- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 26-01-2022

- USD/CAD pares Fed-led gains around weekly high, down for the second day in a week.

- Fed, BOC matched market forecasts whereas Powell, Macklem sound cautiously optimistic.

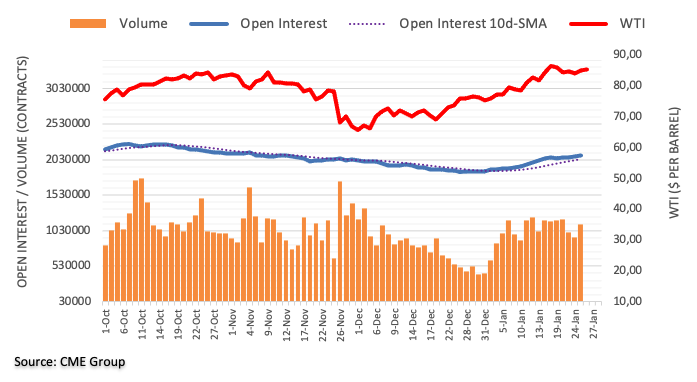

- WTI crude oil prices stay firmer around the highest levels since October 2014.

- US Q4 GDP, Durable Goods Orders will be crucial for near-term direction.

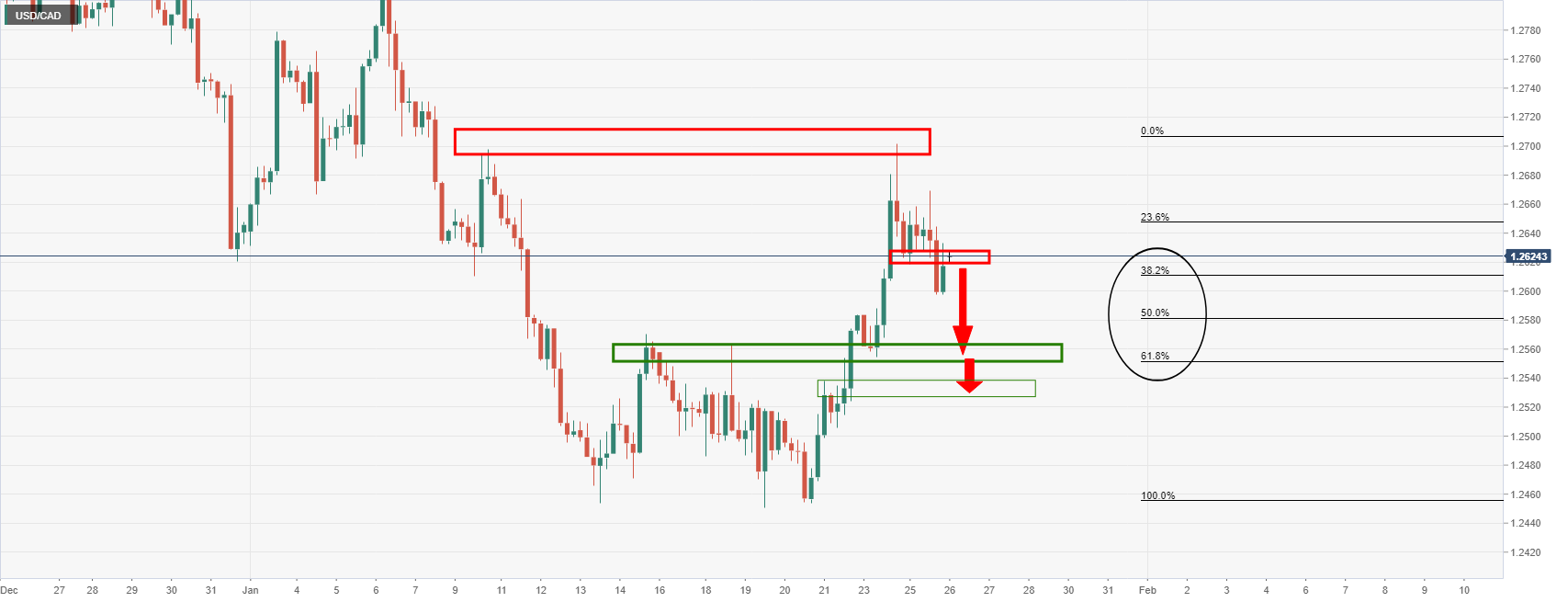

USD/CAD consolidates the previous day’s gains around 1.2660, down 0.11% intraday amid Thursday’s Asian session.

The Loonie pair failed to praise the Bank of Canada’s (BOC) hawkish verdict on Wednesday as the US Federal Reserve (Fed) matched the market’s upbeat expectations. However, strong prices of Canada’s main export item WTI crude oil allow the quote to retreat from a multi-day high.

That said, the US Federal Reserve (Fed) kept benchmark interest rates and tapering targets intact during Wednesday’s Federal Open Market Committee (FOMC) meeting. However, the interesting part from the Monetary Policy Statement was, “The Committee expects it will soon be appropriate to raise the target range for the federal funds rate.”

Fed Chairman Jerome Powell also spoke in sync with the hawkish signals from the US central bank while saying, “There’s plenty of room to raise rates.” Though, his comments like, “The rate-hike path would depend on incoming data and noted that it is ‘impossible’ to predict,” seemed to have underpinned the USD/CAD pair’s latest pullback.

Read: Fed Quick Analysis: Three dovish moves boost stocks, why more could come, why the dollar could rise

Before that, the BOC held benchmark interest rate unchanged at 0.25% while saying, per Reuters, "The BoC repeated that it sees slack being absorbed sometime in the middle quarters of 2022." Following the monetary policy verdict, BOC Chairman Tiff Macklem said, “Interest rates will have to go up to counter inflation.”

Read: Breaking: Bank of Canada leaves policy settings unchanged in December as expected

It’s worth noting that the fears of supply outage due to the geopolitical risks emanating from Russia rejected the dovish EIA Crude Oil Stocks Change to keep WTI oil prices near the highest levels marked since October 2014, up 0.70% around $86.70 at the latest.

Amid these plays, equities and commodities remain on the back foot, except for oil, whereas the US 10-year Treasury yields rose the most in three weeks, up eight basis points (bps) to 1.87% by the end of Wednesday’s North American session.

Moving on, risk catalysts like Ukraine-Russia tussles and Sino-American tensions may play a notable role to direct short-term USD/CAD moves but major attention will be given to the first readings of the US Q4 GDP and Durable Goods Orders for December.

Read: US GDP Preview: Inflation component could steal the show, boost dollar, already buoyed by Russia

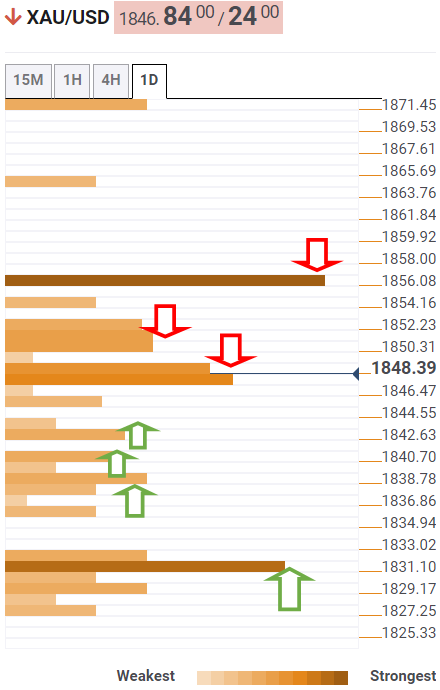

Technical analysis

USD/CAD keeps the five-week-old resistance breakout despite the recent pullback, which in turn keeps buyers hopeful to again challenge the 50-DMA level near 1.2710.

However, a downside break of the previous resistance around 1.2645 will need a clear break of the 100-DMA surrounding 1.2620 to convince USD/CAD bears.

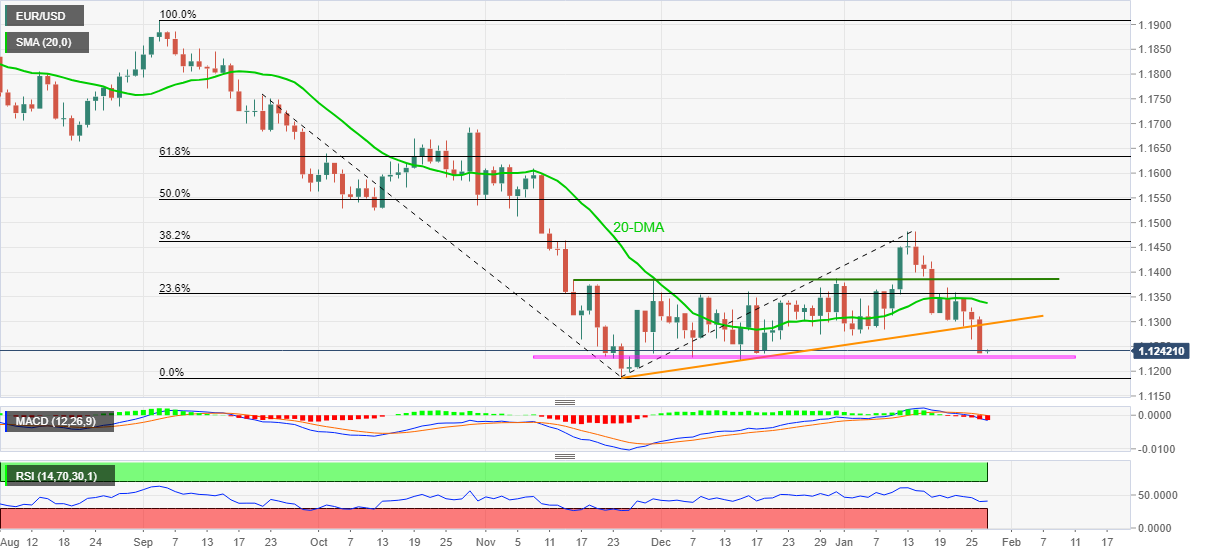

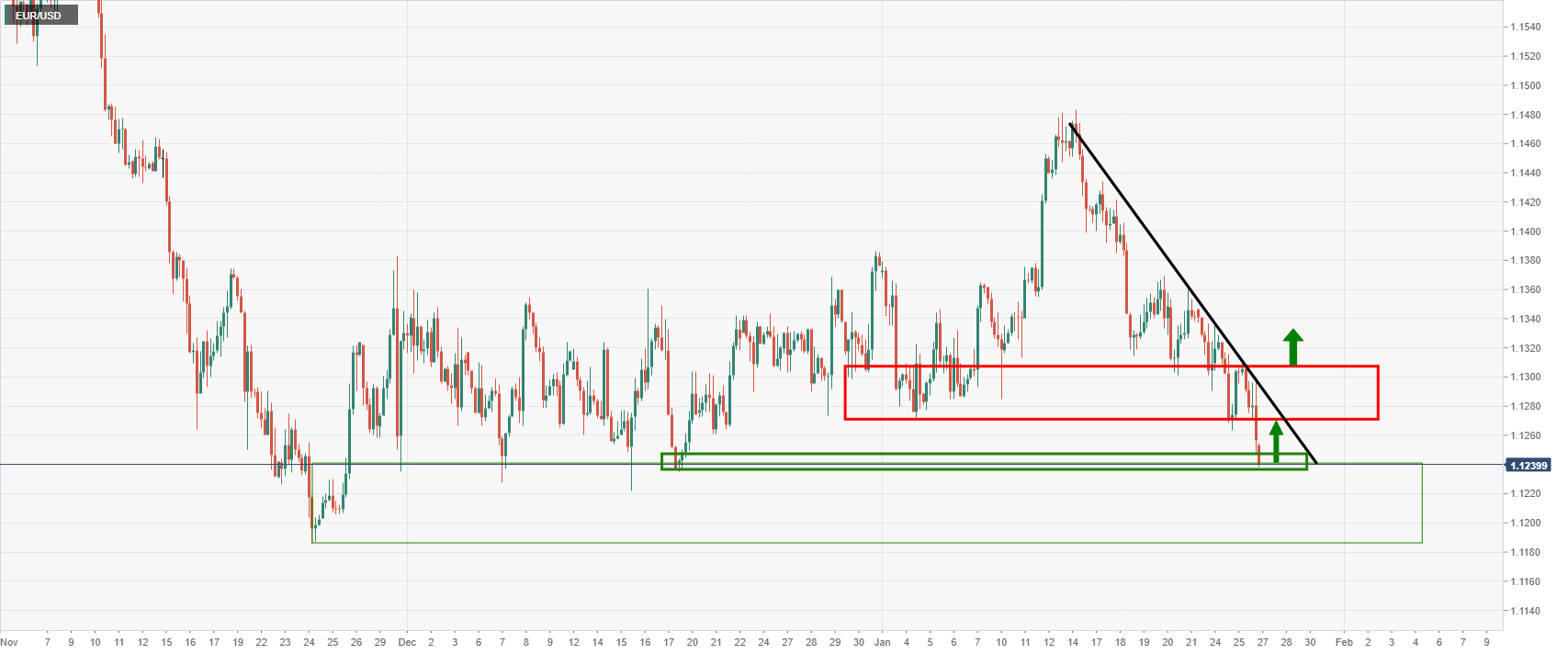

- EUR/USD holds lower ground after Fed directed bears to five-week low.

