- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 24-11-2021

- EUR/CAD slides for the fifth day in a row, amid high oil prices.

- Eurozone coronavirus woes and reimposing of restrictions threatens to derail the EU economic growth.

- EUR/CAD: Bears eye the 1.4100 figure as Eurozone economic and health conditions deteriorate.

The EUR/CAD slides for the fifth consecutive day, barely down some 0.01% trading at 1.4185, during the day at the time of writing. Market sentiment is a mixed bag, as Asian equity futures fluctuate between gainers and losers. In the FX market, risk-sensitive currencies fall, except for the Canadian dollar, underpinned by elevated crude oil prices.

The US crude oil benchmark, the Western Texas Intermediate (WTI), climbs 0.13%, trading at $78.16, after the US and its Asian allies tap oil from the SPR reserves, as the White House tries to stabilize rising gasoline prices throughout the country.

On Wednesday, during the overnight session, the EUR/CAD reached a daily high of around 1.4269. However, rising coronavirus cases throughout the northern hemisphere in Europe as the winter season approaches weighed on the shared currency, as the pair plummeted towards a new year-to-date new low at 1.4162. Countries like Austria -imposing a 20-day lockdown-, France, and Germany, are studying making vaccines mandatory.

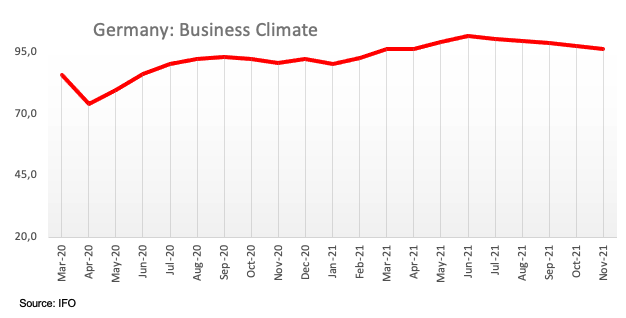

Also, the Eurozone economic docket witnessed the fall of Germany’s IFO survey, which showed that the Business Climate shrank to 96.5, falling for the fifth month in a row.

EUR/CAD Price Forecast: Technical outlook

The EUR/CAD has a bearish bias in the daily chart, as depicted by the daily moving averages (DMA’s) with a downward slope, residing above the spot price. Also, the Relative Strength Index (RSI), a momentum indicator, is at 34, below the 50-central line, aiming lower, confirming the bearish bias.

In the outcome of a downtrend continuation, the first support would be the 1.4100 figure. A breach of that level would expose crucial long-term support levels, like the April 2020 swing low around 1.4052, followed by the February 2017 swing low around 1.3783.

- GBP/USD stays pressured around yearly low after four-day downtrend.

- Bearish MACD signals, sustained trading below September 2020 peak favor sellers.

- 100-week SMA, four-month-old support line offers a tough nut to crack for the bears.

GBP/USD grinds lower around the yearly bottom surrounding 1.3320 amid the initial Asian session on Thursday, after declining for consecutive four days.

Given the cable pair’s failures to rebound following the downside break of the September 2020 high, coupled with the bearish MACD signals, sellers are likely to keep the reins.

However, a convergence of the 100-week SMA and a descending trend line from late July, around 1.3290-75 appears a major challenge for the pair bears.

Even if the quote drops past 1.3275, the 200-week SMA and 38.2% Fibonacci retracement (Fibo.) of March 2020 to June 2021 upside, near 1.3165-60, will act as an additional puzzle for the GBP/USD sellers to solve.

Meanwhile, corrective pullback remains elusive until crossing September 2020 top of 1.3482.

Adding to the upside filters is the 23.6% Fibo. level near 1.3580 and a monthly high surrounding 1.3700.

GBP/USD: Weekly chart

Trend: Limited downside expected

- AUD/USD remains sidelined after dropping to the lowest levels since late September.

- Aussie data improved, virus fears recede at home but mostly firmer US data, covid woes from Eurozone favor bears.

- Fed Minutes, Fed’s Daly also highlights rate hike calls to weigh on the pair.

- US holiday, light calendar in Asia hint at a sluggish session but virus, inflation headlines keep driver’s seat.

AUD/USD seesaws near 0.7200 amid early Thursday morning in Asia, following a south-run to refresh an eight-week low with 0.7183 figure the previous day.

The Aussie pair portrays the market’s sour sentiment amid escalating price pressure and fresh concerns over the return of the coronavirus-led lockdowns. In doing so, the quote ignores mildly positive fundamentals at home amid the Reserve Bank of Australia’s (RBA) repeated rejection to rate hikes.

With a 30-year high of the Fed’s preferred inflation gauge, namely Core PCE Price Index, joining welcome prints of Weekly Jobless Claims, the Fed policymakers’ concerns over tapering and rate hike seems justified, as reflected by the recent FOMC Minutes. Also highlighting the inflation fears and a push for the Fed rate hike were the recent comments from Federal Reserve Bank of San Francisco President and FOMC member Mary Daly who sees, per Reuters, the case for speeding up the QE taper and expects rate hikes at end of 2022.

Other than the fears of the Fed rate hike, worsening COVID-19 conditions in the bloc also weigh on the AUD/USD prices, due to its risk barometer status. After Austria and the Netherlands, record-high cases in Germany triggered multiple warnings to recall the lockdowns from the region.

At home, Construction Work Done during the Q3 improved from -3.1% expected to -0.3%, versus upwardly revised 2.2% previous readouts. Additionally, new daily infections in Australia remain sidelined around 1,500 since last month, helping the Pacific major to announce the easing of the virus-led activity restrictions.

Amid these plays, the US 10-year Treasury yields ease 2.2 basis points (bps) to 1.64% after refreshing monthly high. Even so, the US Dollar Index (DXY) remains firm around the 16-month top while the equities trade mixed of late.

Looking forward, the Thanksgiving Day holiday in the US and an absence of major data/events at home can restrict AUD/USD moves, suggesting a corrective pullback in case of surprise positives. However, bears are likely to keep the reins considering the latest challenges to market sentiment and favors for the Fed rate hike.

Technical analysis

With a daily closing below 78.6% % Fibonacci retracement (Fibo.) of August-October upside, AUD/USD bears are ready to challenge September’s monthly bottom of 0.7169, as well as support line of a month-long falling wedge bullish formation near 0.7165. However, oversold RSI conditions could restrict the quote’s further weakness. On the contrary, the stated wedge’s resistance line around 0.7270 guards the immediate upside of the pair.

Early Thursday morning in Asia, Canadian Finance Minister (FinMin) Chrystia Freeland crossed wires via Reuters.

The policymaker said she will provide some type of fiscal update this fall. “Will have more details in the coming days,” adds Freeland.

While speaking on inflation, Canada's Freeland said, "Global forces are responsible for rising inflation, we cannot look for a made-in-Canada solution."

FX implications

As the covid fears renew, hopes of additional stimulus from Canada could help the USD/CAD prices following the news. That said, broadly strong US dollar, backed by inflation and coronavirus fears, helps the Loonie pair to pause the two-day pullback from the highest levels since September by the press time.

Read: USD/CAD retreats from daily tops around 1.2700 after FOMC minutes

- NZD/JPY bears remain on the lookout for an optimal entry to the downside to targeting 79 the figure.

- Corrections could be the first port of call as markets over into consolidation.

