- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 26-05-2014

Nikkei 14,602.52 +140.35 +0.97%

Hang Seng 22,963.18 -2.68 -0.01%

Shanghai Composite 2,041.48 +6.91 +0.34%

S&P 1,900.53 +8.04 +0.42%

NASDAQ 4,185.81 +31.47 +0.76%

Dow 16,606.27 +63.19 +0.38%

FTSE 1,376.44 +7.27 +0.53%

CAC 4,526.93 +33.78 +0.75%

DAX 9,892.82 +124.81 +1.28%

EUR/USD $1,3644 +0,11%

GBP/USD $1,6840 +0,06%

USD/CHF Chf0,8947 -0,04%

USD/JPY Y101,92 -0,04%

EUR/JPY Y139,06 +0,09%

GBP/JPY Y171,62 +0,01%

AUD/USD $0,9238 +0,10%

NZD/USD $0,8549 +0,05%

USD/CAD C$1,0857 -0,06%

06:00 Switzerland Trade Balance April 2.05 2.05

07:15 Switzerland Employment Level Quarter I 4.19 4.21

08:30 United Kingdom BBA Mortgage Approvals April 45.9 45.2

12:30 U.S. Durable Goods Orders April +2.9% [Revised From +2.6%] -0.4%

12:30 U.S. Durable Goods Orders ex Transportation April +2.4% [Revised From +2.0%] +0.2%

12:30 U.S. Durable goods orders ex defense April +1.8%

13:00 U.S. Housing Price Index, m/m March +0.6% +0.5%

13:00 U.S. Housing Price Index, y/y March +6.9%

13:00 U.S. S&P/Case-Shiller Home Price Indices, y/y March +12.9% +11.9%

13:30 Eurozone ECB President Mario Draghi Speaks

13:43 U.S. Services PMI (Preliminary) April 55.0 55.6

14:00 U.S. Richmond Fed Manufacturing Index May 7 5

14:00 U.S. Consumer confidence May 82.3 83.2

20:30 U.S. API Crude Oil Inventories May -10.3

The stock

indices traded higher due to European parliament elections results and

the speech of the European Central Bank President Mario Draghi. Italia’s Prime

Minister Matteo Renzi’s party election victory boosted European stock markets.

Renzi’s Democratic Party scored a massive 41% of the vote.

The

European Central Bank President Mario Draghi signalled at the conference in

Sintra that the ECB will take action in June if the inflation should weaken.

German

consumer confidence published by Gfk remained unchanged at 8.5 in June, meeting

analysts’ expectations.

Markets in

the U.K. closed for a public holiday.

Banca

Popolare dell’Emilia Romagna SC shares increased 8.9%.

Atos shares

climbed 5.9% after the company reported to acquire rival Bull for about 620

million euros.

Indexes on

the close:

Name Price Change Change %

FTSE

100 closed

DAX 9,892.82 +124.81 +1.28%

Brent

crude fell amid speculation that Ukraine’s election of a new president may help

ease months of tension with Russia, the world’s biggest energy exporter. West

Texas Intermediate slid in New York.

Futures

dropped as much as 0.7 percent in London. Ukraine elected billionaire Petro

Poroshenko as president yesterday, handing him the task of stemming separatist

unrest in the country, a conduit for Russian oil and natural gas supplies to

Europe. China, the second-largest oil user globally, announced plans to slow

its pace of energy consumption.

“There’s

been quite a political vacuum in Ukraine, and that should begin to get

resolved,” Ole Hansen, head of commodity strategy at Saxo Bank A/S in

Copenhagen, said by phone today. “News about Ukraine has been helping to bring

down prices a bit,” he said, describing Poroshenko as “ someone who can sit

down with the Russians to try to work out their differences.”

Brent

for July settlement declined as much as 79 cents to $109.75 a barrel on the

London-based ICE Futures Europe exchange and was at $109.99 at 1:47 p.m. London

time. The contract gained 18 cents to $110.54 on May 23. The volume of all

futures traded was about 74 percent below the 100-day average. Prices have lost

0.7 percent this year.

WTI for

July delivery decreased as much as 43 cents, or 0.4 percent, and was at $104.10

a barrel in electronic trading on the New York Mercantile Exchange. The U.S.

benchmark crude traded at a discount of $5.92 to Brent. The spread closed at

$6.19 on May 23, the narrowest in five weeks.

