- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 25-03-2022

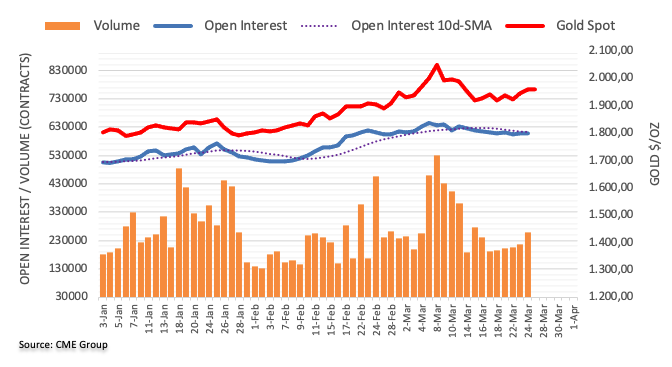

- The yellow metal spent the week in positive territory but short of the previous cycle high.

- Geopolitical issues would keep influencing gold, and any risk-off market mood should benefit precious metals.

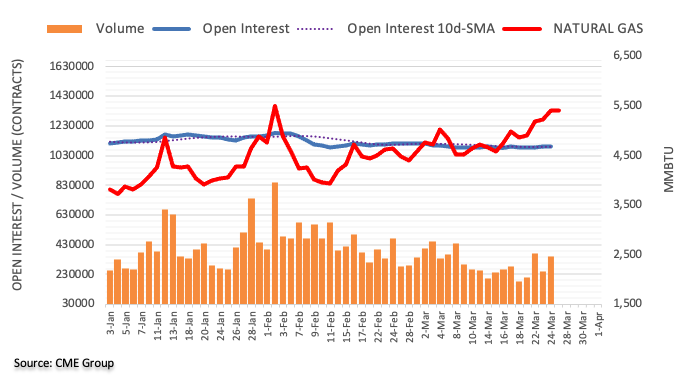

- The energy agreement between the US and EU would make Europe less dependent on Russia’s natural gas.

- XAU/USD Price Forecast: Upward biased, but failure to reclaim $1974 and a horizontal 200-DMA leave gold vulnerable to selling pressure.

Gold (XAU/USD) is set to finish Friday’s session on a lower note, but the week reclaimed some of its brightness, gaining 1.79% as market sentiment fluctuated as the North American session ended. At the time of writing, XAU/USD is trading at $1958.36 a troy ounce, down some 0.19%.

Global equities overnight reflected a mixed market mood, courtesy of Russia’s invasion of Ukraine, high inflation looming, and central bank tightening. Although discussions between Russia and Ukraine provided some advance in secondary matters, negotiations about main issues remain stuck. Meanwhile, once the NATO summit is in the rearview mirror, the US and the Eurozone agreed on natural gas supply deal to cut dependence on Russia.

Late In the North American session, Russia said that it would focus its military efforts on taking complete control of Ukraine’s Dobnbass region, a sign that Moscow may be backing away from taking a more significant stake of Ukraine, as reported by Bloomberg.

Aside from this, the Federal Reserve hawkish pivot keeps weighing on the yellow metal. On Tuesday, Fed Chair Jerome Powell expressed that the Fed would do whatever necessary to return “price stability.” He emphasized that if needed to raise rates more than 25 bps, stated that “[Fed] we will do so.”

XAU/USD traders did react immediately to the headline, pushing the non-yielding towards the weekly low at around $1910 a troy ounce. However, a dampened market mood and US Treasury yields seesawing lifted gold towards the $1950 area.

Friday’s US economic docket featured Pending Home Sales for February, which contracted 4.1% from the expected 1% m/m increase. Furthermore, the University of Michigan Consumer Sentiment Final for March came at 59.4 from 59.7, while inflation expectations stayed at 5.4% vs. 4.9% on the previous report.

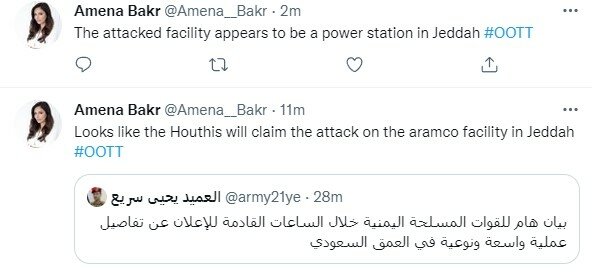

XAU/USD Price Forecast: Technical outlook

Gold (XAU/USD) bias is still up, but it would remain under selling pressure. Failure to reclaim February 24 daily high at $1974 left the precious metal exposed to selling pressure unless XAU bulls recover the aforementioned. It is worth noting that the 200-day moving average (DMA) at $1816.85, from an upslope, is horizontal, indicating that the steep rally above $2000 might be subject to a further correction lower.

Upwards, XAU/USD’s first resistance would be $1974. Once cleared, the next resistance would be $2000, and the YTD high at $2075.82.

On the flip side, and the most likely scenario, XAU/USD’s first support would be March 20 low at $1950.30. Breach of the latter would expose March 16 daily low at $1895.06, followed by November 16, 2021, low at $1877.14.

- The British pound barely advances 0.01% in the day.

- Dismal UK economic data weighed on the GBP/USD pair.

- GBP/USD Price Forecast: The path of least resistance is downward biased, as GBP bulls failed to reclaim 1.3200.

The British pound rebounded from intraday losses in the mid-North American session, though it failed to reclaim the 1.3200 mark, courtesy of a risk-on market mood, Fed hawkishness, and Bank of England’s rate hike, with one dissenter, perceived as a dovish increase. At the time of writing, the GBP/USD is trading at 1.3187.

Late in the North American session, the market sentiment improved, boosting appetite for risk-sensitive currencies like the GBP. Nevertheless, amid an increased appetite for the greenback, disappointing data coming from the UK put a lid on the GBP/USD recovery.

The UK economic docket reported the UK’s Retail Sales, which declined by 0.3% in February, lower than the 0.6% increase expected and trailed January’s 1.9% reading. Furthermore, sales excluding petrol fell 0.7% in February and missed forecasts with around a 0.5% increment estimate.

Meanwhile, across the pond, two commercial banks expect the US central bank to hike 50-bps. On Friday, Goldman Sachs and Citigroup expressed that they estimate that the Federal Reserve would hike 50-bps in the meetings of May and June, which would lift the Federal Funds Rate (FFR) to 1.50% by the end of the first half of the year.

The bank’s forecasts come at what Fed policymakers expressed during the week, led by Fed Chairman Jerome Powell, openness to increasing rates by more than 25 bps, as he spoke at the NABE conference on Monday.

The US economic docket featured Pending Home Sales for February shrank 4.1% from a 1% m/m increase expected. Furthermore, the University of Michigan Consumer Sentiment Final for March came at 59.4 from 59.7, while inflation expectations stayed at 5.4% vs. 4.9% on the previous report.

GBP/USD Price Forecast: Technical outlook

The GBP/USD failure to reclaim the 1.3200 mark for the second-consecutive day left the pair vulnerable to further selling pressure. Furthermore, the Relative Strenght Index (RSI) oscillator is at 44 at bearish territory, aiming down, signaling that the GBP/USD might add to losses in the coming days, as month-end flows towards the greenback might extend the fall.

That said, the GBP/USD first support would be December 8, 2021, a daily low at 1.3160. Breach of the latter would expose the 1.3105, followed by the 1.3000 mark.

- The shared currency barely moves vs. the greenback as traders head into the weekend.

- The EU and the US reached an agreement on natural gas supply.

- EUR/USD Price Forecast: Confined to the 1.0960-1.1000 range.

The EUR/USD remains subdued amid a choppy trading day, as the market mood swings from risk-on to off continue, on “hawkish” comments by Fed officials, stagnate peace talks discussions of Russia and Ukraine, and an attack on Saudi Arab Aramco installations on Friday. At 1.0992, the EUR/USD shows the resilience of the greenback, despite being softer in the day.

As the New York session progresses, the market sentiment is mixed. European and US equity indices fluctuate between gainers and losers, while the US Dollar Index, a gauge of the greenback’s value vs. a basket of six currencies, is barely flat at 98.787.

Russia – Ukraine and NATO updates

Meanwhile, the war in Eastern Europe extends to a whole month of hostilities between Russia and Ukraine. Although there have been peace discussions, both parties have disagreed on the primary issues, as said by the Russian negotiator, early in the day on wires. He added that Russia and Ukraine are getting closer on secondary matters. At the same time, NATO’s summit in Brussels came to an end, with the US and Europe reaching an agreement on natural gas so that Europe would cut energy dependence on Russia.

Although the news is good for the Eurozone, the EUR/USD failed to react positively to it, as the pair stays parked at the 1.0980-1.1000 area.

US commercial banks expect two 50-bps hikes

Earlier in the day, Citigroup and Goldman Sachs analysts expected that the Federal Reserve would hike 50-bps in the two following meetings, in May and June.

On the US front, Fed speaking continues with the New York Fed President John Williams also backing up a 50 bps increase, and he stated, “If it is appropriate to raise by 50 basis points at a meeting, I will do that.”

