- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 24-03-2022

- WTI has slipped near $111.00 as the EU holds confirmation on banning Russian oil.

- Germany and Belgium are notwithstanding the EU’s decision of the embargo on Russian oil.

- An immediate ban on Russian oil will have a devastating impact on the European economy.

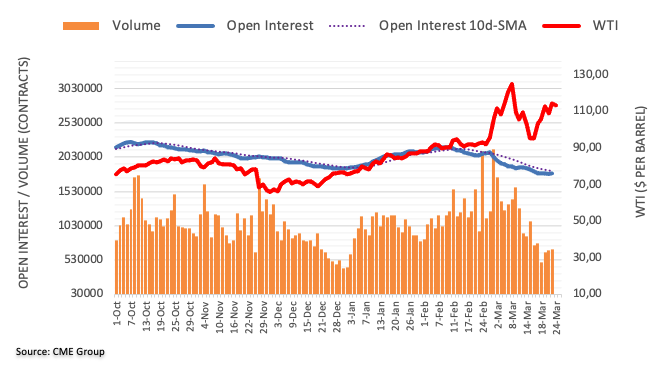

West Texas Intermediate (WTI), futures on NYMEX, has witnessed a steep fall after sensing significant offers near $116.00. The oil prices have slipped in the absence of confirmation on banning Russian oil by the European Union (EU).

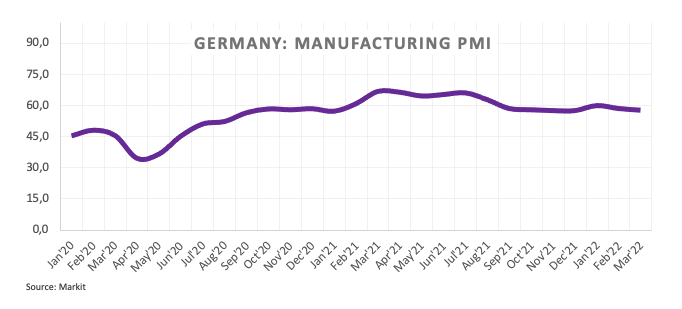

EU leaders summit on prohibiting oil from Moscow didn’t reach any outcome on Thursday. A mixed response was witnessed from the EU members on dropping Russia from their oil importers list. Russia addresses 45% of EU gas imports, 25% of oil imports, and 45% of coal, which indicates their extreme dependency. Some of the EU players have a higher dependency on Russian fossil fuels than the average. Germany fetches more than half of its gas imports from Moscow. Should Germany drops Russia as a gas exporter the former will face escalation in unemployment and a serious drop in manufacturing activities.

Also, Belgium’s prime minister, Alexander De Croo, has supported Germany while stating that an oil embargo “would have a devastating effect on the European economy and I don’t think it’s necessary”.

An immediate ban on Russian oil might be an optimal idea to hurt the Russian economy but not a fair decision for the European economy.

Meanwhile, the US dollar index (DXY) is scaling towards 99.00 on the healthy performance of their economic indications. The weekly Initial Jobless Claims and monthly Markit PMI numbers have outperformed their market estimates and previous prints. This has also raised bets for a 50 basis point (bps) interest rate hike by the Federal Reserve (Fed) in May monetary policy.

“Will consider steps to cope with price hikes after PM instruction expected next week,” said Japanese Finance Minister Shunichi Suzuki during early Friday morning in Asia.

More to come

- AUD/USD bulls await fresh catalysts at 2022 peak, retreats after three-day uptrend.

- Australia follows the West to announce fresh sanctions on Russia, Belarus.

- Market sentiment dwindles as geopolitical, inflation fears join firmer equities, gold.

- Light calendar in Asia may allow traders to consolidate recent gains.

AUD/USD dribbles around 0.7510-20 but stays close to the four-month high during Friday’s Asian session. The risk barometer pair struggles to find traction following a three-day uptrend to refresh the yearly peak.

The market sentiment recently worsened as Australia levied fresh sanctions on Russia and Belarus while taking clues from the Western leaders who criticized Moscow’s invasion of Kyiv the previous day. Australian Foreign Minister Marise Payne announced fresh punitive measures on Belarusian President Lukashenko and members of his family, in addition to unveiling sanctions on Russian diplomats.

On Thursday, US President Joe Biden’s European visit offered multiple macros suggesting the Western readiness for more sanctions for Russia but the bloc’s leaders and other G7 members showed mixed reactions. That said, US President Biden pushed for removing Moscow from the Group of 20 (G20) whereas the North Atlantic Treaty Organization (NATO) members criticized the Russian invasion of Ukraine, as well as China’s friendly relations with Russia, by offering battle groups to defend Kyiv. It’s worth noting that the Russian Foreign Ministry denounced NATO’s artillery help to Ukraine and turned down the US decision to levy sanctions on gold transactions with the Russian central bank.

The fears underpinned gold prices to renew weekly top around $1,960 while the lowest weekly prints of US Jobless Claims since 1969 favored equities to rebound. With this, the AUD/USD prices could ignore firmer yields and refresh yearly highs.

That said, Wall Street ended Thursday on a positive note after snapping a six-day uptrend the previous day while the US 10-year Treasury yields remained firmer around 2.37% by the end of Thursday’s North American session. However, the S&P 500 Futures remain pressured of late, down 0.05% around 4,510 by the press time.

To sum up, challenges to sentiment may test AUD/USD prices but firmer gold can keep buyers hopeful. However, recently covid woes from China and Europe, as well as global dislike for China’s ties with Russia, may trigger consolidation of the weekly gains.

Technical analysis

Although an upward sloping trend line from mid-March restricts immediate AUD/USD declines around 0.7490, the October 2021 peak surrounding 0.7560 challenges the bulls.

- The DXY is approaching 99.00 on tailwinds of higher rate hike expectations.

- NATO community has decided to establish four new battle groups to strengthen their collective defense.

- The outperformance of the US economic indicators is raising the odds of a 50 bps rate hike.

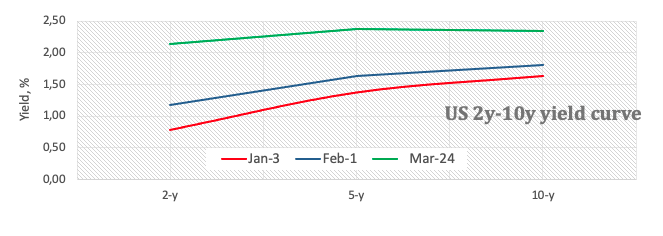

The US dollar index (DXY) is gradually advancing towards the round level resistance of 99.00 as the Federal Open Market Committee (FOMC) members have started preparing investors to brace a 50 basis point (bps) interest rate hike in May monetary policy. To tame the galloping inflation, Federal Reserve (Fed) policymakers are welcoming a healthy interest rate elevation. Apart from that, the headlines coming from Brussels where US President Joe Biden is discussing further sanctions on Russia and strategy to strengthen NATO with its NATO counterparts are improving the appeal for the greenback.

Minutes from the NATO meeting

To retaliate against Russia’s invasion of Ukraine, Western leaders in Brussels have decided to establish four new battle groups in Slovakia, Romania, Bulgaria, and Hungary, which may strengthen their collective defense, particularly on the Eastern flank. This has further escalated tensions for Russia, which may cause a minor delay in the ceasefire between Russia and Ukraine.

Performance of Economic Indicators

The US docket reported Initial Jobless Claims and Markit (Manufacturing and Services) PMI on Thursday. The Initial Jobless Claims landed at 187k much lower than the preliminary estimate and previous figure of 212k and 215k respectively.

While the Markit Manufacturing and Services PMI were printed at 58.5 and 58.9 outperformed the market consensus of 56.3 and 56 respectively. The outperformance from economic indicators has underpinned the greenback.

Key events in the US on Friday: Pending Home Sales, Michigan Consumer Sentiment Index, and Fed Governor Christopher Waller’s speech.

DXY Technical Analysis

On an hourly scale, the DXY is approaching towards the upper trendline, which is placed from March 7 high at 99.41 while the lower trendline placed from February 23 low at 95.77 will continue to act as major support going forward. The greenback-based index has stabilized above the 200-period Exponential Moving Average, which is hovering around 98.50.

DXY hourly chart

-637837604806047328.png)

- The AUD/JPY has printed five-year-highs in the last seven trading days.

- Market sentiment shifts have not been an excuse for the AUD/JPY to keep trading higher.

- AUD/JPY Price Forecast: The bias is upwards as bulls prepare an assault towards 92.00.

AUD/JPY rally extends to nine-straight days, despite days of risk-off market mood with Thursday’s not being the case, as US stocks finished in the green, while Asian equity futures fluctuate, painting a mixed sentiment. At the time of writing, the AUD/JPY is trading at 91.95.

The AUD/JPY has been reaching new year-to-date (YTD) highs in the last seven trading days, breaking on its way north, some critical resistance levels, like Pitchfork’s channel central line around 89.50 and the psychological 90.00 mark.

However, as the Relative Strength Index (RSI) reaches readings above 86,90 and the AUD/JPY is about to pierce the mid-line between the central-top trendlines of Pitchfork’s channel around the 92.00-15 area, the AUD/JPY might be subject to a correction. Nevertheless, the path of least resistance is upwards.

