- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 24-06-2014

Gold $1,320.90 +3.20 +0.24%

ICE Brent Crude Oil $114.13 +0.010 +0.009%

NYMEX Crude Oil $107.06 +1.36 +1.29%

Nikkei 15,376.24 +6.96 +0.05%

Hang Seng 22,880.64 +75.83 +0.33%

Shanghai Composite 2,033.93 +9.57 +0.47%

S&P 1,949.98 -12.63 -0.64%

NASDAQ 4,350.36 -18.32 -0.42%

Dow 16,818.13 -119.13 -0.70%

FTSE 1,386.75 -1.59 -0.11%

CAC 4,518.34 +2.77 +0.06%

DAX 9,938.08 +17.16 +0.17%

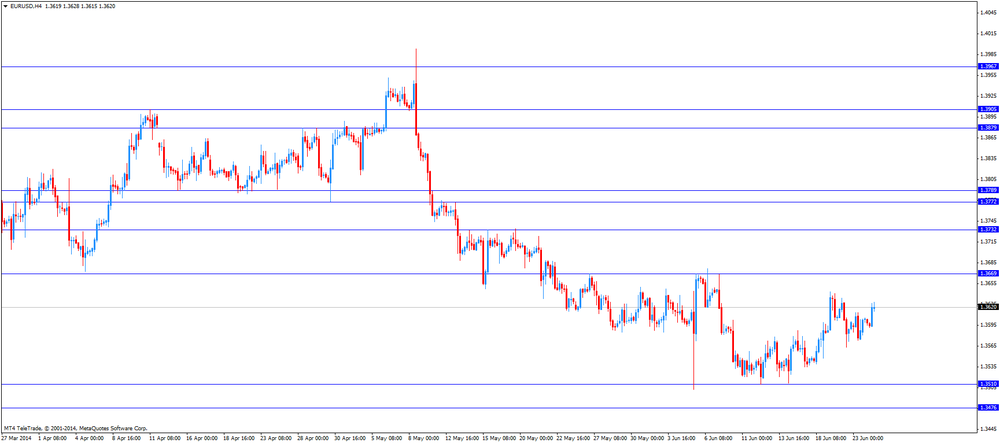

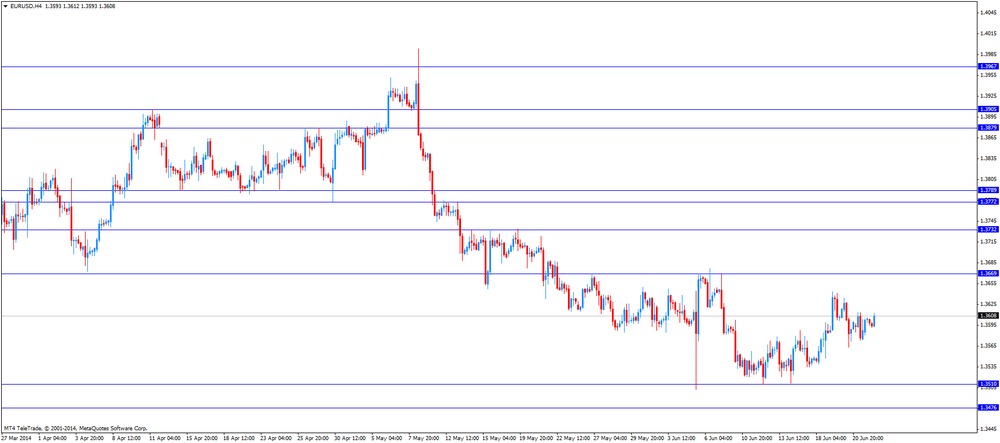

EUR/USD $1,3602 -0,01%

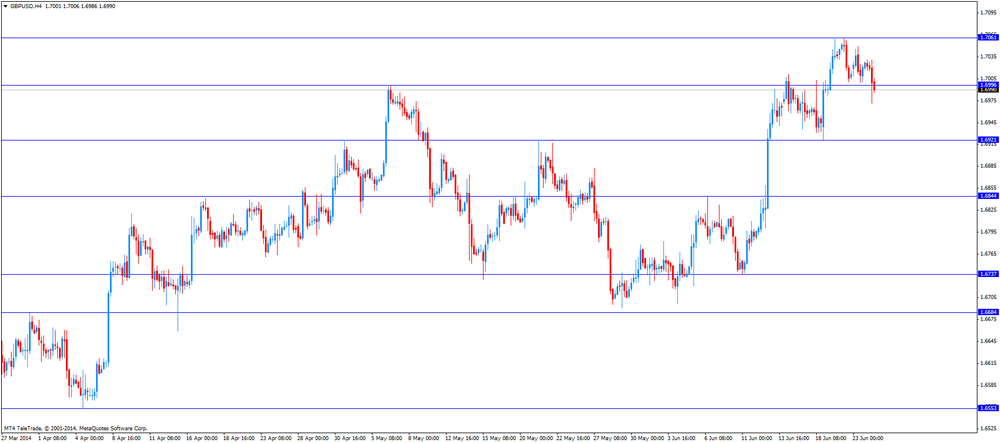

GBP/USD $1,6982 -0,26%

USD/CHF Chf0,8939 -0,03%

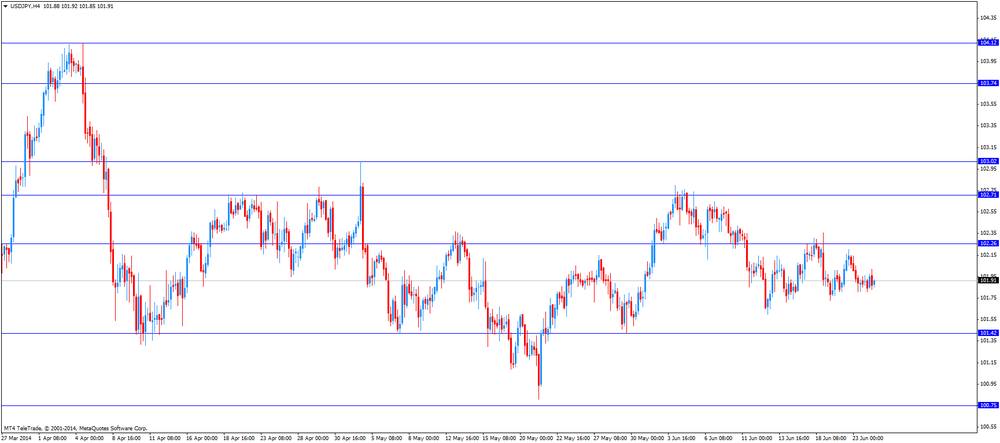

USD/JPY Y101,96 +0,06%

EUR/JPY Y138,69 +0,05%

GBP/JPY Y173,14 -0,20%

AUD/USD $0,9366 -0,60%

NZD/USD $0,8669 -0,58%

USD/CAD C$1,0745 +0,16%

03:00 Australia RBA Assist Gov Lowe Speaks

06:00 United Kingdom Nationwide house price index June +0.7% +0.7%

06:00 United Kingdom Nationwide house price index, y/y June +11.1%

06:00 Germany Gfk Consumer Confidence Survey July 8.5 8.6

06:00 Switzerland UBS Consumption Indicator May 1.72

10:00 United Kingdom CBI retail sales volume balance June 16 25

12:30 U.S. Durable Goods Orders May -0.6% -0.1%

12:30 U.S. Durable Goods Orders ex Transportation May +0.3% +0.3%

12:30 U.S. Durable goods orders ex defense May -0.8%

12:30 U.S. PCE price index, q/q (Finally) Quarter I +1.3% +1.3%

12:30 U.S. PCE price index ex food, energy, q/q (Finally) Quarter I +3.1% +3.1%

12:30 U.S. GDP, q/q (Finally) Quarter I -1.0% -1.7%

13:45 U.S. Services PMI (Preliminary) June 58.1 58.6

14:30 U.S. Crude Oil Inventories June -0.6

Stock indices traded mixed due to the weaker-than-expected German Ifo business climate index. The German Ifo business climate index declined to 109.7 in June from 110.4 in May. That was the lowest level this year. Analysts had expected a fall to 110.3.