The US economic docker featured Pending Home Sales for February shrank 4.1% from a 1% m/m increase estimated. Furthermore, the University of Michigan Consumer Sentiment Final for March came at 59.4 from 59.7, while inflation expectations stayed at 5.4% vs. 4.9% on the previous report.

EUR/USD Price Forecast: Technical outlook

The EUR/USD is still downward biased, though, in the last four trading days, the EUR/USD has been trading in a narrow range, between 1.0960-1.1000. The lack of a catalyst, plus fluctuations in the market mood, might keep the shared currency trendless.

That said, the EUR/USD first support would be 1.0960. Breach of the latter would expose 1.0900, followed by the YTD low at 1.0806. On the flip side, the EUR/USD first resistance would be 1.1000. Once cleared, the next resistance would be 1.1050, followed by 1.1100.

The Bank of Canada is "prepared to act forcefully" to return inflation to its 2.0% target, said Deputy Governor Sharon Kozicki on Friday, reported Reuters.

Additional Remarks:

"It’s important to be clear that returning inflation to the 2% target is our primary focus and unwavering commitment."

"The pace and size of rate hikes and the start of QT will be active parts of our deliberations at our next decision."

"Inflation in Canada is too high, labor markets are tight and there is considerable momentum in demand."

"Households on average appear to be in better financial shape now than at the start of our 2017–18 tightening cycle."

"Household indebtedness is now above pre-pandemic levels and its elevated level remains an important domestic vulnerability."

"High indebtedness could amplify the impact of rising interest rates, and it could also worsen the impact of a future shock."

"A key concern is the broadening of price pressures... around 2/3 of components in the Consumer Price Index are now exhibiting inflation above 3%."

"Persistently elevated inflation increases the risk that longer-run inflation expectations could drift upward."

"The nvasion of Ukraine is adding to inflationary pressures in Canada and the world... the bank is keeping close eye on events and impacts."

- The USD/CHF erases earlier losses but faces solid resistance, which could push the pair lower.

- The market sentiment shifted to a risk-off on an attack of a Saudi Aramco oil facility in Jeddah.

- USD/CHF Price Forecast: The USD/CHF is upward biased per the daily chart, but the pair is bearish in the near term, as shown by the 1-hour chart.

The USD/CHF snaps four days of losses and jumped off the day’s lows, around 0.9260, amid a mixed market mood and expectations of 50-bps increases by the US central bank on its May monetary policy meeting. At the time of writing, the USD/CHF is trading at 0.9304.

A risk-off market mood keeps US equity indices pressured while European bourses fluctuate. The greenback erases earlier losses, up 0.04%, sitting at 98.819, while US Treasury yields skyrocket, with the 10-year up 14 basis points at 2.489%, but short of daily highs around 2.503%.

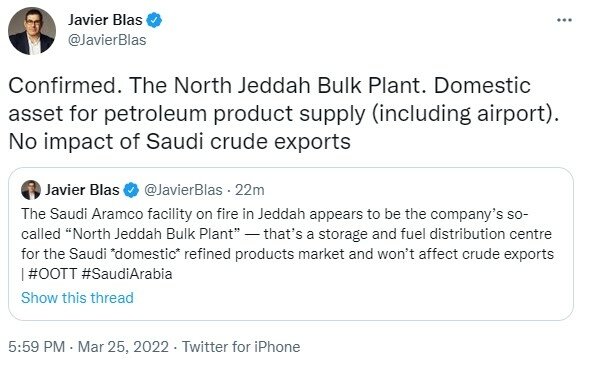

The market mood dampened on reports that a Saudi Aramco oil facility located in Jeddah, Saudi Arabia, was hit by a missile launched by Yemen’s rebel Houthi militia on Friday, reports on social media suggested.

Read more: Saudi Aramco oil facility in Jeddah hit by Yemeni Houthi rebel missile

Overnight, the USD/CHF dropped from 0.9300ish towards 0.9260, the top of an eleven-month-old downslope trendline, previous resistance-turned-support, and jumped off as the North American session evolves, amid a softer demand for the greenback.

USD/CHF Price Forecast: Technical outlook

The USD/CHF daily chart depicts the pair as upward biased, despite breaking below the 0.9373 mark, though it would be resistance ahead of the YTD high around 0.9460.

However, the 1-hour chart depicts the USD/CHF as bearish biased in the near term. The USD/CHF is probing a downslope trendline drawn from March 16 highs, unsuccessfully tested two previous times. If the trendline holds, the USD/CHF first support level would be 0.9300. Breach of the latter would expose Friday’s daily low at 0.9260, followed by March 9 low at 0.9250.

- Gold has seen two-way volatility on Friday and currently trades flat in the mid-$1950s.

- Spot prices are set to end the week up more than 2.0% despite the sharp rise in US yields.

- Geopolitical/inflation risk premia are keeping the precious metal underpinned with Russo-Ukraine peace talks showing no signs of progressing.

Spot gold (XAU/USD) prices have seen indecisive, two-way price action in recent trade, swinging between the mid-$1940s and $1960s. A sharp rally in US yields to fresh multi-year highs to reflect an upping of hawkish Fed bets as market participants reacted to a chorus of major US banks issues hawkish new Fed policy calls helped push XAU/USD back from weekly highs in the $1960s. But geopolitical uncertainty, this time regarding the security of Saudi Arabia’s oil infrastructure after a site in Jeddah was hit by a Houthi missile, is helping keep pricing underpinned above support in the form of recent highs in the $1940s area.

At current levels in the mid-$1950s, gold is trading flat on the day and looks set to post a weekly gain of just under 2.0%. That is quite remarkable given that, on the week, the US 2-year and 10-year yields are both up more than 30 bps as markets bet on a much more hawkish Fed tightening path following recent communications from Chairman Jerome Powell and his fellow FOMC policymakers. Typically, higher yields weigh on gold by raising the “opportunity cost” of holding non-yielding assets.

Gold’s resilience speaks to the mood of a market that is unwilling to relinquish inflation protection at a time when the Russo-Ukraine war continues to rage and the subsequent impact on the global economy is not yet known. The only thing that everyone currently agrees upon is the fact that the war and resultant Western sanctions on Russia are going to be inflationary. With peace talks showing no sign of progress judging by the rhetoric from Russian and Ukrainian negotiators on Friday, it makes sense for a significant degree of geopolitical/inflation risk premia to remain priced into gold.

Gold spent the first half of the week fluctuating in a relatively tight range above $1,920 but regained its traction after breaking above $1,950 on Thursday. XAU/USD needs to use $1,950 as support in order to extend its rebound, FXStreet’s Eren Sengezer reports.

Bullish tilt after the move above $1,950

“Investors grow increasingly concerned over the potential negative impact of a prolonged Russia-Ukraine conflict on global economic activity. A further escalation of geopolitical tensions should help the yellow metal limit its losses and vice versa.”

“The 20-day SMA and the Fibonacci 38.2% retracement of the latest uptrend seem to have formed a key technical level at $1,950. In case gold starts using that level as support, it faces an interim resistance at $1,965 (static level) before it can target $1,990 (Fibonacci 23.6% retracement) and $2,000 (psychological level).”

“XAU/USD could face renewed bearish pressure if it fails to hold above $1,950 and decline toward $1,920 (static level, lower limit of the consolidation channel). With a daily close below that level, the pair could test $1,900 (Fibonacci 61.8% retracement, 50-day SMA).”

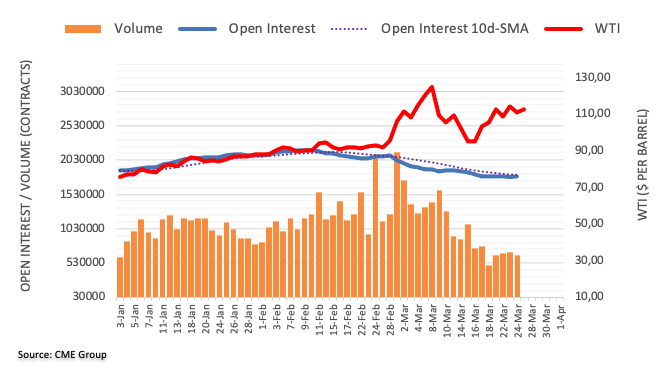

A Saudi Aramco oil facility located in Jeddah, Saudi Arabia, was hit by a missile launched by Yemen's rebel Houthi militia on Friday, reports on social media suggested.

Market Reaction

The news sent oil prices jumping higher, with WTI surging back to $112 from around $110 and also weighed on equities, with the S&P 500 dropping about 25 points to 4515 from around 4540.

- The Loonie extends its weekly gains, so far up 0.78% vs. the US dollar.

- The Russia – Ukraine conflict is still stuck in negotiations, while the US and EU agreed on Natural gas supply.

- Goldman Sachs and Citigroup expect two 50-bps increases by the Fed.

- USD/CAD Price Forecast: Positive divergence between RSI and price action in the 1-hour chart suggests an upward move is on the cards.