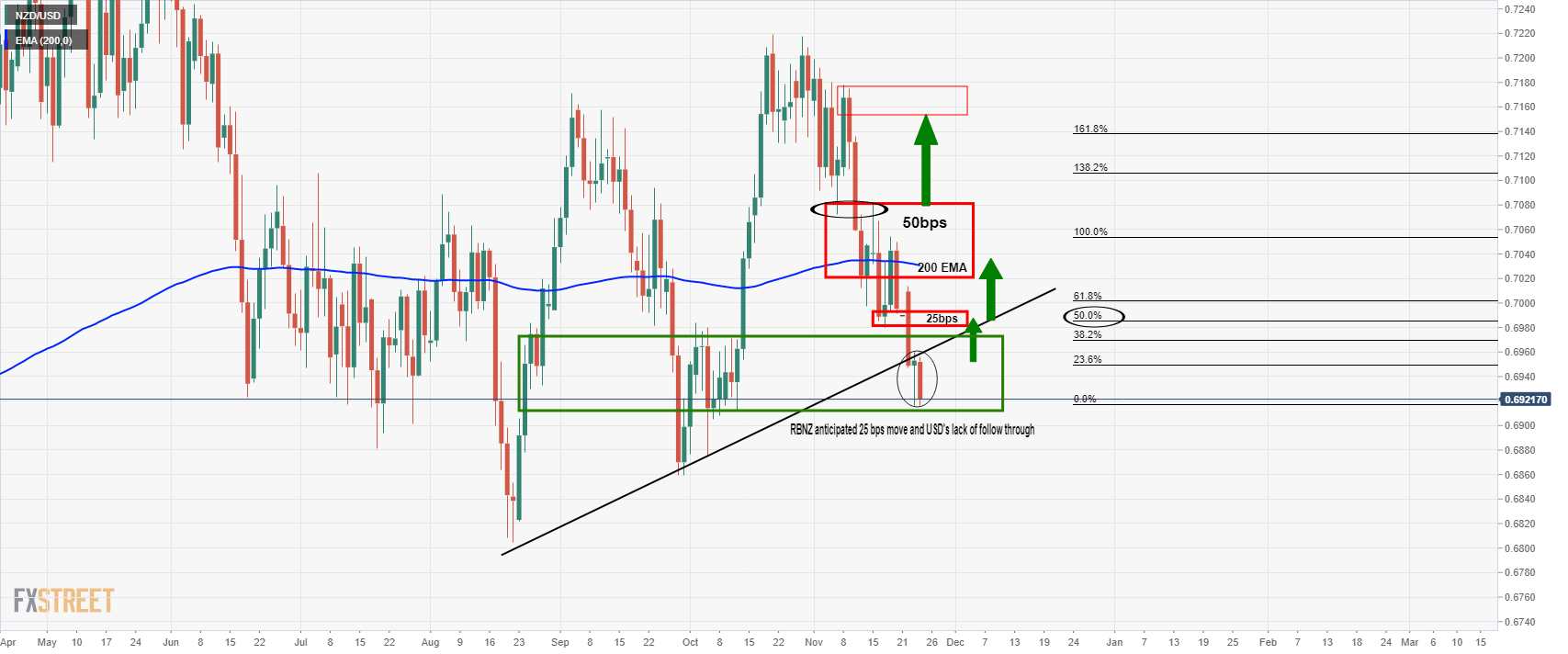

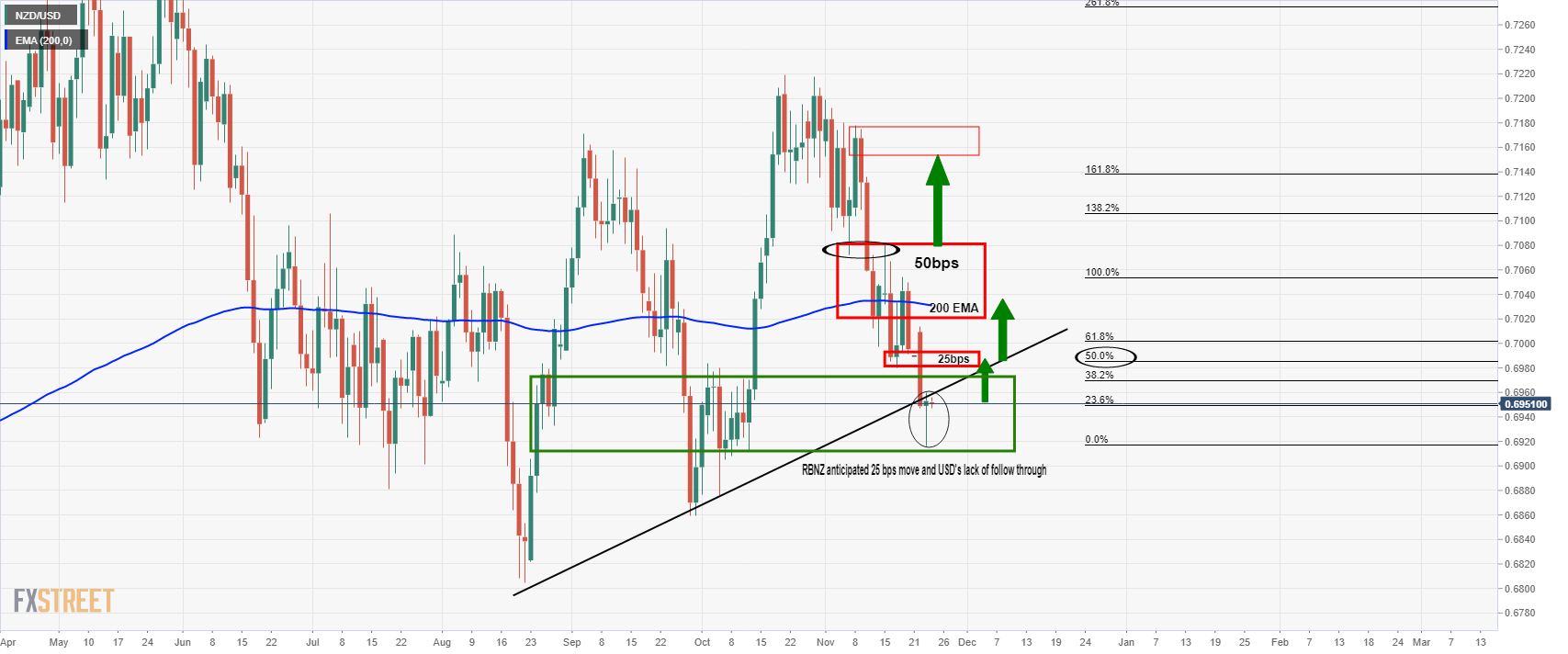

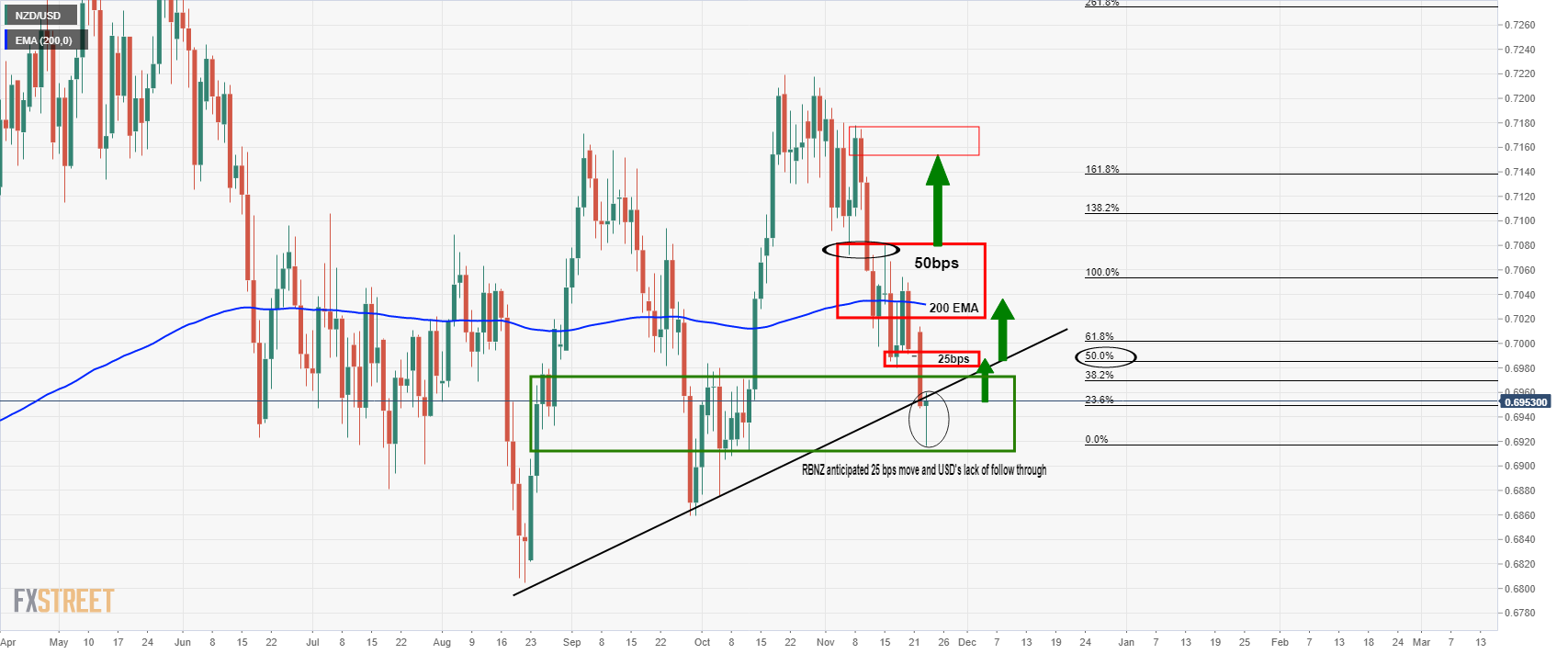

The bears were at it overnight and dishevelled the cross all the way towards a 61.85 Fibonacci retracement area on the daily chart. This was an outcome of the Reserve Bank of New Zealand meeting that disappointed the bulls that were in anticipation of a 50bs rate hike. Instead, the central bank delivered a 25bp hike and the kiwi subsequently collapsed.

The following was the prior analysis before the event that is followed by the aftermath and the prospects for a continuation to the downside in both NZDPY and NZD/USD, but not for a correction.

NZD/JPY daily chart, prior analysis

As illustrated, the price was on the cups of a continuation towards the horizontal support near 79 the figure.

There is still some way to go yet, but the foundations have been laid as the price well and truly breaks down the barriers of the 50% mean reversion area near 79.60. However, we now move into a quiet spell given the US holiday-thin markets.

A period of consolidation that could well lead to a positive correction in the kiwi would likely see the cross move in on the 79.80s being the old closes of the prior candles:

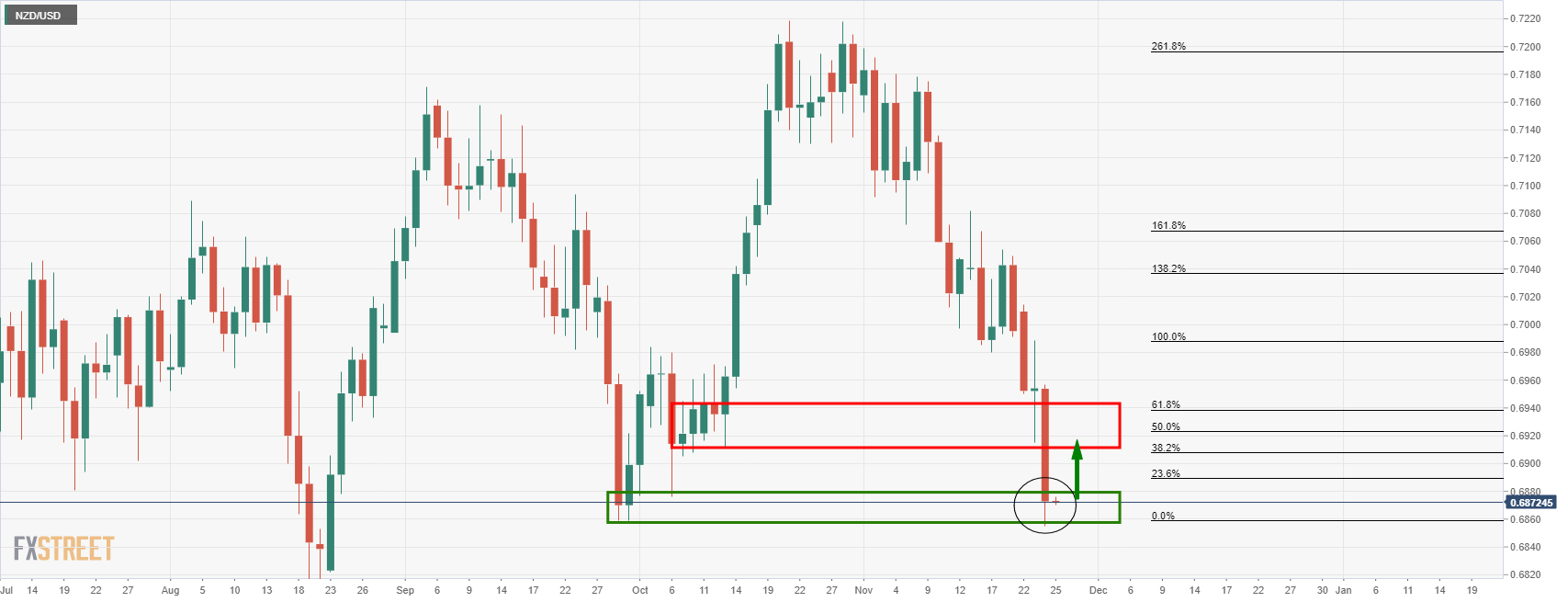

However, that is not to say the price cannot continue lower before such a considerable correction. But looking to the NZD/USD chart, the kiwi does look to be oversold and too in need of a correction:

- AUD/JPY saw subdued trade amid a lack of Australia/Japan-related fundamental developments and remains close to its 50DMA at 82.94.

- The pair may be on the cusp of breaking to the north of a medium-term bearish trend channel.

AUD/JPY spent most of Wednesday’s trading session consolidating close to its 50-day moving average, which currently resides just to the south of the 83.00 level and trading well within recent ranges. In Asia Pacific trade, kneejerk weakness in NZD following a more dovish than expected RBNZ rate decision pulled the Aussie lower and dragged AUD/JPY as low as the 82.70s. The pair then gradually rebounded back to current levels around 83.00 where it looks set to end the session.

FX markets focus has been elsewhere, such as on the evolving European Covid-19 crisis, on a barrage of US data, Fed speak and the Fed minutes. That, combined with a lack of either Australia or Japan-related fundamental developments, meant it is not surprising to see AUD/JPY trade with a lack of conviction. That lack of conviction is likely to be the story of the rest of the week, with most US market participants now on holiday for Thanksgiving.

To the upside, the most immediate resistance for AUD/JPY is this week’s highs in the 83.20 area. To the downside, aside from Tuesday’s lows in the 82.60s, the next main area of support is last week’s low at 82.15 and then the early September high at almost bang on 82.00 just below it.

AUD/JPY breaking out of medium-term bear trend?