AUD/JPY Price Forecast: Technical outlook

That said, the AUD/JPY first resistance would be the mid-line between the central-top trendlines of Pitchfork’s channel around 92.00-15. Breach of the latter would expose 93.00, followed by the 78.6% Fibonacci retracement at 93.39.

On the flip side, In the event of a pull-back, the AUD/JPY first support would be 91.00. Once cleared, the next support would be the 90.00 mark, followed by Pitchfork’s channel central line around 89.50, and then the 89.00 figure.

- USD/CAD remains on the back foot around nine-week low.

- Clear break of 61.8% Fibonacci retracement level directs bears to January’s low.

- RSI conditions may test bears around yearly low, 78.6% Fibo.

- Previous support line, 200-DMA adds to the upside filters.

USD/CAD struggles to defend the 1.2500 threshold around a two-month bottom, despite picking up bids around 1.2530 during the initial Asian session on Friday.

The loonie pair dropped to the lowest levels since January 21 the previous day on breaking the 61.8% Fibonacci retracement (Fibo.) of October-December 2021 upside amid bearish MACD signals. That said, the south-run previously gained support from a clear break of the 200-DMA and multi-day-old rising trend line.

With this, USD/CAD seems to have a smooth journey towards January 2022 low surrounding 1.2450.

However, 78.6% Fibo. level near 1.2430 will challenge the pair bears as the RSI inches closer to the oversold territory.

In a case where the USD/CAD bears conquer the 1.2430 support, the pair becomes vulnerable to test the late 2021 bottom surrounding 1.2290.

Alternatively, the corrective pullback may initially aim for the nearby key Fibonacci retracement resistance level of 1.2545.

Following that, the support-turned-resistance line and the 200-DMA, respectively around 1.2575 and 1.2615, will challenge the USD/CAD bulls.

It should be observed that February’s low near 1.2635 will act as an additional filter to the north during the pair’s upside past 1.2615.

USD/CAD: Daily chart

Trend: Further weakness expected

- NZD/USD fades recent recovery following a volatile day with the first negative close in three.

- NATO criticized Russian invasion and braced for Ukraine help, G7 showed diplomacy while US pushed to remove Moscow from G20.

- Yields stayed firmer even as US data came in mixed, Jobless Claims favored equities.

- Light calendar keeps focus on the risk catalysts for fresh impulse.

NZD/USD dribbles around 0.6960 during the early Friday morning in Asia, after an active Thursday that snapped a two-day uptrend. The market sentiment remains mixed with a rebound in equities failing to justify firmer yields amid indecision over the key risk catalysts surrounding Ukraine and inflation.

US President Joe Biden’s European visit offered multiple macros suggesting the Western readiness for more sanctions but the bloc’s leaders and other G7 members showed mixed reactions. That said, US President Biden pushed for removing Russia from the Group of 20 (G20) whereas the North Atlantic Treaty Organization (NATO) members criticized the Russian invasion of Ukraine, as well as China’s friendly relations with Russia. It’s worth noting that the Russian Foreign Ministry denounced NATO’s artillery help to Ukraine and turned down the US decision to levy sanctions on gold transactions with the Russian central bank.

Elsewhere, fresh fears of covid in China and Europe, with the BA.2 variant tightening grip in the bloc, also weigh on the NZD/USD prices.

On the positive side, a slump in the Weekly Jobless Claims to the levels not seen since 1969 joined firmer US Markit PMIs for February to favor the market’s optimism. However, downbeat prints of US Durable Goods Orders and fears of inflation weighed on the sentiment.

Additionally defending NZD/USD prices are the comments from ANZ saying, “Yesterday the IMF published its regular Article IV report on the NZ economy. It concluded that ‘significant increases in the official cash rate in the near term are appropriate,’ but warned that a weakening global economy and the withdrawal of monetary and fiscal stimulus would contribute to moderating growth, predicting 2.7% in 2022 (ANZ: 2.1%).”

Amid these plays, Wall Street benchmarks ended Thursday on the positive side whereas the US 10-year Treasury yields rose 3.5% around 2.37% by the end of Thursday’s North American session.

Moving on, second-tier US data may entertain NZD/USD traders but headlines concerning Russia and Inflation will be crucial to watch for fresh impulse.

Technical analysis

Although overbought RSI triggered the mid-week pullback from 0.6989, the 61.8% Fibonacci retracement (Fibo.) of October 2021 to January 2022 downside and the 200-DMA, respectively around 0.6950 and 0.6910, limit the short-term downside of the NZD/USD prices.

- USD/CHF is likely to break below the descending triangle formation.

- Bears are firmer below 200 EMA, eyes more downside.

- Slippage of the RSI (14) below 40.00 will strengthen the bears further.

The USD/CHF pair is oscillating in a range of 0.9300-0.9376 this week after sensing intensified selling pressure from March 16 high at 0.9460. It is worth noting that the pair registered a fresh yearly high at 0.9460 but failed to sustain the momentum.

On an hourly scale, the major is auctioning in a descending triangle formation in which the downside remains capped while the asset updates its highs after some intervals. The downside of the descending triangle formation is capped around Monday’s low at 0.9294 while the downward trending trendline is placed from Tuesday’s high at 0.9376.

The pair has failed to defend its 200-period Exponential Moving Average (EMA), which is trading at 0.9332.

Meanwhile, the Relative Strength Index (RSI) (14) is on the verge of surrendering its 40.00-60.00 range and is likely to settle below 40.00. A slippage below 40.00 may attract significant offers and bears will dictate the prices going forward.

Should the asset drops below Monday’s low at 0.9294, bears may strengthen and the pair will drag towards March 7 high at 0.9272, followed by March 2 high at 0.9240.

On the contrary, bears may lose grip if the asset oversteps the 200-period EMA at 0.9332, which will send the pair towards March 18 high at 0.9383. Breach of the latter will expose the greenback bulls to March 15 high at 0.9432.

USD/CHF hourly chart

-637837579906646586.png)

“The European Central Bank would consider extending its money-printing programme beyond this summer if the eurozone economy fell into a 'deep recession' because of the conflict in Ukraine,” said ECB board member Isabel Schnabel said on Thursday, per Reuters.

Additional quotes

The central bank had "left the door ajar" in case events took a turn for the worse for the eurozone, which is highly dependent on Russian gas and other raw materials.

If we now fall into a deep recession due to the Ukraine crisis, we'll have to rethink that.

Otherwise, we'll end the bond purchases in the third quarter and as soon as we've done that we can raise rates at any time depending on how inflation develops.

Estonian central bank governor Madis Mueller, another hawk on the ECB's policy-making Governing Council, said in a Politico interview the ECB would only extend its Asset Purchase Programme if there was 'a dramatic shift' in the inflation outlook.

Market reaction

EUR/USD failed to cheer the news amid mixed concerns over Ukraine-Russia and the market’s anxiety over inflation. That said, the quote was last seen taking rounds to 1.1000 after a volatile day, with mild losses.

Read: EUR/USD braces to 1.1000 amid a firm US dollar

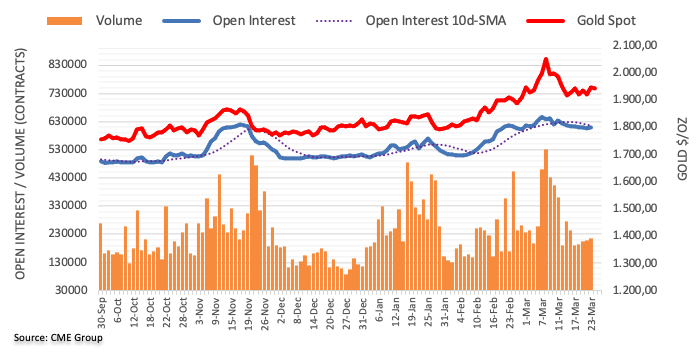

- Gold prices have surpassed $1,950.00 despite rising odds of a 50 bps interest rate hike.

- The precious metal is underpinned after investors prefer bullions as an inflation hedge.

- US Initial Jobless Claims and Markit PMI Composite post robust figures on Thursday.

Gold (XAU/USD) has extended its gains after overstepping the round level resistance of $1,950.00 as investors have underpinned the precious metal on a hawkish stance of US President Joe Biden in NATO meeting on Thursday. Also, the market participants parked their funds in precious metal counter on inflationary pressures.

Uncertainty surrounding the Ukraine crisis escalated on Thursday when Russia’s invasion of Ukraine completed its first month. The aggressive approach adopted by the Western leaders in Brussels to establish four new battle groups in Slovakia, Romania, Bulgaria, and Hungary, which may strengthen their collective defense, particularly on the Eastern flank looks to hold their grip on Russia. This has escalated geopolitical tensions and has underpinned gold prices further.

A case of rising US Treasury yields along with gold prices reflects that investors are pouring funds into the precious metal as an inflation hedge. There is no denying the fact that inflation is skyrocketing in the world economy. Every country is coming forward with inflation mess and messages of hawkish stances on their monetary policies.

