- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 25-02-2022

Russia vetoed a draft UN Security Council resolution on Friday that would have deplored Moscow's invasion of Ukraine, while China abstained from the vote - a move western countries view as a win for showing Russia's international isolation.

The United Arab Emirates and India also abstained from the vote on the US -drafted text. The remaining 11 council members voted in favour. The draft resolution is now expected to be taken up by the 193-member UN General Assembly.

More to come...

- The NZD dollar vs. the JPY finished tie week gaining 1.25%.

- NZD/JPY Technical Outlook: Neutral-upward biased, confirmed by a bullish RSI.

FInishing a busy week on the financial markets, the NZD/JPYended it on the right foot, up 1.25% in the week. Breaking news that Russia would be open to sit down and talk with the Ukrainian Government, increased appetite for riskier assets In the FX space means that risk-sensitive currencies like the NZD and the AUD rose to the detriment of safe-haven peers, like the low yielder Japanese yen. At the time of writing, the NZD/JPY is trading at 77.95.

Friday’s overnight session for North American traders portrayed an upbeat market sentiment, despite the continuation of Russia’s invasion of Ukraine, announced by Russian President Vladimir Putin. In the Asian session, the NZD/JPY was subdued in the 77.20-50 range. However, in the middle of the European session, earlier of New York’s open, the NZD/JPY pair moved upwards, rallying 44-pips, setting Friday’s daily high at78.01.

NZD/JPY Price Forecast: Technical outlook

The NZD/JPY began the North American session, confined between the 50 and the 200-day moving (DMA), lying at 77.26 and 77.89, respectively but late in the New York session, rallied toward 78.00, backtracking to current levels. Based on that, the pair is neutral biased, but the Relative Strength Index (RSI) at 58.50 above the 50-midline and aiming higher indicates the NZD/JPY is bullish biased with enough room before reaching overbought levels. That said, the NZD/JPY is neutral-upward bias.

Upwards, the NZDY/JPY first resistance would be 78.00. Breach of the latter would pave the way towards the 100-DMA at 78.34, followed by January 13 daily high at 78.83.

On the flip side, the NZD/JPY first support would be the 200-DMA at 77.89. Once cleared, the next support would be 50-DMA at 77.26, followed by the 77.00 mark.

- AUD/USD saw a stunning rebound on Friday, rallying back to the mid-0.7200s as risk appetite improved.

- That marks a near 2.0% rebound from Thursday’s post-Russia invasion of Ukraine lows.

- Next week will be busy with the RBA deciding policy, US jobs and ISM surveys and Aussie GDP plus geopolitics.

AUD/USD saw an ultra-impressive rebound on Friday, with the pair rallying back into the mid-0.7200s despite ongoing uncertainty about the European geopolitical landscape and the global economy as fighting between Russian and Ukrainian forces in Ukraine intensified. The pair currently trades in the 0.7330s, up roughly 1.0% on the day, with the Aussie one of the best performing G10 currencies on the session. That marks a near 2.0% rebound from Thursday’s intra-day sub-0.7100 lows.

The recovery on Friday was in part driven by tailwinds the risk-sensitive Aussie received from a rally in global equity markets as traders took a more sanguine view on recent geopolitical events. Traders said sanctions imposed by the West so far on Russia were “soft”, easing fears about energy supply disruptions somewhat, whilst hopes for a diplomatic solution to the war remained. But market commentators also cited healthy dividend payouts from Australian minors, which are normally converted to USD from AUD, as helping support the Aussie throughout the week.

Analysts said the payout could have been worth as much as A$20B, but have not finished, implying the Aussie might be exposed to more downside risks next week. As geopolitical developments in Europe remain front and centre of investors' minds, next week is likely to remain choppy and headline-driven. But its also a big week for economic data and central bank events. US jobs and ISM survey data for February are due, while down under, the RBA will decide on policy and Q4 Australia GDP figures will be released.

- GBP/JPY reclaimed the 155.00 level on Friday, the pair lifted as a risk appetite revival undermined yen demand.

- But GBP/JPY continues to trade lower by about 0.8% on the week and ongoing uncertainty regarding geopolitics.

GBP/JPY was able to reclaim the 155.00 level on Friday, with the pair lifted as a strong recovery in US equity markets and other risk assets dampened demand for the safe-haven yen. At current levels just to the north of the big figure, the pair now trades with gains of more than 1.0% versus Thursday’s lows. From a technical standpoint, the fact that the 200-Day Moving Average at 153.39 held up so well on Thursday (it literally formed the low point of the day’s trade) is a good sign for the bulls.

But GBP/JPY continues to trade lower by about 0.8% on the week and ongoing uncertainty regarding geopolitics and how the war in Ukraine will impact the European/global economy may mate it difficult for the pair to push substantially higher. The West’s sanction response so far to Russia has been seen as soft and there is still hope for a diplomatic solution to the war but fighting in Ukraine is intensifying and casualties are piling up. Depending on developments over the weekend, things really could go either way for GBP/JPY.

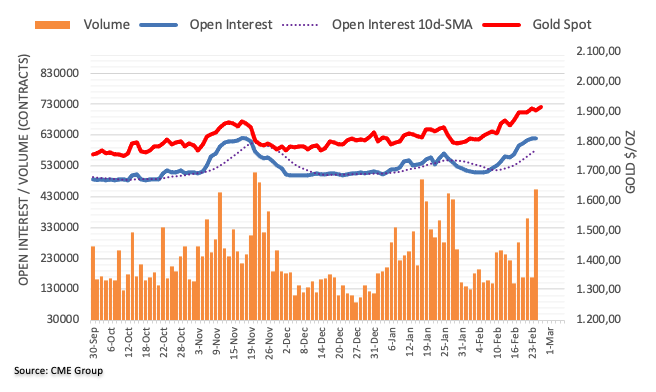

- In the week, XAU/USD is losing so far 0.30%, snapping three consecutive weeks of gains.

- A risk-on market mood, and high US T-bond yields, weighed on the non-yielding metal.

- XAU/USD Technical Outlook: Downward biased, as a bearish harami candle chart pattern looms.

Gold (XAU/USD} is set to end the week with losses after reaching a daily high at $1974.48 on Thursday. Breaking news that Russia would be open to sit down and talk with the Ukrainian Government, increased appetite for riskier assets, to the detriment of save-haven assets, like precious metals and low yielder currencies. Said that XAU/USD remains beneath the $1900 handle, trading at $1892 at the time of writing.

A busy week in the global financial markets witnessed how fragile the market sentiment is. The Ukraine-Russia conflict does not ease, and in fact, as of late, reports said that attacks on Ukraine’s capital Kyiv increased. Ukrainian Ambassador to the US Markarove stated that Russia’s attack on Ukraine has been more brutal, while Kyiv’s mayor reported blasts within minutes, which were heard close to a power station in Kyiv.

Despite the aforementioned, the market mood persists upbeat, as shown by US equities trading in the green, probably on month-end flows. Nevertheless, the greenback falls 0.50% sits at 96.68, while the rise in US Treasury yields weighed on the non-yielding metal, with the 10-year note up 1.5 bps sitting at 1.988%.

XAU/USD, in the last two days, rallied to a one-and-a-half-year high at $1,974.48 early Thursday but has plunged since then and so far failed to cling to the $1900 area. Worth noting that some investors are aware that the Russian Central Bank has some reserves in gold and booked profits ahead of reaching the $2,000 mark in fears that President Putin could use some of those to support the Russian ruble.

The US economic docket reported some macroeconomic data earlier. Durable Good Orders for January smashed expectations rising 1.6% m/m, while Fed’s favorite measure of inflation, PCE annually based, broke the 6% threshold. That said, Fed odds of hiking rates in the March meeting have risen. Later, the UoM Consumer Sentiment for February kept above the 60.0 threshold, but trailed January readings.

Gold Price Forecast: XAU/USD

XAU/USD price action in the week saw a move of $100 on Thursday, as Russia/Ukraine tensions increased. However, Thursday’s candle left a huge wick above the real body, demonstrating intense selling pressure mounted above $1,909. That, alongside Friday’s price action, confirms a bearish harami pattern that would be validated once XAU/USD breaks the $1,878.09 support.

XAU/USD’s first support level would be February 24 daily low at $1,878.09. Breach of the latter would expose the 9-month-old resistance/support trendline around $1,850-55, and then a test of the 50-day moving average (DMA) at $1,829.76.

Russia's Foreign Ministry on Friday said that Kyiv had refused talks with Moscow, Russia's Interfax report. However, Kyiv proposed to return to the issue of talks on February 26.

- Silver prices have traded in subdued fashion on Friday as a sharp pick up in risk appetite dampened safe-haven demand.

- Spot prices have remained subdued in the low $24.00s with the $24.50 mark acting as a ceiling.

- As the war in Ukraine rages on and the Western sanctions response to Russia evolves, uncertainty remains high.