Looking at AUD/JPY over a longer time horizon, the pair may be showing some bullish signs that it is about to break out of a bearish trend channel that has been containing the price action since the start of November. A break to the north would signal a potential move towards the pair’s 21DMA and 15 November highs in the 84.00 area.

- USD/CAD hovers around 1.2668 after the unveiling of FOMC’s last meeting minutes.

- FOMC Minutes: Some participants would like to adjust the QE’s taper pace and raise rates sooner than anticipated if inflation runs hot.

- The US Dollar Index posts day-after-day new 16-month highs close to 97.00.

The USD/CAD slides from daily tops around 1.2700, down some 0.09%, trading at 1.2661 during the New York session at the time of writing. A risk-off market sentiment spurred demand for the greenback, as it keeps posting new year-to-date highs versus most G8 currencies, except for the Canadian dollar, as the FOMC’s last meeting minutes were unveiled.

On Wednesday, the Federal Reserve unveiled the last FOMC meeting minutes, which showed that some participants would like to adjust the QE’s taper pace and raise rates sooner than anticipated if inflation runs hot.

According to Reuters, “some participants suggested that reducing the pace of net asset purchases by more than $15B each month could be warranted.” Further added and It is worth noting that “some participants preferred a somewhat faster pace of reductions that would result in an earlier conclusion to net purchases.”

In the meantime, the US Dollar Index measures the greenback’s performance against a basket of six rivals, is up 0.41%, sitting at 96.80 at press time, but earlier reached a new 16-month high at 96.93.

Earlier in the New York session, the Initial Jobless Claims for the week ending on November 20 increased to 199K, better than the 260K estimated by analysts, the lowest since 1969. Further, the US GDP for Q3 grew by 2.1%. In line with market participants’ expectations.

Moving to the Federal Reserve’s favorite gauge for inflation, the Personal Consumption Expenditure (PCE) Price Index increased by 4.1% YoY in October, in line with the median economist forecasts and confirmed a 0.4% rise from last month’s upwardly revised reading of 3.7%.

USD/CAD Price Forecast: Technical outlook

The USD/CAD pair retreated from 1.2700s daily tops, at press time is trading below the November 23 low at 1.2660. In the case of accomplishing a daily close beneath the abovementioned, it could form a gravestone-doji, which indicates intense selling pressure above the open/close of Wednesday’s price action, opening the door for a further downward move.

In that outcome, the first support level would be the psychological 1.2600. A break of the latter would expose the 100-day moving average (DMA) at 1.2557, immediately followed by the 50-DMA at 1.2529, and then the 1.2500 figure.

-637733838641680769.png)

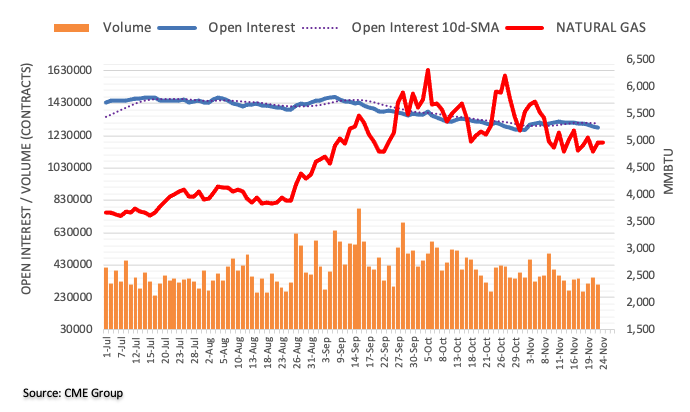

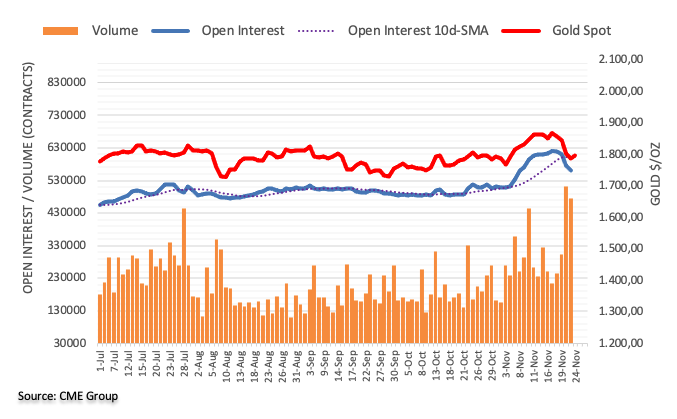

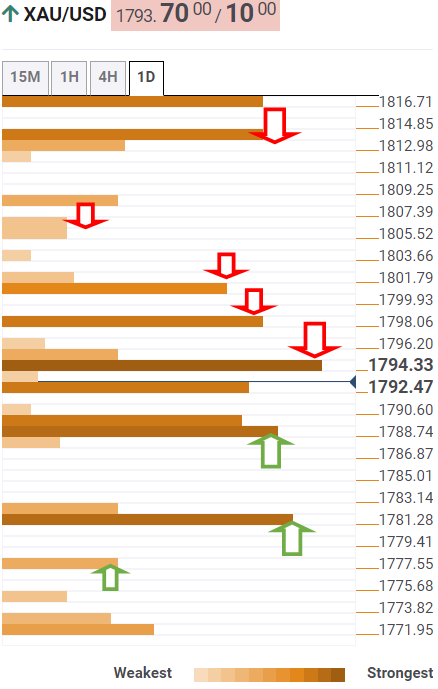

- Gold is under pressure as the US dollar continues to move higher.

- DXY was in a few pints away from the 97 figure on Wednesday as hawks circle above the Fed.

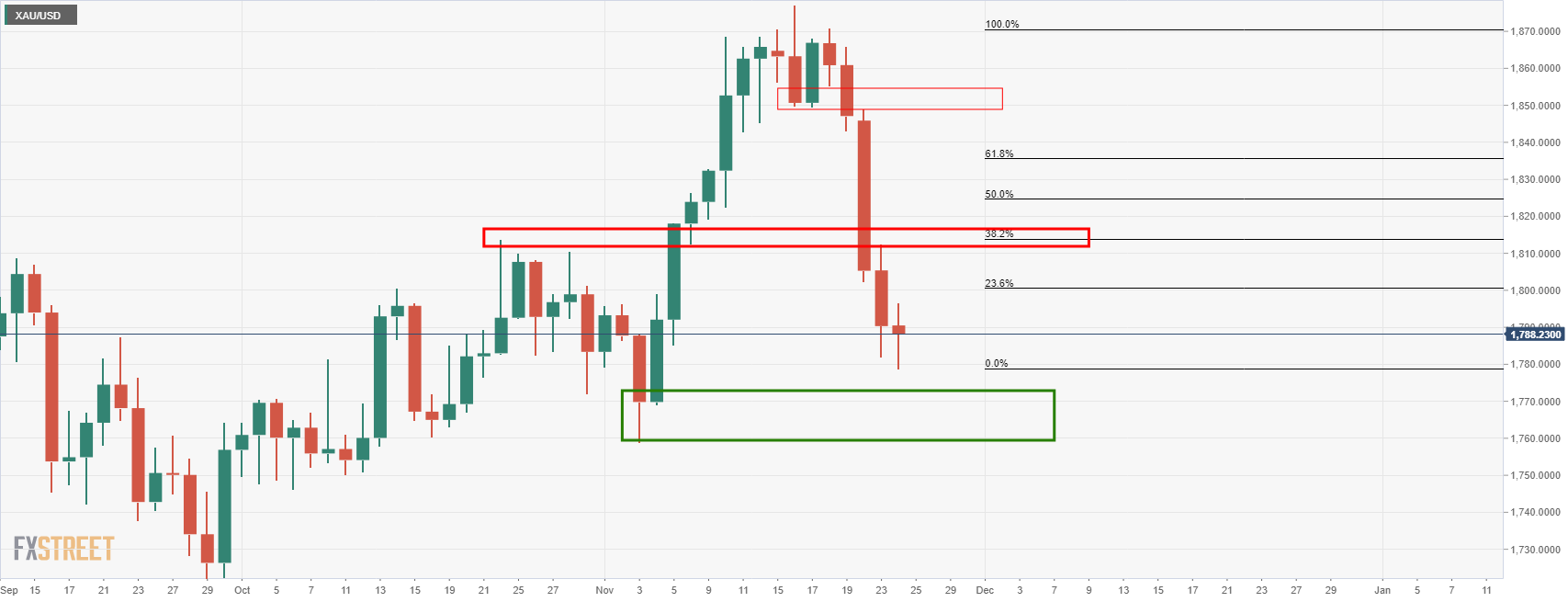

The price of gold on Wednesday was pressured by a surging US dollar and higher volatility on the day. The greenback is in favour as hawkish best ramp up surrounding the Federal Reserve. XAU/USD is down -0.12% at the time of writing and up from the lows of $1,778.61 as the US dollar consolidates into the Thanksgiving holidays and close on Wall Street.

ECB/Fed divergence underpinning the US dollar

On the day, the greenback printed a fresh 16-month high against the euro and the DXY marked territory just shy of 97 the figure. Investors are pricing up the prospect of the Federal Reserve hiking rates in mid-2022 and tapering at a faster pace, potentially commencing such an adjustment as soon as the December meeting. By contrast, the European Central Bank is concerned about covid and growth more so and remains in the dovish camp.

Fed officials sounding more hawkish

Fed officials have been sound far more hawkish of late due to stubbornly high inflation and in today's trade, San Francisco Fed President Mary Daly changed her tune. "If things continue to do what they've been doing, then I would completely support an accelerated pace of tapering," Daly said during an interview with Yahoo Finance published on Wednesday.

daly now advocates for a faster pace of tapering, echoing the rhetoric of Fed Vice Chair Richard Clarida. The vice-chair said last week that the December 14-15 meeting would be an appropriate time to have such a discussion.

The Fed minutes underscored the hawkishness at the Fed today as well. Participants judged prices may take longer to ease and some participants said faster taper could be warranted.

Germany in a thorn in EZs side

Additionally, playing into the hands of the US dollar and weighing on the precious metal, the single currency is under pressure due to newly released covid data in Germany. The reports show that more than 70,000 new coronavirus cases have been reached, by far the biggest one-day increase on record, with some areas yet to report.

This, coupled with economic prints on the day that show German business morale has deteriorated for the fifth month running in November is bound to weigh on the euro. In turn, this could underpin US dollar strength and see the DXY above 97 and underpinned for the foreseeable future.

Mixed outlook for gold

Meanwhile, analysts at TD Securities explained that gold is vulnerable to a deeper consolidation. ''Precious metals prices continue to melt following the Fed Chair's renomination.''

''However, given TD Securities' forecast of slowing growth and inflation next year, market pricing for Fed hikes may ultimately prove too hawkish,'' the analysts added.

Gold technical analysis

From a daily perspective, gold is in no man's land. The price is stalling but is yet to reach the level of support as illustrated above. However, given the current rejection from the day's lows, there are prospects of consolidation and that could lead to a move higher. Bulls would be looking for a meaningful correction and that brings in the 38.2% Fibonacci retracement near $1,1810. This aligns with old highs for the month of October.

- NZD/USD sold off relentlessly on Wednesday, dropping from above 0.6950 to lows in the 0.6850s.

- The pair was weighed by a dovish RBNZ hike and a broad strengthening of the US dollar.

