- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 24-04-2022

- USD/CAD sees more upside to 1.2800 on slippage in oil prices.

- The testimony of Fed’s Powell has cemented the expectation of a 50 bps rate hike by the Fed.

- The higher inflation print in Canada is compelling one more jumbo rate hike by the BOC.

The USD/CAD pair is on the verge of giving a breakout of its consolidation formed in a narrow range of 1.2696-1.2727. The asset has remained in positive territory as a rebound in the risk-off impulse has underpinned the greenback against loonie. The risk-off impulse observed on Friday is expected to be followed on Monday, which will drive the asset higher to the psychological resistance of 1.2800 sooner.

West Texas Intermediate (WTI) prices have lost their strength on renewed fears of oil demand after the International Monetary Fund (IMF) slashed its global growth forecast to 3.6%, much lower than the previously estimated figure of 4.4%. Lower aggregate demand will result in less usage of oil and henceforth a slump in the oil demand for a longer horizon. Meanwhile, China is still recovering from the pandemic of the Covid-19, which has also dented the demand for oil. It is worth noting that Canada is the biggest exporter of oil to the US and slippage in oil prices is affecting the fiscal revenues of Canada.

Apart from that, the higher release of the Consumer Price Index (CPI) by Statistics Canada at 6.7% against the forecast of 6.1% last week has raised the odds of one more jumbo rate hike by the Bank of Canada. In the second week, the BOC raised its interest rate by 50 basis points (bps) to 1%.

Meanwhile, the US dollar index (DXY) is sustaining above 101.00 and a firmer establishment above the round level support will drive it towards the north. The DXY is performing stronger after Federal Reserve (Fed) chair Jerome Powell cemented the expectations of a 50 bps interest rate hike. Going forward, investors will focus on the speech from BOC Governor Tiff Macklem, which is due on Monday.

- XAU/USD is bidding around 61.8% Fibo retracement on a likely hawkish Fed move in May.

- An interest rate hike of 50 bps is going to feature in May as dictated by the Fed policymakers.

- Investors should brace for a quicker reversion to neutral rates to corner the inflation.

Gold (XAU/USD) is displaying a mild positive move in the early Tokyo session after a bearish Friday as the market is attracting volatility in a likely prolonged hawkish environment. The precious metal is drifting lower after failing to reclaim the psychological resistance of $2,000.00 last week as the market participants are bracing faster-than-expected pace to be adopted by the Federal Reserve (Fed) to reverse back to the neutral rates.

Fed chair Jerome Powell in his testimony at the International Monetary Fund (IMF) meeting on Thursday mentioned a 50 basis point (bps) interest rate hike on the cards. This has bolstered the possibility of an event of a jumbo rate hike announcement by the Fed in May monetary policy. Also, Fed’s Powell reported that multi-decade high inflation in the US economy is demanding a quick pace for interest rate elevation, which states that investors should brace for more than one 50 bps rate hike announcement by the Fed this year. Also, the risk-aversion theme in the market is underpinning the greenback against the precious metal.

Gold Technical Analysis

On an hourly scale, XAU/USD is oscillating around 61.8% Fibonacci retracement (placed from March 29 low at $1,890.21 to last week’s high at $1,998.43) at $1,931.56. The 20- and 50-period Exponential Moving Averages (EMAs) at $1,938.20 and $1,944.56 respectively are scaling lower, which adds to the downside filters. Meanwhile, the Relative Strength Index (RSI) (14) has shifted into a bearish range of 20.00-40.00, which signals a fresh bearish impulsive wave ahead.

