- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 25-10-2024

- EUR/USD returned to its bearish ways on Friday.

- A broad upswing in the Dollar Index continues to pummel the Euro.

- Coming up next week: DST, EU CPI, US PCEPI, and another NFP print.

EUR/USD trimmed a near-term rebound on Friday, slamming the door on a clean bullish recovery and keeping bids trapped near the 1.0800 handle to round out the trading week. Fiber shed another half of a percent from Monday’s opening bids, challking in a fourth straight losing week and dragging price action down even further from late September’s peak just north of 1.1200.

Markets will kick off next week with the start of Daylight Savings Time across the European continent, shifting market open hours by an hour. The front half of the trading week is a sedate affair, with Euro traders looking ahead to Wednesday’s European growth update. Pan-EU Gross domestic Product (GDP) growth is expected to hold steady in the third quarter, forecast to print in-line with the previous quarter’s 0.2%. Meanwhile, the annualized growth figure is expected to tick upwards from 0.6% to 0.8% YoY.

Next Thursday will round out the Euro’s representation on the economic calendar, with preliminary Harmonized Index of Consumer Prices (HICP) inflation for October. Headline EU HICP inflation is expected to rise to 1.9% YoY compared to the previous period’s 1.7%.

Next week is a big showing for US Dollar traders. US Personal Consumption Expenditure Price Index (PCEPI) figures land on Thursday, followed by another round of monthly US Nonfarm Payrolls (NFP) jobs data on Friday. Core US PCEPI is expected to have ticked higher in September, forecast to print at 0.2% MoM compared to August’s 0.1%. US NFP net jobs additions are expected to cool off to a moderate 140K net new jobs added in October, down from the previous month’s blowout 254K print.

EUR/USD price forecast

The EUR/USD pair is currently trading below the 50-day EMA and 200-day EMA, signaling a bearish sentiment in the market. The recent price action shows a strong downward momentum from early October, where the price broke below the 50-day EMA and continued to dip beneath the 200-day EMA, further confirming the bearish bias. The current price near 1.0795 is testing a support zone, as evidenced by the small-bodied candles, suggesting some consolidation or an indecisive phase. If the support holds, we could see a temporary pullback towards the 1.0899 resistance level, coinciding with the 200-day EMA. However, a failure to break higher could invite further downside pressure.

The MACD histogram shows weakening negative momentum, but the signal lines remain in bearish territory, suggesting that sellers are still in control despite a possible short-term correction. If the price fails to break above the 50-day EMA near 1.0962, the pair could extend its decline. Smart Money Concepts (SMC) traders may note the formation of a liquidity grab below previous lows, potentially indicating institutional accumulation for a pullback. However, unless key resistance zones are reclaimed, the overall structure remains bearish, and a break below 1.0750 could open the door for further losses toward 1.0650.

EUR/USD daily chart

Euro FAQs

The Euro is the currency for the 19 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

- NZD/USD retreats further, dropping below 0.6000.

- Oversold RSI points to possible corrective bounce, but bearish momentum remains strong.

- The pair stands in lows since early August.

The NZD/USD currency pair has extended its downtrend, with bears maintaining a firm grip as selling momentum builds. During Friday's session, the pair fell by 0.60% to 0.5980, hitting lows not witnessed since August. In addition, the 20-day Simple Moving Average (SMA) is about to complete a bearish crossover with the 100-day SMA which could add selling pressure.

The Relative Strength Index (RSI) remains in oversold territory, currently at 30, indicating intense selling pressure. The RSI's downwards trajectory suggests that bearish momentum is likely to persist, matching the rising red bars on the Moving Average Convergence Divergence (MACD) histogram. That being said, the RSI in oversold terrain might trigger a corrective bounce as sellers might start to run out of steam.

NZD/USD daily chart

Technically, the NZD/USD pair continues to trade below its key moving averages, with the 100-day Simple Moving Average (SMA) at 0.6100 and the 200-day SMA around 0.6150 creating significant resistance. These hurdles are capping the pair's potential for an upward rebound.

Support levels: 0.5950, 0.5930, 0.5900.

Resistance levels: 0.6000,0.6050, 0.6100.

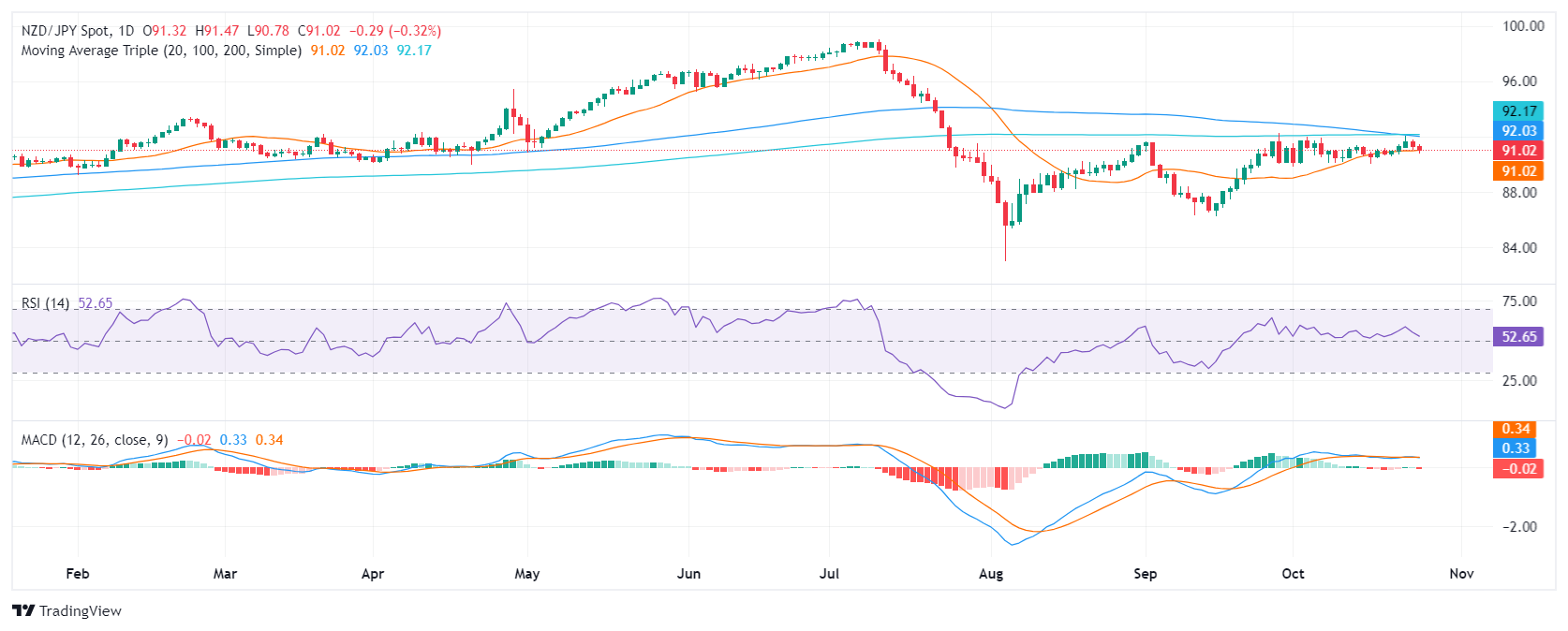

- The NZD/JPY has been trading sideways recently, showing no clear trend.

- Technical indicators suggest a growing bearish momentum, with the RSI and MACD starting to turn in favor of the sellers.

- The 100 and 200-day SMA completed a bearish crossover at 92.00.

The NZD/JPY pair has traded within a tight range recently, demonstrating a lack of clear directional momentum. However, Friday's session saw a modest decline of 0.32% to 91.00, hinting at a potential shift in sentiment.

Technical indicators align with this observation. The Relative Strength Index (RSI) of 52 suggests that buying pressure is on the wane. Meanwhile, the Moving Average Convergence Divergence (MACD) histogram is red and rising, indicating growing bearish momentum. This divergence between the price action and technical indicators suggests that selling forces may be gaining the upper hand.

It is important to note that the 100 and 200-day Simple Moving Averages (SMAs) have converged and crossed at 92.00, forming a strong resistance level. A break below this confluence could intensify selling pressure and add further downward momentum to the pair. Conversely, a break above this key level could indicate a reversal of the current trend.

