- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 25-08-2014

(raw materials / closing price /% change)

Light Crude 93.32 -0.03%

Gold 1,277.00 -0.15%

(index / closing price / change items /% change)

Nikkei 225 15,613.25 +74.06 +0.48%

Hang Seng 25,166.91 +54.68 +0.22%

Shanghai Composite 2,229.27 -11.54 -0.51%

FTSE 100 6,775.25 -2.41 -0.04%

CAC 40 4,342.11 +89.31 +2.10%

Xetra DAX 9,510.14 +170.97 +1.83%

S&P 500 1,997.92 +9.52 +0.48%

NASDAQ 4,557.35 +18.80 +0.41%

Dow Jones 17,076.87 +75.65 +0.44%

(pare/closed(GMT +2)/change, %)

EUR/USD $1,3190 -0,39%

GBP/USD $1,6569 +0,01%

USD/CHF Chf0,9154 +0,17%

USD/JPY Y104,03 +0,12%

EUR/JPY Y137,22 -0,36%

GBP/JPY Y172,38 +0,10%

AUD/USD $0,9296 -0,19%

NZD/USD $0,8340 -0,16%

USD/CAD C$1,0983 +0,36%

(time / country / index / period / previous value / forecast)

02:00 China Leading Index July +1.3%

08:30 United Kingdom BBA Mortgage Approvals July 43.3 44.2

12:30 U.S. Durable Goods Orders July +1.7% Revised From +0.7% +7.4%

12:30 U.S. Durable Goods Orders ex Transportation July +1.9% Revised From +0.8% +0.5%

12:30 U.S. Durable goods orders ex defense July +0.7%

13:00 U.S. Housing Price Index, m/m June +0.4% +0.3%

13:00 U.S. Housing Price Index, y/y June +5.5%

13:00 U.S. S&P/Case-Shiller Home Price Indices, y/y June +9.3% +8.2%

14:00 U.S. Richmond Fed Manufacturing Index August 7 8

14:00 U.S. Consumer confidence August 90.9 89.1

20:30 U.S. API Crude Oil Inventories August -1.4

22:45 New Zealand Food Prices Index, m/m July +1.4%

22:45 New Zealand Food Prices Index, y/y July +1.2%

Stock indices closed higher after comments by the ECB President Mario Draghi. The European Central Bank (ECB) President Mario Draghi said in Jackson Hole on Friday the ECB could add new stimulus measures should inflation decline further. He also said inflation expectations were showing a significant fall.

Ifo released its indices for Germany. The Ifo Business Climate Index declined to 106.3 in August from 108.0 in July, missing expectations for a drop to 107.1.

The Ifo Current Assessment decreased to 111.1 in August from 112.9 in July.

The Ifo Expectations dropped to 101.7 in August from 103.4 in July.

The National Bank of Belgium released its report on business confidence. The business sentiment index declined to -7.3 in August from -7.5 in July, beating expectations for a fall to -8.3.

French President Francois Hollande asked Prime Minister Manuel Valls to form a new government.

Markets in the UK are closed for a public holiday.

Indexes on the close:

Name Price Change Change %

FTSE 100 closed

DAX 9,510.14 +170.97 +1.83%

CAC 40 4,342.11 +89.31 +2.10%

Brent prices rose moderately, while rising above $ 102 per barrel, while WTI oil prices fell slightly. Support prices have geopolitical problems in Ukraine and Libya, while the increased bid restrains growth.

It is learned that Libya has shipped a second tanker from the port of Es Sider, despite fighting in the capital Tripoli on the weekend. Last week, Libya has increased oil production to 612,000 barrels per day, compared with 1.4 million a year ago. Meanwhile, data showed that the export of oil from Iraq in July 2014 increased by 5% year on year to 2.442 million barrels per day. Compared with the previous month, the volume of exports has not changed. In June 2014, Iraq exported 2.427 million bpd. Total exports in July were shipped 75.7 million barrels of oil fields located in the province of Basra. Total income from oil exports in July totaled $ 7.742 billion.

Market participants are also waiting for tomorrow's meeting of Russian President Vladimir Putin and the President of Ukraine Petro Poroshenko. Last week, Ukraine named breakthrough of several dozen Russian trucks across the border "direct invasion" by Russia and accused the Kremlin of preparing provocations. Meanwhile, the Russian Foreign Minister Sergey Lavrov said that Russia wants to organize another convoy to Ukraine in the coming days.

"Oil prices are likely to stabilize, so we do not expect them to further decline. Risks to supply are significant, "- said Commerzbank analyst Carsten Fritsch.