A surge in risk appetite that has seen US equity push back to highs on the week and risk-sensitive currencies perform well is weighing heavily on safe-haven assets like precious metals, government bonds and the US dollar and yen. Hopes that there might be an opportunity for diplomacy between Russia and Ukraine that could bring an end to the war just as it is getting started are one factor fuelling the better mood. The West’s “soft” sanction response to Russia (so far) that has avoided hitting the country’s energy sector is another. Spot silver (XAG/USD) prices have unsurprisingly struggled to make headway on the final trading day of the week, with the $24.50 level acting as a ceiling to the price action.

At current levels around $24.10, silver prices are down about 0.5% on the day and nearly 6.0% lower versus Thursday’s highs above $25.50. Whether the air continues to come out of silver’s recent geopolitical tensions-fuelled rally (XAG/USD is still up more than 7.0% on the month) will be headline dependent. If the chatter about talks between Moscow and Kyiv that could result in an early end to the war does continue to gain traction, that could be a negative catalyst that sends spot silver back below $24.00.

Alternatively, momentum seems to be building towards Western nations kicking Russia out of the SWIFT international payments system, which could reignite some fears about economic disruption. If momentum also builds towards energy sanctions, economic uncertainty and demand for inflation protection could easily lift XAG/USD back above its 200-Day Moving Average at $24.20 and into the upper $24.00s. Traders should remain on their toes. Dependent on developments over the weekend, things could go either way quite aggressively next Monday.

In a statement on the Russo-Ukraine was released on Friday, China said that Ukraine's territory and sovereignty should be respected and urged talks between Ukraine and Russia as soon as possible. China also called for a diplomatic resolution to the crisis as soon as possible.

- The euro edges down 0.58% so far in the week, after falling in three of the week’s five trading days.

- The EUR/USD reached a 2022 YTD low at 1.1106 on Thursday.

- EUR/USD Technical Outlook: The pair is downward biased.

On Friday, the EUR/USD trims some of its weekly losses, recording gains of 0.48% during the North American session. At press time, the EUR/USD is trading at 1.1252.

In the overnight session for North American traders, the shared currency seesawed in the 1.1168.1,1230 range, most of the time. Nevertheless, before Wall Street’s opened, the EUR/USD rallied above 1.1200, breaking on its way, the 100-hour simple moving average (SMA) at 1.1223, reaching a daily high at 1.1266 to stabilize around the 1.1240 area.

EUR/USD Price Forecast: Technical outlook

On Thursday, the EUR/USD reached a YTD low at 1.1106, near the 1.1100 mark, though closed above the mid-line between the top/central Pitchfork’s parallel lines, suggesting profit-taking and buying pressure lifted the pair at the end of New York’s session. It is worth noting that EUR/USD daily moving averages (DMAs) reside above the actual exchange rate, indicating a downward bias. That said, the EUR/USD could aim higher, near February 24 daily high at 1.1308, followed by a leg-down towards the 1.1000 area.

In that outcome, the EUR/USD first support would be 1.1200. Breach of the latter would expose Pitchfork-s mid-line within the top/central parallel lines around 1.1165, followed by February 24 daily low at 1.1106.

- The NZD/USD climbs 0.64% in the week.

- Russia’s attack on Ukraine extends for the third consecutive day amid reports that Putin’s open for talks with Ukraine.

- NZD/USD Technical Outlook: Neutral biased, but the 50-DMA capped Friday’s upward move.

Friday’s trading session so far witnessed risk appetite improved as European and US equities trade in the green, ahead of the weekend on a busy week in the financial markets. In the FX space, risk-sensitive currencies like the antipodeans led by the NZD and the AUD gains, while safe-haven status ones fall. At press time, the NZD/USD surges, trading at 0.6730.

Developments in the Ukraine – Russia conflict

Russia’s attack on Ukraine persists for the third straight day. However, Russias Vladimir Putin reportedly would send a delegation to Minsk for talks with Ukraine. The headline shifted the market mood positively, increasing demand for riskier assets.

It is worth noting that Bloomberg reported that Kyiv’s fall to Russian forces could happen in the next 24/48 hours. That could spur a swing in the market mood, increasing appeal for safe-haven status.

During the Asian session, Reserve Bank of New Zealand (RBNZ) Governor Adrian Orr crossed wires, saying, “We’re particularly concerned about inflation expectations,” considering conditions in Ukraine. The Governor also commented that it would “Keep the possibility of moving rates quicker if necessary.”

The US economic docket featured Durable Goods Orders for January, at 1.6% m/m, higher than 0.6% estimated. Meanwhile, the Federal Reserve’s favorite inflation gauge, the PCE, rose to 6.1% y/y, higher than the 5.8% foreseen, while Core PCE rose to 5.2%, more than the 5.1% expected. Additionally, the University of Michigan Consumer Sentiment Final for February increased to 62.8, better than the 61.7

NZD/USD Price Forecast: Technical outlook

The NZD/USD is neutral biased, though it is trading above the 50-day moving average (DMA) at 0.6724, signaling that an uptrend would accelerate but would be subject to Friday’s daily close above the former.

IF that scenario plays as planned, the NZD/USD would be exposed to upward pressure. That said, the NZD/USD first resistance would be the February 23 high at 0.6809. Once cleared, the following resistance level would be the 100-DMA at 0.6850. Breach of the latter would expose January 13 daily high at 0.6890.

- US equity markets built on Thursday’s stunning intra-day rebound to press higher on Friday despite intensified fighting in Ukraine.

- The West’s soft sanction response plus the US equity market’s strong track record of overcoming geopolitical uncertainty are helping.

- The S&P 500 was last up 1.9%, the Nasdaq 100 up 1.2% and Dow up 2.2%.

Despite an intensification of the fighting in Ukraine, US equity markets have built upon Thursday’s historic intra-day rebound on Friday and look on couse to end the week at highs. The S&P 500 index, which tested 4100 in premarket trade on Thursday, is now trading in the 4370 region, up more than 6.0% from earlier weekly lows and up a further 1.9% on the day on Friday. The rebound over the last two sessions means that the S&P 500 index is, for now, out of “correction” territory – i.e. it is less than 10% below its early January record highs.

Traders/market commentators have attributed a variety of factors as driving the rebound. Firstly, after the initial panic in wake of Russia’s abrupt invasion of Ukraine on Thursday, it quickly become clear to many that the EU and US would not implement sanctions on Russian energy exports amid fears of inflicting economic self-harm. As long as that remains the case, that lessens some of the stagflationary risks associated with the Russo-Ukraine war. Others have cited the fact that, in the past, major geopolitical events have not had a lasting impact on US equity valuations, meaning there has been plenty of demand to buy the dip.

US economic data on Friday was strong, with January personal income and spending metrics both exceeding expectations and durable goods orders over the same period also seeing strong growth, suggestive of economic resilience despite the high prevalence Omicron in January. Economic optimism combined with the fact that the latest Core PCE inflation report (also for January) was largely in line with expectations is likely contributing to the rally.

The latest inflation figures were not viewed as raising the risk of the 50bps Fed rate hike in March, with 25bps now the base case amid new geopolitical uncertainties. This uncertainty was referenced a few times in the Fed’s latest semi-annual Monetary Policy Report and has been mentioned a few times by policymakers over the last two days. Though Fed hawks James Bullard and Christopher Waller seem keen on a 50bps move in March, most other Fed members sounded more cautious.

Looking at the other major US indices; the Nasdaq 100 index rallied more than 1.0% and, likely to the disappointment of the bears, managed a convincing break back to the north of the 14K level. The Nasdaq is stunning more than 8.0% up from its earlier weekly lows near 13K. The Dow, meanwhile, was up roughly 2.2% and is back to probing weekly highs at the 34K level, roughly 5.0% up versus earlier weekly lows. The CBOE Volatility Index or VIX fell three points to the mid-27.00s, a more than 10 point drop from Thursday highs in the 37.00s.

- EUR/GBP hit two-week highs above 0.8400 on Friday but failed to hold and has since dipped to the 0.8380s.

- The pair has been more rangebound than others recently amid UK/EZ growth and BoE/ECB policy uncertainty post-Russia’s invasion of Ukraine.

EUR/GBP hit its highest level in two weeks on Friday, at one point rallying to the north of the 0.8400 level in choppy post-US open trade, though the pair has since swung lower into the 0.8380s again. Friday’s move is consequential insofar as the pair has broken to the north of a 0.8310-0.8380ish range that had prevailed for the rest of the week up until now. But failure to push above resistance in the 0.8400 area and manage a clean break beyond suggests that a more sustained rebound towards monthly highs near 0.8480 isnt really on the cards just yet.

EUR/GBP’s rangebound conditions in recent days stand in sharp contrast to many other FX pairs/asset classes which have seen very high volatility as a result of Russia’s invasion of Ukraine on Thursday. Traders have struggled to determine whether recent developments are bullish or bearish for the pair. Does the damaging impact on global risk appetite favour a higher EUR/GBP because sterling is more risk-sensitive? Or does the EU’s vulnerability to disruptions in Russian energy imports suggests a weaker EUR/GBP given higher risk premia priced into the euro?