- Bearish MACD signals, clear downside break of two-month-old ascending trend line and sustained trading below 20-DMA favor bears.

- Buyers remain cautious until refreshing the 2022 peak, 61.8% FE will challenge bears past 1.1185.

EUR/USD stays pressured around a multi-day low near 1.1240 after the Fed showdown.

That said, the major currency pair dropped the most in over a week while breaking a two-week-old ascending trend line post-Fed, staying below the support-turned-resistance line of 1.1295 by the press time of the initial Asian session on Thursday.

In addition to the downside break of the previously important support line, bearish MACD signals and downbeat RSI line, not oversold, also favor EUR/USD bears to aim for the year 2021 bottom surrounding 1.1185.

However, a horizontal area comprising multiple lows marked since November, near 1.1230, tests the immediate downside of the pair.

It should be noted that the quote’s weakness past 1.1185 will be challenged by the RSI line, which is declining towards the oversold territory. Also likely to test the EUR/USD sellers is the 61.8% Fibonacci Expansion (FE) of the pair’s moves from late September 2021 to the January 2022 swing high, near 1.1120.

Alternatively, a corrective pullback may initially aim for the previous support line, near 1.1295, before directing EUR/USD bulls towards the 20-DMA level of 1.1340.

If the pair buyers manage to cross the 1.1340 mark, a horizontal resistance from November 16, near 1.1385-90, will probe the quote’s upside towards the monthly high, also the yearly peak, of 1.1482.

EUR/USD: Daily chart

Trend: Further weakness expected

Economics at the Bank of America (BofA) reiterated their bullish calls on the US dollar after witnessing the hawkish play of the US Federal Reserve (Fed).

BofA initially said, "Overall, the January FOMC meeting reinforces our view that the Fed will likely need to hike more than the market is currently pricing. This should push rates higher across the US rates curve & in a bear flattening bias."

The analytical piece adds that the USD strongly and broadly appreciated on the back of today's hawkish FOMC decision, with gains skewed somewhat toward lower beta FX - EUR, JPY and CHF.

“US dollar gains accelerated from an initially modest level post-statement release throughout Chair Powell's press conference,” per the US bank.

While concluding the findings, the investment bank said, “We remain bullish USD vs. low beta FX and would look to buy dips on a trend basis into rate liftoff as the market further prices in a more aggressive Fed and hence additional monetary policy divergence.”

Read: Fed Quick Analysis: Three dovish moves boost stocks, why more could come, why the dollar could rise

d to wait till this November before it responds to higher inflation with its first interest rate rise in over a decade,” per the latest Reuters poll.

Key quotes

The poll showed inflation would meet the RBA's target range of 2-3% from next quarter and through 2023 averaging at 2.5% this year and 2.3% in 2023, while the economy is forecast to grow 4.0% this year and 2.9% in 2023.

Economists canvassed in a Reuters Jan 18-25 poll also brought forward their rate hike expectations for third month in a row. Most of the 34 respondents, however, expect the RBA to take more time, with a median forecast for a 15 basis-point move in November.

Two economists expect a rate rise already in the second quarter, seven in the third quarter, 11 in the fourth quarter and 13 still see the central bank first pulling the trigger next year.

Economists were less divided on when the central bank will pull the plug on its bond-buying program, with 17 out 22 of those who answered the question expecting an announcement at the next policy meeting on Feb. 1.

Five others saw the central bank ending the program launched in response to the coronavirus pandemic in May.

The last time the central bank raised rates was more than a decade ago, in Nov. 2010, when it lifted rates to 4.75%.

An expected hike this November would be followed by a 25 basis point increase in the first quarter of next year and another 25 basis points in the June quarter, taking the cash rate back to 0.75% where it was before the pandemic.

FX implications

AUD/USD defended 0.7100 mark, around 0.7120 by the press time, following the hawkish survey results. However, Fed’s rate hike signals and cautiously optimistic Powell tames the Aussie bulls.

Read: AUD/USD defends 0.7100 after Fed showdown, focus shifts to US GDP

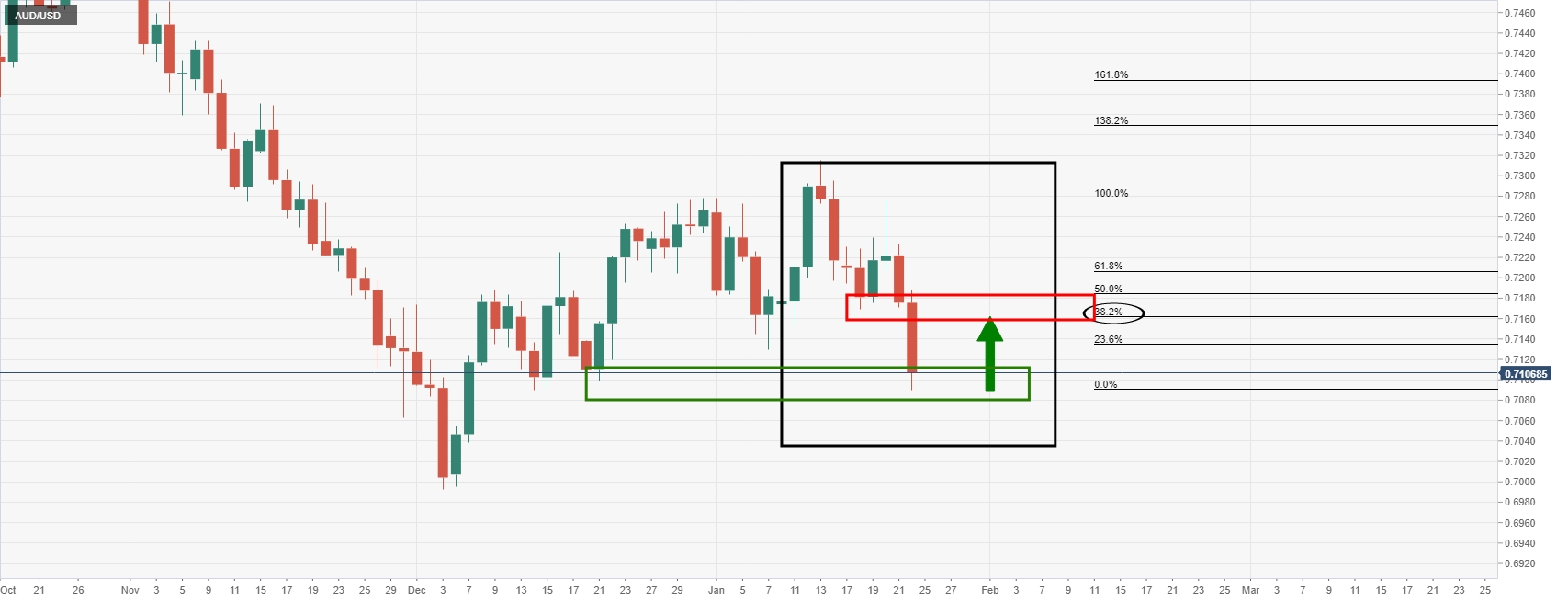

- AUD/USD licks Fed led wounds after declining the most in a week.

- Fed matched upbeat market expectations by signaling faster rate hikes, Powell sounds cautiously optimistic.

- Reuters’ poll suggests RBA will terminate bond-buying in February, lift the rates in November.

- Light calendar in Australia after a day off, US Durable Goods Orders, Advance Q4 GDP is crucial for near-term direction.

AUD/USD braces for the second consecutive weekly fall, despite bouncing off 0.7100, as Fed played by rules to match upbeat market expectations.

That said, the risk barometer pair dropped the most in a week by the end of Wednesday as Fed backed faster rate hikes and monetary policy normalization. However, the quote took a U-turn from 0.7095 to recall 0.7120 level on early Thursday morning in Asia.

The US Federal Reserve (Fed) kept benchmark interest rates and tapering targets intact during Wednesday’s Federal Open Market Committee (FOMC) meeting. However, the interesting part from the Monetary Policy Statement was, “The Committee expects it will soon be appropriate to raise the target range for the federal funds rate.”

Fed Chairman Jerome Powell also spoke in sync with the hawkish signals from the US central bank while saying, “There’s plenty of room to raise rates.” Though, his comments like, “The rate-hike path would depend on incoming data and noted that it is ‘impossible’ to predict,” seemed to have underpinned the AUD/USD rebound from 0.7095.

While following the Fed’s hawkish signals Fed and mostly upbeat comments from Powell, equities and commodities dropped whereas the US 10-year Treasury yields rose the most in three weeks, up eight basis points (bps) to 1.87% by the end of Wednesday’s North American session. The same mood propelled the US dollar.

It’s worth noting, however, that upbeat polls for the Reserve Bank of Australia (RBA), suggesting an end to the Quantitative Easing (QE) in February and wait for November for the rate lift-off, seems to have underpinned the AUD/USD rebound. The reason for the hawkish poll could be linked to the recent strong employment and inflation data from Australia.

“Economists canvassed in a Reuters Jan 18-25 poll also brought forward their rate hike expectations for the third month in a row. Most of the 34 respondents, however, expect the RBA to take more time, with a median forecast for a 15 basis-point move in November. Economists were less divided on when the central bank will pull the plug on its bond-buying program, with 17 out 22 of those who answered the question expecting an announcement at the next policy meeting on Feb. 1,” per Reuters.

That said, AUD/USD traders may now wait for more clues to extend the latest rebound from 0.7095. In doing so, the risk catalysts like Ukraine-Russia tussles and Sino-American tensions may play a notable role. However, more important will be today’s first readings of the US Q4 GDP and Durable Goods Orders for December.

Read: US GDP Preview: Inflation component could steal the show, boost dollar, already buoyed by Russia

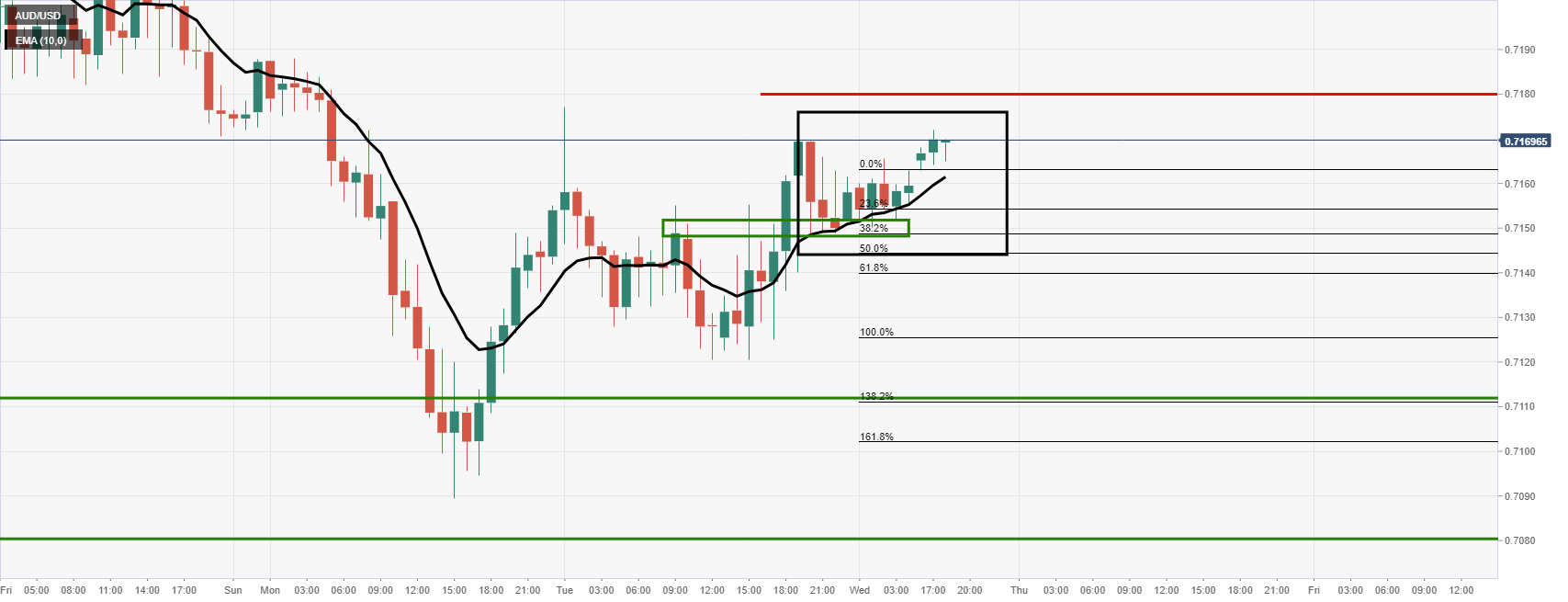

Technical analysis

Multiple lows marked since August 2021 restricts short-term AUD/USD declines around 0.7100. However, a sustained trading below the 50-DMA level near 0.7180 joins bearish MACD signals to keep sellers hopeful.

