- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 26-04-2022

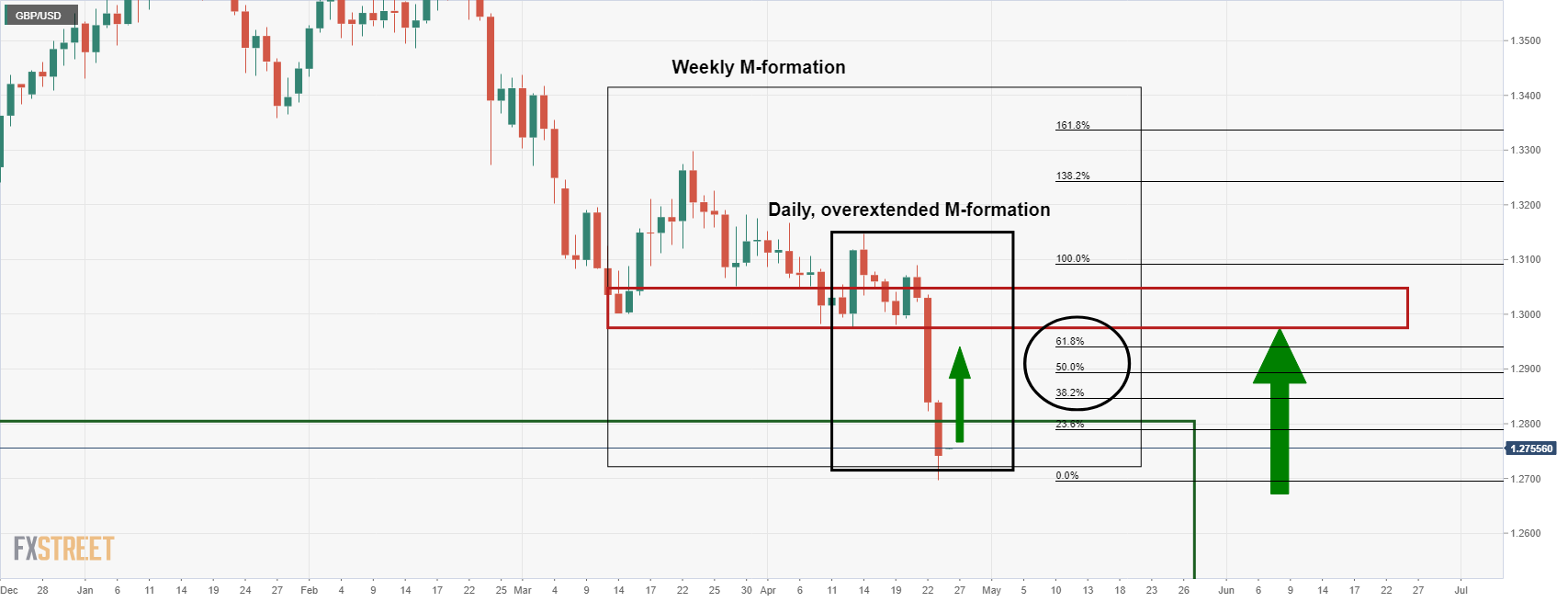

- The cable has plunged around 3.70% in the last four trading sessions.

- A breakdown of the Falling Channel formation has strengthened the greenback bulls.

- Investors seek a pullback for making a short entry.

The GBP/USD pair is falling like a house of cards since Friday after slipping below the two-week-old barricade at 1.2973. The asset has eased around 3.70% in the last four trading sessions and is showing no sign of reversal yet.

The downside breaking of the Falling Channel on the daily scale has vigorously strengthened the greenback bulls. The upper boundary of the above-mentioned chart pattern is placed from June 2021 highs at 1.4249 while the lower boundary is plotted from April 2021 low at 1.3669. A breakdown of the Falling Channel results in volume expansion and wider ticks.

The 10- and 20-period Exponential Moving Averages (EMAs) at 1.2838 and 1.2945 respectively are trending lower, which adds to the downside filters.

Also, the Relative Strength Index (RSI) (14) has shifted into the bearish range of 20.00-40.00, which signals a fresh downside impulsive wave ahead.

After a juggernaut downside, a pullback looks likely. Therefore, investors should wait for a pullback to near the round level barricade of 1.2800 for building fresh shorts. Responsive selling at 1.2800 will drag the asset towards the round level supports at 1.2600 and 1.2500 respectively.

On the flip side, the cable can perform well if the asset oversteps the psychological resistance of 1.3000. This will send the pair towards Thursday’s high at 1.3090, followed by a three-week high at 1.3147.

GBP/USD daily chart

-637866122021949126.png)

- The USD/CHF remains bullish and is up in the month by 4.50%.

- China’s Covid-19 outbreak, Ukraine’s conflict, and a firm US dollar weighed on the CHF.

- USD/CHF Price Forecast: The steepness of the uptrend suggests consolidation might lie ahead.

On Tuesday, the USD/CHF rallied for the third consecutive day and reached a 21-month high at 0.9626. However, as the Asian Pacific session begins, the USD/CHF print modest losses of 0.06%, down from YTD highs, and is trading in the high 0.9610s at the time of writing.

The market mood soared on the back of increasing Covid-19 cases in China. Its last outbreak, which began in Shanghai, triggered lockdowns and isolations. However, contagion expanded to some districts of Beijing and also Mongolia. That keeps investors worried because the Chinese authorities’ zero-covid policy, alongside increasing infections, creates the perfect storm to disrupt the supply side and trigger a raft of inflation.

Elsewhere, the Ukraine-Russia conflict keeps grabbing some headlines. The Polish company PGNIG said that Russia would stop gas deliveries starting April 27th, and they need to be paid in Russian roubles. Later, the retaliation reached Bulgaria, as Gazprom halted gas deliveries, as reported by Reuters.

On Tuesday, the USD/CHF meandered in the 0.9560-90 area, but near the close of Wall Street, broke decisively above the 0.9600 figure, and closed near the YTD high at 0.9623.

USD/CHF Price Forecast: Technical outlook

The USD/CHF remains upward biased and is just shy of June’s 5 2020 swing high around 0.9650. Nevertheless, the USD/CHF’s steeper upside move triggered a sharp move in the Relative Strength Index (RSI) to 75.85, well within overbought conditions, signaling that the USD/CHF might be headed for consolidation before resuming the uptrend.

If that scenario plays out, the USD/CHF’s first support would be the daily pivot at 0.9600. A breach of the latter would expose the 50-1 hour simple moving average (SMA) above the S1 daily pivot, each at 0.9586 and 8.9580, respectively, followed by April’s 26 daily low of 0.9564.

However, if the USD/CHF continues trending up, the USD/CHF’s first resistance would be the YTD high at 0.9626. Once cleared, the next supply zone would be the confluence of the R1 daily pivot and June’s 5 2020 cycle high around 0.9650, followed by the R2 daily pivot at 0.9670, short of the 0.9700 mark.

- EUR/USD finds some bids after an intense sell-off to near 1.0640 on souring market mood.

- The renewed fears of stagflation in Europe have underpinned the greenback against the shared currency.

- Investors are focusing on the speech from ECB’s Lagarde.

The EUR/USD pair is displaying a dead cat bounce after printing a fresh two-year low at 1.0636 in the late New York session as the risk-off impulse mounts higher. The uncertainty over the interest rate decision to be taken by the Federal Reserve (Fed) in May has put the market participants on their toes. This is resulting in a higher appeal for the US dollar index (DXY) and a sell-off in the risk-perceived currencies whose effect is clearly witnessed in the recent sell-off of the shared currency.

The eurozone is underperforming against the greenback as the renewed fears of stagflation amid the Ukraine crisis have worsened the decision-making for European Central Bank (ECB) policymakers. Soaring inflation in Europe due to high energy bills and food prices along with the expectation of a slash in the growth forecast stated by ECB President Christine Lagarde in her testimony at the International Monetary Fund (IMF) meeting has restricted the ECB from marching toward policy tightening.

Meanwhile, the US dollar index (DXY) is facing a minor pullback as profit-booking kicks in after the DXY printed a two-year high at 102.36. On a broader note, the DXY is firmer and will resume its upward journey after a minute correction.

For further guidance, investors will keep an eye on the speech from ECB’s Lagarde, which is due on Wednesday. This will provide insights into the likely monetary policy action by the ECB in June. On the DXY front, the market participants will focus on the annual Gross Domestic Product (GDP) numbers, which are likely to land at 1.1%. While the quarterly GDP is expected to print at 7.2%.

- The NZD/JPY collapses more than 1.50% on Tuesday.

- China’s Covid-19 woes triggered a flight to safe-haven assets, and the JPY rose.

- NZD/JPY Price Forecast: Mixed signals between price action and market sentiment suggest that the NZD/JPY is tilted to the downside.

The New Zealand dollar follows the footsteps of the risk-sensitive currencies battered on Tuesday, amid increasing concerns that China’s coronavirus outbreak and its zero-covid policy create a cocktail that threatens to disrupt the supply chain, spurring elevated prices. Those factors weighed on market sentiment, propelling further yen upside. At the time of writing, the NZD/JPY is trading at 83.36.

Additionally, the Ukraine-Russia hostilities remain and escalated. According to Reuters, Gazprom halted gas deliveries to Bulgaria, while Polish firm PGNIG said Russia would stop gas deliveries starting April 27th.

On Tuesday, the NZD/JPY began the session around 84.73, shy of the daily highs, and dipped towards 84.50 due to negative sentiment in the markets. Nevertheless, the PBoC cutting RRR 100 bps caused a bounce towards the 85.00-14 area, retreating afterward towards the daily low around 83.40, on a negative sentiment shift.

NZD/JPY Price Forecast: Technical outlook

From a technical perspective in the daily chart, the NZD/JPY pair is upward biased. However, the market is being driven by market sentiment, and given that the NZD/JPY broke below March’s 31 low at 84.24, it opened the door for a fall towards October 2021 highs around 82.50.