Gold prices are rising higher despite the rising odds of a 50 basis point (bps) interest rate hike by the Federal Reserve (Fed) in May monetary policy. Fed policymakers have clearly mentioned that the economy is strong enough to withstand the aggressive interest rate elevation approach. Also, the outperformance of US Initial Jobless Claims and Markit PMI composite has failed to restrict the upside in the gold prices.

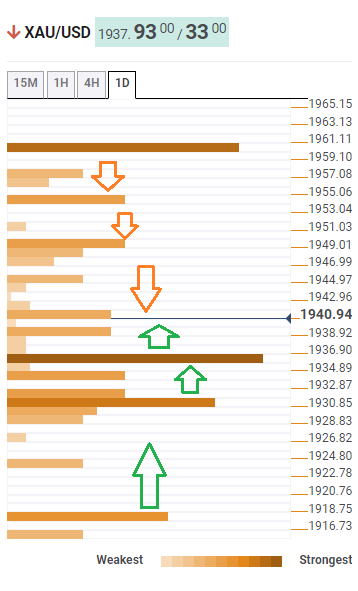

Gold Technical Analysis

XAU/USD has witnessed a strong upside after violating March 14 high at $1,949.80. The trendline placed more March 16 low at $1,895.15 has acted as major support for the counter. The precious metal is auctioning above the 200-period Exponential Moving Average (EMA), which adds to the upside filters. The Relative Strength Index (RSI) (14) is oscillating in the 40.00-60.00 range, which signals the continuation of a bullish trend going forward.

Gold hourly chart

-637837565240226469.png)

- Precious metals benefit from a risk-on market mood amid elevated US Treasury yields.

- US President Biden supported more NATO troops in Eastern Europe while calling Russia to be removed from the G-20 group.

- XAG/USD Price Forecast: The decisive break above $25.40 could lead to a move towards $26.00 and beyond.

As the Asian Pacific session begins, Silver (XAG/USD) advances for the second straight day but retreated from daily highs around $25.85, amidst high US Treasury yields and an upbeat market. At the time of writing, XAG/USD is trading at $25.55.

Global equities overnight were mixed, as European equities fluctuated, while US stocks indices finished Wall Street with gains. Discussions between Russia and Ukraine have failed to progress, extending the war for a fourth-consecutive week. Meanwhile, NATO’s two-day summit kicked in. Worth noting that US President Joe Biden supported the increase of NATO troops on the eastern front, a senior US official reported. Moreover, Biden and European NATO members assessed the risks of Russia’s launching a biological, chemical, or nuclear attack, while Biden called for Russia to be removed from the G-20.

The US Dollar Index, a gauge of the greenback’s value against a basket of peers, has been supported throughout the day, up 0.18%, at 98.789, underpinned by high US Treasury yields. The 10-year benchmark note yield is up to five basis points, sitting at 2.370%, putting a lid on the XAG/USD rally.

Gold (XAU/USD) is also up in the day, some 0.68%, at $1957.88 a troy ounce, despite elevated US Treasury yields.

Aside from this, Fed speakers have continued to grab headlines. Chicago Fed President Charles Evans said he is “comfortable” with 25 bps increases to the Federal Funds Rate but remains “open” to 50 bps increases if needed. Earlier, Minnesota Fed President Neil Kaskari said that 10-year Treasury yields remain low while emphasizing a risk of overdoing it on rate hikes. Kashkari further added that neutral rates

XAG/USD Price Forecast: Technical outlook

Silver (XAG/USD) bias is still upwards. As mentioned on yesterday’s note, “on Monday, the 50-day moving average (DMA) rollover the 200-DMA, forming a golden-cross, a bullish signal that although is lagging, could open the door for further gains on XAG/USD.”

On Thursday, XAG/USD broke November 16, 2021 resistance level at $25.40, leaving it as support. With that said, XAG/USD’s first resistance would be March 24 daily high at $25.85. Once cleared, the next supply zone would be August 4, 2021, a daily high at $26.00, followed by July 16, 2021, at $26.45.

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:01 (GMT) | United Kingdom | Gfk Consumer Confidence | March | -26 | -30 |

| 07:00 (GMT) | United Kingdom | Retail Sales (YoY) | February | 9.1% | 7.8% |

| 07:00 (GMT) | United Kingdom | Retail Sales (MoM) | February | 1.9% | 0.6% |

| 09:00 (GMT) | Eurozone | Private Loans, Y/Y | February | 4.3% | |

| 09:00 (GMT) | Eurozone | M3 money supply, adjusted y/y | February | 6.4% | 6.3% |

| 09:00 (GMT) | Germany | IFO - Expectations | March | 99.2 | 92 |

| 09:00 (GMT) | Germany | IFO - Current Assessment | March | 98.6 | 96.5 |

| 09:00 (GMT) | Germany | IFO - Business Climate | March | 98.9 | 94.2 |

| 14:00 (GMT) | Belgium | Business Climate | March | 2.3 | |

| 14:00 (GMT) | U.S. | FOMC Member Williams Speaks | |||

| 14:00 (GMT) | U.S. | Pending Home Sales (MoM) | February | -5.7% | |

| 14:00 (GMT) | U.S. | Reuters/Michigan Consumer Sentiment Index | March | 62.8 | 59.7 |

| 15:30 (GMT) | U.S. | Fed Barkin Speech | |||

| 17:00 (GMT) | U.S. | Baker Hughes Oil Rig Count | March | 524 |

- The EUR/USD has been trading in a 50-60 pip range in the last three days.

- The greenback stays firm amid a positive market mood

- Russia – Ukraine war remains, though peace talks stagnate.

- EUR/USD Price Forecast: Downward biased, but as the EUR/USD trades above 1.0960, upside risks remain.

The shared currency seesaws on Thursday North American session, courtesy of a positive market mood, while broad US dollar strength across the board helps the greenback to keep the EUR/USD pair confined to the 1.0960-1.1000 area. At press time, the EUR/USD is trading at 1.1000.

The US Dollar remains resilient amid a risk-on market

Risk appetite improved in the New York session, as portrayed by US equities rising, contrarily to European bourses, which fluctuated. The greenback has been supported throughout the day, as reflected by the US Dollar Index up 0.16%, at 98.766, underpinned by elevated US Treasury yields, with the 10-year benchmark note yield up to four basis points, sitting at 2.348%.

On the Geopolitical front, Russia – Ukraine hostilities remain, while peace talks languished. Meanwhile, the NATO two-day summit has not provided EUR/USD tradable news just yet. Worth noting that according to a US official, US President Joe Biden supported the increase of NATO troops on the eastern front. Furthermore, Biden and European NATO members assess the risks of Russia’s launching a biological, chemical, or nuclear attack. Also, Biden called for Russia to be removed from the G-20.

Aside from this, Fed speakers have continued to grab headlines. Chicago Fed President Charles Evans said he is “comfortable” with 25 bps increases to the Federal Funds Rate but remains “open” to 50 bps increases if needed. Earlier, Minnesota Fed President Neil Kaskari said that 10-year Treasury yields remain low while emphasizing a risk of overdoing it on rate hikes.

On Friday, the Eurozone economic docket will unveil March’s IFO Business, Current Conditions, and Expectations for Germany. Across the pond, Pending Home Sales for February, the Universit of Michigan Consumer Expectations for March, and Fed speakers would grab the headlines.

EUR/USD Price Forecast: Technical outlook

The EUR/USD pair remains downward biased. However, as portrayed by the daily chart, in the last two days’ EUR/USD price action, the pair faltered of breaking below Tuesday’s daily low at 1.0960, leaving the EUR/USD exposed for an upward move.

If that scenario plays out, the EUR/USD first resistance would be 1.1043. Breach of the latter would expose Pitchfork’s parallel-line between the top and central ones around 1.1080, followed by 1.1100. On the flip side, the EUR/USD path of least resistance, the first support, would be 1.0960. A decisive break would expose the 1.0901 March 11 low, followed by the YTD low at 1.0806.

What you need to take care of on Friday, March 25:

The American dollar finished the day mostly lower across the FX board, although it managed to keep advancing versus the Japanese yen, with USD/JPY hitting a fresh multi-year high of 122.40.

The EUR/USD pair is still struggling with the 1.1000 threshold, unable to extend gains beyond the level. GBP/USD settled around 1.3180, while commodity-linked currencies keep advancing against their American rival. AUD/USD topped at 0.7527 while USD/CAD bottomed at 1.2509.

US President Joe Biden and European NATO counterparts are preparing for the risk of Moscow launching a nuclear attack. They have also discussed assisting Ukraine with anti-ship missiles and clarified that any gold transaction involving Russia's central bank is subject to existing sanctions. The headline boosted the bright metal, which surged to a fresh weekly high of $1,966.14 a troy ounce, ending the day nearby.

Crude oil prices, on the other hand, consolidated their recent gains, ending the day little changed. WTI trades at around $113.20 a barrel at the time being.

French President Emmanuel Macron later announced that there had been no decision on penalties against Russian oil, gas, and coal. US President Joe Biden said he believes Russia should be removed from the G-20.