Meanwhile, traders are also questioning how recent events might shape the outlook for BoE/ECB policy divergence. The BoE, though continuing to lift interest rates back towards pre-pandemic levels, has sounded more dovish recently about the prospect for long-term tightening. Uncertainty due to war in Ukraine will likely dampen GDP growth this year and further dampen the prospect for long-term tightening. But the same can be said for the Eurozone and the ECB, despite high inflation, might be inclined to stick to its current QE taper plans and push any rate hikes back to 2023.

- The USD/CHF is gaining 0.65% during the week, ahead of the weekend.

- Improved market mood spurred by some developments in Ukraine boosted the greenback.

- USD/CHF Technical Outlook: Neutral biased, with the DMAs almost horizontal in the daily chart.

The USD/CHF advances sharply in the day, amid an improved market sentiment, as Russian President Putin reportedly is ready to send a delegation to Minsk for talks with Ukraine. At the time of writing, the USD/CHF is trading at 0.9276, approaching an eleven-month-old down trendline.

On Friday, during the overnight session for North American traders, the USD/CHF fluctuated between 0.9230—0.9260, with an unclear bias. However, late in the European session, the pair rallied towards 0.9282, an upward move capped by the 11-month-old abovementioned trendline.

USD/CHF Price Forecast: Technical outlook

The USD/CHF bias is neutral, and the pair faces strong resistance at a downslope trendline. However, the daily moving averages (DMAs) below the spot price would advise the USD/CHF as upward biased, but the DMAs slope is almost horizontal.

Upwards, the USD/CHF first resistance would be 0.9282. Breach of the latter would expose February 18 daily high at 0.9296, followed by January 31 daily high at 0.9342.

On the flip side, the USD/CHF first support is 0.9200. Once cleared, the next demand zone would be February 23 daily low at 0.9150, followed by 0.9100.

The US Federal Reserve on Friday released its semiannual Monetary Policy Report (MPR), which it normally does one week ahead of Fed Chair Jerome Powell's semiannual testimony before the US Congress. The report reiterated the Fed's policy guidance that it will soon be appropriate to raise the target range for the Federal Funds rate.

Additional Takeaways:

- With Omicron cases having declined sharply since mid-January, the US slowdown is expected to be brief.

- The FOMC expects it will soon be appropriate to raise the target range for the federal funds rate.

- Inflation readings over the second half of the year suggested that broader-based inflationary pressures had taken hold.

- Recent geopolitical tensions related to the Russia–Ukraine situation are a source of uncertainty in global financial and commodity markets.

- Upward pressure on inflation from prices of goods experiencing both supply chain bottlenecks and strong demand, such as motor vehicles and furniture, has persisted.

- The Fed continues to evaluate the potential systemic risks posed by hedge funds and digital assets and is closely monitoring the transition away from LIBOR.

- A wide range of indicators have been pointing to a very tight labor market.

- The share of categories seeing price increases of 3% or more is above 60% but still below the share seen in the 1970s.

- It is too early to tell what the ultimate effect of the pandemic will be on productivity growth in the coming years.

- Share of higher inflation in services in recent months likely in part due to labor market inflation pressures.

- With appropriate policy, inflation is expected to decline over the course of the year as supply constraints ease and demand moderates.

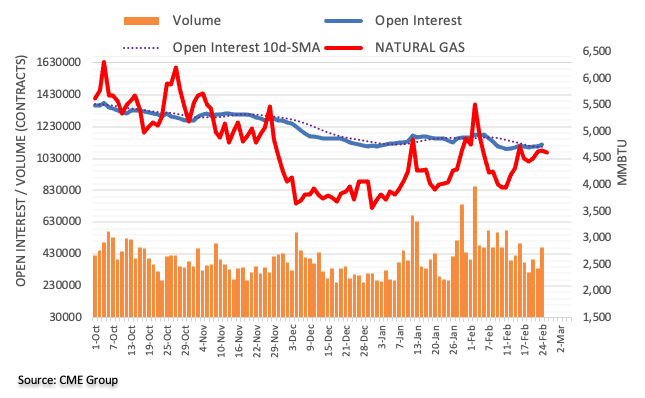

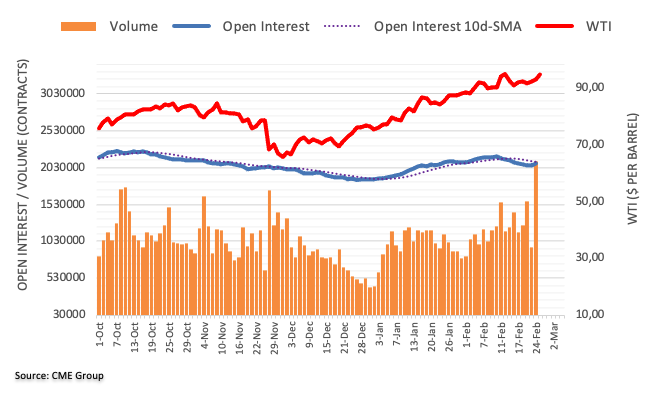

- Geopolitical tensions with Russia have also contributed to higher energy prices, including oil and natural gas.

- US dollar weakens on Friday amid risk appetite.

- A quiet session for cable on Friday after sharp moves.

- GBP/USD is about to post the worst weekly results in months.

The GBP/USD has been moving sideways near 1.3400 in the European session. The pair is trading modestly higher on Friday, holding onto late Thursday’s rebound but in negative territory for the week.

After falling on Thursday to 1.3272, GBP/USD rebounded and peaked on Friday at 1.3440, before retreating to 1.3365. The mentioned level has become a key short-term support. The pair is moving around 1.13400, about to post the worst weekly loss in months.

The deterioration in market sentiment weighed on cable, while the pound lagged behind other currencies in the rebound. EUR/GBP hit a two-week high above 0.8400

Week ahead

Key economic report next week includes the US employment report, while in the UK, no major releases are due, and the focus will be on central bankers. “By the end of Wednesday, we will have heard from all nine Bank of England committee members in the space of a little over a week. That's interesting in itself, having had virtually no commentary from Bank officials in the December-February intermeeting period”, explained analysts at ING.

Regarding the UK outlook, analysts at ING point out “the pressure on household incomes from energy prices is likely to result in slower, perhaps negative growth, later this year. We also expect some of the recent pressure on wages to abate now that the post-reopening movement in the jobs market slows. We therefore think the Bank will deliver fewer hikes than markets expect this year.”

Despite a positive ending so far for financial markets, the advance of Russian troops in Ukraine and its consequences will continue to be a key driver.

Technical levels

German Finance Minister Christian Lindner said on Friday that we must step up sanctions against Russia and that we are open to cutting Russia out of the SWIFT international payments system. Just because we have been thinking about the consequences of cutting Russia out of SWIFT doesn't mean we are against it, Lindner added.

Following an impressive rally to its highest level since September 2020 at $1,974 on Thursday, gold declined below $1,900 on Friday and ended up snapping a three-week winning streak. The yellow metal is set to continue its move higher on protracted tensions in Ukraine, FXStreet’s Eren Sengezer reports.

Technical outlook remains bullish as long as $1,870 support holds

“In case Russia reaffirms its intention to look for a diplomatic solution and refrains from advancing its troops early next week, gold is likely to face additional selling pressure. On the flip side, a prolonged military conflict with Russia's intention to take over Kyiv and additional sanctions from the west could support the precious metal.”

“FOMC Chairman Jerome Powell will testify before the US Senate Banking Committee. If the chairman hints at the possibility of a 50 basis points rate hike in March, gold could start pushing lower. On the flip side, markets are currently pricing a very small chance of a double-dose hike in March and a dollar selloff should be limited in case Powell goes against it.”

“The initial support is located at $1,870 (static level, ascending trend line). In case XAU/USD makes a daily close below that level it could extend its slide toward $1,850 (static level, 20-day SMA).”

“On the upside, $1,900 (psychological level) aligns as first resistance. If buyers managed to flip that level into support, $1,910 (static level) could be seen as the next hurdle before $1,920 (static level).”

See – Gold Price Forecast: XAU/USD to see a renewed upswing in the next few days – Commerzbank

- The USD/JPY gains 0.45% in the week amid an improved market mood.

- Reports from Russia said that Vladimir Putin is open to sending a delegation to Minsk for talks with Ukraine.

- USD/JPY Technical Outlook: Upward biased, but a daily close above 115.49, would open the door for a renewed challenge of YTD high at 116.35.

The USD/JPY is set to finish the week with gains, climbing 0.45%, amid a risk-on market mood, portrayed by global equities, while in the FX space, high-beta currencies lead. Newswires reported that Russian President Vladimir Putin is ready to hold talks with the government in Ukraine following the Russian invasion. The USD/JPY barely advances 0.02%, trading at 115.57 at press time.

