- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 26-01-2024

- S&P 500, NASDAQ Composite end six-day record streaks.

- Despite weaker Friday, US indexes closed in the green for a third straight week.

- US Fed on the docket for next week.

US equities closed mixed on Friday to cap off a week of stunning record closes. Over-eager markets that have been leaning into rate cut bets in recent weeks second-guessed US economic conditions after US Personal Consumption Expenditure (PCE) Price Index figures showed cooling inflation, but consumer spending and housing activity hinted at a US economy that is too robust to allow for a rapid approach on Federal Reserve (Fed) rate cuts.

Money markets repriced odds of a first rate trim from the Fed to the Federal Open Market Committee’s (FOMC) meeting in May, with bets of a March rate cut down to 47% according to the CME’s FedWatch Tool.

US Core YoY PCE Price Index figures for December printed at 2.9% on Friday, below the forecast 3.0% and slipping back from the previous period’s 3.2%. Markets initially rose on reaction to the good news that cooling inflation might lead to faster, sooner rate cuts from the Fed, but an uptick in Personal Spending and Pending Home Sales put a damper on rate hopes.

US Personal Spending rose 0.7% in December compared to the 0.4% forecast and 0.4% previous (revised from 0.2%), and Pending Home Sales jumped 8.3% in December compared to the forecast 1.5% and -0.3% previous (revised from 0.0%).

Revenue forecasts on Wall Street missed expectations for major tech stocks including Intel and chipmaker tool manufacturer KLA Corp, causing equities to rethink recent bullish momentum on tech hopes alongside recent declines in tech darlings Tesla and Apple.

The Dow Jones Industrial Average (DJIA) gained 60 points to close up 0.16% at $38,109.43 while the Standard & Poor’s 500 (S&P) Major equity index closed down 0.07%, shedding a little over 3 points and ending Friday at $4,890.97.

The NASDAQ Composite declined on tech stock hesitancy, losing 55 points and closing down by a third of a percent at $15,455.36.

S&P Technical Outlook

The S&P closed in the green for a third straight week, chalking in 12 winning weeks out of the last 13, and the major index is up nearly 20% from the last significant swing low into $4,102.02 in October.

The S&P 500 is trading well above the 200-day Simple Moving Average (SMA) near $4,425.00, and is in play near the $4,900.00 as investors eye another push towards the $5,000.00 major handle nearby.

S&P 500 Hourly Chart

S&P 500 Daily Chart

- AUD/USD ends week down 0.33%, unable to hold above 0.6600, range-bound.

- Struggle to sustain gains above 200-DMA (0.6576); potential for upward trend watched closely.

- Key supports at 0.6551, 0.6524; rebound above 200-DMA may aim for resistances at 0.6620, 0.6652.

The AUD/USD finished Friday’s session on the back foot, down more than 0.15%, for a total of 0.33% losses in the week. At the time of writing, the pair ended at 0.6573, failing to stay above the 0.6600 figure, which exacerbated the Aussie’s drop below the key 200-day moving average (DMA).

The pair extended its sideways trading, with buyers failing to cling to the 200-DMA at 0.6576, though it seems they remain in charge. This following January’s 17 dip toward 0.6524, with the par extending its gains toward the 0.6550/0.6600 range, still unable to decisively crack the 0.6600 mark and opening the door for a pull back.

With that said, key support levels lie below the exchange rate, with the January 23 daily low of 0.6551, ahead of the January 17 swing low of 0.6524. if the pair slides below this key support level, the buyers' last line of defense would be the 0.6500 figure before diving to the November 17, 2023, low of 0.6452.

On the positive side, if buyers reclaim the 200-DMA, they could extend its rally past the 0.6600 figure toward January’s 24 high at 0.6620. The next supply zone emerges at the 50-DMA at 0.6652.

AUD/USD Price Action – Daily Chart

AUD/USD Key Levels

- The XAU/USD experiences a slight decrease, holding slightly above $2,018 with a minor pullback.

- Key indicators such as RSI and MACD demonstrate a subdued buying momentum, as bulls consolidate December’s rally.

On Friday's session, the XAU/USD was seen trading at $2,018, presenting a slight decline of 0.08% and closing a 0.55% weekly loss. After reaching a level of $2,135 in December, buyers have been largely taking a pause, suggesting a neutral to a bullish outlook on the daily chart. Despite some momentum observed in the four-hour chart, the indicators remain relatively weak.

In addition, the USD recovery fueled by markets adjusting their bets on the Federal Reserve (Fed) due to the US economy showing resilience is pushing the metal lower. On Friday, soft Personal Consumption Expenditures (PCE) figures from December from the US didn’t fuel a significant reaction to the market expectations on the Fed which meets next week. As for now, markets pushed the start of the easing cycle to May from March but the Fed's tone may change those expectations.

XAU/USD levels to watch

The technical indicators on the daily chart, specifically the Relative Strength Index (RSI) and the position of the metal regarding its 20, 100, and 200 Simple Moving Averages (SMAs) paint a diverse picture. Despite the RSI showing a negative slope and currently residing in negative territory, the price manages to stay above the 20, 100, and 200-day SMAs. This is indicative of bullish standing in the broader time frame, and the recent pullback could be explained by the bulls taking a breather after pushing the price to a high of $2,135 in December.

Drilling down to the narrower four-hour chart, the momentum indicators present weak yet existent bullish undertones. The four-hour RSI shows a negative slope but is currently in positive territory, while the four-hour Moving Average Convergence Divergence (MACD) continues to produce flat red bars, again suggesting a hold on bearish momentum.

XAU/USD daily chart

- EUR/JPY up 0.39%, rebounding from daily low as Yen weakens in FX market.

- Bullish harami pattern suggests upside potential; resistance at 161.00, then January 19 high.

- Downside risks if below Tenkan/Sen (160.55); next supports at 160.00, 159.69, 159.51.

The EUR/JPY bounces off weekly lows late on Friday’s North American session and is up 0.39% as the Japanese Yen (JPY) remains the laggard across the FX space. At the time of writing, the cross-pair exchanges hands at 160.77 after reaching a daily low of 159.83.

From a technical standpoint, price action in the last couple of days is forming a ‘bullish harami’ two-candle pattern that reassembles an inside day, which leads to price action to the upside. If buyers lift the 161.00, the next resistance would be the January 19 high at 161.87, with the psychological 162.00 up next.

On the flip side, if sellers drop below the Tenkan/Sen at 160.55, the next support would be 160.00, followed by the January 25 daily low of 159.69 and the Senkou Span A at 159.51.

EUR/JPY Price Action – Daily Chart

EUR/JPY Technical Levels

- The ECB left the door open for data-dependent rate cuts, but remains tepid.

- Earnings beats helped equities shrug off Consumer Confidence miss.

- BoE, Fed the headline risks for next week.

European indexes wrapped up Friday trading firmly in the green, shrugging off a dovish European Central Bank (ECB) and a downside miss in European Consumer Sentiment surveys after the ECB left the door open for data-dependency to trigger rate cuts earlier than the central bank is currently projecting.

The ECB held rates flat this week, cautioning that discussions about rate cuts are still premature, but policymakers noted there would be room on the table for rapid, shallow cuts if Europea economic data turns sour in the near-term, helping to prop up investor sentiment that rate relief could be around the corner. The ECB currently sees no room for a rate trim until sometime in the second half of the year compared to market rate bets hoping for a first cut before June.

France’s CAC40 index surged to a record high on Friday, dragged higher by large upswings in luxury goods, with market bids pinned even higher after Barclay’s upgraded their outlook on the luxury goods sector to overweight.

Germany’s DAX index hit another record close on Friday, with gains in the German sector notably trimmed after German GfK Consumer Confidence came in at an 11-month low of -29.7 for February versus the forecast uptick to -24.5 from January’s -25.1.