Meanwhile, the number of new coronavirus cases, blamed on the Omicron BA.2 variant, are on the rise in Germany, the UK, France and Italy, the top European countries suffering from this new wave. So far, no restrictive measures have been put in place, but on the contrary, the latest of restrictions is being lifted.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Cryptos on the front foot as rebound turns into new uptrend

Like this article? Help us with some feedback by answering this survey:

Mexico's central bank announced on Thursday that it hiked its policy rate by 50 basis points to 6.5% following its march meetings, as expected.

Key takeaways from policy statement

"Board was unanimous on rate decision."

"Available indicators suggest that the Mexican economy might have resumed its recovery during early 2022."

"With this action, the monetary policy stance adjusts to the trajectory required for inflation to converge to its 3% target within the forecast horizon."

"An environment of uncertainty and ample slack conditions prevails, although the latter is expected to be less ample than in the previous quarter."

"Medium-term expectations for headline inflation were revised upwards at the margin, while those for core inflation were left unchanged and longer-term expectations have remained stable at levels above the target."

"For the next monetary policy decisions, the board will monitor thoroughly the behaviour of inflationary pressures and factors impacting foreseen path for inflation and its expectations."

"Given greater inflation pressures, forecasts for headline and core inflation were revised significantly upwards for the entire horizon and convergence to the 3% target is now expected to be attained in the first quarter of 2024."

"In addition to shocks that have affected inflation throughout the pandemic, there are pressures associated with the geopolitical conflict."

"Balance of risks for the trajectory of inflation within the forecast horizon has deteriorated and remains biased to the upside."

Market reaction

The USD/MXN pair showed no immediate reaction to the rate hike decision and was last seen losing 0.4% on a daily basis at 20.1325.

- The Australian dollar advances during the week, so far up 1.30%.

- The US Dollar remains close to the 99.00 mark, though it falters to weigh on the AUD/USD pair.

- US President Biden called for Russia to be removed from the G20.

- AUD/USD Price Forecast: Bias is upwards unless it trades below 0.7440, meaning that a correction is underway.

The AUD/USD edges higher, but the rally appears to be stalling, as shown by Thursday’s price action, about to form a doji candle, meaning the tug-of-war between bulls and bears started, as uncertainty looms. At the time of writing, the AUD/USD is trading at 0.7510.

The greenback stays firm amid a positive market mood

The market mood is risk-on in the North American session, despite that European stocks indices finished with losses. Across the pond, US equities are rising, while the buck shows some resilience to fall, as it trades with gains reflected by the US Dollar Index up 0.20%, at 98.82. US Treasury yields resume their advance after Wednesday’s losses, with the 10-year T-note yield up almost five basis points, sitting at 2.341%.

There has not been any market-moving news on the geopolitical front, with the Russia – Ukraine war still underway. The US President Joe Biden arrived at NATO’s two-day summit in Brussels. According to a senior US official, Biden told NATO that he supported increased NATO troops on the eastern front. Also, Biden called for Russia to be removed from the G-20.

Aside from this, Fed speakers have continued to grab headlines. Chicago Fed President Charles Evans said he is “comfortable” with 25 bps increases to the Federal Funds Rate but remains “open” to 50 bps increases if needed. Earlier, Minnesota Fed President Neil Kaskary said that 10-year Treasury yields remain low while emphasizing a risk of overdoing it on rate hikes.

An absent Australian economic docket would leave AUD/USD traders adrift to US data on Friday. Meanwhile, across the pond, Pending Home Sales for February, the Universit of Michigan Consumer Expectations for March, and Fed speakers would provide a catalyst for AUD/USD traders.

AUD/USD Price Forecast: Technical outlook

The AUD/USD is upward biased, as shown by the daily chart, and with the 50-day moving average, crossing over the 100-DMA, each one sitting at 0.7223 and 0.7216, respectively. Nevertheless, due to the steepness of the rally, plus the Relative Strength Index (RSI) near 68, accelerating toward overbought conditions, the AUD/USD might correct in the near term. However, unless the AUD/USD breaks below 0.7440, the AUD/USD will keep going up.

That said, the AUD/USD first resistance would be October 28, 2021, high at 0.7555. Breach of the latter would expose 0.7600, followed by 0.7700.

- GBP/USD’s failure to reclaim 1.3300 exacerbated the downward move below 1.3200.

- Market sentiment is mixed, as European bourses fluctuate while US stocks advance.

- Positive news from the Russia-Ukraine front could aim for a ceasefire between both countries.

- GBP/USD Price Forecast: Downward biased, as the pair aims towards 1.3100.

The GBP/USD pair slides for the second consecutive day on Thursday and drops below the 1.3200 mark amid a risk-on market mood, which usually favored the British pound, but US central bank hawkishness and broad US dollar strength weighed on the pair. At the time of writing, the GBP/USD is trading at 1.3173.

As abovementioned, the market sentiment turned sour of late. European indices closed Thursday session with losses, though US stocks keep in the green. In the FX space, the greenback stays firm around 98.89 per the US Dollar Index, approaching the 99.00 mark, while US Treasury yields rise.

The Russia-Ukraine conflict is back at the forefront of headlines, with reports that NATO’s two-day summit is underway. According to a senior US administration official, US President Biden told NATO that he supported increased NATO troops on the eastern front. However, it is worth noting that there has been some positive news from Eastern Europe. The Ukrainian Chief of Staff, Andriy Yermak, said there was progress in the ceasefire negotiations with Russia and expressed “careful optimism,” as reported by Axio’s correspondent.

Fed’s Kashkari and Evans crossed wires

Early in the North American session, Minnesota Fed President Neil Kashkari expressed that the risk of overdoing it on rate hikes exists. Furthermore, he added that he sees neutral rates at around 2%. Later, Chicago Fed President Chris Evans said that the Fed first rate hike was the “first of many,” while saying that he’s open to 50 bps increased “if needed.”

In the meantime, the UK economic docket featured March Composite PMI for the UK, dipped to 59.7 vs. February’s 59.9 figure, though higher than the 57.8 foreseen.

The US economic docket featured Initial Jobless Claims for the week ending on March 19, which fell the most since 1969. The reading came at 187K lower than the 212K foreseen. Later in the day, the Markit PMIs for March were revealed, which came better than expected.

GBP/USD Price Forecast: Technical outlook

The GBP/USD is tilted downwards, as noted by the daily chart. Tuesday’s rally stalled around November 26 low at 1.3275, though the pair pierced the 1.3300 mark on Wednesday, as the 50-day moving average (DMA) is about to cross under the 100-DMA, each at 1.3402 and 1.3400, respectively.

With that said, the GBP/USD first support would be December 8, 2021, low at 1.3160. Breach of the latter would expose November’s 13, 2020 daily low at 1.3105, followed by the bottom-trendline of a descending channel around the 1.3020-40 region and the 1.3000 mark.

US President Joe Biden said on Thursday that he thinks Russia should be removed from G20, as reported by Reuters.

Additional takeaways

"Asked that Ukraine be able to attend G20 meetings."

"Ukraine's judgment to make whether it cedes territory to Russia."

"Talked about how major wheat producers US, Canada could increase and disseminate more rapidly food abroad."

"Determined to sustain efforts with allies on Ukraine and build on them."

"Coordinating with G7, EU on food and energy security."

"Russian President Putin didn't think we could sustain this cohesion among allies."

"NATO is more united than ever."

"China understands its economic future is more closely tied to the West than to Russia."

"Discussed need for a system to see who violates sanctions."

"Made no threats to Chinese President Xi but pointed out the number of American and foreign companies that had left Russia."

Market reaction

These remarks had little to no impact on risk sentiment and the S&P 500 Index was last seen rising 1% on the day at 4,500.

Russia's foreign ministry said on Thursday that NATO is reaping terrible results from the decision to pump Ukraine with weapons, Reuters reported citing RIA news agency.

"NATO summit decision to keep providing support to Ukraine confirms alliance wants the conflict to continue," the ministry added.

Market reaction

These comments don't seem to be having a noticeable impact on the market mood. As of writing, the US Dollar Index was up 0.2% on the day and the S&P 500 Index was rising nearly 1%.

European Central Bank (ECB) governing council member Mario Centeno said on Thursday that a recession in the eurozone was not in the ECB's scenario, as reported by Reuters.

"The situation is delicate, it has to be followed very carefully," Centeno further added.

Market reaction

These comments don't seem to be having a noticeable impact on the shared currency's performance against its major rivals. At the time of press, the EUR/USD pair was trading at 1.0985, where it was down 0.15% on a daily basis.

- Silver prices rallied into the upper $25.00s on Thursday amid focus on further upside in US breakeven inflation expectations.

- Silver’s resilience to the higher dollar and yields amid the Fed’s hawkish shift is likely due to ongoing geopolitical concerns.

Spot silver (XAG/USD) prices rallied to ten-day highs on Thursday, breaking back above the $25.50 mark and at one point nearing the $26.00 per troy ounce level. Prices have subsequently leveled off in the $25.60s where they trade higher by about 2.1% on the day, taking gains since Tuesday’s weekly lows in the $24.50s to more than 4.0%. Silver prices were up alongside other precious metals despite a stronger US dollar and higher US yields (both of which would normally weigh on silver). Focus was instead on long-term US inflation expectations after the 5-year break-even rate hit a record high above 3.6%. That implies US bond market participants see US CPI averaging 3.6% over the next five years.

