- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 26-02-2023

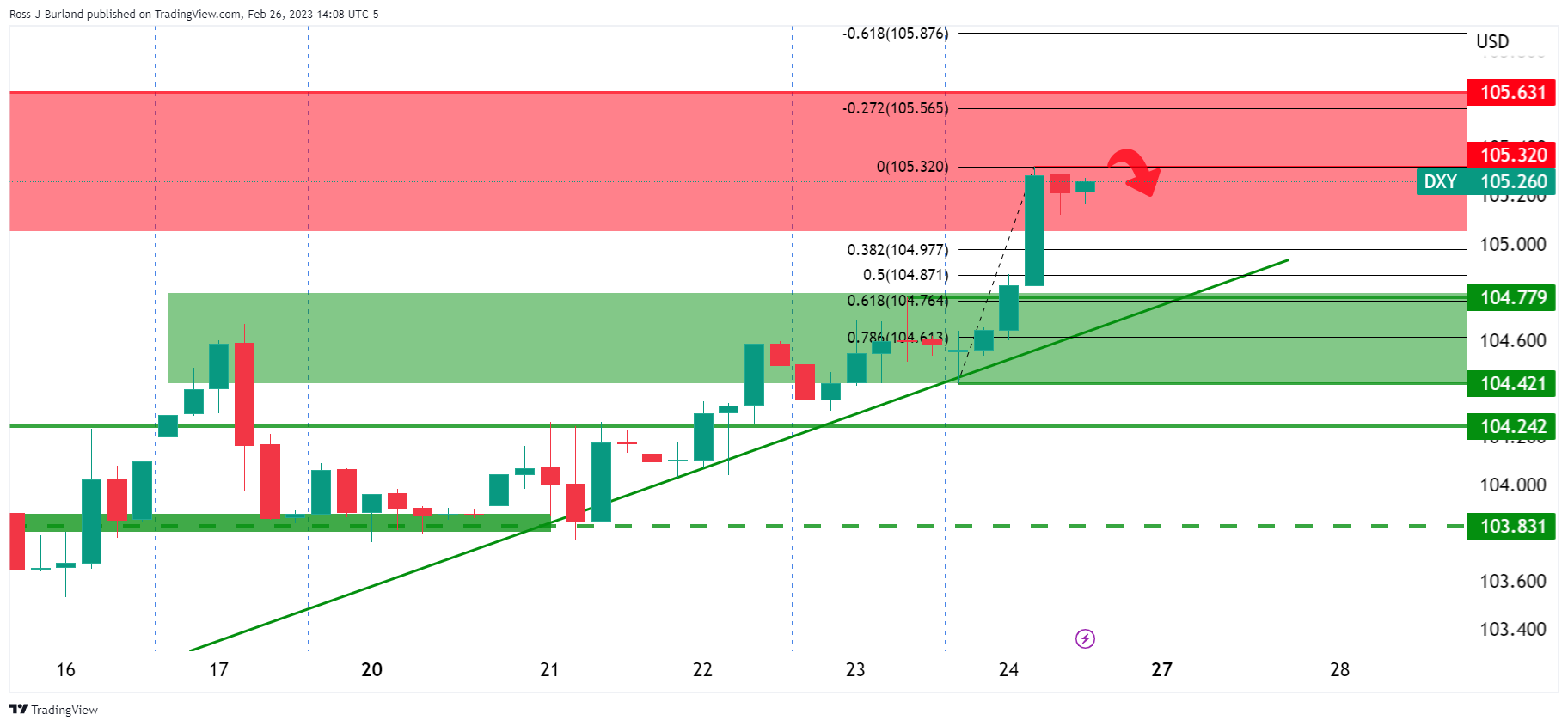

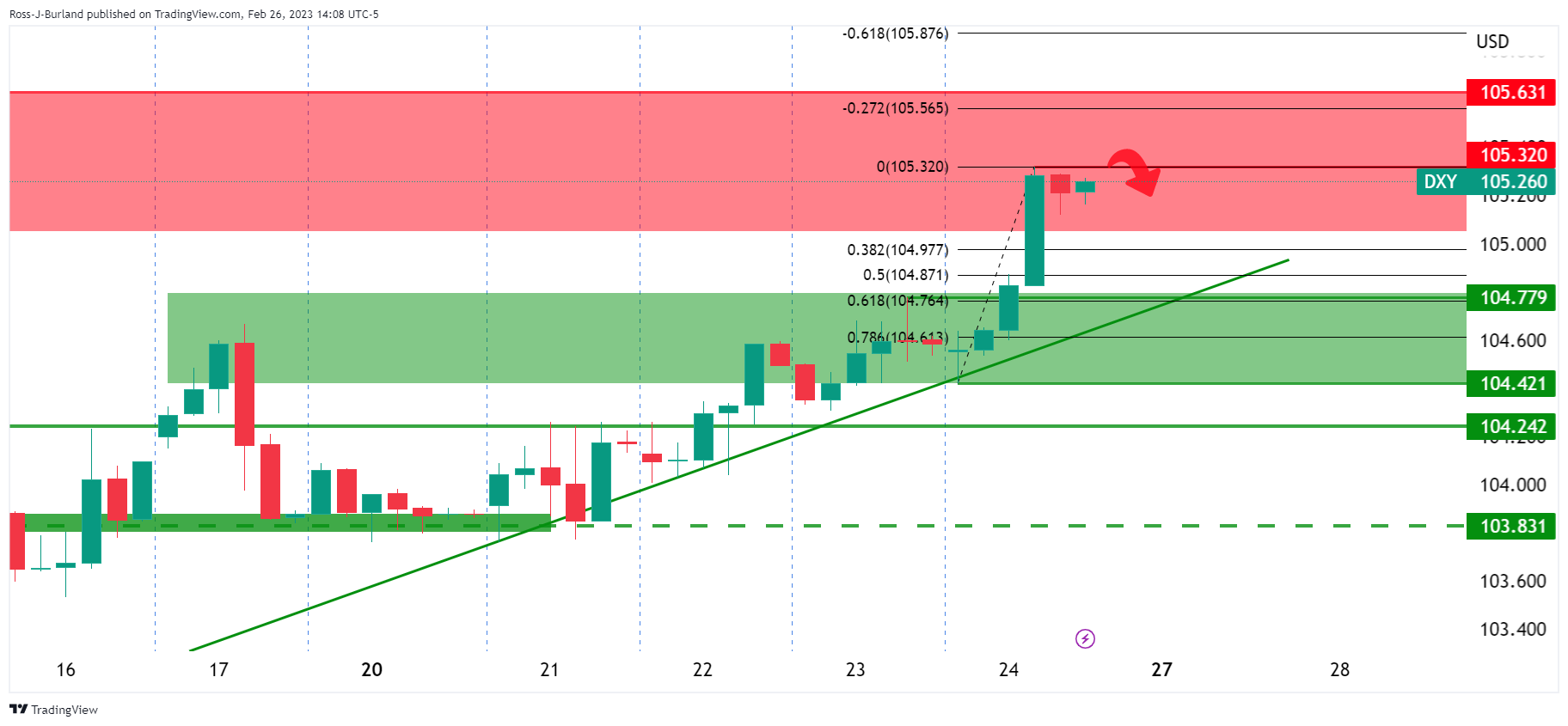

- US Dollar Index pares the biggest weekly gain since September 2022 at seven-week high.

- Strong inflation-linked data underpin hawkish Fed bias to propel DXY run-up.

- Geopolitical fears add strength to the US Dollar’s haven demand.

- US PMIs, Durable Goods Orders eyed for fresh impulse, Fed talks are the key.

US Dollar Index (DXY) clings to mild losses around 105.15 as it consolidates recent gains at the highest levels since early January during Monday’s Asian session. That said, the greenback’s gauge versus six major currencies printed the biggest weekly gain since September 2022 in the last, as well as posted the four-week uptrend, before retreating from the 2023 peak marked in early January.

The DXY bulls cheered hawkish Fed bets, as well as the geopolitical fears surrounding China and Russia, while refreshing the multi-day high. However, a lack of major data/events triggered the quote’s latest pullback.

As per the latest read of the FEDWATCH tool, market players price a year-end effective fed funds rate at 5.3%, versus 5.1% signaled by the US central bank in its December meeting. The hawkish Fed concerns could be linked to the strong US data, mainly suggesting strong inflation pressure, as well as the upbeat comments from the US Federal Reserve (Fed) officials.

Among the US data, Friday’s US Personal Consumption Expenditures (PCE) gained major attention as the headline PCE Price Index rose to 5.4% YoY versus 5.3% prior and 4.9% market forecasts. Further, the more relevant Core PCE Price Index, known as Fed’s favorite inflation gauge, rose to 4.7% YoY, compared 4.6% prior and analysts' forecast of 4.3%.