That said, the pair buyers remain worried until witnessing a clear break of the 100-DMA, around 0.7270 at the latest.

- On Wednesday, the NZD/JPY clings to its gains, up some 0.10%, amid a risk-off environment.

- A risk-off market mood triggered an equities sell-off in the US stock market, influencing risk-sensitive FX currencies, like the NZD.

- The NZD/JPY is downward biased though a break above 77.00 would expose crucial DMAs.

The NZD/JPY edges up in the session, after Wall Street closed, gains some 0.22% after the Federal Reserve unveiled its monetary policy statement. At the time of writing, the NZD/JPY is trading at 76.20.

In the meantime, the risk sentiment got a toll after Fed’s Chairman Jerome Powell press conference, as shown by the NZD/JPY hourly chart, which depicts the pair slumped 60-pips.

However, in the aftermath of the press conference, the cross-currency pair trimmed some of its losses, trading at 76.20

NZD/JPY Price Forecast: Technical outlook

The NZD/JPY is downward biased per the daily chart. Nevertheless, JPY bulls have been unable to print a daily close below December 3, 2021, daily low at 75.96. The 50-day moving average (DMA) resides at 77.64, some 40-pips below the 200-DMA at 78.09, which is trapped between the former and the 100-DMA at 78.48.

That said, the NZD/JPY first support would be 76.00. A breach of the latter would expose the January 24 swing low at 75,74. If that level is broken, the next stop for the cross-currency would be July 20, 2021, pivot low at 75.27, and then August 19, 2021, low at 74.56.

Contrarily, the NZD/JPY first resistance would be January 26 daily high at 76.66. A daily close above that level would send the pair rallying towards January 21 daily high at 77.05, and then the 50-DMA at 77.64.

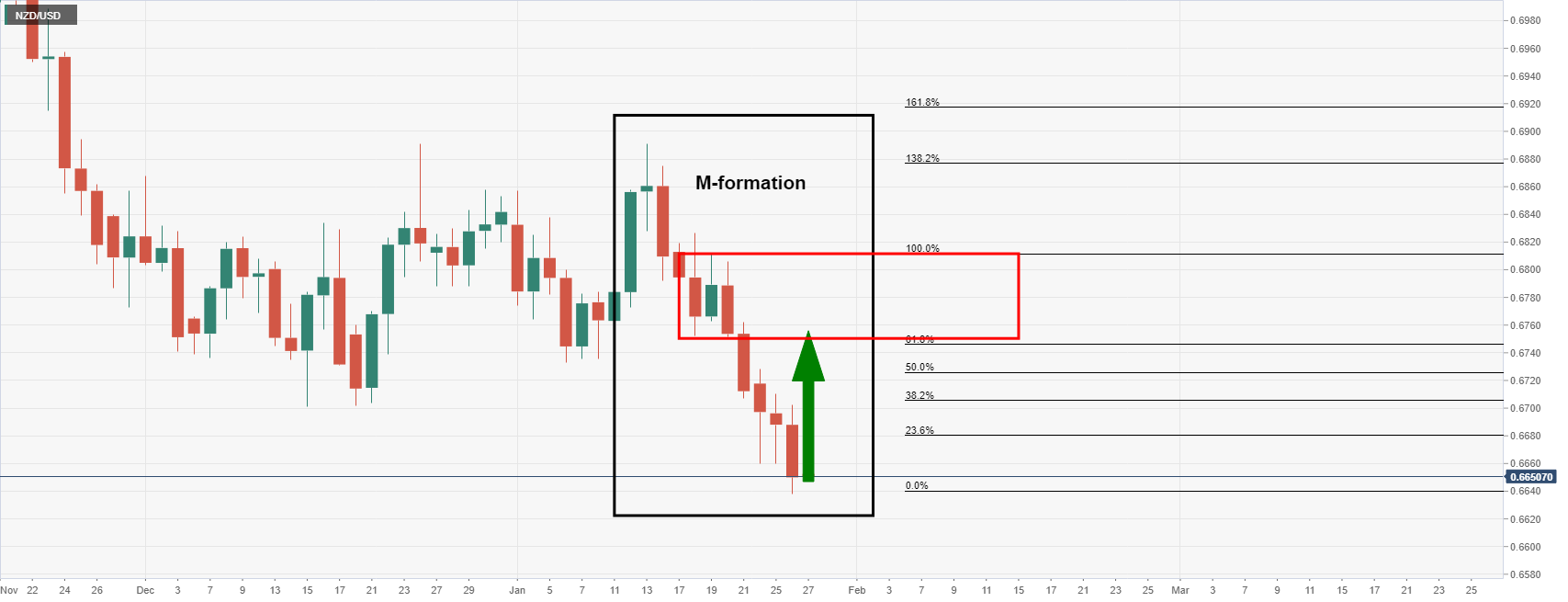

- NZD/USD holds steady despite CPI beat.

- The markets have piled into the US dollar following hawkish Fed Powell.

Consumer Price Index for New Zealand arrived and beat expectations. The consensus expected inflation to rise 1.3% QoQ and 5.7% YoY. However, the data beat 1.4% and 5.9% respectively.

NZD/USD stabilised ahead of the Federal Reserve meeting, but the Fed's chair, Jerome Powell delivered a hawkish commentary at the press conference that shook things up. In early Asia, the bird is ending the day down near 0.5% to 0.6650 after falling from a high of 0.6701 to a low of 0.6638.

Fed's Powell's key comments

- We are of a mind to raise rates at march meeting’.

- The current economy means we can move sooner, perhaps faster than we did last time.

- Next meeting will be coming to more of the details on the Balance Sheet.

- Other forces this year should also bring down inflation.

- Quite a bit of room’ to raise rates without dampening employment.

- No decision made on policy path, path to be led by incoming data.

''Near term, we expect the kiwi’s downtrend to resume and rallies are selling opportunities,'' analysts at ANZ Bank explained.

NZD/USD daily chart

The M-formation is a reversion pattern and bulls can targe the neckline near 0.6750. However, a more shallow target comes near the 38.2% Fibonacci around 0.67 the figure.

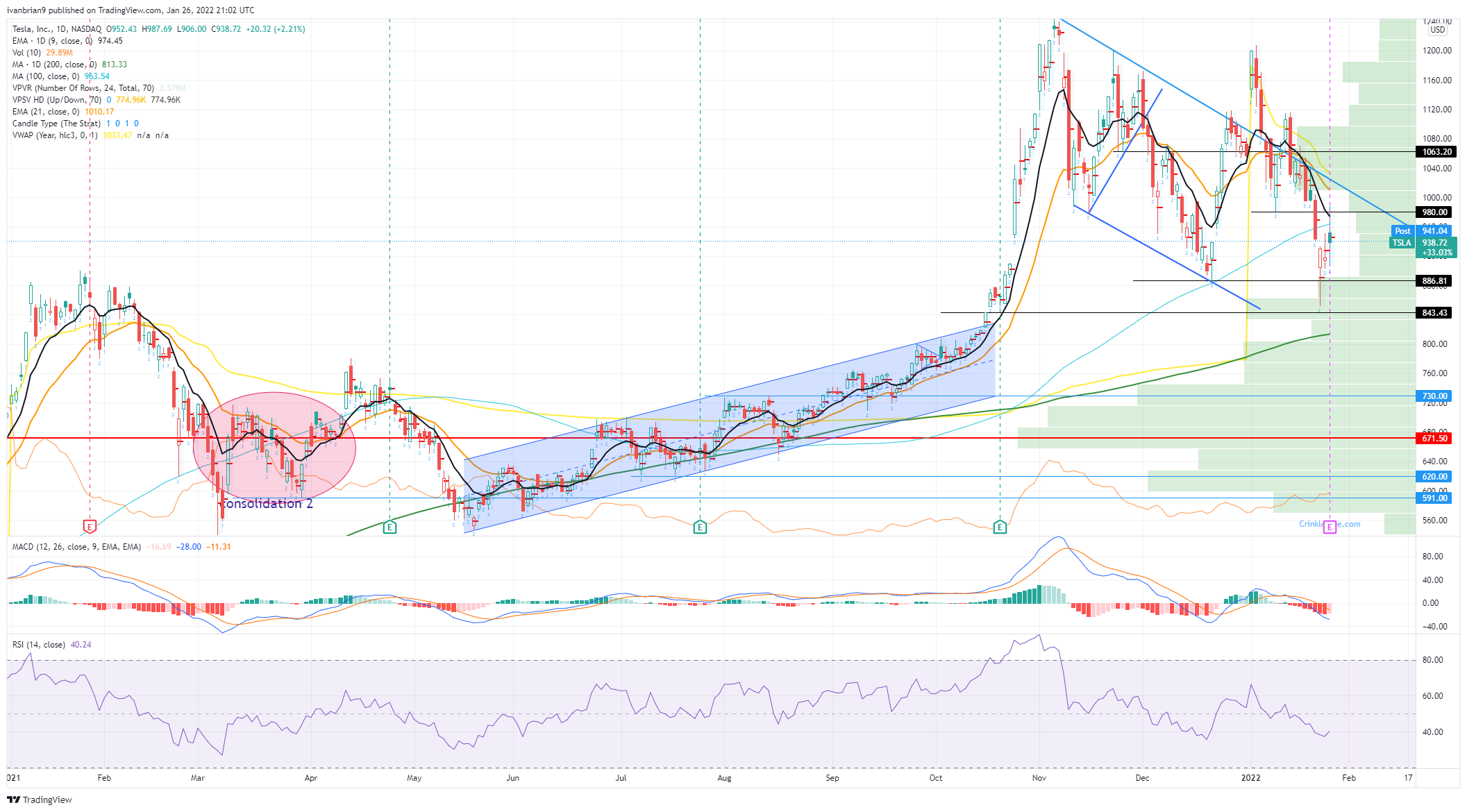

Tesla (TSLA) reported earnings for Q4 after the close on Wednesday. Earnings per share came in at $2.54 versus the average estimate of $2.26. Revenue was $17.72 billion versus estimates for $16.35 billion.

Tesla (TSLA) stock forecast

Tesla stock is trading at $880 versus the regular session close at $938.72, a loss of 6%.

Tesla (TSLA) chart, daily

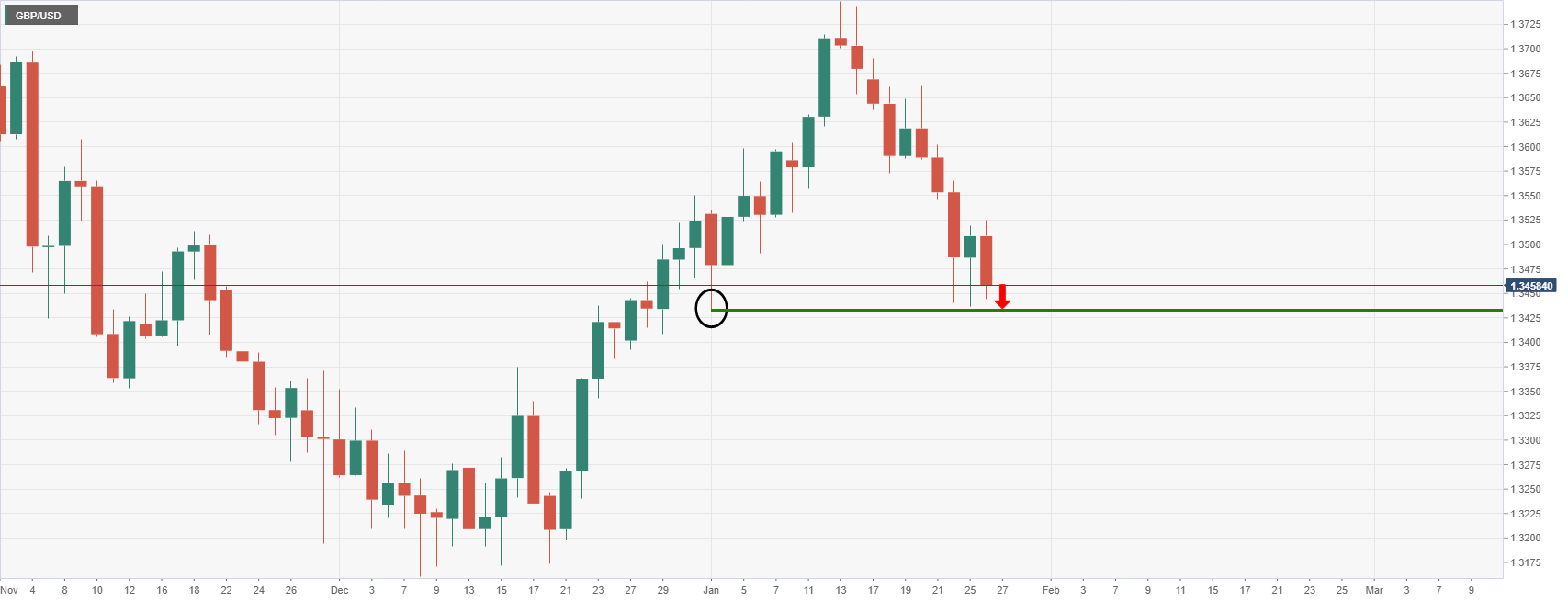

- GBP/USD bears take control and home in on the 2022 lows.