NZD/JPY daily chart

- Gold remains elevated amid renewed Middle East hostilities.

- US election uncertainty adds to gold’s appeal, with polls showing a tight race between Trump and Biden in key swing states.

- Rising US Treasury yields and a rebounding Dollar cap gains, with DXY up 0.29% and limiting further upside for the yellow metal.

Gold price remains firm ahead of the weekend late in the North American session, up 0.18% after hitting a record high on Wednesday at $2,758. Elevated tensions in the Middle East and uncertainty around US elections keep traders flocking to the safe-haven metal. The XAU/USD trades at $2,740 at the time of writing.

Geopolitics pushed aside US economic data as the main driver for price action. Hostilities continued Friday between Israel and Hezbollah at around the border of Israel and Lebanon. Israeli officials said that around 45 missiles were launched by the terrorist organization.

Meanwhile, Israel attacked eastern Lebanon, leading to the closure of the Al-Qaa and the Masnaa border crossings via Lebanese officials and the United Nations. Israel stated they targeted Hezbollah’s infrastructure.

According to CNN, the US Secretary of State Anthony Blinken met with Middle East leaders in London, trying to end the war in Gaza.

Aside from this, traders are also eyeing US elections. Deutsche Bank Analyst Jim Reid wrote, “An Emerson poll of several swing states yesterday had Trump very marginally ahead, including a 1pt lead in Pennsylvania and Wisconsin, and a 2pt lead in North Carolina. But given the margin of error is just over three points for those polls, this remains a very tight race, as reflected in various prediction markets and forecast models.”

Recently, US Treasury yields recovered after diving to daily lows and turned positive, capping Bullion prices. Also, Greenback is staging a recovery as the US Dollar Index (DXY), which tracks the Dollar's value against a basket of six currencies, is up 0.29% at 104.32.

Data-wise, the US economic docket revealed that US Durable Goods Orders dropped in September. At the same time, the University of Michigan (UoM) revealed that Consumer Sentiment amongst Americans improved in October.

Daily digest market movers: Gold price remains firm despite higher US yields

- The US 10-year Treasury note yield rises two basis points to 4.23%.

- US Durable Goods Orders in September fell by 0.8% month-over-month (MoM), which was better than the estimated -1% decline and unchanged from the previous month.

- US Consumer Sentiment in October came in better than expected, rising to 70.5, compared to the forecast of 69.

- The same survey revealed that inflation expectations for one year dropped from 2.9% to 2.7%, while expectations for five years remained unchanged at 3%.

- Data from the Chicago Board of Trade, based on the December fed funds rate futures contract, indicates that investors estimate 49 basis points (bps) of Fed easing by the end of the year.

XAU/USD technical outlook: Gold price rises above $2,740

Gold price remains upward biased, though it has consolidated at around $2,708-$2,758 during the last four days, unable to crack the bottom-top of the range.

Momentum indicators suggest that buyers are gaining strength, with the Relative Strength Index (RSI) reversing its decline and moving upwards in bullish territory.

If XAU/USD clears $2,750, the next resistance level will be the year-to-date (YTD) high at $2,758. Once surpassed, the next target would be $2,800.

On the downside, if bullion prices fall below the October 23 low of $2,708, the next support lies at the 38.2% Fibonacci Retracement level at $2,699, followed by the 50% and 61.8% Fibonacci Retracement levels at $2,681 and $2,662, respectively.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

- AUD/USD continues trading close to dangerous levels near 0.6600.

- Aussie Dollar could benefit from the hawkish tone surrounding the RBA.

- The USD saw some gains due to strong sentiment data from the University of Michigan.

The AUD/USD declined by 0.21% to 0.6620 in Friday's session despite the Reserve Bank of Australia's (RBA) hawkish policy outlook. The decline was primarily attributed to the appreciation of the US Dollar amid less-dovish sentiment surrounding the Federal Reserve (Fed) and strong University of Michigan (UoM) sentiment data, which overshadowed soft Durable Goods figures.

However, the Aussie Dollar could benefit from the RBA's hawkish tone in the coming days.

Daily digest market movers: Australian Dollar declines on US data

- AUD weakened versus USD primarily due to the release of strong UoM data and Durable Goods lower than expected decline.

- In that sense, Durable Goods Orders in the US declined by 0.8% in September, slightly better than market expectations of a 1% decline.

- UoM’s Consumer Sentiment index rose to 70.5 in October, beating expectations.

- The strong US data might prompt the Fed to take a more hawkish stance and table the two consensus cuts for November and December.

- In the meantime, the RBA isn’t showing signs of being completely open to start cutting with markets only betting on 50% chances of a cut in 2024 which could eventually benefit the AUD.

AUD/USD technical outlook: AUD/USD bearish momentum dominates, support at 0.6600

The AUD/USD pair extended its losses on Friday. The Relative Strength Index (RSI) fell into the oversold area, with a value of 34, and is exhibiting a mildly declining slope, suggesting that selling pressure is rising. The Moving Average Convergence Divergence (MACD) histogram is red and rising, indicating that bearish momentum is increasing.

Overall, the technical outlook for the AUD/USD pair is bearish. The decline in the RSI and the rising MACD histogram suggest that selling pressure is dominating the market. However, it is important to note that the pair is trading near support at 0.6600 and may experience a bounce if it manages to hold above this level.

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

- The Dow Jones shed seven-tenths of a percent on Friday.

- A tech stock rally left the Dow in the dust as the blue-chip index waffles.

- Despite holding on the high end, the Dow Jones found its first down week since August.

The Dow Jones Industrial Average (DJIA) declined 300 points on Friday, easing back 0.7% as a broad tech rally left the Dow to fend for itself. The major index shed 2.7% over the week as key stocks ease back into the midrange following a bumper earnings season.

Stocks are struggling overall under the weight of marginally higher bond yields, which have taken a step up recently. Despite cooling off on Friday, with the 10-year Treasury yield easing back toward 4.2% after breaking north of 4.25% during the midweek market sessions, stocks are grappling with buoyed bond yields as the two markets tend to move in opposite directions.

Tesla (TSLA) has extended a rally after quarterly revenue came in higher than expected, helping to bolster a broad-market rally in the tech sector. Major digital darlings including Meta (META) and Netflix (NFLX) also rose on Friday, gaining more than 1% each.

Dow Jones news

Two-thirds of securities listed on the Dow Jones are testing into the low end on Friday, though a knock-on tech rally helped to bolster Intel (INTC) over 2.5% to $23 per share. The tech and AI bubble also found room for Salesforce (CRM), which rose 1.2% and crossed over $290 per share. On the low end, McDonald’s (MCD) shed nearly 3%, falling below $293 per share, with Goldman Sachs (GS) close behind, backsliding around 2.25% and easing below $513 per share. Both companies posted above-forecast revenue reporting recently, prompting an earnings season splurge, but markets are now pulling back their revenue bids.

Dow Jones price forecast

The Dow Jones spent most of the trading week grinding lower toward the 42,000 handle as the major stock index takes a break from 2024’s overall stellar performance. The equity board has snapped a six-week win streak, but is still firmly planted in bull country as markets take a breather and pull back from 43,000.

Oscillating technical indicators remain hopelessly broken as the Dow Jones sets record highs weekly more often than not. Price action has entirely outrun long-term moving averages, with bids testing chart paper well above the 200-day Exponential Moving Average (EMA), struggling to rise to 35,000.

Dow Jones daily chart

Dow Jones FAQs

The Dow Jones Industrial Average, one of the oldest stock market indices in the world, is compiled of the 30 most traded stocks in the US. The index is price-weighted rather than weighted by capitalization. It is calculated by summing the prices of the constituent stocks and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, who also founded the Wall Street Journal. In later years it has been criticized for not being broadly representative enough because it only tracks 30 conglomerates, unlike broader indices such as the S&P 500.

Many different factors drive the Dow Jones Industrial Average (DJIA). The aggregate performance of the component companies revealed in quarterly company earnings reports is the main one. US and global macroeconomic data also contributes as it impacts on investor sentiment. The level of interest rates, set by the Federal Reserve (Fed), also influences the DJIA as it affects the cost of credit, on which many corporations are heavily reliant. Therefore, inflation can be a major driver as well as other metrics which impact the Fed decisions.