The U.S.

dollar traded lower against the most major currencies in the absence of any

major economic reports in the U.S. Markets in the U.S. closed for the Memorial

Day holiday.

The euro

increased against the U.S. dollar after the speech of the European Central Bank

President Mario Draghi. The European Central Bank President Mario Draghi

signalled at new ECB annual conference in Sintra that the ECB will take action

in June if the inflation should weaken.

The euro

was also supported by the European parliament elections results in Greece and

Italy.

The British

pound traded slightly changed against the U.S. dollar in the absence of any

major economic reports in the U.K. Comments by the Bank of England Deputy

Governor Charles Bean supported the British currency. He said that the Bank of

England could hike interest rates before next spring. Markets in the U.K.

closed for a public holiday.

The

Canadian dollar traded higher against the U.S. dollar. Friday’s

better-than-expected consumer price index in Canada continued to weigh on the

Canadian dollar. The consumer price index in Canada increase 0.3% in April

(March: +0.6%), meeting analysts’ expectations. On a year-over-year rate, the

consumer price index in Canada climbed 2.0% in April, from 1.5% in March.

The

Canadian core consumer price index rose 0.2% in April (March: +0.3%), meeting

analysts’ expectations. On a yearly basis, the Canadian core consumer price

index climbed 1.4% in April, from a 1.3% increase in March.

The New

Zealand dollar hits 1-month lows against the U.S. after the release of trade balance

surplus from New Zealand, but later recovered all its losses. New Zealand's

trade surplus dropped to NZ$534 million in April, from NZ$920 million in March.

Analysts had expected the trade surplus to decline to NZ$667 million. Exports

to China from New Zealand were the lowest since September. China is New

Zealand’s second biggest trade partner.

The

Australian dollar traded slightly higher against the U.S. dollar in the absence

of any major economic reports in Australia.

The

Japanese yen traded slightly higher against the U.S. dollar after the release

of the Bank of Japan (BoJ) minutes. The BoJ minutes showed concerns over growth

and inflation views. Three of the Bank of Japan's nine board members wanted the

separate reviews of growth and inflation outlooks.

Gold holds below $ 1,300 an ounce in electronic trading in New York against the backdrop of conflicting signals : the expected reduction of stimulus measures by the Federal Reserve System and the conflict in the Ukraine.

Gold fell on Friday to 0.1% after reports that sales of new homes in the U.S. rose by the largest value since October. Trading platforms in the U.S. and the UK are closed today due to public holidays .

The gold market has fallen in the past year by 28% due to expectations that the Federal Reserve in connection with the economic recovery will begin reducing the bond buyback program . Since the beginning of the year the prices of precious metals rose 7.6 %, including because of strained relations between Russia and Ukraine.

Kazakhstan , Belarus and Turkey in April increased gold reserves , and Mexico - and cut , said the International Monetary Fund .

" Now investors have little reason to invest in gold - says Zhu Sytsyuan analyst Chinese GF Futures Co. - Bidding will be sluggish due to the holidays in the U.S. and in the absence of new macro data . Situation in Ukraine continues to provide background support to the market ."

Assets of SPDR Gold Trust, the biggest gold exchange-traded fund , May 23, has not changed, and on May 21 fell to 776.89 tons , or the lowest level since December 2008. In China, the trading volume indicative contracts for spot delivery on the Shanghai Stock Exchange on May 23, decreased to 9907 kilograms of gold , or the lowest level since April 30.

The cost of the June gold futures on the COMEX trading today in the range of $ 1290.90 - $ 1294.80 per ounce.

EUR/USD; $1.3600, $1.3620, $1.3630, $1.3650

USD/JPY; Y101.35, Y102.00, Y102.30

AUD/USD; $0.9270

AUD/NZD NZ$1.0900

USD/CAD C$1.0975

Economic

calendar (GMT0):

00:00 United Kingdom Bank holiday

00:00 U.S. Bank holiday

06:00 Germany Gfk Consumer Confidence

Survey June 8.5 8.5 8.5

08:00 Eurozone ECB President Mario Draghi

Speaks

The U.S.

dollar traded lower against the most major currencies in the absence of any

major economic reports in the U.S. Markets in the U.S. closed for the Memorial

Day holiday.