On the other hand, Cleveland Fed President Loretta Mester told CNBC on Friday that his funds' rate was above the median in December and still thinks they need to be somewhat above 5%. The policymaker also added that inflation risks still tilted to the upside. Following the suit was Federal Reserve Bank of Boston President Susan Collins who said, “More rate hikes needed to deal with 'too high' inflation.” Furthermore, Governor Philip Jefferson said, “Wage growth in the US is running too high to be consistent with a timely and sustainable return to the Federal Reserve's 2% inflation objective.”

Elsewhere, German and European Union leaders criticized China’s 12-point peace plan and raised the market’s geopolitical fears, which in turn weighed on the market sentiment and propel the US Dollar.

While portraying the mood, Wall Street benchmarks posted the biggest weekly fall in 2023 while the US two-year Treasury bond yields rose to the highest levels since early November 2022.

Looking ahead, this week’s US ISM Manufacturing PMI, Services PMI, Durable Goods Orders and China’s official PMIs will be crucial for the market, as well as for the DXY traders. However, an absence of the US jobs report and a light calendar for the Fed watchers may allow the DXY to pare some of its latest gains.

Technical analysis

The US Dollar Index pullback remains elusive unless providing a daily close below the 200-day Exponential Moving Average (EMA) level surrounding 104.85.

- Oil price has reached near four-day high around $77.00 amid escalating supply worries.

- The 50-period EMA) at $76.65 is barricading the oil price.

- A range shift move by the RSI (14) indicates a bullish reversal.

West Texas Intermediate (WTI), futures on NYMEX, have scaled to near four-day high around $77.00 after a healthy responsive buying from near $74.00. The oil price has ignored the rising hawkish Federal Reserve (Fed) bets after a revival in the United States’ household spending. The catalyst that is infusing strength in the oil price is the supply cut by Russia after sanctions from western allies to trim its funding for arms and ammunition for the invasion of Ukraine.