Next week will see calendar headline risks with the Bank of England (BoE) and the US Federal Reserve (Fed) slated to deliver their respective rate calls and associated monetary policy statements.

France’s CAC40 gained nearly 170 points on Friday to close up 2.28% at €7,634.14, while the pan-European STOXX600 index climbed 5.31 points to end the trading week at €483.84, up 1.11%.

Germany’s DAX indexed closed at record highs but still underperformed its European peers, gaining about a third of a percent and closing at €16,961.39, up nearly 54.5 points.

London’s FTSE 100 index also climbed on Friday, adding 105.36 points to close up by 1.4% at £7,635.09.

DAX Technical Outlook

Germany’s DAX index pinned into near-term highs near €16,950.00 to hit the closing bell at its highest bids ever, and the index is up nearly 3.75% from last week’s swing low into €16,328.00.

The DAX is trading well above technical levels with the 200-day Simple Moving Average (SMA) well below current price action at €15,905.00. The index hasn’t made contact with the 50-day or 200-day SMAs since November of last year, when the German equity index rallied from €14,600.00.

DAX Hourly Chart

DAX Daily Chart

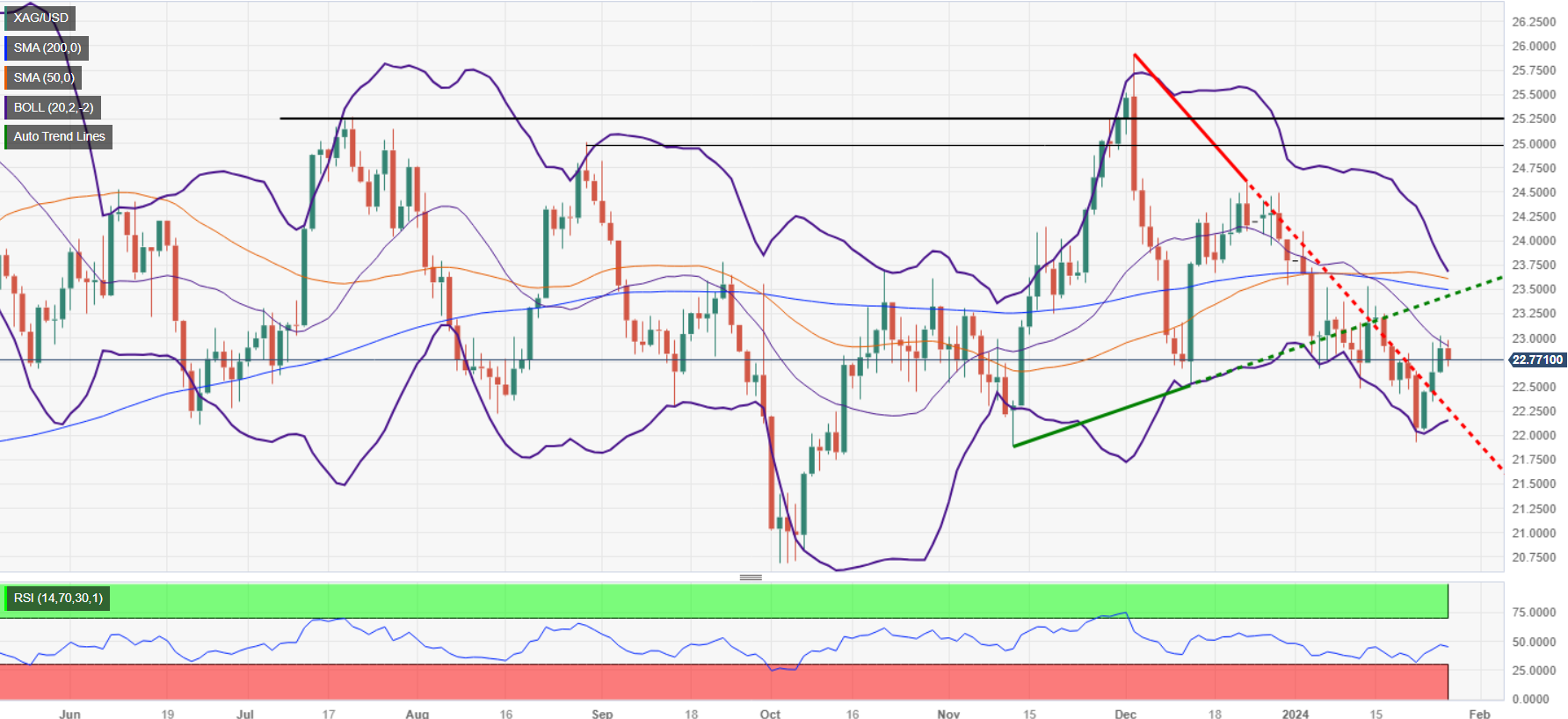

- Silver prices dip, unable to hold above key $23.00 level, indicating a possible ongoing downtrend.

- Break below major supports like 200, 50, and 100-day DMAs strengthens bearish outlook for silver.

- Buyer resistance seen at $23.00 and 100-DMA ($23.15); fall below $22.51 may lead to $22.00, $21.93 supports.

Silver price retreated late in the North American session after hitting a daily high of $22.97, though buyers' failure to reclaim the $23.00 exacerbated the grey metal’s fall to current spot prices. Therefore, the XAG/USD exchanges hands at $22.73, down 0.59%.

After printing three straight positive days, Silver retraced below $23.00, resuming its ongoing downtrend and forming a ‘bearish after sellers dragged prices below key support levels, like the 200, 50, and 100-day moving averages (DMAs). Even though XAG/USD is edging low, as a ‘bearish harami’ chart pattern emerges, it still needs to surpass (again) December’s 13 swing low of $22.51 to challenge the $22.00 figure. The next demand area below that level would be January’s 55 low at $21.93.

On the flip side, buyers are eyeing the $23.00 handle and the 100-DMA at $23.15 as immediate resistance levels in the near term. Once those levels are cleared, the next resistance emerges at the 200-DMA at $23.48.

XAG/USD Price Action – Daily Chart

XAG/USD Technical Levels

It was quite a dull week when it comes to price action in the FX galaxy, particularly in the G10 space. The (widely anticipated) lack of surprises at the BoJ event, coupled with the unemotional tone from the ECB, also contributed to the broad-based sidelined theme. Next week, all the attention is expected to be on the FOMC gathering, while the BoE meeting should also grab some interest.

In the US, the Conference Board will publish its always-relevant Consumer Confidence for the month of January (January 30). The ADP, the Fed event, and Chief Powell’s press conference are on January 31, and it is largely expected to keep its FFTR unchanged. Usual weekly Initial Claims are due on February 1 prior to the key ISM Manufacturing PMI, while Nonfarm Payrolls, the Unemployment Rate and the final Michigan Consumer Sentiment index are all due on February 2. In line with the rest of its peers, the greenback maintained an erratic performance throughout the week, leaving the USD Index (DXY) hovering around the low 103.00s.

In Euroland, advanced Q4 GDP Growth Rate in Germany and the broader euro bloc is due on January 30. Still in Germany, Retail Sales, the labour market report, and the advanced Inflation Rate come on January 31. February’s docket kicks in with the release of the final Manufacturing PMI in Germany and the euro area, as well as the preliminary Inflation Rate in the whole bloc. EUR/USD also traded in an erratic fashion, although always with a gradual decline, which ended in the second consecutive week of losses.

In the UK, Mortgage Approvals are first in line (January 30), seconded by Nationwide Housing Prices on January 31. The final Manufacturing PMI and the BoE gathering are expected on February 1. GBP/USD managed to cling to positive territory in the weekly chart, regaining the 1.2700 zone.

