Y140.00, Y139.50, Y139.20, Y139.00

Bids Y138.40, Y138.20, Y138.00

USD/JPY

Offers Y102.80, Y102.65, Y102.40, Y102.20

Bids Y101.60, Y101.50/40, Y101.00

EUR/GBP

Offers stg0.8100, stg0.8080, stg0.8050, stg0.8040

Bids stg0.8000, stg0.7950, stg0.7900

Stock indices traded mixed on speculation the U.S. GDP will be stronger in the second quarter and due to increased mergers-and-acquisitions activity.

The U.S. GDP dropped 2.9% in the first quarter, missing expectations for a 1.7% decline, after a 1.0% decline the previous quarter. That was the worst performance in five years.

The weak U.S. economic growth in the first quarter was driven by the cold winter in the U.S. Investors speculate that the economic activity in the U.S. will show a solid growth in the second quarter.

Market participants also expect the Federal Reserve will keep interest rates unchanged for a longer period.

London Stock Exchange Group Plc agreed to buy Frank Russell Co. for $2.7 billion.

London Stock Exchange Group Plc shares increased 7.0% after agreeing to acquire Frank Russell Co.

Fresenius Medical Care AG climbed 3.3% after Credit Suisse Group AG raised the company's rating on the stock.

Barclays Plc shares dropped 5.2% after the Attorney General filed a securities fraud lawsuit in New York. The bank is accused of falsifying marketing materials to hide how much high-frequency traders were buying and selling.

Standard Chartered Plc slipped 5% after reporting its first-half operating profit could drop 20%.

Current figures:

Name Price Change Change %

FTSE 100 6,738.37 +4.75 +0.07%

DAX 9,859.32 -8.43 -0.09%

CAC 40 4,459.32 -1.28 -0.03%

EUR/USD $1.3570-75, $1.3585-89, $1.3600, $1.3610-20, $1.3640-50

USD/JPY Y101.00, Y101.50, Y101.65, Y101.95, Y102.00, Y102.20-25, Y102.30

EUR/JPY Y138.00, Y138.20

GBP/USD $1.6900, $1.7000

EUR/GBP stg0.7970, stg0.8030

AUD/USD $0.9400

Asian stock traded higher following gains on Wall Street. U.S. stocks increased yesterday despite the weak U.S. GDP. The U.S. GDP dropped 2.9% in the first quarter, missing expectations for a 1.7% decline, after a 1.0% decline the previous quarter. That was the worst performance in five years.

The weak U.S. economic growth in the first quarter was driven by the cold winter in the U.S. Investors speculate that the economic activity in the U.S. will show a solid growth in the second quarter.

Indexes on the close:

Nikkei 225 15,308.49 +41.81 +0.27%

Hang Seng 23,197.83 +331.13 +1.45%

Shanghai Composite 2,038.68 +13.18 +0.65%

Economic calendar (GMT0):

07:30 Switzerland SNB Quarterly Bulletin Quarter II

The U.S. dollar traded lower against the most major currencies due to yesterday's weaker-than-expected U.S. GDP. The U.S. GDP dropped 2.9% in the first quarter, missing expectations for a 1.7% decline, after a 1.0% decline the previous quarter. That was the worst performance in five years.

The New Zealand dollar traded higher against the U.S dollar in the absence of any major economic reports in New Zealand. The kiwi was supported by yesterday's weak U.S. economic data.

The Australian dollar traded higher against the U.S. dollar. The Aussie was supported by yesterday's weak U.S. economic data.

The number of job vacancies in Australia increased 2.5% in March-May, after a 2.8% gain in December-February.

The Japanese yen traded mixed against the U.S. dollar in the absence of any major economic reports in Japan.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

09:00 Eurozone EU Economic Summit

09:30 United Kingdom BOE Financial Stability Report

09:30 United Kingdom BOE Gov Mark Carney Speaks

12:30 U.S. Initial Jobless Claims June 312 314

12:30 U.S. Personal Income, m/m May +0.3% +0.5%

12:30 U.S. Personal spending June -0.1% +0.4%

12:30 U.S. PCE price index ex food, energy, m/m May +0.2% +0.2%

12:30 U.S. PCE price index ex food, energy, Y/Y May +1.4% +1.7%

22:45 New Zealand Trade Balance, mln May 534 250

23:05 United Kingdom Gfk Consumer Confidence June 0 2

23:30 Japan Unemployment Rate May 3.6% 3.6%

23:30 Japan Household spending Y/Y May -4.6% -1.9%

23:30 Japan Tokyo Consumer Price Index, y/y June +3.1%

23:30 Japan Tokyo CPI ex Fresh Food, y/y June +2.8% +2.8%

23:30 Japan National Consumer Price Index, y/y May +3.4%

23:30 Japan National CPI Ex-Fresh Food, y/y May +3.2% +3.4%

23:50 Japan Retail sales, y/y May -4.3% -1.9%

EUR / USD

Resistance levels (open interest**, contracts)

$1.3685 (2301)

$1.3662 (3441)

$1.3648 (1835)

Price at time of writing this review: $ 1.3632

Support levels (open interest**, contracts):

$1.3614 (1569)

$1.3596 (1063)

$1.3569 (3709)

Comments:

- Overall open interest on the CALL options with the expiration date July, 3 is 32233 contracts, with the maximum number of contracts with strike price $1,3700 (5354);

- Overall open interest on the PUT options with the expiration date July, 3 is 41120 contracts, with the maximum number of contracts with strike price $1,3500 (5294);

- The ratio of PUT/CALL was 1.28 versus 1.35 from the previous trading day according to data from June, 25

GBP/USD

Resistance levels (open interest**, contracts)

$1.7300 (383)

$1.7200 (2065)

$1.7101 (2210)

Price at time of writing this review: $1.6986

Support levels (open interest**, contracts):

$1.6897 (2204)

$1.6799 (1769)

$1.6700 (2412)

Comments:

- Overall open interest on the CALL options with the expiration date July, 3 is 21370 contracts, with the maximum number of contracts with strike price $1,7000 (3108);

- Overall open interest on the PUT options with the expiration date July, 3 is 26458 contracts, with the maximum number of contracts with strike price $1,6700 (2412);

- The ratio of PUT/CALL was 1.24 versus 1.29 from the previous trading day according to data from June, 25

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.