Volatility in the US Dollar Index (DXY) has squeezed dramatically, however, the upside is still favored as Fed policymakers are reiterating a hawkish stance to tame the stubborn inflation.

On a four-hour scale, the oil price has formed a Head and Shoulder chart pattern that conveys a sheer consolidation and results in a downside break after surrendering the neckline. The neckline of the aforementioned chart pattern is plotted from January 5 low at $72.64.

The 50-period Exponential Moving Average (EMA) at $76.65 is barricading the oil price, at the time of writing.

Meanwhile, the Relative Strength Index (RSI) (14) has delivered a range shift move from the bearish range of 20.00-40.00 to the 40.00-60.00 range, indicating a bullish reversal. The RSI (14) has taken support at 40.00.

A responsive buying in the oil price favors an upside to near February 3 high around $78.18 and round-level resistance of $80.00 after surpassing a four-day high around $77.00 decisively.

In an alternate scenario, a confident break below the H&S neckline will drag the asset towards December 9 low at $70.27 followed by September 2021 low around $67.00.

WTI four-hour chart

-638130519420171035.png)

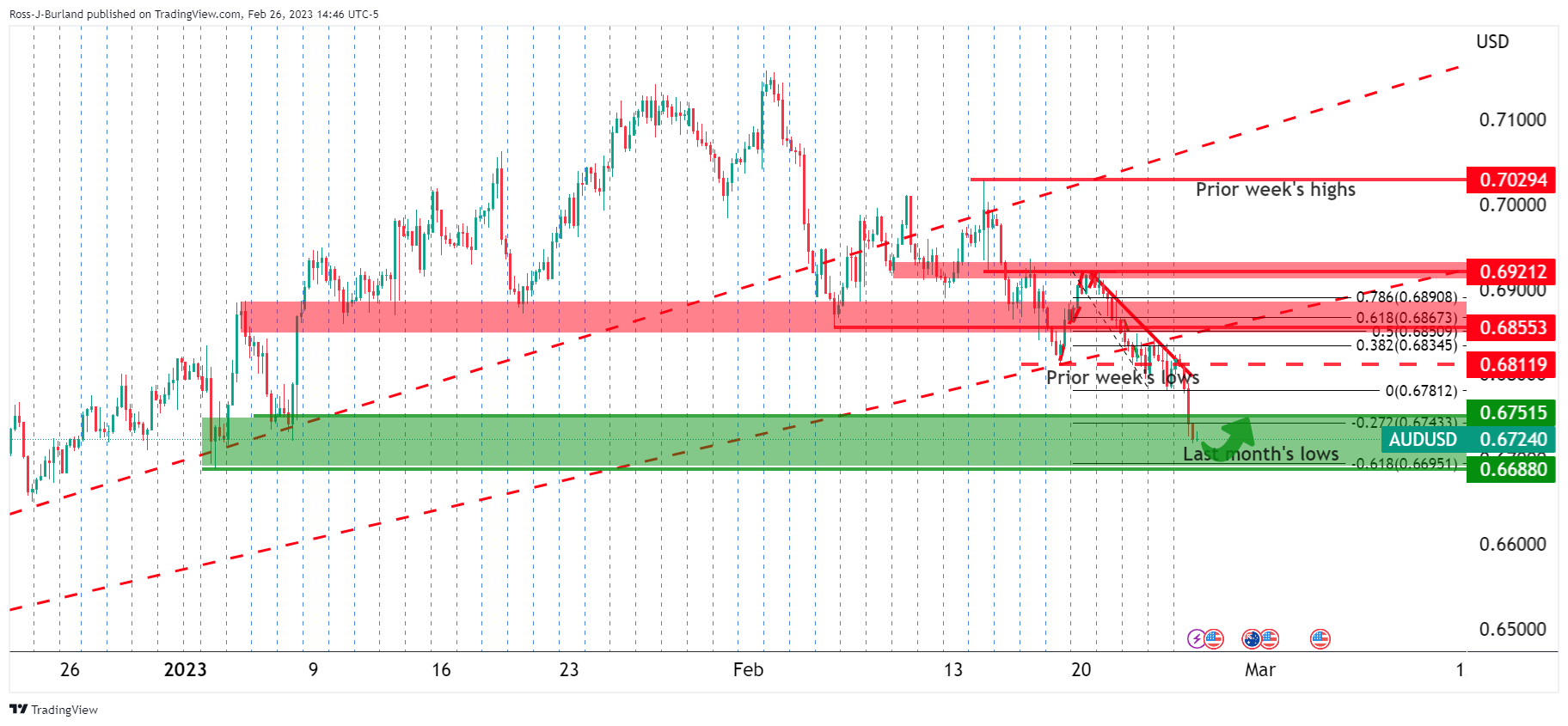

- AUD/USD picks up bids to lick its wounds at the lowest levels in seven weeks.

- Market consolidates ahead of major data/events, seek more clues.

- Strong US data, hawkish Fed bets and geopolitical concerns previously cheered Aussie bulls.

- US/China PMIs, Australia Retail Sales eyed for clear directions.

AUD/USD prints mild gains around 0.6735 during the initial Asian session on Monday as bears take a breather around the lowest levels since early January following a two-week downtrend. In doing so, the Aussie pair traders seem to brace for this week’s key data amid a lack of major directives. However, the hawkish Fed concerns and strong US data keeps the bears hopeful even as the Reserve Bank of Australia (RBA) officials signalled more rate hikes ahead.