Gold hourly chart

-637864372653087425.png)

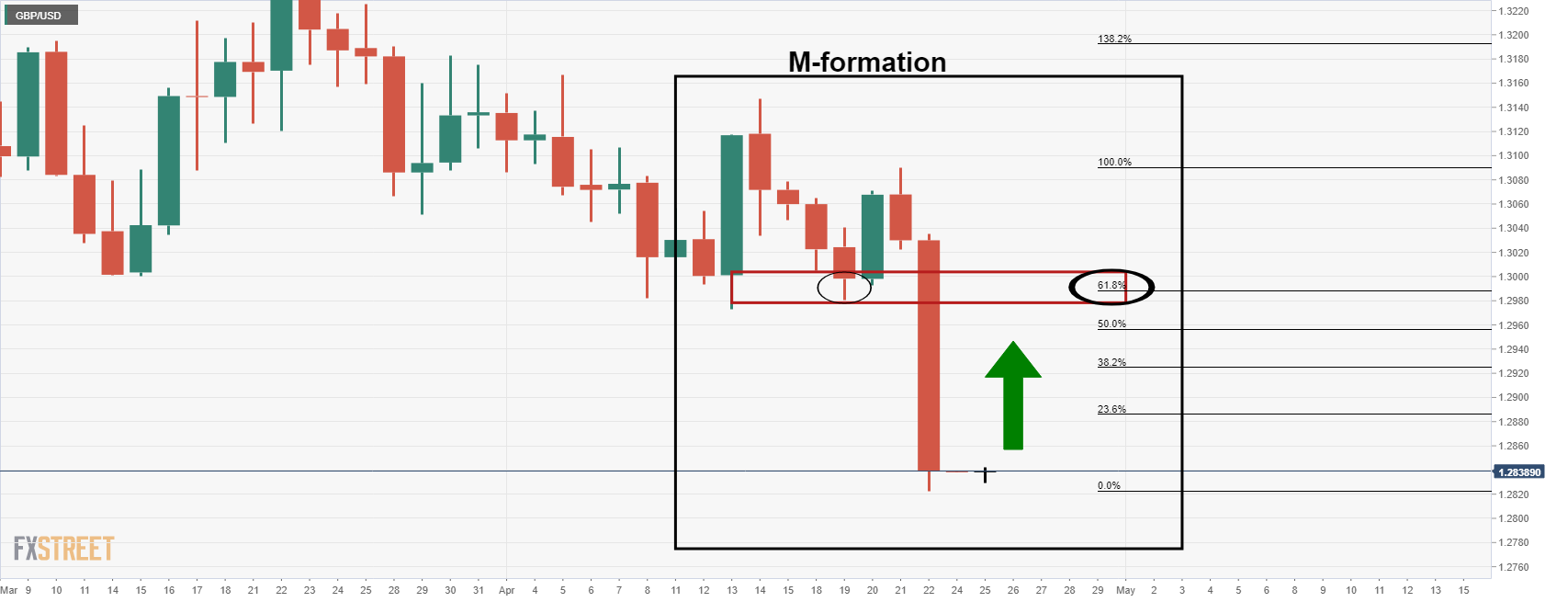

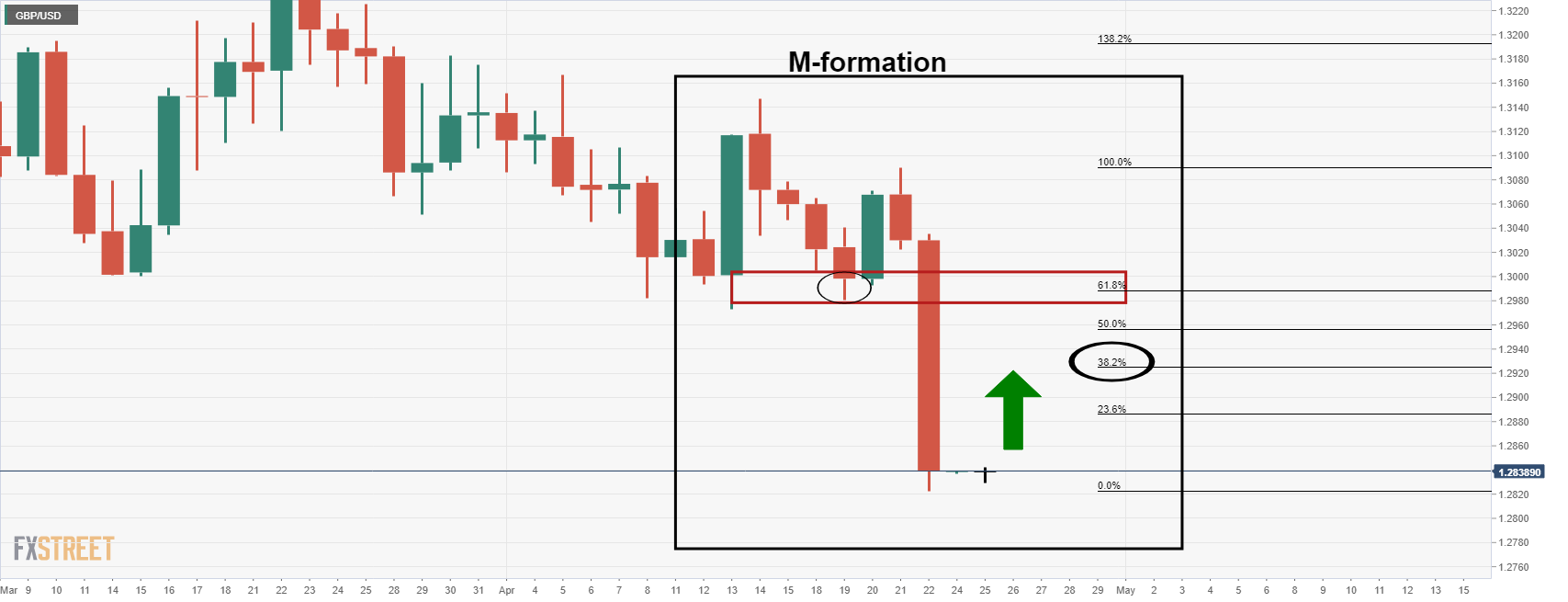

- GBP/USD bulls moving in and eye a significant correction.

- The M-information is compelling and eye a key confluence area.

GBP/USD is under pressure but the bulls could be on the verge of making a move which would be anticipated to be a significant correction in the days ahead.

The following illustrates the market structure and prospects of a reversion along the Fibonacci retracement scale.

GBP/USD daily chart

The M-formation is a bullish reversion pattern with a high completion rate whereby the price would be expected to revert to the neckline of the pattern. However, in this case, the pattern is overextended:

In this scenario, the 38.2% Fibonacci could well be a more achievable target given the strength of the sell-off.

- USD/JPY kick-starts Monday’s session on a flat note as uncertainty loom amid aggressive Fed.

- Soaring inflation and lower unemployment levels are indicating a jumbo rate hike from the Fed.

- The juggernaut fall in the Japanese yen found a pause on verbal intervention by Tokyo’s officials.

The USD/JPY pair has opened on a minor slip at around 128.38 on Monday after a range-bound week. The pair remained in consolidation in a narrow range of 127.46-129.40 last week despite progressive odds of a 50 basis point (bps) interest rate hike by the Federal Reserve (Fed).

The testimony of Fed chair Jerome Powell on Thursday at the International Monetary Fund (IMF) meeting has advocated a jumbo rate hike in May to tame the soaring inflation, which is affecting the households' living expenses. The story of a tantamount figure of 8.5% US inflation rate and consistency in full employment levels is demanding a quick reversion to neutral rates as the situation could shock the US economy.

Meanwhile, the negative market sentiment recorded on Friday is likely to be followed on Monday, which may underpin the mighty greenback. The US dollar index (DXY) is likely to sustain above the round level support of 101.00 on bolstering chances of hawkish guidance From Fed’s Powell in monetary policy next month.

