- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 26-04-2011

Stocks are off of their session highs, but the overall tone of trade is still strong. Despite the upbeat mood of broad market participants, shares of Netflix (NFLX 229.09, -22.58) have taken a deep dive. The stock's 9% loss comes on high share volume, too. In fact, the near 12 million shares of NFLX that have already traded hands today is double the average daily volume. The pace has shares of NFLX headed for one of their highest daily volume totals of the year, even though participation in the broad market remains unimpressive.

Spot gold holds at $1501.25/oz, after trading in a $1493.85 to $1507.86 range. The precious metal posted a new life high of $1518.10 Monday. Spot silver holds at $45.03/oz, in the middle of a $44.70/$47.11 range. Silver posted a 31-year high of $49.31 Monday.

The dollar dropped for a sixth day against the euro, matching the longest losing streak since May 2009, on speculation the Federal Reserve will consider measures to keep yields low to support the U.S. economy.

The greenback fell to almost the lowest level since August 2008 against the currencies of major U.S. trading partners as a report showed home prices dropped by the most in more than a year. The central bank begins a two-day policy meeting that will be followed by Fed Chairman Ben S. Bernanke’s first post policy decision press conference.

The U.S. central bank will leave its target rate for overnight lending between banks at zero to 0.25 percent at its two-day meeting. The Fed may say it plans to complete the purchase of $600 billion of Treasuries by June.

The S&P/Case-Shiller index of home prices in 20 U.S. cities fell 3.3 percent in February from a year earlier in the biggest decrease since November 2009.

“The bias is still very much to sell the dollar, and any pullbacks in euro and the commodity currencies are still very shallow,” said Vassili Serebriakov, a currency strategist at Wells Fargo & Co. in New York. “The market is expecting the Fed statement to reaffirm the weak-dollar trend.”

The euro rose earlier against the yen and dollar as European Central Bank President Jean-Claude Trichet indicated policy makers stand ready to raise interest rates to counter inflation expectations.

“We have risks of second-round effects here and there,” Trichet said in the transcript of an interview with the Finnish publications Helsingin Sanomat and Kauppalehti that was released on the ECB’s website. Second-round effects refer to an increase in consumer prices prompting bigger wage increases that then feed through to faster inflation.

The broad market continues to add steadily to its gain. It is now up nearly 1%. More impressive, though, is the near 3% gain that is presently sported by the Amex Airline Index. Airline shares have been bolstered by better-than-expected results from Delta Air Lines (DAL 9.79, +0.79) and US Airways (LCC 8.74, +0.46).

The Dow Jones Transportation Index is also up more than 2%. UPS (UPS 74.45, +0.81) has been a boon to the space following its latest quarterly report and increased earnings forecast.

- Greece, Ireland and Portugal all separate situations.

The major equity averages continue to gradually add to their gains. The effort has been broad based in that all 10 of the sectors that make up the S&P 500 are at or near their session highs.

Industrials are still today's frontrunners. The sector has sprinted ahead to a 1.9% gain. Consumer discretionary stocks are trailing as they trade with a 0.3% gain. Financials are also lagging; they are up just 0.4%.

Skids lower to C$0.9515/10 in recent dealings, a US investment name a conspicuous seller of the pair in recent dealings, traders say. Area of C$0.9500 suspected of holding bids with talk of stops sub C$0.9480.

"Consumer confidence improved modestly, but this level marks the second highest reading (Feb'11 was the highest) since the recession ended in Jun 2009. Improvement was across components - the present situation and expectations components both increased." They say rising expectations may mean more consumer spending.

Stocks have added to their morning gains. The effort has been supported by a stronger-than-expected Consumer Confidence Index.

The Conference Board just posted its Consumer Confidence Index for April. The Index came in at 65.4, which is not only greater than the 64.4 that had been widely expected, but it is also greater than the upwardly revised 63.8 that was posted for the prior month.

Advancing Sectors: Industrials (+1.4%), Telecom (+0.9%), Health Care (+0.7%), Utilities (+0.5%), Materials (+0.4%), Energy (+0.2%), Tech (+0.2%), Consumer Discretionary (+0.2%), Financials (+0.1%), Consumer Staples (+0.1%)

EUR/USD $1.4360, $1.4400, $1.4500, $1.4600

USD/JPY Y81.25, Y82.35, Y82.75, Y83.10

GBP/USD $1.6500

EUR/GBP stg0.8795

AUD/USD $1.0600

AUD/JPY Y86.00

U.S. stocks were headed for slight gains at Tuesday's open, as investors poured through another round of earnings reports and the latest data on home prices.