Dow Theory is a method for identifying the primary trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA) and only follow trends where both are moving in the same direction. Volume is a confirmatory criteria. The theory uses elements of peak and trough analysis. Dow’s theory posits three trend phases: accumulation, when smart money starts buying or selling; public participation, when the wider public joins in; and distribution, when the smart money exits.

There are a number of ways to trade the DJIA. One is to use ETFs which allow investors to trade the DJIA as a single security, rather than having to buy shares in all 30 constituent companies. A leading example is the SPDR Dow Jones Industrial Average ETF (DIA). DJIA futures contracts enable traders to speculate on the future value of the index and Options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Mutual funds enable investors to buy a share of a diversified portfolio of DJIA stocks thus providing exposure to the overall index.

- Mexican Peso weakens amid political uncertainty after judicial reforms limit judiciary’s ability to challenge constitutional changes.

- President Sheinbaum’s defiance of a federal judge's suspension order adds to concerns about rule of law and economic stability.

- Fears of potential US tariffs under a Trump presidency weigh on the Peso, compounding pressure from Mexico’s internal political shifts.

The Mexican Peso depreciated against the US Dollar on Friday due to political turmoil linked to the recently approved judicial reform. Investors remain uncertain about recently approved reforms, which could threaten the state of law, and affect Mexico’s creditworthiness. At the time of writing, the USD/MXN trades at 19.98, up 0.96%.

Market sentiment remains upbeat, which would usually underpin the Mexican currency. Politics are capping the Peso’s advances after the Senate passed a proposal to make constitutional reforms “unchallengeable.” Its approval would curtail the judiciary's powers to impede reforms made by lawmakers in Congress.

According to Joaquin Monfort, Senior Analyst at FX Street, “Critics argue this would upset the balance of power in Mexico, whilst proponents argue the judiciary is biased and vulnerable to corruption.”

In September, the Mexican Congress passed a judiciary reform allowing judges and magistrates to be elected by popular vote. Regarding these reforms, two federal judges granted suspensions after citizens appealed the changes to the Mexican Constitution.

One of the judges ordered Mexican President Claudia Sheinbaum and the director of the official gazette, Alejandro Lopez Gonzalez, to lower the publication and remove the decree validating the judicial reform from the gazette. However, Sheinbaum said, “We are not going to lower the publication,” incurring in contempt of a federal judge's order.

In the meantime, fears of Donald Trump’s victory in the US election could weigh on the Mexican Peso, as he repeatedly stated that he would impose tariffs of over 200% on cars manufactured and imported from Mexico.

Data-wise, US Durable Goods Orders slumped in September for a second consecutive month, while core shipments remained down in four of the last five months reported.

Recently, the University of Michigan (UoM) Consumer Sentiment for October, on its final reading, improved above estimates and the previous month's reading. Inflation expectations for one year were revised downward and, for five years, remained unchanged.

Daily digest market movers: Mexican Peso dwindles on political instability

- A mixed inflation report in Mexico for the first 15 days of October might prevent the Bank of Mexico (Banxico) from lowering borrowing costs by 50 basis points (bps), according to Monex. Banxico’s next meeting is on November 14.

- US Durable Goods Orders in September slumped 0.8% MoM, below estimates of -1% and unchanged compared to last month.

- US Consumer Sentiment in October was better than expected, rising to 70.5, up from 69 expected.

- The same poll revealed expectations for one year dropped from 2.9% to 2.7% and for five years remained unchanged at 3%.

- Data from the Chicago Board of Trade, via the December fed funds rate futures contract, shows investors estimate 49 bps of Fed easing by the end of the year.

USD/MXN technical outlook: Mexican Peso tumbles as USD/MXN buyers eye 20.00

The USD/MXN is upwardly biased and approaches the psychological 20.00 figure. Momentum suggests that buyers are in charge as the Relative Strength Index (RSI) resumed its advance. Hence, the path of least resistance is tilted to the upside.

If buyers clear the 20.00 figure, they could test the weekly peak at 20.09. On further strength, the USD/MXN could aim toward the year-to-date (YTD) high at 20.22, ahead of key psychological levels of 20.50 and 21.00.

On the other hand, if sellers reclaim the October 18 low at 19.64, this could pave the way for a challenge to 19.50. The next move would be toward the October 4 swing low of 19.10 before testing 19.00.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

- Silver trades at $33.64, bouncing back from a weekly low of $33.09 as RSI approaches overbought territory, signaling bullish momentum.

- Key resistance levels include the October 24 high at $34.29, YTD high at $34.86, and October 2012 peak at $35.40.

- A bearish daily close could shift bias to the downside, with first support at $33.24, followed by $33.00 and October 17 low of $31.32.

Silver prices staged a comeback after dipping to a weekly low of $33.09, though it remains below its opening price by 0.10% late during Friday’s North American session. At the time of writing, XAG/USD trades at $33.64.

XAG/USD Price Forecast: Technical outlook

The grey metal remains upwardly biased, even though it has posted back-to-back days recording new weekly lows. Momentum backs buyers as depicted by the Relative Strength Index (RSI), reaccelerating toward overbought territory. Therefore, the path of least resistance is tilted to the upside.

XAG/USD first resistance would be the October 24 high at $34.29, followed by the year-to-date (YTD) high at $34.86. On further strength, buyers could challenge October 2012 high at $35.40.

Conversely, if XAG/USD prints a bearish daily close, it could pave the way for further downside. the first support would be the October 24 daily low of $33.24, followed by $33.00. A breach of the latter, Silver could tumble as low as $31.32, to the October 17 swing low.

XAG/USD Daily Chart

Silver FAQs

Silver is a precious metal highly traded among investors. It has been historically used as a store of value and a medium of exchange. Although less popular than Gold, traders may turn to Silver to diversify their investment portfolio, for its intrinsic value or as a potential hedge during high-inflation periods. Investors can buy physical Silver, in coins or in bars, or trade it through vehicles such as Exchange Traded Funds, which track its price on international markets.

Silver prices can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can make Silver price escalate due to its safe-haven status, although to a lesser extent than Gold's. As a yieldless asset, Silver tends to rise with lower interest rates. Its moves also depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAG/USD). A strong Dollar tends to keep the price of Silver at bay, whereas a weaker Dollar is likely to propel prices up. Other factors such as investment demand, mining supply – Silver is much more abundant than Gold – and recycling rates can also affect prices.

Silver is widely used in industry, particularly in sectors such as electronics or solar energy, as it has one of the highest electric conductivity of all metals – more than Copper and Gold. A surge in demand can increase prices, while a decline tends to lower them. Dynamics in the US, Chinese and Indian economies can also contribute to price swings: for the US and particularly China, their big industrial sectors use Silver in various processes; in India, consumers’ demand for the precious metal for jewellery also plays a key role in setting prices.

Silver prices tend to follow Gold's moves. When Gold prices rise, Silver typically follows suit, as their status as safe-haven assets is similar. The Gold/Silver ratio, which shows the number of ounces of Silver needed to equal the value of one ounce of Gold, may help to determine the relative valuation between both metals. Some investors may consider a high ratio as an indicator that Silver is undervalued, or Gold is overvalued. On the contrary, a low ratio might suggest that Gold is undervalued relative to Silver.

- US Dollar holds its ground at the end of the week, remains in consolidation mode.

- Fed officials remain cautious on inflation, as Durable Goods Orders miss market expectations.

- Markets continue to see two cuts by year-end.

The US economy remains robust with GDPNow tracking third-quarter growth at 3.4%. The strong economic outlook might push the Federal Reserve (Fed) to adopt a more cautious stance. Investors, meanwhile, are confident of two cuts by the end of 2024.

The US economy remains robust with the Atlanta Fed's GDPNow model tracking Q3 growth at 3.4% and the New York Fed's Nowcast model projecting 3.0% growth for Q3 and 2.6% growth for Q4.

Daily digest market movers: US Dollar with gains, while Goods Orders fall below estimates

- Durable Goods Orders in the US declined by 0.8% MoM in September, slightly better than market expectations of a 1% decline.

- Excluding Transportation, New Orders increased by 0.4%. Excluding Defense, New Orders decreased by 1.1%.

- Transportation equipment, which has been declining for three of the last four months, contributed to the overall decrease in Durable Goods Orders.