- The Fed's chair wore his hawkish hat to the Fed presser on Wednesday.

Trading at 1.3455, GBP/USD is down 0.35% on the day so far, falling in a move that followed a hawkish twist in today's Federal Reserve event. Cable has broken 1.3490 support and has plummetted to a low of 1.3444 in a move that was encouraged by hawkish comments from the Fed's chair, Jerome Powell.

Despite a relatively dovish statement, as per the most hawkish of market expectations, the US dollar and yields have soared on the back of a pivot during the Federal Reserve's chairman's press conference.

Jerome Powell stated in the post-Federal Open Market Committee statement presser that the central bank could move faster and sooner than they did the last time which has promoted both the US dollar and yields to extend gains for the day:

Fed's Powell's key comments

- We are of a mind to raise rates at March meeting’.

- The current economy means we can move sooner, perhaps faster than we did last time.

- Next meeting will be coming to more of the details on the Balance Sheet.

- Other forces this year should also bring down inflation.

- Quite a bit of room’ to raise rates without dampening employment.

- No decision made on policy path, path to be led by incoming data.

GBP/USD technical analysis

As a consequence, US equities are reeling in pain which is hurting the risk-sensitive currencies such as the pound vs the US dollar:

The bears are looking over the abyss at this juncture, in pursuit of the 2022 lows of 1.3431.

What you need to know on Thursday, January 27:

The dollar is ending Wednesday firmly higher across the FX board, following the US Federal Reserve monetary policy decision.

As widely anticipated, rates and taper were left unchanged, although the statement indicates that “ the Committee expects it will soon be appropriate to raise the target range for the federal funds rate.” Ahead of the event, most market participants priced in a rate hike in March. There were no mentions to the balance sheet, but market’s were not expecting those.

Chief Jerome Powell´s press conference was a mixture, as he expressed concerns about the current wave of coronavirus and its potential to damage the economy but also said that he expects inflation to decline over the course of the year. He added that the rate-hike path would depend on incoming data and noted that it is “impossible” to predict, although he also noted that there’s plenty of room to raise rates.

Gold was among the worst performers, shedding roughly $ 30.00 per troy ounce. The bright metal settled at $1,816 a troy ounce. Crude oil prices managed to retain gains, with WTI pulling back from a daily high of $87.92 to end the day at around $86.50 a barrel.

EUR/USD trades around 1.1240, while GBPUSD hovers around 1.3460. The AUD/USD pair nears the weekly low at 0.7089, while USDCAD is currently at 1.2670. The USD/JPY pair trades at 114.60.

Stocks trimmed early gains and turned red, with the DJIA down 154 points after trading up some 400 points ahead of the event.

US government bond yields jumped with the news, with that on the 10-year Treasury note peaking at 1.857%.

Top 3 Price Prediction Bitcoin, Ethereum, XRP: Cryptos to enjoy 20% upswing

Like this article? Help us with some feedback by answering this survey:

In his usual post-Fed meeting press conference, Fed Chair Jerome Powell said on Wednesday that he expects to see progress on inflation in the second half of 2022.

Additional Remarks:

"It's a very, very tight labor market."

"We think there's a pool of people who could come back to labor force, but may not happen quickly."

"I do not expect supply chain issues to be completely worked out by end of year, but do expect progress."

"I expect progress on inflation in the second half of this year."

"We are not making progress, overall, on the supply chain issue."

"We think we are positioned to make changes to our policy to deal with inflation."

"We are positioned to make changes in policy to address the risk of higher inflation."

"We have not made any decision on the size of rate increases."

"That said, we are aware this is a very different expansion than the last one."

"As we work our way through meeting by meeting, we are aware of differences from the last time we raised rates."

"Those differences will be reflected in the policy we implement."

"We are not trying to get inflation below 2%, want inflation expectations well anchored at 2%

"We get to that goal by getting inflation averaging 2% over time."

"Growth this year is forecast to be well above potential."

"The abor market is going to be strong for some time."

"We want inflation back down to 2% in a way that leaves the labor market very strong."

"We want to get inflation back down to 2% but also leave the labor market in a strong position."

"Monetary policy will do its job."

"I don't think the Fed's two goals are in tension."

"A significant threat to the labor market is high inflation."

"High inflation also taking away the benefits of large wage increases."

"We monitor the slope of the yield curve, but we don't control it."

"We take the yield curve into account alongside other considerations."

"The 2s to 10s gap is 'well within range' of normal yield curve slope."

"This is going to be a year in which we move steadily away from highly accommodative policy."

"That will involve ending asset purchases, lifting off and additional rate increases."

"The last thing we will do is allow the balance sheet to run off."

"We will have a couple more meetings about allowing the balance sheet to run off."

"We will then do that as appropriate."

"It's impossible to say exactly how policy will go."

"We will be nimble about this."

"The economy is quite different this time from last tightening cycle."

"All of these things will go into our thinking on policy."

"Asset prices are somewhat elevated."

"I don't think asset prices themselves represent a significant threat to financial stability."

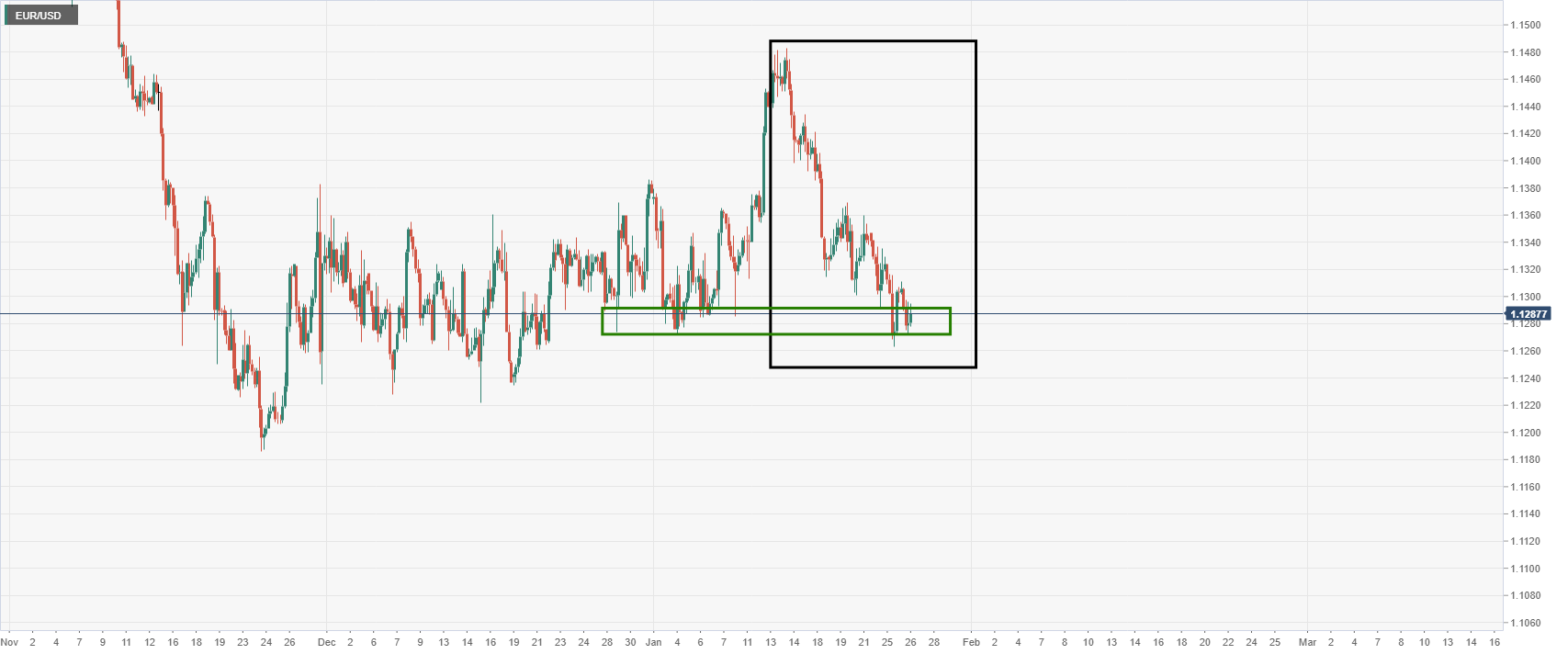

- EUR/USD is under pressure as the Fed chair's hawkish comments send Wa;l Street lower and USD higher.

- Fed's chair, has stated in the presser that they could move faster and sooner than they did the last time.

EUR/USD is down 0.5% on the day following a sell-off on the back of a hawkish turn of events during the Federal Reserve event today, Despite a relatively dovish statement, as per the more hawkish of market expectations, the US dollar and yields have soared on the back of a pivot during the Federal Reserve's chairman's press conference.

Jerome Powell, the Fed's chair, has stated in the presser that they could move faster and sooner than they did the last time which has helped the US dollar to extend on pre presser gains:

Additionally, the Fed's chair stated that they could hike rates at every meeting and that they are in the mind to raise rates in March.

Fed's Powell's key comments, so far

- We are of a mind to raise rates at March meeting’.

- The current economy means we can move sooner, perhaps faster than we did last time.

- Next meeting will be coming to more of the details on the Balance Sheet.

- Other forces this year should also bring down inflation.

- Quite a bit of room’ to raise rates without dampening employment.

- No decision made on policy path, path to be led by incoming data.

EUR/USD technical analysis

As a consequence, US equities are down and EUR/USD has dropped below a key technical level on the charts, losing the 1.13 area and printing a fresh low of 1.1240:

On the wider time frames, such as the H4 chart, the price is seen testing the next critical level of support:

Bulls will need to get back above 1.1310 to be in the clear at this juncture.

- The S&P 500 faced strong resistance at the 200-DMA followed by a sharp drop approaching January 25 daily lows at 4,287.

- The S&P 500 plunges almost 1% during the New York session.

- S&P 500 Technical Outlook: Downward biased, as it failed to reclaim the 200-DMA.

After the Federal Reserve announced that it keep the Federal Funds Rates (FFR) unchanged at the 0 to 0.25% range while signaling that they would hike rates “soon,” the S&P 500 plummets 1.09%. At the time of writing, the S&P 500 sits at 4,313.83.

S&P 500 Price Forecast: Technical outlook

From a technical analysis perspective, the S&P 500 failed to reclaim the 200-DMA, which sits at 4,432.65, eyeing the January 24 cycle low at 4,222.62, which was the low of the 12% correction that began on January 4.

That said, the S&P 500 outlook is bearish biased, spurred in part by the US T-bond 10-year Treasury yield rising up to 1.84%

The S&P 500 first support level would be the aforementioned January 24 low at 4,222.62. A breach of the latter would expose June 18, 2021, daily low, which previously tested the 50-day moving average (DMA) at 4,164.40, followed by May 19, 2021, daily low at 4,061.41.

To the upside, the S&P 500 first resistance would be 4453.23, followed by September 23, 2021, a daily high at 4,465.40. A break above that level would expose the 100-DMA at 4,570.04.

Fed Chair Jerome Powell, in his usual post-Fed meeting press conference on Wednesday, said there is a risk high inflation will be prolonged, even though it's not our base case.

Additional Remarks:

"We have to be able to address all plausible outcomes."

"We need to be in a position to address the risk that inflation remains higher."

"What we need is another long expansion."

"To get back to long expansion, need price stability."

"We need to do our part in getting inflation back down."

"The Covid pandemic is not over and could continue to evolve and harm growth."

"Another risk is further supply chain issues."

"The Eastern Europe situation is another risk."

"There are plenty of risks out there and we can't forget there are risks on both sides."

When asked for details on former Dallas Fed Chief Robert Kaplan's stock-trading, Powell says "Fed board does not have that information."

"Since the last meeting, the inflation situation is slightly worse."

"I would raise my SEPs on inflation for this year if I was writing them today."

"If inflation deteriorates further, we will have to address that."

"Moving away to substantially less accommodative, and in time to non-accommodative policy, will be part of bringing inflation down."

"We need to move to substantially less accommodative policy."

"We will eventually get relief on the supply side, though it's taking longer than expected."

"There's a risk inflation will stay high longer than expected."

"Our aim is to get inflation back down to 2%."

