- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 25-04-2022

- The US Dollar Index hits a fresh 25-month courtesy of dismal market mood and expectations of an aggressive Federal Reserve tightening cycle.

- Most Fed officials aligned to hike 50-bps at the May 4-5 meeting.

- US Dollar Index Price Forecast (DXY): Bull’s target remains the January 2017 highs near 103.82.

The US Dollar Index, a measurement of the greenback’s value against a basket of six currencies, finished with gains of 0.62% and, at the time of writing, is at 101.735, shy of the 2-year high reached during the day at 101.851.

The market mood remains downbeat, as portrayed by Asian equity futures falling. Growing concerns about China’s coronavirus outbreak In Shanghai extended to some Beijing districts, keeping traders on their toes. Fears of wider curbs in Beijing are spooking investors already worried about the risk of a global slowdown as the Fed raises rates to tame inflation.

Additionally, last week’s Fed speaking increased the appetite for the greenback. Money market futures shows that investors have fully priced in a 100% chance of a 0.50% rate hike in the May meeting, while for June, the odds are at 80%, as shown by the CME FedWatch Tool.

In the meantime, the 10-year US Treasury yield, the benchmark note, retreated from last week’s highs around 2.981%, is down ten basis points, at 2.818%.

Last week’s Fed speaking summary

On Thursday of last week, Fed Chair Jerome Powell blessed a half-point interest rate increase by the May 4-5 reunion. Furthermore, San Francisco Fed President Mary Daly noted that the Fed “will likely” raise rates by 50 bps at a couple of meetings. Daly reiterated that the Fed needs to take a measured pace on rate hikes and get interest rates up to 2.5% by the end of the year.

Elsewhere, St. Louis Fed President James Bullard admitted that the Fed is behind the curve but not as everybody thinks, while adding that the Fed has hiked 75 bps before without the world coming to an end.

Last Friday, Cleveland’s Fed President Loretta Mester commented that she would like to get neutral to 2.5% by the end of the year. When asked about 75-bps increases, Mester added that “we don’t need to go there.” Furthermore, she supported a 50-bps increase in May and a few more after.

The economic calendar for the US would feature March’s Durable Goods Orders, the US Gross Domestic Product for the Q1, and the Core Personal Consumption Expenditure (PCE) for March on annual and monthly readings, alongside the Chicago PMI.

Analysts at ING expect Q1 data to show the US economy expanded at a 1-1.5% annualized rate, which would be below Q4 of 2021 at 6.9%, reflecting the Omicron wave of the pandemic that impacted mobility considerably.

US Dollar Index Price Forecast (DXY): Technical outlook

The US Dollar Index (DXY) retains its upward bias, as depicted by the daily chart. The 50 and the 200-day moving averages (DMAs) at 98.596 and 95.504, respectively, are well located under the DXY value, further cementing the upside bias. The Relative Strength Index (RSI) at 71.24 is in overbought territory, so a deceleration in the DXY trend is on the cards.

The DXY first resistance would be 102.00. A break above would expose March’s 24 daily high at 102.21, followed by March’s 20 2020 daily high at 102.99 and then the aforementioned 103.82 swing high.

EUR/GBP has found bids around 0.8400 in early Tokyo as investors await a speech from ECB’s Lagarde.

- The ECB adopted a dovish stance at the IMF meeting along with a slash in the growth forecasts.

- The BOE sees its inflation galloping higher this year amid higher energy bills.

The EUR/GBP pair is observing a minor bounce from 0.8400 after a steep fall from Monday’s high at 0.8440. The pair has remained firmer over the past few trading days despite European Central Bank (ECB) advocating a dovish stance on his testimony at the International Monetary Fund (IMF) meeting.

The ECB officials don’t see a rate hike till it concludes its Asset Purchase Program (APP). The central bank has emphasized reducing growth forecasts amid the Ukraine crisis and a significant plunge in the real income of the households due to higher energy bills and commodity prices. The circumstances are compelling a situation of stagflation in the eurozone. Meanwhile, investors are focusing on the speech from ECB’s President Christine Lagarde, which is due on Wednesday. The speech will provide cues for the plot of the monetary policy to be dictated in the policy announcement.

Meanwhile, Bank of England (BOE) Governor Andrew Bailey in his testimony on Thursday renewed fears of soaring inflation in the sterling area. As per his dictation investors should start bracing for a further jump in inflation, which may move the interest rates higher.

Although a speech from ECB’s Christine Lagarde on Wednesday will hold significant importance, investors will also focus on eurozone Consumer Confidence, which is due on Thursday. The Euro Consumer Confidence is seen at -16.9, similar to its previous close.

- NZD/USD is holding up despite the strength in the US dollar, with the kiwi firm in the session so far.

- Focus is on the Fed and US data amid Chinese covid risks.

At 0.6617, during the time of writing, NZD/USD is in the green and firm, but sticking to a 0.6611/21 range on the day so far following a turbulent start to the week amid the spread of covid-19 in China. The US dollar has thrived whereas the yuan has fallen, and risk sentiment along with it, weighing on commodities and risk-FX.

''The Kiwi followed the global FX trend and weakened against the USD. Concerns over broadening COVID restrictions in China and an associated sharp fall in equity markets drove the fall,'' analysts at ANZ Bank said.

''Ahead of the May FOMC meeting, it is difficult to see the strength in the USD waning much. FOMC members are now in blackout and the clear guidance is that a series of 50bps fed funds rate hikes are necessary. That guidance contrasts with growing downside growth risks outside of the US and is reflected in the current USD strength.''

Meanwhile, from the domestic front, the recent Consumer Price Index showed that prices rose 1.8% in the March quarter. Analysts at Standard Charted said that they now expect the Reserve Bank of New Zealand (RBNZ) to hike the official cash rate (OCR) by 50bps at the May meeting and another 25bps in July to bring the OCR to 2.25%, slightly above neutral (estimated at 2.0%).

''We now expect the rate hikes to be frontloaded, versus our previous call of 25bps hikes at each of the five meetings from April to October, which would take the OCR to 2.25%,'' the analysts argued, adding:

''Given the 50bps hike in April and our expectation of another 50bps hike in May, we drop the 25bps hikes in August and October, keeping our end-2022 OCR unchanged at 2.25%.''

''We think the RBNZ will find it hard to tighten significantly beyond neutral because of the challenges ahead, including heightened geopolitical tensions (and the resulting hit to sentiment), monetary policy tightening, and lingering pandemic risks.''

US data in focus

For the week ahead, during the Fed's blackout period, the focus will be on US data including Real Gross Domestic Product and Core PCE.

''GDP likely slowed sharply in the first quarter Q1 following a significant increase to 6.9% AR in Q4 from 2.3% in Q3. As was the case last quarter, inventories will play a large role though they will be a drag instead. That said, domestic final sales likely continued to strengthen on the back of firming consumer spending. The inflation parts of the report will likely show acceleration,'' analysts at TD Securities said.

- USD/CHF steadies near 0.9600 as investors eye the release of US Consumer Confidence and Durable Goods Orders.

- The asset has remained strong this month amid higher expectations of a rate hike by the Fed.

- Swiss 13-year high CPI print at 2.2% may push the Swiss officials to adopt a hawkish stance.

The USD/CHF pair is oscillating in a narrow range of 0.9547-0.9596 from the New York session, following the footprints of the US dollar index (DXY). The asset is awaiting a potential trigger for further guidance.

On Tuesday, the pair is likely to respond to the release of US Consumer Confidence and Durable Goods Orders. A preliminary estimate for the US Consumer Confidence is 108 against the prior print of 107.2. While the monthly Durable Goods Orders are likely to land at 1% against the prior print of -2.1%. Higher reading from the economic data will fetch significant bids on the counter. The asset has remained in the grip of bulls in April as interest rate hike expectations have dominated the risk-sensitive currencies. The greenback bulls have underpinned against the Swiss franc as the Federal Reserve (Fed) chair Jerome Powell has dictated in its testimony that a 50 basis points (bps) interest rate hike is on the cards.

Meanwhile, the Swiss franc will majorly react to the speech from Swiss National Bank (SNB) Governor Thomas J. Jordan, which is due on Friday. This will provide insights into the likely monetary policy action by the SNB in its upcoming monetary policy. The Swiss Consumer Price Index (CPI) was released at 13-year high of 2.2%, which looks a little over the targeted inflation rate of 2%. This might turn the Swiss policymakers hawkish going forward.

- During the week, the AUD/JPY record losses of 1.29%.

- The market sentiment remains sour as Asian equities are set to open lower on China’s coronavirus woes and global central bank tightening.

- AUD/JPY Price Forecast: Ready to test the MTD lows around 90.11

The Australian dollar slumped sharply on Monday’s session, down some 1.23%, a 200-pip fall, but recovered late as the New York session waned. As Tuesday’s Asian Pacific session begins, the AUD/JPY is trading at 91.83, shy of the 92.00 mark at the time of writing.

US equities finished with an upbeat tone, lifted by the Nasdaq Composite. Asian futures point to a lower open, weighed by China’s coronavirus outbreak issues as fears of wider curbs in Beijing alarms market players, already fretting about a global economic slowdown. Meanwhile, the Ukraine-Russian woes appear to have taken a backseat of late, as worries about global central banks tightening have taken the front stage.

On Monday’s session, the AUD/JPY opened near last Friday’s lows and, without issuing any warning, extended its falls which accelerated as the Europan/North American sessions overlapped, reaching a daily low at 91.11. However, the shift in market mood on Wall Street lifted the AUD/JPY shy of the 92.00 area.

AUD/JPY Price Forecast: Technical outlook

The AUD/JPY daily chart depicts the pair as upward biased despite the recent fall. However, once AUD/JPY bears broke below 92.40, it could be expected sideways or further downward pressure on the pair, as it broke the latest market structure. Also, the Relative Strength Index (RSI), about to close below the 50-midline, will enter the bearish territory, so a move towards March’s 31 daily low at 90.76.

In the AUD/JPY’s 1-hour chart, its first support would be April 25 daily low at 91.11. Once cleared, the next demand zone would be the S1 daily pivot at 90.94, followed by the March 31 cycle low at 90.76. A break of the latter would expose September’s 2017 lows at 90.30, followed by the 90.00 figure.

