- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 25-09-2014

(raw materials / closing price /% change)

Light Crude 92.47 -0.06%

Gold 1,222.00 +0.01%

(index / closing price / change items /% change)

Nikkei 225 16,374.14 +206.69 +1.28%

Hang Seng 23,768.13 -153.48 -0.64%

Shanghai Composite 2,345.1 +1.53 +0.07%

FTSE 100 6,639.71 -66.56 -0.99%

CAC 40 4,355.28 -58.44 -1.32%

Xetra DAX 9,510.01 -151.96 -1.57%

S&P 500 1,965.99 -32.31 -1.62%

NASDAQ Composite 4,466.75 -88.47 -1.94%

Dow Jones 16,945.8 -264.26 -1.54%

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2751 -0,20%

GBP/USD $1,6316 -0,12%

USD/CHF Chf0,9467 +0,13%

USD/JPY Y108,74 -0,29%

EUR/JPY Y138,66 -0,50%

GBP/JPY Y177,42 -0,41%

AUD/USD $0,8789 -1,00%

NZD/USD $0,7930 -1,82%

USD/CAD C$1,1112 +0,48%

(time / country / index / period / previous value / forecast)

02:00 China Leading Index August +1.3%

06:00 Germany Gfk Consumer Confidence Survey October 8.6 8.5

12:30 U.S. PCE price index, q/q Quarter II +2.5%

12:30 U.S. PCE price index ex food, energy, q/q Quarter II +2.0%

12:30 U.S. GDP, q/q (Finally) Quarter II +4.2% +4.6%

13:55 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) September 84.6 85.1

Stock indices closed lower on comments by central bankers. Comments by the European Central Bank President Mario Draghi and the Bank of England Governor Mark Carney weighed on markets.

The European Central Bank (ECB) President Mario Draghi said in an interview with Lithuanian business daily Verslo Zinios that the ECB bank is ready to use additional unconventional instruments to counter deflationary risks.

The Bank of England (BoE) Governor Mark Carney said today that the point when the BoE starts to hike its interest rates is getting closer. The exact point will depend on economic data, so Carney.

The volume of private loans in the Eurozone fell by 1.5% in August, in line with expectations, after a 1.6% drop in July.

M3 money supply in the Eurozone rose 2% in August, exceeding expectations for a 1.9% increase, after a 1.8% growth in July.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,639.71 -66.56 -0.99%

DAX 9,510.01 -151.96 -1.57%

CAC 40 4,355.28 -58.44 -1.32%

The cost of Brent crude fell slightly today, as the high rate of the American currency and increased supply from the Middle East continue to exert pressure on the stock. Meanwhile, the price of WTI crude oil showed a slight increase.

Today, Saudi Arabia, the world's largest oil exporter, reported production of 9597000 barrels of oil per day in August. Despite reduction of 408,000 barrels per day from about 10 million barrels in July, the supply of crude oil to the market, rose to 9.688 million barrels per day in August.

In addition, we add that reportedly Pentagon, USAF, and their Arab allies inflicted air strikes on a small refinery in eastern Syria, controlled group "Islamic state" and is used for illegal transactions with oil.

"The market is mindful of geopolitical risk, but focuses more on supply. There is a possibility that the Brent price closer to $ 90 per barrel, and only if OPEC will take any concrete steps to reduce the supply and maintenance of the price level ", - said a senior analyst at CMC Markets Ric Spooner.

Market participants also continue to assess yesterday's report from the Department of Energy, which showed that commercial oil stocks in the United States last week fell to 4,273,000. Barrels - up to 357,998 million barrels, gasoline inventories decreased by 414 thousand. Barrels - up to 10.324 million barrels, commercial and distillate stocks rose by 823 thousand. barrels - up to 128,595 million barrels. Economists had expected an increase of oil reserves by 750 thousand. Barrels, gasoline inventories immutability and distillate stocks increase by 500 thousand. Barrels.