The rise in inflation expectations since Russia’s invasion of Ukraine has been steep and has unsurprisingly been a key factor underpinning precious metals, which are viewed as an asset class that provides inflation protection. Indeed, silver's (and gold’s) resilience in recent days despite the rally in US yields and the USD as a result of the Fed’s latest hawkish shift has been quite remarkable. Was it not for recent geopolitical developments and the stagflationary risks that Russia’s war in Ukraine creates, the likes of silver would likely be substantially lower at this point.

With commodity strategists fearing that the worst is yet to come regarding the recent rise in energy prices and with Russo-Ukraine peace talks showing no signs of headway whilst Western nations continue to toughen their Russia sanctions, precious metals are likely to remain underpinned. Thursday push back above the 21-Day Moving Average in the $25.25 area for XAG/USD will raise confidence amongst the bulls that a near-term rally back above $26.00 is possible. That would reopen the door to a retest of earlier monthly highs near-$27.00.

- The USD/JPY maintains the foot in the metal, extending its rally to five straight days.

- Fed officials maintain the view that 50 bps increases are not bad.

- US Initial Jobless Claims declined under the 200K mark, the lowest level since 1969.

The USD/JPY pair keeps extending its rally, breaking the 122.00 mark, underpinned by hawkish Fed speaking preparing to hike rates 50 bps in the May meeting, which spurred a jump in US Treasury yields amidst an upbeat mood in the financial markets. At the time of writing, the USD/JPY is trading at 122.30 at new YTD highs,

Of late, the market mood improved, as Europen equities made a U-turn after recording losses earlier in the North American session. Meanwhile, US stocks consolidated in the green, despite growing concerns of high inflation as the US central bank began its tightening cycle.

Firmer US Dollar keeps the Japanese yen pressured

In the meantime, the greenback remains resilient to fall, as it clings to gains, up 0.12%, sits at 98.724, while the US 10-year Treasury yield gains two and a half basis points, up at 2.341%.

Elsewhere, the Russia-Ukraine conflict is grabbing attention as NATO’s two-day summit is underway. Of note is that according to a senior US administration official, US President Biden told NATO that he supported increased NATO troops on the eastern front. The positive news on the front is that Ukrainian Chief of Staff Andriy Yermak said there was progress in the ceasefire negotiations with Russia and expressed “careful optimism,” as reported by Axio’s correspondent.

US central bank policymakers crossed the wires

Meanwhile, Fed speaking continued. The first policymaker to cross the wires was Minnesota’s Fed President Neil Kashkari. He said that there is a risk of overdoing it on rate hikes while reiterating that a neutral interest rate is around 2% for him. Later, Chicago Fed President Chris Evans said that the Fed’s first rate hike was “the first of many this year.” Evans added that he’s open to a 50 bps hike if needed and emphasized that the central bank may begin reducing the balance sheet while raising rates at the same meeting.

The US economic docket featured Initial Jobless Claims for the week ending on March 19, which fell the most since 1969. The reading came at 187K lower than the 212K foreseen. Later in the day, the Markit PMIs for March were revealed, which came better than expected.

Technical levels to watch

Polish PM Mateusz Morawiecki said on Thursday that he would tell EU leaders about the need for a NATO humanitarian mission in Ukraine, given what's happening there is a massacre, reported Reuters.

NATO needed to apply more sanctions on Russia than have currently been agreed, like cutting off port access for Russian ships as well as rail, he added, saying that Russia must also be cut off from financing and from buying oil and gas. The costs of war will be even higher if Russia is allowed to have its way, he warned.

Chicago Fed President Charles Evans said on Thursday that the Fed can begin its balance sheet reduction and raise interest rates in the same meeting, reported Reuters. The risk of slowing the economy into recession isn't high, Evans said. The Fed won't need asset sales until it is well into its balance sheet reduction, Evans added but may need a "cleanup operation" to remove mortgage-backed securities.

Separately, Evans also noted that the data will be an important part of the decisions on the pace and steepness of rate hikes. Evans added that he supports starting to reduce the balance sheet relatively quickly and favours a "pretty brisk pace".

- The Loonie keeps rallying vs. the greenback, as shown by the USD/CAD down 0.27%.

- A mixed market mood keeps the CAD in the driver’s seat amid a firm US dollar.

- USD/CAD Price Forecast: Downward biased, threatening to break below 1.2450.

USD/CAD post modest losses as Thursday North American session kicks in, after overnight’s a subdued session that witnessed the pair fluctuating in the 1.2550-80 range. At the time of writing, the USD/CAD is trading at 1.2525.

Market sentiment is mixed. European stocks fluctuate while US equities are gaining, except for the Russell 2000. The greenback remains firm in the session, as the US Dollar Index shows, barely up 0.08%, sitting at 98.685. US Treasury yields recover from Wednesday’s drop, led by the 10-year benchmark note at 2.357%, up three-and-half basis points.

Developments in Eastern Europe grabbed the headlines

The Russia-Ukraine conflict remains unchanged. Although of late, at press time, Barak Ravid Axio’s reported via Twitter that Ukrainian’s Chief of Staff Andriy Yermmak said there was progress in ceasefire negotiations with Russia. If that is achieved, the market sentiment will react positively to the news.

Meanwhile, the NATO two-day summit in Brussels began. According to a senior US administration official, US President Biden told NATO that he supported increased NATO troops on the eastern front. Furthermore, the US has spoken with allies about assisting Ukraine in obtaining anti-ship missiles.

Aside from this, the US crude oil benchmark WTI falls almost 0.90% in the day, below the $113.50 mark, stopping Canadian dollar appreciation due to its correlation with oil prices.

The US economic docket featured Initial Jobless Claims for the week ending March 17, which fell to the lowest since 1969 as demand for labor far exceeds supply and rampant inflation keeps the incentive to work high.

USD/CAD Price Forecast: Technical outlook

The USD/CAD has been falling steadily for five consecutive days in chunks of 50-60 pips and is about to challenge September 3, 2021, support at 1.2493. Also, the USD/CAD broke below a five-month-old upslope trendline on Wednesday, exerting additional downward pressure on the pair.

With that said, the USD/CAD first support would be the 1.2500 figure. Once cleared, it would immediately test the 1.2493 level abovementioned, followed by the YTD low achieved on January 19 at 1.2450. Breach of the latter would open the door for a renewed test of October 21, 2021, at 1.2288.

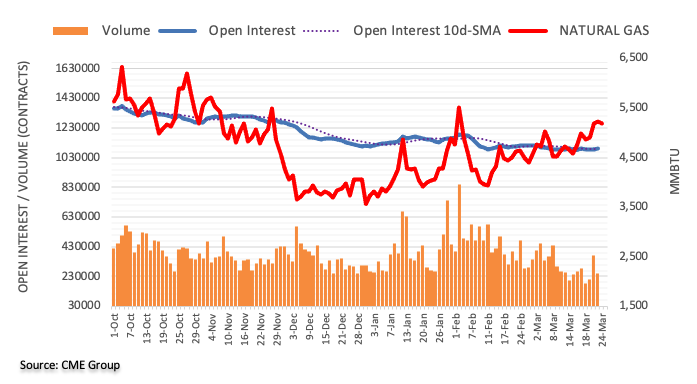

- WTI has been choppy on Thursday, swinging between the $112s area to upper $116.00s as traders weigh various themes.

- Traders continue to fret about Russian supply disruptions due to Western sanctions as US/Iran talks falter.

Oil markets have seen volatile trade thus far this Thursday, with traders juggling a multitude of themes. WTI swung between multi-week highs in the upper $116.00s and $112 area and at current levels around $113 trades about a buck lower on the session. Dips toward $110 attracted solid demand as energy market participants continue to weigh up the size of the loss of Russian oil supply. Executive Director of the IEA Fatih Birol said on Thursday that IEA countries were united in seeking to radically reduce Russian oil and gas imports, with Western nations have imposed harsh sanctions on the Russian economy over its invasion of Ukraine.

On which note, Thursday saw a flurry of NATO and EU summits where those sanctions were marginally toughened, though there was no EU announcement of an EU embargo on Russian oil. Whilst the lack of embargo will come as a disappointment to the oil bulls, Russia’s new demand on Wednesday for so-called “unfriendly” countries to pay for Russian energy purchases in roubles may itself act to significantly reduce EU imports. The extent to which this will be the case remains unclear, with traders also needing to weigh up the loss to global supply after it was announced earlier in the week that Russian crude oil exports from Kazakhstan's Caspian Pipeline Consortium (CPC) terminal had been halted due to storm damage.

Updates regading US/Iran negotiations for a return to the 2015 nuclear pact and removal of sanctions on Iranian oil exports have also been downbeat as of late, reducing the chances that 1.3M barrels per day or more of much needed Iranian exports return to global markets any time soon. “Unless Iran is allowed back to the market quickly it is hard to see how to further price increase, potentially above the recent peaks, can be avoided,” said analysts at PVM.

Though chatter about another coordinated crude oil reserve release appeared to cap WTI gains in the $116 area on Thursday, any bearish impact is likely to be limited/short-lived, given official inventory data on Wednesday showed the US Strategic Petroleum Reserve (SPR) at its lowest since 2002. WTI bulls will likely be looking for a run into the $120s and back towards multi-year highs in the $130 area printed earlier on in the month.