That said, the last week’s RBA Minutes and comments from RBA Governor Philip Lowe, as well as Deputy Governor Guy Bullock, signalled further rate lifts are on the table. However, the hawkish concerns at the Aussie central bank weren’t as strong as those at the Federal Reserve (Fed), which in turn drowned the AUD/USD pair.

It should be noted that the US Dollar Index (DXY) marked a four-week uptrend by the end of Friday, grinding near the highest levels in seven weeks of late, as strong US data, especially relating to inflation, underpinned hawkish Federal Reserve concerns.

Among them, Friday’s US Personal Consumption Expenditures (PCE) gained major attention as the headline PCE Price Index rose to 5.4% YoY versus 5.3% prior and 4.9% market forecasts. Further, the more relevant Core PCE Price Index, known as Fed’s favorite inflation gauge, rose to 4.7% YoY, compared 4.6% prior and analysts' forecast of 4.3%.

On the other hand, Cleveland Fed President Loretta Mester told CNBC on Friday that his funds' rate was above the median in December and still thinks they need to be somewhat above 5%. The policymaker also added that inflation risks still tilted to the upside. On the same line, Federal Reserve Bank of Boston President Susan Collins said, “More rate hikes needed to deal with 'too high' inflation.” Furthermore, Governor Philip Jefferson said, “Wage growth in the US is running too high to be consistent with a timely and sustainable return to the Federal Reserve's 2% inflation objective.”

It’s woth mentioning that US Treasury Secretary Janet Yellen also highlighted the US inflation concerns on the sideline of the Group of 20 (G20) meetings and backed the US Dollar bulls.

Apart from the US data and hawkish Fed concerns, the geopolitical fears surrounding Russia and China also weigh on the AUD/USD price, due to its ties with China, as well as because of the pair’s risk-barometer status.

In the last week, China released its 12-point peace plan on the Ukraine-Russia war but failed to gain accolades due to its ties with Russia. Following that, Germany’s Finance Minister Christian Lindner said on the sidelines of the G20 finance ministers and central bank governors' meeting on Friday that there cannot be any business as usual with Russia as long as this war continues. On the same line, European Commission President Ursula von der Leyen on Friday, “Sanctions are sharply eroding Russia's economic base.” EU’s von der Leyen also stated that China has already taken side for Russia, they have to view their principles in that light.

Against this plays, Wall Street benchmarks posted the biggest weekly fall in 2023 while the US two-year Treasury bond yields rose to the highest levels since early November 2022.

Moving on, AUD/USD traders should keep their eyes on the risk catalysts ahead of this week’s US ISM Manufacturing PMI, Services PMI, Durable Goods Orders and China’s official PMIs. Also important to watch will be Aussie Retail Sales data for January and the fourth quarter (Q4) Gross Domestic Product (GDP).

Technical analysis

AUD/USD rebound remains elusive unless providing a daily close beyond 0.6740 resistance confluence, comprising the 100-DMA and previous support line from late November 2022.

- USD/CHF has recaptured the 0.9400 resistance after a marginal corrective move.

- The Swiss franc asset was heavily bided after a higher-than-projected jump in US consumer spending.

- Fed Mester has favored for rates above 5% and their sustainability for a longer period.

The USD/CHF pair has reclaimed the round-level resistance of 0.9400 after a mild correction in the early Asian session. The Swiss franc asset was heavily bided on Friday after a higher-than-projected jump in United States consumer spending. The monthly US Personal Consumption Expenditure (PCE) jumped by 0.6% in January led by the advancing wage index, which has delighted households to carry more funds for disposal.

A recovery in consumer spending has refreshed fears of a recession in the United States as the Federal Reserve (Fed) is highly likely to consider more rates ahead. Cleveland Federal Reserve (Fed) Bank President Loretta Mester cited “Will need to go above 5% funds rate, stay there for a while.” He further added, “Data shows inflation not yet on trend to get back sustainably to 2% target.”

Rising fears of the US recession forced the market participants to dump S&P500 on Friday. The US equities were heavily sold on fears that more rates by the Fed will result in lower operating margins for firms due to rising interest obligations.

The US Dollar Index (DXY) is demonstrating a volatility contraction minutely below 105.00, however, the upside looks favored amid the risk-aversion theme. The expectations of further policy restrictions by the Fed resulted in a recovery in the US Treasury yields. The alpha provided on 10-year US government bonds scaled to near 3.95%.

Meanwhile, rising inflation in the Swiss area is accelerating fears for the Swiss National Bank (SNB). The inflation is getting beyond the handling capacity of SNB Chairman Thomas J. Jordan, which will result in more rate announcements ahead.

- USD/CAD seesaws around seven-week high as bulls await more clues.

- Broad US Dollar strength supersede Oil price recovery as bulls keep the reins in the last two consecutive weeks.

- Strong US data underpin hawkish Fed bets and propel Loonie pair buyers.

- US ISM PMIs, Canada Q4 GDP eyed for clear directions.

USD/CAD buyers flirt with the 1.3600 threshold during Monday’s sluggish Asian session, following a two-week uptrend to the highest levels since early January. The Loonie pair’s latest gains seem to take more clues from the upbeat US Dollar than prices of Canada’s key export, namely the WTI crude oil. However, the cautious mood ahead of the key Canadian data appears probing the pair buyers of late.