The USD/CAD extends its losses in the week, however it appears to face strong support around the 1.2500 mark, amid a mixed market mood, “hawkish” Fed policymakers, and two North-American-based banks, expecting two consecutive 50 bps increases by the US central bank in the May and June meetings. At the time of writing, the USD/CAD is trading at 1.2509.

The market sentiment remains fragile, though mixed as portrayed by US equities fluctuating, while European bourses stay in the green. The greenback is trading softer, as reflected by the US Dollar Index down 0.13%, at 98.660, while US Treasury yields keep portrays Fed’s hawkishness, with the 10-year T-note yield up eleven basis points, sitting at 2.453%.

The Russia – Ukraine war issues keep influencing the market mood, though on a lower note. The Russian negotiator said that Ukraine and Russia have agreed on secondary matters, but about primary issues, discussions languished. Meanwhile, the US and Europe reached an LNG (Liquified Natural Gas) agreement to cut the Eurozone dependence on Russia.

Oil prices eased from daily highs towards $110.25 on the headline, putting a lid on the Canadian dollar rise vs. the US Dollar.

Goldman Sachs and Citigroup amongst market players expecting 50 bps increases

Elsewhere, Goldman Sachs and Citigroup are the two mentioned banks in the first paragraph, which expect at least two 50-bps increases in the May and June meetings. Furthermore, in a note to clients, Citigroup said that they expect four 50-bps increases to the Federal Funds Rate in 2022.

The economic docket for Canada has the Budget Balance for January, and the Bank of Canada Governor Kozicki would cross wires. On the US front, Fed speaking continues with the New York Fed President John Williams also backing up a 50 bps increase, and he stated, “If it is appropriate to raise by 50 basis points at a meeting, I will do that.”

Also, Pending Home Sales for February shrank 4.1% from a 1% m/m increase expected. Furthermore, the University of Michigan Consumer Sentiment Final for March came at 59.4 from 59.7, while inflation expectations stayed at 5.4% vs. 4.9% on the previous report.

USD/CAD Price Forecast: Technical outlook

The USD/CAD fall extends in the week, though as appreciated by the 1-hour chart, the USD/CAD seems to have reached solid support at the 1.2500 area. Additionally, the Relative Strength Index (RSI), a momentum indicator, is at 38.31, though at a bearish area, shows a positive divergence with USD/CAD price action, suggesting that a move upwards might be on the cards.

If that scenario plays out, the USD/CAD first resistance would be the 50-hour simple moving average (SMA) at 1.2547. Breach of the latter would expose a six-month-old upslope trendline around 1.2570, followed by March 24 daily high at 1.2586 and March 23 daily high at 1.2605.

- DXY remains unable to regain upside traction on Friday.

- US yields reverse the initial drop and resume the uptrend.

- US Final Consumer Sentiment missed expectations at 59.4.

Sellers keep dictating the price action in the greenback, with the US Dollar Index (DXY) navigating the mid-98.00s in a context favourable to the riskier assets.

US Dollar Index appears capped by 99.00

Despite the negative performance, the index at least managed to bounce off daily lows in the 98.40 region, as the downside seems somewhat contained amidst persistent uncertainty in the geopolitical scenario.

The U-turn in US yields also appears to have pushed the buck from daily lows. Indeed, yields across the curve not only left behind the initial cautious stance but are also navigating in fresh highs at the time of writing.

In the US calendar, final prints of the U-Mich Index saw the Consumer Sentiment deflate to 59.4 for the current month, while Pending Home Sales contracted 5.4% in the year to February.

At his speech on Friday, NY Fed J.Williams subscribed to the view that future rate hikes remain data dependent.

What to look for around USD

The weekly recovery in the dollar failed to advance further north of the 99.00 mark, motivating sellers to return to the market on Friday. Concerns surrounding the geopolitical landscape are expected to keep propping up the demand for the buck in combination with prospects of extra tightening by the Fed. Looking at the broader picture, bouts of risk aversion – exclusively emanating from Ukraine - should underpin inflows into the safe havens and lend legs to the dollar at a time when its constructive outlook remains well supported by the current elevated inflation narrative, a potential more aggressive tightening stance from the Fed and the solid performance of the US economy.

Key events in the US this week: Final Consumer Sentiment, Pending Home Sales (Friday).

Eminent issues on the back boiler: Escalating geopolitical effervescence vs. Russia and China. Fed’s rate path this year. US-China trade conflict. Futures of Biden’s Build Back Better plan.

US Dollar Index relevant levels

Now, the index is retreating 0.15% at 98.62 and a break above 98.96 (weekly high March 22) would open the door to 99.29 (high March 14) and finally 99.41 (2022 high March 7). On the flip side, the next down barrier emerges at 97.72 (weekly low March 17) followed by 97.71 (weekly low March10) and then 97.44 (monthly high January 28).

- WTI has stabilised in the $110 area, down another $1 on the day after Thursday’s $3 drop.

- An easing of CPC pipeline disruption concerns plus the EU’s failure to agree on a Russian oil embargo triggered profit-taking.

Front-month WTI futures have stabilised in the $110 area on Friday, with Thursday’s modest bearish momentum continuing for a second day and prices currently down about $1.0 after the slightly more than $3 drop a day earlier. Supply concerns have eased somewhat in the latter half of the week after news broke of a partial resumption of oil flows through to Kazakhstan’s CPC pipeline. Earlier in the week, authorities had announced that oil flows through the 1.3M barrel per day pipeline had been halted due to the need to repair storm damages.

The supply disruption comes as global oil markets face massive uncertainty owing to Russia’s invasion of Ukraine and subsequent harsh sanctions placed on the Russian economy by Western nations. Speculation at the start of the week had been that the EU would on Thursday, following extraordinary NATO/EU leaders meetings, announce an embargo on all Russian oil imports. But this was not the case, with heavily Russia energy import dependant countries like Germany pushing back against this policy out of fear of causing economic self-harm.

The EU’s failure to implement a wider Russia oil import ban has liekly contributed to the further bout of profit-taking in the latter stages of the week. But it seems that traders remain keen to add to long positions in the $110 area. Commodity strategists think that as the impact of the Russo-Ukraine war on Russian oil exports becomes more evidence in the coming month, there remains plenty of room for further upside in WTI. The latest remarks from Russian negotiators suggest that a Russo-Ukraine peace deal, which could potentially precede an easing of Western sanctions, is not likely to be forthcoming any time soon.

NY Fed President and influential FOMC member John Williams said on Friday that the speed of interest rate hikes this year should be driven by the data, reported Reuters.

Additional Remarks:

"The Fed needs to be clear that both balance sheet reduction and rising rates will affect financial conditions."

"Given supply/demand imbalances, we need to move rates steadily back to normal levels."

"I am very focused on thinking about real interest rates."

"We need to keep an eye on if supply chains ebb when deciding the path of rates."

"The war in Ukraine could also affect outlook, so the Fed has to be nimble."

When asked about a 50 bps rate rise in May, Williams says he "will watch data and analyse it."

"If it is appropriate to raise by 50bps at a meeting, I will do that."

"We need to make the right decisions based on what we are seeing in the economy."

- USD/TRY trades within a narrow range in the 14.80/85 band.

- Turkey 10y bond yields in all-time highs near 27.00%.

- Markets’ focus remains largely on the geopolitical landscape.

The Turkish lira depreciates marginally vs. the greenback and motivates USD/TRY to navigate a tight range in the 14.80 zone at the end of the week.

USD/TRY remains capped by 15.00

USD/TRY moved into a consolidative phase in past sessions, always below the 2022 peak around 15.00 recorded earlier in the month.

The monthly uptrend in the pair mirrored the performance of crude oil prices, as the lira is expected to suffer the consequences of higher crude prices, as Turkey’s energy sector largely hinges on imports of the commodity.

No news from the Turkish central bank (CBRT) at its latest meeting seems to have not impacted the currency despite there was no announcements whatsoever regarding measures to curb the rampant inflation.

Somewhat in contrast with the global selloff in bonds, Turkey 10y reference bond yields trade a tad lower from Thursday’s all-time high around 28.30%.

In the domestic calendar, Turkey’s Capacity Utilization improved to 77.3% in March (from 76.6%) and the Manufacturing Confidence eased a bit to 108.5 in the same period (from 109.8).

What to look for around TRY

The lira keeps the range bound theme unchanged vs. the greenback, always in the area below the 15.00 neighbourhood, or yearly lows. In the very near term, price action in the Turkish currency is expected to gyrate around the performance of energy prices, the broad risk appetite trends, the Fed’s rate path and the developments from the Russia-Ukraine peace talks. Extra risks facing TRY also come from the domestic backyard, as inflation gives no signs of easing, real interest rates remain negative and the political pressure to keep the CBRT biased towards low interest rates remain omnipresent.

Key events in Turkey this week: Capacity Utilization, Manufacturing Confidence (Friday).

Eminent issues on the back boiler: Progress (or lack of it) of the government’s new scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Structural reforms. Earlier Presidential/Parliamentary elections?

USD/TRY key levels

So far, the pair is gaining 0.25% at 14.8491 and a drop below 14.5217 (weekly low March 15) would expose 13.8983 (55-day SMA) and finally 13.7063 (low February 28). On the other hand, the next up barrier lines up at 14.9889 (2022 high March 11) seconded by 18.2582 (all-time high December 20) and then 19.00 (round level).