Ukraine – Russia conflict update

Although Russia’s attacks continue for the third consecutive day, Russian Federation President Vladimir Putin “reportedly” is open to sending a delegation to Minsk for talks with Ukraine. The headline has kept investors calmed, as safe-haven peers recorded gains for two consecutive days. However, as reported by Bloomberg, it is only a matter of time before Russia’s forces would take control of Kyiv. That said, uncertainty keeps surrounding the Ukraine – Russia conflict, though caution is warranted when trading the financial markets.

In the meantime, the US economic docket featured Durable Goods Orders for January, which came at 1.6% m/m, higher than 0.6% estimated. Meanwhile, the Federal Reserve’s favorite inflation gauge, the PCE, rose to 6.1% y/y, higher than the 5.8% foreseen, while Core PCE rose to 5.2%, more than the 5.1% expected. Additionally, the University of Michigan Consumer Sentiment Final for February increased to 62.8, better than the 61.7

USD/JPY Price Forecast: Technical outlook

The USD/JPY daily chart depicts the pair as upward biased. The daily moving averages (DMAs) reside below the spot price, with a bullish slope, but to further cement its bias, it would require a daily close above the February 24 close at 115.49.

If that scenario plays out, the USD/JPY first resistance would be February 15 daily high at 115.87. A decisive break would send USD/JPY towards 116.00, followed by the YTD high at 116.35.

- Gold has been unwinding the war-related gains, dropping under $1,900.

- Critical support awaits at $1,885, followed only by $1,868.

- Resistance is at $1,899, then $1,902, if the precious metal recovers.

Will hostilities end in Ukraine? Russia's offer to talk in Minsk has been underpinning a market recovery. The move to stocks from bonds means lower yields, which in turn, has pushed gold lower.

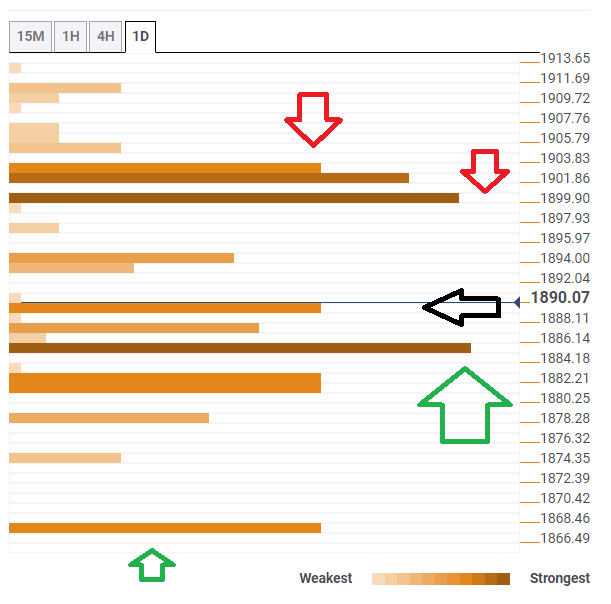

How is gold positioned on the technical chart?

Gold Price: Key levels to watch

The Technical Confluences Detector is showing that gold is struggling around $1,889, which is the convergence of the Fibonacci 23.6% one-week and the SMA 5-15m.

Looking down, $1,885 is a juncture of lines including the Pivot Point one-month Resistance 2 and the 10-day Simple Moving Average. It is critical support.

Looking down, the next level to watch is $1,868, which is where the Fibonacci 61.8% one-week hits the price.

Resistance is at $1,899, which is the confluence of the Bollinger Band 15min-Middle and the Fibonacci 161.8% one-month.

Close by, $1,902 is another tough cap, which is where the Fibonacci 23.6% one-day and the 5-day SMA converge.

XAU/USD Confluence levels

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

- WTI has eased back to near $92.00 from Asia Pacific session highs above $95.00 since the start of European trade.

- In the absence of US/EU/UK sanctions that directly hit Russian energy exports, the case for WTI near $100 is weakened.

- Expectations for a US/Iran nuclear deal and coordinated global oil reserve release has further dampened the price action.

Front-month WTI futures are back to trading in the $92.00 area once again, having ebbed back from Asia Pacific session highs in the $95.00s. Russia renewed its assualt on Ukraine’s capital city of Kyiv during Friday’s Asia Pacific session, which seemed to support oil prices at the time, though the bulls had lost the upper hand by the time European markets opened. Prices are currently probing Thursday’s lows in the mid-$91.00s, a break below which would open the door to a test of earlier weekly lows sub-$91.00.

As the fighting in Ukraine intensifies, a significant degree of risk premia is likely to remain embedded in crude oil prices. However, in the absence of sanctions from the likes of the US, EU and UK that directly target/restrict Russian energy exports, the case for WTI to remain at or near $100 per barrel does not seem to be there. That is escpecially true in the context of other recent key developments, including a further coordinated global release of crude oil reserves (again headed by the US) and US/Iran progress towards a deal on nuclear.

This has helped ease concerns about near-term crude oil market tightness. But Western powers have said all options regarding sanctions on Russia remain on the table, including on its energy sector. It will be key to continue to watch how the Russia/Ukraine war unfolds and whether EU/US leaders succumb to pressure to do more to deter Russian aggression. For now, a sustained break below $90.00 seems unlikely.

Elsewhere, oil prices did not respond to reports that OPEC+ is likely to stick to its existing policy of increasing output quotas at a measured pace of 400K barrels per day each month at its upcoming meeting on March 2. The group's decision would come despite the recent surge in prices following Russia's invasion of Ukraine.

- US dollar drops across the board as stocks surge.

- Mexican peso up supported by risk appetite.

- USD/MXN still up for the week, significantly off highs.

The USD/MXN is falling on Friday after having the biggest daily gains in a month on Thursday. The dollar jumped following the Russian invasion and peaked at 20.78, the highest level in almost a month. Currently, it is back under 20.50.

Thursday’s panic across financial markets pushed USD/MXN to the highest in almost a month. When stocks started to recover, the pair trimmed gains and closed the day under 20.60. On Friday, the recovery of the Mexican peso continues, supported by the better tone across markets.

The USD/MXN bottomed at 20.37 and is it hovering around 20.45. It is far from the weekly top but still positive, about to post the first gain in four weeks. The short-term outlook looks biased to the upside, particularly if it rises back above 20.50. A slide under 20.30 would expose 20.25 and the February low at 20.15.

Wall Street indices are mixed, and European stocks are up 3% on average. Economic data from the US came in above expectations, helping risk sentiment and not the dollar. In Mexico, the data showed the economy stagnated in the fourth quarter after a 0.4% contraction in the third.

USD/MXN daily chart

-637813986630517777.png)

- DXY corrects lower and drops to 96.80.

- Markets’ mood improves on potential Russia-Ukraine talks.

- US PCE rose 6.1% YoY in January, Core PCE gained 5.2%.

The US Dollar Index (DXY), which tracks the greenback vs. a bundle of its main competitors, comes under pressure and slips back below the 97.00 yardstick on Friday.

US Dollar Index looks offered on auspicious news

The index gives away further ground following a tepid change in the markets’ mood after news reported a probable meeting between Russian and Ukrainian officials despite the relentless advance of Russian troops into the country.

The rebound in the appetite for riskier assets also see US yields leaving behind the earlier pessimism and now trading with modest gains for the day.

In the US calendar, inflation tracked by the headline PCE rose 6.1% YoY and 5.2% when excluding food and energy costs. Additional data noted Durable Goods Orders expanding 1.6% MoM in January, Personal Income coming in flat vs. the previous month and Personal Spending growing 2.1% MoM.

Later in the session, Pending Home Sales and the final print of the Consumer Sentiment are also due.

What to look for around USD

The appetite for safer assets continues to bolster the dollar and keeps the index on the positive footing on the back of the deterioration of the geopolitical scenario. The constructive view in the buck remains underpinned by the current elevated inflation narrative and the probability of a more aggressive start of the Fed’s normalization of its monetary conditions. In the longer run, recent hawkish messages from the BoE and the ECB carry the potential to undermine the expected move higher in the dollar in the next months.

Key events in the US this week: PCE, Durable Goods Orders, Personal Income/Spending, Pending Home Sales, Final Consumer Sentiment (Friday).

Eminent issues on the back boiler: Escalating geopolitical effervescence vs. Russia and China. Fed’s rate path this year. US-China trade conflict under the Biden administration.

US Dollar Index relevant levels

Now, the index is losing 0.30% at 96.75 and a break above 97.73 (2022 high Feb.24) would open the door to 97.80 (high Jun.30 2020) and finally 98.00 (round level). On the flip side, the next down barrier emerges at 96.03 (55-day SMA) followed by 95.67 (weekly low Feb.16) and then 95.17 (weekly low Feb.10).

European Central Bank President Christine Lagarde said on Friday that the central bank stands ready to take whatever action is needed to ensure price stability and financial stability in the Eurozone, reported Reuters. Lagarde said that it would be premature to assess the exact impact of the conflict in Ukraine just yet, but warned that the two main channels for the economy would be via prices and confidence. Uncertainty is likely to act as a drag on consumption and growth, she continued, adding that optionality and flexibility remain needed. We'll analyse on March 10 what to do next.