The German Ifo expectations index fell to 104.8 in June from 106.2 in May.

The Bank of England Governor Mark Carney testified before parliament's Treasury committee today. He said that the interest rate hike will be driven by the U.K. economic data. Mr. Carney also said there has been more spare capacity in the labour market that can be absorbed before the interest rate hike.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,787.07 -13.49 -0.20%

DAX 9,938.08 +17.16 +0.17%

CAC 40 4,518.34 +2.77 +0.06%

The U.S. dollar increased against the most major currencies due to the strong U.S. economic data. The Conference Board released its consumer confidence index. The index climbed to 85.2 in June from a reading of 82.2 in May. That was the highest level since January 2008. May's figure was revised down from 83.0. Analysts expected an increase to 83.6.

New home sales in the U.S. jumped 18.6% in May to a seasonally adjusted annual rate of 504,000 units. That was the highest level since May 2008.

Analysts had expected new home sales to rise to 442,000 units. April's figure was revised down to 425,000 units from 433,000 units.

S&P/Case-Shiller home price index climbed 10.8% in April, missing expectations for a gain of 11.6%, after a 12.4% rise in March.

Richmond Fed manufacturing index declined to 3 in June from 7 in May, missing expectations for a fall to 6. Figures above zero indicate expansion.

The euro declined against the U.S. dollar after the release of the better-than-expected U.S. economic data. The German Ifo business climate index declined to 109.7 in June from 110.4 in May. That was the lowest level this year. Analysts had expected a fall to 110.3.

The German Ifo expectations index fell to 104.8 in June from 106.2 in May.

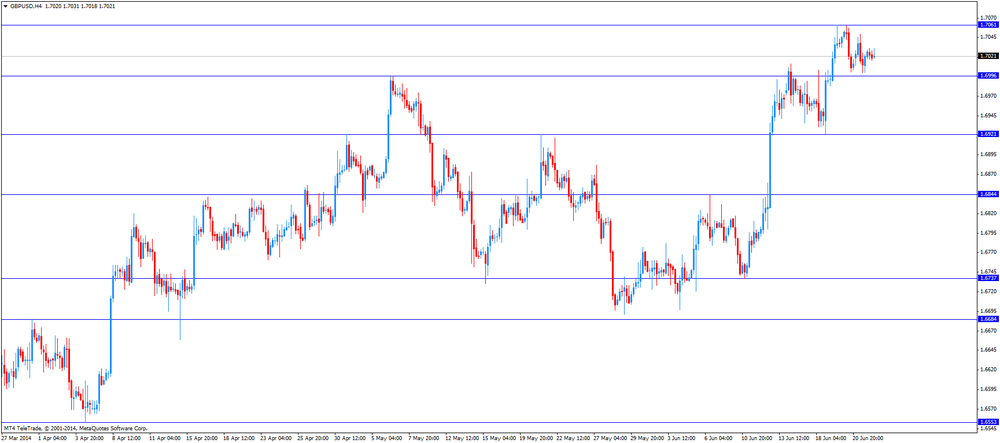

The British pound declined against the U.S. dollar due to the speech of the Bank of England (BoE) Governor Mark Carney and the better-than-expected U.S. economic data. Mark Carney testified before parliament's Treasury committee today. He said that the interest rate hike will be driven by the U.K. economic data. He also said that wages in the U.K. are softer than expected by the BoE.

These comment by Mark Carney means there is no need to hike interest rate.

The British Bankers Association release the mortgage approvals. The U.K. mortgage approvals climbed by £41,800 in May, exceeding expectations for a rise of £41,300, after an increase of £41,900 in April.

The New Zealand dollar fell against the U.S dollar due to the better-than-expected U.S. economic data. No economic reports were released in New Zealand.

The Australian dollar declined against the U.S. dollar due to the better-than-expected U.S. economic data. No economic reports were released in Australia.