This week, investors will be watching a series of key economic indicators of the United States, as market players would like to see further hints on the strength of the recovery and the possible ways of development of monetary policy. On Thursday, the United States, there are data on GDP growth in the second quarter. During the week the United States will also publish reports on orders for durable goods and initial applications for unemployment benefits.

The cost of the October futures on American light crude oil WTI (Light Sweet Crude Oil) to the present moment has dropped to $ 93.50 a barrel on the New York Mercantile Exchange (NYMEX).

October futures price for North Sea Brent crude oil mixture rose $ 0.89 to $ 102.70 a barrel on the London exchange ICE Futures Europe.

The U.S. dollar traded mixed to higher against the most major currencies despite the weaker-than-expected economic data from the U.S. Preliminary services purchasing managers' index declined to 58.5 in August from 60.8 in July, missing forecasts for a drop to 59.2.

New home sales in the U.S. fell by 2.4% to 412,000 units in July, missing expectations for a rise to 426,000 units. That was the slowest pace of new home sales in four months.

June's figure was revised up from 406,000 units.

The greenback remained supported by Friday's comments by Federal Reserve Chair Janet Yellen in Jackson Hole. Janet Yellen said that the U.S. labour market is not yet fully recovered. But she added that the U.S. labour market was improving. The Fed Chair Yellen offered no signal when the Fed will start to raise its interest rate.

Investors speculate that the Fed may hike its interest rate sooner than expected.

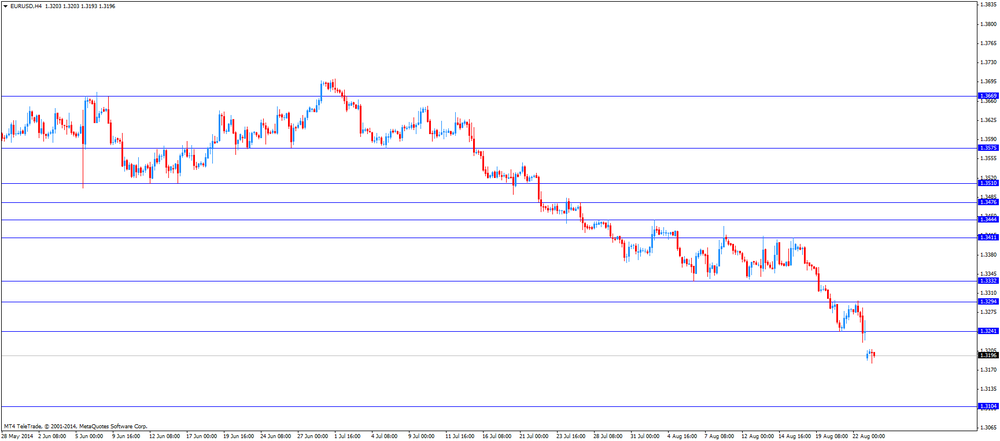

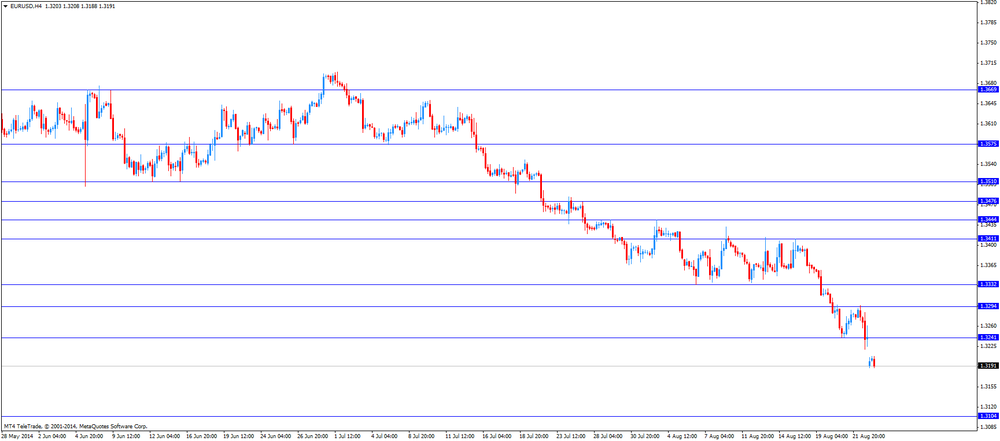

The euro traded mixed against the U.S. dollar. Comments by the ECB President Mario Draghi weighed on the euro. The European Central Bank (ECB) President Mario Draghi said in Jackson Hole on Friday the ECB could add new stimulus measures should inflation decline further. He also said inflation expectations were showing a significant fall.