Market Reaction

The euro doesn't seem to have reacted to Lagarde's latest remarks.

- EUR/USD is trading in much calmer fashion this Friday near the 1.1200 level following Thursday’s massive 200 pip intra-day swing.

- Risk appetite has been on the front foot on Friday, helping push EUR/USD to session highs at 1.1230.

- As geopolitical uncertainty remains elevated and clouds the Fed/ECB policy outlook, EUR/USD may remain contained within 1.1100-1.1300 ranges.

Following Thursday’s extreme volatility that saw EUR/USD drop as much as 200 pips intra-day from above 1.1300 to multi-month lows near 1.1100 after FX markets were roiled by Russia’s decision to launch a full-scale invasion of Ukraine, trade has calmed. The pair has spent Friday’s session pivoting the 1.1200 level as FX market participants come to terms with the largest war in terms of scale in Europe since the end of the second world war. At present, the pair trades with gains of about 0.3% on the day in the 1.1220 area, having seen some strength in recent trade in tandem with improving risk appetite as Russia indicated it was ready for talks with Ukraine.

The Kremlin said it was ready to send a delegation to Minsk, which appears to have revived some minor hopes that a diplomatic solution could halt hostilities. Such hopes are likely unfounded against the backdrop of a further intensification of fighting in Ukraine, as Russian forces struggle to make progress against allegedly highly motivated Ukraine resistance. That suggests the scope for a lasting EUR/USD rebound may be limited for now, especially as the US and EU prepare further sanctions against Russia.

Russian President Vladimir Putin and Foreign Minister Lavrov will both see their European assets frozen in the EU, reports suggest, though for now, the Western response continues to be viewed as soft, given no sanctions yet target Russian energy exports. Another consideration for EUR/USD traders is the implication the war in Ukraine will have on the ECB and Fed policy outlook. So far the market’s view regarding the Fed is that a 50bps hike in March is now less likely. But there appears to be more confusion about how events will impact the ECB.

ECB Chief Economist Philip Lane outlined various scenarios in public remarks on Friday and in all he sees the conflict weakening Eurozone growth and pushing higher inflation. “It seems likely that the ECB will revise its inflation forecast upwards,” said one analyst, concluding that “we may still get an accelerated tapering, as long as the conflict stays within Ukraine”. For now, as uncertainty remains elevated on multiple fronts, EUR/USD may continue to trade within 1.1100-1.1300 ranges.

- USD/RUB stays well on the defensive on RUB gains.

- Geopolitical jitters mitigate on probable negotiation talks.

- US Core PCE rose more than expected in January.

The Russian currency keeps the bid bias unchanged so far on Friday and now drags USD/RUB further south of the 82.00 mark, just to bounce a tad afterwards.

USD/RUB weaker as risk mood improves

USD/RUB extended the corrective downside to the 81.70 zone following news of a probable meeting between Russian and Ukrainian delegations.

In the meantime, Russian troops have already moved into Kyiv, while Russian forces are cited attacking cities in the west of the country.

Meanwhile in Moscow, the MOEX index advances more than 20% and continues to trim part of Thursday’s acute drop and yields of the Russian 10y benchmark note surpasses the 13.00% mark, still below Thursday’s tops around 14.00%.

USD/RUB levels to watch

So far, the pair is losing 1.84% at 82.80 and faces the next hurdle at 86.43 (high Feb.25) followed by 90.00 (all-time high Feb.23) and then 100.00 (round level). On the downside, a breach of 80.41 (monthly high Jan.26) would aim for 76.18 (55-day SMA) and finally 74.25 (monthly low Feb.10).

GBP/USD steadies after taking a hammering this week. Economists at Scotiabank note that the broader balance of technical risks is tilted to the downside for the pound.

Firm resistance to gains between 1.3450/00

“Short-term trends suggest an intraday peak around 1.3440 now and we look for firm resistance to gains between 1.3450/00 in the coming days.”

“Support is 1.3290/00 ahead of a retest of the Dec lows at 1.3160/65.”

The UK Ministry of Defense said that Russia had so far made limited progress on Friday and that Ukrainian forces retain control over key cities, reported Reuters.

- Silver turned lower for the second successive day on Friday and dropped to $24.00.

- Sustained break below an ascending trend line will set the stage for further losses.

- Bullish oscillators on the daily chart warrant caution for aggressive bearish traders.

Silver struggled to capitalize on its intraday uptick, instead met with a fresh supply near mid-$24.00s on Friday and turned lower for the second successive day. The white metal remained on the defensive through the early North American session and was last seen trading just above the $24.00 mark.

Some follow-through selling below the aforementioned handle will confirm a bearish breakdown through an upward sloping trend-line extending from the $22.00 mark, or the monthly low. This will set the stage for an extension of the overnight sharp pullback from the highest level since August 2021.

That said, technical indicators on the daily chart - though have corrected from higher levels - are still holding comfortably in the bullish territory. This makes it prudent to wait for a convincing break through the ascending trend-line before placing aggressive bearish bets around the XAG/USD.

The next relevant support is pegged near the $23.70 region, below with the downward trajectory could get extended towards the $23.35 area. The XAG/USD could eventually drop below the $23.00 mark, towards the $22.85 support zone.

On the flip side, any meaningful bounce from current levels now seems to confront stiff resistance near the daily swing high, around the $24.50-$24.55 region. Sustained strength beyond will negate will reaffirm the ascending trend-line support and push the XAG/USD back towards the $25.00 mark.

Silver daily chart

-637813934991313986.png)

Technical levels to watch

- EUR/USD bounces off Thursday’s 2020 low near 1.1100.

- Near-term outlook remains negative below the 1.1350 zone.

EUR/USD trades on a better mood and regains the area further north of the 1.1200 barrier at the end of the week.

Thursday’s intense retracement dragged spot to new YTD lows just above of the 1.1100 mark. The pair remains under pressure and while capped by the 5-month resistance line, today near 1.1350, further losses should remain well on the cards. The breach of the 2022 low exposes an initial drop to the round levels at 1.1100 followed by 1.1000.

The negative outlook for EUR/USD is expected to remain unchanged while below the key 200-day SMA, today at 1.1618.

EUR/USD daily chart

Yesterday, Russia launched a full-scale invasion of Ukraine from multiple fronts. The crisis immediately plunged financial markets into risk-off mode. Strategists at ABN Amro focus on two key scenarios. They also offer an additional third, very negative scenario.

The price shock scenario (probability: 75%)

“Commodity prices continue their surge higher, and prices remain elevated for the foreseeable future until we see some moves to de-escalate the conflict. Price spikes will have macro-economic implications – primarily by pushing inflation higher, but with second-round effects likely dampening economic activity. With regards to monetary policy, while elevated inflation limits the scope for a significant easing of policy, the downside risks to growth make the risk even greater that the ECB will abort its planned end of asset purchases and rate hikes that we currently have in our base case for December.”

The supply shock scenario (probability: 20%)

“In addition to the price shock, physical supplies of gas are disrupted, perhaps as a counter-response to western sanctions. This depends naturally on just how severe western sanctions become. As well as even bigger gas price spikes, electricity markets would also see significant price surges as a spillover effect. As well as pushing inflation higher still, this would cause contractions in economic activity – i.e. we would essentially be facing a stagflation scenario. This would likely lead to the ECB stepping up asset purchases to stem spread widening.”

The severe supply shock scenario (probability: <5%)

“Western governments impose a ban on Russia’s use of the SWIFT payments system, causing major disruptions to all Russian commodity exports (i.e. not just gas, but also oil, metals and food). Alternatively, Russia itself imposes an export ban against Europe/the US. Either scenario would probably result in a global bottlenecks crisis. This would lead to even bigger shortages and price surges. For the global economy, we would expect the effects on growth (downward) and inflation (upward) to be intensified.”

- Headline and Core Durable Goods Orders rose at a faster than expected pace in January, with December figures also seeing positive revisions.

- This didn't seem to provoke a market reaction with focus more on geopolitics.

According to the latest release by the US Census Bureau, US Durable Goods Orders rose by 1.6% MoM in January compared to market expectations for a 0.8% rise in sales. That marked an acceleration versus December's 1.2% MoM pace of gain, which had seen a big revision higher from -0.7%. The more widely followed Core Durable Goods Orders growth rate was also stronger than expected at 0.7% MoM versus 0.4% consensus forecasts, with December's 0.9% MoM growth rate also being revised substantially higher from 0.6% previously.

Market Reaction

It does not seem as though FX or other markets have reacted to the latest tranche of US data, with focus much more on geopolitical developments for now.

- Core PCE inflation was a little higher than expected in January at 5.2% YoY.

- This didn't seem to provoke a market reaction with focus more on geopolitics.