NY Fed President and influential FOMC member John Williams said on Friday that the economic implications of the Covid-19 pandemic and war in Ukraine are highly uncertain, reported Reuters. Many countries are confronting a sharp rise in inflation and the actions central banks take affect flows of capital across countries. Therefore, transparency in monetary policy can increase its effectiveness and reduce its unintended consequences, he added.

Additional Remarks:

"Risk management at forefront of thinking among central bankers."

"Inflation is at the forefront of all of our thinking."

"We are watching inflation expectations and other indicators very closely."

"Medium and longer-run inflation expectations have stayed remarkably stable."

"Overall financial markets have adjusted expectations with minimal disruption."

The S&P 500 had another strong session on Thursday and closed above key resistance at 4477/81, which analysts at Credit Suisse look to be sustained into the weekly close, particularly given the fresh bullish cross in daily MACD momentum.

Support at 4424/18 needs to hold to keep the immediate risk higher

“S&P 500 closed above the key moving averages at 4477/81, which is a positive development, reinforced by the firm recent cross into positive territory for daily MACD momentum. We are now watching very closely whether the market sustains this move into the weekly close, which would be a significantly positive technical development.”

“We believe the short-term risk stays skewed higher, with resistance seen next at 4522/30, ahead of the 61.8% retracement of the January/February fall at 4550. We see scope for a move above here to test the February highs at 4590/95, but would expect a fresh cap here.”

“Near-term support moves to 4465/56. Below here and then the 13-day exponential moving average at 4424/18, on the back of a reversal below 4477/81 into the weekly close, would mark a more decisive rejection of the key medium and long-term averages. This would turn the short-term risk back lower for a move to 4347/52 next.”

EUR/USD has swung around the 1.10 mark for the better part of the past four days. Economists at Scotiabank note that a close below this level would stand out as a clear bearish signal for the euro.

Support is around the 1.10 figure area followed by 1.0960/65

“A close below 1.10 for the week would stand out as a clear bearish signal for the EUR.”

“The EUR’s bearish trendline from mid-Feb comes in as resistance at ~1.1050, with the mid-figure area broadly set to limit upside followed by 1.1070 and the 1.11 zone.” “Support is around the 1.10 figure area followed by ~1.0960/65 that has held up the EUR in three consecutive sessions; ~1.0950 and ~1.0925 follow.”

According to the final version of the US University of Michigan Consumer Sentiment survey for March, the headline Consumer Sentiment index fell to 59.4 versus the flash estimate released earlier in the month of 59.7. That marked a substantial drop versus February's final estimate of the Consumer Sentiment index of 62.8 and marked the weakest such reading since August 2011.

The final version of the Current Conditions index was revised lower to 67.2 from the flash estimate of 67.8, also below February's 68.2 reading and marking the lowest such reading since August 2011. The final version of the Consumer Expectations index came in at 54.3 versus the 54.4 flash estimate, well below February's 59.4 reading and marking the lowest such reading since October 2011. The One-year Inflation Expectations index also rose to its highest since November 1981 at 5.4%.

Market Reaction

There was no notable market reaction to the latest US data with focus instead on upcoming Fed speak and on recent hawkish revisions to major US bank's forecasts for Fed policy in the coming years.

The US Pending Home Sales index fell by 4.1% MoM in February to 104.9, data released by the National Association of Realtors on Friday showed, below the expected 1.0% MoM gain. Versus February 2021, the Pending Home Sales index was down 5.4%.

Market Reaction

There was no notable market reaction to the latest US data with focus instead on upcoming Fed speak and on recent hawkish revisions to major US bank's forecasts for Fed policy in the coming years. The DXY continues to trade largely unchanged versus pre-data levels in the 98.60s.

US money markets are pricing an additional 200bps in interest rate hikes from the US Federal Reserve by the end of 2022, Bloomberg reported citing Fed swaps. US yields have been moving higher in recent trade to reflect the ongoing hawkish repricing, with the 2-year hitting fresh multi-year highs above 2.25% and 10-year also hitting fresh multi-year highs above 2.45%.

Analysts at Citi recently tweaked their Fed call and now see four successive 50bps hikes from the central bank at its next four policy meetings. Citi predicts there will be a total of 275bps in tightening in 2022 (meaning rates ending the year at 2.75-3.0%), followed by more hikes in 2023 that will see rates hit 3.50-3.75% but the year's end. Risks to the terminal rate remain to the upside given upside risks to inflation, the bank said.

Market Reaction

Market commentators said the new call from Citi sparked the upside in US yields but, interestingly, this has not sparked further upside in the US Dollar Index (DXY), which, though off earlier sub-98.50 lows, has been unable to mount a sustained rally back towards 99.00.

- AUD/USD was seen consolidating its recent strong gains recorded over the past two weeks or so.

- The Fed’s hawkish outlook acted as a tailwind for the USD and kept a lid on any meaningful gains.

- A positive risk tone, bullish commodity prices extended some support to the resources-linked aussie.

The AUD/USD pair seesawed between tepid gains/minor losses through the early North American session and for now, seems to have stabilized above the 0.7500 psychological mark.

The pair witnessed a range-bound price action on Friday and consolidated its recent strong bullish run of over 350 pips from the monthly low, around the 0.7165 region touched last week. The downside remained cushioned amid a generally positive tone around the equity markets, which tends to benefit the perceived riskier aussie.

Apart from this, bullish commodity prices turned out to be another factor that acted as a tailwind for the resources-linked Australian dollar. That said, the emergence of some US dollar dip-buying held back bulls from placing aggressive bets and kept a lid on any further gains for the AUD/USD pair, at least for the time being.

The greenback drew support from expectations that the Fed would adopt a more aggressive policy stance to bring down unacceptably high inflation. In fact, the markets have been pricing in the possibility of a 50 bps rate hike move at the May meeting. This was reinforced by elevated US bond yields, which underpinned the buck.

Nevertheless, the AUD/USD pair now seems to have found acceptance above the 0.7500 mark and remains on track to post strong gains for the second successive week. Bulls now await sustained break through a resistance marked by the top boundary of an ascending channel extending from the YTD low before placing fresh bets.

Technical levels to watch

According to a Russian negotiator at talks with Ukraine, the two sides have come closer together on secondary issues but are not really moving forward on key ones, reported Reuters citing Russia's Interfax.

- EUR/USD clings to daily gains above the 1.1000 mark on Friday.

- The pair looks supported around 1.0960 so far.

EUR/USD reverses the recent weakness and manages to advance to the 1.1040 area, where some decent resistance seems to have turned up.

Further range bound looks likely amidst the ongoing alternating risk appetite trends, with the lower bound emerging around 1.0960 and gains limited by the 1.1140 area.

The medium-term negative outlook for EUR/USD is expected to remain unchanged while below the key 200-day SMA, today at 1.1505.

EUR/USD daily chart

The Russian Defense Ministry said on Friday that its forces will focus on the complete liberation of Donbas and that the army hasn't ruled out the possibility of storming blockaded Ukrainian cities, reported Interfax cited by Reuters. Russia was considering two options for its "special military operation", the Defense Ministry continued, one within the Donbas separatist republics and one within the whole territory of Ukraine.

Russian troops will react immediately to any attempts to close the airspace of Ukraine, the Russian Defense Ministry warned, adding that it is a big mistake that the West supplied weapons to Ukraine, given that it draws out the conflict. The main targets of the first phase of Russia's operation in Ukraine are complete, they added.

- USD/JPY witnessed an intraday pullback from the multi-year peal touched earlier on Friday.

- Extremely overbought conditions prompted some profit-taking amid modest USD weakness.

- The Fed-BoJ monetary policy divergence supports prospects for the emergence of dip-buying.

The USD/JPY pair maintained its offered tone heading into the North American session and was last seen trading around the 121.70-121.75 region, down nearly 0.50% for the day.

The Bank of Japan provided a bullish signal on Friday and refrained from stepping into the markets to arrest the continuous rise in yields. In fact, the yield on the 10-year Japanese government bond (JGB) rose above the level at which the BoJ offered to buy an unlimited amount in February. This, in turn, provided a goodish lift to the Japanese yen. Apart from this, modest US dollar weakness prompted some profit-taking around the USD/JPY pair.

Spot prices witnessed a dramatic intraday turnaround and plunged over 125 pips from the vicinity of mid-122.00s, or the highest level since December 2015 touched earlier this Friday. That said, a combination of factors assisted the USD/JPY pair to find decent support near the 121.20-121.15 region. and stall the intraday corrective pullback. The Fed-BoJ policy divergence, along with a positive risk tone acted as a headwind for the JPY.

It is worth recalling that a slew of influential FOMC members, including Fed Chair Jerome Powell, left the door open for a larger rise in borrowing costs to bring down unacceptably high inflation. The markets were quick to price in the possibility of a 50 bps Fed rate hike move at the May policy meeting. This was reinforced by the fact that the yield on the benchmark 10-year US government bond stood tall near the highest level since 2019.