Influenced the course of trade and current data on business activity. As it became known, a preliminary activity index (PMI) from Markit was 58.5 in September. Market expectations were at the level of 59.4, which is slightly less than the value in the last month at around 59.5. In Markit said: "The continued strong increase in business activity reflects a steep and rapid growth of new orders in September. The last increase in new business volume was the sharpest since June, and one of the fastest observed for the five-year history of the survey. "

The cost of the November futures for the American light crude oil WTI (Light Sweet Crude Oil) rose to $ 93.14 a barrel on the New York Mercantile Exchange (NYMEX).

November futures price for North Sea Brent crude oil mixture fell $ 0.17 to $ 96.79 a barrel on the London exchange ICE Futures Europe.

The U.S. dollar traded mixed against the most major currencies after the U.S. durable goods orders and the number of initial jobless claims. U.S. durable goods orders declined 18.2% in August, missing expectations for a 17.7% drop, after a 22.5% rise in July. July's figure was revised down from a 22.6% increase. That was the largest drop since 1992.

U.S. durable goods orders excluding transportation increased 0.7% last month, in line with expectations, after a 0.5% fall in July. July's figure was revised up from a 0.7% decline.

U.S. durable goods orders excluding defence goods fell 19% last month, after a 24.9% gain in July.

The number of initial jobless claims in the week ending September 20 climbed by 12,000 to 293,000 from 281,000 in the previous week. The previous week's figure was revised from 280,000. Analysts had expected the number of initial jobless claims to increase to 294,000.

The euro traded mixed against the U.S. dollar. The euro remained under pressure after comments by the European Central Bank President Mario Draghi. He said in an interview with Lithuanian business daily Verslo Zinios that the ECB bank is ready to use additional unconventional instruments to counter deflationary risks.

The volume of private loans in the Eurozone fell by 1.5% in August, in line with expectations, after a 1.6% drop in July.

M3 money supply in the Eurozone rose 2% in August, exceeding expectations for a 1.9% increase, after a 1.8% growth in July.

The British pound traded mixed against the U.S. dollar. The Confederation of Business Industry released retail sales for the U.K. The CBI retail sales volume balance fell to +31 in August from +37 in July. Analysts had expected a decline to +34.

The New Zealand dollar declined against the U.S. dollar. The comments by the Reserve Bank of New Zealand (RBNZ) Governor Graeme Wheeler weighed on the kiwi. He said that the kiwi was still "unjustifiably high".

Wheeler warned the strength of the New Zealand dollar was "unjustified and unsustainable".

The RBNZ governor noted when the kiwi declines from an unjustified and unsustainable level, the downward adjustment can be large.

The Australian dollar traded mixed against the U.S. dollar. In the overnight trading session, the Aussie followed the New Zealand dollar and decreased.

The Reserve Bank of Australia (RBA) Governor Glenn Stevens said at an economic forum in Melbourne that he was open to restrictions on home lending to investors, but he said he didn't consider macroprudential tools.

Stevens supported more economy risk taking.

The Japanese yen traded higher against the U.S. dollar in the absence of any major economic reports from Japan.

Gold prices rose sharply, recovering from a nine-month low, which has been associated with the widespread weakening of the American currency. It should be emphasized that from the beginning of September gold fell by 6 per cent last month to complete the strongest decline since June 2013. Demand in the physical market has weakened since last year, when the price fell by 28 percent, but rose slightly in recent weeks. Now traders are waiting for increased demand in the largest gold consumer China and India with the onset of the wedding season and holidays. Sales of gold coins in the United States doubled in September compared with August to 50,000 ounces, according to the United States Mint.

Had little impact as Draghi comments. Speaking at a conference in Vilnius, ECB President Mario Draghi said that the central bank is ready to introduce additional non-traditional instruments, if the inflation target of 2% will be under threat. "We are ready to change the size or composition of our unconventional measures," - said Draghi. ECB President suggested that the euro zone needs to show moderate growth in the second quarter of this year, despite weaker-than-expected economic conditions.