Ukrainian President Volodymyr Zelenskyy's chief of staff Andriy Yermmak said on Thursday that there was progress in ceasefire negotiations with Russia and expressed "careful optimism", reported Axios's Barak Ravid via Twitter. Barak said more would be explained in an upcoming Axios article.

Market Reaction

After days of apparent deadlocks in talks, headlines such as this might well contribute to an upturn in risk appetite. That hasn't been the case just yet, with US equities broadly unreactive thus far to the latest news.

EUR/JPY has surged above its 10-month downtrend. Analysts at Credit Suisse look for a test of the 2021 high at 134.14.

Support is seen at 132.33

“We look for a test of the 2021 high at 134.14. Whilst a fresh rejection from here should be allowed for, with the JPY expected to stay weak in outright terms, we are biased to a sustained break higher in due course. This should then clear the way for a move to trend resistance at 134.41.”

“Through 134.41 is needed to curtail thoughts of a broader mean-reverting range with resistance seen next at 135.85, potentially the 137.50 high of 2018.”

“Support is seen at 132.95 initially, with 132.33 needing to hold to keep the immediate risk higher. Below can see a pullback to 131.99/92, potentially 131.53, but with buyers expected here.”

GBP/USD has failed to recoup the 1.32 handle. Cable needs to close the week above the latter to reinforce its drive higher, economists at Scotiabank report.

Support under the 1.3150/60 zone is at 1.3120

“A convincing break above the 1.32 mark and a close above it for the week would reinforce the pound’s drive higher since mid-month.”

“Resistance past the figure and ~1.3215 is the mid-1.32s, while support under the ~1.3150/60 zone is 1.3120 and 1.3100/10.”

Gold price extends its advance amid mounting tensions in Eastern Europe. What’s more, the yellow metal shrugs off expectations of a hawkish Federal Reserve, strategists at TD Securities report.

Safe-haven demand is trumping a hawkish Fed

“While gold markets could be reflecting a growing cohort of participants interpreting the Fed's hiking path as being behind the curve on inflation, we also see rising risks of that the Fed will deliver a hawkish surprise to markets.”

“We expect the Fed to raise rates by 50bps in both May and June, and to deliver a 25bp hike at each meeting between July and December. And yet, prices have remained incredibly resilient despite this historically negative scenario for gold, as safe-haven flows have trumped fears of a hawkish Fed, with demand for gold surging in response to the war in Ukraine.”

- EUR/USD remains on the defensive for the second straight session.

- A deeper decline to 1.0900 remains well on the table so far.

EUR/USD extends Wednesday’s bearish move to the 1.0970 region, where some contention seems to have emerged.

The pair, in the meantime, remains under pressure and the breach of the weekly low at 1.0960 (March 22) should initially spark further weakness to another weekly low at 1.0900 (March 14).

The medium-term negative outlook for EUR/USD is expected to remain unchanged while below the key 200-day SMA, today at 1.1510.

EUR/USD daily chart

The EUR’s negative trend since the late-week break past 1.11 is continuing today. Economists at Scotiabank expect EUR/USD to slide towards 1.08 on a weekly close below the 1.10 level.

Tuesday and Wednesday lows of ~1.0960/5 stand as key support

“The Tuesday and Wednesday lows of ~1.0960/5 stand as key support ahead of the 1.0950 mark and ~1.0926.”

“Resistance after 1.1000/10 is ~1.1025 and the mid-figure area.”

“A close below 1.10 for the week would signal that EUR losses back to 1.08 is set to resume.”

Chicago Fed President and FOMC member Charles Evans on Thursday said that the Fed needs to move interest rates back up to neutral and that his own view is that, given the pressures he sees, would be comfortable with 25bps hikes, reported Reuters. By next March, Evans continued, rates would be back to neutral at that pace, he continued, adding that we want to be careful. However, Evans signalled an openness to a 50bps rate hike, saying maybe it helps and he would be open minded.

- DXY adds to Wednesday’s advance and flirts with 99.00.

- Next on the upside aligns the weekly top at 99.29 (March 14).

DXY extends the upside momentum and trades at shouting distance from the key 99.00 barrier on Thursday.

Further advance in the index now looks increasingly likely and a break above the 99.00 zone should put a test of the weekly high at 99.29 (March 14) back on the investors’ radar prior to the 2022 peak at 99.41 (March 7).

The current bullish stance in the index remains supported by the 6-month line just above 96.00, while the longer-term outlook for the dollar is seen constructive while above the 200-day SMA at 94.67.

DXY daily chart

- GBP/USD witnessed some follow-through selling for the second successive day on Thursday.

- The risk-on impulse capped the safe-haven USD and helped limit deeper losses for the major.

- The set-up favours bearish traders and supports prospects for a further depreciating move.

The GBP/USD pair witnessed some follow-through selling for the second straight day on Thursday and retreated further from a nearly three-week high, around the 1.3300 mark touched overnight. The downward trajectory dragged spot prices to a two-day low, though stalled ahead of mid-1.3100s.

A generally positive tone around the equity markets capped gains for the safe-haven US dollar, which, in turn, was seen as a key factor that extended some support to the GBP/USD pair. That said, elevated US Treasury bond yields, bolstered by the Fed's hawkish outlook, acted as a tailwind for the buck and failed to assist the pair to register any meaningful recovery.

From a technical perspective, oscillators on the daily chart are still holding in the bearish territory and support prospects for further losses. Some follow-through selling below the 1.3150 area will reaffirm the negative outlook and make the GBP/USD pair vulnerable to retest sub-1.3100 levels, touched in reaction to a dovish assessment of the BoE decision last week.

Acceptance below the 1.3100 round figure will suggest that the recent recovery move from the YTD low has run its course. This, in turn, will set the stage for the resumption of the prior well-established bearish trend witnessed over the past one month or so. The GBP/USD pair could then accelerate the downfall and aim to challenge the key 1.3000 psychological mark.

On the flip side, sustained strength back above the 1.3200 mark might trigger a short-covering move and lift the GBP/USD pair back towards the 1.3255-1.3260 region. Some follow-through buying could allow bulls to make a fresh attempt to conquer the 1.3300 round-figure mark and lift spot prices to the next relevant resistance near the 1.3320-1.3325 region.

GBP/USD 4-hour chart

-637837269775540551.png)

Technical levels to watch

Chicago Fed President and FOMC member Charles Evans on Thursday said that his view on the appropriate path for Fed policy is in line with the median view at the Fed (i.e. six more 25bps hikes in 2022 and a further four in 2023), reported Reuters.

Additional Remarks:

"Monetary policy must shift to a 'timely' removal of accommodation."

"Higher inflation would become embedded in expectations if monetary policy doesn't respond."

The Fed's recent rate hike was the first of many this year."

"The US economy has solid momentum and the labor market is 'downright tight' by some measures."

"The Ukraine crisis and the pandemic both pose upside risk to inflation, downside risk to growth."

"The Fed must be cautious, humble, nimble and policy must not be on a preset course."

Activity growth in the US manufacturing sector accelerated in March, according to the preliminary version of IHS Markit's PMI survey. The "flash" headline Manufacturing PMI rose to 58.5 in March from 57.3 a month earlier, above the expected drop to 56.3. Service sector growth was also stronger than expected with flash PMI coming in at 58.9 versus forecast for a drop to 56.0 from 56.5 in February. That meant the composite PMI measure rose to 58.5 from 55.9 last month.

Market Reaction

There was no FX market reaction to the latest more robust than expected PMI survey results.

US President Joe Biden said on Thursday that, at the NATO summit in Brussels, the alliance had discussed ways to bolster their collective defense, particularly on the Eastern flank, reported Reuters. NATO had agreed to establish four new battle groups in Slovakia, Romania, Bulgaria and Hungary, Biden added, saying that between now and the NATO summit in June, we will develop plans to additional forces and capabilities to strengthen NATO's defenses.

- Despite multiple attempts so far this session, EUR/USD has not been able to break back above the 1.1000 level.

- The euro shrugged off strong Eurozone PMIs with traders concerned about Russia’s new demand for energy payments in roubles.

- The strong buck amid the Fed hawkish shift and safe-haven demand is also weighing on the pair.

Despite multiple attempts so far this session, EUR/USD has not been able to break back to the north of the 1.1000 level and is currently trading closer to session lows in the 1.0980 area, down about 0.25% on the day. The pair saw some strength in early European trade as a result of stronger than forecast flash Eurozone PMI figures for March, but this euro strength was short-lived, with traders very much still focused on the Ukraine war. The risks of an energy crunch in Europe has risen after Russian President Vladimir Putin announced on Wednesday that unfriendly countries (including the EU) would have to purchase Russian energy (including gas) in roubles.

EUR/USD also finds itself weighed upon amid the broadly strong US dollar which 1) reflects safe-haven demand amid the ongoing Ukraine crisis and 2) reflects the recent hawkish shift in Fed communications and subsequent move higher in US yields. With the 21-Day Moving Average (now at 1.1034) continuing to act as a strong level of resistance, EUR/USD downside at this point feels more likely than a sustained break back towards last week’s highs in the 1.1100s. Bears will be eyeing a potential retest of recent near-1.0800 lows.