Corporate news: Early Tuesday, Ford Motor (F, Fortune 500) reported its strongest first quarter in 13 years, posting earnings of 61 cents per share on $33.1 billion in revenue. Ford shares rose more than 4% in premarket trading.

3M (MMM, Fortune 500) shares rose 1% and Delta (DAL, Fortune 500)'s stock advanced 2%. Both companies beat estimates on earnings and revenue.

It wasn't all good news. Lexmark International (LVK) shares fell 7.3% and Coca-Cola (KO, Fortune 500) shares lost 2%. Both companies reported disappointing earnings.

Netflix (NFLX) shares tumbled more than 5%, a day after the company reported solid earnings but issued an outlook that fell short of forecasts.

Amazon.com (AMZN, Fortune 500) is on tap to announce quarterly earnings after the closing bell Tuesday.

Economy: After the start of trading, the Conference Board releases its Consumer Confidence index for April. Economists forecast the index to have edged up to 64.4 from 63.4 in March, showing consumers are slightly more optimistic about the economy.

Meanwhile, this week also brings Wednesday's Federal Reserve press conference and Thursday's report on U.S. economic growth.

EUR/USD printed hourly high on $1.4640 and currently holds around $1.4633. Expect offers in place to $1.4660 with stops above, bids back ahead of $1.4600.

AUD/USD challenges the $1.0750 option barrier. Rate currently trades around $1.0752, off intraday highs of $1.0767.Traders also note that the $1.0800 level holds the next barrier interest, with protective selling sitting ahead.

3M Co (MMM) reported higher than expected first quarter earnings by $0.05 at $1.49 earnings per share vs $1.44 expected.

Ford Motor Co (F) exceeded expectations by $0.12 at $0.62 EPS vs $050.

Among the first quarter earnings announcements expected today with general market estimates include:

Amazon.Com Inc. (AMZN) $0.61 est vs $0.66 year ago

Sunoco Logistics Partners LP (SXL) $1.31 est vs $1.06 year ago

Wesbanco, Inc. (WSBC) $0.34 est vs $0.30 year ago

Data released:

10:00 UK CBI industrial order books balance (April) -11% +3% +5%

10:00 UK CBI industrial output balance (April) 22% - 27%

The dollar fell against the yen and dropped against the franc on speculation the Federal Reserve will discuss measures to keep yields low to support the economy.

Fed policy makers, who begin a two-day meeting today, may consider measures to support the economy as the end of its $600 billion asset-purchase program approaches in June.

“The Federal Reserve is likely to remain cautious and stress that loose monetary policy will be in place in the foreseeable future,” said Lee Hardman, a currency strategist at Bank of Tokyo-Mitsubishi UFJ Ltd.

“We expect the Fed will leave its policy rate on hold,” said Mike Jones, a currency strategist at Bank of New Zealand Ltd. “Should Chairman Ben S. Bernanke indicate the Fed is in no hurry to start reversing policy accommodation, further dollar weakness may be on the cards.”

The U.S. central bank will leave its target rate for overnight lending between banks at zero to 0.25 percent at its two-day meeting starting today, according to another survey. The Fed may say it plans to complete the purchase of $600 billion of Treasuries by June.

EUR/USD rose to a new 2011 highs on $1.4652 before Trichet's comments dragged the rate down to $1.4600/05.

GBP/USD gained to session highs on $1.6533 before retreated to $1.6468.

USD/JPY holds within the narrow range between Y81.55/80.

The S&P/Case-Shiller index of home prices in 20 U.S. cities for the 12 months through February fell 3.3%, the biggest decline since November 2009, according to a survey of economists.

US consumer confidence at 1400GMT the highlights though seen overshadowed by Wednesday's FOMC.

JPM comments on the Weds FOMC statement, saying it will "indicate that QE2 is coming to an end as planned" and could contain "language similar to that used when QE1 was coming to a close."

EUR/USD holds back around $1.4618 after earlier triggering barrier at $1.4650 and taken out on the earlier rally to $1.4653 (new 2011 high). Support now seen to $1.4600, a break to allow for a deeper move toward $1.4580. Resistance now seen from $1.4650 through to $1.4660 with stops above.

The euro slipped on Tuesday after European Central Bank Governor Jean-Claude Trichet said he shares the view that a strong dollar is in the interest of United States, a comment taken by some market players as showing frustration over the dollar's relentless fall and also an attempt to talk up the currency.

Trichet also told two Finnish newspapers he does not see any significant second-round inflation, prompting traders to dump euro long positions against the dollar, although many traders think the dollar will remain under pressure from a perception that the U.S. central bank is far more reluctant to tighten its policy any time soon.