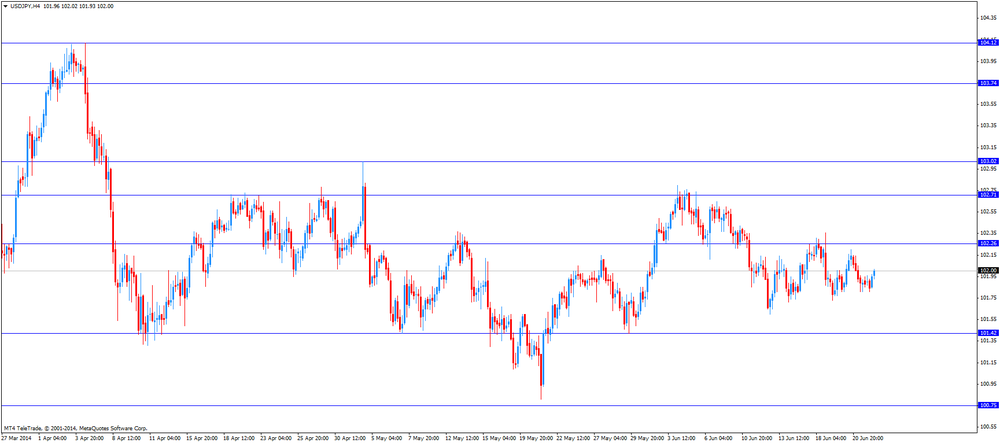

The Japanese yen traded lower against the U.S. dollar due to the better-than-expected U.S. economic data. No economic reports were released in Japan.

Japan's Prime Minister Shinzo Abe unveiled the reform plans of his "third arrow" strategy today. His reform plan focuses to encourage Japanese companies to invest more and create more jobs. The government plans to cut the corporate tax rate and to boost the role of working women due to the shrinking workforce in Japan.

West Texas Intermediate and Brent crudes rose, approaching nine-month highs, as an al-Qaeda offshoot consolidates its control over areas of Iraq, OPEC's second-largest producer.

Iraqi forces have been battling the Sunni Islamic State in Iraq and the Levant for control of the Baiji refinery north of Baghdad for almost two weeks. Russian President Vladimir Putin asked lawmakers in the upper house of parliament to rescind approval they granted to use force in Ukraine. A government report tomorrow is projected to show that U.S. crude supplies fell a fourth week.

"The situations in Iraq and Ukraine continue to support the market," said Gene McGillian, an analyst and broker at Tradition Energy in Stamford, Connecticut. "Things were a little overdone so prices retreated yesterday, but that move's run its course. We are going to continue to trade near nine-month highs as long as fears about Iraqi supply remain."

WTI for August delivery rose 23 cents to $106.40 a barrel at 10:37 a.m. on the New York Mercantile Exchange. Futures touched $107.73 on June 20, the highest intraday price since Sept. 19. The volume of all futures traded was 25 percent below the 100-day average for the time of day.

Brent for August settlement increased 31 cents, or 0.3 percent, to $114.43 a barrel on the London-based ICE Futures Europe exchange. Futures touched $115.71 on June 19, the highest since Sept. 9. The contract slid 0.6 percent yesterday, the biggest loss since May 16. The volume of all futures traded was 69 percent higher than the 100-day average.

Gold prices fluctuate, while investors are trying to understand how this precious metal will trade after rising last week.

Gold prices rose to their highest level since April last week. This happened after the Federal Reserve System (FRS) the USA has surprised investors by taking a softer than expected position at its meeting on monetary policy on Wednesday. The upsurge of violence in Iraq has also pushed gold prices to rise. Some investors use gold as a hedge against low interest rates. This metal is also in demand in terms of geopolitical tensions, as investors believe that it holds its value better than other assets.

Since the price of gold rose by 6% from the lows reached earlier this month, some investors decided to take profits, while others reflect on whether to continue the growth of prices.

"The market seems to have confused" - said Peter Hug, director of Kitco Metals. - After the reaction growth last week, traders are trying to understand whether it was the beginning of a new bull market. "

The gold market experienced the 12-year bull market that ended in 2013. This year, gold prices rose by 9.7%.