NZD/USD faced relentless selling pressure on Wednesday. The pair hit highs above 0.6950 in early Asia Pacific trade, but by midway through the US trading session, it had dropped all the way to the 0.6850s. At current levels around 0.6870, the pair is down on the day by about 1.1%, making the kiwi far and away the worst performing G10 currency on the day.

Selling pressure began during Asia Pacific hours after the RBNZ delivered a more dovish than expected 25bps rate hike. Selling continued in early European trade, though this was more to do with safe-haven demand boosting the US dollar amid further concerns about the European Covid-19 situation. Then US macro forces came into play as the US session began, with strong labour market, inflation, consumption and GDP data as well as hawkish comments from Fed member Mary Daly further boosting the buck.

More recently, the FOMC minutes of the 3 November meeting were released and emphasised the hawkish shift already taking place on the bank even prior to the release of the hotter than expected October Consumer Price Inflation report on 10 November. The US dollar was already enjoying decent gains against most of its G10 counterparts by the time the minutes were released and so FX market trade has since been more consolidative. Recent commentary from RBNZ Governor Adrian Orr, who noted that it would be better for the bank to take small steps when raising the OCR in order to observe the development of the economy, was ignored.

From the kiwi’s perspective, the Thanksgiving holiday in the US, which means that markets there are shut and then only partially open on Friday, is coming at the perfect time to stop the rot. In the absence of US market participants for (pretty much) the rest of the week, FX markets are likely to trade with less conviction, which could hand NZD an opportunity to rebound a little. NZD/USD’s Z-score to its 200-day moving average at current levels is close to -2.00, a level which, when hit, has in recent months been a good indicator of consolidation or a rebound. Moreover, NZD/USD is approaching oversold territory, with an RSI of 32. If that dips below 30, that could trigger some profit-taking.

- USD/JPY continues its three-day rally amid risk-off sentiment despite falling US bond yields.

- The US 10-year Treasury yields remain flat at 1.653%.

- Positive US economic data helped USD/JPY bulls to break the 115.00 figure, eye 116.00.

The USD/JPY extend its rally to three days in a row advancing 0.23%, trading at 115.42 during the New York session at the time of writing. The market mood is in risk-off mode, with US stock indexes falling, US bond yields in the short-term rise, while the long-end dropped, while the greenback stays firm.

The US Dollar Index, a gauge of the greenback’s value against six rivals, advance 0.39%, sitting at 96.87 at press time. Contrarily, the US T-bond 10-year benchmark note drops one basis point, stays at 1.653%.

During the Asian and European sessions, the USD/JPY dipped as low as 114.83, right at the 1-hour 50-simple moving average (SMA), bouncing off those levels up to a break of the 115.00 figure. As US economic data was released during the New York session and the greenback strengthened, the USD/JPY advanced.

USD/JPY Price Forecast: Technical outlook

The USD/JPY has an upward bias, depicted by the daily moving averages (DMA’s) located below the spot price, with an upslope, confirming the bullish bias. On Tuesday, USD bulls failed to break above the 115.00, which they accomplished on Wednesday, thus negating the bearish wedge.

At press time, the pair is testing the March 2017 swing high at 115.51 as well as the 115.60 61.8% Fibonacci retracement of the move down from 2015. A breach of that level would expose the psychological 116.00 level.

On the flip side, failure to overcome the March 2017 strong resistance could pave the way for a correction. The first demand zone would be 115.00, followed by the October 18 swing high-turned support at 114.48, and then the psychological 114.00.

-637733806918313002.png)

Reserve Bank of New Zealand Governor Adrian Orr said on Wednesday that it would be better to take small steps with the official cash rate (OCR) and observe how things go. The comment justifies why the bank opted against hiking the OCR by 50bps at its most recent rate decision on Wednesday. The Governor added that the OCR is the bank's favour tool to deal with inflation, which neared 5.0% YoY in Q3 this year.

Market Reaction

NZD has not seen much of a reaction to the latest remarks and continues to trade near session lows, with NZD/USD in the 0.6860s.

What you need to know on Thursday, November 25:

Demand for the greenback persisted after a batch of US data hinted at stubbornly high inflationary pressures and soon-to-come Federal Reserve action to counter its effects on the economy.

On Wednesday, market participants knew that US inflation soared to its highest in 30-years in October, according to the Core Personal Consumption Expenditures Price Index report. Also, the FOMC published the Minutes of its November meeting. The document showed that policymakers believe they should be prepared to adjust the pace of the asset purchases tapering and raise the target range for the federal funds rate sooner than currently anticipated should inflation continue to run hot. Still, the market’s reaction was quite limited as there were no surprises in the statement.

The EUR/USD pair trades below the 1.1200 figure, hit by local data and ECB’s inaction. Germany published the November IFO survey, which showed that the Business Climate contracted to 96.5, falling for a fifth consecutive month, while Germany published the November IFO survey, which showed that the Business Climate contracted to 96.5, falling for a fifth consecutive month noted that the central bank must not tighten monetary policy too early in response to an inflation spike driven by “purely temporary factors.”

Another factor hitting the EUR and the market’s mood, in general, is the resurgent spread of coronavirus in Europe. Several countries are taking fresh restrictive measures and studying making vaccines mandatory.

GBP/USD came under renewed bearish pressure and dropped to the current 1.3320 region. Bank of England Monetary Policy Committee member Silvana Tenreyro said on Wednesday that she would not want to say specifically if the BOE would make its first rate hike in either December or February. Instead, she prefers a “modest” tightening of the monetary policy.

The USD/JPY pair reached a fresh 2021 high of 115.51, holding nearby at the end of the day. Commodity-linked currencies shed ground unevenly, with AUD/USD now trading below 0.7200 and USD/CAD at around 1.2670.

Global stocks traded in a dull fashion, with European and American indexes mixed around their opening levels.

US Treasury yields are ending the day with modest losses. Nevertheless, the yield on the 10-year note peaked at 1.693%, retreating from the critical 1.70% threshold.

Gold is modestly lower on a daily basis, now trading around $1,785 a troy ounce. Crude oil prices eased modestly, with WTI currently at $78.25 a barrel.

Bitcoin could dodge a steep correction if BTC holds above this price level

Like this article? Help us with some feedback by answering this survey:

Reserve Bank of New Zealand Governor Adrian Orr on Wednesday said that there are capacity pressures everywhere in the country. Orr added that the economy is running above its potential and that rate hikes would slow the desire to buy houses.

Market Reaction

NZD has not seen a reaction to the latest comments from the RBNZ governor. It is widely known that the New Zealand economy is running hot right now and that the RBNZ on course to reduce monetary stimulus over the coming years.

NZD/USD was sent tumbling during Wednesday's Asia Pacific session after the RBNZ delivered a more dovish than expected 25bps rate hike. The bank's guidance on the future path of rate hikes was not as hawkish as money markets had been expecting.

According to Reuters, officials from Turkey's central bank (the CBRT), Turkey's BDDK banking watchdog and the board of the country's banking association are set to meeting on Thursday to discuss recent developments in the economy.

The recent melt-down of the lira, which saw USD/TRY nearly his 13.50 on Tuesday (which at the time meant TRY had lost over 40% of its value versus the US dollar on the year), will be the main topic of discussion.

Market Reaction

Expectations are building that the CBRT, which cut interest rate by a further 100bps last week to 14.00% (taking the total amount of cuts since September to 400bps, despite inflation nearing 20%), will be forced to turn hawkish to stem the lira's decline. Various banks have been calling for the CBRT to start hiking rates back towards 20.00% in the coming quarters.

These expectations have supported the lira on Wednesday and the news of this meeting will only heighten speculation. At present, USD/TRY is more than 5.0% lower on the day and is trading just to the north of the 12.00 level, having rebounded from earlier session lows close to 11.50.

- EUR/USD bears fail to take the cross over the line despite hawkish FOMC minutes.

- US dollar remains firmly in the bullish territory and eyes 97 the figure, DXY.

Volatility has been the name of the game midweek as traders look to the Federal Reserve for clues as to the timing of the first-rate hike in 2022. The FOMC minutes have confirmed a hawkish bias, albeit dependant on the covid contagion risks.

Nevertheless, the US dollar has surged towards the 97 figure on the day as Fed officials advocate for the case of a faster speed in tapering. The Fed meeting in December could well be the time for doing so.

In the minutes today, participants judged prices may take longer to ease and some participants said faster taper could be warranted. This has seen the US dollar firmly underpinned in the 96.90s and the euro backed into a corner.

At the time of writing, EUR/USD is trading at 1.1193 and down by some 0.50%. On top of the Fed risk, Germany has reported more than 70,000 new coronavirus cases, by far the biggest one-day increase on record, with some areas yet to report.

Meanwhile, ''the Deutsche Bank Currency Volatility Index, DBCVIX, which measures expectations for gyrations in FX, has in recent weeks shot from a three-month low to its highest level since March, driven by gyrations in the US dollar, euro, and Japanese yen as well as a broad range of other currencies'', Reuters reported.

Nevertheless, with the session coming to a close and the Thanksgiving holidays tomorrow, the currency market has shut down and consolidation is now taking shape. The euro is holding up despite the bearish environment:

EUR/USD technical analysis

EUR/USD Current price: 1.1192

- The worsening coronavirus situation in Europe undermined demand for the EUR.

- US inflation continued to run hot in October, hinting at soon to come Fed’s action.

- EUR/USD is trading below 1.1200 and could keep falling despite oversold conditions.

Persistent demand for the American currency drove EUR/USD to a fresh 2021 low of 1.1185, with the pair currently trading a few pips above the level. Demand for safe-haven assets was high, as global equities traded dully.

Macroeconomic data fuel the dismal mood, as Germany published the November IFO survey, which showed that the Business Climate contracted to 96.5, falling for a fifth consecutive month. Expectations dropped to 94.2 while the assessment of the current situation contracted to 99. On the other hand, the US published Q3 Gross Domestic Product was upwardly revised to 2.1% in Q3, slightly below the 2.2% expected, while inflation in the country hit a 30-year high, as the core PCE Price Index jumped to 4.1% YoY in October. Among other things, the US also reported that Initial Jobless Claims contracted to 199K in the week ended November 19, the lowest since the pandemic started.

Meanwhile, in Europe, concerns rotate around soaring coronavirus cases as the northern hemisphere heads into the winter. Lockdowns and vaccine mandates are on the table in multiple countries, and a clearer picture will be seen ahead of the weekend, as Germany and France are expected to announce fresh measures to deal with the latest outbreak.

As the day comes to an end, the FOMC published the Minutes of its November meeting. The document showed that policymakers believe they should be prepared to adjust the pace of the asset purchases tapering and raise the target range for the federal funds rate sooner than currently anticipated should inflation continue to run hot. Still, the market’s reaction was quite limited as there were no surprises in the statement.

Germany will publish a revision of its Q3 GDP on Thursday, while the European Central Bank will release the Monetary Policy Meeting Accounts. US markets will be closed amid the Thanksgiving holiday.

EUR/USD short-term technical outlook

The EUR/USD is extremely oversold but still bearish, as the daily chart shows that technical indicators offer modest bearish slopes within extreme levels. In the same chart, the 20 SMA keeps heading lower over 200 pips above the current level while widening the distance with the longer ones, reflecting strong selling interest.