On the Japanese yen front, the release of Japan’s National Consumer Price Index (CPI) at 1.2% is indicating a continuation of ultra-loose monetary policy. Printing National CPI below the targeted inflation rate of 2% doesn’t require a tight stance. It is worth noting that the plummet in the Japanese yen has witnessed a minor pause after a verbal intervention of Japanese Finance Minister Shunichi Suzuki. The Japanese official warned on Wednesday that the negative impact of the extremely weak yen would be much more on the economy rather than its constructive merit for exporters.

An adviser to Ukrainian President Volodymyr Zelenskyy said the US secretary of state and defense chief were meeting with the Ukrainian leader in the highest-level visit to Kyiv by an American delegation since the start of Russia's invasion. Oleksiy Arestovich, Advisor to the Head of Office of the President of Ukraine, announced this.

In other related headlines, the UK MOD has stated that “Russia is planning a staged referendum in the southern city of Kherson aimed at justifying its occupation. The city is key to Russia’s objective of establishing a land bridge to Crimea and dominating southern Ukraine.''

Vladimir Putin has reported to have abandoned the possibility of concluding a peace deal with Ukraine and is "turning to a land-grab strategy," the Financial Times writes, citing three sources with knowledge of the Russian president's plans.

- Aussie CPI will be the key domestic event for the week ahead.

- AUD/USD is testing a monthly 61.8% ratio and support, but is firmly bearish.

AUD/USD is poised for further downside for the week ahead, but that will depend on a key area of support giving out and traders will be looking for a catalyst in this week's inflation data from Australia.

The price of the Aussie has been under pressure for the last few weeks and last week was no exception, ending down 1.74% on Friday for a bearish weekly close. However, there are prospects of the greenback continuing to draw support from Federal Reserve Chair Jerome Powell's comments last Thursday that underpinned a half a percentage point tightening at next month's policy meeting.

Additionally, the French election result is market-friendly and a rise in the euro and equity prices could be reflected through AUD/USD for the open if only giving temporary relief from the downside bias. Nevertheless, there will be plenty of economic indicators, including US Gross Domestic Product and the Aussie Consumer Price Index.

Analysts at TD Securities explained that the Reserve Bank of Australia expects trimmed mean inflation to print above 3%, same as the market and our forecast.

''Higher dwelling prices and transport costs are the usual culprits for the pickup in inflation but a jump in food prices likely adds upside risks. However, unless trimmed mean inflation prints above 4% y/y, we see a low chance of RBA hiking in May and stick to our 15bps hike in June.''

AUD/USD technical analysis

AUD/USD is reaching a monthly support area that has a confluence with the 61.8% ratio. This could prove to be a strong demand area:

The price broke the daily trendline and the imbalance of bids and offers could result in a correction for the forth coming days.