The Japanese docket will see the release of the Unemployment Rate on January 30, ahead of the BoJ Summary of Opinions, flash Industrial Production figures, Consumer Confidence, Housing Starts and Retail Sales, all due on January 31. The usual weekly Foreign Bond Investment will close the calendar on February 1. USD/JPY halted three consecutive weeks of gains, although it maintained the trade in the area of recent peaks north of 148.00.

In Australia, Retail Sales will be in the limelight on January 30, followed by the key Inflation Rate in Q4, Housing Credit, the Monthly CPI Indicator and the final Judo Bank Manufacturing PMI, all on January 31. Building Permits come on February 1, and Home Loans and Investment Lending for Homes are seen on February 2. Despite AUD/USD keeping the consolidation in place, it could not help closing its fourth consecutive week of losses.

In China, the NBS Manufacturing PMI and the Non-Manufacturing PMI are due on January 31.

Regarding central banks, both the Federal Reserve and the Bank of England (BoE) are expected to keep their policy rates unchanged at their gatherings on January 31 and February 1, respectively.

- Crude Oil markets jumped again on Friday, testing two-month highs.

- WTI tips back into $78.00, up over 7.5% in 2024.

- Energy markets are tilted heavily into net long positions.

West Texas Intermediate (WTI) US Crude Oil bid into a two-month high north of 78$.00 per barrel on Friday as barrel traders pile into long bets on continuing geopolitical concerns and near-term supply constraints. Crude Oil prices have skewed to the high side this week after a dogpile into long trades leaves markets exposed to an exacerbated pullback if further net long positions can’t be pulled into the order books.

A cold snap in the US last week temporarily crimped supply lines, adding to a drawdown in US Crude Oil stocks according to reporting by the Energy Information Administration (EIA) this week. EIA barrel counts showed a 9.233 million barrel drawdown in the US for the week ended January 19, adding to the previous week’s drag of 2.492 million barrels. Despite another buildup in refined gasoline adding to already-burgeoning gasoline supplies, energy markets are broadly focusing on the potential for ongoing Crude Oil supply constraints.

Iran-backed Houthi rebels in Yemen launched a fresh attack against US and UK naval targets on Friday, exacerbating Crude Oil jitters despite no reports of significant damage. The Houthis continue to threaten civilian cargo ships bound for the Suez Canal, and nearly ten strikes by coalition naval forces within three weeks have yet to quell Houthi aggression.

According to reporting by Bloomberg, citing Dan Ghali of TD Securities, algorithmic trend followers have pivoted into net long positions with Crude Oil traders net long WTI by around 30%,

WTI Crude Oil Technical Outlook

WTI caught an intraday rebound off the 50-hour Simple Moving Average (SMA) near $76.00 on Friday, and US Crude Oil is up nearly 2.5% on the day. The near-term technical floor is priced in at the 200-hour SMA just north of the $74.00 handle.

Daily candlesticks have WTI testing into the 200-day SMA near 77.25, with oil bids climbing and setting WTI on pace to close in the green for a sixth of the last eight trading session.

WTI Hourly Chart

WT Daily Chart

- The AUD/JPY stands strong at around 97.45, flaunting a gain of 0.25%.

- Despite the upwards movements, the cross will still close a 0.20% weekly loss.

- An optimistic scenario is reflected in larger time frames with the pair trading above the 20,100,200-day SMAs.

On Friday's session, the AUD/JPY was trading at 97.45, up by 0.25%. The daily chart shows a neutral to bullish sentiment, with bulls keenly holding their ground while the four-hour outlook mirrors the daily one, with a predominant bullish presence.

The indications on the daily chart reflect a sideway move with a slight bullish inclination. A surge is suggested by the Relative Strength Index (RSI) with a positive slope and lies in positive space, indicating that the buying strength still holds the upper hand. Yet, the Moving Average Convergence Divergence (MACD) showing static green bars suggests a lack of momentum for further bullish advancement. However, positioning above the 20, 100, and 200-day Simple Moving Averages (SMAs) solidifies the evidence that bulls dominate in the long-run realm, even with the weekly retracement.

The four-hour chart, it echoes a similar sentiment. The Relative Strength Index (RSI), still in positive territory and on an upward bend hints at the continued presence of bullish momentum. In the meanwhile, the Moving Average Convergence Divergence (MACD) laying flat with red bars could point to a short-term pullback or consolidation period. Nonetheless, the bulls' persistence indicates that the uptrend may continue in the following trading sessions, assuming that buying pressure remains.

AUD/JPY levels to watch

AUD/JPY daily chart

- GBP/USD stable in mid-North American session post US data, with soft inflation boosting rate cut expectations.

- US PCE Index shows steady headline inflation at 2.6%; core rate drops to 2.9%, hinting at possible May Fed rate cut.

- Focus shifts to upcoming central bank decisions; Fed likely to hold rates, BoE expected to maintain Bank Rate.

The GBP/USD was virtually unchanged in the mid-North American session on Friday after data from the United States (US) was released. A softer inflation reading was cheered by investors, who remained confident the Federal Reserve (Fed) would cut rates in May. Despite that, the major remains flat, hovering around 1.2700, set to finish the week with minuscule gains.

GBP/USD hovers around its opening price following soft US PCE data; traders eye central bank decisions

The US Personal Consumption Expenditures (PCE) Price Index was revealed by the US Department of Commerce suggesting that inflation continues its downtrend. Headline inflation rose by 2.6%, unchanged compared to November’s and expected figures, while the underlying measures dropped from 3.2% to 2.9%. Although the data could allow a rate cut by the Fed, investors estimate the first one would be in May, according to the Chicago Board of Trade (CBOT). Money market traders expect Fed Chair Jerome Powell and Co. to lower rates to 4% by the year’s end.

Given the fundamental backdrop, GBP/USD traders eye the next week’s monetary policy decisions by both central banks. The Fed is expected to keep rates unchanged on January 31, though market participants will be eyeing Powell’s press conference.

Across the pond, the Bank of England (BoE) is foreseen to keep the Bank Rate at 5.25%, although with a unanimous vote, than the previous 6-3 split by February 1. Investors are eyeing the release of economic projections and the BoE’s press conference.

GBP/USD Price Analysis: Technical outlook

From a technical standpoint, the GBP/USD remains neutrally biased, thought at the brisk of tilting to the downside, as price action closes into the 50-day moving average (DMA), the first support level at 1.2654. if sellers break below the 1.2700 figure and the latter, further downside is seen. The next demand zone would be the January 5 low of 1.2611 and the 1.2600 figure. On the upside, the pairJanuary first resistance would be the January 24 cycle high at 1.2774, before testing 1.2800.

- EUR/USD reclaims territory near 1.0880 after drop into 1.0820.

- German Consumer Confidence declined to 11-month low.

- US PCE inflation eased more than expected, but spending remained high.

EUR/USD recovered recent losses on Friday, recovering back into familiar technical levels. Still, overall gains remained limited after German Consumer Confidence backslid to almost a one-year low as economic conditions in Europe remain tepid at best.

US Personal Consumption Expenditure (PCE) Price Index inflation figures eased more than expected, but further gains in December’s Personal Spending alongside an unexpected uptick in Pending Home Sales trimmed rate cut expectations. With the US domestic economy continuing to bump along at a healthy clip, market hopes for early and deep rate cuts from the Federal Reserve continue to wilt.

Daily digest market movers: EUR/USD pares losses despite determined Greenback

- EUR/USD slipped into multi-week lows early Friday after German Gfk Consumer Confidence in February declined to an 11-month low of -29.7 versus the forecasted improvement from -25.1 to -24.5.

- The US Dollar broadly recovered after US YoY Core PCE Price Index figures in December eased to 2.9% from the forecast of 3.0%, previous 3.2%.

- Despite the easing in inflation, US Personal Spending and Pending Home Sales both stepped higher.