The 4-hour chart also indicates that the pair could fall further as sellers are adding shorts on approaches to a bearish 20 SMA. Technical indicators have lost their bearish strength but hold around intraday lows, with the RSI in oversold territory. A strong support area comes around 1.1160, where the pair bottomed in June 2020. A break below the latter could see the pair test the 1.1000 figure in the next few days.

Support levels: 1.1160 1.1120 1.1075

Resistance levels: 1.1210 1.1250 1.1290

View Live Chart for the EUR/USD

According to a No.10 Downing Street spokesperson, UK PM Boris Johnson met with Irish PM Michael Martin earlier on Wednesday and raised concerns about the substantial gap that remains between the UK and EU regarding Northern Ireland.

The two PMs agreed that an agreement on the implementation of the Northern Ireland Protocal (NIP) was the preferred outcome and the UK and EU would thus continue to work hard to achieve this.

However, the spokesperson said that the UK would be left with no choice but to use the safeguard measures under Article 16 of the NIP if talks did not deliver a rebalanced outcome soon.

Market Reaction

GBP hasn't seen a notable reaction to the latest round of jawboning from the UK over the NIP, with EUR/GBP continuing to trade in subdued fashion around the 0.8400 area.

- XAG/USD remained subdued in the Asian and the European session as investors await FOMC minutes.

- XAG/USD did not react to earlier US economic data.

- XAG/USD: The break of an upslope support trendline on Tuesday, could accelerate the downfall towards $23.00.

Silver (XAG/USD) edges lower during the New York session, down 0.80%, trading at $23.47 at the time of writing. The market sentiment is downbeat and has been like that since Monday when US President Joe Biden renominated Jerome Powell to the Fed for a second four-year period. That benefitted the greenback, with the US Dollar Index closing to the 97.00 figure, sitting at 96.89, up some 0.42%.

Meanwhile, US bond yields are down, except for the short-term ones. The 2-year and the 5-year are rising three and one basis point each, sitting at 0.64% and 1.34%, respectively. The 10-year US Treasury yield is down one basis point, currently at 1.65%.

Further, despite that nominal yields in the long term are lower, real yields have jumped from -1.91% up to -1.67% in the last couple of weeks, thus weighing on the non-yielding metal, as it seems investors start to price in higher interest rates in the US in 2022.

The US economic docket featured the Initial Jobless Claims for the week ending on November 20 increased up to 199K, better than the 260K estimated by analysts, the lowest since 1969. Moving to the Federal Reserve’s favorite gauge for inflation, the Personal Consumption Expenditure (PCE) Price Index increased by 4.1% YoY in October, in line with the median economist forecasts and confirmed a 0.4% rise from last month’s upwardly revised reading of 3.7%.

XAG/USD Price Forecast: Technical outlook

From the technical perspective, the white metal has been trading lower, leaving the 100 and the 200-day moving averages (DMA’s) above the spot price, whereas the 50-DMA lying at $23.53, is support for silver, though at press time, seems to be giving way to USD bulls. Further, the break of a two-month-old upslope support trendline on Tuesday opened the door for further downward pressure on the precious metal.

In the outcome of XAG/USD continuing lower, the first demand area would be the November 23 swing low at $23.27. A breach of the abovementioned would expose November 3 cycle low at $23.02, followed by the August 9 pivot low at $22.17.

On the other hand, if silver reclaims the $24.00 handle, that could pave the way for further upside. The first resistance would be the September 3 swing high at $24.87, immediately followed by $25.00.

-637733774168163365.png)

The minutes of the 3 November FOMC meeting, released on Wednesday, said that various participants noted that the Fed should be prepared to adjust the pace of the QE taper and raise rates sooner than currently anticipated should inflation continue to run hot.

Additional takeaways:

“Some participants suggested that reducing the pace of net asset purchases by more than $15B each month could be warranted so that the committee would be in a better position to make adjustments to the fed funds target range.”

“Participants stressed that maintaining flexibility to implement appropriate policy adjustments on the basis of risk-management considerations should be a guiding principle in conducting policy in the current highly uncertain environment.”

“Participants generally judged that the committee's criterion of substantial further progress had clearly been more than met with respect to inflation.”

“Some participants preferred a somewhat faster pace of reductions that would result in an earlier conclusion to net purchases.”

“Participants noted that beginning to scale back the pace of net asset purchases was not intended to convey any direct signal regarding adjustments to the target range for the federal funds rate.”

“Participants cited upside risks to inflation, including those associated with strong demand for goods and a tight labor market.”

“A few participants cited a number of factors representing potential vulnerabilities to the financial system, including elevated asset valuations and the growing exposure of banks to nonbank financial firms.”

“On inflation expectations, a number of participants discussed the risk that the public's longer-term expectations of inflation might increase to a level above that consistent with the bank’s 2.0% target.”

“Participants generally saw the current elevated level of inflation as largely reflecting factors that were likely to be transitory.”

“Participants judged that inflation pressures could take longer to subside than they had previously assessed.”

Market Reaction

After an initial two-way reaction, the Dollar Index (DXY) has pushed back towards fresh session highs in the 96.90s in wake of the FOMC minutes. The minutes allude to the hawkish shift taking place at the Fed even before the release of the October Consumer Price Inflation report on 10 November, which is likely why the dollar is finding some support. "Various" participants support a potential acceleration of the QE taper and rate hikes and "a number of" committee members are growing worried about longer-term consumer inflation expectations.

- S&P 500 is now dependant on the FOMC minutes.

- Fed members have been leaning towards a faster pace of tapering, stocks could be pressured into the close.

At the top of the hour, we could finally see whether there has been a fundamentally hawkish shift at the Federal reserve amongst policymakers and whether they are advocating for a faster pace of tapering. These minutes are critical as we head into the blackout period that starts next Saturday before the December Federal Reserve meeting. This is the meeting where the Fed could speed up the tapering.

The US dollar has already surged towards the 97 figure on the day following a crucial shift in tone from one of the more dovish policy makers, San Francisco Federal Reserve Bank President Mary Daly. She said that she would be open to accelerating the pace of the central bank's tapering of asset purchases if inflation remained elevated and jobs growth stayed strong.

"If things continue to do what they've been doing, then I would completely support an accelerated pace of tapering," Daly said during an interview with Yahoo Finance published on Wednesday.

Several Fed officials have said in recent weeks that the central bank should consider withdrawing its support more quickly to be better equipped to address elevated inflation. If the minutes today confirm the basis, then this could be the nail in the coffin for US stocks, at least for the close and ahead of the Thanksgiving holidays.

S&P 500 H4 chart

-637733763938303669.png)

As illustrated, the price of the index has reached a 38.2% Fibonacci level and on a hawkish outcome, the stock market could react by falling. This would likely see the S&P 500 home in on the next level of support near 4,630 for a bearish close ahead of the long weekend.

If, on the other hand, the minutes are far more dependent on data, in line with the other comments fro Daly today, ''Daly said she was "open" to the idea, but would like to see more economic reports on inflation and hiring and discuss the approach with her Fed colleagues before deciding,'' then the stock market could react with a sigh of relief and close higher for the day with 4,710 on the radar.

As for forex, the higher betas, such as the Aussie, will be dependent on the outcome of the stock market today and its reaction to the FOMC minutes outcome: AUD/USD Price Analysis: Looking vulnerable around the FOMC minutes, 0.7170s eyed

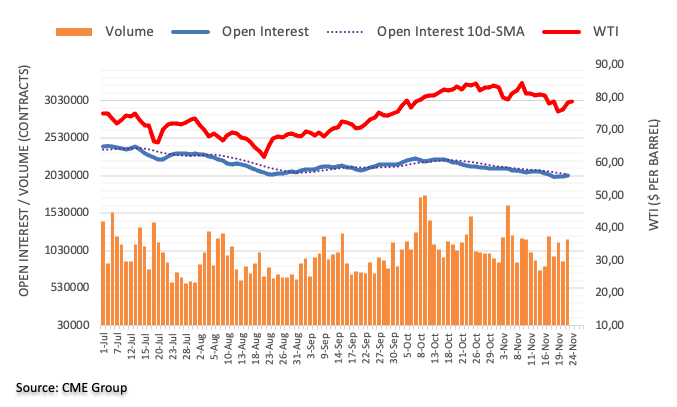

- Oil markets have been rangebound on Wednesday and for the most part stuck within $78.00-$79.00 parameters.

- A WSJ report suggested the Saudis and Russian might be willing to halt future output hikes following the SPR release.

Despite a bombardment of US macro data that ultimately contributed helped push the US dollar to fresh annual highs, an onslaught of European lockdown-related updates and official US crude inventory numbers, crude oil markets have been quite subdued on Wednesday. Front-month futures of the American benchmark for sweet lift crude oil, West Texas Intermediary or WTI, has stuck within a $78.00-$79.00 range for the bulk of the session. At current levels just under $78.50, WTI trades almost bang on flat for the day.

The main theme in crude oil markets continues to be the global coordinated crude oil reserve release and OPEC+’s response. The latest on that front was a report from the Wall Street Journal that suggested central OPEC+ members Saudi Arabia and Russia might be considering pausing output hikes in the months ahead, although separate OPEC+ sources later refuted this idea. OPEC+ oil ministers are scheduled to meet on 2 December, following a meeting of the cartel’s Joint Technical Committee (JTC) on 30 November. Further sources suggested that OPEC+ wants to wait to see the conclusions of its research department before deciding on the next monthly adjustment.

Whilst the release of the now somewhat stale FOMC minutes at 1900GMT on Wednesday will likely turn some heads in FX, bond and maybe equity markets, crude oil traders are less likely to be fussed. Indeed, the outlook for trading conditions for the rest of the week is for low volumes and a lack of conviction. That’s because US markets are closed on Thursday for Thanksgiving, which means futures trade (including for WTI) will close between the hours of 1800GMT and 2300GMT. Some US markets then shut early on Friday though not futures. Many US markets.

- GBP/JPY has been consolidating within recent ranges on Tuesday with FX market focus mostly elsewhere.

- Price action has been squeezed in recent days within the confines of a pennant, with a breakout on the cards.

GBP/JPY has for the most part seen a day of consolidation, with the price action remaining well contained within this week’s low-153.00s to low-154.00s range. At present, the pair is trading around 153.80, slightly to the north of its 50-day moving average (at 153.58), which has been offering gentle support throughout the week. To the upside, the 21DMA is getting closer and currently resides at 154.21.

Price action over the last few days has been squeezing itself into a pennant formation. That suggests a breakout to either the upside, where a test of recent highs in the mid-154.00s is on the cards, or to the downside, where a test of recent lows around 152.500 would be likely.

Driving the day

GBP and JPY have not been at the centre of FX market focus on Wednesday. Rather focus has been on NZD, which got battered after a more dovish than expected 25bps rate hike from the RBNZ, and a strong USD, boosted by good US macro data and hawkish Fed rhetoric. The yen was supported early in the European session amid an elevated demand for havens amid concerns about the state of the European Covid-19 outbreak and tougher lockdowns. This haven bid seems to have eased in the US session, however, as US equities recovered back into positive territory.

FX markets largely ignored comments from dovish BoE member Silvana Tenreyro, who avoided saying explicitly whether she would support a rate hike in December or February, rather saying that she would instead be watching the data. She did concede that policy would require a modest tightening in the coming several quarters, however.