The cost of the August gold futures on the COMEX today rose to $ 1326.6 per ounce.

The Commerce Department released new home sales in the U.S. New home sales jumped 18.6% in May to a seasonally adjusted annual rate of 504,000 units. That was the highest level since May 2008.

Analysts had expected new home sales to rise to 442,000 units. April's figure was revised down to 425,000 units from 433,000 units.

That could be a sign for the housing recovery in the U.S.

Japan's Prime Minister Shinzo Abe unveiled the reform plans of his "third arrow" strategy today. His reform plan focuses to encourage Japanese companies to invest more and create more jobs. The government plans to cut the corporate tax rate below 30% from the current 34%. This process should start next year.

The government wants to boost the role of working women due to the shrinking workforce in Japan. Japan's population is one of the world's most rapidly ageing populations.

The Bank of England Governor Mark Carney testified before the Treasury Select Committee (TSC) today. He said:

- Wages in the U.K. softer than expected by the BoE;

- There has been more spare capacity in the labour market that can be absorbed before the interest rate hike;

- Timing of any interest increases is not as important as the fact any interest rise will be "limited and gradual";

- The interest rate hike will be driven by the U.K. economic data.

EUR/USD $1.3500, $1.3530, $1.3545, $1.3600, $1.3635

USD/JPY Y102.05, Y102.75, Y103.00

EUR/JPY Y138.50, Y139.55

AUD/USD $0.9350/60

NZD/USD NZ$0.8655

USD/CHF Chf0.8900, Chf0.9005

U.S. stock futures were little changed as data showed home prices rose at a slower pace than forecast and investors watched developments in Iraq.

Global markets:

Nikkei 15,376.24 +6.96 +0.05%

Hang Seng 22,880.64 +75.83 +0.33%

Shanghai Composite 2,033.93 +9.57 +0.47%

FTSE 6,788.61 -11.95 -0.18%

CAC 4,521.35 +5.78 +0.13%

DAX 9,928.37 +7.45 +0.08%

Crude oil $106.24 (+0.05%)

Gold $1322.80 (+0.31%)

(company / ticker / price / change, % / volume)

| Caterpillar Inc | CAT | 108.80 | +0.02% | 1.2K |

| General Electric Co | GE | 26.70 | +0.07% | 14.6K |

| Exxon Mobil Corp | XOM | 104.53 | +0.14% | 1.9K |

| Nike | NKE | 75.60 | +0.20% | 2.0K |

| Wal-Mart Stores Inc | WMT | 76.05 | +0.34% | 1.0K |

| Cisco Systems Inc | CSCO | 24.70 | 0.00% | 2.4K |

| Chevron Corp | CVX | 132.94 | -0.03% | 1.7K |

| Pfizer Inc | PFE | 29.44 | -0.03% | 1.0K |

| United Technologies Corp | UTX | 117.10 | -0.03% | 0.1K |

| AT&T Inc | T | 35.37 | -0.06% | 3.0K |

| Microsoft Corp | MSFT | 41.95 | -0.10% | 1.9K |

| Johnson & Johnson | JNJ | 104.62 | -0.12% | 0.2K |

| Goldman Sachs | GS | 170.00 | -0.14% | 0.1K |

| Walt Disney Co | DIS | 82.62 | -0.17% | 3.5K |

| JPMorgan Chase and Co | JPM | 58.08 | -0.19% | 2.1K |

| Intel Corp | INTC | 30.17 | -0.20% | 2.8K |

| Verizon Communications Inc | VZ | 49.63 | -0.20% | 13.0K |

| Visa | V | 208.50 | -0.46% | 0.4K |

| The Coca-Cola Co | KO | 41.54 | -0.46% | 1.4K |

Upgrades:

Downgrades:

Other:

Apple (AAPL) target raised to $97 from $86.32 at Needham

Home Depot (HD) initiated with a Equal-Weight at Morgan Stanley

Economic calendar (GMT0):