Market participants also drew attention to the data on the United States. New orders for durable goods fell by 18.2% in August compared to the previous month to a seasonally adjusted totaled 245.43 billion. Dollars. This was stated by the Ministry of Commerce. Economists had expected orders for durable goods fall by 17.7% in July. Orders rose by 22.5% in July, revised slightly downward from the initially reported growth of 22.6%, due to the huge surge in aircraft orders. Demand for new cars and trucks also fell in August, while the orders of cars and auto parts fell by 6.4%, after rising 10% in July. But excluding the volatile transportation category orders rose 0.7% in August after a 0.5% decline in the previous month, which was revised to reduce the originally reported 0.8%. Excluding defense goods orders fell by 19% last month after rising by 24.9%.

According to forecasts, the price dynamics of quotations of gold today limited support level of $ 1200.0 per ounce and resistance level $ 1225.0 per ounce.

The cost of the October gold futures on the COMEX today rose to 1220.40 dollars per ounce.

The Reserve Bank of Australia (RBA) Governor Glenn Stevens said at an economic forum in Melbourne that he was concerned about double-digit rates in home finance. Stevens also said that he was open to restrictions on home lending to investors, but he said he didn't consider macroprudential tools.

Stevens noted that risk-taking was still essential for the economy.

The Reserve Bank of New Zealand (RBNZ) Governor Graeme Wheeler said today:

- The kiwi was still "unjustifiably high";

- The strength of the New Zealand dollar was "unjustified and unsustainable";

- When the kiwi declines from an unjustified and unsustainable level, the downward adjustment can be large;

- The real exchange rate has not adjusted to the recent fall in commodity prices;

- "Unjustified and unsustainable are important considerations in assessing whether exchange rate intervention is feasible".

The U.S. Commerce Department released durable goods orders today. U.S. durable goods orders declined 18.2% in August, missing expectations for a 17.7% drop, after a 22.5% rise in July. July's figure was revised down from a 22.6% increase. That was the largest drop since 1992.

The significant decline was no surprise.

Orders for the transportation decreased 42% in August, while civilian aircraft orders fall 74.3%.

Orders for automobiles declined 6.4%.

U.S. durable goods orders excluding transportation increased 0.7% last month, in line with expectations, after a 0.5% fall in July. July's figure was revised up from a 0.7% decline.

U.S. durable goods orders excluding defence goods fell 19% last month, after a 24.9% gain in July.

EUR/USD: $1.2800(E1.1bn), $1.2850(E2.8bn), $1.2860(E351mn), $1.2875(E407mn), $1.2900(E1.1bn)

USD/JPY: Y108.80($300mn), Y109.25($825mn), Y109.50($510mn)

GBP/USD: $1.6300(stg389mn), $1.6395-00(stg340mn), $1.6450(stg775mn), $1.6500(stg392mn), $1.6550(stg582mn)

EUR/GBP: Stg0.7870(E175mn), Stg0.7935(E150mn)

USD/CAD: C$1.1000($681mn), C$1.1060($1.16bn), C$1.1100($272mn), C$1.1200($618mn)

U.S. stock futures declined as investors assessed data showing an improving economy for clues on the timing of any Federal Reserve rate increase.