Key Technical Levels

- The Silver Price will extend its losses if a daily close below the 200-DMA is achieved.

- The market sentiment shifted positive, but China’s coronavirus outbreak could turn it sour.

- The greenback remains in the driver’s seat, as shown by the US Dollar Index, reaching a new YTD high at 101.85

- Silver Price Forecast (XAG/USD): A daily close below the 200-DMA could extend the Silver slide towards $22.00.

Silver Price is dropping sharply on the back of an early risk-off dominated session, courtesy of China’s coronavirus outbreak spreading towards Beijing and market participants’ woes regarding a faster pace of tightening by the Federal Reserve. At $23.61, XAG/USD reflects the aforementioned, as safe-haven flows went to the greenback, not precious metals, as Gold is also down 1.73 in the day.

China’s coronavirus spreads from Shanghai to Beijing as further lockdowns loom

The market mood improved late near Wall Street’s close, as US equities recorded gains. China’s growing concerns weighed on commodity prices, as shown by oil, precious, and base metals, ending the day with losses. A renewed coronavirus outbreak in Shanghai triggered lockdowns in the city, extending to certain districts in Beijing. If the lockdowns continue, that would weigh on the global economic outlook. Additionally, the US central bank tightening expectations have fully priced in a 100% chance of a 0.50% rate hike in the May meeting, while for June, the odds are at 80%, as shown by the CME FedWatch Tool.

In the meantime, the greenback remains underpinned by increasing bets that the Federal Reserve would hike rates at a faster pace, with the US Dollar Index gaining some 0.61%, sitting at 101.738. Meanwhile, the US 10-year Treasury yield lost eight basis points on Monday, down to 2.818%.

This week’s highlight of the US economic docket is the first-quarter GDP, which would be unlikely to change the view of Fed policymakers of a 50-bps rate hike in May. Regarding the report, analysts at ING wrote in a note that “t[T]he coming data shouldn’t impact this outlook meaningfully. 1Q GDP data is expected to show the economy expanded at a 1-1.5% annualised rate, which would mark quite a deceleration from 4Q 2021’s 6.9% rate, reflecting the Omicron wave of the pandemic that impacted people movement quite considerably. However, recent data has pointed to a renewed uptick in activity and we expect to see stronger GDP growth for the second quarter.”

Silver Price Forecast (XAG/USD): Technical outlook

On Monday, the XAG/USD daily chart shows that the price action broke below the 200-day moving average (DMA) at $23.85. However, a daily close below the latter is required to further cement that the bias shifted from upwards to neutral. Furthermore, it’s worth noting that the Relative Strength Index (RSI) is aiming downwards, at 34.41, but it has some room to spare if Silver extends its losses.

In the case of further downside, the XAG/USD’s first support would be the February 15 daily low at $23.08. Once cleared, the following demand zone would be the February 11 daily low at $22.86, which, once out of the way, has a long run towards Silver bull’s last line of defense at $22.00.

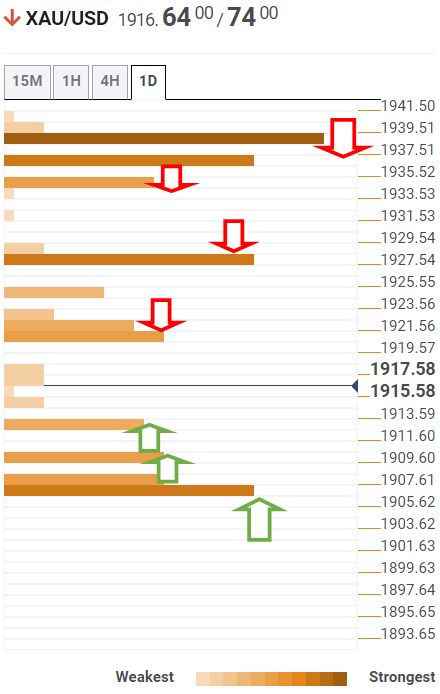

- XAU/USD finds a short-lived cushion near $1,895.00 after the carnage on Monday.

- The aggressive gestures from Fed policymakers have already prepared investors for a jumbo rate hike.

- On Tuesday, US Consumer Confidence and Durable Goods Orders will remain in focus.

Gold (XAU/USD) has witnessed a sheer downside since Monday after slipping below the previous consolidation zone placed in a narrow range of $1,936.78-1,958.37. The precious metal has fallen like a house of cards as investors have started pricing in a tight liquidity environment, which will stay for a longer horizon, going forward. The gold prices are oscillating near their potential cushion levels at around $1,895.40. The asset has witnessed slight support but the price action is advocating more weakness in the counter.

The pessimism in the gold prices is marked by soaring inflation in the US economy. The US Consumer Price Index (CPI) has reached multi-decade highs along with the second booster of the tight labor market has already featured a 50 basis point (bps) interest rate hike by the Federal Reserve (Fed). Well, as per the dictation by Fed chair Jerome Powell in his testimony at the International Monetary Fund (IMF) meeting; a jumbo rate hike is imminent while investors will further focus on the status of balance sheet reduction. Squeezing liquidity from the economy at a faster pace is the need of the hour and Fed policymakers are likely to exploit each measure.

Going forward, the precious metal is likely to dance to the tunes of the US Consumer Confidence and Durable Goods Orders release, which are due on Tuesday. A preliminary reading for the monthly Durable Goods Orders is 1% against the prior print of -2.1%.

Gold Technical Analysis

On a four-hour scale, XAU/USD is trading near its potential demand zone, which is placed in a narrow range of $1,891.38-1,896.31. A bear cross, represented by the 20- and 200-period Exponential Moving Averages (EMAs) at $1,940.00 adds to the downside filters. Meanwhile, the Relative Strength Index (RSI) (14) has established in a 20.00-40.00 range, which signals the strength of the sellers.

Gold four-hour chart

-637865208149705572.png)

- USD/JPY bulls moving back in and take on hourly resistance

- US dollar is on fire as markets turn risk-off on global growth risks.

USD/JPY is taking on bears on the hourly time frame, breaking into key resistance. At 128.12, the price is down a touch for the day, by -0.28% after travelling between a low of 127.52 and 128.13 the high. The greenback has been the favour at the start of the week hitting a two-year high due to a wave of risk aversion that has swept global markets.

Growing worries of an economic slowdown in China and the contagion in global trade coupled with the Ukraine crisis is hammering risk apatite at the start of the week. The greenback, against a basket of its rivals (DXY), has reached a high of 101.856 and was on track for its biggest daily rise since March 11.

There is an additional focus on the Federal reserve during the blackout week before the interest rate decision in May, The Hawkish comments by various policymakers raised the risks of aggressive policy tightening. The money markets are now expecting the Fed to raise interest rates by a half-point at the next two meetings.

Meanwhile, analysts are looking to the US Real Gross Domestic Product this week which has likely slowed sharply in the first quarter following a significant increase to 6.9% AR in Q4 from 2.3% in Q3.

''As was the case last quarter, inventories will play a large role though they will be a drag instead. That said, domestic final sales likely continued to strengthen on the back of firming consumer spending. The inflation parts of the report will likely show acceleration,'' analysts at TD Securities said.

What you need to know on Tuesday 26 April:

Though US equities were able to stage an impressive recovery in the latter hours of US trade, the dominant force in FX markets on Monday remained risk-off flows, with traders citing China lockdown concerns as the major driver. Amid a sharp pullback in global bond yields as traders reassessed global growth prospects amid the rising risk of a wider shutdown of the world’s second-largest economy, the rate-sensitive safe-haven yen was the best performing G10 currency.

USD/JPY dropped back to the 128.00 area, with the pair now more than 1.0% below last week’s multi-decade highs above 129.00. The safe-haven US dollar also benefited as a result of risk-off flows and was the second-best performing major G10 currency, with the Dollar Index (DXY) hitting fresh highs since March 2020 in the upper 101.00s.

The jump in the DXY, which is a trade-weighted basket of major USD currency pairs, was mainly a function of weakness in GBP/USD and EUR/USD as a result of risk aversion. The former at one point dropped under 1.2700 for the first time since September 2020 but was last trading down 0.7% in the 1.2730s, while EUR/USD was down a similar margin just above 1.0700 and also at fresh multi-month lows. Any euro relief in wake of French President Emmanuel Macron’s re-election did not last.

The worst performing of the major G10 currencies was the Aussie, with AUD/USD last trading down about 0.9% in the 0.7175 region, after having been as low as the 0.7130s earlier in the day, its lowest levels since late February. A steep drop in energy, industrial and precious metal prices weighed heavily on the commodity export-dependent Aussie, as did concerns about Chinese lockdowns, given China’s status as Australia’s most important export destination. The commodity-sensitive NZD and CAD held up better, depreciating a respective 0.3% and 0.1% each versus the buck.

The loonie may have been assisted by a hawkish set of remarks from BoC Governor Tiff Macklem on Monday, who reiterated the need for higher interest rates to tackle inflation, suggested a 50 bps rate hike at the next meeting was likely and even floated the possibility of a 75 bps hike. Either way, USD/CAD looks set to end the day in the low 1.2700s having fallen back from the upper 1.2700s and NZD/USD recovered from a brief dip under 0.6600.