"The labor market is very, very strong right now."

"There are very large wage increases."

"The outlook is quite uncertain."

"We will have to adapt due to the uncertainty of the outlook."

"We will move as appropriate."

"We will have to adapt and move as appropriate."

"We fully appreciate this is a different situation than the last time Fed raised rates."

"Right now inflation is high, growth is higher than potential, labor market is historically tight."

- US dollar and yields have shot higher, extending the post-Fed statement gains during Fed Powell's hawkish pivot.

- Bulls have got behind a faster pace of tightening than what had been priced in.

The Federal Reserve did what was expected from them in the main and there had been low volatility in the currency space as a consequence, until Powell's pivot.

As a consequence of a hawkish turn by the Fed's chairman, Jerome Powell, during the presser, the US dollar has picked up a bid and moves to the first position on the Currency Strength Indicators.

Markets were expecting to be "prepared for liftoff" from the meeting which both the statement and the Fed's chair, Jerome Powell, has done. However, guidance on the likely pace of tightening, via QT (quantitative tightening), as well as the funds rate for the year/years ahead, would have been greater catalysts for markets. This did not come. Instead, there were no definitive signals.

However, Powell has stated in the presser that they could move faster and sooner than they did the last time which has helped the US dollar to extend on pre presser gains:

Fed's Powell's key comments, so far

- We are of a mind to raise rates at march meeting’.

- The current economy means we can move sooner, perhaps faster than we did last time.

- Next meeting will be coming to more of the details on the Balance Sheet.

- Other forces this year should also bring down inflation.

- Quite a bit of room’ to raise rates without dampening employment.

- No decision made on policy path, path to be led by incoming data.

Fed's statement, key takeaways

- A rather mixed and fairly dovish statement ticked some of the boxes as follows:

- As expected, the benchmark interest rate was unchanged; The Target Range stands at 0.00% - 0.25% - Interest Rate on Excess Reserves is also unchanged at 0.15%.

- There were no mentions of early rate hikes, let alone a 50bp hike (which some analysts have been expecting).

- QE is not indicated to end early either and that the balance sheet shrinking would start after rate hikes commence.

- The Fed has warned that soon it will be appropriate to raise rates.

- The Fed has stated that both the economy/employment have strengthened and that jobs gains are solid.

- "Overall financial conditions remain accommodative, in part reflecting policy measures to support the economy and the flow of credit to US households and businesses," is an unchanged statement that indicates we are no closer to lift off than of the prior meeting.

- Subsequent to this statement, Fed's funds futures are looking for four rate hikes for this year.

US yields are up on Fed rate hike expectations

US Treasury yields across the curve shot higher on Wednesday after the Federal Reserve chairman added colour to the statement that said US interest rates would rise "soon", adding that it will end its asset purchase program in early March.

The Fed, however, did not set a specific date for raising interest rates. With that being said, federal funds futures have fully priced in a quarter-point tightening for the Fed's March meeting, and another three hikes for 2022.

However, Fed's chairman Powell was uber hawkish in his comments around raising rates at every meeting. "Quite a bit of room to raise rates without hurting jobs'', he added.

As a consequence, the benchmark US 10-year yield rose to 1.855%. The US 30-year yields were moved to 2.172% and on the front end of the curve, US 2-year yields shot up to 1.095%.

In his usual post-Fed meeting press conference, Fed Chair Jerome Powell said on Wednesday that the FOMC is "of a mind" to raise interest rates at the March meeting.

Additional Remarks:

"The ultimate focus we have is on the real economy."

"Financial conditions matter to the extent they have implications for fed's two goals."

"Financial conditions matter when they affect dual goals."

"We are not looking at any one market."

"Our communications with markets is working."

"Financial conditions are reflecting in advance the Fed's decision."

"We will make the decision whether to raise rates at the March meeting."

"We do expect some softening from Omicron, but think it will be temporary."

"We have our eye on risks around the world, but the economy should hold up."

"We do expect this year, but slower than we had expected, that supply chain problems will ebb."

"We will react however inflation moves."

"We are well aware this is a different economy to last tightening cycle."

"If the situation is different than thought, will change our balance sheet plan as needed."

"It's time to stop asset purchases and, at the appropriate time, to start shrinking the balance sheet."

"There's a substantial amount of balance shrinkage to be done."

"We want balance sheet shrinkage to be orderly, predictable."

"After we get underway with rates, then we'll turn to balance sheet."

"We will have another discussion on the balance sheet at our next meeting, and at least one at the meeting after that."

"We will discuss the balance sheet at the next two meetings."

Fed Chair Jerome Powell in his post-Fed meeting press conference said that both sides of our mandate are calling for the Fed to move away from highly accommodative policy.

Additional Remarks:

"The labor market is consistent with max employment."

"That is also my personal view."

"Broad agreement on FOMC will soon be time to raise rates."

"Level of maximum employment may increase as more people return to labor market."

"The policy path we are contemplating would be supportive of that outcome."

"There is quite a bit of room to raise interest rates."

"There is quite a bit of room to raise rates without dampening employment."

"This is a very very strong labor market."

"We can move rates up without having to undermine the jobs market."

"Other forces this year should also bring down inflation."

"Fiscal policy will be less supportive of growth this year."

"Fiscal impulse to growth will be significantly lower, also helping curb inflation."

"There are multiple forces that should be working this year to bring inflation down this year."

"We are prepared to use our tools to ensure higher inflation does not become entrenched."

"The Fed just turning to balance sheet questions."

"This meeting we have put together guidance for decision making."

"This process we will spend time on in upcoming meetings."

"At the appropriate time, we'll give more information on balance sheet reduction."

"The next meeting we will turn to discussing more details on balance sheet reduction."

"At the next meeting will be coming to more of the details on the balance sheet."

"Current economy means we can move sooner and perhaps faster than we did last time."

"We do want balance sheet to be reduced primarily by adjusting reinvestments."

"We think of balance sheet as moving in the background in a predictable manner."

"The active tool is the Fed Funds rate."

"There is an element of uncertainty around the balance sheet."

"Greater clarity we have is on how the Fed funds rate affects financial conditions."

"Balance sheet reduction will start in the background."

"We will arrive at timing, pace and composition of balance sheet reduction, announce it, and will have it running in the background."

"On the size, pace and composition, they are still to be discussed."

- The Federal Reserve kept interest rates unchanged at 0 – 0.25%.

- The AUD/USD initially spiked up to 0.7182, to then retreat towards 0.7140 previous to Fed’s Chair Powell press conference.

The Australian dollar clings to its daily gains after the Federal Reserve signaled that it would raise interest rates “soon” while keeping the Federal Funds Rate (FFR) unchanged at 0 to 0.25%, as widely expected.

The AUD/USD reacted to the upside, reaching a daily high at 0.7182, though as the US central bank Chair Jerome Powell begins his press conference, the pair edges lower some 40 pips, down to 0.7140 at 19:37 GMT.

One of Jerome Powell’s press conference remarks is that the Fed does not have a timing schedule regarding reducing its balance sheet.

Summary of the Federal Reserve monetary policy statement

Federal Reserve policymakers expressed that raising the FFR would be appropriate. In 2021, the US central bank increased the speed of reducing its Quantitative Easing (QE), though it announced another increase in the pace. That said, the Fed will end the QE by early March.

Also, the Fed expressed that it will continue to monitor information for the economic outlook. They noted that “supply and demand imbalances related to the pandemic and its reopening” contributed to elevated inflation levels.

The US central bank expects to begin reducing the balance sheet size once the bank begins the process of hiking rates. Regarding employment, they noted that “job gains have been solid in recent months, and the unemployment rate has declined substantially.”

Update on AUD/USD price action

At press time, at 19:50 GMT, the AUD/USD is plunging to 0.7114, as USD bulls have taken control, pushing the pair down.

Fed Chair Jerome Powell, at his usual post-Fed meeting press conference on Wednesday, said that the Fed has not made decisions on the timing and pace of shrinking the balance sheet or interest rate hikes yet.

Additional Remarks:

"It is not possible to predict the path of the policy rate."

"It is not possible to predict with much confidence the path of policy."

"We will be humble and nimble on policy."

"There are two side risks now."

"We will need to navigate cross-currents, two-sided risks."

"We will be guided by data and the evolving outlook."

"We will try to communicate as clearly as possible."

"We know the economy is in a very different place to 2015."

"The economy now much stronger than then."

"These differences will have implications for pace of rate hikes."

"Beyond that, no decisions made."

In his post-monetary policy announcement press conference, Fed Chair Jerome Powell said on Wednesday that, with elevated inflation and a strong labour market, the Fed will continue to adapt policy.

Additional Remarks:

"The economy has shown great strength."

"The Covid-19 Omicron variant will surely weigh on economic growth this quarter."

"Activity more broadly may also prevent workers reporting to jobs."

"Omicron expected to drop off rapidly."

"If the wave passes quickly, economic effects should dissipate quickly too."

"The labor market has made remarkable progress."

"Improvement in the labor market has been widespread."

"The labor demand remains historically strong."

"Wages are rising at the fastest pace in many years."

"The current wave of the virus may well prolong effects on labor force."

"Inflation remains well above our long-run goal."

"Supply problems larger and longer-lasting than thought."

"High inflation now spread more broadly."

"Inflation is expected to decline over the course of the year."

"We think the best thing we can do is promote a long expansion; that requires price stability."

"Committed to price stability goal."

"Watching carefully to see if the economy evolving in line with expectations."

"The economy no longer need sustained high levels of policy support."

"In light of inflation and employment, the economy no longer needs sustained high levels of support."

"The economic outlook remains highly uncertain, requires humility."

"We need to be nimble."

"We will remain attentive to risks."

"We are repared to respond as appropriate to achieve goals."

"We will remain attentive to higher inflation proving more persistent and react accordingly."

"The Fed Funds rate is our primary means of policy."

"Reducing balance sheet will occur after interest rates rises have begun."

"We will be prepared to adjust any of the details of balance sheet reduction approach."

GBP/USD saw a choppy post-Fed reaction, swinging from just above 1.3500 pre-announcement to as high as the 1.3520s and then lower again to current levels around 1.3510. All said, there hasn’t been much follow-through in terms of an FX market reaction in wake of the Fed’s latest monetary policy decision, which seemed to go down pretty much bang in line with expectations. Interest rates were left on hold as expected and while the Fed didn’t explicity say it would hike rates in March, it said (as expected) that it would soon be time to hike interest rates.

The Fed reiterated that its QE programme would come to an end in March and that it expects to commence reductions in the size of the balance sheet after the process of lifting interest rates has gotten underway. So all in all, nothing new from the Fed’s latest monetary policy statement or rate decision hence the lack of GBP/USD volatility. Attention now turns to Fed Chair Jerome Powell’s press conference, which commences at 1930GMT. Powell will likely be quizzed on topics such as the potential number of/pace of rate hikes in 2022 and beyond, as well as how the discussion regarding quantitative tightening is going. Any more specifics on either of these two topics would be of great interest to market participants.

But Powell is usually a pro at not saying anything that rocks the boat too much during the press conference, so the scope for further FX market volatility may be fairly low. That may mean GBP/USD remains contained within recent 1.3490-1.3530ish ranges. But a lack of surprises from Powell often help risk appetite and gains in risk assets could help give risk-sensitive currencies such as GBP a lift.

- The US central bank kept rates unchanged and signaled it would hike rates “soon.”

- The USD/JPY spiked to 114.48 then retreated to pre-Fed levels on a “buy the rumor, sell the fact” event.

- US 10-year T-bond yield shoot through 1.80%, sits comfortably around that level, post-Fed.

On Wednesday, in the Fed’s first monetary policy meeting, the US central bank maintained rates unchanged at 0 to 0.25%, while on its forward guidance, signaled that it will start hiking rates “soon,” which spurred a spike on the USD/JPY towards 114.48. At press time, the USD/JPY is trading at 114.27 at 19:22 GMT.

USD/JPY Market Reaction

The USD/JPY spiked towards 114.48; meanwhile, the US 10-year Treasury yield shoots through 1.8029%.

Summary of the Federal Reserve monetary policy statement

In an overview of the monetary policy statement, Fed policymakers expressed that raising the Federal Funds Rate would be appropriate. As mentioned the last year, the Fed increased the pace of the bond taper and would end the Quantitative Easing (QE) by early March.

Despite tightening conditions, the US central bank expressed that it will continue to monitor information for the economic outlook. The Fed said that “supply and demand imbalances related to the pandemic and its reopening” contributed to elevated inflation levels.

The US central bank commented that it “expects that reducing the balance sheet size will commence after the process of increasing the target range for the Federal Funds Rates has begun.”

Regarding the job market, they noted that “job gains have been solid in recent months, and the unemployment rate has declined substantially.”

Putting this aside, the USD/JPY trader’s focus turns to the Fed’s Chairman Jerome Powell, who will be speaking at 19:30 GMT.