With that said, the NZD/JPY first support would be the 83.00 figure. A breach of the latter would expose the S1 daily pivot at 82.56, followed by October 2021 highs near 82.50. Once cleared, the next line of defense downwards would be the S2 daily pivot at 82.27.

Key Technical Levels

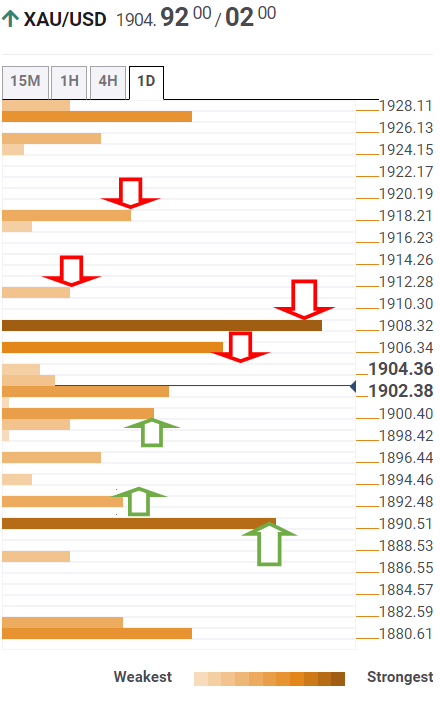

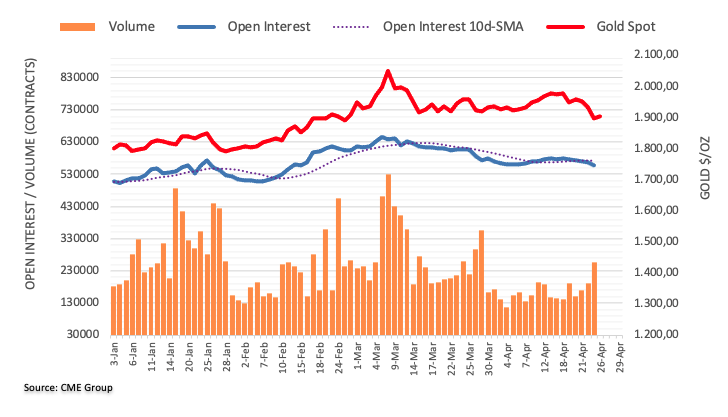

- Gold price is looking vulnerable at around $1,900.00, eyes more downside after breaking the consolidation.

- The DXY has climbed above 102.00 despite weak US Durable Goods Orders.

- The formation of an Inverted Flag is dictating more weakness ahead.

Gold (XAU/USD) is oscillating in a minor range of $1,891.56-1,911.31 since Monday after an intense sell-off from Friday’s high at $1,955.71. The gold prices are stabilizing currently in a concise range but price action is favoring an extreme imbalance on the downside amid the rising US dollar index (DXY).

Soaring expectations of a 50 basis point (bps) interest rate hike by the Federal Reserve (Fed) in May monetary policy is pushing the DXY higher like there is no tomorrow. The asset is exploding its all barricades swiftly and has climbed above the round level resistance of 102.00 firmly. Despite an underperformance from the economic data, the DXY is scaling higher. The US Census Bureau on Tuesday reported the monthly Durable Goods Orders at 0.8% lower than the market consensus of 1%. So it would not be wrong to claim that higher odds of a jumbo rate hike by the Fed have infused fresh blood into the DXY, also it is forcing the gold prices to remain vulnerable from the past few trading sessions.

Going forward, investors will focus on Thursday’s US Gross Domestic Product (GDP) numbers. A preliminary estimate for the yearly US GDP at 1.1%, advocates an underperformance in comparison with the prior print of 6.9%.

Gold Technical Analysis

On an hourly scale, XAU/USD is forming an Inverted Flag chart pattern that signals a consolidation phase after a swift downside move. In this consolidation phase, those investors participate who failed to enjoy the previous fall and those who prefer a continuation bet rather than a reversal. The 50- and 200-period Exponential Moving Averages (EMAs) at $1,910.23 and $1,935.43 respectively are scaling lower, which signals that a bearish trend is intact. Meanwhile, the Relative Strength Index (RSI) (14) is oscillating in the 40.00-60.00 range, which signals a consolidation.

Gold hourly chart

-637866072318799355.png)

- NZD/USD is under pressure and is tracking stocks lower.

- Risk-off sentiment is firmly weighing on the high beta currencies.

NZD/USD is trading down some 0.74% into the start of the early Asian session. The bears are focused on the January 2022 lows on a day that saw the US dollar run higher as per the DXY to fresh bull cycle highs at 102.363.

At 0.6565, the price is 80 pips below the highs of the day at 0.6645.''Reports that Russia has halted gas supplies to Poland raised concerns of a broadening energy stand-off with Europe which would have negative implications for the European manufacturing sector,'' analysts at ANZ Bank said. ''The USD is the main beneficiary of this uncertainty and its strength is broad-based, including against the NZD. Asian FX weakness vs USD is also weighing on the kiwi.''

A combination of risk-off themes has weighed on financial markets this week. For one, the Chinese capital, Beijing, has launched a COVID-19 testing drive for most of its 21 million people in a race to contain a growing coronavirus outbreak and avert a city-wide lockdown.

Beijing reported 33 new COVID-19 infections on Tuesday, bringing the total number of infections found in the capital to 80 since Friday. However, while the numbers seem minuscule, the zero-COVID policy is implemented and authorities are anxious to avoid the kind of spiralling outbreak that has plunged the commercial hub of Shanghai into a strict lockdown for weeks.

The lockdowns in China add to the worries over world trade and inflation risks at a time when NATO is on the brink of war with Russia. It was a 'sell-everything' day on Wall Street as a consequence with the Nasdaq closing at its lowest since December 2020 as investors worried about slowing global growth and a more aggressive Federal Reserve.

Meanwhile, data showed US Consumer Confidence edged lower in April. Additionally, the Atlanta Fed Gross Domestic Product nowcast estimate for the first quarter growth was revised sharply lower to 0.4% from 1.3% on April 19. The next update is on Wednesday, the final estimate before the Bureau of Economic Analysis releases its advance reading of Q1 GDP on Thursday.

- Fears of China’s Covid-19 outbreak would trigger additional lockdowns spurred a dismal market mood.

- Russia retaliates against Poland and Bulgaria to halt gas exports by April 27th.

- The US Dollar Index (DXY) records for a second-consecutive day a new YTD high at 102.36.

- The Australian economic docket to unveil inflation figures.

- AUD/USD Price Forecast: Downward biased, and a test of the 0.7100 is on the cards.

The AUD/USD falls for the fourth consecutive day and records a fresh two-month low around 0.7134, courtesy of a dismal market mood and a resilient US dollar, which extends its gains. At 0.7122, the AUD/USD is aiming toward the 0.7100 level now that March’s 15 cycle low at 0.7165 has been broken.

A dismal market mood boosts the safe-haven currencies

US equities remain trading with losses as the New York session is about to end, while the CBOT Volatility Index (VIX), also called the “fear index,” rose close to 19%, up at 32.09. The aforementioned is the reflection of a dampened market mood. The spread of the China Covid-19 outbreak from Shanghai to some districts of Beijing threatens to spur additional lockdowns, which consequently will disrupt the supply chain. Meanwhile, the Ukraine-Russia conflict escalated as Gazprom halted gas deliveries to Bulgaria, while Polish firm PGNIG said Russia would stop gas deliveries starting April 27th, according to Reuters.

In the FX space, the safe-haven peers benefitted from a pure market sentiment play. The US Dollar Index, a measurement of the greenback’s value against a basket of G8 currencies, recorded a new YTD peak at around 102.36. in the meantime, the US 10-year Treasury yield fell eight basis points and ended around 2.741%.

On Tuesday, the US economic docket featured the CB Consumer Confidence for April, which came at 107.3, lower than the 108 foreseen. Despite being a worse than expected report, Lynn Franco, Senior director of economic indicators at the Conference Board( CB), said that “the Present Situation Index declined, but remains quite high, suggesting the economy continued to expand in the early second quarter.” Furthermore, Franco added that “expectations, while still weak, did not deteriorate further amid high prices, especially at the gas pump, and the war in Ukraine. Vacation intentions cooled but intentions to buy big-ticket items like automobiles, and many appliances rose somewhat.”

Earlier, March’s Durable Good Orders rose by 0.8% m/m, lower than the 1%, but better than the 1.7% contraction of February.

The week ahead, the Australian economic docket will feature inflation figures on Wednesday. The Australian Inflation Rate is expected to jump 1.7% q/q, while on a yearly basis, it is anticipated an uptick from 3.5% to 4.6%. In the US docket on Thursday would be the release of the Q1 GDP and March’s Core PCE inflation on Friday.

AUD/USD Price Forecast: Technical outlook

The AUD/USD broke below March’s 15 daily low at 0.7165, so the pair’s bias is downwards. The AUD/USD first support would be February’s 24 cycle low at 0.7094. A breach of the latter would expose February’s 4 pivot low at 0.7051, followed by January’s 22 swing and YTD low at 0.6967.

What you need to know on Wednesday 27 April:

FX trade was once again dominated by risk-off flows this Tuesday, with the safe-haven yen and US dollar’s outperforming as a result, as US equities cratered. Traders cited everything from China lockdown risk, rising economic and military tensions between Russia/NATO amid the ongoing Russo-Ukraine war, a worsening global growth outlook and the prospect of aggressive monetary tightening from many major central banks as weighing on sentiment. Regarding geopolitics, reports that Russia’s Gazprom is to begin halting gas supplies to Poland and through Bulgaria as soon as 27 April did little to help sentiment late in the session.

The yen extended its recent run of gains against its G10 counterparts, with USD/JPY dropping back to the mid-127.00s versus last week’s highs above 129.00 and EUR/JPY hitting two weeks in the mid-135.00s. Meanwhile, GBP/JPY extended its three-day run of losses from last week’s highs above 168.00 to nearly 5.0%, with the pair eyeing a test of 160.00.