Inflation in the US, as measured by the Core Personal Consumption Expenditures (PCE) Price Index, rose to 5.2% YoY in January, the US Bureau of Economic Analysis reported on Friday. That was above the median economist forecast for 5.1% and marked an acceleration on December's 4.9% reading. MoM, the Core PCE inflation rate was 0.6%, above the median forecast for a rate of 0.5%, and slightly above December's MoM inflation rate also of 0.5%.

Core PCE is the Fed's favoured gauge of underlying inflationary pressures in the US economy. The headlines PCE rate of inflation was 6.1% YoY and 0.6% MoM.

Market Reaction

It does not seem as though FX or other markets have reacted to the latest tranche of US data, with focus much more on geopolitical developments for now.

OPEC+ is likely to stick to its existing policy of increasing output quotas at a measured pace of 400K barrels per day each month at its upcoming meeting on March 2, despite the recent surge in prices following Russia's invasion of Ukraine, five sources told Reuters.

Market Reaction

Oil prices have not reacted to the latest reports. The main focus remains on whether the US and EU will target Russia with harsher sanctions that hit its energy sector and disrupt global energy supplies. At the moment, this seems unlikely, but as the fighting in Ukraine intensifies, public pressure may well build on governments to do more to deter Russian aggression. Sanctions on Russian exports remain a key upside risk for crude oil markets.

- USD/CAD witnessed some selling on Friday and retreated further from the two-month high.

- The set-up still favours bullish trades and supports prospects for the emergence of dip-buying.

- A subsequent decline could find decent support near the 1.2725-20 area and remain limited.

The USD witnessed some selling heading into the early North American session and dragged the USD/CAD pair to a fresh daily low, around the 1.2765 region in the last hour.

The global risk sentiment got a minor lift amid reports that Russia is reportedly ready to send a delegation to Minsk for talks with Ukraine. This, in turn, dented the greenback's safe-haven status and exerted some downward pressure on the USD/CAD pair.

The downside, however, remained limited, at least for now, amid subdued price moves around crude oil prices, which failed to provide any meaningful boost to the commodity-linked loonie. This, in turn, warrants some caution for aggressive bearish traders.

From a technical perspective, the overnight sharp move up to the two-month high confirmed a near-term bullish breakout through a four-week-old trading range. This, along with the fact that technical indicators on the daily chart have just started gaining positive traction, supports prospects for the emergence of some dip-buying around the USD/CAD pair.

Hence, any subsequent decline towards the 1.2730-1.2725 region could still be seen as an opportunity to initiate fresh bullish positions and remain limited near the 1.2700 mark. The next relevant support is pegged near the lower end of the aforementioned trading range, around mid-1.2600s, which should act as a strong near-term base for the USD/CAD pair.

On the flip side, the 1.2800-1.2810 region now seems to act as an immediate resistance. Sustained strength beyond Some follow-through buying beyond the 1.2825-1.2830 area has the potential to push the USD/CAD pair back towards the overnight swing high, around the 1.2875-1.2880 zone. The momentum could further get extended towards reclaiming the 1.2900 mark.

USD/CAD daily chart

-637813921236394964.png)

Technical levels to watch

- DXY comes under some pressure around the 97.00 level.

- Further upside could retest the 2022 high at 97.73.

DXY fades Thursday’s climb to new cycle tops in the 97.70/75 band and returns to the 97.00 neighbourhood at the end of the week.

Bets for the continuation of the upside remain on the rise in the near term, with the next barrier at the 2022 high at 97.73 (February 24) just ahead of the 97.80 level (June 30 2020 high).

The short-term constructive stance remains supported by the 5-month line, today near 95.50, while the outlook for the dollar is seen as positive above the 200-day SMA at 93.89 in the longer run.

DXY daily chart

Russia is reportedly ready to send a delegation to Minsk for talks with Ukraine, reported Russia's state-controlled RIA. Any such Russian delegation could comprise of defense and foreign ministry officials, RIA reported citing the Kremlin. The Kremlin reportedly added that it considers Ukraine's "demilitarisation" a critical part of Ukraine's neutrality.

- Gold traders are taking a breather on Friday after Thursday’s big moves, with prices near flat in the $1900 area.

- Focus remains on the Russia/Ukraine war as fighting intensifies and the West mulls further sanctions.

- Upcoming US data will also be closely watched for any implications for Fed tightening expectations.

Even as the fighting between Russian and Ukrainian military forces all across Ukraine intensifies, market participants appear to be taking somewhat of a breather on Friday after an exhaustive last few days of extreme volatility. That seems to be the case in spot gold (XAU/USD) markets, anyway, with prices currently trading just above the $1900 level and near the mid-point of Friday’s $1890-$1920ish ranges so far. That compares to Thursday’s near $100 intra-day swing from highs to lows after XAU/USD pulled back abruptly from multi-month highs in the $1970s to sub-$1880 lows.

Upcoming US Core PCE inflation data for January might stir things up a little if it surprises to the upside and challenges the recent shift in the market’s view towards the March Fed meeting. In wake of the rise of geopolitical uncertainty in Europe and subsequently cautious commentary from some Fed policymakers on Thursday, markets have taken the view that a 50bps rate hike next month is very unlikely. However, influential Fed Board of Governors member Christopher Waller said on Friday that he wanted to see 100bps of tightening by the middle of the year (endorsing James Bullard’s view) and that there is a strong case for a 50bps March hike.

Even if hot US inflation does restoke Fed tightening bets somewhat, thus perhaps exerting putting upside pressure on US yields and on the US dollar, gold seems likely to continue to be supported by geopolitical risk premia for now. Goldman Sachs said on Friday that the gold rally has much further to go and that if demand for gold ETFs picks up sufficiently, prices could hit fresh record highs in the $2300s.

The EU is planning to freeze the assets of Russian President Vladimir Putin and Foreign Minister Sergey Lavrov under a sanctions package expected to be pushed through this Friday, the FT reported citing people familiar with the matter. EU Foreign Ministers are planning to approve the sanctions this afternoon, the FT reported, alongside additional measures against Russian banks and industry. The report noted, however, that Putin and Lavrov would not be subject to a travel ban, which the FT said underlines the EU's willingness to keep symbolic diplomatic possibilities open.

- AUD/USD caught fresh bids on Friday and built on the overnight bounce from the two-week low.

- The Russia-Ukraine crisis underpinned the safe-haven USD and capped the perceived riskier aussie.

- The focus will remain on the outcome of the NATO summit and the incoming geopolitical headlines.

The AUD/USD pair maintained its strong bid tone heading into the North American session and was last seen trading near the daily high, just above the 0.7200 mark.

The pair regained positive traction on the last day of the week amid some technical buying following the overnight strong rebound from the 0.7100-0.7090 static support. Apart from this, the uptick lacked any obvious fundamental catalyst and remained capped amid the worsening situation in Ukraine, which acted as a tailwind for the US dollar.

In the latest development, Ukrainian media reported Russian forces have entered the Obolon district, which is approximately 10 km from Kyiv - the capital city. Adding to this, calls to disconnect Russia from the so-called SWIFT global payment system kept investors on the edge and extended support to safe-haven assets, including the buck.

Meanwhile, Russia's Foreign Minister Sergei Lavrov said that they want the Ukrainian people to be independent and have the possibility to freely define their destiny. Lavrov further added that Russia will ensure the demilitarisation of Ukraine but sees no possibility of recognising the current Ukrainian government as democratic.

Lavrov also said that Ukrainian President Volodymyr Zelenskiy was lying that he was ready to discuss the neutral status of Ukraine. This dashed hopes for a ceasefire and continued weighing on investors' sentiment, which was evident from the prevalent cautious mood around the equity markets and warrants caution for bullish traders.

Investors now look forward to the outcome of an extraordinary virtual summit of NATO Heads of State and Government. Apart from this, the incoming headlines surrounding the Russia-Ukraine saga will influence the broader market risk sentiment, which, in turn, will influence the USD demand and provide some impetus to the AUD/USD pair.

Technical levels to watch

The Mayor of Kyiv Vitali Klitscho on Friday said that the city had entered into a defensive phase, according to Reuters. Russian press citing Russia's Defense Ministry subsequently reported that the Russian military has blocked off the city of Kyiv from the West. The Russian Defense Ministry reiterated its statement that it will not strike residential areas of Kyiv.

- USD/CHF turned positive for the second straight day amid renewed USD buying interest.

- The Russia-Ukraine war benefitted the greenback’s status as the global reserve currency.

- Friday’s US macro releases might do little to influence or provide any impetus to the pair.

The USD/CHF pair held on to its modest intraday gains through the mid-European session and was last seen trading near the daily high, around the 0.9260 region.

Following the overnight pullback from the two-week high, the USD/CHF pair attracted fresh buying near the 0.9240-0.9235 region on Friday and was supported by reviving US dollar demand. The market sentiment remains jittery amid worries about the worsening situation in Ukraine. This, in turn, continued benefitting the greenback's status as the global reserve currency and acted as a tailwind for the major.