- Personal Spending rose 0.7% in December versus the 0.4% forecast, with the previous month’s print getting revised to 0.4% from 0.2%.

- US Pending Home Sales climbed 8.3% in December compared to the expected rebound to 1.5% from the previous month’s 0.3% decline (revised down from 0.0%).

- Next week brings European Gross Domestic Product (GDP) numbers on Tuesday, with the next high-impact rate call from the US Federal Reserve (Fed) slated for Wednesday.

- Euro area Q4 GDP is expected to print at -0.1%, in line with the previous figure as the pan-European economy lags in stagnation.

- Federal Reserve expected to hold rates steady in January, CME FedWatch Tool suggests markets pivoted to betting on the first rate cut in May after rate bets shifted post-PCE print.

Euro price today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the Japanese Yen.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.15% | -0.03% | -0.11% | 0.05% | 0.18% | 0.16% | -0.36% | |

| EUR | 0.16% | 0.13% | 0.05% | 0.20% | 0.35% | 0.33% | -0.21% | |

| GBP | 0.02% | -0.12% | -0.08% | 0.06% | 0.23% | 0.20% | -0.33% | |

| CAD | 0.11% | -0.04% | 0.07% | 0.16% | 0.29% | 0.28% | -0.25% | |

| AUD | -0.03% | -0.19% | -0.06% | -0.14% | 0.15% | 0.13% | -0.41% | |

| JPY | -0.19% | -0.35% | -0.21% | -0.31% | -0.16% | -0.02% | -0.54% | |

| NZD | -0.16% | -0.33% | -0.20% | -0.27% | -0.13% | 0.00% | -0.53% | |

| CHF | 0.34% | 0.19% | 0.31% | 0.23% | 0.37% | 0.52% | 0.51% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Technical Analysis: EUR/USD gets pushed back into technical barriers, but topside limited

EUR/USD hit a multi-week low of 1.0813 early Friday before a rebound into the 200-hour Simple Moving Average (SMA) near 1.0880. Dollar bets continue to weigh on USD pairs, keeping EUR/USD leaning toward a near-term middle around 1.0850.

Despite intraday tests into the low side, EUR/USD is set to continue languishing in an ongoing congestion pattern between the 50-day and 200-day SMAs at 11.0925 and 1.0850, respectively. The pair has been trapped within the consolidation pattern since dropping from December’s peak near 1.1140.

EUR/USD Hourly Chart

EUR/USD Daily Chart

Euro FAQs

What is the Euro?

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day.

EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

What is the ECB and how does it impact the Euro?

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy.

The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa.

The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

How does inflation data impact the value of the Euro?

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control.

Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

How does economic data influence the value of the Euro?

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency.

A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall.

Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

How does the Trade Balance impact the Euro?

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

- DXY Index records a loss, unable to consolidate past 200-day SMA.

- Core PCE figures from December came in weak.

- Markets are still pushing the start of the Fed’s easing cycle to May.

The US Dollar (USD) Index is presently grappling with losses, trading at 103.35 on the DXY, in response to the release of softer Personal Consumption Expenditures (PCE) data for December, which gave the doves hope of earlier rate cuts.

In that sense, market expectations hint at a possible rate cut by the Fed in March. However, if economic growth sustains itself, a March rate cut seems unlikely. This is why bets have continued to shift toward the easing cycle beginning in May. In case the US continues to show resilience and markets delay expectations of the cuts, the downside is limited for the short term.

Daily Digest Market Movers: US Dollar declines after December PCE data

- The December Core PCE Price Index (YoY), the Fed’s preferred gauge of inflation, came in at 2.9%, slightly under the consensus of 3% and a decrease from the previous 3.2%.

- The headline index remained constant at 2.6% as anticipated.

- The 2-year, 5-year and 10-year US bond yields are on the rise, currently trading at 4.35%, 4.04% and 4.14%, respectively.

- The CME FedWatch Tool indicates that no changes in hike rates are expected for the January meeting, while markets are hinting at rate cuts in March and May 2024 with higher odds for the easing cycle to start in the latter.

Technical Analysis: DXY Index short-term buying pressure wanes as bulls struggle to defend the 200-day SMA

The indicators on the daily chart reflect a tussle between buying and selling pressure. The Relative Strength Index (RSI) showcases a negative slope yet remains in positive territory, hinting toward diminishing buying momentum. Thus, a potential shift toward sellers might be on the cards.

In unison, the Moving Average Convergence Divergence (MACD) indicator is also signaling a decline in upward pressure as the green bars on the histogram have started to decrease.

On observing the position of the index relative to its Simple Moving Averages (SMAs), we notice a mix of buying and selling pressure. The DXY holding above the 20-day SMA suggests attempts by bulls to control the short-term market trend, even as lingering bearish undertones persist.

The fact that the index is still below the 100 and 200-day SMAs, however, indicates that bears are maintaining a bullish grip on the broader context. The sellers seem to be dominating the narrative in the longer run, with the bulls struggling to gain ground.

Support Levels: 103.30, 103.00, 102.80, 102.60 (20-day SMA).

Resistance Levels: 103.50 (200-day SMA), 103.70, 103.90.

US Dollar FAQs

What is the US Dollar?

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022.

Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

How do the decisions of the Federal Reserve impact the US Dollar?

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

What is Quantitative Easing and how does it influence the US Dollar?

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

What is Quantitative Tightening and how does it influence the US Dollar?

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

- Mexican Peso strengthens for third day, bolstered by strong trade balance and weak US PCE figures.

- Mexico's sizable December trade surplus and robust job market underscore economic strength amid global uncertainty.

- US Fed's core PCE index falling below 3% fuels May rate cut expectations, benefiting emerging currencies like MXN.

The Mexican Peso (MXN) stays on a mission and climbs for the third straight day versus the US Dollar (USD) after data from Mexico suggests the Trade Balance expanded more than expected, while inflation data in the United States (US) was softer. That has increased the odds of a rate cut by the US Federal Reserve (Fed), keeping the Greenback (USD) pressured as the interest rate differential would likely support the emerging market currency. The USD/MXN trades at 17.17, down 0.15% on the day.

The National Statistics Agency (INEGI) in Mexico revealed the country posted a surplus in December. That data and strong labor market data revealed on Thursday portray the economy's strength bolstered by the prospects of nearshoring.

In the meantime, the Fed’s preferred gauge for inflation, the Personal Consumption Expenditures (PCE) Price Index, was unchanged, though the core annualized figure dipped below the 3% threshold, a sign that the restrictiveness of policy is driving prices down. That said, investors seem convinced that the Fed will cut rates in May by 25 basis points (bps), according to the CME FedWatch Tool.

Daily Digest Market Movers: Mexican Peso continues to recover and trim weekly losses

- Mexico’s Trade Balance clocked a surplus in December of $4.242 billion, exceeding the previous reading and forecasts of $1.4 billion.

- During the last week, economic data from Mexico witnessed mixed readings in the mid-month inflation report, with headlines exceeding forecasts and the core Consumer Price Index (CPI) slipping below the 5% threshold. That could prevent the Bank of Mexico (Banxico) from cutting rates in the first quarter of 2024, even though two of its members expressed interest in December.

- Mexico’s Economic Activity shrank in November, while annual figures slid from 4.2% to 2.3%, less than forecast.

- The labor market in Mexico remains strong as the Unemployment Rate dropped from 2.7% to 2.6%.

- The economy in Mexico is beginning to show the impact of high rates set by Banxico at 11.25%, even though most analysts estimate the economy will grow above 2% in 2024. Nevertheless, retail sales missing estimates, the economy growing below 3% in November and inflation reaccelerating puts a stagflationary scenario in play.

- On January 5, a Reuters poll suggested the Mexican Peso could weaken 5.4% to 18.00 per US Dollar in the 12 months following December.