The US Dollar Index (DXY), meanwhile, hit fresh multi-month highs in the 102.30s, as it continues to hone in one 2020 highs near 103.00. The bulk of the gains for the DXY were driven by losses in EUR/USD and GBP/USD, with the euro and sterling the two worst performers of the major G10 currencies. The former came within a whisker of hitting its 2020 low at 1.0936 and posted a 0.7% on-the-day drop, while the latter slumped over 1.2% to fall into the upper 1.2500s, taking its three-day run of losses to around 3.5%.

Traders cited receding BoE tightening bets and concerning UK government borrowing data for the 2021/22 year as weighing on sentiment towards the pound and the usual concerns about energy-related stagflation in the Eurozone as weighing on the euro. Meanwhile, robust US March Durable Goods, February S&P/Case-Shiller House Price Index and April Conference Board Consumer Confidence survey data released earlier in the day did not have an impact on USD sentiment.

Turning to the rest of the major G10 currencies; the Aussie, kiwi and loonie all held up better than sterling, losing roughly 0.6% on the day each versus the buck, with the losses cushioned as energy prices gained on geopolitical tensions. AUD/USD nontheless fell to its lowest levels since late February in the 0.7130s, NZD/USD fell back under 0.6600 and USDCAD hit new multi-week highs above 1.2800.

Attention turns in the upcoming session to the release of Australian Q1 2022 Consumer Price Inflation figures and Chinese February Industrial Profits data at 0230BST. However, the main driver of sentiment through the coming Asia Pacific session is likely to remain the state of the Covid-19 outbreak/lockdown situation in China.

- The euro weakened vs. the Japanese yen amidst a risk-off mood, and the EUR/JPY fell 1.13%.

- China’s coronavirus outbreak, and Russia-Ukraine jitters, weighed on sentiment.

- EUR/JPY Price Forecast: The pair bias is neutral-upwards, but downside risks remain around 135.27.

On Tuesday, the EUR/JPY dropped to a fresh two-week-low on a second-consecutive risk-off trading session, favoring safe-haven currencies like the JPY, the CHF, and the greenback. At the time of writing, the EUR/JPY is trading at 135.65, near a 200-pip fall.

Dampened market mood boosts the safe-haven yen

US equities remain trading with losses as the New York session end looms. The aforementioned is the reflection of a dampened market mood. China’s coronavirus outbreak that started in Shanghai disseminated to some Beijing districts. Meanwhile, in China’s inner Mongolia, Baotou city imposed a lockdown due to Covid-19 cases. In the Russia-Ukraine conflict, online talks continued, but hostilities remained,

During Tuesday’s overnight session, the EUR/JPY opened shy of the daily highs, around 137.25, and weakened some towards 136.50 but recovered to 137.50. However, once European traders got to their offices, and market sentiment turned sour, the EUR/JPY nosedived towards the weekly lows at 135.39.

EUR/JPY Price Forecast: Technical outlook

The EUR/JPY remains tilted neutral-upwards from the daily chart perspective. In the last two days, the price action fell shy of April’s 11 daily low at 135.27, a fundamental level. A break of the latter could pave the way for a EUR/JPY move towards April’s 5 swing low at 134.30. However, unless that happens, the bias remains neutral-upwards.

The EUR/JPY’s first resistance would be 136.00. A break above would expose the 137.00 figure, followed by February’s 2020 swing high at 137.50 and the YTD high at 140.00.

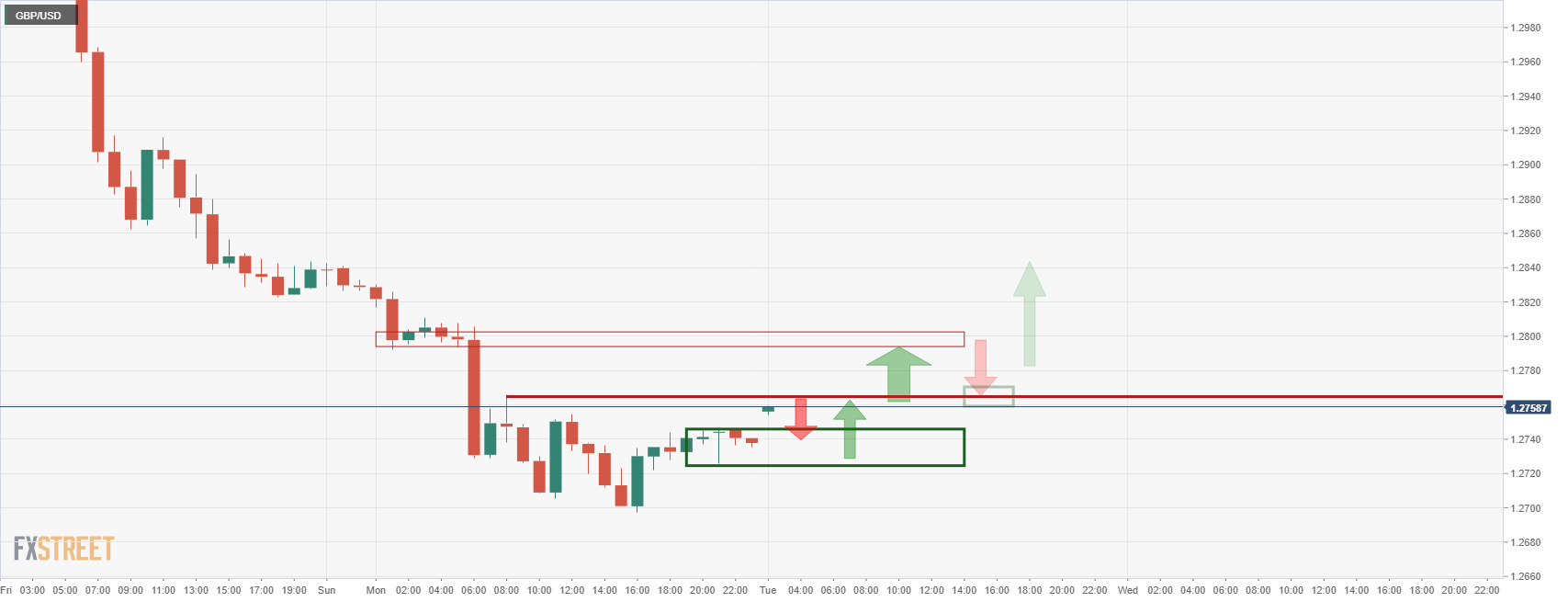

- USD/JPY bears could be about to move in a critical area on the hourly chart.

- The US dollar has been relentless and has gone on to score a fresh bull cycle high in DXY.

At 127.58, the price of USD/JPY is down 0.43% and was pressured to fresh bear corrective lows on Tuesday at 127.02. In recent trade, however, the US dollar has rallied and pushed the yen back to 127.63.

The US dollar improved versus its major trading partners early Tuesday, with the DXY up 0.59% printing fresh cycle highs yet again. However, the yen can attract a safe haven bid also which raises the prospects of a downside continuation as soon as the US dollar bulls start to move out.

The focus will turn to the Bank of Japan meets Wednesday and Thursday and is expected to maintain its ultra-low interest rate policy. The BoJ continues to buy securities to defend its interest rate cap. Japan’s position as a net importer of commodities combined with the very dovish position of the BoJ has been weighing heavily on JPY, which can all stall any significant advance in the yen for the meanwhile.

Meanwhile, Wall Street tumbled on Tuesday, led lower by the Nasdaq as investors worried about slowing global growth and a more aggressive Federal Reserve. Additionally, the Atlanta Fed Gross Domestic Product nowcast estimate for the first quarter growth was revised sharply lower to 0.4% from 1.3% on April 19. The next update is on Wednesday, the final estimate before the Bureau of Economic Analysis releases its advance reading of Q1 GDP on Thursday.

Personal income and spending on Friday will also be a key release for the US while Federal Reserve officials remain in quiet period before the May 3-4 Federal Open Market Committee meeting. markets expect that a 50-basis point increase is a distinct possibility based on recent comments from officials.

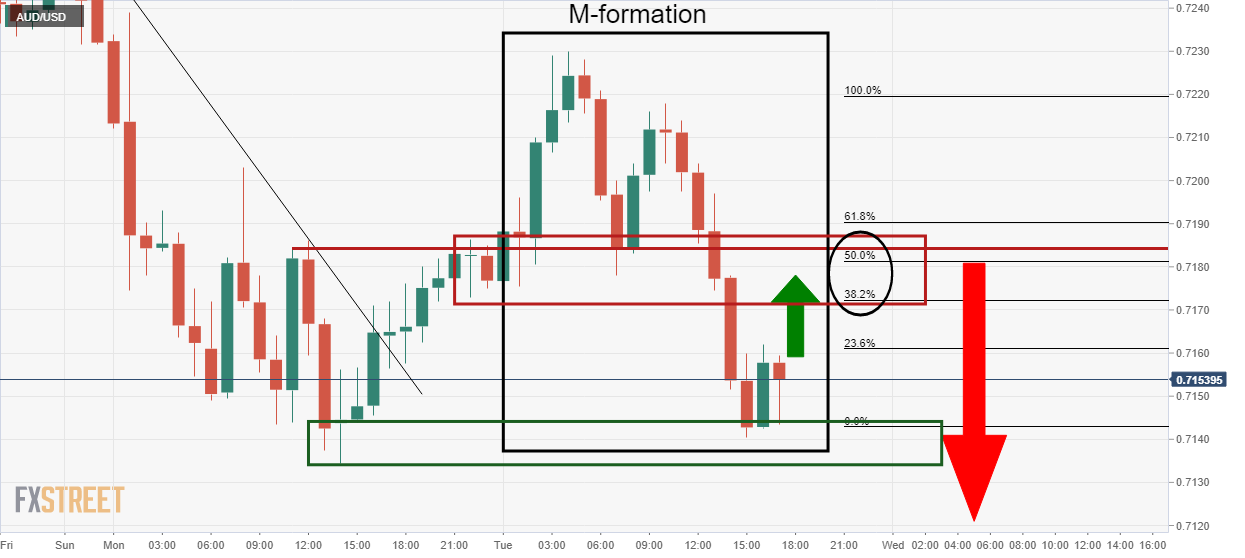

USD/JPY H1 chart

The M-formation is a reversion pattern that has drawn in the price to the neckline of the pattern. This is seeing the price start to decelerate in the correction near a 50% and 61.8% ratio area. Therefore, there has been a significant enough correction to attract in the bears again at a discount that could lead to a downside continuation.