- On the positive side, the Michigan Consumer Sentiment index rose to 70.5, beating expectations and helping the USD avoid losses.

DXY technical outlook: DXY breached 200-day SMA, now consolidating

The DXY index breached the 200-day SMA this week, but over-extension forced a retreat. The index is now expected to consolidate, correcting overbought conditions.

Despite gains by the end of the week, the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) indicators remain dangerously close to the overbought territory, so traders should consider eventual losses for the index. Supports lie at 104.50, 104.30 and 104.00, while resistances stand at 104.70, 104.90 and 105.00.

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

- Pair trades sideways within a narrow range, indicating indecisive market sentiment.

- RSI suggests increasing selling pressure, while MACD signals weakening bullish momentum.

- The pair remains below the 20-day SMA, indicating a bearish bias in the short term

EUR/GBP continues to trade within a constricted range, with limited price movements in recent sessions. The pair currently trades near 0.8340 having faced resistance at the 20-day SMA, maintaining a neutral bias.

Analyzing the technical indicators, the Relative Strength Index (RSI) has declined to 45, suggesting increasing selling pressure. The MACD, while still in positive territory, is decreasing, indicating weakening buying momentum. This confluence of signals points to a neutral to slightly bearish bias in the short term.

Support levels are seen at 0.8330, 0.8315, and 0.8300, while resistance levels stand at 0.8350, 0.8370, and 0.8400. In the near term, the pair is likely to continue trading within this range unless buyers manage to break above the 20-day SMA, thereby shifting the technical outlook more favorably.

EUR/GBP daily chart

UK Chancellor Reeves is walking a thin line as she seeks to find a balance between finding the funds to invest for growth while also maintaining the air of budgetary prudence, Rabobank’s FX analyst Jane Foley notes.

GBP is holding up well so far

“To avoid shocking gilt investors too much by the October 30 budget announcements, Reeves has already leaked various parts of her agenda. GBP is holding up well so far, in part because the BoE is less dovish than some other G10 central banks.”

“Meanwhile, a more dovish ECB is undermining the resilience of the EUR. Despite the risks to GBP posed by a change in fiscal policy settings, our central view remains that EUR/GBP will continue to edge lower to the 0.8150 area on a 12-month view.”

“We will revise our USD forecasts in early November and see downside risk to our cable view.”

- EUR/CAD trades plum in the middle of a multi-week range as both constituent currencies face similar negative fundamentals.

- The central banks of Canada and the Eurozone are expected to slash rates at the end of 2024 – a negative for both EUR and CAD.

- CAD also faces downside pressure from US election risk and the lower Crude Oil prices.

EUR/CAD lengthens its range-bound price action on Friday, trading at 1.5000 after edging higher on the day. The pair is plum in the center of an 11-week range and unable to gain directionality due to the similar monetary policy outlook of the two currencies’ central banks.

Both the European Central Bank (ECB) and Bank of Canada (BoC) are in the process of cutting interest rates as inflation pressures from the Covid-19 crisis ease.

The relative level of interest rates set by central banks is a major driver of the exchange rate because it impacts the flow of money. Capital tends to flow to where it can earn more and so favors currencies with higher interest rates, all other things being equal. As such neither the CAD nor EUR are particularly outperforming since both their central banks are expected to lower rates aggressively.

EUR/CAD 4-hour Chart

In its recent October meeting the BoC surprised markets by slashing its official interest rate (that which sets the interest rates of commercial banks) by 50 basis points (bps) (0.50%), bringing the official overnight rate down to 3.75%, from 4.25% previously.

Many analysts had expected a more cautious 25 bps (0.25%) reduction. The decision had negative repercussions for the Canadian Dollar (CAD) which weakened in most of its pairs although the effect was muted against the Euro, with EUR/CAD actually closing marginally higher on the day.

The reason CAD did not fall against the Euro on the day (Wednesday) was partly because of the publication of a story by Reuters which reported that the ECB was considering cutting interest rates to below the “neutral” rate. The neutral rate, also known as the “equilibrium level” of interest rates, is a theoretical level at which inflation should remain unchanged. For the ECB the neutral rate is said to be between 1.5% and 2.0%. Given the ECB’s key interest rate is 3.40% this would imply a radical reduction on the horizon.

The story intensified speculation the ECB might be preparing to cut interest rates more aggressively at its last meeting of the year in December 2024, with swap rates, which are used to predict central bank decisions, pricing a healthy chance of a 50 bps reduction.

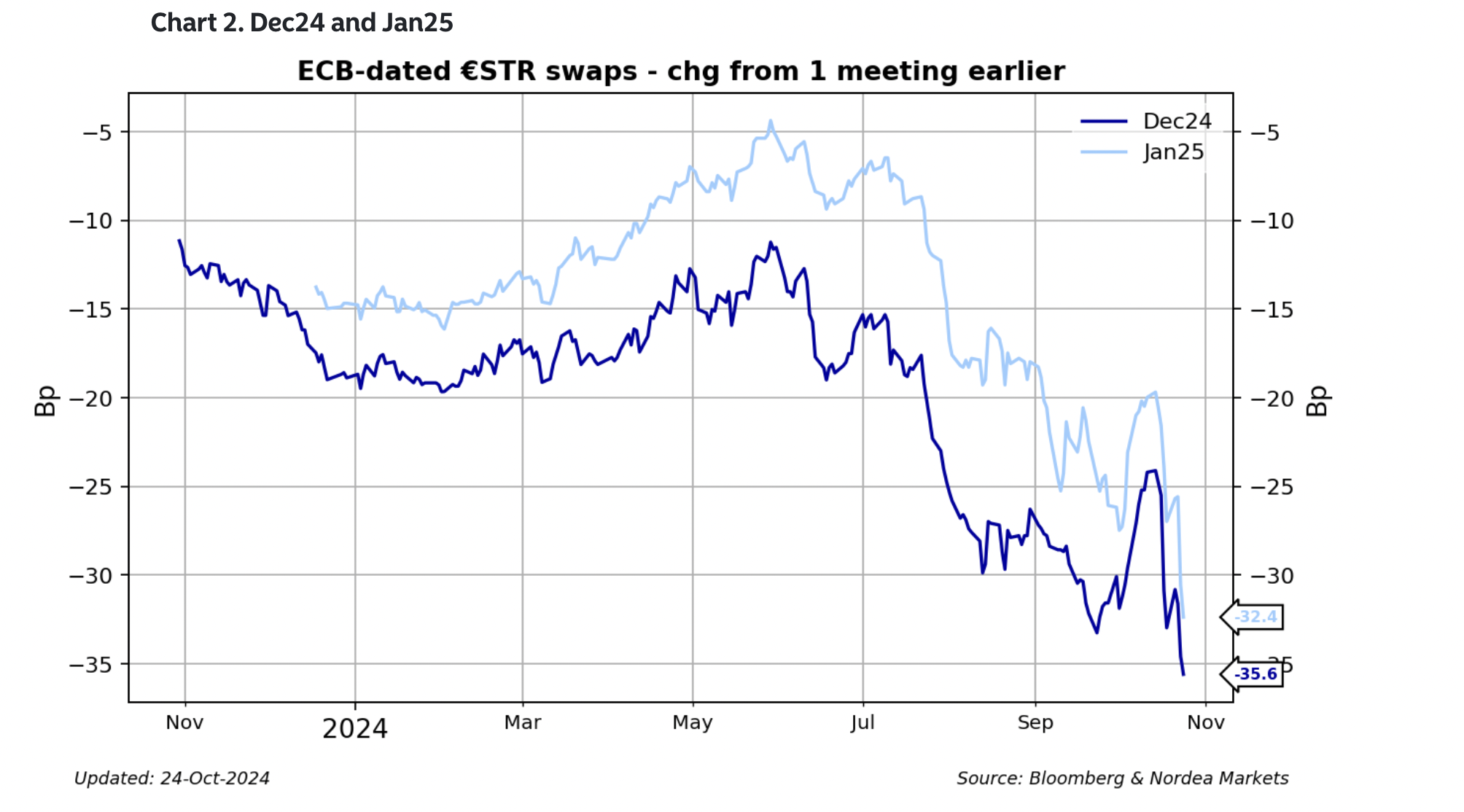

“Rates are falling significantly as markets are pricing a higher probability of the ECB going for a 50 bps rate cut in December,” said Andres Larsson, Senior FX Analyst at Nordea Bank, adding, “..and a higher probability of the ECB eventually cutting rates to below neutral,”

According to Larsson, the market is pricing in “-35.6bp for the December ECB meeting and -32.4bp for the ECB meeting on 25 January.” This is substantially higher than a few weeks ago.