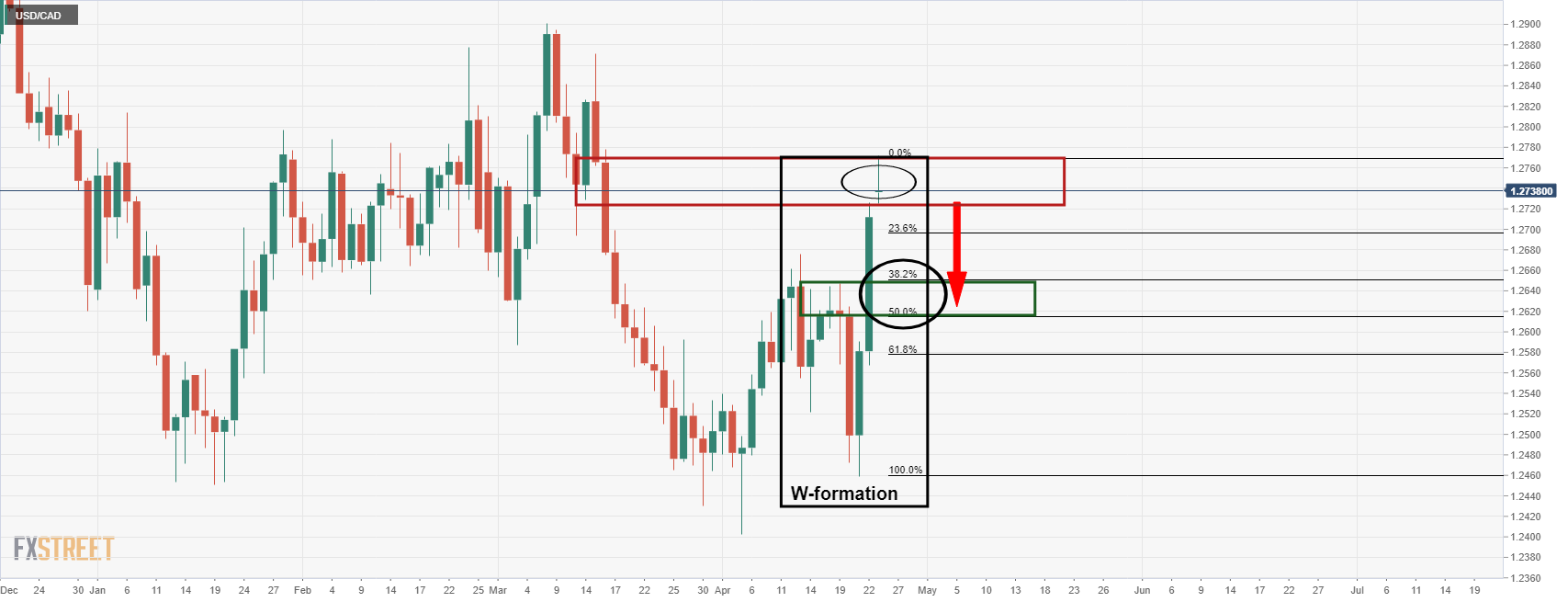

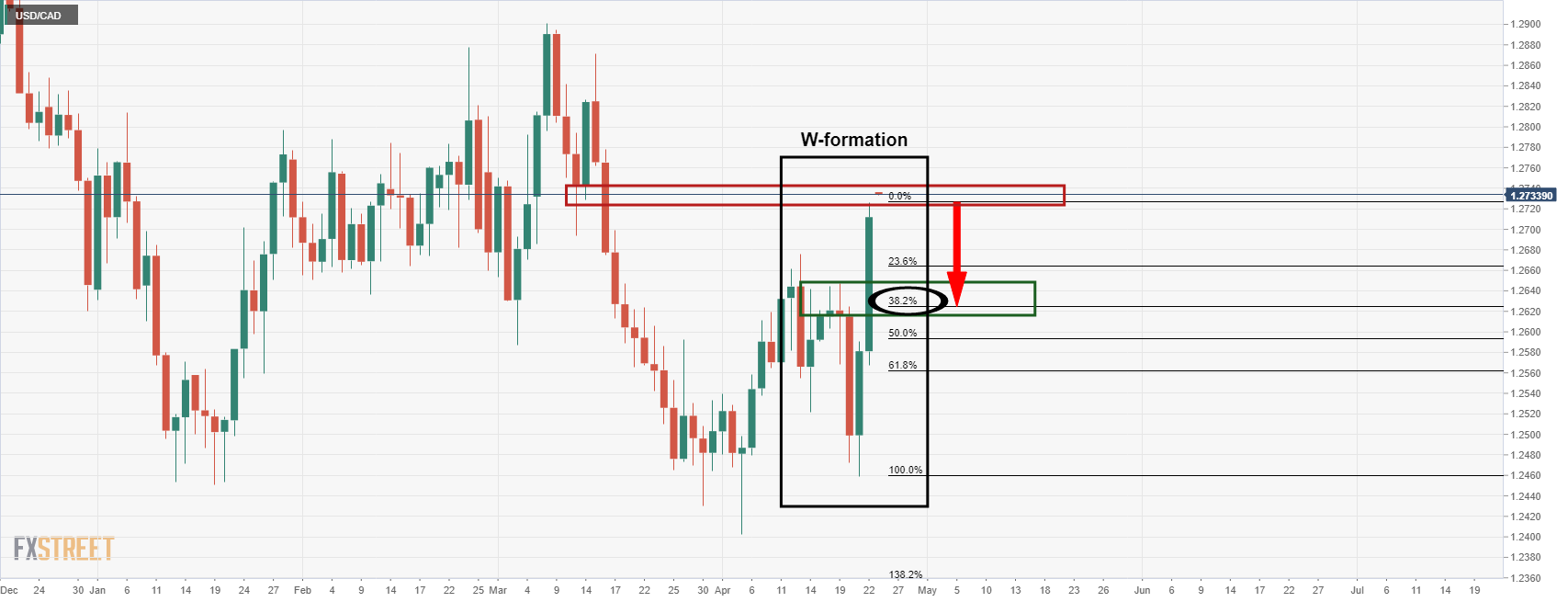

- The bears are in control and eye a significant correction.

- The daily doji is being formed on Monday in a key resistance area.

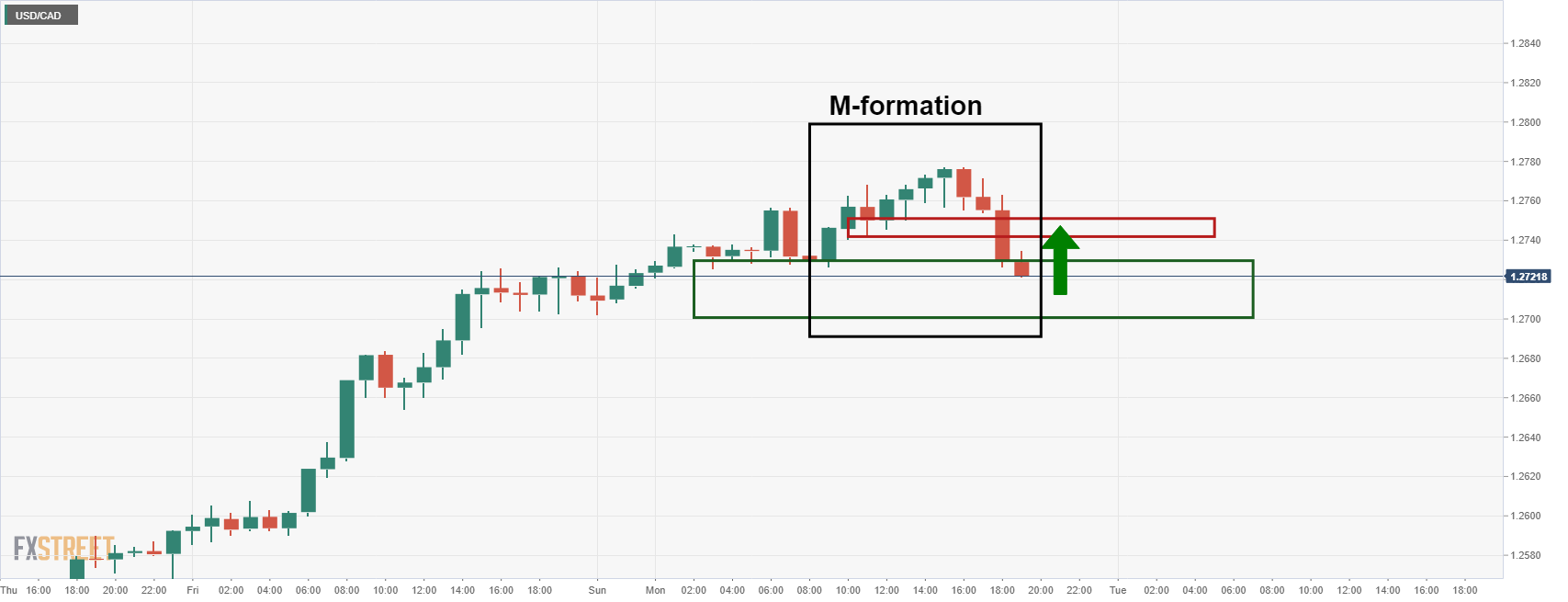

USD/CAD is under pressure as the price of oil picks up in late US trade. Nevertheless, the bears are may wish to move out in hourly support and the M-formation does not bode well for short-term short positions.

USD/CAD H1 chart

As illustrated, the price is in the hands of the bears, but the reversion pattern is menacing for the near term.

USD/CAD daily chart

On the other hand, the daily chart is highly bearish in terms of market structure. Monday's daily candle is on the way to forming a doji in a resistance area. The daily impulse is overextended and due for a correction and the W-formation is a bearish reversion pattern. The prior resistance in the formation, or the neckline, aligns with the 38.2% and 50% ratios as a confluence target area for the days ahead.

- The Australian dollar falls some 0.92% on Monday amidst a dismal market mood.

- China’s coronavirus outbreak and the US central bank’s aggressive hawkish tilt spurred a flight to safe-haven assets.

- AUD/USD Price Forecast: The break of the 200-DMA opened the door for further AUD/USD weakness.

On Monday, the AUD/USD fell sharply in the middle of a dampened market mood trading day in the financial markets, courtesy of China’s coronavirus outbreak which has spread to some districts of Beijing, threatening to slow down the world’s second-largest economy, and fears of a Federal Reserve aggressive tightening. At 0.7179, the AUD/USD is down and about to record losses of 0.94%.

China’s coronavirus spread to Beijing might slow its economy, commodities fall

The market sentiment, as previously mentioned, keeps global equities under pressure, except for the tech-heavy Nasdaq Composite, up 0.42%. Also, commodities keep heading south amid China’s growing concerns, as shown by oil, precious and base metals, which record losses. That also weighed on the pair, as the Australian economy heavily depends on China. Furthermore, Iron ore prices recorded losses of 12%, a headwind for the AUD/USD.