- Across the border, on Friday, the US PCE rose 2.6% in the 12 months to December, unchanged and as expected, while core PCE dipped from 3.2% to 2.9% and below forecasts.

- Latest data in the United States (US) suggests the economy remains robust and resilient after growing 3.3% in Q4 of 2023, exceeding estimates of 2%, while expanding 2.5% for the full year.

- Nevertheless, mixed readings in other data suggest that risks have become more balanced. That is reflected by investors speculating that the Fed will cut rates by 139 basis points during 2024, according to the Chicago Board of Trade (CBOT) data.

- The US Department of Commerce announced that Durable Goods Orders in December remained stagnant, recording a 0% change. This is a notable decrease from the 5.5% increase seen in November, primarily due to a downturn in transportation equipment manufacturing.

- The US Bureau of Labor Statistics disclosed that Initial Jobless Claims for the week ending January 20 increased to 214K, exceeding both the figures from the previous week and the anticipated 200K.

Technical Analysis: Mexican Peso gains traction as USD/MXN slumps below 17.15

The USD/MXN has accelerated to the downside after printing losses for three straight days, but it continues to exchange hands above strong support from the 50-day Simple Moving Average (SMA) at 17.13. A breach of the latter will expose the January 22 low, followed by the 17.00 psychological figure.

On the flip side, if buyers reclaim the next resistance level at the 200-day SMA at 17.34, that could open the door to challenge the 100-day SMA at 17.41. Further upside is seen above the psychological 17.50 figure, ahead of rallying to the May 23 high from last year at 17.99.

USD/MXN Price Action – Daily Chart

Mexican Peso FAQs

What key factors drive the Mexican Peso?

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

How do decisions of the Banxico impact the Mexican Peso?

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

How does economic data influence the value of the Mexican Peso?

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

How does broader risk sentiment impact the Mexican Peso?

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

- Canadian Dollar finds some room against the USD post-PCE print.

- Canada absent from the economic calendar until next Wednesday.

- Market focus to pivot toward upcoming Fed rate call.

The Canadian Dollar (CAD) found some space on Friday, bolstered by climbing Crude Oil markets and clawing back some of the week’s losses. The US Dollar Index (DXY) broadly fell early Friday ahead of US Personal Consumption Expenditure (PCE) figures, and the DXY saw a choppy recovery after the annualized Core PCE Price Index slid more than expected.

Canada is absent on the economic calendar until next Wednesday’s Canadian Gross Domestic Product (GDP) print, but effects are likely to be muted with broader markets focused on next week’s US Federal Reserve rate call and monetary policy statement.

Daily digest market movers: Canadian Dollar pares some of the week’s losses on Friday

- US Core PCE inflation printed at 2.9% YoY on Friday versus 3.0% forecast, 3.2% previously.

- Despite easing in Fed’s preferred inflation metric, US Personal Spending rose 0.7% MoM compared to the 0.4% forecast and 0.4% previous (revised up from 0.2%).

- US Pending Home Sales also rose 8.3% in December, well above the 1.5% forecast and the previous month’s -0.3% (revised down from 0.0%).

- US inflation continues to ease, but stubbornly robust consumption continues to weigh on rate cut hopes.

- Swap market bets of a Fed rate cut in March declined to 46% post-PCE release, falling back below 50%.

- According to the CME’s FedWatch Tool, markets are now pricing in May for the first rate cut.

- Next week’s Canadian MoM GDP for November expected to improve to 0.1% from 0.0%.

- Canada GDP to be engulfed by Fed rate call and Federal Open Market Committee (FOMC) press conference.

- Crude Oil markets saw new eight-week highs as supply concerns weigh on energy investors, West Texas Intermediate (WTI) US Crude Oil tests $77.00 per barrel on Friday.

Canadian Dollar price today

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the strongest against the Japanese Yen.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.15% | -0.05% | -0.16% | -0.01% | 0.14% | 0.13% | -0.41% | |

| EUR | 0.14% | 0.09% | 0.00% | 0.14% | 0.32% | 0.27% | -0.26% | |

| GBP | 0.06% | -0.09% | -0.10% | 0.04% | 0.23% | 0.21% | -0.34% | |

| CAD | 0.14% | 0.01% | 0.09% | 0.12% | 0.30% | 0.28% | -0.25% | |

| AUD | 0.01% | -0.15% | -0.06% | -0.15% | 0.16% | 0.14% | -0.40% | |

| JPY | -0.16% | -0.32% | -0.21% | -0.31% | -0.18% | -0.04% | -0.56% | |

| NZD | -0.11% | -0.28% | -0.17% | -0.29% | -0.13% | 0.03% | -0.53% | |

| CHF | 0.41% | 0.26% | 0.36% | 0.27% | 0.39% | 0.55% | 0.55% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Technical Analysis: Canadian Dollar in the green for Friday but still soft on the week

The Canadian Dollar (CAD) found some room heading into the closing bell, gaining a third of a percent against the Japanese Yen (JPY) and around a quarter of a percent against the New Zealand Dollar (NZD). The CAD is flat on the day against the Euro (EUR) and shed a quarter of a percent against the rebounding Swiss Franc (CHF).

The Canadian Dollar pushed back against the US Dollar on Friday as USD/CAD fell to an intraday low of 1.3414, but a broad-market Greenback recovery pulled the pair back into the 1.3450 region.

The USD/CAD’s near-term decline from the week’s peak near 1.3530 saw the pair slide around 0.9% peak-to-trough, and the pair is now recovering toward the 200-hour Simple Moving Average (SMA) near 1.3480. On the top end, an intraday technical resistance zone is priced in around 1.3490.

A halting Friday decline leaves USD/CAD at risk of slumping back into a near-term congestion zone as the 50-day and 200-day SMAs consolidate into a technical swamp near the 1.3500 term.

USD/CAD Hourly Chart

USD/CAD Daily Chart

Canadian Dollar FAQs

What key factors drive the Canadian Dollar?

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

How do the decisions of the Bank of Canada impact the Canadian Dollar?

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

How does the price of Oil impact the Canadian Dollar?

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

How does inflation data impact the value of the Canadian Dollar?

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

How does economic data influence the value of the Canadian Dollar?

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

- EUR/GBP gained momentum and rose to 0.8540.

- The cross will tally a 0.40% weekly loss, and the daily chart shows that the bears are in command.

- In the four-hour chart indicators gained momentum.

During Friday's trading session, the EUR/GBP rose slightly to 0.8540 showing mild gains. That being said, the bears asserted their influence during the week, leading to a weekly loss of 0.40% pushing the cross down to its lowest point since September.

In that sense, the main factor that is benefiting the Pound over the Euro is that the British economy is holding resilient while the European economies are showing signs of weakness. Moreover, markets are expecting less easing from the Bank of England (BoE) with a total of 125 bps of cuts vs the expected 150 bps from its European peer which also benefits the GBP. This week the ECB met and left its policy unchanged with subtle indications on when the easing will begin, and as for now, markets are seeing the first cut somewhere in Q2.

EUR/GBP daily chart

From a technical outlook on the daily chart, evidence of strong bearish pressure resonates. This is reflected by the negative terrain of the Relative Strength Index (RSI) coupled with its downward slope. Complementing this bearish bias are the increasing red bars of the Moving Average Convergence Divergence (MACD), indicating the potential for further downturns. Moreover, the cross remains entrenched below the 20, 100, and 200-day Simple Moving Averages (SMAs).

Switching to a shorter, four-hour timeframe, a different scenario appears to be forming as indicators seem to be entering in a consolidation phase. The four-hour RSI indicates a positive slope, albeit still within negative territory, signaling a weak recovery moment. Additionally, the decreasing red bars in the four-hour MACD offer a hint of bullish momentum, but without a clear vindication of a reversal. Thus, the buying momentum is seen to have a slight upper hand in this lower time frame, but with a need for further corroboration to offset the broader bearish outlook.