That said, the US Dollar Index (DXY) marked a four-week uptrend by the end of Friday, grinding near the highest levels in seven weeks of late, on strong United States data, especially relating to inflation, underpinned hawkish Federal Reserve concerns.

On Friday, the Personal Consumption Expenditures (PCE) Price Index rose to 5.4% YoY versus 5.3% prior and 4.9% market forecasts. Further, the more relevant Core PCE Price Index, known as Fed’s favorite inflation gauge, rose to 4.7% YoY, compared 4.6% prior and analysts' forecast of 4.3%.

While tracing upbeat US data, the Federal Reserve (Fed) officials were also hawkish and backed the US Dollar bulls, as well as USD/CAD pair buyers.

Cleveland Fed President Loretta Mester told CNBC on Friday that his funds' rate was above the median in December and still thinks they need to be somewhat above 5%. The policymaker also added that inflation risks still tilted to the upside. On the same line, Federal Reserve Bank of Boston President Susan Collins said, “More rate hikes needed to deal with 'too high' inflation.” Furthermore, Governor Philip Jefferson said, “Wage growth in the US is running too high to be consistent with a timely and sustainable return to the Federal Reserve's 2% inflation objective.”

Also highlighting the US inflation woes was US Treasury Secretary Janet Yellen who spoke on the sideline of the Group of 20 (G20) meetings on Friday. “Inflation is coming down if you measure it on a 12-month basis, but still core inflation, which I think will fall further, remains higher than is consistent with 2%,” said the diplomat.

On the other hand, WTI crude oil seesaw around $76.50 after bouncing off a three-week low in the last two consecutive days. It’s worth noting that the odds of higher energy demand, due to easing recession fears, seem to favor Oil prices.

Amid these plays, Wall Street closed in the red while the US two-year Treasury bond yields rose to the highest levels since early November 2022.

Moving on, US ISM Manufacturing and Services PMI, as well as Canada’s fourth quarter (Q4) Gross Domestic Product (GDP) will be important for the USD/CAD traders to watch for clear directions. That said, inflation concerns and the Fed talks appear to have more capacity to propel USD/CAD than the Canadian data unless being extremely different than market forecasts.

Technical analysis

A daily closing beyond a downward-sloping trend line from November 2022, now immediate support around 1.3560, directs the USD/CAD bulls towards the last December’s peak surrounding 1.3700.

- GBP/USD is looking vulnerable above 1.1940 amid the risk-off market mood.

- The USD Index is gathering strength to reclaim the immediate resistance of 105.00 amid hawkish Fed bets.

- Downward-sloping 20-and 50-period EMAs add to the downside filters.

The GBP/USD pair is displaying a volatility contraction around 1.1940 in the early Tokyo session. The Cable looks set to deliver further weakness as a fresh renewal in the Federal Reserve’s (Fed) hawkish bets has strengthened the US Dollar.

S&P500 futures witnessed immense pressure last week on hopes that more rates are in pipeline by the Fed as the United States inflation has turned persistent due to the strong labor market. The US Dollar Index (DXY) is gathering strength to reclaim the immediate resistance of 105.00. A jump in the monthly US core Personal Consumption Expenditure (PCE) price index by 0.6% sent 10-year US Treasury yields to near 3.95%.

GBP/USD is auctioning in an Inverted Flag chart pattern on an hourly scale. The chart pattern indicates a sheer consolidation that is followed by a breakdown. Usually, the consolidation phase of the chart pattern serves as an inventory adjustment in which those participants initiate shorts, which prefer to enter an auction after the establishment of a bearish bias.

It is worth noting that the Inverted Flag is forming around the horizontal support plotted from February 17 low at 1.1915. An inventory adjustment near crucial support indicates that bulls US Dollar bulls are gathering strength to discover more losses.

Downward-sloping 20-and 50-period Exponential Moving Averages (EMAs) at 1.2007 and 1.975 respectively, add to the downside filters.

The Relative Strength Index (RSI) (14) is oscillating in the 20.00-40.00 range, which indicates that the downside momentum is active.

A confident break below February 17 low at 1.1915 will drag the Cable firmly towards January 5 low at 1.1875 followed by the round-level support at 1.1800.

On the contrary, a move above February 24 high at 1.2040 will drive the asset towards February 23 high around 1.2080. A breach of the latter will expose the asset to February 21 high of around 1.2140.

GBP/USD hourly chart

“UK Prime Minister Rishi Sunak has launched a private charm offensive to win around influential Conservative Brexiteers to his compromise Northern Ireland Brexit deal,” said The Times on Sunday.

“Sunak may have obtained significant concessions in a looming Brexit deal,” the news adds.

Also read: UK’s Raab: UK on cusp of new Brexit deal with EU over Northern Ireland

The news arrives ahead of the UK Sunak and European Commission President Ursula von der Leyen’s announcement of a new Brexit deal for Northern Ireland on Monday if the two can agree final details during lunchtime talks in Britain.

"The Prime Minister wants to ensure any deal fixes the practical problems on the ground, ensures trade flows freely within the whole of the UK, safeguards Northern Ireland’s place in our Union and returns sovereignty to the people of Northern Ireland," a statement from Sunak's office said per Reuters.

Key quotes

The prime minister has spent the past few days in one-to-one meetings with senior Brexiteer backbenchers taking them through the outline of the deal that he will announce today and trying to assuage their concerns.

Yesterday senior cabinet ministers were enlisted to ring around other members of the Tory parliamentary party to brief them on the key elements of the agreement before the formal announcement today.