In the meantime, the greenback remains underpinned by increasing bets that the Federal Reserve would hike rates by 50-bps, as shown by Short Term Interest Rates (STIRs), fully pricing in a 0.50% increase. The reflection of the aforementioned is the US Dollar Index, edging up 0.57%, sitting at 101.698.

Data-wise, the Australian and US economic docket would have some tier 1 data to release. The Consumer Price Index (CPI) for Q1 will be revealed in Australia. Across the pond, the US Gross Domestic Product (GDP) for Q1 is expected to show some growth, but at a much slower pace than last year.

AUD/USD Price Forecast: Technical outlook

The AUD/USD broke several daily moving averages (DMAs) on its sharp fall, including the “trendsetter” 200-DMA lying at 0.7291, which denotes bullish/bearishness on an asset, depending on the location of the price. Worth noting that the Relative Strength Index (RSI) accelerated its downward trend, but at 33.05, it still has some room to spare in the case of further AUD/USD weakness.

Therefore, the AUD/USD first support would be the March 15 cycle low at 0.7165. A breach of the latter would expose the April 25 daily low at 0.7134, followed by the February 24 daily low at 0.7095.

- GBP/JPY has extended on last Friday’s losses and is back to trading near two-week lows in the 163.00 area.

- Risk-off flows and an associated downturn in UK bond yields was the main factor driving the drop on Monday.

- The pair now trades more than 3.0% below last week’s peak above 168.00.

GBP/JPY was last trading lower by 1.1%, after extending on last Friday’s slightly larger loss to fall back to near the 163.00 level for the first time in nearly two weeks and, in doing so, drop below its 21-Day Moving Average (currently at 163.18) for the first time since mid-March. The latest move has been driven by a combination of risk-off flows hurting risk-sensitive sterling and benefiting the safe-haven yen and downside in UK bond yields, which reduces the UK’s rate advantage over Japan thus improving the yen’s relative investment appeal versus GBP.

At current levels in the 162.80s, the pair now trades more than 3.0% below last week’s multi-year highs above the 168.00 mark. According to technicians, the latest drop back under the 21-Day Moving Average opens the door to a pullback all the way to the 50DMA and key support in the form of early 2022 and late 2021 highs near-158.00, a further 3.0% drop from current levels.

The main fundamental catalyst behind the risk-averse start to the week that has weighed so heavily on GBP/JPY is the negative Covid-19 news coming out of China, a story that will be a key driver of sentiment in the coming weeks. Should further cities go into Shanghai style-lockdown, global growth forecasts will be further called into question and this could easily provoke further downside for GBP/JPY.

Aside from China lockdown risks, GBP/JPY traders will also be watching this week’s BoJ meeting, with the bank expected to reiterate its ultra-dovish stance. That could mean some downside risks for the yen. In terms of UK data and domestic themes, there isn't much to note. Discontent regarding the UK PM’s so-called “partygate” scandal continues to foment but doesn’t yet look likely to endanger his job.

- EUR/USD bears n charge at the start of the week.

- Covid spread in China is playing havoc on risk sentiment.

EUR/USD has been pressured at the start of the week. At 1.0712, the pair is down some 0.8% after falling from a high of 1.0815 to a low of 1.0696. Risk sentiment was poor and government bond yields slumped due to the COVID-19 related shutdowns in China that are expected to compound supply chain restrictions, undermining prospects of a global recovery.

The worsening of supply-chain restrictions in China is not only troublesome for the global economy and work trade, but they are also worrisome because it makes it harder for the Federal Reserve to control inflation in the US at multi-decade highs. nevertheless, the US dollar has picked up a safe haven bid and rallied to 101.856 on the day as per the DXY index.

''A strong USD suggests that a sharp rebound in EUR/USD may be out of reach near-term. That said, the tone of the June 9 European Central Bank meeting is likely to be instrumental in determining whether or not EUR/USD can make a moderate recovery,'' analysts at Rabobank said.

''It is our central view that EUR/USD will end the year higher in the 1.10 area,'' the analysts added. ''This view has depended on the assumption that the ECB will have started to hike rates and on the coincident view that investors will be preparing for slower US growth next year. The possibility of another Covid related wave of economic uncertainty coinciding with aggressive Fed tightening would likely result in a stronger for longer USD.''

Meanwhile, the media blackout ahead of the FOMC meeting is in effect and so there will be no Fed speakers until Chair Powell’s post-decision press conference the afternoon of May 4. instead, traders will look to the is week's US core March PCE reading Friday that will be important.

PCE is expected to ease a tick to 5.3% YoY, but analysts at Brown Brothers Harriman said that they see upside risks given inflation data already reported for March. 'If so, expect another leg higher in US rates.''

- On Monday, the Japanese yen benefited from a dismal market mood, gaining 1.19% vs. the euro.

- China’s Covid-19 outbreak expanding to Beijing, alongside central bank tightening, turned the sentiment sour.

- EUR/JPY Price Forecast: If a daily close below 137.50 is achieved, a dip towards 134.00 is on the cards.

The EUR/JPY nose dives from daily highs around 139.00 towards 136.40s daily lows due to a risk-off market mood that increased demand for safe-haven assets. In the FX space, investors scrambled towards the JPY, the CHF, and the USD, as most G8 currencies print losses vs. the previously mentioned peers. In the North American session, at the time of writing, the EUR/JPY is trading at 137.13.

The market sentiment remained sour throughout the day, spurred by the Covid-19 outbreak in China, which started in Shanghai and is expanding towards Beijing, as reported by Reuters. Also, the Ukraine-Russia jitters and central banks tightening monetary conditions triggered risk aversion.

On Monday, in the Asian session, the EUR/JPY opened near the daily pivot at 138.82 and pushed towards the 139.00 mark to record a daily high. Afterward, the EUR/JPY plummeted more than 250-pips, reaching a daily low at 136.48.

EUR/JPY Price Forecast: Technical outlook

The EUR/JPY daily chart shows the pair remaining upward biased. However, the break below February’s 2018 highs at 137.50 opened the door for further losses. Furthermore, a daily close below the latter and a drop towards 134.00 is on the cards.

If that scenario plays out, the EUR/JPY first support would be 136.00. Break below would expose April’s 11 daily low at 135.27. Once cleared, the EUR/JPY bear’s next target would be April’s 5 daily low at 134.29, followed by the 134.00 mark.

Key Technical Levels

- The British pound extended its last week’s losses on weaker than expected UK economic data.

- Also, a dismal market mood and flight to safe-haven assets weighed on the GBP boosts the USD.

- GBP/USD Price Forecast: To remain downward pressured unless the 1.3000 is reclaimed.

The GBP/USD plummets to fresh multi-year lows, below the 1.2700 mark, amidst a dampened market mood and odds that the US central bank would hike rates aggressively throughout the year. In the FX space, the greenback remains in the driver’s seat, while risk-sensitive currencies like the GBP, the CAD, and the antipodeans fall. At the time of writing, the GBP/USD is trading at 1.2726 in the North American session.

Sentiment turned sour on China’s Covid-19 outbreak, central bank tightening

Global equities still cling to losses. China’s Covid-19 outbreak over the last two weeks in Shanghai threatens to extend to Beijing, as reported by Reuters. Also, Fed expectations of a 0.50 bps increase in the US, on a slowing economic outlook, threaten to trigger a global “stagflation,” as mentioned by some financial analysts.

The GBP/USD recorded losses of 1.71% in the last week on weaker than expected UK economic data. A worse than expected April’s Gfk Consumer Sentiment (at -38 vs. -33 foreseen) kept the British pound under pressure, hitting its lowest level since the Global Financial Crisis (GFC) of 2008. It is worth noting that a GfK Consumer Sentiment reading has preceded four of the last five recessions in the UK. Additionally, the drop in the Retail Sales from -0.3% estimated to -1.4% emphasizes that the UK economy is losing momentum, painting a cloudly environment as the Bank of England (BoE) goes through its tightening cycle.

Elsewhere, last week comments from Bank of England (BoE) Catherine Mann prepared the case for a 50-bps rate hike in May. Nevertheless, with weaker than expected data in the previous week, analysts at Rabo bank wrote in a note that “on the heels of the retail sales plunge in March, it may be tough to convince the majority of the MPC to announce a move larger than 25 bps next month. In the face of strong inflationary pressures, it is our view that the Bank will announce three more 25 bps rate hikes in the coming months bringing the peak in rates to 1.5%.”

GBP/USD Price Forecast: Technical outlook

The GBP/USD remains downward pressured but fell short of testing September’s 2020 cycle lows around 1.2675, staging a recovery towards current price levels. The bounce off 1.2697 YTD lows provided some air to GBP/USD bears because the Relative Strength Index (RSI) reached oversold conditions, with its reading at 26.40. Nevertheless, once the RSI reclaims 30, further downside is expected.

With that said, the GBP/USD first support would be the YTD low at 1.2697. Once cleared, the next support would be September’s 2020 cycle lows around 1.2675, followed by July’s 2020 swing lows near 1.2479.

- USD/JPY has dropped back under 128.00 with the yen outperforming in the G10.

- The yen is benefitting from a bullish combination of risk-off flows, lower commodities and lower global bond yields.

- Ahead, US GDP and Core PCE plus the BoJ’s policy announcement will be the major risk events of the week.

The yen has thus far this week enjoyed some rare time as the best performing of the major G10 currencies, and was last trading up about 0.6% versus the buck, and with much larger gains against some of its risk-sensitive G10 counterparts. The Japanese currency on Monday took advantage of a combination of yen bullish factors including 1) risk-off flows in risk assets which spurred demand for safe-haven currencies, 2) downside in global yields which saw rate differentials to Japan shrink, boosting the low-yielding yen’s investment appeal and 3) a sharp drop in global commodities, which out to boost the terms of trade of the heavily commodity import-dependent Japanese economy.

USD/JPY was last trading in the upper 127.00s, now more than 1.25% below last week’s peaks above 129.00, and is eyeing a push lower towards support in the 125.00 area. Should the trends of weaker equities and commodities plus lower yields continue this week, then USD/JPY should have a decent chance of testing this support, which also happens to coincide with the pair’s 21-Day Moving Average. The main driver of these trends at the start of the week has been the news out of China of tighter lockdowns in Shanghai and Covid-19 cases being picked up in Beijing, which has triggered fears of wider lockdowns across the country.