Eurozone data out on Thursday failed to quell speculation after October Purchasing Manager Indexes – surveys that indicate economic activity for leading sectors of the economy – revealed Manufacturing activity in the region rose but was still in contraction territory (below 50) at 45.9 and Services PMI dipped to 51.2 from 51.4 in September.

“Today’s PMIs were more or less in line with expectations, although the employment component dropped below 50, pointing to the risk of rising unemployment ahead,” said Larsson.

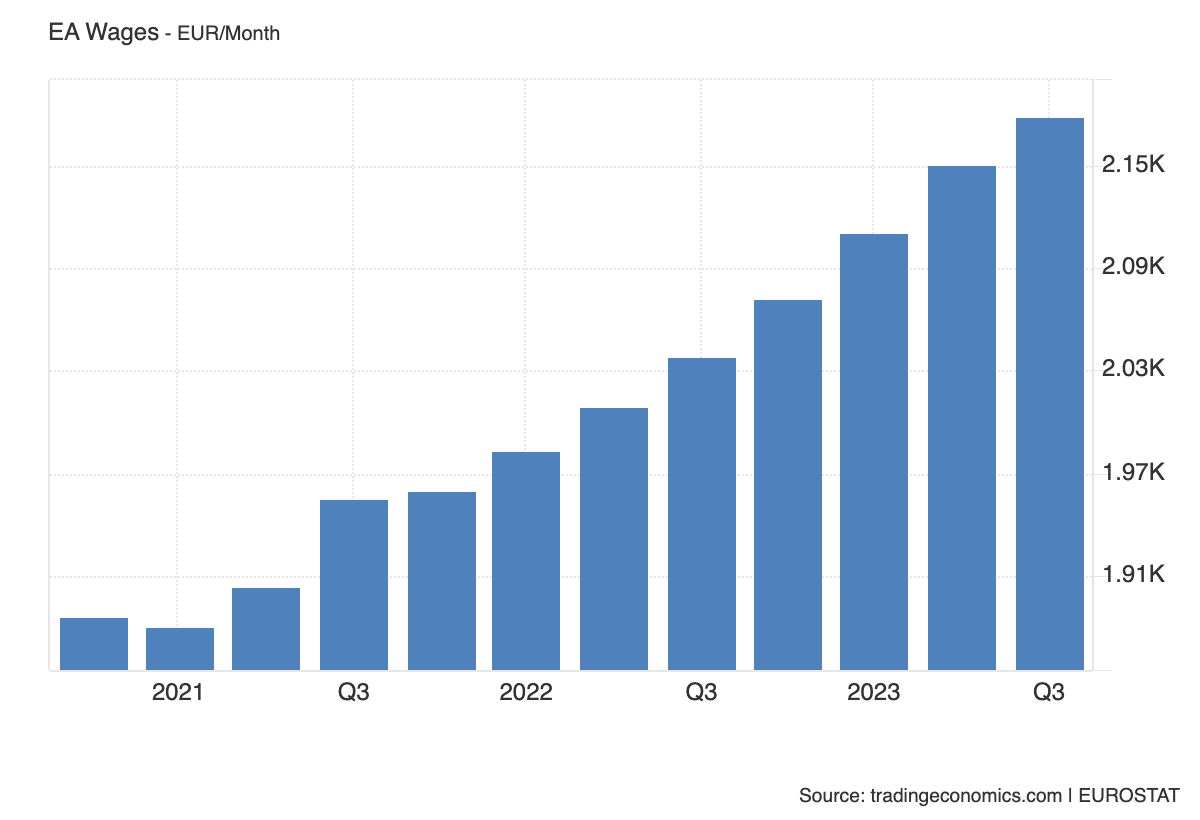

Employment and wages could be a key determining factor for whether the ECB decides to go for a “Christmas slasher” or not.

The ECB’s Chief Economist Martin Lane has said that wage inflation is likely to stay elevated in the second half of 2024 which is likely to prevent the ECB from making big cuts to interest rates before 2025. If true, this could inject some caution into ECB at the December meeting and suggest the bank might opt for a softer 25 bps cut instead. Such a move would provide upside for EUR/CAD.

According to official Wage Growth data, Eurozone wages rose 4.5% in the second quarter which, though lower than the 5.2% in the previous quarter, remained high. There is still no data for Q3, however, but the Eurozone Average Monthly Wage continues to rise quite strongly, reaching EUR 2,180 in September.

On Friday, the German IFO Business Climate Index showed a higher than expected reading, providing some reassurance regarding the outlook for the German economy, which has been seen as a weak link in the Eurozone despite historically being its engine house. This may have helped EUR/CAD nudge higher into the end of the week.

“The headline German IFO Business Climate Index rebounded to 86.5 in October from 85.4 in September. The data came in above the estimated 85.6 print,” said Dhwani Mehta, Senior Analyst at FXStreet.

From Canada, meanwhile, data on Friday showed shoppers reigning in their spending after data showed it rose by only 0.4% MoM in August, from 0.9% in July and below estimates of 0.5%.

EUR/CAD might also be biased to rise due to other factors weighing on the Canadian Dollar, which include the increased chance of Republican nominee Donald Trump winning the US presidential elections, and lower Crude Oil prices, since Oil is Canada’s largest export.

Former President Trump has vowed to impose tariffs on foreign imports in order to kickstart a recovery in US manufacturing, and if he targets Canadian imports this would reduce demand for CAD, weakening it. At the moment Canada, the US and Mexico enjoy a free trade deal, however, a Trump presidency might result in the US’s withdrawal. The deal is up for renegotiation in 2026.

According to the model of leading election website FiveThirtyEight, Trump now has a slightly higher 51% chance of winning. That said, the website’s master poll, which aggregates, averages, and weights polls according to recency, shows Vice-President Kamala Harris still in the lead with 48.1% versus Trump’s 46.4%.

Most betting websites offer better odds of Trump winning than Harris. The former President is also nudging ahead in key marginal seats that could decide the outcome of a too-close-to-call vote.

“Polls in the battleground states have remained very tight and within the margin of error,” says Jim Reid, Global Head of Macro Research at Deutsche Bank on Friday. “For instance, an Emerson poll of several swing states yesterday had Trump very marginally ahead, including a 1pt lead in Pennsylvania and Wisconsin, and a 2pt lead in North Carolina," said Jim Reid, Global Head of Macro Research at Deutsche Bank in a note on Friday.

- GBP/USD remains above the 100-day SMA at 1.2967, with a break above 1.3000 potentially targeting 1.3015 and weekly high of 1.3057.

- RSI signals mild bullish momentum, but bias remains bearish below the neutral line, adding to resistance at the 1.3000 mark.

- Sellers need to break below 1.2967, with further support at the bottom trendline near 1.2925/35 for a bearish shift.

The Pound Sterling recovered some ground and traded at around three-day highs of 1.2998 yet remained unable to crack the 1.3000 figure at the time of writing. Market mood has improved slightly, a headwind for Greenback, which, despite that, is headed to sustain weekly gains of more than 0.50%.

GBP/USD Price Forecast: Technical outlook

The GBP/USD trades above the 100-day Simple Moving Average (SMA) at 1.2967, with buyers pressing to clear the 1.3000 figure. The Relative Strength Index (RSI) is bearish below its neutral line but slightly tilted to the upside in the short term.

If buyers lift GBP/USD above 1.3000, they could push prices to October 22 high at 1.3015, followed by the weekly peak at 1.3057. Conversely, sellers need to drive the GBP/USD below the 100-day SMA, followed by the bottom trendline of an ascending channel at around 1.2925/35.