Follow the coverage here: Fed Press Conference: Chairman Jerome Powell speech live stream – January 26

- The Fed disappoints the US dollar bulls with a benign outcome in the statement.

- EUR/USD sits around pre-event levels awaiting Fed's chair Powell.

The Federal Open Market Committee's two-day meeting has concluded on Wednesday and the statement has been released along with the Fed's interest rate decision in a highly anticipated event for financial markets.

Markets were expecting the Fed to give guidance on asset purchases that were expected to conclude in March. However, traders were looking for hints around the starting point for QT or "sooner" and "faster" on hikes.

Fed's statement, key takeaways

A rather mixed and fairly dovish statement ticked some of the boxes as follows:

As expected, the benchmark interest rate was unchanged; The Target Range stands at 0.00% - 0.25% - Interest Rate on Excess Reserves is also unchanged at 0.15%.

There were no mentions of early rate hikes, let alone a 50bp hike (which some analysts have been expecting).

QE is not indicated to end early either and that the balance sheet shrinking would start after rate hikes commence.

The Fed has warned that soon it will be appropriate to raise rates.

The Fed has stated that both the economy/employment have strengthened and that jobs gains are solid.

"Overall financial conditions remain accommodative, in part reflecting policy measures to support the economy and the flow of credit to US households and businesses," is an unchanged statement that indicates we are no closer to lift off than of the prior meeting.

Subsequent to this statement, Fed's funds futures are looking for four rate hikes for this year.

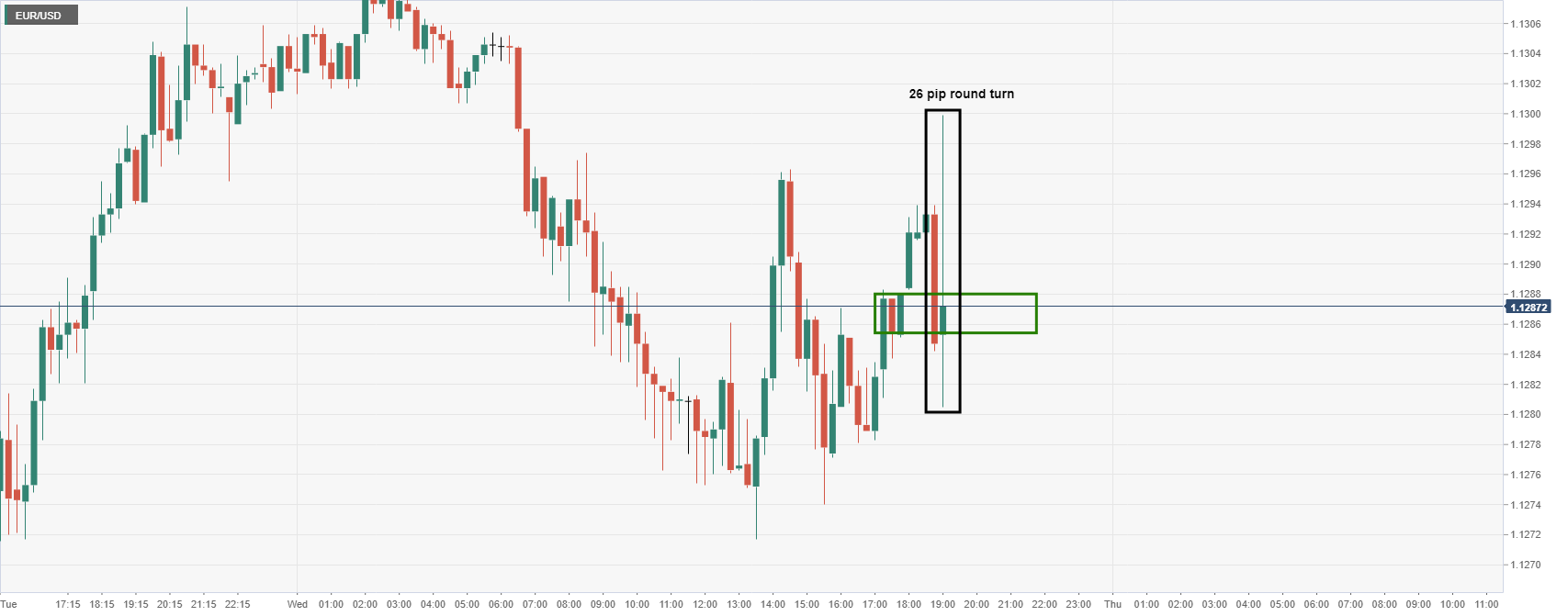

EUR/USD: Reaction and technical analysis

Following the Fed's statement, EUR/USD has made a round trip of between 26 pips and is pretty much stationed to where it was before the release:

Meanwhile, the euro recently denied bulls an extension to and through the 1.15 psychological level when reaccumulation failed to play out following the breakout of the late 1.13 area near 1.1390:

Instead, the price plummeted back into the consolidation area, weighed heavily by risk-off markets due to geopolitical angst over tensions between Russia and the Ukraine:

Given that the statement is leaning slightly dovish compared to some of the more hawkish expectations in the markets, the US dollar could continue to struggle in the event that geopolitical angst abates. The euro would be expected to benefit in a pick up of risk apatite in global equities as well. EUR/USD bulls will need to get back above 1.13 the figure though...

Meanwhile, the markets will now look for clarity from the Fed's chair, Jerome Powell. His comments could provide volatility for EUR/USD traders:

Watch Live: Fed's chair, Jerome Powell

Jerome Powell, will be delivering his remarks on the monetary policy outlook at a press conference following the meeting of the Board of Governors. Powell's speech will start at 19:30 GMT.

Follow our live coverage of the Fed's policy announcements and the market reaction.

The US Federal Reserve announced on Wednesday that the FOMC had agreed to leave the Federal Funds target range unchanged at 0.0-0.25%, in line with expectations. The central bank said that it would soon be appropriate to raise the Federal Funds rate, the strong hint that many market participants would have been looking for that a first post-pandemic rate hike in March is likely.

Additional Takeaways as summarised by Reuters:

"The Fed will bring bond-buying to an end in early March."

"The Fed is prepared to adjust the stance of monetary policy as appropriate if risks emerge that impede its goals."

"In assessing monetary policy, the Fed will continue to monitor incoming information for the economic outlook."

"Supply and demand imbalances related to the pandemic and the reopening of the economy have continued to contribute to elevated levels of inflation."

"The sectors most adversely affected by the pandemic have improved in recent months but are being affected by the recent sharp rise in Covid-19 cases."

"To increase treasuries by $20B, MBS by $10B starting in February."

"The Fed expects that reducing balance sheet size will commence after the process of increasing the target range for the federal funds rate has begun."

The Fed reaffirms in an identical statement the longer-run goals and monetary policy strategy adopted in August 2020.

"Progress on vaccinations and an easing of supply constraints are expected to support continued gains in economic activity and employment as well as a reduction in inflation."

"The policy vote was unanimous."

"Indicators of economic activity and employment have continued to strengthen."

"The Fed agreed principles for reducing the balance sheet."

"Job gains have been solid in recent months, and the unemployment rate has declined substantially."

"In the longer run, the Fed intends to hold primarily Treasury securities."

"The Fed is prepared to adjust any details on reducing balance sheet in light of economic and financial developments."

Market Reaction

The Dollar Index saw a mixed, two-way initial reaction as traders digest what appears to have been a very much in line with expectations Fed monetary policy statement and decision. Attention now turns to Fed Chair Jerome Powell's appearance at the press conference from 1930GMT.

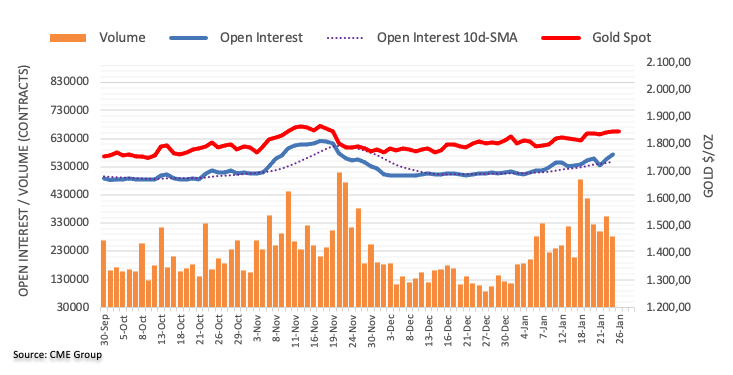

- Spot gold prices have dropped back to the $1830 area in recent trade amid pre-Fed profit-taking and technical selling.

- All eyes are on the Fed's policy announcement at 1900GMT and press conference with Fed Chair Jerome Powell at 1930GMT.

Spot gold (XAU/USD) prices have been under selling pressure in recent trade, dropping from the mid-$1840s prior to the US open to around the $1830 as the Fed monetary policy announcement at 1330GMT looms. A combination of pre-Fed profit-taking and short-term, intra-day technical selling have been cited as the reason for XAU/USD’s recent drop, with gold not receiving any impetus from subdued FX or bond markets, which are both in their typical pre-Fed lull. Starting with the technicians; since last week, gold had been supported by an uptrend, but this uptrend broke a few hours back, triggering some technical selling and a drop back to the $1830 support area.

Moving on to the pre-Fed profit-taking; gold has been performing well in recent weeks and is up more than 2.5% from its lows in the $1780 area printed back on the first day of the year. That solid run of recent gains has come despite a US dollar that has been strengthening (over the last two weeks, anyway) and US bond yields, which have remained well support close to multi-month/year highs. The run higher this year in US bond yields (the 10-year is more than 25bps higher on the year already) has come amid increased bets on Fed hawkishness, something that would normally hit gold.

However, sharp equity market downside (since the start of the year) and geopolitical tensions appear to have infused gold with some safe-haven demand. But that doesn’t mean Fed tightening isn't still a threat to gold and it seems as though on Wednesday, traders were eager to book some profit on long XAU/USD positions just in case the Fed hits markets with a hawkish surprise (which would likely be gold negative). In a scenario where a hawkish surprise sends the US dollar and yields surging, key areas of support to watch for gold include last week’s low in the $1805 area, then the annual low just above $1780. In a bullish gold scenario, Tuesday’s highs just above $1850 would be the key resistance to watch.

Jerome Powell, Chairman of the Federal Reserve System, will be delivering his remarks on the monetary policy outlook at a press conference following the meeting of the Board of Governors. Powell's speech will start at 19:30 GMT.

Follow our live coverage of the Fed's policy announcements and the market reaction.

Related articles

Federal Reserve Interest Rate Decision Preview: Inflation, Omicron and equities.

Fed January Preview: Three possible scenarios for gold.

Fed Preview: Three ways Powell could out-dove markets, dealing a blow to the dollar.

About Jerome Powell (via Federalreserve.gov)

Jerome H. Powell took office as Chairman of the Board of Governors of the Federal Reserve System on February 5, 2018, for a four-year term. Mr. Powell also serves as Chairman of the Federal Open Market Committee, the System's principal monetary policymaking body. Mr. Powell has served as a member of the Board of Governors since taking office on May 25, 2012, to fill an unexpired term. He was reappointed to the Board and sworn in on June 16, 2014, for a term ending January 31, 2028.

- The shared currency edges low, amid a risk-on market mood ahead of the Fed.

- EUR/USD is downward biased though upside risks remain if the Fed fails to deliver a hawkish statement and could expose resistance levels at 1.1314 and 1.1398.

- A hawkish Fed statement could expose support levels at 1.1263 and 1.1186.

The shared currency remains slightly down, subdued ahead of the Federal Reserve unveiling of its first monetary policy statement of 2022. At the time of writing is trading at 1.1292, losing 0.11%.

A risk-on market mood prevails ahead of the FOMC, as shown by US equities rising between 0.90% and 2.56%. It appears that investors put the eastern Europe crisis on the side as they get ready for the Fed.

In the meantime, the US Dollar Index, which measures the greenback’s value against a basket of its rivals, advances some 0.12%, clings to 96.06, as the Fed looms. Furthermore, the US 10-year Treasury yield is flat, around 1.77%.

EUR/USD Price Forecast: Technical outlook

In the early stages of Wednesday’s Asian session, the EUR/USD was subdued in a 5-pip narrow range, within t.1300-05. When European traders got to their desks, the 1.1300 figure gave way for USD bulls ahead of the Fed, sending the pair tumbling to 1.1271.

That said, the EUR/USD daily chart depicts the pair as downward biased. The 50-day moving average (DMA) at 1.1314 is the first resistance level and would be under pressure when the Fed releases its monetary policy statement. IF that level is breached, the next resistance would be January 14 daily low previous support-turned-resistance at 1.1398, followed by a downslope trendline drawn from November 2021 cycle highs that pass around the 1.1435-50 area.

On the flip side, the pair’s first support would be January 25 daily low at 1.1263. A break of that level would expose December’s 15, 2021, low at 1.1261, followed by 2021 yearly low at 1.1186, and then 1.0870.