Elevated US Treasury bond yields attracted some USD dip-buying and further contributed to limiting the downside for the USD/JPY pair, at least for the time being. The fundamental backdrop favours bullish traders, suggesting that Friday's downfall could be categorized as a corrective pullback amid extremely overbought conditions. Hence, any subsequent slide might still be seen as a buying opportunity and is more likely to remain limited.

Technical levels to watch

White House National Security Advisor Jake Sullivan said on Friday that the US and its NATO allies are doing contingency planning for the possibility that Russia chooses to strike NATO territory, reported Reuters.

- Silver stabilised above the $25.50 area on Friday amid a broadly subdued tone to trade across markets.

- Upcoming Fed speak and US data probably won’t impact markets much, with $26.00 likely to continue acting as a ceiling.

Spot silver (XAG/USD) prices have stabilised to the north of the $25.50 per troy ounce area on Friday amid a broadly subdued tone to trade across markets with conditions winding down ahead of the weekend. US bond markets have stabilised with yields broadly unchanged on the day but remaining close to recently hit multi-year highs, while FX markets are not seeing a great deal of action (apart from the yen gaining some ground as traders take profits on recent shorts). In pre-market trade, meanwhile, US equity markets are enjoying a further push higher led by the tech sector, but this doesn’t appear to be burnishing silver’s safe-haven appeal.

The week isn’t over just yet, with influential Fed policymakers Christopher Waller and John Williams scheduled to speak later in the session and US February pending home sales and March Michigan Consumer Sentiment survey data set for release. Rhetoric from Fed members this week has been hawkish leaning and Waller and Williams are unlikely to deviate from this line. This shouldn’t impact silver much, given there has been plenty of time by now for traders to price in Fed hawkishness.

The outlook for a fresh push higher in XAG/USD before the weekend probably isn’t the best. A test of Thursday’s weekly highs in the $25.80s is a possibility, but selling pressure ahead of the $26.00 level may well continue to cap the price action. To the downside, previous highs from recent session in the $25.50 area should continue to offer support, as has already been the case in recent hours.

US Treasury Secretary Janet Yellen on Friday said that it is not now appropriate to sanction China as a partner of Russia, reported Bloomberg. Yellen continued that she is not seeing the end of globalisation but that she is concerned that the situation in Ukraine will reduce the prospects for global growth over the near year.

Global growth will be hurt by the recent jump in oil and other commodity prices, Yellen noted, saying that she is concerned about the spillover to countries dependent on wheat imports. It is conceivable that oil prices could go even higher, she warned. On the US economy, Yellen said she is not seeing weakness, noting strong job gains.

USD/MXN has returned back to its pre-war in Ukraine levels at around 20.30. Economists at CIBC Capital Markets expect the pair to edge higher toward the 20.90 mark.

Limited room for hawkish surprises

“A look at the ex-ante real policy rate shows that only 80- 160 bps in additional rate hikes (not counting the March decision) are needed to bring the real policy rate to the upper half of Banxico’s neutral real policy range, suggesting limited room for a further increase in rates in the 1Y range.”

“We find it difficult to believe that the 50 bps pace of rate increases will be maintained for a prolonged period, a view backstopped by the current division among the board members and the negative surprises in economic activity numbers.”

“Despite the attractiveness of the MXN carry on less convoluted local politics, we maintain our upward USD/MXN bias towards the 20.90 mark from current levels.”

The Swedish krona has proven to be the weakest performing major versus both the US dollar and the euro in the first quarter. But as rates are set to rise, economists at CIBC Capital Markets expect the EUR/SEK pair to trade back towards 2021 lows into the second half of the year.

SEK set for liftoff as Riksbank hike expectations rise

“Should CPI remain elevated and external risks moderate we would expect the market to increasingly price in a hawkish Riksbank bias, validating our positive SEK outlook.”

“We anticipate EUR/SEK trading back towards 2021 lows into H2 2022.”

- DXY’s weekly rebound met strong resistance at 99.00.

- The resumption of sellers could drag the index to 97.70.

The index reverses part of the weekly recovery and revisits the 98.40 zone at the end of the week.

The 99.00 region demonstrated to be quite a tough nut to crack for dollar bulls so far this week, allowing the re-emergence of some selling bias in DXY on Friday. Against that, a deeper retracement in the dollar could extend to the weekly low in the 97.70 region (March 17) in the near term.

The current bullish stance in the index remains supported by the 6-month line in the 96.00 area, while the longer-term outlook for the dollar is seen constructive while above the 200-day SMA at 94.70.

DXY daily chart

The dong has directionally moved in line with other Asian currencies amid the recent sell-off but has weakened by much less. Economists at ANZ Bank expect the VND to strengthen throughout the year and forecast USD/VND at 22,700 by end-2022.

Slower pace of reserve accumulation by the SBV to boost the dong

“We believe the recovery in Vietnam’s economy, aided by exports and resilient FDI inflows, will continue to buttress fundamentals. However, some risks are on the radar, especially from high oil prices and a potential slowdown in Europe that can weigh on exports.”

“Our baseline forecasts project a decent BoP support, which, along with a slower pace of reserve accumulation by the SBV, means that the strengthening bias for VND will likely continue.”

“We forecast USD/VND at 22,700 by year-end.”

The first quarter of 2022 has been marked with high volatility for the Thai baht. The currency lost about 2.7% of its value month-to-date in March. Looking ahead, economists at ANZ Bank expect THB to appreciate in the coming months and forecast USD/THB at 32.10 by end-2022.

Tourism sector expected to pick up pace

“Rising global commodity and oil prices will exert further strain on the current account balance, thereby weakening the baht. However, the tourism sector is expected to pick up pace as COVID-19 becomes endemic and countries relax travel rules.”

“We expect the currency to strengthen over the second half of 2022, backed by a recovery in tourism as tensions moderate, and end the year at 32.10.”

AUD/USD’s extension north of 0.75 is not surprising. Economists at OCBC believe that the aussie is set to test the October 2021 high of 0.7556.

Immediate support aligns at 0.7450

“The setup is favourably for a test of the Oct 2021 high at 0.7556. Nevertheless, the pace and extent of the up-move is stretched, and the next leg towards that target could be a grind, especially if recently established AUD-longs start to take profit at levels north of 0.75.”

“Immediate support enters at 0.7450.”

USD/JPY pushed through 122.00 on Thursday. Some retracement is seen today, though in the near-term, the focus will still be on USD/JPY upside as the pair pushes closer to mid-120s.

Technical pull-backs on the cards

“Even as we are structurally positive on the USD/JPY towards the mid-120s, do not rule out technical pull-backs. The 121.00 locus may be the first support in that case.”

“For now, the BoJ and Fin Min have refrained from directly commenting on JPY weakness.”

- EUR/JPY fades the initial spike to fresh 2022 highs past 134.00.

- Next of relevance on the upside comes the 2018 tops near 137.50.

EUR/JPY returns to the negative ground after an auspicious start of the day lifted it to new 2022 peaks in the 134.70/75 band on Friday.

The upside momentum in the cross appears unabated for the time being, although the proximity of the overbought territory might spark a near-term correction. The continuation of the uptrend is expected to meet the next significant barrier at the 2018 high at 137.50 recorded on February 2 of that year.

In the meantime, while above the 200-day SMA (130.00), the outlook for the cross is expected to remain constructive.

EUR/JPY daily chart

EUR/USD closed virtually unchanged on Thursday and was last seen clinging to small daily gains above 1.10. Economists at OCBC Bank see risks tilted to the downside, with the 1.0950 and 1.0900 levels as next bearish targets.

Heavy within range

“Range-bound for now, but with a bias to search lower towards 1.0950 and 1.0900.”

“As the Russia-Ukraine concerns consistently fade from the market’s view, the focus will likely revert back to front-end yield differentials, which should point to further downside for the pair.”

- EUR/GBP gained some follow-through positive traction for the third successive day on Friday.

- The recent price action constitutes the formation of an inverted head and shoulders pattern.

- Neutral technical indicators on the daily chart warrant caution for aggressive bullish traders.

The EUR/GBP cross gained traction for the third successive day on Friday and built on this week's goodish rebound from sub-0.8300 levels. The cross maintained its bid tone through the first half of the European session and was last seen trading just a few pips below the multi-day peak, around mid-0.8300s.

A dovish assessment of the Bank of England decision last week, along with the disappointing release of the UK Retail Sales data on Friday, contributed to the British pound's relative underperformance. On the other hand, the shared currency drew support from modest US dollar weakness and extended support to the EUR/GBP cross.

Looking at the broader picture, the recent price action constitutes the formation of a bullish inverted head and shoulders pattern on the daily chart. The pattern, however, is not complete until the neckline resistance is broken. The said barrier is pegged just ahead of the very important 200-DMA, near the 0.8455-0.8460 region.

In the meantime, the 0.8400 round-figure mark could act as immediate strong resistance. Given that technical indicators on the daily chart are yet to confirm a bullish bias, the said handle is more likely to keep a lid on any meaningful upside for the EUR/GBP cross.