GBP/USD Price Chart – Daily

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.03% | -0.10% | 0.14% | 0.12% | 0.09% | 0.21% | 0.06% | |

| EUR | 0.03% | -0.05% | 0.16% | 0.14% | 0.11% | 0.24% | 0.08% | |

| GBP | 0.10% | 0.05% | 0.24% | 0.19% | 0.16% | 0.29% | 0.10% | |

| JPY | -0.14% | -0.16% | -0.24% | -0.03% | -0.06% | 0.07% | -0.10% | |

| CAD | -0.12% | -0.14% | -0.19% | 0.03% | -0.04% | 0.10% | -0.10% | |

| AUD | -0.09% | -0.11% | -0.16% | 0.06% | 0.04% | 0.13% | -0.07% | |

| NZD | -0.21% | -0.24% | -0.29% | -0.07% | -0.10% | -0.13% | -0.20% | |

| CHF | -0.06% | -0.08% | -0.10% | 0.10% | 0.10% | 0.07% | 0.20% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

- Silver price rebounds after the release of the US Durable Goods Orders data for September.

- Fresh demand for US core goods contracted steadily by 0.8%.

- Improving market sentiment could dampen the appeal of safe-haven assets.

Silver price (XAG/USD) recovers its intraday losses after discovering buying interest near the key support of $33.00 in Friday’s New York session. The white metal rebounds after the release of the United States (US) Durable Goods Orders for September, which showed that fresh demand for long-lasting goods declined steadily by 0.8%. However, the pace at which Durable Goods Orders contracted was slower than estimates of 1.0%.

The US Dollar (USD) edged lower after the release of the Durable Goods Orders data, with the US Dollar Index (DXY) struggling to hold 104.00. 10-year US Treasury yields fall to near 4.19%. Lower yields on interest-bearing assets reduce the opportunity cost of holding an investment in non-yielding assets, such as Silver.

The Silver price faced pressure in the last two trading sessions amid profit-booking after it posted a fresh high close to $35 on Tuesday, the highest level seen in over 12 years.

Meanwhile, an improvement in investors’ risk appetite could weigh on the Silver price. The market sentiment has improved as investors start digesting expectations that former US President Donald Trump will win over current Vice President Kamala Harris in national elections on November 5. The S&P 500 has opened on a positive note on Friday.

Also, the visit of US Secretary of State Antony Blinken to Saudi Arabia has slightly renewed hopes of a ceasefire in the war between Iran and Israel in southern cities of Lebanon.

Silver technical analysis

Silver price bounces back from 33.00 in North American trading hours on Friday. The white metal aims to revisit a fresh over 12-year high near $35.00. The asset strengthened after breaking above the horizontal resistance plotted from May 21 high of $32.50 on a daily timeframe, which will act as a support for now. Upward-sloping 20- and 50-day Exponential Moving Averages (EMAs) near $32.30 and $31.10, respectively, signal more upside ahead.

The 14-day Relative Strength Index (RSI) oscillates above 60.00, points to an active bullish momentum.

Silver daily chart

Silver FAQs

Silver is a precious metal highly traded among investors. It has been historically used as a store of value and a medium of exchange. Although less popular than Gold, traders may turn to Silver to diversify their investment portfolio, for its intrinsic value or as a potential hedge during high-inflation periods. Investors can buy physical Silver, in coins or in bars, or trade it through vehicles such as Exchange Traded Funds, which track its price on international markets.

Silver prices can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can make Silver price escalate due to its safe-haven status, although to a lesser extent than Gold's. As a yieldless asset, Silver tends to rise with lower interest rates. Its moves also depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAG/USD). A strong Dollar tends to keep the price of Silver at bay, whereas a weaker Dollar is likely to propel prices up. Other factors such as investment demand, mining supply – Silver is much more abundant than Gold – and recycling rates can also affect prices.

Silver is widely used in industry, particularly in sectors such as electronics or solar energy, as it has one of the highest electric conductivity of all metals – more than Copper and Gold. A surge in demand can increase prices, while a decline tends to lower them. Dynamics in the US, Chinese and Indian economies can also contribute to price swings: for the US and particularly China, their big industrial sectors use Silver in various processes; in India, consumers’ demand for the precious metal for jewellery also plays a key role in setting prices.

Silver prices tend to follow Gold's moves. When Gold prices rise, Silver typically follows suit, as their status as safe-haven assets is similar. The Gold/Silver ratio, which shows the number of ounces of Silver needed to equal the value of one ounce of Gold, may help to determine the relative valuation between both metals. Some investors may consider a high ratio as an indicator that Silver is undervalued, or Gold is overvalued. On the contrary, a low ratio might suggest that Gold is undervalued relative to Silver.

The Pound Sterling (GBP) is a mild outperformer on the session, Scotiabank’s Chief FX Strategist Shaun Osborne notes.

GBP outperforms moderately

“Markets were showing some signs of concern yesterday over an adjustment in how UK debt is measured for setting UK fiscal rules.”

“This will allow the government to borrow a lot more in next week’s budget potentially. The announcement by Chancellor Reeves Thursday pressured UK Gilts. Markets appear less perturbed this morning, however, with UK bonds outperforming European debt slightly.”

“GBP was showing some positive signs on the intraday chart yesterday and while progress has been limited, short-term technicals still offers some tantalizing signs of potential gains this morning. Spot is testing minor trend resistance at 1.2980 and a clear push above here should prompt additional gains to the 1.3050 zone over the next 1-2 days.”

“Support is 1.2945/50 and 1.2910.”

A slight improvement in business sentiment in China would probably lend support to oil prices. After all, weak demand in the world's second-largest oil consumer is one of the major disappointments this year, weighing on prices, Commerzbank’s commodity analyst Barbara Lambrecht notes.

Rapid advance of electric mobility curbs oil consumption in China

“The IEA currently expects Chinese daily oil demand to increase by only 100,000 barrels this year, compared with last year. At the beginning of the year, it had still assumed demand growth of 700,000 barrels. In addition to the weak economy, the rapid advance of electric mobility is also curbing oil consumption in China. Sales of electric cars are also rising sharply in the most important consumer country, the US, but their market share is so low that they are not yet significantly reducing oil consumption.”

“If the purchasing managers' index there also improves slightly, as analysts expect, this could also dampen demand concerns in the oil market. In addition, the first survey-based estimates of OPEC production in October will be published at the end of next week, which are likely to show a significant increase in Libyan oil production following the agreement between the parties to the conflict. The latest developments in production in Iraq are more uncertain.”

“Although the country has committed to offsetting overproduction in the first half of the year, this is not yet reflected in current production estimates. The lack of discipline among some OPEC+ members is putting particular strain on the patience of swing-producer Saudi Arabia. According to Bloomberg, the country's oil export revenues fell to their lowest level in more than three years in August. The high deviations of some from their production targets are a burden on prices.”

ECB policymakers have perhaps said all that can possibly be said about the outlook for rates this week. The upshot of the range of comments from key officials is that rates will fall a bit more—and will quite likely drop again in December—but the case for a 50bps cut has not been made and more measured moves are (for the moment) preferable, Scotiabank’s Chief FX Strategist Shaun Osborne notes.

Euro steadies on the day

“Swaps continue to reflect 35bps of easing priced in for the December 12th meeting. Repricing ECB risks may give the EUR a bit more of a foothold around 1.08 in the short run.”

“The EUR closed on a relatively solid footing yesterday. The gain was relatively mild but it was the biggest one-day rise in a month. Bearish technical momentum looks neutral on the intraday chart and the daily RSI oscillator is starting to correct from oversold—a positive.”

“Spot is trading above minor trend resistance on the 6-hour chart this morning and that should provide sone underpinning for the EUR at 1.0800/10 intraday. A push above 1.0875, to set a fresh, short-term high, is needed to generate more lift, however.”

- Durable Goods Orders in the US declined in September.

- US Dollar Index stays in daily range near 104.00 after the data.

Durable Goods Orders in the US decreased $2.2 billion, or 0.8%, to $284.8 billion in September, the US Census Bureau reported on Friday. This reading followed the 0.8% decrease (revised from 0%) recorded in August and came in slightly better than the market expectation for a decline of 1%.

"Excluding transportation, new orders increased 0.4%," the publication read. "Excluding defense, new orders decreased 1.1%. Transportation equipment, also down three of the last four months, drove the decrease, $3.1 billion or 3.1% to $95.4 billion."

Market reaction

The US Dollar Index showed no immediate reaction to these figures and was last seen trading virtually unchanged on the day near 104.00.