02:00 China Leading Index May +0.9% +0.7%

06:00 Switzerland Trade Balance May 2.45 2.77 2.77

08:00 Germany IFO - Business Climate June 110.4 110.3 109.7

08:00 Germany IFO - Current Assessment June 114.8 114.8

08:00 Germany IFO - Expectations June 106.2 104.8

08:30 United Kingdom BBA Mortgage Approvals May 42.2 41.3 41.8

08:30 United Kingdom BOE Gov Mark Carney Speaks

08:30 United Kingdom Inflation Report Hearings

The U.S. dollar traded mixed against the most major currencies ahead of the U.S. economic data. S&P/Case-Shiller home price index should climb 11.7% in April, after a 12.4% rise in March.

The consumer confidence in the U.S. should rise to 83.6 in June from 83.0 in May.

The euro increased against the U.S. dollar despite the weaker-than-expected German Ifo business climate index. The German Ifo business climate index declined to 109.7 in June from 110.4 in May. That was the lowest level this year. Analysts had expected a fall to 110.3.

The German Ifo expectations index fell to 104.8 in June from 106.2 in May.

The British pound declined against the U.S. dollar after the speech of the Bank of England (BoE) Governor Mark Carney. Mark Carney testified before parliament's Treasury committee today. He said that the interest rate hike will be driven by the U.K. economic data. He also said that wages in the U.K. are softer than expected by the BoE.

These comment by Mark Carney means there is no need to hike interest rate.

The British Bankers Association release the mortgage approvals. The U.K. mortgage approvals climbed by £41,800 in May, exceeding expectations for a rise of £41,300, after an increase of £41,900 in April.

EUR/USD: the currency pair increased to $1.3628

GBP/USD: the currency pair decreased to $1.6972

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:05 U.S. FOMC Member Charles Plosser Speaks

13:00 Belgium Business Climate June -6.8 -4.1

13:00 U.S. S&P/Case-Shiller Home Price Indices, y/y April +12.4% +11.7%

14:00 U.S. Consumer confidence June 83.0 83.6

14:00 U.S. New Home Sales May 433 442

14:00 U.S. Treasury Sec Lew Speaks

EUR/USD

Offers $1.3695/00, $1.3688, $1.3670/80, $1.3645

Bids $1.3580, $1.3550, $1.3535, $1.3515/10

GBP/USD

Offers $1.7110/20, $1.7090, $1.7080/85, $1.7062

Bids $1.6992, $1.6980, $1.6950, $1.6910/00

AUD/USD

Offers $0.9545, $0.9500, $0.9460, $0.9450

Bids $0.9380, $0.9350, $0.9320

EUR/JPY

Offers Y140.00, Y139.50, Y139.20, Y139.00

Bids Y138.40, Y138.20, Y138.00

USD/JPY

Offers Y102.80, Y102.65, Y102.40, Y102.20

Bids Y101.70, Y101.50, Y101.00

EUR/GBP

Offers stg0.8100, stg0.8080, stg0.8050, stg0.8035/40

Bids stg0.7950, stg0.7900

Stock indices traded mixed due to the weaker-than-expected German Ifo business climate index. The German Ifo business climate index declined to 109.7 in June from 110.4 in May. That was the lowest level this year. Analysts had expected a fall to 110.3.

The German Ifo expectations index fell to 104.8 in June from 106.2 in May.

The Bank of England Governor Mark Carney testified before parliament's Treasury committee today. He said that the interest rate hike will be driven by the U.K. economic data.

Concerns over in Iraq and Ukraine also weighed on stock markets.

Current figures:

Name Price Change Change %

FTSE 100 6,788.36 -12.20 -0.18%

DAX 9,922.53 +1.61 +0.02%

CAC 40 4,521.28 +5.71 +0.13%

EUR/USD $1.3500, $1.3530, $1.3545, $1.3600, $1.3635

USD/JPY Y102.05, Y102.75, Y103.00

EUR/JPY Y138.50, Y139.55

AUD/USD $0.9350/60

NZD/USD NZ$0.8655

USD/CHF Chf0.8900, Chf0.9005

Asian stock traded slightly higher. Concerns over escalating violence in Iraq weighed on stock markets.