This will be a key theme in the week ahead, but USD/JPY traders should keep an eye on the economic calendar. The BoJ will be setting monetary policy on Thursday and expectations for it to reiterate its ultra-dovish policy stance pose a risk to the nascent yen comeback. The first estimate of US Q1 GDP figures on Thursday followed by March Core PCE inflation on Friday will also keep markets thinking about the outlook for the US economy and for Fed policy, even though the Fed will be quiet given blackout ahead of its policy meeting in the first week of May.

- US dollar holds onto significant daily gains across the board on risk aversion.

- NZD/USD heads for lowest daily close since late January.

- AUD/NZD falls to three weeks lows.

The NZD/USD bottomed hours ago at 0.6580, the lowest level in almost three months. It then rebounded, trimming losses and peaked at 0.6633 before turning back to the 0.6600 area. The pair remains under pressure on the back of a stronger US dollar across the board.

The kiwi is falling for the third consecutive day versus the dollar, accumulating a decline of more than 200 pips. The key driver is risk aversion. The worsening in the situation with COVID in China and concerns about the impact of a more aggressive tightening from the Federal Reserve.

Equity prices in Wall Street are falling 1% on average while at the same time US yields are falling sharply amid a rally in Treasuries with investors looking for safety. The US 10-year yield stands at 2.77%, the lowest since April 14.

Despite the decline versus the dollar and the deterioration in market sentiment, the kiwi is not among the worst performers in the G10 space. AUD/NZD dropped to the lowest level in three weeks at 1.0823, moving further away from the one-year highs it reached last week at 1.0998.

Below 0.6590, next stop at 2022 lows

The bias in NZD/USD remains negative. The area of 0.6585/90 is a key support and a break lower should clear the way to more losses, targeting the 2022 low at 0.6528 (interim support at 0.6555. On the upside, resistance levels are seen at 0.6640 followed by 0.6675 and 0.6715.

Technical levels

Bank of Canada Governor Tiff Macklem on Monday refused to rule out lifting interest rates by more than 50 bps, but said that such a move would be very unusual, reported Reuters. He also said that the government's 2022 budget is expansive, but will have very little macro-economic impact.

His remarks come after said he expects the bank will be considering another 50 bps increase in June, and that how high rates go will depend on how the economy responds and how the outlook for inflation evolves.

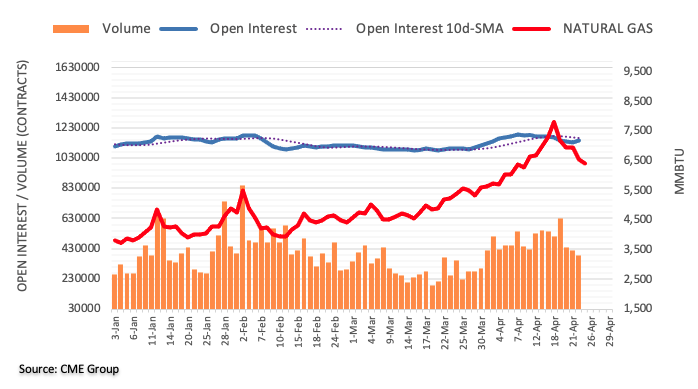

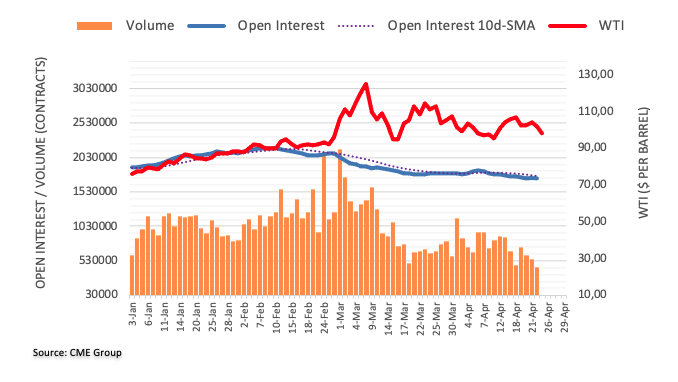

- Oil prices slumped on Monday amid concerns about demand in China, and amid risk-off flows and the stronger buck.

- WTI dropped over $6.0 to the $95.00s, and is eyeing a test of March/April lows in the $93.00 area.

Oil prices have seen a steep decline on Monday, with front-month WTI futures last trading lower by more than $6.0 (or over 6.0%) in the $95.00s, having dropped under $100 for the first time in nearly two weeks. Oil bears will be eyeing a test of April and March lows in the $93.00 area, a break below which could feasibly open the door to a drop towards the next key area of support in the $88 and $85 areas.

Market commentators attributed negative news about the state of the Covid-19 outbreak in China as driving the moves, given China’s continued strict adherence to a policy of zero-Covid-19. A few Covid-19 cases were reported in Beijing, sparking fears that the city might be plunged into a lockdown like Shanghai has been in over the last few weeks. In Shanghai, reports suggest the lockdown has been toughened in some areas, with residents reportedly fenced into their apartment blocks.

“It seems that China is the elephant in the room… The tightening COVID-zero restrictions in Shanghai, and fears Omicron has spread in Beijing, torpedoed sentiment today,” said one analyst. “Shanghai shows no signs of letting up its strict zero-COVID policy; instead vowing to step up the enforcement of COVID restrictions, which could hurt oil demand further,” said another. China is the world's second-largest consumer of crude oil and, according to a Bloomberg report last week has already seen its daily consumption drop by around 1.2MBPD this month, nearly 10% of the nation’s demand.

Elsewhere, steep losses across global equities and in other major commodity markets amid broad risk-off flows have also contributed to the downturn in crude oil prices, as has the strengthening of the US dollar. The DXY hit new year-to-date highs in the upper 101.00s on Monday. A stronger dollar makes USD-denominated oil more expensive for international buyers, hurting demand.

- A firm US dollar and a dismal market mood weighed on the Swiss franc, which is losing some 0.15%.

- The US Dollar Index continues reaching YTD highs, now around 101.782.

- USD/CHF Price Forecast: Remains tilted upwards, but solid resistance around 0.9600 could spook buyers.

The USD/CHF rallies amidst a risk-off market sentiment, triggering a flight to safe-haven assets. In the FX space, the greenback is bolstered by increasing odds of an aggressive Federal Reserve, which propels the USD/CHF up some 0.17% in the North American session, and is trading at 0.9585 at the time of writing.

As previously mentioned, the buck remains in the driver’s seat in the FX complex. The US Dollar Index, a measurement of the greenback’s value against a basket of six peers (including the Swiss franc), is trading at multi-year highs around 101.782 and is gaining 0.66%, despite falling US Treasury yields.

The US 10-year Treasury yield is losing twelve basis points on the day, and trading at 2.779%, after hitting a YTD high at 2.981% last Wednesday.

On Monday’s Asian and European session, the USD/CHF opened below last week’s close, though it achieved a bounce near the 0.9600 figure, retreating afterward, before settling around the daily pivot point at 0.9560.

USD/CHF Price Forecast: Technical outlook

The USD/CHF remains bullish from a daily chart perspective, but the Relative Strength Index (RSI) reading around 74.50 suggests the pair could be topping in the near term.

The USD/CHF 1-hour chart shows bulls' failure to reclaim 0.9600 opened the door for a dip towards the daily pivot point around 0.9560. However, they recovered some ground, lifting the USD/CHF price to 0.9580. The Relative Strength Index (RSI) is back above the 50-midline (bullish territory) at 58.12. However, price action in the overnight session for North American traders showed that the 0.9600 supply zone would be difficult to overcome.

To the upside, the USD/CHF's first line of resistance would be the confluence of the major round figure and the R1 daily pivot at 0.9600. A breach of the latter would expose the R2 daily pivot at 0.9630, followed by the June 5, 2020 swing high around 0.9650.

On the flip side, the USD/CHF first support would be the confluence of the 50-day Simple Moving Average (SMA) and the daily pivot near the 0.9557-0.9560 range. Once cleared, the following support would be the S1 daily pivot, which confluences with June 30, 2020, daily high, turned support at 0.9533, followed by the S2 daily pivot at 0.9500.

Key Technical Levels

Bank of Canada Governor Andrew Bailey reiterated on Monday that interest rates in Canada will need to be lifted and said that inflation is too high and is going to be elevated for longer than we previously thought, reported Reuters.

Additional Remarks as summarised by Reuters:

Demand is beginning to run ahead of the economy’s productive capacity.

Businesses can’t find enough workers to meet demand and they’ll need to raise wages to attract and retain staff.

A broadening in price pressures is a big concern.

The bank is committed to using interest rates to return inflation to its target and will do so forcefully if needed

We do not have a pre-set destination for the policy interest rate.

How high rates go will depend on how the economy responds and how the outlook for inflation evolves.

Reiterates it may be appropriate to pause our tightening once we get closer to the neutral rate and then take stock.

Reiterates that, on the other hand, the BoC may need to take rates modestly above neutral for a period to bring demand and supply back into balance and inflation back to target.

Macklem said that it's fair to say that prices increases are not 'transitory' as he said they would be last year.

Macklem said that inflation is close to peak.

Macklem said he expects the bank will be considering another 50 bps increase in June.

- The USD/CAD is gaining in the week by some 0.39%.

- A dismal market sentiment, courtesy of China’s Covid-19 outbreak, weighed on oil prices and the CAD.

- USD/CAD Price Forecast: Tilted to the upside, once broken the 200-DMA around 1.2624.

The USD/CAD rallies in the middle of a flight to safe-haven peers in the FX space, using the US dollar, the JPY, and the CHF as safety vehicles in a risk-off market mood. Also, falling oil prices and increasing bets that the Federal Reserve would hike rates 0.50% in the May 4-5 meeting boost the prospects of the greenback. At the time of writing, the USD/CAD is trading at 1.2755 at fresh monthly highs at the time of writing.

The Covid-19 outbreak in China weighed on market sentiment

Global equities are recording losses. The abovementioned factors and China’s Covid-19 lockdown in Shanghai threaten to slow down economic recovery. China’s situation is expanding towards Beijing, as reported by Reuters.