Russian state-owned gas supplier Gazprom is to halt supplies going through Bulgaria into Europe as of Wednesday 27 April, Bloomberg reported on Tuesday, citing the Bulgarian Energy Ministry.

The report comes after Gazprom earlier notified Poland's gas supplier PGNIG that it would be halting gas supplies as of 0800CET on Wednesday.

Bloomberg framed the news as a "major escalation in the fight between Moscow and Europe over crucial energy supplies", noting it comes against the backdrop of a standoff between the two sides over Russian demands for gas payments to be made in roubles.

- AUD/JPY hit fresh monthly lows beneath the 91.00 level on Tuesday, the pair heavily weighed amid risk-off flows.

- An energy price bounce has helped AUD/JPY recover above 91.00, though it still trades 5.0% lower versus last week’s highs.

- Risk appetite will remain the key driver, though Aussie CPI and the BoJ’s policy announcement will be worth watching.

AUD/JPY hit fresh monthly lows beneath the 91.00 level on Tuesday, the pair heavily weighed amid as a steep sell-off engulfed global equity markets with investors fretting about everything from China lockdown risk, economic and military tensions with Russia amid the ongoing Russo-Ukraine war, a worsening global growth outlook and the prospect of aggressive tightening from many of the world’s major central banks in the coming quarters.

A bounce in energy prices in the latter half of US trade amid fears that Russia is on the verge of cutting gas supplies to the EU has helped the commodity-sensitive recovery some poise in recent trade. As a result, AUD/JPY has been able to recover back to the north of the 91.00 level. But the pair is still trading nearly 5.0% lower versus last week’s highs close to the 96.00 mark.

If risk appetite remains ropey and global yields remain on the back foot as a result, the prospect for a continued recovery in the yen, which had up until the last few days suffered a beating in April, may continue. AUD/JPY bears will be looking for a break below support in the form of the late March lows at 90.75, which could open the door to a test of support from 2015 and 2017 in the respective 90.70s and 90.30s areas.

AUD/JPY traders should also keep an eye on scheduled economic events this week, which include key Australian Q1 Consumer Price Inflation figures out on Wednesday ahead of the BoJ’s monetary policy announcement on Thursday. Should the Australian inflation data spur fresh RBA tightening bets, and the BoJ double down on its dovish policy stance of negative interest rates and yield curve control (as expected), that could provide AUD/JPY with some bullish impetus.

- The EUR/GBP hits four-week highs just shy of 0.8460, up 0.62% on Tuesday.

- The British pound remains battered as the GBP/USD breaks below 1.2600.

- EUR/GBP Price Forecast: It is neutral biased, but a daily close above the 200-DMA would further cement the case for a shift in the trend.

The EUR/GBP surged to four-week new highs around 0.8458 on Tuesday, amid a risk-off market sentiment, which sent the British pound tumbling across the board, losing 0.61% vs. the euro, and 1% against the greenback. At the time of writing, the EUR/GBP is trading at 0.8453.

Risk-aversion keeps the GBP as the laggard in the FX space

European and US equities are still on the back foot, trading with losses. The recent China coronavirus outbreak in Shanghai, which extended to Beijing and Mongolia, keeps investors on their toes because, based on China's Covid-19 zero-tolerance, it could trigger another raft of inflation courtesy of supply chain disruptions. Also, escalations in the Ukraine-Russia conflict summed up the dismal market mood.

On Tuesday, the EUR/GBP opened around the 0.8400 figure in the Asian session. However, as European traders took over, the GBP weakened, sending the EUR/GBP rallying from 0.8393 to 0.8456.

EUR/GBP Price Forecast: Technical outlook

The EUR/GBP remains neutral biased. However, it is trading above the 200-day moving average (DMA), which lies at 0.8445, signaling that the bias will shift to neutral-bullish if a daily close above the latter is achieved. A break above 0.8512 would shift the bias to bullish, but solid resistance lies ahead. It is worth noting that the EUR/GBP upside in the last three trading sessions caused a jump in the Relative Strength Index (RSI), but at 64.66, it would provide some upward room for the EUR/GBP if bulls attempt to push prices higher.

With that said, the EUR/GBP's first resistance would be the February 7 daily high at 0.8478. A breach of the latter would expose the 0.8500 figure. Once cleared, the next resistance would be the 1-year-old downslope trendline lying around the 0.8535-50 area.

GBP/USD has dumped on Tuesday in widespread risk-off, breaking below 1.26 the figure in a fresh bear-cycle low for 2022:

GBP/USD daily chart

A number of risk-off factors are being built into the price, from lower growth forecasts for the global economy, China's covid spread and the contagion risks associated with the Ukraine crisis.

The US dollar (DXY) was up for a fourth straight day on Tuesday, hitting its highest level since March 2020, and is now up nearly 7% on the year.

Meanwhile, the Chicago Board of Options Exchange Market Volatility Index, or VIX, a measure of implied volatility based on the prices of a basket of S&P 500 Index options with 30 days to expiration, surged more than 16% to 31.78.

The Dow Jones Industrial Average has slumped 1.69% to 33,392 the low with the S&P 500 down 1.9% to 4,200 and the Nasdaq Composite 2.67% lower at 13,099.

Bond yields eased ahead of next week's meeting of the Federal Reserve's policy meeting where traders are in anticipation that the meeting will end with an interest-rate hike of up to 50 basis points. The yield on the US 10-year note was making a fresh low of 2.726%.

Domestically, the sterling has been pressured of late by a weak economic outlook and less hawkish Bank of England expectations that are concerned about risks of a possible recession.

Data released on Friday showed sliding retail sales and consumer confidence approaching all-time lows.

Additionally, Brexit risks are back at the fore. Prime Minister Boris Johnson said last Friday that the nation does not rule out taking further steps to address problems in Northern Ireland caused by post-Brexit arrangements.

A political crisis as lawmakers triggered an investigation into whether Johnson had misled parliament over Downing Street parties during lockdown is also simmering away in the background.

- Bears are fully in control targeting a break of critical market structure.

- AUD/USD bulls looking for an optimal entry and correction opportunities.

AUD/USD is heavily offered as the US dollar continues to rally in a risk-off setting. However, corrections could be on the cards and the Aussie is testing a critical level of market structure that opens prospects of trading opportunities.

AUD/USD daily chart

The daily chart shows that the price is firmly offered but is now meeting a daily support area that could hold and lead to a significant bullish correction. The 38.2% Fibonacci retracement level is located at 0.7258.

AUD/USD H1 chart

The hourly chart's M-formation is a reversion pattern. The price that has been supported at the prior lows would be expected to continue to correct towards the neckline of the pattern that has a confluence with a 50% mean reversion ratio near 0.7180.

AUD/USD M1 chart

On the 1-minute chart, where scalpers are looking for trading opportunities on a very short term time frame, should the market correct towards the hourly objective, a break of the resistance will open the prospects of a rally in order to mitigate around 20 pips of the imbalance of price between there and the neckline of the M-formation.

At the next FOMC meeting (May 3-4), the Federal Reserve is expected to raise interest rates by 50 basis points. According to analysts at Wells Fargo, the first 50 bps rate hike in over 20 years and the start of balance sheet runoff shows that the Fed means business in its fight against inflation.

Key Quotes:

“The FOMC raised its target range for the fed funds rate by 25 bps at its March 15-16 meeting. However, the minutes of the meeting revealed that some members would have supported a 50 bps rate hike had the conflict in Ukraine, which began only three weeks earlier, not clouded the outlook.”

“We look for the FOMC to announce a 50 bps rate hike at the conclusion of its May 3-4 meeting. A parade of Fed speakers have signaled over the past few weeks that they would be comfortable hiking the funds rate by 50 bps at that meeting.”

“In our view, the risk that the Committee surprises the market with a 75 bps rate hike, although not our base case call, is materially greater than a 25 bps surprise increase. We expect that the FOMC will hike rates by another 50 bps at its June 14-15 meeting before beginning to raise rates at a more gradual 25 bps-per-meeting pace in July.”

“We also look for the FOMC to announce a plan at its May 3-4 meeting to start shrinking its balance sheet by no longer reinvesting the principal payments received from its securities holdings, up to a monthly cap.”

“We look for the Fed to shrink its balance sheet from roughly $9 trillion today to about $6.5 trillion at end-2024.”

“Regardless of the exact magnitude, the May 3-4 FOMC meeting likely will send a clear signal from monetary policymakers. The first 50 bps rate hike in over 20 years and the start of balance sh

- Aside from strength in energy stocks amid higher oil prices, US equity markets were a see of red on Tuesday.

- The S&P 500 fell back to test the 4,200 level and eyed a break towards March lows.

- China lockdowns, Russo-Ukraine war/Russo-Western tensions, growth concerns and expectations for central bank tightening have all been cited as hurting sentiment.

Aside from strength in energy stocks amid a rebound in oil prices, US equity markets were a sea of red on Tuesday, with the major indices led lower most notably by weakness in mega-cap tech stocks ahead of earnings in the coming days.

Apple was last trading down 2.6%, Microsoft 2.7%, Alphabet 2.9%, Facebook 3.0% and Amazon 4.0%, while Tesla shares slid more than 11%. Microsoft and Alphabet will both be reporting Q1 figures after Tuesday’s closing bell, while a third of the companies in the S&P 500 will be reporting their Q1 results just this week.

The S&P 500 index was last trading down over 2.0% and testing the 4,200 level, a break below which would likely see it test March lows in the 4,160 region next. The much more heavily tech/growth stock weighted Nasdaq 100 index was last trading down over 3.0% and eyeing an imminent test of its March lows just above 13,000.