The weaker-than-expected economic data from Germany also weighed on the euro. Ifo released its indices for Germany. The Ifo Business Climate Index declined to 106.3 in August from 108.0 in July, missing expectations for a drop to 107.1.

The Ifo Current Assessment decreased to 111.1 in August from 112.9 in July.

The Ifo Expectations dropped to 101.7 in August from 103.4 in July.

The National Bank of Belgium released its report on business confidence. The business sentiment index declined to -7.3 in August from -7.5 in July, beating expectations for a fall to -8.3.

The British pound traded mixed against the U.S. dollar in the absence of any major economic reports in the UK. Markets in the UK are closed for a public holiday.

The New Zealand dollar traded mixed against the U.S dollar in the absence of any major reports in New Zealand. In the overnight trading session, the kiwi dropped against the greenback. Investors speculate the Reserve Bank of New Zealand intervened in the market. New Zealand's central bank has recently said the kiwi is too high and mentioned the possibility it could intervene in the market by selling the local currency.

The Australian dollar traded lower against the U.S. dollar in the absence of any major reports in Australia.

The Japanese yen traded mixed against the U.S. dollar due to strong U.S. currency. No major reports were released in Japan.

The Bank of Japan (BoJ) Governor Haruhiko Kuroda said in Jackson Hole on Saturday that the stimulus measures by Japan's central bank were proving effective. Kuroda also said Japan's labour market is showing "significant improvement. He added the BoJ will continue its accommodative monetary policy until the 2% inflation target is met.

Gold prices fell slightly today, approaching at the same time to two-month low, due to the strengthening of the dollar and expectations of rising interest rates the Fed. Experts note that the steady growth of the American economy could lead to an increase in Federal Reserve interest rates, which are already beginning to affect the formation of the price of gold, which becomes less attractive as a tool for hedging inflation. Over the past month, hedge funds reduced bets on gold was in the 4 th time. Total open interest in futures and options in New York City almost reached the 5-year low. As a result of the fall of quotations for the precious metal by 2%, which was not in May, the assets of gold exchange-traded fund (ETF) lost $ 1.2 billion.

"In terms of market sentiment, I think it's a negative price reduction. Every time the price can not hold above $ 1,300, starts disappointment "- said a senior dealer at Lee Cheoung Gold Dealers in Hong Kong Ronald Leung. "The Fed chief Janet Yellen said earlier about the possibility of rising interest rates. All these factors have a negative impact on gold. The only good news - this increase in demand at that price level, "- said Leung.

As for today's events, the attention turned to data on the United States, which showed that the results of last month sales of new buildings in the United States declined significantly, registering with the second consecutive monthly decrease. However, experts point out that the growth of real estate stocks on the market and moderate price increases should help to stimulate demand in the coming months. According to the report, the seasonally adjusted new home sales fell by 2.4 percent to an annual rate of 412,000 units, the lowest level since March. Sales for June were revised upwards - to the level of 422 thousand. 407 thousand. Units. Economists forecast that new home sales to rise to 426 thousand. Units. The Ministry of Commerce also said: inventories of new homes on the market increased by 4.1 percent - to 205, 000 units, the highest since August 2010. In view of the July sales pace will require 6.0 months to implement all the stocks (the highest rate since October 2011). Recall that in June this ratio was 5.6 months.

We also add that the margins on gold bars in Hong Kong rose to $ 0,70-1,10 per ounce to prices in London from $ 0.50-1.00 last week due to sales to jewelers. Margins in Singapore held at the level of $ 0.80-1.00 to London prices.

The cost of the October gold futures on the COMEX currently down to $ 1276.00 per ounce.

The Bank of Japan (BoJ) Governor Haruhiko Kuroda in an interview with Corriere della Sera:

- BoJ could extend its quantitative easing programme if inflation in Japan failed to reach a 2% target by April 2015;

- The economy in Japan was recovering in the current quarter after a decline in the second quarter;

- He does not expect the Eurozone to slip into deflation;

- His main worry is the Ukraine crisis.

The U.S. Commerce Department released new home sales figures today.

June's figure was revised up from 406,000 units.

The median price of new homes rose 2.9% from July 2013 to $269,800.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 United Kingdom Bank holiday

08:00 Germany IFO - Business Climate August 108.0 107.1 106.3

08:00 Germany IFO - Current Assessment August 112.9 111.1

08:00 Germany IFO - Expectations August 103.4 101.7

The U.S. dollar traded mixed to lower against the most major currencies ahead of the economic data from the U.S. Preliminary services purchasing managers' index is expected to decline to 59.2 in August from 60.8 in July.

New home sales in the U.S. are expected to rise to 426,000 units in July from 406,000 units in June.