Global markets:

Nikkei 16,374.14 +206.69 +1.28%

Hang Seng 23,768.13 -153.48 -0.64%

Shanghai Composite 2,345.1 +1.53 +0.07%

FTSE 6,681.48 -24.79 -0.37%

CAC 4,412.69 -1.03 -0.02%

DAX 9,672.28 +10.31 +0.11%

Crude oil $93.27 (+0.56%)

Gold $1213.80 (-0.55%)

(company / ticker / price / change, % / volume)

| Goldman Sachs | GS | 187.92 | +0.06% | 1.9K |

| American Express Co | AXP | 88.67 | +0.17% | 0.1K |

| Caterpillar Inc | CAT | 101.37 | +0.17% | 0.1K |

| Procter & Gamble Co | PG | 85.60 | +0.42% | 0.2K |

| Microsoft Corp | MSFT | 47.08 | 0.00% | 3.3K |

| Pfizer Inc | PFE | 30.31 | 0.00% | 0.3K |

| Boeing Co | BA | 128.53 | -0.04% | 2.3K |

| Verizon Communications Inc | VZ | 50.05 | -0.04% | 1.2K |

| Home Depot Inc | HD | 92.97 | -0.05% | 0.9K |

| Chevron Corp | CVX | 122.30 | -0.08% | 0.1K |

| McDonald's Corp | MCD | 94.92 | -0.08% | 0.1K |

| Intel Corp | INTC | 34.72 | -0.09% | 1.1K |

| Johnson & Johnson | JNJ | 108.54 | -0.09% | 1K |

| Exxon Mobil Corp | XOM | 95.72 | -0.10% | 0.2K |

| AT&T Inc | T | 35.36 | -0.11% | 54.1K |

| Nike | NKE | 80.75 | -0.11% | 1.2K |

| Cisco Systems Inc | CSCO | 24.95 | -0.12% | 0.1K |

| General Electric Co | GE | 25.90 | -0.12% | 2.1K |

| Visa | V | 214.04 | -0.17% | 4.0K |

| International Business Machines Co... | IBM | 191.95 | -0.19% | 3.7K |

| JPMorgan Chase and Co | JPM | 61.47 | -0.26% | 8.4K |

| E. I. du Pont de Nemours and Co | DD | 72.61 | -0.30% | 1.5K |

| The Coca-Cola Co | KO | 42.11 | -0.38% | 0.6K |

Upgrades:

Yahoo! (YHOO) downgraded to Sector Perform from Outperform at RBC Capital Mkts

Barrick Gold (ABX) upgraded to Overweight from Neutral at HSBC Securities

Downgrades:

Other:

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

02:30 Australia RBA's Governor Glenn Stevens Speech

08:00 Eurozone M3 money supply, adjusted y/y August +1.8% +1.9% +2.0%

08:00 Eurozone Private Loans, Y/Y August -1.6% -1.5% -1.5%

10:00 United Kingdom CBI retail sales volume balance September 37 34 31

The U.S. dollar traded higher against the most major currencies ahead of the U.S. durable goods orders and the number of initial jobless claims. The U.S. durable goods orders are expected to drop 17.7% in August, after a 22.6% increase in July.

The number of initial jobless claims is expected to by 14,000 to 294,000.

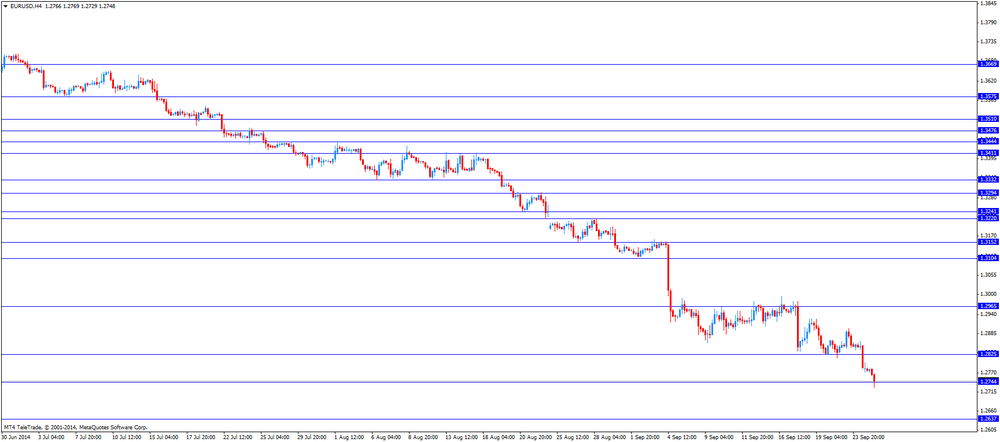

The euro traded lower against the U.S. dollar after comments by the European Central Bank President Mario Draghi. He said in an interview with Lithuanian business daily Verslo Zinios that the ECB bank is ready to use additional unconventional instruments to counter deflationary risks.