EUR/GBP daily chart

-638418831190119196.png)

Gold prices are near all-time highs. Strategists at TD Securities analyze the yellow metal’s outlook.

Balance of risks in Gold prices tilted to the upside

While US data remains strong, the Fed can use the trends in core PCE to justify the start of rate cuts. The Fed wants to engineer a soft landing, which allows it to emphasize disinflation over growth.

A cutting cycle should eventually attract discretionary trader capital, which should support Gold towards new all-time highs.

CTA trend followers still hold substantial dry-powder to deploy, physical market buying activity has remained strong, and China is buying gold at a fast clip – all of which tilt the balance of risks in Gold prices to the upside, hot data notwithstanding.

Donald Trump has at least a good chance of a second term in office. Forward-looking politics should prepare for this, strategists at Commerzbank report.

It cannot be said that there would be a U-turn in US policy under Trump

Under President Trump, the Americans are unlikely to continue to support Ukraine to the current extent. The Europeans will therefore have to shoulder a greater burden. This also applies to defense spending as a whole. The US position here is likely to be that it is primarily the responsibility of the European NATO members to invest sufficiently in protection against Russia. The pressure to raise defense budgets will continue to increase. So far, many countries have struggled to even reach NATO's 2% target.

Donald Trump's preference for a robust foreign trade policy based on tariffs, among other things, could lead to a resurgence of trade disputes between the US and the EU.

However, it cannot be said that there would be a U-turn in US policy under Trump. Rather, he would probably only accelerate trends that are already in place; a certain move away from Europe and an increased US focus on the Asian region is to be expected with any future administration. The same applies to the push for more protectionism. This enjoys broad bipartisan support. However, President Trump would probably ensure that Europeans can no longer turn a blind eye to these developments.

Last year ended on a strong note for the Swedish Krona (SEK). Economists at Danske Bank analyze EUR/SEK outlook.

Global macro cycle does not bode well for the SEK in 2024

The cyclical backdrop remains a headwind for the SEK amid subpar and even recession-like European growth outlook.

The Riksbank will not lag the ECB in the easing cycle, which leaves the SEK in a vulnerable position. Repricing of central banks may hurt risk sentiment.

The structural flows picture is still a medium-term headwind for the SEK.

Should the global economy pick up more than expected in 2024, this could lend support to the SEK over the medium term.

Forecast 11.20 (1M), 11.40 (3M), 11.60 (6M), 11.60 (12M)

The consensus view in 2024 is that the Dollar will decline. Economists at ING agree but with some caveats.

Back up in short-term rates is a Dollar positive

We sympathise with the increasing consensus view that the Dollar will trend lower in 2024. However, we think markets are wrong to price Fed rate cuts as soon as March, and a rebound in short-dated USD yields could give the Dollar breathing room in the near term.

The kind of rangebound trading seen so far in January may be the norm for a bit longer in G10.

- EUR/USD rises in North American trading, buoyed by softer US core PCE inflation data.

- Fed's core PCE index fall to 2.9% raises hopes for interest rate cut, aiding EUR/USD's climb.

- Mixed European signals: German consumer confidence falls, Spanish unemployment at 16-year low, ahead of Fed decision.

The EUR/USD gained some 0.14% in early trading during the North American session as prices in the United States (US) remained above the US Federal Reserve’s goal but eased compared to November’s figures. The major trades at 1.0866 after diving to a low of 1.0812.

The Euro got a life-line of a softer US PCE report

The Fed’s preferred gauge for inflation, the Personal Consumption Expenditures (PCE), rose 2.6% in the 12 months to December, as expected on an annual basis, while core PCE dipped from 3.2% to 2.9% and below forecasts. After the data, the EUR/USD climbed sharply and clocked a daily high of 1.0885 before retreating toward current exchange rates, as the data reaffirmed investors' speculations that the Fed could begin cutting rates by the summer.

The CME FedWatch Tool depicts the odds for a quarter of a percentage rate cut by the Fed at 51.4%, while 50 basis points stand at 37.8%. Nevertheless, US Treasury bond yields reversed its course, climbing higher and putting a lid on the EUR/USD rise.

Meanwhile, data across the pond showed that German consumers remain pessimistic amidst economic uncertainty after the GfK Consumer Confidence for February plunged from .25.4 in January to -29.7. In Spain, the Unemployment Rate fell to levels last seen in 2007, from 11.84% to 11.76% in the last quarter of 2023, according to an INE report.

Ahead of the next week, the main spotlight would be the Federal Reserve’s monetary policy decision on January 30-31.

EUR/USD Price Analysis: Technical outlook

Following the US data release, the EUR/USD advanced towards 1.0900 but failed to break yesterday’s high, which could pave the way for a pullback to the 200-day moving average (DMA) at 1.0843. Downside risks are seen at today’s low 1.0812, followed by the 1.0800 figure. Conversely, if buyers lift the spot prices above 1.0900, as they eye the 50-DMA at 1.0920.

After ending 2023 on a weak note on the anticipation of a H1 2024 pivot by the Fed, the USD is back on an uptrend. Economists at the National Bank of Canada analyze Dollar’s outlook.

Growth in the US to stumble in 2024

Going forward, there are some signs that rate cuts by the Fed may not be the first to occur among the world’s central banks as inflation surprises on the upside.

We expect growth in the US to stumble in 2024.

We believe the Dollar should appreciate this year as risk returns to the forefront.

Financial markets have started 2024 with a rebound in interest rates as central banks have pushed back against expectations of near-term rate cuts. Economists at Nordea keep their baseline forecasts largely unchanged but see risks towards earlier ECB and later Fed cuts.

Is the Fed close to cutting or not?

We leave our baseline financial forecasts largely unchanged at this time as we find that the recent developments do not justify any bigger changes.

We continue to forecast 100 bps of Fed cuts this year, with the first move in March, but this is more due to the Fed’s dovish signals at the December meeting rather than how we see the US economy developing. Risks are tilted towards a later start and fewer cuts.

The ECB has argued almost in unison that no near-term rate cuts should be expected. We still see the first move in June, 25 bps, and quarterly 25 bps cuts from there onwards, but risks are towards an earlier start and steeper cuts.

What ultimately matters more for the Gold market is when and how much the US Fed cuts interest rates, strategists at Commerzbank say.

Fed unlikely to fuel hopes of rapid interest rate cuts

Institutional investors tended to sell Gold last year as the large ETF outflows indicate: According to the World Gold Council (WGC), a good 55 tons were sold off in the final quarter of the year; the total outflow is likely to have been just under 245 tons last year. This trend, which tends to weigh on prices, has continued into the new year. However, we assume that sentiment will turn as the year continues and that this group of investors will increase their positions again as soon as interest rate cuts are within reach.

However, the Fed is unlikely to hint at this after its meeting next week: after all, it wants to see more success in the fight against inflation first. If the labour market report on Friday provides further evidence of this, the Gold price could rise again somewhat at the end of the week.

The GBP/USD pair rebounds within the broader trading range. Economists at Scotiabank analyze cable’s outlook.

Intraday price action looks bullish but momentum remains soft

The Pound Sterling (GBP) is up mildly on the day, having found firm support on intraday weakness below the 1.2700 level.

Intraday price action looks bullish (outside range on the 6-hour chart) but momentum remains soft and the GBP rally may struggle to extend gains through the upper 1.2700s/low 1.2800s on the session.

The broader 1.2600/1.2825 range remains intact.

- AUD/USD bounces back to near 0.6600 on improved market sentiment.

- Investors await the US core PCE data for fresh guidance on interest rates.

- Australian inflation is anticipated to soften to 4.3% in the last quarter of 2023.