GBP/USD tries to pushback bears

GBP/USD struggles to overcome the bearish bias as it picks up bids to 1.1950 by the press time.

Also read: GBP/USD Weekly Forecast: Pound Sterling bears eye a sustained move below 1.2000

“The UK ‘is on the cusp’ of securing a new Brexit deal on Northern Ireland,” British Deputy Prime minister Dominic Raab told BBC’s Laura Kuenssberg on Sunday.

More comments

The government had made ‘great progress’ negotiating with the European Union.

We're not there yet, but it would be a really important deal.

I think it would mark a paradigm shift first and foremost for the communities in Northern Ireland, but I think it would be a significant achievement.

If there are any new rules that would apply in relation to Northern Ireland, it must be right that there is a Northern Irish democratic check on that.

The UK wants to see a move away from checks on every consignment of goods coming into Northern Ireland from the rest of the UK.

GBP/USD stays pressured

GBP/USD remains depressed around 1.1940, following a three-day downtrend.

Also read: GBP/USD Weekly Forecast: Pound Sterling bears eye a sustained move below 1.2000

- Gold price remains pressured near two-month low, following consecutive four weekly declines.

- Strong United States data underpin US Dollar strength and weigh on XAU/USD.

- Firmer US Treasury bond yields, geopolitical fears also exert downside pressure on Gold price.

- More clues of US inflation will be eyed for short-term XAU/USD direction.

Gold price (XAU/USD) stays depressed at the lowest levels in two-months after declining in the last five consecutive days, as well as printing four-week south-run. That said, the yellow metal begins the week’s trading on a back foot around $1,810 as bears cheer strong US Dollar amid upbeat United States economics. Among the US data, the Federal Reserve (Fed) favored inflation gauge offered major blow to the XAU/USD price.

Gold price slumps as US Dollar jumps

Gold price dropped in the last four consecutive weeks, as well as five days in a row, as the US Dollar marked the biggest weekly jump since September 2022. That said, the US Dollar Index (DXY) marked four-week uptrend by the end of Friday, grinding near the highest levels in seven weeks of late, on strong United States data, especially relating to the inflation, underpinned hawkish Federal Reserve concerns.

On Friday, the Personal Consumption Expenditures (PCE) Price Index rose to 5.4% YoY versus 5.3% prior and 4.9% market forecasts. Further, the more relevant Core PCE Price Index, known as Fed’s favorite inflation gauge, rose to 4.7% YoY, compared 4.6% prior and analysts' forecast of 4.3%.

Prior to that, the second reading of the Gross Domestic Product Annualized, better known as Real GDP, eased to 2.7% for the fourth quarter (Q4) versus 2.9% first forecasts. Further, the Personal Consumption Expenditure (PCE) Price and Core PCE for the said period rose to 3.7% and 4.3% QoQ versus 3.2% and 3.9% respective first estimations.

Additionally, the Chicago Fed National Activity Index improved to 0.23 in January from -0.46 (revised), versus 0.03 analysts’ estimates. On the same line, Initial Jobless Claims also eased to 192K for the week ended on February 17 from 195K (revised) prior, compared to 200K expected.

Hawkish Federal Reserve talks also weigh on XAU/USD

While tracing upbeat US data, the Federal Reserve (Fed) officials were also hawkish and backed the US Dollar bulls, as well as weighing on the Gold price.

Cleveland Fed President Loretta Mester told CNBC on Friday that his funds rate was above the median in December and still thinks they need to be somewhat above 5%. The policymaker also added that inflation risks still tilted to the upside. On the same line, Federal Reserve Bank of Boston President Susan Collins said, “More rate hikes needed to deal with 'too high' inflation.” Furthermore, Governor Philip Jefferson said, “Wage growth in the US is running too high to be consistent with a timely and sustainable return to the Federal Reserve's 2% inflation objective.”

Not only the Fed talks but US Treasury Secretary Janet Yellen also backed inflation fears on the sideline of the Group of 20 (G20) meetings on Friday. “Inflation is coming down if you measure it on a 12-month basis, but still core inflation, which I think will fall further, remains higher than is consistent with 2%,” said the diplomat.

It’s worth noting that the hawkish United States data and hawkish Federal Reserve (Fed) talks underpin markets bets of higher Fed rates and weigh on the Gold price. As per the latest reading of the FEDWATCH tool, market players price a year-end effective fed funds rate at 5.3%, versus 5.1% signalled by the US central bank in its December meeting.

Geopolitical risks also please Gold bears

Other than the United States data and the hawkish Fed bets, geopolitical fears surrounding Russia and China also weigh on the Gold price. Recently, China released its 12-point peace plan but failed to gain accolades due to its ties with Russia.

Following this, “There cannot be any business as usual with Russia as long as this war continues,” Germany’s Finance Minister Christian Lindner said on the sidelines of the G20 finance ministers and central bank governors' meeting on Friday.

On the same line, European Commission President Ursula von der Leyen on Friday, “sanctions are sharply eroding Russia's economic base.” EU’s von der Leyen also stated that China has already taken side for Russia, they have to view their principles in that light.

More inflation clues eyed

Given the absence of the United States employment data, more signals for the US inflation will be eyed for near-term directions of the Gold price. Among them, the US Durable Goods Orders and ISM PMIs for February will be eyed closely. As most of the top-tier US releases have backed the inflation fears, the odds of the further XAU/USD declines can’t be ruled out.