The euro increased

against the U.S. dollar after the speech of the European Central Bank President

Mario Draghi. The European Central Bank President Mario Draghi signalled at new

ECB annual conference in Sintra that the ECB will take action in June if the

inflation should weaken.

The British

pound traded higher against the U.S. dollar in the absence of any major

economic reports in the U.K. Markets in the U.K. closed for a public holiday.

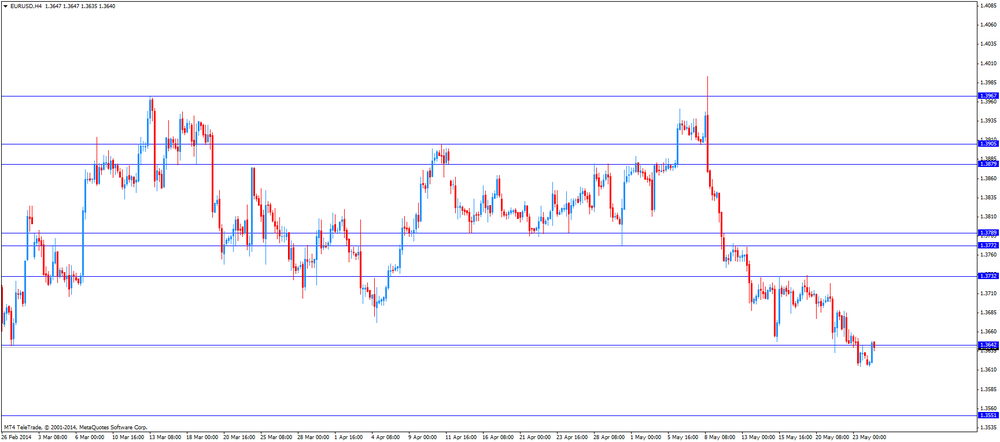

EUR/USD:

the currency pair climbed to $1.3648

GBP/USD:

the currency pair increased to $1.6853

USD/JPY:

the currency pair declined to Y101.86

The most

important news that are expected (GMT0):

23:50 Japan CSPI, y/y April +0.7%

EUR/USD

Offers $1.3800, $1.3775, $1.3735, $1.3685/90

Bids $1.3600, $1.3550, $1.3525/20, $1.3500

GBP/USD

Offers $1.6950, $1.6930/35, $1.6900

Bids $1.6800, $1.6780, $1.6730

AUD/USD

Offers $0.9300, $0.9280, $0.9250

Bids $0.9200, $0.9150, $0.9100

EUR/JPY

Offers Y140.00, Y139.75/80, Y139.50, Y139.20

Bids Y138.50, Y138.20, Y138.00, Y137.50

USD/JPY

Offers Y103.00, Y102.40, Y102.10

Bids Y101.50, Y101.05/00, Y100.80

EUR/GBP

Offers stg0.8170, stg0.8140, stg0.8120,

Bids stg0.8050, stg0.8035/30, stg0.8005/000

The stock

indices traded higher due to European parliament elections results. Italy’s

Prime Minister Matteo Renzi’s party election victory boosted European stock

markets. Renzi’s Democratic Party scored a massive 40% of the vote.

The

European Central Bank President Mario Draghi signalled at the conference in

Sintra that the ECB will take action in June if the inflation should weaken.

German consumer

confidence published by Gfk remained unchanged at 8.5 in June, meeting analysts’

expectations.

Markets in

the U.K. closed for a public holiday.

Banca

Popolare dell’Emilia Romagna SC shares increased 6.9%.

Atos shares

climbed 4.6% after the company reported to acquire rival Bull for about 620

million euros.

Current

figures:

Name Price Change Change %

FTSE

100 closed

DAX 9,859.39 +91.38 +0.94%

CAC 40 4,509.66 +16.51 +0.37%

EUR/USD; $1.3600, $1.3620(VL), $1.3630, $1.3650

USD/JPY; Y101.35, Y102.00, Y102.30

AUD/USD; $0.9270

AUD/NZD NZ$1.0900

USD/CAD C$1.0975

The European

Central Bank President Mario Draghi said at conference in Sintra, Portugal:

- The ECB monitors

exchange rate and credit dynamics closely;

- Low level

of harmonised consumer price index (HICP) in the Eurozone is caused by the strong

euro;

- The ECB

should monitor closely the negative inflationary spiral;

- The ECB

could purchase assets in the case of weakening inflation;

- Low

inflation will be last for a longer period of tome but gradually return to 2%.