The greenback remained supported by Friday's comments by Federal Reserve Chair Janet Yellen in Jackson Hole. Janet Yellen said that the U.S. labour market is not yet fully recovered. But she added that the U.S. labour market was improving. The Fed Chair Yellen offered no signal when the Fed will start to raise its interest rate.

Investors speculate that the Fed may hike its interest rate sooner than expected.

The euro traded lower against the U.S. dollar after comments by the ECB President Mario Draghi. The European Central Bank (ECB) President Mario Draghi said in Jackson Hole on Friday the ECB could add new stimulus measures should inflation decline further. He also said inflation expectations were showing a significant fall.

The weaker-than-expected economic data from Germany also weighed on the euro. Ifo released its indices for Germany. The Ifo Business Climate Index declined to 106.3 in August from 108.0 in July, missing expectations for a drop to 107.1.

The Ifo Current Assessment decreased to 111.1 in August from 112.9 in July.

The Ifo Expectations dropped to 101.7 in August from 103.4 in July.

The British pound traded higher against the U.S. dollar in the absence of any major economic reports in the UK. Markets in the UK are closed for a public holiday.

EUR/USD: the currency pair fell to $1.3183

GBP/USD: the currency pair rose to $1.6597

USD/JPY: the currency pair declined to Y103.85

The most important news that are expected (GMT0):

13:00 Belgium Business Climate August -7.5 -8.3

13:45 U.S. Services PMI (Preliminary) August 60.8 59.2

14:00 U.S. New Home Sales July 406 426

22:45 New Zealand Trade Balance, mln July 247 -475

EUR/USD

Offers $1.3350, $1.3325/35, $1.3300, $1.3215-20

Bids $1.3185/80, $1.3150, $1.3110-00

GBP/USD

Offers $1.6700

Bids $1.6500

AUD/USD

Offers $0.9380, $0.9350, $0.9330-35

Bids $0.9255/50, $0.9220/00

EUR/JPY

Offers Y139.00, Y138.50, Y138.20

Bids Y137.00, Y136.80, Y136.50

USD/JPY

Offers Y105.50, Y105.00, Y104.50

Bids Y103.20, Y103.00, Y102.50

EUR/GBP

Offers stg0.8100, stg0.8040

Bids stg0.7900

Stock indices traded higher after comments by the ECB President Mario Draghi. The European Central Bank (ECB) President Mario Draghi said in Jackson Hole on Friday the ECB could add new stimulus measures should inflation decline further. He also said inflation expectations were showing a significant fall.

Ifo released its indices for Germany. The Ifo Business Climate Index declined to 106.3 in August from 108.0 in July, missing expectations for a drop to 107.1.

The Ifo Current Assessment decreased to 111.1 in August from 112.9 in July.

The Ifo Expectations dropped to 101.7 in August from 103.4 in July.

French President Francois Hollande asked Prime Minister Manuel Valls to form a new government.

Markets in the UK are closed for a public holiday.

Current figures:

Name Price Change Change %

FTSE 100 closed

DAX 9,436.79 +97.62 +1.05%

CAC 40 4,300.55 +47.75 +1.12%

Most Asian stock indices closed higher due to Friday's comments by the Fed Chair Janet Yellen. Janet Yellen said in Jackson Hole that the U.S. labour market is not yet fully recovered. But she added that the U.S. labour market was improving. The Fed Chair Yellen offered no signal when the Fed will start to raise its interest rate.

Investors speculate that the Fed may hike its interest rate sooner than expected.

Market participants continue to monitor developments in Ukraine. Russian President Vladimir Putin will meet Ukrainian President Petro Poroshenko in Minsk on Tuesday.

Indexes on the close:

Nikkei 225 15,613.25 +74.06 +0.48%

Hang Seng 25,166.91 +54.68 +0.22%

Shanghai Composite 2,229.27 -11.54 -0.51%

EUR/USD $1.3250(E200mn), $1.3300(E433mn), $1.3320-25(E218mn)

USD/JPY Y103.00($900mn), Y103.10($475mn), Y103.25-30($450mn), Y103.35($1bn), Y104.00($700mn)

GBP/USD $1.6640(stg180mn), $1.6700(stg131mn)

USD/CHF Chf0.8935($236mn), Chf0.8950($124mn)

EUR/CHF Chf1.2100(E100mn)

AUD/USD $0.9200-10(A$270mn), $0.9275(A$245mn), $0.9350(A$209mn)

USD/CAD C$1.0925

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 United Kingdom Bank holiday

08:00 Germany IFO - Business Climate August 108.0 107.1 106.3

08:00 Germany IFO - Current Assessment August 112.9 111.1

08:00 Germany IFO - Expectations August 103.4 101.7

The U.S. dollar traded mixed to higher against the most major currencies due to Friday's comments by Federal Reserve Chair Janet Yellen in Jackson Hole. Janet Yellen said that the U.S. labour market is not yet fully recovered. But she added that the U.S. labour market was improving. The Fed Chair Yellen offered no signal when the Fed will start to raise its interest rate.