In the latest development, Ukrainian media reported Russian forces have entered the Obolon district, which is approximately 10 km from Kyiv - the capital city. Adding to this, gunfire was heard in Kyiv’s historic city centre. There were also mentions of Russian air missiles being spotted in the north of Kyiv. This, along with calls to disconnect Russia from the so-called SWIFT global payment system, kept investors on the edge.

This was seen as a key factor that pushed the USD/CHF pair into the positive territory for the second successive day - also the third in the previous four. Despite the intraday positive move of nearly 40 pips, spot prices remain well below the overnight swing high, warranting some caution before placing aggressive bullish bets. Nevertheless, the incoming geopolitical headlines will continue to play a key role in driving the pair.

Friday's economic docket highlights the release of the Fed's preferred inflation gauge - the Core PCE Price Index - and Durable Goods Orders, due during the early North American session. The data, however, might do little to influence the USD price dynamics or provide any meaningful impetus to the USD/CHF pair. Hence, the market focus will remain glued to fresh developments surrounding the Russia-Ukraine saga.

Technical levels to watch

- EUR/JPY remains well under pressure around 129.00.

- Next on the downside emerges the 2022 low at 127.90.

EUR/JPY extends the weekly bearishness and revisits the 128.70 region, where some initial contention has emerged so far.

Further losses in EUR/JPY remains well in the pipeline in light of the recent price action and following the risk aversion scenario. That said, a deeper pullback could initially visit the 2022 low at 127.91 (February 24) followed by the December 2021 low in the mid-127.00s (December 20).

Further downside in the cross is likely below the 2-month line near 128.90. On the longer term, the outlook for the cross is seen as negative while below the 200-day SMA, today at 130.34.

EUR/JPY daily chart

Bank of England policymaker Catherine Mann said on Friday that there is very little in the data that shows a reduction in inflation expectations, except in the gilt market, as reported by Reuters.

Additional takeaways

"MPC had differences over how to assess whether the economy had recovered from COVID."

"MPC also differed on weight to put on the level of employment versus participation rates, how to assess inflation expectations."

"It would be dangerous to conclude that covid has led to permanent changes in UK labour force."

"Rise in energy prices has been a surprise to central banks, geopolitical issues at play."

"Much of UK goods price inflation has come from abroad, not something boe could predict."

"QE has created a lot of liquidity, not had a big impact on the real economy."

"QE has increasingly been absorbed by the financial sector, not transmitted on to the real economy."

"If inflation dynamics of 2021 are repeated in 2022, inflation will exceed boe forecasts."

"I want to emphasise my focus on inflation expectations."

Market reaction

The GBP/USD pair largely ignored these comments and was last seen posting small daily gains at 1.3385.

Ukrainian President Volodymyr Zelenskyy said on Friday that Europe can still stop the Russian aggression against Ukraine if it acts swiftly, as reported by Reuters.

Additional takeaways

"Russian assault is like a repeat of World War Two."

"Europe is slow to help Ukraine while Russian tanks attack people."

"Calling on European citizens to protest to force their governments to more decisive action."

Market reaction

Markets remain relatively quiet following these remarks. As of writing, the EUR/USD pair was down 0.13% on a daily basis at 1.1175.

European Central Bank chief economist Philip Lane told policymakers on Friday that the Russia-Ukraine was could shave 0.3%-0.4% off the eurozone GDP in the middle scenario, Reuters reported, citing people familiar with the matter.

Additional takeaways

"Presented severe scenario where GDP is cut by close to 1%."

"The mild scenario showed no impact, now seen as unlikely."

"These were 'back-of-envelope' preliminary calculations, mostly derived from commodity prices."

Told meeting there would be a significant increase to 2022 inflation forecast."

"Hinted at inflation below target at end of horizon."

Market action

The shared currency stays on the back foot on Friday and the EUR/USD pair was last seen losing 0.17% on a daily basis at 1.1172.

Economist at UOB Group Ho Woei Chen, CFA, reviews the latest interest rate decision by the BoK.

Key Takeaways

“In line with market consensus, the Bank of Korea (BOK) kept its benchmark base rate unchanged at 1.25% at its Feb meeting.”

“The BOK officially raised its 2022 inflation forecast to 3.1% from 2.0% after warning in Jan that inflation could exceed the path projected in Nov 2021. The sharply higher inflation outlook underpins expectation that the BOK will resume its rate normalisation in Apr/May.”

“After three rate hikes, we think the BOK can afford to wait and see how other global central banks respond to the Russia-Ukraine crisis and the impact on already high energy prices while also assessing the risks from record high COVID-19 infections at home. Nevertheless, based on expectation of a higher inflation trajectory this year, we maintain our forecast for another 50 bps interest rate hike, likely with 25 bps each in 2Q and 3Q to bring the base rate to 1.75% by end-2022.”

Russia's Foreign Minister Sergei Lavrov claimed on Friday that Ukrainian President Zelenskyy was lying when he said he was ready to discuss the neutral status of Ukraine, Reuters reported, citing Interfax news agency.

Additional takeaways

"Russia does not see the possibility to recognise the current government in Ukraine as democratic."

"No one is planning to occupy Ukraine."

"Russia wants Ukrainian people to be independent."

"Russia will ensure demilitarisation of Ukraine."

Market reaction

Investors remain cautious following these remarks and the US Dollar Index stays in the positive territory above 97.00.

EUR/CHF tentatively violated the low of January forming a daily hammer at 1.0279. Economists at Société Générale expect the pair to bounce towards the 76.4% retracement of recent pullback at 1.0530.

EUR/CHF forms a daily hammer

“The daily hammer pattern denotes downside momentum has got arrested.”

“A bounce is likely, however, 1.0530, the 76.4% retracement of recent pullback should cap.”

“Next downside projections are at 1.0265 and 1.0160.”

Gold price climbed for a time to $1,975 on the back of the escalating Russia-Ukraine conflict, putting it at its highest level since September 2020. If the situation worsens, the yellow metal would see renewed upside pressure, strategists at Commerzbank report.

Gold profits from falling bond yields and slump on stock markets

“Gold is in considerable demand as a safe haven in the current environment, as also evidenced by further ETF inflows. In addition, gold has been profiting from falling bond yields and a slump on many stock markets – both of which indicate high-risk aversion among market participants.”

“We believe it possible that the gold price will see a renewed upswing in the next few days – especially if the situation in Ukraine escalates any further.”

See – Gold Price Forecast: XAU/USD to push higher towards $2,000 protracted escalation in Ukraine – UBS

- GBP/JPY turned lower for the third successive day amid reviving demand for the safe-haven JPY.

- Escalating Russia-Ukraine conflict kept investors on the edge and benefitted safe-haven assets.

- Modest USD strength weighed on the GBP, which further contributed to the intraday selling bias.

The GBP/JPY cross witnessed some selling during the first half of the European session and dropped to a fresh daily low, around the 154.15 region in the last hour.

The cross gained some positive traction during the early part of the trading on Friday, albeit struggled to capitalize on the move and met with a fresh supply near the 154.80 region. The worsening situation in Ukraine continued weighing on investors' sentiment, which, in turn, benefitted the safe-haven Japanese yen and acted as a headwind for the GBP/JPY cross.

In the latest developments, reports indicated that Russian forces have entered the Obolon district in Kyiv. According to the Kyiv Independent, the Ukrainian military is fighting off the Russian troops and there are also mentions of Russian air missiles spotted in north of Kyiv. Adding to this, calls to disconnect Russia from the SWIFT kept investors on the edge.

How is Russian-Ukraine war impacting financial markets? Follow our live coverage updates!

Meanwhile, reviving safe-haven demand underpinned the US dollar and attracted fresh selling around the British pound. This was seen as another factor that dragged the GBP/JPY cross into the negative territory for the third successive day. A subsequent slide below the 154.00 round figure will set the stage for a slide towards challenging the 200-day SMA support.

Nevertheless, the GBP/JPY cross seems all set to post heavy weekly losses and remains at the mercy of the incoming geopolitical headlines. Hence, the focus will be on the outcome of the NATO summit, which might influence the broader market risk sentiment. This, in turn, would drive demand for the safe-haven JPY and provide some meaningful impetus to the GBP/JPY cross.

Technical levels to watch

USD/INR is once again challenging the graphical hurdle of 75.70. Above here, the pair will target December levels of 76.40, economists at Société Générale report.

75.70 is next resistance

“The 75.70 resistance must be overcome for denoting extension in the bounce towards December levels of 76.40.”

“The 200-DMA at 74.30 is near-term support.”

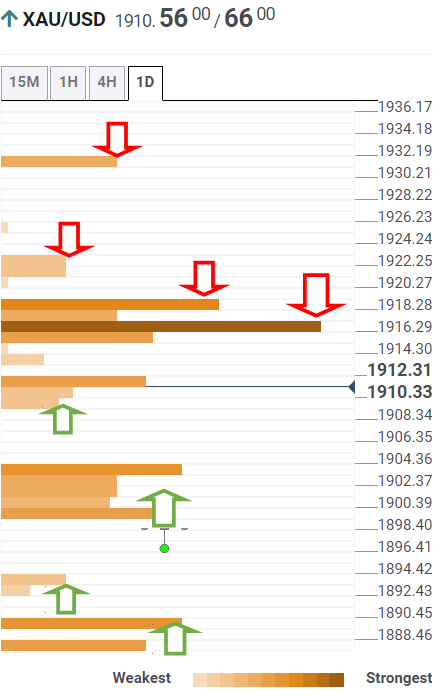

- Gold price remains bid amid mounting Russia-Ukraine tensions.