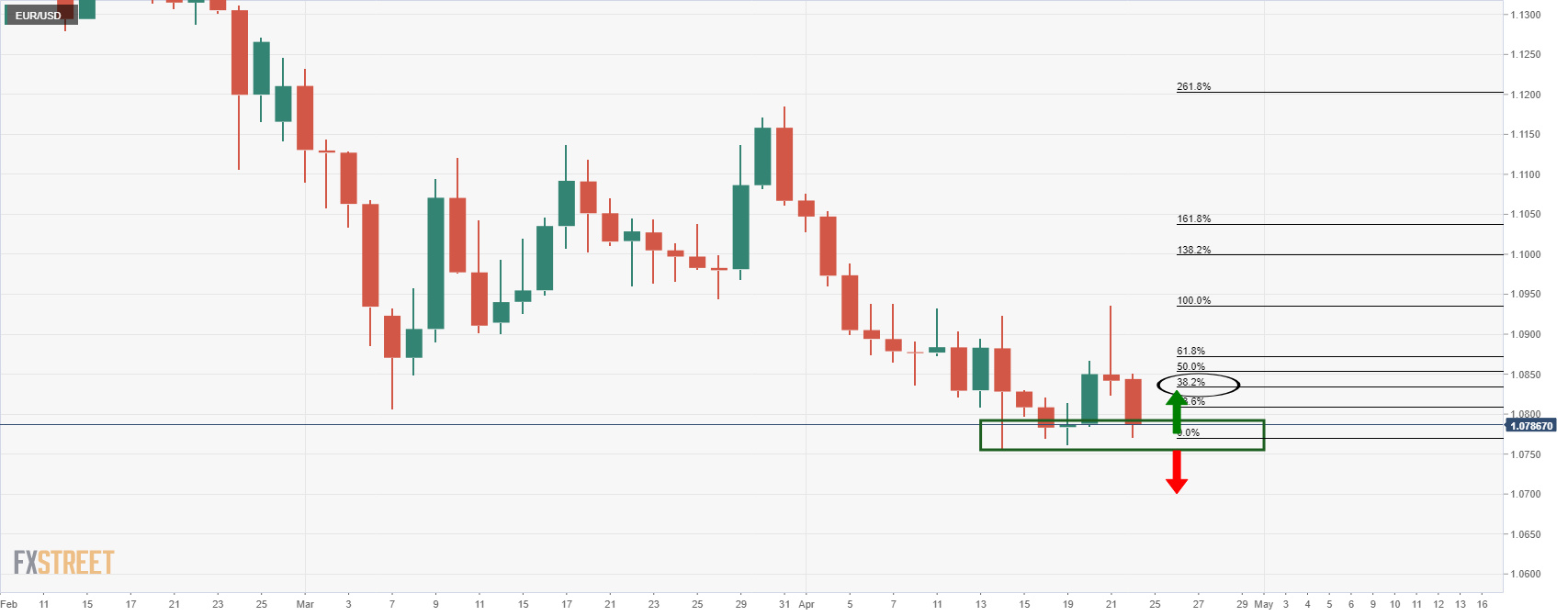

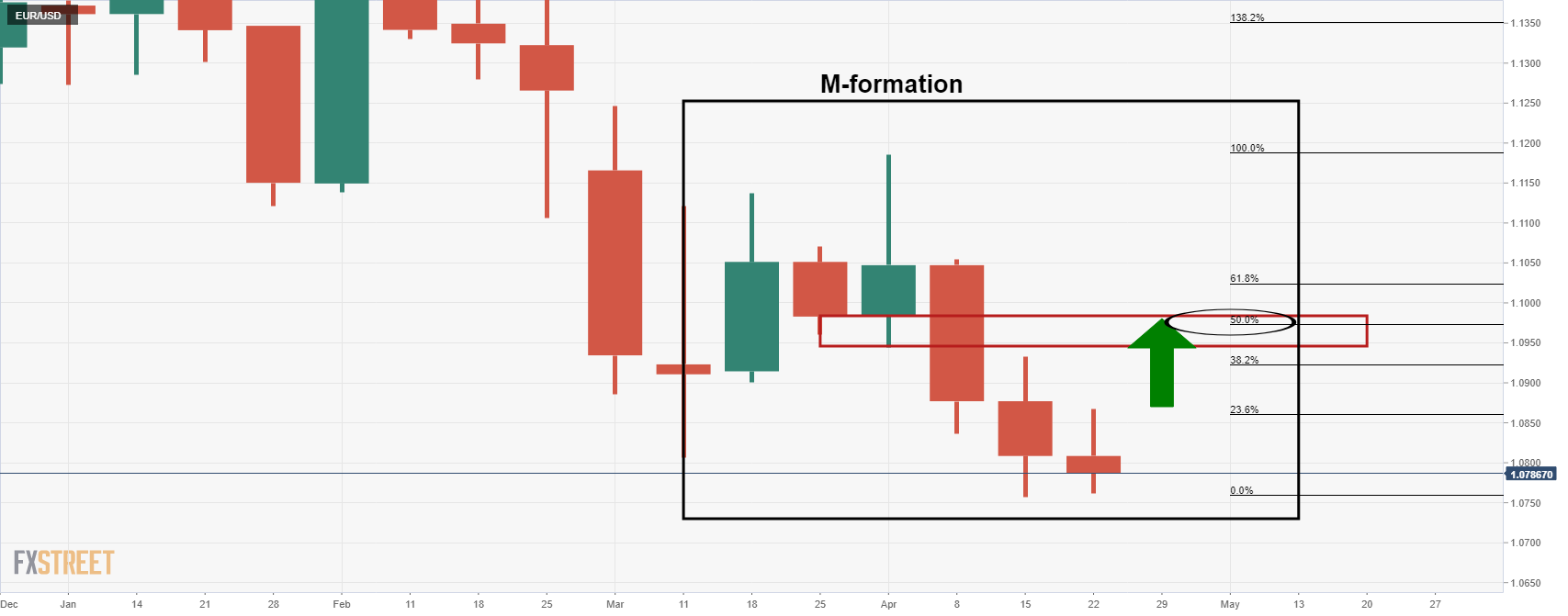

- EUR/USD has been under pressure, but French elections results could draw out the bulls.

- Weekly chart's M-formation eyed for the week ahead.

EUR/USD ended Friday on the back foot but momentum in the week's price action lost some momentum and the bulls could be about to show up. The French election result should be reflected in the price for the open as it is euro friendly considering markets prefer the status quo. Even though Le Pen has toned down her anti-euro rhetoric, plenty of her initiatives would have put Paris on a collision course with EU partners.

Emmanuel Macron has beaten far-right candidate Marine Le Pen to win the French presidency, projections show. He has taken 58% of the vote to her 42% in a narrower victory than their previous contest in 2017. The result could see EUR/USD pare back some of the 0.33% lost on Friday with the single currency touching a low of 1.0796, although some way off the cycle low of 1.0757 printed the prior week.

''The yield premium demanded by investors to hold French 10-year bonds versus European benchmark Germany, a key barometer of relative risks, fell to a three-week lows around 42 basis points on Friday as investors anticipated a Macron win,'' Reuters wrote.

Meanwhile, the Russia/Ukraine conflict on the doorstep of NATO and the borders of the EU has rapidly replaced Covid as the key source of global risk. The European Central Bank is bracing for the possibility of a long conflict that raises the prospect of a negative supply shock, elevated energy and food prices and untimely, a higher cost of living.