The Dow was holding up a tad better, though still not well, and was last trading down about 1.9% in the 33,400 area, where it still resides about 2.5% above its March lows. The S&P 500 CBOE Volatility Index (VIX), often referred to as Wall Street’s “fear gauge” broke back above 30.00 and to its highest level in more than one month in the mid-31.00s.

Driving the day

Analysts highlighted a combination of bearish factors as weighing on investor sentiment on Tuesday. These include concerns about the impact of Chinese lockdowns and concerns about potential escalation of Russia/West economic tensions and violence in Ukraine/Europe as Russian officials again jawbone about nuclear war risks.

Both of these themes are contributing to concerns about longer-lasting inflationary pressures and stagflationary risks. And these bearish themes come against the backdrop of aggressive (expected) tightening from most of the world’s major central bank (excluding China and Japan). This puts valuations under pressure amid a higher risk-free rate and puts earnings under pressure, assuming higher rates equal weaker long-term growth.

Robust US March Durable Goods, February S&P/Case-Shiller House Price Index and April Conference Board Consumer Confidence survey data released earlier in the day did not have an impact on sentiment. The highlights of the economic calendar this week include the first estimate of US Q1 GDP growth figures on Thursday followed by March Core PCE inflation data on Friday.

- The USD/CAD is surging by some 0.45% on Tuesday.

- A downbeat market mood courtesy of China’s Covid-19 outbreak, Russo-Ukraine tussles, and a firm US dollar, a tailwind for the USD/CAD.

- USD/CAD Price Forecast: Bullish biased and aiming towards 1.2800.

The USD/CAD soars and records a six-week high near 1.2826 amid a risk-aversion environment that spurred appetite for safe-haven assets, boosting the greenback, the JPY, and the CHF. At the time of writing, the USD/CAD retreated from daily highs and is trading at 1.2795, shy of the 1.2800 figure.

Risk-aversion keeps the US dollar buoyant

Global equities remain defensive amidst increased Covid-19 cases in China. The outbreak that started in Shanghai already expanded to some districts of Beijing and Mongolia, threatening to trigger another raft of lockdowns that could spur a jump in inflation due to supply chain disruptions. In the geopolitical environment, Russia-Ukraine talks continue, but most news around the conflict depicts an escalation of the battle.

In the meantime, the US Dollar Index, a measurement of the greenback’s value against a basket of six peers, recorded a new two-year and half high at 102.235, but it is gaining 0.47%, sitting at 102.215. Contrarily, the US 10-year Treasury yield is losing eight and a half basis points, down to 2.740%.

An absent Canadian economic docket left USD/CAD traders adrift of the US busy week. The US docket featured the Durable Good Orders for March, which rose by 0.8% m/m, lower than the 1% estimated but far better than the 1.7% contraction of February.

Late, the CB Consumer Confidence for April at 107.3, lower than the 108 expected. Despite being a worse than expected report, Lynn Franco, Senior director of economic indicators at the Conference Board( CB), said that “the Present Situation Index declined, but remains quite high, suggesting the economy continued to expand in early second quarter.” Furthermore, Franco added that “expectations, while still weak, did not deteriorate further amid high prices, especially at the gas pump, and the war in Ukraine. Vacation intentions cooled but intentions to buy big-ticket items like automobiles and many appliances rose somewhat.”

Ahead in the US docket on Thursday would be the release of the Q1 GDP and March’s Core PCE inflation on Friday.

USD/CAD Price Forecast: Technical outlook

The USD/CAD recorded a six-week high at 1.2826 but retreated. Nevertheless, the USD/CAD bias is tilted to the upside. The Relative Strength Index (RSI) at 64.36 accelerates towards the 70 mark (overbought conditions), but with enough room, so the USD/CAD can print another leg up.

With that said, the USD/CAD first resistance would be 1.2800. A breach of the latter would expose the March 15 daily high at 1.2871, followed by the March 7 swing high at 1.2901 and then 2021 yearly high at 1.2963.

Major Russia state-owned gas supplier Gazprom informed Polish gas company PGNIG on Tuesday that it will halt supplies of gas as of 0800CET on Wednesday, a breach of the Yamal contract, PGNIG said according to Reuters.

PGNIG said it will take steps to reinstate the flow of gas according to the Yamal contract, adding that it is prepared to obtain gas from various other sources, including gas connections on the west and south of the Polish border.

PGNIG said it is in touch with the Gaz-system and companies are monitoring Gazprom's decision to cease gas supplies.

Bloomberg framed the news as a "major escalation in the fight between Moscow and Europe over crucial energy supplies", noting it comes against the backdrop of a standoff between the two sides over Russian demands for gas payments to be made in roubles.

Market Reaction

Once the reports of Russia halting gas flows to Poland as of Wednesday started doing the rounds on Twitter and in the financial press, markets started to move on the story. WTI recently rallied to session highs in the mid-$102.00s, while the S&P 500 is currently trading at session lows and testing 4200. The DXY is also remains firmly on the front foot and at its highest levels since March 2020 in the 102.20 area.

Data released on Tuesday showed an 0.8% increse in Durable Goods Orders in March, below the 1% of market consensus. Despite a disappointing headline print due to a drop in aircraft bookings, the March durable goods report shows that capital spending remained intact in March with orders rising across all core categories, explained analysts at Wells Fargo.

Key Quotes:

“The fact that orders for durable goods increased just 0.8% in March rather than the 1.0% that had been expected by the consensus is partly a function of weakness in aircraft orders. Civilian aircraft orders were down 9.9% and defense aircraft orders tumbled 25.6%. But transportation as a whole was actually positive for the month thanks to a surge in bookings for motor vehicles.”

“The underlying trend in nondefense capital goods shipments remains strong, up 9% at an annualized rate over the past three months. But after adjusting for the run up in prices, we expect to see a more muted outturn for first quarter equipment spending when first quarter GDP is released on Thursday.”

“Despite all the hand-wringing over rising interest rates and high inflation, an overlooked positive for economic growth is the fact that capital spending remains intact. The rebound in this cycle for core capital goods spending has already handily eclipsed the rebounds that followed the early 2000s tech-wreck and the downturn associated with the financial crisis in 2008 & 2009.”

- Kiwi fails to recover versus US dollar, back at monthly lows.

- Consolidation under 0.6600 to keep the pair under pressure.

- US dollar rises across the board as US stocks drop sharply.

The NZD/USD erased all the bounce and is back at the 11-week low area, under 0.6600. Earlier on Tuesday, the pair climbed to 0.6644, hitting a two-day high, but it reversed and turned again to the downside as market sentiment deteriorated.

Risk aversion weighs on NZD/USD

The US dollar is among the top performers on Tuesday boosted by risk aversion. The DXY trades at the highest level since March 2020 above 102.00, even as US yields decline sharply. The Dow Jones is falling by 1.68%, and the Nasdaq plummets 3.22% ahead of important earnings reports.

The rally in Treasuries is not affecting the dollar. The US 10-year stands at 2.74%, and the 30-year at 2.83%, levels not seen since April 14. The greenback remains strong as the move is being driven by deterioration in market sentiment and not by a change in expectations regarding Federal Reserve’s monetary policy.

The NZD/USD will likely remain under pressure while below 0.6600. It recently dropped to 0.6578, hitting the lowest level since early February. It is hovering near the lows. The next support might be located at 0.6560 followed by the 2022 low around 0.6530.

Technical levels

- US dollar accelerates to the upside, DXY hits fresh two-year highs above 102.00.

- Risk aversion weighs on the pound, Nasdaq tumbles 3%.

- GBP/USD at lowest since July 2020, eyes 1.2600.

After a short-lived recovery, the GBP/USD pair resumed its downtrend, breaking under 1.2670. It bottomed at 1.2616, hitting the lowest level since July 2020.

Pound among worst performers

The pound is under pressure amid risk aversion. EUR/GBP trades at 0.8440, at the highest in three weeks, GBP/JPY bottomed at 160.40 (is down almost 300 pips for the day), and AUD/GBP is losing a hundred pips, reversing sharply from the monthly high it reached on Monday at 1.7885.

In Wall Street, the Dow Jones is falling by 1.46% and the Nasdaq tumbles by 3.10%. In Europe, the main stock indices are down 0.75% on average. Investors await earnings reports from Microsoft and Alphabet.

The dollar, measured by the US Dollar Index, trades with a gain of 0.41% at 102.15, the highest level since March 2020. At the same time, US yields are at weekly lows as demand for Treasuries surges on the back of the deterioration in market sentiment. The US 10-year bottomed at 2.72% and the 30-year at 2.83%.

Oversold, but who cares?

The GBP/USD is falling for the fourth consecutive day, accumulating a decline of more than 400 pips. Technical indicators are in oversold territory but no signs of a consolidation or a correction are seen.

The negative momentum in cable remains intact. The next resistance might be seen around 1.2600, followed by 1.2580. On the upside, resistance levels are seen at 1.2665, followed by 1.2700 and 1.2770.

Technical levels

- GBP/JPY’s sharp reversal back from multi-year highs above 168.00 printed at the start of last week extended on Tuesday.

- The pair shed another 1.6%, taking its three-day run of losses to nearly 4.0%.

- Risk-off flows, lower UK yields, receding BoE tightening bets and worrying UK government borrowing data in 2021/22 are all weighing.

GBP/JPY’s sharp reversal back from multi-year highs above 168.00 printed at the start of last week extended on Tuesday, with the pair shedding another 1.6%, taking its three-day run of losses to nearly 4.0%. At current levels just above 160.50, the pair now trades over 4.5% below last week’s multi-year peaks and has nearly erased the entirety of its monthly gains.

The ongoing reversal lower in GBP/JPY is being driven by a combination of bearish factors. The risk-sensitive pair is being weighed by continued selling pressure in global equity markets as investors fret about globally rising interest rates and how this might impact long-term growth. Meanwhile, UK yields have reversed sharply lower in tandem with some of their global peers, reducing the UK’s yield advantage over the yen and weighing on the pair.