The AUD/USD pair rebounds to near the round-level resistance of 0.6600 in the late London session. The Aussie asset recovers as appeal for risk-perceived currencies ahead of the United States Core Personal Consumption Expenditure (PCE) Price Index data for December, which will be released at 13:30 GMT.

S&P500 futures have recovered majority of losses generated in the Asian session, portraying a sharp revival in the risk-appetite of investors. The US Dollar Index (DXY) has fallen to near 103.38 after failing to recapture the monthly high of 103.82. 10-year US Treasury yields have dropped to near 4.11%.

Market sentiment is improving despite investors see the Federal reserve (Fed) reducing interest rates from May instead of March amid resilient US economy. The US economy grew at a robust pace of 3.3% in the last quarter of 2023, which itself is encouraging for growth prospects in 2024. This will allow Fed policymakers to avoid rush for commencing the ‘rate-cut’ campaign.

Meanwhile, investors await fresh guidance for the interest rate outlook, which would be offered by the US core PCE price index data. As per the estimates, monthly core PCE was up by 0.2% against slight increase of 0.1% in November. The annual inflation gauge rose at a slower pace of 3% vs. former growth rate of 3.2%.

On the Australian Dollar front, investors await the Q4 Consumer Price Index (CPI) data, which will release next week. Price pressures are anticipated to soften significantly to 4.3% from 5.4% reading in the July-September quarter, which will provide some relief to Reserve Bank of Australia (RBA) policymakers.

Economists at Scotiabank analyze Dollar’s outlook as USD edges lower as markets position ahead of core PCE data.

USD is looking prone to more losses

The USD is looking prone to more losses in broad terms with the DXY again struggling to extend much above the 103.50 area – the point I highlighted at the start of the week that the index would need to extend through to rally.

US Personal Income is forecast to rise 0.3% in December, with Spending up 0.5% in the month. The core PCE deflator is expected to drop back to 3.0% YoY, from 3.2% in November, however.

Signs of slower inflation will add to market bets that the Fed will be thinking a bit harder about rate cuts in the coming months. Soft data may see the USD slip a little but I’m not yet inclined to rule out a further extension of the USD’s early 2024 rebound.

DXY support is 102.75.

- The US Dollar has struck a double-whammy with positive US data and a disappointing ECB on Thursday.

- Traders brace for the Fed’s preferred inflation gauge – the Personal Consumption Expenditures.

- The US Dollar Index breaks out of a range and could finally be able to trade away from it.

The US Dollar (USD) pops against most major peers painting charts green this Friday in the aftermath of the US tripod print of US Gross Domestic Product - Durable Goods - Jobless Claims on Thursday. At that same time the European Central Bank (ECB) disappointed the market by not sticking out its neck and providing forward guidance to the markets on rate cuts. Traders were quick to punish the Euro and favor the Greenback on the back of these events.

On the economic front, traders are gearing up for the US Federal Reserve’s (Fed) preferred Personal Consumption Expenditures (PCE) release. Expectations are for a small uptick in all elements on the monthly base, while the yearly bases are expected to come down. Any decline in these numbers will be attributed to US Dollar weakness in the pipeline.

Daily digest market movers: Fed’s barometer set to hit markets

- Sweden is set to join NATO once Hungary ratifies the agreement in parliament after Turkey already did earlier this week.

- US Treasury Secretary Janet Yellen said during an interview with ABC that she sees “no reason” for a recession this year.

- The European Central Bank will release its official rate decision and guiding letter around 13:15 GMT. A press release with Q&A by Christina Lagarde will follow suit near 14:45.

- The Personal Consumption Expenditures (PCE) data for December is due to be released at 13:30 GMT:

- Monthly Headline PCE is expected to jump from -0.1% to 0.2%.

- Yearly Headline PCE is seen heading from 2.6% to an unchanged 2.6%.

- Monthly Core PCE is heading from 0.1% to 0.2%.

- Yearly Core PCE should shrink from 3.2% to 3.0%.

- Personal Income is seen heading from 0.4% to 0.3%.

- Personal Spending will head from 0.2% to 0.4%.

- Last data point for this Friday comes near 15:00 with Pending Home Sales, expected to head from 0% to 1.5% for December versus November.

- Equity markets are in the red this last day of the week with in Asia all indices down over 1% for Japan and China. Mainland Europe is taking over the sour mood and is trading down near 0.50% halfway through the European session. US Futures are in a similar decline with the Nasdaq leading the charge with Tesla and Intel dragging down the index.

- The CME Group’s FedWatch Tool shows that markets are pricing in a 97.4% possibility for an unchanged rate decision on January 31, with a slim 2.6% chance of a cut.

- The benchmark 10-year US Treasury Note trades near 4.10%, which is a touch lower than where it was earlier this week.

US Dollar Index Technical Analysis: Is this the one or another false break?

The US Dollar Index (DXY) is having a copy-paste moment from earlier this week of last week’s performance. Again the DXY is able to snap above the 200-day Simple Moving Average (SMA) near 103.51, though could face headwinds from the PCE print later this Friday. If the DXY is unable to close off this Friday or this week for that matter, above the 200-day SMA, expect to see another downfall with a test at 103 for a break lower.

In case the DXY would be able to run further away from the 200-day SMA, more upside is in the tank. Look for 104.41 as the first resistance level on the upside, in the form of the 100-day SMA. If that gets breached as well, nothing will hold the DXY from heading to either 105.88 or 107.20 – the high of September.

With the repetition of another break above the 200-day SMA, yet again, a bull trap could get formed once prices would start sliding below the same moving average. This would see a long squeeze with US Dollar bulls being forced to start selling around 103.14 at the 55-day SMA. Once below it, the downturn is open towards 102.00.

Inflation FAQs

What is inflation?

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

What is the Consumer Price Index (CPI)?

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

What is the impact of inflation on foreign exchange?

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attract more global capital inflows from investors looking for a lucrative place to park their money.

How does inflation influence the price of Gold?

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it.

Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.

Can China’s stock market rescue package support the Australian Dollar (AUD)? Economists at Société Générale analyze Aussie’s outlook.

Chinese stocks to the AUD’s rescue?

The AUD tracked Chinese equities over the past few years until a major break in 4Q23. As US rates eventually peaked and started to decline, the US Dollar fell in a pro-carry environment that benefited AUD/USD despite the slide in Asian stocks. However, 2024 looks more challenging, with AUD/USD declining in line with falling equities.

The Chinese authorities have just delivered a major rescue package to the stock market. If it succeeds in restoring investors’ confidence, Chinese stocks could eventually rescue the Australian Dollar.

- EUR/USD gains ground as ECB members doubted the interest rate cut in March.

- ECB’s Gediminas Simkus expressed confidence that the data would not support a rate cut in March.

- ECB’s Martins Kazaks showed confidence in monetary policy but advocated for patience for the time being.

- Traders are poised to focus on the US PCE Price Index before making aggressive bets on the US Dollar.

EUR/USD moves higher to near 1.0870 during the European session on Friday. This upward movement could be attributed to the relatively hawkish comments from European Central Bank (ECB) members. ECB policymaker Gediminas Simkus expressed confidence that the data would not support a rate cut in March. Simkus stated that rate cuts are more likely as the year progresses, and there is less optimism within the ECB compared to market expectations at the moment.

Another ECB member, Martins Kazaks, conveyed confidence in monetary policy but advocated for patience for the time being. Kazaks mentioned that while interest rates should eventually start to decrease, the ECB is not in a rush to begin the process. He emphasized that cutting rates too early would be worse than waiting a bit longer.

However, the Euro encountered a challenge following the release of the European Central Bank (ECB) interest rate decision on Thursday. The ECB opted to keep its interest rates unchanged for a third consecutive meeting, resulting in downward pressure on the Euro (EUR). This, in turn, has had a dampening effect on the EUR/USD pair. The ECB maintained its Main Refinancing Operations Rate at 4.50%, and the Deposit Facility Rate at 4.0%.