There are still concerns over the health of China's economy despite yesterday's Chinese economic data. China's HSBC manufacturing purchasing managers' index rose to 50.8 in June from 49.4 in May. Analysts had expected an increase to 49.7.

The Chinese leading index declined 0.7% May, after a 0.9% gain in April. This data was released today.

Investors are awaiting Prime Minister Shinzo Abe's press conference later in the day. Mr. Abe should unveil the reform plans of his "third arrow" strategy.

Indexes on the close:

Nikkei 225 15,376.24 +6.96 +0.05%

Hang Seng 22,880.64 +75.83 +0.33%

Shanghai Composite 2,033.93 +9.57 +0.47%

Economic calendar (GMT0):

02:00 China Leading Index May +0.9% +0.7%

06:00 Switzerland Trade Balance May 2.45 2.77 2.77

08:00 Germany IFO - Business Climate June 110.4 110.3 109.7

08:00 Germany IFO - Current Assessment June 114.8 114.8

08:00 Germany IFO - Expectations June 106.2 104.8

08:30 United Kingdom BBA Mortgage Approvals May 42.2 41.3 41.8

08:30 United Kingdom BOE Gov Mark Carney Speaks

08:30 United Kingdom Inflation Report Hearings

The U.S. dollar traded mixed against the most major currencies. The U.S. currency was supported by the better-than-expected he U.S. manufacturing purchasing managers' index. The U.S. manufacturing purchasing managers' index climbed to 57.5 in June from 56.4 in May, beating expectations for a decline to 56.1.

The New Zealand dollar traded mixed against the U.S dollar in the absence of any major economic reports in New Zealand. The kiwi was still supported by yesterday's Chinese economic data. China's HSBC manufacturing purchasing managers' index rose to 50.8 in June from 49.4 in May. Analysts had expected an increase to 49.7.

The Australian dollar declined against the U.S. dollar in the absence of any major economic reports in Australia.

The Japanese yen traded slightly lower against the U.S. dollar in the absence of any major economic reports in Japan.

EUR/USD: the currency pair declined to $1.3590

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair increased to Y101.97

The most important news that are expected (GMT0):

12:05 U.S. FOMC Member Charles Plosser Speaks

13:00 Belgium Business Climate June -6.8 -4.1

13:00 U.S. S&P/Case-Shiller Home Price Indices, y/y April +12.4% +11.7%

14:00 U.S. Consumer confidence June 83.0 83.6

14:00 U.S. New Home Sales May 433 442

14:00 U.S. Treasury Sec Lew Speaks

EUR / USD

Resistance levels (open interest**, contracts)

$1.3682 (2410)

$1.3655 (3467)

$1.3624 (388)

Price at time of writing this review: $ 1.3595

Support levels (open interest**, contracts):

$1.3575 (1032)

$1.3552 (4096)

$1.3521 (5037)

Comments:

- Overall open interest on the CALL options with the expiration date July, 3 is 30740 contracts, with the maximum number of contracts with strike price $1,3700 (3845);

- Overall open interest on the PUT options with the expiration date July, 3 is 42368 contracts, with the maximum number of contracts with strike price $1,3500 (5359);

- The ratio of PUT/CALL was 1.38 versus 1.37 from the previous trading day according to data from June, 23

GBP/USD

Resistance levels (open interest**, contracts)

$1.7300 (385)

$1.7201 (2081)

$1.7103 (2286)

Price at time of writing this review: $1.7024

Support levels (open interest**, contracts):

$1.6995 (1194)

$1.6898 (1641)

$1.6799 (1720)

Comments:

- Overall open interest on the CALL options with the expiration date July, 3 is 19786 contracts, with the maximum number of contracts with strike price $1,7100 (2353);

- Overall open interest on the PUT options with the expiration date July, 3 is 25038 contracts, with the maximum number of contracts with strike price $1,6750 (2267);

- The ratio of PUT/CALL was 1.27 versus 1.20 from the previous trading day according to data from June, 23

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.