The volume of private loans in the Eurozone fell by 1.5% in August, in line with expectations, after a 1.6% drop in July.

M3 money supply in the Eurozone rose 2% in August, exceeding expectations for a 1.9% increase, after a 1.8% growth in July.

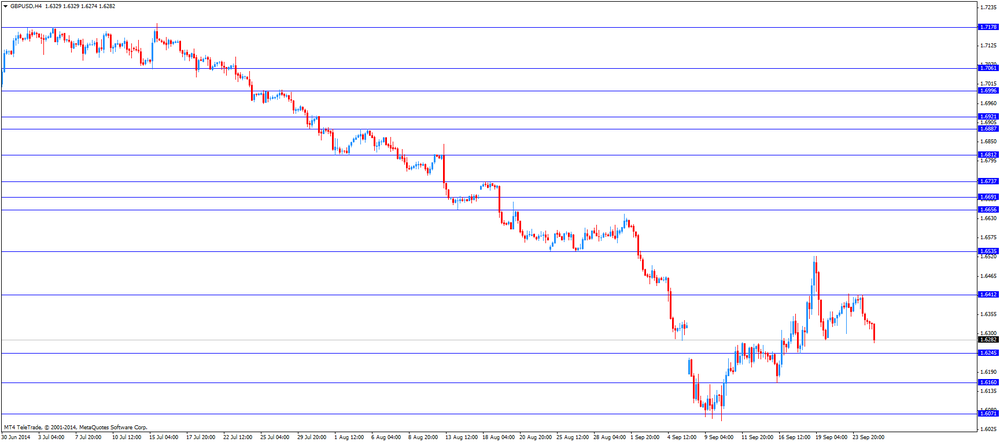

The British pound traded lower against the U.S. dollar. The Confederation of Business Industry released retail sales for the U.K. The CBI retail sales volume balance fell to +31 in August from +37 in July. Analysts had expected a decline to +34.