- USD/CHF extends its rally to four consecutive days, marching towards 0.9400.

- The US Dollar Index climbs towards 96.90, ahead of FOMC minutes.

- USD/CHF: A break of a 4-month old downslope resistance trendline opened the door for a renewed test of 2021 year-to-date high.

The USD/CHF extends its gains for four days in a row, advancing firmly towards the 0.9400 figure, up 0.26%, trading at 0.9356 during the New York session at the time of writing. A risk-off market mood maintains safe-haven currencies firmly bid, except for the Swiss franc and the Japanese yen, posting losses against the buck.

In the meantime, the US Dollar Index (DXY), which tracks the greenback’s performance against a basket of its peers, advances 0.43%, sitting at 96.90.

USD/CHF Price Forecast: Technical outlook

The USD/CHF has an upward bias in the daily chart, as shown by the daily moving averages (DMA’s) with an upslope, residing well beneath the spot price. Also, Wednesday’s break of an eight-month-old downslope resistance trendline indicates that the USD/CHF is firmly heading towards the 2021 year-to-date high at 0.9473.

The first resistance on the way north would be the psychological 0.9400 figure. A breach of the former would expose the April 1 swing high at 0.9473, followed by the June 29, 2020 cycle high at 0.9528.

On the flip side, failure to break over the abovementioned would expose the 0.9300 figure. A break below that level would reveal the confluence of the 50-DMA and the November 19 swing low around the 0.9225-50 region, which once gave way, it would leave the 0.9200 as the last line of defense for USD bulls.

-637733730574262602.png)

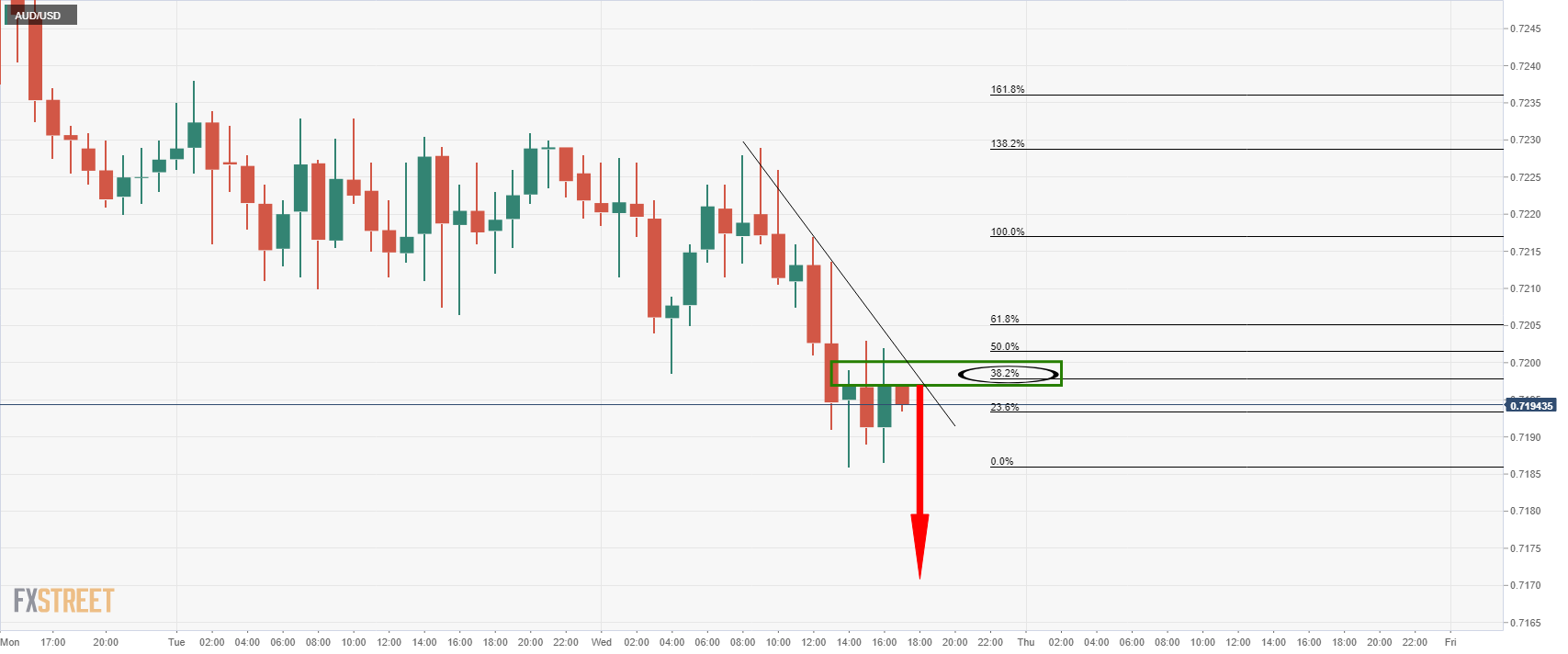

- AUD/USD is on the verge of a downside continuation towards daily lows.

- DXY has headed for a test of 97 the figure again.

- FOMC minutes are coming up and could be the final catalyst of the week.

The US data dump ahead of the long weekend and Thanksgiving Holidays in North America has seen the US dollar mark fresh 16-month cycles highs on Wednesday. The dollar index DXY has rallied to a high 96.937.

Investors have started to price the prospect that the Federal Reserve will begin hiking rates in mid-2022, in stark contrast to the European Central Bank which is expected to remain more dovish as covid risks loom.

This is what makes today's FOMC minutes critical, albeit they come at a time as US traders will be looking to square positions ahead of the holidays, so it could go either way. Volatility or little trading activity until after the weekend and depending on the outcome.

Fed officials have contributed to the more hawkish view on US interest rates of late as the central bank faces stubbornly high inflation. The minutes will be scrutinised for signs of a faster pace of tapering and sooner timings of lift-off. Anything that points towards this should keep the US dollar underpinned into the close. This leaves high beta currencies, such as the Aussie vulnerable.

The following illustrates the daily lows and the prospects of a drop into here from an hourly perspective:

AUD/USD daily chart

The price is not far off from the prior daily lows in the 0.7170s, just some 15 pips at the time of writing and an hour ahead of the minutes.

AUD/USD H1 chart

The price has already corrected to a 38.2% Fibonacci retracement level where it meets dynamic resistance and has stalled in the correction. This leaves scope for a downside extension from here.

If the US dollar can squeeze out the last remaining bears on the day and score fresh highs on the minutes into the 97's, then the above scenario in AUD/USD has a high probability of playing out.

DXY M15 chart

- GBP/USD extends to four days its fall, down almost 1.5%.

- Risk-off market sentiment dented the prospects of risk-sensitive currencies like the British pound, favors the greenback.

- The US Dollar Index is closing to 97.00 after the renomination of Powell amid positive US jobs data.

The British pound continues its free-fall, down for the fourth consecutive day, reaching a new year-to-date low around 1.3324, down some 0.34%, trading at 1.3334 during the New York session at the time of writing. On Wednesday, the market sentiment is downbeat, as portrayed by US equity indices falling. In turn, FX risk-sensitive currencies like the GBP, the AUD, and the NZD, record losses in the day against the greenback.

Meanwhile, the US Dollar Index, which measures the buck’s performance against a basket of six rivals, advances 0.45%, sitting at 96.92, closing to the 97.00 figure, that despite that, the US 10-year Treasury yield remains unchanged at 1.669%.

On Wednesday, the UK economic docket featured Sylvana Tenreyro, Bank of England (BoE) Monetary Policy Committee (MPC) member. Tenreyro said she would not want to say specifically if the BoE would raise rates in December or February when the central bank updates its economic projections.

In the meantime, across the pond, a full US macroeconomic docket ahead of Thanksgiving unveiled the US Initial Jobless Claims, Durable Goods data, GDP, and the Fed favorite gauge of inflation, the Personal Consumption Expenditure figures.

The Initial Jobless Claims for the week ending on November 20 increased up to 199K, better than the 260K estimated by analysts, the lowest since 1969. Moreover, Durable Good Orders for October (MoM) shrank to 0.5% more than the 0.4% contraction expected by market participants. However, orders excluding transportation rose more than estimations, up to 0.5% vs. 0.2%, for the same period. Further, the US GDP for Q3 grew by 2.1%. In line with market participants’ expectations.

Moving to the Federal Reserve’s favorite gauge for inflation, the Personal Consumption Expenditure (PCE) Price Index increased by 4.1% YoY in October, in line with the median economist forecasts and confirmed a 0.4% rise from last month’s upwardly revised reading of 3.7%.

GBP/USD Price Forecast: Technical outlook

Cable continues trading within a descending channel, with the daily moving averages (DMA’s) with a downslope above the spot price, confirming the bearish bias. Two days ago, the GBP/USD broke below the September 29 swing low 1.3411, a crucial support level exposing the bottom-trendline of the descending channel. Additionally to those two bearish signals, the Relative Strength Index (RSI), a momentum indicator, is at 34, aiming lower, with sufficient room, to extend the British pound fall vs. the US dollar.

In the outcome of a downtrend continuation, the following support would be the 1.3300 figure, followed by the bottom-trendline of the descending channel, around the 1.3250-1.3300 area. A breach of the latter would expose the 1.3200 price level.

On the flip side, the first resistance would be 1.3400. A break of that level would expose the November 18 cycle high at 1.3513, followed by the confluence of the 50-DMA and the November 9 swing high around 1.3607.

-637733697529023038.png)

- US dollar holds onto daily gains across the board.

- US yields retreat but USD/JPY remains firm near the top.

- After many economic reports, attention turns to FOMC minutes.

The USD/JPY rose to 115.47, during the American session and after the release of US economic data. A stronger US dollar continues to offer support to the pair that is rising for the third consecutive day.

The pair pulled back after hitting a fresh multi-year high, holding above 115.25. The trend and the momentum remain positive. The dollar is on its way to the highest daily close versus the yen since January 2017.

Mixed to upbeat US data

Economic data showed Initial Jobless Claims dropped to 199K, the lowest since 1969; Q3 GDP was revised from 2.2% to 2.1%; Personal Spending gained 1.3% in October and Personal Income rebounded 0.5% in October; the Core PCE Index rose 4.1% from a year ago; New Home Sales rose 0.4% in October; and the November Consumer Sentiment Index from the University of Michigan was revised from higher to 67.4. At 19:00 GMT the Federal Reserve will release the minutes from its latest meeting.

The numbers initially boosted US yields and the dollar across the board. During the last hours, yields pulled back and limited gains in USD/JPY. The 10-year yield is at 1.64%, while the 30-year fell under 2%.

Despite the retreat in US yields, the US dollar remains firm across the board. The DXY is up by 0.40% at 96.85, about to post the highest close since July 7. On Thursday, Wall Street will remain close due to Thanksgiving.

Technical levels

European Central Bank governing council member and Bundesbank head Jens Weidmann said on Wednesday that upside risks to inflation dominate in both Germany and the rest of the Eurozone. The flexibility of the PEPP should not be transferred to any other bond-buying programme, Weidmann continued, adding that the ECB should not lock in ultra-easy policy settings for long given elevated inflation uncertainty.

On inflation, Weidmann warned that inflation will peak near 6.0% in Germany and only fall back below 3.0% at the end of next year. Weidmann said that Germany's 2021 growth is likely to be significantly lower than the Bundesbank June forecast, with the recovery instead pushed further out. Companies' complaints about labour shortages have increased particularly in Germany, but also among its European neighbours, he added. In the future, he continued, tensions in the labour market could make it easier for employees and trade unions to push for noticeably higher wages.