- Risk-aversion returns as Russia closes in on Kyiv, US-NATO meeting eyed.

- Gold Price Forecast: A win-win amid Russia-Ukraine war, inflation woes, $2000 still eyed?

Gold price braces for yet another turbulent day, with volatility to remain through the roof amid incoming updates on the Russia-Ukraine war. Russia is reportedly ready for taking control of Kyiv, the capital of Ukraine, with the ground forces closing in. Further, Moscow is preparing retaliatory sanctions against the West. Against this backdrop, gold price will continue to remain at the mercy of the risk sentiment driven by the Russia-Ukraine geopolitical developments.

Read: Markets quake on Russian invasion of Ukraine but quickly discover Realpolitik

Gold Price: Key levels to watch

The Technical Confluences Detector shows that gold price needs to recapture the $1,917 critical hurdle on a sustained basis to resume the uptrend.

That level is the convergence of the Fibonacci 38.2% one-day and pivot point one-month R3.

Gold bulls will then face an immediate barrier at $1,920, which is the pivot point one-week R1.

Acceptance above the latter will trigger a fresh upswing towards $1,931, the Bollinger Band one-day Upper.

Ahead of that the SMA10 four-hour at $1,921 could challenge the renewed upside.

On the downside, the immediate cap is seen at $1,908, the SMA5 four-hour, below which a dense cluster of healthy support levels between $1,902-$1,900 will come into play.

Further down, the SMA50 four-hour at $1,892 will get probed, as bears flex their muscles towards the Fibonacci 23.6% one-week at $1,890.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

GBP/USD fell to its lowest level since late December at 1.3271 on Thursday. While above 1.3250, cable is expected to enjoy a rebound towards 1.3565 and the recent peak of 1.3644, economists at Société Générale report.

Bounce expected

“Projections at 1.3250 is first support. Defending this can lead to a bounce towards 1.3565 and recent peak of 1.3644.”

“December low of 1.3160/1.3130 is crucial support.”

The Russian ruble faces depreciation pressure and the Russian central bank has started interventions in the foreign exchange market. Analysts at Nordea think the pair could climb even beyond the 100 level.

Russian central bank to intervene in the FX market

“We expect the ruble to face depreciation pressure in the coming weeks, while the central bank will keep intervening in the FX markets.”

“Earlier, we estimated that in a ‘clear escalation’ scenario EUR/RUB could stabilise at a level around 95 after the initial shock. The current situation is worse than we assumed in our scenario, and as a result, EUR/RUB is expected to climb towards 100 and even above that but the uncertainty is extremely high.”

GBP/USD has lost its recovery momentum in the early European session. Sellers are likely to retain control unless the market mood improves ahead of the weekend, FXStreet’s Eren Sengezer reports.

GBP/USD to stay on the back foot

“A significant positive shift risk sentiment is unlikely to be witnessed in the short-term and GBP/USD recovery attempts should remain as technical corrections.”

“Static support seems to have formed at 1.3360. In case buyers give up on this level, GBP/USD could extend its slide toward 1.3300 (psychological level) and 1.3280 (static level, multi-month low).”

“On the upside, cable could extend its recovery if it manages to rise above 1.3420 (static level) and start using it as support. In that case, 1.3500 (psychological level) aligns as the next bullish target.”

EUR/USD remains offered and breaks below 1.1200. Economists at Société Générale expect the pair to suffer additional losses on a break under 1.1120.

Descending trend line at 1.1330/1.1345 to cap bounces

“A bounce is not ruled out, however, a descending trend line at 1.1330/1.1345 could cap. Crossing this would be essential for a retest of 1.1485.”

“In the event 1.1120 gets violated, there would be a risk of next leg of downtrend towards projections of 1.1080/1.1040.”

- USD/CAD attracted some dip-buying on Friday amid renewed USD strength.

- An escalation in the Russia-Ukraine conflict benefitted the safe-haven USD.

- A pullback in oil prices undermined the loonie and further extended support.

The USD/CAD pair reversed intraday losses and climbed to the top end of its daily trading range, back above the 1.2800 mark during the early part of the European session.

Following the overnight pullback from the two-month high and an early downtick on Friday, the USD/CAD pair attracted fresh buying near the 1.2770 region and was supported by renewed US dollar strength. The worsening situation in Ukraine. This was seen as a key factor that continued acting as a tailwind for the safe-haven greenback and assisted the pair to regain some traction.

In the latest developments, reports indicated that Russian forces have entered the Obolon district in Kyiv. According to the Kyiv Independent, the Ukrainian military is fighting off the Russian troops and there are also mentions of Russian air missiles spotted in north of Kyiv. This, in turn, kept investors on the edge and kept a lid on the early optimistic move in the markets.

Apart from this, the intraday pullback in crude oil prices undermined the commodity-linked loonie and provided modest lift to the USD/CAD pair. The intraday uptick, however, lacked follow-through buying hopes for a likely Russia-Ukraine ceasefire. Hence, the market focus will remain on the outcome of the NATO summit and fresh developments surrounding the Russia-Ukraine saga.

Friday's US economic docket highlights the release of the Fed's preferred inflation gauge - the Core PCE Price Index - and Durable Goods Orders, due later during the early North American session. The data, however, might do little to influence the USD or provide any meaningful impetus, leaving the USD/CAD pair at the mercy of the incoming geopolitical headlines.

Technical levels to watch

- EUR/USD adds to recent losses in the sub-1.1200 area.

- The dollar remains strong and weighs on the pair.

- ECB Lagarde, US PCE next of importance in the calendar.

Sellers remain in control of the shared currency and drag EUR/USD back below 1.1200 the figure at the end of the week.

EUR/USD looks to Russia-Ukraine

EUR/USD is down for the third session in a row on Friday, always on the back of the solid demand for the greenback, which remains in turn underpinned by the persistent risk aversion.

Indeed, investors keep favouring the “flight-to-safety” sentiment at the end of the week against the backdrop of further deterioration in the Russia-Ukraine front.

The move lower in spot came in tandem with renewed weakness in yields of the key 10y German Bund, now gyrating around the 0.16% area as the demand for bonds remain firm.

In the domestic docket, final Germany GDP Growth Rate showed the economy expanded 1.8% YoY in Q4 and contracted 0.3% inter-quarter. In addition, ECB’s M3 Money Supply expanded 6.4% in the year to January. Later in the session, the final EMU Consumer Confidence is due ahead of the speech by ECB’s Lagarde.

Across the pond, PCE and Core PCE are due followed by Durable Goods Orders, Personal Income/Spending and the final Consumer Sentiment gauge.

What to look for around EUR

EUR/USD continues to look to the geopolitical scenario and risk appetite trends for near-term direction. On this, the recent deterioration of the Russia-Ukraine front is expected to keep the pair under pressure amidst solid risk-off sentiment and demand for the greenback. In the meantime, bouts of strength in the pair should remain underpinned by speculation of a potential interest rate hike by the ECB probably sooner than many anticipate, higher German yields, persevering elevated inflation and a decent pace of the economic activity and auspicious results from key fundamentals in the region. The threat to this view, as usual, comes from the Fed and a potential tighter-than-expected start of the normalization of its monetary conditions.

Key events in the euro area this week: Eurogroup Meeting, Germany Final Q4 GDP, EMU Final Consumer Confidence, ECB Lagarde (Friday).

Eminent issues on the back boiler: Asymmetric economic recovery post-pandemic in the euro area. Speculation of ECB tightening/tapering later in the year. Presidential elections in France in April. Geopolitical concerns from the Russia-Ukraine conflict.

EUR/USD levels to watch

So far, spot is losing 0.14% at 1.1175 and faces the next up barrier at 1.1323 (55-day SMA) followed by 1.1390 (weekly high Feb.21) and finally 1.1395 (weekly high Feb.16). On the other hand, a drop below 1.1106 (2022 low Feb.24) would target 1.1100 (round level) en route to 1.1000 (round level).

Russian Foreign Ministry said in a statement, the country’s Foreign Minister Sergei Lavrov will hold talks with officials from the self-proclaimed Donetsk and Luhansk republics of eastern Ukraine on Friday.

Key takeaways

“Both sides are likely to discuss Russian military operations in Ukraine, as well as the opening of the embassies of the Donetsk People's Republic and the Luhansk People's Republic in Moscow.“

“They will also discuss the opening of Russian diplomatic outposts in the two regions.”

Russian President Vladimir Putin signed decrees on Monday to recognize the two breakaway regions as independent states before ordering a full-blown invasion of Ukraine.

Related reads