Meanwhile, many analysts have for some time been warning that expectations for BoE monetary tightening this year (money markets were last pricing a further six 25 bps hikes) are overly excessive. The BoE has been coming across as more and more concerned about UK economic weakness as a result of the ongoing cost-of-living squeeze, concerns which will only have risen in wake of last week’s week UK Retail Sales figures.

A paring back on BoE tightening bets thus might also be weighing on the pair. If risk appetite remains on the ropes in the coming sessions, GBP/JPY bears will likely be looking for a break under 160 and a test of key support in the upper 158.00s (the 50-Day Moving Average) and at 158.00 (the 2021 highs).

UK borrowing 20% higher than expected in 2021/22

Analysts also highlighted UK government borrowing data released on Tuesday as weighing on the pound, with government borrowing in the just ended 2021/22 fiscal year coming in 20% higher than forecast by the UK Office for Budget Responsibility (OBR) just one month ago.

Analysts said the data highlights the challenges faced by UK Chancellor Rishi Sunak. On the one hand, Sunak is under pressure to ease the impact of the most severe cost-of-living crisis in the UK in multiple decades. However, on the other, Sunak faces pressure to get UK government finances in order following a pandemic-related spending splurge in 2020 and 2021.

It is more than two months since Russia started its large-scale attack on Ukraine. With the May 9 Victory Day approaching, economists at Danske Bank think Russia is likely to step up their offensive against Ukraine.

Russian offensive is likely to expand and become nastier

“We think Russia’s clear underperformance in the conventional warfare increases the risk of them resorting to the use of tactical nuclear weapons or chemical or biological weapons. Such action could prompt a more aggressive response by the West/NATO, which could lead to an escalation.”

“We think the latest developments could constitute a false flag operation by Russia, marking an escalation as Russia may be seeking a pretext to expand its military operations to Moldova in an effort to step up pressure in the southwest of Ukraine.”

“As another recent twist, Germany reversed its earlier decision not to send heavy weapons directly to Ukraine. While further military support to Ukraine and tighter sanctions are needed to halt the Russian offensive, and the latest action by Germany highlights the sense of urgency, we think they also raise the risk of an escalation in the conflict.”

“Russia announced on Tuesday April 26 that it will again hold joint drills with Belarus from April 26 to 29. The previous joint military drills were held in the period of February 10-20. Russia attacked Ukraine on February 24.”

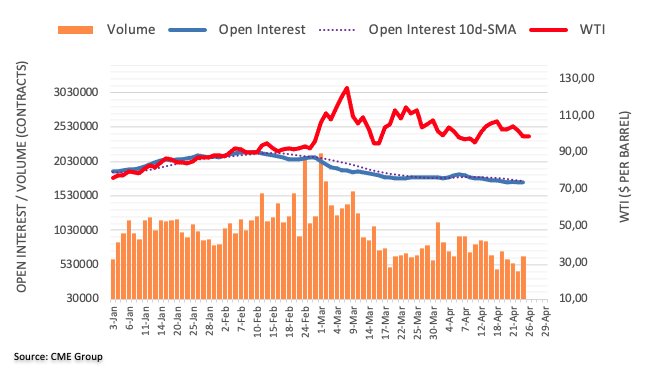

- Oil prices have stabilised on Tuesday with WTI near the $100 level as traders mull geopolitics and China lockdown risks.

- WTI has stayed within $10 of the $100 mark since the start of April.

Oil prices have seen stabilisation on Tuesday following Monday’s choppy trading conditions, as traders mull China lockdown risks against a still very tense geopolitical backdrop as Western arm shipments in Ukraine continue and the EU mulls fresh sanctions. Front-month WTI futures rallied back to, but were unable to hold above, the $100 per barrel mark, and at current levels in the mid-$99.00s, trade with on the day gains of a little over $1.0.

An FT report on Tuesday suggested the EU is mulling imposing a price cap on what it pays Russia for oil imports, after reports over the weekend the EU is looking at various “smart sanctions” that would inflict maximum damage on Russia whilst minimizing the impact on the Eurozone. Either way, risks remain tilted towards greater disruption to Russian supply, not less, with various analysts thinking Russian output will have declined by as much as 3M barrels per day by the start of next month versus pre-war levels.

But WTI prices remain in the red on the week, as the cloud of uncertainty relating to Chinese demand amid a growing risk of more major cities going into lockdown continues to hang over the market. A Bloomberg report at the end of last week estimated that as much as 10% of Chinese demand might already have been lost as a result of the lockdowns in China and Beijing could be next, with all 22M residents now partaking in mass testing that could result in strict lockdowns in some districts.

Looking ahead, geopolitics and Russian energy sanctions, the demand situation in China, plus other themes like OPEC+ output struggles and US/Iran nuclear deal talks will remain key driving forces in the market. Since the start of April, WTI has stayed within at least $10 of the $100 level and that seems likely to remain the case in the coming days, provided the situation in China doesn’t significantly worse. In this scenario, a break lower towards $90.00 would be on the cards.

- EUR/USD extends the recent breach of the 1.0700 level.

- Next on the downside emerges the 2020 low at 1.0635.

EUR/USD drops further and prints new lows for the year around 1.0650 on Tuesday.

The downside momentum in the pair gathers extra steam and now the door looks wide open to a potential visit to the 2020 low at 1.0635 (March 23) in the short-term horizon.

While below the 2-month line around 1.1020, extra losses remain well on the cards for the pair.

EUR/USD daily chart

Having reached a recent peak in the 0.7661 area in early April, the AUD/USD pair dived on Mondayday back to an intraday low around 0.7135. A weaker outlook for China is the main risk that could prevent the aussie to reach the 0.77 level over the next six months, economists at Rabobank report.

RBA signaling a hawkish position to support AUD

“We maintain that AUD/USD can shift higher in the coming months. This view is based on the improvement in Australia’s terms of trade which stems from higher energy prices linked with the Russia/Ukraine conflict. It also assumes the development of a hawkish stance from the RBA and the likelihood that the USD will finish the year lower vs. a broad basket on currencies. A sharp slowdown in growth in China this year linked with Covid outbreaks is a risk to this view.”

“Australian economic strength and a more hawkish RBA can lift AUD/USD to the 0.77 area on a six-month view.”

- AUD/USD struggled to capitalize on its modest intraday gains amid an extension of the USD rally.

- Aggressive Fed rate hike bets, mostly upbeat US macro data lifted the USD to over a two-year high.

- The risk-off mood, weaker iron ore prices further collaborated to cap the resources-linked aussie.

The AUD/USD pair surrendered a major part of its intraday gains and retreated below the 0.7200 mark, closer to the daily low during the early North American session.

The pair attracted some buying on Tuesday, though the intraday positive move ran out of steam near the 0.7230 region amid the uninterrupted US dollar rally to the highest level since March 2020. Expectations that the Fed would hike interest rates by 50 bps at each of its next four meetings in May, June, July and September continued underpinning the buck.

Adding to this, the risk-off mood further benefitted the greenback's relative safe-haven status and acted as a headwind for the perceived riskier aussie. The prospects for a more aggressive policy tightening by the Fed, along with prolonged COVID-19 lockdowns in China, fueled concerns about slowing global economic growth and weighed on investors' sentiment.

On the economic data front, the headline US Durable Goods Orders fell short of market expectations and increased by 0.8% MoM in March. This, however, marked a solid rebound from the previous month's upwardly revised reading of -1.7%. Adding to this, orders excluding transportation items climbed 1.1% against 0.6% expected and continued lending support to the USD.

Apart from this, an extended slump in iron ore prices further collaborate to cap any meaningful upside for the resources-linked Australian dollar. The fundamental backdrop seems tilted firmly in favour of bearish traders and supports prospects for an extension of the AUD/USD pair's recent sharp pullback from the 0.7660 region, or the YTD peak touched earlier this month.

Technical levels to watch

- DXY records new highs just above the 102.00 yardstick on Tuesday.

- Extra gains could see the 2020 high near 103.00 retested.

The upside bias in the dollar remains unabated and pushes DXY to record fresh highs in levels last traded back in March 2020 above the 102.00 barrier on Tuesday.

The ongoing intense upside has just entered the overbought territory – as per the daily RSI above 70 - and this could be the prologue to a potential technical correction in the short-term horizon. The underlying bullish bias, however, remains intact and still targets the 2020 high at 102.99 (March 20).

The current bullish stance in the index remains supported by the 7-month line near 96.70, while the longer-term outlook for the dollar is seen constructive while above the 200-day SMA at 95.55.

DXY daily chart

- Silver has recovered some poise on Tuesday after losing over 6.0% in the past three sessions.

- But the precious metal remains at risk of further losses against the backdrop of a strengthening US dollar.

- After XAG/USD failed to retake its 200DMA in the $23.80s, bears are calling for further downside and eyeing 2022 lows.

Spot silver (XAG/USD) prices have recovered some poise on Tuesday after dropping more than 6.0% between last Thursday and Monday. XAG/USD currently trades flat on the day near the $23.60 per troy ounce mark, though failed in an earlier attempt to push back above the 200-Day Moving Average at $23.85 and test key resistance around $24.00.

Precious metal markets owe their stabilisation on Tuesday to a continued drop in US and global bond yields as investors fret about global growth prospects, but continue to face difficulties in staging a rebound as a result of the strong US dollar. The US Dollar Index (DXY) rose momentarily above the 102.00 level for the first time since March 2020 in earlier trade, primarily as a result of weakness in the euro and pound.

Traders are citing a combination of still very ropey broader market risk appetite conditions (which tend to benefit the safe-haven buck) and expectations that the Fed will outpace many of its major G10 central bank peers (like the ECB and BoE) in terms of monetary tightening as supporting the buck on Tuesday and in recent sessions.

While weakness in risk appetite would traditionally be seen as a positive for the likes of silver and other precious metals, a stronger US dollar makes USD-denominated precious metals more expensive for foreign buyers, thus reducing demand. If the buck is strong as a result of Fed tightening expectations, that’s a double whammy, as higher interest rates raise the “opportunity cost” of holding non-yielding assets like silver, further reducing demand.