Market Reaction

Weidmann is a known hawk and his comments have, thus, unsurprisingly failed to give from session lows under 1.1200. EUR/USD has been weighed heavily on Wednesday by a combination of factors. Firstly, there was speculation during the European morning that Germany would soon announce a full lockdown and vaccine mandate and the infection/hospitalisation statistics across the continent continue to worsen. More recent reports suggest the new German government coalition, which formally announced itself on Wednesday, won't heed former Chancellor Angela Merkel's call for an immediate move to lockdown.

The tone of Wednesday's November German IFO report also did little to inspire confidence in the euro. The Ifo Institute forecasts a stagnation in growth in Q4, chiming with the above comments made by Weidmann, while ING, reacting to the data, warned that "the risk of stagnation or even recession in the German economy at the turn of the year has clearly increased".

Meanwhile, the market's broad bid for safe-haven assets has helped boost the dollar, whilst strong US data (initial weekly jobless claims fell under 200K for the first time since before the pandemic and Core PCE rose to 4.1%) and hawkish Fed commentary has also helped add to the bid.

The US 10-year yield has continued higher this week and is now very close to key support at 1.685/705%. A major base looks increasingly imminent. Economists at Credit Suisse look for a move above 2% into 2022.

A sharp rise in yields is likely

“US 10-year Bond Yields are back pressuring key long-term support at 1.685/705% after medium and long-term moving averages recently posted a bearish “death cross”, which pointed to a further deterioration in the trend following setup. Furthermore, short-term momentum is reaccelerating and weekly MACD remains outright bearish.”

“We believe a breakout above major support at 1.685/705% may be imminent, which would confirm a three-year basing structure, which would very likely take us above the year-to-date highs and retracement support between 1.775% and 1.82%.”

“Going into 2022, we maintain our long-held view that a move to 1.965/2.00% is likely in the first quarter, followed by retracement support at 2.16/18%.”

See: US 10-year Treasury yield could reach 2.05/10% on a break above 1.80% – SocGen

- EUR/USD reached a new 16-month low at 1.1185, though it found strong support, reclaiming the 1.1200 figure.

- US Dollar Index retreated once the PCE was released, down from 96.93 to 96.85.

- EUR/USD: Failure to hold above 1.1200 would expose May 2020 support around 1.1018.

The shared currency cannot recover from three weeks in a row loss, declines some 0.49%, trading at 1.1195 during the New York session at the time of writing. A packed Wednesday’s of US economic data ahead of Thanksgiving keeps EUR/USD traders in front of the screen longer than expected. Further, a risk-off market sentiment keeps the greenback firmly bid, with the US Dollar Index near the 97.00 figure, reaching a new 16-month high for the third time in the week.

US Initial Jobless Claims increase below the 200K figure, boosts the greenback

On Wednesday, earlier In the American session, a full US macroeconomic docket unveiled the US Initial Jobless Claims, Durable Goods data, and GDP figures. The Initial Jobless Claims for the week ending on November 10 rose to 199K, lower than the 260K foreseen by analysts.

Moreover, in a month-over-month reading, the Durable Good Orders for October fell 0.5% more than the 0.4% contraction expected by analysts. Excluding transportation, orders rose more than expectations, up to 0.5% vs. 0.2%, for the same period. Further, the US GDP for Q3 grew by 2.1%. In line with market participants’ expectations.

Meanwhile, the Federal Reserve’s favorite gauge for inflation, the Personal Consumption Expenditure (PCE) Price Index, rose to 4.1% YoY in October, the US Bureau of Economic Analysis reported on Wednesday. That was in line with the median economist forecasts and confirmed a 0.4% rise from last month’s upwardly revised reading of 3.7%.

EUR/USD Price Forecast: Technical outlook

The daily chart depicts a strong downtrend on the EUR/USD pair. It is worth noting that despite the daily moving averages (DMA’s) still residing above the spot price, the downward move seems to be overextended. Though aiming higher, the Relative Strength Index (RSI) is located in oversold conditions at 26, indicating that the pair might be due to a future correction.

In the outcome of extending the downward move, the first support level would be the 1.1100 figure. A breach of the abovementioned would expose the May 1, 2020, cycle high-turned support at 1.1018, followed by the May 25, 2020, swing low at 1.0870.

On the other hand, if EUR bulls hold the 1.1200 figure, the 1.1300 figure would be the first resistance. A break of the latter would expose the November 18 swing high at 1.1374.

-637733653808429415.png)

Rising real yields should put pressure on gold. In the view of strategists at Credit Suisse, the precious metal may be in the throes of constructing a large top.

Resistance at $1,877 is expected to cap

“Our base case remains that we are close to a peak in inflation expectations and 10-year US Real Yields are in the process of building a large and important bearish ‘wedge’ reversal. If our view is correct, it would suggest gold may in fact be forming a large and significant top.”

“The immediate risk is seen lower for support next at $1,759, removal of which can see a retest of long-term pivotal support at $1,691/77. Beneath this latter area at any stage would in our view mark a major top.”

“Resistance at $1,877 is now expected to cap but only above $1,917 would suggest we are seeing an important turn higher.”

Bank of England Monetary Policy Committee (MPC) member Silvana Tenreyro said on Wednesday that she would not want to say specifically if the BoE would make its first rate hike in either December or February.

Commercial crude oil inventories in the US increase by 1.0 million barrels in the week ending November 19, the weekly report published by the US Energy Information Administration (EIA) revealed on Wednesday. This reading came in above market expectations for an inventory draw of 0.5 million barrels.

However, gasoline stocks saw a slightly larger than forecast draw of 0.603 million barrels versus forecasts for a 0.5 million barrel draw. That decline took gasoline inventories to their lowest level since 2017, the EIA said. Distillate stocks also saw a larger than forecast draw of 2.0M barrels versus forecasts for a 1.0M barrel draw.

Market Reaction

US oil prices have not reacted to the latest mixed EIA inventory report. WTI prices, for now, continue to consolidate in the $78.00-$78.50 area.

- Gold holds negative tone intact amid higher US yields.

- The dollar remains strong after economic data from the US.

- FOMC minutes to be released later on Wednesday ahead of US holiday.

Gold dropped further and printed a fresh two-week low at $1778. It is hovering around $1780 after the release of US economic data, including the Core PCE.

A reversal of a hundred dollars

Gold prices are falling again on Wednesday for the fifth consecutive day. The recovery toward $1800 proved to be short-lived and XAU/USD turned back to the downside. Recently bottomed at $1778, a hundred dollar below last week’s top.

US economic data released on Wednesday came in from mixed to upbeat. Personal Income and Spending rose more than expected in October, initial jobless claims dropped to the lowest since 1969 and consumer sentiment rebounded modestly. On the negative front, Q3 GDP data was revised from 2.2% to 2.1%; Durable Goods Orders fell 0.5%, and New Home Sales rose to 745K (annual rate) below the 800K expected.

US yields remained near weekly highs after the numbers supporting the US dollar in the market and keeping XAU/USD under pressure. At 19:00 GMT the Federal Reserve will released the minutes of its latest meeting.

Short-term outlook

The negative outlook remains intact, particularly with prices breaking and consolidating below every support it recently broke. XAU/USD is back under key moving averages (20, 55, 100 and 200 days). Under $1780, the next support stands at $1770, before the November low at $1758. On the upside, a consolation above $1795, should provide more support for a recovery in prices, that should be seen as a corrective move.

Gold looks set to decline further as no signs of consolidation are seen yet. Although after falling during five consecutive days, technical indicators are showing extreme oversold readings.

Technical levels

- USD/CAD advances firmly towards 1.2700 amid broad US dollar strength across the board.

- The US Dollar Index continues posting day-after-day new 16-month highs close to 97.00.

- US Initial Jobless Claims rose for the first time in the year under 200K.

The USD/CAD advances firmly towards the 1.2700 as the New York session begins, up 0.18%, trading at 1.2694 at the time of writing. A risk-off market sentiment spurred demand for the greenback, as it keeps posting new year-to-date highs versus most G8 currencies. The US Dollar Index, which measures the greenback's performance against a basket of six rivals, is up 0.41%, sitting at 96.80, at press time, but earlier reached a new 16-month high at 96.93.

In the overnight session, the USD/CAD pair remained steady around the Tuesday low at 1.2664, meandering in a narrow trading range, before crucial US macroeconomic data.

US Initial Jobless Claims rose for the first time in the year under 200K

The US macroeconomic docket featured US Initial Jobless Claims, Durable Goods data, and GDP figures. The Initial Jobless Claims for the week ending on November 10 rose to 199K, lower than the 260K foreseen by analysts. The USD/CAD jumped 20 pips on the release, reaching a daily high above 1.2700.

Furthermore, the Durable Good Orders for October on a monthly basis fell 0.5% more than the 0.4% contraction expected by analysts. Excluding transportation, orders rose more than expectations, up to 0.5% vs. 0.2%, for the same period. Market participants seem to have ignored the data, as the Fed's current focus is on jobs and inflation.

Also, the US GDP for Q3 grew by 2.1%. In line with market participants' expectations. That said, USD/CAD attention turns to the Fed favorite gauge of inflation, the Personal Consumption Expenditure for October, expected at 4.6%.

- New Home Sales grew 0.4% in October.

- New Home Sales growth in September received a hefty downgrade to 7.1% from 14%.

- Thus, the number of sales over the past 12 months came in at just 745K, versus last month's estimate of 800K prior to revisions.

Following a 7.1% (downwardly revised from 14.0%) surge in sales in September, New Home Sales in the US rose by a modest 0.4% in October, data published by the US Commerce Department showed on Wednesday.

Given the hefty downwards revision to the September figure, instead of rising to 800K, the number of New Home Sales over the past 12 months rose to just 745K from 742K in September. Note that last month's New Home Sales over the past 12 months figure was revised lower from 800K.

Market Reaction

Despite New Home Sales over the past 12 months running at a much slower pace than thought prior to Wednesday's data release, FX markets have not seen any reaction to the data.

- The UoM's final estimate of Consumer Sentiment for November was revised a little higher from the flash estimate to 67.4.

- That still marks its weakest reading since 2011.

The University of Michigan's (UoM) final estimate of the Consumer Sentiment Index came in at 67.4 in November, slightly above the flash estimate of 66.8 released earlier in the month, but well down from October's reading of 71.7. That still marks the weakest reading since 2011.

The Current Conditions Index rose to 73.6 from the flash estimate of 73.2, while the Consumer Expectations Index rose to 63.5 from the flash estimate of 63.0.

Market Reaction

FX markets did not pay much attention to the modest positive revisions to the final UoM consumer sentiment survey.

In the first few weeks of November, the Turkish lira has lost close to 25% of its value, while year-to-date the currency has weakened over 40% against the US dollar. Economists at Wells Fargo expect local actions to be taken in an attempt to stabilize the TRY, although further lira depreciation and new record lows against the dollar are very likely.

Turkish authorities to take action in response to the sell-off

“We fully expect interest rates to be cut again at the next monetary policy meeting on December 16 and for the lira to continue to hit new lows against the dollar by the end of this year and throughout 2022 and 2023.”