Gold price technical analysis

Gold price remains inside a three-week-old bearish channel, poking late 2022 lows of late.

That said, the quote’s downside break of a one-week-old horizontal support line, around $1,817, joins the bearish signals from the Moving Average Convergence and Divergence (MACD) indicator to strength the downside bias.

However, lower line of the stated channel joins oversold conditions of the Relative Strength Index (RSI) line, placed at 14, hints at limited downside room, which in turn highlights $1,790 as the short-term key support.

In a case where the Gold price remains bearish past $1,790, multiple supports near $1,775-80 could challenge the XAU/USD sellers.

On the flip side, the aforementioned one-week-old horizontal support-turned-resistance guards the immediate Gold price upside near $1,818.

More importantly, the XAU/USD buyers remain off the table unless the precious metal remains below $1,834-35 resistance confluence, encompassing the 50-Simple Moving Average (SMA) and top line of the stated channel.

Gold price: Four-hour chart

Trend: Limited downside expected

- EUR/USD is expected to show further weakness below 1.0540 as US inflation has rebounded.

- Higher-than-anticipated US consumer spending resulted in an intense sell-off in the US equities.

- ECB Lagarde has reiterated that a 50 bps interest rate hike announcement is on the table.

The EUR/USD pair is juggling in a narrow range above 1.0540 in the early Asian session. The major currency pair is likely to show more weakness after surrendering the immediate support of 1.0540 ahead. The downside bias for the shared currency pair is escalating after a surprise rebound in the United States Personal Consumption Expenditure (PCE) Price Index. A revival in the households’ spending in January has propelled the expectations that the Federal Reserve (Fed) will continue hiking rates till summer.

Investors dumped US equities after a higher-than-anticipated jump in consumer spending in January fueled the risk of more policy tightening by Fed chair Jerome Powell in March. S&P500 futures settled the week with losses of around 2.60%, portraying a risk-aversion theme.

Fed’s preferred inflation tool reported a surprise jump to 4.7% vs. the consensus of 4.3% and the former release of 4.7% on an annual basis. Consumer spending has jumped by 0.6% in January against a jump of 0.4% recorded in December. A strong employment cost index due to the tight labor market has fueled consumer spending due to higher funds with households for disposal.

The US Dollar Index (DXY) looks set to reclaim the critical resistance of 105.00 ahead amid the risk-off market mood. Meanwhile, rising expectations of more policy tightening by the Fed sent US Treasury yields higher. The return provided on 10-year US government bonds scaled to near 3.95%.

On the Eurozone front, European Central Bank (ECB) President Christine Lagarde reiterated the need for further interest rate hike by 50 basis points (bps) in March. ECB Lagarde cited “More tightening will be required if fiscal cooperation is absent.” She further added ''There is every reason to believe that we will do another 50 basis points in March.”

- NZD/USD sent to the backfoot on hawkish US data.

- US Dollar firms on US PCE and rate hike outlook.

NZD/USD was pressured at the end of last week due to a late surge in the USD as demand for the currency took off, sending the DXY index through 105 in the wake of a stronger-than-expected US core PCE deflator.

This was the Fed’s preferred measure of inflation, and the data companies a slew of prior inflationary data outcomes from the US calendar over the past few weeks.

The data's reacceleration has sent shockwaves through US markets, which analysts at ANZ Bank explained ''which are now pricing in a 5.4% peak in the fed funds rate and are in the process of pricing out cuts in H2 2023.''

The analysts said that they've discussed this potential for some time, and it is now materialising. ''But while it speaks to a stronger-than-otherwise USD, unlike in 2022, the Fed isn’t outpacing all other central banks, and locally, risks are now tilted towards the RBNZ also having more work to do,'' the analysts argued. ''That may in time make the NZD more resilient to USD strength than other currencies, but that wasn’t evident overnight.''

Meanwhile, New Zealand Retail Sales for the fourth quarter came in at -0.6% vs the prior 0.4%. For the year, it arrived at -4%.

More tightening will be required if fiscal cooperation is absent, Christine Lagarde, president of the European Central Bank said as reported in The Economic Times.

Largde said, ''there is every reason to believe that we will do another 50 basis points in March. After that, we will see. We are data dependent.''

She added, ''we will do more hikes if necessary to return inflation to our target of 2% in a timely manner. It will take what it will take. What I know is that we will return inflation to 2%. And we want to not only return it to 2%, but to keep it there sustainably.''

Politico reported that Western countries have ''slapped a new round of sanctions on Russia in the nick of time on Friday, striving to present a united front as the world marked the first anniversary of Vladimir Putin’s invasion of Ukraine.''

The article reported that ''in a show of solidarity with Kyiv, both the US and the UK imposed sanctions earlier on Friday.''

It has been confirmed today that EU states have backed new sanctions after a clash between Poland and Italy held up the process for days.

For a list of new sanctions, see here. Among them, they include about ''120 individuals and entities on the sanction list. New export restrictions have been introduced on sensitive dual-use and advanced technologies that contribute to Russia's military capabilities and technological enhancement, based on information received from Ukraine, our Member States and our partners. Today's package imposes import bans on the following Russian high-revenue goods:

- Bitumen and related materials like asphalt; and

- Synthetic rubber and carbon blacks.

Three Russian banks have been added to the list of entities subject to the asset freeze and the prohibition to make funds and economic resources available. Today's package imposes new reporting obligations on Russian Central Bank assets.''