"I don't take it lightly that Trichet is talking about the dollar rather than the euro. European policymakers became alarmed when the euro rose above $1.45 in 2007 and they started to rein in the dollar's fall," said Minori Uchida, a senior analyst at the Bank of Tokyo-Mitsubishi UFJ, adding that the world's policy-makers are increasingly worried about the dollar's fall.

"In the Group of Seven (G7) statement right after the dollar index hit a record low in March 2008, the G7 said it was concerned about currency moves. The U.S doesn't necessarily want to cheapen the dollar against the euro and the yen. Its target is China. So I wouldn't be surprised if there were international moves (to stem the dollar's fall)," he added.

The dollar rose 0.3% against a basket of major currencies to 74.190, pulling away from a three-year low of 73.735 hit last week.

Despite the dollar's gain on Tuesday, many market players think the U.S. currency will remain fragile given the perception that the Federal Reserve will be in no rush to unwind its easy monetary policy.

The Fed is expected to say it will stick to its plan to complete a $600 billion bond-buying programme in June at its two-day policy meeting starting on Tuesday, with the focus on the post-meeting news conference by Fed Chairman Ben Bernanke on Wednesday - the first regularly scheduled news briefing by a Fed chief in the U.S. central bank's 97-year history.

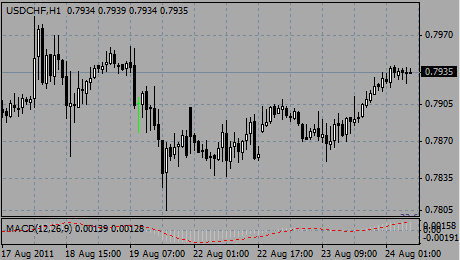

USD/CHF remains under pressure after refreshing record lows at Chf0.8740. Currently rate holds around Chf0.8772. Support area comes between Chf0.8640/60.

GBP/USD is down 10 pips lower at $1.6480 following release of much weaker than expected UK CBI survey. Gilts are little changed with 10-year Gilt holding above

the 3.50% yield level.

EUR/USD printed session highs on $1.4653, posting fresh 2011 highs after triggering barrier interest at $1.4650. Rate retains a firm tone, currently trading around $1.4626. Further stops seemn palced through to $1.4660.

EUR/GBP challenged reported resistance area between stg0.8875/80, touching a high of stg0.8877 before it retreated to current stg0.8865. Above stg0.8880 cross can edge on toward stg0.8900 ahead of stronger resistance seen up at stg0.8920/25.

USD/JPY Y81.25, Y82.35, Y82.75, Y83.10

GBP/USD $1.6500

EUR/GBP stg0.8795

AUD/USD $1.0600

AUD/JPY Y86.00

UK CBI monthly trends at 1000GMT ahead of US Redbook retail sales at 1255GMT and US consumer confidence at 1400GMT the highlights though seen overshadowed by Wednesday's FOMC.

The dollar won a reprieve on Monday after last week's steep slide but traders said it could head for a test of its all-time low against a basket of currencies if the U.S. Federal Reserve takes a cautious stance towards tightening later in the week.

In thin trade due to Easter holidays in Australia and much of Europe, Japanese importer bids for dollars were enough to boost the U.S. currency against the yen and help it to erase earlier losses against other currencies.

With dollar interest rates seen taking a pivotal role in the market, players are looking to a news conference by Chairman Ben Bernanke on Wednesday after the central bank's two-day policy meeting.

The dollar index rose slightly to 74.07, but many trader says it could test a three-year low of 73.735 hit last week. A break of that could open the way for a test of the record low of 70.698 hit in 2008.

The dollar has been falling due to perceptions that the United States is set to maintain an easy monetary policy even as most other major global economies look to tighter monetary policy to rein in inflation.

The Fed is widely expected to stick to completing its $600 billion asset purchase programme in June but many market players think a backdrop of softer-than-expected economic data, weak housing markets and possible government austerity measures to tackle the budget deficit all make it more likely the Fed will keep its support for the recovery in place for some time.

Many analysts believe the U.S. central bank will hold the size of its balance sheet steady by reinvesting maturing assets after June to avoid a passive tightening -- an issue that will likely be discussed at the April 26-27 meeting.

UK CBI monthly trends at 1000GMT ahead of US Redbook retail sales at 1255GMT and US consumer confidence at 1400GMT the highlights though seen overshadowed by Wednesday's FOMC.

Comments: cable remains under pressure and trades under $1.6500 mark. The nearest support $1.6435/30. ahead of $1.6380. The nearest resistance - around $1.6500. Above growth is possible to $1.6550.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.