“Our most recent forecasts for the USD/TRY exchange rate have the lira dropping to 13.00 by Q2-2022 and eventually reaching 14.50 by the beginning of Q1-2023. Our forecasts imply about another 15% depreciation of the lira by the beginning of 2023; however, risks around this forecast are without question tilted toward more lira weakness than we currently anticipate.”

“In the very near future, we expect Turkish authorities to instruct local banks to re-start selling US dollars and purchasing Turkish lira; however, Turkish banks likely do not have enough US dollars to disrupt the downward pressure on the lira.”

“We expect Turkish authorities to reach out to allies such as Qatar, China, Azerbaijan, and other Asian nations as well as Russia in an attempt to enhance, extend or even initiate US dollar FX swap lines. However, broader market forces are currently too powerful, and we doubt these FX swap lines, if secured, will do much to alter the depreciation path ahead for the lira.”

Inflation in the US, as measured by the Personal Consumption Expenditures (PCE) Price Index, rose to 4.1% YoY in October, the US Bureau of Economic Analysis reported on Wednesday. That was in line with the median economist forecasts and confirmed a 0.4% rise from last month's upwardly revised reading of 3.7%. MoM, the Core PCE Price Index rose at a pace of 0.4%, also in line with expectations, a 0.2% acceleration from the 0.2% rise seen in September.

Market Reaction

FX markets did not react to the inline with forecast US inflation numbers.

France will continue discussions with the UK over post-Brexit fishing access for a few days before any retaliatory measures will be taken, European Affairs Minister Clement Beaune told the French senate on Wednesday, according to Reuters.

Market Reaction

Brexit hasnt been the main theme driving FX or GBP markets on Wednesday. Rather it has been European lockdown fears, strong US data and hawkish Fedspeak. GBP/USD continues to trade lower on the day by about 0.3% just under 1.3350 and EUR/GBP continues to trade close to 0.8400.

- President Lopez Obrador nominates Victoria Rodríguez to head the central bank.

- Mexican peso tumbles across the board after the announcement.

- Inflation in Mexico surpasses 7% to levels not seen in 20 years.

The Mexican peso is falling sharply against its main rivals on Wednesday, affected by the news regarding the nomination for the next head of the Bank of Mexico. The USD/MXN is rising almost 2%, trading near 21.60, the highest level since March.

As of writing, USD/MXN trades at 21.53. It peaked at 21.61, and a daily close around current levels would be the highest since October of 2020. The pair is testing the 2021 top it established back in March at 21.62.

Nomination changes at Banxico and higher than expected inflation

Mexican President Andres Manuel Lopez Obrador withdrew his nomination of former finance minister Arturo Herrera for governor of the central bank to replace current head, Alejandro Díaz de León. Lopez Obrador did not want Díaz de Leon to continue at the post and nominated Herrera back in June, leaving his post at the government a few weeks later.

On Wednesday, Lopez Obrador nominated Victoria Rodríguez Ceja. She holds a job at the Finance secretary and, if confirmed by the Senate, would be the first-ever female to lead Banxico.

The announcement came after data showed inflation accelerated during the first half of November (headline and core) surpassing expectations. The annual rate reached 7.05%, the highest level since April 2001. Banxico rose interest rates at the last meeting for the fourth consecutive time to 5% in order to curb inflation. Wednesday’s inflation figures warrant that more hikes are on the way.

At the same time, the US dollar remains strong in the market, boosted by recent economic data and higher yields. The rally of the greenback adds more fuel to the USD/MXN.

Technical levels

- EUR/USD drops further and records new 2021 low near 1.1190.

- US revised Q3 GDP came at 2.1% QoQ; Claims rose by 199K WoW.

- October’s PCE, final Consumer Sentiment comes up next.

The tenacious upside in the greenback forced EUR/USD to lose further ground and record new 16-month low at 1.1192 on Wednesday.

EUR/USD remains offered ahead of FOMC

In the meantime, the selloff in EUR/USD remains everything but abated, down for the third week in a row and navigating the negative territory for the fourth straight month so far.

Indeed, the Fed-ECB policy divergence continues to lend wings to the buck and pushes the US Dollar Index to new cycle peaks in levels just shy of the round level at 97.00, while higher US yields across the curve also add to the indefatigable upside moment in the dollar.

In the docket, earlier figures from the IFO survey in Germany saw the Business Climate easing to 96.5 in November, which has also put the pair under extra pressure. In the US, MBA Mortgage Applications rose 1.8% in the week to November 19, Initial Claims rose by 199K in the week to November 20, Durable Goods Orders contracted at a monthly 0.5% in October and another revision of GDP figures now sees the economy expanding 2.1% QoQ in the July-September period.

Later in the session, inflation figures tracked by the PCE are due seconded by the final reading of the November Consumer Sentiment, all ahead of the publication of the FOMC Minutes of the November 2-3 meeting.

EUR/USD levels to watch

So far, spot is losing 0.49% at 1.1192 and faces the next up barrier at 1.1322 (10-day SMA) followed by 1.1452 (20-day SMA) and finally 1.1464 (weekly high Nov.15). On the other hand, a break below 1.1186 (2021 low Nov.24) would target 1.1185 (monthly low Jul.1 2020) en route to 1.1168 (low Jun.19 2020).

According to Reuters, the Swiss government is to hold off on imposing any new nationwide restrictions to curb the spread of Covid-19 for now, despite characterising the health situation as "critical". The government said it expects the health situation to continue worsening in the coming weeks, which could lead to a rapid rise in hospitalisations.

"In light of the relatively low occupation of COVID-19 patients in (hospitals') intensive care units and strong regional differences, the moment has not yet come in the Federal Council's opinion to tighten measures throughout Switzerland" a government statement said on Wednesday.

Market Reaction

The Swiss franc has not seen any notable reaction to the latest news out of Switzerland.

Federal Reserve Bank of San Francisco President and FOMC member Mary Daly said on Wednesday that she sees the case to be made for speeding up the pace of the Fed's QE taper, which currently runs at $15B per month. If things continue to go as they have been going, she would completely support an acceleration of tapering, Daly added.

Daly continued that adding support to an already robustly growing economy isn't what the Fed wants to do and that she wants to bring that support down. However, she said that it would be premature to call for an acceleration of the taper today, as more data is needed. If the jobs market continues to fire on all cylinders and inflation comes in high again, that would support the case for acceleration, she said.

The decision on asset purchase tapering is different from that on rate hikes, she said, adding that her outlook is that the Fed is going to want to raise interest rates at the end of the next year. If there were one or two rate hikes next year, that would not surprise her at all, Daly said, saying that she wants to be data-dependent and not tied to any specific number of hikes. Even if the Fed did hike a few times next year, she added, it would still be providing accommodation.

Market Reaction

Daly's hawkish remarks, where she has indicated her openness to a faster QE taper and flexibility on rate hikes in 2022, are boosting the US dollar and US bond yields. The DXY is at fresh 16-month highs just under 96.00 and 2-year yields are now up 3bps on the session at just under 0.65%, its highest level since the start of the pandemic.

- USD/TRY climbs above 13.0000 for the first time ever on Wednesday.

- The lira manages to regain ground and drags spot lower afterwards.

- Turkey seeks to clinch a swap agreement with UAE.

Following new all-time highs past the 13.0000 yardstick earlier in the session, USD/TRY now corrects sharply lower and revisits the 12.0000 area on Wednesday.

USD/TRY off fresh all-time peaks above 13.0000

USD/TRY now partially fades Tuesday’s nearly 12% advance following news that Ankara could be negotiating a swap agreement with the UAE on Wednesday.

It is worth recalling that the lira collapsed on Tuesday after President Erdogan candidly defended the ongoing easing cycle by the Turkish central bank (CBRT), particularly following last week’s 100bps reduction of the One-Week Repo Rate.

Since the September meeting, the CBRT reduced the policy rate by 400 bps to 15.00%, all in context where the domestic inflation came in just short of 20.00% YoY in October.

The lira is by far the worst performing EM currency so far this year, shedding near 43% vs. the US dollar. In addition, spot clinched a new record after advancing for eleven straight sessions, from November 9 to November 23.

Data wise in Turkey, the Capacity Utilization improved a tad to 78.1% in November and the Manufacturing Confidence eased marginally to 108.4 in the same period.

USD/TRY key levels

So far, the pair is losing 4.82% at 12.0694 and a drop below 10.9237 (10-day SMA) would expose 9.8325 (high Oct.25) and finally 9.4722 (monthly low Nov.2). On the other hand, the next up barrier lines up at 13.1105 (all-time high Nov.24) followed by 14.0000 (round level).

- A combination of factors dragged GBP/USD lower for the fourth successive day.

- Brexit woes weighed on the GBP; hawkish Fed expectations underpinned the USD.

- Mixed US economic data did little to provide any meaningful impetus to the major.

The GBP/USD pair maintained its offered tone through the early North American session and had a rather muted reaction to the mixed US macro data. The pair was last seen trading around mid-1.3300s, just a few pips above YTD low set in the last hour.

The pair extended its recent downfall from levels just above the key 1.3500 psychological mark and continued losing ground for the fourth successive day on Wednesday. The impasse over the post-Brexit arrangement in Northern Ireland and fishing rights continued acting as a headwind for the British pound. This, along with the emergence of fresh buying around the US dollar, exerted some pressure on the GBP/USD pair.

In fact, the key USD Index shot to a fresh 16-month peak and remained well supported by expectations that the Fed would hike interest rates sooner rather than later amid rising inflationary pressures. Apart from this, the risk-off impulse in the equity markets further benefitted the greenback's relative safe-haven status. The combination of factors, to a larger extent, helped offset retreating US Treasury bond yields.

The USD held on to its gains and moved little after the Prelim (second estimate) US GDP print showed that the economy expanded by a 2.1% annualized pace during the third quarter of 2021. This was slightly better than the 2.0% growth reported originally, though missed market expectations for a reading of 2.1%. Separately, the US Weekly Initial Jobless Claims dropped more than expected to 199K from 270K in the previous week.

Meanwhile, the headline US Durable Goods Orders unexpected declined by 0.5% in October, while orders excluding transportation items matched estimates and increased 0.5% during the reported month. The data did little to dent the prevalent strong bullish sentiment surrounding the USD or lend any support to the GBP/USD pair. This, in turn, suggests that the recent downward trajectory might still be far from being over.

Technical levels to watch

- Weekly Initial Jobless Claims in US declined by 71,000.

- US Dollar Index continues to push higher toward 97.00.

There were 199,000 initial claims for unemployment benefits in the US during the week ending November 20, the data published by the US Department of Labor (DOL) revealed on Wednesday. This reading followed the previous print of 270,000 (revised from 268,000) and came in better than the market expectation of 260,000.

Market reaction

The greenback continues to outperform its rivals after this data and the US Dollar Index was last seen rising 0.3% on the day at 96.78.

Key takeaways

"The 4-week moving average was 252,250, a decrease of 21,000 from the previous week's revised average."

"The advance seasonally adjusted insured unemployment rate was 1.5% for the week ending November 13."

"The advance number for seasonally adjusted insured unemployment during the week ending November 13 was 2,049,000, a decrease of 60,000 from the previous week's revised level."

- Durable Goods Orders fell by 0.5% MoM in October, but orders excluding transportation rose at a pace of 0.5% MoM.

- The DXY recently probed highs of the day.