Nevertheless, the ECB is poised to end net purchases in forthcoming months, potentially as soon as July ahead of raising rates by 25bp once per quarter from September this year. However, analysts at Nordea explained that the rise in forward-starting inflation swaps risks forcing the ECB to turn more aggressive despite more and more signs of a growth slowdown ahead. ''ECB rate hikes now priced in for July, Sep (almost) and Dec despite more and more signs of a slowdown.''

EUR/USD technical analysis

The price has moved in on the prior lows that could prove to be robust in the open and see the euro revert to mitigate the imbalance of price in Friday's bearish impulse. If not, then the downside is wide open for the week ahead. 1.0630 is a target going by the weekly chart, but the M-formation remains compelling for a move higher.

In the second round of the French presidential elections, exit polls show incumbent Emmanuel Macron winning with around 58% of the votes. Challenger Marine Le Pen is on course to receive 42% of the votes.

Le Pen said "we would of course have liked the result to be different," practically conceding defeat. According to the Guardian, exit polls in France are accurate and a 16% margin is considered insurmountable. Opinion polls pointed to a victory for the pro-business Macron, albeit with a smaller margin.

Markets have yet to open for the new week in Asia. EUR/USD's closing level on Friday was 1.0796, below higher levels recorded earlier in the week. The US dollar received a boost due to safe-haven flows. Investors are also eyeing Russia's war in Ukraine, China's covid-related lockdowns in Shanghai, and the Federal Reserve's upcoming interest rate rises.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.