On the flip side, a cluster of support between the 0.8330-0.8300 area should protect the immediate downside. A convincing break below will negate the head and shoulders pattern and make the EUR/GBP cross vulnerable to resume its well-established bearish trend. The next relevant support is pegged near mid-0.8200s.

EUR/GBP daily chart

Technical levels to watch

The Federal Reserve is now very concerned with the acceleration in inflation and is saying it's full-steam ahead on tightening. In the view of economists at CIBC Capital markets, this is the denouement of the dollar dominance story as markets have moved to expect too much tightening from the Fed.

Peak hawkishness portends USD softening

“The big risk now for USD bulls is that we’re close to ‘peak hawkishness’ in terms of market pricing for the Fed. That skews the balance of risks to the USD to the downside for the latter part of the year.”

“As the Fed progresses on its path to hike rates and shrink its balance sheet via QT, investors should keep close tabs on the deceleration in inflation and growth, and the potential for a covid comeback, which would lend merit to our call for a more moderate dose of 150bps from the Fed this year, including the March hike.”

“Currency markets will be especially sensitive to any shift in tone from Fed speakers should that be the case.”

The dollar is approaching the end of the week on a softer note. Nonetheless, economists at ING think that lingering Russia-related downside risk for sentiment and upside risk for commodity prices continue to warrant a stronger dollar and weaker European currencies.

Dollar softness looks unlikely to last

“The US and its allies have repeatedly warned that Russia may escalate the current conflict with a variety of different weapons, and Putin appears quite determined to use an unexpected range of tools to counter-sanctions. too. All this continues to signal significant upside risks for commodity prices and downside risks for risk sentiment.”

“Markets may find the current levels as relatively attractive to build back some defensive long-USD positions, mostly against European currencies.”

“We also think that a market that is inching closer to pricing in 100bp of rate hikes by the Federal Reserve at the next two meetings may favour the dollar.”

UOB Group’s Senior Economist Julia Goh and Economist Loke Siew Ting assess the latest BSP event.

Key Takeaways

“As widely expected, Bangko Sentral ng Pilipinas (BSP) left its policy rates unchanged for the 11th straight meeting today (24 Mar). The overnight reverse repurchase (RRP) rate was maintained at 2.00%, overnight deposit rate at 1.50%, and overnight lending rate at 2.50%.”

“There are greater concerns about the potential broadening of price pressures disanchoring inflation expectations in today’s monetary policy statement, against signs of domestic economic activity gaining stronger traction. This is accompanied by a sharp upward revision in BSP’s inflation forecast for 2022 to 4.3% (from 3.7% projected in Feb; UOB est: 3.5%), surpassing its medium-term target range of 2%-4%, with a higher Dubai oil price assumption of USD102/bbl (previous est: USD83/bbl).”

“Although BSP continues to rely on non-monetary measures to tame inflation for now, it remains to be seen if these measures are enough to contain the potential second-round inflation effects amid petitions for a hike in minimum wage and public transport fare. This alongside a more hawkish Fed tilt and further improvement in domestic economic activities will likely prompt BSP to move up its timeline for rate hikes to 2Q22, in our view. The next Monetary Board meeting will be on 19 May.”

- GBP/USD turned lower for the third straight day following the early uptick to the 1.3225 region.

- Disappointing UK Retail Sales data weighed on sterling amid the emergence of some USD buying.

- The Fed’s hawkish outlook continued acting as a tailwind for the greenback and exerted pressure.

The GBP/USD pair extended its intraday descent through the first half of the European session and dropped back closer to the overnight low, around the 1.3160-1.3155 area in the last hour.

Following an early uptick to the 1.3225 area, the GBP/USD pair met with a fresh supply on Friday and drifted into the negative territory for the third successive day. The Bank of England's softer view on the need for further rate hikes acted as a headwind for the British pound, which was further pressured by the disappointing UK macro data.

In fact, the UK Office for National Statistics reported that monthly Retail Sales declined by 0.3% in February as against market expectations for a deceleration in growth to 0.6 from the 1.9% in January. Adding to this, sales excluding fuel fell 0.7% during the reported month and also missed consensus estimates pointing to a 0.5% increase.

On the other hand, the US dollar trimmed a part of its intraday losses and continued drawing some support from rising bets for a 50 bps Fed rate hike at the May meeting. This was seen as another factor that exerted some downward pressure on the GBP/USD pair, with bears now awaiting a convincing break below the ascending trend-channel support.

Sustained weakness below mid-1.3100s will mark a breakdown through the bearish flag pattern and pave the way for a slide towards challenging the post-BoE low, around the 1.3090 region. Some follow-through selling could drag the GBP/USD pair further towards challenging the YTD low, around the key 1.3000 psychological mark touched earlier this month.

Technical levels to watch

When asked about the refusal of some European countries to start paying for Russian gas in roubles, a Kremlin spokesperson said on Friday that President Vladimir Putin has ordered Gazprom to accept payment in roubles.

"Gazprom needs to work out how that can be done from a technical and logistical point of view," the spokesperson added. "Novatek was not instructed to accept payments in roubles."

Market reaction

The USD/RUB pair is pushing lower on Friday and was last seen losing 0.65% on a daily basis at 96.3630.

- Gold price is consolidating near weekly highs above $1,950 amid indecisive markets.

- The Ukraine updates, Fedspeak and yields’ price action will be closely followed.

- Gold price has room to rise towards $1,990 amid Ukraine woes, bullish technicals.

After two straight days of gains, gold price is consolidating the upside amid indecisive markets. The US dollar is recovering the early lost ground while the Treasury yields are stabilizing at higher levels. Investors are awaiting a clarity on the Russia-Ukraine crisis amid ongoing hostilities in Ukraine and a stronger Western response on Russia. Gold traders are also weighing in the recent hawkish Fedspeak against the US economic outlook and soaring inflation. Looking ahead, volatility in gold price could briefly return, as the focus now shifts towards next week’s US Nonfarm Payrolls (NFP) release.

Read: This commodities boom is about to get even bigger – Are you ready? [Video]

Gold Price: Key levels to watch

The Technical Confluences Detector shows that gold price is looking to find acceptance above $1,960, the convergence of the Fibonacci 23.6% one-day, the previous year’s high and SMA5 four-hour.

Gold bulls will then target the previous day’s high of $1,966, with the $1,970 round level next in sight. The pivot point one-day R1 aligns at that point.

The previous month’s high of $1,975 will be the level to beat for bulls.

Alternatively, the immediate support awaits at the Fibonacci 61.8% one-week of $1,955, below which sellers will look out for the Fibonacci 61.8% one-day support at $1,949.

Failure to resist above the latter will kickstart a fresh downswing towards the pivot point one-day S1 at $1,942.

The confluence of the previous day’s low and SMA5 one-day at $1,937 will challenge the bullish commitments should the downside pick up steam.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

European Commission President Ursula von der Leyen said, via Reuters, "US LNG will replace that of Russia's,” after striking an LNG deal with the US on Friday.

"Europe will work towards ensuring stable demand for additional US LNG until at least 2030," von der Leyen said.

Meanwhile, US President Joe Biden said that the US and EU are “coming together to reduce Europe’s dependency on Russian energy.”

Related content

- Germany’s Habeck: We hope that by summer we will have halved oil imports from Russia

- US President Biden: Announces US ban on Russian oil, gas and energy imports

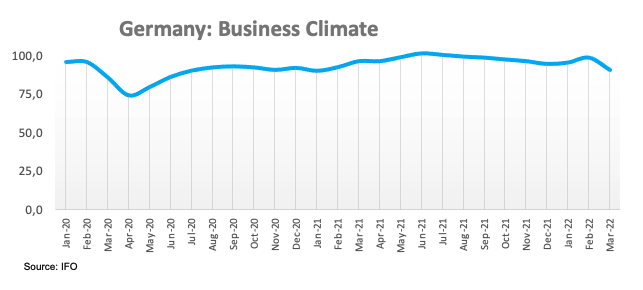

- EUR/USD comes under pressure and retests 1.1000.

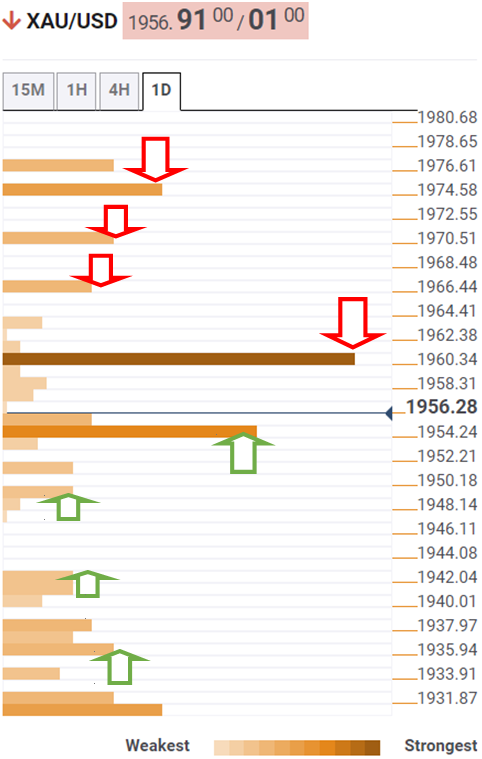

- The German IFO Business Climate dropped to 90.8 in March.