“In Shanghai, authorities have erected fences outside residential buildings, sparking fresh public outcry. In Beijing, many people have begun stockpiling food, fearing a similar lockdown after the emergence of a few cases of COVID-19.”

Consequently, commodity prices are down, led by the US crude oil benchmark, Western Texas Intermediate (WTI), down close to 5%, exchanging hands at $96.70 per barrel, weighing on the commodity-linked Loonie. Production and delivery of oil products in Canada contributed just under 10% of the Gross Domestic Product (GDP).

An absent Monday’s US economic docket left USD/CAD traders adrift to the Bank of Canada (BoC) Governor Tiff Macklem, and Senior Deputy Governor Rogers are scheduled to testify before the House of Commons Standing Committee on Finance at 11:00 ET on Monday.

USD/CAD Price Forecast: Technical outlook

The USD/CAD broke April’s 13 previous monthly high at 1.2676 and gave fresh legs to the pair, as it broke above the 1.2700 figure quickly. It extended its gains and is accelerating the uptrend towards 1.2800. However, the Relative Strength Index (RSI) at 62.19, with its steeper slope, has enough space before reaching overbought conditions.

Given the previously-mentioned, the USD/CAD first resistance would be 1.2800. Break above would expose a solid supply zone around March’s 13 daily high at 1.2871, followed by March’s 7 daily high at 1.2901.

- EUR/USD puts the 1.0700 support to the test on Monday.

- A drop below 1.0707 exposes a retracement to 1.0635.

EUR/USD keeps correcting lower and challneges the 1.0700 key level at the beginning of the week.

The downside momentum in the pair accelerated on Monday and the breach of the 1.0700 area could motivate EUR/USD to attempt an assault to the 2020 low at 1.0635 (March 23).

While below the 200-day SMA, today at 1.1404, the outlook for the pair is expected to remain negative.

EUR/USD daily chart

According to Russia's First Deputy Envoy to the UN, Russia sees no point in agreeing to a ceasefire in Ukraine at the moment, reported Russia's state-run RIA media agency, as cited by Reuters. The First Deputy Envoy to the UN said that Russia believes that Kyiv may use any ceasefire to stage provocations and said that Russia has not struck residential areas of Ukraine's city of Odesa.

These latest comments come after the FT reported over the weekend that Russian President Vladimir Putin had dropped his hopes for a deal with Ukraine and instead shifted to a so-called "land-grab" strategy.

- DXY keeps pushing higher and records new highs around 101.70.

- Further upside could see the 2020 high near 103.00 revisited.

DXY keeps the bid bias well and sound and reaches new cycle peaks past 101.70 on Monday.

The sharp rebound from the 99.80 region (April 21) carries the potential to extend further. Against that, the breakout of the so far 2022 high at 101.73 (April 25) on a convincing fashion could motivate the index to attempt a visit to the 2020 high at 102.99 (March 20).

The current bullish stance in the index remains supported by the 7-month line near 96.70, while the longer-term outlook for the dollar is seen constructive while above the 200-day SMA at 95.50.

DXY daily chart

- EUR/GBP climbed to the monthly peak on Monday, though struggled to capitalize on the move.

- Friday’s dismal UK macro data continued weighing on the British pound and extended support.

- Sustained USD buying undermined the shared currency and kept a lid on any meaningful upside.

The EUR/GBP cross retreated a few pips from the monthly peak touched during the mid-European session and was last seen trading with modest gains, around the 0.8425 region.

Following an early dip to sub-0.8400s, the EUR/GBP cross regained positive traction for the fifth successive day on Monday and built on last week's strong move up. The disappointing UK macro data released on Friday indicated that the domestic economy is under stress from the soaring cost of living. This, in turn, was seen as a key factor that continued weighing on the British pound and acted as a tailwind for spot prices.

On the other hand, hawkish remarks by some ECB policymakers contributed to the shared currency's relative outperformance against its British counterpart. It is worth recalling that ECB Vice President Luis de Guindos had said that a rate hike is possible in the second half of the year. Moreover, ECB Governing Council member Pierre Wunsch suggested a probable rate hike in July and also anticipated that rates could be positive as soon as this year.

Furthermore, Joachim Nagel, President of the Deutsche Bundesbank, noted that the ECB could raise interest rates at the start of the third quarter. ECB President Christine Lagarde, however, said that the central bank may need to cut its growth outlook further amid concerns about the fallout from Russia's invasion of Ukraine. This, along with sustained US dollar buying, held back the euro bulls from placing fresh bets and capped the EUR/GBP cross.

Even from a technical perspective, the intraday positive move faltered just ahead of a technically significant 200-day SMA, currently around mid-0.8400s, which should now act as a pivotal point. This makes it prudent to wait for sustained strength beyond the said barrier before positioning for any further near-term appreciating move amid absent relevant market moving economic releases.

Technical levels to watch

- EUR/USD hit fresh annual lows just above 1.0700 on Monday as risk-off flows saw the buck strengthen across the board.

- Ahead of a busy week of US and Eurozone GDP and inflation data, bears continue to target the 2020 lows.

EUR/USD has stabilised at fresh annual lows just to the north of the 1.0700 level in early Monday US trade, as the US dollar gains across the board amid the distinctly risk-off tone to the broader market trade. At current levels in the 1.0720s, EUR/USD trades with losses of about 0.7% on the day, which would mark the worst day for the pair since 5 April, with the pair seeing losses on a similar scale to GBP/USD, but less severe than other more risk-sensitive G10/USD majors.

ECB sources cited by Reuters over the weekend highlight a sense of urgency being felt by many ECB policymakers to end net QE purchases as soon as possible and hinting towards the possibility of multiple rate hikes before the end of the year from July or August failed to lift the euro on Monday. As far as EUR/USD traders are concerned, the ECB’s hawkish shift in recent weeks towards a preference to ending QE and a start to rate hikes in Q3 has been negated by a comparatively larger hawkish shift from the Fed.

That explains to a large part why EUR/USD has been able to sustain lasting rallies, with a fragile risk appetite backdrop and elevated European geopolitical/economic risks associated with the Russo-Ukraine war also weighing. Eurozone and US GDP numbers are out later in the week and are unlikely to distract from the above noted broader narratives.

US March Core PCE inflation data and preliminary April Eurozone Consumer Price Inflation figures will be of more interest, with both expected to show still very elevated inflation levels that continue to argue in favour of Fed and ECB monetary tightening. EUR/USD are likely to look to fade any rallies, with many short-term bears looking for the pair to test 2020 lows in the 1.0630 area sometime in the coming days/weeks.

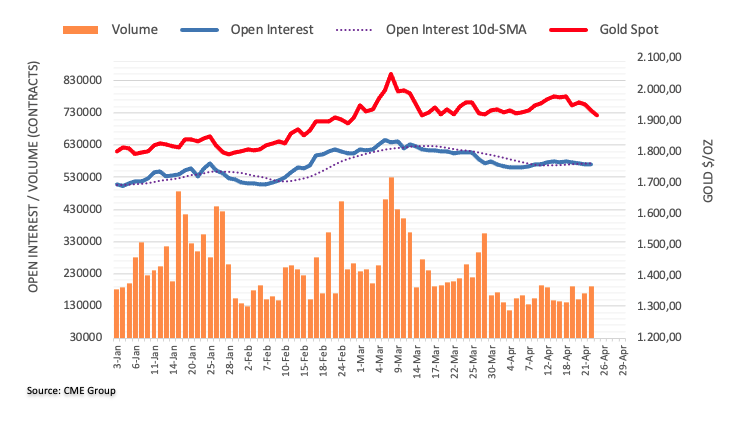

Gold Price remains on slippery slopes. Coronavirus-related lockdowns in China are set to continue weighing on the yellow metal, economists at TD Securities report.

Few participants left with appetite to buy gold

“Gold prices are succumbing to a weakening yuan as China’s worsening COVID-19 outbreak saps the buying impulse from yet another pillar of demand for bullion.”

“With little over a week remaining for the Fed to hike by 50bp and to begin quantitative tightening as we expect, demand for bullion from the investor community is likely to ease.”

“Shanghai's reinvigorated appetite for the yellow metal has helped to support prices, but a weakening yuan should translate into less demand from this cohort.”

The GBP’s crash through 1.30 on Friday is not letting up to start the week as cable heads towards a test of 1.27. Below here, the way is clear towards the 1.25 level, economists at Scotiabank report.

Trading in oversold territory could slow the cable’s decline

“There are no major support markets between the 1.27 level and the 1.25 figure aside from the Sep 2020 low of ~1.2675 and psychological support at the figure and mid-figure areas.”

“Trading in oversold territory may slow the GBP’s decline as it did in mid-March which was followed by a three cents gain roughly.”

“Resistance is 1.2765/70 followed by the 1.28 zone and the mid figure.”

EUR/USD firmly broke under the 1.08 figure, surpassing last week’s intraday lows, and tested the low-1.07s. After the 1.07 level, the March 2020 low of 1.0636 stands as key support, economists at Scotiabank report.

Resistance after the mid-1.07s is the 1.0780 mark

“The 1.07 zone stands as key support ahead of the next key level of 1.0636 – its March 2020 low.”

“Resistance after the mid-1.07s is ~1.0780, the 1.08 area and the mid-1.08s.”

- GBP/USD witnessed heavy selling for the third successive day and tumbled to the 1.2700 mark.

- Friday’s dismal UK macro data weighed on the GBP and exerted pressure amid stronger USD.

- Extremely oversold conditions on short-term charts held back bears from placing fresh bets.

The GBP/USD pair remained under intense selling pressure for the third successive day on Monday and plunged to the 1.2700 mark, or its lowest level since September 2020 during the mid-European session.

The British pound was pressured by last week's dismal macro data, which indicated that the UK economy is under stress from the soaring inflation. On the other hand, the prospects for a more aggressive policy tightening by the Fed pushed the US dollar to a more than two-year high and contributed to the heavily offered tone surrounding the GBP/USD pair.

From a technical perspective, the pair on Friday confirmed a fresh bearish breakdown through the 1.3000 psychological mark. The subsequent downfall and acceptance below the 50% Fibonacci retracement level of the 1.1411-1.4249 strong move up, around the 1.2800 mark, was seen as a fresh trigger for bearish traders and accelerated the intraday decline.