Ahead, US flash PMIs for March are out next at 1345GMT followed by more Fed speak and given the hawkish shift seen by other policymakers who have spoken thus far, the recipe remains towards a stronger buck. Geopolitics, of course, remains a key theme to watch as well as the G7 and EU announce tougher sanctions against Russia and NATO announces a bolstering of its forces on its Eastern flank.

Barnabas Gan, Economist at UOB Group, comments on the latest release of inflation figures in Singapore.

Key Takeaways

“Singapore’s consumer prices rose at its fastest rate since Feb 2013 at 4.3% y/y (+0.9% m/m nsa) in Feb 2022, due to higher food and oil prices. This is slightly higher compared to market expectations for a 4.2% y/y print. Core inflation decelerated to 2.2% in the same month (Jan: +2.6% y/y).”

“Headline inflation has climbed for six straight months, suggesting that inflation risks stay magnified. Meanwhile, core inflation is above the 2.0% handle for the third straight reading. The authorities have kept their headline and core inflation outlook unchanged at 2.5 - 3.5% and 2.0 - 3.0% respectively.”

“On the back of higher consumer prices, we have upgraded our inflation outlook to average 3.5% in 2022 in our UOB 2Q22 Quarterly Report. Coupled with the strong S$NEER seen at the time of writing (1.91% above the mid-point), we maintain our call for MAS to “slightly” steepen the S$NEER gradient in April 2022 while there is also a material risk for the MAS to recentre its policy band higher.”

- Gold Price resumes its advance amid mounting tensions in Eastern Europe.

- Mixed US data had no impact on the bright metal as the focus remains on sentiment.

- XAUUSD is nearing a solid static resistance around $1,960 with a near-term bullish stance.

Gold Price nudges higher and currently trades at around $1,955, after hitting a fresh weekly high of $1,957.84 a troy ounce mid-European session. Volatility around XAUUSD increased alongside its near-term bullish potential as investors try to asset the latest developments in the Russia-Ukraine crisis.

A sour market mood boosted demand for XAUUSD throughout the first half of the day amid headlines coming from the war front. US President Joe Biden has met with other European leaders to discuss the situation, and, alongside NATO, are preparing for a risk of Moscow launching a nuclear attack. They have also discussed assisting Ukraine with anti-ship missiles. The sentiment improved a bit on headlines signaling they would announce a major initiative to direct shipments of liquified natural gas to Europe, to replace that usually coming from sanctioned Russia.

European indexes have managed to trim most of their early losses, now trading mixed not far away from their opening levels. The bounce in EU indexes has also provided support to US ones, which are starting the day with modest losses after plummeting on Wednesday. Overall, risk-off will likely prevail as market participants see the crisis in the Old Continent steepening, without no diplomatic resolution at sight.

Also read: XAUUSD price moves: A consequence of conflict or/and interest rate increases?

Gold Price Technical Outlook

Gold Price neared a strong static resistance level, the 38.2% retracement of the 1,799.38/2,070.50 rally at around $1,960.00. The bright metal is up for a second consecutive day, currently crossing above a mildly bullish 20 DMA. Technical indicators in the daily chart fall short of confirming a bullish continuation, as the Momentum heads lower within neutral levels, while the RSI indicator is stable at around 55.

XAUUSD turned bullish in the near term, and according to the 4-hour chart, which shows that the price is challenging bears’ determination around the 100 SMA, while the 20 SMA picks up below the current level.

Once $1,960 is cleared, the next relevant resistance level for Gold Price is $1,970.03, March 10 daily low, followed by the $1,992.00 price zone. Support levels are at the daily low of $1,937.33, and the next Fibonacci support is at $1,925.20.

- EUR/JPY extends the upside to the vicinity of 134.00.

- Bulls’ immediate target emerges at the 2021 high (134.12).

EUR/JPY advances for the third session in a row, although a breakout of 134.00 the figure remains elusive for the time being.

The cross has quickly left behind the previous YTD high beyond 133.00 the figure (March 10), although the subsequent bullish attempt faltered just ahead of the 134.00 mark. The door therefore remains open to a potential visit to the 2021 top at 134.12 (June 1).

In the meantime, while above the 200-day SMA (129.98), the outlook for the cross is expected to remain constructive.

EUR/JPY daily chart

- USD/JPY continued scaling higher on Thursday and shot the highest level since December 2015.

- The divergent Fed-BoJ monetary policy outlooks weighed on the JPY amid a positive risk tone.

- Elevated US bond yields underpinned the USD and remained supportive of the strong move up.

The USD/JPY pair maintained its strong bid tone through the early North American session and climbed to a fresh multi-year top, closer to the 122.00 round-figure mark in the last hour.

A combination of supporting factors assisted the USD/JPY pair to build on this week's breakout momentum through the 120.00 psychological mark and scale higher for the fifth successive day on Thursday. A generally positive risk tone undermined the safe-haven Japanese yen, which was further weighed down by the divergence between the Bank of Japan and the Fed monetary policy outlooks.

In fact, a slew of influential FOMC members, including Fed Chair Jerome Powell, raised the possibility of a 50 bps rate hike at the upcoming policy meeting in May. This, along with concerns that surging crude oil prices would put upward pressure on the already high inflation, pushed the yield on the benchmark 10-year US government bond back closer to the highest level since 2019.

Conversely, the Japanese 10-year bond yield remained anchored below the BoJ's 0.25% ceiling amid the ultra-loose policy stance adopted by the Japanese central bank. This, in turn, resulted in the further widening of the US-Japanese bond yield spread, which was seen as another factor that drove flows away from the Japanese yen and contributed to the USD/JPY pair's strong bullish trajectory.

The relentless rally witnessed over the past three weeks or so, which sums up to gains of nearly 700 pips, lifted spot prices to levels not seen since December 2015. It, however, remains to be seen if bulls are able to retain their dominant position or opt to take some profits off the table amid extremely overbought conditions on short-term charts.

On the economic data front, the US Durable Goods Orders fell short of market expectations, though the disappointment was offset by a larger than anticipated fall in the Weekly Initial Jobless Claims. Given that the focus remains glued to fresh developments surrounding the Russia-Ukrain saga, the mixed releases did little to provide any meaningful impetus to the USD/JPY pair.

Technical levels to watch

In the view of strategists at ANZ Bank, tightening monetary policies could dampen investors’ appetite for gold. However, the yellow metal is unlikely to slide below the $1,900 level.

XAU/USD to trade near $1,950 over next three months

“Global central banks are beginning to tighten monetary policy in a bid to contain inflation. Worsening supply chain disruptions and elevated commodities prices may prompt the US Fed to make more aggressive rate hikes through the year. This could dampen investors’ appetite for gold, but its downside looks protected near $1,900/oz over the next six months.”

“We expect gold prices to trade near $1,950/oz over next three months and average $1,900/oz for this year.”

According to a US official on Thursday, the US announced new sanctions on Russia's state Duma as an entity and its 328 members, reported Reuters. The US also announced new sanctions on Russian oligarchs Herman Gref, the head of Sberbank and Gennady Timchenko, as well as the 17 board members of the Russian financial institution Sovcombank. The 48 largest Russian state-owned defense enterprises that form a part of Russia's defense industrial base were all also sanctioned, the US official announced.

According to a US official, the G7 and EU will announce a new initiative aimed at stopping Russia from evading sanctions, reported Reuters. The G7 and EU will engage with other countries to urge them to adopt similar sanctions against Russia and will make clear that any transaction involving gold related to Russia's central bank is covered by existing sanctions.

Fed board of governors member Christopher Waller said on Thursday that he is looking closely at rea estate to judge the appropriateness of the Fed's monetary stance, reported Reuters.

Additional Remarks:

"I am watching whether the sharp, ongoing increase in home prices poses financial stability risks."

"The rising cost of rent has implications for monetary policy."

"The Fed's purchases of mortgage-backed securities in response to pandemic reduced mortgage rates by 40 basis points."

"The recent rebound in mortgage rates, house price rises have made home-buying less affordable."

"Demand for houses is up, supply is constrained... the home price rise isn't fueled by excessive leverage or easy lending."

"I am hopeful that the pandemic-specific factors pushing up home prices and rents will ease in next year or so."

In a joint statement released following Thursday's extraordinary meeting of NATO heads of state, NATO said that Russia's attack on Ukraine threatens global security. The statement condemned Russia's attack on civilians and said it would also hold Belarus to account. The statement called on China to abstain from supporting Russia's war in any way. NATO reiterated that it will continue to protect and defend every inch of allied territory.

Minneapolis Fed President Neil Kashkari said on Thursday that inflation is very high and he has thus pencilled in seven rate hikes for this year, reported Reuter.

- Gold Price resumes its advance amid mounting tensions in Eastern Europe.

- Mixed US data had no impact on the bright metal as the focus remains on sentiment.

- XAUUSD is nearing a solid static resistance around $1,960 with a near-term bullish stance.

Gold Price surged to $1,948.56 a troy ounce on Wednesday amid a souring market’s mood that sent Wall Street into the red. XAUUSD accelerated its advance during London trading hours to hit a fresh weekly high of $1,957.84, approaching a robust static resistance area. It quickly retreated from the level ahead of US data releases, holding nearby afterwards, as the figures had no impact on the bright metal.