The price of Palladium jumped by more than 9% at times yesterday, reaching its highest level since December last year at just under $1,170 an ounce, Commerzbank’s commodity analyst Barbara Lambrecht notes.

Palladium price rallies after fear sanctions kicks in

“According to informed sources, the US government is set to call on the rest of the G7 to impose sanctions on Russian Palladium (and Titanium). Russia has a dominant position in the Palladium market, with one company supplying 40% of the world's mine supply. The EU, which imports about half of its Palladium, obtained about a third of its imports from Russia in 2021.”

“The share is likely to have declined, but is likely to remain significant. The US also continues to buy Russian Palladium. This is not the first time that fears of sanctions have driven up the price of Palladium. The most massive price increase occurred shortly after the start of the war in Ukraine.” “Last December, Palladium also jumped after the US and UK imposed new sanctions on Russian Aluminium, Copper and Nickel, fuelling fears that Palladium would be the next metal to be targeted. A month ago, Palladium also rallied significantly when Russian President Putin threatened to impose export restrictions on certain metals, without specifically mentioning Palladium.

- GBP/JPY has broken out of the top of a Right-Angle Triangle and moved some of the distance towards its target.

- The pair will probably go higher, subject to confirmation.

GBP/JPY has broken out of a Right-Angle Triangle pattern and rallied higher.

The pair completed a decisive move above the upper boundary of a Triangle pattern (see chart) and peaked on Wednesday at 198.44.

The first upside target for the pattern lies at 199.59 (blue shaded rectangle), the 61.8% Fibonacci extrapolation of the height of the triangle (at its widest point) higher.

GBP/JPY Daily Chart

The pair has pulled back since peaking but the odds favor it eventually rallying back up to the aforementioned target. A break above Wednesday’s 198.44 high would provide bullish confirmation.

The Relative Strength Index (RSI) momentum indicator is not yet in the overbought zone (above 70) suggesting the pair has room to go higher.

- EUR/JPY has broken above the ceiling of its multi-month range indicating it could be poised to move even higher.

- Resistance from the 100 and 200-day SMA remains the last hurdle before bulls can run free.

EUR/JPY pierced cleanly through the ceiling of its multi-month range and appears to have established a foothold in the territory above.

Thursday’s mild withdrawal soon found support at the top of the range in the 163.80s suggesting resistance has metamorphosed into support. On Friday price has so far also remained above the range ceiling.

Lying immediately above price however is stiff resistance from a cluster of the (blue) 100 and (green) 200-day Simple Moving Averages (SMA).

EUR/JPY Daily Chart

The short and medium-term trends are bullish suggesting the odds favor more upside to come, however, the two SMAs are major obstacles that need to be traversed before bulls can be confident of following through higher.

A break above 164.90 would probably confirm a decisive break above these two SMAs and result in a move up to the minimum target for the breakout from the range at 169.68. This is the 61.8% Fibonacci extrapolation of the height of the range to the upside.

Alternatively, it is still also possible EUR/JPY could capitulate back inside the range. However, for this to be confirmed, price would have to break below 161.85 (October 17 swing low). This seems less likely given the decisive way in which price broke out of the ceiling of the range on Wednesday.

The Relative Strength Index (RSI) momentum indicator is not yet in the overbought zone (above 70) suggesting the pair has room to go higher.

On the gold market, the rally could at least lose momentum. This is because the quarterly report on gold demand will probably show that, while investment demand is strong, physical demand is weakening due to high demand, Commerzbank’s Commodity analyst Barbara Lambrecht notes.

Weakening physical demand to dampen the bull market

“The quarterly report of the World Gold Council, to be published on Wednesday, is likely to confirm that long-term investors are showing increased interest in gold – inflows of almost 100 tons were recorded in gold ETFs in the third quarter – but high prices are likely to have an adverse effect on physical demand, especially in Asia.”

“This is at least suggested by the significant drop in China's gold imports. Data for gold shipments in September will be published by the Hong Kong Statistics Authority on Monday. In India, the reduction of the import tax in August had led to a significant increase in imports, but in September, gold imports had already fallen again.”

“We think that a weakening of physical demand will dampen the bull market in the long term.”

The price of Brent crude has stabilised at around USD 75 per barrel, at least for the time being, Commerzbank’s commodity analyst Barbara Lambrecht notes.

US inventory report comes out without much impact on prices

“Market participants remain fundamentally torn between supply risks due to the tense situation in the Middle East and demand concerns. This week's weekly inventory report from the US Department of Energy did not provide much clarity either. US crude oil inventories rose by 5.5 million barrels week-on-week, more than expected.”

“However, this was also due to a rebound in crude imports (after a weak hurricane-related week), so it should not be over-interpreted, especially as the increase was accompanied by a significant rise in refinery runs. The latter rose earlier than usual after the maintenance period and may also have led to a rise in gasoline stocks, which is unusual for this time of year.”

“That the latter is not a cause for concern is also shown by the continued robust demand for gasoline in the US. All in all, despite the rise in stocks, this was a report without much impact on prices.”

The Canadian Dollar (CAD) is little changed on the session. CAD remains soft against the USD but it has held up a little better than most of G10 peers on the week despite the Bank of Canada’s aggressive rate cut Wednesday, Scotiabank’s Chief FX Strategist Shaun Osborne notes.

CAD little changed on the session

“Only the CHF has lost less ground against a generally stronger USD since this time last Friday and losses for the AUD and NZD exceed 1%. Context is important. There is a marginal improvement in underlying CAD drivers into the end of the week, pointing to a mild improvement in the CAD’s fair value estimate (1.3857).”

“Canadian Retail Sales are expected to rise 0.5% in August (0.4% in ex-autos terms). On consensus data may give the CAD a small nudge up (providing the release is not overshadowed by US data). The Canadian government’s announcement of meaningful curbs on immigration yesterday has potentially significant implications for growth and productivity etc., but it’s not clear that the plan is entirely feasible.”

“Spot has stabilized from a technical point of view and intraday oscillator signals are showing tentative signs of correcting from overbought. But the USD remains well-supported on minor dips to support at 1.3800/10. A break below the figure may see USD losses extend but only to 1.3750 or so in the short run. Resistance is 1.3850/60.”

The S&P Global Flash manufacturing and services PMIs for October rebounded after slipping in September. The manufacturing PMI rose to 57.4 from an eight-month low of 56.5 in September, while the services PMI edged up to 57.9 from 57.7 in September. The PMIs give a relatively narrow picture of the overall economy, but they still carry some value, Commerzbank’s FX analyst Charlie Lay notes.

RBI to stay prudent

“The bottom line is that they remain well above the 50-level and still point to strong economic momentum. Encouragingly, there were ongoing signs of firm domestic demand and strong new export orders, suggesting India continues to benefit from the global expansion. This is translating to positive employment growth, which should in turn help support domestic consumption.”

“In terms of implications for monetary policy, it will reinforce the Reserve Bank of India’s (RBI) cautious and judicious approach to policy easing. RBI recently shifted to a neutral tone, but there are no signs of an imminent easing. The recent uptick in inflation for September, back above RBI’s mid-point target of 4%, will cement their view to stay prudent.”

“This will also provide some support for INR. We saw this dynamic play out in the past month. INR held up the best among Asian currencies amid the USD rebound. For example, since the end of September, Asian currencies ex-Japan retreated by around 3% vs USD but INR is down only by 0.3%.”

The US Dollar (USD) rally may be coming off the boil. A lower close for the Dollar Index (DXY) yesterday signals some—potential—technical headwinds for the index for starters and markets may be getting a little concerned about one of the essential drivers of the October rebound, Scotiabank’s Chief FX Strategist Shaun Osborne notes.

USD stabilizes as rally shows signs of maturing

“Rising Treasury yields have provided strong tailwinds for the USD amid still resilient economic data. But there is evidence that some of the firming trend in yields is the result investors demanding a greater premium for holding long term US Treasury debt. The NY Fed’s estimated term premium has nudged up to around 20bps, likely reflecting concerns about tariff risks and US fiscal sustainability as the US presidential election race tightens.”

“Stocks are up slightly while bonds are mixed—European debt is (mostly) a little softer while US Treasurys are outperforming modestly. Positive US data surprises have been running at their strongest since the spring, reflecting both the resilience of the US economy and market observers underestimating the durability of growth momentum. Durable goods are expected to fall 1.0% in September, with the ex-transport figure expected to fall just 0.1%.”