On the flip side, the stronger-than-expected Gross Domestic Product (GDP) Annualized figure from the United States has provided support for the US Dollar (USD), reinforcing the downward pressure on the EUR/USD pair. Market participants will closely monitor the release of the Personal Consumption Expenditures (PCE) Price Index data on Friday for additional insights into US economic conditions.

EUR/USD recovers from the low 1.0800s. Economists at Scotiabank analyze the pair’s outlook.

ECB hawks downplay early rate cut

Pushback on the idea of earlier cuts from some European Central Bank (ECB) hawks today may have helped lift the EUR.

The EUR’s retest of the past week’s range extended a little below the 1.0820 base seen earlier this week but not by much and the positive price reaction since the dip to 1.0813 earlier suggests that the sideways range trade remains intact.

Resistance is 1.0920/1.0930.

EUR/USD moved lower to around the 1.0850 mark after the relatively dovish ECB meeting. Economists at Danskr Bank analyze the pair's outlook.

Selling EUR/USD on rallies in the near term

While we recognise that our Fed (first cut in March) and ECB (first cut in June) forecasts, all else equal, are positive for EUR/USD in H1, we believe that the broader pricing in the G10 could be more decisive for the cross, as we perceive current market expectations for rate cuts to be excessive.

We still maintain our bias towards selling EUR/USD on rallies in the near term, and we forecast EUR/USD at 1.0700/1.0500 on a 6/12M horizon.

- EUR/JPY snaps its losing streak after the Japanese CPI data.

- The annual Tokyo CPI fell below the BoJ 2.0% target for the first time in nearly two years.

- The Euro received losses as ECB’s Lagarde mentioned the possibility of a rate cut in the summer.

EUR/JPY snaps its four-day losing streak, rebounding to near 160.60 during the European session on Friday. The decelerated Japanese inflation numbers have weakened the Japanese Yen (JPY), which in turn, acts as a tailwind for the EUR/JPY cross.

The annual Tokyo Consumer Price Index (CPI) in Japan's national capital decelerated to 1.6% in January from the previous reading of 2.4%. Consumer inflation has fallen below the Bank of Japan's (BoJ) 2.0% target for the first time in nearly two years. Moreover, Core CPI (YoY) decreased to 3.1% from 3.5% prior.

According to the Bank of Japan (BoJ) Minutes of the December meeting, BoJ Board members expressed their views on the monetary policy outlook and Yield Curve Control (YCC). The consensus among members was the need to "patiently maintain an easy policy." Many members emphasized the importance of confirming a positive wage inflation cycle before considering an end to negative rates and YCC.

Furthermore, BoJ Governor Kazuo Ueda reiterated a strong commitment to achieving the 2.0% inflation target. Ueda's statements indicated a potential gradual reduction of extensive stimulus measures in the future, aligning with the central bank's goals for inflation and economic stability.

On the other side, the European Central Bank (ECB) decided to keep its interest rates unchanged for a third consecutive meeting, contributing to downward pressure on the Euro (EUR). This, in turn, has weighed on the EUR/JPY cross. The ECB maintained its Main Refinancing Operations Rate at 4.50%, and the Deposit Facility Rate at 4.0%.

ECB President Christine Lagarde hinted at the possibility of a rate cut in the summer in the monetary policy statement. Market participants are anticipating a first 50 basis point cut from the ECB by June. Rate swaps currently reflect expectations of a total of 140 basis points in rate cuts from the ECB by the end of 2024.

- WTI Oil breaks out of its downtrend since October.

- China diplomats have urged Iran to keep control of Houthi rebels.

- The US Dollar Index broke out of tight range and holds good cards to jump higher.

Oil prices are paring back earlier gains after Oil prices surged near 6% since its opening price on Monday for this week. The moves came after more and more shipping companies called for the longer haul around Africa instead of venturing the Suez passage via the Red Sea. Meanwhile China has opened up a fresh can of diplomats who have urged several key Iran personal and key military people to keep a lid on the Houthi rebels and defuse the tension in the Red Sea.

Meanwhile, the US Dollar Index (DXY) defied friend, foe and gravity with a substantial surge in the DXY on Thursday. The move came on the back of a double-score with positive US Gross Domestic Product and Durable Goods orders. Some headwinds are emerging though with the Personal Consumption Expenditure (PCE) on the docket this Friday, and markets looking for a further decline in US inflation.

Crude Oil (WTI) trades at $76.70 per barrel, and Brent Oil trades at $81.45 per barrel at the time of writing.

Oil news and market movers: China puts oil back on the map

China has urged Iran to control the Houthi rebels in order to put back a safe passage via the Suez Canal and the Red Sea in place. The move comes as no surprise with China having export issues, and now the longer haul around Africa adds to even more slowing export numbers from the Asian producer.

Oil traders are gearing up for more upticks in Oil as well, signalling that clearly something has broken in US Oil production. Recent Oil stockpile numbers showed substantial drawdowns, which means the US might need to be heading to markets to restock.

Next week all eyes will be on tanker-tracking data to be released, which will provide an insight into whether OPEC+ is complying with Oil production cuts.

This Friday the Oil markets will close off with the weekly Baker Hughes US Oil Rig Count at 18:00 GMT. Previous number was at 497, which was a second consecutive decline from the 501 peak at the start of 2024.

Oil Technical Analysis: A sprint to $80 granted?

Oil prices could be seen surging higher from here after markets jumped on the element of China mingling in the Red Sea tension. Either way, the three-week-long-haul around Africa will see more demand coming in for fuel to say the least. Meanwhile next week, tanker info being released, could give a brief snapshot of how the supply side is looking, where any hints on complying or over complying to OPEC+ production cuts, might add to more upside into next week.

On the upside, $74 is out of the way and should act as support as of now. Although quite far off, $80 comes into the picture should tensions build further. Once $80 is broken, $84 is next on the topside.

As said in the paragraph above, $74 will now act as support for the nearterm on any sudden declines. The $67 level could still come into play as the next support to trade at, as it aligns with a triple bottom from June. Should that triple bottom break, a new low could be close at $64.35 – the low of May and March 2023 – as the last line of defence.

-638418611868677184.png)

US WTI Crude Oil: Daily Chart

WTI Oil FAQs

What is WTI Oil?

WTI Oil is a type of Crude Oil sold on international markets. The WTI stands for West Texas Intermediate, one of three major types including Brent and Dubai Crude. WTI is also referred to as “light” and “sweet” because of its relatively low gravity and sulfur content respectively. It is considered a high quality Oil that is easily refined. It is sourced in the United States and distributed via the Cushing hub, which is considered “The Pipeline Crossroads of the World”. It is a benchmark for the Oil market and WTI price is frequently quoted in the media.

What factors drive the price of WTI Oil?

Like all assets, supply and demand are the key drivers of WTI Oil price. As such, global growth can be a driver of increased demand and vice versa for weak global growth. Political instability, wars, and sanctions can disrupt supply and impact prices. The decisions of OPEC, a group of major Oil-producing countries, is another key driver of price. The value of the US Dollar influences the price of WTI Crude Oil, since Oil is predominantly traded in US Dollars, thus a weaker US Dollar can make Oil more affordable and vice versa.

How does inventory data impact the price of WTI Oil

The weekly Oil inventory reports published by the American Petroleum Institute (API) and the Energy Information Agency (EIA) impact the price of WTI Oil. Changes in inventories reflect fluctuating supply and demand. If the data shows a drop in inventories it can indicate increased demand, pushing up Oil price. Higher inventories can reflect increased supply, pushing down prices. API’s report is published every Tuesday and EIA’s the day after. Their results are usually similar, falling within 1% of each other 75% of the time. The EIA data is considered more reliable, since it is a government agency.

How does OPEC influence the price of WTI Oil?