Federal Reserve Bank of Cleveland leader Loretta Mester said it will take more tightening for the Fed to get inflation back to 2%.

Key comments

''Data shows inflation not yet on trend to get back sustainably to 2% target.''

''Strong inflation pressures are ‘still with us’.''

''Focus on 25bps versus 50bps misses bigger picture.''

''Will need to go above 5% funds rate, stay there for a while.''

''Needs to keep at rate hikes until inflation trend breaks lower.''

''Declines to say what size rate rises needed at March FOMC.''

''View on inflation and economy remain unchanged by latest data.''

US Dollar update

The US Dollar climbed to seven-week peaks on Friday after data showed US inflation accelerated while consumer spending rebounded last month.

A correction could be on the cards for the days ahead.

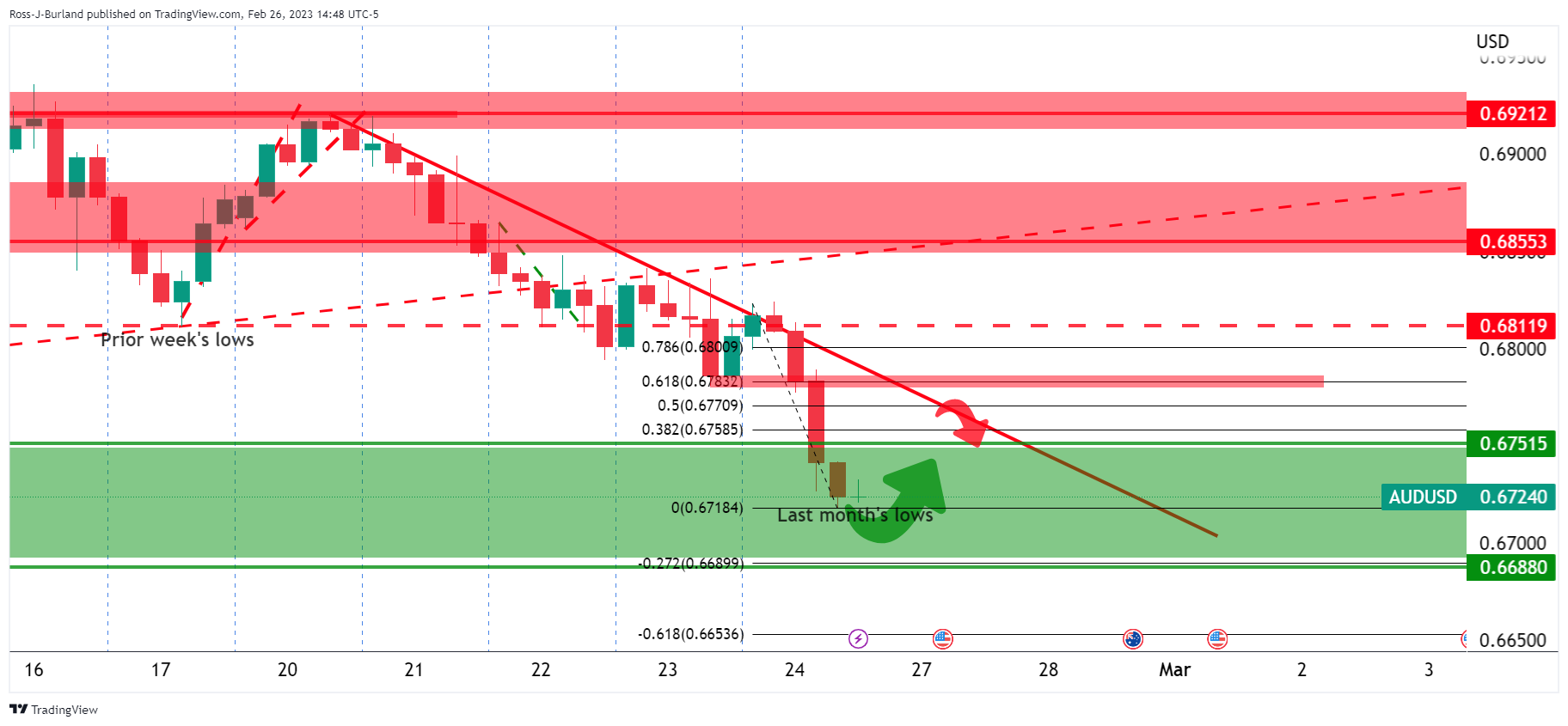

- AUD/USD bulls are lurking for the initial balance this week.

- US Dollar is sky-high and could be due for a correction.

The US Dollar climbed to seven-week peaks on Friday, leaving the Aussie on the backfoot after data showed US inflation accelerated while consumer spending rebounded last month.

With the Federal Reserve sentiment in the driving seat, the data will be key this week ahead of the second Friday of the month's US Nonfarm Payrolls. ISM surveys will follow last Friday's Personal Consumption Expenditures (PCE) price index, tracked by the Fed for monetary policy which rose 0.6% last month after gaining 0.2% in December. In the 12 months through January, the PCE price index accelerated 5.4% after rising 5.3% in December. This sent the US Dollar heavily bid as follows:

US Dollar charts

However, we are now in correction territory on the US Dollar which makes for a bullish outlook for the initial balance this week for AUD/USD.

AUD/USD H4 charts

AUD/USD, while potentially on course for a full test of last month's lows, is now in a correction zone and the trendline resistance is compelling for a target of liquidity.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.