“Better than expected data might give the USD a small lift today but an overbought DXY looks increasingly prone to some, minor at least, corrective losses. Weakness in the index below 104 may prompt a further decline towards 103.40/50. Note Japan goes to the polls this weekend, with the ruling LDP at risk of losing its lower house majority.”

- USD/CHF is charting a sideways course just beneath its September high and the 100-day SMA.

- The pair is in a short-term uptrend, favoring a extension higher subject to a clear break above the SMA.

USD/CHF flatlines in the 0.8660s after pausing in its run up from the late September lows. The pair is close to the (blue) 100-day Simple Moving Average (SMA), currently situated at 0.8691.

USD/CHF Daily Chart

The short and medium-term trends are bullish and given the principle that “the trend is your friend” the odds favor an extension higher.

That said, USD/CHF has now reached the target generated by the breakout from the late August and September range at 0.8680. This suggests bullish pressure might wane.

A break above the 100-day SMA and the 0.8700 level would confirm a further extension to the 0.8750 resistance level (August 15 high).

The Relative Strength Index (RSI) momentum indicator is still not in overbought suggesting the pair has room for more upside.

The Bank of Japan is once again in an unenviable position. It would like to continue raising interest rates, which are still stuck at 0.25%, and would like to take advantage of rising inflation to finally move away from its long-standing zero interest rate policy. But the timing is always difficult to get right. When it raised rates in the summer, a very weak US employment report followed a few days later, which, together with the rate hike, triggered sharp swings in the JPY and the stock market. And next week's timing does not seem ideal either, Commerzbank’s FX analyst Volkmar Baur notes.

BoJ can confidently leave rates unchanged next week

“First of all, the Japanese themselves go to the polls on Sunday. After Prime Minister Ishiba Shigeru won an internal party election last month to take over the premiership from Kishida Fumio, he called a snap election to secure his mandate. According to opinion polls, however, this appears to have backfired. The current ruling coalition of the LDP and Komei is in danger of losing its parliamentary majority.”

“As a result, when the BoJ meets next Thursday, it may still be unclear what the government will look like in the coming years and what its fiscal plans are for the near future. In addition, less than a week after the BoJ meeting, another somewhat important election will take place in the US, which could also cause significant market volatility.”

“Perhaps the timing is not so bad after all. Given the political uncertainties, the BoJ can confidently leave rates unchanged next week. This will allow it to avoid any uncomfortable questions about what has happened to its plans for further rate hikes. And will give the BoJ another six weeks until its next meeting.”

- Crude Oil dips back to $70.00 as markets price in a fresh string of events in Israel.

- US Secretary of State Blinken’s diplomatic efforts could result in ceasefire talks.

- The US Dollar Index finds support at 104.00 ahead of US Durable Goods.

Crude Oil price consolidates on Friday on headlines that US Secretary of State Antony Blinken might be able to get both Israel and Iran at the table for ceasefire talks. The Biden administration is stepping up efforts to broker a ceasefire deal in light of the US presidential election on November 5. A breakthrough would be a win for the Biden administration, for the Democrats, and for Kamala Harris’s chances of becoming President.

The US Dollar Index (DXY), which tracks the performance of the Greenback against six other currencies, is consolidating on Friday after profit taking on Thursday and ahead of the US Durable Goods data for September and the University of Michigan final October reading. It is important where the DXY closes this Friday, as it will determine if the DXY can rally further next week on the back of uncertainty on the US presidential election outcome.

At the time of writing, Crude Oil (WTI) trades at $70.48 and Brent Crude at $74.42

Oil news and market movers: Growth outlook bearish

- The International Energy Agency (IEA) has warned that global demand growth would continue to weaken due to China’s slowdown and uptake of electric vehicles, Bloomberg reports.

- Next week, all eyes will be on the OIl companies like BP, Shell, Chevron, and ExxonMobil. They will report Q3 earnings during the week. Other big firms due to report include PetroChina, Sinopec, and TotalEnergies, Reuters reports.

- Eni sold a shipment of CPC Blend to ExxonMobil on the Platts window. This year has been tough for Oil refining, according to Neste’s Chief Executive Officer, Reuters reports.

Oil Technical Analysis: Stepping up efforts

Crude Oil price has been unable to keep trading above the pivotal levels of $71.46 and $71.68. With falling back below those two important pivotal levels, the risk of more downside could be at hand. Should US Secretary of State Antony Blinken be able to get a ceasefire deal or get the parties at least around the table, more downsides could arise in the Crude Oil price.

On the upside, the 55-day Simple Moving Average (SMA) at $71.68 remains the first level to reclaim. Next up, the hefty technical level at $75.01, with the 100-day Simple Moving Average (SMA) and a few pivotal lines, is possibly the next big hurdle ahead.

On the downside, traders need to look much lower, at $67.12, a level that supported the price in May and June 2023. In case that level breaks, the 2024 year-to-date low emerges at $64.75 followed by $64.38, the low from 2023.

US WTI Crude Oil: Daily Chart

WTI Oil FAQs

WTI Oil is a type of Crude Oil sold on international markets. The WTI stands for West Texas Intermediate, one of three major types including Brent and Dubai Crude. WTI is also referred to as “light” and “sweet” because of its relatively low gravity and sulfur content respectively. It is considered a high quality Oil that is easily refined. It is sourced in the United States and distributed via the Cushing hub, which is considered “The Pipeline Crossroads of the World”. It is a benchmark for the Oil market and WTI price is frequently quoted in the media.

Like all assets, supply and demand are the key drivers of WTI Oil price. As such, global growth can be a driver of increased demand and vice versa for weak global growth. Political instability, wars, and sanctions can disrupt supply and impact prices. The decisions of OPEC, a group of major Oil-producing countries, is another key driver of price. The value of the US Dollar influences the price of WTI Crude Oil, since Oil is predominantly traded in US Dollars, thus a weaker US Dollar can make Oil more affordable and vice versa.

The weekly Oil inventory reports published by the American Petroleum Institute (API) and the Energy Information Agency (EIA) impact the price of WTI Oil. Changes in inventories reflect fluctuating supply and demand. If the data shows a drop in inventories it can indicate increased demand, pushing up Oil price. Higher inventories can reflect increased supply, pushing down prices. API’s report is published every Tuesday and EIA’s the day after. Their results are usually similar, falling within 1% of each other 75% of the time. The EIA data is considered more reliable, since it is a government agency.

OPEC (Organization of the Petroleum Exporting Countries) is a group of 12 Oil-producing nations who collectively decide production quotas for member countries at twice-yearly meetings. Their decisions often impact WTI Oil prices. When OPEC decides to lower quotas, it can tighten supply, pushing up Oil prices. When OPEC increases production, it has the opposite effect. OPEC+ refers to an expanded group that includes ten extra non-OPEC members, the most notable of which is Russia.

The US Dollar (USD) is expected to trade in a range between 7.1180 and 7.1440. Momentum is slowing; a breach of 7.0900 would indicate that USD is more likely to trade in a range instead of strengthening further, UOB Group’s FX analysts Quek Ser Leang and Lee Sue Ann notes.

USD/CNH can reach 7.1440 short term

24-HOUR VIEW: “Our view for USD to ‘rise to 7.1500’ did not materialise, as it pulled back from a high of 7.1462, closing largely unchanged at 7.1350 (- 0.02%). The current price movements are likely part of a range trading phase. Today, we expect USD to trade between 7.1180 and 7.1440.”

1-3 WEEKS VIEW: “Our update from Monday (21 Oct, spot at 7.1170) remains valid. As highlighted, the recent buildup in momentum is slowing, and a breach of 7.0900 would indicate that USD is more likely to trade in a range instead of strengthening further. Looking ahead, USD has to break and remain above 7.1500 before an advance to 7.1600 can be expected.”

Most recently, our Fed expectations were largely in line with those of the market. Just like the market, we expect the Fed to lower its key rate to around 3½%. Therefore, there is little to be said for idiosyncratic USD strength. However, we had previously expected the ECB to cut its key rate by far less than the market expects. This is no longer the case, Commerzbank’s Head of FX and Commodity Research Ulrich Leuchtmann notes.

EUR/USD target us lowered from 1.15 to 1.11