Most Asian

stock indices surged due to the positive U.S. housing data, following the U.S. indices.

The U.S. new home sales increased 6.4% in April to a seasonally adjusted annual

rate of 433,000 units. March's figure was revised up to 407,000 from 384,000.

Analysts had expected a gain to 425,000.

The

Japanese index Nikkei 225 has benefited from the weak yen.

Indexes on

the close:

Nikkei

225 14,602.52 +140.35 +0.97%

Hang

Seng 22,963.18 -2.68 -0.01%

Shanghai

Composite 2,041.48 +6.91 +0.34%

Dainippon

Sumitomo Pharma Co. slid 21% after the company suspended its study on an experimental

drug for colorectal cancer.

Economic

calendar (GMT0):

00:00 United Kingdom Bank holiday

00:00 U.S. Bank holiday

06:00 Germany Gfk Consumer Confidence Survey June 8.5 8.5 8.5

08:00 Eurozone ECB President Mario Draghi Speaks

The U.S.

dollar traded mixed against the most major currencies. The U.S. currency was

supported by the positive U.S. housing data, published on Friday. The U.S. new

home sales increased 6.4% in April to a seasonally adjusted annual rate of

433,000 units. March's figure was revised up to 407,000 from 384,000. Analysts

had expected a gain to 425,000.

Markets in

the U.S. closed for the Memorial Day holiday.

The New

Zealand dollar hits 1-month lows against the U.S. after the release of trade

balance surplus from New Zealand. New Zealand's trade surplus dropped to NZ$534

million in April, from NZ$920 million in March. Analysts had expected the trade

surplus to decline to NZ$667 million. Exports to China from New Zealand were

the lowest since September. China is New Zealand’s second biggest trade

partner.

The

Australian dollar traded slightly higher against the U.S. dollar in the absence

of any major economic reports in Australia.

The

Japanese yen traded slightly higher against the U.S. dollar after the release

of the Bank of Japan (BoJ) minutes. The BoJ minutes showed concerns over growth

and inflation views. Three of the Bank of Japan's nine board members wanted the

separate reviews of growth and inflation outlooks.

EUR/USD:

the currency pair declined to $1.3615

GBP/USD:

the currency pair traded mixed

USD/JPY:

the currency pair traded mixed

The most

important news that are expected (GMT0):

23:50 Japan CSPI, y/y April +0.7%

EUR / USD

Resistance levels (open interest**, contracts)

$1.3777 (3260)

$1.3742 (4266)

$1.3690 (552)

Price at time of writing this review: $ 1.3618

Support levels (open interest**, contracts):

$1.3599 (2833)

$1.3584 (6379)

$1.3563 (3500)

Comments:

- Overall open interest on the CALL options with the expiration date June, 6 is 56873 contracts, with the maximum number of contracts with strike price $1,3850 (6343);

- Overall open interest on the PUT optionswith the expiration date June, 6 is 73732 contracts, with the maximum number of contractswith strike price $1,3500 (6679);

- The ratio of PUT/CALL was 1.30 versus 1.26 from the previous trading day according to data from May, 23

GBP/USD

Resistance levels (open interest**, contracts)

$1.7100 (1855)

$1.7001 (2727)

$1.6903 (2070)

Price at time of writing this review: $1.6835

Support levels (open interest**, contracts):

$1.6796 (1669)

$1.6698 (2394)

$1.6599 (1605)

Comments:

- Overall open interest on the CALL options with the expiration date June, 6 is 23555 contracts, with the maximum number of contracts with strike price $1,7000 (2727);

- Overall open interest on the PUT optionswith the expiration date June, 6 is 25155 contracts, with the maximum number of contracts with strike price $1,6700 (2542);

- The ratio of PUT/CALL was 1.07 versus 1.05 from the previous trading day according to data from May, 23

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.