That said, extremely oversold oscillators on hourly/daily charts held back traders from placing fresh bets and assisted the GBP/USD pair to find some support near the 1.2700 mark. The attempted intraday recovery, however, met with a fresh supply near the 1.2755 region. This, in turn, suggests that the near-term bearish trend might still be far from being over.

A convincing break below the 1.2700 mark, leading to a subsequent break through the September 2020 low, around the 1.2675 region, will reaffirm the negative bias. The GBP/USD pair might then turn vulnerable to weaken further below the 1.2600 round figure and accelerate the slide towards the 61.8% Fibo. level, around the key 1.2500 psychological mark.

On the flip side, the 1.2755-1.2760 region now seems to act as an immediate resistance ahead of the 1.2800 mark. Any subsequent move up is more likely to run out of steam near the 50% Fibo. level., around the 50% Fibo. level, around the 1.2825-1.2830 region, which should act as a pivotal point. Sustained strength beyond could trigger a near-term short-covering move.

GBP/USD daily chart

-637864902585721589.png)

Key levels to watch

Gold Price has risen significantly since the beginning of the year. Strategists at Commerzbank are revising their gold price forecast upwards and expect a price of $1,900 per troy ounce at the end of the year.

Gold Price to rise to $2,000 next year

“We expect a price level of $1,900 at the end of the year (previous forecast $1,800). This means that we do not expect any stronger price decline despite the pronounced rate hike expectations.”

“Inflation is likely to remain at a higher level in the longer-term, which will have a dampening effect on real interest rates. Whether central banks are ready or willing to raise key interest rates far above inflation rates remains to be seen.”

“Weaker economic data are likely to raise doubts as to whether interest rates will actually be raised as much as is expected on the futures markets.”

“For next year, we expect the price to rise to $2,000 per troy ounce (previously $1,900).”

EUR/GBP has extended its sharp recovery to turn the spotlight back on the important 200-day moving average (DMA) at 0.8450. Analysts at Credit Suisse only see the pair marking a more important turn higher on a sustained close above this mark.

Further near-term strength in the broader sideways range

“A sustained hold above 200-DMA at 0.8450 is needed to rekindle thoughts of a potential base, with resistance seen next at the March high at 0.8514/23. Only a close above this latter area though would see a base established to raise the prospect of a more significant turn higher, with resistance then seen next at the December 2021 high at 0.8601.”

“Support is seen at 0.8383 initially, then the 55-DMA at 0.8359, which we look to try and hold. Below 0.8311/10 though is needed to ease the immediate upside bias for a fall back to potential trend support at 0.8260.”

EUR/USD has fallen sharply for a clear break below the 1.0806 recent low and uptrend from 2017. Analysts at Credit Suisse look for a test of the 2020 low at 1.0635.

Resistance at 1.0934 to cap

“The rapid sell-off has already seen support from the April 2020 low at 1.0727 removed and we stay directly negative for the ‘measured wedge objective’ seen at 1.0675/74 and eventually the 2020 low at 1.0635. Whilst we would look for signs of a better floor here, a direct break would warn of a yet further and significant break lower with support then seen next at the April 2017 low at 1.0579, then 1.0496/93.”

“Resistance is seen initially at 1.0758/60, then the 13-day exponential average and price resistance at 1.0836/59, which we look to now try and cap. A break can see a recovery back to 1.0934/33, but only a break above here would mark the completion of a near-term base to clear the way for a recovery back to 1.1034/40.”

The S&P 500 has completed a bearish “outside week”. With the market having gapped lower on Friday on increased volume, analysts at Credit Suisse look for a retest of the 4115 YTD low.

The bearish risk for the market has increased sharply

“The aggressive sell-off last week on increased volume has seen not only a bearish ‘outside week’ established, but also a bearish ‘reversal day’ on Thursday and the market then gap lower on Friday, along with a sharp turn lower on weekly MACD momentum again from zero.

We not only maintain our immediate negative outlook, but look for a further deterioration and a fall to retest support at the 23.6% retracement of the 2020/2021 uptrend at 4199. Below here can see support next at 4162/58 and eventually back at the 4115 Q1 YTD low. Whilst a fresh hold here should be allowed for, we see the risk for an eventual break as high to expose the 38.2% retracement of the entire 2020/2021 uptrend at 3855/15.”

“Resistance is seen at 4295 initially, then 4316, with the immediate risk seen staying lower whilst below 4370/94.”

Concerns over French politics are refusing to go away. Simultaneously, heightened fears of supply issues resulting from lockdown fears in China have compounded support for the safe-haven USD. Therefore, the EUR/USD pair is unlikely to enjoy substantial gains in the near-term, economists at Rabobank report.

Slower growing Chinese economy and a rapid pace of Fed tightening support the greenback

“A fractured French electorate and concerns about energy security in Europe continue to cloud the outlook for the EUR.”

“A strong USD suggests that a sharp rebound in EUR/USD may be out of reach near-term. That said, the tone of the June 9 ECB meeting is likely to be instrumental in determining whether or not EUR/USD can make a moderate recovery.”

“It is our central view that EUR/USD will end the year higher in the 1.10 area. This view has depended on the assumption that the ECB will have started to hike rates and on the coincident view that investors will be preparing for slower US growth next year.”

“The possibility of another covid related wave of economic uncertainty coinciding with aggressive Fed tightening would likely result in a stronger for longer USD.”

- AUD/USD slumped under 0.7200 on Monday to its lowest since late February, a drop of over 1.0% on the day.

- The pair is being weighed by concerns about widening lockdowns in China and associated sharp downside in global commodity markets.

Aussie underperformance that dragged AUD/USD under support around the key 0.7200 level and to its lowest levels since late February has continued in the run up to the start of US trade. At current levels in the 0.7160s, the pair trades with losses of sightly more than 1.0% on the day. A sharp downturn in global commodity prices, from oil to copper and precious metals, amid concerns about widening lockdowns in key Australian export market and key global commodity consumer China is weighing heavily on the Australian dollar at the start of the week.

The past two sessions have seen AUD/USD technicals take a sharp turn for the worse. The pair broke below an uptrend in play since late January at the end of last week in the 0.7400 area and has since tumbled below its important 50 and 200-Day Moving Averages near 0.7350 and 0.7300 respectively. Bears will not be eyeing a test of 2022 lows just under the 0.7000 level.

Much will depend on whether the outbreak in China, which has now spread to some districts of Beijing, continues to grow, triggering further strict lockdowns in the world’s second largest economy, on which the Australian economy is heavily dependant. If, as many analysts fear, more cities are headed for the kind of lockdown seen in Shanghai over the last few weeks, AUD/USD hitting 0.7000 is a good bet.

AUD/USD traders will also have some key US and Australian data points to keep an eye on this week. The Aussie bulls will be hoping for a spicey Q1 2022 Australian Consumer Price Inflation report to boost expectations for RBA tightening and thus reverse some of the currency’s recent weakness. But US data in the form of the first estimate of Q1 GDP growth (on Thursday) and March Core PCE inflation (on Friday) are likely to keep Fed tightening bets robust and the buck broadly supported ahead of the Fed’s policy meeting next week.

GBP/USD finally saw a decisive break of the 1.30 March low last week. Analysts at Credit Suisse look for the risk to stay directly lower for a test of the 61.8% retracement and psychological barrier at 1.2500/1.2494.

Resistance at 1.3000 set to cap

“With the USD expected to stay strong, we look for the risk to stay directly lower. Support is seen next at the 1.2676 low from September 2020 ahead of the 61.8% retracement and psychological barrier at 1.2500/1.2494. Whilst we would look for this to hold at first, we see no reason not to look for a break in due course with support then seen next at 1.2251.”

“Resistance is seen at 1.2812 initially, then 1.2862 with 1.2917 ideally capping to keep the immediate risk lower. Above can see a recovery back to 1.2973/82, potentially 1.3000, but with sellers expected here.”

- USD/CAD scaled higher for the third straight day and shot to over a one-month high on Monday.

- Sliding oil prices undermined the loonie and remained supportive amid sustained USD buying.

- The technical setup favours bullish traders and supports prospects for additional near-term gains.

The USD/CAD pair gained traction for the third successive day on Monday and climbed to a six-week high, around the 1.2765-1.2770 region during the first half of the European session.

The momentum reaffirmed last week's bullish breakout through the 1.2650 hurdle, or the 50% Fibonacci retracement level of the 1.2901-1.2403 downfall and was sponsored by a combination of factors. Crude oil prices dropped to a near two-week low, which undermined the commodity-linked loonie and acted as a tailwind for spot prices amid sustained US dollar buying.

Looking at the broader picture, acceptance above the 1.2700 mark and sustained strength beyond the 61.8% Fibo. level could be seen as a fresh trigger for bullish traders. The constructive outlook is reinforced by the fact that technical indicators on the daily chart are holding in the positive territory and are still far from being in the overbought zone.

This, in turn, supports prospects for a further near-term appreciating move towards an intermediate hurdle near the 1.2780-1.2785 region en-route the next relevant resistance near the 1.2800-1.2810 area. Some follow-through buying should pave the way for additional gains and allow bulls to aim back to conquer the 1.2900 mark, or the YTD peak touched in March.

On the flip side, the 1.2700 mark (61.8% Fibo. level) now seems to protect the immediate downside and any further pullback could be seen as a buying opportunity. This, in turn, should help limit losses near the 50% Fibo. level resistance breakpoint, around the 1.2650 region. The latter should act as a pivotal point and strong base for the USD/CAD pair.

A convincing break below will negate the near-term positive outlook and prompt some technical selling. The USD/CAD pair might then turn vulnerable to weakening further below the 38.2% Fibo. level, around the 1.2600-1.2590 region, and accelerate the slide towards the 1.2560-1.2555 support. The downward trajectory could get extended towards the 1.2500 psychological mark.

USD/CAD daily chart

-637864865412671215.png)

Key levels to watch

Why can there be Brexit and not "Frexit"? The United Kingdom became impoverished by leaving the European Union, but this exit was not disastrous. It would be disastrous for France due to five factors, economists at Natixis report.