The dismal market mood that boost demand for XAUUSD is directly linked to the ongoing developments in Eastern Europe. US President Joe Biden has met with other European leaders to discuss the situation and, alongside NATO, are preparing for a risk of Moscow launching a nuclear attack. They have also discussed assisting Ukraine with anti-ship missiles.

Also read: XAUUSD price moves: A consequence of conflict or/and interest rate increases?

XAUUSD Technical Outlook

Gold Price neared a strong static resistance level, the 38.2% retracement of the 1,799.38/2,070.50 rally at around $1,960.00. The bright metal is up for a second consecutive day, currently crossing above a mildly bullish 20 DMA. Technical indicators in the daily chart fall short of confirming a bullish continuation, as the Momentum heads lower within neutral levels, while the RSI indicator is stable at around 55.

XAUUSD turned bullish in the near term, and according to the 4-hour chart, which shows that the price is challenging bears’ determination around the 100 SMA, while the 20 SMA picks up below the current level.

Once $1,960 is cleared, the next relevant resistance level is $1,970.03, March 10 daily low, followed by the $1,992.00 price zone. Support levels are at the daily low of $1,937.33, and the next Fibonacci support is at $1,925.20.

- AUD/USD struggled to find acceptance above the 0.7500 mark and edged lower on Thursday.

- The Fed’s hawkish outlook, elevated US bond yields underpinned the USD and exerted pressure.

- A positive risk tone extended support to the perceived riskier aussie and helped limit the downside.

- The pair reacted little to mixed US macro data as the focus remains on geopolitical developments.

The AUD/USD pair recovered a few pips from the daily low and was last seen trading around the 0.7480 region, down nearly 0.20% for the day.

Having struggled to find acceptance above the 0.7500 psychological mark, the AUD/USD pair edged lower on Thursday and eroded a major part of the overnight gains to the highest level since November 2021. The intraday downtick was sponsored by a broad-based US dollar strength, though a generally positive risk tone helped limit deeper losses for the perceived riskier aussie.

The USD continued drawing support from growing acceptance that the Fed would adopt a more aggressive policy response to combat stubbornly high inflation. In fact, a slew of influential FOMC members, including Fed Chair Jerome Powell, raised the possibility of a 50 bps rate hike at the upcoming policy meeting in May. This continued acting as a tailwind for the buck.

The Fed's hawkish outlook was reinforced by elevated US Treasury bond yields, which were further supported by concerns that surging oil prices would put upward pressure on already high inflation. This, along with the lack of progress in the Russia-Ukraine peace negotiations, further benefitted the greenback's relative safe-haven status and weighed on the AUD/USD pair.

On the economic data front, the US Durable Goods Orders fell short of market expectations and declined sharply by 2.2% in February as against the 1.6% rise reported in the previous month. Orders excluding transportation items also contracted 0.6% during the reported month as compared to consensus estimates pointing to modest deceleration in growth to 0.6% from the 0.8% in January.

This, however, was offset by the Weekly Initial Jobless Claims, which fell to 187K during the week ended March 18 from the previous week's upwardly revised reading of 215K. The mixed releases did little to influence the USD or provide any meaningful impetus to the AUD/USD pair as the focus remains glued firmly to fresh developments surrounding the Russia-Ukraine saga.

Technical levels to watch

There were 187,000 initial jobless claims in the US in the week ending on 19 March, less than the 212,000 expected and below the week prior, when there were 215,000 claims (revised up from 214,000), data published by the US Department of Labor (DOL) revealed on Thursday. The four-week moving average of initial claims thus fell to 211,750 from 223,250 the week before.

Continued claims in the week ending on 12 March fell to 1.35M, much less than the expected drop to 1.41M from 1.417M the week prior (which was revised down from 1.419M). The Insured Unemployment rate in the week ending on 12 March remained at 1.0% versus 1.0% the week before.

Market Reaction

The US dollar hasn't reacted to the latest mixed US data, where Durable Goods Orders figures underwhelmed, but weekly jobless claims were much stronger than forecast. The DXY remains contained 99.00 level.

According to the latest release by the US Census Bureau, US Durable Goods Orders fall by 2.2% MoM in February, compared to market expectations for a 0.5% decline. That marked a sharp reversal after January's 1.6% gain. Core Durable Goods Orders, meanwhile, fell 0.6% MoM versus an expected gain of 0.6%, also a sharp reversal from the 0.8% growth seen in January.

Market Reaction

The US dollar hasn't reacted to the latest mixed US data, where Durable Goods Orders figures underwhelmed, but weekly jobless claims were much stronger than forecast. The DXY remains contained 99.00 level.

- EUR/NOK accelerates losses to multi-year lows around 9.4500.

- The Norges Bank raised the policy rate by 25 bps to 0.75%.

- Higher crude oil prices also lent support to NOK.

The Norwegian krone appreciates further and drags EUR/NOK to fresh lows around 9.4500, an area last visited back in October 2018.

EUR/NOK weaker on Norges Bank, Brent

EUR/NOK dropped to fresh multi-year lows after the Norges Bank raised the policy rate by 25 bps to 0.75% at its meeting on Thursday, broadly in line with market expectations.

However, the Nordic central bank sounded more hawkish than expected following its upbeat assessment of the domestic economic growth prospects and after it acknowledged that rates could go up to “around 2.5% at the end of 2023.”

Also collaborating with the acute uptrend in NOK appears the recovery in prices of the European reference Brent crude, which surpassed the $123.00 mark per barrel earlier on Thursday.

EUR/NOK significant levels

As of writing the cross is losing 1.04% at 9.4643 and faces the next resistance at 9.6921 (weekly high March 22) followed by 9.9802 (monthly high March 15) and then 10.0978 (200-day SMA). On the other hand, a breach of 9.4514 (2022 low March 24) would open the door to 9.4176 (monthly low October 16 2018) and finally 9.3866 (2018 low July 10).

- Gold hit more than one-week highs above $1950 on Thursday as focus remains on geopolitical risk.

- Focus now turns to whether XAU/USD can press on towards $2000 with more Fed speak and US PMIs upcoming.

Spot gold (XAU/USD) prices recently hit fresh more than one-week highs to the north of the $1950 level, despite the slightly stronger US dollar, higher US yields and subdued tone to global equity and commodity market trade. Typically, a slightly stronger US dollar would weigh on USD-denominated gold by making it more expensive for the holders of foreign currency, while higher yields increase the “opportunity cost” of holding onto the precious metal. It thus appears that traders are buying gold as a hedge ahead of important upcoming geopolitical risk events in Europe.

Coming up, NATO’s Secretary-General Jens Stoltenberg will be partaking in a press conference following an extraordinary meeting of the NATO Heads of State earlier in the day. At that meeting, as well as Thursday’s EU Council Meeting, Western nations are expected to announce further sanctions on Russia and support for Ukraine. One of the key themes if whether the EU will embargo Russian oil, with initial reports suggesting the bar for this is high.

Meanwhile, the situation on the ground in Ukraine doesn’t give any cause for optimism with the war having seemingly entered a stalemate and the Ukrainians now accusing the Russians of using white phosphorous in the east amid stalled peace talks. Traders clearly view gold as good value at current levels given these risks, hence why XAU/USD was able to push convincingly back above its 21-Day Moving Average for the first time since the middle of the month. Ahead of more Fed speak and US March flash PMIs, focus will be on whether the precious metal can make further headway back towards the $2000 mark.

- USD/CAD attracted some buying on Thursday amid a broad-based USD strength.

- An uptick in oil prices underpinned the loonie and capped the upside for the pair.

- The focus remains on fresh developments surrounding the Russia-Ukraine saga.

The USD/CAD pair quickly retreated a few pips from the daily high touched in the last hour and was last seen trading with modest intraday gains, around the 1.2565-1.2570 region.

The pair gained some positive traction during the first half of the trading on Thursday and was supported by a broad-based US dollar strength, underpinned by the Fed's hawkish outlook. Growing acceptance that the Fed will adopt a more aggressive policy response to combat stubbornly high inflation turned out to be a key factor that acted as a tailwind for the buck.

In fact, a slew of influential FOMC members, including Fed Chair Jerome Powell, raised the possibility of a 50 bps rate hike at the upcoming policy meeting in May. This, along with concerns that surging oil prices might put upward pressure on the already high inflation, pushed the US Treasury bond yields higher. The combination of factors continued to underpin the greenback.

That said, an uptick in crude oil prices underpinned the commodity-linked loonie and kept a lid on any meaningful upside for the USD/CAD pair. The markets remain worried about the lack of progress in the Russia-Ukraine peace negotiations. Apart from this, the stoppage of crude exports from Kazakhstan's Caspian Pipeline Consortium (CPC) terminal underpinned crude oil prices.

The mixed fundamental backdrop and the lack of any follow-through buying warrant some caution before confirming that the recent pullback from the 1.2900 mark, or the YTD top has run its course. Market participants now look forward to the US economic docket, featuring the release of the flash PMI prints, Durable Goods Orders and the usual Weekly Initial Jobless Claims.