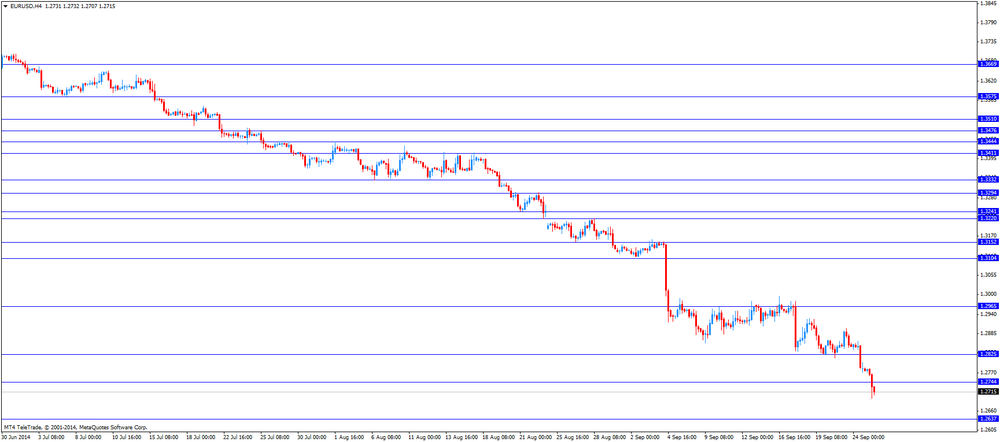

EUR/USD: the currency pair fell to $1.2696

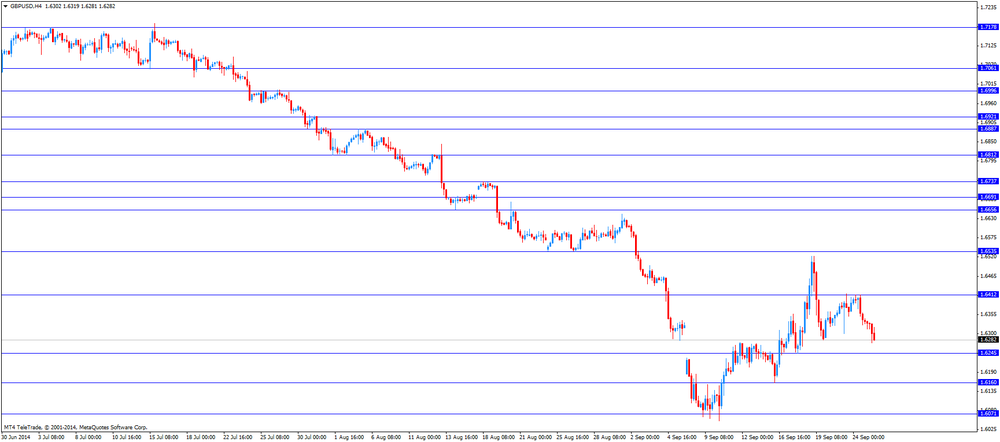

GBP/USD: the currency pair declined to $1.6274

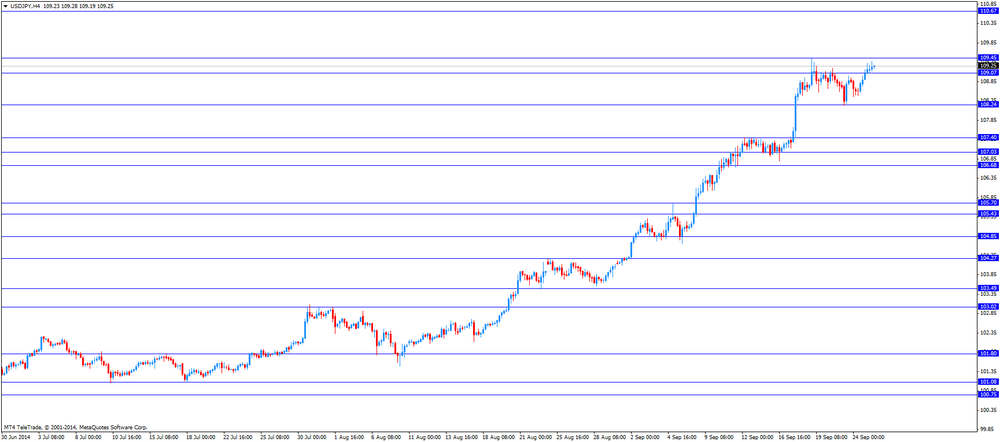

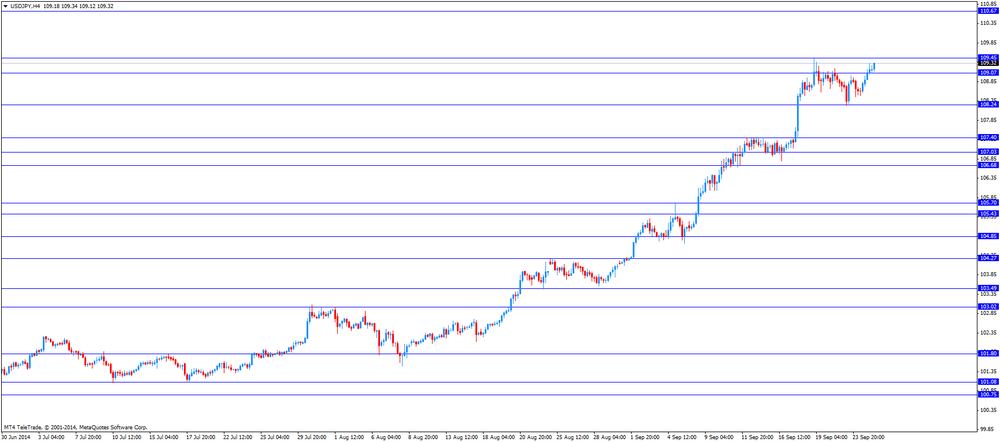

USD/JPY: the currency pair rose to Y109.37

The most important news that are expected (GMT0):

12:30 U.S. Durable Goods Orders August +22.6% -17.7%

12:30 U.S. Durable Goods Orders ex Transportation August -0.7% Revised From -0.8% +0.7%

12:30 U.S. Durable goods orders ex defense August +24.9%

12:30 U.S. Initial Jobless Claims September 280 294

13:45 U.S. Services PMI (Preliminary) September 59.5 59.4

23:30 Japan Tokyo Consumer Price Index, y/y September +2.8%

23:30 Japan Tokyo CPI ex Fresh Food, y/y September +2.7% +2.7%

23:30 Japan National Consumer Price Index, y/y August +3.4%

23:30 Japan National CPI Ex-Fresh Food, y/y August +3.3% +3.2%

EUR/USD

Offers $1.2820-30, $1.2800, $1.2750/60

Bids $1.2660/50, $1.2600

GBP/USD

Offers

Bids 1.6210/00, 1.6180

AUD/USD

Offers $0.8980, $0.8940/60, $0.8900, $0.8835/40

Bids $0.8780, $0.8750, $0.8700

EUR/JPY

Offers Y140.50, Y140.20, Y140.00, Y139.40/50

Bids Y138.80, Y138.20, Y138.00

USD/JPY

Offers Y110.50, Y110.00, Y109.50, Y109.40

Bids Y109.00, Y108.60/50, Y108.40

EUR/GBP

Offers stg0.7900

Bids stg0.7800

Most stock indices traded higher on speculation for further stimulus measures by the European Central Bank.