- AUD/USD bears are waiting in the wings of the Fed for a bullish outcome for the greenback.

- A fresh daily bearish impulse in AUD/USD could be in the making.

- However, a sell the fact outcome could play into the hands of the Aussie.

Trading near 0.7170, AUD/USD is firm ahead of the Federal Reserve at the top of the hour. The Aussie has benefitted this week from expectations of earlier domestic interest hikes, lower equity market volatility and a softer US dollar.

Since the start of the week, AUD/USD has climbed from a low of 0.7090 to a corrective high of 0.7177 in a technical move illustrated below. However, drivers from the geopolitical and central bank sentiments have underscored the bullish bias leading into today's showdown event in the Fed.

Risk sentiment improves ahead of Fed

Risk sentiment has improved on Wednesday with European stocks jumping. Eurostoxx50 was up 2.3% despite the Russia-Ukraine tensions that remain high. However, dialling down the angst, the Ukrainian Foreign Minister Dmytro Kuleba said Wednesday that Russia has not assembled sufficient forces to launch an imminent full-scale invasion of Ukraine.

This was in response to the Russian Foreign Minister Sergey Lavrov threatening "appropriate response measures" if the West continues its "aggressive line." Nevertheless, markets are of the mind that Word war III is not imminent as the West has said it is not going to get drawn in militarily. Instead, any sanctions for any invasion of Ukraine would be financial and economic.

Rising geopolitical tensions around Russia and Ukraine have weighed on the global equities market, and high beta currencies such as the Aussie, with the S&P 500 index flirting with a correction twice this week. However, Wall Street's main indexes have climbed on Wednesday after two turbulent sessions and ahead of the outcome of a Federal Reserve policy meeting, with a stellar outlook from Microsoft boosting technology stocks.

The US dollar has subsequently held below a 2-1/2 week high as risk sentiment stabilized hours before policymakers at the Federal Reserve are widely expected to indicate their readiness to start raising interest rates starting in March.

Nevertheless, the DXY is up for the third straight day and trading around 96.087 a the time of writing. The 2022 high near 96.462 is close but charts suggest an eventual test of the November high near 96.938, analysts at Brown Brothers Harriman argued.

''The dollar is mostly higher today, which supports our view that the dollar remains in the unique position of gaining during periods of both risk-on and risk-off. When all is said and done, the US fundamental story remains solid, giving the Fed confidence to continue removing accommodation at an accelerated pace. This is ultimately dollar-positive.''

Meanwhile, analysts at TD Securities said in a note today that ''USD resilience should persist through the January FOMC meeting, particularly on the risk of an earlier QT start. Barring that, the dollar bloc seem best positioned to weather the storm given tightening is already priced in. ''

What to watch for at the Fed

''Chair Powell is likely to take the opportunity to prepare markets for liftoff,'' the analysts at TD Securities said.

''Any hints around the starting point for QT or "sooner" and "faster" on hikes could be market-moving. A March rate hike is almost fully priced in and the market is pencilling in nearly 4 hikes in 2022. Equity weakness could leave the Fed a bit concerned, but the Chair is likely to stress only gradual removal of accommodation.''

Meanwhile, the analysts at BBH warn of some possible “buy the rumour, sell the fact” price action after the decision.

''A very hawkish Fed is universally expected and if Powell and company deliver anything remotely cautious or dovish, there may be some knee-jerk profit-taking on the long dollar and short UST positions.''

''We advise investors to look through this price action and instead focus on the fundamental story. Given what we know about the US labour market and recent inflation trends, the underlying story remains dollar-positive,'' the analysts said.

AUD domestic drivers

AUD/USD has been finding some support from a bigger-than-expected drop in Australia’s unemployment in December (to 4.2%) and firm inflation data. Australia’s Core Consumer Prices surpassed the midpoint of the Reserve Bank’s 2-3% target for the first time since June 2014.

This lifted bond yields and narrowed the divergence between the US and AU rates. The surprise lifted expectations of earlier interest-rate hikes. Traders are trying to second guess whether these factors will see the Reserve Bank of Australia react to such improvements in data with a significant hawkish turn at the 1 February meeting.

AUD/USD technical analysis

As per the prior analysis, AUD/USD Price Analysis: Bulls going against the grain to M-formation neckline target, the price has move din on the target as follows:

AUD/USD prior analysis

The M-formation was neckline was identified as a bullish target.

AUD/USD live market

The neckline has been reached and traders will now wait to see what the outcome of the Fed entails for the currency markets.

AUD/USD levels to watch around Fed

In yesterday's approach to the target, from a lower time frame basis, the market structure and flight path were illustrated and forecasted as follows:

The price indeed moved in on the support before moving higher towards the M-formation's neckline:

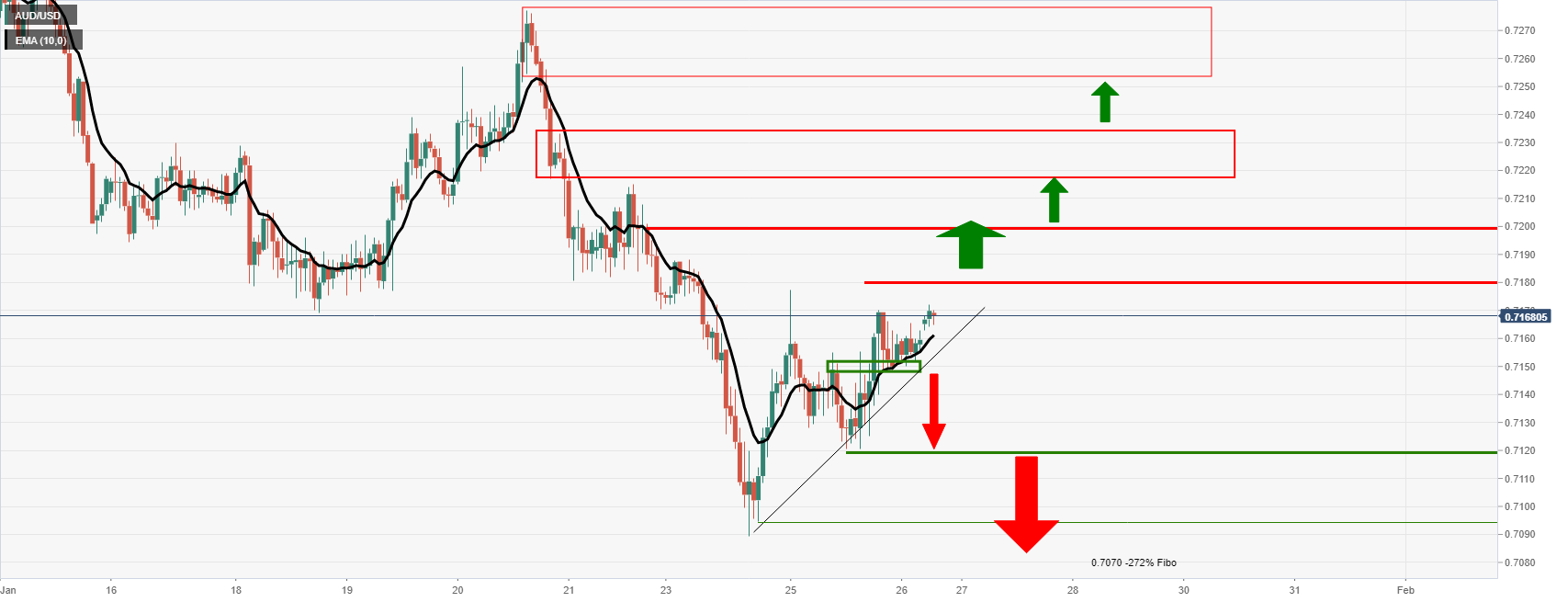

In doing so, 0.7180 is now only a handful of pips away. 0.7150 is key support heading into the Fed which aligns with the dynamic trendline support that protects 0.7120. A break of 0.7120 opens the risk of a significant breach of the lows near 0.7190 and then 0.7070 -272% Fibo. On the upside, a break of 0.7180 will open 0.7200, then 0.7220/30 as the last major resistance before 0.7250/80:

AUD/USD daily bearish outlook

All in all, a bullish outcome for the US dollar would be expected to play out as a daily bearish continuation on the daily chart as illustrated above.

- The white metal extends its slide to four days in a row.

- Fed’s hawkish expectations weighed on silver, and any “dovish” signal could be viewed as an opportunity for XAG bulls.

- XAG/USD is downward biased, though upside risks remain due to the 200-DMA closing the spot price.

Silver (XAG/USD) slides for the fourth consecutive day, mainly attributed to monetary policy tightening expectations of the US central bank. At the time of writing, XAG/USD is trading at $23.79, down some 0.21%.

The market sentiment is upbeat, as portrayed by US equities trading higher. That alongside Fed policymakers signaling three rate hikes in 2022, amid the possibility of a fourth one, keep precious metals under pressure. At the same time, gold is plunging close to 1%, sitting at $1831,75, after reaching a daily high around $1,850, a $20 drop ahead of the release of the Fed monetary policy statement.

In the meantime, the US 10-year Treasury yield advances 0.5 basis points up to 1.783%, underpinning the greenback. The US Dollar Index, a gauge of the greenback’s performance against a basket of six peers, advances 0.18% sits at 96.118.

The consensus among some analysts cited by Bloomberg expects that Fed’s Chairman Jerome Powell will lay the groundwork for a March 2022 rate hike, at the same month that the Quantitative Easing (QE) ends. What keeps market participants nervous, as witnessed by the recent fall of the S&P close to 10%, is the Quantitative Tightening (QT) speed and when it will begin. Some investors expect it to kick in by the beginning of the second half of the year, others by the end, while the minority expects it to begin by June.

XAG/USD Price Forecast: Technical outlook

The non-yielding metal sits near the 50% Fibonacci retracement drawn from the last pivot low at $22.81 to the highest of the year at $24.70. Earlier in the session, it reached below of it, near the 61.8% Fibo level at $23.53, though it bounced back immediately.

Despite the aforementioned, silver is downward biased. On January 20, it faced strong resistance at the confluence of a downslope trendline and the 200-day moving average (DMA) around $24.70, but it was unable to break it, dropping $1.00 since then.

On the downside, the first support would be the 61.8% Fibo retracement at $23.53. A break under that level would open the door to the 78.6% Fibo level at $23.21 and then the January 18 cycle low at $22.82.

To the upside, the first resistance is the 38.2% Fibonacci retracement level at $23.98, unsuccessfully broken one time. The next supply zone would be the January 24 daily high at $24.31, followed by the abovementioned 200-DMA at $24.60.

- USD/CAD has slipped back to 1.2600 recently despite the BoC holding rates, as risk appetite/strong oil prices support CAD.

- BoC Governor Macklem’s press conference remarks didn’t move the loonie and attention is now on the upcoming Fed meeting.

After its initial post-BoC rate hold pop as high as the 1.2640s, USD/CAD has dropped back to the 1.2600 level and is back to trading lower by about 0.2% on the session. Whilst a minority of market participants/analysts had been expecting the central bank to hike interest rates by 25bps to 0.50% on Wednesday, explaining the initial post-policy announcement weakness, the loonie has remained underpinned by positive risk appetite and higher crude oil prices. The S&P 500 is currently trading about 1.5% higher on the day and is now trading in the green on the week, facilitating outperformance amongst the more risk-sensitive G10 currencies such as CAD. Meanwhile, WTI has surged nearly $2.0 and is only a whisker away from last week’s multi-year highs, supported by ongoing geopolitical (Russia/Ukraine/NATO) and OPEC+ supply concerns.

BoC Governor Tiff Macklem’s remarks in the post-meeting press conference did not seem to rock the boat much for the loonie. The governor explained the reason for holding off on a rate hike on Wednesday (Omicron weighing on the economy) and alluded to the need to raise interest rates and begin reducing the size of the balance sheet in the months ahead. Somewhat dovishly, he did emphasise that the rate hike path would not be automatic, with each hike to be taken on a meeting-by-meeting basis, and alluded to the possibility of a mid-hiking cycling pause if needed. But this doesn’t seem to have impacted longer-term expectations for the BoC rate path much.

With USD/CAD’s top on Wednesday confirming a downtrend from Monday’s highs, technicians may see the pair as having entered a short-term bearish trend. The bears may now be targetting a move back towards the 200-day moving average at 1.2500 and test of recent lows in the 1.2450 area. Should risk appetite continue to improve and crude oil prices continue to advance, USD/CAD’s short-term path should be downwards. One key event to watch on Wednesday is of course the upcoming Fed policy announcement; like the BoC, the Fed is expected to tee up rate hikes and QT in the coming months. FX markets could be volatile, having ignored US trade data earlier in the session that showed a larger than anticipated, monthly goods trade deficit in December of over $100B for the first time.