Investors speculate that the Fed may hike its interest rate sooner than expected.

Tensions over Ukraine also weighed on markets.

The New Zealand dollar dropped against the U.S dollar in the absence of any major reports in New Zealand. Investors speculate the Reserve Bank of New Zealand intervened in the market. New Zealand's central bank has recently said the kiwi is too high and mentioned the possibility it could intervene in the market by selling the local currency.

The Australian dollar traded mixed against the U.S. dollar in the absence of any major reports in Australia.

The Japanese yen traded lower against the U.S. dollar due to strong U.S. currency. No major reports were released in Japan.

The Bank of Japan (BoJ) Governor Haruhiko Kuroda said in Jackson Hole on Saturday that the stimulus measures by Japan's central bank were proving effective. Kuroda also said Japan's labour market is showing "significant improvement. He added the BoJ will continue its accommodative monetary policy until the 2% inflation target is met.

EUR/USD: the currency pair declined to $1.3188

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair rose to Y104.27

The most important news that are expected (GMT0):

13:00 Belgium Business Climate August -7.5 -8.3

13:45 U.S. Services PMI (Preliminary) August 60.8 59.2

14:00 U.S. New Home Sales July 406 426

22:45 New Zealand Trade Balance, mln July 247 -475

EUR / USD

Resistance levels (open interest**, contracts)

$1.3331 (1637)

$1.3280 (119)

$1.3246 (27)

Price at time of writing this review: $ 1.3206

Support levels (open interest**, contracts):

$1.3163 (5968)

$1.3129 (3927)

$1.3089 (6303)

Comments:

- Overall open interest on the CALL options with the expiration date September, 5 is 58416 contracts, with the maximum number of contracts with strike price $1,3400 (6838);

- Overall open interest on the PUT options with the expiration date September, 5 is 61665 contracts, with the maximum number of contracts with strike price $1,3100 (6303);

- The ratio of PUT/CALL was 1.06 versus 1.10 from the previous trading day according to data from August, 22

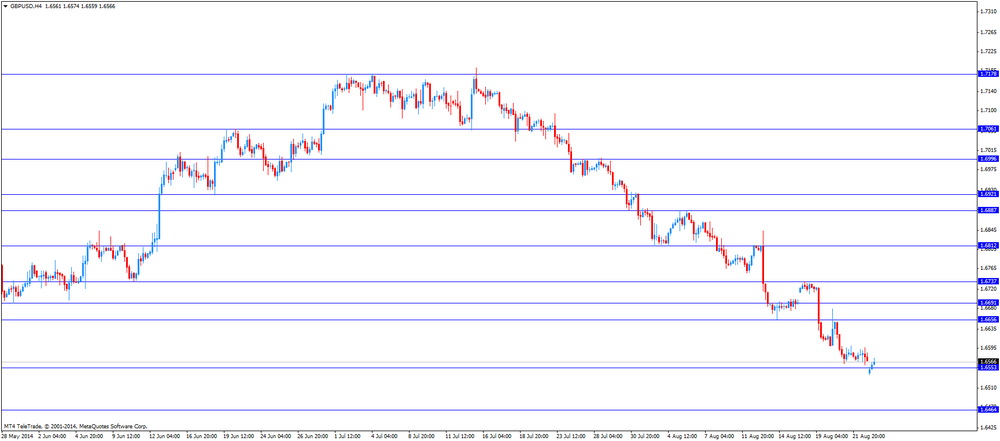

GBP/USD

Resistance levels (open interest**, contracts)

$1.6800 (1803)

$1.6701 (1057)

$1.6604 (524)

Price at time of writing this review: $1.6563

Support levels (open interest**, contracts):

$1.6497 (1936)

$1.6399 (932)

$1.6300 (658)

Comments:

- Overall open interest on the CALL options with the expiration date September, 5 is 29078 contracts, with the maximum number of contracts with strike price $1,7000 (2760);

- Overall open interest on the PUT options with the expiration date September, 5 is 29583 contracts, with the maximum number of contracts with strike price $1,6800 (4026);

- The ratio of PUT/CALL was 1.02 versus 1.03 from the previous trading day according to data from August, 22

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.