Technicians might interpret XAG/USD’s failure to retake its 200DMA as a bearish sign moving forward. US Q1 GDP and March Core PCE data out later this week is likely to underline expectations that Fed tightening is on autopilot for the rest of the year, and could further undermine silver as the week drags on. Longer-term bears will be eyeing an eventual pullback all the way lower to support in the form of the 2022 lows in the $22.00 area.

In the opinion of economists at Scotiabank, the EUR/GBP could extend its advance towards 0.86 if the Bank of England (BoE) pushes back against rate expectations at next week’s decision.

EUR/GBP to test 0.85 in the coming days

“We see the EUR extending its gains versus the GBP to a test of 0.85 in the coming days and a move towards 0.86 (at least) if the BoE pushes back against rate expectations at next week’s rate announcement.”

“The run of Eurozone CPI releases that starts on Thursday with data from Germany and Spain would, all else equal, likely add fuel to the fire of ECB hike bets. However, there is a risk of a big miss versus forecasts that could check ECB expectations (and thus weigh on the EUR) owing to lower energy and gasoline prices in Spain and a tax cut on German fuel.”

EUR/SEK is now trading around pre-Ukraine-war levels. In the opinion of economists at ING, the Riksbank should continue to be a broadly supportive factor for the krona in the coming months as a radical shift in its rhetoric.

More support to the krona, but watch for external risks

“This week’s policy decision can continue to offer support to the krona. Naturally, a rate hike this Thursday would likely see SEK rally, but we also think that a hawkish shift in the rate projections and some endorsement of the market’s tightening expectations can be enough to put some mild pressure on EUR/SEK. We think only a clear pushback against market pricing would have a material negative impact on SEK.”

“The Riksbank should continue to be a broadly supportive factor for SEK in the coming months. However, the external environment should continue to prove quite challenging for the krona, which may suffer from its high beta to both global risk sentiment and eurozone’s economic outlook.”

“EUR/SEK risks are by and large balanced for Q2, and we expect it to hover around the 10.40 mark into the summer months. Later in the year, some stabilisation in sentiment and the Riksbank’s advantage over the ECB in the tightening cycle can push EUR/SEK to the 10.20-10.00 area.”

- After dropping under 1.0700 during APac trade, EUR/USD continues to press lower towards its 2020 lows in the 1.0630s.

- The pair continues to suffer as a result of expectations for Fed/ECB policy divergence, as well as Russo-Ukraine war risks.

After dipping back under the 1.0700 level during Asia Pacific trading hours, EUR/USD has continued to trade with a negative bias throughout European trading hours and continues to make bearish headway towards its 2020 lows in the 1.0630s. At current levels around 1.0670, the pair is trading with on the day losses of about 0.4%, with the euro failing to take advantage of the hawkish comments from ECB policymaker Martin Kazaks.

Kazaks reiterated his preference for the bank to begin rate hikes in July and called expectations for two or three hikes this year “quite reasonable”. As analysts have noted, the recent hawkish shift in policy guidance from the ECB towards rate hikes in Q3 has failed to lift the euro against the US dollar because the recent hawkish shift from the Fed has been larger.

The Fed is now expected to lift interest rates in 50 bps intervals at its next few meetings and is likely to take interest rates back to neutral (around 2.5%) by the end of the year, with the risk of much higher rates to follow in 2023 dependant on inflation outcomes. This divergence, as well as higher stagflation risks in the Eurozone versus US as a result of the Russo-Ukraine war, explains why EUR/USD has had such a tough time holding onto rallies in recent weeks.

If the pair does break below its 2020 lows in the coming days, as is very possible, the door would be open to a drop to the next key area of support in the form of the 2017 lows at 1.0340, which would mark a further more than 3.0% decline from current levels.

Signs point to the Bank of England (BoE) disappointing market expectations for the rest of the year. Another leg lower in yield differentials could dive the GBP/USD pair to a test of 1.25, economists at Scotiabank report.

BoE repricing is a risk

“The spread of 2-yr Gilts vs USTs has oscillated around -1% for the past four weeks or so but looks set to mark a new pandemic low in the coming weeks that would drive additional GBP weakness.”

“Another leg lower in yield differentials amid a cautious BoE vs a hawkish Fed (as well as some near-term political anxiety ahead of the May 5 local elections) could fuel GBP losses to a test of 1.25.”

EUR/USD is nearing a test of the March 2020 low near 1.0635. Further losses are likely, economists at BBH report.

ECB tightening expectations have eased a bit

“The swaps market is now pricing in 125 bp of tightening over the next 12 months vs. 150 bp at the start of this week, with another 75 bp of tightening priced in over the following 12 months that would see the deposit rate peak near 1.5%. This still seems way too aggressive to us.”

“We look for a test of the March 2020 low near 1.0635. After that is the February 2017 low near 1.05 and then the January 2017 low near 1.0340.”

- USD/CAD attracted aggressive dip-buying on Tuesday and rallied to a fresh multi-week high.

- Aggressive Fed rate hikes continued boosting the USD and remained supportive of the move.

- An intraday bounce in crude oil prices failed to underpin the loonie or hinder the momentum.

The USD/CAD pair rallied over 100 pips from the daily swing low and shot to the 1.2800 neighbourhood, or a fresh six-week high during the early North American session.

Rising bets for a more aggressive policy tightening by the Fed, along with the prevalent risk-off mood, pushed the safe-haven US dollar to its highest level since March 2020. This, in turn, was seen as a key factor that acted as a tailwind for the USD/CAD pair. Bulls seemed rather unaffected by an intraday pickup in crude oil prices, which tend to underpin the commodity-linked loonie.

From a technical perspective, last week's sustained breakthrough the 50% Fibonacci retracement level of the 1.2901-1.2403 downfall was seen as a fresh trigger for bullish traders. The emergence of aggressive dip-buying on Tuesday and acceptance above the 61.8% Fibo. level adds credence to the constructive outlook. This, in turn, supports prospects for a further appreciating move.

Hence, some follow-through strength towards the next relevant hurdle, around the 1.2825-1.2830 region, remains a distinct possibility. The positive momentum could further get extended and allow the USD/CAD pair to aim back to conquer the 1.2900 round-figure mark, or the YTD peak touched in March.

On the flip side, the 1.2740 region now seems to protect the immediate downside ahead of the 1.2700 mark, or the 61.8% Fibo. level. Any further decline might continue to tempt bullish traders near the 1.2685-1.2675 region. This, in turn, should help limit the downside near the 50% Fibo. level, around mid-1.2600s, which should now act as strong base for the USD/CAD pair.

USD/CAD daily chart

-637865762719668164.png)

Key levels to watch

- EUR/JPY adds to Monday’s weakness and breaks below 136.00.

- Next on the downside comes the April lows around 134.30.

EUR/JPY keeps correcting lower and breaches the 136.00 support to clinch new multi-day lows on Tuesday.

Further weakness remains well in place in the very near term. Against that, the corrective move in the cross could extend further and revisit the monthly lows around 134.30.

In the meantime, while above the 200-day SMA at 130.59, the outlook for the cross is expected to remain constructive.

EUR/JPY daily chart

According to the latest headline S&P/Case-Shiller Home Price Index released by Standard & Poors (S&P), home prices were up 20.2% YoY in February, above expectations for a 19% gain and up from January's YoY gain of 19.2%. The headline index showed that house prices gained 2.4% MoM in February, above the expected gain of 1.5% and above January's 1.7% gain.

According to the House Price Index released by the Federal Housing Finance Agency at the same time, house prices were up 19.4% YoY in February and 2.1% MoM.

Market Reaction

There was no reaction to the latest Durable Goods Orders figures, with the DXY still trading just under the 102.00 and, thus, still at multi-month highs.

- GBP/USD witnessed heavy selling for the fourth straight day and dived to a fresh YTD low.

- Aggressive Fed rate hikes, the risk-off mood underpinned the USD and exerted pressure.

- Mostly upbeat US Durable Goods Orders remained supportive of the strong USD bid tone.

The GBP/USD pair continued losing ground through the early North American session and dived to its lowest level since September 2020, around the 1.2675 region in the last hour.

The US dollar surged to a more than two-year peak and continued drawing support from growing acceptance that the Fed would tighten its monetary policy at a faster pace to curb soaring inflation. In fact, the markets now expect the US central bank to raise interest rates by 50 bps at each of its next four meetings in May, June, July and September.

This, along with the prevalent risk-off environment, drove haven flows towards the greenback. The prospects for rapid interest rate hikes in the US, along with prolonged COVID-19 lockdowns in China, fueled concerns about the global economic slowdown. This, in turn, took its toll on the risk sentiment and benefitted traditional safe-haven assets.

On the economic data front, the headline US Durable Goods Orders fell short of market expectations and increased by 0.8% MoM in March. This, however, marked a solid rebound from the previous month's upwardly revised reading of -1.7%. Adding to this, orders excluding transportation items climbed 1.1% against 0.6% expected and underpinned the buck.

Conversely, the British pound was weighed down by the recent disappointing domestic data, which indicated that the UK economy is under stress from the soaring cost of living. This might have forced investors to scale back their bets on future interest rate hikes by the Bank of England and supports prospects for a further depreciating move for the GBP/USD pair.

With the latest leg down, spot prices have retreated over 400 pips from the vicinity of the 1.3100 round-figure mark touched last week. That said, slightly oversold conditions on short-term charts might hold back bearish traders from placing aggressive bets and help limit any further losses for the GBP/USD pair, at least for the time being.

Technical levels to watch

- US Durable Goods Orders rose 0.8% MoM in March, a tad under the expected 1.0% gain.

- FX markets did not reaction, with the DXY remaining close to mutli-month highs near 102.00.

US Durable Goods Orders rose 0.8% MoM in March, data released by the US Census Bureau on Tuesday showed. That was a tad under median expectations for a 1.0% MoM gain but nonetheless marked an improvement versus February's 1.7% MoM decline, which had been revised slightly higher from a 2.1% decline.

Core Durable Goods Orders saw a larger than expected MoM gain of 1.1% versus median forecasts for a 0.6% reading, a decent improvement after February's 0.5% decline, which had been revised a little higher from a 0.6% decline.