- US Consumer Sentiment, Fedspeak next of note across the pond.

The daily rebound in EUR/USD faltered just ahead of the 1.1040 level and sparked a subsequent corrective drop to the 1.1000 neighbourhood on Friday.

EUR/USD: Upside appears capped by 1.1040

Despite the retracement from daily peaks, EUR/USD kept the bid bias unchanged at the end of the week against the backdrop of the correction in the US dollar and the generalized better tone in the risk-linked galaxy.

Somewhat limiting the upside potential in the pair comes the drop in Germany’s Business Climate to 90.8 in March, as per the latest report by the IFO institute.

Later in the NA session, the final March U-Mich gauge is due along with Pending Home Sales and speeches by FOMC’s Williams, Barkin and Waller.

What to look for around EUR

EUR/USD retakes the 1.1000 mark and advances further north in tandem with the better mood among market participants. So far, pockets of strength in the single currency should appear reinforced by the speculation of the start of the hiking cycle by the ECB at some point by year end, while higher German yields, elevated inflation, the decent pace of the economic recovery and auspicious results from key fundamentals in the region are also supportive of a firmer euro for the time being.

Key events in the euro area this week: Germany IFO Business Climate (Friday).

Eminent issues on the back boiler: Asymmetric economic recovery post-pandemic in the euro area. Speculation of ECB tightening/tapering later in the year. Presidential elections in France in April. Impact of the geopolitical conflict in Ukraine.

EUR/USD levels to watch

So far, spot is up 0.14% at 1.1011 and faces the next up barrier at 1.1137 (weekly high March 17) followed by 1.1219 (55-day SMA) and finally 1.1266 (100-day SMA). On the other hand, a drop below 1.0960 (low March 22) would target 1.0900 (weekly low March 14) en route to 1.0805 (2022 low March 7).

- AUD/USD witnessed modest intraday pullback from the fresh YTD top touched earlier this Friday.

- The Fed’s hawkish outlook, elevated US bond yields underpinned the USD and acted as a headwind.

- Rising commodity prices continued lending support to the aussie and helped limit any further losses.

The AUD/USD pair extended its intraday retracement slide from the YTD top and dropped to sub-0.7500 levels or a fresh daily low during the first half of the European session.

The pair struggled to capitalize on its early gains and witnessed modest intraday pullback from the highest level since early November 2021, around the 0.7535 touched this Friday. The downtick could be attributed to the emergence of some dip-buying around the US dollar, which continued drawing support from the Fed's hawkish outlook.

In fact, influential FOMC members, including Fed Chair Jerome Powell, left the door open for a larger rise in borrowing costs to bring down unacceptably high inflation. Investors were quick to price in a 50 bps rate hike at the May meeting and pushed the yield on the benchmark 10-year US government bond back closer to the 22-month high.

Moreover, concerns that surging crude oil prices would continue to put upward pressure on consumer prices remained supportive of elevated US Treasury bond yields. This, in turn, acted as a tailwind for the buck and prompted some profit-taking around the AUD/USD pair, especially after the recent blowout rally of over 350 pips from the monthly low.

The downside, however, remains cushioned amid rising commodity prices, which continued lending some support to the resources-linked Australian dollar. Hence, it will be prudent to wait for strong follow-through selling before confirming that the AUD/USD pair has topped out in the near term and positioning for any meaningful corrective slide.

Nevertheless, the AUD/USD pair remains on track to post gains for the second successive week. Market participants now look forward to the US economic docket, featuring the release of revised Michigan Consumer Sentiment Index and Pending Home Sales data. This, along with the US bond yields, will influence the USD price dynamics and provide some impetus.

Technical levels to watch

Following the release of the German IFO Business Survey, the institute’s Economist Klaus Wohlrabe said that “the economy faces uncertain times.”

Additional quotes

Industry supply chain issues have become worse, 80.2% of companies facing them (vs 74.6% in February).

Price expectations have risen, two-thirds of companies want to increase prices.

Price expectations have risen in retail as well.

We don't see a recession in Germany in the first quarter.

Logistics sector has major concerns about coming months.

Concerns include shortage of drivers, diesel prices are high.

EUR/USD reaction

EUR/USD is testing bids at 1.1000 on the dismal German IFO Survey. The spot is currently trading at 1.1002, up 0.06% on the day.

- German IFO Business Climate Index came in at 90.8 in March.

- IFO Current Economic Assessment fell to 97.1 this month.

- March German IFO Expectations Index arrived at 85.1.

The headline German IFO Business Climate Index slumped to 90.8 in March versus last month's 98.5 and the consensus estimates of 94.2.

Meanwhile, the Current Economic Assessment dropped to 97.1 points in the reported month as compared to last month's 98.6 and 96.5 anticipated.

The IFO Expectations Index – indicating firms’ projections for the next six months, worsened to 85.1 in March from the previous month’s 98.4 reading and much better than the market expectations of 92.0.

Market reaction

EUR/USD is paring back gains on the mixed German IFO survey.

At the time of writing, the pair is up 0.15% on the day, trading at 1.1011.

About German IFO

The headline IFO business climate index was rebased and recalibrated in April after the IFO research Institute changed series from the base year of 2000 to the base year of 2005 as of May 2011 and then changed series to include services as of April 2018. The survey now includes 9,000 monthly survey responses from firms in the manufacturing, service sector, trade and construction.

UOB Group’s FX Strategists noted USD/CNH faces extra consolidation in the near term, likely between 6.3450 and 6.4000.

Key Quotes

24-hour view: “Our expectations for USD to ‘advance to 6.4000’ did not materialize as it traded between 6.3798 and 6.3931 before closing little changed at 6.3840 (-0.09%). The underlying tone has softened and the bias is on the downside. However, any weakness is unlikely to break 6.3700. Resistance is at 6.3850 followed by 6.3900.”

Next 1-3 weeks: “Yesterday (24 Mar, spot at 6.3890), we highlighted that the bias for USD on the upside but the chance for a clear break of 6.4105 is not high. We added, “a breach of the ‘strong support’ level at 6.3730 would indicate that the build-up in momentum has fizzled out”. While our ‘strong support’ level is not breached, the build-up is momentum has fizzled out. In other words, USD is not ready to head higher and is likely to trade between 6.3450 and 6.4000 for now.”

- DXY reverses part of the recent advance and revisits 98.40.

- US yields lose some upside traction, although remain near recent highs.

- US final Consumer Sentiment, Fedspeak due next in the NA session.

The US Dollar Index (DXY), which tracks the greenback vs. a basket of its main competitors, faces some downside pressure and slips back to the 98.40 region at the end of the week.

US Dollar Index weaker on improved risk appetite

The index sheds ground following two daily gains in a row on Friday on the back of the better mood in the risk-associated universe and a mild corrective downside in US yields across the curve.

Indeed, US yields appear to have run out of upside traction so far, although they manage well to keep the trade in the area of recent highs and always underpinned by speculation of a faster and tighter Fed’s normalization in the next months.

In addition, the lack of news from the geopolitical scenario now seems to be lending some support to the risk complex, while investors continue to closely follow developments from President Biden’s meetings with European leaders, with further economic sanctions against Moscow on top of the agenda.

In the US calendar, the final prints of the Consumer Sentiment are due seconded by Pending Home Sales and speeches by NY Fed J.Williams (permanent voter, centrist), Chicago Fed C.Evans (2023 voter, centrist) and FOMC’s R.Waller (permanent voter, hawkish).

What to look for around USD

The weekly recovery in the dollar failed to advance further north of the 99.00 mark, motivating sellers to return to the market on Friday. Concerns surrounding the geopolitical landscape are expected to keep propping up the demand for the buck in combination with prospects of extra tightening by the Fed. Looking at the broader picture, bouts of risk aversion – exclusively emanating from Ukraine - should underpin inflows into the safe havens and lend legs to the dollar at a time when its constructive outlook remains well supported by the current elevated inflation narrative, a potential more aggressive tightening stance from the Fed and the solid performance of the US economy.

Key events in the US this week: Final Consumer Sentiment, Pending Home Sales (Friday).

Eminent issues on the back boiler: Escalating geopolitical effervescence vs. Russia and China. Fed’s rate path this year. US-China trade conflict. Futures of Biden’s Build Back Better plan.

US Dollar Index relevant levels

Now, the index is retreating 0.17% at 98.61 and a break above 98.96 (weekly high March 22) would open the door to 99.29 (high March 14) and finally 99.41 (2022 high March 7). On the flip side, the next down barrier emerges at 97.72 (weekly low March 17) followed by 97.71 (weekly low March10) and then 97.44 (monthly high January 28).

German Economy Minister and Vice-Chancellor Robert Habeck said on Friday, they hope that by summer oil imports from Russia will be halved.

Additional quotes

We have made good steps on energy security.

We have managed to reduce coal and oil imports from Russia in last four weeks.

Reducing energy imports from Russia is aimed at forcing Putin to stop war.

We hope to stop all coal exports from Russia by autumn.