The European Central Bank (ECB) President Mario Draghi said in an interview with Lithuanian business daily Verslo Zinios that the ECB bank is ready to use additional unconventional instruments to counter deflationary risks.

The volume of private loans in the Eurozone fell by 1.5% in August, in line with expectations, after a 1.6% drop in July.

M3 money supply in the Eurozone rose 2% in August, exceeding expectations for a 1.9% increase, after a 1.8% growth in July.

Current figures:

Name Price Change Change %

FTSE 6,699.62 -6.65 -0.10%

DAX 9,706.64 +44.67 +0.46%

CAC 40 4,427.74 +14.02 +0.32%

Most Asian stock closed higher on yesterday's U.S. new home sales. New home sales in the U.S. rose 18.0% to a seasonally adjusted annual rate of 504,000 units in August, up from 427,000 units in July. That was the highest level since May 2008.

Hong Kong's Hang Seng index was dragged down by casino operators.

Indexes on the close:

Nikkei 225 16,374.14 +206.69 +1.28%

Hang Seng 23,768.13 -153.48 -0.64%

Shanghai Composite 2,345.1 +1.53 +0.07%

EUR/USD: $1.2800(E1.1bn), $1.2850(E2.8bn), $1.2860(E351mn), $1.2875(E407mn), $1.2900(E1.1bn)

USD/JPY: Y108.80($300mn), Y109.25($825mn), Y109.50($510mn)

GBP/USD: $1.6300(stg389mn), $1.6395-00(stg340mn), $1.6450(stg775mn), $1.6500(stg392mn), $1.6550(stg582mn)

EUR/GBP: Stg0.7870(E175mn), Stg0.7935(E150mn)