BoC Governor Tiff Macklem, in his post-monetary policy meeting and Monetary Policy Report release press conference, said that Wednesday's decision to hold interest rates was consistent with the bank's deliberate approach, before adding that the spread of Omicron is weighing on the economy.

Additional Remarks:

"Reopening the economy has proven complicated."

"We want monetary policy to be a source of confidence, not uncertainty."

"We are going to learn more about Omicron in the coming weeks."

"Confident inflation will come down because we are seeing evidence global supply chain issues are starting to be resolved."

"Rising rates will dampen demand growth and ensure domestic sources of inflation do not build up."

"Inflation is uncomfortably high."

"Rate hikes won't be automatic... we will take decisions at each meeting."

"Won't say how fast or how far rates will be going up."

"We might take a few steps, then pause the rate hiking path and assess progress."

In his post-BoC policy announcement/Monetary Policy Report release press conference on Wednesday, Governor Tiff Macklem said that interest rates will have to go up to counter inflation. Canadians should expect a rising path of interest rates, given the BoC is committed to bringing inflation back to target.

Additional Remarks:

"There is some uncertainty about how quickly inflation will come down because we’ve never experienced a pandemic like this before."

"Unevenness across sectors remains, but taking all the evidence together, the governing council judges the economy is now operating close to its capacity."

"Some evidence that supply disruptions may have peaked, but the spread of omicron is a new wildcard that could further disrupt global supply chains."

"We also considered the potential for some reversal of the large price increases for goods; this would pull inflation down more quickly than we forecast."

"Rising house prices and evident capacity pressures suggest that if demand continues to grow faster than supply this will put upward pressure on inflation."

"We were mindful that the rapid spread of omicron will dampen spending in the first quarter... so we decided to keep our policy rate unchanged today."

"Removing forward guidance is a significant shift in monetary policy, and we judged that it is appropriate to move forward in a deliberate series of steps."

"Bank will keep holdings of Canadian government bonds on our balance sheet roughly constant at least until we begin to raise the policy interest rate... at that time, we will consider exiting the reinvestment phase."

- Positive risk sentiment weighs on the Swiss franc, boosting the greenback.

- The US Dollar advances some 0.27% ahead of the release of the Fed monetary policy statement.

- USD/CHF is upward biased but faces strong resistance at the 100-DMA

The USD/CHF surges in the North American session reclaim the 0.9200 figure ahead of the FOMC monetary policy decision. At press time, the USD/CHF is trading at 0.9207.

Risk sentiment is positive, portrayed by European and US equities trading in the green, despite Ukraine and Russian tensions not easing. However, the expectations of a hawkish hold of the Federal Reserve keep USD bulls in charge of the pair.

USD/CHF Price Forecast: Technical outlook

In the Asian session, the USD/CHF remained subdued in a narrow range of 10-pips range, within 0.9170-80. However, as European traders got to their desks, USD bulls took control of the pair, propelling an upward move that reclaimed the 0.9200 figure.

From a technical perspective, the USD/CHF is neutral-upward biased. At press time, the pair faces strong resistance at the 100-day moving average (DMA) at 0.9211. A breach of that level would expose the January 11 daily high at 0.9278, followed by the confluence of a downslope trendline and December 15, 2021, around 0.9294-0.9305.

On the flip side, the USD/CHF first support would be 0.9200. If broken, the next support would be the 200-DMA at 0.9160, adding further downward pressure on the pair, sending it towards November 2, 2021, a daily low at 0.9085.

The Bank of Canada (BoC) held the overnight rate at 0.25% in January, in line with consensus. The CAD weakened following the decision. That said, a hawkish hold alongside what economists at TD Securities think will be a bit of a relief risk rally still leaves the loonie better placed for now.

Rate hikes will be coming soon

“The Bank of Canada held the overnight rate at 0.25% in January, in line with consensus, although markets were pricing a much higher probability of liftoff. The Bank also provided strong signal for a March hike by noting that economic slack has been absorbed.”

“We look for the Bank to hike by 25 bps at its next meeting.”

“We think it is difficult to fade the CAD with a central bank set to hike. That said, with how the curve is priced, we are cognisant that any additional gains will eventually be grounds for lightening up on longs.”

“Near-term, we are biased to a relief rally following a terrible start in equities this year. That should benefit the CAD.”

- The British pound slides in the New York session, some 0.10%.

- Market sentiment improvement since the Asian session underpins FX risk-sensitive currencies.

- GBP/USD is downward biased, but a Fed dovish hold could send the pair towards 1.3600.

As the New York session begins, the British pound slides for the second day in the week, ahead of the Fed monetary policy statement release. At the time of writing, the GBP/USD is trading at 1.3496.

Risk sentiment is upbeat, as portrayed by European stock indices in the green, and US equity futures point to a higher open. However, the Ukraine – Russia crisis looms. Despite investors’ good mood, market participants should be aware of geopolitical and central bank news crossing the wires.

UK's political domestic issues and a hawkish Fed weigh on the GBP

That, alongside domestic political issues spurred by the so-called “party gate” in No. 10 Downing Street, would dent the prospects of the GBP. Angela Rayner, Labour’s deputy leader, said that Conservative MP’s should stop propping the current PM, adding that he “should finally do the decent thing and resign.”

An absent UK economic docket leaves GBP/USD investors leaning on the greenback dynamics.

In the meantime, GBP/USD traders would take cues of the FOMC monetary policy meeting. The expectations are for a hawkish hold, though forward guidance of hiking rates and how soon the Quantitative Tightening (QT) would begin. Being the Fed’s first monetary policy meeting of 2022, there would not be any Summary of Economic Projections (SEP).

The GBP/USD was subdued during the overnight session for North American traders, around the 1.3490-1.3523 range, ahead of the FOMC meeting. The break of the 100-day moving average (DMA) lying at 1.3530 accelerated the fall near the 50-DMA at 1.3419. However, on Tuesday, the pair bounced off those levels and closed above 1.3500.

GBP/USD Price Forecast: Technical outlook

The GBP/USD is downward biased, per the location of the daily moving averages (DMAs), with the shorter time-frame below the longer time ones. However, the fact that price action broke above the 50-DMA, which lies at 1.3419, suggests that the pair might be subject to buying pressure in the near term. Nevertheless, unless the GBP/USD breaks above the 100-DMA at 1.3530, then that would open the door for further gains.

The GBP/USD first resistance would be the latter mentioned. A break above that level would expose a downslope trendline around 1.3550-60, which would expose the 1.3600 figure once broken.

On the flip side, the first support would be January 25 daily low at 1.3436. A breach of the latter would send the pair tumbling to the 50-DMA at 1.3419, followed by the 1.3400 figure.

- USD/CAD surged back above 1.2600 after the BoC disappointed some hawkish bets by holding interest rates steady at 0.25%.

- But it was a hawkish hold, with the bank signaling rate hikes and QT will be coming soon.

- That, plus recovering risk appetite and higher oil prices may limit loonie losses.

USD/CAD surged from the 1.2560s to the 1.2630 area after the Bank of Canada on Wednesday opted to hold interest rates at 0.25%, disappointing calls from a minority of market participants and economists for a 25bps rate hike to 0.50%. Ahead of the meeting, a Bloomberg poll revealed that seven out of 31 analysts were looking for a 25bps rate hike, thus the pricing out of these hawkish bets seems behind the latest bout of loonie weakness. On the session, USD/CAD is now back to trading flat, having been as much as 0.5% lower prior to the policy announcement.

The BoC’s latest policy announcement can be characterised as a hawkish hold. The bank noted that overall slack in the economy had now been absorbed, satisfying the condition for future rate hikes and strongly hinting towards a hike at the next meeting in March. The bank then added that, at the time when interest rates start to rise, it will consider ending balance sheet reinvestments and ways to reduce the balance sheet’s overall size. In other words, while the BoC held off on hiking rates on Wednesday, it signaled that rate hikes and quantitative tightening will be coming very soon.

This might serve to limit loonie downside for the time being, with the BoC looking very likely to at the very least keep pace with the Fed when it comes to monetary tightening. Note also that the backdrop of recovering risk appetite (US stocks are advancing strongly and are now higher on the week) and stronger crude oil prices as geopolitical tensions bubble may combine to shield the risk/commodity-sensitive loonie from further downside. Technicians will note resistance in the 1.2700 area and support in the 1.2450 area as the key levels to keep an eye on.

The Bank of Canada announced on Wednesday that it was holding its overnight interest rate at 0.25%, as the majority of market participants had been expecting. Note that a minority had expected a 25bps rate hike to 0.50%. The bank also signaled that a rate hike would likely be coming in March by saying that overall slack in the economy had been absorbed, satisfying the conditions outlined in the bank's forward guidance for an interest rate hike.

Additional Takeaways as summarised by Reuters:

On rate hikes...

- Overall slack in the economy has been absorbed, satisfying the condition outlined in the bank’s forward guidance on its policy interest rate.

- The BoC has decided to end its extraordinary commitment to hold its policy rate at the effective lower bound.

- The BoC will use its monetary policy tools to ensure that higher near-term inflation expectations do not become embedded in ongoing inflation.

- The BoC expects interest rates will need to increase, with the timing and pace of those increases guided by the bank’s commitment to achieving the 2% inflation target.

On possible balance sheet reduction...

- BoC will keep its holdings of Canadian government bonds on its balance sheet roughly constant at least until it begins to raise the policy interest rate.

- It is continuing its reinvestment phase, keeping its overall holdings of Canadian government bonds roughly constant.

- At that time, the BoC will consider exiting the reinvestment phase and reducing the size of its balance sheet.

Economic/financial commentary...

- Financial conditions remain broadly accommodative but have tightened with growing expectations that monetary policy will normalize sooner than was anticipated

- The Omicron variant is weighing on activity in the first quarter.

Market Reaction

USD/CAD saw a positive reaction to reflect loonie weakness after the BoC disappointed a minority of market participants by not opting to surprise with a 25bps rate hike on Wednesday, but rather signal a rate hike coming up at the next meeting. USD/CAD currently trades about 60 pips above its pre-BoC announcement levels. Given it was a hawkish hold, with the bank signalling rate hikes and quantitative tightening will be coming soon, the loonie's overall losses may be somewhat limited.

- Gold breaks under 1840$ and drops to the lowest in two days.

- US dollar remains mixed across the board as market participants await the FOMC statement.

- Wall Street opens in green, recovering from Tuesday’s slide.

Gold prices tumbled after the beginning of the American session. XAU/USD broke under 1840$ and quickly dropped to the 1830$ area, reaching the lowest level in two days. It remains under pressure ahead before the FOMC statement.

Probably technical factors weighed on the last leg lower in XAU/USD. The area around 1840$ offered support during several hours. Now the yellow metal is about to test the key $1830 support zone. A break lower would add more pressure, probably accelerating the decline. If XAU/USD holds above $1830, a rebound seems likely. The $1850 zone is the relevant resistance.

Market participants await the outcome of the FOMC meeting. The statement will be delivered at 19:00 GMT and could significantly impact gold prices. “A hawkish hold is widely expected as the Fed sets the market up for liftoff at the next meeting March 15-16. WIRP (Bloomberg World Interest Rate Probabilities) suggests a hike then is fully priced in, as are three more quarterly hikes this year. There won’t be any updated macro forecasts or Dot Plots for today’s decision, but we expect Chair Powell to send a very clear signal that the Fed is looking beyond recent stock market volatility and instead focusing on the tight labor market” explained analysts at Brown Brother Harriman.

“Markets will be keen to see any clues on how soon the Fed will allow balance sheet runoff. We had thought this would be a 2023 story, but given recent official comments and the Fed’s accelerated timeline, we believe runoff will begin in Q3”, said a BBH report. They warn of some possible “buy the rumor, sell the fact” price action after the decision that could send the dollar lower, and could benefit XAU/USD, particularly if the same behaviour takes place in the bond market.

Technical levels

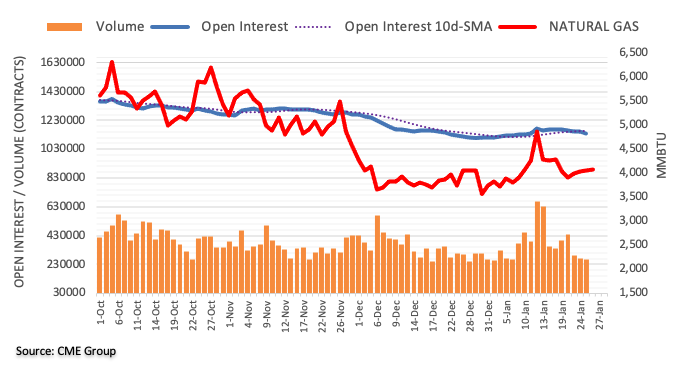

- WTI hit highs for the week above $87.00 on Wednesday amid a risk appetite recovery and ongoing geopolitical concerns.

- Ahead, oil traders will be watching official US inventories, the Fed policy meeting, OPEC+ headlines and further geopolitical updates.