Why the United Kingdom can leave the EU and France cannot

“UK long-term interest rates were spontaneously low, while the tight yield spread between France and Germany is linked to the ECB’s commitment to stabilise interest rates between euro-zone countries. France’s exit from the eurozone would then lead to a sharp rise in France’s long-term interest rates.”

“The UK gross external debt is in the country's own currency while France’s gross external debt is in euros. This means that a depreciation of the pound sterling has no effect on the UK external debt, while a depreciation of the French franc against the euro, which would be very likely if France left the EU, would lead to an unsustainable rise in France’s external debt.”

“The pound sterling is an important reserve currency, given the weight of the UK, which enables the country to receive capital inflows, thanks to this reserve currency role of the pound sterling, and therefore to easily finance a permanent external deficit. If France left the EU, the French franc would no longer be a reserve currency at all, and it would become very difficult to finance France’s external deficit.”

“The London financial centre has suffered little from the UK's exit from the EU, which would not be the case for Paris, which is a financial centre only because France is in the eurozone.”

“Replacing exports to the rest of the world with exports to the EU is much easier for the UK than for France. After leaving the EU, the UK succeeded in replacing part of its exports to the EU with exports to the rest of the world. It is doubtful that France would be able to make the same substitution, given the weakness of foreign trade and the chronic decline in export market shares.”

- Silver has slumped towards $23.50 this Monday amid a broader sell-off in risk assets and commodities and as USD strengthens.

- Now XAG/USD is below its 200DMA, bears are eyeing an eventual drop towards Q4 2021 lows in the $21.00s.

Spot silver (XAG/USD) prices came under heavy selling pressure on Monday in tandem with a broader downturn in the market’s appetite for risk and downside in other key commodities such as across energy and metals. Traders cited risk aversion relating to the increased risk of lockdowns in China with a Covid-19 outbreak now reported in Beijing, continued pessimism about the prospects for a peace deal in the Russo-Ukraine war and, perhaps most importantly, recent hawkish chatter from central bank policymakers.

Either way, XAG/USD was last trading down nearly 2.5% on the day just above the $23.50 per troy ounce mark, having broken below key resistance in the form of the 200-Day Moving Average at $23.85 and the March lows at $23.97. That means spot silver prices are trading at their lowest since mid-February, prior to the start of Russia’s invasion of Ukraine, with a modest downturn in global yields on the day as a result of risk aversion likely the only thing stopping silver crashing further towards $23.00.

But the bears will be confident in wake of the recent breakout below the 200DMA, with many calling for a drop towards support in the form of the Q4 2021 lows in the $21.00s in the coming weeks as the US dollar continues to rise on hawkish Fed sentiment and risk-off flows. The key risk events for traders to monitor this week include the first estimate of US Q1 GDP growth on Thursday followed by March Core PCE inflation on Friday, with the latter likely to endorse Fed plans/market expectations for a 50 bps rate hike at next week’s meeting.

- EUR/JPY comes under pressure and approaches 137.00.

- The April lows around 134.30 emerge as the next support of note.

EUR/JPY adds to Friday’s retracement and revisits the vicinity of the 137.00 mark at the beginning of the week.

Further weakness should not be ruled out in the very near term. That said, the corrective move in the cross could extend further and retest the monthly lows around 134.30.

In the meantime, while above the 200-day SMA at 130.56, the outlook for the cross is expected to remain constructive.

EUR/JPY daily chart

Quek Ser Leang at UOB Group’s Global Economics & Markets Research suggests USD/IDR could edge higher and test the 14,470 region.

Key Quotes

“We expected USD/IDR to trade sideways between 14,335 and 14,385 last week. USD/IDR subsequently traded between 14,323 and 14,365 before surging higher upon opening today. The price actions suggest USD/IDR could strengthen further from here.”

“A break of 14,470 would not be surprising but last July’s high at 14,565 is likely out of reach for this week. Support is at 14,410 followed by 14,385.”

- USD/JPY witnessed some selling on Monday, though the downtick lacked bearish conviction.

- Weakness below the 100-hour SMA/ascending trend-line could stall near the 23.6% Fibo. level.

- Sustained move back above the 129.00 mark will set the stage for an extension of the bullish trend.

The USD/JPY pair edged lower on the first day of a new week, albeit lacked follow-through selling and remained well within Friday's broader trading range. The pair traded with a mild negative bias through the first half of the European session and was last seen hovering around the 100-hour EMA, just above the 128.00 round-figure mark.

The prevalent risk-off mood drove some haven flows and benefitted the Japanese yen, which, in turn, acted as a headwind for spot prices. Bearish traders further took cues from a further pullback in the US Treasury bond yields, though the Fed-BoJ policy divergence helped limit any deeper losses for the USD/JPY pair, at least for now.

From a technical perspective, bulls are trying to defend support marked by ascending trend-line support extending from the monthly low. This is followed by the 23.6% Fibonacci retracement level of the 121.28-129.41 parabolic rise, which stalled last week's sharp corrective pullback from the 129.40 area, or a fresh 20-year high.

The latter should act as a pivotal point for short-term traders and help determine the next leg of a directional move. A convincing breakthrough should pave the way for deeper losses and drag the USD/JPY pair towards the 127.00 mark, below which the USD/JPY pair could accelerate the fall to test the 126.35 region, or the 38.2% Fibo. level.

On the flip side, the 128.40 region now seems to act as an immediate hurdle ahead of the 129.00-129.10 region. Some follow-through buying will suggest that the corrective slide has run its course and lift the USD/JPY pair back towards the two-decade peak, around the 129.40 area. The momentum could then allow bulls to reclaim the 130.00 psychological mark.

USD/JPY 1-hour chart

-637864805316331548.png)

Key levels to watch

Quek Ser Leang at UOB Group’s Global Economics & Markets Research noted USD/MYR faces the next significant up barrier at 4.40.

Key Quotes

“We highlighted last Monday (18 Apr, spot at 4.2460) that ‘upward momentum is beginning to build’ and we held the view that the ‘risk for USD/MYR is on the upside towards 4.2600, possibly 4.2650’. While our view for USD/MYR to strengthen was correct, we did not anticipate the manner by which it lifted off and rocketed to a high of 4.3240 last Friday. Note that USD/MYR gained a whopping 2.13% last week, its largest 1-week advance in more than 2 years.”

“USD/MYR extended its rally upon opening today and the risk for this week is still clearly on the upside. With all the resistance levels on the daily chart been taken out, the resistance level to focus on from here is at the weekly declining trend-line connecting the highs of 2017 and 2020 (level is currently near 4.4000). That said, it is left to be seen if USD/MYR has enough momentum to reach this level within this week. In order to maintain the current strong momentum, USD/MYR should ideally not move below 4.2800.”

- EUR/USD comes under heavy pressure near 1.0700.

- German 10y bund yields break below the 0.90%.

- Germany IFO survey surprised to the upside in April.

The single currency started the week well into the negative territory and dragged EUR/USD to the 1.0700 region earlier on Monday.

EUR/USD weak on risk-off mood

EUR/USD adds to the pessimism seen in the second half of last week and extends the leg lower to the boundaries of the 1.0700 yardstick at the beginning of the week.

The sharp selloff in the European currency follows fresh concerns over the impact of current lockdown measures on the Chinese economy, which have also spread to the broader risk-linked galaxy.

In the domestic calendar, Business Climate in Germany unexpectedly improved to 91.8 for the current month. Despite the positive surprise in this key event, the euro failed to spark a noticeable bounce.

Data wise across the pond, the Chicago Fed National Activity Index will be the salient event later in the NA session.

What to look for around EUR

EUR/USD’s price action shows further deterioration and revisits the 1.0700 neighbourhood at the beginning of the week. The outlook for the pair still remains tilted towards the bearish side, always in response to dollar dynamics, geopolitical concerns and the Fed-ECB divergence. As usual, occasional pockets of strength in the single currency should appear reinforced by speculation the ECB could raise rates before the end of the year, while higher German yields, elevated inflation, the decent pace of the economic recovery and auspicious results from key fundamentals in the region are also supportive of a rebound in the euro.

Key events in the euro area this week: Germany IFO Business Climate (Monday) – Germany GfK Consumer Confidence (Wednesday) – ECB 2021 Annual Report, Consumer Confidence, Economic Sentiment, Germany Flash Inflation Rate (Thursday) – Germany, EMU Flash Q1 GDP Growth Rate, EMU Flash Inflation Rate (Friday).

Eminent issues on the back boiler: Asymmetric economic recovery post-pandemic in the euro area. Speculation of ECB tightening/tapering later in the year. Second round of the presidential elections in France (April 24). Impact on the region’s economic growth prospects of the war in Ukraine.

EUR/USD levels to watch

So far, spot is down 0.58% at 1.0733 and a break below 1.0707 (2022 low April 25) would target 1.0700 (round level) en route to 1.0635 (2020 low March 23). On the upside, the next hurdle appears at 1.0936 (weekly high April 21) seconded by 1.1000 (round level) and finally 1.1051 (55-day SMA).

- GBP/USD witnessed aggressive follow-through selling for the third successive day on Monday.

- Signs that the UK economy is under stress from soaring inflation weighed heavily on the GBP.

- Aggressive Fed rate hike bets, the risk-off mood pushed the USD to a more than two-year high.

- Oversold oscillators make it prudent to wait for some consolidation before the next leg down.

The GBP/USD pair continued losing ground through the first half of the European session and dived to its lowest level since September 2020, around the 1.2720-1.2715 region in the last hour.

The pair extended last week's sharp downfall from the vicinity of the 1.3100 round-figure mark and remained under intense selling pressure for the third successive day on Monday. The British pound was weighed down by Friday's disappointing release of the UK Retail Sales and the flash Services PMI. This, along with sustained US dollar buying, turned out to be a key factor that continued exerting downward pressure on the GBP/USD pair.

The Office for National Statistics reported on Friday that UK Retail Sales volumes fell 1.4% MoM in March and suggested that the expected consumption drag from high inflation might have arrived already. Adding to this, the flash PMI pointed to the biggest loss of momentum for service sector activity since Omicron hit businesses at the end of last year. The macro data indicated that the UK economy is under stress from the soaring cost of living.