USD/CAD: C$1.1000($681mn), C$1.1060($1.16bn), C$1.1100($272mn), C$1.1200($618mn)

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

02:30 Australia RBA's Governor Glenn Stevens Speech

08:00 Eurozone M3 money supply, adjusted y/y August +1.8% +1.9% +2.0%

08:00 Eurozone Private Loans, Y/Y August -1.6% -1.5% -1.5%

The U.S. dollar traded higher against the most major currencies. The greenback remained supported by yesterday's U.S. new home sales. New home sales in the U.S. rose 18.0% to a seasonally adjusted annual rate of 504,000 units in August, up from 427,000 units in July. That was the highest level since May 2008.

The New Zealand dollar dropped against the U.S. dollar after comments by the Reserve Bank of New Zealand (RBNZ) Governor Graeme Wheeler. He said that the kiwi was still "unjustifiably high".

Wheeler warned the strength of the New Zealand dollar was "unjustified and unsustainable".

The RBNZ governor noted when the kiwi declines from an unjustified and unsustainable level, the downward adjustment can be large.

The Australian dollar fell against the U.S. dollar, following the New Zealand dollar.

The Reserve Bank of Australia (RBA) Governor Glenn Stevens said at an economic forum in Melbourne that he was open to restrictions on home lending to investors, but he said he didn't consider macroprudential tools.

Stevens supported more economy risk taking.

The Japanese yen traded lower against the U.S. dollar in the absence of any major economic reports from Japan.

EUR/USD: the currency pair fell to $1.2762

GBP/USD: the currency pair decreased to $1.6314

USD/JPY: the currency pair rose to Y109.33

The most important news that are expected (GMT0):

10:00 United Kingdom CBI retail sales volume balance September 37 34

12:30 U.S. Durable Goods Orders August +22.6% -17.7%

12:30 U.S. Durable Goods Orders ex Transportation August -0.7% Revised From -0.8% +0.7%

12:30 U.S. Durable goods orders ex defense August +24.9%

12:30 U.S. Initial Jobless Claims September 280 294

13:45 U.S. Services PMI (Preliminary) September 59.5 59.4

23:30 Japan Tokyo Consumer Price Index, y/y September +2.8%

23:30 Japan Tokyo CPI ex Fresh Food, y/y September +2.7% +2.7%

23:30 Japan National Consumer Price Index, y/y August +3.4%

23:30 Japan National CPI Ex-Fresh Food, y/y August +3.3% +3.2%

EUR / USD

Resistance levels (open interest**, contracts)

$1.2887 (2758)

$1.2857 (914)

$1.2805 (96)

Price at time of writing this review: $ 1.2765

Support levels (open interest**, contracts):

$1.2730 (6046)

$1.2703 (3091)

$1.2670 (3142)

Comments:

- Overall open interest on the CALL options with the expiration date October, 3 is 56219 contracts, with the maximum number of contracts with strike price $1,3000 (5111);

- Overall open interest on the PUT options with the expiration date October, 3 is 60357 contracts, with the maximum number of contracts with strike price $1,2800 (6046);

- The ratio of PUT/CALL was 1.07 versus 1.10 from the previous trading day according to data from September, 24

GBP/USD

Resistance levels (open interest**, contracts)

$1.6600 (1387)

$1.6501 (2594)

$1.6403 (1632)

Price at time of writing this review: $1.6323

Support levels (open interest**, contracts):

$1.6295 (4981)

$1.6198 (2052)

$1.6099 (3349)

Comments:

- Overall open interest on the CALL options with the expiration date October, 3 is 31721 contracts, with the maximum number of contracts with strike price $1,6700 (3699);

- Overall open interest on the PUT options with the expiration date October, 3 is 41658 contracts, with the maximum number of contracts with strike price $1,6300 (4981);

- The ratio of PUT/CALL was 1.31 versus 1.29 from the previous trading day according to data from September, 24

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.