We hope that by summer we are only importing 24% of gas from Russia.

We have reduced our dependency on Russian coal to 25% from 50%.

We have reduced Russian oil imports to 25% from 35%, and Russian gas down to 40% from 55%

In talks to tap into floating storage and regasification units (FSRU) for liquefied natural gas of 27 GW capacity.

Exposure of eastern German refineries to Rosneft oil shows it was a mistake to give Russian state company so much reach.

We will consult with our partners about Putin's demand that we pay for Russian gas with roubles.

Will become almost independent of Russian gas by summer 2024.

Market reaction

WTI oil is extending its pullback below $109.00, losing 1.75% on the day.

The start of the Ukraine conflict saw the SGD weaken further, pushing the S$NEER lower. But it has since rebounded. Economists at ANZ Bank expect the MAS to continue normalising monetary policy, leading to a stronger SGD.

MAS will continue to normalise policy

“Our view that the MAS will continue to normalise policy and re-centre the policy band mean the S$NEER should continue to test the upper bound of the policy band. With MAS policy set on an appreciation path with further increases in the slope of the policy band likely, this will lead to a stronger Singdollar.”

“We forecast SGD to appreciate towards 1.32 by the end of the year.”

- USD/CAD gained some positive traction on Friday and snapped seven days of the losing streak.

- Retreating oil prices undermined the loonie and assisted the pair to defend the 1.2500 mark.

- A positive risk tone weighed on the safe-haven USD and might keep a lid on any further gains.

The USD/CAD pair edged higher during the early part of the European session and climbed to a fresh daily high, around mid-1.2500s in the last hour.

Having defended the key 1.2500 psychological mark, the USD/CAD pair gained some bullish traction on Friday and recovered a major part of the overnight slide to the two-month low. This marked the first day of a positive move in the previous nine and was sponsored by modest downtick in crude oil prices, which tend to undermine the commodity-linked loonie.

The European Union remained split on imposing an oil embargo on Russia and eased growing market fears of a supply crunch. Adding to this, US energy secretary Jennifer Granholm said on Thursday that the United States and its allies were discussing a possible further coordinated release of oil from storage. This, in turn, weighed on the black liquid.

On the other hand, a generally positive tone around the equity markets undermined the safe-haven US dollar and held back bulls from placing aggressive bets around the USD/CAD pair. Even from a technical perspective, this week's convincing break and acceptance below the very important 200-day SMA warrants caution before confirming that the pair has bottomed out.

Market participants now look forward to the US economic docket, featuring the release of revised Michigan Consumer Sentiment Index and Pending Home Sales data. This, along with the broader risk sentiment and the US bond yields, will influence the USD. Traders will further take cues from oil price dynamics for some short-term opportunities around the USD/CAD pair.

Technical levels to watch

EUR/USD has benefited from some dollar softness to climb back above 1.10, although the pair is struggling to find enough bullish support to extend the run to 1.11. The balance of risks for EUR/USD remains skewed to the downside in the view of analysts at ING, who expect a drop to 1.08-1.09 in the coming weeks.

Not enough bullish steam

“The combination of lingering Russia-related risks, high energy prices and Fed-ECB policy divergence still points to a weaker, rather than stronger, EUR/USD.”

“We continue to expect a drop to 1.08-1.09 in the coming weeks.”

In the view of economists at CIBC Capital Markets, financial markets look to be expecting too much tightening from the Bank of England (BoE) this year, which will weigh on sterling ahead as markets recalibrate.

Markets expecting too much from BoE

“The March BoE meeting resulted in a 25bps hike to 0.75%, marking three straight hikes. However, in view of BoE warnings over rising policy risks and adjustments to policy language, we view the move as a dovish hike, and we maintain a bias towards sterling weakness over the next few months.”

“We assume that once rates hit 1.0%, triggering the QT threshold, the bank will be reluctant to rush towards additional tightening. Hence if we see 1.0% in May, we would expect a protracted pause thereafter, likely extending into 2023.”

“Our expectation for a less aggressive policy profile than what’s implied by the interest rate market underlines risks of GBP underperformance.”

FX option expiries for March 25 NY cut at 10:00 Eastern Time, via DTCC, can be found below.

- EUR/USD: EUR amounts

- 1.0800 422m

- 1.0925 453m

- 1.1000 1.7b

- 1.1100 574m

- USD/JPY: USD amounts

- 117.80 440m

- 118.50 406m

- AUD/USD: AUD amounts

- 0.7375 411m

- USD/CAD: USD amounts

- 1.2400 330m

- 1.2610 517m

- 1.2650 646m

- 1.2670 360m

- 1.2700 594m

EUR/GBP has climbed back to the middle of the 0.83-0.84 range after having failed to decisively break below the 0.83 support earlier this week. Meanwhile, cable seems, for now, stuck at 1.32 after having briefly traded around 1.33 again. Economists at ING expect EUR/GBP to break under 0.83 whereas GBP/USD is unlikely to slide below 1.30.

EUR/GBP set to break below the 0.83 level in the near-term

“The euro’s higher exposure to Russia-related and commodity-related risks warrants a break below the 0.83 level in the near-term.”

“Some support to the dollar may put some pressure on the cable in the coming days but there may not be enough bearish push to send it below 1.30.”

Norway’s central bank has hiked rates for the third time, taking the deposit rate up to 0.75%. But the bigger news is that Norges Bank has considerably upgraded the number of rate hikes it expects to implement by the end of 2023. Economists at ING think that the hawkish projections by Norges Bank all but reinforce the rate outlook for the krone.

EUR/NOK to trade below 9.50

“The 25bp hike and pledge to hike again in June was accompanied by a sizeable hawkish revision in rate projections, with a terminal rate now seen at 2.5% in 2023. The positive terms of trade shock along with rising domestic inflation leave little doubt that NB will follow through on its upgraded rate path.”

“NB’s hawkishness – paired with instability in the Russia-Ukraine situation which could continue to push energy prices higher – points to more EUR/NOK weakness in the coming weeks.

“We expect a decisive break below 9.50 very soon, with room for a move to the 9.30-9.40 region.”

Despite the eurozone being the area that is the most economically exposed to the war in Ukraine, the European Central Bank (ECB) has become increasingly hawkish of late. While the ECB will trail the Federal Reserve, the potential for greater fiscal support in the eurozone in the second half of 2022 could support gains in the euro, economists at CIBC Capital Markets report.

EUR/USD retesting YTS lows at 1.0806 should be a short-lived story

“Extended ECB inertia allied to ongoing Ukraine-related uncertainties points towards risks of EUR/USD potentially retesting year-to-date lows at 1.0806. But that should be a short-lived story.”

“A patient ECB, and the potential for Euro area fiscal support, should support both economic conditions and the euro in the latter half of the year. A more tempered pace for the first year of Fed hikes relative to current market expectations should work in the same direction.”

- USD/CHF drifted lower for the fourth successive day amid a broad-based USD weakness.

- The risk-on impulse undermined the safe-haven CHF and helped limit losses for the pair.

- The Fed’s hawkish outlook supports prospects for the emergence of some USD buying.

The USD/CHF pair now seems to have entered a bearish consolidation phase and was seen oscillating in a range just a few pips above the two-week low, around the 0.9270 area.

The pair prolonged its recent sharp retracement slide from the 0.9460 area or the highest level since April 2021 and continued losing ground on the last day of the week. This marked the fourth successive day of the negative move - also the seventh in the previous eight - and was sponsored by modest US dollar weakness.

That said, a generally positive tone around the equity markets undermined the safe-haven Swiss franc and extended some support to the USD/CHF pair. Apart from this, rising bets for a 50 bps Fed rate hike at the May policy meeting acted as a tailwind for the buck and helped limit further losses for the pair, at least for now.

It is worth mentioning that a slew of influential FOMC members, including Fed Chair Jerome Powell, left the door open for a larger rise in borrowing costs to contain unacceptably high inflation. The speculations were further fueled by surging oil prices, which could continue to put upward pressure on already elevated consumer prices.

This, in turn, assisted the yield on the benchmark 10-year US government bond to hold steady near the 22-month high touched earlier this week, which should act as a tailwind for the greenback. That said, the USD/CHF pair's inability to attract any buyers warrants some caution before positioning for any meaningful appreciating move.

Market participants now look forward to the US economic docket, featuring the release of revised Michigan Consumer Sentiment Index and Pending Home Sales data. The focus, however, will remain on geopolitical developments. Apart from this, the US bond yields will influence the USD and provide some impetus to the USD/CHF pair.

Technical levels to watch

Although EUR/USD seems to have steadied above 1.10, it could find it difficult to continue to push higher in case the data from Germany highlight the negative impact of the Russia-Ukraine conflict on business sentiment, FXStreet’s Eren Sengezer reports.

German Ifo survey could derail euro's recovery

“The Ifo Institute is expected to announce a deterioration in German business confidence. The Expectations Index is forecast to decline to 92 in March from 99.2 in February and the Current Assessment Index is expected to fall to 96.5 from 98.6. In case these data come in worse than analysts' estimate, the common currency could come under renewed selling pressure and vice versa.”