Market Reaction

There was no reaction to the latest Durable Goods Orders figures, with the DXY still trading just under the 102.00 and, thus, still at multi-month highs.

- USD/JPY edged lower for the second straight day and dropped to a one-week low on Tuesday.

- The risk-off mood benefitted the safe-haven JPY and exerted pressure amid sliding US bond yields.

- The technical setup favours bearish traders, though the Fed-BoJ policy divergence should limit losses.

The USD/JPY pair witnessed some selling for the second successive day and dropped to a one-week low during the early part of trading on Tuesday. The pair remained depressed through the mid-European session and was last seen trading just above the mid-127.00s.

The prevalent risk-off mood benefitted the safe-haven Japanese yen and exerted downward pressure on the USD/JPY pair. Bearish traders further took cues from retreating US Treasury bond yields, though sustained US dollar buying should help limit any further losses.

From a technical perspective, the USD/JPY pair was flirting with the 23.6% Fibonacci retracement level of the 121.28-129.41 parabolic rise. The said support coincides with the 200-hour SMA, which, in turn, should now act as a pivotal point for short-term traders.

Given the overnight break through an ascending trend-line extending from the monthly low, the bias seems tilted in favour of bears. Hence, some follow-through selling would set the stage for an extension of the corrective pullback from the 129.40 area, or a fresh 20-year high.

The USD/JPY pair might then accelerate the fall and turn vulnerable to weaken further below the 127.00 round-figure mark. The downward trajectory could then get extended and drag spot prices to the next relevant support near the 126.35 area, or the 38.2% Fibo. level.

On the flip side, the 128.00 mark now seems to act as an immediate resistance ahead of the ascending trend-line support breakpoint, around the 128.20 zone. Sustained strength beyond will suggest that the corrective slide has run its course and pave the way for additional gains.

That said, any meaningful upside is likely to remain capped near the 129.00 mark ahead of the Bank of Japan policy decision on Thursday. Nevertheless, the BoJ-Fed policy divergence should continue to act as a tailwind, suggesting that the downtick could be seen as a buying opportunity.

USD/JPY 1-hour chart

-637865726090487142.png)

Key levels to watch

Russian Foreign Minister Sergey Lavrov said on Tuesday that it is too early to talk about mediation in talks with Ukraine, though Russia remains committed to a diplomatic solution, reported Reuters.

His comments come after Russian President Vladimir Putin last week accused Ukraine of not being ready to seek mutually acceptable solutions.

An FT report this morning suggested that the EU is mulling a cap on the price paid for Russian oil as a way to hit Kremlin revenues in its next sanctions package.

Russia would like to avoid a scenario where it would need to intervene in the situation in Moldova's breakaway region of Transnistria, Russia's state-run new agency RIA reported on Tuesday, as cited by Reuters.

The US earlier said it is watching events in the sovereign nation of Moldova closely, adding that it is too soon to comment on recent explosions in the government buildings of the self-declared breakaway region of Transnistria.

Russia is being accused by Ukraine of staging false flag operations in Transnistria, a region occupied by Russian troops, that could justify opening a new front to the Russo-Ukraine war. Moldova's region of Transnistria borders Ukraine to the southwest (near Odesa).

US durable goods orders overview

Tuesday's US economic docket highlights the release of Durable Goods Orders data for March. The US Census Bureau will publish the monthly report at 12:30 GMT and is expected to show that headline orders rose 1% during the reported month as compared to the 2.1% fall reported in February. Orders excluding transportation items, which tend to have a broader impact, are anticipated to have increased by 0.6% in March and reversed the previous month's decline.

How could it affect EUR/USD?

A surprisingly stronger than expected readings would lift expectations from Thursday's release of the Advance Q1 GDP report and reinforce bets for a more aggressive policy tightening by the Fed. This would result in higher US Treasury bond yields, which should allow the US dollar to prolong its recent bullish trajectory to the highest level since March 2020.

Conversely, any disappointment is more likely to be overshadowed by concerns about the economic fallout from prolonged COVID-19 lockdowns in China. This, along with the prevalent risk-off mood, should act as a tailwind for the safe-haven buck, suggesting that the path of least resistance for the EUR/USD pair is to the downside.

Meanwhile, Eren Sengezer, Editor at FXStreet, provided a brief technical outlook for the EUR/USD pair: “The latest candle on the four-hour chart closed below 1.0700. The Relative Strength Index (RSI) indicator on the same chart stays near 40 and the descending line coming from April 21 stays intact, highlighting EUR/USD's bearish bias in the near term.”

Eren also offered important technical levels to trade the major: “It's worth noting that EUR/USD will touch its weakest level since April 2017 with a drop below 1.0635. Sellers might see such a move as a profit-taking opportunity and trigger a correction in the pair. In that case, 1.0700 (psychological level) aligns as the next recovery target before 1.0730 (static level) and 1.0760 (static level).”

“On the downside, a daily close below 1.0640 is likely to open the door for additional losses toward 1.0600 (psychological level) and 1.0570 (static level from March 2017),” Eren added further.

Key Notes

• EUR/USD Forecast: Bears eye 1.0640 as next target

• EUR/USD: Unlikely to break out broad downtrend until Eurozone’s macro backdrop improves – HSBC

• EUR/USD: Downside risks dominate – Commerzbank

About US durable goods orders

The Durable Goods Orders, released by the US Census Bureau, measures the cost of orders received by manufacturers for durable goods, which means goods planned to last for three years or more, such as motor vehicles and appliances. As those durable products often involve large investments they are sensitive to the US economic situation. The final figure shows the state of US production activity. Generally speaking, a high reading is bullish for the USD.

Pentagon Spokesperson John Kirby said on Tuesday that Russia is already a weaker military and is a weaker state (since its invasion of Ukraine) and that the US wants Russia to be unable to threaten its neighbors again in the future.

The US is watching events in the sovereign nation of Moldova closely, Kirby noted, adding that it is too soon to comment on recent explosions in the government buildings of the self-declared breakaway region of Transnistria. Russia is being accused by Ukraine of staging false flag operations in Transnistria, a region occupied by Russian troops, that could justify opening a new front to the Russo-Ukraine war. Moldova's region of Transnistria borders Ukraine to the southwest (near Odesa).

Chinese President Xi Jinping commented on Monday that China will step up infrastructure construction, including of oil and gas pipelines, and that China will speed up the construction of its green and low carbon energy base, reported Reuters citing Chinese state media. China will build a batch of regional and general aviation and cargo airports, Xi added, and to meet financing needs from infrastructure construction, China will step up fiscal spending.

Xi's comments come after he pledged to step up fiscal support to border and less developed areas one week ago.

UOB Group’s Economist Barnabas Gan reviews the latest inflation figures in Singapore.

Key Takeaways

“Singapore’s consumer prices rose at its fastest rate in a decade at 5.4% y/y (+1.2% m/m nsa) in Mar 2022. This is significantly faster compared to market expectations for a 4.7% y/y (+0.8% m/m nsa) print. Core inflation also accelerated to 2.9% y/y in the same month (Feb: +2.2% y/y).”

“Headline inflation has climbed for seven straight months, while core inflation stayed above the 2.0% handle for the fourth straight reading. In line with the recent MAS policy statement, authorities have upgraded their headline and core inflation forecast to 4.5 – 5.5% (from 2.5 – 3.5%) and 2.5% - 3.5% (from 2.0 – 3.0%) in 2022, respectively.”

“As discussed in our latest MAS policy and GDP report, we keep our headline inflation forecast to average 4.5%. Moreover, we expect core inflation to breach 3.0% for the rest of this year, and average 3.5% for the year.”

Una nueva jornada negativa en los activos asociados al riesgo ve al EUR/USD retroceder por debajo del soporte de 1.0700 y registrar nuevos mínimos para lo que va del año en la zona de 1.0670 hoy martes.

Como siempre, el rally en el billete verde permanece sin cambios y siempre fortalecido por la persistente y renovada aversión al riesgo, que ha empujado al Indice Dólar (DXY) a nuevos topes de ciclo en la vecindad de 102.00, valores observados por última vez en marzo de 2020.

La actual preferencia de los participantes del mercado por activos considerados más seguros obedece a la (creciente) especulación acerca de la posibilidad de una desaceleración en la economía china debido a la reimposición de medidas de restricción a la actividad social y económica como respuesta al abrupto resurgimiento de casos de COVID.

Colaborando con la perspectiva anterior, comienza a notarse cierta preocupación entre los inversores acerca de la posibilidad que la economía americana pueda entrar en recesión como respuesta a una normalización más “agresiva” por parte de la Reserva Federal para lo que resta del año.

Nada para destacar en lo que hace al calendario doméstico, mientras que del otro lado del océano verán la luz los pedidos de bienes duraderos, resultados del sector de viviendas y la siempre crítica confianza del consumidor medida por el Conference Board.

Enfoque técnico de corto plazo

El descenso en EUR/USD ha generado más tracción y ha registrado un nuevo mínimo del año en 1.0672 el 26 de abril. De continuar con esa tendencia, el par podría visitar el mínimo de 2020 en 1.0635 del 23 de marzo más temprano que tarde.

Ocasionales rebotes deberían encontrar resistencia inicial en el tope semanal en 1.0936 (abril 21) para luego intentar probar la barrera psicológica de 1.1000. Una vez superada, aparecería la valla transitoria en la media móvil de 55-días en 1.1038, que precede al máximo semanal del 31 de marzo en 1.1184. En el camino ascendente, el par debería superar la línea de resistencia de 8-meses en la zona de 1.1160 para aliviar la presión vendedora y habilitar una probable prueba de los máximos semanales en 1.1390 (febrero 21) y 1.1395 (febrero 16).

En el más largo plazo, la perspectiva del par se mantiene negativa siempre que navegue por debajo de la crítica media móvil de 200-días, hoy en 1.1399.

- USD/CHF witnessed subdued/range-bound price moves through the first half of the European session.

- The risk-off mood drove some haven flows towards the CHF and kept a lid on any meaningful gains.